UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

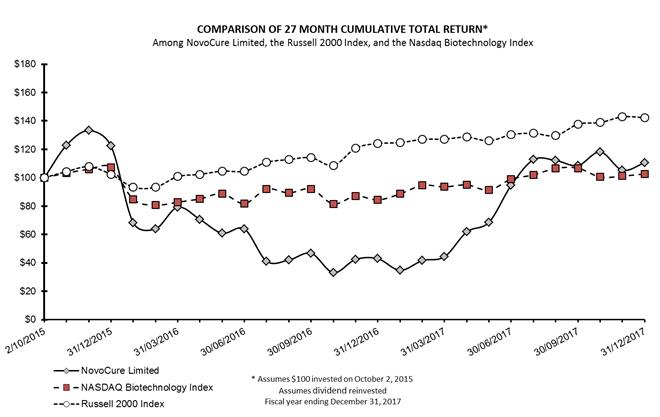

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-37565

NovoCure Limited

(Exact Name of Registrant as Specified in Its Charter)

|

Jersey (State or Other Jurisdiction of Incorporation or Organization) |

98-1057807 (I.R.S. Employer Identification No.) |

|

|

|

|

No. 4 The Forum Grenville Street St. Helier, Jersey JE2 4UF (Address of Principal Executive Offices)

|

|

Registrant’s telephone number, including area code: +44 (0) 15 3475 6700

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class |

|

|

Name of each exchange on which registered |

|

|

Ordinary shares, no par value per share |

NASDAQ Global Select Market |

||||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

|

|

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the outstanding common equity of the registrant held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $909,514,284.

The number of shares of the registrant’s ordinary shares outstanding as of February 16, 2018 was 89,882,437.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2018 annual meeting of shareholders are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this Form 10-K. Such definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2017.

|

|

|

Page |

|

ii |

||

|

Item 1. |

1 |

|

|

Item 1A. |

18 |

|

|

Item 1B. |

46 |

|

|

Item 2. |

46 |

|

|

Item 3. |

46 |

|

|

Item 4. |

46 |

|

|

Item 5. |

48 |

|

|

Item 6. |

51 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 |

|

Item 7A. |

65 |

|

|

Item 8. |

66 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

97 |

|

Item 9A. |

97 |

|

|

Item 9B. |

97 |

|

|

Item 10. |

98 |

|

|

Item 11. |

98 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

98 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

98 |

|

Item 14. |

98 |

|

|

Item 15. |

99 |

|

|

Item 16. |

102 |

|

|

103 |

||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts or statements of current condition, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements contained in this report are based on our current plans, expectations, hopes, beliefs, intentions or strategies concerning future developments and their impact on us. Forward-looking statements contained in this report constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, the commercialization of Optune and our other delivery systems, our intellectual property and delivery system research and development. In particular, these forward-looking statements include, among others, statements about:

|

|

• |

our research and development, clinical trial and commercialization activities and projected expenditures; |

|

|

• |

the further commercialization of Optune and our delivery system candidates; |

|

|

• |

our business strategies and the expansion of our sales and marketing efforts in the United States and in other countries; |

|

|

• |

the market acceptance of Optune and our other delivery systems by patients, physicians, third-party payers and others in the healthcare and scientific community; |

|

|

• |

our plans to pursue the use of Tumor Treating Fields delivery systems for the treatment of solid tumor cancers other than GBM; |

|

|

• |

our estimates regarding revenues, expenses, capital requirements and needs for additional financing; |

|

|

• |

our ability to obtain regulatory approvals for the use of Tumor Treating Fields in cancers other than GBM and any future delivery systems; |

|

|

• |

our ability to acquire the supplies needed to manufacture our delivery systems from third-party suppliers; |

|

|

• |

our ability to manufacture adequate supply; |

|

|

• |

our ability to secure adequate coverage from third-party payers to reimburse us for our delivery systems; |

|

|

• |

our ability to receive reimbursement from third-party payers for use of our delivery systems; |

|

|

• |

our ability to maintain and develop our intellectual property position; |

|

|

• |

our cash needs; and |

|

|

• |

our prospects, financial condition and results of operations. |

These forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these factors are described in Part I, Item IA, Risk Factors, of this Annual Report on Form 10-K. We do not intend to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ii

Overview

We are a global oncology company developing a proprietary platform technology called Tumor Treating Fields, the use of electric fields tuned to specific frequencies to disrupt solid tumor cancer cell division. Our key priorities are to drive commercial adoption of Optune, our first commercial Tumor Treating Fields delivery system, for the treatment of glioblastoma (“GBM”) and to advance programs testing the efficacy and safety of Tumor Treating Fields in multiple solid tumor indications through our clinical pipeline.

We were founded in 2000 and operated as a development stage company through December 31, 2011. We initially received U.S. Food and Drug Administration (“FDA”) approval for Optune in 2011 for use as a monotherapy treatment for adult patients with GBM following confirmed recurrence after chemotherapy. In October 2015, we received FDA approval to market Optune for the treatment of adult patients with newly diagnosed GBM in combination with temozolomide, a chemotherapy drug. We have also received approval to market Optune in the European Union (“EU”), Switzerland, Japan and certain other countries. We have built a commercial organization and launched Optune in the United States, Germany, Austria, Switzerland, Israel and Japan, which we refer to as our currently active markets. 2017 was marked by substantial growth in our business as compared to 2016, driven primarily by increasing awareness of Optune’s unprecedented five-year survival data in newly diagnosed GBM and increasing physician confidence and belief in Optune as a standard treatment for GBM.

We have researched the biological effects of Tumor Treating Fields extensively. Tumor Treating Fields uses electric fields tuned to specific frequencies to disrupt cancer cell division, inhibiting tumor growth and causing affected cancer cells to die. Because Tumor Treating Fields is delivered regionally, acts only on dividing cells (a biological process to as mitosis) and is frequency tuned to target cancer cells of a specific size, we believe there is minimal damage to healthy cells. We believe our preclinical and clinical research demonstrates that Tumor Treating Fields’ mechanism of action affects fundamental aspects of cell division and may have broad applicability across a variety of solid tumors. We have demonstrated in preclinical studies that Tumor Treating Fields can offer additive or synergistic benefits in combination with other anti-cancer agents, which may lead to greater efficacy without significantly increasing the side effects.

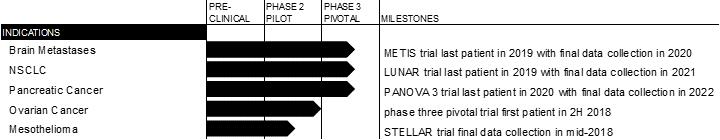

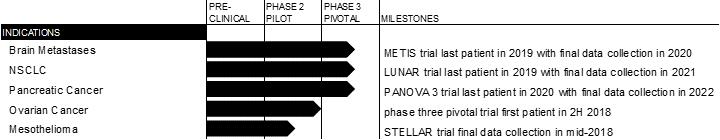

In addition to our clinical and commercial progress in GBM, we are currently planning or conducting clinical trials evaluating the use of Tumor Treating Fields in brain metastases, non-small-cell lung cancer (“NSCLC”), pancreatic cancer, ovarian cancer and mesothelioma. We anticipate expanding our clinical pipeline over time to study the safety and efficacy of Tumor Treating Fields for additional solid tumor indications.

We own all commercialization rights to Tumor Treating Fields in oncology. Our robust global patent and intellectual property portfolio consists of over 140 issued patents, with numerous additional patent applications pending worldwide. We believe we will maintain exclusive rights to market Tumor Treating Fields for all solid tumor indications in our key markets through the life of our patents.

We were incorporated in the Bailiwick of Jersey in 2000. Our U.S. operations are located in Portsmouth, New Hampshire, Malvern, Pennsylvania, and New York City. Additionally, we have offices in Germany, Switzerland and Japan, and a research center in Israel. We completed our initial public offering (“IPO”) of our ordinary shares in October 2015. Our ordinary shares are quoted on the NASDAQ Global Select Market under the symbol “NVCR.”

Our therapy

By using physics to influence biology, we discovered another way to treat solid tumor cancers.

Tumor Treating Fields is a cancer therapy that uses electric fields tuned to specific frequencies to disrupt cell division, inhibiting tumor growth and causing affected cancer cells to die. After more than a decade of preclinical research in 18 different cancer cell lines, Tumor Treating Fields has demonstrated a consistent anti-mitotic effect. In our clinical research and commercial experience to date, Tumor Treating Fields has exhibited no systemic toxicity, with mild to moderate skin irritation being the most common side effect.

Recognizing what electric fields are and how they can be utilized for medical applications is essential to understanding Tumor Treating Fields. An electric field is a field of force. Electric fields surround all charged objects. An electric field exerts forces on other charged objects within it. Tumor Treating Fields uses alternating electric fields specifically tuned to target cancer cells. Once the electric fields enter the cancer cell, they attract and repel charged proteins during cancer cell division.

1

Tumor Treating Fields utilizes the natural electrical properties of dividing cancer cells. While many intracellular molecules are slightly polarized or neutral, some are highly polarized and are strongly affected by Tumor Treating Fields. For example, tubulin is a highly polarized cellular protein that must orient spatially to form the mitotic spindle, which segregates chromosomes into two daughter cells during mitosis. In the presence of Tumor Treating Fields, tubulin aligns with the direction of the electric field, causing disruption of mitotic spindle formation and eventual cell death. Septin is another highly polarized molecule in cells that must orient spatially to form the contractile ring needed to split daughter cells during mitosis. In the presence of Tumor Treating Fields, septin aligns with the direction of the electric field, leading to improper localization of the contractile ring. This process causes membrane blebbing, a sign of cell damage, and eventual cell death.

Research is ongoing to further develop our understanding of the multi-pronged mechanism behind Tumor Treating Fields. In addition to its anti-mitotic effect, Tumor Treating Fields has been shown to interfere with DNA damage response, to induce autophagy and to reduce cell migration and invasion.

We believe Tumor Treating Fields causes minimal damage to healthy cells surrounding affected cancer cells. The biological effects of Tumor Treating Fields are dependent on the frequency of oscillation (kHz) and the field intensity (V/cm). The cell membrane serves as a filter for electric fields unless tuned to a specific frequency, with the frequency required to penetrate the membrane principally linked to cell size. Cancer cells tend to be a different size than surrounding normal healthy cells and, as a result, we believe treatment with Tumor Treating Fields selectively targets cancer cells while minimizing damage to normal cells. Additionally, since the molecules affected by Tumor Treating Fields are primarily those utilized during mitosis, proliferating cancer cells are affected more than resting, non-dividing normal cells. Tumor Treating Fields is regionally delivered to the tumor site rather than systemically delivered throughout the body and, as a result, the parts of the body not covered by Tumor Treating Fields are generally not affected.

Although it is currently only approved for the treatment of GBM, we believe the basic mechanism behind treatment with Tumor Treating Fields may be broadly applicable to solid tumors and is not limited to a specific tumor type or genetic marker. Tumor Treating Fields is intended principally for use in combination with other standard-of-care cancer treatments. Our preclinical experience to date has demonstrated that combining Tumor Treating Fields with radiation, chemotherapy or immunotherapy may lead to additive efficacy or stronger efficacy than the effect of either treatment alone, and in some cases synergistic efficacy, or stronger efficacy than the sum of the effects of both treatments. The synergistic effect is most pronounced in preclinical studies with certain taxane-based chemotherapies. Importantly, Tumor Treating Fields do not appear to increase the systemic toxicities of radiation, chemotherapy or immunotherapy. No dose-limiting cumulative toxicity has been reported with Tumor Treating Fields and we believe the basic mechanism of action is unlikely to result in a cumulative toxic effect. Treatment with Tumor Treating Fields is different than radiation, chemotherapy, and immunotherapy and we believe it can be combined with many of these therapies to enhance efficacy against multiple solid tumor types.

Our technology

Treatment with Tumor Treating Fields is delivered through a portable, medical device. The complete delivery system, called Optune for the treatment of GBM, includes a portable electric field generator, transducer arrays, rechargeable batteries and accessories. Sterile, single-use transducer arrays are placed directly on the skin in the region surrounding the tumor and connected to the electric field generator to deliver therapy. Transducer arrays are changed when hair growth or the hydrogel reduces array adhesion to the skin, which is typically two to three times per week for our GBM patients. The therapy is designed to be delivered continuously throughout the day and night and efficacy is strongly correlated to compliance. If the device is not on, the patient is not being treated. The electric field generator can be run from a standard power outlet or carried with a battery in a specially designed bag that we provide to patients. Including the battery, Optune weighs approximately 2.7 pounds.

Tumor Treating Fields penetrates the volume of tissue between the arrays. The distribution of the field within a certain part of the body depends on the exact layout of the transducer arrays and the passive electrical properties, mainly resistance, of the different tissues between them. Array placement is optimized for each patient using proprietary software called NovoTAL, based on morphometric measurements of the patient’s anatomy according to a recent MRI scan and the location of the tumor.

We plan to use the same field generator technology across all indications for which Tumor Treating Fields is approved. We plan to specifically target individual solid tumor types by tuning the field generator to the appropriate frequency based upon tumor cell size and adjusting the output power to treat the required tumor tissue volume. Our transducer arrays have been developed and are in use, either commercially or clinically, for application on the head, chest and abdomen.

2

We plan to continue to enhance our Tumor Treating Fields delivery systems to improve ease of use for patients. We recently developed a transducer array in a tan color (instead of white) for GBM patients which is intended to be less conspicuous for patients using Optune. The tan array has been available to certain patients in Europe, the Middle East and Africa (“EMEA”) since October 2017 and we expect all EMEA patients will transition to the tan array in the first half of 2018. Pending applicable regulatory approvals, we hope to launch the tan transducer array in the United States in the second half of 2018. We are also working to develop a next generation transducer array intended to minimize the impact of wires and improve overall aesthetics through the use of new materials.

We are developing a remote download capability for monthly treatment compliance reports to improve visibility of compliance data for patients and physicians. Over time, we may also have the opportunity to advance the engineering of our Tumor Treating Fields delivery systems to optimize the electric field distribution, frequency and intensity in individual patients, potentially improving efficacy. Any enhancements or development work will be subject to the applicable regulatory reviews and approvals.

Our commercial business

The first indication we pursued for Tumor Treating Fields was GBM, the most common form of primary brain cancer. GBM are tumors that arise from astrocytes – the star-shaped cells that make up the “glue-like,” or supportive tissue of the brain. These tumors are usually highly malignant because the cells reproduce quickly and they are supported by a large network of blood vessels. GBM is an aggressive disease for which there are few effective treatment options.

Since the approval of temozolomide as a chemotherapy treatment in 2005, standard treatment for GBM generally includes maximal debulking surgery, radiation therapy with concomitant low-dose temozolomide and post radiation, high dose temozolomide. Prior to the approval of Optune, the median overall survival for patients with newly diagnosed GBM was approximately 15 months with standard therapies, and two-year survival was approximately 30%. Five-year survival was under 10%.

Our markets

We have received approval to market Optune in the Unites States, EU, Switzerland, Japan and certain other countries. We have built a commercial organization and launched Optune for the treatment of GBM in the United States, Germany, Austria, Switzerland, Israel and Japan, which we refer to as our currently active markets. Refer to Part II, Item 8 “Financial Statements and Supplementary Data”, Note 18, “Supplemental information” for more information regarding our assets and net revenues.

We estimate that approximately:

|

• |

12,500 people are diagnosed with GBM or tumors that typically progress to GBM in the United States each year. Of this population, we estimate that approximately 9,300 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. |

|

• |

3,600 people are diagnosed with GBM or tumors that typically progress to GBM in Germany each year. Of this population, we estimate that approximately 2,700 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. |

|

• |

1,500 people are diagnosed with GBM or tumors that typically progress to GBM in Japan each year. Of this population, we estimate that approximately 1,100 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. |

|

• |

1,000 people are diagnosed with GBM or tumors that typically progress to GBM in our other currently active markets: Austria, Switzerland and Israel. Of this population, we estimate that approximately 750 patients are candidates for treatment with Optune based upon the rate of disease progression and medical eligibility. |

EF-11 phase 3 pivotal clinical trial data for the treatment of recurrent GBM

We initially received FDA approval for Optune in 2011 for use as a monotherapy treatment for adult patients with GBM, following confirmed recurrence after chemotherapy. The FDA approved Optune based on the EF-11 trial (“EF-11”), a randomized, phase 3 pivotal clinical trial. While the trial did not achieve its primary endpoint of superiority, the trial results indicate that monotherapy treatment with Optune monotherapy provides patients with clinically comparable extension of survival compared to chemotherapy and that patients treated with Optune alone had significantly fewer side effects and an overall better quality of life than patients treated with chemotherapy alone.

3

EF-11 was a multicenter, active controlled clinical trial of 237 adults with recurrent GBM. Participants received either Optune as a monotherapy (n=120) or the physician’s choice of chemotherapy (n=117). Chemotherapies chosen for the active control arm included mainly bevacizumab, nitrosureas and temozolomide. The primary endpoint for the trial was overall survival. The secondary endpoints included progression free survival at six months, radiological response rate, one-year survival rate, adverse event severity and frequency and quality of life. Overall survival for patients treated with Optune alone and active chemotherapy were 6.6 months and 6.0 months, respectively (p=0.27: HR = 0.86). Progression free survival was not significantly different between the groups and progression free survival at six months was numerically higher in the Optune arm (21.4% vs. 15.2%).

Twice as many EF-11 patients responded to Optune than to active chemotherapy (12 patients versus 6 patients). Three patients in the Optune alone arm had a complete response versus no patients in the active chemotherapy arm.

EF-11 trial demonstrated that patient compliance is important for successful outcomes. Patients who used Optune more than 75% of the time had a significant survival advantage compared to those who used it less than 75% of the time (median survival was 7.8 months compared to 4.5 months, respectively; p<0.05).

EF-14 phase 3 pivotal clinical trial data for the treatment of newly diagnosed GBM

In October 2015, we received FDA approval to market Optune for the treatment of adult patients with newly diagnosed supratentorial GBM in combination with temozolomide. The FDA approved Optune for newly diagnosed GBM based on the EF-14 trial (“EF-14”), which was a randomized, phase 3 pivotal clinical trial which compared, post radiation, Optune plus temozolomide versus temozolomide alone for the treatment of newly diagnosed GBM. The primary endpoint of the trial was progression free survival and a powered secondary endpoint was overall survival.

In the EF-14 interim analysis of the per-protocol population of 315 patients, upon which FDA approval was based, Optune plus temozolomide significantly extended median overall survival by 4.9 months from 15.6 months for temozolomide alone to 20.5 months for Optune plus temozolomide (p=0.0042). Optune was the first treatment in more than ten years to increase overall survival in newly diagnosed GBM. Optune plus temozolomide also significantly improved progression free survival by 3.2 months (p=0.0013). The EF-14 interim analysis results were published in JAMA in 2015. In 2016, the National Comprehensive Cancer Network Clinical Practice Guidelines in Oncology® (NCCN Guidelines®) for Central Nervous Systems Cancers were updated and now include alternating electric fields therapy (Optune) in combination with temozolomide following standard brain radiation therapy with concurrent temozolomide as a Category 2A recommended postoperative adjuvant treatment option for patients with newly diagnosed supratentorial GBM.

Optune plus temozolomide has demonstrated consistent superiority versus temozolomide alone in all analyses since the interim results were reported. The EF-14 five-year analysis of the intent-to-treat population of 695 patients was presented at the American Association for Cancer Research Annual Meeting in April 2017. The EF-14 intent-to-treat five year analysis results were published in JAMA in December 2017.

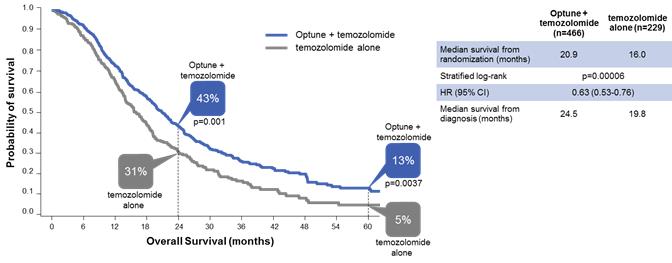

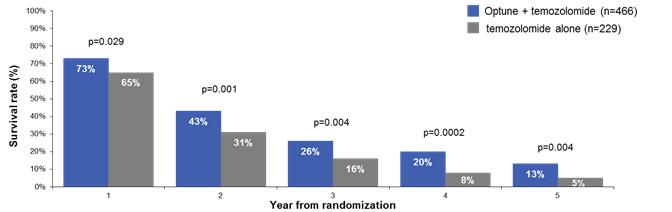

In that analysis, Optune plus temozolomide demonstrated unprecedented five-year survival results. Median overall survival was significantly extended by nearly five months (median overall survival of 20.9 months versus 16.0 months for temozolomide alone; p<0.001: HR 0.63). Optune plus temozolomide also significantly improved progression free survival. Median progression free survival was extended by 2.7 months from 4.0 months for temozolomide alone to 6.7 months for Optune plus temozolomide (p<0.001: HR 0.63). Optune plus temozolomide demonstrated consistently superior survival compared to temozolomide alone with 2.5 times greater overall survival at five years.

4

The following graph presents the overall survival data in the intent-to-treat population from our five-year analysis:

The following graph presents the survival rates by year in the intent-to-treat population from our five-year analysis:

In September 2017 at the American Society for Radiation Oncology Annual Meeting, we presented quality of life data from a prespecified analysis of our EF-14 trial demonstrating that the combination of Optune and temozolomide did not negatively influence health-related quality of life compared to temozolomide alone for newly diagnosed GBM patients except for itchy skin under Optune’s tranducer arrays. The analysis also demonstrated that a higher proportion of patients treated with Optune and temozolomide reported stable or improved quality life for global health status, pain, physical functioning and leg weakness.

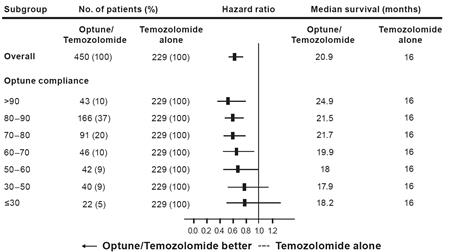

In November 2017, we presented a retrospective post-hoc analysis of our EF-14 trial at the Annual Meeting of the Society for Neuro-Oncology showing that increased compliance with Optune predicted increased survival in GBM patients. An Optune compliance threshold as low as 50 percent correlated with significantly improved outcomes in patients treated with Optune together with temozolomide compared to patients treated with temozolomide alone. The greater patients’ compliance with Optune, the better their outcomes. Patients who used Optune more than 90 percent of the time (n=43) had the greatest chance of survival: a median survival of 24.9 months from randomization and a five-year survival of 29.3 percent.

5

The following graph presents the effect of compliance on overall survival from our five-year analysis:

The following graph presents the overall survival data from our five-year analysis for patients who used Optune more than 90 percent of the time:

The significant extension of progression free and overall survival in patients receiving Optune in combination with temozolomide in the EF-14 trial was not specific to any prognostic subgroup or tumor genetic marker and was consistent regardless of MGMT methylation status, extent of resection, age, performance status or gender. Optune was safely combined with temozolomide with no significant increase in serious adverse events compared with temozolomide alone. The most common side effect related to Optune was mild to moderate skin irritation.

Commercial execution

Our first commercial priority in each market is to generate awareness of Optune and our unprecedented five-year survival data. We believe we have achieved high levels of awareness in our currently active markets amongst neuro-oncologists and neurosurgeons who treat GBM patients. Neuro-oncologists and neurosurgeons wrote approximately 59% of our prescriptions in 2017. We remain focused on developing awareness amongst radiation oncologists and medical oncologists who treat GBM patients. Radiation oncologists are our second largest and fastest growing customer segment and represented approximately 25% of our prescriptions in 2017. Healthcare providers must undergo a certification training in order to prescribe Optune. As of December 31, 2017, we had more than 60 sales force colleagues globally, responsible for promotion to certified prescribers at 1,122 clinical centers, including certified prescribers at 714 clinical centers in the United States, 245 clinical centers in Europe, and 163 clinical centers in Japan.

6

Once awareness has been established, our commercial priority shifts to increasing the percentage of physicians who routinely discuss Optune with their patients and increasing the percentage of physicians who confidently position Optune plus temozolomide as the treatment for newly diagnosed GBM that offers the best chance for long-term survival. We also work to ensure the prescriber has the necessary resources to effectively discuss Optune with their patients and to complete the prescription process. We believe that, unlike traditional cancer therapies, the patient perception of treatment plays a significant role in determining whether or not a prescription for Optune is written and subsequently filled. Therefore, we have also focused efforts on developing targeted tools to support the physician-patient dialogue and patient education. We currently operate as a direct-to-patient distributor of Optune in the United States and EMEA. Once an appropriate Optune patient is identified by a certified prescriber, the healthcare provider’s office submits a prescription order form and supporting documentation to us. We employ a team of device support specialists who provide technical training to the patient and caregiver. Once treatment is initiated, we provide 24/7 technical support for patients and caregivers as well as assistance with insurance reimbursement. We also provide the healthcare provider and the patient with a monthly compliance report for monitoring patient use of Optune. In Japan, we distribute our product through hospitals and provide patient support services under a contractual arrangement with the hospital. We believe we have the experience, expertise and infrastructure to scale our sales and marketing efforts in our key markets. In addition to our commercial organization, we believe we have established a scalable supply chain.

The number of active patients on therapy is our principal revenue driver. There were 1,834 active patients on Optune at December 31, 2017, an increase of 68% versus December 31, 2016. Of the global active patients, there were 1,320 active patients in the United States, 512 active patients in our EMEA markets and 2 active patients in Japan. An active patient is a patient who is receiving treatment with Optune under a commercial prescription order as of the measurement date, including patients who may be on a temporary break from treatment and who plan to resume treatment in less than 60 days. Growth in the number of active patients is a factor of both new patient starts and treatment duration. Median treatment duration differs based upon the clinical diagnosis of the patient. For the twelve months ended December 31, 2017, 62% of prescriptions received were for patients with newly diagnosed GBM. Median treatment duration for patients with recurrent GBM was 4.1 months in our published commercial registry data and 8.2 months in the intent-to-treat five-year analysis of our EF-14 trial in newly diagnosed GBM.

Prescriptions are a leading indicator of demand. In 2017, 4,119 prescriptions were received, an increase of 47% versus 2016. Of those prescriptions, 3,102 were received in the U.S. and 1,017 were received outside of the U.S., primarily in EMEA. A prescription is a commercial order for Optune that is received from a physician certified to treat patients with Optune for a patient not previously on Optune. Orders to renew or extend treatment are not included in this total.

The conversion of prescriptions to new patients is driven by the prescription fill rate and the time to fill. In 2017, our prescription fill rate was between 70-75% each quarter. Our estimated penetration rate considers our new patient starts over the estimated patients that are candidates for treatment with Optune in each of our currently active markets. For the twelve months ended December 31, 2017, we estimate a penetration rate of 20% in our currently active markets.

We believe there are many more patients who could benefit from treatment with Optune than are currently on therapy. In 2018, we plan to focus on increasing penetration in currently active markets and anticipate strategically expanding into additional geographic markets in the future.

Billing and reimbursement

We provide Optune directly to patients following receipt of a prescription order and a signed patient service agreement. We bill payers a single monthly fee for a month of therapy and we bear the financial risk of securing payment from patients and third-party payers in all markets except for Japan. We distribute our product through hospitals in Japan with the hospitals receiving reimbursement from the government mandated insurance program and in turn contracting with us for the equipment, supplies and services necessary to treat patients with Optune.

The monthly list price for Optune is $21,000 in the United States and we have set list prices in our other currently active markets that are approximately equivalent to this price subject to currency fluctuations. We typically negotiate discounts from our list price with healthcare payers in order to secure reimbursement for Optune.

As of December 31, 2017, more than 210 million Americans had coverage of Optune for newly diagnosed and/or recurrent GBM. Additionally, we had negotiated contracts to establish Optune as an in-network benefit for more than 178 million American lives. In 2017, 20- 25% of our active U.S. patients were beneficiaries of the Medicare fee-for-service program, which has denied coverage for our claims to date. We are actively appealing Medicare coverage denials through the Administrative Law Judge (“ALJ”) process with Centers for Medicare and Medicaid Services (“CMS”). Currently, there are significant delays in the assignment of ALJ cases and as of December 31, 2017, a de minimis number of Medicare fee-for-service cases have been fully adjudicated with an ALJ. Our ability to be appropriately reimbursed for Medicaid patients is impacted by the status of Medicare coverage.

7

We continue to engage in active discussions with the CMS administration regarding Medicare reimbursement for Optune. The discussion currently focuses on ensuring Medicare appropriately prices the billing code for Optune under its existing rules. Medicare does not have a defined timeline for establishing pricing for DME billing codes. We plan to request Medicare coverage for Optune after we understand how CMS and Medicare intend to calculate pricing for the Optune billing code. We continue to treat Medicare patients although we have not yet received any material payments from Medicare.

In Germany, we are able to bill healthcare payers for individual cases and each case is evaluated individually on its merits and under the payer’s specific rules for such cases. We have started the formal process for the German Federal Joint Committee (“G-BA”) to review Optune and determine whether to recommend Optune for national reimbursement. In September 2017, the G-BA published its decision to support a clinical trial studying Optune for the treatment of newly diagnosed GBM and has submitted the proposed trial protocol for public comment. We will continue to bill payers for individual cases as we advance through the review process in Germany.

In August 2017, we signed a contract with the Federation of Austrian Social Insurance Institutions that secures reimbursement for Optune for patients with newly diagnosed GBM in Austria. We are pursuing reimbursement for Optune in Switzerland and Israel. We continue to treat patients in both markets and do not expect material revenue in either market while our reimbursement applications are pending.

In December 2017, the Japanese Ministry of Health, Labour and Welfare (“MHLW”) approved the recommendation by Japan’s Central Social Insurance Medical Council to provide national reimbursement for Optune for the treatment of newly diagnosed glioblastoma.

Our clinical pipeline

Based on the results of our preclinical research, we have developed a pipeline strategy to advance Tumor Treating Fields through phase 2 pilot and phase 3 pivotal trials across multiple solid tumor types. We anticipate expanding our clinical pipeline over time for additional solid tumor indications.

Current Clinical Pipeline

The solid tumor types subject to our phase 2 pilot and phase 3 pivotal trials are described in greater detail below, as well as additional details regarding these trials.

Brain metastases

Metastatic cancer is cancer that has spread from the place where it first started to another place in the body. In metastasis, cancer cells break away from where they first formed (the primary cancer), travel through the blood or lymph system, and form new tumors (the metastatic tumors) in other parts of the body. The exact incidence of brain metastases is unknown because no national cancer registry documents brain metastases. However, it has been estimated that 170,000 new cases are diagnosed in the United States each year, 75,000 new cases are diagnosed in Europe each year, and 13,000 new cases are diagnosed in Japan each year. Brain metastases occur in roughly 15% of all cancer patients, and we believe that approximately 40% of brain metastases are a result of NSCLC.

As with GBM, brain metastases are commonly treated with a combination of surgery and radiation. Chemotherapy is often given for the primary tumor, but many chemotherapy agents do not cross the blood brain barrier and are thus ineffective in the treatment of brain metastases. When brain metastases appear, they are either surgically removed or treated with radiation using stereotactic radiosurgery (“SRS”) when possible. Whole brain radiation therapy, although effective in delaying progression or recurrence of brain metastases when given either before or after SRS, is associated with neurotoxicity with a significant decline in cognitive and emotional functioning. Thus, whole brain radiation therapy is often delayed until later in the disease course and is often used as a last resort. This practice results in a window of unmet need after localized surgery and SRS are used and before whole brain radiation therapy is administered to delay or prevent the additional spread of brain metastases.

8

In 2016, we enrolled the first patient in our METIS trial, a phase 3 pivotal trial testing the effectiveness of SRS plus Tumor Treating Fields compared to SRS alone in patients with brain metastases resulting from NSCLC. We have opened the trial to 270 patients and anticipate enrolling the last patient in 2019. We anticipate data will be available for presentation approximately 12 months following last patient enrollment.

Non-small cell lung cancer

Lung cancer is the most common cause of cancer-related death worldwide, and NSCLC accounts for approximately 85% of all lung cancers. The incidence of NSCLC is approximately 214,000 new cases annually in the United States, approximately 350,000 new cases annually in Europe, and approximately 95,000 new cases annually in Japan. Of the 214,000 Americans diagnosed with lung cancer annually, only 18% are alive five years later.

Physicians use different combinations of surgery, radiation and pharmacological therapies to treat NSCLC, depending on the stage of the disease. Surgery, which may be curative in a subset of patients, is usually used in early stages of the disease. Since 1991, radiation with a combination of platinum-based chemotherapy drugs has been the first line standard of care for locally advanced or metastatic NSCLC. Certain immune checkpoint inhibitors have recently been approved for the first line treatment of NSCLC and the standard of care in this setting appears to be evolving rapidly. The standard of care for second line treatment is also evolving and may include may include platinum based chemotherapy for patients who received immune checkpoint inhibitors as their first line regimen, pemetrexed, docetaxel or immune checkpoint inhibitors.

Phase 2 pilot trial

In 2013, we published the results of our phase 2 pilot trial evaluating the safety and efficacy of Tumor Treating Fields in the treatment of advanced NSCLC. The pilot study focused on the effects of treatment with Tumor Treating Fields in combination with standard of care pemetrexed chemotherapy. Results of the pemetrexed Phase 3 FDA registration trial were used as a historical control in this trial.

A total of 42 patients were recruited to the study with a minimum follow-up of six months. Efficacy results based on 41 evaluable patients showed both progression free survival and overall survival for patients receiving Tumor Treating Fields in combination with pemetrexed increased compared to historical control data for pemetrexed alone. Median progression free survival in the Tumor Treating Fields-treated group was 6.5 months (compared to 2.9 months in the historical control) and median overall survival was 13.8 months (compared to 8.3 months in the historical control). Adverse events reported in this combination study were comparable to those reported with pemetrexed alone, suggesting minimal added toxicities due to Tumor Treating Fields.

Phase 3 pivotal trial

In February 2017, we enrolled the first patient in our LUNAR trial, a phase 3 pivotal trial testing the effectiveness of Tumor Treating Fields in combination with immune checkpoint inhibitors or docetaxel versus immune checkpoint inhibitors or docetaxel alone. We believe our protocol incorporates the evolving standard of care for second-line treatment of NSCLC. We have opened the trial to 534 patients and anticipate enrolling the last patient in 2019. The protocol specifies an event-driven interim analysis. We anticipate final data will be available for presentation approximately 18 months following last patient enrollment.

Pancreatic cancer

Pancreatic cancer is one of the most lethal cancers and is the third most frequent cause of death from cancer in the United States. While overall cancer incidence and death rates are declining, the incidence and death rates for pancreatic cancer are increasing. The incidence of pancreatic cancer is 54,000 new cases annually in the United States, approximately 130,000 new cases annually in Europe, and approximately 39,000 new cases annually in Japan. Pancreatic cancer is the only major cancer with a five-year relative survival rate in the single digits, at just 8 percent.

Physicians use different combinations of surgery, radiation and pharmacological therapies to treat pancreatic cancer, depending on the stage of the disease. For patients with locally advanced pancreatic cancer involving encasement of arteries but no extra-pancreatic disease, the standard of care is surgery followed by chemotherapy with or without radiation. Unfortunately, the majority of locally advanced cases are diagnosed once the cancer is no longer operable, generally leaving chemotherapy with or without radiation as the only treatment option.

9

We have completed a phase 2 pilot trial in advanced pancreatic adenocarcinoma, the PANOVA trial, examining Tumor Treating Fields in combination with standard of care chemotherapy.

The first cohort was a single-arm, open-label, historically-controlled, multi-center trial designed to test the feasibility, safety and preliminary efficacy of Tumor Treating Fields in combination with the chemotherapy gemcitabine. This cohort included 20 patients with advanced pancreatic cancer whose tumors could not be removed surgically and who had not received chemotherapy or radiation therapy prior to the clinical trial with a minimum follow-up of six months. Results of the first cohort were presented at the American Society of Clinical Oncology Gastrointestinal Cancers Symposium in 2016. Results of the nab-paclitaxel phase 3 FDA registration trial were used as a historical control in this trial.

In the first cohort, efficacy results showed that progression free survival and overall survival of patients treated with Tumor Treating Fields combined with gemcitabine were more than double those of gemcitabine-treated historical controls. Median progression free survival in the Tumor Treating Fields-treated group was 8.3 months (compared to 3.7 months in the gemcitabine historical control), with locally advanced patients reaching a median progression free survival of 10.3 months and patients with metastatic disease reaching a median progression free survival of 5.7 months. The median overall survival for all patients was 14.9 months (compared to 6.7 months in the gemcitabine historical control). Median overall survival was longer than 15 months in locally advanced patients and 86% of patients were alive at end of follow up. Patients with metastatic disease experienced a median overall survival of 8.3 months. Median one-year survival was 55% (compared to 22% in the gemcitabine historical control). Thirty percent of the evaluable tumors, or 19 patients in total, had partial responses (compared to 7% with gemcitabine alone) and another 30% had stable disease, which means that the cancer is neither decreasing nor increasing in extent or severity.

Following the approval of nab-paclitaxel, a taxane-based chemotherapy, for the treatment of advanced pancreatic cancer, we expanded this study to include a second cohort of 20 patients that were treated with Tumor Treating Fields in combination with nab-paclitaxel and gemcitabine. Results of the second cohort were presented at the American Association for Cancer Research Annual in April 2017.

In the second cohort, efficacy results showed that progression free survival and overall survival of patients treated with Tumor Treating Fields combined with nab-paclitaxel plus gemcitabine were more than double those of nab-paclitaxel plus gemcitabine-treated historical controls. Median progression free survival in the Tumor Treating Fields-treated group was 12.7 months (compared to 5.5 months in the nab-paclitaxel plus gemcitabine historical control) and median overall survival was not yet reached. Median one-year survival was 72% (compared to 35% in nab-paclitaxel plus gemcitabine historical control). Forty percent of the evaluable tumors had partial responses (compared to 23% with the nab-paclitaxel plus gemcitabine alone) and another 47% had stable disease.

Safety results from both cohorts suggested that Tumor Treating Fields plus first-line chemotherapies nab-paclitaxel and/or gemcitabine may be tolerable and safe in patients with advanced pancreatic cancer. Patients reported no serious adverse events related to Tumor Treating Fields.

Phase 3 pivotal trial

In December 2017, we received FDA approval of our investigational device exemption (“IDE”) application to initiate our PANOVA 3 trial, a phase 3 pivotal trial testing the effectiveness of Tumor Treating Fields with nab-paclitaxel and gemcitabine as a front-line treatment for unresectable locally advanced pancreatic cancer. We have opened the trial to 556 patients and anticipate enrolling the last patient in 2020. The protocol specifies an event-driven interim analysis. We anticipate final data will be available for presentation approximately 18 months following last patient enrollment.

Ovarian cancer

In the United States, ovarian cancer ranks fifth in cancer deaths among women, accounting for more deaths than any other cancer of the female reproductive system. Ovarian cancer incidence increases with age, and the median age at time of diagnosis is 63 years old. The incidence of ovarian cancer is approximately 22,000 new cases annually in the United States, approximately 68,000 new cases annually in Europe, and approximately 10,000 new cases annually in Japan.

Physicians use different combinations of surgery and pharmacological therapies to treat ovarian cancer, depending on the stage of the disease. Surgery is usually used in early stages of the disease and is usually combined with chemotherapy, including paclitaxel and platinum-based chemotherapy. Unfortunately, the majority of patients are diagnosed at an advanced stage when the cancer has spread outside of the ovaries to include regional tissue involvement and/or metastases. Platinum-based chemotherapy remains the standard of care in advanced ovarian cancer, but most patients with advanced ovarian cancer will have tumor progression or, more commonly, recurrence. Almost all patients with recurrent disease ultimately develop platinum resistance, and the prognosis for this population remains poor.

10

We have completed a 30 patient phase 2 pilot trial in recurrent ovarian cancer, the INNOVATE trial, examining Tumor Treating Fields in combination with standard of care chemotherapy. This trial was a single-arm, open-label, historically-controlled, multi-center study, designed to test the feasibility, safety and preliminary efficacy of Tumor Treating Fields in combination with weekly paclitaxel. The paclitaxel control arm from the bevacizumab phase 3 FDA registration trial was used as a historical control in this trial. Results were presented at the American Association for Cancer Research Annual in April 2017.

A total of 30 patients were recruited to the study with a minimum follow-up of six months. Safety results suggested that Tumor Treating Fields in combination with weekly paclitaxel may be tolerable and safe as first-line treatment for patients with recurrent ovarian cancer. Median progression free survival in the Tumor Treating Fields-treated group was 8.9 months (compared to 3.9 months in the paclitaxel-alone historical control) and median overall survival was not yet reached. Median one-year survival was 61%. Efficacy results based on the 30 evaluable patients suggested more than doubling of the progression free survival and an improvement in overall survival among patients who received Tumor Treating Fields therapy with paclitaxel compared to paclitaxel alone.

Phase 3 pivotal trial

Based on our phase 2 pilot trial results, we expect to commence a phase 3 pivotal trial in recurrent ovarian cancer in 2018.

Mesothelioma

Malignant mesothelioma is a rare thoracic solid tumor cancer that has been strongly linked to asbestos exposure. It has a long latency period of at least 20-30 years following exposure, and global incidence is still increasing in countries where asbestos is still in use. There are approximately 3,000 new cases of mesothelioma annually in the United States, an estimated incidence of 1,000 new cases annually in Japan and a predicted peak of approximately 9,000 male deaths from mesothelioma in Western Europe that may occur around the year 2018. The prognosis of mesothelioma patients is very poor, with a median overall survival of approximately 12 months in most reported studies. Of the 3,000 Americans diagnosed with mesothelioma annually, only 9% are alive five years later. Mesothelioma is often limited to the thoracic cavity and progresses regionally, making it an attractive target for Tumor Treating Fields.

Physicians use different combinations of surgery and pharmacological therapies to treat mesothelioma, depending on the stage of the disease. Surgery may be used for patients with early stage disease. However, most cases are diagnosed once the cancer is at a later stage, involving extensive tumor growth and regional lymph node spread, and surgical resection for the treatment of mesothelioma is feasible for only a minority of patients. First line standard of care treatment includes pemetrexed, a chemotherapy, in combination with platinum-based chemotherapy, including carboplatin or cisplatin. Second-line treatments may include the chemotherapies oxaliplatin, gemcitabine, vinorelbine or immunotherapies. Despite the many advances in chemotherapy made in recent decades, treatment effectiveness remains very limited.

Phase 2 pilot trial

We enrolled the last patient in our phase 2 pilot trial in mesothelioma, the STELLAR trial, in March 2017. There is a minimum 12 month follow up following last patient enrollment and we anticipate final data collection in the first half of 2018. The STELLAR trial is a single-arm, open-label, multi-center trial designed to test the efficacy and safety of Tumor Treating Fields in combination with pemetrexed combined with cisplatin or carboplatin in patients with unresectable, previously untreated malignant mesothelioma. The historical control for this trial is the results of the 2003 pemetrexed phase 3 FDA registration trial.

An interim analysis of the first 42 patients enrolled in the trial with an average follow-up time of 11.5 months was presented at the International Association for the Study of Lung Cancer in 2016. The one-year survival rate of patients treated with Tumor Treating Fields combined with pemetrexed and cisplatin or carboplatin was 80% (compared to 50% in the pemetrexed and cisplatin-alone historical controls). Median progression free survival in the Tumor Treating Fields-treated group was 7.3 months (compared to 5.7 months in the pemetrexed and cisplatin-alone historical control) and one-year survival rate was 79.7% (compared to 50.3% in the pemetrexed and cisplatin-alone historical control). Median overall survival had not yet been reached. No device-related serious adverse events had been reported to date.

In May 2017, we received humanitarian use device (“HUD”) designation for the use of Tumor Treating Fields for the treatment of pleural mesothelioma. The HUD designation is the first step in obtaining a Humanitarian Device Exemption (“HDE”) for the treatment of pleural mesothelioma with Tumor Treating Fields. Assuming the final data readout from our STELLAR trial is consistent with the interim analysis, we expect to submit an HDE application to the FDA for approval. An approved HDE would allow us to market Tumor Treating Fields in combination with standard of care chemotherapy as a treatment for pleural mesothelioma in the United States.

11

We outsource production of all of our system components to qualified partners. Disposable transducer array manufacturing, the dominant activity in our manufacturing supply chain, includes several specialized processes. Production of the durable system components follows standard electronic medical device methodologies.

We have supply agreements in place with our third-party manufacturing partners. We hold safety stocks of single source components in quantities we believe are sufficient to protect against possible supply chain disruptions.

We currently obtain the ceramic discs used in the transducer arrays for Optune from a single supplier. We have technically qualified and entered into a supply agreement with an additional supplier, and we have requested regulatory approval to use these ceramic disks in the EU. This source will be able to ship product for use within the United States and Japan at a future date pending regulatory approval.

We are developing second sources for all critical materials. We have qualified and entered into supply agreements with second source third party manufacturing partners for the transducer array subassemblies and transducer array final assemblies. They are currently approved to ship transducer array subassemblies for use in the United States and the EU and will be able to ship product for use in Japan pending regulatory approval. In addition, they are approved to ship transducer array final assemblies for use in the EU and will be able to ship product for use in the United States and Japan pending regulatory approval. We anticipate that the diversification of our supply chain will both ensure a continuity of supply and reduce costs.

Intellectual property

We own all commercialization rights to Tumor Treating Fields in oncology. Our robust global patent and intellectual property portfolio consists of over 140 issued patents. The patents have expected expiration dates between 2021 and 2035. We have also filed over 40 additional patent applications worldwide that, if issued, may protect aspects of our platform beyond 2035. We believe we will maintain exclusive rights to market Tumor Treating Fields for all solid tumor indications in our key markets through the life of our patents. However, our reliance on intellectual property involves certain risks, as described under the heading “Risk factors—Risks relating to intellectual property.”

In addition to our patent portfolio, we further protect our intellectual property by maintaining the confidentiality of our trade secrets, know-how and other confidential information. Given the length of time and expense associated with bringing delivery systems candidates through development and regulatory approval to the market place, the healthcare industry has traditionally placed considerable importance on obtaining patent protection and maintaining trade secrets, know-how and other confidential information for significant new technologies, products and processes.

Our policy is to require each of our employees, consultants and advisors to execute a confidentiality agreement before beginning their employment, consulting or advisory relationship with us. These agreements generally provide that the individual must keep confidential and not disclose to other parties any confidential information developed or learned by the individual during the course of their relationship with us except in limited circumstances. These agreements also generally provide that we own, or the individual is required to assign to us, all inventions conceived by the individual in the course of rendering services to us.

In 2015, we entered into a settlement agreement (the “Settlement Agreement”) with the Technion Research and Development Foundation (“Technion”) to resolve certain potential disputes regarding intellectual property developed by our founder and previously assigned to us. Pursuant to the Settlement Agreement, and in exchange for a release of potential disputes from the third party, the Company is obligated to pay a $5.5 million milestone payment (the “Milestone Payment”) to Technion in the quarter following the quarter in which the Company achieves $250.0 million of cumulative net sales (as defined in the Settlement Agreement) (the “Net Sales Milestone”). We achieved the Net Sales Milestone in the fourth quarter of 2017 and anticipate making the Milestone Payment in the first quarter of 2018.

In 2005, we granted an exclusive license to a third party, NovoBiotic LLC, to certain of our key intellectual property for use outside the field of oncology. We are not entitled to any future revenues from this license.

Competition

The market for cancer treatments is intensely competitive, subject to rapid change and significantly affected by new product and treatment introductions and other activities of industry participants. The general bases of competition are overall effectiveness, side effect profile, availability of reimbursement and general market acceptance of a product as a suitable cancer treatment.

12

We believe our intellectual property rights would provide an obstacle to the introduction of Tumor Treating Fields delivery systems by a competitor, and we intend to protect and enforce our intellectual property. In addition, even after the expiration of our U.S. patents, we believe that potential market entrants applying low-intensity, alternating electric fields to solid tumors in the United States will have to undertake their own clinical trials and regulatory submissions to prove equivalence to Tumor Treating Fields, a necessary step in receiving regulatory approvals for a competing product.

Presently, the traditional biotechnology, pharmaceutical and medical technology industries expend significant resources in developing novel and proprietary therapies for the treatment of solid tumors, including GBM and the other indications that we are currently investigating. As we work to increase market acceptance of Tumor Treating Fields, we compete with companies commercializing or investigating other anti-cancer therapies, some of which are in clinical trials for GBM that currently specifically exclude patients who have been or are being treated with Tumor Treating Fields.

Government regulation

Our delivery systems and operations are subject to extensive regulation by the FDA under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and by agencies and notified bodies of the countries or regions in which we develop and market our delivery systems. In addition, our delivery systems must meet the requirements of a large and growing body of international standards that govern the preclinical and clinical testing, manufacturing, labeling, certification, storage, recordkeeping, advertising, promotion, export and marketing and distribution, among other things, of Tumor Treating Fields and our delivery systems.

In the United States, advertising and promotion of medical devices, in addition to being regulated by the FDA, are also regulated by the Federal Trade Commission and by state regulatory and enforcement authorities. Promotional activities for FDA-regulated products of other companies have been the subject of enforcement action brought under healthcare reimbursement laws and consumer protection statutes. In addition, under the federal Lanham Act and similar state laws, competitors and others can initiate litigation relating to unfair competition based on advertising claims. In addition, we are required to meet regulatory requirements in countries outside the United States, which can change rapidly with relatively short notice.

Our research, development and clinical programs, as well as our manufacturing and marketing operations, are subject to extensive regulation.

Failure by us or by our suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA or other regulatory authorities, which may result in any number of regulatory enforcement actions, or civil or criminal liability.

Food and Drug Administration

The FDA regulates the development, testing, manufacturing, labeling, storage, recordkeeping, promotion, marketing, distribution and service of medical devices in the United States to ensure that medical products distributed domestically are safe and effective for their intended uses. In addition, the FDA regulates the export of medical devices manufactured in the United States to international markets and the importation of medical devices manufactured abroad. The FDA has broad post-market and regulatory enforcement powers to ensure compliance with the FDCA.

The FDA governs the following activities that we perform or that are performed on our behalf:

|

• |

product design, development and manufacture; |

|

• |

product safety, testing, labeling and storage; |

|

• |

record keeping procedures; |

|

• |

product marketing, sales and distribution; and |

|

• |

post-marketing surveillance, complaint handling, medical device reporting, reporting of deaths, serious injuries or device malfunctions and repair or recall of products. |

We have registered three of our facilities with the FDA. We are subject to announced and unannounced inspections by the FDA to determine our compliance with the Quality System Regulation (“QSR”) and other regulations and these inspections include the manufacturing facilities of our suppliers.

13

FDA’s premarket clearance and approval requirements

Unless an exemption applies, before we can commercially distribute medical devices in the United States, we must obtain, depending on the type of device, either prior 510(k) clearance or premarket approval (“PMA”) from the FDA. The FDA classifies medical devices into one of three classes. Devices deemed to pose lower risks are placed in either class I or II, which typically requires the manufacturer to submit to the FDA a premarket notification requesting permission to commercially distribute the device. This process is generally known as 510(k) clearance. Some low-risk devices are exempted from this requirement. Devices deemed by the FDA to pose the greatest risks, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared 510(k) device, are placed in class III, requiring PMA approval.

Premarket approval (PMA) pathway

Optune, which is the only delivery system we have marketed in the United States, is classified as a Class III device as it is deemed a life-sustaining device. Accordingly, we were required to receive PMA approval for Optune, which the FDA granted in April 2011 and October 2015 for the treatment of recurrent and newly diagnosed supratentorial GBM, respectively, in adult patients. We expect that we will be required to receive PMA approval for future indications (and the applicable delivery systems for such indications) using Tumor Treating Fields.

A PMA must be supported by extensive data, including from technical tests, preclinical studies and clinical trials, manufacturing information and intended labeling to demonstrate, to the FDA’s satisfaction, the safety and effectiveness of a medical device for its intended use. During the PMA review period, the FDA will typically request additional information or clarification of the information already provided. Also, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA may or may not accept the panel’s recommendation. In addition, the FDA will generally conduct a pre-approval inspection of the manufacturing facility or facilities to ensure compliance with QSRs. Prior to approval of the Optune PMA for the treatment of recurrent GBM, we and our critical component suppliers were each inspected by the FDA.

New PMAs or PMA supplements are required for modifications that affect the safety or effectiveness of our delivery systems, including, for example, certain types of modifications to a delivery system’s indication for use, manufacturing process, labeling and design. PMA supplements often require submission of the same type of information as a PMA, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA and may not require any or as extensive clinical data as the original PMA required, or the convening of an advisory panel. The FDA requires a company to make the determination as to whether a new PMA or PMA supplement application is to be filed. If a company determines that neither a new PMA nor a PMA supplement application is required for modifications, it must nevertheless notify the FDA of these modifications in its PMA Annual Report. The FDA may review a company’s decisions when reviewing the PMA Annual Report and require the filing of an application.

We have received approval for a number of PMA supplements since approval of the PMA for recurrent GBM, including for modifications to Optune’s electric field generator, transducer arrays, software, manufacturing processes and labeling. In 2015, we received FDA approval to expand our label for Optune to include the treatment of newly diagnosed GBM and in 2016, we received FDA approval for our second generation Optune system. Future modifications may be considered by us as the need arises, some of which we may deem to require a PMA supplement application and others to require reporting in our PMA Annual Report.

Clinical trials

Clinical trials are generally required to support a PMA. Such trials generally require an IDE approval from the FDA for a specified number of patients and study sites, unless the product is deemed a non-significant risk device eligible for more abbreviated IDE requirements. Clinical trials are subject to extensive monitoring, recordkeeping and reporting requirements. Clinical trials must be conducted under the oversight of an institutional review board (“IRB”) for the relevant clinical trial sites and must comply with FDA regulations, including those relating to good clinical practices. To conduct a clinical trial, we also are required to obtain the patients’ informed consent in form and substance that complies with both FDA requirements and state and federal privacy and human subject protection regulations. We, the FDA or the respective IRB could suspend a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the anticipated benefits. Even if a trial is completed, the results of clinical testing may not adequately demonstrate the safety and efficacy of the device or may otherwise not be sufficient to obtain FDA approval to market the product in the United States.

Post-approval studies are also typically required as a condition of PMA approval to reinforce the reasonable assurance of safety and effectiveness. Such studies are conducted in the post-market setting with the approved device, often to address the long-term use of the device or other discrete questions that may have been raised based on the clinical data from the IDE clinical study. The FDA required a post-approval registry study as a condition of approval for Optune for recurrent GBM. We have obtained approval of the protocol for this study and the study is fully enrolled.

14

Sales and marketing of medical devices outside of the United States are subject to foreign regulatory requirements that vary widely from country to country. These include the requirement to affix a CE mark to our medical devices in the EU. Whether or not we have obtained FDA approval, our delivery systems must be subject to conformity assessment procedure in which a notified body can be involved. Apart from low risk medical devices (Class I with no measuring function and which are not sterile), where the manufacturer can issue a declaration of conformity based on a self-assessment of the conformity of its products with the Essential Requirements laid down in the Medical Devices Directive, a conformity assessment procedure requires the intervention of a notified body. The notified body typically audits and examines products’ technical file and the quality system for the manufacture, design and final inspection of our devices before issuing a CE Certificate of Conformity demonstrating compliance with the relevant Essential Requirements or the quality system requirements laid down in the relevant Annexes to the Medical Devices Directive. Following the issuance of this CE Certificate of Conformity, we can draw up a declaration of conformity and affix the CE mark to the delivery systems covered by this CE Certificate of Conformity and the declaration of conformity. The time required to CE mark our delivery systems or to obtain approval from other foreign authorities may be longer or shorter than that required for FDA approval. Pursuant to a mutual recognition agreement, our products bearing a CE mark may be exported to Switzerland. In the EU, a clinical study must receive a positive opinion from a local ethics committee and approval from the competent authority in the applicable EU member states in which the clinical study is conducted. When a clinical study relates to a CE marked medical device that will be used as part of the study according to its CE mark intended purpose, the approval of the competent authorities is not required. In Japan, we must obtain approvals from the MHLW to market our delivery systems. Each regulatory approval process outside of the United States includes all the risks associated with FDA regulation, as well as country-specific regulations.

Pervasive and continuing regulation

After a device is placed on the market, numerous regulatory requirements apply depending upon the country in which the device is being marketed. These may include:

|

• |

product listing and establishment registration, which helps facilitate FDA inspections and other regulatory action; |

|

• |

QSR, which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process for products marketed in the United States; |

|

• |

labeling regulations and FDA and equivalent competent authority in other jurisdictions requiring promotion is truthful and non-misleading and prohibiting the promotion of products for uncleared, unapproved or off-label uses; |

|

• |

approval of product modifications that affect the safety or effectiveness of one of our delivery systems that has been approved or is the subject of a CE Certificate of Conformity; |

|

• |

Medical Device Reporting regulations of the FDCA and medical device vigilance, which require that manufacturers comply with FDA or equivalent competent authority requirements in other jurisdictions to report if their device may have caused or contributed to a death or serious injury, or has malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction of the device or a similar device were to recur; |

|

• |

post-approval restrictions or conditions, including post-approval study commitments; |

|

• |

post-market surveillance regulations, which apply when necessary to protect the public health or to provide additional safety and effectiveness data for the device; |

|

• |

the FDA’s and equivalent competent authority’s recall authority, whereby they can ask, or under certain conditions order, device manufacturers to recall from the market a product that is in violation of governing laws and regulations; |

|

• |

regulations pertaining to voluntary recalls; and |

|

• |

notices of corrections or removals. |