UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One) | |

|

|

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the Quarterly Period Ended

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. employer identification number) |

| ||

(Address of principal executive offices) |

| (zip code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

|

| The (Nasdaq Capital Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The number of shares outstanding with respect to each of the classes of our common stock, as of April 28, 2023, is set forth below:

Class |

| Number of shares outstanding |

Common Stock, par value $0.001 per share |

|

MONOPAR THERAPEUTICS INC.

TABLE OF CONTENTS

| 2 |

| Table of Contents |

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included in this Quarterly Report on Form 10-Q are forward-looking statements. The words “hopes,” “believes,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “expects,” “intends,” “may,” “could,” “should,” “would,” “will,” “continue,” and similar expressions are intended to identify forward-looking statements. The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those matters expressed in or implied by forward-looking statements:

· | our ability to raise sufficient funds within the next 12 months in order for us to (1) continue the clinical development of camsirubicin through and beyond our ongoing Phase 1b dose escalation clinical trial, (2) support further preclinical and clinical development of MNPR-101 for radiopharmaceutical use in advanced cancers, and (3) support further development of MNPR-202 and related compounds; as well as our ability to further raise additional funds in the future to support any future product candidate programs through completion of clinical trials, and our current and future product candidate programs through the approval processes and, if applicable, commercialization; |

|

|

· | our ability to raise funds at acceptable terms;

|

· | our ability to find a suitable pharmaceutical partner or partners to further our development efforts, under acceptable financial terms; |

|

|

· | risks and uncertainties associated with our research and development activities, including our clinical trials, regulatory submissions, and manufacturing and quality expenses; |

|

|

· | estimated timeframes for our clinical trials and regulatory reviews for approval to market products are uncertain; |

|

|

· | the rate of market acceptance and competitiveness in terms of pricing, efficacy and safety, of any products for which we receive marketing approval, and our ability to competitively market any such products as compared to larger pharmaceutical firms; |

|

|

· | the difficulties of commercialization, marketing and product manufacturing and overall strategy; |

|

|

· | uncertainties of intellectual property position and strategy including new discoveries and patent filings; |

|

|

· | our ability to attract and retain experienced and qualified key personnel and/or to find and utilize external sources of experience, expertise and scientific, medical and commercialization knowledge to complete product development and commercialization of new products; |

|

|

· | the risks inherent in our estimates regarding the level of needed expenses, capital requirements and the availability of required additional financing at acceptable terms; |

|

|

· | the impact of government laws and regulations including increased governmental control of healthcare and pharmaceuticals, resulting in direct price controls driving lower prices, other governmental regulations affecting cost requirements and structures for selling therapeutic products, and recent governmental legislation affecting other industries which may indirectly increase our costs of obtaining goods and services; |

|

|

· | the uncertain continuing impact of COVID-19 on our ability to advance our clinical programs and raise additional financing; |

|

|

· | the cumulative impact of domestic and global inflation, volatility in financial markets and the banking industry and/or the potential for an economic recession increasing our costs of obtaining goods and services or making financing more difficult to obtain on acceptable terms or at all; |

|

|

· | the uncertain impact of the Russia-Ukraine war on our clinical material manufacturing expenses and timelines, as well as on general economic, trade and financial market conditions; and |

|

|

· | uncertainty of our financial projections and operational timelines and the development of new competitive products and technologies. |

| 3 |

| Table of Contents |

Although we believe that the risk assessments identified in such forward-looking statements are appropriate, we can give no assurance that such risks will materialize. Cautionary statements are disclosed in this Quarterly Report on Form 10-Q, including without limitation statements in the section entitled “Item 1A - Risk Factors,” addressing forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements. We undertake no obligation to update any statements made in this Quarterly Report on Form 10-Q or elsewhere, including without limitation any forward-looking statements, except as required by law.

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances projected in this information.

| 4 |

| Table of Contents |

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in “Item 1A - Risk Factors” of our December 31, 2022 Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 23, 2023 and “Item 1A - Risk Factors” of this Quarterly Report on Form 10-Q. These risks include, among others, the following:

| · | We are a clinical stage biopharmaceutical company with a history of financial losses. We expect to continue to incur significant losses for the foreseeable future and may never achieve or maintain cash self-sufficiency or profitability, which could result in a decline in the market value of our common stock. |

|

|

|

| · | Funds raised to date are not sufficient to (1) continue the clinical development of camsirubicin through and beyond our ongoing Phase 1b dose escalation clinical trial; (2) support further development of MNPR-101 for radiopharmaceutical use in advanced cancers; or (3) support continued development of MNPR-202 and related compounds. If we are unable to raise enough funds within the next 12 months from the sale of our common stock or other financing efforts, or conclude a strategic agreement or collaboration such as out-licensing our product candidates, or entering into a clinical or commercial partnership, we will likely have to terminate one or more programs. There can be no assurance that we will be able to secure such financing or find a suitable development partner on satisfactory terms. |

|

|

|

| · | The termination of our Validive clinical trial at the end of March 2023 resulted in a decrease in our stock price. If our stock price does not increase in the next several months, it may have serious adverse consequences on our ability to raise funds, which may cause us to delay, restructure or otherwise reconsider our operations.

|

| · | We do not have and may never have any approved products on the market. Our business is highly dependent upon receiving marketing approvals from various U.S. and international governmental agencies and would be severely harmed if we are not granted approvals to manufacture and sell our product candidates. |

|

|

|

| · | Our clinical trials may not yield sufficiently conclusive results for regulatory agencies to approve the use of our products, which would adversely affect our financial condition. |

|

|

|

| · | If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals will be delayed or prevented, which would materially delay our program schedules and adversely affect our financial condition. |

|

|

|

| · | If we or our licensees, development collaborators, or suppliers are unable to manufacture our products in sufficient quantities or at defined quality specifications, or are unable to obtain regulatory approvals for the manufacturing facility, we may be unable to develop and/or meet demand for our products and lose time to market and potential revenues. |

|

|

|

| · | We rely on qualified third parties to conduct our active pharmaceutical ingredient manufacturing, our drug product manufacturing, non-clinical studies, and our clinical trials. If these third parties do not or cannot successfully carry out their contractual duties and meet expected deadlines or performance goals, the initiation or conduct of our clinical trials would be delayed and we may be unable to obtain regulatory approval for, or commercialize, our current product candidates or any future products, and our financial condition would be adversely affected. |

|

|

|

| · | The Russia-Ukraine war, and resulting sanctions against Russia and Russian entities, and Russian reduction in gas shipments to the EU and other allies, have increased fuel costs, reduced access to critical supplies and may cause shipping delays. The broader economic, trade and financial market consequences are uncertain at this time, which may increase the cost of supplies for our clinical materials, may delay the manufacture of our clinical materials, may increase costs of other goods and services or make it more difficult or costly to raise additional financing, any of which could cause an adverse effect on our clinical programs and on our financial condition. |

| 5 |

| Table of Contents |

| · | Market variables, such as inflation of product costs, labor rates and fuel, freight and energy costs, as well as geopolitical events could likely cause us to suffer significant increases in our operating and administrative expenses. |

|

|

|

| · | Unstable market and economic conditions, such as the recent volatility in the markets due to concerns about bank stability and economic challenges due to inflation, may have serious adverse consequences on our ability to raise funds, which may cause us to delay, restructure or otherwise reconsider our operations. |

|

|

|

| · | The effects of economic and political pressure to lower pharmaceutical prices are a major threat to the economic viability of new research-based pharmaceutical products, and any significant decrease in drug prices could materially and adversely affect the financial appeal of our products and investment prospects. |

|

|

|

| · | We face significant competition from other biotechnology and pharmaceutical companies, and from research-based academic medical institutions, in our targeted medical indications, and our operating results would be adversely affected if we fail to compete effectively. Many competitors have greater organizational capabilities in our industry, much higher available capital resources, and established marketing resources and sales in the targeted markets. Competition and technological change may make our product candidates obsolete or non-competitive. |

|

|

|

| · | The termination of third-party licenses would adversely affect our rights to important compounds or technologies which are essential to develop and market our products. |

|

|

|

| · | If we and our third-party licensors do not obtain and preserve protection for our respective intellectual property rights, our competitors may be able to develop and market competing drugs, which would adversely affect our financial condition. |

|

|

|

| · | If we lose key management leadership, and/or the expertise and experience of our scientific personnel, and if we cannot recruit qualified employees or other highly qualified and experienced personnel for future requirements, we would be at risk to experience significant program delays and increased compensation and operational costs, and our business would be materially disrupted. |

|

|

|

| · | The long-term effects of COVID-19 are highly uncertain, and their scope and impact could have a substantial negative bearing on our business, financial condition, operating results, stock price and ability to raise additional funds. |

| 6 |

| Table of Contents |

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

Monopar Therapeutics Inc.

Condensed Consolidated

Balance Sheets

(Unaudited)

|

| March 31, 2023 |

|

| December 31, 2022* |

| ||

|

| |||||||

Assets |

| |||||||

|

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Investments |

|

|

|

|

|

| ||

Other current assets |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset |

|

|

|

|

|

| ||

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity | ||||||||

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current liabilities |

| $ |

|

| $ |

| ||

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Non-current operating lease liability |

|

|

|

|

|

| ||

Total liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 8) |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock, par value of $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated other comprehensive income |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

Total stockholders’ equity |

|

|

|

|

|

| ||

Total liabilities and stockholders’ equity |

| $ |

|

| $ |

| ||

* Derived from the Company’s audited consolidated financial statements.

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 7 |

| Table of Contents |

Monopar Therapeutics Inc.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(Unaudited)

|

| Three Months Ended March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Operating expenses: |

|

|

|

|

|

| ||

Research and development |

| $ |

|

| $ |

| ||

General and administrative |

|

|

|

|

|

| ||

Total operating expenses |

|

|

|

|

|

| ||

Loss from operations |

|

| ( | ) |

|

| ( | ) |

Interest income |

|

|

|

|

|

| ||

Net loss |

|

| ( | ) |

|

| ( | ) |

Other comprehensive income: |

|

|

|

|

|

|

|

|

Foreign currency translation loss |

|

| ( | ) |

|

| ( | ) |

Unrealized gain on investments |

|

|

|

|

|

| ||

Comprehensive loss |

| $ | ( | ) |

| $ | ( | ) |

Net loss per share: |

|

|

|

|

|

|

|

|

Basic and diluted |

| $ | ( | ) |

| $ | ( | ) |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

|

|

|

| ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 8 |

| Table of Contents |

Monopar Therapeutics Inc.

Condensed Consolidated Statement of Stockholders’ Equity

Three Months Ended March 31, 2023

(Unaudited)

|

|

|

|

|

|

| Accumulated |

|

|

|

|

| ||||||||||||

|

|

|

| Additional |

|

| Other |

|

|

|

| Total |

| |||||||||||

|

| Common Stock |

|

| Paid- |

|

| Comprehensive |

|

| Accumulated |

|

| Stockholders’ |

| |||||||||

|

| Shares |

|

| Amount |

|

| in Capital |

|

| Income |

|

| Deficit |

|

| Equity |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance at January 1, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

Issuance of common stock under a Capital on DemandTM Sales Agreement with JonesTrading Institutional Services, LLC, net of commissions, fees and offering costs of $37,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Issuance of common stock to non-employee directors pursuant to vested restricted stock units |

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

| |||||

Issuance of common stock to employees pursuant to vested restricted stock units, net of taxes |

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | ||||

Stock-based compensation (non-cash) |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net loss |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Other comprehensive income, net |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Balance at March 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 9 |

| Table of Contents |

Monopar Therapeutics Inc.

Condensed Consolidated Statement of Stockholders’ Equity

Three Months Ended March 31, 2022

(Unaudited)

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

| |||||||||||

|

|

|

|

|

| Additional |

|

| Other |

|

|

|

| Total |

| |||||||||

|

| Common Stock |

|

| Paid- |

|

| Comprehensive |

|

| Accumulated |

|

| Stockholders’ |

| |||||||||

|

| Shares |

|

| Amount |

|

| in Capital |

|

| Loss |

|

| Deficit |

|

| Equity |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance at January 1, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

| ||||

Issuance of common stock to non-employee directors pursuant to vested restricted stock units |

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

| |||||

Issuance of common stock to employees pursuant to vested restricted stock units, net of taxes |

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | ||||

Stock-based compensation (non-cash) |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net loss |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Other comprehensive loss |

|

| — |

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||

Balance at March 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ | ( | ) |

| $ |

| ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 10 |

| Table of Contents |

Monopar Therapeutics Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

|

| For the Three Months Ended March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation expense (non-cash) |

|

|

|

|

|

| ||

Changes in operating assets and liabilities, net |

|

|

|

|

|

|

|

|

Other current assets |

|

| ( | ) |

|

|

| |

Accounts payable, accrued expenses and other current liabilities |

|

| ( | ) |

|

| ( | ) |

Operating lease right-of-use assets and liabilities, net |

|

|

|

|

| ( | ) | |

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

| ( | ) |

|

|

| |

Maturities of short-term investments |

|

|

|

|

|

| ||

Net cash used in investing activities |

|

| ( | ) |

|

|

| |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Cash proceeds from the sales of common stock under a Capital on DemandTM Sales Agreement |

|

|

|

|

|

| ||

Taxes paid related to net share settlement of vested restricted stock units |

|

| ( | ) |

|

| ( | ) |

Net cash provided by (used in) financing activities |

|

|

|

|

| ( | ) | |

Effect of exchange rates |

|

| ( | ) |

|

| ( | ) |

Net decrease in cash and cash equivalents |

|

| ( | ) |

|

| ( | ) |

Cash and cash equivalents at beginning of period |

|

|

|

|

|

| ||

Cash and cash equivalents at end of period |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 11 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Note 1 – Nature of Business and Liquidity

Nature of Business

Monopar Therapeutics Inc. (“Monopar” or the ”Company”) is a clinical-stage biopharmaceutical company focused on developing proprietary therapeutics designed to extend life or improve quality of life for cancer patients. Monopar currently has three compounds in development: 1) camsirubicin (generic name for MNPR-201, GPX-150; 5-imino-13-deoxydoxorubicin), a Phase 1b clinical stage novel analog of doxorubicin engineered specifically to retain anticancer activity while minimizing toxic effects on the heart; 2) MNPR-101 RIT and MNPR-101-Zr, a preclinical stage uPAR-targeted antibody being developed as a radioimmunotherapeutic and companion diagnostic for advanced cancers; and 3) an early stage camsirubicin analog, MNPR-202, for various cancers. On March 27, 2023, the Company discontinued its Validive Phase 2b/3 VOICE trial based upon its Data Safety Monitoring Board’s determination that the trial did not meet the pre-defined threshold for efficacy of a 15% absolute difference in severe oral mucositis prevention between Validive and placebo. Other than clinical site close-out related expense to be incurred in Q2 2023, the Company will not incur any license or royalty obligations or incur any significant expenses beyond Q2 2023 related to Validive.

Liquidity

The Company has incurred an accumulated deficit of approximately $

Market variables over which the Company has no control, such as inflation of product costs, higher capital costs, labor rates and fuel, freight and energy costs, as well as geopolitical events could cause the Company to suffer significant increases in its operating and administrative expenses.

The Russia-Ukraine war, and resulting sanctions against Russia and Russian entities or allies, have increased fuel costs and may cause shipping delays. The broader economic, trade and financial market consequences are uncertain at this time, which may increase the cost of supplies for the Company’s clinical materials, may delay the manufacture of its clinical materials, may increase costs of other goods and services, or make it more difficult or costly to raise additional financing, any of which could cause an adverse effect on the Company’s clinical and development program and on the Company’s financial condition.

The coronavirus disease (“COVID-19”) continues to affect economies and business around the world. Due to many uncertainties, the Company is unable to estimate COVID-19’s financial impact or duration in light of global vaccine rollouts, treatment options and potential surges of new cases from current or future COVID-19 variants or its potential impact on the Company’s current clinical trial and development programs, including COVID-19’s effect on drug candidate manufacturing, shipping, patient recruitment at clinical sites and regulatory agencies around the globe.

| 12 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Note 2 – Significant Accounting Policies

Basis of Presentation

These condensed consolidated financial statements include the financial results of Monopar Therapeutics Inc., its wholly-owned French subsidiary, Monopar Therapeutics, SARL, and its wholly-owned Australian subsidiary, Monopar Therapeutics Australia Pty Ltd, and have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) and include all disclosures required by GAAP for financial reporting. All intercompany accounts have been eliminated. The principal accounting policies applied in the preparation of these condensed consolidated financial statements are set out below and have been consistently applied in all periods presented. The Company has been primarily involved in performing research activities, developing product candidates, and raising capital to support and expand these activities.

The accompanying interim unaudited condensed consolidated financial statements contain all normal, recurring adjustments necessary to present fairly the Company’s condensed consolidated financial position as of March 31, 2023, and the Company’s condensed consolidated results of operations and comprehensive loss for the three months ended March 31, 2023, and 2022, and the Company’s condensed consolidated cash flows for the three months ended March 31, 2023, and 2022.

The interim condensed consolidated results of operations and comprehensive loss and condensed consolidated cash flows for the periods presented are not necessarily indicative of the condensed consolidated results of operations or cash flows which may be reported for the remainder of 2023 or for any future period. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted. The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2022, included in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 23, 2023.

Functional Currency

The Company’s consolidated functional currency is the U.S. Dollar. The Company’s Australian subsidiary and French subsidiary use the Australian Dollar and European Euro, respectively, as their functional currency. At each quarter-end, each foreign subsidiary’s balance sheets are translated into U.S. Dollars based upon the quarter-end exchange rate, while their statements of operations and comprehensive loss and statements of cash flows are translated into U.S. Dollars based upon an average exchange rate during the period.

Comprehensive Loss

Comprehensive loss represents net loss plus any income or losses not reported in the condensed consolidated statements of operations and comprehensive loss, such as foreign currency translations gains and losses and unrealized gains and losses on debt security investments that are reflected on the Company’s condensed consolidated statements of stockholders’ equity.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported amounts of expenses in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Going Concern Assessment

The Company applies Accounting Standards Codification 205-40 (“ASC 205-40”), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which the Financial Accounting Standards Board (“FASB”) issued to provide guidance on determining when and how reporting companies must disclose going concern uncertainties in their financial statements. ASC 205-40 requires management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date of issuance of the entity’s financial statements (or within one year after the date on which the financial statements are available to be issued, when applicable). Further, a company must provide certain disclosures if there is “substantial doubt about the entity’s ability to continue as a going concern.” In April 2023, the Company analyzed its cash requirements at least through June 2024 and has determined that, based upon the Company’s current available cash, the Company has no substantial doubt about its ability to continue as a going concern.

| 13 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Cash Equivalents

The Company considers all highly liquid investments purchased with a maturity of 90 days or less on the date of purchase to be cash equivalents. Cash equivalents as of March 31, 2023, and December 31 2022, consisted of two money market accounts and U.S. Treasury Bills.

Investments

The Company considers all of its investments in debt securities (U.S. Government or Agencies), with maturities at the date of purchase from three months to one year to be available-for-sale securities. These investments are recorded at fair value with the unrealized gains and losses reflected in accumulated other comprehensive income (loss) on the Company’s condensed consolidated balance sheets. Realized gains and losses from the sale of investments, if any are determined, are recorded net in the condensed consolidated statements of operations and comprehensive loss. The investments selected by the Company have a low level of inherent credit risk given they are issued by the U.S. government and any changes in their fair value are primarily attributable to changes in interest rates and market liquidity. Investments as of March 31, 2023, and December 31, 2022, consisted of U.S. Treasury Bills with maturities of 91 days to one year.

Prepaid Expenses

Prepayments are expenditures for goods or services before the goods are used or the services are received and are charged to operations as the benefits are realized. Prepaid expenses may include payments to development collaborators in excess of actual expenses incurred by the collaborator measured at the end of each reporting period. Prepayments also include insurance premiums, dues and subscriptions and software costs of $

Leases

Lease agreements are evaluated to determine whether an arrangement is or contains a lease in accordance with ASC 842, Leases. Right-of-use lease assets and lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at the commencement date. The right-of-use lease asset on the Company’s condensed consolidated balance sheets includes any lease payments made and excludes lease incentives. The incremental borrowing taking into consideration the Company’s credit quality and borrowing rate for similar assets is used in determining the present value of future payments. Lease expense is recorded as general and administrative expenses on the Company’s condensed consolidated statements of operations and comprehensive loss. ASC 842 was adopted by the Company on January 1, 2019.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentration of credit risk consist of cash and cash equivalents. The Company maintains cash and cash equivalents at two reputable financial institutions. As of March 31, 2023, the balance at one financial institution was in excess of the $

| 14 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Fair Value of Financial Instruments

For financial instruments consisting of cash and cash equivalents, investments, accounts payable, accrued expenses, and other current liabilities, the carrying amounts are reasonable estimates of fair value due to their relatively short maturities.

The Company adopted ASC 820, Fair Value Measurements and Disclosures, as amended, which addresses the measurement of the fair value of financial assets and financial liabilities. Under this standard, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

The standard establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs reflect assumptions market participants would use in pricing an asset or liability based on market data obtained from independent sources. Unobservable inputs reflect a reporting entity’s pricing an asset or liability developed based on the best information available under the circumstances. The fair value hierarchy consists of the following three levels:

Level 1 - instrument valuations are obtained from real-time quotes for transactions in active exchange markets involving identical assets.

Level 2 - instrument valuations are obtained from readily available pricing sources for comparable instruments.

Level 3 - instrument valuations are obtained without observable market values and require a high-level of judgment to determine the fair value.

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each reporting period. There were no transfers between Level 1, 2 or 3 of the fair value hierarchy during the three months ended March 31, 2023, and 2022. The following table presents the assets and liabilities that are reported at fair value on our condensed consolidated balance sheets on a recurring basis. No values were recorded in Level 2 or Level 3 at March 31, 2023, and December 31, 2022.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

March 31, 2023 |

| Level 1 |

|

| Total |

| ||

Assets: |

|

|

|

|

|

| ||

Cash equivalents(1) |

| $ |

|

| $ |

| ||

Investments(2) |

|

|

|

|

|

| ||

Total |

| $ |

|

| $ |

| ||

December 31 2022 |

| Level 1 |

|

| Total |

| ||

Assets: |

|

|

|

|

|

| ||

Cash equivalents(1) |

| $ |

|

| $ |

| ||

Investments(2) |

|

|

|

|

|

| ||

Total |

| $ |

|

| $ |

| ||

(1) | Cash equivalents as of March 31, 2023, and December 31, 2022, represent the fair value of the Company’s investment in two money market accounts and U.S. Treasury Bills with maturities at the date of purchase of less than 90 days. |

|

|

(2) | Investments represents the fair value of the Company’s investment in U.S. Treasury Bills with maturities at the date of purchase from 91 days to one year. |

| 15 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Net Loss per Share

Net loss per share for the three months ended March 31, 2023, and 2022, is calculated by dividing net loss by the weighted-average shares of common stock outstanding during the periods. Diluted net loss per share for the three months ended March 31, 2023, and 2022, is calculated by dividing net loss by the weighted-average shares of the sum of a) weighted average common stock outstanding (

Research and Development Expenses

Research and development (“R&D”) costs are expensed as incurred. Major components of R&D expenses include salaries and benefits paid to the Company’s R&D staff, compensation expenses of G&A personnel performing R&D, fees paid to consultants and to the entities that conduct certain R&D activities on the Company’s behalf and materials and supplies which were used in R&D activities during the reporting period.

Clinical Trials Accruals

The Company accrues and expenses the costs for clinical trial activities performed by third parties based upon estimates of the percentage of work completed over the life of the individual study in accordance with agreements established with contract research organizations, service providers, and clinical trial sites. The Company estimates the amounts to accrue based upon discussions with internal clinical personnel and external service providers as to progress or stage of completion of trials or services and the agreed upon fees to be paid for such services. Costs of setting up clinical trial sites for participation in the trials are expensed immediately as R&D expenses. Clinical trial site costs related to patient screening and enrollment are accrued as patients are screened/entered into the trial.

Collaborative Agreements

The Company and its collaborative partners are active participants in collaborative agreements and all parties would be exposed to significant risks and rewards depending on the technical and commercial success of the activities. Contractual payments to the other parties in collaboration agreements and costs incurred by the Company when the Company is deemed to be the principal participant for a given transaction are recognized on a gross basis in R&D expenses. Royalties and license payments are recorded as earned.

During the three months ended March 31, 2023, and 2022, no milestones were met, and no royalties were earned, therefore, the Company did not pay or accrue/expense any license or royalty payments.

Licensing Agreements

The Company has various agreements licensing technology utilized in the development of its product or technology programs. The licenses contain success milestone obligations and royalties on future sales. During the three months ended March 31, 2023, and 2022, no milestones were met, and no royalties were earned, therefore, the Company did not pay or accrue/expense any license or royalty payments under any of its license agreements.

| 16 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Patent Costs

The Company expenses costs relating to issued patents and patent applications, including costs relating to legal, renewal and application fees, as a component of general and administrative expenses in its condensed consolidated statements of operations and comprehensive loss.

Income Taxes

The Company uses an asset and liability approach for accounting for deferred income taxes, which requires recognition of deferred income tax assets and liabilities for the expected future tax consequences of events that have been recognized in its financial statements but have not been reflected in its taxable income. Estimates and judgments are required in the calculation of certain tax liabilities and in the determination of the recoverability of certain deferred income tax assets, which arise from temporary differences and carryforwards. Deferred income tax assets and liabilities are measured using the currently enacted tax rates that apply to taxable income in effect for the years in which those tax assets and liabilities are expected to be realized or settled.

The Company regularly assesses the likelihood that its deferred income tax assets will be realized from recoverable income taxes or recovered from future taxable income. To the extent that the Company believes any amounts are not “more likely than not” to be realized, the Company records a valuation allowance to reduce the deferred income tax assets. In the event the Company determines that all or part of the net deferred tax assets are not realizable in the future, an adjustment to the valuation allowance would be charged to earnings in the period such determination is made. Similarly, if the Company subsequently determines deferred income tax assets that were previously determined to be unrealizable are now realizable, the respective valuation allowance would be reversed, resulting in an adjustment to earnings in the period such determination is made.

Internal Revenue Code Sections 382 and 383 (“Sections 382 and 383”) limit the use of net operating loss (“NOL”) carryforwards and R&D credits, after an ownership change. To date, the Company has not conducted a Section 382 or 383 study, however, because the Company will continue to raise significant amounts of equity in the coming years, the Company expects that Sections 382 and 383 will limit the Company’s usage of NOLs and R&D credits in the future.

ASC 740, Income Taxes, requires that the tax benefit of net operating losses, temporary differences, and credit carryforwards be recorded as an asset to the extent that management assesses that realization is “more likely than not.” Realization of the future tax benefits is dependent on the Company’s ability to generate sufficient taxable income within the carryforward period. The Company has reviewed the positive and negative evidence relating to the realizability of the deferred tax assets and has concluded that the deferred tax assets are not “more likely than not” to be realized. As a result, the Company recorded a full valuation allowance as of March 31, 2023, and December 31, 2022. U.S. Federal R&D tax credits from 2016 to 2019 were utilized to reduce payroll taxes in future periods and were recorded as other current assets (anticipated to be received within 12 months), on the Company’s condensed consolidated balance sheets. The Company intends to maintain the valuation allowance until sufficient evidence exists to support its reversal. The Company regularly reviews its tax positions. For a tax benefit to be recognized, the related tax position must be “more likely than not” to be sustained upon examination. Any amount recognized is generally the largest benefit that is “more likely than not” to be realized upon settlement. The Company’s policy is to recognize interest and penalties related to income tax matters as an income tax expense. For the three months ended March 31, 2023 and 2022, the Company did not have any interest or penalties associated with unrecognized tax benefits.

| 17 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

The Company is subject to U.S. Federal, Illinois and California state income taxes. In addition, the Company is subject to local tax laws of France and Australia. Tax regulations within each jurisdiction are subject to the interpretation of the related tax laws and regulations and require significant judgment to apply. Monopar was originally formed as an LLC in December 2014, then incorporated on December 16, 2015. The Company is subject to U.S. Federal, state and local tax examinations by tax authorities for the tax years 2015 through 2021. The Company does not anticipate significant changes to its current uncertain tax positions through March 31, 2024. The Company plans on filing its U.S. Federal and state tax returns for the year ended December 31, 2022, prior to the extended filing deadlines in all jurisdictions.

Stock-Based Compensation

The Company accounts for stock-based compensation arrangements with employees, non-employee directors and consultants using a fair value method, which requires the recognition of compensation expense for costs related to all stock-based awards, including stock option and restricted stock unit (“RSU”) grants. The fair value method requires the Company to estimate the fair value of stock-based payment awards on the date of grant using an option pricing model or the closing stock price on the date of grant in the case of RSUs.

Stock-based compensation expense for awards granted to employees, non-employee directors and consultants are based on the fair value of the underlying instrument calculated using the Black-Scholes option-pricing model on the date of grant for stock options and using the closing stock price on the date of grant for RSUs and recognized as expense on a straight-line basis over the requisite service period, which is the vesting period. Determining the appropriate fair value model and related assumptions requires judgment, including estimating the future stock price volatility and expected terms. The expected volatility rates are estimated based on the Company’s historical actual volatility over the two-year period from its initial public offering on December 18, 2019 through December 31, 2021 for stock-based awards granted in 2022. For awards granted during the three months ended March 31, 2023, the expected volatility rates were estimated based on the Company’s historical actual volatility over the three-year period from its initial public offering on December 18, 2019, through December 31, 2022. The expected term for options granted to date is estimated using the simplified method. Forfeitures only include known forfeitures to-date as the Company accounts for forfeitures as they occur due to a limited history of forfeitures. The Company has not paid dividends and does not anticipate paying a cash dividend in the future vesting period and, accordingly, uses an expected dividend yield of zero. The risk-free interest rate is based on the rate of U.S. Treasury securities with maturities consistent with the estimated expected term of the awards.

Note 3 - Investments

As of March 31, 2023, the Company had two money market accounts and available-for-sale investments with contractual maturities of one year or less as follows:

As of March 31, 2023 |

| Cost Basis |

|

| Unrealized Gains |

|

| Aggregate Fair Value |

| |||

|

|

|

|

|

|

|

|

|

| |||

U.S. Treasury Bills |

| $ |

|

| $ |

|

| $ |

| |||

Money Market Accounts |

|

|

|

|

|

|

|

|

| |||

Total |

| $ |

|

| $ |

|

| $ |

| |||

As of March 31, 2023, there were no available-for-sale securities in an unrealized-loss position. U.S. Treasury Bills classified as Investments on the condensed consolidated balance sheet as of March 31, 2023 were $

| 18 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

As of December 31, 2022 the Company had two money market accounts and available-for-sale investments with contractual maturities of one year or less as follows:

As of December 31, 2022 |

| Cost Basis |

|

| Unrealized Gains |

|

| Aggregate Fair Value |

| |||

|

|

|

|

|

|

|

|

|

| |||

U.S. Treasury Bills |

| $ |

|

| $ |

|

| $ |

| |||

Money Market Accounts |

|

|

|

|

|

|

|

|

| |||

Total |

| $ |

|

| $ |

|

| $ |

| |||

As of December 31, 2022, there were no available-for-sale securities in an unrealized-loss position and there were no sales of available-for-sale securities made during 2022. U.S. Treasury Bills classified as Investments on the condensed consolidated balance sheet as of December 31, 2022 were $

See Note 2 for additional discussion regarding the Company’s fair value measurements.

Note 4 - Capital Stock

Holders of the common stock are entitled to receive such dividends as may be declared by the Board of Directors out of funds legally available therefor. To date no dividends have been declared. Upon dissolution and liquidation of the Company, holders of the common stock are entitled to a ratable share of the net assets of the Company remaining after payments to creditors of the Company. The holders of shares of common stock are entitled to one vote per share for the election of each director nominated to the Board and one vote per share on all other matters submitted to a vote of stockholders.

The Company’s amended and restated certificate of incorporation authorizes the Company to issue

Sales of Common Stock

On April 20, 2022, the Company entered into a Capital on Demand™ Sales Agreement with JonesTrading Institutional Services LLC (“JonesTrading”), pursuant to which Monopar may offer and sell, from time to time, through or to JonesTrading, as sales agent or principal, shares of Monopar’s common stock. On April 20, 2022, the Company filed a prospectus supplement with the U.S. Securities and Exchange Commission relating to the offer and sale of its common stock from time to time pursuant to the agreement up to an aggregate amount of $

As of March 31, 2023, the Company had

| 19 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Note 5 - Stock Incentive Plan

In April 2016, the Company’s Board of Directors and stockholders representing a majority of the Company’s outstanding stock at that time, approved the Monopar Therapeutics Inc. 2016 Stock Incentive Plan, as amended (the “Plan”), allowing the Company to grant up to an aggregate

During the three months ended March 31, 2023, the Company’s Plan Administrator Committee (with regards to non-officer employees and consultants) and the Company’s Compensation Committee, as ratified by the Board of Directors (in case of executive officers and non-employee directors), granted to executive officers, non-officer employees, non-employee directors and consultants aggregate stock options for the purchase of

Under the Plan, the per share exercise price for the shares to be issued upon exercise of an option shall be determined by the Plan Administrator, except that the per share exercise price shall be no less than 100% of the fair market value per share on the grant date. Fair market value is the Company’s closing price on the grant date on Nasdaq. Stock options generally expire after

Stock option activity under the Plan was as follows:

|

| Options Outstanding |

| |||||

|

| Number of Shares Subject to Options |

|

| Weighted-Average Exercise Price |

| ||

Balances at December 31, 2022 |

|

|

|

|

|

| ||

Granted(1) |

|

|

|

|

|

| ||

Forfeited(2) |

|

| ( | ) |

|

|

| |

Balances at March 31, 2023 |

|

|

|

|

|

| ||

Unvested options outstanding expected to vest(3) |

|

|

|

|

|

| ||

(1) | |

|

|

(2) | Forfeited options represent unvested shares and vested, unexercised shares related to employee terminations. |

|

|

(3) | Forfeitures only include known forfeitures to-date as the Company accounts for forfeitures as they occur due to a limited history of forfeitures. |

| 20 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Exercise Prices |

| Number of Shares Subject to Options Outstanding |

|

| Weighted-Average Remaining Contractual Term in Years |

|

| Number of Shares Subject to Options Fully Vested and Exercisable |

|

| Weighted-Average Remaining Contractual Term in Years |

| ||||

$ |

|

|

|

|

|

|

|

|

|

|

|

| ||||

$ |

|

|

|

|

|

|

|

|

|

|

|

| ||||

$ |

|

|

|

|

|

|

|

|

|

|

|

| ||||

$ |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Restricted stock unit activity under the Plan was as follows:

|

| Restricted Stock Units (#) |

|

| Weighted- Average Grant Date Fair Value per Unit ($) |

| ||

Unvested balance at December 31, 2022 |

|

|

|

|

|

| ||

Granted |

|

|

|

|

|

| ||

Vested |

|

| ( | ) |

|

|

| |

Unvested Balance at March 31, 2023 |

|

|

|

|

|

| ||

During the three months ended March 31, 2023, and 2022, the Company recognized $

The fair value of options granted for the three months ended March 31, 2023, was based on the Black-Scholes option-pricing model assuming the following factors:

| 21 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Stock option grants and fair values under the Plan were as follows:

|

| Three Months Ended March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

Stock options granted |

|

|

|

|

|

| ||

Weighted-average grant date fair value per share |

| $ |

|

|

|

| ||

Fair value of shares vested |

| $ |

|

|

|

| ||

At March 31, 2023, the aggregate intrinsic value of outstanding vested stock options was approximately $

Note 6 - Related Party Transactions

As of March 31, 2023, Tactic Pharma, LLC (“Tactic Pharma”), the Company’s initial investor, beneficially owned

None of the related parties discussed in this paragraph received compensation other than market-based salary, market-based stock-based compensation and benefits and performance-based incentive bonus or in the case of non-employee directors, market-rate Board fees and market-rate stock-based compensation. The Company considers the following individuals as related parties: Two of the Company’s board members were also Managing Members of Tactic Pharma as of March 31, 2023. Chandler D. Robinson is a Company Co-Founder, Chief Executive Officer, common stockholder, Managing Member of Tactic Pharma, former Manager of the predecessor LLC, Manager of CDR Pharma, LLC and Board member of Monopar as a C Corporation. Michael Brown is a Managing Member of Tactic Pharma (as of February 1, 2019, with no voting power as it relates to Monopar), a previous managing member of Monopar as an LLC, common stockholder and Board member of Monopar as a C Corporation.

Note 7 – Commitments and Contingencies

License, Development and Collaboration Agreements

Onxeo S.A.

In June 2016, the Company executed an option and license agreement with Onxeo S.A. (“Onxeo”), a public French company, which gave Monopar the exclusive option to license (on a world-wide exclusive basis) Validive to pursue treating severe oral mucositis in patients undergoing chemoradiation treatment for head and neck cancers. The pre-negotiated Onxeo license agreement for Validive as part of the option agreement includes clinical, regulatory, developmental and sales milestones and escalating royalties on net sales . On September 8, 2017, the Company exercised the license option, and therefore paid Onxeo the $1 million fee under the option and license agreement.

On March 27, 2023, Monopar announced the discontinuation of its Validive Phase 2b/3 VOICE trial based upon the Data Safety Monitoring Board (“DSMB”) determination that the trial did not meet the pre-defined threshold for efficacy of a 15% absolute difference in severe oral mucositis prevention between Validive and placebo. The Company does not anticipate further development under the Onxeo license agreement or any future license or royalty obligations.

| 22 |

| Table of Contents |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2023

Grupo Español de Investigación en Sarcomas (“GEIS”)

In June 2019, the Company executed a clinical collaboration agreement with GEIS for the development of camsirubicin in patients with advanced soft tissue sarcoma (“ASTS”). Following completion of the Company’s Phase 1b clinical trial in the U.S. that Monopar initiated in the third quarter of 2021 with the first patient dosed in October 2021, the Company continues to expect that GEIS will sponsor and lead a multi-country, randomized, open-label Phase 2 clinical trial to evaluate camsirubicin head-to-head against doxorubicin, the current first-line treatment for ASTS. The Company will provide study drug and supplemental financial support for the clinical trial. During the three months ended March 31, 2023 and March 31, 2022, no expenses were incurred under the GEIS agreement. The Company can terminate the agreement by providing GEIS with advance notice, and without affecting the Company’s rights and ownership to any related intellectual property or clinical data. In the second quarter of 2021, due to regulatory delays in Spain, Monopar decided to conduct an open-label Phase 1b clinical trial of camsirubicin in the U.S., therefore no expenses were incurred related to the GEIS collaboration beyond March 31, 2021.

XOMA Ltd.

The intellectual property rights contributed by Tactic Pharma to the Company included the non-exclusive license agreement with XOMA Ltd. for the humanization technology used in the development of MNPR-101. Pursuant to such license agreement, the Company is obligated to pay XOMA Ltd.

Legal Contingencies

The Company may be subject to claims and assessments from time to time in the ordinary course of business. No claims have been asserted to date.

Indemnification

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representations and warranties and provide for general indemnification. The Company’s exposure under these agreements is unknown because it involves claims that may be made against the Company in the future, but that have not yet been made. To date, the Company has not paid any claims nor been required to defend any action related to its indemnification obligations. However, the Company may record charges in the future as a result of future claims against these indemnification obligations.

In accordance with its second amended and restated certificate of incorporation, amended and restated bylaws and the indemnification agreements entered into with each officer and non-employee director, the Company has indemnification obligations to its officers and non-employee directors for certain events or occurrences, subject to certain limits, while they are serving at the Company’s request in such capacities. There have been no indemnification claims to date.

| 23 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and related notes contained in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion and analysis are set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business and related financing activities, includes forward-looking statements that involve risks and uncertainties.

Overview

We are a clinical stage biopharmaceutical company focused on developing proprietary therapeutics designed to extend life or improve quality of life for cancer patients. We are building a drug development pipeline through the licensing and acquisition of therapeutics in late preclinical or in clinical development stages. We leverage our scientific and clinical experience to help reduce the risk of and accelerate the clinical development of our drug product candidates.

Financial Status

Our cash, cash equivalents and investments as of March 31, 2023, was $11.7 million. As discussed further below and elsewhere in this Quarterly Report, we expect that our current funds will be sufficient for us to obtain topline results from our ongoing open-label Phase 1b camsirubicin clinical trial as planned by the end of 2023 (but as discussed below, this may not be the case if camsirubicin reaches even higher dose levels than we are anticipating and topline results are deferred as dosing continues beyond 2023), advance our MNPR-101 radiopharmaceutical program into its first in human clinical trial and close out our terminated Validive Phase 2b/3 (VOICE) clinical program. We will require additional funding to advance our clinical and preclinical programs and we anticipate that we will seek to raise additional capital within the next 12 months to fund our future operations.

Our primary funding source over the past three years was sales of shares of our common stock under at-the-market sales programs through Capital on DemandTM Sales Agreements with JonesTrading Institutional Services LLC (“Jones Trading”). For the three months ended March 31, 2023, we sold 244,392 shares of our common stock at an average gross price per share of $3.46 for net proceeds of $823,855, after fees and commissions of $21,144. In addition, we incurred legal, accounting and other fees totaling $16,517 for net proceeds after fees, commissions and expenses of $807,338. There have been no additional sales from April 1, to April 28, 2023.

Validive Clinical Update

On March 27, 2023, we announced the completion of a pre-specified interim analysis for our Validive Phase 2b/3 VOICE trial for the prevention of severe oral mucositis (“SOM”) in patients undergoing chemoradiotherapy (“CRT”) for oropharyngeal cancer (“OPC”). The interim analysis included the first approximately 50% of the total planned patients to be enrolled. It was conducted by an independent Data Safety Monitoring Board (“DSMB”), which informed us that the trial did not meet the pre-defined threshold for efficacy of a 15% absolute difference in SOM prevention between Validive and placebo. The DSMB also reported that there were no safety concerns attributed to Validive. Based on not meeting the pre-specified efficacy threshold, we announced that we will discontinue the study along with the active development of Validive.

Camsirubicin Clinical Update

We are currently enrolling advanced soft tissue sarcoma patients into the fifth dose-level cohort (650 mg/m2) of our Phase 1b camsirubicin clinical trial, which is nearly 2.5x the highest dose evaluated in any prior camsirubicin clinical trial (265mg/m2). The Phase 1b data to date show an improvement in median progression free survival from what was observed in the prior camsirubicin Phase 2 trial (265 mg/m2). This is supportive of our dose-response hypothesis with camsirubicin. Additionally, one of the three patients in the 520 mg/m2 dose-level cohort recently went from having what was initially determined to be an unresectable cancer to, after several cycles of camsirubicin treatment and a corresponding 21% reduction in tumor dimensions, being determined to be resectable. This changed the course of treatment for this patient, who recently then underwent surgical resection of the cancer. To date, no drug-related cardiotoxicity has been observed with camsirubicin treatment as evaluated by the industry standard left ventricular ejection fraction (“LVEF”). This compares favorably to the well-documented dose-restricting cardiotoxicity experienced with doxorubicin, the current first-line treatment for ASTS.

| 24 |

| Table of Contents |

To date, 75% of camsirubicin patients in this Phase 1b trial have experienced no hair loss. Of the 25% with any hair loss, only 8% experienced >50% hair loss and only 17% experienced low grade hair loss. This compares favorably to the approximately 50% of doxorubicin treated patients in recent ASTS clinical trials reporting some amount of hair loss, with the majority of these patients experiencing >50% hair loss. Only 8% of camsirubicin patients in the Phase 1b trial have experienced low grade, mild oral mucositis. This compares favorably to the roughly 35-40% of doxorubicin treated patients in recent ASTS clinical trials that experienced mild-to-severe oral mucositis.

MNPR-101 for Radiopharmaceutical Use Development Update

Pursuant to our 50/50 cost-sharing collaboration agreement with NorthStar Medical Radioisotopes, LLC (“NorthStar”) to develop potential radioimmunotherapeutics based on MNPR-101 (“MNPR-101 RITs”), we have coupled MNPR-101 to imaging and therapeutic radioisotopes. The resulting conjugates, MNPR-101-Zr and MNPR-101-PCTA-Ac225, are designed to be highly selective agents that have the potential to image and kill certain cancer cells. By eradicating these cancer cells with a uPAR-targeted RIT (“uPRIT”), the therapeutic goal is to spare healthy cells while quickly killing the cancer cells.

Based on promising preclinical imaging results with MNPR-101-Zr showing high uptake across multiple tumor types, and with preclinical therapeutic efficacy and biodistribution studies utilizing the radioisotopes actinium-225 (“Ac-225”) and lutetium-177 (“Lu-177”), we and NorthStar committed to additional funding with the aim of initiating a first-in-human imaging study with MNPR-101-Zr as early as end of this year. MNPR-101-Zr is a zirconium-89 labeled version of MNPR-101, a highly selective antibody against the urokinase plasminogen activator receptor (“uPAR”). Positron emission tomography (“PET”) imaging of preclinical mouse models for triple-negative breast, colorectal, and pancreatic tumors displayed high and selective uptake of MNPR-101-Zr in these uPAR-expressing tumors. Additionally, preclinical triple negative breast cancer mouse model studies with Ac-225 and Lu-177 radiolabeled MNPR-101 showed a promising dose-dependent-anti-cancer-effect and favorable biodistribution profile. These proof-of-concept studies provide support for a first-in-human PET imaging study with MNPR-101-Zr and a future therapeutic study using Ac-225 labeled MNPR-101 RIT. Overall, the imaging and therapeutic results demonstrate the potential utility of MNPR-101 as a precision targeting agent for both imaging and treatment in multiple cancer indications.

MNPR-202 and Related Analogs Updates

In June 2021, we entered into a collaboration agreement with the Cancer Science Institute of Singapore (“CSI Singapore”), one of Asia’s premier cancer research centers, at the National University of Singapore (“NUS”) (consistently ranked as one of the world’s top universities) to evaluate the activity of MNPR-202 and related analogs in multiple types of cancer. MNPR-202 was designed to retain the same potentially non-cardiotoxic backbone as camsirubicin but is modified at other positions which may enable it to work in certain cancers that are resistant to camsirubicin and doxorubicin. In collaboration with Dr. Anand Jeyasekharan of CSI Singapore, we presented an abstract and poster of the preclinical data of MNPR-202 at the American Society of Hematology 64th Annual Meeting in New Orleans, LA. The poster presented the following promising data about MNPR-202:

| - | has a similar cytotoxic potency to doxorubicin |

| - | generates increased DNA damage in the cancer cells compared to doxorubicin |

| - | has a unique immune activation profile versus doxorubicin |

| - | demonstrates increased apoptosis (programmed cell death) compared to doxorubicin |

| - | causes a distinct set of genes to be upregulated and downregulated versus doxorubicin and |

| - | may also be superior to doxorubicin in certain combination treatment regimens. |

A combination drug screen with 183 compounds was performed, revealing distinct differences in the synergy profile between doxorubicin versus MNPR-202 when used along with other compounds. For example, MNPR-202 demonstrated a more favorable synergy profile with the experimental anti-cancer agent volasertib compared to doxorubicin.

| 25 |

| Table of Contents |

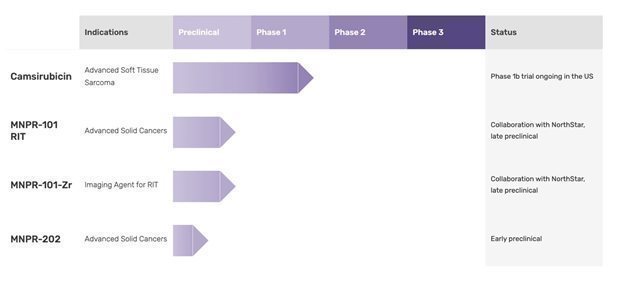

Our Product Pipeline

Our Strategy

Our management team has extensive experience in developing therapeutics and medical technologies through global regulatory approval and commercialization. In aggregate, companies they co-founded have achieved four drug approvals and three diagnostic medical imaging device approvals in the U.S. and the EU, successfully sold an asset developed by management which went on to have a positive Phase 3 clinical trial, sold two oncology-focused diagnostic imaging businesses to Fortune Global 1000 firms, and completed the clinical and commercial development and ultimately the sale of a commercial biopharmaceutical company for over $800 million in cash. In addition, the team has supported multiple regulatory submissions with the FDA and the European Medicines Agency (“EMA”) and launched multiple drugs in the U.S and the EU. Understanding the preclinical, clinical, regulatory and commercial development processes and hurdles are key factors in successful drug development and the expertise demonstrated by our management team across all of these areas increases the probability of success in advancing the product candidates in our product pipeline. Our strategic goal is to acquire, develop and commercialize promising oncology product candidates that address important unmet medical needs of cancer patients. Five key elements of our strategy to achieve this goal are to:

· | Advance the clinical development of camsirubicin, by pursuing indications where doxorubicin has demonstrated efficacy. ASTS will be the first indication, which is anticipated to allow camsirubicin to go head-to-head against doxorubicin, the current first-line treatment. In this indication, camsirubicin previously demonstrated clinical benefit (stable disease or partial response) in 52.6% of patients evaluable for tumor progression in a single-arm Phase 2 study. Clinical benefit was proportional to dose and was consistently observed at higher cumulative doses of camsirubicin (>1000 mg/m2). Camsirubicin was very well tolerated in this Phase 2 study and underscored the ability to potentially administer camsirubicin without restriction as to cumulative dose (doxorubicin is limited due to heart toxicity to 450 mg/m2 cumulative dose). Our current ongoing Phase 1b clinical trial continues towards establishing a new, higher recommended dose for the next Phase 2 ASTS clinical trial. |

|

|