UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report | October 31, 2018 |

LEGG MASON

US DIVERSIFIED CORE ETF

UDBI

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of publicly traded U.S. equity securities.

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason US Diversified Core ETF for the twelve-month reporting period ended October 31, 2018. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

| II | Legg Mason US Diversified Core ETF |

Economic review

Economic activity in the U.S. was mixed during the twelve months ended October 31, 2018 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that fourth quarter 2017 and first quarter 2018 U.S. gross domestic product (“GDP”)i growth was 2.3% and 2.2%, respectively. GDP growth then accelerated to 4.2% during the second quarter of 2018 — the strongest reading since the third quarter of 2014. Finally, the U.S. Department of Commerce’s second reading for third quarter 2018 GDP growth — released after the reporting period ended — was 3.5%. The deceleration in GDP growth in the third quarter of 2018 reflected a downturn in exports and decelerations in nonresidential fixed investment and personal consumption expenditures. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

Job growth in the U.S. was solid overall and supported the economy during the reporting period. As reported by the U.S. Department of Labor, when the reporting period ended on October 31, 2018, the unemployment rate was 3.7%, versus 4.1% when the period began. October 2018’s reading equaled the lowest unemployment rate since 1969. The percentage of longer-term unemployed also declined during the reporting period. In October 2018, 22.5% of Americans looking for a job had been out of work for more than six months, versus 23.8% when the period began.

Looking back, at its meeting that concluded on September 20, 2017, the Federal Reserve Board (the “Fed”)ii kept the federal funds rateiii on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….” At its meeting that ended on December 13, 2017, the Fed raised rates to a range between 1.25% and 1.50%. As expected, the Fed kept rates on hold at its meeting that concluded on January 31, 2018. However, at its meeting that ended on March 21, 2018, the Fed again raised the federal funds rate, moving it to a range between 1.50% and 1.75%. At its meeting that concluded on June 13, 2018, the Fed raised the federal funds rate to a range between 1.75% and 2.00%. Finally, at its meeting that ended on September 26, 2018, the Fed raised the federal funds rate to a range between 2.00% and 2.25%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

November 30, 2018

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| Legg Mason US Diversified Core ETF | III |

Investment commentary (cont’d)

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| IV | Legg Mason US Diversified Core ETF |

Q. What is the Fund’s investment strategy?

A. Legg Mason US Diversified Core ETF (the “Fund”) seeks to track the investment results of the QS DBI US Diversified Index (the “Underlying Index”). The Underlying Index seeks to provide exposure to equities of U.S. companies and is based on a proprietary methodology created and sponsored by QS Investors, LLC (“QS Investors”), the Fund’s subadviser. The Underlying Index is composed of U.S. companies that are included in the MSCI USA IMI Index.

The proprietary rules-based process initially groups this universe of securities into multiple investment categories based on industries. Within each of these investment categories, securities are weighted by market capitalization. The process then combines those investment categories with more highly correlated historical performance into a smaller number of “clusters.” A cluster is a group of investment categories based on industry that have demonstrated a tendency to behave similarly (high correlation). Thereafter, each of these clusters is equally weighted in the Underlying Index to produce a diversified portfolio. QS Investors anticipates that the number of component securities in the Underlying Index will range from 2,200 to 2,500. The Underlying Index may include large, medium and small capitalization companies. The components of the Underlying Index, and the degree to which these components represent certain sector and industries, may change over time. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The Underlying Index is reconstituted on a different date from the MSCI USA IMI Index. Securities that are removed from, or added to, the MSCI USA IMI Index are removed from, or considered for inclusion in, the Underlying Index at the next annual reconstitution or quarterly rebalancing of the Underlying Index. The Fund’s portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The Fund may trade at times other than when the Underlying Index is rebalanced or reconstituted for a variety of reasons, including when adjustments may be made to its representative sampling process from time to time or when investing cash.

The term “diversified” highlights the purpose of QS Investors’ Diversification Based Investing methodology, which seeks to avoid concentration risks often identified with market cap-weighted funds. The term “core” highlights the segment of the investment universe where the Fund invests — as opposed to introducing value or size biases or investing in niche segments of the market.

The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose the Underlying Index. The equity securities that the Fund will hold are principally common stocks.

The Fund may invest up to 20% of its net assets in certain index futures, options, options on index futures, swap contracts or other derivatives related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including exchange-traded funds; exchange-traded notes; and in securities and other instruments not included in its Underlying Index but which QS Investors believes will help the Fund track its Underlying Index. The Fund may invest in exchange-traded equity index futures to

| Legg Mason US Diversified Core ETF 2018 Annual Report | 1 |

Fund overview (cont’d)

manage industry exposure and for cash management purposes.

Q. What were the overall market conditions during the Fund’s reporting period?

A. U.S. equity markets’ hit all-time highs during the twelve-month reporting period ended October 31, 2018, before dramatically pulling back in the final month. In October 2018, investors appeared to react to rising risk by pivoting away from the growth stocks that had provided most of the gains to that point in 2018 and which had become expensive according to a number of fundamental measures. Despite the pull-back, most of the sectors posted gains, several in double digits. The market generally benefited from strong economic statistics and muted inflation. Only the Materials sector had a meaningfully negative return.

The last months of 2017 saw strong corporate profits and a positive outlook for 2018, driven by the reduction in the corporate tax rates mandated by the U.S. tax overhaul program approved in late December 2017. The housing market, including new home starts, and job growth remained strong, with sentiment positive for both business and consumers. Rising oil prices did not appear to be a headwind for consumers, nor did a season of notable natural disasters across the southern and western US.

Global equities experienced significant volatility during the first quarter of 2018. Despite a backdrop of solid and synchronized global economic growth, most major equity markets including the U.S. entered correction territory in early February 2018. This downturn was followed by a rally and, as the quarter progressed, markets alternated abruptly between “risk on” to “risk off” periods. Investor fears of rapid interest rate increases, potential trade wars between the U.S. and China and the possible regulation of the technology industry caused several sell-offs. The U.S. equity market saw more than twenty days with gains or losses of more than 1%.

Equity market performance in the second quarter of 2018 was positive in the U.S. and only a few other developed markets. As in 2017 and the start of 2018, equity market performance was driven by a narrow segment of stocks; despite bouts of volatility during the first half of 2018, a rally in momentum/growth stocks persisted, as investors seemed to be focused on seeking growth while disregarding valuations. Corporate earnings data was positive, setting the stage for the U.S. Federal Reserve Board (the “Fed”)i to hike rates in June 2018.

In the third quarter of 2018, the U.S. equity market again had the best regional performance. A variety of positive economic and macro data points provided support to equities, including below-average volatility, low jobless claims, strength in manufacturing data, and rising consumer confidence.

The final month of the reporting period proved to be a challenging month for investors, as volatility returned in earnest. Throughout the month, practically every asset class sold off to some extent, both in the U.S. and abroad. Despite a solid start to the third quarter earnings season, no signs of a weakening U.S. economy and no material change in the uncertainty surrounding trade and tariffs, the Russell 3000 Indexii declined -7.4%, realizing the worst one month equity return since September 2011. In this final month, the market also reflected a rotation in terms of style and sector, as investors appeared to

| 2 | Legg Mason US Diversified Core ETF 2018 Annual Report |

reassess the risk of further interest rate hikes and escalating trade tensions with China; there was a movement away from growth/momentum stocks to value opportunities and low volatility, dividend-paying stocks. Cyclical sectors were the largest to sell-off, while more defensive sectors held their ground.

The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended October 31, 2018, Legg Mason US Diversified Core ETF generated a 5.62% return on a net asset value (“NAV”)iii basis and 5.44% based on its market priceiv per share.

The performance table shows the Fund’s total return for the twelve months ended October 31, 2018 based on its NAV and market price as of October 31, 2018. The Fund seeks to track the investment results of the QS DBI US Diversified Index, which returned 5.93% for the same period. The Fund’s broad-based market index, the Russell 3000 Index, returned 6.60% over the same time frame. The Lipper Multi-Cap Core Funds Category Average1 returned 3.43% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as

of October 31, 2018 (unaudited) |

||||||||

| 6 months | 12 months | |||||||

| Legg Mason US Diversified Core ETF: | ||||||||

| $31.40 (NAV) |

1.65 | % | 5.62 | %*† | ||||

| $31.40 (Market Price) |

1.62 | % | 5.44 | %*‡ | ||||

| QS DBI US Diversified Index | 1.80 | % | 5.93 | % | ||||

| Russell 3000 Index | 2.70 | % | 6.60 | % | ||||

| Lipper Multi-Cap Core Funds Category Average1 | 0.13 | % | 3.43 | % | ||||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Principal value and investment returns will fluctuate so shares, when redeemed or sold in the market, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns shown are typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the number of days the market price of the Fund’s shares was greater than the Fund’s NAV and the number

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended October 31, 2018 including the reinvestment of all distributions, including returns of capital, if any, calculated among the 815 funds for the six-month period and among the 781 funds for the twelve-month period in the Fund’s Lipper category. |

| Legg Mason US Diversified Core ETF 2018 Annual Report | 3 |

Fund overview (cont’d)

of days it was less than the Fund’s NAV (i.e., premium or discount) for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated March 1, 2018, the gross total annual fund operating expense ratio for the Fund was 0.30%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions at market price.

Q. What were the leading contributors to performance?

A. The primary contributors to performance by virtue of return and weight in the Underlying Index were the Consumer Discretionary, Health Care and Information Technology sectors, all of which had double digit returns for the reporting period.

Q. What were the leading detractors from performance?

A. The leading detractors from performance in the Underlying Index were the Energy and Materials sectors. Along with the Industrials sector, these were the only sectors with negative returns for the reporting period.

Looking for additional information?

The Fund’s daily NAV is available on-line at www.leggmason.com/etf. The Fund is traded under the symbol “UDBI” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Legg Mason US Diversified Core ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

QS Investors, LLC

November 20, 2018

RISKS: Equity securities are subject to market and price fluctuations. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Diversification does not guarantee a profit or protect against a loss. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision.

| 4 | Legg Mason US Diversified Core ETF 2018 Annual Report |

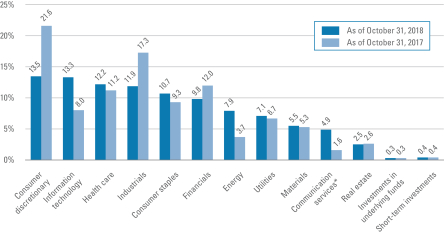

Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2018 were: Consumer Discretionary (13.5%), Information Technology (13.3%), Health Care (12.2%), Industrials (11.9%) and Consumer Staples (10.6%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| ii | The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| iii | Net Asset Value (“NAV”) is calculated by subtracting total liabilities from total assets and dividing the result by the number of shares outstanding. |

| iv | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| Legg Mason US Diversified Core ETF 2018 Annual Report | 5 |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2018 and October 31, 2017. The composition of the Fund’s investments is subject to change at any time. |

| * | As of September 28, 2018, the Telecommunication Services sector was broadened to include some companies previously classified in the Consumer Discretionary and Information Technology sectors and renamed the Communication Services sector. |

| 6 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on May 1, 2018 and held for the six months ended October 31, 2018.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund Shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| 1.65% | $ | 1,000.00 | $ | 1,016.50 | 0.30 | % | $ | 1.52 | 5.00 | % | $1,000.00 | $ | 1,023.69 | 0.30 | % | $ | 1.53 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended October 31, 2018. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| Legg Mason US Diversified Core ETF 2018 Annual Report | 7 |

| Net Asset Value | ||||

| Average annual total returns1 | ||||

| Twelve Months Ended 10/31/18 | 5.62 | % | ||

| Inception* through 10/31/18 | 10.73 | |||

| Cumulative total returns1 | ||||

| Inception date of 12/28/15 through 10/31/18 | 33.62 | % | ||

| Market Price | ||||

| Average annual total returns2 | ||||

| Twelve Months Ended 10/31/18 | 5.44 | % | ||

| Inception* through 10/31/18 | 10.73 | |||

| Cumulative total returns2 | ||||

| Inception date of 12/28/15 through 10/31/18 | 33.61 | % | ||

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the fund. Market price returns shown are typically based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV is determined, which is typically 4:00 p.m. Eastern time (US). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestments of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is December 28, 2015. |

| 8 | Legg Mason US Diversified Core ETF 2018 Annual Report |

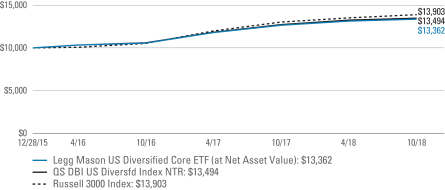

Historical performance

Value of $10,000 invested in

Legg Mason US Diversified Core ETF vs. QS DBI US Diversified Index and Russell 3000 Index† — December 28, 2015 - October 2018

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in the Legg Mason US Diversified Core ETF on December 28, 2015, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through October 31, 2018. The hypothetical illustration also assumes a $10,000 investment in the QS DBI US Diversified Index and the Russell 3000 Index. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The QS DBI US Diversified Index (the “Underlying Index”) is an index composed of publicly traded U.S. equity securities that are included in the MSCI USA IMI Index. The Underlying Index is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadviser. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| Legg Mason US Diversified Core ETF 2018 Annual Report | 9 |

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Common Stocks — 99.2% |

| |||||||||||||||

| Communication Services — 4.9% |

| |||||||||||||||

| Diversified Telecommunication Services — 1.9% |

| |||||||||||||||

| AT&T Inc. |

901 | $ | 27,643 | |||||||||||||

| CenturyLink Inc. |

119 | 2,456 | ||||||||||||||

| Cogent Communications Holdings Inc. |

11 | 572 | ||||||||||||||

| ORBCOMM Inc. |

40 | 381 | * | |||||||||||||

| Verizon Communications Inc. |

539 | 30,772 | ||||||||||||||

| Vonage Holdings Corp. |

51 | 676 | * | |||||||||||||

| Zayo Group Holdings Inc. |

18 | 538 | * | |||||||||||||

| Total Diversified Telecommunication Services |

63,038 | |||||||||||||||

| Entertainment — 0.8% |

| |||||||||||||||

| Activision Blizzard Inc. |

40 | 2,762 | ||||||||||||||

| Electronic Arts Inc. |

17 | 1,547 | * | |||||||||||||

| Netflix Inc. |

30 | 9,053 | * | |||||||||||||

| Take-Two Interactive Software Inc. |

9 | 1,160 | * | |||||||||||||

| Twenty-First Century Fox Inc., Class A Shares |

41 | 1,866 | ||||||||||||||

| Twenty-First Century Fox Inc., Class B Shares |

13 | 587 | ||||||||||||||

| Viacom Inc., Class B Shares |

15 | 480 | ||||||||||||||

| Walt Disney Co. |

71 | 8,153 | ||||||||||||||

| Total Entertainment |

25,608 | |||||||||||||||

| Interactive Media & Services — 1.7% |

| |||||||||||||||

| Alphabet Inc., Class A Shares |

16 | 17,449 | * | |||||||||||||

| Alphabet Inc., Class C Shares |

16 | 17,228 | * | |||||||||||||

| Facebook Inc., Class A Shares |

129 | 19,581 | * | |||||||||||||

| TripAdvisor Inc. |

16 | 834 | * | |||||||||||||

| Twitter Inc. |

38 | 1,321 | * | |||||||||||||

| Total Interactive Media & Services |

56,413 | |||||||||||||||

| Media — 0.5% |

| |||||||||||||||

| CBS Corp., Class B Shares, Non Voting Shares |

16 | 918 | ||||||||||||||

| Charter Communications Inc., Class A Shares |

8 | 2,563 | * | |||||||||||||

| Comcast Corp., Class A Shares |

214 | 8,162 | ||||||||||||||

| Discovery Inc., Class A Shares |

18 | 583 | * | |||||||||||||

| Discovery Inc., Class C Shares |

28 | 821 | * | |||||||||||||

| DISH Network Corp., Class A Shares |

10 | 307 | * | |||||||||||||

| GCI Liberty Inc., Class A Shares |

10 | 473 | * | |||||||||||||

| Liberty Broadband Corp., Class C Shares |

6 | 497 | * | |||||||||||||

| Liberty Media Corp-Liberty SiriusXM, Class C Shares |

14 | 578 | * | |||||||||||||

See Notes to Financial Statements.

| 10 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Media — continued |

| |||||||||||||||

| Omnicom Group Inc. |

9 | $ | 669 | |||||||||||||

| Total Media |

15,571 | |||||||||||||||

| Total Communication Services |

160,630 | |||||||||||||||

| Consumer Discretionary — 13.5% |

| |||||||||||||||

| Auto Components — 0.8% |

| |||||||||||||||

| Adient PLC |

24 | 730 | ||||||||||||||

| American Axle & Manufacturing Holdings Inc. |

37 | 561 | ||||||||||||||

| Aptiv PLC |

87 | 6,682 | ||||||||||||||

| Autoliv Inc. |

31 | 2,584 | ||||||||||||||

| BorgWarner Inc. |

76 | 2,995 | ||||||||||||||

| Cooper Tire & Rubber Co. |

13 | 402 | ||||||||||||||

| Cooper-Standard Holdings Inc. |

5 | 463 | * | |||||||||||||

| Dana Inc. |

40 | 623 | ||||||||||||||

| Delphi Technologies PLC |

26 | 558 | ||||||||||||||

| Dorman Products Inc. |

8 | 632 | * | |||||||||||||

| Fox Factory Holding Corp. |

17 | 913 | * | |||||||||||||

| Garrett Motion Inc. |

11 | 167 | * | |||||||||||||

| Gentex Corp. |

72 | 1,516 | ||||||||||||||

| Gentherm Inc. |

25 | 1,091 | * | |||||||||||||

| Goodyear Tire & Rubber Co. |

102 | 2,148 | ||||||||||||||

| LCI Industries |

6 | 416 | ||||||||||||||

| Lear Corp. |

18 | 2,392 | ||||||||||||||

| Modine Manufacturing Co. |

34 | 442 | * | |||||||||||||

| Standard Motor Products Inc. |

8 | 433 | ||||||||||||||

| Tenneco Inc. |

14 | 482 | ||||||||||||||

| Veoneer Inc. |

21 | 705 | * | |||||||||||||

| Visteon Corp. |

10 | 790 | * | |||||||||||||

| Total Auto Components |

27,725 | |||||||||||||||

| Automobiles — 1.0% |

| |||||||||||||||

| Ford Motor Co. |

955 | 9,120 | ||||||||||||||

| General Motors Co. |

321 | 11,746 | ||||||||||||||

| Harley-Davidson Inc. |

28 | 1,070 | ||||||||||||||

| Tesla Inc. |

32 | 10,794 | * | |||||||||||||

| Thor Industries Inc. |

10 | 697 | ||||||||||||||

| Winnebago Industries Inc. |

13 | 358 | ||||||||||||||

| Total Automobiles |

33,785 | |||||||||||||||

| Diversified Consumer Services — 1.9% |

| |||||||||||||||

| Adtalem Global Education Inc. |

74 | 3,747 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 11 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Diversified Consumer Services — continued |

||||||||||||||||

| American Public Education Inc. |

19 | $ | 622 | * | ||||||||||||

| Bright Horizons Family Solutions Inc. |

63 | 7,239 | * | |||||||||||||

| Career Education Corp. |

73 | 1,050 | * | |||||||||||||

| Carriage Services Inc. |

21 | 400 | ||||||||||||||

| Chegg Inc. |

106 | 2,892 | * | |||||||||||||

| frontdoor Inc. |

75 | 2,554 | * | |||||||||||||

| Graham Holdings Co., Class B Shares |

6 | 3,486 | ||||||||||||||

| Grand Canyon Education Inc. |

55 | 6,858 | * | |||||||||||||

| H&R Block Inc. |

253 | 6,715 | ||||||||||||||

| Houghton Mifflin Harcourt Co. |

164 | 1,099 | * | |||||||||||||

| K12 Inc. |

38 | 814 | * | |||||||||||||

| Laureate Education Inc., Class A Shares |

54 | 804 | * | |||||||||||||

| Regis Corp. |

42 | 707 | * | |||||||||||||

| ServiceMaster Global Holdings Inc. |

151 | 6,475 | * | |||||||||||||

| Sotheby’s |

49 | 2,058 | * | |||||||||||||

| Strategic Education Inc. |

25 | 3,145 | ||||||||||||||

| U.S. Service Corp. International |

213 | 8,833 | ||||||||||||||

| Weight Watchers International Inc. |

47 | 3,107 | * | |||||||||||||

| Total Diversified Consumer Services |

62,605 | |||||||||||||||

| Hotels, Restaurants & Leisure — 1.6% |

| |||||||||||||||

| Aramark |

15 | 539 | ||||||||||||||

| Caesars Entertainment Corp. |

102 | 876 | * | |||||||||||||

| Carnival Corp. |

43 | 2,410 | ||||||||||||||

| Chipotle Mexican Grill Inc. |

2 | 921 | * | |||||||||||||

| Cracker Barrel Old Country Store Inc. |

4 | 635 | ||||||||||||||

| Darden Restaurants Inc. |

17 | 1,811 | ||||||||||||||

| Dave & Buster’s Entertainment Inc. |

9 | 536 | ||||||||||||||

| Domino’s Pizza Inc. |

3 | 806 | ||||||||||||||

| Dunkin’ Brands Group Inc. |

10 | 726 | ||||||||||||||

| Extended Stay America Inc. |

32 | 521 | ||||||||||||||

| Hilton Worldwide Holdings Inc. |

37 | 2,633 | ||||||||||||||

| Las Vegas Sands Corp. |

38 | 1,939 | ||||||||||||||

| Marriott International Inc., Class A Shares |

31 | 3,624 | ||||||||||||||

| Marriott Vacations Worldwide Corp. |

5 | 442 | ||||||||||||||

| McDonald’s Corp. |

79 | 13,975 | ||||||||||||||

| MGM Resorts International |

48 | 1,281 | ||||||||||||||

| Norwegian Cruise Line Holdings Ltd. |

32 | 1,410 | * | |||||||||||||

| Royal Caribbean Cruises Ltd. |

17 | 1,780 | * | |||||||||||||

See Notes to Financial Statements.

| 12 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Hotels, Restaurants & Leisure — continued |

||||||||||||||||

| Six Flags Entertainment Corp. |

14 | $ | 754 | |||||||||||||

| Starbucks Corp. |

149 | 8,682 | ||||||||||||||

| Texas Roadhouse Inc. |

7 | 423 | ||||||||||||||

| Vail Resorts Inc. |

3 | 754 | ||||||||||||||

| Wendy’s Co. |

39 | 672 | ||||||||||||||

| Wyndham Hotels & Resorts Inc. |

7 | 345 | ||||||||||||||

| Wynn Resorts Ltd. |

10 | 1,006 | ||||||||||||||

| Yum! Brands Inc. |

33 | 2,984 | ||||||||||||||

| Total Hotels, Restaurants & Leisure |

52,485 | |||||||||||||||

| Household Durables — 0.8% |

| |||||||||||||||

| Cavco Industries Inc. |

4 | 802 | * | |||||||||||||

| DR Horton Inc. |

81 | 2,913 | ||||||||||||||

| Garmin Ltd. |

37 | 2,448 | ||||||||||||||

| Helen of Troy Ltd. |

7 | 869 | * | |||||||||||||

| Installed Building Products, Inc. |

11 | 335 | * | |||||||||||||

| iRobot Corp. |

10 | 882 | * | |||||||||||||

| KB Home |

25 | 499 | ||||||||||||||

| La-Z-Boy Inc. |

16 | 445 | ||||||||||||||

| Leggett & Platt Inc. |

22 | 799 | ||||||||||||||

| Lennar Corp., Class A Shares |

62 | 2,665 | ||||||||||||||

| M/I Homes Inc. |

15 | 363 | * | |||||||||||||

| MDC Holdings Inc. |

14 | 393 | ||||||||||||||

| Meritage Homes Corp. |

11 | 410 | * | |||||||||||||

| Mohawk Industries Inc. |

14 | 1,746 | * | |||||||||||||

| Newell Brands Inc. |

119 | 1,890 | ||||||||||||||

| NVR Inc. |

1 | 2,239 | * | |||||||||||||

| PulteGroup Inc. |

54 | 1,327 | ||||||||||||||

| Taylor Morrison Home Corp., Class A Shares |

25 | 413 | * | |||||||||||||

| Tempur Sealy International Inc. |

13 | 601 | * | |||||||||||||

| Toll Brothers Inc. |

21 | 707 | ||||||||||||||

| TopBuild Corp. |

13 | 593 | * | |||||||||||||

| Tupperware Brands Corp. |

12 | 421 | ||||||||||||||

| Whirlpool Corp. |

15 | 1,646 | ||||||||||||||

| Total Household Durables |

25,406 | |||||||||||||||

| Internet & Direct Marketing Retail — 1.7% |

| |||||||||||||||

| Amazon.com Inc. |

27 | 43,146 | * | |||||||||||||

| Booking Holdings Inc. |

3 | 5,624 | * | |||||||||||||

| eBay Inc. |

55 | 1,597 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 13 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Internet & Direct Marketing Retail — continued |

||||||||||||||||

| Expedia Group Inc. |

12 | $ | 1,505 | |||||||||||||

| Groupon Inc. |

97 | 317 | * | |||||||||||||

| GrubHub Inc. |

7 | 649 | * | |||||||||||||

| MercadoLibre Inc. |

3 | 974 | ||||||||||||||

| Qurate Retail Inc. |

58 | 1,273 | * | |||||||||||||

| Wayfair Inc. , Class A Shares |

5 | 551 | * | |||||||||||||

| Total Internet & Direct Marketing Retail |

55,636 | |||||||||||||||

| Media — 0.1% |

| |||||||||||||||

| Liberty Global PLC, Class A Shares |

25 | 626 | * | |||||||||||||

| Liberty Global PLC, Class C Shares |

15 | 384 | * | |||||||||||||

| Sirius XM Holdings Inc. |

144 | 867 | ||||||||||||||

| Total Media |

1,877 | |||||||||||||||

| Multiline Retail — 2.0% |

| |||||||||||||||

| Big Lots Inc. |

26 | 1,079 | ||||||||||||||

| Dillard’s Inc., Class A Shares |

5 | 352 | ||||||||||||||

| Dollar General Corp. |

127 | 14,145 | ||||||||||||||

| Dollar Tree Inc. |

113 | 9,526 | * | |||||||||||||

| JC Penney Co. Inc. |

327 | 481 | * | |||||||||||||

| Kohl’s Corp. |

86 | 6,513 | ||||||||||||||

| Macy’s Inc. |

157 | 5,384 | ||||||||||||||

| Nordstrom Inc. |

63 | 4,143 | ||||||||||||||

| Ollie’s Bargain Outlet Holdings Inc. |

29 | 2,694 | * | |||||||||||||

| Target Corp. |

241 | 20,155 | ||||||||||||||

| Total Multiline Retail |

64,472 | |||||||||||||||

| Specialty Retail — 1.8% |

| |||||||||||||||

| Advance Auto Parts Inc. |

8 | 1,278 | ||||||||||||||

| AutoNation Inc. |

10 | 405 | * | |||||||||||||

| AutoZone Inc. |

3 | 2,200 | * | |||||||||||||

| Best Buy Co. Inc. |

26 | 1,824 | ||||||||||||||

| Burlington Stores Inc. |

9 | 1,543 | * | |||||||||||||

| CarMax Inc. |

19 | 1,290 | * | |||||||||||||

| Five Below Inc. |

4 | 455 | * | |||||||||||||

| Foot Locker Inc. |

13 | 613 | ||||||||||||||

| Gap Inc. |

30 | 819 | ||||||||||||||

| Home Depot Inc. |

107 | 18,819 | ||||||||||||||

| L Brands Inc. |

28 | 908 | ||||||||||||||

| Lithia Motors Inc., Class A Shares |

6 | 534 | ||||||||||||||

| Lowe’s Cos. Inc. |

80 | 7,618 | ||||||||||||||

See Notes to Financial Statements.

| 14 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Specialty Retail — continued |

||||||||||||||||

| Monro Inc. |

7 | $ | 521 | |||||||||||||

| Murphy USA Inc. |

5 | 403 | * | |||||||||||||

| O’Reilly Automotive Inc. |

8 | 2,566 | * | |||||||||||||

| RH |

3 | 347 | * | |||||||||||||

| Ross Stores Inc. |

34 | 3,366 | ||||||||||||||

| Tiffany & Co. |

12 | 1,336 | ||||||||||||||

| TJX Cos. Inc. |

62 | 6,813 | ||||||||||||||

| Tractor Supply Co. |

15 | 1,378 | ||||||||||||||

| Ulta Beauty Inc. |

6 | 1,647 | * | |||||||||||||

| Urban Outfitters Inc. |

12 | 474 | * | |||||||||||||

| Williams-Sonoma Inc. |

8 | 475 | ||||||||||||||

| Total Specialty Retail |

57,632 | |||||||||||||||

| Textiles, Apparel & Luxury Goods — 1.8% |

| |||||||||||||||

| Carter’s Inc. |

14 | 1,344 | ||||||||||||||

| Columbia Sportswear Co. |

11 | 993 | ||||||||||||||

| Crocs Inc. |

20 | 411 | * | |||||||||||||

| Deckers Outdoor Corp. |

10 | 1,272 | * | |||||||||||||

| Fossil Group Inc. |

24 | 521 | * | |||||||||||||

| G-III Apparel Group Ltd |

12 | 478 | * | |||||||||||||

| Hanesbrands Inc. |

102 | 1,750 | ||||||||||||||

| Lululemon Athletica Inc. |

29 | 4,081 | * | |||||||||||||

| Michael Kors Holdings Ltd. |

43 | 2,383 | ||||||||||||||

| NIKE Inc., Class B Shares |

349 | 26,189 | ||||||||||||||

| PVH Corp. |

20 | 2,416 | ||||||||||||||

| Ralph Lauren Corp. |

16 | 2,074 | ||||||||||||||

| Skechers U.S.A. Inc. Class A Shares |

44 | 1,257 | * | |||||||||||||

| Steven Madden Ltd. |

28 | 876 | ||||||||||||||

| Tapestry Inc. |

76 | 3,215 | ||||||||||||||

| Under Armour Inc., Class A Shares |

61 | 1,349 | * | |||||||||||||

| Under Armour Inc., Class C Shares |

59 | 1,170 | * | |||||||||||||

| VF Corp. |

89 | 7,376 | ||||||||||||||

| Wolverine World Wide Inc. |

32 | 1,125 | ||||||||||||||

| Total Textiles, Apparel & Luxury Goods |

60,280 | |||||||||||||||

| Total Consumer Discretionary |

441,903 | |||||||||||||||

| Consumer Staples — 10.6% |

| |||||||||||||||

| Beverages — 1.8% |

| |||||||||||||||

| Brown-Forman Corp., Class B Shares |

33 | 1,529 | ||||||||||||||

| Coca-Cola Co. |

547 | 26,190 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 15 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Beverages — continued |

| |||||||||||||||

| Constellation Brands Inc., Class A Shares |

24 | $ | 4,782 | |||||||||||||

| Molson Coors Brewing Co., Class B Shares |

21 | 1,344 | ||||||||||||||

| Monster Beverage Corp. |

52 | 2,748 | * | |||||||||||||

| PepsiCo Inc. |

191 | 21,465 | ||||||||||||||

| Total Beverages |

58,058 | |||||||||||||||

| Food & Staples Retailing — 2.0% |

| |||||||||||||||

| Casey’s General Stores Inc. |

7 | 883 | ||||||||||||||

| Costco Wholesale Corp. |

71 | 16,233 | ||||||||||||||

| Kroger Co. |

131 | 3,899 | ||||||||||||||

| Performance Food Group Co. |

26 | 762 | * | |||||||||||||

| Sprouts Farmers Market Inc. |

28 | 753 | * | |||||||||||||

| Sysco Corp. |

89 | 6,348 | ||||||||||||||

| US Foods Holding Corp. |

35 | 1,021 | * | |||||||||||||

| Walgreens Boots Alliance Inc. |

134 | 10,689 | ||||||||||||||

| Walmart Inc. |

236 | 23,666 | ||||||||||||||

| Total Food & Staples Retailing |

64,254 | |||||||||||||||

| Food Products — 1.8% |

| |||||||||||||||

| Archer-Daniels-Midland Co. |

105 | 4,961 | ||||||||||||||

| B&G Foods Inc. |

13 | 339 | ||||||||||||||

| Bunge Ltd. |

21 | 1,298 | ||||||||||||||

| Calavo Growers Inc. |

6 | 582 | ||||||||||||||

| Campbell Soup Co. |

25 | 935 | ||||||||||||||

| Conagra Brands Inc. |

102 | 3,631 | ||||||||||||||

| Darling Ingredients Inc. |

38 | 785 | * | |||||||||||||

| Flowers Foods Inc. |

42 | 811 | ||||||||||||||

| General Mills Inc. |

96 | 4,205 | ||||||||||||||

| Hain Celestial Group Inc. |

23 | 572 | * | |||||||||||||

| Hershey Co. |

30 | 3,214 | ||||||||||||||

| Hormel Foods Corp. |

67 | 2,924 | ||||||||||||||

| Hostess Brands Inc. |

45 | 468 | * | |||||||||||||

| Ingredion Inc. |

9 | 911 | ||||||||||||||

| J & J Snack Foods Corp. |

3 | 468 | ||||||||||||||

| JM Smucker Co. |

21 | 2,275 | ||||||||||||||

| John B Sanfilippo & Son Inc. |

6 | 378 | ||||||||||||||

| Kellogg Co. |

51 | 3,339 | ||||||||||||||

| Kraft Heinz Co. |

115 | 6,322 | ||||||||||||||

| Lamb Weston Holdings Inc. |

32 | 2,501 | ||||||||||||||

| Lancaster Colony Corp. |

4 | 686 | ||||||||||||||

See Notes to Financial Statements.

| 16 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Food Products — continued |

| |||||||||||||||

| McCormick & Co. Inc., Non Voting Shares |

20 | $ | 2,880 | |||||||||||||

| Mondelez International Inc., Class A Shares |

272 | 11,419 | ||||||||||||||

| Post Holdings Inc. |

13 | 1,149 | * | |||||||||||||

| Sanderson Farms Inc. |

4 | 394 | ||||||||||||||

| TreeHouse Foods Inc. |

12 | 547 | * | |||||||||||||

| Tyson Foods Inc., Class A Shares |

49 | 2,936 | ||||||||||||||

| Total Food Products |

60,930 | |||||||||||||||

| Household Products — 2.0% |

| |||||||||||||||

| Church & Dwight Co. Inc. |

34 | 2,019 | ||||||||||||||

| Clorox Co. |

21 | 3,117 | ||||||||||||||

| Colgate-Palmolive Co. |

151 | 8,992 | ||||||||||||||

| Energizer Holdings, Inc. |

15 | 882 | ||||||||||||||

| Kimberly-Clark Corp. |

68 | 7,092 | ||||||||||||||

| Procter & Gamble Co. |

471 | 41,768 | ||||||||||||||

| Spectrum Brands Holdings Inc. |

6 | 390 | ||||||||||||||

| WD-40 Co. |

3 | 501 | ||||||||||||||

| Total Household Products |

64,761 | |||||||||||||||

| Personal Products — 0.9% |

| |||||||||||||||

| Avon Products Inc. |

326 | 639 | * | |||||||||||||

| Coty Inc., Class A Shares |

273 | 2,880 | ||||||||||||||

| Edgewell Personal Care Co. |

35 | 1,679 | * | |||||||||||||

| elf Beauty, Inc. |

32 | 339 | * | |||||||||||||

| Estee Lauder Cos. Inc., Class A Shares |

122 | 16,768 | ||||||||||||||

| Herbalife Nutrition Ltd. |

72 | 3,835 | ||||||||||||||

| Inter Parfums Inc. |

21 | 1,239 | ||||||||||||||

| Medifast Inc. |

6 | 1,270 | ||||||||||||||

| Nu Skin Enterprises Inc. , Class A Shares |

32 | 2,247 | ||||||||||||||

| USANA Health Sciences Inc. |

5 | 585 | * | |||||||||||||

| Total Personal Products |

31,481 | |||||||||||||||

| Tobacco — 2.1% |

| |||||||||||||||

| Altria Group Inc. |

489 | 31,805 | ||||||||||||||

| Philip Morris International Inc. |

401 | 35,316 | ||||||||||||||

| Universal Corp. |

8 | 543 | ||||||||||||||

| Vector Group Ltd. |

37 | 500 | ||||||||||||||

| Total Tobacco |

68,164 | |||||||||||||||

| Total Consumer Staples |

347,648 | |||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 17 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Energy — 7.9% |

| |||||||||||||||

| Energy Equipment & Services — 3.9% |

| |||||||||||||||

| Apergy Corp. |

51 | $ | 1,988 | * | ||||||||||||

| Archrock Inc. |

111 | 1,139 | ||||||||||||||

| Baker Hughes a GE Co. |

261 | 6,966 | ||||||||||||||

| C&J Energy Services Inc. |

56 | 1,052 | * | |||||||||||||

| Cactus Inc., Class A Shares |

29 | 970 | * | |||||||||||||

| Core Laboratories N.V. |

26 | 2,216 | ||||||||||||||

| Diamond Offshore Drilling Inc. |

52 | 737 | * | |||||||||||||

| Dril-Quip Inc. |

27 | 1,149 | * | |||||||||||||

| Ensco PLC, Class A Shares |

300 | 2,142 | ||||||||||||||

| Exterran Corp. |

20 | 418 | * | |||||||||||||

| Forum Energy Technologies Inc. |

82 | 735 | * | |||||||||||||

| FRANK’S INTERNATIONAL NV |

83 | 589 | ||||||||||||||

| Halliburton Co. |

555 | 19,247 | ||||||||||||||

| Helix Energy Solutions Group Inc. |

83 | 707 | * | |||||||||||||

| Helmerich & Payne Inc. |

63 | 3,924 | ||||||||||||||

| Keane Group, Inc. |

56 | 704 | * | |||||||||||||

| Matrix Service Co. |

29 | 590 | * | |||||||||||||

| McDermott International Inc. |

108 | 835 | * | |||||||||||||

| Nabors Industries Ltd. |

248 | 1,232 | ||||||||||||||

| National Oilwell Varco Inc. |

236 | 8,685 | ||||||||||||||

| Newpark Resources Inc. |

64 | 525 | * | |||||||||||||

| Nine Energy Service Inc. |

22 | 815 | * | |||||||||||||

| Noble Corp. PLC |

164 | 823 | ||||||||||||||

| Oceaneering International Inc. |

67 | 1,269 | * | |||||||||||||

| Oil States International Inc. |

48 | 1,069 | * | |||||||||||||

| Patterson-UTI Energy Inc. |

140 | 2,330 | ||||||||||||||

| ProPetro Holding Corp. |

71 | 1,253 | * | |||||||||||||

| Rowan Cos. PLC, Class A Shares |

86 | 1,368 | * | |||||||||||||

| RPC Inc. |

44 | 655 | ||||||||||||||

| Schlumberger Ltd. |

877 | 44,999 | ||||||||||||||

| SEACOR Holdings Inc. |

18 | 864 | * | |||||||||||||

| Select Energy Services Inc., Class A Shares |

66 | 631 | * | |||||||||||||

| Superior Energy Services Inc. |

72 | 564 | * | |||||||||||||

| TechnipFMC PLC |

269 | 7,075 | ||||||||||||||

| TETRA Technologies Inc. |

167 | 496 | * | |||||||||||||

| Tidewater Inc. |

22 | 591 | * | |||||||||||||

| Transocean Ltd. |

271 | 2,984 | ||||||||||||||

See Notes to Financial Statements.

| 18 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Energy Equipment & Services — continued |

| |||||||||||||||

| U.S. Silica Holdings Inc. |

64 | $ | 896 | |||||||||||||

| Unit Corp. |

30 | 694 | * | |||||||||||||

| Weatherford International PLC |

639 | 863 | ||||||||||||||

| Total Energy Equipment & Services |

126,789 | |||||||||||||||

| Oil, Gas & Consumable Fuels — 4.0% |

| |||||||||||||||

| Anadarko Petroleum Corp. |

55 | 2,926 | ||||||||||||||

| Antero Resources Corp. |

37 | 588 | * | |||||||||||||

| Apache Corp. |

49 | 1,854 | ||||||||||||||

| Cabot Oil & Gas Corp. |

58 | 1,405 | ||||||||||||||

| Cheniere Energy Inc. |

24 | 1,450 | * | |||||||||||||

| Chesapeake Energy Corp. |

199 | 699 | * | |||||||||||||

| Chevron Corp. |

187 | 20,879 | ||||||||||||||

| Cimarex Energy Co. |

5 | 397 | ||||||||||||||

| Concho Resources Inc. |

24 | 3,338 | * | |||||||||||||

| ConocoPhillips |

116 | 8,108 | ||||||||||||||

| Continental Resources Inc. |

15 | 790 | * | |||||||||||||

| Delek US Holdings Inc. |

20 | 734 | ||||||||||||||

| Denbury Resources Inc. |

114 | 393 | * | |||||||||||||

| Devon Energy Corp. |

56 | 1,814 | ||||||||||||||

| Diamondback Energy Inc. |

12 | 1,348 | ||||||||||||||

| Energen Corp. |

15 | 1,080 | * | |||||||||||||

| EOG Resources Inc. |

57 | 6,004 | ||||||||||||||

| EQT Corp. |

30 | 1,019 | ||||||||||||||

| Exxon Mobil Corp. |

411 | 32,749 | ||||||||||||||

| Hess Corp. |

21 | 1,205 | ||||||||||||||

| HollyFrontier Corp. |

18 | 1,214 | ||||||||||||||

| Kinder Morgan Inc. |

201 | 3,421 | ||||||||||||||

| Marathon Oil Corp. |

95 | 1,804 | ||||||||||||||

| Marathon Petroleum Corp. |

72 | 5,072 | ||||||||||||||

| Murphy Oil Corp. |

30 | 956 | ||||||||||||||

| Newfield Exploration Co. |

21 | 424 | * | |||||||||||||

| Noble Energy Inc. |

55 | 1,367 | ||||||||||||||

| Oasis Petroleum Inc. |

51 | 513 | * | |||||||||||||

| Occidental Petroleum Corp. |

75 | 5,030 | ||||||||||||||

| ONEOK Inc. |

41 | 2,690 | ||||||||||||||

| Parsley Energy Inc., Class A Shares |

19 | 445 | * | |||||||||||||

| PBF Energy Inc., Class A Shares |

23 | 963 | ||||||||||||||

| PDC Energy Inc. |

14 | 594 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 19 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Oil, Gas & Consumable Fuels — continued |

||||||||||||||||

| Phillips 66 |

43 | $ | 4,421 | |||||||||||||

| Pioneer Natural Resources Co. |

17 | 2,504 | ||||||||||||||

| QEP Resources Inc. |

62 | 552 | * | |||||||||||||

| Range Resources Corp. |

29 | 460 | ||||||||||||||

| SM Energy Co. |

22 | 535 | ||||||||||||||

| Southwestern Energy Co. |

122 | 652 | * | |||||||||||||

| Targa Resources Corp. |

31 | 1,602 | ||||||||||||||

| Valero Energy Corp. |

43 | 3,917 | ||||||||||||||

| Whiting Petroleum Corp. |

19 | 709 | * | |||||||||||||

| Williams Cos Inc. |

121 | 2,944 | ||||||||||||||

| WPX Energy Inc. |

58 | 930 | * | |||||||||||||

| Total Oil, Gas & Consumable Fuels |

132,499 | |||||||||||||||

| Total Energy |

259,288 | |||||||||||||||

| Financials — 9.8% |

| |||||||||||||||

| Banks — 1.3% |

| |||||||||||||||

| 1st Source Corp. |

12 | 559 | ||||||||||||||

| Bank of America Corp. |

225 | 6,187 | ||||||||||||||

| Bank of Hawaii Corp. |

8 | 628 | ||||||||||||||

| BB&T Corp. |

16 | 787 | ||||||||||||||

| Citigroup Inc. |

55 | 3,600 | ||||||||||||||

| City Holding Co. |

21 | 1,549 | ||||||||||||||

| Comerica Inc. |

9 | 734 | ||||||||||||||

| East-West Bancorp Inc. |

11 | 577 | ||||||||||||||

| Fifth Third Bancorp |

19 | 513 | ||||||||||||||

| First Commonwealth Financial Corp. |

79 | 1,067 | ||||||||||||||

| First Interstate BancSystem Inc., Class A Shares |

46 | 1,907 | ||||||||||||||

| First Republic Bank |

5 | 455 | ||||||||||||||

| FNB Corp. |

50 | 592 | ||||||||||||||

| Huntington Bancshares Inc. |

61 | 874 | ||||||||||||||

| JPMorgan Chase & Co. |

74 | 8,067 | ||||||||||||||

| KeyCorp |

26 | 472 | ||||||||||||||

| PNC Financial Services Group Inc. |

14 | 1,799 | ||||||||||||||

| Regions Financial Corp. |

39 | 662 | ||||||||||||||

| Sandy Spring Bancorp Inc. |

35 | 1,244 | ||||||||||||||

| SunTrust Banks Inc. |

11 | 689 | ||||||||||||||

| Tompkins Financial Corp. |

23 | 1,682 | ||||||||||||||

| U.S. Bancorp |

36 | 1,882 | ||||||||||||||

| Wells Fargo & Co. |

97 | 5,163 | ||||||||||||||

See Notes to Financial Statements.

| 20 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Banks — continued |

||||||||||||||||

| Zions Bancorp |

15 | $ | 706 | |||||||||||||

| Total Banks |

42,395 | |||||||||||||||

| Capital Markets — 1.2% |

| |||||||||||||||

| Affiliated Managers Group Inc. |

4 | 455 | ||||||||||||||

| Ameriprise Financial Inc. |

5 | 636 | ||||||||||||||

| Bank of New York Mellon Corp. |

52 | 2,461 | ||||||||||||||

| BlackRock Inc. |

6 | 2,469 | ||||||||||||||

| Cboe Global Markets Inc. |

8 | 903 | ||||||||||||||

| Charles Schwab Corp. |

61 | 2,821 | ||||||||||||||

| CME Group Inc. |

16 | 2,932 | ||||||||||||||

| E*TRADE Financial Corp. |

13 | 643 | ||||||||||||||

| Eaton Vance Corp. |

9 | 405 | ||||||||||||||

| FactSet Research Systems Inc. |

4 | 895 | ||||||||||||||

| Franklin Resources Inc. |

25 | 763 | ||||||||||||||

| Goldman Sachs Group Inc. |

17 | 3,831 | ||||||||||||||

| Intercontinental Exchange Inc. |

34 | 2,619 | ||||||||||||||

| Invesco Ltd. |

34 | 738 | ||||||||||||||

| Janus Henderson Group PLC |

21 | 516 | ||||||||||||||

| MarketAxess Holdings Inc. |

3 | 629 | ||||||||||||||

| Moody’s Corp. |

11 | 1,600 | ||||||||||||||

| Morgan Stanley |

67 | 3,059 | ||||||||||||||

| Morningstar Inc. |

5 | 624 | ||||||||||||||

| MSCI Inc. |

8 | 1,203 | ||||||||||||||

| Nasdaq Inc. |

10 | 867 | ||||||||||||||

| Northern Trust Corp. |

16 | 1,505 | ||||||||||||||

| Raymond James Financial Inc. |

6 | 460 | ||||||||||||||

| S&P Global Inc. |

16 | 2,917 | ||||||||||||||

| SEI Investments Co. |

12 | 641 | ||||||||||||||

| State Street Corp. |

21 | 1,444 | ||||||||||||||

| T Rowe Price Group Inc. |

15 | 1,455 | ||||||||||||||

| TD Ameritrade Holding Corp. |

13 | 672 | ||||||||||||||

| Total Capital Markets |

40,163 | |||||||||||||||

| Consumer Finance — 1.3% |

| |||||||||||||||

| Ally Financial Inc. |

106 | 2,693 | ||||||||||||||

| American Express Co. |

141 | 14,485 | ||||||||||||||

| Capital One Financial Corp. |

93 | 8,305 | ||||||||||||||

| Credit Acceptance Corp. |

2 | 849 | * | |||||||||||||

| Discover Financial Services |

70 | 4,877 | ||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 21 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Consumer Finance — continued |

| |||||||||||||||

| Encore Capital Group Inc. |

15 | $ | 381 | * | ||||||||||||

| FirstCash Inc. |

12 | 965 | ||||||||||||||

| Green Dot Corp., Class A Shares |

16 | 1,212 | * | |||||||||||||

| Navient Corp. |

96 | 1,112 | ||||||||||||||

| OneMain Holdings Inc. |

17 | 485 | * | |||||||||||||

| PRA Group Inc. |

16 | 493 | * | |||||||||||||

| SLM Corp. |

132 | 1,338 | * | |||||||||||||

| Synchrony Financial |

146 | 4,217 | ||||||||||||||

| Total Consumer Finance |

41,412 | |||||||||||||||

| Diversified Financial Services — 1.4% |

| |||||||||||||||

| Berkshire Hathaway Inc., Class B Shares |

197 | 40,440 | ||||||||||||||

| Cannae Holdings Inc. |

47 | 868 | * | |||||||||||||

| Jefferies Financial Group Inc. |

35 | 751 | ||||||||||||||

| Texas Pacific Land Trust |

1 | 760 | ||||||||||||||

| Voya Financial Inc. |

34 | 1,488 | ||||||||||||||

| Total Diversified Financial Services |

44,307 | |||||||||||||||

| Insurance — 1.1% |

| |||||||||||||||

| Aflac Inc. |

46 | 1,981 | ||||||||||||||

| Allstate Corp. |

23 | 2,202 | ||||||||||||||

| American Financial Group Inc. |

4 | 400 | ||||||||||||||

| American International Group Inc. |

44 | 1,817 | ||||||||||||||

| AON PLC |

15 | 2,343 | ||||||||||||||

| Arch Capital Group Ltd. |

21 | 596 | ||||||||||||||

| Arthur J Gallagher & Co. |

7 | 518 | ||||||||||||||

| Assured Guaranty Ltd. |

11 | 440 | ||||||||||||||

| Axis Capital Holdings Ltd. |

9 | 502 | ||||||||||||||

| Brown & Brown Inc. |

16 | 451 | ||||||||||||||

| CHUBB Ltd. |

32 | 3,997 | ||||||||||||||

| Cincinnati Financial Corp. |

5 | 393 | ||||||||||||||

| CNO Financial Group Inc. |

22 | 416 | ||||||||||||||

| Everest Re Group Ltd. |

3 | 654 | ||||||||||||||

| Fidelity National Financial Inc. |

23 | 769 | ||||||||||||||

| Hartford Financial Services Group Inc. |

24 | 1,090 | ||||||||||||||

| Lincoln National Corp. |

19 | 1,144 | ||||||||||||||

| Markel Corp. |

1 | 1,093 | * | |||||||||||||

| Marsh & McLennan Cos. Inc. |

28 | 2,373 | ||||||||||||||

| MetLife Inc. |

65 | 2,677 | ||||||||||||||

| Principal Financial Group Inc. |

23 | 1,083 | ||||||||||||||

See Notes to Financial Statements.

| 22 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Insurance — continued |

||||||||||||||||

| Progressive Corp. |

37 | $ | 2,579 | |||||||||||||

| Prudential Financial Inc. |

26 | 2,438 | ||||||||||||||

| Reinsurance Group of America Inc. |

4 | 569 | ||||||||||||||

| Renaissancere Holdings Ltd. |

4 | 489 | ||||||||||||||

| Torchmark Corp. |

5 | 423 | ||||||||||||||

| Travelers Cos. Inc. |

17 | 2,127 | ||||||||||||||

| Unum Group |

16 | 580 | ||||||||||||||

| Willis Towers Watson PLC |

5 | 716 | ||||||||||||||

| Total Insurance |

36,860 | |||||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) — 2.2% |

| |||||||||||||||

| AG Mortgage Investment Trust Inc. |

46 | 796 | ||||||||||||||

| AGNC Investment Corp. |

458 | 8,171 | ||||||||||||||

| Annaly Capital Management Inc. |

1,314 | 12,969 | ||||||||||||||

| Anworth Mortgage Asset Corp. |

108 | 471 | ||||||||||||||

| Apollo Commercial Real Estate Finance Inc. |

162 | 3,031 | ||||||||||||||

| Arbor Realty Trust Inc. |

96 | 1,160 | ||||||||||||||

| ARMOUR Residential REIT Inc. |

54 | 1,176 | ||||||||||||||

| Blackstone Mortgage Trust Inc., Class A Shares |

107 | 3,610 | ||||||||||||||

| Capstead Mortgage Corp. |

111 | 761 | ||||||||||||||

| Chimera Investment Corp. |

184 | 3,422 | ||||||||||||||

| Colony Credit Real Estate Inc. |

133 | 2,838 | ||||||||||||||

| Dynex Capital Inc. |

105 | 608 | ||||||||||||||

| Exantas Capital Corp. |

91 | 1,032 | ||||||||||||||

| Granite Point Mortgage Trust Inc. |

34 | 633 | ||||||||||||||

| Hannon Armstrong Sustainable Infrastructure Capital Inc. |

71 | 1,473 | ||||||||||||||

| Invesco Mortgage Capital Inc. |

122 | 1,840 | ||||||||||||||

| Ladder Capital Corp. |

93 | 1,566 | ||||||||||||||

| MFA Financial Inc. |

483 | 3,347 | ||||||||||||||

| New Residential Investment Corp. |

360 | 6,437 | ||||||||||||||

| New York Mortgage Trust Inc. |

233 | 1,431 | ||||||||||||||

| PennyMac Mortgage Investment Trust |

78 | 1,506 | ||||||||||||||

| Ready Capital Corp. |

28 | 429 | ||||||||||||||

| Redwood Trust Inc. |

94 | 1,543 | ||||||||||||||

| Starwood Property Trust Inc. |

308 | 6,690 | ||||||||||||||

| TPG RE Finance Trust Inc. |

33 | 654 | ||||||||||||||

| Two Harbors Investment Corp. |

330 | 4,848 | ||||||||||||||

| Total Mortgage Real Estate Investment Trusts (REITs) |

72,442 | |||||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 23 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Thrifts & Mortgage Finance — 1.3% |

| |||||||||||||||

| Axos Financial Inc. |

43 | $ | 1,305 | * | ||||||||||||

| Beneficial Bancorp Inc. |

65 | 1,016 | ||||||||||||||

| Capitol Federal Financial Inc. |

136 | 1,688 | ||||||||||||||

| Dime Community Bancshares Inc. |

23 | 371 | ||||||||||||||

| Essent Group Ltd. |

77 | 3,035 | ||||||||||||||

| Federal Agricultural Mortgage Corp. (FAMC), Class C Shares |

10 | 698 | ||||||||||||||

| First Defiance Financial Corp. |

30 | 817 | ||||||||||||||

| Flagstar Bancorp Inc. |

31 | 955 | * | |||||||||||||

| HomeStreet Inc. |

35 | 909 | * | |||||||||||||

| Kearny Financial Corp. |

74 | 958 | ||||||||||||||

| LendingTree Inc. |

9 | 1,815 | * | |||||||||||||

| Meridian Bancorp Inc. |

49 | 776 | ||||||||||||||

| Meta Financial Group Inc. |

24 | 606 | ||||||||||||||

| MGIC Investment Corp. |

361 | 4,408 | * | |||||||||||||

| New York Community Bancorp Inc. |

456 | 4,368 | ||||||||||||||

| NMI Holdings Inc., Class A Shares |

48 | 1,015 | * | |||||||||||||

| Northfield Bancorp Inc. |

47 | 619 | ||||||||||||||

| Northwest Bancshares Inc. |

105 | 1,695 | ||||||||||||||

| OceanFirst Financial Corp. |

57 | 1,443 | ||||||||||||||

| Ocwen Financial Corp |

175 | 613 | * | |||||||||||||

| Oritani Financial Corp. |

27 | 394 | ||||||||||||||

| Provident Financial Services Inc. |

67 | 1,635 | ||||||||||||||

| Radian Group Inc. |

207 | 3,972 | ||||||||||||||

| TFS Financial Corp. |

48 | 706 | ||||||||||||||

| United Financial Bancorp Inc. |

78 | 1,205 | ||||||||||||||

| Walker & Dunlop Inc. |

19 | 797 | ||||||||||||||

| Washington Federal Inc. |

67 | 1,887 | ||||||||||||||

| Waterstone Financial Inc. |

24 | 392 | ||||||||||||||

| WSFS Financial Corp. |

37 | 1,574 | ||||||||||||||

| Total Thrifts & Mortgage Finance |

41,672 | |||||||||||||||

| Total Financials |

319,251 | |||||||||||||||

| Health Care — 12.2% |

| |||||||||||||||

| Biotechnology — 1.9% |

| |||||||||||||||

| AbbVie Inc. |

134 | 10,432 | ||||||||||||||

| ACADIA Pharmaceuticals Inc. |

35 | 682 | ||||||||||||||

| Agios Pharmaceuticals Inc. |

13 | 820 | * | |||||||||||||

| Alexion Pharmaceuticals Inc. |

18 | 2,017 | * | |||||||||||||

| Alkermes PLC |

9 | 367 | ||||||||||||||

See Notes to Financial Statements.

| 24 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Biotechnology — continued |

| |||||||||||||||

| Alnylam Pharmaceuticals Inc. |

8 | $ | 643 | * | ||||||||||||

| Amgen Inc. |

58 | 11,182 | ||||||||||||||

| Array BioPharma Inc. |

48 | 778 | * | |||||||||||||

| Biogen Inc. |

17 | 5,173 | * | |||||||||||||

| BioMarin Pharmaceutical Inc. |

12 | 1,106 | * | |||||||||||||

| Bluebird Bio Inc. |

4 | 459 | * | |||||||||||||

| Blueprint Medicines Corp. |

10 | 608 | * | |||||||||||||

| Celgene Corp. |

61 | 4,368 | * | |||||||||||||

| Exact Sciences Corp. |

18 | 1,279 | * | |||||||||||||

| Exelixis Inc. |

38 | 527 | * | |||||||||||||

| FibroGen Inc. |

9 | 386 | * | |||||||||||||

| Gilead Sciences Inc. |

117 | 7,977 | ||||||||||||||

| Incyte Corp. |

14 | 908 | * | |||||||||||||

| Ionis Pharmaceuticals Inc. |

10 | 496 | * | |||||||||||||

| Ligand Pharmaceuticals |

3 | 494 | * | |||||||||||||

| Loxo Oncology Inc. |

6 | 916 | * | |||||||||||||

| Neurocrine Biosciences Inc. |

9 | 964 | * | |||||||||||||

| Regeneron Pharmaceuticals Inc. |

6 | 2,035 | * | |||||||||||||

| Sage Therapeutics Inc. |

5 | 643 | * | |||||||||||||

| Sarepta Therapeutics Inc. |

5 | 669 | * | |||||||||||||

| Seattle Genetics Inc. |

11 | 617 | * | |||||||||||||

| Ultragenyx Pharmaceutical Inc. |

7 | 339 | * | |||||||||||||

| United Therapeutics Corp. |

5 | 554 | * | |||||||||||||

| Vertex Pharmaceuticals Inc. |

20 | 3,389 | * | |||||||||||||

| Total Biotechnology |

60,828 | |||||||||||||||

| Health Care Equipment & Supplies — 2.2% |

| |||||||||||||||

| Abbott Laboratories |

149 | 10,272 | ||||||||||||||

| ABIOMED Inc. |

4 | 1,365 | ||||||||||||||

| Align Technology Inc. |

6 | 1,327 | ||||||||||||||

| Avanos Medical Inc. |

11 | 623 | * | |||||||||||||

| Baxter International Inc. |

49 | 3,063 | ||||||||||||||

| Becton Dickinson and Co. |

21 | 4,840 | ||||||||||||||

| Boston Scientific Corp. |

106 | 3,831 | * | |||||||||||||

| Cantel Medical Corp. |

5 | 396 | ||||||||||||||

| Cooper Cos. Inc. |

4 | 1,033 | ||||||||||||||

| Danaher Corp. |

58 | 5,765 | ||||||||||||||

| Dentsply Sirona Inc. |

24 | 831 | ||||||||||||||

| Dexcom Inc. |

7 | 929 | * | |||||||||||||

See Notes to Financial Statements.

| Legg Mason US Diversified Core ETF 2018 Annual Report | 25 |

Schedule of investments (cont’d)

October 31, 2018

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Health Care Equipment & Supplies — continued |

||||||||||||||||

| Edwards Lifesciences Corp. |

15 | $ | 2,214 | |||||||||||||

| Globus Medical Inc., Class A Shares |

15 | 793 | * | |||||||||||||

| Hill-Rom Holdings Inc. |

6 | 504 | ||||||||||||||

| Hologic Inc. |

26 | 1,014 | * | |||||||||||||

| IDEXX Laboratories Inc. |

8 | 1,697 | * | |||||||||||||

| Insulet Corp. |

6 | 529 | * | |||||||||||||

| Integra LifeSciences Holdings Corp. |

8 | 429 | * | |||||||||||||

| Intuitive Surgical Inc. |

9 | 4,691 | * | |||||||||||||

| LivaNova PLC |

9 | 1,008 | ||||||||||||||

| Masimo Corp. |

7 | 809 | * | |||||||||||||

| Medtronic PLC |

113 | 10,150 | ||||||||||||||

| Neogen Corp. |

5 | 304 | * | |||||||||||||

| Penumbra Inc. |

5 | 680 | * | |||||||||||||

| ResMed Inc. |

15 | 1,589 | ||||||||||||||

| STERIS PLC |

8 | 874 | ||||||||||||||

| Stryker Corp. |

31 | 5,029 | ||||||||||||||

| Teleflex Inc. |

4 | 963 | ||||||||||||||

| Varian Medical Systems Inc. |

8 | 955 | * | |||||||||||||

| West Pharmaceutical Services Inc. |

6 | 635 | ||||||||||||||

| Zimmer Biomet Holdings Inc. |

19 | 2,158 | ||||||||||||||

| Total Health Care Equipment & Supplies |

71,300 | |||||||||||||||

| Health Care Providers & Services — 1.9% |

| |||||||||||||||

| Aetna Inc. |

26 | 5,158 | ||||||||||||||

| AmerisourceBergen Corp. |

10 | 880 | ||||||||||||||

| Anthem Inc. |

19 | 5,236 | ||||||||||||||

| Cardinal Health Inc. |

17 | 860 | ||||||||||||||

| Centene Corp. |

15 | 1,955 | * | |||||||||||||

| Cigna Corp. |

19 | 4,062 | ||||||||||||||

| CVS Health Corp. |

76 | 5,502 | ||||||||||||||

| DaVita Inc. |

8 | 539 | * | |||||||||||||

| Encompass Health Corp. |

8 | 538 | ||||||||||||||

| Express Scripts Holding Co. |

46 | 4,461 | * | |||||||||||||

| HCA Healthcare Inc. |

24 | 3,205 | ||||||||||||||

| Henry Schein Inc. |

8 | 664 | * | |||||||||||||

| Humana Inc. |

11 | 3,525 | ||||||||||||||

| Laboratory Corp. of America Holdings |

5 | 803 | * | |||||||||||||

| McKesson Corp. |

16 | 1,996 | ||||||||||||||

| Mednax Inc. |

12 | 495 | * | |||||||||||||

See Notes to Financial Statements.

| 26 | Legg Mason US Diversified Core ETF 2018 Annual Report |

Legg Mason US Diversified Core ETF

| Security | Shares | Value | ||||||||||||||

| Health Care Providers & Services — continued |

||||||||||||||||

| Molina Healthcare Inc. |

5 | $ | 634 | * | ||||||||||||