UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________

FORM 10-K

______________________________________________________________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 001-37565

______________________________________________________________________

(Exact Name of Registrant as Specified in Its Charter)

______________________________________________________________________

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||

(Address of Principal Executive Offices, including zip code)

Registrant’s telephone number, including area code: +44 (0) 15 3475 6700

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

______________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging Growth Company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the outstanding common equity of the registrant held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $2,773,948,801 .

The number of shares of the registrant’s ordinary shares outstanding as of February 22, 2021 was 102,411,738 .

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page | ||||||||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as "anticipate," "will," "estimate," "expect," "project," "intend," "should," "plan," "believe," "hope," and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and research and development related to our Tumor Treating Fields ("TTFields") delivery systems marketed under various brand names, including "Optune," "Optune Lua," and software, tools and other items to support and optimize the delivery of TTFields (collectively, the "Products"). In particular, these forward-looking statements include, among others, statements about:

•our research and development, clinical trial and commercialization activities and projected expenditures;

•the further commercialization of our Products for current and future indications;

•our business strategies and the expansion of our sales and marketing efforts in the United States ("U.S.") and in other countries;

•the market acceptance of our Products for current and future indications by patients, physicians, third-party payers and others in the healthcare and scientific community;

•our plans to pursue the use of our Products for the treatment of indications other than glioblastoma ("GBM") and malignant pleural mesothelioma ("MPM");

•our estimates regarding revenues, expenses, capital requirements and needs for additional financing;

•our ability to obtain regulatory approvals for the use of our Products in indications other than GBM and MPM;

•our ability to acquire from third-party suppliers the supplies needed to manufacture our Products;

•our ability to manufacture adequate supply;

•our ability to secure and maintain adequate coverage from third-party payers to reimburse us for our Products for current and future indications;

•our ability to receive payment from third-party payers for use of our Products for current and future indications;

•our ability to maintain and develop our intellectual property position;

•our ability to manage the risks associated with business disruptions caused by natural disasters, extreme weather events, pandemics such as the COVID-19 (coronavirus) or international conflict or other disruptions outside of our control;

•our cash needs; and

•our prospects, financial condition and results of operations.

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from

ii

those projected in these forward-looking statements. Factors which may cause such differences to occur include those risks and uncertainties set forth under Part I, Item IA, Risk Factors, of this Annual Report on Form 10-K, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission the ("SEC"). We do not intend to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

iii

Summary of Risk Factors

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. You should read this summary together with the more detailed description of each risk factor contained below.

Risks relating to the manufacturing, marketing and sales of our products

•We currently have only two products approved for use for specific indications. Our ability to expand our product line and their uses requires regulatory approval, which is costly and requires significant time and effort to obtain.

•To date, we have generated only limited operating profits, and we have a history of incurring substantial operating losses. As we expand, we may experience difficulties managing our growth.

•To obtain approvals for new products and indications and to continue to market our existing products, we are required to conduct preclinical and clinical trials and other testing. Our clinical trials could be delayed or otherwise adversely affected by many factors, including difficulties in enrolling patients and problems with third-party providers. Continued testing of our products may not yield successful results and could reveal currently unknown safety hazards associated with our products. We may choose to, or may be required to, suspend, repeat or terminate our clinical trials if they are not conducted in accordance with regulatory requirements, the results are negative or inconclusive or the trials are not well designed.

•Our products do not have a significant history in the marketplace, as a result we may have difficulty:

◦developing an adequate sales and marketing organization or contracting with third parties to assist us in doing so;

◦achieving market acceptance of our products by healthcare professionals, patients and/or third-party payers; and

◦securing and maintaining adequate coverage and reimbursement from third-party payers, including governmental agencies in the countries where we market our products.

•We depend on single-source suppliers for some of our components, the loss of which could prevent or delay shipments of our products to customers or delay our clinical trials.

•Quality control problems with respect to materials supplied by third-party suppliers could prevent or delay shipments of our products to customers or delay our clinical trials.

•We face competition from numerous competitors.

•Because of the specialized nature of our business, the termination of relationships with our key employees, consultants and advisors may be detrimental to our business.

•Product liability suits, whether or not meritorious, could be brought against us and result in expensive and time-consuming litigation, payment of substantial damages and/or expenses and an increase in our insurance rates.

•Other future litigation and regulatory actions could have a material adverse impact on the Company.

•We are subject to fluctuations in global economic, political, environmental, and industry conditions, some of which may be unfavorable, including as a result of the COVID-19 pandemic.

•Our products and infrastructure face certain risks, including from cyber security breaches and data leakage. We are also subject to privacy and data security laws.

Risks relating to the regulation of our business

•Legislative and regulatory changes in the U.S. and in other countries regarding healthcare and government-sponsored programs may adversely affect us.

•We are subject to extensive post-marketing regulation by the U.S. Federal Drug Administration ("FDA") and comparable authorities in other jurisdictions, which could cause us to incur significant costs to maintain compliance.

•Modifications to our products may require regulatory approvals and our regulators may not agree with our conclusions regarding whether new approvals are required. Regulatory authorities may require us to cease promoting or to recall the modified versions of our products until such approvals are obtained.

•In addition to FDA requirements, we will spend considerable time and money complying with other federal, state, local and foreign rules, regulations and guidance.

•If we, our collaborative partners, our contract manufacturers, or our component suppliers fail to comply with regulations, the manufacturing and distribution of our products could be interrupted.

•Our products could be subject to recalls that could harm our reputation and financial results.

•If our products cause or contribute to a death or a serious injury, or malfunction in certain ways, we will be subject to medical device reporting regulations, which can result in voluntary corrective actions or agency enforcement actions.

•We are not permitted to promote the use of our products for unapproved or off-label uses.

•The United Kingdom’s exit from the EU could adversely impact our business.

•Changes in tax or other laws, regulations or treaties, or adverse determinations by governmental authorities could increase our tax burden or subject our shareholders to additional taxes.

•We are affected by and subject to environmental laws and regulations that could be costly to comply with or that may result in costly liabilities.

•Safety issues concerning lithium-ion batteries could have a material adverse impact on our business.

Risks relating to intellectual property

•If we fail to protect, sustain, further build and enforce our intellectual property rights, competitors may be able to develop competing therapies.

•Intellectual property litigation and disputes may cause us to incur substantial costs, divert attention from the management of our business, harm our reputation, or require us to remove certain products from the market.

•Changes in U.S. patent law could impair our ability to protect our delivery systems.

Risks relating to our ordinary shares and capital structure

•The market price for our ordinary shares may be volatile, which could result in substantial losses.

•Our ordinary shares are issued under the laws of Jersey, which may not provide the level of legal certainty and transparency afforded by incorporation in a U.S. state.

•U.S. shareholders may not be able to enforce civil liabilities against us.

•We have borrowed a significant amount of debt and have the ability to borrow additional debt in the future.

•Transactions relating to our convertible notes may dilute the ownership interest of existing shareholders, or may otherwise depress the price of our ordinary shares.

PART I

ITEM 1. BUSINESS

Overview

We are a global oncology company with a proprietary platform technology called Tumor Treating Fields ("TTFields"), which are electric fields tuned to specific frequencies that disrupt cancer cell division. Our key priorities are to drive commercial adoption of Optune and Optune Lua, our commercial TTFields delivery systems, and to advance clinical and product development programs intended to extend overall survival in some of the most aggressive forms of cancer.

Optune is approved by the U.S. Food and Drug Administration ("FDA") under the Premarket Approval ("PMA") pathway for the treatment of adult patients with newly diagnosed gioblastoma ("GBM") in combination with temozolomide, a chemotherapy drug, and for adult patients with GBM following confirmed recurrence after chemotherapy as monotherapy treatment. We also have approval or a CE certificate to market Optune for the treatment of GBM in the European Union ("EU"), Japan and certain other countries. We market Optune in the U.S., Austria, Germany, Israel, Japan, Sweden and Switzerland, which we refer to as our "active markets." With respect to GBM, our sales and marketing efforts are principally focused on driving adoption with both neuro-oncologists and radiation oncologists. We are expanding our commercial operations into France with an initial focus on developing key opinion leader relationships in GBM and establishing a path to reimbursement for our Products.

Optune Lua is approved by the FDA under the Humanitarian Device Exemption ("HDE") pathway to treat malignant pleural mesothelioma ("MPM") in combination with standard chemotherapies. We have received CE certification to market Optune Lua (under the name "NovoTTF-100L") in the EU and Switzerland. We currently market Optune Lua in the U.S., and are evaluating plans to expand access to our therapy for MPM patients in other markets. With respect to MPM, our commercial efforts are principally focused on generating awareness and on establishing a dialogue with third-party payers around access to Optune Lua.

We believe the mechanism of action behind TTFields therapy may be broadly applicable to solid tumor cancers. Currently, we are conducting phase 3 pivotal trials evaluating the use of TTFields in brain metastases from non-small cell lung cancer ("brain metastases"), non-small cell lung cancer ("NSCLC"), ovarian cancer and pancreatic cancer. In 2020, we enrolled our first patient in our global phase 4 TRIDENT trial to test the potential survival benefit of initiating Optune concurrent with radiation therapy versus following radiation therapy in patients with newly diagnosed GBM. We are also conducting phase 2 pilot trials evaluating the use of TTFields in liver cancer and gastric cancer, as well as testing the potential incremental survival benefit of TTFields delivered using high-intensity arrays versus standard arrays. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of TTFields for additional solid tumor indications and combinations with other cancer treatment modalities. In the second quarter of 2021, we plan to launch the KEYNOTE B36 trial ("KEYNOTE B36"), a phase 2 pilot trial to study TTFields with pembrolizumab in first-line NSCLC through our clinical trial collaboration with MSD (a tradename of Merck & Co., Inc.).

Our therapy is delivered through a medical device and we continue to advance our Products with the intention to extend survival and maintain quality of life for patients. We have several product development programs underway that prioritize impact on both TTFields dose and patient ease of use. Our intellectual property portfolio contains over 185 issued patents and numerous patent applications pending worldwide. We believe we own global commercialization rights to our Products in oncology and are well-positioned to extend those rights into the future as we continue to find innovative ways to improve our Products.

In 2018, we granted Zai Lab (Shanghai) Co., Ltd. ("Zai") a license to commercialize Optune in China, Hong Kong, Macau and Taiwan ("Greater China") under a License and Collaboration Agreement (the "Zai Agreement"). The Zai Agreement also establishes a development partnership intended to accelerate the development of TTFields in multiple solid tumor cancer indications. For additional information, see Note 12 to the Consolidated Financial Statements.

Our ordinary shares are quoted on the NASDAQ Global Select Market under the symbol "NVCR." We were incorporated in the Bailiwick of Jersey in 2000. Our principal operations are located in Switzerland, the U.S. and Israel.

Our therapy

When cancer develops, rapid and uncontrolled division of unhealthy cells occurs. Electrically charged proteins within the cell are critical for cell division, making the rapidly dividing cancer cells vulnerable to electrical

1

interference. TTFields therapy is a cancer treatment that uses electric fields tuned to specific frequencies to disrupt cancer cell division.

All cells are surrounded by a bilipid membrane, which separates the interior of the cell, or cytoplasm, from the space around it. This membrane prevents low frequency electric fields from entering the cell. TTFields, however, have a unique frequency range, between 100 to 500 kHz, enabling the electric fields to penetrate the cancer cell membrane. As healthy cells differ from cancer cells in their division rate, geometry and electric properties, the frequency of TTFields can be tuned to specifically affect the cancer cells while leaving healthy cells mostly unaffected.

Whether cells are healthy or cancerous, cell division, or mitosis, is the same. When mitosis starts, charged proteins within the cell, or microtubules, form the mitotic spindle. The spindle is built on electric interaction between its building blocks. During division, the mitotic spindle segregates the chromosomes, pulling them in opposite directions. As the daughter cells begin to form, electrically polarized molecules migrate towards the midline to make up the mitotic cleavage furrow. The furrow contracts and the two daughter cells separate. TTFields can interfere with these conditions. When TTFields are present in a dividing cancer cell, they cause the electrically charged proteins to align with the directional forces applied by the field, thus preventing the mitotic spindle from forming. Electrical forces also interrupt the migration of key proteins to the cell midline, disrupting the formation of the mitotic cleavage furrow. Interfering with these key processes disrupts mitosis and can lead to cell death.

Our track record of fundamental scientific research extends across two decades and, in all of our preclinical research to date, TTFields has demonstrated a consistent anti-mitotic effect. Research is ongoing to further refine our understanding of the multi-pronged mechanism of action of TTFields. In addition to its anti-mitotic effect, TTFields has been shown to inhibit DNA damage repair, to induce autophagy, to reduce cell migration and invasion, to increase cell membrane permeability and disrupt the blood-brain barrier, and to induce immunogenic cell death. Beyond our internal research efforts, we provide independent researchers with preclinical laboratory bench systems, known as inovitro™ and inovivo™, and we grant funding to support basic and translational research on TTFields. We also support independent research through our Investigator-Sponsored Trials and Preclinical Material Transfer Agreement programs in order to enhance our understanding of the optimal use of TTFields.

TTFields is intended principally for use in combination with other standard-of-care cancer treatments. There is a growing body of evidence that supports TTFields' broad applicability with certain other cancer therapies, including radiation therapy, certain chemotherapies and certain immunotherapies. In our clinical research and commercial experience to date, TTFields has exhibited no systemic toxicity, with mild to moderate skin irritation being the most common side effect.

Our technology

TTFields therapy is delivered through a portable medical device. The complete delivery system, called Optune or Optune Lua, includes a portable electric field generator, arrays, rechargeable batteries and accessories. Sterile, single-use arrays are placed directly on the skin in the region surrounding the tumor and connected to the electric field generator to deliver therapy. Arrays are changed when hair growth or the hydrogel reduces array adhesion to the skin. The therapy is designed to be delivered continuously throughout the day and night, and efficacy is strongly correlated to time on therapy. When the device is turned on, TTFields are continuously generated within the specific region of the body covered by the arrays. Healthy tissues located outside of this region remain unaffected by the therapy. The electric field generator can be run from a standard power outlet or carried with a battery in a specially designed bag that we provide to patients.

We plan to use the same field generator technology across all indications for which our Products are approved. We plan to specifically target individual solid tumor types by optimizing field generator parameters such as frequency and power output. Our arrays have been developed and are in use, either commercially or clinically, for application on the head, chest and abdomen.

Through engineering efforts, we plan to continue to advance our Products to optimize TTFields therapy for patients. We have several product development programs underway intended to extend survival and maintain quality of life. Our development programs will prioritize impact on both TTFields dose and patient ease of use and are primarily focused on enhancements to the field generator, arrays and software applications. We are developing a third generation device to optimize the use of electric fields to treat tumors, next generation arrays to be more flexible and deliver higher intensities, next generation array layout planning software, and patient-centered software to support larger patient populations in multiple indications. Over time, we may have the opportunity to optimize the energy delivered to individual patients, potentially improving efficacy. Any enhancements will be subject to applicable regulatory reviews and approvals.

2

Our commercial business

Optune is currently marketed in our active markets for the treatment of GBM, the most common form of primary brain cancer and an aggressive disease for which there are few effective treatment options. Optune Lua is currently marketed in the U.S. for the treatment of MPM, a rare cancer that has been strongly linked to asbestos exposure. Our first commercial priority in each active market is to generate awareness of our Products and our clinical trial data.

Treatment of newly diagnosed GBM

In 2015, we received FDA approval to market Optune for the treatment of adult patients with newly diagnosed supratentorial GBM in combination with temozolomide. The FDA approved Optune for newly diagnosed GBM based on the EF-14 trial ("EF-14"), which was a randomized, phase 3 pivotal clinical trial which compared, post radiation, Optune plus temozolomide versus temozolomide alone for the treatment of newly diagnosed GBM. The primary endpoint of the trial was progression-free survival and a powered secondary endpoint was overall survival.

In EF-14, Optune plus temozolomide demonstrated unprecedented five-year survival results. Median overall survival was extended by nearly five months (median overall survival of 20.9 months versus 16.0 months for temozolomide alone). Median progression-free survival was extended by 2.7 months to 6.7 months for Optune plus temozolomide from 4.0 months for temozolomide alone. The final EF-14 data were published in JAMA in 2017.

The following graph presents the overall survival data in the intent-to-treat population from our five-year analysis:

The extension of progression-free and overall survival in patients receiving Optune in combination with temozolomide in EF-14 was not specific to any prognostic subgroup or tumor genetic marker and was consistent regardless of MGMT methylation status, extent of resection, age, performance status or gender. Optune was safely combined with temozolomide with no significant increase in serious adverse events compared with temozolomide alone. The most common side effect related to Optune was mild to moderate skin irritation.

Quality of life data from a pre-specified analysis of EF-14 demonstrated that patients treated with Optune and temozolomide maintained quality of life over time and across predefined daily-functioning domains. Both healthcare professionals and patients reported stable quality of life evaluation scores up to one year of Optune use. Physical, role, social, emotional and cognitive functioning for patients treated with Optune and temozolomide all remained stable and comparable with patients treated with temozolomide alone.

In 2018, the National Comprehensive Cancer Network Clinical Practice Guidelines in Oncology® (NCCN Guidelines®) for Central Nervous Systems Cancers were updated to include alternating electric fields therapy (Optune) in combination with temozolomide following standard brain radiation therapy with concurrent temozolomide as a Category 1 recommended postoperative adjuvant treatment option for patients with newly diagnosed supratentorial GBM.

A post-hoc analysis of EF-14 showed that more time on Optune predicted increased survival in GBM patients. An Optune monthly usage threshold as low as 50 percent correlated with significantly improved outcomes in patients

3

treated with Optune together with temozolomide compared to patients treated with temozolomide alone. The greater the patients’ monthly usage of Optune, the better their outcomes. Patients who used Optune more than 90 percent of the time (n=43) had the greatest chance of survival: a median survival of 24.9 months from randomization and a five-year probability of survival of 29.3 percent.

In 2019, a separate post-hoc analysis of EF-14 showed that higher intensities at the tumor bed were associated with increased survival in GBM patients. Patients treated with Optune at higher intensities (greater than or equal to 1.06 V/cm; n=119) had a median overall survival of 24.3 months compared to a median overall survival of 21.6 months for patients treated with Optune at lower intensities (less than 1.06 V/cm; n=221).

In these analyses, both time on therapy and higher levels of energy (power loss density) were associated with improved overall survival, independent of each other. In addition, patients who used Optune at least 18 hours per day at higher energy levels (n=78) had a median overall survival of 25.1 months (95% CI 20.8-39.4).

Treatment of recurrent GBM

We initially received FDA approval for Optune in 2011 for use as a monotherapy treatment for adult patients with GBM, following confirmed recurrence after chemotherapy. The FDA approved Optune based on the EF-11 trial ("EF-11"), a randomized, phase 3 pivotal clinical trial.

EF-11 was a multi-center, active controlled clinical trial of 237 adults with recurrent GBM. Participants received either Optune as a monotherapy (n=120) or the physician’s choice of chemotherapy (n=117). Chemotherapies chosen for the active control arm included mainly bevacizumab, nitrosoureas and temozolomide. The primary endpoint was superiority in overall survival. Overall survival for patients treated with Optune alone and active chemotherapy was 6.6 months and 6.0 months, respectively (p=0.27: HR = 0.86). The trial demonstrated that Optune provided clinically comparable survival with an overall better quality of life.

More objective radiological responses were observed in the Optune group than in the active control chemotherapy group (14 patients versus 7 patients). Three patients in the Optune alone arm had a complete response versus no patients in the active chemotherapy arm.

In 2020, the FDA-mandated EF-19 post-approval registry trial confirmed the effectiveness and safety of Optune as monotherapy and further strengthened Optune's clinical profile in recurrent GBM. The EF-19 trial studied Optune as a monotherapy for the treatment of recurrent GBM in 192 patients compared to the 117 recurrent GBM patients who received best standard of care chemotherapy in Novocure’s EF-11 registration trial. Optune as monotherapy reduced the risk of death with fewer adverse events compared to best standard of care chemotherapy. For patients who received at least one course of therapy, Optune prolonged survival by a median 1.7 months. No new safety signals were noted.

Treatment of MPM

In 2019, we received FDA approval via the HDE pathway to market Optune Lua (then known as NovoTTF-100L) for the treatment of adult patients with unresectable, locally advanced or metastatic MPM concurrent with pemetrexed and platinum-based chemotherapy. The FDA approved Optune Lua for MPM based on the STELLAR trial ("STELLAR"). STELLAR was a single-arm, open-label, multi-center trial designed to test the safety and efficacy of Optune in combination with pemetrexed combined with cisplatin or carboplatin in patients with unresectable, previously untreated MPM. The trial was powered to prospectively determine the overall survival in patients treated with Optune Lua plus chemotherapy. Secondary endpoints included overall response rate (per mRECIST criteria), progression-free survival and safety.

STELLAR investigated safety and efficacy among 80 patients treated with Optune Lua plus standard of care chemotherapy. In STELLAR, the median overall survival was 18.2 months (95% CI, 12.1-25.8 months) across all patients treated with Optune Lua plus chemotherapy. The median overall survival was 21.2 months for patients with epithelioid MPM (n=53) and 12.1 months for patients with non-epithelioid MPM (n=27). 62% of patients enrolled in STELLAR who used Optune Lua plus chemotherapy were still alive at one year, with 42% of patients alive at two years. The disease control rate in patients with at least one follow-up CT scan performed (n=72) was 97%. 40% of patients had a partial response, 57% had stable disease, and 3% had progressive disease. The median progression-free survival was 7.6 months (95% CI, 6.7-8.6 months).

There was no increase in serious systemic adverse events when Optune Lua was added to chemotherapy. Mild-to-moderate skin irritation was the only device-related side effect with Optune Lua. The STELLAR data were published in The Lancet Oncology in 2019.

4

Our commercial markets

We have built a commercial organization and market Optune for the treatment of GBM in the U.S., Austria, Germany, Israel, Japan, Sweden and Switzerland, which we refer to as our active markets. We have also built a commercial organization to market Optune Lua for the treatment of MPM in the U.S.

In 2021, we estimate that approximately:

•15,000 people will be diagnosed with GBM or tumors that typically progress to GBM in the U.S. Of this population, we estimate that approximately 11,200 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. We estimate that approximately 8,200 of eligible patients will actively seek treatment.

•4,600 people will be diagnosed with GBM or tumors that typically progress to GBM in Germany. Of this population, we estimate that approximately 3,400 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. We estimate that approximately 2,500 of eligible patients will actively seek treatment.

•2,200 people will be diagnosed with GBM or tumors that typically progress to GBM in Japan. Of this population, we estimate that approximately 1,600 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. We estimate that approximately 1,200 of eligible patients will actively seek treatment.

•1,600 people will be diagnosed with GBM or tumors that typically progress to GBM in our other active markets: Austria, Israel, Sweden and Switzerland. Of this population, we estimate that approximately 1,200 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. We estimate that approximately 900 of eligible patients will actively seek treatment.

In 2021, we estimate that approximately 3,000 people are diagnosed with malignant mesothelioma in the U.S. each year. Of this population, we estimate that approximately 1,600 patients are candidates for treatment with Optune Lua based upon the rate of disease progression and medical eligibility.

We believe there are many more patients who could benefit from treatment with TTFields than are currently on therapy. We continue to focus on increasing penetration for GBM in our active markets and on successfully expanding our MPM business in the U.S. In the future, we anticipate strategically expanding into additional geographic markets and additional indications, pending regulatory approval.

Commercial execution

As of December 31, 2020, we had 84 sales force colleagues globally. Healthcare providers must undergo a certification training in order to prescribe our Products.

As of December 31, 2020, we trained more than 3,700 GBM prescribers in our active markets. With respect to the treatment of GBM, our sales and marketing efforts are principally focused on driving adoption with both neuro-oncologists and radiation oncologists. In certain countries, neurosurgeons and medical oncologists also drive adoption. We continue to focus on driving key academic center engagement in our active markets.

As of December 31, 2020, we trained more than 130 MPM prescribers in the U.S. With respect to the treatment of MPM, our sales and marketing efforts are principally focused on certification training, supporting the required Institutional Review Board approval process, and driving awareness among radiation oncologists and thoracic oncologists. We believe the benefit of our education efforts will extend beyond MPM to future indications treated by the same prescribers and that radiation oncologists will continue to play an increasingly important role in driving adoption of our Products in both current and future indications.

We currently operate as a direct-to-patient distributor of our Products in all active markets except for Japan. In Japan, we distribute Optune through hospitals and provide patient support services under a contractual arrangement with the hospital. Once an eligible patient is identified by a certified prescriber, the healthcare provider’s office submits a prescription order form and supporting documentation to us. We employ a team of Device Support Specialists who provide technical training to the patient and any caregivers. Once treatment is initiated, we provide 24/7 technical support for patients and caregivers as well as assistance with insurance reimbursement. We also provide the healthcare provider and the patient with a usage report for monitoring patient

5

time on therapy. We believe we have the experience, expertise and infrastructure to scale our sales and marketing efforts in our active markets. In addition to our commercial organization, we believe we have established a scalable supply chain.

Billing and reimbursement

We provide our Products directly to patients following receipt of a prescription order and a signed patient service agreement (except in Japan as described above). The number of active patients on therapy and the amount of net revenue recognized per active patient are our principal revenue drivers. An active patient is a patient who is receiving treatment under a commercial prescription order as of the measurement date, including patients who may be on a temporary break from treatment and who plan to resume treatment in less than 60 days. Growth in the number of active patients is a factor of both new patient starts and treatment duration. Median treatment duration differs based upon the patient's clinical diagnosis.

We bill payers a single monthly fee for a month of therapy and we bear the financial risk of securing payment from third-party payers and patients in all markets except for Japan. We distribute our Products through hospitals in Japan with the hospitals receiving reimbursement from the government-mandated insurance program and in turn contracting with us for the equipment, supplies and services necessary to treat patients with our Product.

Currently, the monthly list price for our therapy in the U.S. is $21,000 and we have set list prices in our other active markets that are approximately equivalent to this price, subject to currency fluctuations. We typically negotiate discounts from our list price with healthcare payers, and in certain cases we accept government-mandated discounts from our list prices in order to secure reimbursement for our Products.

We continue to work with payers to expand access to Optune for patients with GBM. As of December 31, 2020, we have received national reimbursement for Optune in Austria, Germany, Israel, Japan, Sweden and Switzerland, where coverage becomes effective on April 1, 2021.

In the U.S., a substantial majority of Americans with private health insurance had coverage of Optune for newly diagnosed GBM and/or recurrent GBM as of December 31, 2020. As of September 2019, Americans who are beneficiaries of the Medicare fee-for-service program also have coverage of Optune for newly diagnosed GBM. Our team is focused on working through the typical administrative ramp-up with Medicare to ensure that we realize the full financial benefit as soon as possible. We are actively appealing Medicare fee-for-service coverage denials up to and including the Administrative Law Judge ("ALJ") process with Centers for Medicare and Medicaid Services ("CMS").

We are engaged in an initial dialogue with certain payers regarding access to Optune Lua for patients with MPM. We anticipate that MPM claims during initial commercialization will go through an appeal process with payers, similar to our early experience with GBM. We anticipate that our ability to gain meaningful coverage for Optune Lua will be dependent on inclusion in the relevant clinical guidelines for MPM.

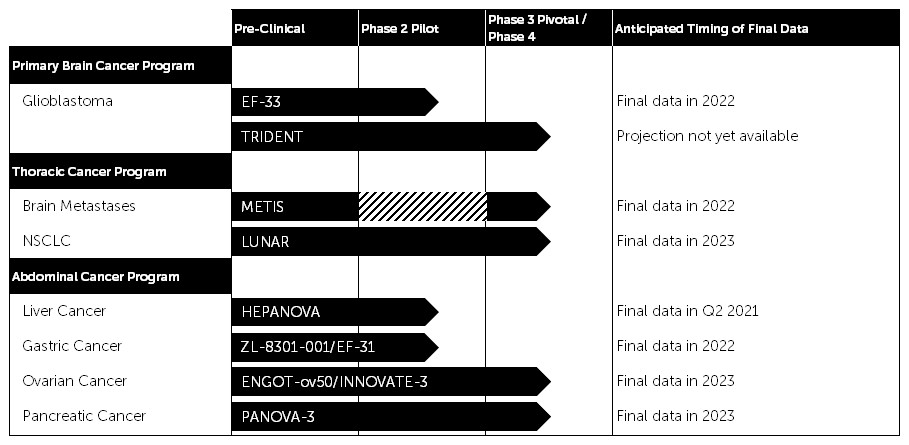

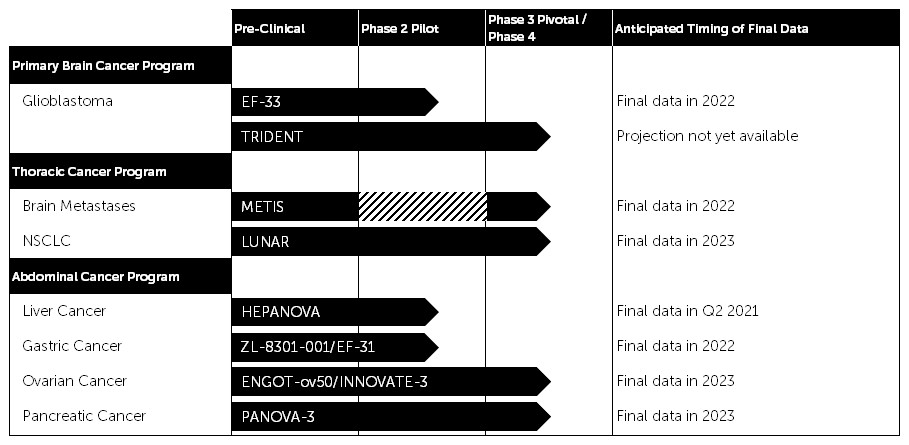

Our development pipeline

Based on the results of our preclinical research, we have developed a pipeline strategy to advance TTFields through phase 2 pilot, phase 3 pivotal trials and phase 4 post-marketing studies across multiple solid tumor types. We anticipate expanding our clinical pipeline over time to include additional solid tumor cancer indications.

6

Current Development Pipeline

The solid tumor cancers subject to our phase 2 pilot, phase 3 pivotal, and phase 4 post-marketing trials, as well as the trials themselves, are described in greater detail below.

Glioblastoma

We continue to conduct research in our approved indications to further advance the scientific evidence supporting the use of TTFields in GBM and to gather additional information about our therapy's optimal use.

EF-33 phase 2 pilot trial

In 2020, we enrolled the first patient in our EF-33 trial, an open-label, single-arm phase 2 pilot clinical trial to study if Optune delivered at 200 kHz to the brain using high-intensity arrays in the treatment of recurrent GBM significantly improves the clinical outcomes of patients compared to using standard transducer arrays. The primary endpoint is progression-free survival. Secondary endpoints include overall survival, progression-free survival rate at six months, overall survival rate at one year and two years, overall radiological response, and severity and frequency of adverse events. All comparisons will be made against historical control data from the EF-11 study. EF-33 is expected to enroll 25 patients and we anticipate data will be available in 2022.

TRIDENT phase 4 post-marketing trial

In 2020, we enrolled the first patient in our TRIDENT trial ("TRIDENT"), a phase 4 post-marketing trial testing the potential survival benefit of initiating Optune concurrent with radiation therapy in patients with newly diagnosed GBM. The primary endpoint is overall survival. Secondary endpoints include progression-free survival, survival rates at one and two years, overall radiological response, severity and frequency of adverse effects, pathological changes in resected GBM tumors post treatment, quality of life, and correlation of overall survival to TTFields dose. TRIDENT is designed to accrue 950 patients with 24 months minimum follow-up after the last patient enrolled.

Brain metastases

Metastatic cancer is cancer that has spread from the place where it first started to another place in the body. In metastasis, cancer cells break away from where they first formed (the primary cancer), travel through the blood or lymph system, and form new tumors (the metastatic tumors) in other parts of the body. The exact incidence of brain metastases is unknown because no national cancer registry documents brain metastases, and estimates from scientific literature vary greatly based on the study methodology applied. It is estimated that between 100,000 and

7

240,000 new cases are diagnosed in the U.S. each year with brain metastases estimated to occur in between 10% to 40% of all cancer patients.

Brain metastases are commonly treated with a combination of surgery and radiation. Chemotherapy is often given for the primary tumor, but many chemotherapy agents do not cross the blood brain barrier and are thus ineffective in the treatment of brain metastases. When brain metastases appear, they are either surgically removed or treated with radiation using stereotactic radiosurgery ("SRS") when possible. Whole brain radiation therapy, although effective in delaying progression or recurrence of brain metastases when given either before or after SRS, is associated with neurotoxicity with a significant decline in cognitive functioning. Thus, whole brain radiation therapy is often delayed until later in the disease course and is often used as a last resort. This practice results in a window of unmet need after localized surgery and SRS are used and before whole brain radiation therapy is administered to delay or prevent the additional spread of brain metastases.

METIS phase 3 pivotal trial

In 2016, we enrolled the first patient in our METIS trial ("METIS"), a phase 3 pivotal trial testing the effectiveness of SRS plus TTFields compared to SRS alone in patients with brain metastases resulting from NSCLC. It is estimated that between 20 to 40% of patients with NSCLC develop brain metastases, with an estimated 38,000 to 77,000 patients diagnosed each year in the U.S. with brain metastases resulting from NSCLC. The primary endpoint of METIS is time to first intracranial progression. Secondary endpoints include, among others, time to neurocognitive failure, overall survival and radiological response rate following study treatments. The study is designed to accrue 270 patients with data analyzed 12 months after the last patient in. We anticipate data will be available in 2022.

Non-small cell lung cancer

Lung cancer is the most common cause of cancer-related death worldwide, and NSCLC accounts for approximately 85% of all lung cancers. It is estimated that approximately 193,000 patients are diagnosed with NSCLC each year in the U.S.

Physicians use different combinations of surgery, radiation and pharmacological therapies to treat NSCLC, depending on the stage of the disease. Surgery, which may be curative in a subset of patients, is usually used in early stages of the disease. Since 1991, radiation with a combination of platinum-based chemotherapy drugs has been the first line standard of care for locally advanced or metastatic NSCLC. Certain immune checkpoint inhibitors have recently been approved for the first line treatment of NSCLC and the standard of care in this setting appears to be evolving rapidly. The standard of care for second line treatment is also evolving and may include platinum-based chemotherapy for patients who received immune checkpoint inhibitors as their first line regimen, pemetrexed, docetaxel or immune checkpoint inhibitors.

EF-15 phase 2 pilot trial

In 2013, we published the results of our phase 2 pilot trial, the EF-15 trial ("EF-15"), evaluating the safety and efficacy of TTFields in the treatment of advanced NSCLC. EF-15 focused on the effects of treatment with TTFields in combination with standard of care pemetrexed chemotherapy. Results of the pemetrexed Phase 3 FDA registration trial were used as a historical control in this trial.

A total of 42 patients were recruited to the study with a minimum follow-up of six months. Efficacy results based on 41 evaluable patients showed both progression-free survival and overall survival for patients receiving TTFields in combination with pemetrexed increased compared to historical control data for pemetrexed alone. Median time to in-field progression in the TTFields-treated group was 6.5 months (compared to 2.9 months in the historical control) and median overall survival was 13.8 months (compared to 8.3 months in the historical control). Adverse events reported in this combination study were comparable to those reported with pemetrexed alone, suggesting minimal added toxicities due to TTFields.

KEYNOTE B36 phase 2 pilot trial

In July 2020, we entered into a clinical trial collaboration with MSD, a trade name of Merck & Co., Inc. through a subsidiary, to develop TTFields together with MSD’s anti-PD-1 therapy pembrolizumab for treatment of first-line NSCLC, expanding our research in the lung cancer space. We plan to conduct a phase 2 pilot study. KEYNOTE B36, evaluating TTFields concomitant with pembrolizumab for first-line treatment of intrathoracic advanced or

8

metastatic, PD-L1 positive NSCLC. KEYNOTE B36 is expected to enroll its first patient in the second quarter of 2021.

LUNAR phase 3 pivotal trial

In 2017, we enrolled the first patient in our LUNAR trial ("LUNAR"), a phase 3 pivotal trial testing the effectiveness of TTFields in combination with immune checkpoint inhibitors or docetaxel versus immune checkpoint inhibitors or docetaxel alone for patients with stage 4 NSCLC who progressed during or after platinum-based therapy. It is estimated that approximately 46,000 patients receive second-line treatment for stage 4 NSCLC each year in the U.S. The primary endpoint is superior overall survival of patients treated with TTFields plus immune checkpoint inhibitors or docetaxel versus immune checkpoint inhibitors or docetaxel alone. We believe our protocol incorporates the evolving standard of care for second-line treatment of NSCLC. TTFields is intended principally for use in combination with other standard-of-care treatments, and LUNAR was designed to generate data that contemplates multiple outcomes, all of which we believe will be clinically meaningful.

LUNAR is designed to enroll 534 patients with data analyzed 18 months after the last patient in. We anticipate final data will be available in 2023. The protocol specifies an enrollment-driven interim analysis at 432 patients, which we anticipate will occur in the fourth quarter of 2021.

Liver cancer

Liver cancer is a leading cause of cancer deaths worldwide and is the sixth leading cause of cancer deaths annually in the U.S. The incidence of liver cancer is approximately 42,000 new cases annually in the U.S. The five-year survival rate with existing standards of care is less than 20%.

Hepatocellular carcinoma is the most widespread type of cancer that originates from the liver. Advanced liver cancer has spread either to the lymph nodes or to other organs and, because these cancers are widespread, they cannot be treated with surgery. The current common standard treatment for patients with advanced disease and those who progressed on loco-regional therapy is systemic therapy with sorafenib, lenvatinib, or atezolizumab plus bevacizumab.

HEPANOVA phase 2 pilot trial

In 2018, we opened our HEPANOVA trial, a single-arm, phase 2 pilot clinical trial in liver cancer testing the safety and efficacy of TTFields in combination with sorafenib for the treatment of advanced hepatocellular cancer that are not eligible for standard local therapies or surgery. The primary endpoint is overall response rate, and secondary endpoints include progression-free and overall survival at one year. We have completed enrollment of 25 patients at multiple centers across Europe and anticipate data will be available in the second quarter of 2021.

Gastric cancer

Gastric cancer is the third leading cause of cancer deaths worldwide and the third leading cause of cancer deaths in China. The incidence of gastric cancer is approximately 478,500 new cases annually in China, and approximately 26,000 new cases annually in the U.S. The five-year overall survival rate of gastric cancer is approximately 36%.

Current therapies include surgery, chemotherapy, radiotherapy and targeted therapy. A commonly used chemotherapy regimen in treating gastric cancer is XELOX, a combination of oxaliplatin and capecitabine. In patients diagnosed with advanced gastric cancer that is no longer operable, combination chemotherapy extends progression-free survival and overall survival to 3-6 months and 8-14 months, respectively.

EF-31 phase 2 pilot trial

In 2020, we opened our EF-31 trial, a single-arm, phase 2 pilot clinical trial in gastric cancer in partnership with Zai testing the safety and efficacy of TTFields and XELOX chemotherapy as first-line treatment for patients with unresectable gastric adenocarcinoma or gastroesophageal junction adenocarcinoma. The primary endpoint is investigator-assessed objective response rate, and secondary endpoints include progression-free and overall survival. The trial is expected to enroll a total of 28 patients in multiple centers across Greater China, and we anticipate data will be available in 2022.

9

Ovarian cancer

In the U.S., ovarian cancer ranks fifth in cancer deaths among women, with approximately 24,000 women diagnosed each year. Ovarian cancer incidence increases with age, and the median age at time of diagnosis is 63 years old.

Physicians use different combinations of surgery and pharmacological therapies to treat ovarian cancer, depending on the stage of the disease. Surgery is usually used in early stages of the disease and is usually combined with chemotherapy, including paclitaxel and platinum-based chemotherapy. Unfortunately, the majority of patients are diagnosed at an advanced stage when the cancer has spread outside of the ovaries to include regional tissue involvement and/or metastases. Platinum-based chemotherapy remains part of the standard of care in advanced ovarian cancer, but most patients with advanced ovarian cancer will have tumor progression or, more commonly, recurrence. Almost all patients with recurrent disease ultimately develop platinum resistance, and the prognosis for this population remains poor.

INNOVATE phase 2 pilot trial

In 2018, we published the results of our phase 2 pilot trial in recurrent ovarian cancer, the INNOVATE trial ("INNOVATE"), examining TTFields in combination with standard of care chemotherapy. INNOVATE was a multi-center, non-randomized, open-label trial designed to test the feasibility, safety and preliminary efficacy of TTFields in combination with weekly paclitaxel. The paclitaxel control arm from the bevacizumab phase 3 FDA registration trial was used as a historical control in this trial.

A total of 31 patients were recruited to the study with a minimum follow-up of six months. Safety results suggested that TTFields in combination with weekly paclitaxel may be tolerable and safe as second-line treatment for patients with recurrent ovarian cancer. Median progression-free survival in the TTFields-treated group was 8.9 months (compared to 3.9 months in the paclitaxel-alone historical control), and median overall survival was not yet reached. The one-year survival rate was 61%. Efficacy results based on the 31 evaluable patients suggested more than doubling of the progression-free survival and an improvement in overall survival among patients who received TTFields therapy with paclitaxel compared to paclitaxel alone.

INNOVATE-3 phase 3 pivotal trial

In 2019, we enrolled the first patient in our INNOVATE-3 trial ("INNOVATE-3"), a phase 3 pivotal trial testing the effectiveness of TTFields with paclitaxel in patients with platinum-resistant ovarian cancer. It is estimated that approximately 16,000 patients are diagnosed with platinum-resistant ovarian cancer each year in the U.S. The primary endpoint of INNOVATE-3 is overall survival. Secondary endpoints include progression-free survival, objective response rate, severity and frequency of adverse events, time to undisputable deterioration in health-related quality of life or death, and quality of life. The study is designed to accrue 540 patients with data analyzed 18 months after the last patient in. We anticipate final data in 2023. The protocol specifies an enrollment-driven interim analysis at last patient in, which we anticipate will occur in the third quarter of 2021.

The European Network for Gynaecological Oncological Trial groups ("ENGOT") and The GOG Foundation, Inc. ("GOG"), third-party clinical trial networks, are collaborating with us on the trial. ENGOT and GOG were involved in the development of the trial, and the collaborations are intended to facilitate enrollment of INNOVATE-3 at leading cancer centers in Europe and the United States.

Pancreatic cancer

Pancreatic cancer is one of the most lethal cancers and is the third most frequent cause of death from cancer in the U.S. While overall cancer incidence and death rates are remaining stable or declining, the incidence and death rates for pancreatic cancer are increasing. It is estimated that approximately 53,000 patients are diagnosed with pancreatic cancer each year in the U.S. Pancreatic cancer has a five-year relative survival rate in the single digits, at just 10 percent.

Physicians use different combinations of surgery, radiation and pharmacological therapies to treat pancreatic cancer, depending on the stage of the disease. For patients with locally advanced pancreatic cancer involving encasement of arteries but no extra-pancreatic disease, the standard of care is surgery followed by chemotherapy with or without radiation. Unfortunately, the majority of locally advanced cases are diagnosed once the cancer is no longer operable, generally leaving chemotherapy with or without radiation as the only treatment option.

10

PANOVA phase 2 pilot trial

In 2018, we published the results of our phase 2 pilot trial in advanced pancreatic adenocarcinoma, the PANOVA trial ("PANOVA"), examining TTFields in combination with standard of care chemotherapy.

PANOVA was a multicenter, non-randomized, open-label trial. The trial included 40 patients with locally advanced or metastatic pancreatic cancer whose tumors could not be removed surgically and who had not received chemotherapy or radiation therapy prior to the clinical trial. Patients were enrolled between 2014 and 2016 in two cohorts: The first cohort of 20 patients received TTFields with standard doses of gemcitabine alone. The second cohort of 20 patients received TTFields with standard doses of nab-paclitaxel plus gemcitabine.

In the first cohort, efficacy results showed that progression-free survival and overall survival of patients treated with TTFields combined with gemcitabine were more than double those of gemcitabine-treated historical controls. Median progression-free survival in the TTFields-treated group was 8.3 months (compared to 3.7 months in the gemcitabine historical control), with locally advanced patients reaching a median progression-free survival of 10.3 months and patients with metastatic disease reaching a median progression-free survival of 5.7 months. The median overall survival for all patients was 14.9 months (compared to 6.7 months in the gemcitabine historical control). Median overall survival was not reached in locally advanced patients and 86% of patients were alive at end of follow up. Patients with metastatic disease experienced a median overall survival of 8.3 months. One-year survival was 55% (compared to 22% in the gemcitabine historical control). Of 11 patients with available CT scans, 5 (45%) had a partial response (compared to 7% with gemcitabine alone), 5 (45%) had stable disease, which means that the cancer is neither decreasing nor increasing in extent or severity, and 1 (10%) had progressive disease.

In the second cohort, efficacy results showed that progression-free survival and overall survival of patients treated with TTFields combined with nab-paclitaxel plus gemcitabine were more than double those of nab-paclitaxel plus gemcitabine-treated historical controls. Median progression-free survival in the TTFields-treated group was 12.7 months (compared to 5.5 months in the nab-paclitaxel plus gemcitabine historical control) and median overall survival was not yet reached. The one-year survival rate was 72% (compared to 35% in nab-paclitaxel plus gemcitabine historical control). Of the 15 patients with available CT scans, 6 (40%) had a partial response (compared to 23% with the nab-paclitaxel plus gemcitabine alone), 7 (47%) had stable disease and 2 (13%) had progressive disease.

Safety results from both cohorts suggested that TTFields plus first-line chemotherapies nab-paclitaxel and/or gemcitabine may be tolerable and safe in patients with advanced pancreatic cancer. Patients reported no serious adverse events related to TTFields.

PANOVA-3 phase 3 pivotal trial

In 2018, we enrolled the first patient in our PANOVA-3 trial ("PANOVA-3"), a phase 3 pivotal trial testing the effectiveness of TTFields with nab-paclitaxel and gemcitabine versus nab-paclitaxel and gemcitabine alone as a front-line treatment for unresectable locally advanced pancreatic cancer. It is estimated that approximately 43,000 patients are diagnosed with unresectable pancreatic cancer each year in the U.S. The primary endpoint of PANOVA-3 is overall survival. Secondary endpoints include progression-free survival, local progression-free survival, objective response rate, one-year survival rate, quality of life, pain-free survival, resectability rate and toxicity.

The study is designed to accrue 556 patients with data analyzed 18 months after the last patient in. We anticipate final data will be available in 2023. The protocol specifies an enrollment-driven interim analysis at last patient in, which we now anticipate will occur in 2022.

Zai License and Collaboration Agreement

In 2018, we announced a strategic collaboration with Zai. The collaboration agreement grants Zai a license to commercialize our Products in Greater China and establishes a development partnership intended to accelerate the development of TTFields in multiple solid tumor cancer indications. Zai has launched Optune for the treatment of newly diagnosed GBM in Hong Kong and for the treatment of newly diagnosed and recurrent GBM in mainland China. Zai has also launched Optune Lua for the treatment of MPM in Hong Kong and intends to file a Marketing Authorization Application in mainland China in 2021. For additional information, see Note 12 to the Consolidated Financial Statements.

11

Manufacturing and supply chain

We outsource production of all of our system components to qualified partners. Disposable array manufacturing, the dominant activity in our manufacturing supply chain, includes several specialized processes. Production of the durable system components follows standard electronic medical device methodologies.

We have supply agreements in place with our third-party manufacturing partners. While we currently obtain some critical materials for use in certain jurisdictions from single source suppliers, we have developed or are in the process of developing and obtaining regulatory approval for second sources for critical materials in all jurisdictions. We hold safety stocks of single source components in quantities that we believe are sufficient to protect against possible supply chain disruptions. We anticipate that the diversification of our supply chain will both ensure a continuity of supply and reduce costs.

Intellectual property

We believe we own global commercialization rights to our Products in oncology and are well-positioned to extend those rights into the future as we continue to find innovative ways to improve our Products. Our robust global patent and intellectual property portfolio consists of over 185 issued patents covering various aspects of TTFields and our Products. In the U.S., our patents have expected expiration dates between 2021 and 2037. We have also filed over 125 additional patent applications worldwide, including 45 new U.S. patent applications in 2020, that, if issued, may protect aspects of our platform beyond the current last-to-expire patent in the relevant market. These pending applications cover innovations relating to our arrays, field generators and software platform, in addition to other topics related to TTFields. Our reliance on intellectual property involves certain risks, as described under the heading "Risk factors—Risks relating to intellectual property."

In addition to our patent portfolio, we further protect our intellectual property by maintaining the confidentiality of our trade secrets, know-how and other confidential information. Given the length of time and expense associated with bringing delivery systems candidates through development and regulatory approval to the market place, the healthcare industry has traditionally placed considerable importance on obtaining patent protection and maintaining trade secrets, know-how and other confidential information for significant new technologies, products and processes.

Our policy is to require each of our employees, consultants and advisors to execute a confidentiality agreement before beginning their employment, consulting or advisory relationship with us. These agreements generally provide that the individual must keep confidential and not disclose to other parties any confidential information developed or learned by the individual during the course of their relationship with us except in limited circumstances. These agreements also generally provide that we own, or the individual is required to assign to us, all inventions conceived by the individual in the course of rendering services to us. Despite measures taken to protect our intellectual property, unauthorized parties may copy certain aspects of our products or obtain and use information that we believe is proprietary.

Pursuant to our strategic collaboration with Zai, we granted Zai a license to commercialize TTFields in Greater China. For additional information, see Note 12 to the Consolidated Financial Statements.

In 2015, we entered into a settlement agreement with the Technion Research and Development Foundation to resolve certain potential disputes regarding intellectual property developed by our founder and previously assigned to us.

In 2005, we granted an exclusive license to a third party, NovoBiotic LLC, to certain of our key intellectual property for use outside the field of oncology. In December 2020, we entered into an agreement with Novobiotic LLC that terminated all pre-existing agreements between the parties, including any restrictions on our use of intellectual property outside the field of oncology.

Competition

The market for cancer treatments is intensely competitive, subject to rapid change and significantly affected by new product and treatment introductions and other activities of industry participants. The general bases of competition are overall effectiveness, side effect profile, cost, availability of reimbursement and general market acceptance of a product as a suitable cancer treatment.

Our intellectual property portfolio is continuously expanding as we find new and unique ways to improve TTFields therapy. We believe these intellectual property rights would provide an obstacle to the introduction of state of the art

12

TTFields delivery systems by a competitor. However, competitors may be able to offer less sophisticated TTFields delivery systems that utilize technology described in expired patents and/or choose to market their system(s) in countries where we have limited or no enforceable intellectual property rights. Competitors could also pursue alternative technologies for the application of TTFields into a patient that we did not foresee or protect. We are aware of a few third parties in the United States and China developing devices and filing for intellectual property protection related to TTFields.

Even after the expiration of our U.S. patents, we believe that potential U.S. market entrants applying low-intensity, alternating electric fields to solid tumors in the U.S. will have to undertake their own clinical trials and regulatory submissions to prove equivalence to our Products, a necessary step in receiving regulatory approvals for a competing product.

Presently, the traditional biotechnology, pharmaceutical and medical technology industries expend significant resources in developing novel and proprietary therapies for the treatment of solid tumors, including GBM, MPM and other indications that we are currently investigating. As we work to increase market acceptance of our Products, we compete with companies commercializing or investigating other anti-cancer therapies, some of which are in clinical trials for GBM or MPM that currently specifically exclude patients who have been or are being treated with our Products. The introduction of competing therapies could materially impact our business and financial results.

Government regulation

In the U.S., our Products and our operations are subject to extensive regulation by the FDA under the Federal Food, Drug, and Cosmetic Act ("FDCA"). In the EU member states where we market our Products and operate, we are currently subject to, inter alia, the Medical Device Directive ("MDD") as implemented into national legislation by the EU member states. From May 26, 2021, the MDD will be replaced and repealed by the Medical Device Regulation ("MDR"), which will apply directly in all EU member states. In Switzerland, our Products and operations are subject to, inter alia, the Medical Devices Ordinance, which implements the MDD into Swiss law (See "Foreign approvals and CE mark" below). In Japan, our Products and operations are subject to regulation by the Pharmaceuticals and Medical Device Agency ("PMDA") under the Pharmaceuticals and Medical Devices Act ("PMD Act"). In addition, our Products must meet the requirements of a large and growing body of national, regional and international standards that govern the preclinical and clinical testing, manufacturing, labeling, certification, storage, recordkeeping, advertising, promotion, export and marketing and distribution, among other things, of our Products for current and future indications.

In the U.S., advertising and promotion of medical devices, in addition to being regulated by the FDA, is also regulated by the Federal Trade Commission and by state regulatory and enforcement authorities. In the EU, advertising and promotion is subject to not only the general provisions of the MDD or MDR, but also general EU advertising rules on misleading and comparative advertising and unfair commercial practices, as implemented at the EU member state level, such as the Heilmittelwerbegesetz in Germany. Promotional activities for FDA-regulated products of other companies have been the subject of government enforcement actions brought under healthcare laws and consumer protection statutes. In addition, we are required to meet analogous regulatory requirements in countries outside the U.S., which can change rapidly with relatively short notice. Competitors can also initiate litigation alleging false advertising for our promotional efforts under the Lanham Act, or under similar state laws.

Our research, development and clinical programs, as well as our manufacturing and marketing operations, are also subject to extensive regulation.

Failure by us or by our suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA or other regulatory authorities, which may result in any number of regulatory enforcement actions, or civil or criminal liability.

Food and Drug Administration

The FDA regulates the development, testing, manufacturing, labeling, storage, recordkeeping, promotion, marketing, distribution and service of medical devices in the U.S. to ensure that medical products distributed domestically are safe and effective for their intended uses. In addition, the FDA regulates the export of medical devices manufactured in the U.S. to international markets and the importation of medical devices manufactured abroad. The FDA has broad post-market and regulatory enforcement powers to ensure compliance with the FDCA.

The FDA governs the following activities that we perform or that are performed on our behalf:

•product design, development and manufacture;

13

•product safety, testing, labeling and storage;

•record keeping procedures;

•product marketing, sales and distribution; and

•post-marketing surveillance, complaint handling, medical device reporting, reporting of deaths, serious injuries or device malfunctions and repair or recall of products.

We have registered three of our facilities with the FDA. We are subject to announced and unannounced inspections by the FDA to determine our compliance with the Quality System Regulation ("QSR") and other regulations and these inspections include the manufacturing facilities of our suppliers.

FDA’s premarket clearance and approval requirements

Unless an exemption applies, before we can commercially distribute medical devices in the U.S., we must obtain, depending on the type of device, either prior 510(k) clearance or premarket approval ("PMA") from the FDA. The FDA classifies medical devices into one of three classes. Devices deemed to pose lower risks are placed in either class I or II, which typically requires the manufacturer to submit to the FDA a premarket notification requesting permission to commercially distribute the device. This process is generally known as 510(k) clearance. Some low-risk devices are exempted from this requirement. Devices deemed by the FDA to pose the greatest risks, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared 510(k) device, are placed in class III, generally requiring PMA.

Premarket approval (PMA) pathway

Optune and Optune Lua are classified as Class III devices as they are deemed to be life-sustaining devices. Accordingly, we were required to receive PMA for Optune, which the FDA granted in April 2011 and October 2015 for the treatment of recurrent and newly diagnosed supratentorial GBM, respectively, in adult patients. We expect that we will be required to receive PMA for the use of our Products for future indications.

A PMA must be supported by extensive data, including from technical tests, preclinical studies and clinical trials, manufacturing information and intended labeling to demonstrate, to the FDA’s satisfaction, the safety and effectiveness of a medical device for its intended use. During the PMA review period, the FDA will typically request additional information or clarification of the information already provided. Also, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA may or may not accept the panel’s recommendation. In addition, the FDA will generally conduct a pre-approval inspection of the manufacturing facility or facilities to ensure compliance with the QSR. Prior to approval of the Optune PMA for the treatment of recurrent GBM, we and our critical component suppliers were each inspected by the FDA.

New PMAs or PMA supplements are required for modifications that affect the safety or effectiveness of our delivery systems, including, for example, certain types of modifications to a delivery system’s indication for use, manufacturing process, labeling and design. PMA supplements often require submission of the same type of information as a PMA, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA and may not require any or as extensive clinical data as the original PMA required, or the convening of an advisory panel. The FDA requires a company to make the determination as to whether a new PMA or PMA supplement application is to be filed. If a company determines that neither a new PMA nor a PMA supplement application is required for modifications, it must nevertheless notify the FDA of these modifications in its PMA Annual Report. The FDA may review a company’s decisions when reviewing the PMA Annual Report and require the filing of an application.

As is typical with medical device companies, we have received approval for a number of post-approval PMA supplements for GBM, including for modifications to Optune’s electric field generator, arrays, software, manufacturing processes and labeling. Future modifications may be considered by us as the need arises, some of which we may deem to require a PMA supplement application and others to require reporting in our PMA Annual Report.

For class III devices intended to treat disease affecting 8,000 individuals or less per year in the U.S., called Humanitarian Use Devices ("HUD"), the FDA has a separate marketing authorization pathway called the HDE.

14

Approval basis for an HDE is a "reasonable assurance of safety" and that the probable benefit to health outweighs risk of injury from its use, which means a traditional phase 3 pivotal trial usually is not required to support approval.

In 2019, the FDA approved Optune Lua (then known as "NovoTTF-100L") for the treatment of MPM under the HDE pathway. Devices approved through an HDE application are subject to certain requirements, including specific labeling restrictions and the requirement that a facility’s institutional review board ("IRB") or Local Committee approve the use of the device before it can be distributed in that facility. In addition, there is a general prohibition on profiting from sales of devices approved under the HDE standard. As part of the approval process, we applied for an exemption from this limitation, which the FDA granted. Otherwise, HDE approved devices are generally required to follow the same requirements as PMA approved devices.

Clinical trials