nvcr-20200331false2020Q10001645113--12-31P4YP3YP3YP6Y00016451132020-01-012020-03-31xbrli:shares00016451132020-04-23iso4217:USD00016451132020-03-3100016451132019-12-3100016451132019-01-012019-03-3100016451132019-01-012019-12-31iso4217:USDxbrli:shares0001645113us-gaap:CommonStockMember2019-12-310001645113us-gaap:AdditionalPaidInCapitalMember2019-12-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001645113us-gaap:RetainedEarningsMember2019-12-310001645113us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001645113us-gaap:CommonStockMember2020-01-012020-03-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001645113us-gaap:RetainedEarningsMember2020-01-012020-03-310001645113us-gaap:CommonStockMember2020-03-310001645113us-gaap:AdditionalPaidInCapitalMember2020-03-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001645113us-gaap:RetainedEarningsMember2020-03-310001645113us-gaap:CommonStockMember2018-12-310001645113us-gaap:AdditionalPaidInCapitalMember2018-12-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001645113us-gaap:RetainedEarningsMember2018-12-3100016451132018-12-310001645113us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001645113us-gaap:CommonStockMember2019-01-012019-03-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001645113us-gaap:RetainedEarningsMember2019-01-012019-03-310001645113us-gaap:CommonStockMember2019-03-310001645113us-gaap:AdditionalPaidInCapitalMember2019-03-310001645113us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001645113us-gaap:RetainedEarningsMember2019-03-3100016451132019-03-310001645113us-gaap:EmployeeStockOptionMembernvcr:TwoThousandFifteenPlanMember2020-01-012020-03-310001645113us-gaap:RestrictedStockUnitsRSUMembernvcr:TwoThousandFifteenPlanMember2020-01-012020-03-310001645113nvcr:PerformanceBasedShareUnitsPSUsMembersrt:MinimumMembernvcr:TwoThousandFifteenPlanMember2020-01-012020-03-310001645113nvcr:PerformanceBasedShareUnitsPSUsMembernvcr:TwoThousandFifteenPlanMembersrt:MaximumMember2020-01-012020-03-310001645113nvcr:TwoThousandFifteenPlanMember2020-03-310001645113us-gaap:RestrictedStockUnitsRSUMember2020-03-032020-03-030001645113nvcr:PerformanceBasedShareUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-03-032020-03-030001645113nvcr:PerformanceBasedShareUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2020-03-032020-03-030001645113us-gaap:ShareBasedCompensationAwardTrancheThreeMembernvcr:PerformanceBasedShareUnitsPSUsMember2020-03-032020-03-030001645113nvcr:PerformanceBasedShareUnitsPSUsMembersrt:MinimumMember2020-01-012020-03-310001645113nvcr:PerformanceBasedShareUnitsPSUsMembersrt:MaximumMember2020-01-012020-03-310001645113us-gaap:EmployeeStockMember2020-03-310001645113us-gaap:EmployeeStockMember2020-01-012020-03-310001645113us-gaap:EmployeeStockOptionMember2020-01-012020-03-310001645113us-gaap:EmployeeStockOptionMember2019-01-012019-03-310001645113srt:MinimumMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001645113us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-01-012019-12-31xbrli:pure0001645113us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001645113us-gaap:EmployeeStockMember2019-01-012019-03-310001645113us-gaap:EmployeeStockMember2019-01-012019-12-310001645113nvcr:CostOfRevenueMember2020-01-012020-03-310001645113nvcr:CostOfRevenueMember2019-01-012019-03-310001645113nvcr:CostOfRevenueMember2019-01-012019-12-310001645113us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-03-310001645113us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-03-310001645113us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001645113nvcr:SalesAndMarketingMember2020-01-012020-03-310001645113nvcr:SalesAndMarketingMember2019-01-012019-03-310001645113nvcr:SalesAndMarketingMember2019-01-012019-12-310001645113us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-03-310001645113us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-03-310001645113us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001645113us-gaap:EmployeeStockOptionMember2020-01-012020-03-310001645113country:US2020-03-310001645113country:US2019-12-310001645113country:CH2020-03-310001645113country:CH2019-12-310001645113country:IL2020-03-310001645113country:IL2019-12-310001645113country:DE2020-03-310001645113country:DE2019-12-310001645113nvcr:OthersCountriesMember2020-03-310001645113nvcr:OthersCountriesMember2019-12-310001645113country:US2020-01-012020-03-310001645113country:US2019-01-012019-03-310001645113country:US2019-01-012019-12-310001645113country:DE2020-01-012020-03-310001645113country:DE2019-01-012019-03-310001645113country:DE2019-01-012019-12-310001645113nvcr:EMEAExculdingGermanyMember2020-01-012020-03-310001645113nvcr:EMEAExculdingGermanyMember2019-01-012019-03-310001645113nvcr:EMEAExculdingGermanyMember2019-01-012019-12-310001645113country:JP2020-01-012020-03-310001645113country:JP2019-01-012019-03-310001645113country:JP2019-01-012019-12-310001645113country:CN2020-01-012020-03-310001645113country:CN2019-01-012019-03-310001645113country:CN2019-01-012019-12-310001645113us-gaap:LicenseMembernvcr:LicenseAndCollaborationAgreementMemberus-gaap:AccountingStandardsUpdate201409Member2020-01-012020-03-310001645113nvcr:LicenseAndCollaborationAgreementMember2020-03-310001645113us-gaap:NaturalDisastersAndOtherCasualtyEventsMember2020-01-012020-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-37565

NovoCure Limited

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Jersey | | 98-1057807 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

No. 4 The Forum

Grenville Street

St. Helier, Jersey JE2 4UF

(Address of principal executive offices, including zip code)

+44 (0) 15 3475 6700

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

_______________________________________________________

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary Shares, no par value | NVCR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding as of April 23, 2020 |

| Ordinary shares, no par value | | 100,440,295 Shares |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and research and development related to our Tumor Treating Fields delivery systems marketed under various brand names, including Optune, Optune Lua and software and systems to support and optimize the delivery of Tumor Treating Fields (collectively, the “Products”). In particular, these forward-looking statements include, among others, statements about:

•our research and development, clinical trial and commercialization activities and projected expenditures;

•the further commercialization of our Products for current and future indications;

•our business strategies and the expansion of our sales and marketing efforts in the United States and in other countries;

•the market acceptance of our Products for current and future indications by patients, physicians, third-party payers and others in the healthcare and scientific community;

•our plans to pursue the use of our Products for the treatment of solid tumor cancers other than glioblastoma multiforme (“GBM”) and malignant pleural mesothelioma (“MPM”);

•our estimates regarding revenues, expenses, capital requirements and needs for additional financing;

•our ability to obtain regulatory approvals for the use of our Products in cancers other than GBM and MPM;

•our ability to acquire from third-party suppliers the supplies needed to manufacture our Products;

•our ability to manufacture adequate supply;

•our ability to secure and maintain adequate coverage from third-party payers to reimburse us for our Products for current and future indications;

•our ability to receive payment from third-party payers for use of our Products for current and future indications;

•our ability to maintain and develop our intellectual property position;

•our ability to manage the risks and business disruptions associated with the COVID-19 (coronavirus) pandemic;

•our cash needs; and

•our prospects, financial condition and results of operations.

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Factors which may cause such differences to occur include those risks and uncertainties set forth under Part I, Item 1A., “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 filed on February 27, 2020 (the “2019 10-K”) and in Part II, Item 1A of this Quarterly Report on Form 10-Q, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission. In our prior filings, including our 2019 10-K, references to

NovoTTF-100L now refer to Optune Lua. We do not intend to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

TRADEMARKS

This Quarterly Report on Form 10-Q includes trademarks of NovoCure Limited and other persons. All trademarks or trade names referred to herein are the property of their respective owners.

NovoCure Limited

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | | | | | | | | |

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS | | | |

| U.S. dollars in thousands (except share data) | | | |

| March 31,

2020 | | December 31, 2019 |

| Unaudited | | Audited |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 181,919 | | | $ | 177,321 | |

| Short-term investments | 149,349 | | | 148,769 | |

| Restricted cash | 786 | | | 2,095 | |

| Trade receivables | 65,139 | | | 58,859 | |

| Receivables and prepaid expenses | 42,483 | | | 29,202 | |

| Inventories | 22,502 | | | 23,701 | |

| Total current assets | 462,178 | | | 439,947 | |

| LONG-TERM ASSETS: | | | |

| Property and equipment, net | 9,778 | | | 9,342 | |

| Field equipment, net | 8,467 | | | 7,684 | |

| Right-of-use assets, net | 17,201 | | | 17,571 | |

| Other long-term assets | 4,824 | | | 4,904 | |

| Total long-term assets | 40,270 | | | 39,501 | |

| TOTAL ASSETS | $ | 502,448 | | | $ | 479,448 | |

| | | |

| The accompanying notes are an integral part of these unaudited consolidated financial statements. | | | |

| | | | | | | | | | | |

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS | | | |

| U.S. dollars in thousands (except share data) | | | |

| March 31,

2020 | | December 31, 2019 |

| Unaudited | | Audited |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Trade payables | $ | 40,408 | | | $ | 36,925 | |

| Other payables, lease liabilities and accrued expenses | 43,795 | | | 49,386 | |

| Total current liabilities | 84,203 | | | 86,311 | |

| LONG-TERM LIABILITIES: | | | |

| Long-term loan, net of discount and issuance costs | 149,465 | | | 149,424 | |

| Deferred revenue | 8,772 | | | 7,807 | |

| Long-term leases | 13,274 | | | 14,140 | |

| Employee benefits | 4,519 | | | 3,754 | |

| Other long-term liabilities | 267 | | | 222 | |

| Total long-term liabilities | 176,297 | | | 175,347 | |

| TOTAL LIABILITIES | 260,500 | | | 261,658 | |

| | | |

| COMMITMENTS AND CONTINGENCIES | | | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

| Share capital - | | | |

Ordinary shares no par value, unlimited shares authorized; issued and outstanding: 100,362,973 shares and 99,528,435 shares at March 31, 2020 (unaudited) and December 31, 2019, respectively | — | | | — | |

| Additional paid-in capital | 892,510 | | | 871,442 | |

| Accumulated other comprehensive income (loss) | (3,629) | | | (2,767) | |

| Retained earnings (accumulated deficit) | (646,933) | | | (650,885) | |

| TOTAL SHAREHOLDERS' EQUITY | 241,948 | | | 217,790 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 502,448 | | | $ | 479,448 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | |

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS | | | | | | | | | |

| U.S. dollars in thousands (except share and per share data) | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31, |

| 2020 | | 2019 | | | | | | 2019 |

| Unaudited | | | | | | | | Audited |

| Net revenues | $ | 101,828 | | | $ | 73,309 | | | | | | | $ | 351,318 | |

| Cost of revenues | 24,496 | | | 19,814 | | | | | | | 88,606 | |

| Gross profit | 77,332 | | | 53,495 | | | | | | | 262,712 | |

| | | | | | | | | |

| Operating costs and expenses: | | | | | | | | | |

| Research, development and clinical trials | 25,271 | | | 17,042 | | | | | | | 79,003 | |

| Sales and marketing | 28,834 | | | 22,333 | | | | | | | 96,675 | |

| General and administrative | 26,608 | | | 20,238 | | | | | | | 87,948 | |

| Total operating costs and expenses | 80,713 | | | 59,613 | | | | | | | 263,626 | |

| | | | | | | | | |

| Operating income (loss) | (3,381) | | | (6,118) | | | | | | | (914) | |

| Financial expenses (income), net | 2,432 | | | 2,371 | | | | | | | 7,910 | |

| | | | | | | | | |

| Income (loss) before income tax | (5,813) | | | (8,489) | | | | | | | (8,824) | |

| Income tax | (9,765) | | | 3,661 | | | | | | | (1,594) | |

| Net income (loss) | $ | 3,952 | | | $ | (12,150) | | | | | | | $ | (7,230) | |

| | | | | | | | | |

| Basic net income (loss) per ordinary share | $ | 0.04 | | | $ | (0.13) | | | | | | | $ | (0.07) | |

Weighted average number of ordinary shares used in computing basic net income (loss) per share | 99,877,567 | | | 94,811,282 | | | | | | | 97,237,549 | |

| | | | | | | | | |

| Diluted net income (loss) per ordinary share | $ | 0.04 | | | $ | (0.13) | | | | | | | $ | (0.07) | |

| Weighted average number of ordinary shares used in computing diluted net income (loss) per share | 108,100,623 | | | 94,811,282 | | | | | | | 97,237,549 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) | | | | | | | | | |

| U.S. dollars in thousands | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31, |

| 2020 | | 2019 | | | | | | 2019 |

| Unaudited | | | | | | | | Audited |

| Net income (loss) | $ | 3,952 | | | $ | (12,150) | | | | | | | $ | (7,230) | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | |

| Change in foreign currency translation adjustments | (200) | | | (261) | | | | | | | (304) | |

| Pension benefit plan | (662) | | | (81) | | | | | | | (1,063) | |

| Total comprehensive income (loss) | $ | 3,090 | | | $ | (12,492) | | | | | | | $ | (8,597) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY | | | | | | | | | |

| U.S. dollars in thousands (except share data) | | | | | | | | | |

| Ordinary shares | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained earnings (accumulated

deficit) | | Total shareholders'

equity |

| | | | | | | | | |

| Balance as of December 31, 2019 (audited) | 99,528,435 | | | $ | 871,442 | | | $ | (2,767) | | | $ | (650,885) | | | $ | 217,790 | |

| | | | | | | | | |

| Share-based compensation to employees | — | | | 16,557 | | | — | | | — | | | 16,557 | |

| Exercise of options and vested RSUs | 834,538 | | | 4,511 | | | — | | | — | | | 4,511 | |

Other comprehensive income (loss), net of tax benefit of $0 | — | | | — | | | (862) | | | — | | | (862) | |

| Net income (loss) | — | | | — | | | | | | 3,952 | | | 3,952 | |

| Balance as of March 31, 2020 (unaudited) | 100,362,973 | | | | $ | 892,510 | | | | $ | (3,629) | | | | $ | (646,933) | | | | $ | 241,948 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ordinary shares | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained earnings (accumulated

deficit) | | Total shareholders'

equity |

| | | | | | | | | |

| Balance as of December 31, 2018 (audited) | 93,254,185 | | | $ | 757,314 | | | $ | (1,400) | | | $ | (643,655) | | | $ | 112,259 | |

| | | | | | | | | |

| Share-based compensation to employees | — | | | 9,649 | | | — | | | — | | | 9,649 | |

| Exercise of options and warrants and vested RSUs | 2,438,612 | | | 16,978 | | | — | | | — | | | 16,978 | |

Other comprehensive income (loss), net of tax benefit of $11 | — | | | — | | | (342) | | | — | | | (342) | |

| Net income (loss) | — | | | — | | | — | | | (12,150) | | | (12,150) | |

| Balance as of March 31, 2019 (unaudited) | 95,692,797 | | | $ | 783,941 | | | $ | (1,742) | | | $ | (655,805) | | | $ | 126,394 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | |

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | |

| U.S. dollars in thousands | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31, |

| 2020 | | 2019 | | | | | | 2019 |

| Unaudited | | | | | | | | Audited |

| Cash flows from operating activities: | | | | | | | | | |

| Net income (loss) | $ | 3,952 | | | $ | (12,150) | | | | | | | $ | (7,230) | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | | |

| Depreciation and amortization | 1,888 | | | | 1,929 | | | | | | | | 8,460 | |

| Asset write-downs and impairment of field equipment | 6 | | | | 75 | | | | | | | | 398 | |

| Share-based compensation | 16,557 | | | | 9,649 | | | | | | | | 52,416 | |

| Foreign currency remeasurement loss (gain) | (7) | | | | — | | | | | | | | (917) | |

| Decrease (increase) in accounts receivables | (19,718) | | | | (2,036) | | | | | | | | (36,496) | |

| Amortization of discount (premium) | (539) | | | | (578) | | | | | | | | (2,176) | |

| Decrease (increase) in inventories | 1,147 | | | | (1,583) | | | | | | | | (1,159) | |

| Decrease (increase) in other long-term assets | 1,235 | | | | (86) | | | | | | | | 3,446 | |

| Increase (decrease) in accounts payables and accrued expenses | (2,339) | | | | 2,246 | | | | | | | | 16,883 | |

| Increase (decrease) in other long-term liabilities | (225) | | | | (1,781) | | | | | | | | (7,006) | |

| Net cash provided by (used in) operating activities | $ | 1,957 | | | $ | (4,315) | | | | | | | $ | 26,620 | |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | |

| Purchase of property, equipment and field equipment | $ | (3,112) | | | $ | (2,325) | | | | | | | $ | (10,485) | |

| Proceeds from maturity of short-term investments | — | | | 105,661 | | | | | | | 420,661 | |

| Purchase of short-term investments | — | | | (104,325) | | | | | | | (461,843) | |

| Net cash provided by (used in) investing activities | $ | (3,112) | | | $ | (989) | | | | | | | $ | (51,667) | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | |

| Proceeds from issuance of shares, net | $ | — | | | $ | — | | | | | | | $ | 2,467 | |

| Repayment of long-term loan | (8) | | | (8) | | | | | | | (31) | |

| Exercise of options and warrants | 4,511 | | | 16,978 | | | | | | | 59,245 | |

| Net cash provided by (used in) financing activities | $ | 4,503 | | | $ | 16,970 | | | | | | | $ | 61,681 | |

| | | | | | | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | $ | (59) | | | $ | (261) | | | | | | | $ | 26 | |

| | | | | | | | | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 3,289 | | | 11,405 | | | | | | | 36,660 | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 179,416 | | | 142,756 | | | | | | | 142,756 | |

| | | | | | | | | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 182,705 | | | $ | 154,161 | | | | | | | $ | 179,416 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31, |

| 2020 | | 2019 | | | | | | 2019 |

| Unaudited | | | | | | | | Audited |

| Supplemental cash flow activities: | | | | | | | | | |

| Cash paid during the period for: | | | | | | | | | |

| Income taxes | $ | 2,209 | | | $ | 3,033 | | | | | | | $ | 11,241 | |

| Interest | $ | 3,415 | | | $ | 3,379 | | | | | | | $ | 13,699 | |

| Non-cash activities in accordance with of ASC-842: | | | | | | | | | |

| Right-of-use assets obtained in exchange for lease obligations | $ | 783 | | | $ | 15,733 | | | | | | | $ | 22,943 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

NOVOCURE LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

NOTE 1: ORGANIZATION AND BASIS OF PRESENTATION

Organization. NovoCure Limited (including its consolidated subsidiaries, the “Company”) was incorporated in the Bailiwick of Jersey and is principally engaged in the development, manufacture and commercialization of Tumor Treating Fields delivery systems, including Optune and Optune Lua, for the treatment of solid tumors. The Company has received regulatory approval from the U.S. Food and Drug Administration (“FDA”) under the Premarket Approval (“PMA") pathway and regulatory approvals and clearances in certain other countries for Optune to treat adult patients with glioblastoma multiforme (“GBM”). The Company also has received FDA approval under the Humanitarian Device Exemption pathway to market Optune Lua for unresectable, locally advanced or metastatic malignant pleural mesothelioma (“MPM”) in combination with standard chemotherapies.

Financial statement preparation. The accompanying unaudited consolidated financial statements include the accounts of the Company and intercompany accounts and transactions have been eliminated. In the opinion of the Company’s management, the consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation for the periods presented. The preparation of these consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in these consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. These consolidated financial statements and accompanying notes should be read in conjunction with the Company’s annual consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 10-K”) filed with the Securities and Exchange Commission on February 27, 2020.

The significant accounting policies applied in the audited annual consolidated financial statements of the Company as disclosed in the 2019 10-K are applied consistently in these unaudited interim consolidated financial statements, except as noted below:

Recently Adopted Accounting Pronouncements.

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 amends the impairment model to utilize an expected loss methodology in place of the currently used incurred loss methodology, which will result in the more timely recognition of losses. ASU 2016-13 also applies to employee benefit plan accounting, with an effective date of the first quarter of fiscal 2020. The Company adopted the standard effective as of January 1, 2020, and the adoption of this standard did not have an impact on the Company's consolidated financial statements.

In August 2018, FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. The amendments in this ASU align the requirements for capitalizing implementation costs incurred in a hosting arrangement with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. The implementation costs incurred in a hosting arrangement that is a service contract should be presented as a prepaid asset in the balance sheet and expensed over the term of the hosting arrangement to the same line item in the statement of income as the costs related to the hosting fees. The Company adopted the standard effective as of January 1, 2020, and the adoption of this standard did not have an impact on the Company's consolidated financial statements.

NOTE 2: CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

Cash equivalents include items almost as liquid as cash, such as certificates of deposit and time deposits with maturity periods of three months or less when purchased.

| | | | | | | | | | | |

| March 31,

2020 | | December 31,

2019 |

| Unaudited | | Audited |

| Cash | $ | 8,192 | | | $ | 18,377 | |

| Money market funds | 173,727 | | | 158,944 | |

| Total cash and cash equivalents | $ | 181,919 | | | $ | 177,321 | |

The Company invests in marketable U.S. Treasury Bills (“T-bills”) that are classified as held-to-maturity securities. The amortized cost and recorded basis of the T-bills are presented as short-term investments.

| | | | | | | | | | | |

| March 31,

2020 | | December 31,

2019 |

| | Unaudited | | Audited |

| Short-term investments | $ | 149,349 | | | $ | 148,769 | |

Quoted market prices were applied to determine the fair value of cash equivalents and short-term investments, therefore they are categorized as Level 1 in accordance with Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures.” The estimated fair value of the Company’s short-term investments as of March 31, 2020 and December 31, 2019 was $149,951 and $148,738, respectively.

NOTE 3: INVENTORIES

Inventories are stated at the lower of cost or net realizable value. The weighted average methodology is applied to determine cost. As of March 31, 2020 and December 31, 2019, the Company’s inventories were composed of:

| | | | | | | | | | | |

| March 31,

2020 | | December 31,

2019 |

| | Unaudited | | Audited |

| Raw materials | $ | 3,889 | | | $ | 3,912 | |

| Work in progress | 7,498 | | | 6,482 | |

| Finished products | 11,115 | | | 13,308 | |

| Total | $ | 22,502 | | | $ | 23,701 | |

NOTE 4: COMMITMENTS AND CONTINGENT LIABILITIES

Operating Leases. The facilities of the Company are leased under various operating lease agreements for periods, including options for extensions, ending no later than 2030. The Company also leases motor vehicles under various operating leases, which expire on various dates, the latest of which is in 2023.

Pledged deposits and bank guarantees. As of March 31, 2020 and December 31, 2019, the Company pledged bank deposits of $1,612 and $1,557, respectively, to cover bank guarantees in respect of its leases of operating facilities and obtained bank guarantees for the fulfillment of the Company’s lease and other contractual commitments of $1,387 and $1,390, respectively.

NOTE 5: SHARE OPTION PLAN AND ESPP

In September 2015, the Company adopted the 2015 Omnibus Incentive Plan (the “2015 Plan”). Under the 2015 Plan, the Company can issue various types of equity compensation awards such as share options, restricted shares, performance shares, restricted share units (“RSUs”), performance-based share units (“PSUs”), long-term cash awards and other share-based awards.

Options granted under the 2015 Plan generally have a four-year vesting period and expire ten years after the date of grant. Options granted under the 2015 Plan that are canceled or forfeited before expiration become available for future grants. RSUs granted under the 2015 Plan generally vest over a three year period. PSUs granted under the 2015 Plan generally vest between a three and six year period as performance targets are attained. RSUs and PSUs granted under the 2015 Plan that are canceled before expiration become available for future grants. As of March 31, 2020, 11,430,386 ordinary shares were available for grant under the 2015 Plan.

A summary of the status of the Company’s option plans as of March 31, 2020 and changes during the period then ended is presented below:

| | | | | | | | | | | |

| Three months ended March 31, 2020 | | |

| Unaudited | | |

| Number

of options | | Weighted

average

exercise

price |

| Outstanding at beginning of year | 10,350,810 | | | $ | 20.40 | |

| Granted | 671,530 | | | 69.37 | |

| Exercised | (291,088) | | | 15.52 | |

| Forfeited and canceled | (6,025) | | | 41.39 | |

| Outstanding as of March 31, 2020 | 10,725,227 | | | $ | 23.58 | |

| | | |

| Exercisable options | 4,572,967 | | | $ | 16.17 | |

For the three months, ended March 31, 2020, options to purchase 291,088 ordinary shares were exercised, resulting in the issuance of 291,088 ordinary shares.

A summary of the status of the Company’s RSUs and PSUs as of March 31, 2020 and changes during the period then ended is presented below.

| | | | | | | | | | | |

| Three months ended March 31, 2020 | | |

| Unaudited | | |

| Number

of RSU/PSUs | | Weighted

average

grant date fair value |

| Unvested at beginning of year | 1,474,395 | | | $ | 30.26 | |

| Granted (1) | 3,747,545 | | | 54.07 | |

| Vested | (543,450) | | | 22.10 | |

| Forfeited and cancelled | (3,194) | | | 52.84 | |

| Unvested as of March 31, 2020 | 4,675,296 | | | 50.28 | |

(1) Represents RSUs and PSUs granted on March 3, 2020 as follows: (a) 527,041 RSUs that are expensed based on their grant date fair value of $69.37 per RSU over the service period of three years; (b) 408,539 PSUs that have a mix of service and clinical milestone vesting conditions, cliff-vest in pre-determined increments, and that have been deemed probable to vest and are therefore expensed beginning in the first quarter of 2020 based on their grant date fair value of $69.37 per PSU; (c) 108,113 PSUs that have a mix of service and clinical milestone vesting conditions, cliff-vest in pre-determined increments, and that will begin to be expensed at $69.37 per PSU when it becomes probable that the milestones will be achieved, and (d) 2,703,852 PSUs that have a mix of service, market and other milestone performance vesting conditions (including but not limited to new FDA approved indications), cliff-vest in pre-determined increments, and that will begin to be expensed at $48.16 per PSU when it becomes probable that the milestones will be achieved. The PSUs vest no earlier than three years from the date of grant and no later than six years from the date of grant. The grant date fair value of PSUs with market vesting conditions were obtained by using Monte Carlo simulations. All RSUs and PSUs are expensed in accordance with ASC 718.

In September 2015, the Company adopted an employee share purchase plan (“ESPP”) to encourage and enable eligible employees to acquire ownership of the Company’s ordinary shares purchased through accumulated payroll

deductions on an after-tax basis. In the United States, the ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code and the provisions of the ESPP are construed in a manner consistent with the requirements of such section. As of March 31, 2020, 4,050,089 ordinary shares were available to be purchased by eligible employees under the ESPP and 414,559 shares had been issued under the ESPP.

The fair value of share-based awards was estimated using the Black-Scholes model for all equity grants. For market condition awards, the Company also applied the Monte-Carlo simulation model. We assessed fair value using the following underlying assumptions:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | Year ended December 31,

2019 |

| 2020 | | 2019 | | |

| Unaudited | | | | Audited |

| Stock Option Plans | | | | | |

| | | | | |

| | | | | |

| | | | | |

| Expected term (years) | 6.25 | | 6.23 | | 5.50-6.5 |

| Expected volatility | 54% | | 55% | | 55%-61% |

| Risk-free interest rate | 0.86% | | 2.40% | | 1.73%-2.40% |

| Dividend yield | 0.00 | % | | 0.00 | % | | 0.00 | % |

| ESPP | | | | | |

| Expected term (years) | 0.50 | | 0.50 | | 0.50 |

| Expected volatility | 47% | | | 62% | | 44%-62% |

| Risk-free interest rate | 1.57% | | 2.51% | | 2.10%-2.51% |

| | | | | |

| | | | | |

| Dividend yield | 0.00 | % | | 0.00 | % | | 0.00 | % |

The total non-cash share-based compensation expense related to all of the Company’s equity-based awards recognized for the three months ended March 31, 2020 and 2019 and the year ended December 31, 2019 was:

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31,

2019 |

| 2020 | | 2019 | | | | | | |

| Unaudited | | | | | | | | Audited |

| Cost of revenues | $ | 590 | | | $ | 426 | | | | | | | $ | 2,231 | |

| Research, development and clinical trials | 3,394 | | | 1,188 | | | | | | | 7,570 | |

| Sales and marketing | 3,616 | | | 1,962 | | | | | | | 11,897 | |

| General and administrative | 8,957 | | | 6,073 | | | | | | | 30,718 | |

| Total share-based compensation expense | $ | 16,557 | | | $ | 9,649 | | | | | | | $ | 52,416 | |

NOTE 6: EARNINGS PER SHARE

Basic net income (loss) per share is computed based on the weighted average number of ordinary shares outstanding during each period. Diluted net income per share is computed based on the weighted average number of ordinary shares outstanding during the period, plus potential dilutive shares considered outstanding during the period, in accordance with ASC 260-10, as determined under the treasury stock method. Basic and diluted net loss per ordinary share was the same for each period presented, except for the three months ended March 31, 2020, as the inclusion of all potential dilutive shares (deriving from options, RSUs and the ESPP) outstanding would be anti-dilutive.

The calculation of diluted earnings per share includes the weighted average of potentially dilutive securities, which consists of ordinary shares underlying outstanding share options, RSUs, performance share units and the ESPP. The effect of these dilutive securities under the treasury stock method was approximately 8,223,056 shares for the three months ended March 31, 2020.

The Company excluded 352,291 share options under the treasury stock method from the computation of dilutive net income per share for the three months ended March 31, 2020 because including them would had have an anti-dilutive effect.

NOTE 7: SUPPLEMENTAL INFORMATION

The Company operates in a single reportable segment.

The following table presents long-lived assets by location:

| | | | | | | | | | | |

| March 31,

2020 | | December 31,

2019 |

| | Unaudited | | Audited |

| United States | $ | 9,562 | | | $ | 8,896 | |

| Switzerland | 2,472 | | | 3,067 | |

| Israel | 3,366 | | | 2,753 | |

| Germany | 711 | | | 729 | |

| Others | 2,134 | | | 1,581 | |

| Total long-term assets | $ | 18,245 | | | $ | 17,026 | |

The Company’s revenues by geographic region, based on the customer’s location, are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | | | Year ended December 31,

2019 |

| 2020 | | 2019 | | | | | | |

| Unaudited | | | | | | | | Audited |

| United States | $ | 69,259 | | | $ | 46,604 | | | | | | | $ | 232,805 | |

| EMEA: | | | | | | | | | | | | |

| Germany | 21,802 | | | 20,238 | | | | | | | 86,564 | |

| Other EMEA | 2,674 | | | 2,282 | | | | | | | 8,782 | |

| Japan | 6,451 | | | 3,370 | | | | | | | 17,912 | |

| Greater China (1) | 1,642 | | | 815 | | | | | | | 5,255 | |

| Total net revenues | $ | 101,828 | | | $ | 73,309 | | | | | | | $ | 351,318 | |

(1) Reflects revenue recognized in accordance with a License and Collaboration Agreement (the "Zai Agreement") between us and Zai Lab (Shanghai) Co., Ltd. (“Zai”), dated September 10, 2018, pursuant to which Zai is commercializing Optune in China, Hong Kong, Macau and Taiwan (referred to in this table as “Greater China”) and also includes $90 recognized during the three months ended March 31, 2020 from reaching a clinical trial milestone during the period. The full amount of the milestone payable is $2,000 that will be recognized over the remainder of the Zai performance period ending in September 2024. For additional information, see Note 12 to the Consolidated Financial Statements in our 2019 10-K.

NOTE 8: INCOME TAX

In accordance with the changes to the U.S. tax code enacted in response to the economic impacts of COVID-19 signed into legislation on March 27, 2020 the Company recorded a net tax benefit of $11,269 in the first quarter of 2020. The benefit results from net operating loss carry-backs in the U.S.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide information to assist you in better understanding and evaluating our financial condition and results of operations. We encourage you to read this MD&A in conjunction with our unaudited consolidated financial statements and the notes thereto for the period ended March 31, 2020 included in Part I, Item 1 of this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. Please refer to the information under the heading “Cautionary Note Regarding Forward-Looking Statements” elsewhere in this report. References to the words “we,” “our,” “us,” and the “Company” in this report refer to NovoCure Limited, including its consolidated subsidiaries.

Overview

We are a global oncology company with a proprietary platform technology called Tumor Treating Fields, the use of electric fields tuned to specific frequencies to disrupt solid tumor cancer cell division. Our key priorities are to drive adoption of Optune and Optune Lua, our commercial Tumor Treating Fields delivery systems (collectively, our “Products”), and to advance clinical and product development programs intended to extend overall survival in some of the most aggressive forms of cancer.

Optune is approved by the United States Food and Drug Administration (“FDA”) under the premarket approval (“PMA”) pathway for the treatment of adult patients with newly diagnosed glioblastoma multiforme (“GBM”) in combination with temozolomide, a chemotherapy drug, and for adult patients with GBM following confirmed recurrence after chemotherapy as monotherapy treatment. We also have approval to market Optune for the treatment of GBM in the European Union (“EU”), Japan and certain other countries. Optune Lua is approved by the FDA under the humanitarian device exemption (“HDE”) pathway to treat malignant pleural mesothelioma (“MPM") in combination with standard chemotherapies. We have submitted an application to our notified body for CE Certification for Optune Lua in the EU.

We market Optune in the U.S., Austria, Germany, Israel, Japan, Sweden and Switzerland, which we refer to as our active markets, and we market Optune Lua in the U.S. With respect to the treatment of GBM, our sales and marketing efforts are principally focused on driving adoption with both neuro-oncologists and radiation oncologists. With respect to the treatment of MPM, our commercial efforts are principally focused on generating awareness with radiation oncologists and on establishing a dialogue with third-party payors around access to Optune Lua. We are expanding our commercial operations into France with an initial focus on developing key opinion leader relationships in GBM and establishing a path to reimbursement for our products.

We continue to work with payers to expand access to Optune for patients with GBM. In January 2020, the State of Israel Ministry of Health added Optune in combination with temozolomide to the Israeli medical services basket, establishing national reimbursement for Optune in newly diagnosed GBM in Israel. In March 2020, the German Federal Joint Committee (“G-BA”), updated its directive for Contracted Medical Care to include Tumor Treating Fields, establishing national reimbursement for Optune in newly diagnosed GBM in Germany.

As of March 31, 2020, the total number of contracted GBM lives was approximately 263 million in the U.S., approximately 111 million in our active EMEA markets and approximately 127 million in Japan.

Our general business operations and clinical trials have been impacted by the global COVID-19 pandemic, and we anticipate that it will continue to impact us in the near term. We are following the guidance of the World Health Organization, the U.S. Centers for Disease Control and Prevention, and local health authorities and are working to minimize the spread of COVID-19 through work-at-home policies for employees who are not directly involved in operations or patient support. Our field-based patient support teams continue to conduct in-person patient visits when possible and leverage technology to conduct new patient starts and provide ongoing patient support visits, virtually. We are respecting any restrictions on external visitors at the cancer centers, hospitals and research institutions we serve and utilizing telephone and web-based technologies to engage healthcare professionals and enable information sharing. Clinical trial site expansion has been materially delayed as clinical sites devote significant resources to COVID-19. We are actively monitoring the various components of our global supply chain in an effort to ensure we maintain adequate inventories of all key products. At this time, there is no material impact to our global supply chain. The pandemic did not have a material adverse effect on our financial results in the first quarter 2020.

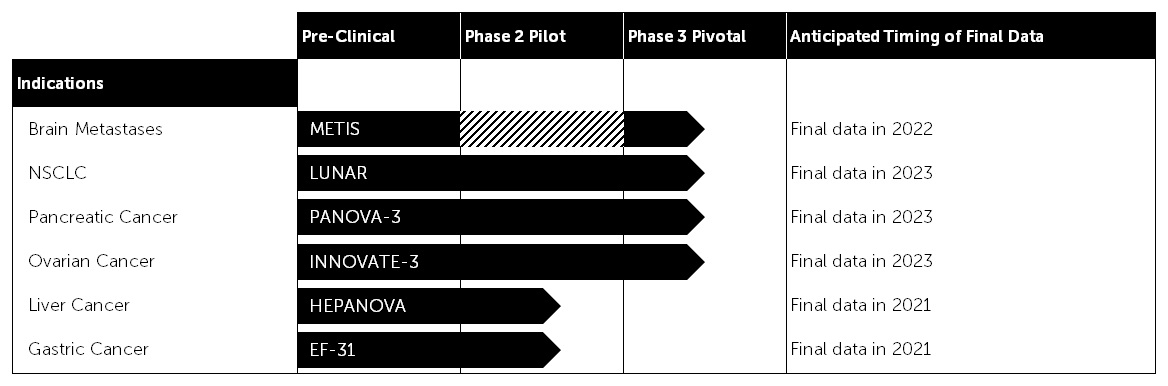

We believe the mechanism of action behind Tumor Treating Fields therapy may be broadly applicable to solid tumor cancers. Currently, we are conducting phase 3 pivotal trials evaluating the use of Tumor Treating Fields in brain metastases, non-small cell lung cancer (“NSCLC”), pancreatic cancer and ovarian cancer. We are also conducting phase 2 pilot trials evaluating the use of Tumor Treating Fields in liver cancer and gastric cancer. We plan to initiate additional randomized trials in GBM in order to further advance the scientific evidence supporting the use of Optune in GBM and to gather additional information about Optune's optimal use. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of Tumor Treating Fields for additional solid tumor indications.

The enrollment timelines for our METIS, LUNAR and PANOVA-3 phase 3 pivotal trials are reliant on clinical trial site expansion. We are evaluating the initiation of new clinical trial sites using a risk-based framework in accordance with local regulations and site policies, but clinical trial site expansion has been materially delayed as clinical sites devote significant resources to the COVID-19 global pandemic.

The European Network for Gynaecological Oncological Trial Groups ("ENGOT") and The GOG Foundation, Inc. ("GOG"), third-party clinical trial networks, are collaborating with us on our INNOVATE-3 phase 3 pivotal trial, which we believe is facilitating enrollment at leading cancer centers. Notwithstanding delays in clinical trial site expansion related to the COVID-19 global pandemic, INNOVATE-3 patient enrollment trends continued to outpace our expectations in the first quarter, driving an acceleration in our anticipated enrollment timeline.

We now expect data from the METIS phase 3 pivotal trial in 2022, data from the LUNAR, PANOVA-3 and INNOVATE-3 phase 3 pivotal trials in 2023 with interim analyses in 2021 and data from the EF-31 phase 2 pilot trial in 2021. The table below presents the current status of the ongoing or completed clinical trials in our pipeline and anticipated timing of final data.

Our therapy is delivered through a medical device, and we have several product development programs underway intended to improve efficacy and usability for patients. We believe we have a robust patent and intellectual property portfolio, with over 180 issued patents and numerous patent applications pending worldwide. We believe we own global commercialization rights to our Products in oncology and that we are well-positioned to extend those rights into the future as we continue to find innovative ways to improve our Products.

In 2018, we entered into a License and Collaboration Agreement (the “Zai Agreement”) between us and Zai Lab (Shanghai) Co., Ltd. (“Zai”) pursuant to which we granted Zai a license to commercialize Optune in China, Hong Kong, Macau and Taiwan (“Greater China”). The Zai Agreement also establishes a development partnership intended to accelerate the development of Tumor Treating Fields in multiple solid tumor indications. For additional information, see Note 12 to the Consolidated Financial Statements in our 2019 10-K.

We view our operations and manage our business in one operating segment. For the three months ended March 31, 2020, our net revenues were $101.8 million. Our net income for the three months ended March 31, 2020 was $4.0 million. As of March 31, 2020, we had an accumulated deficit of $646.9 million. Our accumulated deficit primarily resulted from costs incurred in connection with our preclinical and clinical trial programs, costs incurred to commercialize our Products and general and administrative costs necessary to operate as a global oncology business.

Critical Accounting Policies and Estimates

In accordance with U.S. generally accepted accounting principles (“GAAP”), in preparing our financial statements, we must make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of net revenues and expenses during the reporting period. We develop and periodically change these estimates and assumptions based on historical experience and on various other factors that we believe are reasonable under the circumstances. Actual results may differ from these estimates.

The critical accounting policies requiring estimates, assumptions and judgments that we believe have the most significant impact on our consolidated financial statements can be found in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 10-K”). For additional information, see Note 1 to our unaudited consolidated financial statements in Part I, Item 1 of this Quarterly Report. There were no other material changes to our critical accounting policies and estimates as compared to the critical accounting policies and estimates described in our 2019 10-K.

Commentary on Results of Operations

Net revenues. Our revenues are primarily derived from patients using our Products in our active markets. We charge for treatment with our Products on a monthly basis. Our potential net revenues per patient are determined by our ability to secure payment, the monthly fee we collect and the number of months that the patient remains on therapy.

We also receive revenues pursuant to the Zai Agreement. For additional information regarding the Zai Agreement, see Note 12 to the Consolidated Financial Statements in our 2019 10-K.

Cost of revenues. We contract with third parties to manufacture our Products. Our cost of revenues is primarily comprised of the following:

•disposable transducer arrays;

•depreciation expense for the field equipment, including the electric field generator used by patients; and

•personnel, warranty and overhead costs such as facilities, freight and depreciation of property, plant and equipment associated with managing our inventory, warehousing and order fulfillment functions.

Operating expenses. Our operating expenses consist of research, development and clinical trials, sales and marketing and general and administrative expenses. Personnel costs are a significant component for each category of operating expenses and consist of wages, benefits and bonuses. Personnel costs also include share-based compensation.

Financial expenses, net. Financial expenses, net primarily consists of credit facility interest expense and related debt issuance costs, interest income from cash balances and short-term investments and gains (losses) from foreign currency transactions. Our reporting currency is the U.S. dollar. We have historically held substantially all of our cash balances in U.S. dollar denominated accounts to minimize the risk of translational currency exposure.

Results of Operations

The following discussion provides an analysis of our results of operations and reasons for material changes therein for the three months ended March 31, 2020 as compared to the three months ended March 31, 2019.

Three months ended March 31, 2020 compared to three months ended March 31, 2019

The following table sets forth our consolidated statements of operations data:

| | | | | | | | | | | |

| Three months ended March 31, | | |

| 2020 | | 2019 |

| Unaudited | | |

| Net revenues | $ | 101,828 | | | | $ | 73,309 | |

| Cost of revenues | 24,496 | | | | 19,814 | |

| Gross profit | 77,332 | | | | 53,495 | |

| | | | | | |

| Operating costs and expenses: | | | | | | |

| Research, development and clinical trials | 25,271 | | | | 17,042 | |

| Sales and marketing | 28,834 | | | | 22,333 | |

| General and administrative | 26,608 | | | | 20,238 | |

| Total operating costs and expenses | 80,713 | | | | 59,613 | |

| | | | | | |

| Operating income (loss) | (3,381) | | | | (6,118) | |

| Financial expenses (income), net | 2,432 | | | | 2,371 | |

| | | | | | |

| Income (loss) before income taxes | (5,813) | | | | (8,489) | |

| Income taxes | (9,765) | | | | 3,661 | |

| Net income (loss) | $ | 3,952 | | | | $ | (12,150) | |

| | | | | | |

| Basic net income (loss) per ordinary share | $ | 0.04 | | | | $ | (0.13) | |

| Weighted average number of ordinary shares used in computing basic net income (loss) per share | 99,877,567 | | | | 94,811,282 | |

| Diluted net income (loss) per ordinary share | $ | 0.04 | | | | $ | (0.13) | |

| Weighted average number of ordinary shares used in computing diluted net income (loss) per share | 108,100,623 | | | | 94,811,282 | |

The following table details the share-based compensation expense included in costs and expenses:

| | | | | | | | | | | |

| Three months ended March 31, | | |

| 2020 | | 2019 |

| Unaudited | | |

| Cost of revenues | $ | 590 | | | | $ | 426 | |

| Research, development and clinical trials | 3,394 | | | | 1,188 | |

| Sales and marketing | 3,616 | | | | 1,962 | |

| General and administrative | 8,957 | | | | 6,073 | |

| Total share-based compensation expense | $ | 16,557 | | | | $ | 9,649 | |

Key performance indicators

We believe certain commercial operating statistics are useful to investors in evaluating our commercial business as they help our management and investors evaluate and compare the adoption of our Products from period to period. The number of active patients on therapy is our principal revenue driver. An "active patient" is a patient who is receiving treatment under a commercial prescription order as of the measurement date, including patients who may be on a temporary break from treatment and who plan to resume treatment in less than 60 days. Prescriptions are a leading indicator of demand. A "prescription received" is a commercial order for Optune or Optune Lua that is received from a physician certified to treat patients with our Products for a patient not previously on Optune or Optune Lua. Orders to renew or extend treatment are not included in this total.

The following table includes certain commercial operating statistics for and as of the end of the periods presented.

| | | | | | | | | | | |

| March 31, | | |

| Operating statistics | 2020 | | 2019 |

| Active patients at period end | | | |

| United States | 2,023 | | | | 1,778 | |

| EMEA: | | | | | | |

| Germany | 514 | | | | 510 | |

| Other EMEA | 336 | | | | 225 | |

| Japan | 222 | | | | 118 | |

| 3,095 | | | | 2,631 | |

| | | | | | | | | | | | | | | |

| | | | | Three months ended March 31, | | |

| | | | | | 2020 | | 2019 |

| Prescriptions received in period | | | | | | | |

| United States | | | | | 986 | | | | 925 | |

| EMEA: | | | | | | | | | | |

| Germany | | | | | 207 | | | | 254 | |

| Other EMEA | | | | | 122 | | | | 76 | |

| Japan | | | | | 94 | | | | 55 | |

| | | | | 1,409 | | | | 1,310 | |

In the U.S., there were six active MPM patients on therapy as of March 31, 2020 and six MPM prescriptions were received in the three months ended March 31, 2020.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Net revenues | $ | 101,828 | | | $ | 73,309 | | | $ | 28,519 | | | 39 | % |

Net revenues. Net revenues increased $28.5 million, or 39%, to $101.8 million for the three months March 31, 2020 from $73.3 million for the three months ended March 31, 2019. This was primarily due to an increase of 464 active patients in our currently active markets, representing 18% growth, and an improvement in the net revenues booked per active patient. The increase in net revenues per active patient benefited from continued improvements in U.S. reimbursement rates.

For the three months ended March 31, 2020, we recognized $7.1 million in net revenues from Medicare beneficiaries billed under the coverage policy effective on September 1, 2019. We continue to work through typical administrative ramp-up issues and expect our net revenues from Medicare beneficiaries to continue to increase as we gain experience processing Medicare claims.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Cost of revenues | $ | 24,496 | | | $ | 19,814 | | | $ | 4,682 | | | 24 | % |

Cost of revenues. Our cost of revenues increased by $4.7 million, or 24%, to $24.5 million for the three months ended March 31, 2020 from $19.8 million for the three months ended March 31, 2019. The increase in cost of revenues was primarily due to the cost of shipping transducer arrays to a higher volume of commercial patients. Gross margin was 76% for the three months ended March 31, 2020 and 73% for the three months ended March 31, 2019.

Operating Expenses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Research, development and clinical trials | $ | 25,271 | | | $ | 17,042 | | | $ | 8,229 | | | 48 | % |

| Sales and marketing | 28,834 | | | 22,333 | | | 6,501 | | | 29 | % |

| General and administrative | 26,608 | | | 20,238 | | | 6,370 | | | 31 | % |

| Total operating expenses | $ | 80,713 | | | $ | 59,613 | | | $ | 21,100 | | | 35 | % |

Research, development and clinical trials expenses. Research, development and clinical trials expenses increased $8.2 million, or 48%, to $25.3 million for the three months ended March 31, 2020 from $17.0 million for the three months ended March 31, 2019. The change is primarily due to an increase in clinical trial and personnel expenses for our phase 3 pivotal and phase 4 post-marketing trials and an increase in costs associated with medical affairs, basic research and engineering.

Sales and marketing expenses. Sales and marketing expenses increased $6.5 million, or 29%, to $28.8 million for the three months ended March 31, 2020 from $22.3 million for the three months ended March 31, 2019. The change was primarily due to an increase in marketing expenses related to the launch of Optune Lua and an increase in personnel costs to support our growing commercial business.

General and administrative expenses. General and administrative expenses increased $6.4 million, or 31%, to $26.6 million for the three months ended March 31, 2020 from $20.2 million for the three months ended March 31, 2019. The change was primarily due to an increase in personnel costs and an increase in professional services.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Financial expenses (income), net | $ | 2,432 | | | $ | 2,371 | | | $ | 61 | | | 3 | % |

Financial expenses, net. Financial expenses increased $0.1 million, or 3%, to $2.4 million for the three months ended March 31, 2020 from $2.4 million for the three months ended March 31, 2019.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Income taxes | $ | (9,765) | | | $ | 3,661 | | | $ | (13,426) | | | (367) | % |

Income taxes. Income taxes decreased $13.4 million, or 367%, to a benefit of $9.8 million for the three months ended March 31, 2020 from $3.7 million for the three months ended March 31, 2019. In accordance with the changes to the U.S. tax code enacted in response to the economic impacts of COVID-19 signed into legislation on March 27, 2020 the Company recorded a net tax benefit of $11,269 in the first quarter of 2020. The benefit results from net operating loss carry-backs in the U.S. The change also reflects a change in the mix of applicable statutory tax rates in certain active jurisdictions.

Non-GAAP financial measures

We also measure our performance based upon a non-GAAP measurement of earnings before interest, taxes, depreciation, amortization and shared-based compensation ("Adjusted EBITDA"). We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because it helps investors evaluate and compare the

results of our operations from period to period by removing the impact of earnings attributable to our capital structure, tax rate and material non-cash items, specifically share-based compensation.

We calculate Adjusted EBITDA as operating income before financial expenses and income taxes, net of depreciation, amortization and share-based compensation. The following table reconciles net loss (which is the most directly comparable GAAP operating performance measure) to Adjusted EBITDA.

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | |

| 2020 | | 2019 | | 2018 |

| Net income (loss) | $ | 3,952 | | | | $ | (12,150) | | | | $ | (20,724) | |

| Add: Income tax | (9,765) | | | | 3,661 | | | | 3,194 | |

| Add: Financial expenses (income), net | 2,432 | | | | 2,371 | | | | 4,853 | |

| Add: Depreciation and amortization | 1,888 | | | | 1,929 | | | | 2,203 | |

| EBITDA | $ | (1,493) | | | | $ | (4,189) | | | | $ | (10,474) | |

| Add: Share-based compensation | 16,557 | | | | 9,649 | | | | 8,520 | |

| Adjusted EBITDA | $ | 15,064 | | | | $ | 5,460 | | | | $ | (1,954) | |

| | | | | |

Adjusted EBITDA increased by $9.6 million, or 176%, to $15.1 million for the three months ended March 31, 2020 from $5.5 million for the three months ended March 31, 2019. This improvement in fundamental financial performance was driven by net revenue growth coupled with an ongoing commitment to disciplined management of expenses.

Liquidity and Capital Resources

We have incurred significant losses and cumulative negative cash flows from operations since our founding in 2000. As of March 31, 2020, we had an accumulated deficit of $646.9 million. To date, we have primarily financed our operations through the issuance and sale of equity and the proceeds from long-term loans.

At March 31, 2020, we had $331.3 million in cash, cash equivalents and short-term investments, an increase of $5.2 million compared to $326.1 million at December 31, 2019. The increase in our cash, cash equivalents and short-term investments was primarily due to cash flow from operations and the exercise of options partially offset by the purchase of field equipment.

We believe our cash, cash equivalents and short-term investments as of March 31, 2020 are sufficient for our operations for at least the next 12 months based on our existing business plan and our ability to control the timing of significant expense commitments. We expect that our research, development and clinical trials expenses, sales and marketing expenses and general and administrative expenses will continue to increase over the next several years and may outpace our gross profit. As a result, we may need to raise additional capital to fund our operations.

The following summary of our cash flows for the periods indicated has been derived from our unaudited consolidated financial statements, which are included elsewhere in this Quarterly Report.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| 2020 | | 2019 | | Change | | % Change |

| Net cash provided by (used in) operating activities | $ | 1,957 | | | | $ | (4,315) | | | | $ | 6,272 | | | | (145) | % |

| Net cash provided by (used in) investing activities | (3,112) | | | | (989) | | | | (2,123) | | | | 215 | % |

| Net cash provided by (used in) financing activities | 4,503 | | | | 16,970 | | | | (12,467) | | | | (73) | % |

| Effect of exchange rate changes on cash and cash equivalents | (59) | | | | (261) | | | | 203 | | | | (78) | % |

| Net increase (decrease) in cash, cash equivalents and restricted cash | $ | 3,289 | | | | $ | 11,405 | | | | $ | (8,115) | | | | (71) | % |

Operating activities. Net cash provided by (used in) operating activities primarily represents our net income (loss) for the periods presented. Adjustments to net income (loss) for non-cash items include share-based compensation, depreciation and amortization, and asset write-downs and impairment of field equipment. Operating cash flows are

also impacted by changes in working capital, principally trade receivables, trade payables and accrued expenses, inventories, and other long-term assets.

Net cash provided by operating activities was $2.0 million for the three months ended March 31, 2020, as compared to $4.3 million used in operating activities for the three months ended March 31, 2019. Gross profit increased by $23.8 million for the three months ended March 31, 2020 versus the three months ended March 31, 2019, fully funding incremental investments of $8.2 million in research and development and $12.9 million in sales, marketing, general and administrative expenses. The transition to positive cash flow from operations was primarily driven by a decrease in net loss and an increase in the amount of non-cash share-based compensation included in the reported net income (loss), offset by an increase in working capital.

Investing activities. Our investing activities consist primarily of capital expenditures to purchase property and equipment and field equipment, as well as investments in and redemptions of our short-term investments.

Net cash used in investing activities was $3.1 million for the three months ended March 31, 2020, compared to $1.0 million for the three months ended March 31, 2019. The increased net cash used in investing activities was primarily attributable to the purchase of property and equipment to support our growing commercial business.Financing activities. To date, our primary financing activities have been the sale of equity and the proceeds from long-term loans.

Financing activities. Net cash provided by financing activities was $4.5 million for the three months ended March 31, 2020, as compared to $17.0 million for the three months ended March 31, 2019. The year-over-year decrease in cash provided by financing activities was primarily related to a decrease in proceeds from the exercise of options.

As of March 31, 2020, our material outstanding indebtedness consisted of $150.0 million of principal outstanding under our term loan credit facility (the "2018 Credit Facility"). Interest on the outstanding loan is 9% annually, payable quarterly in arrears. The 2018 Credit Facility will mature on February 7, 2023, at which time any unpaid principal and accrued unpaid interest in respect of the loan will be due and payable. We may prepay amounts outstanding under the 2018 Credit Facility in full at any time. Any prepayment (whether permitted or mandatory) is subject to a prepayment premium and/or make-whole payment. The prepayment fee if we prepay outstanding loan amounts prior to February 7, 2021 is 2.0% and is 1.0% if made after the February 7, 2021 but prior to February 7, 2022. If we prepay outstanding loan amounts prior to August 7, 2020, we must pay a make-whole amount equal to the amount of interest that would have accrued on the amount of all principal we prepaid from the date of such prepayment through February 7, 2021. We must prepay the 2018 Credit Facility (i) in full or in part upon the entry into certain licensing arrangements and (ii) in full in the event of a change of control.

All obligations under the 2018 Credit Facility are guaranteed by certain of our domestic direct and indirect subsidiaries. In addition, the obligations under the 2018 Credit Facility are secured by a first-priority security interest in substantially all of the property and assets of, as well as the equity interests owned by, us and the other guarantors. The 2018 Credit Facility contains other customary covenants. As of March 31, 2020, we were in compliance with such covenants.

Contractual Obligations and Commitments

There have been no material changes from the information disclosed in our 2019 10-K.

Off-Balance Sheet Arrangements

We did not have during the periods presented, and we do not currently have, any off-balance sheet arrangements as defined under U.S. Securities and Exchange Commission (“SEC”) rules.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There have been no material changes from the information disclosed in our 2019 10-K.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As required by Rule 13a-15(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our management, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures as of March 31, 2020. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate, to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on the evaluation of our disclosure controls and procedures as of March 31, 2020, our Chief Executive Officer and Chief Financial Officer have concluded that, as of March 31, 2020, our disclosure controls and procedures were effective at the reasonable assurance level.

Changes in Internal Control over Financial Reporting

There has been no change in our internal control over financial reporting during the quarter ended March 31, 2020 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II—OTHER INFORMATION

Item 1. Legal Proceedings

There have been no material changes to our legal proceedings disclosed in the 2019 10-K except as noted below.

In February 2019, a civil claim was filed in the District Court in Haifa, Israel (the “Court”), by Ofir Paz (“Paz”), a former member of our Board of Directors, and EES Investments Ltd., a company wholly owned by Paz (together with Paz, “Plaintiff”) against us and Prof. Yoram Palti (together, the “Respondents”). Plaintiff claims that he is entitled to 210,000 ordinary shares (adjusted for share capital splits since 2003) from Respondents pursuant to an alleged 2003 verbal agreement between Plaintiff and Prof. Palti, who was also a member of our Board of Directors at that time, for Plaintiff’s contribution to the advancement of our business and the consummation of a third party investment in our company. In May 2019, we filed a motion to dismiss the claim. In September 2019, Plaintiff filed a motion to amend the claim, requesting that Asaf Danziger be added as a respondent. On April 3, 2020, the Court dismissed the claim and the motion to amend the claim due to the expiration of the statute of limitations.

Item 1A. Risk Factors

There have been no material changes to our risk factors disclosed in Part I, Item 1A “Risk Factors” to the 2019 10-K, except as supplemented and updated as follows. Also note that references in the 2019 10-K to NovoTTF-100L now refer to Optune Lua.

The COVID-19 pandemic could materially adversely impact our business, including our clinical trials.

As the COVID-19 pandemic continues to spread around the globe, we have experienced and will likely continue to experience disruptions that could severely impact our business and clinical trials, which could include:

•delays or difficulties in onboarding active patients and enrolling patients in our clinical trials;

•delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff;

•declines in prescriptions written due to a perception that our Products are difficult to administer remotely or if patients are unwilling to travel to treatment sites or receive in-home treatment assistance from us or other caregivers;

•reductions in third-party reimbursements, which could materially affect our revenue, as most of our patients rely on third-party payors to cover the cost of our Products and a material number of our patients could lose access to their private health insurance plan if they or someone in their family lose their job;

•diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials;

•interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others;

•delays in receiving approval from local regulatory authorities to initiate our planned clinical trials;

•delays in clinical sites receiving the supplies and materials needed to conduct our clinical trials;

•interruption in global shipping that may affect the transport of active patient and clinical trial materials;

•changes in local regulations as part of a response to the COVID-19 coronavirus outbreak which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether;

•delays in necessary interactions with local regulators, ethics committees and other important agencies and contractors due to limitations in employee resources or forced furlough of government employees;

•disruption of our supply chain, as our suppliers and common carriers are unable to meet our requirements to provide us the materials we need for clinical trial and active patient care needs;