UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report | December 31, 2021 |

WESTERN ASSET

TOTAL RETURN ETF

WBND

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to maximize total return, consistent with prudent investment management and liquidity needs.

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Total Return ETF for the twelve-month reporting period ended December 31, 2021. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Patrick O’Connor

President and Chief Executive Officer - Investment Management President

January 31, 2022

|

II |

Western Asset Total Return ETF |

Q. What is the Fund’s investment strategy?

A. Western Asset Total Return ETF (the “Fund”) seeks to maximize total return, consistent with prudent investment management and liquidity needs. Under normal market conditions, the Fund will seek its investment objective by investing at least 80% of its assets in a portfolio comprised of fixed income securities, debt instruments, derivatives, equity securities of any type acquired in reorganizations of issuers of fixed income securities or debt instruments (“work out securities”), non-convertible preferred securities, warrants, cash and cash equivalents, foreign currencies, and exchange-traded funds (“ETFs”) that provide exposure to these investments (“Principal Investments”). Debt instruments include loans and similar debt instruments.

The fixed income securities and debt instruments in which the Fund may invest may pay fixed, variable or floating rates of interest. The Fund will not invest more than 20% of its portfolio in asset-backed securities (“ABS”) and non-agency, non-government sponsored enterprise and privately issued mortgage-backed securities (“MBS”) or more than 10% of the Fund’s total assets in collateralized debt obligations (“CDOs”). The Fund will also not invest more than 20% of its total assets in junior loans (e.g., debt instruments that are unsecured and subordinated).

Although the Fund may invest in securities and debt instruments of any maturity, the Fund expects the normal range of the Fund’s effective duration to be approximately 2 to 9 years.

The Fund may invest up to 30% of its assets in below investment grade fixed income securities or debt instruments commonly known as “junk bonds” or “high yield securities”.

The Fund may invest in securities issued by both U.S. and non-U.S. issuers (including issuers in emerging markets), but the Fund will not invest more than 30% of its total assets in securities or debt instruments of non-U.S. issuers or more than 25% of its total assets directly in non-U.S. dollar denominated securities or debt instruments.

At Western Asset Management Company, LLC (“Western Asset”), the Fund’s subadviser, we utilize a fixed income team approach, with decisions derived from interaction among various investment management sectors. The sector teams are comprised of Western Asset’s senior portfolio management personnel, research analysts and an in-house economist. Under this team approach, management of client fixed income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Fixed income markets experienced periods of volatility and, overall, declined over the twelve-month reporting period ended December 31, 2021. Volatility was driven by a number of factors, including the repercussions from the COVID-19 pandemic, rebounding global growth, sharply rising inflation, fluctuating interest rates, and expectations for less accommodative central bank monetary policy. Most spread sectors (non-Treasuries) outperformed similar duration Treasuries, as many investors looked to generate incremental yield in the relatively low interest rate environment.

| Western Asset Total Return ETF 2021 Annual Report |

1 |

Fund overview (cont’d)

Short-term U.S. Treasury yields moved sharply higher as the Federal Reserve Board (the “Fed”) telegraphed that it was poised to begin raising interest rates in 2022. The yield for the two-year Treasury note began the reporting period at 0.13% and ended the reporting period at 0.73%. The low of 0.09% occurred on February 5, 2021 and the high of 0.76% took place on December 27, 2021. Long-term U.S. Treasury yields also moved higher, as positive economic data and rising inflation triggered expectations that the Fed would remove its monetary policy accommodation sooner than previously anticipated. The yield for the ten-year Treasury began the reporting period at 0.93% (equaling the low for the period) and ended the reporting period at 1.52%. The high of 1.74% took place on March 19 and March 31, 2021.

All told, the Bloomberg U.S. Aggregate Indexi returned -1.54% for the twelve-month reporting period ended December 31, 2021. For comparison purposes, riskier fixed income securities, including high-yield bonds and emerging market debt, produced mixed results. Over the fiscal year, the Bloomberg U.S. Corporate High Yield 2% Issuer Cap Indexii and the JPMorgan Emerging Markets Bond Index Globaliii returned 5.26% and -1.51%, respectively.

Q. How did we respond to these changing market conditions?

A. A number of adjustments were made to the Fund during the reporting period. We tactically managed the Fund’s duration as yields fluctuated over the reporting period, maintaining an overall long position relative to the Bloomberg U.S. Aggregate Index for most of the year. Additionally, as investment-grade spreads tightened earlier in the year, we trimmed some of the Fund’s exposure to certain high-quality investment-grade corporate bonds that we felt were close to being fully valued. Throughout the latter part of the year, we reduced exposure to agency MBS, thereby increasing the Fund’s underweight, particularly in securities that we believed were most at risk of spread-widening as the Fed tapers its purchase program. We also increased the Fund’s exposure, especially in local currency, to select emerging market countries where fundamentals still appeared sound, and where sovereign yields remained attractive relative to comparable developed market yields. During the year, the Fund reduced its allocation to Treasury Inflation-Protected Securities (“TIPS”)iv as breakeven inflation rates exceeded pre-pandemic levels and we believed further upside was limited. Finally, we added back investment-grade exposure in the final quarter of the year as spreads widened due to concerns over the COVID-19 Omicron variant.

During the reporting period, the Fund used interest rate futures, options, swaps and swaptions to manage its duration and yield curve exposure. In aggregate, these instruments detracted from results. Credit default swaps on both investment-grade and high-yield issuers and indices were used to manage the Fund’s credit exposures and had a minimal impact on relative performance. Finally, the Fund’s use of currency forwards and options on currencies, to take outright currency positions as well as to hedge non-U.S. dollar currency exposure, was a modest contributor to returns.

|

2 |

Western Asset Total Return ETF 2021 Annual Report |

Performance review

For the twelve months ended December 31, 2021, Western Asset Total Return ETF generated a -2.98% return on a net asset value (“NAV”)v basis and -2.90% based on its market pricevi per share.

The performance table shows the Fund’s total return for the twelve months ended December 31, 2021 based on its NAV and market price. The Fund’s broad-based market index, the Bloomberg U.S. Aggregate Index, returned -1.54% over the same time frame. The Lipper Core Plus Bond Funds Category Averagevii returned -0.86% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as of December 31, 2021 (unaudited) | ||||||||

| 6 months | 12 months | |||||||

| Western Asset Total Return ETF: | ||||||||

| $26.22 (NAV) |

-1.50 | % | -2.98 | % *† | ||||

| $26.28 (Market Price) |

-1.64 | % | -2.90 | % *‡ | ||||

| Bloomberg U.S. Aggregate Index | 0.06 | % | -1.54 | % | ||||

| Lipper Core Plus Bond Funds Category Average | 0.00 | % | -0.86 | % | ||||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.franklintempleton.com.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.franklintempleton.com.

As of the Fund’s current prospectus dated May 1, 2021, the gross total annual fund operating expense ratio for the Fund was 0.51%.

The management agreement between Legg Mason ETF Investment Trust (the “Trust”) on behalf of the Fund and Legg Mason Partners Fund Advisor, LLC (the “manager” or “LMPFA”) (the “Management Agreement”) provides that LMPFA will pay all operating expenses of the Fund, other than interest expenses, taxes, brokerage expenses, future 12b-1 fees (if any), acquired fund fees and expenses, extraordinary expenses and the management fee payable to LMPFA under the Management Agreement. LMPFA will also pay all subadvisory fees of the Fund. The manager has agreed to waive and/or reimburse management fees so that the ratio of total annual fund operating expenses will not exceed 0.45% (subject to the same exclusions as the Management Agreement).

| Western Asset Total Return ETF 2021 Annual Report |

3 |

Fund overview (cont’d)

Total annual fund operating expenses after waiving and/or reimbursing management fees exceed the expense cap as a result of acquired fund fees and expenses. This arrangement cannot be terminated prior to May 1, 2022 without the Board of Trustee’ consent.

| * | Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares. |

| † | Total return assumes the reinvestment of all distributions at NAV. |

| ‡ | Total return assumes the reinvestment of all distributions at market price, which typically is based upon the official closing price of the Fund’s shares. |

Q. What were the leading contributors to performance?

A. The largest contributors to the Fund’s relative performance during the reporting period were its exposures to corporate credit and structured products. Overweight exposures to corporate credit, particularly to high-yield bonds, contributed to performance as credit spreads tightened during the course of the year.

The Fund’s exposures to structured products, including non-agency residential MBS, Commercial MBS and ABS, were also beneficial as fundamentals continued to improve and spreads in these sectors generally tightened during the reporting period.

Q. What were the leading detractors from performance?

A. The most significant detractor from performance was the Fund’s rates positioning. The Fund’s long duration positioning detracted from returns as yields rose, especially during the first quarter of the reporting period.

The Fund’s exposures to emerging markets and non-U.S. developed markets also detracted from returns, as the U.S. dollar strengthened against many currencies and emerging market U.S. dollar-denominated bond spreads widened and local rates ended higher during the year.

Looking for additional information?

The Fund’s daily NAV is available online at www.franklintempleton.com. The Fund is traded under the symbol “WBND” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

|

4 |

Western Asset Total Return ETF 2021 Annual Report |

Thank you for your investment in Western Asset Total Return ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company, LLC

January 29, 2022

RISKS: Fixed income securities involve interest rate, credit, inflation and reinvestment risks. As interest rates rise, the value of fixed income securities falls. High-yield securities include greater price volatility, illiquidity and possibility of default. International investments are subject to special risks, including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Emerging market countries tend to have economic, political and legal systems that are less developed and are less stable than those of more developed countries. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The use of leverage may increase volatility and possibility of loss. Potential active and frequent trading may result in higher transaction costs and increased investor liability. Asset-backed, mortgage-backed or mortgage-related securities are subject to prepayment and extension risks. Active management and diversification do not ensure gains or protect against market declines. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

Portfolio holdings and breakdowns are as of December 31, 2021 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 12 through 52 for a list and percentage breakdown of the Fund’s holdings.

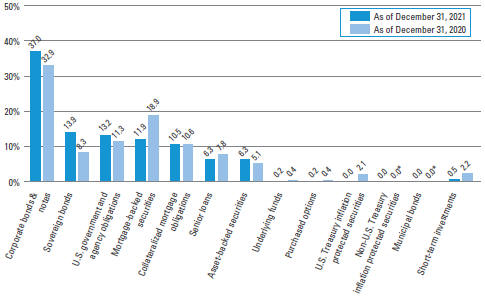

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio managers’ current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of December 31, 2021 were: corporate bonds & notes (36.2%), sovereign bonds (13.6%), U.S. government & agency obligations (12.9%), mortgage-backed securities (11.7%) and collateralized mortgage obligations (10.3%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| Western Asset Total Return ETF 2021 Annual Report |

5 |

Fund overview (cont’d)

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Bloomberg U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage-and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| ii | The Bloomberg U.S. Corporate High Yield—2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| iii | The JPMorgan Emerging Markets Bond Index Global tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| iv | U.S. Treasury Inflation-Protected Securities (“TIPS”) are inflation-indexed securities issued by the U.S. Treasury in five-year, ten-year and thirty-year maturities. The principal is adjusted to the Consumer Price Index, the commonly used measure of inflation. The coupon rate is constant but generates a different amount of interest when multiplied by the inflation-adjusted principal. |

| v | Net Asset Value (“NAV”) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| vi | Market price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The market price may differ from the Fund’s NAV. |

| vii | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended December 31, 2021, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 312 funds for the six-month period and among the 311 funds for the twelve-month period in the Fund’s Lipper category. |

|

6 |

Western Asset Total Return ETF 2021 Annual Report |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of December 31, 2021 and December 31, 2020 and does not include derivatives, such as written options, futures contracts, forward foreign currency contracts and swap contracts. The composition of the Fund’s investments is subject to change at any time. |

| * | Represents less than 0.1% |

| Western Asset Total Return ETF 2021 Annual Report |

7 |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on July 1, 2021 and held for the six months ended December 31, 2021.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

|

Based on actual total return1

|

Based on hypothetical total return1

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| -1.50% | $ | 1,000.00 | $ | 985.00 | 0.45 | % | $ | 2.25 | 5.00 | % | $1,000.00 | $ | 1,022.94 | 0.45 | % | $ | 2.29 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended December 31, 2021. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

|

8 |

Western Asset Total Return ETF 2021 Annual Report |

| Net Asset Value | ||||

| Average annual total returns1 | ||||

| Twelve Months Ended 12/31/21 | -2.98 | % | ||

| Inception* through 12/31/21 | 6.42 | |||

| Cumulative total returns1 | ||||

| Inception date of 10/3/18 through 12/31/21 | 22.37 | % | ||

| Market Price | ||||

| Average annual total returns2 | ||||

| Twelve Months Ended 12/31/21 | -2.90 | % | ||

| Inception* through 12/31/21 | 6.48 | |||

| Cumulative total returns2 | ||||

| Inception date of 10/3/18 through 12/31/21 | 22.61 | % | ||

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and effective July 1, 2020, market price returns typically are based upon the official closing price of the Fund’s shares. Prior to July 1, 2020, market price returns generally were based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV was determined, which was typically 4:00 p.m. Eastern time (U.S.). Market price performance reported for periods prior to July 1, 2020 continue to reflect market prices calculated based upon the mid-point between the bid and ask on the Fund’s principal trading market typically as of 4:00 p.m. Eastern time (U.S.). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is October 3, 2018. |

| Western Asset Total Return ETF 2021 Annual Report |

9 |

Fund performance (unaudited) (cont’d)

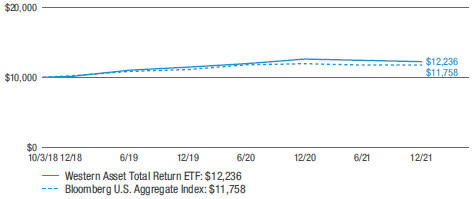

Historical performance

Value of $10,000 invested in

Western Asset Total Return ETF vs Bloomberg U.S. Aggregate Index† — October 3, 2018 — December 31, 2021

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, maybe worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in the Western Asset Total Return ETF on October 3, 2018 (inception date), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through December 31, 2021. The hypothetical illustration also assumes a $10,000 investment in the Bloomberg U.S. Aggregate Index (the “Index”). The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The Index is a broad-based bond index comprised of government, corporate, mortgage and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. The Index is not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

|

10 |

Western Asset Total Return ETF 2021 Annual Report |

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Corporate Bonds & Notes — 36.2% | ||||||||||||||||

| Communication Services — 4.9% | ||||||||||||||||

| Diversified Telecommunication Services — 1.4% |

|

|||||||||||||||

| AT&T Inc., Senior Notes |

2.300 | % | 6/1/27 | 90,000 | $ | 91,562 | ||||||||||

| AT&T Inc., Senior Notes |

1.650 | % | 2/1/28 | 90,000 | 88,094 | |||||||||||

| AT&T Inc., Senior Notes |

2.250 | % | 2/1/32 | 30,000 | 28,990 | |||||||||||

| AT&T Inc., Senior Notes |

2.550 | % | 12/1/33 | 20,000 | 19,561 | |||||||||||

| AT&T Inc., Senior Notes |

5.350 | % | 9/1/40 | 20,000 | 25,337 | |||||||||||

| AT&T Inc., Senior Notes |

5.550 | % | 8/15/41 | 10,000 | 13,111 | |||||||||||

| AT&T Inc., Senior Notes |

3.100 | % | 2/1/43 | 130,000 | 126,378 | |||||||||||

| AT&T Inc., Senior Notes |

4.350 | % | 6/15/45 | 19,000 | 21,416 | |||||||||||

| AT&T Inc., Senior Notes |

3.300 | % | 2/1/52 | 20,000 | 19,586 | |||||||||||

| AT&T Inc., Senior Notes |

3.500 | % | 9/15/53 | 50,000 | 50,445 | |||||||||||

| AT&T Inc., Senior Notes |

3.550 | % | 9/15/55 | 67,000 | 67,243 | |||||||||||

| AT&T Inc., Senior Notes |

3.650 | % | 9/15/59 | 20,000 | 20,198 | |||||||||||

| Verizon Communications Inc., Senior Notes |

3.000 | % | 3/22/27 | 10,000 | 10,567 | |||||||||||

| Verizon Communications Inc., Senior Notes |

2.100 | % | 3/22/28 | 40,000 | 40,076 | |||||||||||

| Verizon Communications Inc., Senior Notes |

3.150 | % | 3/22/30 | 40,000 | 42,318 | |||||||||||

| Verizon Communications Inc., Senior Notes |

1.750 | % | 1/20/31 | 60,000 | 56,787 | |||||||||||

| Verizon Communications Inc., Senior Notes |

2.550 | % | 3/21/31 | 140,000 | 141,248 | |||||||||||

| Verizon Communications Inc., Senior Notes |

2.355 | % | 3/15/32 | 104,000 | 102,473 | (a) | ||||||||||

| Verizon Communications Inc., Senior Notes |

4.500 | % | 8/10/33 | 340,000 | 399,721 | |||||||||||

| Verizon Communications Inc., Senior Notes |

5.250 | % | 3/16/37 | 30,000 | 38,984 | |||||||||||

| Verizon Communications Inc., Senior Notes |

2.650 | % | 11/20/40 | 150,000 | 142,533 | |||||||||||

| Verizon Communications Inc., Senior Notes |

2.875 | % | 11/20/50 | 265,000 | 251,455 | |||||||||||

| Total Diversified Telecommunication Services |

|

1,798,083 | ||||||||||||||

| Interactive Media & Services — 0.4% |

||||||||||||||||

| Alphabet Inc., Senior Notes |

0.450 | % | 8/15/25 | 20,000 | 19,540 | |||||||||||

| Alphabet Inc., Senior Notes |

0.800 | % | 8/15/27 | 30,000 | 29,048 | |||||||||||

| Alphabet Inc., Senior Notes |

1.100 | % | 8/15/30 | 30,000 | 28,358 | |||||||||||

| Tencent Holdings Ltd., Senior Notes |

3.680 | % | 4/22/41 | 400,000 | 415,145 | (a) | ||||||||||

| Total Interactive Media & Services |

492,091 | |||||||||||||||

| Media — 2.0% |

||||||||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes |

5.125 | % | 5/1/27 | 250,000 | 257,500 | (a) | ||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes |

4.500 | % | 8/15/30 | 10,000 | 10,232 | (a) | ||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes |

4.250 | % | 2/1/31 | 98,000 | 98,860 | (a) | ||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

11 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Media — continued |

||||||||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes |

4.500 | % | 5/1/32 | 450,000 | $ | 462,938 | ||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

4.908 | % | 7/23/25 | 270,000 | 297,299 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

5.050 | % | 3/30/29 | 100,000 | 114,480 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

2.800 | % | 4/1/31 | 50,000 | 49,475 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

5.375 | % | 4/1/38 | 80,000 | 95,466 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

3.500 | % | 3/1/42 | 20,000 | 19,398 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

5.750 | % | 4/1/48 | 60,000 | 74,824 | |||||||||||

| Charter Communications Operating LLC/ Charter Communications Operating Capital Corp., Senior Secured Notes |

4.800 | % | 3/1/50 | 20,000 | 22,393 | |||||||||||

| Comcast Corp., Senior Notes |

3.150 | % | 3/1/26 | 20,000 | 21,324 | |||||||||||

| Comcast Corp., Senior Notes |

3.300 | % | 4/1/27 | 50,000 | 53,741 | |||||||||||

| Comcast Corp., Senior Notes |

4.150 | % | 10/15/28 | 45,000 | 51,085 | |||||||||||

| Comcast Corp., Senior Notes |

4.250 | % | 10/15/30 | 190,000 | 219,273 | |||||||||||

| DISH DBS Corp., Senior Notes |

5.875 | % | 11/15/24 | 510,000 | 523,903 | |||||||||||

| DISH DBS Corp., Senior Notes |

5.125 | % | 6/1/29 | 50,000 | 45,500 | |||||||||||

| DISH DBS Corp., Senior Secured Notes |

5.250 | % | 12/1/26 | 20,000 | 20,316 | (a) | ||||||||||

| Total Media |

2,438,007 | |||||||||||||||

| Wireless Telecommunication Services — 1.1% |

|

|||||||||||||||

| CSC Holdings LLC, Senior Notes |

5.375 | % | 2/1/28 | 200,000 | 207,074 | (a) | ||||||||||

| CSC Holdings LLC, Senior Notes |

4.500 | % | 11/15/31 | 200,000 | 197,500 | (a) | ||||||||||

| Sprint Capital Corp., Senior Notes |

8.750 | % | 3/15/32 | 320,000 | 480,000 | |||||||||||

| Sprint Corp., Senior Notes |

7.875 | % | 9/15/23 | 20,000 | 22,025 | |||||||||||

| T-Mobile USA Inc., Senior Notes |

2.250 | % | 2/15/26 | 10,000 | 10,025 | |||||||||||

| T-Mobile USA Inc., Senior Notes |

2.625 | % | 2/15/29 | 40,000 | 39,400 | |||||||||||

| T-Mobile USA Inc., Senior Notes |

2.875 | % | 2/15/31 | 30,000 | 29,628 | |||||||||||

| T-Mobile USA Inc., Senior Notes |

3.500 | % | 4/15/31 | 40,000 | 41,615 | |||||||||||

See Notes to Financial Statements.

|

12 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Wireless Telecommunication Services — continued |

|

|||||||||||||||

| T-Mobile USA Inc., Senior Notes |

3.500 | % | 4/15/31 | 40,000 | $ | 41,615 | (a) | |||||||||

| T-Mobile USA Inc., Senior Secured Notes |

3.500 | % | 4/15/25 | 210,000 | 222,490 | |||||||||||

| T-Mobile USA Inc., Senior Secured Notes |

3.750 | % | 4/15/27 | 10,000 | 10,829 | |||||||||||

| T-Mobile USA Inc., Senior Secured Notes |

2.550 | % | 2/15/31 | 40,000 | 39,799 | |||||||||||

| Vodafone Group PLC, Senior Notes |

4.375 | % | 5/30/28 | 80,000 | 90,015 | |||||||||||

| Total Wireless Telecommunication Services |

|

1,432,015 | ||||||||||||||

| Total Communication Services |

6,160,196 | |||||||||||||||

| Consumer Discretionary — 3.3% | ||||||||||||||||

| Automobiles — 1.1% |

||||||||||||||||

| Ford Motor Credit Co. LLC, Senior Notes |

3.375 | % | 11/13/25 | 500,000 | 519,460 | |||||||||||

| Ford Motor Credit Co. LLC, Senior Notes |

4.000 | % | 11/13/30 | 200,000 | 215,160 | |||||||||||

| General Motors Co., Senior Notes |

5.400 | % | 10/2/23 | 20,000 | 21,407 | |||||||||||

| General Motors Co., Senior Notes |

6.125 | % | 10/1/25 | 130,000 | 149,335 | |||||||||||

| General Motors Co., Senior Notes |

5.950 | % | 4/1/49 | 10,000 | 13,688 | |||||||||||

| Nissan Motor Co. Ltd., Senior Notes |

3.522 | % | 9/17/25 | 200,000 | 209,636 | (a) | ||||||||||

| Nissan Motor Co. Ltd., Senior Notes |

4.345 | % | 9/17/27 | 240,000 | 259,091 | (a) | ||||||||||

| Total Automobiles |

1,387,777 | |||||||||||||||

| Hotels, Restaurants & Leisure — 1.0% |

||||||||||||||||

| Las Vegas Sands Corp., Senior Notes |

2.900 | % | 6/25/25 | 160,000 | 159,561 | |||||||||||

| McDonald’s Corp., Senior Notes |

3.700 | % | 1/30/26 | 10,000 | 10,759 | |||||||||||

| McDonald’s Corp., Senior Notes |

3.500 | % | 3/1/27 | 10,000 | 10,801 | |||||||||||

| McDonald’s Corp., Senior Notes |

3.800 | % | 4/1/28 | 50,000 | 54,934 | |||||||||||

| McDonald’s Corp., Senior Notes |

4.450 | % | 9/1/48 | 230,000 | 283,194 | |||||||||||

| NCL Corp. Ltd., Senior Notes |

5.875 | % | 3/15/26 | 250,000 | 248,892 | (a) | ||||||||||

| Sands China Ltd., Senior Notes |

5.125 | % | 8/8/25 | 200,000 | 209,812 | |||||||||||

| Sands China Ltd., Senior Notes |

2.300 | % | 3/8/27 | 200,000 | 188,260 | (a) | ||||||||||

| VOC Escrow Ltd., Senior Secured Notes |

5.000 | % | 2/15/28 | 40,000 | 39,600 | (a) | ||||||||||

| Total Hotels, Restaurants & Leisure |

1,205,813 | |||||||||||||||

| Household Durables — 0.1% |

||||||||||||||||

| Lennar Corp., Senior Notes |

4.500 | % | 4/30/24 | 40,000 | 42,487 | |||||||||||

| MDC Holdings Inc., Senior Notes |

6.000 | % | 1/15/43 | 10,000 | 12,651 | |||||||||||

| Total Household Durables |

55,138 | |||||||||||||||

| Internet & Direct Marketing Retail — 1.0% |

||||||||||||||||

| Amazon.com Inc., Senior Notes |

1.500 | % | 6/3/30 | 10,000 | 9,691 | |||||||||||

| Amazon.com Inc., Senior Notes |

2.100 | % | 5/12/31 | 20,000 | 20,272 | |||||||||||

| Amazon.com Inc., Senior Notes |

3.875 | % | 8/22/37 | 470,000 | 552,407 | |||||||||||

| Amazon.com Inc., Senior Notes |

4.050 | % | 8/22/47 | 90,000 | 109,120 | |||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

13 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Internet & Direct Marketing Retail — continued |

|

|||||||||||||||

| Prosus NV, Senior Notes |

3.061 | % | 7/13/31 | 200,000 | $ | 194,956 | (a) | |||||||||

| Prosus NV, Senior Notes |

3.832 | % | 2/8/51 | 400,000 | 373,063 | (a) | ||||||||||

| Total Internet & Direct Marketing Retail |

1,259,509 | |||||||||||||||

| Multiline Retail — 0.0%†† |

||||||||||||||||

| Target Corp., Senior Notes |

2.250 | % | 4/15/25 | 50,000 | 51,527 | |||||||||||

| Specialty Retail — 0.1% |

||||||||||||||||

| Home Depot Inc., Senior Notes |

2.700 | % | 4/15/30 | 30,000 | 31,477 | |||||||||||

| Home Depot Inc., Senior Notes |

3.350 | % | 4/15/50 | 90,000 | 98,151 | |||||||||||

| Total Specialty Retail |

129,628 | |||||||||||||||

| Textiles, Apparel & Luxury Goods — 0.0%†† |

||||||||||||||||

| NIKE Inc., Senior Notes |

2.750 | % | 3/27/27 | 50,000 | 52,970 | |||||||||||

| Total Consumer Discretionary |

4,142,362 | |||||||||||||||

| Consumer Staples — 1.9% | ||||||||||||||||

| Beverages — 0.5% |

||||||||||||||||

| Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide Inc., Senior Notes |

3.650 | % | 2/1/26 | 90,000 | 96,629 | |||||||||||

| Anheuser-Busch InBev Worldwide Inc., Senior Notes |

4.000 | % | 4/13/28 | 40,000 | 44,492 | |||||||||||

| Anheuser-Busch InBev Worldwide Inc., Senior Notes |

4.750 | % | 1/23/29 | 10,000 | 11,639 | |||||||||||

| Anheuser-Busch InBev Worldwide Inc., Senior Notes |

3.500 | % | 6/1/30 | 20,000 | 21,921 | |||||||||||

| Anheuser-Busch InBev Worldwide Inc., Senior Notes |

4.439 | % | 10/6/48 | 30,000 | 35,857 | |||||||||||

| Anheuser-Busch InBev Worldwide Inc., Senior Notes |

4.500 | % | 6/1/50 | 80,000 | 98,626 | |||||||||||

| Coca-Cola Co., Senior Notes |

3.375 | % | 3/25/27 | 30,000 | 32,405 | |||||||||||

| Coca-Cola Co., Senior Notes |

1.450 | % | 6/1/27 | 50,000 | 49,707 | |||||||||||

| Diageo Investment Corp., Senior Notes |

2.875 | % | 5/11/22 | 50,000 | 50,425 | |||||||||||

| PepsiCo Inc., Senior Notes |

2.250 | % | 3/19/25 | 10,000 | 10,333 | |||||||||||

| PepsiCo Inc., Senior Notes |

2.625 | % | 3/19/27 | 60,000 | 62,823 | |||||||||||

| PepsiCo Inc., Senior Notes |

1.625 | % | 5/1/30 | 40,000 | 38,790 | |||||||||||

| Total Beverages |

553,647 | |||||||||||||||

| Food & Staples Retailing — 0.0%†† |

||||||||||||||||

| Walmart Inc., Senior Notes |

1.500 | % | 9/22/28 | 20,000 | 19,876 | |||||||||||

| Walmart Inc., Senior Notes |

1.800 | % | 9/22/31 | 10,000 | 9,900 | |||||||||||

| Total Food & Staples Retailing |

29,776 | |||||||||||||||

| Food Products — 0.7% |

||||||||||||||||

| Hershey Co., Senior Notes |

0.900 | % | 6/1/25 | 10,000 | 9,868 | |||||||||||

See Notes to Financial Statements.

|

14 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Food Products — continued |

||||||||||||||||

| Kraft Heinz Foods Co., Senior Notes |

4.250 | % | 3/1/31 | 10,000 | $ | 11,371 | ||||||||||

| Kraft Heinz Foods Co., Senior Notes |

5.000 | % | 6/4/42 | 20,000 | 24,879 | |||||||||||

| Kraft Heinz Foods Co., Senior Notes |

5.200 | % | 7/15/45 | 260,000 | 330,583 | |||||||||||

| Kraft Heinz Foods Co., Senior Notes |

4.375 | % | 6/1/46 | 50,000 | 58,550 | |||||||||||

| Kraft Heinz Foods Co., Senior Notes |

4.875 | % | 10/1/49 | 30,000 | 37,678 | |||||||||||

| Kraft Heinz Foods Co., Senior Notes |

5.500 | % | 6/1/50 | 190,000 | 257,238 | |||||||||||

| Mars Inc., Senior Notes |

2.700 | % | 4/1/25 | 20,000 | 20,797 | (a) | ||||||||||

| Mars Inc., Senior Notes |

3.200 | % | 4/1/30 | 70,000 | 75,381 | (a) | ||||||||||

| Mars Inc., Senior Notes |

3.200 | % | 4/1/30 | 10,000 | 10,769 | (b) | ||||||||||

| Mondelez International Inc., Senior Notes |

1.500 | % | 5/4/25 | 90,000 | 90,083 | |||||||||||

| Total Food Products |

927,197 | |||||||||||||||

| Household Products — 0.0%†† |

||||||||||||||||

| Procter & Gamble Co., Senior Notes |

2.800 | % | 3/25/27 | 10,000 | 10,575 | |||||||||||

| Procter & Gamble Co., Senior Notes |

3.000 | % | 3/25/30 | 30,000 | 32,606 | |||||||||||

| Total Household Products |

43,181 | |||||||||||||||

| Tobacco — 0.7% |

||||||||||||||||

| Altria Group Inc., Senior Notes |

2.350 | % | 5/6/25 | 10,000 | 10,235 | |||||||||||

| Altria Group Inc., Senior Notes |

5.375 | % | 1/31/44 | 10,000 | 11,542 | |||||||||||

| Altria Group Inc., Senior Notes |

3.875 | % | 9/16/46 | 30,000 | 29,017 | |||||||||||

| Altria Group Inc., Senior Notes |

5.950 | % | 2/14/49 | 250,000 | 311,983 | |||||||||||

| Altria Group Inc., Senior Notes |

6.200 | % | 2/14/59 | 4,000 | 5,214 | |||||||||||

| BAT Capital Corp., Senior Notes |

3.557 | % | 8/15/27 | 70,000 | 73,416 | |||||||||||

| BAT Capital Corp., Senior Notes |

3.734 | % | 9/25/40 | 80,000 | 76,843 | |||||||||||

| BAT Capital Corp., Senior Notes |

4.540 | % | 8/15/47 | 80,000 | 83,666 | |||||||||||

| Cargill Inc., Senior Notes |

1.375 | % | 7/23/23 | 40,000 | 40,313 | (a) | ||||||||||

| Philip Morris International Inc., Senior Notes |

2.500 | % | 11/2/22 | 140,000 | 141,996 | |||||||||||

| Philip Morris International Inc., Senior Notes |

1.125 | % | 5/1/23 | 30,000 | 30,130 | |||||||||||

| Philip Morris International Inc., Senior Notes |

2.100 | % | 5/1/30 | 30,000 | 29,356 | |||||||||||

| Total Tobacco |

843,711 | |||||||||||||||

| Total Consumer Staples |

2,397,512 | |||||||||||||||

| Energy — 5.6% | ||||||||||||||||

| Energy Equipment & Services — 0.0%†† |

||||||||||||||||

| Halliburton Co., Senior Notes |

3.800 | % | 11/15/25 | 2,000 | 2,150 | |||||||||||

| Oil, Gas & Consumable Fuels — 5.6% |

||||||||||||||||

| BP Capital Markets America Inc., Senior Notes |

3.790 | % | 2/6/24 | 10,000 | 10,527 | |||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

15 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Oil, Gas & Consumable Fuels — continued |

||||||||||||||||

| BP Capital Markets America Inc., Senior Notes |

3.410 | % | 2/11/26 | 20,000 | $ | 21,333 | ||||||||||

| BP Capital Markets America Inc., Senior Notes |

3.937 | % | 9/21/28 | 100,000 | 110,661 | |||||||||||

| BP Capital Markets America Inc., Senior Notes |

3.633 | % | 4/6/30 | 80,000 | 88,266 | |||||||||||

| BP Capital Markets PLC, Senior Notes |

3.506 | % | 3/17/25 | 20,000 | 21,299 | |||||||||||

| Cameron LNG LLC, Senior Secured Notes |

2.902 | % | 7/15/31 | 100,000 | 104,113 | (a) | ||||||||||

| Cameron LNG LLC, Senior Secured Notes |

3.302 | % | 1/15/35 | 60,000 | 62,628 | (a) | ||||||||||

| Cheniere Energy Inc., Senior Secured Notes |

4.625 | % | 10/15/28 | 30,000 | 31,912 | |||||||||||

| Cheniere Energy Partners LP, Senior Notes |

4.000 | % | 3/1/31 | 10,000 | 10,489 | |||||||||||

| Cheniere Energy Partners LP, Senior Notes |

3.250 | % | 1/31/32 | 10,000 | 10,100 | (a) | ||||||||||

| Chevron Corp., Senior Notes |

1.554 | % | 5/11/25 | 50,000 | 50,424 | |||||||||||

| Chevron Corp., Senior Notes |

1.995 | % | 5/11/27 | 10,000 | 10,150 | |||||||||||

| Chevron Corp., Senior Notes |

2.236 | % | 5/11/30 | 60,000 | 60,687 | |||||||||||

| ConocoPhillips, Senior Notes |

3.750 | % | 10/1/27 | 20,000 | 21,924 | (a) | ||||||||||

| ConocoPhillips, Senior Notes |

4.300 | % | 8/15/28 | 120,000 | 135,311 | (a) | ||||||||||

| Continental Resources Inc., Senior Notes |

4.500 | % | 4/15/23 | 20,000 | 20,609 | |||||||||||

| Continental Resources Inc., Senior Notes |

2.268 | % | 11/15/26 | 20,000 | 19,850 | (a) | ||||||||||

| Continental Resources Inc., Senior Notes |

4.375 | % | 1/15/28 | 50,000 | 54,052 | |||||||||||

| Continental Resources Inc., Senior Notes |

5.750 | % | 1/15/31 | 50,000 | 58,881 | (a) | ||||||||||

| Continental Resources Inc., Senior Notes |

4.900 | % | 6/1/44 | 30,000 | 33,247 | |||||||||||

| Coterra Energy Inc., Senior Notes |

3.900 | % | 5/15/27 | 110,000 | 118,209 | (a) | ||||||||||

| Coterra Energy Inc., Senior Notes |

4.375 | % | 3/15/29 | 140,000 | 156,434 | (a) | ||||||||||

| Devon Energy Corp., Senior Notes |

5.850 | % | 12/15/25 | 90,000 | 102,904 | |||||||||||

| Devon Energy Corp., Senior Notes |

5.000 | % | 6/15/45 | 330,000 | 398,878 | |||||||||||

| Diamondback Energy Inc., Senior Notes |

2.875 | % | 12/1/24 | 70,000 | 72,619 | |||||||||||

| Diamondback Energy Inc., Senior Notes |

3.250 | % | 12/1/26 | 30,000 | 31,639 | |||||||||||

| Diamondback Energy Inc., Senior Notes |

3.500 | % | 12/1/29 | 10,000 | 10,604 | |||||||||||

| Ecopetrol SA, Senior Notes |

5.875 | % | 5/28/45 | 190,000 | 181,689 | |||||||||||

| Energy Transfer LP, Junior Subordinated Notes (6.750% to 5/15/25 then 5 year Treasury Constant Maturity Rate + 5.134%) |

6.750 | % | 5/15/25 | 50,000 | 50,000 | (c)(d) | ||||||||||

| Energy Transfer LP, Senior Notes |

2.900 | % | 5/15/25 | 70,000 | 72,312 | |||||||||||

| Energy Transfer LP, Senior Notes |

4.950 | % | 6/15/28 | 10,000 | 11,249 | |||||||||||

| Energy Transfer LP, Senior Notes |

5.250 | % | 4/15/29 | 10,000 | 11,454 | |||||||||||

| Energy Transfer LP, Senior Notes |

3.750 | % | 5/15/30 | 100,000 | 105,966 | |||||||||||

| Energy Transfer LP, Senior Notes |

6.250 | % | 4/15/49 | 60,000 | 78,376 | |||||||||||

| Energy Transfer LP, Senior Notes |

5.000 | % | 5/15/50 | 80,000 | 92,056 | |||||||||||

See Notes to Financial Statements.

|

16 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Oil, Gas & Consumable Fuels — continued |

||||||||||||||||

| Enterprise Products Operating LLC, Senior Notes |

4.150 | % | 10/16/28 | 70,000 | $ | 78,580 | ||||||||||

| Enterprise Products Operating LLC, Senior Notes |

2.800 | % | 1/31/30 | 80,000 | 83,411 | |||||||||||

| Enterprise Products Operating LLC, Senior Notes |

3.700 | % | 1/31/51 | 200,000 | 209,827 | |||||||||||

| EOG Resources Inc., Senior Notes |

4.375 | % | 4/15/30 | 100,000 | 115,557 | |||||||||||

| EOG Resources Inc., Senior Notes |

3.900 | % | 4/1/35 | 70,000 | 79,345 | |||||||||||

| EOG Resources Inc., Senior Notes |

4.950 | % | 4/15/50 | 10,000 | 13,585 | |||||||||||

| EQM Midstream Partners LP, Senior Notes |

6.000 | % | 7/1/25 | 130,000 | 141,375 | (a) | ||||||||||

| EQT Corp., Senior Notes |

3.000 | % | 10/1/22 | 60,000 | 60,600 | |||||||||||

| EQT Corp., Senior Notes |

3.900 | % | 10/1/27 | 285,000 | 305,668 | |||||||||||

| EQT Corp., Senior Notes |

5.000 | % | 1/15/29 | 20,000 | 22,150 | |||||||||||

| EQT Corp., Senior Notes |

3.625 | % | 5/15/31 | 40,000 | 41,500 | (a) | ||||||||||

| Exxon Mobil Corp., Senior Notes |

2.992 | % | 3/19/25 | 50,000 | 52,546 | |||||||||||

| Exxon Mobil Corp., Senior Notes |

3.482 | % | 3/19/30 | 40,000 | 43,798 | |||||||||||

| Exxon Mobil Corp., Senior Notes |

3.452 | % | 4/15/51 | 140,000 | 151,658 | |||||||||||

| Kinder Morgan Inc., Senior Notes |

4.300 | % | 3/1/28 | 110,000 | 122,232 | |||||||||||

| Kinder Morgan Inc., Senior Notes |

5.550 | % | 6/1/45 | 20,000 | 25,286 | |||||||||||

| Kinder Morgan Inc., Senior Notes |

5.050 | % | 2/15/46 | 20,000 | 23,971 | |||||||||||

| Kinder Morgan Inc., Senior Notes |

5.200 | % | 3/1/48 | 50,000 | 61,757 | |||||||||||

| MPLX LP, Senior Notes |

4.875 | % | 6/1/25 | 90,000 | 98,483 | |||||||||||

| MPLX LP, Senior Notes |

4.800 | % | 2/15/29 | 60,000 | 68,509 | |||||||||||

| MPLX LP, Senior Notes |

2.650 | % | 8/15/30 | 150,000 | 149,315 | |||||||||||

| MPLX LP, Senior Notes |

4.500 | % | 4/15/38 | 100,000 | 111,985 | |||||||||||

| MPLX LP, Senior Notes |

5.500 | % | 2/15/49 | 10,000 | 12,770 | |||||||||||

| Occidental Petroleum Corp., Senior Notes |

3.500 | % | 8/15/29 | 80,000 | 82,184 | |||||||||||

| Occidental Petroleum Corp., Senior Notes |

6.600 | % | 3/15/46 | 110,000 | 142,725 | |||||||||||

| Occidental Petroleum Corp., Senior Notes |

4.200 | % | 3/15/48 | 60,000 | 60,000 | |||||||||||

| Occidental Petroleum Corp., Senior Notes |

4.400 | % | 8/15/49 | 100,000 | 101,250 | |||||||||||

| Parsley Energy LLC/Parsley Finance Corp., Senior Notes |

4.125 | % | 2/15/28 | 10,000 | 10,062 | (a) | ||||||||||

| Petrobras Global Finance BV, Senior Notes |

5.750 | % | 2/1/29 | 610,000 | 656,512 | |||||||||||

| Pioneer Natural Resources Co., Senior Notes |

1.125 | % | 1/15/26 | 10,000 | 9,710 | |||||||||||

| Pioneer Natural Resources Co., Senior Notes |

2.150 | % | 1/15/31 | 60,000 | 57,889 | |||||||||||

| Qatar Energy, Senior Notes |

3.300 | % | 7/12/51 | 200,000 | 205,874 | (a) | ||||||||||

| Range Resources Corp., Senior Notes |

4.875 | % | 5/15/25 | 70,000 | 72,275 | |||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

17 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Oil, Gas & Consumable Fuels — continued |

||||||||||||||||

| Shell International Finance BV, Senior Notes |

4.375 | % | 5/11/45 | 50,000 | $ | 60,748 | ||||||||||

| Shell International Finance BV, Senior Notes |

4.000 | % | 5/10/46 | 30,000 | 34,886 | |||||||||||

| Shell International Finance BV, Senior Notes |

3.250 | % | 4/6/50 | 20,000 | 21,279 | |||||||||||

| Southwestern Energy Co., Senior Notes |

5.375 | % | 3/15/30 | 10,000 | 10,715 | |||||||||||

| Southwestern Energy Co., Senior Notes |

4.750 | % | 2/1/32 | 10,000 | 10,531 | |||||||||||

| Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes |

5.000 | % | 1/15/28 | 10,000 | 10,537 | |||||||||||

| Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes |

6.875 | % | 1/15/29 | 20,000 | 22,376 | |||||||||||

| Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes |

4.875 | % | 2/1/31 | 40,000 | 43,438 | |||||||||||

| Transcontinental Gas Pipe Line Co. LLC, Senior Notes |

7.850 | % | 2/1/26 | 140,000 | 170,889 | |||||||||||

| Transcontinental Gas Pipe Line Co. LLC, Senior Notes |

3.250 | % | 5/15/30 | 100,000 | 105,401 | |||||||||||

| Western Midstream Operating LP, Senior Notes |

4.350 | % | 2/1/25 | 40,000 | 41,801 | |||||||||||

| Western Midstream Operating LP, Senior Notes |

4.500 | % | 3/1/28 | 10,000 | 10,875 | |||||||||||

| Western Midstream Operating LP, Senior Notes |

5.300 | % | 2/1/30 | 120,000 | 131,885 | |||||||||||

| Western Midstream Operating LP, Senior Notes |

5.500 | % | 8/15/48 | 80,000 | 95,562 | |||||||||||

| Western Midstream Operating LP, Senior Notes |

6.500 | % | 2/1/50 | 120,000 | 141,901 | |||||||||||

| Western Midstream Operating LP, Senior Notes (3 mo. USD LIBOR + 1.850%) |

1.972 | % | 1/13/23 | 10,000 | 9,985 | (d) | ||||||||||

| Williams Cos. Inc., Senior Notes |

7.750 | % | 6/15/31 | 80,000 | 108,277 | |||||||||||

| Williams Cos. Inc., Senior Notes |

8.750 | % | 3/15/32 | 40,000 | 59,232 | |||||||||||

| Total Oil, Gas & Consumable Fuels |

6,993,559 | |||||||||||||||

| Total Energy |

6,995,709 | |||||||||||||||

| Financials — 10.4% | ||||||||||||||||

| Banks — 7.1% |

||||||||||||||||

| Banco Santander SA, Senior Notes |

3.848 | % | 4/12/23 | 200,000 | 206,869 | |||||||||||

See Notes to Financial Statements.

|

18 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Banks — continued |

||||||||||||||||

| Bank of America Corp., Senior Notes |

5.000 | % | 1/21/44 | 100,000 | $ | 131,317 | ||||||||||

| Bank of America Corp., Senior Notes (2.572% to 10/20/31 then SOFR + 1.210%) |

2.572 | % | 10/20/32 | 160,000 | 160,769 | (d) | ||||||||||

| Bank of America Corp., Senior Notes (2.687% to 4/22/31 then SOFR + 1.320%) |

2.687 | % | 4/22/32 | 690,000 | 700,230 | (d) | ||||||||||

| Bank of America Corp., Senior Notes (3.004% to 12/20/22 then 3 mo. USD LIBOR + 0.790%) |

3.004 | % | 12/20/23 | 50,000 | 51,033 | (d) | ||||||||||

| Bank of America Corp., Senior Notes (3.970% to 3/5/28 then 3 mo. USD LIBOR + 1.070%) |

3.970 | % | 3/5/29 | 200,000 | 218,845 | (d) | ||||||||||

| Bank of America Corp., Senior Notes (4.330% to 3/15/49 then 3 mo. USD LIBOR + 1.520%) |

4.330 | % | 3/15/50 | 70,000 | 86,598 | (d) | ||||||||||

| Bank of America Corp., Subordinated Notes |

4.200 | % | 8/26/24 | 200,000 | 214,372 | |||||||||||

| Bank of Montreal, Senior Notes |

1.850 | % | 5/1/25 | 90,000 | 91,329 | |||||||||||

| Bank of Nova Scotia, Senior Notes |

1.300 | % | 6/11/25 | 50,000 | 49,710 | |||||||||||

| Barclays Bank PLC, Senior Notes |

1.700 | % | 5/12/22 | 200,000 | 200,680 | |||||||||||

| BNP Paribas SA, Senior Notes (2.219% to 6/9/25 then SOFR + 2.074%) |

2.219 | % | 6/9/26 | 200,000 | 201,860 | (a)(d) | ||||||||||

| BNP Paribas SA, Senior Notes (5.198% to 1/10/29 then 3 mo. USD LIBOR + 2.567%) |

5.198 | % | 1/10/30 | 200,000 | 232,687 | (a)(d) | ||||||||||

| Canadian Imperial Bank of Commerce, Senior Notes |

0.950 | % | 6/23/23 | 50,000 | 50,061 | |||||||||||

| Citigroup Inc., Senior Notes |

8.125 | % | 7/15/39 | 240,000 | 405,771 | |||||||||||

| Citigroup Inc., Senior Notes (1.678% to 5/15/23 then SOFR + 1.667%) |

1.678 | % | 5/15/24 | 50,000 | 50,554 | (d) | ||||||||||

| Citigroup Inc., Senior Notes (2.520% to 11/3/31 then SOFR + 1.177%) |

2.520 | % | 11/3/32 | 430,000 | 429,491 | (d) | ||||||||||

| Citigroup Inc., Senior Notes (3.106% to 4/8/25 then SOFR + 2.842%) |

3.106 | % | 4/8/26 | 130,000 | 136,283 | (d) | ||||||||||

| Citigroup Inc., Senior Notes (3.980% to 3/20/29 then 3 mo. USD LIBOR + 1.338%) |

3.980 | % | 3/20/30 | 60,000 | 66,233 | (d) | ||||||||||

| Citigroup Inc., Senior Notes (4.412% to 3/31/30 then SOFR + 3.914%) |

4.412 | % | 3/31/31 | 60,000 | 68,524 | (d) | ||||||||||

| Citigroup Inc., Subordinated Notes |

4.400 | % | 6/10/25 | 150,000 | 163,354 | |||||||||||

| Citigroup Inc., Subordinated Notes |

5.500 | % | 9/13/25 | 150,000 | 169,639 | |||||||||||

| Cooperatieve Rabobank UA, Senior Notes (1.339% to 6/24/25 then 1 year Treasury Constant Maturity Rate + 1.000%) |

1.339 | % | 6/24/26 | 250,000 | 246,407 | (a)(d) | ||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

19 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Banks — continued |

||||||||||||||||

| Credit Agricole SA, Senior Notes (1.907% to 6/16/25 then SOFR + 1.676%) |

1.907 | % | 6/16/26 | 250,000 | $ | 250,480 | (a)(d) | |||||||||

| Fifth Third Bancorp, Senior Notes |

3.650 | % | 1/25/24 | 10,000 | 10,476 | |||||||||||

| HSBC Holdings PLC, Senior Notes (2.099% to 6/4/25 then SOFR + 1.929%) |

2.099 | % | 6/4/26 | 200,000 | 201,296 | (d) | ||||||||||

| Intesa Sanpaolo SpA, Senior Notes |

3.125 | % | 7/14/22 | 200,000 | 202,277 | (a) | ||||||||||

| Intesa Sanpaolo SpA, Senior Notes |

3.375 | % | 1/12/23 | 200,000 | 204,349 | (a) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (2.083% to 4/22/25 then SOFR + 1.850%) |

2.083 | % | 4/22/26 | 90,000 | 91,347 | (d) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (2.545% to 11/8/31 then SOFR + 1.180%) |

2.545 | % | 11/8/32 | 80,000 | 80,450 | (d) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (2.580% to 4/22/31 then SOFR + 1.250%) |

2.580 | % | 4/22/32 | 130,000 | 131,670 | (d) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (2.739% to 10/15/29 then SOFR + 1.510%) |

2.739 | % | 10/15/30 | 200,000 | 205,497 | (d) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (4.023% to 12/5/23 then 3 mo. USD LIBOR + 1.000%) |

4.023 | % | 12/5/24 | 90,000 | 94,893 | (d) | ||||||||||

| JPMorgan Chase & Co., Senior Notes (4.452% to 12/5/28 then 3 mo. USD LIBOR + 1.330%) |

4.452 | % | 12/5/29 | 100,000 | 113,489 | (d) | ||||||||||

| JPMorgan Chase & Co., Subordinated Notes |

4.950 | % | 6/1/45 | 110,000 | 143,145 | |||||||||||

| Lloyds Banking Group PLC, Senior Notes |

3.900 | % | 3/12/24 | 200,000 | 211,262 | |||||||||||

| Lloyds Banking Group PLC, Senior Notes |

4.375 | % | 3/22/28 | 200,000 | 224,368 | |||||||||||

| Royal Bank of Canada, Senior Notes |

1.600 | % | 4/17/23 | 80,000 | 80,898 | |||||||||||

| Royal Bank of Canada, Senior Notes |

1.150 | % | 6/10/25 | 50,000 | 49,568 | |||||||||||

| Swedbank AB, Senior Notes |

1.300 | % | 6/2/23 | 200,000 | 201,185 | (a) | ||||||||||

| Toronto-Dominion Bank, Senior Notes |

0.750 | % | 6/12/23 | 100,000 | 100,005 | |||||||||||

| Toronto-Dominion Bank, Senior Notes |

1.150 | % | 6/12/25 | 40,000 | 39,663 | |||||||||||

| US Bancorp, Senior Notes |

1.450 | % | 5/12/25 | 100,000 | 100,412 | |||||||||||

| Wells Fargo & Co., Senior Notes |

3.750 | % | 1/24/24 | 20,000 | 20,999 | |||||||||||

| Wells Fargo & Co., Senior Notes |

3.000 | % | 10/23/26 | 100,000 | 105,059 | |||||||||||

| Wells Fargo & Co., Senior Notes |

4.150 | % | 1/24/29 | 50,000 | 55,970 | |||||||||||

| Wells Fargo & Co., Senior Notes (1.654% to 6/2/23 then SOFR + 1.600%) |

1.654 | % | 6/2/24 | 100,000 | 100,846 | (d) | ||||||||||

| Wells Fargo & Co., Senior Notes (2.188% to 4/30/25 then SOFR + 2.000%) |

2.188 | % | 4/30/26 | 90,000 | 91,590 | (d) | ||||||||||

| Wells Fargo & Co., Senior Notes (2.879% to 10/30/29 then SOFR + 1.432%) |

2.879 | % | 10/30/30 | 310,000 | 322,272 | (d) | ||||||||||

See Notes to Financial Statements.

|

20 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Banks — continued |

||||||||||||||||

| Wells Fargo & Co., Senior Notes (3.584% to 5/22/27 then 3 mo. USD LIBOR + 1.310%) |

3.584 | % | 5/22/28 | 100,000 | $ | 107,502 | (d) | |||||||||

| Wells Fargo & Co., Senior Notes (5.013% to 4/4/50 then SOFR + 4.502%) |

5.013 | % | 4/4/51 | 450,000 | 614,490 | (d) | ||||||||||

| Wells Fargo & Co., Subordinated Notes |

4.750 | % | 12/7/46 | 270,000 | 336,974 | |||||||||||

| Total Banks |

8,825,048 | |||||||||||||||

| Capital Markets — 2.3% |

||||||||||||||||

| Bank of New York Mellon Corp., Senior Notes |

1.600 | % | 4/24/25 | 30,000 | 30,276 | |||||||||||

| Credit Suisse AG, Senior Notes |

2.950 | % | 4/9/25 | 250,000 | 261,683 | |||||||||||

| Credit Suisse Group AG, Senior Notes (2.193% to 6/5/25 then SOFR + 2.044%) |

2.193 | % | 6/5/26 | 250,000 | 251,397 | (a)(d) | ||||||||||

| Goldman Sachs Group Inc., Senior Notes |

3.200 | % | 2/23/23 | 10,000 | 10,256 | |||||||||||

| Goldman Sachs Group Inc., Senior Notes |

3.850 | % | 7/8/24 | 80,000 | 84,645 | |||||||||||

| Goldman Sachs Group Inc., Senior Notes |

3.500 | % | 4/1/25 | 190,000 | 200,913 | |||||||||||

| Goldman Sachs Group Inc., Senior Notes |

3.500 | % | 11/16/26 | 50,000 | 53,285 | |||||||||||

| Goldman Sachs Group Inc., Senior Notes (2.650% to 10/21/31 then SOFR + 1.264%) |

2.650 | % | 10/21/32 | 220,000 | 221,377 | (d) | ||||||||||

| Goldman Sachs Group Inc., Senior Notes (4.223% to 5/1/28 then 3 mo. USD LIBOR + 1.301%) |

4.223 | % | 5/1/29 | 90,000 | 99,974 | (d) | ||||||||||

| Goldman Sachs Group Inc., Subordinated Notes |

5.150 | % | 5/22/45 | 310,000 | 403,145 | |||||||||||

| Morgan Stanley, Senior Notes (2.188% to 4/28/25 then SOFR + 1.990%) |

2.188 | % | 4/28/26 | 130,000 | 132,550 | (d) | ||||||||||

| Morgan Stanley, Senior Notes (2.511% to 10/20/31 then SOFR + 1.200%) |

2.511 | % | 10/20/32 | 230,000 | 229,755 | (d) | ||||||||||

| Morgan Stanley, Senior Notes (2.699% to 1/22/30 then SOFR + 1.143%) |

2.699 | % | 1/22/31 | 50,000 | 51,154 | (d) | ||||||||||

| Morgan Stanley, Senior Notes (3.622% to 4/1/30 then SOFR + 3.120%) |

3.622 | % | 4/1/31 | 110,000 | 119,866 | (d) | ||||||||||

| Morgan Stanley, Senior Notes (4.431% to 1/23/29 then 3 mo. USD LIBOR + 1.628%) |

4.431 | % | 1/23/30 | 50,000 | 56,978 | (d) | ||||||||||

| Morgan Stanley, Subordinated Notes (2.484% to 9/16/31 then SOFR + 1.360%) |

2.484 | % | 9/16/36 | 30,000 | 28,889 | (d) | ||||||||||

| UBS AG, Senior Notes |

1.750 | % | 4/21/22 | 200,000 | 200,629 | (a) | ||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

21 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Capital Markets — continued |

||||||||||||||||

| UBS AG, Senior Notes |

4.500 | % | 6/26/48 | 200,000 | $ | 261,057 | (a) | |||||||||

| UBS Group AG, Junior Subordinated Notes (7.000% to 1/31/24 then USD 5 year ICE Swap Rate + 4.344%) |

7.000 | % | 1/31/24 | 200,000 | 215,650 | (a)(c)(d) | ||||||||||

| Total Capital Markets |

2,913,479 | |||||||||||||||

| Diversified Financial Services — 0.8% |

||||||||||||||||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes |

2.450 | % | 10/29/26 | 350,000 | 352,870 | |||||||||||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes |

3.000 | % | 10/29/28 | 150,000 | 152,121 | |||||||||||

| International Lease Finance Corp., Senior Notes |

5.875 | % | 8/15/22 | 150,000 | 154,629 | |||||||||||

| National Securities Clearing Corp., Senior Notes |

1.500 | % | 4/23/25 | 250,000 | 251,500 | (a) | ||||||||||

| Park Aerospace Holdings Ltd., Senior Notes |

5.500 | % | 2/15/24 | 90,000 | 96,509 | (a) | ||||||||||

| Total Diversified Financial Services |

1,007,629 | |||||||||||||||

| Insurance — 0.2% |

||||||||||||||||

| American International Group Inc., Senior Notes |

2.500 | % | 6/30/25 | 30,000 | 30,933 | |||||||||||

| American International Group Inc., Senior Notes |

3.750 | % | 7/10/25 | 50,000 | 53,501 | |||||||||||

| Berkshire Hathaway Finance Corp., Senior Notes |

4.250 | % | 1/15/49 | 70,000 | 85,952 | |||||||||||

| Guardian Life Global Funding, Secured Notes |

1.100 | % | 6/23/25 | 20,000 | 19,809 | (a) | ||||||||||

| New York Life Global Funding, Senior Secured Notes |

0.950 | % | 6/24/25 | 40,000 | 39,413 | (a) | ||||||||||

| Total Insurance |

229,608 | |||||||||||||||

| Total Financials |

12,975,764 | |||||||||||||||

| Health Care — 3.5% | ||||||||||||||||

| Biotechnology — 0.7% |

||||||||||||||||

| AbbVie Inc., Senior Notes |

3.750 | % | 11/14/23 | 10,000 | 10,470 | |||||||||||

| AbbVie Inc., Senior Notes |

2.600 | % | 11/21/24 | 300,000 | 311,290 | |||||||||||

| AbbVie Inc., Senior Notes |

3.200 | % | 11/21/29 | 330,000 | 352,833 | |||||||||||

| AbbVie Inc., Senior Notes |

4.750 | % | 3/15/45 | 60,000 | 74,837 | |||||||||||

| AbbVie Inc., Senior Notes |

4.250 | % | 11/21/49 | 40,000 | 48,087 | |||||||||||

| Gilead Sciences Inc., Senior Notes |

3.650 | % | 3/1/26 | 80,000 | 86,188 | |||||||||||

| Total Biotechnology |

883,705 | |||||||||||||||

| Health Care Equipment & Supplies — 0.3% |

||||||||||||||||

| Abbott Laboratories, Senior Notes |

3.750 | % | 11/30/26 | 130,000 | 143,654 | |||||||||||

See Notes to Financial Statements.

|

22 |

Western Asset Total Return ETF 2021 Annual Report |

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Health Care Equipment & Supplies — continued |

|

|||||||||||||||

| Becton Dickinson and Co., Senior Notes |

3.363 | % | 6/6/24 | 37,000 | $ | 38,737 | ||||||||||

| Roche Holdings Inc., Senior Notes |

2.607 | % | 12/13/51 | 200,000 | 196,401 | (a) | ||||||||||

| Total Health Care Equipment & Supplies |

378,792 | |||||||||||||||

| Health Care Providers & Services — 1.2% |

||||||||||||||||

| Anthem Inc., Senior Notes |

3.650 | % | 12/1/27 | 40,000 | 43,882 | |||||||||||

| Centene Corp., Senior Notes |

4.625 | % | 12/15/29 | 60,000 | 64,708 | |||||||||||

| Centene Corp., Senior Notes |

3.375 | % | 2/15/30 | 20,000 | 20,368 | |||||||||||

| Cigna Corp., Senior Notes |

3.750 | % | 7/15/23 | 4,000 | 4,160 | |||||||||||

| Cigna Corp., Senior Notes |

4.125 | % | 11/15/25 | 30,000 | 32,809 | |||||||||||

| Cigna Corp., Senior Notes |

4.800 | % | 8/15/38 | 160,000 | 196,800 | |||||||||||

| CVS Health Corp., Senior Notes |

3.625 | % | 4/1/27 | 10,000 | 10,851 | |||||||||||

| CVS Health Corp., Senior Notes |

2.125 | % | 9/15/31 | 40,000 | 39,171 | |||||||||||

| CVS Health Corp., Senior Notes |

2.700 | % | 8/21/40 | 100,000 | 96,316 | |||||||||||

| CVS Health Corp., Senior Notes |

5.050 | % | 3/25/48 | 190,000 | 248,413 | |||||||||||

| HCA Inc., Senior Notes |

5.625 | % | 9/1/28 | 40,000 | 46,740 | |||||||||||

| HCA Inc., Senior Notes |

3.500 | % | 9/1/30 | 60,000 | 63,413 | |||||||||||

| Humana Inc., Senior Notes |

4.500 | % | 4/1/25 | 10,000 | 10,898 | |||||||||||

| Humana Inc., Senior Notes |

3.950 | % | 3/15/27 | 20,000 | 21,858 | |||||||||||

| Humana Inc., Senior Notes |

3.125 | % | 8/15/29 | 90,000 | 94,295 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

1.250 | % | 1/15/26 | 10,000 | 9,962 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

3.875 | % | 12/15/28 | 20,000 | 22,415 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

2.875 | % | 8/15/29 | 50,000 | 52,892 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

2.000 | % | 5/15/30 | 140,000 | 138,987 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

5.700 | % | 10/15/40 | 30,000 | 41,772 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

2.900 | % | 5/15/50 | 10,000 | 10,186 | |||||||||||

| UnitedHealth Group Inc., Senior Notes |

3.250 | % | 5/15/51 | 170,000 | 183,911 | |||||||||||

| Total Health Care Providers & Services |

1,454,807 | |||||||||||||||

| Pharmaceuticals — 1.3% |

||||||||||||||||

| Bristol-Myers Squibb Co., Senior Notes |

2.600 | % | 5/16/22 | 20,000 | 20,166 | |||||||||||

| Bristol-Myers Squibb Co., Senior Notes |

3.200 | % | 6/15/26 | 20,000 | 21,507 | |||||||||||

| Bristol-Myers Squibb Co., Senior Notes |

3.400 | % | 7/26/29 | 140,000 | 153,300 | |||||||||||

| Bristol-Myers Squibb Co., Senior Notes |

4.250 | % | 10/26/49 | 40,000 | 49,430 | |||||||||||

| Johnson & Johnson, Senior Notes |

0.550 | % | 9/1/25 | 40,000 | 39,156 | |||||||||||

| Johnson & Johnson, Senior Notes |

0.950 | % | 9/1/27 | 80,000 | 78,242 | |||||||||||

| Johnson & Johnson, Senior Notes |

3.625 | % | 3/3/37 | 30,000 | 34,440 | |||||||||||

| Merck & Co. Inc., Senior Notes |

0.750 | % | 2/24/26 | 100,000 | 98,026 | |||||||||||

| Merck & Co. Inc., Senior Notes |

1.450 | % | 6/24/30 | 30,000 | 28,723 | |||||||||||

| Merck & Co. Inc., Senior Notes |

2.750 | % | 12/10/51 | 60,000 | 59,370 | |||||||||||

| Pfizer Inc., Senior Notes |

0.800 | % | 5/28/25 | 60,000 | 59,282 | |||||||||||

See Notes to Financial Statements.

| Western Asset Total Return ETF 2021 Annual Report |

23 |

Schedule of investments (cont’d)

December 31, 2021

Western Asset Total Return ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Pharmaceuticals — continued |

||||||||||||||||

| Teva Pharmaceutical Finance Co. BV, Senior Notes |

2.950 | % | 12/18/22 | 280,000 | $ | 280,507 | ||||||||||

| Teva Pharmaceutical Finance Netherlands III BV, Senior Notes |

2.800 | % | 7/21/23 | 90,000 | 90,312 | |||||||||||

| Teva Pharmaceutical Finance Netherlands III BV, Senior Notes |

3.150 | % | 10/1/26 | 340,000 | 319,600 | |||||||||||

| Teva Pharmaceutical Finance Netherlands III BV, Senior Notes |

5.125 | % | 5/9/29 | 320,000 | 313,699 | |||||||||||

| Total Pharmaceuticals |

1,645,760 | |||||||||||||||

| Total Health Care |

4,363,064 | |||||||||||||||

| Industrials — 3.4% | ||||||||||||||||

| Aerospace & Defense — 1.2% |

||||||||||||||||

| Boeing Co., Senior Notes |

1.433 | % | 2/4/24 | 220,000 | 219,664 | |||||||||||

| Boeing Co., Senior Notes |

4.875 | % | 5/1/25 | 90,000 | 98,466 | |||||||||||

| Boeing Co., Senior Notes |

2.196 | % | 2/4/26 | 140,000 | 139,967 | |||||||||||

| Boeing Co., Senior Notes |

3.200 | % | 3/1/29 | 110,000 | 113,210 | |||||||||||

| Boeing Co., Senior Notes |

5.150 | % | 5/1/30 | 90,000 | 104,859 | |||||||||||

| Boeing Co., Senior Notes |

3.250 | % | 2/1/35 | 130,000 | 130,994 | |||||||||||

| Boeing Co., Senior Notes |

3.550 | % | 3/1/38 | 10,000 | 10,169 | |||||||||||

| Boeing Co., Senior Notes |

5.705 | % | 5/1/40 | 130,000 | 166,973 | |||||||||||

| Boeing Co., Senior Notes |

5.805 | % | 5/1/50 | 70,000 | 94,789 | |||||||||||

| Boeing Co., Senior Notes |

5.930 | % | 5/1/60 | 20,000 | 27,754 | |||||||||||

| L3Harris Technologies Inc., Senior Notes |

4.854 | % | 4/27/35 | 50,000 | 60,961 | |||||||||||

| Lockheed Martin Corp., Senior Notes |

3.550 | % | 1/15/26 | 50,000 | 54,125 | |||||||||||

| Northrop Grumman Corp., Senior Notes |

3.250 | % | 1/15/28 | 130,000 | 139,128 | |||||||||||

| Raytheon Technologies Corp., Senior Notes |

2.250 | % | 7/1/30 | 170,000 | 169,517 | |||||||||||

| Total Aerospace & Defense |

1,530,576 | |||||||||||||||

| Airlines — 1.3% |

||||||||||||||||

| Delta Air Lines Inc., Senior Notes |

3.625 | % | 3/15/22 | 20,000 | 20,000 | |||||||||||

| Delta Air Lines Inc., Senior Notes |

3.800 | % | 4/19/23 | 30,000 | 30,673 | |||||||||||

| Delta Air Lines Inc., Senior Notes |

2.900 | % | 10/28/24 | 60,000 | 61,178 | |||||||||||

| Delta Air Lines Inc., Senior Notes |

7.375 | % | 1/15/26 | 490,000 | 576,875 | |||||||||||

| Delta Air Lines Inc., Senior Secured Notes |

7.000 | % | 5/1/25 | 370,000 | 423,062 | (a) | ||||||||||

| Delta Air Lines Inc./SkyMiles IP Ltd., Senior Secured Notes |

4.500 | % | 10/20/25 | 90,000 | 94,591 | (a) | ||||||||||

| Delta Air Lines Inc./SkyMiles IP Ltd., Senior Secured Notes |

4.750 | % | 10/20/28 | 70,000 | 76,439 | (a) | ||||||||||