Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: November 30

Date of reporting period: November 30, 2021

Table of Contents

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

Table of Contents

| Annual Report | November 30, 2021 |

CLEARBRIDGE

DIVIDEND STRATEGY

ESG ETF

YLDE

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Table of Contents

Fund objective

The Fund seeks dividend income, growth of dividend income and long-term capital appreciation.

Dear Shareholder,

We are pleased to provide the annual report of ClearBridge Dividend Strategy ESG ETF for the twelve-month reporting period ended November 30, 2021. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Patrick O’Connor

President and Chief Executive Officer - Investment Management President

December 31, 2021

|

II |

ClearBridge Dividend Strategy ESG ETF |

Table of Contents

Q. What is the Fund’s investment strategy?

A. ClearBridge Dividend Strategy ESG ETF (the “Fund”) seeks dividend income, growth of dividend income and long-term capital appreciation.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in dividend-paying stocks or other instruments with similar economic characteristics that offer the potential for income growth and capital appreciation over time and that meet its financial and environmental, social and governance (“ESG”) criteria. The Fund may also invest in companies that ClearBridge Investments, LLC (“ClearBridge”), the Fund’s subadviser, believes are making substantial progress toward becoming a leader in ESG policies.

Determination of a company’s ESG standards is based on ClearBridge’s proprietary research approach. We will exercise judgment to determine ESG best practices based on its twenty-five-year history of managing ESG investment strategies through an established proprietary process. We utilize a fundamental, bottom-up research approach that emphasizes company analysis, management and stock selection.

The ESG evaluation is integrated into a thorough assessment of investment worthiness based on financial criteria as well as ESG considerations including innovative workplace policies, employee benefits and programs; environmental management system strength, eco-efficiency and life-cycle analysis; community involvement, strategic philanthropy and reputation management; and strong corporate governance and independence of the board. The ESG analysis is conducted by the fundamental analyst platform on a sector-specific basis, and a proprietary ESG rating is assigned to each company.

The Fund invests primarily in common stocks. Equity securities in which the Fund may invest also include preferred securities, convertible securities, securities of other investment companies and of real estate investment companies (“REITs”) and warrants and rights. The Fund may invest in equity securities of foreign issuers, either directly or through depositary receipts. The Fund may invest in companies of any size but focuses on large cap companies. We, as portfolio managers, focus on companies that we believe to be of high quality and that:

| • | Pay an attractive dividend |

| • | Have the potential to significantly grow their dividends |

| • | Provide consistent and competitive risk-adjusted returns achieved by capitalizing on the convergence between a company’s investment potential and its ESG attributes. |

We use fundamental analysis to identify companies with strong balance sheets, dominant market positions and reasonable valuations. It is also our intention to engage and encourage management to improve in certain ESG areas identified by ClearBridge through the sector analysts’ lead engagements. We will sell a security if the issuer no longer meets its ClearBridge’s financial or ESG criteria.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

1 |

Table of Contents

Fund overview (cont’d)

Q. What were the overall market conditions during the Fund’s reporting period?

A. Equities delivered robust performance during the twelve-month reporting period ended November 30, 2021, as the approval and subsequent rollout of multiple COVID-19 vaccines combined with accommodative monetary policy and ambitious fiscal spending helped the S&P 500 Indexi to a gain of 27.92%. The market was led by cyclical1 stocks benefiting from the economic recovery, as reopened businesses, greater mobility and a healthy consumer encouraged spending and production, and high-growth technology stocks benefiting from strong secular trends as well as a lingering stay-at-home environment. More defensive, non-cyclical2 sectors trailed.

The reporting period began with positive developments for COVID-19 vaccines and resolution of the U.S. election, which led to a broadening of market leadership from the mega cap growth stocks that had soared during the height of pandemic lockdowns. Positive COVID-19 vaccine trial results from Pfizer/BioNTech and Moderna increased optimism about an eventual return to normal economic activity, sparking a rally in cyclical areas of the market. In the fourth quarter of 2020, value stocks, led by energy and financials, outperformed growth stocks for the first time since 2018. Stocks also benefited as Joe Biden won the race for president and looked set to govern with a small majority in Congress.

Aggressive fiscal and monetary policies continued unabated in early 2021, helping support consumer demand that, combined with stop-and-start supply chain recovery as COVID-19 rippled through global regions, raised inflation concerns and led to soaring commodity prices. Despite waves of COVID-19 periodically offering a bid to tech stocks that would benefit from a stay-at-home environment, inflation worries led to a steepening yield curve, weighing on high-multiple growth stocks and supporting cyclicals. Amid easing business restrictions and accommodating fiscal and monetary policies, the U.S. economy picked up steam, with business confidence and new jobs numbers increasing steadily.

Markets wavered in September after the Delta variant of COVID-19 put a pause on recovery plays and higher inflation coincided with signals from the Federal Reserve Board that it would reduce its bond buying as early as November and potentially raise the federal funds rate in late 2022 or 2023. Equities delivered a flattish third quarter of 2021, as already-challenging labor and supply shortages and broad-based inflationary pressures intensified, weighing on industrials and materials companies. Energy felt crosswinds from a slowing Chinese economy even while global demand remained strong. Robust third quarter 2021 corporate earnings, however, suggesting companies have largely been able to absorb inflationary pressures, led to strong gains in October, while the discovery of the Omicron variant of COVID-19 in late November 2021 reintroduced risks of pandemic-related restrictions.

| 1 | Cyclicals consists of the following industries: automotive, entertainment, gaming, home construction, lodging, retailers, restaurants, textiles, and other consumer services. |

| 2 | Non-cyclicals consists of the following industries: consumer products, food/beverage, health care, pharmaceuticals, supermarkets and tobacco. |

|

2 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

Q. How did we respond to these changing market conditions?

A. While continuing to maintain a broadly diversified portfolio of high-quality companies that we believe are capable of compounding earnings and dividends at attractive rates over time, on the margin, we increased our exposure to banks and energy — sectors we expect are poised to benefit from higher prices and rising rates. For example, we initiated a position in JPMorgan Chase and added to existing positions in U.S. Bancorp and Bank of America. JPMorgan Chase and Bank of America are making big commitments to support climate-friendly businesses through climate financing, the third goal of COP26, as well as through their own operations. Bank of America, for example, recently announced a goal of deploying and mobilizing $1 trillion by 2030 in its Environmental Business Initiative in order to accelerate the transition to a low-carbon, sustainable economy. JPMorgan Chase has pledged to facilitate over $2.5 trillion over ten years to address climate change and contribute to sustainable development.

As energy prices rose, we remixed our energy holdings to benefit more directly from rising commodity prices. Within the traditional energy sector, we emphasize investments in natural gas, as it is the cleanest of the fossil fuels and instrumental in lowering the world’s carbon emissions. In energy we exited our investment in pipeline company Kinder Morgan, as 2020 revealed some challenges in its business profile, and initiated a position in TC Energy, which we deemed higher-quality, as well as Chesapeake Energy, similarly focused on natural gas though we believe with more upside to rising commodity prices.

We decreased the Fund’s underweight to the information technology (IT) sector, continuing to build the Fund’s position in Oracle, bought in late 2020, which is positioned to leverage major trends in technology, such as the cloud and digital transformation, but has sported a modest valuation. We also bought Cisco Systems; the resumption of on-premises tech spending as work-from-home abates should benefit Cisco at the same time it is launching several new product cycles. Cisco is also increasingly becoming a services provider with a subscription model that should provide a steady revenue stream and support healthy dividend growth.

Within the consumer staples sector, we sold Unilever, which was facing increasing margin pressure, and increased the Fund’s exposure to a reopening economy by adding to an existing position in Coca-Cola, which we think should benefit from increased on-premises consumption as vaccinations spread worldwide and COVID-19 variants decrease in severity, yet also provide some defensive strength.

In the utilities sector, we added to the Fund’s position in Sempra Energy, a best-in-class utility with regulated assets in California and Texas. Both states offer attractive regulated returns and high-single-digit growth as both transition to renewable energy sources and Texas enjoys robust residential and commercial growth.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

3 |

Table of Contents

Fund overview (cont’d)

Performance review

For the twelve months ended November 30, 2021, ClearBridge Dividend Strategy ESG ETF generated a 18.69% return on a net asset value (“NAV”)ii basis and 18.75% based on its market priceiii per share.

The performance table shows the Fund’s total return for the twelve months ended November 30, 2021 based on its NAV and market price. The Fund’s broad-based market index, the S&P 500 Index, returned 27.92% over the same time frame. The Lipper Equity Income Funds Category Averageiv returned 21.75% for the period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as of November 30, 2021 (unaudited) |

||||||||

| 6 months | 12 months | |||||||

| ClearBridge Dividend Strategy ESG ETF: | ||||||||

| $41.01 (NAV) |

3.15 | % | 18.69 | %*† | ||||

| $ 41.07 (Market Price) |

3.09 | % | 18.75 | %*‡ | ||||

| S&P 500 Index | 9.38 | % | 27.92 | % | ||||

| Lipper Equity Income Funds Category Average | 1.60 | % | 21.75 | % | ||||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.franklintempleton.com.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.franklintempleton.com.

As of the Fund’s current prospectus dated March 31, 2021, the gross total annual fund operating expense ratio for the Fund was 0.60%.

| * | Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares. |

| † | Total return assumes the reinvestment of all distributions at NAV. |

| ‡ | Total return assumes the reinvestment of all distributions at market price, which typically is based upon the official closing price of the Fund’s shares. |

|

4 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

Q. What were the leading contributors to performance?

A. On an absolute basis, the Fund had positive returns in ten of the eleven economic sectors in which it was invested during the reporting period, with the greatest contribution to returns coming from the IT, financials and materials sectors. Relative to the benchmark, stock selection in the consumer discretionary sector drove positive performance. In terms of sector allocation, an underweight to the health care sector aided performance.

In terms of individual Fund holdings, leading contributors to performance for the reporting period included Microsoft, Apple, Bank of America, Home Depot and Nucor.

Q. What were the leading detractors from performance?

A. Relative to the benchmark, stock selection in the communication services, IT, consumer staples, energy and real estate sectors were the main detractors. An underweight to IT and overweights to the consumer staples, utilities and materials sectors also hurt relative results.

In terms of individual Fund holdings, leading detractors from performance for the reporting period included Verizon, Unilever, Colgate-Palmolive, Sempra Energy and Activision Blizzard.

Q. Were there any significant changes to the Fund during the reporting period?

A. Over the course of the reporting period we established new positions in TC Energy and Chesapeake Energy in the energy sector, JPMorgan Chase in the financials sector and Cisco Systems in the IT sector. We closed positions in Unilever in the consumer staples sector, Kinder Morgan in the energy sector and International Paper in the materials sector.

Looking for additional information?

The Fund’s daily NAV is available online at www.franklintempleton.com. The Fund is traded under the symbol “YLDE” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

5 |

Table of Contents

Fund overview (cont’d)

Thank you for your investment in ClearBridge Dividend Strategy ESG ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

John Baldi

Portfolio Manager

ClearBridge Investments, LLC

Michael Clarfeld, CFA

Portfolio Manager

ClearBridge Investments, LLC

Mary Jane McQuillen

Portfolio Manager

ClearBridge Investments, LLC

Peter Vanderlee, CFA

Portfolio Manager

ClearBridge Investments, LLC

December 15, 2021

|

6 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

RISKS: Equity securities are subject to market and price fluctuations. Dividends are not guaranteed, and a company may reduce or eliminate its dividend at any time. The Fund’s environmental, social and governance (“ESG”) investment strategy may limit the types and number of investment opportunities available to the Fund and, as a result, may underperform funds that are not subject to such criteria. The Fund’s ESG investment strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole, or forgoing opportunities to invest in securities that might otherwise be advantageous to buy. The Fund may also underperform other funds screened for different ESG standards. In addition, the subadviser may be unsuccessful in creating a portfolio composed of companies that exhibit positive ESG characteristics.

Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and social, political and economic uncertainties, which could result in significant market fluctuations. Securities or other assets in the Fund’s portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

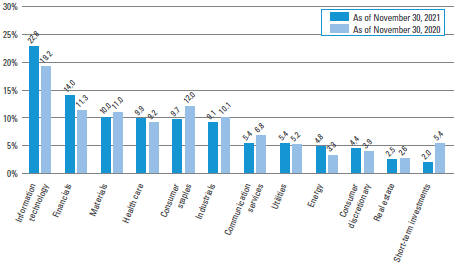

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of November 30, 2021 were: information technology (22.7%), financials (13.9%), materials (10.0%), health care (9.9%) and consumer staples (9.7%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The S&P 500 Index is an unmanaged index of the stocks of 500 leading companies, and is generally representative of the performance of larger companies in the U.S. |

| ii | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| iii | Market price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market price may differ from the Fund’s NAV. |

| iv | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended November 30, 2021, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 475 funds for the six-month period and 471 funds for the twelve-month period in the Fund’s Lipper category. |

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

7 |

Table of Contents

| Investment breakdown (%) as a percent of total investments | ||||

| † | The bar graph above represents the composition of the Fund’s investments as of November 30, 2021 and November 30, 2020. The composition of the Fund’s investments is subject to change at any time. |

|

8 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on June 1, 2021 and held for the six months ended November 30, 2021.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During |

|||||||||||||||||||||||||||||

| 3.15% | $ | 1,000.00 | $ | 1,031.50 | 0.59 | % | $ | 3.00 | 5.00% | $1,000.00 | $ | 1,022.11 | 0.59 | % | $ | 2.99 | ||||||||||||||||||||||

| 1 | For the six months ended November 30, 2021. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

9 |

Table of Contents

| Net Asset Value | ||||

| Average annual total returns1 | ||||

| Twelve Months Ended 11/30/21 | 18.69 | % | ||

| Inception* through 11/30/21 | 13.37 | |||

| Cumulative total returns1 | ||||

| Inception date of 5/22/17 through 11/30/21 | 76.49 | % | ||

| Market Price | ||||

| Average annual total returns2 | ||||

| Twelve Months Ended 11/30/21 | 18.75 | % | ||

| Inception* through 11/30/21 | 13.40 | |||

| Cumulative total returns2 | ||||

| Inception date of 5/22/17 through 11/30/21 | 76.71 | % | ||

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and effective July 1, 2020, market price returns typically are based upon the official closing price of the Fund’s shares. Prior to July 1, 2020, market price returns generally were based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV was determined, which was typically 4:00 p.m. Eastern time (U.S.). Market price performance reported for periods prior to July 1, 2020 continue to reflect market prices calculated based upon the mid-point between the bid and ask on the Fund’s principal trading market typically as of 4:00 p.m. Eastern time (U.S.).These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is May 22, 2017. |

|

10 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

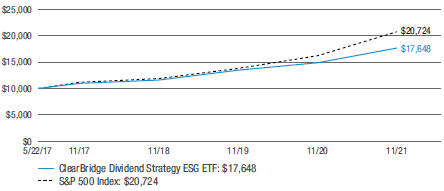

Historical performance

Value of $10,000 invested in

ClearBridge Dividend Strategy ESG ETF vs S&P 500 Index† — May 22, 2017 - November 30, 2021

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in ClearBridge Dividend Strategy ESG ETF on May 22, 2017 (inception date), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through November 30, 2021. The hypothetical illustration also assumes a $10,000 investment in the S&P 500 Index (the “Index”). The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. The Index is not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

11 |

Table of Contents

November 30, 2021

ClearBridge Dividend Strategy ESG ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||||||||||

| Common Stocks — 97.6% | ||||||||||||||||

| Communication Services — 5.4% | ||||||||||||||||

| Diversified Telecommunication Services — 1.7% |

||||||||||||||||

| Verizon Communications Inc. |

6,890 | $ | 346,360 | |||||||||||||

| Entertainment — 1.4% |

||||||||||||||||

| Walt Disney Co. |

2,030 | 294,147 | * | |||||||||||||

| Media — 2.3% |

||||||||||||||||

| Comcast Corp., Class A Shares |

9,382 | 468,913 | ||||||||||||||

| Total Communication Services |

1,109,420 | |||||||||||||||

| Consumer Discretionary — 4.4% | ||||||||||||||||

| Hotels, Restaurants & Leisure — 1.6% |

||||||||||||||||

| Starbucks Corp. |

3,040 | 333,305 | ||||||||||||||

| Specialty Retail — 2.8% |

||||||||||||||||

| Home Depot Inc. |

1,400 | 560,854 | ||||||||||||||

| Total Consumer Discretionary |

894,159 | |||||||||||||||

| Consumer Staples — 9.7% | ||||||||||||||||

| Beverages — 2.3% |

||||||||||||||||

| Coca-Cola Co. |

7,158 | 375,437 | ||||||||||||||

| PepsiCo Inc. |

620 | 99,064 | ||||||||||||||

| Total Beverages |

474,501 | |||||||||||||||

| Food Products — 4.0% |

||||||||||||||||

| Mondelez International Inc., Class A Shares |

6,320 | 372,501 | ||||||||||||||

| Nestle SA, ADR |

3,421 | 439,598 | ||||||||||||||

| Total Food Products |

812,099 | |||||||||||||||

| Household Products — 3.4% |

||||||||||||||||

| Colgate-Palmolive Co. |

2,960 | 222,059 | ||||||||||||||

| Procter & Gamble Co. |

3,310 | 478,560 | ||||||||||||||

| Total Household Products |

700,619 | |||||||||||||||

| Total Consumer Staples |

1,987,219 | |||||||||||||||

| Energy — 4.8% | ||||||||||||||||

| Oil, Gas & Consumable Fuels — 4.8% |

||||||||||||||||

| Chesapeake Energy Corp. |

1,640 | 97,646 | ||||||||||||||

| TC Energy Corp. |

8,067 | 378,423 | ||||||||||||||

| Williams Cos. Inc. |

19,033 | 509,894 | ||||||||||||||

| Total Energy |

985,963 | |||||||||||||||

| Financials — 13.9% | ||||||||||||||||

| Banks — 6.6% |

||||||||||||||||

| Bank of America Corp. |

13,303 | 591,584 | ||||||||||||||

| JPMorgan Chase & Co. |

1,289 | 204,732 | ||||||||||||||

See Notes to Financial Statements.

|

12 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

ClearBridge Dividend Strategy ESG ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||||||||||

| Banks — continued |

||||||||||||||||

| PNC Financial Services Group Inc. |

1,449 | $ 285,453 | ||||||||||||||

| US Bancorp |

5,023 | 277,973 | ||||||||||||||

| Total Banks |

1,359,742 | |||||||||||||||

| Capital Markets — 2.8% |

||||||||||||||||

| BlackRock Inc. |

641 | 579,855 | ||||||||||||||

| Insurance — 4.5% |

||||||||||||||||

| American International Group Inc. |

5,321 | 279,885 | ||||||||||||||

| MetLife Inc. |

4,881 | 286,319 | ||||||||||||||

| Travelers Cos. Inc. |

2,353 | 345,773 | ||||||||||||||

| Total Insurance |

911,977 | |||||||||||||||

| Total Financials |

2,851,574 | |||||||||||||||

| Health Care — 9.9% | ||||||||||||||||

| Health Care Equipment & Supplies — 1.7% |

||||||||||||||||

| Becton Dickinson and Co. |

1,487 | 352,627 | ||||||||||||||

| Health Care Providers & Services — 2.2% |

||||||||||||||||

| UnitedHealth Group Inc. |

1,017 | 451,772 | ||||||||||||||

| Pharmaceuticals — 6.0% |

||||||||||||||||

| Johnson & Johnson |

2,733 | 426,157 | ||||||||||||||

| Merck & Co. Inc. |

4,940 | 370,055 | ||||||||||||||

| Pfizer Inc. |

7,889 | 423,876 | ||||||||||||||

| Total Pharmaceuticals |

1,220,088 | |||||||||||||||

| Total Health Care |

2,024,487 | |||||||||||||||

| Industrials — 9.1% | ||||||||||||||||

| Air Freight & Logistics — 2.4% |

||||||||||||||||

| United Parcel Service Inc., Class B Shares |

2,509 | 497,710 | ||||||||||||||

| Commercial Services & Supplies — 1.8% |

||||||||||||||||

| Waste Management Inc. |

2,230 | 358,294 | ||||||||||||||

| Electrical Equipment — 1.1% |

||||||||||||||||

| Emerson Electric Co. |

2,570 | 225,749 | ||||||||||||||

| Industrial Conglomerates — 1.7% |

||||||||||||||||

| Honeywell International Inc. |

1,770 | 357,965 | ||||||||||||||

| Road & Rail — 2.1% |

||||||||||||||||

| Union Pacific Corp. |

1,790 | 421,796 | ||||||||||||||

| Total Industrials |

1,861,514 | |||||||||||||||

| Information Technology — 22.7% | ||||||||||||||||

| Communications Equipment — 1.4% |

||||||||||||||||

| Cisco Systems Inc. |

5,389 | 295,533 | ||||||||||||||

See Notes to Financial Statements.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

13 |

Table of Contents

Schedule of investments (cont’d)

November 30, 2021

ClearBridge Dividend Strategy ESG ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||||||||||

| IT Services — 4.1% |

||||||||||||||||

| Mastercard Inc., Class A Shares |

1,211 | $ | 381,368 | |||||||||||||

| Visa Inc., Class A Shares |

2,359 | 457,103 | ||||||||||||||

| Total IT Services |

838,471 | |||||||||||||||

| Semiconductors & Semiconductor Equipment — 3.1% |

||||||||||||||||

| Broadcom Inc. |

580 | 321,135 | ||||||||||||||

| Texas Instruments Inc. |

1,590 | 305,868 | ||||||||||||||

| Total Semiconductors & Semiconductor Equipment |

627,003 | |||||||||||||||

| Software — 8.6% |

||||||||||||||||

| Microsoft Corp. |

4,290 | 1,418,231 | ||||||||||||||

| Oracle Corp. |

3,818 | 346,445 | ||||||||||||||

| Total Software |

1,764,676 | |||||||||||||||

| Technology Hardware, Storage & Peripherals — 5.5% |

||||||||||||||||

| Apple Inc. |

6,792 | 1,122,718 | ||||||||||||||

| Total Information Technology |

4,648,401 | |||||||||||||||

| Materials — 10.0% | ||||||||||||||||

| Chemicals — 7.1% |

||||||||||||||||

| Ecolab Inc. |

1,969 | 436,074 | ||||||||||||||

| Linde PLC |

1,530 | 486,754 | ||||||||||||||

| PPG Industries Inc. |

3,379 | 520,941 | ||||||||||||||

| Total Chemicals |

1,443,769 | |||||||||||||||

| Construction Materials — 1.9% |

||||||||||||||||

| Vulcan Materials Co. |

2,060 | 394,779 | ||||||||||||||

| Metals & Mining — 1.0% |

||||||||||||||||

| Nucor Corp. |

1,947 | 206,888 | ||||||||||||||

| Total Materials |

2,045,436 | |||||||||||||||

| Real Estate — 2.4% | ||||||||||||||||

| Equity Real Estate Investment Trusts (REITs) — 2.4% |

||||||||||||||||

| American Tower Corp. |

1,339 | 351,461 | ||||||||||||||

| Boston Properties Inc. |

1,400 | 150,976 | ||||||||||||||

| Total Real Estate |

502,437 | |||||||||||||||

| Utilities — 5.3% | ||||||||||||||||

| Electric Utilities — 3.5% |

||||||||||||||||

| Edison International |

4,480 | 292,454 | ||||||||||||||

| NextEra Energy Inc. |

4,890 | 424,354 | ||||||||||||||

| Total Electric Utilities |

716,808 | |||||||||||||||

| Multi-Utilities — 1.8% |

||||||||||||||||

| Sempra Energy |

3,139 | 376,272 | ||||||||||||||

| Total Utilities |

1,093,080 | |||||||||||||||

| Total Investments before Short-Term Investments (Cost — $18,944,153) |

20,003,690 | |||||||||||||||

See Notes to Financial Statements.

|

14 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

ClearBridge Dividend Strategy ESG ETF

(Percentages shown based on Fund net assets)

| Security | Rate | Shares | Value | |||||||||||||

| Short-Term Investments — 2.0% | ||||||||||||||||

| JPMorgan 100% U.S. Treasury Securities Money Market Fund, Institutional Class (Cost — $417,000) |

0.006% | 417,000 | $ | 417,000 | ||||||||||||

| Total Investments — 99.6% (Cost — $19,361,153) |

20,420,690 | |||||||||||||||

| Other Assets in Excess of Liabilities — 0.4% |

83,608 | |||||||||||||||

| Total Net Assets — 100.0% |

$ | 20,504,298 | ||||||||||||||

| * | Non-income producing security. |

| Abbreviation(s) used in this schedule: | ||||

| ADR | — American Depositary Receipts | |||

See Notes to Financial Statements.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

15 |

Table of Contents

Statement of assets and liabilities

November 30, 2021

| Assets: | ||||

| Investments, at value (Cost — $19,361,153) |

$ | 20,420,690 | ||

| Receivable for securities sold |

67,919 | |||

| Dividends and interest receivable |

25,959 | |||

| Total Assets |

20,514,568 | |||

| Liabilities: | ||||

| Investment management fee payable |

10,270 | |||

| Total Liabilities |

10,270 | |||

| Total Net Assets | $ | 20,504,298 | ||

| Net Assets: | ||||

| Par value (Note 5) |

$5 | |||

| Paid-in capital in excess of par value |

19,689,594 | |||

| Total distributable earnings (loss) |

814,699 | |||

| Total Net Assets | $20,504,298 | |||

| Shares Outstanding | 500,000 | |||

| Net Asset Value | $41.01 | |||

See Notes to Financial Statements.

|

16 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

For the Year Ended November 30, 2021

| Investment Income: | ||||

| Dividends |

$ | 301,283 | ||

| Interest |

42 | |||

| Less: Foreign taxes withheld |

(1,482) | |||

| Total Investment Income |

299,843 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

103,570 | |||

| Total Expenses |

103,570 | |||

| Net Investment Income | 196,273 | |||

| Realized and Unrealized Gain (Loss) on Investments (Notes 1 and 3): | ||||

| Net Realized Gain From Investment Transactions |

3,787,475 | |||

| Change in Net Unrealized Appreciation (Depreciation) From Investments |

(1,169,435) | |||

| Net Gain on Investments | 2,618,040 | |||

| Increase in Net Assets From Operations | $ | 2,814,313 | ||

See Notes to Financial Statements.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

17 |

Table of Contents

Statements of changes in net assets

| For the Years Ended November 30, | 2021 | 2020 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 196,273 | $ | 153,960 | ||||

| Net realized gain (loss) |

3,787,475 | (150,236) | ||||||

| Change in net unrealized appreciation (depreciation) |

(1,169,435) | 1,208,186 | ||||||

| Increase in Net Assets From Operations |

2,814,313 | 1,211,910 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Total distributable earnings |

(201,900) | (128,925) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(201,900) | (128,925) | ||||||

| Fund Share Transactions (Note 5): | ||||||||

| Net proceeds from sale of shares (450,000 and 150,000 shares issued, respectively) |

17,711,085 | 4,719,139 | ||||||

| Cost of shares repurchased (300,000 and 0 shares repurchased, respectively) |

(12,060,325) | — | ||||||

| Increase in Net Assets From Fund Share Transactions |

5,650,760 | 4,719,139 | ||||||

| Increase in Net Assets |

8,263,173 | 5,802,124 | ||||||

| Net Assets: | ||||||||

| Beginning of year |

12,241,125 | 6,439,001 | ||||||

| End of year |

$ | 20,504,298 | $12,241,125 | |||||

See Notes to Financial Statements.

|

18 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

| For a share of beneficial interest outstanding throughout each year ended November 30, unless otherwise noted: |

||||||||||||||||||||

| 20211 | 20201 | 20191 | 20181 | 20171,2 | ||||||||||||||||

| Net asset value, beginning of year | $34.97 | $32.20 | $28.46 | $27.39 | $25.12 | |||||||||||||||

| Income from operations: | ||||||||||||||||||||

| Net investment income |

0.44 | 0.56 | 0.55 | 0.46 | 0.24 | |||||||||||||||

| Net realized and unrealized gain |

6.06 | 2.71 | 3.92 | 1.10 | 2.18 | |||||||||||||||

| Total income from operations |

6.50 | 3.27 | 4.47 | 1.56 | 2.42 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.46) | (0.50) | (0.58) | (0.48) | (0.15) | |||||||||||||||

| Net realized gains |

— | — | (0.15) | (0.01) | — | |||||||||||||||

| Total distributions |

(0.46) | (0.50) | (0.73) | (0.49) | (0.15) | |||||||||||||||

| Net asset value, end of year | $41.01 | $34.97 | $32.20 | $28.46 | $27.39 | |||||||||||||||

| Total return, based on NAV3 |

18.69 | % | 10.43 | % | 16.09 | % | 5.75 | % | 9.68 | % | ||||||||||

| Net assets, end of year (000s) | $20,504 | $12,241 | $6,439 | $4,269 | $2,739 | |||||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Gross expenses |

0.59 | % | 0.59 | % | 0.59 | % | 0.59 | % | 0.59 | %4 | ||||||||||

| Net expenses |

0.59 | 0.59 | 0.59 | 0.59 | 0.59 | 4 | ||||||||||||||

| Net investment income |

1.12 | 1.80 | 1.84 | 1.65 | 1.78 | 4 | ||||||||||||||

| Portfolio turnover rate5 | 9 | % | 10 | % | 12 | % | 10 | % | 5 | % | ||||||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period May 22, 2017 (inception date) to November 30, 2017. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 4 | Annualized. |

| 5 | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

19 |

Table of Contents

1. Organization and significant accounting policies

ClearBridge Dividend Strategy ESG ETF (the “Fund”) is a separate diversified investment series of Legg Mason ETF Investment Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Fund is an actively managed exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities. Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors who have entered into agreements with the Fund’s distributor (“Authorized Participants”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

Shares of the Fund are listed and traded at market prices on NASDAQ. The market price for the Fund’s shares may be different from the Fund’s NAV. The Fund issues and redeems shares at NAV only in blocks of a specified number of shares or multiples thereof (“Creation Units”). Only Authorized Participants may purchase or redeem Creation Units directly with the Fund at NAV. Creation Units are created and redeemed principally in-kind (although under some circumstances its shares are created and redeemed partially for cash). Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares directly from the Fund at NAV.

The Fund seeks dividend income, growth of dividend income and long-term capital appreciation.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services typically use

|

20 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will use the currency exchange rates, generally determined as of 4:00 p.m. (London Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Global Fund Valuation Committee (known as Legg Mason North Atlantic Fund Valuation Committee prior to March 1, 2021) (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

21 |

Table of Contents

Notes to financial statements (cont’d)

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — quoted prices in active markets for identical investments |

| • | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant (Level 3) |

Total | ||||||||||||

| Common Stocks† | $ | 20,003,690 | — | — | $ | 20,003,690 | ||||||||||

| Short-Term Investments† | 417,000 | — | — | 417,000 | ||||||||||||

| Total Investments | $ | 20,420,690 | — | — | $ | 20,420,690 | ||||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or may pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions,

|

22 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(d) REIT distributions. The character of distributions received from Real Estate Investment Trusts (‘‘REITs’’) held by the Fund is generally comprised of net investment income, capital gains, and return of capital. It is the policy of the Fund to estimate the character of distributions received from underlying REITs based on historical data provided by the REITs. After each calendar year end, REITs report the actual tax character of these distributions. Differences between the estimated and actual amounts reported by the REITs are reflected in the Fund’s records in the year in which they are reported by the REITs by adjusting related investment cost basis, capital gains and income, as necessary.

(e) Distributions to shareholders. Distributions from net investment income of the Fund, if any, are declared and paid on a quarterly basis. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of November 30, 2021, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

23 |

Table of Contents

Notes to financial statements (cont’d)

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(g) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the current year, the following reclassifications have been made:

| Total Distributable Earnings (Loss) |

Paid-in Capital |

|||||||

| (a) | $ | (3,834,964) | $ | 3,834,964 | ||||

| (a) | Reclassifications are due to book/tax differences in the treatment of an in-kind distribution of securities. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and ClearBridge Investments, LLC (“ClearBridge”) is the Fund’s subadviser. Western Asset Management Company, LLC (“Western Asset”) manages the portion of the Fund’s cash and short-term instruments allocated to it. LMPFA, ClearBridge and Western Asset are indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Resources”).

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. The Fund is responsible for paying interest expenses, taxes, brokerage expenses, future 12b-1 fees (if any), acquired fund fees and expenses, extraordinary expenses and the management fee payable to LMPFA under the investment management agreement.

Under the investment management agreement and subject to the general supervision of the Fund’s Board of Trustees, LMPFA provides or causes to be furnished all investment management, supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain distribution services (provided pursuant to a separate distribution agreement) and investment advisory services (provided pursuant to separate subadvisory agreements) under a unitary fee structure. The Fund pays an investment management fee, calculated daily and paid monthly, at an annual rate of 0.59% of the Fund’s average daily net assets.

As compensation for its subadvisory services, LMPFA pays ClearBridge a fee monthly, at an annual rate equal to 70% of the management fee paid by the Fund to LMPFA, net of (i) all fees and expenses incurred by LMPFA under the investment management agreement (including without limitation any subadvisory fee paid to another subadviser to the Fund) and (ii) expense waivers, if any, and reimbursements. LMPFA pays Western Asset monthly a fee of 0.02% of the portion of the Fund’s average daily net assets allocated to Western Asset for the management of cash and other short-term instruments, net of expense waivers, if any, and reimbursements.

Franklin Distributors, LLC (known as Legg Mason Investor Services, LLC prior to July 7, 2021) (“Franklin Distributors”) serves as the distributor of Creation Units for the Fund on an

|

24 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

agency basis. Franklin Distributors is an indirect, wholly-owned broker-dealer subsidiary of Franklin Resources.

The Fund’s Board of Trustees has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan, the Fund is authorized to pay service and/or distribution fees calculated at an annual rate of up to 0.25% of its average daily net assets. No service and/or distribution fees are currently paid by the Fund, and there are no current plans to impose these fees.

All officers and one Trustee of the Trust are employees of Franklin Resources or its affiliates and do not receive compensation from the Trust.

3. Investments

During the year ended November 30, 2021, the aggregate cost of purchases and proceeds from sales of investments (excluding in-kind transactions and short-term investments) were as follows:

| Purchases | $ | 1,909,058 | ||

| Sales | 1,438,312 |

During the year ended November 30, 2021, in-kind transactions (Note 5) were as follows:

| Contributions | $ | 17,055,206 | ||

| Redemptions | 11,662,757 | |||

| Realized gain (loss)* | 3,836,198 |

| * | Net realized gains on redemptions in-kind are not taxable to the remaining shareholders of the Fund. |

The in-kind contributions and in-kind redemptions shown in this table may not agree with the Fund Share Transactions on the Statement of Changes in Net Assets. This table represents the accumulation of the Fund’s daily net shareholder transactions while the Statement of Changes in Net Assets reflects gross shareholder transactions including any cash component of the transactions.

At November 30, 2021, the aggregate cost of investments and the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| Cost | Gross Unrealized Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation |

|||||||||||||

| Securities | $ | 19,362,720 | $ | 1,602,119 | $ | (544,149) | $ | 1,057,970 | ||||||||

4. Derivative instruments and hedging activities

During the year ended November 30, 2021, the Fund did not invest in derivative instruments.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

25 |

Table of Contents

Notes to financial statements (cont’d)

5. Fund share transactions

At November 30, 2021, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. Fund shares are issued and redeemed by the Fund only in Creation Units or Creation Unit aggregations, where 50,000 shares of the Fund constitute a Creation Unit. Such transactions are made principally on an in-kind basis and under some circumstances partially on a cash basis, with a separate cash payment, which is a balancing cash component to equate the transaction to the net asset value per share of the Fund on the transaction date. Transactions in capital shares of the Fund are disclosed in detail in the Statement of Changes in Net Assets. Authorized Participants are subject to standard creation and redemption transaction fees to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. Creations and redemptions for cash (when cash creations and redemptions are available or specified) may be subject to an additional variable fee.

6. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended November 30, was as follows:

| 2021 | 2020 | |||||||

| Distributions paid from: | ||||||||

| Ordinary income | $ | 201,900 | $ | 128,925 | ||||

As of November 30, 2021, the components of distributable earnings (loss) on a tax basis were as follows:

| Undistributed ordinary income — net | $ | 38,305 | ||

| Deferred capital losses* | (281,574) | |||

| Unrealized appreciation (depreciation)(a) | 1,057,968 | |||

| Total distributable earnings (loss) — net | $ | 814,699 |

| * | These capital losses have been deferred in the current year as either short-term or long-term losses. The losses will be deemed to occur on the first day of the next taxable year in the same character as they were originally deferred and will be available to offset future taxable capital gains. |

| (a) | The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales. |

7. Recent accounting pronouncement

In March 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting. In January 2021, the FASB issued ASU No. 2021-01, with further amendments to Topic 848. The amendments in the ASUs provide optional temporary accounting recognition and financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of the LIBOR and other interbank-offered based reference rates as of the end of 2021 and 2023. The ASUs are effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. Management has

|

26 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

reviewed the requirements and believes the adoption of these ASUs will not have a material impact on the financial statements.

8. Other matter

The outbreak of the respiratory illness COVID-19 (commonly referred to as “coronavirus”) has continued to rapidly spread around the world, causing considerable uncertainty for the global economy and financial markets. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The COVID-19 pandemic could adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance. In addition, the outbreak of COVID-19, and measures taken to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers.

9. Subsequent event

In September 2021, the Fund’s Board of Trustees approved changing the Fund’s fiscal year end from November 30th to March 31st.

| ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

27 |

Table of Contents

Report of independent registered public accounting firm

To the Board of Trustees of Legg Mason ETF Investment Trust and Shareholders of ClearBridge Dividend Strategy ESG ETF

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of ClearBridge Dividend Strategy ESG ETF (one of the funds constituting Legg Mason ETF Investment Trust, referred to hereafter as the “Fund”) as of November 30, 2021, the related statement of operations for the year ended November 30, 2021, the statement of changes in net assets for each of the two years in the period ended November 30, 2021, including the related notes, and the financial highlights for each of the three years in the period ended November 30, 2021 and for the period May 22, 2017 (inception date) through November 30, 2017 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended November 30, 2021 and the financial highlights for each of the three years in the period ended November 30, 2021 and for the period May 22, 2017 (inception date) through November 30, 2017 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of November 30, 2021 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

January 19, 2022

We have served as the auditor of one or more investment companies in the Franklin Templeton Group of Funds since 1948.

|

28 |

ClearBridge Dividend Strategy ESG ETF 2021 Annual Report |

Table of Contents

Statement regarding liquidity risk management program (unaudited)

Each of the Funds has adopted and implemented a written Liquidity Risk Management Program (the “LRMP”) as required by Rule 22e-4 under the Investment Company Act of 1940 (the “Liquidity Rule”). The LRMP is designed to assess and manage each Fund’s liquidity risk, which is defined as the risk that the Fund could not meet requests to redeem shares issued by the Fund without significant dilution of remaining investors’ interests in the Fund. Each of the Funds is an exchange-traded fund (“ETF”) that is considered an “In-Kind ETF” under the Liquidity Rule, which means that the Fund satisfies requests for redemption through in-kind transfers of portfolio securities, positions, and other assets, except for a de minimis amount of cash, and publishes its portfolio holdings daily. In accordance with the Liquidity Rule, the LRMP includes policies and procedures that provide for: (1) assessment, management, and review (no less frequently than annually) of each Fund’s liquidity risk; (2) prohibiting the Fund’s acquisition of Illiquid investments that would result in the Fund holding more than 15% of its net assets in Illiquid assets. The LRMP also requires reporting to the SEC (on a non-public basis) and to the Board if the Fund’s holdings of Illiquid assets exceed 15% of the Fund’s net assets. As an In-Kind ETF, the Fund is not required to include in the LRMP policies and procedures relating to classification of portfolio holdings into four liquidity categories or establishing a highly liquid investment minimum (“HLIM”).

The Funds’ Board of Trustees approved the appointment of the Director of Liquidity Risk within the Investment Risk Management Group (the “IRMG”) as the Administrator of the LRMP. The IRMG maintains the Investment Liquidity Committee (the “ILC”) to provide oversight and administration of policies and procedures governing liquidity risk management for FT products and portfolios. The ILC includes representatives from Franklin Templeton’s Risk, Trading, Global Compliance, Legal, Investment Compliance, Investment Operations, Valuation Committee, Product Management and Global Product Strategy.

In assessing and managing each Fund’s liquidity risk, the ILC considers, as relevant, a variety of factors, including the Fund’s investment strategy and the liquidity of its portfolio investments during both normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources including the Funds’ interfund lending facility and line of credit. Because the Funds are ETFs, the ILC also considers, as relevant, (1) the relationship between the Fund’s portfolio liquidity and the way in which, and the prices and spread at which, Fund shares trade, including the efficiency of the arbitrage function and the level of active participation by market participants, including authorized participants and (2) the effect of the composition of baskets on the overall liquidity of the Fund’s portfolio.

| ClearBridge Dividend Strategy ESG ETF |

29 |

Table of Contents

Additional information (unaudited)

Information about Trustees and Officers

The business and affairs of ClearBridge Dividend Strategy ESG ETF (the “Fund”) are conducted by management under the supervision and subject to the direction of its Board of Trustees. The business address of each Trustee is One Franklin Parkway, San Mateo, California 94403-1906. Information pertaining to the Trustees and officers of the Fund is set forth below.

The Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request by calling the Fund at 1-877-721-1926.

| Independent Trustees† | ||

| Rohit Bhagat | ||

| Year of birth | 1964 | |

| Position(s) with Trust | Lead Independent Trustee | |

| Term of office1 and length of time served2 | Since July 2021 | |

| Principal occupation(s) during the past five years | Managing Member, Mukt Capital, LLC (private investment firm) (2014-present); Advisor, Optimal Asset Management (investment technology and advisory services company) (2015-present); and formerly, Chairman, Asia Pacific, BlackRock (2009-2012); Global Chief Operating Officer, Barclays Global Investors (investment management) (2005-2009); and Senior Partner, The Boston Consulting Group (management consulting) (1992-2005). | |

| Number of funds in fund complex overseen by Trustee | 59 | |

| Other Directorships held by Trustee during the past five years | AssetMark Financial Holdings, Inc. (investment solutions) (2018- present) and PhonePe (payment and financial services) (2020-present); and formerly, Axis Bank (financial) (2013-2021), FlipKart Limited (eCommerce company) (2019-2020), CapFloat Financial Services Pvt., Ltd. (non-banking finance company) (2018) and Zentific Investment Management (hedge fund) (2015-2018). | |

| Deborah D. McWhinney | ||

| Year of birth | 1955 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since July 2021 | |

| Principal occupation(s) during the past five years | Director of various companies; and formerly, Board Member, Lloyds Banking Group (2015-2018) (financial institution) and Fresenius Medical Group (2016-2018) (healthcare); Chief Executive Officer (2013-2014) and Chief Operating Officer (2011-2013), CitiGroup Global Enterprise Payments (financial services); and President, Citi’s Personal Banking and Wealth Management (2009-2011). | |

| Number of funds in fund complex overseen by Trustee | 59 | |

| Other Directorships held by Trustee during the past five years | IHS Markit (information services) (2015-present), Borg Warner (automotive) (2018-present) and LegalShield (consumer services) (2020-present); and formerly, Fluor Corporation (construction and engineering) (2014-2020) and Focus Financial Partners, LLC (financial services) (2018-2020). | |

|

30 |

ClearBridge Dividend Strategy ESG ETF |

Table of Contents

| Independent Trustees† (cont’d) | ||

| Anantha K. Pradeep | ||

| Year of birth | 1963 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since July 2021 | |