UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

NovoCure Limited

(Exact Name of Registrant as Specified in Its Charter)

|

Jersey |

|

98-1057807 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

Incorporation or Organization) |

|

Identification No.) |

(Address of principal executive offices)

+

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Ordinary Shares, no par value |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Class |

|

Outstanding as of July 18, 2019 |

|

Ordinary shares, no par value |

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and research and development related to our Tumor Treating Fields delivery systems marketed under various brand names, including Optune, the NovoTTF-100L System (“NovoTTF-100L”) and software and systems to support and optimize the delivery of Tumor Treating Fields (collectively, the “Products”). In particular, these forward-looking statements include, among others, statements about:

|

|

• |

our research and development, clinical trial and commercialization activities and projected expenditures; |

|

|

• |

the further commercialization of our Products for current and future indications; |

|

|

• |

our business strategies and the expansion of our sales and marketing efforts in the United States and in other countries; |

|

|

• |

the market acceptance of our Products for current and future indications by patients, physicians, third-party payers and others in the healthcare and scientific community; |

|

|

• |

our plans to pursue the use of our Products for the treatment of solid tumor cancers other than glioblastoma (“GBM”) and malignant pleural mesothelioma (“MPM”); |

|

|

• |

our estimates regarding revenues, expenses, capital requirements and needs for additional financing; |

|

|

• |

our ability to obtain regulatory approvals for the use of our Products in cancers other than GBM and MPM; |

|

|

• |

our ability to acquire from third-party suppliers the supplies needed to manufacture our Products; |

|

|

• |

our ability to manufacture adequate supply; |

|

|

• |

our ability to secure and maintain adequate coverage from third-party payers to reimburse us for our Products for current and future indications; |

|

|

• |

our ability to receive payment from third-party payers for use of our Products for current and future indications; |

|

|

• |

our ability to maintain and develop our intellectual property position; |

|

|

• |

our cash needs; and |

|

|

• |

our prospects, financial condition and results of operations. |

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Factors which may cause such differences to occur include those risks and uncertainties set forth under Part I, Item 1A., “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission. We do not intend to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

TRADEMARKS

This Quarterly Report on Form 10-Q includes trademarks of NovoCure Limited and other persons. All trademarks or trade names referred to herein are the property of their respective owners.

ii

NovoCure Limited

Quarterly Report on Form 10-Q

TABLE OF CONTENTS

|

|

|

|

|

Page |

||

|

|

ii |

|||||

|

|

ii |

|||||

|

|

||||||

|

|

||||||

|

Item 1. |

|

|

2 |

|||

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

13 |

||

|

Item 3. |

|

|

21 |

|||

|

Item 4. |

|

|

21 |

|||

|

|

||||||

|

|

||||||

|

Item 1. |

|

|

22 |

|||

|

Item 1A. |

|

|

22 |

|||

|

Item 2. |

|

|

58 |

|||

|

Item 3. |

|

|

58 |

|||

|

Item 4. |

|

|

58 |

|||

|

Item 5. |

|

|

58 |

|||

|

Item 6. |

|

|

59 |

|||

|

|

||||||

|

|

|

|

60 |

|||

- 1 -

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Short-term investments |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

|

|

|

|

|

|

|

Trade receivables |

|

|

|

|

|

|

|

|

|

Receivables and prepaid expenses |

|

|

|

|

|

|

|

|

|

Inventories |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

|

Field equipment, net |

|

|

|

|

|

|

|

|

|

Right-of-use assets, net |

|

|

|

|

|

|

|

|

|

Other long-term assets |

|

|

|

|

|

|

|

|

|

Total long-term assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 2 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share data)

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Trade payables |

|

$ |

|

|

|

$ |

|

|

|

Other payables, lease liabilities and accrued expenses |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term loan, net of discount and issuance costs |

|

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

|

|

|

|

|

|

|

Employee benefit liabilities |

|

|

|

|

|

|

|

|

|

Long-term lease liabilities |

|

|

|

|

|

|

|

|

|

Other long-term liabilities |

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Share capital - |

|

|

|

|

|

|

|

|

|

Ordinary shares par value, unlimited shares authorized; issued and outstanding: December 31, 2018, respectively |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive income (loss) |

|

|

( |

) |

|

|

( |

) |

|

Retained earnings (accumulated deficit) |

|

|

( |

) |

|

|

( |

) |

|

Total shareholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 3 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except share and per share data)

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

Year ended December 31, |

|

|||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

2018 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

Audited |

|

|||||||||||

|

Net revenues |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research, development and clinical trials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

( |

) |

|

Financial expenses (income), net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

( |

) |

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per ordinary share |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

$ |

( |

) |

|

Weighted average number of ordinary shares used in computing basic and diluted net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

U.S. dollars in thousands

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2018 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Net income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in foreign currency translation adjustments |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Pension benefit plan |

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

Total comprehensive income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 4 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

U.S. dollars in thousands (except share data)

|

|

|

Ordinary shares |

|

|

Additional paid-in |

|

|

Accumulated other comprehensive |

|

|

Retained earnings (accumulated |

|

|

Total shareholders' |

|

|||||

|

|

|

Shares |

|

|

capital |

|

|

loss |

|

|

deficit) |

|

|

equity |

|

|||||

|

Balance as of December 31, 2018 (audited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation to employees |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Exercise of options and warrants and vested RSUs |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Other comprehensive income (loss), net of tax benefit of $ |

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

|

( |

) |

|

Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance as of March 31, 2019 (Unaudited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation to employees |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Proceeds from issuance of shares |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Exercise of options and warrants and vested RSUs |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Other comprehensive income (loss), net of tax benefit of $ |

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

|

( |

) |

|

Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance as of June 30, 2019 (Unaudited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

Additional paid-in |

|

|

Accumulated other comprehensive |

|

|

Retained earnings (accumulated |

|

|

Total shareholders' |

|

|||||

|

|

|

Shares |

|

|

capital |

|

|

loss |

|

|

deficit) |

|

|

equity |

|

|||||

|

Balance as of December 31, 2017 (audited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation to employees |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Exercise of options and warrants and vested RSUs |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Cumulative effect adjustment on retained earnings (*) |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of tax benefit of $ |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance as of March 31, 2018 (Unaudited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation to employees |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Proceeds from issuance of shares |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Exercise of options and warrants and vested RSUs |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Other comprehensive income (loss), net of tax benefit of $ |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net income (loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance as of June 30, 2018 (Unaudited) |

|

|

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

(*)

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 5 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2018 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset write-downs and impairment of field equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation to employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease (increase) in trade receivables |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Amortization of discount (premium) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Decrease (increase) in receivables and prepaid expenses |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Decrease (increase) in inventories |

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

Decrease (increase) in other long-term assets |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Decrease (increase) in right of use assets, net |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

Increase (decrease) in trade payables |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in other payables and accrued expenses |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Increase (decrease) in employee benefit liabilities, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in long-term lease liability |

|

|

( |

) |

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

|

- |

|

|

Increase (decrease) in other long-term liabilities |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Purchase of field equipment |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from maturity of short-term investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by (used in) investing activities |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of shares, net |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds from long-term loan, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Repayment of long-term loan |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Repayment of other long-term loan |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Exercise of options and warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash, cash equivalents and restricted cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the end of the period |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Interest |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Non-cash activities upon implementation of ASC-842: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Right of use assets obtained in exchange for lease obligations |

|

$ |

|

|

|

$ |

- |

|

|

$ |

|

|

|

$ |

- |

|

|

$ |

- |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 6 -

NOVOCURE LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

NOTE 1: ORGANIZATION AND BASIS OF PRESENTATION

Organization. NovoCure Limited (including its consolidated subsidiaries, the “Company”) was incorporated in the Bailiwick of Jersey and is principally engaged in the development, manufacture and commercialization of Tumor Treating Fields delivery systems, including Optune and NovoTTF-100L, for the treatment of solid tumors. The Company has received regulatory approval from the U.S. Food and Drug Administration (“FDA”) under the Premarket Approval pathway and regulatory approvals and clearances in certain other countries for Optune to treat adult patients with GBM. The Company also has received FDA approval under the Humanitarian Device Exemption pathway to market NovoTTF-100L for unresectable, locally advanced or metastatic MPM in combination with standard chemotherapies.

Financial statement preparation. The accompanying consolidated financial statements include the accounts of the Company and intercompany accounts and transactions have been eliminated. In the opinion of the Company’s management, the consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation for the periods presented. The preparation of these consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in these consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. These consolidated financial statements and accompanying notes should be read in conjunction with the Company’s annual consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 (the “2018 10-K”) filed with the Securities and Exchange Commission on February 28, 2019.

The significant accounting policies applied in the audited annual consolidated financial statements of the Company as disclosed in the 2018 10-K are applied consistently in these unaudited interim consolidated financial statements, except as noted below:

Recently Adopted Accounting Pronouncements. In 2016, the FASB issued ASU No. 2016-02, "Leases (Topic 842)", which amends the existing standards for lease accounting, requiring lessees to recognize most leases on their balance sheets. The new standard establishes a right-of-use model that requires a lessee to recognize a right-of-use asset and lease liability on the balance sheet for all leases with a term longer than 12 months. Leases will be classified as finance or operating. The standard is effective for interim and annual reporting periods beginning after December 15, 2018.

The provisions of ASU 2016-02 are to be applied using a modified retrospective approach. In July 2018, the FASB issued ASU No. 2018-11, "Targeted Improvements - Leases (Topic 842)." This update provides an additional (and optional) transition method to adopt the new leases standard. Under this method, an entity initially applies the new leases standard at the adoption date and recognizes a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. Consequently, the prior comparative period’s financials will remain the same as those previously presented. The Company adopted the new standard as of January 1, 2019 and it has also elected to adopt the package of practical expedients permitted in ASC 842.

The amendments in ASU 2018-11 provide lessors with a practical expedient, by class of underlying asset, not to separate non-lease components from the associated lease component and, instead, to account for those components as a single component if the non-lease components otherwise would be accounted for under the new revenue guidance (Topic 606) and both of the following are met:

1. The timing and pattern of transfer of the non-lease component(s) and associated lease component are the same.

2. The lease component, if accounted for separately, would be classified as an operating lease.

As the non-lease component(s) associated with the lease component is the predominant component of the combined component, the Company accounts for the combined component in accordance with Topic 606.

The consolidated financial statements for the three and six months ended June 30, 2019 are presented under the new standard, while comparative year and other periods presented are not adjusted and continue to be reported in accordance with Topic 840, Leases.

- 7 -

NOTE 2: CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS

Cash equivalents include items almost as liquid as cash, such as certificates of deposit and time deposits with maturity periods of three months or less when purchased.

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

Cash |

|

$ |

|

|

|

$ |

|

|

|

Money market funds |

|

|

|

|

|

|

|

|

|

Total cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

The Company invests in marketable U.S. Treasury Bills (“T-bills”) that are classified as held-to-maturity securities. The amortized cost and recorded basis of the T-bills are presented as short-term investments.

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

Short-term investments |

|

$ |

|

|

|

$ |

|

|

The estimated fair value of the Company’s short-term investments as of June 30, 2019 and December 31, 2018 was $

We use quoted market prices to determine the fair value of cash equivalents and short-term investments, therefore they are categorized as level 1.

NOTE 3: INVENTORIES

Inventories are stated at the lower of cost or net realizable value. The weighted average methodology is applied to determine cost. As of June 30, 2019 and December 31, 2018, the Company’s inventories were composed of:

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

Raw materials |

|

$ |

|

|

|

$ |

|

|

|

Work in progress |

|

|

|

|

|

|

|

|

|

Finished products |

|

|

|

|

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

NOTE 4: COMMITMENTS, RIGHTS OF USE AND CONTINGENT LIABILITIES

Operating Leases and Rights of Use.

Under ASU No. 2016-02, “Leases (Topic 842), all leases with durations greater than 12 months, including non-cancelable operating leases, are now recognized on the balance sheet. The aggregated present value of lease agreements, net of deferred rent, are recorded as a long-term asset titled right-of-use assets. The corresponding lease liabilities are split between other payables within current liabilities and long-term lease liabilities within long-term liabilities. The lease liabilities are presented without consideration for deferred rent.

- 8 -

Upon implementation of ASC-842, effective January 1, 2019, the Company recorded an increase in right-of-use assets obtained in exchange for lease obligations of $

|

|

|

June 30, |

|

|

|

|

|

2019 |

|

|

|

|

|

Unaudited |

|

|

|

Future minimum lease payments: |

|

|

|

|

|

2019 (excluding the six months ended June 30, 2019) |

|

$ |

|

|

|

2020 |

|

|

|

|

|

2021 |

|

|

|

|

|

2022 |

|

|

|

|

|

2023 |

|

|

|

|

|

Thereafter |

|

|

|

|

|

Total future minimum lease payments |

|

$ |

|

|

|

Less imputed interest |

|

|

( |

) |

|

Net present value of future minimum lease payments |

|

$ |

|

|

|

|

|

|

|

|

|

Presented as of June 30, 2019: |

|

|

|

|

|

Short-term lease liabilities |

|

$ |

|

|

|

Long-term lease liabilities |

|

|

|

|

|

Net present value of future minimum lease payments |

|

$ |

|

|

|

|

|

|

|

|

|

Weighted average of remaining operating lease term |

|

|

5.24 |

|

|

|

|

|

|

|

|

Weighted average of operating lease discount rate |

|

|

|

% |

The right-of-use assets are presented net of $

Pledged deposits and bank guarantees. As of June 30, 2019 and December 31, 2018, the Company pledged bank deposits of $

NOTE 5: SHARE CAPITAL

In September 2015, the Company adopted the 2015 Omnibus Incentive Plan (the “2015 Plan”). Under the 2015 Plan, the Company can issue various types of equity compensation awards such as share options, restricted shares, performance shares, restricted stock units (“RSUs”), performance units, long-term cash awards and other share-based awards.

Options granted under the 2015 Plan generally have a four-year vesting period and expire

- 9 -

A summary of the status of the Company’s option plans as of June 30, 2019 and changes during the period then ended is presented below:

|

|

|

Six months ended June 30, 2019 |

|

|||||

|

|

|

Unaudited |

|

|||||

|

|

|

Number of options |

|

|

Weighted average exercise price |

|

||

|

Outstanding at beginning of year |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Exercised |

|

|

( |

) |

|

|

|

|

|

Forfeited and cancelled |

|

|

( |

) |

|

|

|

|

|

Outstanding as of June 30, 2019 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable options |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

For the six months, ended June 30, 2019, options to purchase

A summary of the status of the Company’s RSUs as of June 30, 2019 and changes during the period then ended is presented below:

|

|

|

Six months ended June 30, 2019 |

|

|||||

|

|

|

Unaudited |

|

|||||

|

|

|

Number of RSUs |

|

|

Weighted average grant date fair value price |

|

||

|

Unvested at beginning of year |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Vested |

|

|

( |

) |

|

|

|

|

|

Forfeited and cancelled |

|

|

( |

) |

|

|

|

|

|

Unvested as of June 30, 2019 |

|

|

|

|

|

$ |

|

|

In September 2015, the Company adopted an employee share purchase plan (“ESPP”) to encourage and enable eligible employees to acquire ownership of the Company’s ordinary shares purchased through accumulated payroll deductions on an after-tax basis. In the United States, the ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code and the provisions of the ESPP will be construed in a manner consistent with the requirements of such section. The Company began its offerings under the ESPP on August 1, 2016. As of June 30, 2019,

- 10 -

The fair value of share-based awards was estimated using the Black-Scholes model for all equity grants. For market condition awards, the Company also applied the Monte-Carlo simulation model, with the following underlying assumptions:

|

|

|

|

Six months ended June 30, |

|

Year ended December 31, |

||

|

|

|

|

2019 |

|

2018 |

|

2018 |

|

|

|

|

Unaudited |

|

Audited |

||

|

Stock Option Plans |

|

|

|

|

|

|

|

|

Expected term (years) |

|

|

5.50-6.50 |

|

5.50-6.25 |

|

5.50-6.25 |

|

Expected volatility |

|

|

55%-57% |

|

52%-55% |

|

52%-55% |

|

Risk-free interest rate |

|

|

2.21%-2.40% |

|

2.70%-2.89% |

|

2.70%-2.99% |

|

Dividend yield |

|

|

|

|

|

|

|

|

ESPP |

|

|

|

|

|

|

|

|

Expected term (years) |

|

|

0.50 |

|

0.50 |

|

0.50 |

|

Expected volatility |

|

|

|

|

|

|

45%-53% |

|

Risk-free interest rate |

|

|

|

|

|

|

1.61%-2.14% |

|

Dividend yield |

|

|

|

|

|

|

|

The total non-cash share-based compensation expense related to all of the Company’s equity-based awards recognized for the three and six months ended June 30, 2019 and 2018 and the year ended December 31, 2018 was:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2018 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Cost of revenues |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Research, development and clinical trials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total share-based compensation expense |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

NOTE 6: SUPPLEMENTAL INFORMATION

The Company operates in a single reportable segment.

The following table presents long-lived assets by location:

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2019 |

|

|

2018 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

United States |

|

$ |

|

|

|

$ |

|

|

|

Switzerland |

|

|

|

|

|

|

|

|

|

Israel |

|

|

|

|

|

|

|

|

|

Germany |

|

|

|

|

|

|

|

|

|

Others |

|

|

|

|

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

- 11 -

The Company’s revenues by geographic region, based on the customer’s location, are summarized as follows:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

2018 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

United States |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

EMEA (*) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Japan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Greater China (1) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Total |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) including Germany |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1) |

Reflects revenue recognized in accordance with a License and Collaboration Agreement between us and Zai Lab (Shanghai) Co., Ltd. (“Zai”), dated September 10, 2018, pursuant to which Zai is commercializing Optune in China, Hong Kong, Macau and Taiwan (referred to in this table as “Greater China”). For additional information, see Note 12 to the Consolidated Financial Statements in our 2018 10-K. |

- 12 -

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide information to assist you in better understanding and evaluating our financial condition and results of operations. We encourage you to read this MD&A in conjunction with our consolidated financial statements and the notes thereto for the period ended June 30, 2019 included in Part I, Item 1 of this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. Please refer to the information under the heading “Cautionary Note Regarding Forward-Looking Statements” elsewhere in this report. References to the words “we,” “our,” “us,” and the “Company” in this report refer to NovoCure Limited, including its consolidated subsidiaries.

Overview

We are a global oncology company with a proprietary platform technology called Tumor Treating Fields, the use of electric fields tuned to specific frequencies to disrupt solid tumor cancer cell division. Our key priorities are to drive adoption of Optune and the NovoTTF-100L System (“NovoTTF-100L”), our commercial Tumor Treating Fields delivery systems, and to advance programs testing the efficacy and safety of Optune and NovoTTF-100L in multiple solid tumor indications through our clinical pipeline.

We have built a commercial organization in the United States, Austria, Germany, Israel, Japan, Sweden and Switzerland, which we refer to as our currently active markets. Optune is approved by the U.S. Food and Drug Administration (“FDA”) under the Premarket Approval (“PMA”) pathway for the treatment of adult patients with newly diagnosed glioblastoma (“GBM”) in combination with temozolomide, a chemotherapy drug, and for use as monotherapy treatment for adult patients with GBM following confirmed recurrence after chemotherapy. We also have approval to market Optune for the treatment of GBM in the European Union, Japan and certain other countries.

In May 2019, NovoTTF-100L received approval by the FDA under the Humanitarian Device Exemption (“HDE”) pathway to treat unresectable, locally advanced or metastatic malignant pleural mesothelioma (“MPM”) in combination with standard chemotherapies. We have initiated a phased launch for MPM shaped by our learnings from our GBM rollout. In 2019, we will focus on certifying radiation oncologists and driving adoption at the approximately 30 centers that we believe see the majority of U.S. MPM patients. We certified our first MPM prescribers in early June. Certifications are ongoing and information has been requested by multiple sites to support the required institutional review board approval. We expect our first MPM patient to start therapy in the third quarter. We are currently exploring the appropriate regulatory pathway for MPM in our currently active markets outside of the U.S.

We continue to work with payers to expand access to Optune for patients with GBM. As of June 30, 2019, more than 246 million Americans had coverage of Optune for newly diagnosed and/or recurrent GBM. The percentage of our U.S. active patient population who are beneficiaries of the Medicare fee-for-service program, which has denied coverage for our claims to date, continues to range from 20 to 25 percent. We are actively appealing Medicare fee-for-service coverage denials through the Administrative Law Judge (“ALJ”) process with Centers for Medicare and Medicaid Services (“CMS”).

In 2018, the Medicare durable medical equipment Medicare Administrative Contractors (“DME MACs”) confirmed that they accepted our local coverage determination (“LCD”) reconsideration request for the treatment of newly diagnosed GBM and planned to take steps to publish a final LCD for newly diagnosed GBM. In March 2019, the DME MACs met with a contractor advisory committee, a formal mechanism for healthcare professionals to be informed of the evidence used in developing the LCD and to promote communications between the DME MACs and the healthcare community. The panel expressed their confidence that there is sufficient evidence to determine that Optune provides net positive health outcomes in the Medicare-eligible population (3.82 on a scale of 1 to 5).

- 13 -

In May 2019, the DME MACs issued a proposed LCD that provides coverage of Optune for newly diagnosed GBM, subject to certain restrictions. The proposed LCD was subject to a 45-day public comment period which closed in June 2019. The DME MACs released a final LCD and fee schedule amount in July 2019 which provides coverage and pricing of Optune for newly diagnosed GBM, effective September 1, 2019. In response to public comments, the final coverage criteria eliminated or revised many of the restrictions originally proposed.

In June 2019, the German Institute for Quality and Efficiency in Healthcare (“IQWiG”), published its rapid report concluding that, based on a review of our EF-14 phase 3 pivotal trial, patients with newly diagnosed GBM lived longer when treated with Optune in addition to standard chemotherapy, without affecting quality of life. According to the published timeline, we now expect a national reimbursement decision in Germany no later than October 2020.

We expect to begin a dialogue with payers around access to NovoTTF-100L for patients with MPM in future quarters. We anticipate MPM claims during the early launch phase will go through an appeal process with payers, similar to our early experience with GBM.

In order to further advance the scientific evidence supporting the use of Optune in GBM and gather additional information about Optune’s optimal use, we plan to initiate two additional randomized trials in GBM. The first trial, which we plan to begin as early as 2019, will be designed to study the potential benefit of earlier initiation of Optune, concurrent with radiation therapy, versus initiation post radiation and is intended to support possible label expansion. The second trial, which we plan to begin in 2020, will be designed to identify potential efficacy signals when Optune is combined with temozolomide and several other therapeutic agents in a multifactorial trial design and is intended to identify optimal combination treatments.

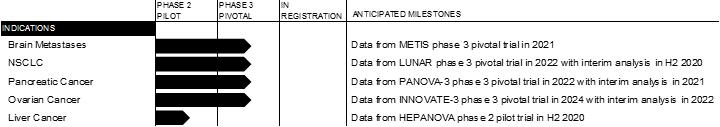

Currently, we are conducting phase 3 pivotal trials evaluating the use of Optune in brain metastases, non-small-cell lung cancer, pancreatic cancer and ovarian cancer. We are also conducting a phase 2 pilot trial evaluating the use of Optune in liver cancer. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of Optune for additional solid tumor indications.

In March 2019, we enrolled the first patient in our INNOVATE-3 /ENGOT-ov50 trial, a phase 3 pivotal trial testing the effectiveness of Optune with paclitaxel in patients with recurrent, platinum-resistant ovarian cancer. The protocol specifies overall survival as primary endpoint and an event-driven interim analysis, which we anticipate will occur in 2022. The European Network for Gynaecological Oncological Trial groups (“ENGOT”) and The GOG Foundation, Inc. (“GOG”), third-party clinical trial networks, are collaborating with us on the trial. ENGOT and GOG were involved in the development of the trial and the collaborations are intended to facilitate enrollment of INNOVATE-3 at leading cancer centers in Europe and the United States.

The table below presents the current status of the ongoing or completed clinical trials in our pipeline and our expected next milestone for each. We now expect the LUNAR interim analysis in the second half of 2020, with final data from LUNAR in 2022.

We believe we have a robust patent and intellectual property portfolio, with over 145 issued patents and numerous patent applications pending worldwide covering global commercialization rights to Optune in oncology.

- 14 -

In 2018, we granted Zai Lab (Shanghai) Co., Ltd. (“Zai”) a license to commercialize Optune in China, Hong Kong, Macau and Taiwan under a License and Collaboration Agreement (the “Zai Agreement”). Zai has submitted to the Chinese regulatory authorities an application to designate Optune as an Innovative Medical Device and is pursuing a clinical trial waiver for the GBM indication in China. Should a clinical trial waiver be granted, Zai intends to launch Optune in China before the end of 2019. On the clinical development front, Zai is working to finalize the protocol for a phase 2 pilot trial in gastric cancer and is collaborating closely with our clinical teams to initiate trials in other key indications in China.

Financial Overview. We view our operations and manage our business in one operating segment. For the three and six months ended June 30, 2019, our net revenues were $86.7 million and $160.0 million, respectively, and our net loss was $1.3 million and $13.4 million, respectively. As of June 30, 2019, we had an accumulated deficit of $657.1 million.

Critical Accounting Policies and Estimates

In accordance with U.S. generally accepted accounting principles (“GAAP”), in preparing our financial statements, we must make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of net revenues and expenses during the reporting period. We develop and periodically change these estimates and assumptions based on historical experience and on various other factors that we believe are reasonable under the circumstances. Actual results may differ from these estimates.

The critical accounting policies requiring estimates, assumptions and judgments that we believe have the most significant impact on our consolidated financial statements can be found in our Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 (the “2018 10-K”). For additional information, see Note 1 to our Unaudited Consolidated Financial Statements. There were no other material changes to our critical accounting policies and estimates as compared to the critical accounting policies and estimates described in our 2018 10-K.

Commentary on Results of Operations

Net revenues. Our revenues are primarily derived from patients using Optune in our currently active markets. We charge for treatment with Optune and NovoTTF-100L on a monthly basis. Our potential net revenues per patient are determined by our ability to secure payment, the monthly fee we collect and the number of months that the patient remains on therapy.

We also recognized revenue pursuant to the Zai Agreement in the first and second quarters of 2019. For additional information regarding the Zai Agreement, see Note 12 to the Consolidated Financial Statements in our 2018 10-K.

Cost of revenues. We contract with third-party manufacturers that manufacture Optune and NovoTTF-100L. Our cost of revenues is primarily comprised of the following:

|

|

• |

disposable transducer arrays; |

|

|

• |

depreciation expense for the field equipment, including the electric field generator used by patients; and |

|

|

• |

personnel, warranty and overhead costs such as facilities, freight and depreciation of property, plant and equipment associated with managing our inventory, warehousing and order fulfillment functions. |

Operating expenses. Our operating expenses consist of research, development and clinical trials, sales and marketing and general and administrative expenses. Personnel costs are a significant component for each category of operating expenses and consist of wages, benefits and bonuses. Personnel costs also include share-based compensation.

Financial expenses, net. Financial expenses, net primarily consists of credit facility interest expense and related debt issuance costs, interest income from cash balances and short-term investments and gains (losses) from foreign currency transactions. Our reporting currency is the U.S. dollar. We have historically held substantially all of our cash balances in U.S. dollar denominated accounts to minimize the risk of translational currency exposure.

- 15 -

Results of Operations

The following table includes certain commercial patient operating statistics for and as of the end of the periods presented.

|

|

|

|

|

|

June 30, |

|

||||||||||

|

Operating statistics |

|

|

|

|

|

|

|

|

|

2019 |

|

|

2018 |

|

||

|

Active patients at period end (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

|

|

|

|

|

|

|

|

1,846 |

|

|

|

1,575 |

|

|

EMEA (*) |

|

|

|

|

|

|

|

|

|

|

737 |

|

|

|

557 |

|

|

Japan |

|

|

|

|

|

|

|

|

|

|

143 |

|

|

|

37 |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

2,726 |

|

|

|

2,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) including Germany |

|

|

|

|

|

|

|

|

|

|

496 |

|

|

|

387 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||

|

Gross billings (in millions) |

|

$ |

170.1 |

|

|

$ |

135.6 |

|

|

$ |

328.0 |

|

|

$ |

261.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prescriptions received in period (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

989 |

|

|

|

947 |

|

|

|

1,914 |

|

|

|

1,893 |

|

|

EMEA (*) |

|

|

299 |

|

|

|

265 |

|

|

|

629 |

|

|

|

547 |

|

|

Japan |

|

|

74 |

|

|

|

32 |

|

|

|

129 |

|

|

|

62 |

|

|

Total |

|

|

1,362 |

|

|

|

1,244 |

|

|

|

2,672 |

|

|

|

2,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) including Germany |

|

|

224 |

|

|

|

190 |

|

|

|

478 |

|

|

|

400 |

|

|

(1) |