0001645113PRE 14Afalse00016451132023-01-012023-12-31iso4217:USD00016451132022-01-012022-12-3100016451132021-01-012021-12-3100016451132020-01-012020-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001645113ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310001645113ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310001645113ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310001645113ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001645113ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001645113ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001645113ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001645113ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001645113ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310001645113ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310001645113ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310001645113ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-31000164511312023-01-012023-12-31000164511322023-01-012023-12-31000164511332023-01-012023-12-31000164511342023-01-012023-12-31000164511352023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

______________________________________________ | | | | | | | | |

| Filed by the Registrant ☑ | Filed by a Party other than the Registrant ☐ | |

Check the appropriate box: | | | | | |

| ☑ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

NovoCure Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | | | | | | | | |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies:

|

| (2) | Aggregate number of securities to which transaction applies:

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4) | Proposed maximum aggregate value of transaction:

|

| (5) | Total fee paid:

|

| | | | | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid:

|

| (2) | Form, Schedule or Registration Statement No.:

|

| (3) | Filing Party:

|

| (4) | Date Filed:

|

| | |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 5, 2024 |

|

|

|

|

To the shareholders of NovoCure Limited:

NOTICE IS HEREBY GIVEN that the Annual General Meeting of Shareholders (“Annual Meeting”) of NovoCure Limited, a Jersey (Channel Islands) corporation (the “Company”, “Novocure”, “we”, “us” or “our”), will be held on June 5, 2024, at 9:00 a.m. U.S. Eastern Time (“ET”), at Second Floor, No. 4 The Forum, Grenville Street, St. Helier, Jersey, Channel Islands JE2 4UF. Novocure is actively monitoring developments regarding the coronavirus (COVID-19) pandemic and related guidance issued by public health authorities. The health and well-being of Novocure’s directors, employees and shareholders are paramount. We may hold a virtual-only Annual Meeting via live webcast if it is advisable or required. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be posted on our website and filed with the Securities and Exchange Commission as additional proxy materials.

The purpose of the Annual Meeting is to consider and take action on the following:

1.To elect ten directors named in the Proxy Statement to hold office for a one-year term expiring at our 2025 annual general meeting of shareholders or until their successors are duly elected and qualified or until their offices are vacated;

2.The approval and ratification of the appointment, by the Audit Committee of our Board of Directors (the “Board”), of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global (“EY Global”), as the auditor and independent registered public accounting firm of the Company for the Company’s fiscal year ending December 31, 2024;

3.A non-binding advisory vote to approve executive compensation;

4.Approve our 2024 Omnibus Incentive Plan to replace our 2015 Omnibus Incentive Plan; and

5.Approve our "Say On Pay" Frequency.

The foregoing items of business will be proposed as ordinary resolutions. These proposals are more fully described in the Proxy Statement. Only shareholders who owned our Ordinary Shares at the close of business on April 2, 2024 (the “Record Date”) can vote at this meeting or at any adjournments that take place or postponements thereof.

A shareholder entitled to attend and vote at the Annual Meeting is entitled to appoint one or more proxies to attend and vote in the place of such shareholder and such proxy or proxies need not also be a shareholder of the Company. We have elected to use the Internet as our primary means of providing our proxy materials to shareholders. Consequently, you will not receive paper copies of our proxy materials (including the proxy card), unless you specifically request such materials. We will send a notice regarding the Internet availability of proxy materials (the “Notice of Internet Availability”) on or about April 22, 2024 to our shareholders of record as of the close of business on the Record Date. The Notice of Internet Availability contains instructions for accessing the proxy materials on the Internet, including the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”), and provides information on how shareholders may obtain paper copies free of charge. The Notice of Internet Availability also provides the date, time and location of the

Annual Meeting, the matters to be acted upon at the meeting and the recommendation from our Board with regard to each matter, and information on how to attend the meeting. Electronic delivery of our proxy materials will significantly reduce our printing and mailing costs and the environmental impact of mailing these materials.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. Other than voting in person at the Annual Meeting, you may vote over the Internet, by telephone or by completing and mailing a proxy card or voting instruction card forwarded by your bank, broker or other holder of record. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the Annual Meeting. Please review the instructions on the proxy card or voting instruction card forwarded by your bank, broker or other holder of record regarding each of these voting options.

Our Board recommends that you vote FOR the election of the director nominees named in Proposal 1 of the Proxy Statement, FOR the approval and ratification of the appointment of EY Global as our auditor and independent registered public accounting firm for the Company’s fiscal year ending December 31, 2024 in Proposal 2 of the Proxy Statement, FOR the non-binding advisory vote to approve executive compensation in Proposal 3 of the Proxy Statement, FOR approval of our 2024 Omnibus Incentive Plan in Proposal 4 of the Proxy Statement, and ONE YEAR for the frequency of our "Say On Pay" vote in Proposal 5 of the Proxy Statement.

By Order of the Board of Directors

William F. Doyle

Executive Chairman of the Board of Directors

St. Helier, Jersey, Channel Islands

April 22, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 5, 2024

The Proxy Statement, Notice of Annual General Meeting of Shareholders

and Annual Report are available at www.proxyvote.com.

The Board of Directors (the “Board”) of NovoCure Limited (the “Company”, “Novocure”, “we”, “us” or “our”) is soliciting your proxy to vote at our Annual General Meeting of Shareholders (“Annual Meeting”) to be held on Wednesday, June 5, 2024, at 9:00 a.m. U.S. ET, at Second Floor, No. 4 The Forum, Grenville Street, St. Helier, Jersey, Channel Islands JE2 4UF, and any adjournment or postponement of that meeting.

We have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending a Notice of Internet Availability to holders of record of our ordinary shares (“Ordinary Shares”) as of April 2, 2024 (the “Record Date”). All shareholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability, or to request a printed set of the proxy materials. Instructions on how to request a printed copy by mail or e-mail may be found in the Notice of Internet Availability and on the website referred to in the Notice of Internet Availability, including instructions on how to request paper copies on an ongoing basis. On or about April 22, 2024, we are making this Proxy Statement available on the Internet and are mailing the Notice of Internet Availability to all shareholders entitled to vote at the Annual Meeting.

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”), which contains financial statements for the fiscal year ended December 31, 2023, accompanies this Proxy Statement if you have requested and received a copy of the proxy materials in the mail. Shareholders that receive the Notice of Internet Availability can access this Proxy Statement and the Annual Report at the website referred to in the Notice of Internet Availability. The Annual Report and this Proxy Statement are also available on our investor relations website at www.novocure.com and at the website of the SEC at www.sec.gov. You also may obtain a copy of the Annual Report, without charge, by writing to Investor Relations, NovoCure Limited, 1550 Liberty Ridge Drive, Suite 115, Wayne, Pennsylvania 19087, USA.

This Summary highlights certain information included in this Proxy Statement. This Summary does not contain all of the information that you should consider prior to voting. Please review the complete Proxy Statement and the Annual Report that accompanies the Proxy Statement for additional information.

| | |

2024 ANNUAL MEETING OF SHAREHOLDERS |

| | | | | |

| Date and Time: | Wednesday, June 5, 2024, at 9:00 a.m. U.S. ET |

| |

| Place: | Second Floor, No. 4 The Forum, |

| Grenville Street, St. Helier, Jersey, Channel Islands JE2 4UF |

| |

| Record Date: | April 2, 2024 |

| |

| Voting Deadline: | Votes submitted by Internet, telephone or mail must be received by 11:59 p.m. ET on June 2, 2024 to be counted. Shareholders may also vote in person at the Annual Meeting. |

| | |

| VOTING MATTERS AND BOARD RECOMMENDATIONS |

| | | | | | | | |

| Voting Matter | Board

Recommendation | Page Number with

More Information |

| Election of director nominees | FOR all nominees | |

Approval and ratification of the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global (“EY Global”) as our auditor and independent registered public accounting firm for the Company’s fiscal year ending December 31, 2024 | FOR | |

| Non-binding advisory vote to approve executive compensation | FOR | |

Approve our 2024 Omnibus Incentive Plan | FOR | |

Approve our Say on Pay Frequency | ONE YEAR | |

| | | | | |

| Stock Symbol | NVCR |

| Exchange | NASDAQ Global Select Market |

| Ordinary Shares Outstanding on the Record Date | 107,606,309 |

| Registrar and Transfer Agent | Computershare Shareowner Services LLC |

| Principal Executive Office | Second Floor, No. 4 The Forum, Grenville Street

St. Helier, Jersey, Channel Islands JE2 4UF |

| Corporate Website | www.novocure.com |

You have the opportunity to vote on the election of the following director nominees whose terms of office are expiring. Additional information regarding each director nominee’s experience, skills and qualifications to serve as a member of our Board can be found in the Proxy Statement under Proposal 1 – Election of Directors. All of our directors are being elected for a one-year term at the 2024 annual general meeting of shareholders.

| | | | | | | | | | | | | | | | | |

| Name | Age | Years on Board | Occupation | Independent | Committees |

| Asaf Danziger | 57 | 12 | Chief Executive Officer, Novocure | No | None |

| William Doyle | 61 | 20 | Executive Chairman, Novocure | No | None |

| Jeryl Hilleman | 66 | 6 | Former Chief Financial Officer of Intersect ENT, Inc. | Yes | Audit |

| David Hung | 66 | 6 | Founder, President and Chief Executive Officer, Nuvation Bio Inc. | Yes | Nominating and Corporate Governance |

| Kinyip Gabriel Leung | 62 | 13 | Former Vice Chairman, Novocure Board | Yes | Compensation, Nominating and Corporate Governance |

| Martin Madden | 63 | 7 | Former Vice President Research and Development of DePuy-Synthes of Johnson & Johnson | Yes | Audit; Compensation |

| Allyson Ocean | 52 | 1 | Professor of Clinical Medicine at the Weill Medical College of Cornell University; Medical oncologist and attending physician in gastrointestinal oncology at NewYork-Presbyterian Hospital/Weill Cornell Medical Center; Medical oncologist at The Jay Monahan Center for Gastrointestinal Health | Yes | Nominating and Corporate Governance |

| Timothy Scannell | 59 | 3 | Former President and Chief Operating Officer, Stryker Corporation | Yes | Audit, Nominating and Corporate Governance |

| Kristin Stafford | 42 | 1 | Senior Vice President, Chief Accounting Officer, Royalty Pharma plc | Yes | Compensation |

| William Vernon | 68 | 18 | Former Chief Executive Officer of Kraft Foods Group, Inc. | Yes | Compensation |

The statistics below relate to our current directors, including nominees:

•80% of our Board members are independent

•Average age of directors is 59.6

•Average tenure of directors is 8.7 years

•30% of our Board members identify as female

•Highly qualified directors reflect broad mix of business backgrounds, skills and experiences

•70% of directors have international experience

•30% of directors have experience as a public company Chief Executive Officer ("CEO") or executive chair in the past five years

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Independent | Non-independent |

| Summary of Experience, Qualifications, Attributes and Skills | Hilleman | Hung | Leung | Madden | Ocean | Scannell | Stafford | Vernon | Danziger | Doyle |

| Public Company CEO / Exec. Chair (past 5 years) | | ✔ | | | | | | ✔ | ✔ | ✔ |

| Senior Executive Leadership | ✔ | ✔ | ✔ | ✔ | | ✔ | ✔ | ✔ | ✔ | ✔ |

| Commercial | | ✔ | ✔ | | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Corporate Governance | ✔ | | ✔ | | ✔ | ✔ | ✔ | ✔ | | |

| Cybersecurity | ✔ | | | | | | | | | |

| Financial Literacy | ✔ | | | ✔ | | ✔ | ✔ | | | ✔ |

| International | ✔ | | ✔ | | ✔ | ✔ | ✔ | | ✔ | ✔ |

| Pharmaceuticals / Medical Device | | ✔ | ✔ | ✔ | ✔ | | ✔ | ✔ | ✔ | ✔ |

| Product Development | | ✔ | ✔ | ✔ | ✔ | ✔ | | ✔ | | ✔ |

| Risk Management | ✔ | ✔ | | ✔ | | | | | ✔ | |

| Planned Committee Membership | |

| Audit | Chair | | | ✔ | | ✔ | | | | |

| Compensation | | | ✔ | ✔ | | | ✔ | Chair | | |

| Nominating and Corporate Governance | | ✔ | ✔ | | ✔ | Chair | | | | |

The table below provides certain highlights of the composition of our Board members and nominees as of the record date, with categories as set forth by Nasdaq Listing Rule 5606):

| | | | | | | | | | | | | | |

Board Diversity Matrix (As of April 2, 2024) |

| Total Number of Directors: 10 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Gender Identity |

| Directors | 3 | 7 | — | — |

| Demographic Background |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | 2 | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 3 | 4 | — | — |

| Two or More Races or Ethnicities | — | 1 | — | — |

| LGBTQ+ | — |

| Did Not Disclose Demographic Background | — |

| | |

| CORPORATE GOVERNANCE HIGHLIGHTS |

•Separate Executive Chairman of the Board and Chief Executive Officer positions

•Strong Lead Independent Director position

•Three fully independent Board committees

•Executive session of independent directors and committee members held at each regularly-scheduled Board meeting and committee meeting

•Frequent Board and committee meetings to ensure awareness and alignment

◦Seven Board meetings in 2023

◦16 standing committee meetings in 2023

•Directors attended 98.46% of Board and committee meetings held in 2023

•Annual Board and committee self-assessments and discussions with individual directors

•Strong clawback and anti-hedging/anti-pledging policies

•Senior executives do not receive tax gross-ups on severance or change in control benefits

•Significant share ownership requirements for directors and senior executives

•Our Board and its committees have an active role in risk oversight

| | |

2023 CORPORATE ACHIEVEMENTS |

Increased acceptance of Tumor Treating Fields therapy ("TTFields")

•3,755 active patients on Optune Gio® and Optune Lua® as of December 31, 2023, an increase of 9% from the same period in 2022.

•Received 6,083 total prescriptions in 2023, an increase of 10% compared to 2022.

•Received regulatory approval and successfully launched Optune Gio for the treatment of newly diagnosed glioblastoma ("GBM") in France.

Advanced our clinical and product development pipelines

•Announced the results from the phase 3 LUNAR clinical trial, which explored the efficacy and safety of TTFields therapy together with physician’s choice immune checkpoint inhibitor or docetaxel (collectively, “systemic therapies”) for the treatment of metastatic non-small cell lung cancer (“NSCLC”) following disease progression on or after use of platinum-based chemotherapy. Patients treated with TTFields and systemic therapies demonstrated a statistically significant and clinically meaningful improvement in overall survival without an increase in systemic toxicity. Results of the LUNAR clinical trial were published in The Lancet Oncology and served as the clinical basis for a Premarket Approval (“PMA”) application, which was submitted to the U.S. Food and Drug Administration (“FDA”) and is currently under substantive review.

•Completed enrollment in the phase 3 PANOVA-3 clinical trial, studying the use of TTFields therapy and paclitaxel and gemcitabine for the treatment of locally advanced pancreatic cancer, and the phase 3 METIS clinical trial, studying the use of TTFields monotherapy following stereotactic radiosurgery for the treatment of brain metastases from NSCLC.

•Launched the phase 3 LUNAR-2 clinical trial, exploring the use of TTFields therapy together with platinum-based chemotherapy and the anti-PD-1 therapy pembrolizumab for the first-line treatment of metastatic NSCLC.

•Launched the phase 2 PANOVA-4 clinical trial, in collaboration with Roche, studying the use of TTFields therapy together with paclitaxel, gemcitabine, and the PD-L1 inhibitor atezolizumab for the treatment of metastatic pancreatic cancer.

•Successfully launched our lighter, thinner next generation arrays for the treatment of newly diagnosed glioblastoma in multiple European markets.

•Submitted a PMA supplement application to the FDA for the use of our next generation arrays for the treatment of newly diagnosed GBM in the U.S.

Developed and expanded our talent pool

•Restructured and expanded executive leadership team to solidify and strengthen leadership capability in anticipation of a period of significant innovation and growth, including the hiring of Chief Human Resources Officer, Michael Puri, and Chief Medical Officer, Nicolas Leupin, MD, PhD.

•Increased total employee headcount to 1,497 as of December 31, 2023, a year-over-year increase of 13%.

Created shareholder value by building a profitable business

•Generated $509 million in annual net revenues.

•Invested a record $223 million in research and development initiatives to advance our clinical and product development pipelines.

•Cash, cash equivalents and short-term investments totaling $910 million at December 31, 2023.

| | |

| EXECUTIVE COMPENSATION HIGHLIGHTS |

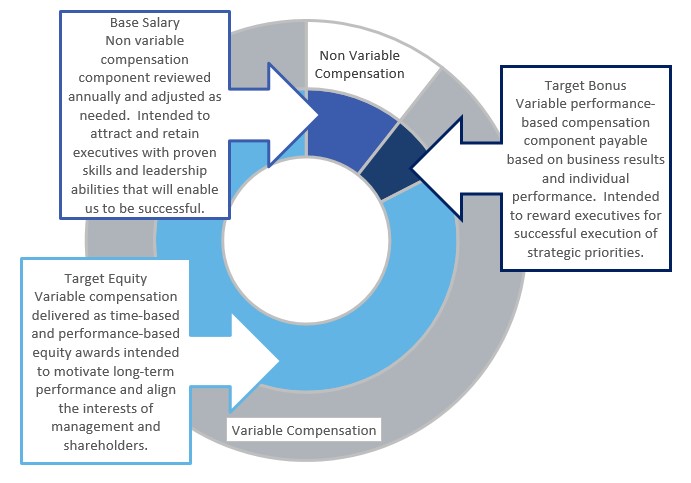

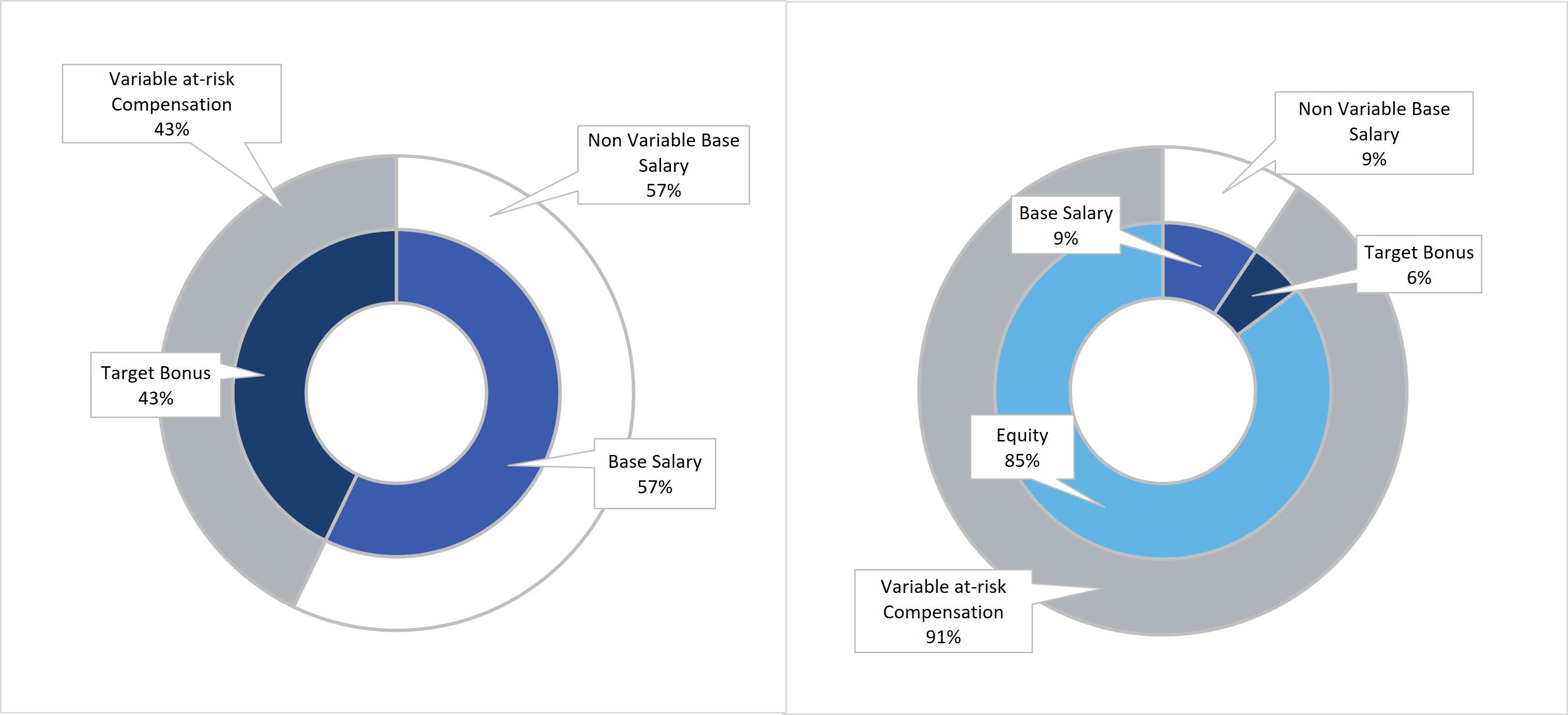

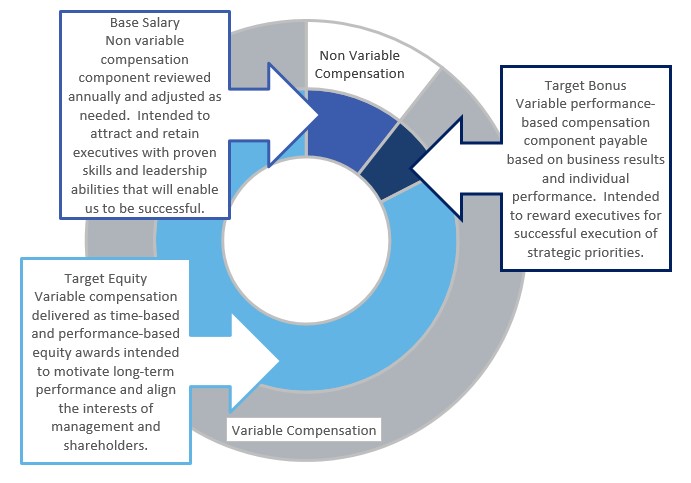

The primary objectives of our executive compensation program are to attract, retain and motivate superior executive talent, to provide incentives that reward the achievement of performance goals that we believe support the enhancement of shareholder value and to align the executives’ interests with those of shareholders through long-term incentives. The following table highlights some of our executive compensation policies and practices, which are structured to drive performance and align our executives’ interests with our shareholders’ long-term interests:

| | | | | | | | | | | | | | |

| WHAT WE DO | | | WHAT WE DON'T DO |

| ✔ | Pay for performance | | X | No plans that encourage excessive risk |

| ✔ | Pay competitively | | X | No share option repricing |

| ✔ | Align compensation with shareholder interests | | X | No gross-ups in the event of a change in control |

| ✔ | Double trigger change in control provisions | | X | No excessive perks |

| ✔ | Independent compensation consultant | | X | No special health or welfare benefits |

| ✔ | Robust stock ownership and retention guidelines | | | |

| ✔ | Clawback and recoupment policy | | | |

| ✔ | Anti-hedging and anti-pledging policy | | | |

| ✔ | Annual say-on-pay vote | | | |

| | |

| THE PROXY PROCESS AND SHAREHOLDER VOTING |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | | |

| Who can vote at the Annual Meeting? |

Only shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 107,606,309 Ordinary Shares issued and outstanding and entitled to vote. On each matter to be voted upon, you have one vote for each Ordinary Share you own as of the Record Date.

| | |

| What am I being asked to vote on? |

You are being asked to vote on three proposals:

•Proposal 1: To elect the ten directors named in this Proxy Statement to hold office for a one-year term expiring at our 2025 annual general meeting of shareholders or until their successors are duly elected and qualified or their offices are vacated;

•Proposal 2: To approve and ratify the appointment, by the Audit Committee of our Board (the “Audit Committee”), of EY Global, as our auditor and independent registered public accounting firm for the fiscal year ending December 31, 2024;

•Proposal 3: To hold a non-binding advisory vote to approve our executive compensation;

•Proposal 4: To approve our new 2024 Omnibus Incentive Plan; and

•Proposal 5: To hold a non-binding advisory vote to approve the frequency of the advisory vote on executive compensation.

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

The procedures for voting, depending on whether you are a shareholder of record or a beneficial owner holding in “street name,” are as follows:

| | |

| Shareholder of Record—Shares Registered in Your Name |

If you are a shareholder of record, you may vote in any of the following manners:

•To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

•To vote over the Internet prior to the Annual Meeting, follow the instructions provided on the Notice of Internet Availability or on the proxy card by accessing www.proxyvote.com using the control number contained on the Notice of Internet Availability or proxy card.

•To vote by telephone, call 1-800-690-6903 (toll free). You will need to have the control number printed on your Notice of Internet Availability or proxy card available when you call.

•To vote by mail, complete, sign and date the proxy card and return it promptly to Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, USA. As long as your signed proxy card is received by June 2, 2024, your shares will be voted as you direct.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by mail, Internet or telephone to ensure your vote is counted. The Internet and telephone voting facilities for eligible shareholders of record will close at 11:59 p.m. ET on June 2, 2024. Proxy cards submitted by mail must be received by 11:59 p.m. ET on June 2, 2024 to be counted. Even if you have submitted your vote before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

| | |

| Beneficial Owner—Shares Registered in the Name of Broker, Bank or Other Nominee (“Street Name”) |

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you will receive a voting instruction card from that organization. Simply complete and mail the voting instruction card to ensure that your vote is counted or follow such other instructions to submit your vote by the Internet or telephone, if such options are provided by your broker, bank or other nominee. You are also invited to attend the Annual Meeting. However, to vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other nominee authorizing you to vote at the Annual Meeting. Contact your broker, bank or other nominee to request a proxy form.

| | |

| How does the Board recommend I vote on the Proposals? |

Our Board recommends that you vote:

•FOR the election of each of the director nominees named in this Proxy Statement (Proposal 1);

•FOR the approval and ratification of the appointment of EY Global as our auditor and independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2);

•FOR the non-binding advisory resolution to approve our executive compensation (Proposal 3);

•FOR approval of the 2024 Omnibus Incentive Plan (Proposal 4); and

•ONE YEAR as the frequency of the non-binding advisory vote on executive compensation (Proposal 5).

| | |

| How many votes are needed to approve each proposal? |

With respect to Proposal 1, the election of each of the director nominees, each nominee who receives the affirmative vote of the simple majority of votes cast at the Annual Meeting will be elected. Abstentions and votes by a broker that have not been directed by the beneficial owner to vote (“broker non-votes”) will not be counted for the purposes of determining the number of votes cast and will accordingly have no effect on the outcome of this proposal.

With respect to Proposal 2, the approval and ratification of the appointment of EY Global as our auditor and independent registered public accounting firm for the fiscal year ending December 31, 2024, the affirmative vote of the simple majority of votes cast is required for approval. Abstentions and broker non-votes will not be counted for the purposes of determining the number of votes cast and will accordingly have no effect on the outcome of this proposals.

With respect to Proposal 3, the non-binding advisory vote on our executive compensation, the affirmative vote of the simple majority of votes cast is required for approval. Abstentions and broker non-votes will not be counted for the purposes of determining the number of votes cast and will accordingly have no effect on the outcome of this proposal.

With respect to Proposal 4, approval of our 2024 Omnibus Incentive Plan, the affirmative vote of the simple majority of votes cast is required for approval. Abstentions and broker non-votes will not be counted for the purposes of determining the number of votes cast and will accordingly have no effect on the outcome of this proposal.

With respect to Proposal 5, the determination of the frequency of an advisory vote on executive compensation, the affirmative vote of the simple majority of votes cast is required to approve one year, two years, or three years as the shareholders’ recommended frequency on this Proposal. However, if none of the options receive the vote of a majority, the option receiving the greatest number of votes will be considered the frequency recommended by our shareholders. Abstentions and broker non-votes will not be counted for the purposes of determining the number of votes cast and will accordingly have no effect on the outcome of this proposal.

Broadridge Financial Solutions, Inc. has been engaged as our independent agent, or “Inspector of Election,” to tabulate shareholder votes.

| | |

| Can I change my vote after submitting my proxy vote? |

Yes. You can revoke your proxy vote at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy vote in any one of three ways:

•You may submit a new vote on the Internet or by telephone or submit a properly completed proxy card with a later date.

•You may send written notice that you are revoking your proxy to our General Counsel, NovoCure Limited, 1550 Liberty Ridge Drive, Suite 115, Wayne, Pennsylvania 19087, USA, Attention: General Counsel. Such notice must be received by June 2, 2024.

•You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by such broker, bank or other nominee to revoke an earlier vote.

| | |

| What are “broker non-votes”? |

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote on matters deemed “non-routine.” If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters.

Proposal 2, the approval and ratification of the appointment of EY Global as our auditor and independent registered public accounting firm for the fiscal year ending December 31, 2024, is considered “routine” under applicable rules. A broker or other nominee may generally vote on routine matters without voting instructions from beneficial owners, and therefore no broker non-votes are expected to exist in connection with Proposal 2.

The remaining proposals are considered “non-routine” under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on those proposals. Accordingly, if you own shares in street name through a broker, bank or other nominee, please be sure to provide voting instructions to your nominee to ensure that your vote is counted on each of the proposals.

| | |

| What if I return a proxy card but do not make specific choices? |

If we receive your signed and dated proxy card and the proxy card does not specify how your shares are to be voted, your shares will be voted “FOR” the election of each of the director nominees, “FOR” the approval and ratification of the appointment of EY Global as our auditor and independent registered public accounting firm for the year ending December 31, 2024, “FOR” the non-binding advisory resolution to approve our executive compensation, "FOR" approval of the 2024 Omnibus Incentive Plan and “ONE YEAR” as the frequency of the non-binding advisory vote on executive compensation. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

| | |

| Who will solicit proxies on behalf of the Board? |

Proxies may be solicited on behalf of the Board by Novocure’s directors, officers and regular employees. Additionally, the Board has retained Alliance Advisors, LLC (“Alliance”), a proxy solicitation firm, to solicit proxies on the Board’s behalf. We will pay Alliance an estimated fee of $30,000 plus costs and expenses. In addition, Alliance and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement.

The original solicitation of proxies by mail may be supplemented by telephone, facsimile, Internet and personal solicitation by Alliance, our directors, officers or other regular employees. Proxies may also be solicited by advertisements in periodicals, press releases issued by us and postings on our corporate website. Unless expressly indicated otherwise, information contained on our corporate website is not part of this proxy statement.

| | |

| Who is paying for this proxy solicitation? |

Novocure will pay for the entire cost of soliciting proxies, including the fees due to Alliance, as discussed above. In addition to the mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the beneficial owners of shares held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

| | |

| What if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials? |

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all of the shares you own, you must follow the instructions for voting on each Notice of Internet Availability or proxy card you receive, as applicable.

| | |

| How will voting on any business not described in this Proxy Statement be conducted? |

We are not aware of any business to be considered at the Annual Meeting other than the items described in this Proxy Statement. If any other matter is properly presented at the Annual Meeting, your proxy will vote your shares using his or her best judgment.

| | |

| What is the quorum requirement? |

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority of Ordinary Shares issued and outstanding and entitled to vote on the business being transacted are present in person or represented by proxy at the time when the Annual Meeting proceeds to business.

If you are a shareholder of record, your shares will be counted towards the quorum only if you submit a valid proxy or vote in person at the Annual Meeting. If you are a beneficial owner of shares held in “street name,” your shares will be counted towards the quorum if your broker or nominee submits a proxy for your shares at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If within half an hour from the time appointed for the Annual Meeting there is no quorum or if during the Annual Meeting a quorum ceases to be present, the Annual Meeting shall stand adjourned to the same day in the next week at the same time and place or to such other time and place as the directors shall determine.

| | |

| How can I find out the results of the voting at the Annual Meeting? |

Voting results will be announced by the filing of a Current Report on Form 8-K with the SEC within four business days after the Annual Meeting.

ELECTION OF DIRECTORS

Our Articles of Association (“Articles”) provide that our Board may consist of between two (2) and thirteen (13) directors, as determined by our Board from time to time. Our Board currently has ten (10) members.

Effective from their appointment at the Annual Meeting, directors serve one year terms expiring at the next annual general meeting of shareholders. Each director will hold office until his or her successor has been elected and qualified, or until such director’s earlier death, resignation or removal as provided for in our Articles. If a vacancy arises on our Board during the term of a director’s appointment as a result of death, resignation or removal, then a majority of our directors then in office (acting upon the recommendation of our independent directors or a committee thereof) shall have the power at any time and from time to time to appoint any person to be a director as a replacement to fill the vacancy and such person will serve for the remainder of the term of the director he or she has replaced.

Each person nominated for election at the Annual Meeting has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as our Board may propose.

The following table sets forth, for our director nominees, information with respect to their ages, independence, and length of service on our Board:

| | | | | | | | | | | |

| Name | Age | Independent | Director

Since |

| Asaf Danziger | 57 | No | 2012 |

| William Doyle | 61 | No | 2004 |

| Jeryl Hilleman | 66 | Yes | 2018 |

| David Hung | 66 | Yes | 2018 |

| Kinyip Gabriel Leung | 62 | Yes | 2011 |

| Martin Madden | 63 | Yes | 2017 |

| Allyson Ocean | 52 | Yes | 2023 |

| Timothy Scannell | 59 | Yes | 2021 |

| Kristin Stafford | 42 | Yes | 2023 |

| William Vernon | 68 | Yes | 2006 |

| | |

Nominees for Election to a One-Year Term Expiring at the 2025 Annual General Meeting of Shareholders |

Experience: Mr. Danziger has served as our Chief Executive Officer since 2002. From 1998 to 2002, Mr. Danziger was CEO of Cybro Medical, a subsidiary of Imagyn Medical Technologies, Inc., a medical products company.

Education: B.Sc. in Material Engineering, Ben Gurion University of the Negev, Israel.

Other Public Company Directorships: None.

We believe that Mr. Danziger is qualified to serve on our Board due to his service as our Chief Executive Officer and his extensive knowledge of our Company and industry.

Experience: Mr. Doyle has served as our Executive Chairman since 2016, as Chairman of the Board since 2009 and as a member of our Board of Directors since 2004. From 2002 to 2018, Mr. Doyle was the managing director of WFD Ventures LLC, a private venture capital firm he co-founded. Prior to 2002, Mr. Doyle was a member of Johnson & Johnson’s Medical Devices and Diagnostics Group Operating Committee and was Vice President, Licensing and Acquisitions. While at Johnson & Johnson, Mr. Doyle was also chairman of the Medical Devices Research and Development Council, and Worldwide President of Biosense-Webster, Inc. and a member of the board of directors of Cordis Corporation and Johnson & Johnson Development Corporation, Johnson & Johnson’s venture capital subsidiary. Earlier in his career, Mr. Doyle was a management consultant in the healthcare group of McKinsey & Company. Mr. Doyle is also a member of the Governing Board of the Pershing Square Sohn Cancer Research Alliance. From 2014 to 2016 he was a member of the investment team at Pershing Square Capital Management L.P., a private investment firm and from November 2016 to January 2021, Mr. Doyle served as the Executive Chairman of BlinkHealth LLC.

Education: S.B. in Materials Science and Engineering, Massachusetts Institute of Technology; M.B.A., Harvard Business School.

Other Public Company Directorships: Director of Elanco Animal Health, Inc. since 2020 and ProKidney Corp. since 2022. Formerly a director of Minerva Neurosciences, Inc. from 2017 to 2023, OptiNose, Inc. from 2004 to 2020 and Zoetis, Inc. from 2015 to 2016.

We believe Mr. Doyle is qualified to serve on our Board due to his business and investment experience and his extensive knowledge of our Company and our industry. Mr. Doyle is a recognized expert in medical devices commercialization with over 20 years’ experience in the advanced technology and healthcare industries as an entrepreneur, executive, management consultant and investor.

Experience: Ms. Hilleman retired from Intersect ENT, Inc., a medical device company, where she served as Chief Financial Officer from June 2014 to December 2019. Prior to joining Intersect ENT, Ms. Hilleman served as Chief Financial Officer of several public life sciences companies including Ocera Therapeutics, Inc. from 2013 to 2014, Amyris, Inc., from 2008 to 2012, and Symyx Technologies, Inc. from 1997 to 2007.

Education: A.B. in History, Brown University; M.B.A., Wharton Graduate School of Business.

Other Public Company Directorships: Director of HilleVax since 2021 (HilleVax became public in 2022), director of Minerva Neurosciences, Inc. since 2018 and director of SI-Bone, Inc. since 2019. Formerly a director of Talis Biomedical from 2021 to 2022 and Xenoport, Inc., a biopharmaceutical company, from 2005 until it was acquired in 2016.

We believe that Ms. Hilleman is qualified to serve on our Board due to her business and accounting experience serving as an executive and director of several biotechnology and oncology companies.

Experience: Dr. Hung is the founder, President, Chief Executive Officer and Director of Nuvation Bio Inc., a biotech company, since April 2018. Dr. Hung was previously Chief Executive Officer and a Director of Axovant Sciences, Inc., a biopharmaceutical company, from April 2017 to February 2018. As a founder of Medivation Inc. (“Medivation”), a biopharmaceutical company, he served as President, Chief Executive Officer and a Director of Medivation from 2004 to 2016. From 1998 until 2001, Dr. Hung was employed by ProDuct Health, Inc., a privately held medical device company, as Chief Scientific Officer from 1998 to 1999 and as President and Chief Executive Officer and Director from 1999 to 2001.

Education: A.B. in Biology, Harvard College; M.D., University of California, San Francisco, School of Medicine.

Other Public Company Directorships: Director of Nuvation Bio Inc. since 2019. Formerly a director of ARYA Sciences Acquisition Corp. from 2018 to 2021, of Establishment Labs Holdings Inc. from 2016 to 2021, of Axovant Sciences, Inc. from 2017 to 2018, and of Medivation from 2004 to 2016.

We believe that Dr. Hung is qualified to serve on our Board due to his business leadership experience, his medical background and his experience as an executive in our industry and as the Chief Executive Officer of both clinical and commercial stage pharmaceutical companies.

Experience: Mr. Leung was the Vice Chairman of our Board and an employee of Novocure from 2011 to 2016, coordinating Novocure’s global commercial operations. From 2003 to 2010, he worked for OSI Pharmaceuticals, Inc. (“OSI”), a specialty pharmaceutical company, prior to its acquisition by Astellas Pharma Inc., last serving as Executive Vice President of OSI and the President of OSI’s Oncology and Diabetes Business. Prior to his tenure at OSI, from 1999 to 2003, Mr. Leung served as Group Vice President of the Global Prescription Business at Pharmacia Corporation, a global pharmaceutical and healthcare company. From 1991 to 1999, Mr. Leung was an executive at Bristol-Myers Squibb Company, a global pharmaceutical and healthcare company.

Education: B.S. with High Honors, University of Texas at Austin; M.S. in Pharmacy (with a concentration in Pharmaceutical Marketing), University of Wisconsin-Madison.

Other Public Company Directorships: Formerly a director of Pernix Therapeutics Holdings, Inc. from 2016 to 2019, Albany Molecular Research Inc. from 2010 to 2016 and Delcath Systems, Inc. from 2011 to 2014.

We believe that Mr. Leung is qualified to serve on our Board due to his extensive knowledge of our business as a former employee of Novocure and his experience in our industry, including global management. Specifically, Mr. Leung was responsible for the launch of erlotinib (Tarceva), a chemotherapy drug for non-small cell lung cancer, while at OSI. While at Pharmacia Corporation, Mr. Leung led its oncology franchise with business and medical affairs operations in over 80 countries. At Bristol-Myers Squibb, he oversaw the growth of chemotherapy drugs Taxol and Paraplatin.

Experience: Mr. Madden retired after a 30-year career at Johnson & Johnson (1986 to January 2017), where he served as Vice President Research and Development of DePuy-Synthes and Vice President Medical Device R&D transformation from February 2016 to January 2017, as Vice President New Product Development, Medical Devices from July 2015 to February 2016, and as Vice president R&D Global Surgery Group from January 2012 to July 2015. Earlier in his career, Mr. Madden was a medical device engineer and innovator, and a leader of cross-functional teams charged with incubating, developing, and launching new products.

Education: M.B.A. with Honors, Columbia University; M.S. with Honors in Mechanical Engineering, Carnegie-Mellon University; B.S. in Mechanical Engineering, summa cum laude, University of Dayton.

Other Public Company Directorships: Director of Microbot Medical Inc. since 2017. Formerly a director of TSO3, Inc. (acquired by Stryker Corporation) (2018 to 2019).

We believe that Mr. Madden is qualified to serve on our Board due to his extensive experience with and his status as a world leader in medical device innovation and new product development. During his thirty year tenure with Johnson & Johnson’s medical device organization, Mr. Madden was an innovator and research leader for nearly every medical device business including cardiology, electrophysiology, peripheral vascular surgery, general and colorectal surgery, aesthetics, orthopaedics, sports medicine, spine, and trauma. As an executive and a vice president of Johnson & Johnson, Mr. Madden served on the management boards of Johnson & Johnson’s Global Surgery Group, Ethicon, Ethicon Endo-Surgery, DePuy-Synthes, and Cordis, with responsibility for research and development – inclusive of organic and licensed/acquired technology. He was also chairman of Johnson & Johnson’s Medical Device Research Council, with responsibility for talent strategy and technology acceleration.

Experience: Dr. Ocean was elected to our Board in February 2023. Dr. Ocean is currently a Professor of Clinical Medicine at the Weill Medical College of Cornell University, where she has held various positions since 2004. Dr. Ocean also currently serves as a medical oncologist and attending physician in gastrointestinal oncology at NewYork-Presbyterian Hospital/Weill Cornell Medical Center, as well as a medical oncologist at The Jay Monahan Center for Gastrointestinal Health.

Education: Tufts University, B.S. and M.D.

Other Public Company Directorships: None.

We believe that Dr. Ocean is qualified to serve on our Board because she is an internationally recognized academic gastrointestinal medical oncologist, specializing in translational and clinical research, development of novel therapeutics, and patient advocacy. Dr. Ocean is co-founder and Scientific Advisory Board Chair of Let’s Win Pancreatic Cancer, an award-winning non-profit organization missioned to increase access to treatment options and clinical trials for patients with pancreatic cancer. Additionally, Dr. Ocean serves on several scientific advisory boards, from which she brings extensive knowledge from both the clinical and patient experience perspective.

Experience: Mr. Scannell was elected to our Board in February 2021. He recently retired after 32 years of service at Stryker Corporation. At Stryker, Mr. Scannell served as President and Chief Operating Officer from 2018 to 2021. Prior to this position, he served as group president of MedSurg and Neurotechnology from 2008 to 2018 and previously served as vice president/general manager of Stryker Biotech and president of Stryker Spine.

Education: University of Notre Dame, B.A. and M.B.A. in Business Administration.

Other Public Company Directorships: Director since 2014 and Chairman of the Board since 2019 of Insulet Corporation and director of Exact Sciences Corporation since October 2023. Formerly a director of Renalytix plc from March 2022 to October 2023 and of Molekule, Inc. from 2022 to March 2024.

We believe Mr. Scannell is qualified to serve on our Board due to his extensive business experience in our industry and as an executive leading a high-growth med-tech public company.

Experience: Ms. Stafford was elected to our Board in March 2023. Ms. Stafford is currently Senior Vice President, Chief Accounting Officer for Royalty Pharma plc, a position she has held since December 2018. Prior to this position, she served as Vice President, Finance of Royalty Pharma and Chief Financial Officer of BioPharma Credit plc, an affiliate of Royal Pharma, from 2016 to 2018. Ms. Stafford is a Certified Public Accountant and holds a bachelor of science degree in business administration from Sonoma State University.

Education: Sonoma State University, B.S. in Business Administration.

Other Public Company Directorships: None.

We believe that Ms. Stafford is qualified to serve on our Board because of her extensive financial expertise as a senior executive in the pharmaceutical industry and her earlier background as an accounting professional in other industries, including as a company controller and as an independent auditor.

Experience: Mr. Vernon has served as our Lead Independent Director since May 2016. Mr. Vernon served as the Chief Executive Officer of Kraft Foods Group, Inc., a food products company, from 2012 to 2014 and also served as its Senior Advisor through May 2015. From 2009 to 2011, Mr. Vernon served as the President of Kraft Foods North America and an Executive Vice President of Kraft Foods. From 2006 to 2009, Mr. Vernon served as the healthcare industry partner for Ripplewood Holdings, a private equity firm. From 1982 to 2006, Mr. Vernon held various roles at Johnson & Johnson. He served as company Group Chairman of DePuy Orthopaedics, a provider of orthopedic products and services, from 2004 to 2005, President of Centocor, a biotechnology company, from 2001 to 2004, President of McNeil Consumer Pharmaceuticals and Nutritionals, Worldwide, an OTC and nutritional products company, from 1999 to 2001 and President of The Johnson & Johnson-Merck Joint Venture, an OTC remedies company, from 1995 to 1999.

Education: B.A. in History, Lawrence University; M.B.A., Northwestern University’s Kellogg School of Management.

Other Public Company Directorships: Director of Nuvation Bio Inc. since 2021 and director of McCormick & Company since 2017. Formerly a director of Intersect ENT Inc., a healthcare equipment company, from 2015 to 2021, a director of The White Wave Foods Company, a food products company, from 2016 to 2017, a director of Axovant Sciences from 2017 to 2018, a director of Medivation, Inc., from 2006 to 2016, and a director of the Kraft Foods Group from 2012 to 2015.

We believe Mr. Vernon is qualified to serve on our Board due to his business and investment experience as an executive in our industry and as the former Chief Executive Officer of a global Fortune 500 company, with particular expertise in marketing.

OUR BOARD RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH NOMINEE NAMED IN THIS PROXY STATEMENT

APPROVAL AND RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board has engaged EY Global as our auditor and independent registered public accounting firm for the year ending December 31, 2024, and is seeking ratification of such appointment by our shareholders at the Annual Meeting. EY Global has audited our financial statements since 2003. Representatives of EY Global are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Jersey company law requires us to appoint an auditor at each annual general meeting to hold office from the conclusion of that meeting to the conclusion of the next annual general meeting. It is therefore proposed that the shareholders approve and thereby ratify the reappointment of EY Global as our auditor and independent registered public accounting firm. If our shareholders fail to approve and ratify the selection, our Audit Committee will reconsider whether or not to retain EY Global. Our Audit Committee will determine the fees to be paid to the auditors for the year ending December 31, 2024.

| | |

| Principal Accountant Fees and Services |

The following table provides information regarding the fees incurred to EY Global during the years ended December 31, 2023 and 2022. All fees described below were pre-approved by our Audit Committee. | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

Audit Fees (1) | $ | 907,301 | | | $ | 902,460 | |

| | | |

Tax Fees (2) | 7,613 | | | 70,000 | |

| Total Fees | $ | 914,914 | | | $ | 972,460 | |

(1)Audit Fees consist of fees billed for professional services performed by EY Global for the audit of our annual financial statements, the review of interim financial statements, and related services that are normally provided in connection with registration statements.

(2)Tax Fees consist of fees for professional services, including tax consulting and compliance services and transfer pricing services performed by EY Global.

| | |

| Pre-Approval Policies and Procedures |

Before an independent registered public accounting firm is engaged by the Company to render audit or non-audit services, our Audit Committee must review the terms of the proposed engagement and pre-approve the engagement.

OUR BOARD AND OUR AUDIT COMMITTEE RECOMMEND A VOTE “FOR” THE APPROVAL AND RATIFICATION OF APPOINTMENT OF EY GLOBAL AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

NON-BINDING ADVISORY VOTE ON THE APPROVAL OF EXECUTIVE COMPENSATION

Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) enables our shareholders to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in “Compensation Discussion and Analysis,” the 2023 Summary Compensation Table and the related compensation tables, notes, and narratives in this Proxy Statement. This proposal, known as a “Say-on-Pay" proposal, gives our shareholders the opportunity to express their views on our named executive officers' compensation as a whole. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this Proxy Statement.

The Say-on-Pay vote is advisory and, therefore, it is not binding on us, our Board or our Compensation Committee. The Say-on-Pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which our Compensation Committee and our Board will consider when determining executive compensation following the Annual Meeting. Consistent with the preference of our shareholders as determined by the last vote to approve the frequency of our Say-on-Pay vote, we intend to conduct a Say-on-Pay vote annually.

Our compensation programs are designed to support our business goals and promote our long-term profitable growth. Our equity programs are intended to align compensation with the long-term interests of our shareholders. We urge shareholders to read the “Compensation Discussion and Analysis” section of this Proxy Statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives. We also encourage you to review the 2023 Summary Compensation Table and other related compensation tables and narratives, which provide detailed information on the compensation of our named executive officers. Our Board and our Compensation Committee believe that the policies and procedures described and explained in the “Compensation Discussion and Analysis” are effective in achieving our goals, and that the compensation of our named executive officers reported in this Proxy Statement has supported and contributed to the Company's recent and long-term success. Accordingly, we ask our shareholders to vote “FOR” the approval of our executive compensation on a non-binding advisory basis.

OUR BOARD RECOMMENDS A VOTE “FOR” THE FOLLOWING NON-BINDING RESOLUTION

RESOLVED, that the compensation of our named executive officers as disclosed in “Compensation

Discussion and Analysis,” the 2023 Summary Compensation Table and the related compensation tables,

notes, and narratives in this Proxy Statement is hereby APPROVED.

APPROVAL OF 2024 OMNIBUS INCENTIVE PLAN

We are asking shareholders to approve the NovoCure Limited 2024 Omnibus Incentive Plan (the “2024 Plan”), which was adopted by our Board on April 4, 2024, subject to shareholder approval. We are seeking shareholder approval of the 2024 Plan as a successor to our 2015 Omnibus Incentive Plan (the “2015 Plan”), which will terminate as of the date our shareholders approve the 2024 Plan. If the 2024 Plan is not approved by our shareholders, we will continue to operate our 2015 Plan in accordance with its terms until the earlier of its expiration date in September 2025 or we deplete the available shares under our 2015 Plan.

Why We are Asking our Shareholders to Approve the 2024 Plan

Currently, we maintain the 2015 Plan to grant share options, restricted share units, performance-based share units and other equity-based and cash-based awards in order to provide long-term incentives to our employees, executives and directors. Our Board decided to adopt and seek approval for the 2024 Plan as the successor to the 2015 Plan because the 2015 Plan would expire pursuant to its terms in September 2025 and the Board desired to update the plan provisions to conform with certain current market practices in response to feedback from our shareholders. The 2024 Plan will not have an automatic replenishment feature (also known as an evergreen provision).

Approval of the 2024 Plan by our shareholders will allow us to continue to grant share options, restricted share unit awards, performance-based share awards and other equity-based and cash-based awards in order to secure and retain the services of our employees, executive officers and directors, and to provide long-term incentives that are designed to align the interests of our employees and directors with the interests of our shareholders.

Requested Shares

We are seeking shareholder approval of 9,000,000 shares for issuance under the 2024 Plan (less any shares subject to awards granted under our 2015 Plan after April 2, 2024 and prior to the effective date of the 2024 Plan). If shareholders approve the 2024 Plan, it will become effective on the date of the annual meeting (the “Effective Date”) and no new awards will be granted under the 2015 Plan on or after such date. Any awards outstanding under the 2015 Plan on the Effective Date of the 2024 Plan remain subject to and will be paid under the 2015 Plan, and any shares subject to outstanding awards under the 2015 Plan that subsequently expire, terminate, or are canceled or forfeited for any reason without issuance of shares will become available for issuance under the 2024 Plan, in accordance with the adjustment and share counting rules under the 2024 as further described below.

We are seeking approval to issue 9,000,000 shares under the 2024 Plan, all of which remained available under the 2015 Plan and will carry forward into the 2024 Plan. If the 2024 Plan is approved, we will cancel shares that would have been issuable under the 2015 Plan as of the Effective Date, which we estimate will be approximately 2,000,000 shares in excess of the 9,000,000 share request. No awards will be granted under the 2024 Plan unless shareholders approve it at the annual meeting. If shareholders do not approve the 2024 Plan, we will continue to have the authority to grant awards under the 2015 Plan until its expiration in September 2025. As of the Record Date, 11,034,414 shares remained available for issuance under our 2015 Plan and 21,834,794 shares were subject to outstanding awards under our 2015 Plan.

Based on historic grant practices and our current share price, our Board has estimated that the aggregate number of shares requested to be approved should be sufficient to cover awards for the next one to two year(s).

Why You Should Vote to Approve the 2024 Plan

Equity awards are an important part of our compensation philosophy.

•All full-time employees and Non-Employee Directors are eligible to receive awards:.approximately 63% of our outstanding equity awards are held by our broad employee population and approximately 36% of our outstanding equity awards are held by our executive officers and Non-Employee Directors.

•The 2024 Plan incentivizes long-term thinking to align with the interests of our shareholders.

•The 2024 Plan underlies our ability to reward, retain and motivate key talent which we believe will result in building long-term shareholder value.

•We face strong competition for talent from our peers and equity awards allow us to effectively compete for talent.

We believe we manage our equity award use carefully and dilution is reasonable.

•We monitor our annual burn rate, dilution and equity expense to ensure we maximize shareholder value.

•We use industry benchmarks to competitively grant the appropriate number of equity awards necessary to attract, reward, and retain employees and Non-Employee Directors.

We believe the size of our share reserve request is reasonable.

•We have adapted our grant practices and guidelines to align with the requested share pool reserve and remain competitive.

•We anticipate the requested share pool is adequate to cover equity awards for the next one to two years.

The consequences of the 2024 Plan not being approved are significant.

We compete for talent with many companies that offer equity incentives as a key element of their compensation programs. Without shareholder approval of the 2024 Plan:

•we will lose access to an important compensation tool that is key to our ability to attract, motivate, reward, and retain our key employees and Non-Employee Directors;

•we may need to significantly increase the cash component of employee compensation to continue to attract and retain key talent; and

•the requested share pool reserve will not become available for issuance, and the 2015 Plan will continue as in effect subject to authorized share limits and annual increases.

The Company believes that the following additional details are important for shareholders to consider.

Equity Awards Are an Important Part of Our Compensation Philosophy

We are a global oncology company with a proprietary platform technology called Tumor Treating Fields ("TTFields"), which are electric fields that exert physical forces to kill cancer cells via a variety of mechanisms. Our key priorities are to drive commercial adoption of Optune Gio® and Optune Lua®, our commercial TTFields devices, and to advance clinical and product development programs intended to extend overall survival in some of the most aggressive forms of cancer.

Our Board believes that the 2024 Plan is necessary to ensure that the number of shares available for issuance is sufficient to allow us to continue to attract and retain the services of talented individuals essential to our long-term growth and financial success. Our Board strongly believes that the issuance of equity awards is a key element underlying our ability to attract, retain and motivate our employees, including our executive officers, and is a substantial contributing factor to our success and the growth of our business. To date, we have relied significantly on equity incentives in the form of share option and restricted share unit awards to attract and retain employees, plus performance-based share awards to attract, incentivize and retain executive officers. We believe that equity incentives are necessary for us to remain competitive in the marketplace for executive and other talent, as the offering of shares to all employees is a common practice in our industry. Because of the long-term nature of bringing clinical therapies to market, our Board believes that long-term incentive programs are vital to aligning our employees with our strategy. Therefore, our Board believes that the 2024 Plan is in the best interests of the Company and its shareholders and recommends a vote in favor of this Proposal No. 4.

Our equity granting practices are broad-based and play an important role throughout the Company. We are especially proud that we grant all new employees an equity award when they join us, creating alignment with our shareholders from the very beginning. During the past three fiscal years (2021-2023), the number of awards we granted to non-Named Executive Officers was over 73% of the total grants made during the period.

Assuming approval of the 2024 Plan, our total overhang, including all awards outstanding and available for grant, will be equal to 25.4% of our total shares outstanding as of the Record Date. Based on our expected grant practices and our current share price, we believe that the adoption of the 2024 Plan and new total share reserve of 9,000,000 shares will provide the Board with flexibility to continue to make annual equity awards to employees and new hires

through the next one to two years and will allow us to remain competitive in the marketplace with respect to attracting, retaining and motivating key personnel and Non-Employee Directors.

We Believe We Manage Our Equity Incentive Award Use Carefully, and Dilution Is Reasonable

Equity awards are a vital part of our overall compensation program. Our compensation philosophy reflects broad-based eligibility for equity incentive awards, and we grant awards to all of our full-time employees. However, we recognize that equity awards dilute existing shareholders, and, therefore, we must responsibly manage the growth of our equity compensation program. We are committed to effectively monitoring our equity compensation share reserve, including our “burn rate,” to maximize shareholders’ value by granting the appropriate number of equity incentive awards necessary to attract, reward, and retain employees and Non-Employee Directors. The tables below show our 2023 overhang and burn rate percentages.

We Believe the Size of Our Share Reserve Request Is Reasonable

If the 2024 Plan is approved by our shareholders, we expect to have approximately 9,000,000 shares available for grant after our annual meeting (less any shares subject to awards made under the 2015 Plan after April 2, 2024 and prior to the Effective Date and subject to adjustment in the event of certain capitalization events and the share recycling provisions, each as described in the 2024 Plan), which we anticipate (based on our expected grant practices and our current share price) being a pool of shares sufficient for grants through one to two years, and necessary to provide a predictable amount of equity for attracting, retaining, and motivating employees.

Outstanding Grants and Usage under the 2015 Plan

Overhang

The following table provides certain additional information regarding our use of equity awards:

| | | | | |

As of April 2, 2024 (except where noted) | |

| Total number of common shares subject to outstanding options | 11,782,976 |

| Weighted-average exercise price of outstanding options | $32.59 |

| Weighted-average remaining term of outstanding stock options at March 31, 2024 | 6.3 years |

| Total number of shares of common stock subject to outstanding full value awards (RSUs and PSUs (at target)) | 10,349,421 |

| Total number of shares of common stock available for grant (1) | 14,585,543 |

| Total number of shares of common stock outstanding | 107,606,309 |

Per-share closing price of common stock as reported on Nasdaq on April 2, 2024 | $14.39 |

| |

(1) Includes PSUs granted at maximum payout that are not included in shares subject to outstanding grants. If the 2024 Plan is approved, we will cancel shares that would have been issuable under the 2015 Plan as of the Effective Date in excess of the 9,000,000 shares requested.

We have a broad-based equity award practice: approximately 63% of our outstanding equity awards are held by our broad employee population and approximately 36% of our outstanding equity awards are held by our executive officers and Non-Employee Directors.

Assuming approval of the 2024 Plan, our total overhang, including all awards outstanding and available for grant, will be equal to 25.44% of our total shares outstanding as of the Record Date (excluding approximately 3.6 million "outperformance" PSUs that are not probable to vest). The adoption of the 2024 Plan and new total share reserve of 9,000,000 shares will provide the Board with flexibility to continue to make annual equity awards to eligible employees and new hires through the next one to two years and allows us to remain competitive in the marketplace with respect to attracting, retaining and motivating key personnel and Non-Employee Directors.

Burn Rate

The Company monitors shareholder dilution by tracking the number of shares subject to equity awards that it grants annually, commonly referred to as the burn rate. Burn rate shows how rapidly a company is depleting its shares reserved for equity compensation awards and is defined for this purpose as the number of equity awards granted as incentives during the year divided by the weighted average number of shares of common stock outstanding during the year. The Company has calculated the burn rate for the past three years, as set forth in the following table:

| | | | | | | | | | | | | | |

| Total Number of Common Shares Subject to Options Granted | Total Number of Common Shares Subject to Full Value Awards Granted | Weighted Average Common Shares Outstanding | Burn Rate |

Fiscal Year 2023 | 1,192,916 | 1,626,223 | 106,391,178 | 2.65% |

| Fiscal Year 2022 | 857,077 | 1,439,897 | 104,660,476 | 2.20% |

Fiscal Year 2021 | 466,360 | 532,196 | 103,433,274 | 0.97% |

The above burn rates cover fiscal years 2021-2023. In January 2024 (fiscal year 2024), following a reduction in workforce in November 2023, one-time retention awards were granted to our non-executive officer employees. These retention awards were granted to motivate and retain key talent and will impact the full fiscal year 2024 burn rate.

2024 Plan Highlights

The 2024 Plan includes provisions that are designed to protect our shareholders' interests and to reflect corporate governance best practices. Highlights of the 2024 Plan are as follows:

•Governance. The Compensation Committee, which is comprised solely of independent directors, will administer the 2024 Plan.

•Fixed pool; No evergreen. The total number of ordinary shares authorized for issuance under the 2024 Plan is fixed (subject to adjustment in the event of certain capitalization events and the share recycling provisions, each as described in the 2024 Plan) at 9,000,000 shares, or approximately 8.4% of our ordinary shares outstanding at the Record Date (less any shares subject to awards made under the 2015 Plan after April 2, 2024 and prior to the Effective Date).

•No single trigger accelerated vesting upon change in control. The 2024 Plan does not provide for any automatic mandatory vesting of awards upon a change in control. The Compensation Committee has discretion to provide whether and how a change in control affects outstanding awards.

•Prohibition on repricing. Except as permitted in the event of certain equitable adjustments as set forth in the 2024 Plan, or in connection with a change in control, the 2024 Plan specifically prohibits us from repricing any outstanding share option or share appreciation right by reducing the exercise price or strike price of the share option or share appreciation right or canceling any outstanding share option or share appreciation right that has an exercise price or strike price in excess of the current fair market value in exchange for cash or other share awards without obtaining the approval of our shareholders.

•Prohibition on the payment of dividends and dividend equivalents on unvested share options and share appreciation rights. The 2024 Plan prohibits the payment or crediting of dividends or dividend equivalents with respect to share options or share appreciation rights awards.

•Prohibition on the payment of dividends and dividend equivalents prior to the vesting of awards. The 2024 Plan prohibits the payment or crediting of dividends or dividend equivalents with respect to awards (other than share options and share appreciation rights) prior to the vesting of the awards.