ster-202212312022falseFY0001645070P5YP1Y0.0050.0050.005P4YP10YP3YP3YP3YP1YP4YP4YP1YP4YP1YP5YP2YP3YP4Y0.33330.33330.3333P2YP3YP2YP3YP2YP3Y00016450702022-01-012022-12-3100016450702022-06-30iso4217:USD00016450702023-02-28xbrli:shares00016450702021-12-3100016450702022-12-31iso4217:USDxbrli:shares00016450702020-01-012020-12-3100016450702021-01-012021-12-3100016450702019-12-3100016450702020-12-310001645070us-gaap:CommonStockMember2019-12-310001645070us-gaap:AdditionalPaidInCapitalMember2019-12-310001645070us-gaap:TreasuryStockCommonMember2019-12-310001645070us-gaap:RetainedEarningsMember2019-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001645070us-gaap:CommonStockMember2020-01-012020-12-310001645070us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001645070us-gaap:RetainedEarningsMember2020-01-012020-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001645070us-gaap:CommonStockMember2020-12-310001645070us-gaap:AdditionalPaidInCapitalMember2020-12-310001645070us-gaap:TreasuryStockCommonMember2020-12-310001645070us-gaap:RetainedEarningsMember2020-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001645070us-gaap:CommonStockMember2021-01-012021-12-310001645070us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001645070us-gaap:RetainedEarningsMember2021-01-012021-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001645070us-gaap:CommonStockMember2021-12-310001645070us-gaap:AdditionalPaidInCapitalMember2021-12-310001645070us-gaap:TreasuryStockCommonMember2021-12-310001645070us-gaap:RetainedEarningsMember2021-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001645070us-gaap:CommonStockMember2022-01-012022-12-310001645070us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001645070us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001645070us-gaap:RetainedEarningsMember2022-01-012022-12-310001645070us-gaap:AccountingStandardsUpdate201613Member2022-01-012022-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate201613Member2021-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2021-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Memberus-gaap:RetainedEarningsMember2021-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Member2021-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001645070us-gaap:CommonStockMember2022-12-310001645070us-gaap:AdditionalPaidInCapitalMember2022-12-310001645070us-gaap:TreasuryStockCommonMember2022-12-310001645070us-gaap:RetainedEarningsMember2022-12-310001645070us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100016450702021-09-102021-09-10xbrli:pure00016450702021-09-240001645070us-gaap:IPOMemberus-gaap:CommonStockMember2021-09-272021-09-270001645070us-gaap:IPOMemberus-gaap:CommonStockMember2021-09-270001645070us-gaap:IPOMember2021-09-272021-09-270001645070ster:ExistingStockholdersMember2021-09-272021-09-270001645070us-gaap:OverAllotmentOptionMember2021-09-272021-09-2700016450702021-09-272021-09-270001645070ster:SterlingCheckCorpMember2022-12-310001645070us-gaap:SoftwareDevelopmentMember2022-01-012022-12-31ster:Segment0001645070us-gaap:NonUsMember2021-12-310001645070country:IN2021-12-310001645070country:CA2021-12-310001645070us-gaap:NonUsMember2022-12-310001645070country:IN2022-12-310001645070country:CA2022-12-310001645070us-gaap:CostOfGoodsTotalMemberster:NewYorkStateOfficeOfCourtAdministrationMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001645070us-gaap:CostOfGoodsTotalMemberster:NewYorkStateOfficeOfCourtAdministrationMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2022-01-010001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001645070srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001645070srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001645070srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001645070us-gaap:ComputerEquipmentMember2022-01-012022-12-310001645070us-gaap:SoftwareDevelopmentMember2020-01-012020-12-310001645070us-gaap:SoftwareDevelopmentMember2021-01-012021-12-310001645070srt:MinimumMember2022-01-012022-12-310001645070srt:MaximumMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MinimumMemberster:ShareBasedPaymentArrangementOptionRestrictedStockAndRestrictedStockUnitsRSUsMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MaximumMemberster:ShareBasedPaymentArrangementOptionRestrictedStockAndRestrictedStockUnitsRSUsMember2022-01-012022-12-310001645070us-gaap:AccountingStandardsUpdate201602Member2022-01-010001645070ster:EmploymentBackgroundInvestigationsIncMember2021-11-302021-11-300001645070ster:EmploymentBackgroundInvestigationsIncMember2021-11-300001645070ster:EmploymentBackgroundInvestigationsIncMember2021-01-012021-12-310001645070ster:EmploymentBackgroundInvestigationsIncMember2021-12-310001645070ster:EmploymentBackgroundInvestigationsIncMember2022-12-312022-12-310001645070ster:EmploymentBackgroundInvestigationsIncMember2022-12-310001645070ster:EmploymentBackgroundInvestigationsIncMember2021-11-302022-12-310001645070ster:EmploymentBackgroundInvestigationsIncMember2022-12-012022-12-310001645070us-gaap:CustomerListsMemberster:EmploymentBackgroundInvestigationsIncMember2021-11-302021-11-300001645070us-gaap:TradeNamesMemberster:EmploymentBackgroundInvestigationsIncMember2021-11-302021-11-300001645070us-gaap:NoncompeteAgreementsMemberster:EmploymentBackgroundInvestigationsIncMember2021-11-302021-11-300001645070ster:EmploymentBackgroundInvestigationsIncMember2020-01-012020-12-310001645070us-gaap:FurnitureAndFixturesMember2021-12-310001645070us-gaap:FurnitureAndFixturesMember2022-12-310001645070us-gaap:ComputerEquipmentMember2021-12-310001645070us-gaap:ComputerEquipmentMember2022-12-310001645070us-gaap:LeaseholdImprovementsMember2021-12-310001645070us-gaap:LeaseholdImprovementsMember2022-12-310001645070srt:MinimumMemberus-gaap:CustomerListsMember2022-01-012022-12-310001645070srt:MaximumMemberus-gaap:CustomerListsMember2022-01-012022-12-310001645070us-gaap:CustomerListsMember2021-12-310001645070us-gaap:CustomerListsMember2022-12-310001645070srt:MinimumMemberus-gaap:TrademarksMember2022-01-012022-12-310001645070srt:MaximumMemberus-gaap:TrademarksMember2022-01-012022-12-310001645070us-gaap:TrademarksMember2021-12-310001645070us-gaap:TrademarksMember2022-12-310001645070us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2022-01-012022-12-310001645070us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2022-01-012022-12-310001645070us-gaap:NoncompeteAgreementsMember2021-12-310001645070us-gaap:NoncompeteAgreementsMember2022-12-310001645070us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2022-01-012022-12-310001645070us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2022-01-012022-12-310001645070us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001645070us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001645070srt:MinimumMemberus-gaap:InternetDomainNamesMember2022-01-012022-12-310001645070srt:MaximumMemberus-gaap:InternetDomainNamesMember2022-01-012022-12-310001645070us-gaap:InternetDomainNamesMember2021-12-310001645070us-gaap:InternetDomainNamesMember2022-12-310001645070us-gaap:OffMarketFavorableLeaseMembersrt:MinimumMember2022-01-012022-12-310001645070us-gaap:OffMarketFavorableLeaseMembersrt:MaximumMember2022-01-012022-12-310001645070us-gaap:OffMarketFavorableLeaseMember2021-12-310001645070us-gaap:OffMarketFavorableLeaseMember2022-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-012021-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberster:InternalCostMember2021-01-012021-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberster:ExternalCostMember2021-01-012021-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberster:InternalCostMember2022-01-012022-12-310001645070us-gaap:SoftwareAndSoftwareDevelopmentCostsMemberster:ExternalCostMember2022-01-012022-12-3100016450702022-01-01ster:lease0001645070srt:MinimumMember2022-12-310001645070srt:MaximumMember2022-12-310001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-12-310001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2022-12-310001645070us-gaap:SecuredDebtMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMember2021-12-310001645070us-gaap:SecuredDebtMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMember2022-12-310001645070us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001645070us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001645070us-gaap:LineOfCreditMember2022-11-290001645070us-gaap:SecuredDebtMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMember2022-11-290001645070us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-11-290001645070us-gaap:LineOfCreditMemberster:SecuredOvernightFinancingRateSOFRMember2022-11-292022-11-290001645070ster:AdjustedSecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2022-11-292022-11-290001645070srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-11-292022-11-290001645070srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-11-292022-11-290001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-11-290001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-01-012022-12-31ster:office0001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-12-310001645070us-gaap:SecuredDebtMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMemberster:DebtInstrumentAmortizationPeriodOneMember2022-11-290001645070us-gaap:SecuredDebtMemberster:DebtInstrumentAmortizationPeriodTwoMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMember2022-11-290001645070us-gaap:SecuredDebtMemberster:DebtInstrumentAmortizationPeriodThreeMemberster:TermLoans676Due2027Memberus-gaap:LineOfCreditMember2022-11-290001645070us-gaap:ScenarioAdjustmentMemberus-gaap:LineOfCreditMember2022-11-290001645070ster:GoldmanSachsLendingPartnersLLCMemberus-gaap:LineOfCreditMember2022-11-290001645070us-gaap:LineOfCreditMember2022-12-310001645070us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2022-01-012022-12-310001645070us-gaap:LineOfCreditMember2022-01-012022-12-310001645070us-gaap:FairValueInputsLevel2Memberus-gaap:LineOfCreditMember2021-12-310001645070us-gaap:LineOfCreditMember2021-08-100001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-100001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-08-100001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-08-110001645070us-gaap:LineOfCreditMember2021-08-110001645070srt:MinimumMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070srt:MaximumMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070srt:MaximumMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070srt:MinimumMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2020-12-310001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-11-012021-11-010001645070srt:MinimumMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-01-012021-12-310001645070us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-12-310001645070us-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:FairValueInputsLevel2Memberus-gaap:LineOfCreditMember2021-12-310001645070ster:FedFundsEffectiveRateMemberus-gaap:LineOfCreditMember2022-11-292022-11-290001645070ster:FedFundsEffectiveRateMemberus-gaap:SecuredDebtMemberster:A2015FirstLienTermLoan450Due2024Memberus-gaap:LineOfCreditMember2021-08-112021-08-110001645070ster:FedFundsEffectiveRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-08-112021-08-110001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001645070us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001645070us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2021-12-31ster:instrument0001645070us-gaap:NondesignatedMember2022-12-310001645070us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherCurrentLiabilitiesMember2021-12-310001645070us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:OtherCurrentLiabilitiesMember2022-12-310001645070us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2021-12-310001645070us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2022-12-310001645070us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2022-12-310001645070us-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001645070us-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001645070us-gaap:CostOfSalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001645070us-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001645070us-gaap:InterestRateSwapMemberster:GainLossOnInterestRateSwapsMember2020-01-012020-12-310001645070us-gaap:InterestRateSwapMemberster:GainLossOnInterestRateSwapsMember2021-01-012021-12-310001645070us-gaap:InterestRateSwapMemberster:GainLossOnInterestRateSwapsMember2022-01-012022-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001645070us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310001645070us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310001645070ster:NationalCrimeCheckPtyLtdMember2018-12-310001645070ster:NationalCrimeCheckPtyLtdMember2021-09-012021-09-300001645070ster:NationalCrimeCheckPtyLtdMember2022-09-30ster:vote00016450702022-11-230001645070us-gaap:CostOfSalesMember2020-01-012020-12-310001645070us-gaap:CostOfSalesMember2021-01-012021-12-310001645070us-gaap:CostOfSalesMember2022-01-012022-12-310001645070ster:CorporateTechnologyAndProductionSystemsMember2020-01-012020-12-310001645070ster:CorporateTechnologyAndProductionSystemsMember2021-01-012021-12-310001645070ster:CorporateTechnologyAndProductionSystemsMember2022-01-012022-12-310001645070us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001645070us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001645070us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001645070ster:NonQualifiedStockOptionsMember2022-12-310001645070us-gaap:RestrictedStockMember2022-12-310001645070us-gaap:RestrictedStockUnitsRSUMember2022-12-310001645070ster:A2015LongTermEquityIncentivePlanMember2015-12-310001645070us-gaap:PerformanceSharesMemberster:A2015LongTermEquityIncentivePlanMember2015-12-310001645070ster:A2015LongTermEquityIncentivePlanMember2021-08-042021-08-040001645070ster:A2015LongTermEquityIncentivePlanMember2015-01-012015-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2015-01-012015-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberster:ServiceBasedVestingStockOptionsMember2015-01-012015-12-310001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2015-01-012015-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberster:ServiceBasedVestingStockOptionsMember2015-01-012015-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2020-01-012020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2021-01-012021-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2022-01-012022-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2020-01-012020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2021-01-012021-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2022-01-012022-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2020-11-012020-11-300001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2020-11-012020-11-300001645070ster:ServiceBasedAndPerformanceBasedStockOptionsMemberster:A2015LongTermEquityIncentivePlanMember2020-11-012020-11-30ster:employee0001645070ster:ServiceBasedAndPerformanceBasedStockOptionsMemberster:A2015LongTermEquityIncentivePlanMember2020-01-012020-12-310001645070ster:ServiceBasedAndPerformanceBasedStockOptionsMemberster:A2015LongTermEquityIncentivePlanMember2021-01-012021-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2021-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2021-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:ServiceBasedVestingStockOptionsMember2022-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:PerformanceBasedStockOptionsMember2022-12-310001645070ster:ServiceBasedAndPerformanceBasedStockOptionsMemberster:A2015LongTermEquityIncentivePlanMember2022-12-310001645070ster:ServiceBasedAndPerformanceBasedStockOptionsMemberster:A2015LongTermEquityIncentivePlanMember2022-01-012022-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:StockOptionsIssuedForPromissoryNotesMember2020-12-012020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:StockOptionsIssuedForPromissoryNotesMember2020-01-012020-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberster:StockOptionsIssuedForPromissoryNotesMember2021-08-172021-08-170001645070ster:A2021OmnibusIncentivePlanMember2021-01-012021-12-310001645070ster:A2021OmnibusIncentivePlanMember2021-08-042021-08-040001645070ster:A2021OmnibusIncentivePlanMember2021-08-040001645070ster:A2021OmnibusIncentivePlanMember2022-12-310001645070ster:A2021OmnibusIncentivePlanMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2021-09-272021-09-270001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2021OmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-09-272021-09-270001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2021OmnibusIncentivePlanMemberster:NonEmployeeDirectorsMemberus-gaap:EmployeeStockOptionMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberster:NonEmployeeDirectorsMemberus-gaap:EmployeeStockOptionMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberster:NonEmployeeDirectorsMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMembersrt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMember2020-12-310001645070ster:A2021OmnibusIncentivePlanMember2020-01-012020-12-310001645070ster:A2021OmnibusIncentivePlanMember2021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-09-272021-09-270001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2021-12-312021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-12-312021-12-310001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2021-12-312021-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MinimumMemberster:RestrictedStockOtherMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MaximumMemberster:RestrictedStockOtherMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2020-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockMember2022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-09-272021-09-270001645070us-gaap:ShareBasedCompensationAwardTrancheTwoMemberster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-09-272021-09-270001645070ster:A2021OmnibusIncentivePlanMembersrt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMembersrt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001645070ster:A2021OmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001645070us-gaap:EmployeeStockMember2021-08-040001645070us-gaap:EmployeeStockMember2021-08-042021-08-040001645070us-gaap:EmployeeStockMember2021-01-012021-12-310001645070us-gaap:EmployeeStockMember2021-12-310001645070us-gaap:EmployeeStockMember2022-12-310001645070ster:A2015LongTermEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberster:ServiceBasedVestingStockOptionsMember2016-01-012016-12-310001645070us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001645070us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001645070us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001645070ster:StockOptionsIssuedForPromissoryNotesMember2020-01-012020-12-310001645070ster:StockOptionsIssuedForPromissoryNotesMember2021-01-012021-12-310001645070ster:StockOptionsIssuedForPromissoryNotesMember2022-01-012022-12-310001645070us-gaap:RestrictedStockMember2020-01-012020-12-310001645070us-gaap:RestrictedStockMember2021-01-012021-12-310001645070us-gaap:RestrictedStockMember2022-01-012022-12-310001645070us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001645070us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001645070us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001645070country:US2020-01-012020-12-310001645070country:US2021-01-012021-12-310001645070country:US2022-01-012022-12-310001645070country:US2022-12-310001645070us-gaap:ForeignPlanMember2020-01-012020-12-310001645070us-gaap:ForeignPlanMember2021-01-012021-12-310001645070us-gaap:ForeignPlanMember2022-01-012022-12-310001645070srt:AffiliatedEntityMemberster:ManagementServiceAgreementMember2021-09-012021-09-300001645070us-gaap:InvestorMemberster:ManagementServiceAgreementMember2021-09-012021-09-300001645070ster:AnnualCashCompensationAgreementMemberus-gaap:InvestorMember2018-12-012018-12-310001645070ster:CashCompensationAgreementMemberus-gaap:InvestorMember2018-01-012019-03-310001645070srt:AffiliatedEntityMember2020-01-012020-12-310001645070srt:AffiliatedEntityMember2021-01-012021-12-310001645070srt:AffiliatedEntityMember2022-01-012022-12-310001645070srt:AffiliatedEntityMember2021-12-310001645070srt:AffiliatedEntityMember2022-12-310001645070us-gaap:InvestorMember2020-01-012020-12-310001645070us-gaap:InvestorMember2021-01-012021-12-310001645070us-gaap:InvestorMember2022-01-012022-12-310001645070us-gaap:InvestorMember2022-12-310001645070us-gaap:InvestorMember2021-12-310001645070ster:ScreeningServicesMember2020-01-012020-12-310001645070ster:ScreeningServicesMember2021-01-012021-12-310001645070ster:ScreeningServicesMember2022-01-012022-12-310001645070us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310001645070us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001645070us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001645070country:US2020-01-012020-12-310001645070country:US2021-01-012021-12-310001645070country:US2022-01-012022-12-310001645070us-gaap:NonUsMember2020-01-012020-12-310001645070us-gaap:NonUsMember2021-01-012021-12-310001645070us-gaap:NonUsMember2022-01-012022-12-310001645070srt:ParentCompanyMember2021-12-310001645070srt:ParentCompanyMember2022-12-310001645070srt:ParentCompanyMember2020-01-012020-12-310001645070srt:ParentCompanyMember2021-01-012021-12-310001645070srt:ParentCompanyMember2022-01-012022-12-310001645070us-gaap:SubsequentEventMemberster:ACheckGlobalMember2023-03-012023-03-010001645070us-gaap:SubsequentEventMember2023-01-012023-02-280001645070us-gaap:SubsequentEventMemberus-gaap:NondesignatedMemberus-gaap:InterestRateSwapMember2023-02-28

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-40829

Sterling Check Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | | 37-1784336 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

1 State Street Plaza, 24th Floor | | |

New York, New York | | 10004 |

(Address of principal executive offices) | | (Zip code) |

| | |

Registrant’s telephone number, including area code: |

1(800) 853-3228 |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | STER | | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐ No ☑

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☑ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the common stock held by non-affiliates of the registrant, based on the closing price of the common stock as reported by the Nasdaq Stock Market LLC on June 30, 2022, the last business day of the registrant’s most recently completed second quarter, was approximately $563.3 million.

The total number of outstanding shares of the registrant’s common stock, $0.01 par value per share, as of February 28, 2023 was 96,297,609 (excluding treasury shares of 1,541,163).

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

Document | | Incorporated as to |

| Proxy Statement for the | | Part III |

2023 Annual Meeting of Stockholders | | |

| | |

| | |

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we intend that all forward-looking statements that we make will be subject to the safe harbor protections created thereby. You can generally identify forward-looking statements by our use of forward-looking terminology such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “playbook,” “potential,” “predict,” “projection,” “seek,” “should,” “will” or “would,” or the negative thereof or other variations thereon or comparable terminology. In particular, statements that address market trends, and statements regarding our expectations, beliefs, plans, strategies, objectives, prospects or assumptions, or statements regarding future events or performance contained in this Annual Report on Form 10-K under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this Annual Report on Form 10-K under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” may cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements, or could affect our share price. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

•changes in economic, political and market conditions, including concerns of a potential economic downturn or recession, and the impact of these changes on our clients’ hiring trends;

•the sufficiency of our cash to meet our liquidity needs;

•the possibility of cyber-attacks, security vulnerabilities and internet disruptions, including breaches of data security and privacy leaks, data loss and business interruptions;

•our ability to comply with the extensive United States (“U.S.”) and foreign laws, regulations and policies applicable to our industry, and changes in such laws, regulations and policies;

•our compliance with data privacy laws and regulations;

•potential liability for failures to provide accurate information to our clients, which may not be covered, or may be only partially covered, by insurance;

•the possible effects of negative publicity on our reputation and the value of our brand;

•our failure to compete successfully;

•our ability to keep pace with changes in technology and to provide timely enhancements to our products and services;

•the continued impact of COVID-19 on global markets, economic conditions and the response by governments and third parties;

•our ability to cost-effectively attract new clients and retain our existing clients;

•our ability to grow our Identity-as-a-Service offerings;

•our success in new product introductions and adjacent market penetrations;

•our ability to expand into new geographies;

•our ability to pursue and integrate strategic mergers and acquisitions;

•design defects, errors, failures or delays with our products and services;

•systems failures, interruptions, delays in services, catastrophic events and resulting interruptions;

•natural or man-made disasters including pandemics and other significant public health emergencies, outbreaks of hostilities or effects of climate change and our ability to deal effectively with damage or disruption caused by the foregoing;

•our ability to implement our business strategies profitably;

•our ability to retain the services of certain members of our management;

•our ability to adequately protect our intellectual property;

•our ability to implement, maintain and improve effective internal controls;

•our ability to comply with public company requirements in a timely and cost-effective manner, and expense strain on our resources and diversion of our management’s attention resulting from public company compliance requirements; and

•the other risks described in Item 1A. “Risk Factors” of this Annual Report on Form 10-K.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance and our actual results of operations, financial condition and liquidity and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. In addition, even if our results of operations, financial condition and liquidity and events in the industry in which we operate, are consistent with the forward-looking statements contained in this Annual Report on Form 10-K, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Annual Report on Form 10-K speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report on Form 10-K.

Investors and others should note that we announce material financial and operational information using our investor relations website, press releases, U.S. Securities and Exchange Commission (“SEC”) filings and public conference calls and webcasts. Information about Sterling Check Corp., our business, and our results of operations may also be announced by posts on our accounts on social media channels, including the following: Instagram, Facebook, LinkedIn and Twitter. The information contained on, or that can be accessed through, our social media channels and on our website is deemed not to be incorporated in this Annual Report on Form 10-K or to be a part of this Annual Report on Form 10-K. The information that we post through these social media channels and on our website may be deemed material. As a result, we encourage investors, the media and others interested in Sterling Check Corp. to monitor these social media channels in addition to following our investor relations website, press releases, SEC filings and public conference calls and webcasts. The list of social media channels we use may be updated from time to time on our investor relations website.

PART I

Item 1. Business.

Sterling Overview

Sterling Check Corp. (“the Company,” “Sterling,” “we,” “us” or “our”) is incorporated in the state of Delaware and its principal executive offices are at 1 State Street Plaza, 24th Floor, New York, New York. Our phone number is 1 (800) 853-3228 and our website address is www.sterlingcheck.com. Our common stock is traded on the Nasdaq Stock Market LLC under the symbol “STER”.

We are a leading global provider of technology-enabled background and identity verification services. We provide the foundation of trust and safety that our clients need to create great environments for their most essential resource—people. We offer a comprehensive hiring and risk management solution that begins with identity verification, followed by criminal background screening, credential verification, drug and health screening, processing of employee documentation required for onboarding and ongoing risk monitoring. Our services are generally delivered through our purpose-built, proprietary, cloud-based technology platform that empowers

organizations with real-time and data-driven insights to conduct and manage their employment screening programs efficiently and effectively. Our clients face a dynamic and rapidly evolving global labor market with increasing complexity and regulatory requirements. We believe that our services and platform enable organizations to make more informed employment decisions, improve workplace safety, protect their brand and mitigate risk. As a result, we believe our solutions are mission-critical to our clients’ core human resources, risk management and compliance functions. During the twelve months ended December 31, 2022, we completed over 110 million searches for over 50,000 clients, including over 50% of the Fortune 100 and over 50% of the Fortune 500.

We have built an award-winning proprietary and cloud-based technology platform. Our client and candidate interfaces provide easy-to-use and mobile-first ordering, task and program management, results delivery and reporting analytics. This enables our clients to gain meaningful insights into their risk mitigation programs, all while creating exceptional candidate and employee experiences. Our interfaces are supported by our powerful artificial intelligence (“AI”)-driven fulfillment platform, which leverages more than 3,300 automation integrations, including Application Programming Interfaces (“APIs”) and Robotic Process Automation (“RPA”) bots. This enables 90% of our United States (“U.S.”) criminal searches to be automated and allows us to complete 50% of U.S. criminal searches within the first five minutes, 65% of U.S. criminal searches within the first 15 minutes, over 70% of U.S. criminal searches within the first hour and 90% within the first day. As of December 31, 2022, over 95% of our revenue is processed through platforms hosted in the cloud, which allows us to consistently maintain 99.9% platform availability while being prepared to scale into the future. These platforms are seamlessly integrated into over 75 applicant tracking systems (“ATS”) and Human Capital Management (“HCM”) systems and our clients’ in-house supply chain systems, thus creating relatively frictionless, fast and unified candidate hiring experiences. Moreover, gig economy, contingent workforce, and enterprise clients, who utilize proprietary candidate workflow systems, may integrate into Sterling’s platform by leveraging our proprietary API. When combined, we believe our solutions deliver convenient and easy-to-use front-end interfaces, accurate and fast results, and enable our clients to effectively manage complex programs in a compliant and cost-effective manner. We believe that our technology cannot be easily replicated without substantial investment.

As part of our strategic transformation, in early 2019, we launched Project Ignite, a three-phase strategic investment initiative to create a cloud-native enterprise-class global platform. The remaining investment, which we substantially completed in 2022, migrated our corporate technological infrastructure to the cloud and enabled us to decommission redundant fulfillment systems. We have benefited from the delivery of our new client and candidate interfaces, scalable cloud-based infrastructure for our global production platform and an improved security environment through new business wins, improved client retention and the ability to launch products rapidly to meet immediate client needs, as we did in 2022 when we developed our robust and proprietary core I-9 offering into a fully integrated I-9 solution within our Sterling platform and partner ecosystem. In 2022, we also strengthened our competitive differentiation through the expansion of our identity capabilities in both the U.S. and the United Kingdom (the “U.K”). In the U.S., with ID.me, we believe that we became the only background screening provider to have a fully integrated reusable identity workflow within the screening process, furthering our leadership position to deliver identity services for employers in the U.S. In the U.K., we became the first background screening organization to become a certified digital identity service provider and have partnered with Yoti to develop a comprehensive global identity verification solution. This new capability enables a faster and easier experience for prospective talent in the U.K. to verify themselves using modern technology while reducing the chance of identity fraud. At the end of 2022, we also launched Project Nucleus which we expect to drive meaningful cost savings and efficiency gains in our cost of revenues. This initiative aims to enhance our organization by re-engineering processes, driving fulfillment labor cost reductions and identifying and executing on additional automation opportunities with a focus on our global fulfillment process. As part of our journey of growth and optimization, in 2022, we continued to refine our corporate strategy and our commitment to delivering stockholder value by executing on the growth opportunities in front of us. We have a number of key execution elements to help us achieve our goals, including increasing our revenues with existing clients, acquiring new clients, growing market share internationally, and utilizing M&A to supplement our organic revenue growth. As part of our refreshed strategy, we have begun executing on a restructuring program to realign senior leadership and functions, with the goal of elevating our go-to-market strategy and accelerating our technology and product innovation. Over the long term, we expect these investments and strategic changes to further enhance our margins, improve time to market as we build once and deploy globally and allow us to increase innovation.

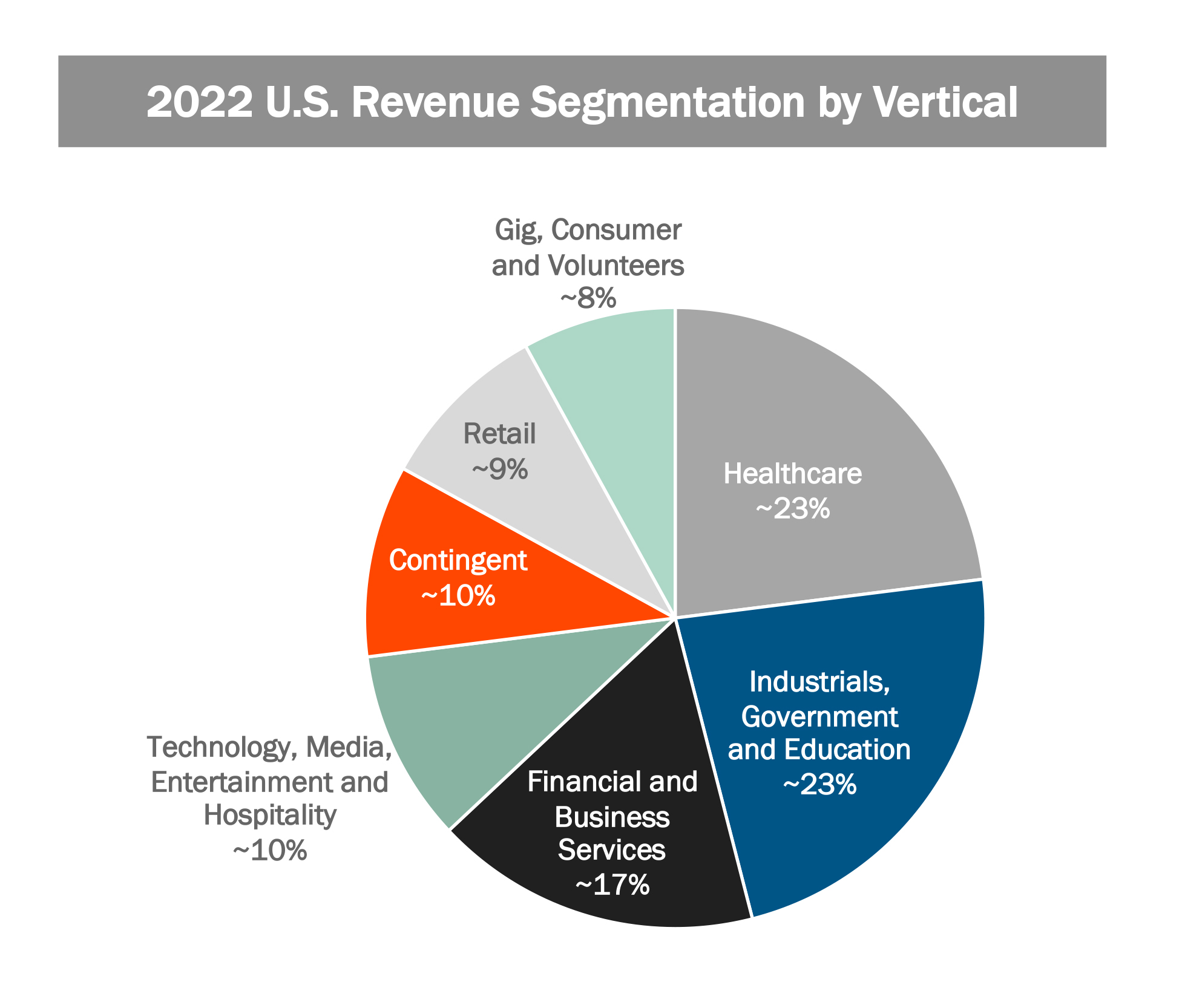

Our client-centric approach underpins everything we do. We serve a diverse and global client base in a wide range of industries, such as healthcare, gig economy, financial and business services, industrials, retail, contingent, technology, media and entertainment, transportation and logistics, hospitality, education and government. Employers are facing numerous challenges, including complex and changing legal and regulatory requirements, a rise in fraudulent job applications, a growing spotlight on reputation and a more complex global workforce. Successfully navigating these challenges requires an industry-specific perspective, given differing candidate profiles, economics, competitive dynamics and regulatory demands. To serve these differing needs,

our sales and support delivery model is organized around teams dedicated to specific industries (“Verticals”) and geographic markets (“Regions”). Our delivery model provides our clients with both the personal touch and consultative partnership of a small boutique firm and the global reach, scale, innovation and resources of an industry leader. Additionally, this delivery model supports our principle of “Compliance by Design”, enabling clients to maintain compliance globally. We believe the combination of our deep market expertise from our sales and support combined with the flexibility of our proprietary technology platform enable us to deliver industry-relevant, highly specialized solutions to our clients in a scalable manner, driving growth and differentiating us from our competitors. This has allowed us to develop long-standing relationships and a highly trusted brand with our clients as evidenced by the average tenure of our top 100 clients, based on 2021 and 2022 total revenue, at nine years, our average client net promoter score (“NPS”) of greater than 50 and a gross retention rate of 96% for 2021 and 2022.

Throughout our more than 45-year operating history, innovation and self-disruption have been at the core of what we do every day. Our history of unique, industry-oriented market insights allows us to be at the forefront of innovation which includes multiple industry-leading solutions. For example, we pioneered criminal fulfillment technology (CourtDirect), arrest record and incarceration alert products, post-hire monitoring capabilities, AI-enhanced record review and validation process and the industry’s only proprietary technology in a single-sourced U.S.-nationwide fingerprint network. Our commitment to innovation has continued with the recent development of enhanced global language support capabilities, a cloud-based operating platform, our exclusive partnership with the Financial Industry Regulatory Authority, Inc. (“FINRA”) serving as their fingerprint services provider, and a comprehensive global identity verification solution through our partnership with ID.me in the U.S. and with Yoti internationally. Enabled by our market leadership and platform investments, we have established a foundation and roadmap for future innovation which includes industry-specific products, growing our Identity-as-a-Service capabilities and further geographic expansion.

On September 27, 2021, we completed our initial public offering (“IPO”), in which we and certain selling stockholders sold an aggregate of 16,427,750 shares of our common stock, $0.01 par value per share, consisting of 4,760,000 newly issued shares that we sold, 9,525,000 secondary shares that the selling stockholders sold and 2,142,750 shares that the selling stockholders sold pursuant to the full exercise of the underwriters’ option to purchase additional shares at an offering price of $23.00 per share, resulting in net proceeds to us of $94.5 million, after deducting the underwriting discount of $6.8 million and offering expenses of $8.1 million, of which $0.2 million was unpaid as of December 31, 2021. On November 1, 2021, we utilized proceeds from the IPO and cash on hand to repay $100.0 million of outstanding borrowings under our term loan (the “First Lien Term Loan”).

On November 30, 2021, we acquired Employment Background Investigations, Inc. (“EBI”) for a purchase price of $67.8 million, consisting of $66.3 million of cash and $1.5 million of contingent consideration recorded at fair value. EBI provides background screening, drug testing, occupational healthcare and electronic Form I-9 solutions for today’s talent acquisition and workforce management needs. This acquisition expanded our presence in key U.S. Verticals, including financial services, healthcare, retail, manufacturing and transportation.

On November 23, 2022, our board of directors authorized the repurchase of up to $100.0 million of our shares of common stock over a period through December 31, 2024. The program is expected to be funded through our existing cash and future free cash flow. The share repurchase program is being executed on a discretionary basis through open market repurchases, private transactions or other transactions, including through block trades and Rule 10b5-1 trading plans. During the three months ended December 31, 2022, we repurchased 939,417 shares for approximately $14.0 million.

On November 29, 2022, we completed the refinancing of our existing credit facilities with new credit facilities comprised of a $300.0 million term loan and a $400.0 million revolving credit facility. The 2022 Credit Agreement (as defined in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Credit Facility”) extended our debt maturity profile to November 2027, increased our credit capacity, and is expected to reduce our annual interest expense. On February 28, 2023, we entered into an amortizing $300.0 million notional value interest rate swap. The notional value steps down from $300.0 million to $150.0 million on February 27, 2026. The swap provides for us to pay, as applied to the notional value, a fixed rate of interest of 4.26% monthly and receive, on a monthly basis, an amount equal to the greater of the one-month term SOFR and a floor of (0.10%), as applied to the notional value (the “Floating Leg”). The interest rate swap matures on November 29, 2027. The interest expense related to the 2022 Credit Agreement will be offset by proceeds received from the Floating Leg of the interest rate swap.

In January 2023, we expanded our global presence into Latin America through the acquisition of Socrates Limited and its affiliates (‘Socrates”), the largest independent screening company in Latin America. The acquisition will allow us to better serve the rapidly growing regional hiring needs of both multi-national and local clients in a region with rapidly increasing hiring demands.

On March 1, 2023, we acquired all of the outstanding shares of A-Check Global, a U.S.-based employment screening organization, providing us access to a high quality, enterprise-focused customer base diversified across attractive verticals including healthcare and telecom.

For the years ended December 31, 2020, 2021 and 2022, our revenues were $454.1 million, $641.9 million and $766.8 million, respectively. Our net losses were $52.3 million and $18.5 million for the years ended December 31, 2020 and 2021, respectively, and our net income was $19.4 million for the year ended December 31, 2022. We recorded an operating loss of $23.1 million for the year ended December 31, 2020 and operating income of $0.4 million and $59.0 million for the years ended December 31, 2021 and 2022, respectively. For the years ended December 31, 2020, 2021 and 2022, our Adjusted EBITDA was $99.8 million, $179.2 million and $198.5 million, respectively, and our Adjusted Net Income was $26.7 million, $92.2 million and $106.5 million, respectively. For the definitions of Adjusted EBITDA and Adjusted Net Income and a reconciliation to net income, their most directly comparable financial measure presented in accordance with accounting principles generally accepted in the United States of America, see Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

Our Market Opportunity

The global background and identity verification market in which we operate is large, growing and highly fragmented representing a $18 billion total addressable market as of 2021, which is expected to grow at a 12% compound annual growth rate (“CAGR”) to $33 billion in 2026. The total addressable market comprises three distinct components as follows: the $6 billion global pre-hire employment screening services market (source: Acclaro Growth Partners (“Acclaro”), July 2021), expected to grow at a 6% CAGR to $9 billion in 2026, the $3 billion global post-hire employment screening services market (source: Acclaro, July 2021), expected to grow at a 12% CAGR to $5 billion in 2026, as well as the $9 billion global identity verification market (source: MarketsandMarkets, December 2021), expected to grow at a 17% CAGR to $19 billion in 2026.

Our addressable market is rapidly evolving and benefits from a number of key demand drivers, many of which increase the need for more flexible, comprehensive screening and hiring solutions, including the following:

•Growing participation in the gig economy and contingent workforce

The gig economy and contingent workforce consists of independent contractors, online platform workers, contract firm workers and contingent workers. According to Upwork’s 2022 Freelance Forward survey, 39% of the U.S. workforce performed freelance work during 2022, an increase over 2021’s 36% rate, and this proportion is expected to increase. Amongst Gen-Z and millennials, the share of workers who participated in freelance work are even higher at 43% and 46%, respectively. The rise and expansion of the gig economy and contingent workforce results in a greater portion of the workforce being sourced from temporary or on-demand labor pools. Additionally, the rise of competing gig platforms has made it easier for gig workers to shift between platforms, thus increasing the demand for screening. As the gig economy caters to clients in a very direct and personal way (e.g., rideshare, goods delivery, household services) and large corporations continue to increase utilization of a contingent workforce that may access sensitive information, safe and effective background screening capabilities have become critical. We believe that continued growth in the gig and contingent workforce model for the foreseeable future will support clear demand for Sterling’s deep expertise and tailored solutions.

•Elevated voluntary employee churn

Generational and structural shifts in the workforce have led to elevated levels of voluntary employee churn, particularly with younger workers. Members of the millennial and Gen-Z generations switch jobs more frequently than previous generations. According to a December 2022 LinkedIn study, 61% of American workers are considering leaving their jobs in 2023. Among Gen-Z workers, 72% are considering quitting, as are 66% of millennials. Moreover, the generational movement away from unions and defined benefit plans reduces contractual and financial incentives to stay in a particular role, reducing switching costs for employees. The ongoing structural shift from in-office to remote work further reduces the historical geographic matching challenge employers and employees faced, further reducing switching costs for employees and expanding talent pools for employers. These trends support increasing demand for global, fast and efficient employment screening and identity verification services that only providers of scale, like Sterling, can sufficiently address.

•The rise of fraudulent job applications and growing spotlight on a company’s reputational risk

False claims within job applications are a growing concern for employers. According to a 2023 ResumeBuilder.com study, 72% of Americans admit to lying on their resumes, with education and years

of experience being the top two areas of falsification. False claims by candidates can put an organization at significant risk. Costs include not only salary but also incentives, benefits, recruiting expenses, administrative costs and the cost to restart the process in recruiting a candidate. In extreme cases, the employee may cause harm in the workplace, leading to a claim of negligent hiring, forcing the employer to contend with the cost and time of litigation and possible significant damages or settlements. Additionally, there may be considerable reputational risk to the employer, whose safety and trust may be called into question. Utilizing background and identification verification services helps organizations to mitigate these risks.

•Proliferation of personal data driving need for identity verification

According to a 2022 report by the Federal Trade Commission, the total number of fraud and identity thefts in 2021 was 5.7 million, an almost 18% increase compared to 2020 (4.9 million). In addition, according to a recent Risk Based Security report, the top two data types exposed in breaches were names (63.9%) and Social Security numbers (40.6%). This growth in exposed identities, especially names and social security numbers, puts more identities at risk of theft. Verifying identity is a powerful tool that employers can use to help ensure that their candidates and workers are who they claim to be and that fraudulent data is not used during the hiring and onboarding process.

•Increase in background screening adoption outside the U.S.

We believe that pre-hire candidate screening is significantly less common outside of the U.S. Many international markets are beginning to view employment background checks as a critical component of their hiring functions. Additionally, the international expansion of U.S.-based global companies and their desire to offer centralized and comparable hiring practices has introduced the benefits of background screening to foreign markets. For these employers, global background checks are critical in order to comply with regulatory requirements, standardize their quality of hires and protect against negligent hiring risks. However, international background checks or verifying foreign credentials presents additional complexities, as employers may not be familiar with foreign customs or information sources, and the time and cost to hire employees with international histories are often much more significant. Background and identity verification service firms that can navigate these international challenges present a clear advantage for employers.

•Increase in continuous monitoring or post-hire screening processes

While some industries have regulatory requirements for post-hire screening, employers from all industries are increasingly focused on managing risk in the workplace through continuous screening and monitoring. According to a 2021 report by the Professional Background Screening Association (“PBSA”), 19% of organizations worldwide conduct background checks on a recurring basis in addition to during the initial hiring/onboarding process. Continuous screening allows for greater mobility and safety for remote, onsite and contingent jobs, with monitoring solutions such as screening for healthcare sanctions, medical licenses, motor vehicle registration monitoring and social media monitoring helping ensure compliance with on-going certification and licensing requirements as well as prompting risk warnings on any changes to an employee’s profile, including any criminal activity, drug use or health changes, amongst others.

•Increasing regulatory, compliance and risk management requirements

Increasing regulation is creating a heightened and complex risk of potential liabilities related to hiring and workforce management that is increasingly difficult for employers to manage. U.S. employee privacy and data protection laws are complicated and vary state-to-state. In addition, the interpretation of the Fair Credit Reporting Act (“FCRA”) is continuously evolving. Other complexities include variations in drug testing laws by industry and state and the introduction of “ban the box” and “fair chance” laws at the local, state, and federal level, which limit an employer’s ability to inquire about criminal histories and to consider them in making employment decisions. Outside the U.S., the European Union General Data Protection Regulation (“GDPR”) introduced significant changes in the way personal data is protected and handled in the European Union (the “EU”). In response, organizations are increasing their focus on compliance functions to ensure they meet these evolving legal and regulatory requirements, often turning to outsourced service providers. As they do, large service providers like Sterling with the depth and experience to help companies navigate these intricacies will continue to benefit from the increase in regulatory complexity.

Our Competitive Strengths

We believe we differentiate ourselves through the following key competitive strengths:

•A market leader with significant scale and breadth. We are a leading global provider of technology-enabled background and identity verification services across a wide array of industries and geographies—completing 110 million searches across over 240 countries and territories in 35 languages for over 50,000 highly-diversified clients during the year ended December 31, 2022. We are a market leader in the U.S., Canada and many markets throughout the world, including within Europe, the Middle East and Africa (“EMEA”), Asia Pacific (“APAC”) and Latin America. Our global fulfillment capabilities are supported by operations in 16 jurisdictions—the U.S., Australia, Brazil, Canada, China, Colombia, Hong Kong, India, Malaysia, Mexico, the Netherlands, the Philippines, Poland, Singapore, the United Arab Emirates and the U.K. We believe this differentiates Sterling with large, marquee clients who demand sophisticated solutions across broad enterprises with nuanced operating priorities.

•Award-winning, proprietary technology platform and extensive global product suite.

We believe our proprietary technology platform and global product suite provide us with a number of competitive advantages, including the following:

Proprietary Technology and Analytics Platform: We operate a global cloud-based platform, purpose-built to address the unique needs of our clients. With over 95% of our revenue processed through platforms in the cloud, our technology platform is scalable to serve our global client base and flexible to adapt to changing dynamics within industries. We deliver a seamless user experience—our mobile-friendly client and candidate interfaces (Sterling Client Hub, Sterling Candidate Hub and Sterling Analytics Hub) are intuitive and easy-to-use. Our customizable, powerful data analytics platform provides clients with the information they need to gain real-time insights and make data-driven decisions as they seek to manage, streamline and optimize their programs. Our proprietary fulfillment platform technologically sets us apart in our ability to manage the complexities of background screening. Sterling’s fulfillment platform is AI-driven and augmented with RPA, which results in high accuracy, low hiring costs and low time-to-hire rates, with over 70% of U.S. criminal searches completed within the first hour and 90% within the first day. Integrated clients represent a growing share of our business, with over 60% of revenue now integrated. We expect this percentage to continue to increase as adoption of ATS and HCM software solutions grows. We have developed a comprehensive integration platform by partnering with many of the leading HCM and ATS platforms. Those clients with third-party HCM and ATS systems may integrate with Sterling through one of our over 75 platform integrations. Gig economy, contingent workforce and enterprise clients, who utilize proprietary candidate workflow systems, may integrate into Sterling’s platform by leveraging our well-documented public RESTful API. This API provides clients with access to Sterling’s powerful services along with a wide range of capabilities, customization options and mobility solutions. All of our platform integrations create opportunities for our clients to improve productivity and profitability, and in turn create stickier client relationships for Sterling. We believe that these proprietary systems cannot be easily replicated without substantial investment.

Global Product Suite: We offer an extensive suite of global products addressing a wide range of complex client needs. Our solutions include identity verification, comprehensive background screening, credential verification, drug and health screening, processing of employee documentation required for onboarding and ongoing risk monitoring. Sterling’s background screening solutions utilize proprietary automation technology that we believe delivers thorough, fast and accurate records with global criminal screening capabilities in over 240 countries and territories. Our credential verification services are backed by our proprietary fulfillment engine. We provide comprehensive drug and health screenings with access to approximately 20,000 collection sites supporting the Substance Abuse and Mental Health Services Administration (“SAMHSA”) in the U.S. Sterling provides onboarding document management services as well as ongoing workforce and medical license monitoring. We believe our global product suite positions us well to access a broader set of clients and future revenue and growth opportunities.

Identity Workflow Solutions: We believe we offer one of the most complete full-stack identity workflow technologies, which allows our clients to verify a candidate’s identity before starting a background check. With more work shifting remote, the growth of gig economy contract work and an increasing use of the contingent workforce, the need for pre-verified identity during the pre-employment process continues to grow. Our full suite of identity solutions includes telecom and device verification, document verification, facial recognition, biometric matching and video chat identity proofing. In addition to online identity verification, we have proprietary technology in a single-sourced national network of fingerprint collection sites across all 50 U.S. states, where we can capture and use multiple sets of biometrics in a single visit using internally developed innovative hardware and software, which can be integrated with

the Federal Bureau of Investigation (the “FBI”), FINRA and other screening processes. We believe our identity solutions add demonstrable value to clients and candidates, and we are well-positioned to benefit as the market adopts identity verification as part of background screening.

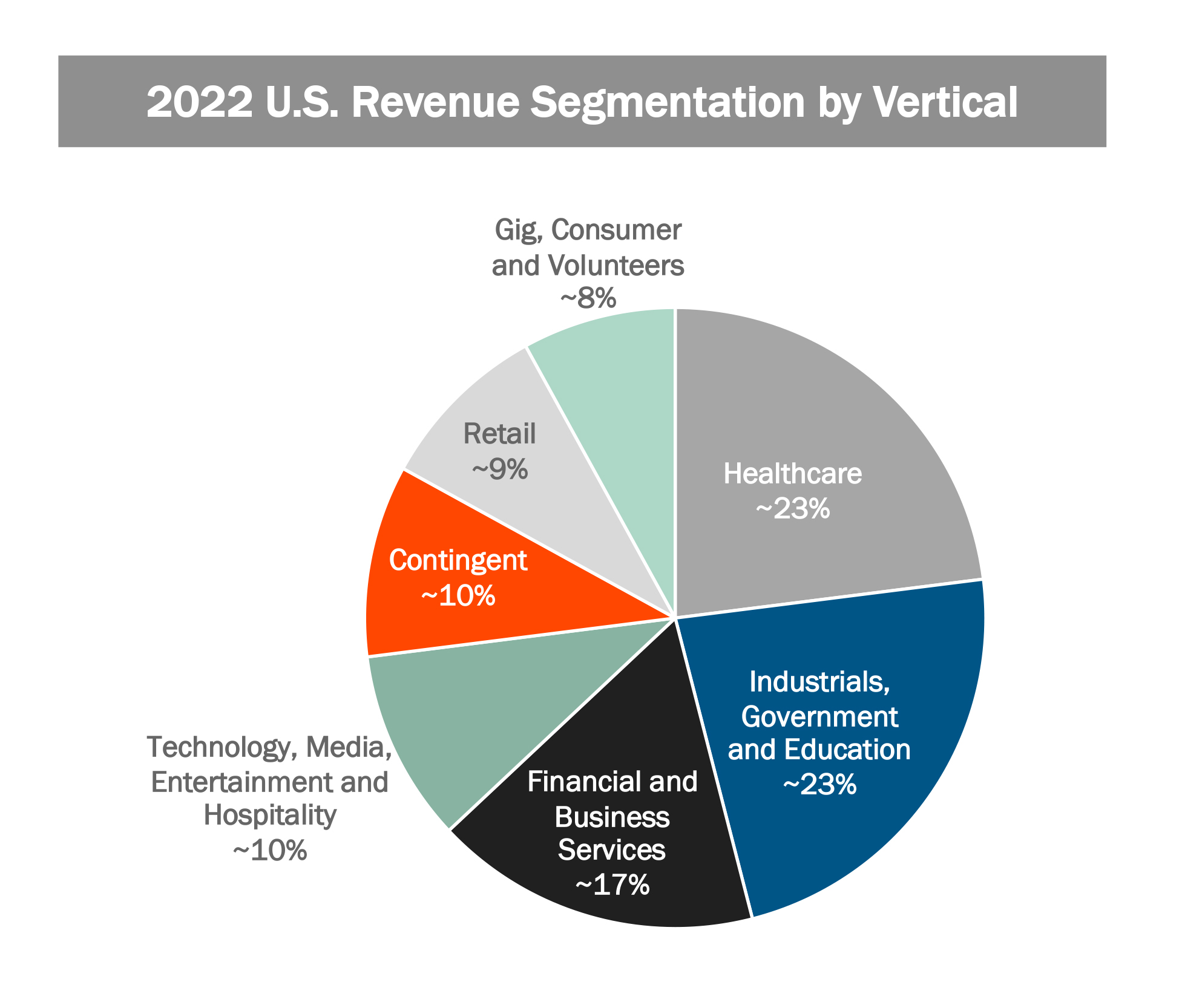

•Highly diversified and long-tenured client base. Our deep insight into the industries and geographies we serve through more than 45 years of experience has allowed us to develop a client base that is diversified across size, industry and geography with minimal concentration. This is enabled by our deep market expertise and our delivery model where we have verticalized around specific industries and geographic markets. This go-to-market approach creates a cycle of innovation, product development, benchmarking and consultative best-practices. We currently serve over 50,000 clients, including over 50% of the Fortune 100 and over 50% of the Fortune 500. Our gross retention rate for 2021 and 2022 was 96%. In 2022, no single client accounted for more than 3% of our revenue and our top 25 clients accounted for less than 25% of our revenue. The average relationship for our top 100 clients, based on 2021 and 2022 total revenue, is nine years and growing. These metrics reflect how deeply embedded we are in our clients’ daily human resources (“HR”) and compliance workflows. We are well diversified across healthcare, the gig economy, financial and business services, industrials, retail, contingent, technology, media and entertainment, transportation and logistics, hospitality, education and government industries. As the complexity and nuances of acquiring talent increases for organizations, we believe we are well-positioned to grow with our clients.

•Attractive financial profile. We have an attractive business model underpinned by recurring revenues, significant operating leverage and low capital requirements that contribute to strong free cash flow. A majority of our U.S. enterprise client contracts are exclusive to Sterling or require Sterling to be used as the primary provider. Additionally, they are typically multi-year agreements with automatic renewal terms, no termination for convenience clauses and set pricing with Sterling’s right to increase prices at certain intervals including the ability to increase pass-through costs to our clients with 30 days notice. The strength of our contract terms combined with our high levels of client retention results in a high degree of revenue visibility. The vast majority of our revenues are either recurring or re-occurring in nature. While we experienced year-over-year revenue declines in the fourth quarter of 2022 due to base revenue moderation caused by macroeconomic uncertainty, we have otherwise shown consistency in our execution, with our organic revenues growing by double digits year-over-year in seven out of the eight quarters of 2021 and 2022. We have driven these results by deploying strategies and tactics focused on winning new business, driving up-sell and cross-sell, and increasing our gross retention rate. In the eight quarters of 2021 and 2022, when our total Company average revenue growth was 32% per quarter, our average revenue growth from the combination of new business, up-sell and cross-sell, net of attrition, was 14% per quarter. Additionally, we benefit from natural operating leverage, utilizing our robust automation processes that result in attractive contribution margins associated with incremental revenue generated from our solutions. Our capital requirements remain minimal with capital expenditures (including capitalized software development costs and exclusive of acquisitions) of 3.0% of revenues in 2021 and 2.6% of revenues in 2022. We incurred net losses of $52.3 million and $18.5 million for the years ended December 31, 2020 and 2021, respectively, and generated net income for the year ended December 31, 2022 of $19.4 million. Although we incurred net losses during 2020 and 2021, we continued to generate strong free cash flow, allowing us the financial flexibility to invest in the business and pursue growth through acquisitions.

•Experienced management team with depth of experience and track record of success. Our senior management team has a track record of strong performance and significant expertise in the markets we serve and technology-enabled businesses, with 90% of our senior management team being new or in new roles since 2018. Our Chief Executive Officer (“CEO”), Josh Peirez, has extensive strategy, product and operational experience and plays an instrumental role in driving Sterling toward our global vision. Our Chief Financial Officer (“CFO”), Peter Walker, has over 10 years of experience as a CFO with global expertise in finance, strategy, M&A and risk management and leads the finance organization, investor relations and all aspects of financial management and reporting. Our President and Chief Operating Officer, Lou Paglia, leads global operations and is responsible for driving revenue growth, delivering client service, and ensuring our services meet the evolving market needs. We also maintain a strong core of business leaders dedicated to specific Verticals and Regions that leverage substantial experience across the background screening, risk management and information services industries. We believe this management team is well positioned to lead our business into the future.

Growth Strategy

We intend to capitalize on our attractive market opportunity by continuing to execute across the following key revenue and profit growth strategies:

•Expand existing client relationships. Our substantial base of over 50,000 existing clients presents a significant opportunity to increase adoption of new services. Since 2019, over 50% of new clients in the U.S. have contracted for more than one product line, which demonstrates our ability to grow within our client base. We have implemented rigorous client success programs to better anticipate our clients’ needs and identify appropriate solutions. For example, we conduct quarterly business reviews with our enterprise clients, where we review program performance, client needs, industry trends and potential enhancement opportunities. Through this collaborative approach, we cultivate long-term client relationships primed for adoption of new services. Further, we are seeing global clients that use different providers in different geographies consolidate into one platform, and we believe we are well positioned to take advantage of this trend.