UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-37565

(Exact Name of Registrant as Specified in Its Charter)

|

Jersey |

|

98-1057807 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

Incorporation or Organization) |

|

Identification No.) |

No. 4 The Forum

Grenville Street

St. Helier, Jersey JE2 4UF

(Address of principal executive offices)

+44 (0) 15 3475 6700

(Registrant’s Telephone Number, Including Area Code)

(Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Class |

|

Outstanding as of July 19, 2018 |

|

Ordinary shares, no par value |

|

92,902,560 Shares |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and delivery system research and development. In particular, these forward-looking statements include, among others, statements about:

|

|

• |

our research and development, clinical trial and commercialization activities and projected expenditures; |

|

|

• |

the further commercialization of Optune®, our first Tumor Treating Fields delivery system, and our other Tumor Treating Fields delivery system candidates; |

|

|

• |

our business strategies and the expansion of our sales and marketing efforts in the United States and in other countries; |

|

|

• |

the market acceptance of Optune and our other Tumor Treating Fields delivery systems by patients, physicians, third-party payers and others in the healthcare and scientific community; |

|

|

• |

our plans to pursue the use of Tumor Treating Fields for the treatment of solid tumor cancers other than glioblastoma (“GBM”); |

|

|

• |

our estimates regarding revenues, expenses, capital requirements and needs for additional financing; |

|

|

• |

our ability to obtain regulatory approvals for the use of Tumor Treating Fields in cancers other than GBM and any future delivery systems; |

|

|

• |

our ability to acquire the supplies needed to manufacture our delivery systems from third-party suppliers; |

|

|

• |

our ability to manufacture adequate supply; |

|

|

• |

our ability to secure adequate coverage from third-party payers to reimburse us for our delivery systems; |

|

|

• |

our ability to receive reimbursement from third-party payers for use of our delivery systems; |

|

|

• |

our ability to maintain and develop our intellectual property position; |

|

|

• |

the impact of acts of terrorism, cybersecurity attacks or intrusions; |

|

|

• |

our cash needs; |

|

|

• |

our ongoing legal proceedings and tax audits; and |

|

|

• |

our prospects, financial condition and results of operations. |

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Factors which may cause such differences to occur include those risks and uncertainties set forth under Part I, Item 1A., “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission. We do not intend to update publicly any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

This Quarterly Report on Form 10-Q includes trademarks of NovoCure Limited and other persons. All trademarks or trade names referred to herein are the property of their respective owners.

ii

Quarterly Report on Form 10-Q

|

|

|

|

|

Page |

||

|

|

ii |

|||||

|

|

ii |

|||||

|

|

||||||

|

|

||||||

|

Item 1. |

|

|

2 |

|||

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

13 |

||

|

Item 3. |

|

|

21 |

|||

|

Item 4. |

|

|

21 |

|||

|

|

||||||

|

|

||||||

|

Item 1. |

|

|

22 |

|||

|

Item 1A. |

|

|

22 |

|||

|

Item 2. |

|

|

22 |

|||

|

Item 3. |

|

|

22 |

|||

|

Item 4. |

|

|

22 |

|||

|

Item 5. |

|

|

22 |

|||

|

Item 6. |

|

|

23 |

|||

|

|

||||||

|

|

|

|

24 |

|||

- 1 -

NOVOCURE LIMITED AND SUBSIDIARIES

U.S. dollars in thousands

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2018 |

|

|

2017 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

114,456 |

|

|

$ |

78,592 |

|

|

Short-term investments |

|

|

104,499 |

|

|

|

104,719 |

|

|

Restricted cash |

|

|

2,169 |

|

|

|

2,126 |

|

|

Trade receivables |

|

|

37,643 |

|

|

|

29,567 |

|

|

Receivables and prepaid expenses |

|

|

11,216 |

|

|

|

8,105 |

|

|

Inventories |

|

|

19,906 |

|

|

|

22,025 |

|

|

Total current assets |

|

|

289,889 |

|

|

|

245,134 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

8,891 |

|

|

|

9,031 |

|

|

Field equipment, net |

|

|

8,108 |

|

|

|

9,036 |

|

|

Severance pay fund |

|

|

111 |

|

|

|

111 |

|

|

Other long-term assets |

|

|

2,877 |

|

|

|

1,986 |

|

|

Total long-term assets |

|

|

19,987 |

|

|

|

20,164 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

309,876 |

|

|

$ |

265,298 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 2 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share data)

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2018 |

|

|

2017 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Trade payables |

|

$ |

20,434 |

|

|

$ |

17,206 |

|

|

Other payables and accrued expenses |

|

|

24,813 |

|

|

|

32,996 |

|

|

Total current liabilities |

|

|

45,247 |

|

|

|

50,202 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term loan, net of discount and issuance costs |

|

|

149,195 |

|

|

|

97,342 |

|

|

Employee benefit liabilities |

|

|

2,473 |

|

|

|

2,453 |

|

|

Other long-term liabilities |

|

|

880 |

|

|

|

1,737 |

|

|

Total long-term liabilities |

|

|

152,548 |

|

|

|

101,532 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

197,795 |

|

|

|

151,734 |

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Share capital - |

|

|

|

|

|

|

|

|

|

Ordinary shares no par value, unlimited shares authorized; issued and outstanding: 92,503,273 shares and 89,478,032 shares at June 30, 2018 (unaudited) and December 31, 2017, respectively |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

729,684 |

|

|

|

697,165 |

|

|

Accumulated other comprehensive loss |

|

|

(1,273 |

) |

|

|

(1,343 |

) |

|

Accumulated deficit |

|

|

(616,330 |

) |

|

|

(582,258 |

) |

|

Total shareholders' equity |

|

|

112,081 |

|

|

|

113,564 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

309,876 |

|

|

$ |

265,298 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 3 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except share and per share data)

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2017 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Net revenues |

|

$ |

61,514 |

|

|

$ |

38,376 |

|

|

$ |

113,639 |

|

|

$ |

73,256 |

|

|

$ |

177,026 |

|

|

Cost of revenues |

|

|

19,833 |

|

|

|

13,152 |

|

|

|

38,071 |

|

|

|

24,816 |

|

|

|

55,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

41,681 |

|

|

|

25,224 |

|

|

|

75,568 |

|

|

|

48,440 |

|

|

|

121,417 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research, development and clinical trials |

|

|

11,362 |

|

|

|

9,371 |

|

|

|

22,466 |

|

|

|

18,782 |

|

|

|

38,103 |

|

|

Sales and marketing |

|

|

19,196 |

|

|

|

16,360 |

|

|

|

37,331 |

|

|

|

31,116 |

|

|

|

63,528 |

|

|

General and administrative |

|

|

18,208 |

|

|

|

15,023 |

|

|

|

35,533 |

|

|

|

27,445 |

|

|

|

59,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating costs and expenses |

|

|

48,766 |

|

|

|

40,754 |

|

|

|

95,330 |

|

|

|

77,343 |

|

|

|

160,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(7,085 |

) |

|

|

(15,530 |

) |

|

|

(19,762 |

) |

|

|

(28,903 |

) |

|

|

(39,328 |

) |

|

Financial expenses, net |

|

|

2,860 |

|

|

|

2,183 |

|

|

|

7,713 |

|

|

|

4,629 |

|

|

|

9,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(9,945 |

) |

|

|

(17,713 |

) |

|

|

(27,475 |

) |

|

|

(33,532 |

) |

|

|

(48,497 |

) |

|

Income taxes |

|

|

5,565 |

|

|

|

3,461 |

|

|

|

8,759 |

|

|

|

5,687 |

|

|

|

13,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(15,510 |

) |

|

$ |

(21,174 |

) |

|

$ |

(36,234 |

) |

|

$ |

(39,219 |

) |

|

$ |

(61,662 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per ordinary share |

|

$ |

(0.17 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.70 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares used in computing basic and diluted net loss per share |

|

|

91,331,862 |

|

|

|

88,218,868 |

|

|

|

90,658,735 |

|

|

|

87,835,926 |

|

|

|

88,546,719 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

U.S. dollars in thousands

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2017 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Net loss |

|

$ |

(15,510 |

) |

|

$ |

(21,174 |

) |

|

$ |

(36,234 |

) |

|

$ |

(39,219 |

) |

|

$ |

(61,662 |

) |

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in foreign currency translation adjustments |

|

|

11 |

|

|

|

1 |

|

|

|

21 |

|

|

|

10 |

|

|

|

8 |

|

|

Pension benefit plan |

|

|

44 |

|

|

|

183 |

|

|

|

49 |

|

|

|

134 |

|

|

|

532 |

|

|

Total comprehensive loss |

|

$ |

(15,455 |

) |

|

$ |

(20,990 |

) |

|

$ |

(36,164 |

) |

|

$ |

(39,075 |

) |

|

$ |

(61,122 |

) |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 4 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

U.S. dollars in thousands (except share data)

|

|

|

Ordinary shares |

|

|

Additional paid-in |

|

|

Accumulated other comprehensive |

|

|

Accumulated |

|

|

Total shareholders' |

|

|||||

|

|

|

Shares |

|

|

capital |

|

|

loss |

|

|

deficit |

|

|

equity |

|

|||||

|

Balance as of December 31, 2017 (audited) |

|

|

89,478,032 |

|

|

$ |

697,165 |

|

|

$ |

(1,343 |

) |

|

$ |

(582,258 |

) |

|

$ |

113,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of shares |

|

|

54,386 |

|

|

|

938 |

|

|

|

- |

|

|

|

- |

|

|

|

938 |

|

|

Share-based compensation to employees |

|

|

- |

|

|

|

18,726 |

|

|

|

- |

|

|

|

- |

|

|

|

18,726 |

|

|

Exercise of options and warrants and vested RSUs |

|

|

2,970,855 |

|

|

|

12,855 |

|

|

|

- |

|

|

|

- |

|

|

|

12,855 |

|

|

Cumulative effect adjustment on retained earnings (*) |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

2,162 |

|

|

|

2,162 |

|

|

Other comprehensive income, net of tax benefit of $8 |

|

|

- |

|

|

|

- |

|

|

|

70 |

|

|

|

- |

|

|

|

70 |

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(36,234 |

) |

|

|

(36,234 |

) |

|

Balance as of June 30, 2018 (Unaudited) |

|

|

92,503,273 |

|

|

$ |

729,684 |

|

|

$ |

(1,273 |

) |

|

$ |

(616,330 |

) |

|

$ |

112,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) |

Resulting from the adoption of ASC 606. |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 5 -

NOVOCURE LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2017 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(15,510 |

) |

|

$ |

(21,174 |

) |

|

$ |

(36,234 |

) |

|

$ |

(39,219 |

) |

|

$ |

(61,662 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,287 |

|

|

|

1,811 |

|

|

|

4,490 |

|

|

|

3,471 |

|

|

|

7,677 |

|

|

Asset write-downs and impairment of field equipment |

|

|

93 |

|

|

|

59 |

|

|

|

142 |

|

|

|

134 |

|

|

|

241 |

|

|

Share-based compensation to employees |

|

|

10,206 |

|

|

|

7,570 |

|

|

|

18,726 |

|

|

|

12,131 |

|

|

|

27,116 |

|

|

Increase in trade receivables |

|

|

(3,599 |

) |

|

|

(2,064 |

) |

|

|

(5,271 |

) |

|

|

(7,550 |

) |

|

|

(23,228 |

) |

|

Amortization of discount |

|

|

(370 |

) |

|

|

103 |

|

|

|

2,057 |

|

|

|

209 |

|

|

|

252 |

|

|

Decrease (increase) in receivables and prepaid expenses |

|

|

(1,277 |

) |

|

|

3,354 |

|

|

|

(3,111 |

) |

|

|

(1,461 |

) |

|

|

1,979 |

|

|

Decrease in inventories |

|

|

482 |

|

|

|

803 |

|

|

|

2,120 |

|

|

|

403 |

|

|

|

3,524 |

|

|

Increase in other long-term assets |

|

|

(278 |

) |

|

|

(38 |

) |

|

|

(898 |

) |

|

|

(294 |

) |

|

|

(554 |

) |

|

Increase (decrease) in trade payables |

|

|

1,016 |

|

|

|

(1,638 |

) |

|

|

3,229 |

|

|

|

(5,195 |

) |

|

|

(1,150 |

) |

|

Increase (decrease) in other payables and accrued expenses |

|

|

(528 |

) |

|

|

4,888 |

|

|

|

(8,828 |

) |

|

|

3,478 |

|

|

|

14,460 |

|

|

Increase in employee benefit liabilities, net |

|

|

1 |

|

|

|

130 |

|

|

|

77 |

|

|

|

239 |

|

|

|

440 |

|

|

Increase (decrease) in other long-term liabilities |

|

|

(16 |

) |

|

|

321 |

|

|

|

(816 |

) |

|

|

870 |

|

|

|

(2,229 |

) |

|

Net cash used in operating activities |

|

$ |

(7,493 |

) |

|

$ |

(5,875 |

) |

|

$ |

(24,317 |

) |

|

$ |

(32,784 |

) |

|

$ |

(33,134 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

$ |

(854 |

) |

|

$ |

(376 |

) |

|

$ |

(1,591 |

) |

|

$ |

(1,406 |

) |

|

$ |

(2,459 |

) |

|

Purchase of field equipment |

|

|

(604 |

) |

|

|

(859 |

) |

|

|

(1,974 |

) |

|

|

(2,261 |

) |

|

|

(4,907 |

) |

|

Proceeds from maturity of short-term investments |

|

|

60,000 |

|

|

|

60,000 |

|

|

|

105,000 |

|

|

|

120,000 |

|

|

|

120,000 |

|

|

Purchase of short-term investments |

|

|

(59,384 |

) |

|

|

(59,352 |

) |

|

|

(104,134 |

) |

|

|

(104,006 |

) |

|

|

(104,006 |

) |

|

Net cash provided by (used in) investing activities |

|

$ |

(842 |

) |

|

$ |

(587 |

) |

|

$ |

(2,699 |

) |

|

$ |

12,327 |

|

|

$ |

8,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of shares, net |

|

$ |

938 |

|

|

$ |

781 |

|

|

$ |

938 |

|

|

$ |

781 |

|

|

$ |

1,540 |

|

|

Proceeds from long-term loan, net |

|

|

- |

|

|

|

- |

|

|

|

149,150 |

|

|

|

- |

|

|

|

- |

|

|

Proceeds from other long-term loans |

|

|

- |

|

|

|

19 |

|

|

|

- |

|

|

|

19 |

|

|

|

19 |

|

|

Repayment of long-term loan |

|

|

- |

|

|

|

- |

|

|

|

(100,000 |

) |

|

|

- |

|

|

|

- |

|

|

Repayment of other long-term loan |

|

|

(24 |

) |

|

|

(19 |

) |

|

|

(41 |

) |

|

|

(37 |

) |

|

|

(76 |

) |

|

Exercise of options and warrants |

|

|

10,274 |

|

|

|

1,286 |

|

|

|

12,855 |

|

|

|

1,363 |

|

|

|

3,685 |

|

|

Net cash provided by financing activities |

|

$ |

11,188 |

|

|

$ |

2,067 |

|

|

$ |

62,902 |

|

|

$ |

2,126 |

|

|

$ |

5,168 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

$ |

11 |

|

|

$ |

(1 |

) |

|

$ |

21 |

|

|

$ |

10 |

|

|

$ |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash, cash equivalents and restricted cash |

|

|

2,864 |

|

|

|

(4,396 |

) |

|

|

35,907 |

|

|

|

(18,321 |

) |

|

|

(19,330 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

113,761 |

|

|

|

86,123 |

|

|

|

80,718 |

|

|

|

100,048 |

|

|

|

100,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the end of the period |

|

$ |

116,625 |

|

|

$ |

81,727 |

|

|

$ |

116,625 |

|

|

$ |

81,727 |

|

|

$ |

80,718 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

$ |

8,256 |

|

|

$ |

1,500 |

|

|

$ |

12,014 |

|

|

$ |

4,902 |

|

|

$ |

10,286 |

|

|

Interest |

|

$ |

3,416 |

|

|

$ |

2,533 |

|

|

$ |

6,425 |

|

|

$ |

5,041 |

|

|

$ |

10,162 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

- 6 -

NOVOCURE LIMITED AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share data)

NOTE 1: ORGANIZATION AND BASIS OF PRESENTATION

Organization. NovoCure Limited (including its consolidated subsidiaries, the “Company”) was incorporated in the Bailiwick of Jersey and is principally engaged in the development, manufacture and commercialization of Tumor Treating Fields for the treatment of solid tumors. The Company has regulatory approvals and clearances in certain countries for Optune, its first Tumor Treating Fields delivery system, to treat adult patients with glioblastoma (“GBM”).

Financial statement preparation. The accompanying consolidated financial statements include the accounts of the Company and its consolidated subsidiaries, and intercompany accounts and transactions have been eliminated. In the opinion of the Company’s management, the consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation. The preparation of these consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in these consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. These consolidated financial statements and accompanying notes should be read in conjunction with the Company’s annual consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 10-K”) filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2018.

The significant accounting policies applied in the audited annual consolidated financial statements of the Company as disclosed in the 2017 10-K are applied consistently in these unaudited interim consolidated financial statements, except as noted below:

Recently Adopted Accounting Pronouncements. In May 2014, FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) (ASU 2014-09), an updated standard on revenue recognition and issued subsequent amendments to the initial guidance in March 2016, April 2016, May 2016 and December 2016 within ASU 2016-08, 2016-10, 2016-12 and 2016-20, respectively (collectively, “ASC 606”). The core principle of the new standard is for companies to recognize revenue to depict the transfer of goods and services to patients in amounts that reflect the consideration to which the company expects to be entitled in exchange for those goods and services. In addition, the new standard requires expanded disclosures. The Company has adopted the standard effective January 1, 2018 using the modified retrospective method for all contracts. The reported results for 2018 reflect the application of ASC 606 guidance while the reported results for 2017 were prepared under the guidance of ASC 605, Revenue Recognition (ASC 605). The amount of revenue recognized in 2018 reflects the consideration to which the Company expects to be entitled to receive in exchange for Optune.

In preparation for adoption of the standard, the Company has implemented internal controls and key system functionality to enable the preparation of financial information, including the assessment of the impact of the standard. The Company uses the portfolio approach to apply the standard to portfolios of contracts with similar characteristics. Adoption of the standard resulted in an increase to trade receivables of $2,807, deferred revenues of $645 and a cumulative impact to the Company's accumulated deficit as of January 1, 2018 of $2,162.

Optune is comprised of two main components: (1) an electric field generator and (2) transducer arrays and related accessories. We retain title to the electric field generator, and the patient is provided replacement transducer arrays and technical support for the device during the term of treatment. The electric field generator and transducer arrays are always supplied and function together and are not sold on a standalone basis.

To recognize revenue under ASC 606, the Company applies the following five steps:

1. Identify the contract with a patient. A contract with a patient exists when (i) the Company enters into an enforceable contract with a patient that defines each party’s rights regarding delivery of and payment for Optune, (ii) the contract has commercial substance and (iii) the Company determines that collection of substantially all consideration for Optune is probable based on the payer’s intent and ability to pay the promised consideration. The evidence of a contract generally consists of a prescription, a patient service agreement and the verification of the assigned payer for the contract and intention to collect.

2. Identify the performance obligations in the contract. Optune contracts include the lease of the device, the supply obligation of disposable transducer arrays and technical support for the term of treatment. To the extent a contract includes multiple promised products and/or services, the Company must apply judgment to determine whether those products and/or services are capable of being distinct in the context of the contract. If these criteria are not met the promised products and/or services are accounted for as

- 7 -

a combined performance obligation. In the Company’s case, Optune’s device, support, and disposables are provided as one inseparable package of monthly treatment for a single monthly fee.

3. Determine the transaction price. The transaction price is determined based on the consideration to which the Company will be entitled in exchange for providing Optune to the patient. To the extent the transaction price includes variable consideration, the Company estimates the amount of variable consideration that should be included in the transaction price utilizing either the expected value method or the most likely amount method depending on the nature of the variable consideration. Variable consideration is included in the transaction price if, in the Company’s judgment, it is probable that a significant future reversal of cumulative revenue under the contract will not occur. The Company has agreements with many payers that define explicit discounts off the gross transaction price. In addition to the explicit discounts negotiated with each payer, the Company expects to receive, in aggregate for a given portfolio, less than the gross revenue net of explicit discounts. ASC 606 requires that the Company recognize this variable consideration as an implicit discount in the billing period. The implicit discount includes both an estimate of claims that will pay at an amount less than billed and an estimate of claims that will not pay within a given time horizon. The implicit discount adjustments to the transaction price are due to concessions, not collectability concerns driven by payer credit risk.

4. Allocate the transaction price to performance obligations in the contract. If a contract contains a single performance obligation, the entire transaction price is allocated to the single performance obligation. As discussed above, there is one performance obligation under the Company’s contracts and, therefore, the monthly transaction price determined for the performance obligation will be recognized over time ratably over the monthly term of the treatment.

5. Recognize revenue when or as the Company satisfies a performance obligation. The Company satisfies performance obligations over time as discussed above. Revenue is recognized at the time the related performance obligation is satisfied by transferring a promised service to a patient. The patient consumes the benefits of Optune treatment on a daily basis over the monthly term. As this criterion is met, the revenues will be recognized over the monthly term.

In accordance with ASC 606, the impact of our adoption of ASC 606 on our condensed consolidated statements of income for the six and three months ended June 30, 2018 were a decrease in net revenues of $5,531 and $1,993, respectively, an increase in net loss of $5,371 and $2,035, respectively, and a decrease in our basic and diluted net loss per ordinary share of $0.06 and $0.02, respectively. The impact of our adoption of Topic 606 on our balance sheet as of June 30, 2018 was a decrease in trade receivables of $2,760, an increase to other payables and accrued expenses (deferred revenues net of tax provision) of $521 and an accumulated deficit as of June 30, 2018 of $3,209.

In August 2016, FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230) Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 eliminates the diversity in practice related to the classification of certain cash receipts and payments for debt prepayment or extinguishment costs, the maturing of a zero coupon bond, the settlement of contingent liabilities arising from a business combination, proceeds from insurance settlements, distributions from certain equity method investees and beneficial interests obtained in a financial asset securitization. ASU 2016-15 designates the appropriate cash flow classification, including requirements to allocate certain components of these cash receipts and payments among operating, investing and financing activities. The retrospective transition method, requiring adjustment to all comparative periods presented, is required unless it is impracticable for some of the amendments, in which case those amendments would be prospectively as of the earliest date practicable. The Company adopted the standard effective as of January 1, 2018, and the adoption of this standard did not have an impact on the Company's consolidated financial statements.

In November 2016, FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. This standard requires the presentation of the statement of cash flows to show the changes in the total of cash, cash equivalents, restricted cash and restricted cash equivalents. The standard is effective for fiscal years and the interim periods within those fiscal years beginning after December 15, 2017. The Company adopted the standard retrospectively to all periods presented effective as of January 1, 2018.

Recent Accounting Pronouncements. In February 2016, FASB issued ASU 2016-02-Leases (ASC 842), which sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract (i.e. lessees and lessors). The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight line basis over the term of the lease, respectively. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than twelve months regardless of their classification. Leases with a term of twelve months or less will be accounted for similar to existing guidance for operating leases. The new standard requires lessors to account for leases using an approach that is substantially equivalent to existing guidance for sales-type leases, direct financing leases and operating leases. ASC 842 supersedes the previous leases standard, ASC 840. The standard is

- 8 -

effective on January 1, 2019, with early adoption permitted. The Company currently anticipates adopting the new standard effective January 1, 2019 and is evaluating the impact of the adoption of this standard on its consolidated financial statements.

In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. ASU 2016-13 amends the impairment model to utilize an expected loss methodology in place of the currently used incurred loss methodology, which will result in the more timely recognition of losses. ASU 2016-13 also applies to employee benefit plan accounting, with an effective date of the first quarter of fiscal 2020. The amendments in this update are effective for fiscal years beginning after December 31, 2019, including interim periods within those fiscal years. The Company is currently assessing the impact of the adoption of this standard on its consolidated financial statements, footnote disclosures and employee benefit plans’ accounting.

In June 2018, FASB issued ASU 2018-07 to expand the scope of ASC Topic 718, Compensation - Stock Compensation, to include share-based payment transactions for acquiring goods and services from nonemployees. The pronouncement is effective for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2018, with early adoption permitted. The Company is evaluating the effects of this standard on its consolidated financial statements.

NOTE 2: SHORT-TERM INVESTMENTS

The Company invests in marketable U.S. Treasury Bills (“T-bills”) that are classified as held-to-maturity securities. The amortized cost and recorded basis of the T-bills are presented as short-term investments in the amount of $104,499 and $104,719 as of June 30, 2018 and December 31, 2017, respectively, and their estimated fair value as of June 30, 2018 and December 31, 2017 was $104,512 and $104,655, respectively.

NOTE 3: INVENTORIES

Inventories are stated at the lower of cost or market. The weighted average methodology is applied to determine cost. As of June 30, 2018 and December 31, 2017, the Company’s inventories were composed of:

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2018 |

|

|

2017 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

Raw materials |

|

$ |

2,519 |

|

|

$ |

4,276 |

|

|

Work in progress |

|

|

5,267 |

|

|

|

8,435 |

|

|

Finished products |

|

|

12,120 |

|

|

|

9,314 |

|

|

Total |

|

$ |

19,906 |

|

|

$ |

22,025 |

|

NOTE 4: COMMITMENTS AND CONTINGENT LIABILITIES

The facilities of the Company are leased under various operating lease agreements for periods ending no later than 2024. The Company also leases motor vehicles under various operating leases, which expire on various dates, the latest of which is in 2021.

As of June 30, 2018 and December 31, 2017, the Company pledged bank deposits of $1,145 and $1,038, respectively, to cover bank guarantees in respect of its leases of operating facilities and obtained bank guarantees for the fulfillment of the Company’s lease and other contractual commitments of $1,305 and $1,202, respectively.

In the first quarter of 2018, the Company made a milestone payment of $5.5 million (the “Milestone Payment”) to the Technion Research and Development Foundation (“Technion”) pursuant to the settlement agreement dated February 10, 2015 (the “Settlement Agreement”). Pursuant to the Settlement Agreement, and in exchange for a release of potential disputes regarding intellectual property developed by our founder and previously assigned to us, the Company was obligated to pay the Milestone Payment to Technion in the quarter following the quarter in which the Company achieved $250.0 million of cumulative net sales (as defined in the Settlement Agreement) (the “Net Sales Milestone”). The Company achieved the Net Sales Milestone in the fourth quarter of 2017.

NOTE 5: LONG TERM LOAN

On February 7, 2018, the Company and certain of its subsidiaries entered into a Loan and Security Agreement (“2018 Loan Agreement”) with BioPharma Credit PLC pursuant to which such lender made a term loan to the Company in the principal amount of $150 million (the “2018 Credit Facility”). The term loan, which was drawn in full upon execution of the 2018 Loan Agreement, bears

- 9 -

interest at 9.0% per annum, payable quarterly in arrears. The Company used a portion of the proceeds of the 2018 Credit Facility to repay in full the Company’s obligations under its existing term loan credit facility and will use the remaining proceeds to fund general corporate purposes.

The 2018 Credit Facility will mature on February 7, 2023, at which time any unpaid principal and accrued unpaid interest in respect of the term loan will be due and payable. The Company may prepay the term loan, in full, at any time. The Company must prepay the term loan (i) in full or in part upon the entry into certain licensing arrangements and (ii) in full in the event of a change of control. In each case, any prepayment (whether permitted or mandatory) is subject to a prepayment premium and/or make-whole payment. The pre-payment fee if the Company prepays outstanding loan amounts prior to February 7, 2021 is 2.0% and is 1.0% if made after the February 7, 2021 but prior to February 7, 2022.

All obligations under the 2018 Credit Facility are guaranteed by the Company’s current and future direct and indirect subsidiaries. In addition, the obligations under the 2018 Credit Facility are secured by a first-priority security interest in substantially all of the property and assets of, as well as the equity interests owned by, the Company and certain of the other guarantors. The 2018 Credit Facility contains other customary covenants.

Total net issuance costs of the 2018 Credit Facility, which were $805 as of June 30, 2018, are presented net of the 2018 Credit Facility proceeds and are amortized to interest expense over the five year term of the loan using the effective interest method.

On February 7, 2018, the Company’s 2015 term loan credit facility was terminated upon the Company’s repayment in full of the term loan issued thereunder. The un-amortized discount in the amount of $1,160 and issuance costs in the amount of $1,399 were fully amortized and included in the Company’s first quarter finance expenses.

NOTE 6: SHARE CAPITAL

For the six months ended June 30, 2018, warrants to purchase 201,692 ordinary shares with an exercise price of $3.59 per share were cashlessly exercised, resulting in the issuance of 167,212 ordinary shares. Also, warrants to purchase 1,549 ordinary shares with an exercise price of $3.59 per share were exercised for cash. For the six months ended June 30, 2018, options to purchase 2,253,654 ordinary shares were exercised, resulting in the issuance of 2,251,676 ordinary shares.

NOTE 7: EQUITY INCENTIVE PLANS

In September 2015, the Company adopted the 2015 Omnibus Incentive Plan (the “2015 Plan”). Under the 2015 Plan, the Company can issue various types of equity compensation awards such as share options, restricted shares, performance shares, restricted stock units (“RSUs”), performance units, long-term cash awards and other share-based awards.

Options granted under the 2015 Plan generally have a four-year vesting period and expire ten years after the date of grant. Options granted under the 2015 Plan that are cancelled or forfeited before expiration become available for future grants. RSUs granted under the 2015 Plan vest in equal installments over a three-year period. As of June 30, 2018, 10,416,052 ordinary shares were available for grant under the 2015 Plan.

- 10 -

A summary of the status of the Company’s option plans as of June 30, 2018 and changes during the period then ended is presented below:

|

|

|

Six months ended June 30, 2018 |

|

|||||

|

|

|

Unaudited |

|

|||||

|

|

|

Number of options |

|

|

Weighted average exercise price |

|

||

|

Outstanding at beginning of year |

|

|

14,806,027 |

|

|

$ |

10.64 |

|

|

Granted |

|

|

2,199,389 |

|

|

|

22.31 |

|

|

Exercised |

|

|

(2,253,654 |

) |

|

|

6.54 |

|

|

Forfeited and cancelled |

|

|

(127,262 |

) |

|

|

14.59 |

|

|

Outstanding as of June 30, 2018 |

|

|

14,624,500 |

|

|

$ |

12.99 |

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable options |

|

|

5,955,869 |

|

|

$ |

10.20 |

|

|

|

|

|

|

|

|

|

|

|

A summary of the status of the Company’s RSUs as of June 30, 2018 and changes during the period then ended is presented below:

|

|

|

Six months ended June 30, 2018 |

|

|||||

|

|

|

Unaudited |

|

|||||

|

|

|

Number of RSUs |

|

|

Weighted average grant date fair value price |

|

||

|

Unvested at beginning of year |

|

|

1,651,219 |

|

|

$ |

9.66 |

|

|

Granted |

|

|

482,232 |

|

|

|

22.20 |

|

|

Vested |

|

|

(550,418 |

) |

|

|

9.66 |

|

|

Forfeited and cancelled |

|

|

(10,760 |

) |

|

|

12.13 |

|

|

Unvested as of June 30, 2018 |

|

|

1,572,273 |

|

|

$ |

13.49 |

|

In September 2015, the Company adopted an employee share purchase plan (“ESPP”) to encourage and enable eligible employees to acquire ownership of the Company’s ordinary shares purchased through accumulated payroll deductions on an after-tax basis. In the United States, the ESPP is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Internal Revenue Code and the provisions of the ESPP will be construed in a manner consistent with the requirements of such section. The Company began its offerings under the ESPP on August 1, 2016. As of June 30, 2018, 2,223,319 ordinary shares were available to be purchased by eligible employees under the ESPP and 314,207 shares had been issued under the ESPP.

The fair value of share-based awards was estimated using the Black-Scholes model for all equity grants. For market condition awards, the Company also applied the Monte-Carlo simulation model, with the following underlying assumptions:

|

|

|

Six months ended June 30, |

|

Year ended December 31, |

||

|

|

|

2018 |

|

2017 |

|

2017 |

|

|

|

Unaudited |

|

Audited |

||

|

Stock Option Plans |

|

|

|

|

|

|

|

Expected term (years) |

|

5.50-6.25 |

|

5.50-6.25 |

|

5.50-6.25 |

|

Expected volatility |

|

52%-55% |

|

57%-59% |

|

57%-59% |

|

Risk-free interest rate |

|

2.70%-2.89% |

|

1.99%-2.23% |

|

1.97%-2.23% |

|

Dividend yield |

|

0.00% |

|

0.00% |

|

0.00% |

|

ESPP |

|

|

|

|

|

|

|

Expected term (years) |

|

0.50 |

|

0.50 |

|

0.50 |

|

Expected volatility |

|

53% |

|

82% |

|

76%-82% |

|

Risk-free interest rate |

|

1.61% |

|

0.62% |

|

0.62%-1.13% |

|

Dividend yield |

|

0.00% |

|

0.00% |

|

0.00% |

- 11 -

The total non-cash share-based compensation expense related to all of the Company’s equity-based awards recognized for the three and six months ended June 30, 2018 and 2017 and the year ended December 31, 2017 was:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2017 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

Cost of revenues |

|

$ |

263 |

|

|

$ |

131 |

|

|

$ |

428 |

|

|

$ |

274 |

|

|

$ |

467 |

|

|

Research, development and clinical trials |

|

|

1,286 |

|

|

|

811 |

|

|

|

2,192 |

|

|

|

1,673 |

|

|

|

3,587 |

|

|

Sales and marketing |

|

|

1,893 |

|

|

|

1,735 |

|

|

|

3,329 |

|

|

|

2,390 |

|

|

|

3,784 |

|

|

General and administrative |

|

|

6,764 |

|

|

|

4,893 |

|

|

|

12,777 |

|

|

|

7,794 |

|

|

|

19,278 |

|

|

Total share-based compensation expense |

|

$ |

10,206 |

|

|

$ |

7,570 |

|

|

$ |

18,726 |

|

|

$ |

12,131 |

|

|

$ |

27,116 |

|

NOTE 8: SUPPLEMENTAL INFORMATION

The Company operates in a single reportable segment.

The following table presents long-lived assets by location:

|

|

|

June 30, |

|

|

December 31, |

|

||

|

|

|

2018 |

|

|

2017 |

|

||

|

|

|

Unaudited |

|

|

Audited |

|

||

|

United States |

|

$ |

9,731 |

|

|

$ |

10,372 |

|

|

Switzerland |

|

|

4,211 |

|

|

|

5,114 |

|

|

Israel |

|

|

2,238 |

|

|

|

2,081 |

|

|

Others |

|

|

819 |

|

|

|

500 |

|

|

Total |

|

$ |

16,999 |

|

|

$ |

18,067 |

|

The Company’s revenues by geographic region, based on the customer’s location, are summarized as follows:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

Year ended December 31, |

|

|||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2017 |

|

|||||

|

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

|||||||||||

|

United States |

|

$ |

41,935 |

|

|

$ |

31,367 |

|

|

$ |

79,738 |

|

|

$ |

60,526 |

|

|

$ |

134,688 |

|

|

EMEA (*) |

|

|

18,522 |

|

|

|

6,891 |

|

|

|

32,396 |

|

|

|

12,559 |

|

|

|

42,035 |

|

|

Japan |

|

|

1,057 |

|

|

|

118 |

|

|

|

1,505 |

|

|

|

171 |

|

|

|

303 |

|

|

Total |

|

$ |

61,514 |

|

|

$ |

38,376 |

|

|

$ |

113,639 |

|

|

$ |

73,256 |

|

|

$ |

177,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) including Germany |

|

$ |

17,651 |

|

|

$ |

6,817 |

|

|

$ |

31,009 |

|

|

$ |

12,216 |

|

|

$ |

40,215 |

|

- 12 -

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide information to assist you in better understanding and evaluating our financial condition and results of operations. We encourage you to read this MD&A in conjunction with our consolidated financial statements and the notes thereto for the period ended June 30, 2018 included in Part I, Item 1 of this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. As a result of many factors, such as those set forth under Part I, Item 1A, “Risk Factors”, of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 10-K”), our actual results may differ materially from those anticipated in these forward-looking statements. References to the words “we,” “our,” “us,” and the “Company” in this report refer to NovoCure Limited, including its consolidated subsidiaries.

Overview

We are a global oncology company developing a proprietary platform technology called Tumor Treating Fields, the use of electric fields tuned to specific frequencies to disrupt solid tumor cancer cell division. Our key priorities are to drive commercial adoption of Optune, our first commercial Tumor Treating Fields delivery system, for the treatment of glioblastoma (“GBM”) and to advance programs testing the efficacy and safety of Tumor Treating Fields in multiple solid tumor indications through our clinical pipeline.

We were founded in 2000 and operated as a development stage company through December 31, 2011. We initially received U.S. Food and Drug Administration (“FDA”) approval for Optune in 2011 for use as a monotherapy treatment for adult patients with GBM following confirmed recurrence after chemotherapy. In October 2015, we received FDA approval to market Optune for the treatment of adult patients with newly diagnosed GBM in combination with temozolomide, a chemotherapy drug. We have also received approval to market Optune in the European Union (“EU”), Switzerland, Japan and certain other countries. We have built a commercial organization and launched Optune in the United States, Germany, Austria, Switzerland, Israel and Japan, which we refer to as our currently active markets.

In March 2018, the National Comprehensive Cancer Network Clinical Practice Guidelines in Oncology® (NCCN Guidelines®) for Central Nervous Systems Cancers were updated to include alternating electric field therapy as a Category 1 treatment for patients with newly diagnosed GBM in conjunction with temozolomide after maximal safe resection and completion of radiation therapy. The updated recommendation follows the publication of Novocure’s EF-14 phase 3 pivotal trial five-year survival results in the Journal of the American Medical Association (JAMA) in December 2017. The EF-14 five-year survival results demonstrated Optune plus temozolomide significantly improved survival outcomes in patients with newly diagnosed GBM compared to temozolomide alone. A category 1 recommendation indicates, based upon high-level evidence, that there is uniform NCCN consensus that the intervention is appropriate.

We continue to work with payers to expand access to Optune for patients with newly diagnosed and recurrent GBM. As of June 30, 2018, we estimate that more than 227 million Americans had coverage of Optune for newly diagnosed and/or recurrent GBM. Additionally, we had signed contracts to establish Optune as an in-network benefit for more than 220 million American lives. The percentage of our U.S. active patient population who are beneficiaries of the Medicare fee-for-service program, which has denied coverage for our claims to date, continues to range from 20 to 25 percent. In Germany, we are able to bill healthcare payers for individual cases and have started the formal process to secure national reimbursement through a clinical trial. We have received national reimbursement for Optune in Japan and Austria, and we are pursuing reimbursement for Optune in Switzerland and Israel.

Medicare has the authority to issue national coverage determinations or to defer coverage decisions to its regional Medicare Administrative Contractors (“MACs”). Medicare has not issued a national coverage determination for Optune. The two MACs that currently administer the durable medical equipment (“DME”) benefit for Medicare issued a joint local coverage determination (“LCD”) policy in 2014 stating that Optune is not reasonable and necessary for the treatment of recurrent GBM. On June 20, 2018, we submitted an LCD reconsideration request to the Medicare DME MACs. Our decision to file for coverage follows the announcement by the Centers for Medicare and Medicaid Services (“CMS”) in June 2018 that it has developed a methodology that will recognize current commercial pricing for newly covered DME items and that commercial pricing information will be taken into account when establishing a new fee schedule amount. We believe this methodology reflects the significant progress made during our multi-year dialogue with CMS and will generate a commercially acceptable price for Optune in the U.S. for the Medicare fee-for-service program.

The MACs should make a final LCD reconsideration decision within 90 days of the June 20th submission. The decision will state whether the MACs intend to keep the policy as is or make it less restrictive. If the final decision made is to revise the LCD, the normal process for LCD development would then be followed. While the timeline for LCD development is not fixed and can vary widely, we believe it will take approximately six months from a decision to revise the LCD to secure Medicare coverage and payment for Optune.

- 13 -

We have researched the biological effects of Tumor Treating Fields extensively. Tumor Treating Fields uses electric fields tuned to specific frequencies to disrupt cancer cell division, inhibiting tumor growth and causing affected cancer cells to die. Because Tumor Treating Fields is delivered regionally, acts only on dividing cells (a biological process known as mitosis) and is frequency-tuned to target cancer cells of a specific size, we believe there is minimal damage to healthy cells. We believe our pre-clinical and clinical research demonstrates that Tumor Treating Fields’ mechanism of action affects fundamental aspects of cell division and may have broad applicability across a variety of solid tumors. We have demonstrated in preclinical studies that Tumor Treating Fields can offer additive or synergistic benefits in combination with other anti-cancer agents, which may lead to greater efficacy without significantly increasing the side effects.

We believe we have a robust global patent and intellectual property portfolio, with numerous patent applications pending worldwide. We believe we will maintain exclusive rights to market Tumor Treating Fields for all solid tumor indications in our key markets through the life of our patents.

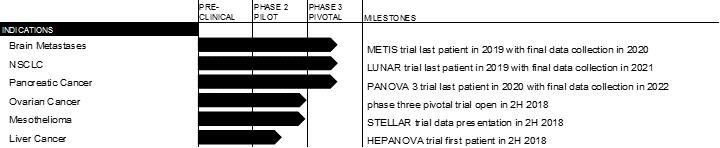

We are currently planning or conducting clinical trials evaluating the use of Tumor Treating Fields in brain metastases, non-small-cell lung cancer (“NSCLC”), pancreatic cancer, ovarian cancer, mesothelioma and liver cancer. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of Tumor Treating Fields for additional solid tumor indications.

In April 2018, we reported positive top-line results from our STELLAR phase 2 pilot trial in mesothelioma. These results exceeded the results of the interim analysis for all efficacy endpoints and demonstrated clinically meaningful improvements in overall survival and progression free survival among patients who received Tumor Treating Fields plus standard of care chemotherapy, pemetrexed and cisplatin or carboplatin, compared to historical control data of patients who received standard of care chemotherapy alone. The STELLAR data has been accepted as a mini-oral presentation at the 19th World Conference on Lung Cancer hosted by the International Association for the Study of Lung Cancer (IASLC) in September 2018. We plan to submit a Humanitarian Device Exemption application to the FDA for approval in upcoming months and anticipate a 2019 launch in the United States, pending regulatory approval.

In June 2018, we opened a single-arm, phase 2 pilot clinical trial in liver cancer, the HEPANOVA trial, which will study Tumor Treating Fields in combination with sorafenib, a chemotherapy drug, as a treatment in 25 patients with advanced liver cancer. We anticipate first patient enrollment in the second half of 2018.The table below presents the current status of the ongoing or completed clinical trials in our pipeline and our expected next milestone for each.

Financial Overview. We view our operations and manage our business in one operating segment. For the three and six months ended June 30, 2018, our net revenues were $61.5 million and $113.6 million, respectively, and our net loss was $15.5 million and $36.2 million, respectively. Our net loss for the three and six months ended June 30, 2018 includes $10.2 million and $18.7 million, respectively, in non-cash share-based compensation expense. As of June 30, 2018, we had an accumulated deficit of $616.3 million.

Critical Accounting Policies and Estimates

In accordance with U.S. generally accepted accounting principles (“GAAP”), in preparing our financial statements, we must make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of net revenues and expenses during the reporting period. We develop and periodically change these estimates and assumptions based on historical experience and on various other factors that we believe are reasonable under the circumstances. Actual results may differ from these estimates.

- 14 -

The critical accounting policies requiring estimates, assumptions and judgments that we believe have the most significant impact on our consolidated financial statements can be found in our 2017 10-K. We adopted ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, and ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date as of January 1, 2018. For additional information, see Note 1 to our Unaudited Consolidated Financial Statements. There were no other material changes to our critical accounting policies and estimates as compared to the critical accounting policies and estimates described in our 2017 10-K.

Commentary on Results of Operations

Net revenues. Substantially all of our revenues are derived from patients using Optune in our currently active markets. We charge patients or their third-party healthcare payers on a monthly basis. Our potential net revenues per patient are determined by our ability to secure payment from payers, the monthly fee we collect and the number of months that the patient remains on therapy.