UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: October 31

Date of reporting period: April 30, 2019

| ITEM 1. | REPORT TO STOCKHOLDERS. | |

| The Semi-Annual Report to Stockholders is filed herewith. | ||

| Semi-Annual Report | April 30, 2019 |

LEGG MASON

LOW VOLATILITY

HIGH DIVIDEND ETF

LVHD

Beginning in April 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Legg Mason Funds held in your account with your financial intermediary.

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of equity securities of U.S. companies with relatively high yield and low price and earnings volatility.

Dear Shareholder,

We are pleased to provide the semi-annual report of Legg Mason Low Volatility High Dividend ETF for the six-month reporting period ended April 30, 2019. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

May 31, 2019

| II | Legg Mason Low Volatility High Dividend ETF |

Economic review

Economic activity in the U.S. was mixed during the six months ended April 30, 2019 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that third quarter 2018 U.S. gross domestic product (“GDP”)i growth was 3.4%. Fourth quarter 2018 GDP growth then moderated to 2.2%. Finally, the U.S. Department of Commerce’s second reading for first quarter 2019 GDP growth, released after the reporting period ended, was 3.1%. The acceleration in GDP growth during the first quarter of 2019 was attributed to an upturn in state and local government spending, increases in private inventory investment and exports, and a smaller decrease in residential investment. These movements were partly offset by decelerations in personal consumption expenditures and nonresidential fixed investment, along with a downturn in federal government spending. Imports also turned down.

Job growth in the U.S. was solid overall and was a tailwind for the economy during the reporting period. As reported by the U.S. Department of Labor, when the reporting period ended on April 30, 2019, the unemployment rate was 3.6%, versus 3.7% when the period began. April 2019’s reading was the lowest reading since December 1969. However, the percentage of longer-term unemployed moved higher during the reporting period. In April 2019, 21.1% of Americans looking for a job had been out of work for more than six months, versus 20.8% when the period began.

| Legg Mason Low Volatility High Dividend ETF | III |

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (the “Fed”)ii respond to the economic environment?

A. The Fed continued tightening its monetary policy, as it raised interest rates once during the reporting period and further reduced its balance sheet. As widely expected, the Fed raised the federal funds rateiii at its meeting that ended on December 19, 2018, to a range between 2.25% and 2.50%. This represented the Fed’s fourth rate hike in 2018. However, at its meeting that concluded on January 30, 2019, the Fed kept interest rates on hold and said, “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate ….” Finally, at its meeting that concluded on March 20, 2019, most Federal Open Market Committee (“FOMC”)iv members indicated that they did not feel additional rate hikes would be needed in 2019.

Q. What factors impacted the U.S. stock market during the reporting period?

A. The U.S. stock market produced strong results during the reporting period. In total, the market fell sharply over the first two months of the reporting period. This was attributed to trade war concerns, indications that the Fed would continue monetary tightening, and fears of moderating growth and corporate profits. The market then reversed course and moved higher over the last four months of the reporting period. This turnaround was triggered by corporate earnings that were strong overall, the Fed’s indication of a pause in raising interest rates and signs of progress in trade negotiations between the U.S. and China. All told, for the six months ended April 30, 2019, the S&P 500 Indexv returned 9.76%.

Looking at the U.S. stock market more closely, large-cap stocks, as measured by the Russell 1000 Indexvi, returned 10.00% over the reporting period. In contrast, mid-cap stocks, as measured by the Russell Midcap Indexvii, returned 11.65%, whereas small-cap stocks, as measured by the Russell 2000 Indexviii, generated the weakest relative results, returning 6.06%. From an investment style perspective, growth and value stocks, as measured by the Russell 3000 Growthix and Russell 3000 Valuex Indices, returned 11.81% and 7.61%, respectively, during the six months ended April 30, 2019.

Performance review

For the six months ended April 30, 2019, Legg Mason Low Volatility High Dividend ETF generated a 8.96% return on a net asset value (“NAV”)xi basis and 8.99% based on its market pricexii per share.

The performance table shows the Fund’s total return for the six months ended April 30, 2019 based on its NAV and market price as of April 30, 2019. The Fund seeks to track the investment results of an index composed of equity securities of U.S. companies with relatively high yield and low price and earnings volatility, the QS Low Volatility High Dividend Indexxiii, which returned 9.15% for the same period. The Fund’s broad-based market index, the Russell 3000 Indexxiv, returned 9.71% over the same time frame. The Lipper Multi-Cap Value Funds Category Averagexv returned 6.69% for the period. Please note that Lipper performance returns are based on each fund’s NAV.

| IV | Legg Mason Low Volatility High Dividend ETF |

| Performance Snapshot as

of April 30, 2019 (unaudited) |

||||

| 6 months | ||||

| Legg Mason Low Volatility High Dividend ETF: | ||||

| $32.32 (NAV) |

8.96 | %*† | ||

| $32.33 (Market Price) |

8.99 | %*‡ | ||

| QS Low Volatility High Dividend Index | 9.15 | % | ||

| Russell 3000 Index | 9.71 | % | ||

| Lipper Multi-Cap Value Funds Category Average |

6.69 | % | ||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns shown are typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the number of days the market price of the Fund’s shares was greater than the Fund’s NAV and the number of days it was less than the Fund’s NAV (i.e., premium or discount) for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 1, 2019, the gross total annual fund operating expense ratio for the Fund was 0.27%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, at market price.

Looking for additional information?

The Fund’s daily NAV is available on-line at www.leggmason.com/etf. The Fund is traded under the symbol “LVHD” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

May 31, 2019

| Legg Mason Low Volatility High Dividend ETF | V |

Investment commentary (cont’d)

RISKS: Equity securities are subject to market and price fluctuations. Dividends are not guaranteed, and a company may reduce or eliminate its dividend at any time. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Distributions are not guaranteed and are subject to change. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| VI | Legg Mason Low Volatility High Dividend ETF |

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Federal Open Market Committee (“FOMC”) is a policy-making body of the Federal Reserve System responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| v | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| vi | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 90% of the U.S. market. |

| vii | The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap represents approximately 31% of the total market capitalization of the Russell 1000 companies. |

| viii | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| ix | The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| x | The Russell 3000 Value Index measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

| xi | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| xii | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| xiii | The QS Low Volatility High Dividend Index (the “Underlying Index”) seeks to provide more stable income through investments in stocks of profitable U.S. companies with relatively high dividend yields and lower price and earnings volatility. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC (“QS Investors”), the Fund’s subadviser. QS Investors is affiliated with both Legg Mason Partners Fund Advisor, LLC (“LMPFA”), the Fund’s investment manager, and the Fund. The Underlying Index is composed of stocks of U.S. companies across a wide range of market capitalizations, including the largest 3,000 U.S. stocks as determined by the Solactive US Broad Market Index. Stocks in the Underlying Index must have demonstrated profitability over the last four fiscal quarters as a whole. Stocks whose yields are not supported by earnings are excluded from the Underlying Index. QS Investors anticipates that the number of component securities in the Underlying Index will range from 50 to 100, but this number may vary due to market movements. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The Underlying Index may include large-, mid- or small-capitalization companies. The Fund’s portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The components of the Underlying Index, and the degree to which these components represent certain sectors and industries, may change over time. |

| xiv | The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| xv | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended April 30, 2019, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 402 funds in the Fund’s Lipper category. |

| Legg Mason Low Volatility High Dividend ETF | VII |

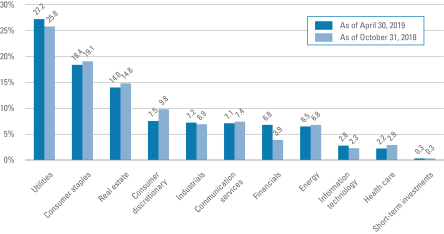

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of April 30, 2019 and October 31, 2018 and does not include derivatives such as futures contracts. The composition of the Fund’s investments is subject to change at any time. |

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 1 |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on November 1, 2018 and held for the six months ended April 30, 2019.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| 8.96% | $ | 1,000.00 | $ | 1,089.60 | 0.27 | % | $ | 1.40 | 5.00 | % | $1,000.00 | $ | 1,023.46 | 0.27 | % | $ | 1.35 | |||||||||||||||||||||||||||||||||

| 2 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

| 1 | For the six months ended April 30, 2019. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181), then divided by 365. |

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 3 |

Schedule of investments (unaudited)

April 30, 2019

Legg Mason Low Volatility High Dividend ETF

| Security | Shares | Value | ||||||||||||||

| Common Stocks — 99.5% | ||||||||||||||||

| Communication Services — 7.0% | ||||||||||||||||

| Diversified Telecommunication Services — 4.6% |

||||||||||||||||

| AT&T Inc. |

561,762 | $ | 17,392,152 | |||||||||||||

| Verizon Communications Inc. |

303,948 | 17,382,786 | ||||||||||||||

| Total Diversified Telecommunication Services |

34,774,938 | |||||||||||||||

| Media — 2.4% |

||||||||||||||||

| Omnicom Group Inc. |

228,212 | 18,263,806 | ||||||||||||||

| Total Communication Services |

53,038,744 | |||||||||||||||

| Consumer Discretionary — 7.4% | ||||||||||||||||

| Automobiles — 2.6% |

||||||||||||||||

| Ford Motor Co. |

1,857,355 | 19,409,360 | ||||||||||||||

| Distributors — 1.2% |

||||||||||||||||

| Genuine Parts Co. |

91,794 | 9,412,557 | ||||||||||||||

| Hotels, Restaurants & Leisure — 2.9% |

||||||||||||||||

| Carnival Corp. |

261,384 | 14,339,526 | ||||||||||||||

| Cracker Barrel Old Country Store Inc. |

42,748 | 7,213,298 | ||||||||||||||

| Las Vegas Sands Corp. |

6,683 | 448,095 | ||||||||||||||

| Total Hotels, Restaurants & Leisure |

22,000,919 | |||||||||||||||

| Specialty Retail — 0.7% |

||||||||||||||||

| L Brands Inc. |

205,826 | 5,277,378 | ||||||||||||||

| Total Consumer Discretionary |

56,100,214 | |||||||||||||||

| Consumer Staples — 18.4% | ||||||||||||||||

| Food Products — 8.1% |

||||||||||||||||

| Archer-Daniels-Midland Co. |

372,725 | 16,623,535 | ||||||||||||||

| General Mills Inc. |

381,403 | 19,630,812 | ||||||||||||||

| Hershey Co. |

125,774 | 15,702,884 | ||||||||||||||

| Kraft Heinz Co. |

280,629 | 9,328,108 | ||||||||||||||

| Total Food Products |

61,285,339 | |||||||||||||||

| Household Products — 7.9% |

||||||||||||||||

| Clorox Co. |

114,651 | 18,313,204 | ||||||||||||||

| Kimberly-Clark Corp. |

160,148 | 20,559,800 | ||||||||||||||

| Procter & Gamble Co. |

194,997 | 20,763,281 | ||||||||||||||

| Total Household Products |

59,636,285 | |||||||||||||||

| Tobacco — 2.4% |

||||||||||||||||

| Altria Group Inc. |

324,711 | 17,641,549 | ||||||||||||||

| Total Consumer Staples |

138,563,173 | |||||||||||||||

See Notes to Financial Statements.

| 4 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

Legg Mason Low Volatility High Dividend ETF

| Security | Shares | Value | ||||||||||||||

| Energy — 6.5% | ||||||||||||||||

| Oil, Gas & Consumable Fuels — 6.5% |

||||||||||||||||

| Exxon Mobil Corp. |

243,233 | $ | 19,526,745 | |||||||||||||

| Phillips 66 Co. |

156,684 | 14,770,601 | ||||||||||||||

| Valero Energy Corp. |

158,627 | 14,381,124 | ||||||||||||||

| Total Energy |

48,678,470 | |||||||||||||||

| Financials — 6.8% | ||||||||||||||||

| Banks — 2.1% |

||||||||||||||||

| PacWest Bancorp |

143,076 | 5,658,656 | ||||||||||||||

| People’s United Financial Inc. |

422,718 | 7,308,794 | ||||||||||||||

| Umpqua Holdings Corp. |

167,201 | 2,902,609 | ||||||||||||||

| Total Banks |

15,870,059 | |||||||||||||||

| Capital Markets — 0.2% |

||||||||||||||||

| Cohen & Steers Inc. |

23,179 | 1,162,427 | ||||||||||||||

| Insurance — 1.0% |

||||||||||||||||

| American Financial Group Inc. |

34,006 | 3,520,641 | ||||||||||||||

| Old Republic International Corp. |

194,238 | 4,343,162 | ||||||||||||||

| Total Insurance |

7,863,803 | |||||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) — 2.1% |

||||||||||||||||

| AGNC Investment Corp. |

533,857 | 9,497,316 | ||||||||||||||

| Arbor Realty Trust Inc. |

58,945 | 805,189 | ||||||||||||||

| New Residential Investment Corp. |

317,492 | 5,337,040 | ||||||||||||||

| TPG RE Finance Trust Inc. |

23,697 | 467,068 | ||||||||||||||

| Total Mortgage Real Estate Investment Trusts (REITs) |

16,106,613 | |||||||||||||||

| Thrifts & Mortgage Finance — 1.4% |

||||||||||||||||

| Capitol Federal Financial Inc. |

44,703 | 616,901 | ||||||||||||||

| New York Community Bancorp Inc. |

753,866 | 8,767,462 | ||||||||||||||

| Northwest Bancshares Inc. |

54,859 | 956,192 | ||||||||||||||

| Total Thrifts & Mortgage Finance |

10,340,555 | |||||||||||||||

| Total Financials |

51,343,457 | |||||||||||||||

| Health Care — 2.2% | ||||||||||||||||

| Pharmaceuticals — 2.2% |

||||||||||||||||

| Pfizer Inc. |

411,659 | 16,717,472 | ||||||||||||||

| Industrials — 7.2% | ||||||||||||||||

| Air Freight & Logistics — 2.2% |

||||||||||||||||

| United Parcel Service Inc., Class B Shares |

153,896 | 16,346,833 | ||||||||||||||

| Electrical Equipment — 5.0% |

||||||||||||||||

| Eaton Corp. PLC |

247,395 | 20,489,254 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 5 |

Schedule of investments (unaudited) (cont’d)

April 30, 2019

Legg Mason Low Volatility High Dividend ETF

| Security | Shares | Value | ||||||||||||||

| Electrical Equipment — continued |

||||||||||||||||

| Emerson Electric Co. |

241,684 | $ | 17,157,147 | |||||||||||||

| Total Electrical Equipment |

37,646,401 | |||||||||||||||

| Total Industrials |

53,993,234 | |||||||||||||||

| Information Technology — 2.8% | ||||||||||||||||

| IT Services — 2.8% |

||||||||||||||||

| Paychex Inc. |

246,898 | 20,815,970 | ||||||||||||||

| Real Estate — 14.0% | ||||||||||||||||

| Equity Real Estate Investment Trusts (REITs) — 14.0% |

||||||||||||||||

| Agree Realty Corp. |

23,463 | 1,536,123 | ||||||||||||||

| Apple Hospitality REIT Inc. |

150,518 | 2,476,021 | ||||||||||||||

| Chatham Lodging Trust |

38,644 | 760,900 | ||||||||||||||

| Crown Castle International Corp. |

160,027 | 20,128,196 | ||||||||||||||

| Easterly Government Properties Inc. |

45,602 | 820,836 | ||||||||||||||

| EPR Properties |

64,307 | 5,071,250 | ||||||||||||||

| Four Corners Property Trust Inc. |

34,716 | 987,323 | ||||||||||||||

| Gaming and Leisure Properties Inc. |

132,358 | 5,344,616 | ||||||||||||||

| Highwoods Properties Inc. |

71,372 | 3,181,764 | ||||||||||||||

| Hospitality Properties Trust |

89,177 | 2,318,602 | ||||||||||||||

| Industrial Logistics Properties Trust |

21,747 | 431,678 | ||||||||||||||

| Lamar Advertising Co., Class A Shares |

71,786 | 5,934,549 | ||||||||||||||

| Lexington Realty Trust |

128,538 | 1,165,840 | ||||||||||||||

| Liberty Property Trust |

103,094 | 5,117,586 | ||||||||||||||

| LTC Properties Inc. |

28,693 | 1,292,907 | ||||||||||||||

| Monmouth Real Estate Investment Corp. |

31,225 | 429,031 | ||||||||||||||

| National Health Investors Inc. |

25,839 | 1,949,036 | ||||||||||||||

| National Retail Properties Inc. |

107,997 | 5,682,802 | ||||||||||||||

| Piedmont Office Realty Trust Inc., Class A Shares |

82,919 | 1,726,374 | ||||||||||||||

| Public Storage |

53,417 | 11,814,772 | ||||||||||||||

| STORE Capital Corp. |

172,204 | 5,737,837 | ||||||||||||||

| Ventas Inc. |

299,383 | 18,295,295 | ||||||||||||||

| WP Carey Inc. |

37,763 | 2,995,361 | ||||||||||||||

| Total Real Estate |

105,198,699 | |||||||||||||||

| Utilities — 27.2% | ||||||||||||||||

| Electric Utilities — 12.0% |

||||||||||||||||

| American Electric Power Co. Inc. |

225,447 | 19,286,991 | ||||||||||||||

| Duke Energy Corp. |

217,926 | 19,857,417 | ||||||||||||||

| Evergy Inc. |

12,703 | 734,487 | ||||||||||||||

| Eversource Energy |

241,129 | 17,279,304 | ||||||||||||||

See Notes to Financial Statements.

| 6 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

Legg Mason Low Volatility High Dividend ETF

| Security | Shares | Value | ||||||||||||||

| Electric Utilities — continued |

||||||||||||||||

| Hawaiian Electric Industries Inc. |

45,852 | $ | 1,901,941 | |||||||||||||

| OGE Energy Corp. |

138,569 | 5,867,012 | ||||||||||||||

| Pinnacle West Capital Corp. |

90,952 | 8,664,997 | ||||||||||||||

| Xcel Energy Inc. |

296,912 | 16,775,528 | ||||||||||||||

| Total Electric Utilities |

90,367,677 | |||||||||||||||

| Multi-Utilities — 15.2% |

||||||||||||||||

| Ameren Corp. |

174,912 | 12,728,346 | ||||||||||||||

| CenterPoint Energy Inc. |

323,105 | 10,016,255 | ||||||||||||||

| Consolidated Edison Inc. |

225,446 | 19,424,427 | ||||||||||||||

| Dominion Energy Inc. |

258,112 | 20,099,181 | ||||||||||||||

| DTE Energy Co. |

124,039 | 15,592,943 | ||||||||||||||

| NorthWestern Corp. |

46,308 | 3,234,614 | ||||||||||||||

| Public Service Enterprise Group Inc. |

312,272 | 18,627,025 | ||||||||||||||

| WEC Energy Group Inc. |

189,146 | 14,834,721 | ||||||||||||||

| Total Multi-Utilities |

114,557,512 | |||||||||||||||

| Total Utilities |

204,925,189 | |||||||||||||||

| Total Investments before Short-Term Investments (Cost — $706,952,495) |

|

749,374,622 | ||||||||||||||

| Rate | ||||||||||||||||

| Short-Term Investments — 0.3% | ||||||||||||||||

| Invesco Treasury Portfolio, Institutional Class (Cost — $2,172,666) |

2.378 | % | 2,172,666 | 2,172,666 | ||||||||||||

| Total Investments — 99.8% (Cost — $709,125,161) |

|

751,547,288 | ||||||||||||||

| Other Assets in Excess of Liabilities — 0.2% |

1,447,567 | |||||||||||||||

| Total Net Assets — 100.0% |

$ | 752,994,855 | ||||||||||||||

| Abbreviation used in this schedule: | ||

| REIT | — Real Estate Investment Trust | |

At April 30, 2019, the Fund had the following open futures contracts:

| Number of Contracts |

Expiration Date |

Notional Amount |

Market Value |

Unrealized Appreciation |

||||||||||||||||

| Contracts to Buy: | ||||||||||||||||||||

| E-Mini S&P 500 Index | 13 | 6/19 | $ | 1,848,197 | $ | 1,916,525 | $ | 68,328 | ||||||||||||

See Notes to Financial Statements.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 7 |

Statement of assets and liabilities (unaudited)

April 30, 2019

| Assets: | ||||

| Investments, at value (Cost — $709,125,161) |

$ | 751,547,288 | ||

| Dividends and interest receivable |

1,455,002 | |||

| Receivable from broker — variation margin on open futures contracts |

68,363 | |||

| Receivable for Fund shares sold |

34,949 | |||

| Deposits with brokers for open futures contracts |

32,505 | |||

| Total Assets |

753,138,107 | |||

| Liabilities: | ||||

| Investment management fee payable |

143,252 | |||

| Total Liabilities |

143,252 | |||

| Total Net Assets | $ | 752,994,855 | ||

| Net Assets: | ||||

| Par value (Note 5) |

$ | 233 | ||

| Paid-in capital in excess of par value |

728,448,220 | |||

| Total distributable earnings (loss) |

24,546,402 | |||

| Total Net Assets | $ | 752,994,855 | ||

| Shares Outstanding | 23,300,000 | |||

| Net Asset Value | $32.32 | |||

See Notes to Financial Statements.

| 8 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended April 30, 2019

| Investment Income: | ||||

| Dividends |

$ | 12,304,433 | ||

| Interest |

27,774 | |||

| Total Investment Income |

12,332,207 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

805,228 | |||

| Total Expenses |

805,228 | |||

| Net Investment Income | 11,526,979 | |||

| Realized and Unrealized Gain (Loss) on Investments and Futures Contracts (Notes 1, 3 and 4): |

| |||

| Net Realized Gain (Loss) From: |

||||

| Investment transactions |

4,935,199 | |||

| Futures contracts |

(445,478) | |||

| Net Realized Gain |

4,489,721 | |||

| Change in Net Unrealized Appreciation (Depreciation) From: |

||||

| Investments |

37,142,929 | |||

| Futures contracts |

172,405 | |||

| Change in Net Unrealized Appreciation (Depreciation) |

37,315,334 | |||

| Net Gain on Investments and Futures Contracts | 41,805,055 | |||

| Increase in Net Assets From Operations | $ | 53,332,034 | ||

See Notes to Financial Statements.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 9 |

Statements of changes in net assets

| For the Six Months Ended April 30, 2019 (unaudited) and the Year Ended October 31, 2018 |

2019 | 2018 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 11,526,979 | $ | 20,135,495 | ||||

| Net realized gain (loss) |

4,489,721 | (1,194,737) | ||||||

| Change in net unrealized appreciation (depreciation) |

37,315,334 | (7,129,106) | ||||||

| Increase in Net Assets From Operations |

53,332,034 | 11,811,652 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Total distributable earnings(a) |

(10,400,008) | (20,202,397) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(10,400,008) | (20,202,397) | ||||||

| Fund Share Transactions (Note 5): | ||||||||

| Net proceeds from sale of shares (5,800,000 and 10,100,000 shares issued, respectively) |

182,500,136 | 304,989,897 | ||||||

| Cost of shares repurchased (1,650,000 and 5,550,000 shares repurchased, respectively) |

(50,517,333) | (165,282,853) | ||||||

| Increase in Net Assets From Fund Share Transactions |

131,982,803 | 139,707,044 | ||||||

| Increase in Net Assets |

174,914,829 | 131,316,299 | ||||||

| Net Assets: | ||||||||

| Beginning of period |

578,080,026 | 446,763,727 | ||||||

| End of period(b) |

$ | 752,994,855 | $ | 578,080,026 | ||||

| (a) | Distributions from net investment income and from realized gains are no longer required to be separately disclosed (Note 7). For the year ended October 31, 2018, distributions from net investment income were $20,202,397. |

| (b) | Parenthetical disclosure of undistributed net investment income is no longer required (Note 7). For the year ended October 31, 2018, end of year net assets included undistributed net investment income of $619,004. |

See Notes to Financial Statements.

| 10 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

| For a share of beneficial interest outstanding

throughout each year ended October 31, unless otherwise noted: |

||||||||||||||||

| 20191,2 | 20181 | 20171 | 20161,3 | |||||||||||||

| Net asset value, beginning of period | $30.19 | $30.60 | $27.55 | $24.96 | ||||||||||||

| Income (loss) from operations: | ||||||||||||||||

| Net investment income |

0.59 | 1.09 | 1.03 | 0.80 | ||||||||||||

| Net realized and unrealized gain (loss) |

2.07 | (0.41) | 3.03 | 2.26 | 4 | |||||||||||

| Total income from operations |

2.66 | 0.68 | 4.06 | 3.06 | ||||||||||||

| Less distributions from: | ||||||||||||||||

| Net investment income |

(0.53) | (1.09) | (1.01) | (0.47) | ||||||||||||

| Total distributions |

(0.53) | (1.09) | (1.01) | (0.47) | ||||||||||||

| Net asset value, end of period | $32.32 | $30.19 | $30.60 | $27.55 | ||||||||||||

| Total return, based on NAV5 |

8.96 | % | 2.25 | % | 14.89 | % | 12.28 | % | ||||||||

| Net assets, end of period (millions) | $753 | $578 | $447 | $95 | ||||||||||||

| Ratios to average net assets: | ||||||||||||||||

| Gross expenses |

0.27 | %6 | 0.27 | % | 0.29 | % | 0.30 | %6 | ||||||||

| Net expenses |

0.27 | 6 | 0.27 | 0.29 | 0.30 | 6 | ||||||||||

| Net investment income |

3.87 | 6 | 3.60 | 3.45 | 3.42 | 6 | ||||||||||

| Portfolio turnover rate7 | 5 | % | 44 | % | 28 | % | 48 | % | ||||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended April 30, 2019 (unaudited). |

| 3 | For the period December 28, 2015 (inception date) to October 31, 2016. |

| 4 | Calculation of the net gain per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized losses presented in the Statement of Operations due to the timing of the of the sales and repurchases of Fund shares in relation to fluctuating market values of the investments of the Fund. |

| 5 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | Annualized. |

| 7 | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 11 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Legg Mason Low Volatility High Dividend ETF (the “Fund”) is a separate diversified investment series of Legg Mason ETF Investment Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Fund is an exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities. The Fund is designed to track an index. Similar to shares of an index mutual fund, each share of the Fund represents an ownership interest in an underlying portfolio of securities intended to track an index. Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors who have entered into agreements with the Fund’s distributor (“Authorized Participants”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

Shares of the Fund are listed and traded at market prices on NASDAQ. The market price for the Fund’s shares may be different from the Fund’s NAV. The Fund issues and redeems shares at NAV only in blocks of a specified number of shares or multiples thereof (“Creation Units”). Only Authorized Participants may purchase or redeem Creation Units directly with the Fund at NAV. Creation Units are issued and redeemed generally in-kind for a basket of securities and/or cash. Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares directly from the Fund at NAV.

The Fund seeks to track the investment results of the QS Low Volatility High Dividend Index (the “Underlying Index”). The Underlying Index seeks to provide more stable income through investments in stocks of profitable U.S. companies with relatively high dividend yields and lower price and earnings volatility. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadviser.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative

| 12 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will use the currency exchange rates, generally determined as of 4:00 p.m. (London Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 13 |

Notes to financial statements (unaudited) (cont’d)

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — quoted prices in active markets for identical investments |

| • | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Common stocks† | $ | 749,374,622 | — | — | $ | 749,374,622 | ||||||||||

| Short-term investments† | 2,172,666 | — | — | 2,172,666 | ||||||||||||

| Total investments | $ | 751,547,288 | — | — | $ | 751,547,288 | ||||||||||

| Other financial instruments: | ||||||||||||||||

| Futures contracts |

68,328 | — | — | 68,328 | ||||||||||||

| Total | $ | 751,615,616 | — | — | $ | 751,615,616 | ||||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Futures contracts. The Fund uses futures contracts generally to gain or manage exposure to certain asset classes, sectors, or markets or for cash management purposes. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

| 14 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

Upon entering into a futures contract, the Fund is required to deposit cash or securities with a broker in an amount equal to a certain percentage of the contract amount. This is known as the ‘‘initial margin’’ and subsequent payments (‘‘variation margin’’) are made or received by the Fund each day, depending on the daily fluctuation in the value of the contract. For certain futures, including foreign denominated futures, variation margin is not settled daily, but is recorded as a net variation margin payable or receivable. The daily changes in contract value are recorded as unrealized gains or losses in the Statement of Operations and the Fund recognizes a realized gain or loss when the contract is closed.

Futures contracts involve, to varying degrees, risk of loss in excess of the amounts reflected in the financial statements. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(c) Counterparty risk and credit-risk-related contingent features of derivative instruments. The Fund may invest in certain securities or engage in other transactions, where the Fund is exposed to counterparty credit risk in addition to broader market risks. The Fund may invest in securities of issuers, which may also be considered counterparties as trading partners in other transactions. This may increase the risk of loss in the event of default or bankruptcy by the counterparty or if the counterparty otherwise fails to meet its contractual obligations. The Fund’s subadviser attempts to mitigate counterparty risk by (i) periodically assessing the creditworthiness of its trading partners, (ii) monitoring and/or limiting the amount of its net exposure to each individual counterparty based on its assessment and (iii) requiring collateral from the counterparty for certain transactions. Market events and changes in overall economic conditions may impact the assessment of such counterparty risk by the subadviser. In addition, declines in the values of underlying collateral received may expose the Fund to increased risk of loss.

With exchange traded and centrally cleared derivatives, there is less counterparty risk to the Fund since the exchange or clearinghouse, as counterparty to such instruments, guarantees against a possible default. The clearinghouse stands between the buyer and the seller of the contract; therefore, the credit risk is limited to failure of the clearinghouse. While offset rights may exist under applicable law, the Fund does not have a contractual right of offset against a clearing broker or clearinghouse in the event of a default of the clearing broker or clearinghouse.

The Fund has entered into master agreements, such as an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement, with certain of its derivative counterparties that govern over-the-counter derivatives and provide for general obligations, representations, agreements, collateral posting terms, netting provisions in the event of default or termination and credit related contingent features. The credit related contingent features include, but are not limited to, a percentage decrease in the Fund’s net assets or NAV over a specified period of time. If these credit related contingent features were triggered, the derivatives counterparty could terminate the positions and demand payment or require additional collateral.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 15 |

Notes to financial statements (unaudited) (cont’d)

Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. However, absent an event of default by the counterparty or a termination of the agreement, the terms of the ISDA Master Agreements do not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the Fund and the applicable counterparty. The enforceability of the right to offset may vary by jurisdiction.

Collateral requirements differ by type of derivative. Collateral or margin requirements are set by the broker or exchange clearinghouse for exchange traded derivatives while collateral terms are contract specific for over-the-counter traded derivatives. Cash collateral that has been pledged to cover obligations of the Fund under derivative contracts, if any, will be reported separately in the Statement of Assets and Liabilities. Securities pledged as collateral, if any, for the same purpose are noted in the Schedule of Investments.

As of April 30, 2019, the Fund did not have any open OTC derivative transactions with credit related contingent features in a net liability position.

(d) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(e) Return of capital estimates. Distributions received from the Fund’s investments in certain securities, most notably master limited partnerships and real estate investment trusts, generally are comprised of income realized gains and/or return of capital. The Fund records investment income, realized capital gains and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each issuer and other industry sources. These estimates may subsequently be revised based on information received from the issuers after their tax reporting periods are concluded.

(f) Distributions to shareholders. Distributions from net investment income of the Fund, if any, are declared and paid on a quarterly basis. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to

| 16 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of October 31, 2018, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(h) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and QS Investors, LLC (“QS Investors”) is the Fund’s subadviser. Western Asset Management Company, LLC (“Western Asset”) manages the portion of the Fund’s cash and short-term instruments allocated to it. LMPFA, QS Investors and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. The Fund is responsible for paying interest expenses, taxes, brokerage expenses, future 12b-1 fees (if any), acquired fund fees and expenses, extraordinary expenses and the management fee payable to LMPFA under the investment management agreement.

Under the investment management agreement and subject to the general supervision of the Fund’s Board of Trustees, LMPFA provides or causes to be furnished all investment management, supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain distribution services (provided pursuant to a separate distribution agreement) and investment advisory services (provided pursuant to separate subadvisory agreements) under a unitary fee structure. The Fund pays an investment management fee, calculated daily and paid monthly, at an annual rate of 0.27% of the Fund’s average daily net assets.

As compensation for its subadvisory services, LMPFA pays QS Investors monthly 90% of the management fee paid by the Fund to LMPFA, net of (i) all fees and expenses incurred by LMPFA under the investment management agreement (including without limitation any subadvisory fee paid to another subadviser to the Fund) and (ii) expense waivers, if any, and reimbursements. LMPFA pays Western Asset monthly a fee of 0.02% of the portion of the Fund’s average daily net assets allocated to Western Asset for the management of cash and other short-term instruments, net of expense waivers, if any, and reimbursements.

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 17 |

Notes to financial statements (unaudited) (cont’d)

Legg Mason Investor Services, LLC, a wholly-owned broker-dealer subsidiary of Legg Mason, serves as the distributor of Creation Units for the Fund on an agency basis.

The Fund’s Board of Trustees has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan, the Fund is authorized to pay service and/or distribution fees calculated at an annual rate of up to 0.25% of its average daily net assets. No service and/or distribution fees are currently paid by the Fund, and there are no current plans to impose these fees.

All officers and one Trustee of the Trust are employees of Legg Mason or its affiliates and do not receive compensation from the Trust.

3. Investments

During the six months ended April 30, 2019, the aggregate cost of purchases and proceeds from sales of investments (excluding in-kind transactions and short-term investments) were as follows:

| Purchases | $ | 29,457,540 | ||

| Sales | 29,052,038 |

During the six months ended April 30, 2019, in-kind transactions (See Note 5) were as follows:

| Contributions | $ | 182,455,694 | ||

| Redemptions | 50,380,102 | |||

| Realized gain (loss)* | 6,646,829 |

| * | Net realized gains on redemptions in-kind are not taxable to the remaining shareholders of the Fund. |

The in-kind contributions and in-kind redemptions shown in this table may not agree with the Fund Share Transactions on the Statement of Changes in Net Assets. This table represents the accumulation of the Fund’s daily net shareholder transactions while the Statement of Changes in Net Assets reflects gross shareholder transactions including any cash component of the transactions.

At April 30, 2019, the aggregate cost of investments and the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

| Cost | Gross Unrealized Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation |

|||||||||||||

| Securities | $ | 709,125,161 | $ | 65,831,525 | $ | (23,409,398) | $ | 42,422,127 | ||||||||

| Futures contracts | — | 68,328 | — | 68,328 | ||||||||||||

| 18 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

4. Derivative instruments and hedging activities

Below is a table, grouped by derivative type, that provides information about the fair value and the location of derivatives within the Statement of Assets and Liabilities at April 30, 2019.

| ASSET DERIVATIVES1 | ||||

| Equity Risk |

||||

| Futures contracts2 | $ | 68,328 | ||

| 1 | Generally, the balance sheet location for asset derivatives is receivables/net unrealized appreciation (depreciation) and for liability derivatives is payables/net unrealized appreciation (depreciation). |

| 2 | Includes cumulative appreciation (depreciation) of futures contracts as reported in the Schedule of Investments. Only variation margin is reported within the receivables and/or payables on the Statement of Assets and Liabilities. |

The following tables provide information about the effect of derivatives and hedging activities on the Fund’s Statement of Operations for the six months ended April 30, 2019. The first table provides additional detail about the amounts and sources of gains (losses) realized on derivatives during the period. The second table provides additional information about the change in unrealized appreciation (depreciation) resulting from the Fund’s derivatives and hedging activities during the period.

| AMOUNT OF REALIZED GAIN (LOSS) ON DERIVATIVES RECOGNIZED | ||||

| Equity Risk |

||||

| Futures contracts | $ | (445,478) | ||

| CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) ON DERIVATIVES RECOGNIZED | ||||

| Equity Risk |

||||

| Futures contracts | $ | 172,405 | ||

During the six months ended April 30, 2019, the volume of derivative activity for the Fund was as follows:

| Average Market Value |

||||

| Futures contracts (to buy) | $ | 1,768,811 | ||

5. Fund share transactions

At April 30, 2019, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. Fund shares are issued and redeemed by the Fund only in Creation Units or Creation Unit aggregations, where 50,000 shares of the Fund constitute a Creation Unit. Such transactions are generally on an in-kind basis, with a separate cash payment, which is a balancing cash component to equate the transaction to the net asset value per share of the Fund on the transaction date. Transactions in capital shares of the Fund are disclosed in detail in the Statement of Changes in Net Assets. Authorized Participants are subject to standard creation and redemption transaction fees to

| Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report | 19 |

Notes to financial statements (unaudited) (cont’d)

offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. Creations and redemptions for cash (when cash creations and redemptions are available or specified) may be subject to an additional variable fee.

6. Deferred capital losses

As of October 31, 2018, the Fund had deferred capital losses of $22,231,397, which have no expiration date, that will be available to offset future taxable capital gains.

7. Recent accounting pronouncements

In August 2018, the Securities and Exchange Commission released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. Effective with the current reporting period, the Fund adopted the Final Rule with the most notable impacts being that the Fund is no longer required to present the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net Assets. The tax components of distributable earnings and distributions to shareholders continue to be disclosed within the Notes to Financial Statements.

The Fund has adopted the disclosure provisions of the Financial Accounting Standards Board Accounting Standards Update No. 2018-13, Fair Value Measurement (Topic 820) — Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”) which introduces new fair value disclosure requirements as well as eliminates and modifies certain existing fair value disclosure requirements. ASU 2018-13 would be effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years; however, management has elected to early adopt ASU 2018-13. The impact of the Fund’s adoption was limited to changes in the Fund’s financial statement disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy.

| 20 | Legg Mason Low Volatility High Dividend ETF 2019 Semi-Annual Report |

Board approval of management and subadvisory agreements (unaudited)

At a meeting of the Trust’s Board of Trustees, the Board considered the re-approval for an annual period of the management agreement pursuant to which Legg Mason Partners Fund Advisor, LLC (the “Manager”) provides the Fund with investment advisory and administrative services, the sub-advisory agreement pursuant to which QS Investors, LLC (“QS Investors “) provides day-to-day management of the Fund’s portfolio, and the sub-advisory agreement pursuant to which Western Asset Management Company, LLC (“Western Asset” and, together with QS Investors, the “Sub-Advisers”) provides day-to-day management of the Fund’s cash and short-term instruments allocated to it by the Manager. (The management agreement and sub-advisory agreements are collectively referred to as the “Agreements.”) The Manager and the Sub-Advisers are wholly-owned subsidiaries of Legg Mason, Inc. The Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”)) of the Fund were assisted in their review by Fund counsel and independent legal counsel and met with independent legal counsel in executive sessions separate from representatives of the Manager and the Sub-Advisers. The Independent Trustees requested and received information from the Manager and the Sub-Advisers they deemed reasonably necessary for their review of the Agreements and the performance of the Manager and the Sub-Advisers. Included was information about the Manager, the Sub-Advisers and the Fund’s distributor, as well as the management, sub-advisory and distribution arrangements and services provided to the Fund and other funds overseen by the Board. This information was initially reviewed by a special committee of the Independent Trustees and then by the full Board.

In voting to approve the Agreements, the Independent Trustees considered whether the approval of the Agreements would be in the best interests of the Fund and its shareholders, an evaluation based on several factors including those discussed below.

Nature, extent and quality of the services provided to the fund under the management agreement and sub-advisory agreements

The Board received and considered information regarding the nature, extent and quality of services provided to the Fund by the Manager and the Sub-Advisers under the Management Agreement and Sub-Advisory Agreements, respectively, during the past year. The Trustees also considered the Manager’s supervisory activities over the Sub-Advisers. In addition, the Independent Trustees received and considered other information regarding the administrative and other services rendered to the Fund by the Manager, including services specific to the Fund’s operation as an exchange-traded fund. The Board noted information received at regular meetings throughout the year related to the services rendered by the Manager in its management of the Fund’s affairs and the Manager’s role in coordinating the activities of the Sub-Advisers and the Fund’s other service providers. The Board’s evaluation of the services provided by the Manager and the Sub-Advisers took into account the Board’s knowledge and familiarity gained as Trustees of funds in the Legg Mason fund complex, including the scope and quality of the investment management and other capabilities of the Manager and the Sub-Advisers and the quality of the Manager’s administrative and other services. The Board

| Legg Mason Low Volatility High Dividend ETF | 21 |

Board approval of management and subadvisory agreements (unaudited) (cont’d)

observed that the scope of services provided by the Manager had expanded over time as a result of regulatory and other developments, including maintaining and monitoring its own and the Fund’s compliance programs specific to the Fund’s operation as an exchange-traded fund. The Board reviewed information received from the Manager and the Fund’s Chief Compliance Officer regarding the Fund’s compliance policies and procedures established pursuant to Rule 38a-1 under the Investment Company Act of 1940, as amended.

The Board reviewed the qualifications, backgrounds and responsibilities of the Fund’s senior personnel and the portfolio management team primarily responsible for the day-to-day portfolio management of the Fund. The Board considered the services provided to the Legg Mason fund complex and the Manager’s commitment to continue to provide effective and efficient investment management services. The Board also considered, based on its knowledge of the Manager and the Manager’s affiliates, the financial resources available to the Manager’s parent organization, Legg Mason, Inc.

The Board considered the division of responsibilities among the Manager and the Sub-Advisers and the oversight provided by the Manager. The Board also considered the arrangements for communication and processing of orders for creations and redemptions of Fund shares. In addition, management also reported to the Board on, among other things, its business plans regarding exchange-traded funds, recent organizational changes, portfolio manager compensation plan and policy regarding portfolio managers’ ownership of fund shares.

The Board concluded that, overall, it was satisfied with the nature, extent and quality of services provided (and expected to be provided) under the respective Agreement by the Manager and the Sub-Advisers.

Fund performance

The Board received and reviewed performance information for the Fund and for a group of passively managed, managed volatility, strategic beta exchange-traded funds consisting of two multi-cap value funds and two multi-cap core funds (the “Performance Group”) selected by Broadridge Financial Solutions Inc. (“Broadridge”), an independent provider of investment company data. The Board was provided with a description of the methodology Broadridge used to determine the similarity of the Fund with the funds included in the Performance Group. The Trustees noted that they also had received and discussed with management at periodic intervals information on the investment performance of the Fund in comparison to similar exchange-traded funds and benchmark performance indices, including the QS Low Volatility High Dividend Index, the Fund’s underlying index. The information comparing the Fund’s performance to that of the Performance Group was for the one-year period ended June 30, 2018 and the period since the Fund’s inception (December 28, 2015) through June 30, 2018. The Fund performed below the median performance of the funds in the Performance Group for each period. The Board reviewed performance information provided by the Manager for periods ended September 30, 2018, which showed that the Fund’s performance was below the

| 22 | Legg Mason Low Volatility High Dividend ETF |

Broadridge category average during the third quarter. The Trustees noted that due to the limitations in providing comparable funds in the Performance Group, the statistical information provided in Broadridge’s report may or may not provide meaningful direct comparisons to the Fund in all instances. The Trustees also noted that the Fund generally performed in line with its underlying index during the periods under review. The Trustees further noted that the Manager and QS Investors were committed to providing the resources necessary to assist the Fund’s portfolio managers. Based on its review, and noting the limited period of performance data available, the Board determined to continue to evaluate the Fund’s performance and directed the Independent Trustees’ performance committee to continue to periodically review Fund performance with the Manager and report to the full Board.

Management fees and expense ratios

The Board reviewed and considered the contractual management fee rate (the “Actual Management Fee”) paid by the Fund to the Manager over the Fund’s last fiscal year in light of the nature, extent and quality of the management and sub-advisory services provided by the Manager and the Sub-Advisers, respectively. The Board noted that the Manager, and not the Fund, pays the sub-advisory fees to the Sub-Advisers and, accordingly, that the retention of the Sub-Advisers does not increase the fees and expenses incurred by the Fund. The Board also noted that the Manager pays all fund expenses, other than the Actual Management Fee and certain other expenses. Because of the Fund’s “unitary fee” structure, the Board recognized that the Fund’s fees and expenses will vary within a much smaller range and the Manager will bear the risk that Fund expenses may increase over time. On the other hand, the Board noted that it is possible that the Manager could earn a profit on the fees charged under the management agreement and would benefit from any price decreases in third-party services covered by the management agreement.

The Board noted that the Manager provides the Fund with regulatory compliance and administrative services, office facilities and Fund officers (including the Fund’s chief financial, chief legal and chief compliance officers), and that the Manager coordinates and oversees the provision of services to the Fund by other fund service providers, including the Sub-Advisers. Management also discussed with the Board the Fund’s distribution arrangements.