UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 001-37565

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of | (I.R.S. Employer | |||||||

| Incorporation or Organization) | Identification No.) | |||||||

(Address of principal executive offices, including zip code)

+44 (0) 15 3475 6700

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

_______________________________________________________

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ .

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding as of July 23, 2021 | |||||||

| Ordinary shares, no par value | ||||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission (the “SEC”) and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and research and development related to our Tumor Treating Fields delivery systems marketed under various brand names, including Optune and Optune Lua, and software and systems to support and optimize the delivery of Tumor Treating Fields (collectively, our “Products”). In particular, these forward-looking statements include, among others, statements about:

•our research and development, clinical trial and commercialization activities and projected expenditures;

•the further commercialization of our Products for current and future indications;

•our business strategies and the expansion of our sales and marketing efforts in the United States and in other countries;

•the market acceptance of our Products for current and future indications by patients, physicians, third-party payers and others in the healthcare and scientific community;

•our plans to pursue the use of our Products for the treatment of solid tumor cancers other than glioblastoma multiforme (“GBM”) and malignant pleural mesothelioma (“MPM”);

•our estimates regarding revenues, expenses, capital requirements and needs for additional financing;

•our ability to obtain regulatory approvals for the use of our Products in indications other than GBM and MPM;

•our ability to acquire from third-party suppliers the supplies needed to manufacture our Products;

•our ability to manufacture adequate supply of our Products;

•our ability to secure and maintain adequate coverage from third-party payers to reimburse us for our Products for current and future indications;

•our ability to receive payment from third-party payers for use of our Products for current and future indications;

•our ability to maintain and develop our intellectual property position;

•our ability to manage the risks associated with business disruptions caused by natural disasters, extreme weather events, pandemics such as the COVID-19 pandemic, including the emergence of variant strains, or international conflict and other disruptions outside of our control;

•our cash needs; and

•our prospects, financial condition and results of operations.

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Factors which may cause such differences to occur include those risks and uncertainties set forth under Part I, Item 1A., “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed on February 25, 2021, as well as other risks and uncertainties set forth from time to time in the reports we file with the SEC. In our prior filings, references to NovoTTF-100L now refer

i

to Optune Lua. We do not intend to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

TRADEMARKS

This Quarterly Report on Form 10-Q includes trademarks of NovoCure Limited and other persons. All trademarks or trade names referred to herein are the property of their respective owners.

ii

NovoCure Limited

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

| Page | ||||||||

1

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS | |||||||||||

| U.S. dollars in thousands (except share data) | |||||||||||

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| ASSETS | |||||||||||

| CURRENT ASSETS: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Short-term investments | |||||||||||

| Restricted cash | |||||||||||

| Trade receivables, net | |||||||||||

| Receivables and prepaid expenses | |||||||||||

| Inventories | |||||||||||

| Total current assets | |||||||||||

| LONG-TERM ASSETS: | |||||||||||

| Property and equipment, net | |||||||||||

| Field equipment, net | |||||||||||

| Right-of-use assets | |||||||||||

| Other long-term assets | |||||||||||

| Total long-term assets | |||||||||||

| TOTAL ASSETS | $ | $ | |||||||||

| The accompanying notes are an integral part of these unaudited consolidated financial statements. | |||||||||||

2

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS | |||||||||||

| U.S. dollars in thousands (except share data) | |||||||||||

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||

| CURRENT LIABILITIES: | |||||||||||

| Trade payables | $ | $ | |||||||||

| Other payables, lease liabilities and accrued expenses | |||||||||||

| Total current liabilities | |||||||||||

| LONG-TERM LIABILITIES: | |||||||||||

| Long-term debt, net | |||||||||||

| Deferred revenue | |||||||||||

| Long-term leases | |||||||||||

| Employee benefits | |||||||||||

| Other long-term liabilities | |||||||||||

| Total long-term liabilities | |||||||||||

| TOTAL LIABILITIES | |||||||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||||

| SHAREHOLDERS' EQUITY: | |||||||||||

| Share capital - | |||||||||||

Ordinary shares no par value, unlimited shares authorized; issued and outstanding: | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

| Retained earnings (accumulated deficit) | ( | ( | |||||||||

| TOTAL SHAREHOLDERS' EQUITY | |||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | $ | |||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

3

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||||||||||||||

| U.S. dollars in thousands (except share and per share data) | |||||||||||||||||||||||||||||

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Net revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Cost of revenues | |||||||||||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||||||||

| Operating costs and expenses: | |||||||||||||||||||||||||||||

| Research, development and clinical trials | |||||||||||||||||||||||||||||

| Sales and marketing | |||||||||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||||||||

| Total operating costs and expenses | |||||||||||||||||||||||||||||

| Operating income (loss) | ( | ( | |||||||||||||||||||||||||||

| Financial expenses (income), net | |||||||||||||||||||||||||||||

| Income (loss) before income tax | ( | ( | ( | ||||||||||||||||||||||||||

| Income tax | ( | ( | |||||||||||||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Basic net income (loss) per ordinary share | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing basic net income (loss) per share | |||||||||||||||||||||||||||||

| Diluted net income (loss) per ordinary share | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing diluted net income (loss) per share | |||||||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

4

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) | |||||||||||||||||||||||||||||

| U.S. dollars in thousands | |||||||||||||||||||||||||||||

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||||||||||||||||||||

| Change in foreign currency translation adjustments | ( | ( | |||||||||||||||||||||||||||

| Pension benefit plan | ( | ( | |||||||||||||||||||||||||||

| Total comprehensive income (loss) | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| U.S. dollars in thousands (except share data) | |||||||||||||||||||||||||||||

| Ordinary shares | Additional paid-in capital | Accumulated other comprehensive loss | Retained earnings (accumulated deficit) | Total shareholders' equity | |||||||||||||||||||||||||

| Balance as of December 31, 2020 (audited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| Share-based compensation to employees | — | — | — | ||||||||||||||||||||||||||

| Exercise of options and vested RSUs | — | — | |||||||||||||||||||||||||||

| — | ( | — | ( | ||||||||||||||||||||||||||

Other comprehensive income (loss), net of tax benefit of $ | — | — | — | ||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balance as of March 31, 2021(Unaudited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| Share-based compensation to employees | — | — | — | ||||||||||||||||||||||||||

| Proceeds from issuance of shares | — | — | |||||||||||||||||||||||||||

| Exercise of options and vested RSUs | — | — | |||||||||||||||||||||||||||

Other comprehensive income (loss), net of tax benefit of $ | — | — | — | ||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balance as of June 30, 2021 (Unaudited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

5

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| U.S. dollars in thousands (except share data) | |||||||||||||||||||||||||||||

| Ordinary shares | Additional paid-in capital | Accumulated other comprehensive loss | Retained earnings (accumulated deficit) | Total shareholders' equity | |||||||||||||||||||||||||

| Balance as of December 31, 2019 (audited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| Share-based compensation to employees | — | — | — | ||||||||||||||||||||||||||

| Exercise of options and vested RSUs | — | — | |||||||||||||||||||||||||||

Other comprehensive income (loss), net of tax benefit of $ | — | — | ( | — | ( | ||||||||||||||||||||||||

| Net income (loss) | — | — | — | ||||||||||||||||||||||||||

| Balance as of March 31, 2020 (Unaudited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| Share-based compensation to employees | — | — | — | ||||||||||||||||||||||||||

| Proceeds from issuance of shares | — | — | |||||||||||||||||||||||||||

| Exercise of options and vested RSUs | — | — | |||||||||||||||||||||||||||

Other comprehensive income (loss), net of tax benefit of $ | — | — | — | ||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ||||||||||||||||||||||||||

| Balance as of June 30, 2020 (Unaudited) | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

6

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||||||||||||||||

| U.S. dollars in thousands | |||||||||||||||||||||||||||||

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||||||||||||

| Net income (loss) | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |||||||||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||||||||

| Asset write-downs and impairment of field equipment | |||||||||||||||||||||||||||||

| Share-based compensation | |||||||||||||||||||||||||||||

| Foreign currency remeasurement loss (gain) | ( | ( | ( | ||||||||||||||||||||||||||

| Decrease (increase) in accounts receivables | ( | ( | ( | ||||||||||||||||||||||||||

| Amortization of discount (premium) | ( | ( | |||||||||||||||||||||||||||

| Decrease (increase) in inventories | ( | ( | ( | ||||||||||||||||||||||||||

| Decrease (increase) in other long-term assets | ( | ||||||||||||||||||||||||||||

| Increase (decrease) in accounts payables and accrued expenses | ( | ||||||||||||||||||||||||||||

| Increase (decrease) in other long-term liabilities | ( | ( | ( | ( | |||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||||||||||||

| Purchase of property, equipment and field equipment | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||

| Proceeds from maturity of short-term investments | |||||||||||||||||||||||||||||

| Purchase of short-term investments | ( | ( | |||||||||||||||||||||||||||

| Net cash provided by (used in) investing activities | $ | ( | $ | ( | $ | $ | ( | $ | ( | ||||||||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||||||||||||||

| Proceeds from issuance of shares, net | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Proceeds from long term debt, net | |||||||||||||||||||||||||||||

| Repayment of long-term loan | ( | ( | ( | ( | ( | ||||||||||||||||||||||||

| Exercise of options and warrants | |||||||||||||||||||||||||||||

| Net cash provided by (used in) financing activities | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | |||||||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at the beginning of the period | |||||||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at the end of the period | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

7

| NOVOCURE LIMITED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||||||||||||||||

| U.S. dollars in thousands | |||||||||||||||||||||||||||||

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 | |||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Supplemental cash flow activities: | |||||||||||||||||||||||||||||

| Cash paid during the period for: | |||||||||||||||||||||||||||||

| Income taxes paid (refunded), net | $ | $ | $ | $ | $ | ( | |||||||||||||||||||||||

| Interest paid | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Non-cash activities: | |||||||||||||||||||||||||||||

| Right-of-use assets obtained in exchange for lease liabilities | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

8

NOVOCURE LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

NOTE 1: ORGANIZATION AND BASIS OF PRESENTATION

Organization. NovoCure Limited (including its consolidated subsidiaries, the "Company") was incorporated in the Bailiwick of Jersey and is principally engaged in the development, manufacture and commercialization of Tumor Treating Fields ("TTFields") delivery systems, including Optune and Optune Lua (collectively, our "Products"), for the treatment of solid tumor cancers. The Company currently markets Optune in the United States ("U.S."), Austria, Germany, Israel, Japan, Sweden and Switzerland. The Company currently markets Optune Lua in the U.S. The Company also has a License and Collaboration Agreement (the "Zai Agreement") with Zai Lab (Shanghai) Co., Ltd. ("Zai") to market Optune in China, Hong Kong, Macau and Taiwan ("Greater China").

Financial statement preparation. The accompanying unaudited consolidated financial statements include the accounts of the Company and intercompany accounts and transactions have been eliminated. In the opinion of the Company’s management, the consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation for the periods presented. The preparation of these consolidated financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the amounts reported in these consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. These consolidated financial statements and accompanying notes should be read in conjunction with the Company’s annual consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the "2020 10-K") filed with the Securities and Exchange Commission on February 25, 2021.

The significant accounting policies applied in the audited annual consolidated financial statements of the Company as disclosed in the 2020 10-K are applied consistently in these unaudited interim consolidated financial statements, except as noted below:

Recently Adopted Accounting Pronouncements.

In August 2020, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2020-06, Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (ASU 2020-06), which simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts in an entity’s own equity. Among other changes, ASU 2020-06 removes from GAAP the liability and equity separation model for convertible instruments with a cash conversion feature, and as a result, after adoption, entities will no longer separately present in equity an embedded conversion feature for such debt. Similarly, the embedded conversion feature will no longer be amortized into income as interest expense over the life of the instrument. Instead, entities will account for a convertible debt instrument wholly as debt unless (1) a convertible instrument contains features that require bifurcation as a derivative under Accounting Standards Codification ("ASC Topic 815"), Derivatives and Hedging, or (2) a convertible debt instrument was issued at a substantial premium. Additionally, ASU 2020-06 requires the application of the if-converted method to calculate the impact of convertible instruments on diluted earnings per share (EPS), which is consistent with the Company’s accounting treatment under the current standard. ASU 2020-06 is effective for fiscal years beginning after December 15, 2021, with early adoption permitted for fiscal years beginning after December 15, 2020, and can be adopted on either a fully retrospective or modified retrospective basis. The Company early adopted ASU 2020-06, effective January 1, 2021 on a modified retrospective basis.

The impact of the Company’s adoption of ASU 2020-06 on the balance sheet as of January 1, 2021 was an increase in long term debt, net of $128,972 , a decrease in additional paid-in capital of $132,474 , and a decrease in accumulated deficit of $3,502 . Interest expense recognized in future periods will be reduced as a result of accounting for the convertible debt instrument as a single liability measured at its amortized cost. For additional information see Note 5 of these unaudited consolidated financial statements.

In December 2019, the FASB issued Accounting Standard Update No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes (ASU 2019-12), which simplifies the accounting for income taxes, eliminates certain exceptions within ASC 740, Income Taxes, and clarifies certain aspects of the current guidance. ASU 2019-12 is effective for the Company as of January 1, 2021 and the adoption of this standard did not have a material impact on the Company's consolidated financial statements.

9

NOTE 2: CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

Cash equivalents include items almost as liquid as cash, such as certificates of deposit and time deposits with maturity periods of three months or less when purchased. As of June 30, 2021 and December 31, 2020, the Company’s cash and cash equivalents were composed of:

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| Cash | $ | $ | |||||||||

| Money market funds | |||||||||||

| Total cash and cash equivalents | $ | $ | |||||||||

The Company also invests in marketable U.S. Treasury Bills (“T-bills”) that are classified as held-to-maturity securities. The amortized cost and recorded basis of the T-bills are presented as short-term investments.

As of June 30, 2021 and December 31, 2020, the Company’s short-term investments were:

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| Short-term investments | $ | $ | |||||||||

Quoted market prices were applied to determine the fair value of cash equivalents and short-term investments, therefore they were categorized as Level 1 in accordance with ASC 820, “Fair Value Measurements and Disclosures.” The estimated fair value of the Company’s short-term investments as of June 30, 2021 and December 31, 2020 was $549,921 and $607,905 , respectively.

NOTE 3: INVENTORIES

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| Raw materials | $ | $ | |||||||||

| Work in progress | |||||||||||

| Finished products | |||||||||||

| Total | $ | $ | |||||||||

NOTE 4: COMMITMENTS AND CONTINGENT LIABILITIES

Operating Leases. The facilities of the Company are leased under various operating lease agreements for periods, including options for extensions, ending no later than 2030. The Company also leases motor vehicles under various operating leases, which expire on various dates, the latest of which is in 2024.

Pledged deposits and bank guarantees. As of June 30, 2021 and December 31, 2020, the Company pledged bank deposits of $1,418 and $1,438 , respectively, to cover bank guarantees in respect of its leases of operating facilities and obtained bank guarantees for the fulfillment of the Company’s lease and other contractual commitments of $1,750 and $1,687 , respectively.

10

NOTE 5: CONVERTIBLE NOTE

On November 5, 2020, the Company issued $575,000 aggregate principal amount of 0 % Convertible Senior Notes due 2025 (the “Notes”).

The Notes are senior unsecured obligations of the Company. The Notes do not bear regular interest, and the principal amount of the Notes will not accrete. Special interest, if any, payable in accordance with the terms of the Notes will be payable in cash semi-annually in arrears on May 1 and November 1 of each year, beginning on May 1, 2021. The Notes mature on November 1, 2025, unless earlier repurchased, redeemed or converted. For additional information, see Note 10(a) to the Consolidated Financial Statements in the 2020 10-K.

In January 2021, the Company irrevocably elected to settle all conversions of Notes by a combination of cash and the Company's ordinary shares and that the cash portion per $1,000 principal amount of Notes for all conversion settlements shall be $1,000 . Accordingly, from and after the date of the election, upon conversion of any Notes, holders of Notes will receive, with respect to each $1,000 principal amount of Notes converted, cash in an amount up to $1,000 and the balance of the conversion value, if any, in ordinary shares (the "Conversion Shares").

The net carrying amount of the liability and equity components of the Notes as of June 30, 2021 and December 31, 2020 are as follows:

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| Liability component, net: | |||||||||||

| Principal amount | $ | $ | |||||||||

| Unamortized discount | ( | ||||||||||

| Unamortized issuance costs | ( | ( | |||||||||

| Net carrying amount of liability component (1) | $ | $ | |||||||||

Equity component, net: | |||||||||||

| Conversion feature | $ | $ | |||||||||

Issuance costs | ( | ||||||||||

| Net carrying amount of equity component | $ | $ | |||||||||

(1) An effective interest rate determines the fair value of the Notes, therefore they are categorized as Level 3 in accordance with ASC 820, "Fair Value Measurements and Disclosures." The estimated fair value of the Net carrying amount of liability component of the Notes as of June 30, 2021 and December 31, 2020 were $495,271 and $450,437 , respectively.

11

Finance expense related to the Notes was as follows:

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, 2020 | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

Amortization of debt discount | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Amortization of debt issuance costs | |||||||||||||||||||||||||||||

Total finance expense recognized | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

NOTE 6: SHARE OPTION PLANS AND ESPP

In September 2015, the Company adopted the 2015 Omnibus Incentive Plan (the “2015 Plan”). Under the 2015 Plan, the Company can issue various types of equity compensation awards such as share options, restricted shares, performance shares, restricted share units (“RSUs”), performance-based share units (“PSUs”), long-term cash awards and other share-based awards.

Options granted under the 2015 Plan generally have a four-year vesting period and expire ten years after the date of grant. Options granted under the 2015 Plan that are canceled or forfeited before expiration become available for future grants. RSUs granted under the 2015 Plan generally vest over a three year period. PSUs granted under the 2015 Plan generally vest between a - and six-year period as performance targets are attained. RSUs and PSUs granted under the 2015 Plan that are canceled before expiration become available for future grants. As of June 30, 2021, 14,521,697 ordinary shares were available for grant under the 2015 Plan.

A summary of the status of the Company’s option plans as of June 30, 2021 and changes during the period then ended is presented below:

| Six months ended June 30, 2021 | |||||||||||

| Unaudited | |||||||||||

| Number of options | Weighted average exercise price | ||||||||||

| Outstanding at beginning of year | $ | ||||||||||

| Granted | |||||||||||

| Exercised | ( | ||||||||||

| Forfeited and canceled | ( | ||||||||||

| Outstanding as of June 30, 2021 | $ | ||||||||||

| Exercisable options | $ | ||||||||||

For the six months ended June 30, 2021, options to purchase 798,511 ordinary shares were exercised, resulting in the issuance of 798,511 ordinary shares.

12

| Six months ended June 30, 2021 | |||||||||||

| Unaudited | |||||||||||

| Number of RSU/PSUs | Weighted average grant date fair value | ||||||||||

| Unvested at beginning of year | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited and cancelled | ( | ||||||||||

| Unvested as of June 30, 2021 (1) | |||||||||||

(1) Includes PSUs that have a mix of service, market and other milestone performance vesting conditions which are vested upon achievements of performance milestones which are not probable, as of June 30, 2021, in accordance with ASC 718 as follows:

June 30, 2021 | |||||||||||||||||

| Number of PSUs | Fair value at grant date per PSU | Total fair value at grant date | |||||||||||||||

| $ | $ | ||||||||||||||||

| $ | |||||||||||||||||

| $ | |||||||||||||||||

These PSUs will be expensed over the performance period when the vesting conditions become probable in accordance with ASC 718.

In September 2015, the Company adopted an employee share purchase plan (“ESPP”) to encourage and enable eligible employees to acquire ownership of the Company’s ordinary shares purchased through accumulated payroll deductions on an after-tax basis. In the United States, the ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code and the provisions of the ESPP are construed in a manner consistent with the requirements of such section. As of June 30, 2021, 4,989,076 ordinary shares were available to be purchased by eligible employees under the ESPP.

13

The fair value of share-based awards was estimated using the Black-Scholes model for all equity grants. For market condition awards, the Company also applied the Monte-Carlo simulation model. We assessed fair value using the following underlying assumptions:

| Six months ended June 30, | Year ended December 31, 2020 | ||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

| Unaudited | Audited | ||||||||||||||||

| Stock Option Plans | |||||||||||||||||

| Expected term (years) | |||||||||||||||||

| Expected volatility | |||||||||||||||||

| Risk-free interest rate | |||||||||||||||||

| Dividend yield | % | % | % | ||||||||||||||

| ESPP | |||||||||||||||||

| Expected term (years) | |||||||||||||||||

| Expected volatility | % | % | |||||||||||||||

| Risk-free interest rate | % | % | |||||||||||||||

| Dividend yield | % | % | % | ||||||||||||||

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, 2020 | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Cost of revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Research, development and clinical trials | |||||||||||||||||||||||||||||

| Sales and marketing | |||||||||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||||||||

| Total share-based compensation expense | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

NOTE 7: Basic and diluted net income (loss) per ordinary share

14

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, 2020 | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| Net income (loss) attributable to ordinary shares as reported used in computing basic and diluted net income (loss) per share | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing basic net income (loss) per share | |||||||||||||||||||||||||||||

| Potentially dilutive shares that were excluded from the computation of basic net income (loss) per share: | |||||||||||||||||||||||||||||

| Options | |||||||||||||||||||||||||||||

| Restricted share units | |||||||||||||||||||||||||||||

| ESPP | |||||||||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing diluted net income (loss) per share | |||||||||||||||||||||||||||||

| Weighted anti-dilutive shares outstanding which were not included in the diluted calculation | |||||||||||||||||||||||||||||

| Basic net income (loss) per ordinary share | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

| Diluted net income (loss) per ordinary share | $ | ( | $ | $ | ( | $ | $ | ||||||||||||||||||||||

15

NOTE 8: SUPPLEMENTAL INFORMATION

The Company operates in a single reportable segment.

The following table presents long-lived assets by location:

| June 30, 2021 | December 31, 2020 | ||||||||||

| Unaudited | Audited | ||||||||||

| United States | $ | $ | |||||||||

| Israel | |||||||||||

| Switzerland | |||||||||||

| Japan | |||||||||||

| Germany | |||||||||||

| Others | |||||||||||

| Total | $ | $ | |||||||||

The Company’s revenues by geographic region, based on the customer’s location, are summarized as follows:

| Three months ended June 30, | Six months ended June 30, | Year ended December 31, 2020 | |||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Unaudited | Unaudited | Audited | |||||||||||||||||||||||||||

| United States | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| EMEA: | |||||||||||||||||||||||||||||

| Germany | |||||||||||||||||||||||||||||

| Other EMEA | |||||||||||||||||||||||||||||

| Japan | |||||||||||||||||||||||||||||

| Greater China (1) | |||||||||||||||||||||||||||||

| Total net revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

(1) For additional information, see Note 12 to the Consolidated Financial Statements in the 2020 10-K.

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide information to assist you in better understanding and evaluating our financial condition and results of operations. We encourage you to read this MD&A in conjunction with our unaudited consolidated financial statements and the notes thereto for the period ended June 30, 2021 included in Part I, Item 1 of this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. Please refer to the information under the heading “Cautionary Note Regarding Forward-Looking Statements” elsewhere in this report. References to the words “we,” “our,” “us,” and the “Company” in this report refer to NovoCure Limited, including its consolidated subsidiaries.

Critical Accounting Policies and Estimates

In accordance with U.S. generally accepted accounting principles (“GAAP”), in preparing our financial statements, we must make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of net revenues and expenses during the reporting period. We develop and periodically change these estimates and assumptions based on historical experience and on various other factors that we believe are reasonable under the circumstances. Actual results may differ from these estimates.

The critical accounting policies requiring estimates, assumptions and judgments that we believe have the most significant impact on our consolidated financial statements can be found in our 2020 10-K. For additional information, see Note 1 to our unaudited consolidated financial statements in Part I, Item 1 of this Quarterly Report. There were no other material changes to our critical accounting policies and estimates as compared to the critical accounting policies and estimates described in our 2020 10-K.

Overview

We are a global oncology company with a proprietary platform technology called Tumor Treating Fields ("TTFields"), which are electric fields tuned to specific frequencies that disrupt cancer cell division. Our key priorities are to drive commercial adoption of Optune and Optune Lua, our commercial TTFields delivery systems, and to advance clinical and product development programs intended to extend overall survival in some of the most aggressive forms of cancer.

Optune is approved by the U.S. Food and Drug Administration ("FDA") under the Premarket Approval ("PMA") pathway for the treatment of adult patients with newly diagnosed GBM in combination with temozolomide, a chemotherapy drug, and for adult patients with GBM following confirmed recurrence after chemotherapy as monotherapy treatment. We also have approval or a CE certificate to market Optune for the treatment of GBM in the European Union ("EU"), Japan and certain other countries. We market Optune in the U.S., Austria, Germany, Israel, Japan, Sweden and Switzerland, which we refer to as our "active markets." With respect to GBM, our sales and marketing efforts are principally focused on driving adoption with both neuro-oncologists and radiation oncologists. We are expanding our commercial operations into France with an initial focus on developing key opinion leader relationships in GBM and establishing a path to reimbursement for our Products.

Optune Lua is approved by the FDA under the Humanitarian Device Exemption ("HDE") pathway to treat MPM in combination with standard chemotherapies. We have received CE certification to market Optune Lua (under the name "NovoTTF-100L") in the EU and Switzerland. We currently market Optune Lua in the U.S., and are evaluating plans to expand access to our therapy for MPM patients in other markets. With respect to MPM, our commercial efforts are principally focused on generating awareness, educating thoracic oncologists about the benefits of TTFields, and establishing a dialogue with third-party payers around access to Optune Lua.

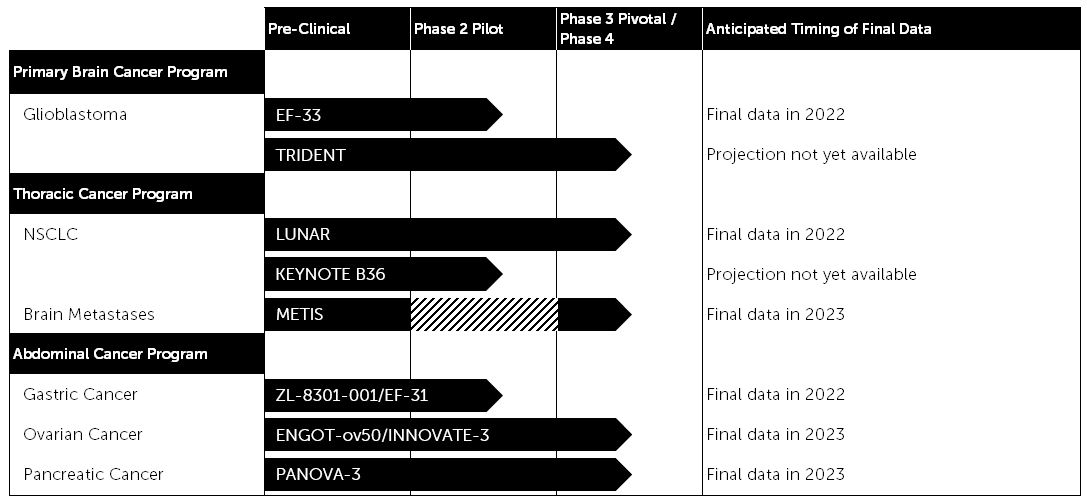

We believe the mechanism of action behind TTFields therapy may be broadly applicable to solid tumor cancers. Currently, we are conducting phase 3 pivotal trials evaluating the use of TTFields in non-small-cell lung cancer ("NSCLC"), brain metastases from non-small-cell lung cancer ("brain metastases"), ovarian cancer and pancreatic cancer. In 2020, we enrolled our first patient in our global phase 4 TRIDENT trial to test the potential survival benefit of initiating Optune concurrent with radiation therapy versus following radiation therapy in patients with newly diagnosed GBM. We recently concluded a phase 2 pilot trial evaluating the use of TTFields in liver cancer and are conducting a phase 2 pilot trial in gastric cancer, as well as testing the potential incremental survival benefit of TTFields delivered using high-intensity arrays versus standard arrays. We anticipate expanding our clinical pipeline

17

over time to study the safety and efficacy of TTFields for additional solid tumor indications and combinations with other cancer treatment modalities.

In April 2021, we announced that an independent data monitoring committee ("DMC") informed Novocure that the pre-specified interim analysis for the phase 3 pivotal LUNAR trial for the treatment of NSCLC was accelerated given the length of accrual and the number of events observed, to date. The interim analysis included data from 210 patients accrued through February 2021. After review of the interim analysis, the DMC concluded that the LUNAR trial should continue with no evidence of increased systemic toxicity. The DMC went on to comment that the continued accrual to 534 patients as proposed in the original protocol, given the current rate of accrual and the interim data presented, is likely unnecessary and possibly unethical for patients randomized to control. For this reason, the DMC recommended an adjustment of accrual to approximately 276 patients with a 12-month follow-up following the enrollment of the last patient. The DMC believes this amended protocol would provide adequate data regarding toxicity and efficacy, providing sufficient overall power, as well as potentially providing important information regarding efficacy within treatment subgroups. In May 2021, the FDA approved our investigational device exemption ("IDE") supplement incorporating the recommended protocol changes and we now expect final data in 2022.

In April 2021, the FDA approved our IDE application to initiate the KEYNOTE B36 phase 2 pilot trial to study TTFields with pembrolizumab in first-line NSCLC through our clinical collaboration with MSD (a tradename of Merck & Co.). KEYNOTE B36 currently has five clinical trial sites actively evaluating patients for enrollment.

In May 2021, we entered into a clinical trial collaboration with GT Medical Technologies, Inc., to develop TTFields together with GT Medical Technologies’ GammaTile Surgically Targeted Radiation Therapy for the treatment of recurrent GBM, expanding our research in the treatment of GBM. We plan to conduct a phase 2 pilot study to test the effectiveness and safety of neo-adjuvant TTFields followed by resection, GammaTile Therapy, and adjuvant TTFields for recurrent GBM. This clinical trial collaboration presents an important opportunity to study the radio-sensitizing effect of TTFields.

In July 2021, we announced the final results of our phase 2 pilot HEPANOVA trial investigating TTFields together with sorafenib, a kinase inhibitor, in 27 patients with advanced liver cancer. Historical control data showed an objective response rate of 4.5% and disease control rate of 43% for patients treated with sorafenib alone. In 21 evaluable patients, HEPANOVA showed a 9.5% objective response rate and 76% disease control rate, as well as 5.8 months of progression free survival. These results are even more encouraging when considering the poor prognosis of the study population. Over half of the patients in HEPANOVA were categorized as Child-Pugh Class B, compared to 5% in the historical control, indicating significant liver functional compromise. Research conducted to date has shown that TTFields anti-mitotic effect requires extended exposure to the therapy for maximum impact and this was a challenge for HEPANOVA with a median treatment duration of only 10 weeks. Of the patients who received at least 12 weeks of therapy, the disease control rate reached 91% with an objective response rate of 18%. These data demonstrate that TTFields have the potential to extend survival in advanced liver cancer. Our team, along with trial investigators, are actively designing a phase 3 pivotal trial that contemplates TTFields therapy together with the current standard of care, including immunotherapy, and have engaged the FDA regarding the use of TTFields in advanced liver cancer.

The enrollment timelines for our METIS trial are reliant on clinical site expansion in regions that continue to be materially delayed as clinical sites devote significant resources to the COVID-19 global pandemic. Our clinical affairs teams are focused on accelerating enrollment at existing clinical sites, but our efforts are challenged by a heavy reliance on virtual engagement and, as a result, we now anticipate a two quarter delay in last patient enrollment for METIS, with final data in 2023. It is estimated that between 20% and 40% of patients with non-small-cell lung cancer develop brain metastases and, together with LUNAR, the METIS data represents an important opportunity to demonstrate the efficacy of TTFields at multiple stages of lung cancer.

The table below presents the current status of the ongoing clinical trials in our oncology pipeline and anticipated timing of final data.

18

Our therapy is delivered through a medical device and we continue to advance our Products with the intention to extend survival and maintain quality of life for patients. We have several product development programs underway that prioritize impact on both TTFields' dose and patient ease of use.

In June 2021, we announced the initiation of a clinical usability study for a new, flexible torso array. This array was designed to improve patient comfort for all torso and abdominal indications. The flexible design is intended to improve skin adhesion, to increase degrees-of-motion, and potentially to reduce skin irritation.

Our oncology intellectual property portfolio contains over 185 issued patents and numerous patent applications pending worldwide. We believe we own global commercialization rights to our Products in oncology and are well-positioned to extend those rights into the future as we continue to find innovative ways to improve our Products.

In 2018, we granted Zai Lab (Shanghai) Co., Ltd. ("Zai") a license to commercialize Optune in China, Hong Kong, Macau and Taiwan ("Greater China") under a License and Collaboration Agreement (the "Zai Agreement"). The Zai Agreement also establishes a development partnership intended to accelerate the development of TTFields in multiple solid tumor cancer indications. For additional information, see Note 12 to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the "2020 10-K").

We view our operations and manage our business in one operating segment. For the three and six months ended June 30, 2021, our net revenues were $133.5 million and $268.2 million, respectively. Our net loss for the three and six months ended June 30, 2021, was $14.6 million and $18.8 million, respectively. As of June 30, 2021, we had an accumulated deficit of $646.3 million. Our net loss resulted primarily from net revenue growth which was more than offset by increasing investments in research and development to advance our pipeline programs and increase acceptance of TTFields across the global oncology community.

Impact of COVID-19

The COVID-19 pandemic did not have a material impact on our financial results through the second quarter of 2021. The pandemic has had and is having an impact on our day-to-day operations, which varies by region based on factors such as geographical spread, stage of containment and recurrence of the pandemic in each region. We believe the prolonged disruption caused by the COVID-19 pandemic is resulting in persisting volatility across global health care systems, such as fluctuations in patient volumes and changes in patterns of care in certain regions, including in areas where the pandemic eased during the quarter. For example, we continue to see fluctuations in the timing of surgeries and radiation therapy in certain regions, which has had some adverse influence on the eligible patient population for Optune. TTFields is an emerging modality in cancer care and requires significant educational effort to drive awareness and acceptance of our therapy. We have relied heavily on virtual engagement to manage these educational efforts for more than a year, which poses challenges to our ability to effectively communicate and engage with our customers and partners around the world. The COVID-19 pandemic is also having an impact on

19

clinical trial enrollments, study operations, and regulatory responsiveness, such as described above with respect to our METIS trial.

Given the aggressive nature of the cancers that we treat, we believe that the fundamental value proposition of the TTFields platform remains unchanged. We continue to evaluate and plan for the potential effects of the COVID-19 pandemic on our business moving forward. The extent to which the COVID-19 pandemic may impact our business and clinical trials in the future will depend on further developments, which are highly uncertain and cannot be predicted with confidence. The COVID-19 pandemic may also have the effect of heightening many of the other risks described in our risk factors disclosed in our 2020 10-K.

Commentary on Results of Operations

Net revenues. Our revenues are primarily derived from patients using our Products in our active markets. We charge for treatment with our Products on a monthly basis. Our potential net revenues per patient are determined by our ability to secure payment, the monthly fee we collect and the number of months that the patient remains on therapy.

We also receive revenues pursuant to the Zai Agreement. For additional information regarding the Zai Agreement, see Note 12 to the Consolidated Financial Statements in our 2020 10-K.

Cost of revenues. We contract with third parties to manufacture our Products. Our cost of revenues is primarily comprised of the following:

•disposable arrays;

•depreciation expense for the field equipment, including the electric field generator used by patients; and

•personnel and overhead costs such as facilities, freight and depreciation of property, plant and equipment associated with managing our inventory, warehousing and order fulfillment functions.

Operating expenses. Our operating expenses consist of research, development and clinical trials, sales and marketing and general and administrative expenses. Personnel costs are a significant component for each category of operating expenses and consist of wages, benefits and bonuses. Personnel costs also include share-based compensation.

Financial expenses, net. Financial expenses, net primarily consists of credit facility interest expense and related debt issuance costs, interest income from cash balances and short-term investments and gains (losses) from foreign currency transactions. Our reporting currency is the U.S. dollar. We have historically held substantially all of our cash balances in U.S. dollar denominated accounts to minimize the risk of translational currency exposure.

20

Results of Operations

The following discussion provides an analysis of our results of operations and reasons for material changes therein for the three and six months ended June 30, 2021 as compared to the three and six months ended June 30, 2020. The tables contained in this section report U.S. dollars in thousands (except share, patient, and prescription data).

The following table sets forth our consolidated statements of operations data:

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Unaudited | Unaudited | ||||||||||||||||||||||||||||

| Net revenues | $ | 133,517 | $ | 115,925 | $ | 268,212 | $ | 217,753 | |||||||||||||||||||||

| Cost of revenues | 28,599 | 25,474 | 54,984 | 49,970 | |||||||||||||||||||||||||

| Gross profit | 104,918 | 90,451 | 213,228 | 167,783 | |||||||||||||||||||||||||

| Operating costs and expenses: | |||||||||||||||||||||||||||||

| Research, development and clinical trials | 50,315 | 29,918 | 96,231 | 55,190 | |||||||||||||||||||||||||

| Sales and marketing | 34,138 | 28,461 | 65,495 | 57,294 | |||||||||||||||||||||||||

| General and administrative | 32,760 | 25,404 | 63,885 | 52,012 | |||||||||||||||||||||||||

| Total operating costs and expenses | 117,213 | 83,783 | 225,611 | 164,496 | |||||||||||||||||||||||||

| Operating income (loss) | (12,295) | 6,668 | (12,383) | 3,287 | |||||||||||||||||||||||||

| Financial expenses (income), net | 940 | 2,617 | 3,586 | 5,049 | |||||||||||||||||||||||||

| Income (loss) before income taxes | (13,235) | 4,051 | (15,969) | (1,762) | |||||||||||||||||||||||||

| Income taxes | 1,406 | 2,396 | 2,800 | (7,369) | |||||||||||||||||||||||||

| Net income (loss) | $ | (14,641) | $ | 1,655 | $ | (18,769) | $ | 5,607 | |||||||||||||||||||||

| Basic net income (loss) per ordinary share | $ | (0.14) | $ | 0.02 | $ | (0.18) | $ | 0.06 | |||||||||||||||||||||

| Weighted average number of ordinary shares used in computing basic net income (loss) per share | 103,484,866 | 100,718,893 | 103,061,557 | 100,298,230 | |||||||||||||||||||||||||

| Diluted net income (loss) per ordinary share | $ | (0.14) | $ | 0.02 | $ | (0.18) | $ | 0.05 | |||||||||||||||||||||

| Weighted average number of ordinary shares used in computing diluted net income (loss) per share | 103,484,866 | 107,647,802 | 103,061,557 | 107,897,907 | |||||||||||||||||||||||||

21

The following table details the share-based compensation expense included in costs and expenses:

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Unaudited | Unaudited | ||||||||||||||||||||||

| Cost of revenues | $ | 827 | $ | 559 | $ | 1,560 | $ | 1,149 | |||||||||||||||

| Research, development and clinical trials | 8,505 | 3,779 | 13,629 | 7,173 | |||||||||||||||||||

| Sales and marketing | 6,429 | 4,769 | 10,900 | 8,385 | |||||||||||||||||||

| General and administrative | 12,120 | 9,663 | 20,655 | 18,620 | |||||||||||||||||||

| Total share-based compensation expense | $ | 27,881 | $ | 18,770 | $ | 46,744 | $ | 35,327 | |||||||||||||||

Key performance indicators

We believe certain commercial operating statistics are useful to investors in evaluating our commercial business as they help our management team and investors evaluate and compare the adoption of our Products from period to period. The number of active patients on therapy is our principal revenue driver. An "active patient" is a patient who is receiving treatment under a commercial prescription order as of the measurement date, including patients who may be on a temporary break from treatment and who plan to resume treatment in less than 60 days. Prescriptions are a leading indicator of demand. A "prescription received" is a commercial order for Optune or Optune Lua that is received from a physician certified to treat patients with our Products for a patient not previously on Optune or Optune Lua. Orders to renew or extend treatment are not included in this total.

The following table includes certain commercial operating statistics for and as of the end of the periods presented.

| June 30, | |||||||||||

| Operating statistics | 2021 | 2020 | |||||||||

| Active patients at period end | |||||||||||

| United States | 2,206 | 2,143 | |||||||||

| EMEA: | |||||||||||

| Germany | 571 | 535 | |||||||||

| Other EMEA | 419 | 365 | |||||||||

| Japan | 291 | 235 | |||||||||

| Total | 3,487 | 3,278 | |||||||||

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Prescriptions received in period | |||||||||||||||||||||||

| United States | 967 | 968 | 1,884 | 1,954 | |||||||||||||||||||

| EMEA: | |||||||||||||||||||||||

| Germany | 237 | 231 | 485 | 438 | |||||||||||||||||||

| Other EMEA | 138 | 138 | 272 | 260 | |||||||||||||||||||

| Japan | 108 | 85 | 211 | 179 | |||||||||||||||||||

| Total | 1,450 | 1,422 | 2,852 | 2,831 | |||||||||||||||||||

In the U.S., there were 15 active MPM patients on therapy as of June 30, 2021 and 11 MPM prescriptions were received in the three months ended June 30, 2021.

22

Three and six months ended June 30, 2021 compared to three and six months ended June 30, 2020

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Net revenues | $ | 133,517 | $ | 115,925 | 15 | % | $ | 268,212 | $ | 217,753 | 23 | % | |||||||||||||||||||||||

Net revenues. Net revenues increased 15% to $133.5 million for the three-month period ending June 30, 2021 from $115.9 million for the same period in 2020, and increased 23% to $268.2 for the six-month period ended June 30, 2021 from $217.8 for the same period in 2020. The increase resulted primarily from an increase of 209 active patients in our currently active markets, representing 6% growth, a sustained improvement in the net revenues booked per active patient, and the launch of Optune in China.

We recorded $8.2 million and $17.5 million in revenues from Medicare fee-for-service beneficiaries billed under the coverage policy effective on September 1, 2019 for the three and six month period ended June 30, 2021, a decrease of 24% and 7% from the $10.8 million and $18.9 million recognized in the same period in 2020. The decrease in revenue from Medicare does not reflect a reduction in active Medicare patients or a decrease in the contribution we ultimately expect from Medicare beneficiaries, but instead reflects the impact of an extended appeal timeline for certain claims.

In the second quarter of 2021, we did not record a material amount of incremental net revenues resulting from the successful appeal of previously denied claims for Medicare fee-for-service beneficiaries billed prior to established coverage.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Cost of revenues | $ | 28,599 | $ | 25,474 | 12 | % | $ | 54,984 | $ | 49,970 | 10 | % | |||||||||||||||||||||||

Cost of revenues. Our cost of revenues increased by 12%, to $28.6 million for the three months ended June 30, 2021 from $25.5 million for the same period in 2020, and increased by 10% to $55.0 for the six months ended June 30, 2021 from $50.0 for the same period in 2020. For the three and six month period, the increase in cost of revenues was primarily due to the cost of shipping transducer arrays to a higher volume of commercial patients and increasing shipments of equipment to Zai Lab. We continue to focus on opportunities to increase efficiencies and scale within our supply chain. This includes evaluating new materials, manufacturers, and processes that could lead to lower costs. One example of this is by reducing the current cost-per array. Year-over-year, we have seen a 7% improvement in cost-per-array.

Excluding sales to Zai, cost of revenues per active patient per month decreased 2% and 5% to $2,520 and $2,468 for the three and six months ended June 30, 2021 from $2,578 and $2,608 for the same period in 2020. Cost of revenues per active patient is calculated by dividing the cost of revenues for the quarter less equipment sales to Zai for the quarter by the average of the active patients at the end of the prior quarter and the ending active patients in the current quarter. This quarterly figure is then divided by three to estimate the monthly cost of revenues per active patient. Sales to Zai are deducted because they are sold at cost and in anticipation of future royalties from Zai, and Zai patient counts are not included in our active patient population. Product sales to Zai totaled $2.4 million and $3.9 for the three and six months ended June 30, 2021 compared to $0.8 million and $1.6 million for the three and six months ended June 30, 2020.

Gross margin was 79% for the three months ended June 30, 2021 compared to 78% for the three months ended June 30, 2020. Gross margin was 79% for the six months ended June 30, 2021 and 77% for the six months ended June 30, 2020.

23

Operating Expenses.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Research, development and clinical trials | $ | 50,315 | $ | 29,918 | 68 | % | $ | 96,231 | $ | 55,190 | 74 | % | |||||||||||||||||||||||

| Sales and marketing | 34,138 | 28,461 | 20 | % | 65,495 | 57,294 | 14 | % | |||||||||||||||||||||||||||

| General and administrative | 32,760 | 25,404 | 29 | % | 63,885 | 52,012 | 23 | % | |||||||||||||||||||||||||||

| Total operating expenses | $ | 117,213 | $ | 83,783 | 40 | % | $ | 225,611 | $ | 164,496 | 37 | % | |||||||||||||||||||||||

Research, development and clinical trials expenses. Research, development and clinical trials expenses increased 68% to $50.3 million for the three-month period ended June 30, 2021 from $29.9 million for the same period in 2020, and increased 74% to $96.2 million for the six-month period ended June 30, 2021 from $55.2 in the same period in 2020. For the three and six month period, the change is primarily due to an increase in clinical trial and personnel expenses for our phase 3 pivotal, post-marketing, and label-expansion trials, an increase in development and personnel expenses to support our product development programs, increased investments in preclinical research and the expansion of our medical affairs activities.

Sales and marketing expenses. Sales and marketing expenses increased 20% to $34.1 million for the three months ended June 30, 2021 from $28.5 million for the same period in 2020, and increased 14% to $65.5 million for the six-month period ended June 30, 2021 from $57.3 million for the same period in 2020. For the three and six month period, the change was primarily due to an increase in personnel and professional services costs as we continue to enhance our commercial capabilities in anticipation of potential future approvals in new indications. Accordingly, we are investing heavily in our market access capabilities in order to evaluate opportunities, identify optimal access pathways, and successfully gain reimbursement in new geographies.

General and administrative expenses. General and administrative expenses increased 29% to $32.8 million for the three months ended June 30, 2021 from $25.4 million for the same period in 2020, and increased 23% to $63.9 million for the six months ended June 30, 2021 from $52.0 million for the same period in 2020. For the three and six month period, the change was primarily due to an increase in personnel costs and professional services.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Financial expenses (income), net | $ | 940 | $ | 2,617 | (64) | % | $ | 3,586 | $ | 5,049 | (29) | % | |||||||||||||||||||||||

Financial expenses, net. Financial expenses decreased 64% to $0.9 million for the three months ended June 30, 2021 from $2.6 million for the same period in 2020, and decreased 29% to $3.6 for the six months ended June 30, 2021 from $5.0 for the same period in 2020. For the three and six month period, the decrease was primarily due to the absence of interest payments as a result of the loan repayment in August 2020.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Income taxes | $ | 1,406 | $ | 2,396 | (41) | % | $ | 2,800 | $ | (7,369) | (138) | % | |||||||||||||||||||||||

Income taxes. Income taxes decreased 41% to $1.4 million for the three months ended June 30, 2021 from $2.4 million for the same period in 2020, and increased 138% to $2.8 million for the six months ended June 30, 2021 from a benefit of $7.4 million for the same period in 2020. For the three months ended June 30, 2021 the decrease reflects a change in the mix of applicable statutory tax rates in certain jurisdictions. For the six months ended June 30, 2021, the increase was primarily due to a net one-time tax benefit of $11.3 million which was recorded in the first quarter of 2020 in response to the changes in the U.S. tax code related to the economic impacts of the COVID-19 pandemic. The variance also reflects a change in the mix of applicable statutory tax rates in certain active jurisdictions.

24

Non-GAAP financial measures

We also measure our performance using a non-GAAP measurement of earnings before interest, taxes, depreciation, amortization and shared-based compensation (“Adjusted EBITDA”). We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because it helps investors evaluate and compare the results of our operations from period to period by removing the impact of earnings attributable to our capital structure, tax rate and material non-cash items, specifically share-based compensation.

We calculate Adjusted EBITDA as operating income before financial expenses and income taxes, net of depreciation, amortization and share-based compensation. The following table reconciles net income (loss), which is the most directly comparable GAAP operating performance measure, to Adjusted EBITDA.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

| Net income (loss) | $ | (14,641) | $ | 1,655 | (985) | % | $ | (18,769) | $ | 5,607 | (435) | % | |||||||||||||||||||||||

| Add: Income tax | 1,406 | 2,396 | (41) | % | 2,800 | (7,369) | (138) | % | |||||||||||||||||||||||||||

| Add: Financial income (expenses), net | 940 | 2,617 | (64) | % | 3,586 | 5,049 | (29) | % | |||||||||||||||||||||||||||

| Add: Depreciation and amortization | 2,480 | 2,601 | (5) | % | 4,850 | 4,489 | 8 | % | |||||||||||||||||||||||||||

| EBITDA | $ | (9,815) | $ | 9,269 | (206) | % | $ | (7,533) | $ | 7,776 | (197) | % | |||||||||||||||||||||||

| Add: Share-based compensation | 27,881 | 18,770 | 49 | % | 46,744 | 35,327 | 32 | % | |||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 18,066 | $ | 28,039 | (36) | % | $ | 39,211 | $ | 43,103 | (9) | % | |||||||||||||||||||||||

Adjusted EBITDA decreased by 36% to $18.1 million for the three months ended June 30, 2021 from $28.0 million for the same period in 2020, and decreased by 9% to $39.2 for the six months ended June 30, 2021 from $43.1 for the same period in 2020. The decrease was driven by investments in research and development, sales and marketing, and other operational activities to maximize future growth opportunities. We believe these focused investments are critical to our efforts to realize the long-term potential of the TTFields platform.

Liquidity and Capital Resources

We have incurred significant losses and cumulative negative cash flows from operations since our founding in 2000. As of June 30, 2021, we had an accumulated deficit of $646.3 million. To date, we have primarily financed our operations through the issuance and sale of equity and the proceeds from long-term loans.

At June 30, 2021, we had $899.0 million in cash, cash equivalents and short-term investments, an increase of $56.5 million compared to $842.6 million at December 31, 2020. The increase in our cash, cash equivalents and short-term investments was primarily due to the cash flow from operations and the exercise of options.

We believe our cash, cash equivalents and short-term investments as of June 30, 2021 are sufficient for our operations for at least the next 12 months based on our existing business plan and our ability to control the timing of significant expense commitments. We expect that our research, development and clinical trials expenses, sales and marketing expenses and general and administrative expenses will continue to increase over the next several years and may outpace our gross profit. As a result, we may need to raise additional capital to fund our operations.

25

The following summary of our cash flows for the periods indicated has been derived from our unaudited consolidated financial statements, which are included elsewhere in this Quarterly Report:

| Six months ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | Change | % Change | ||||||||||||||||||||

| Net cash provided by operating activities | $ | 43,952 | $ | 14,698 | $ | 29,254 | 199 | % | |||||||||||||||

| Net cash provided by (used in) investing activities | 51,553 | (6,427) | 57,980 | (902) | % | ||||||||||||||||||

| Net cash provided by (used in) financing activities | 19,014 | 9,848 | 9,166 | 93 | % | ||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (105) | 50 | (155) | (310) | % | ||||||||||||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | $ | 114,414 | $ | 18,169 | $ | 96,245 | 530 | % | |||||||||||||||

Operating activities. Net cash provided by operating activities primarily represents our net income (loss) for the periods presented. Adjustments to net income (loss) for non-cash items include share-based compensation, depreciation and amortization, and asset write-downs. Operating cash flows are also impacted by changes in operating assets and liabilities, principally trade payables, deferred revenues, other payables, prepaid expenses, inventory and trade receivables.

Net cash provided by operating activities was $44.0 million for the six months ended June 30, 2021, as compared to $14.7 million provided by operating activities for the six months ended June 30, 2020. Gross profit increased by $45.4 million for the six months ended June 30, 2021 versus the six months ended June 30, 2020, funding incremental investments of $41.0 million in research and development and $20.1 million in sales, marketing, general and administrative expenses. The increase in positive cash flow from operations was primarily driven by higher cash earnings, lower interest payments, the receipt of income tax refunds, as well as the timing of receipts and payments in the ordinary course of business.

Investing activities. Our investing activities consist primarily of capital expenditures to purchase property and equipment and field equipment, as well as investments in and redemptions of our short-term investments.

Net cash provided by investing activities was $51.6 million for the six months ended June 30, 2021, compared to $6.4 million used in investing activities for the six months ended June 30, 2020. The net cash provided by investing activities for the six months ended June 30, 2021 was primarily attributable to $58.2 million of net proceeds from maturity of short-term investments, partially offset by the purchase of $6.6 million of property and equipment. The net cash used in investing activities for the six months ended June 30, 2020 was primarily attributable to the purchase of $6.4 million of property and equipment.

Financing activities. To date, our primary financing activities have been the sale of equity and the proceeds from long-term loans. Net cash provided by financing activities was $19.0 million for the six months ended June 30, 2021, as compared to $9.8 million provided by financing activities for the six months ended June 30, 2020. The net cash provided by financing activities for the six months ended June 30, 2021 and June 30, 2020 included proceeds from the exercise of options and purchase of shares under the Company's stock option plan and employee share purchase plan ("ESPP").

Convertible Notes

On November 5, 2020, we issued $575.0 million aggregate principal amount of 0% Convertible Senior Notes due 2025 (the “Notes”). The Notes are senior unsecured obligations. The Notes do not bear regular interest, and the principal amount of the Notes will not accrete. The Notes are convertible at an initial conversion rate of 5.9439 ordinary shares per $1,000 principal amount of the Notes, which is equivalent to an initial conversion price of approximately $168.24 per ordinary share. Prior to the close of business on July 31, 2025, a holder of Notes may convert their Notes at any time during any calendar quarter (and only during such calendar quarter), if the last reported sale price of ordinary shares for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter, is greater than or equal to $218.712. The Notes are also convertible at the option of the holders upon the satisfaction of certain other conditions and during certain periods, and if the Company exercises its right to redeem the Notes as permitted or required by the indenture. On or after August 1, 2025 until the close of the business on

26

the business day immediately preceding the maturity date, holders may convert all or any portion of their Notes at the conversion rate at any time irrespective of the foregoing conditions.

In January 2021, we irrevocably elected to settle all conversions of Notes by a combination of cash and our ordinary shares and that the cash portion per $1,000 principal amount of Notes for all conversion settlements shall be $1,000. Accordingly, from and after the date of the election, upon conversion of any Notes, holders of Notes will receive, with respect to each $1,000 principal amount of Notes converted, cash in an amount up to $1,000 and the balance of the conversion value, if any, in our ordinary shares

For more information, see Note 10(a) to the Consolidated Financial Statements in the 2020 10-K.

Term loan credit facility

On November 6, 2020, we entered into a new three-year $150.0 million senior secured revolving credit facility with a syndicate of relationship banks (the "2020 Credit Facility"). We may, subject to certain conditions and limitations, increase the revolving credit commitments outstanding under the 2020 Credit Facility or incur new incremental term loans in an aggregate principal amount not to exceed an additional $100.0 million.