gcpwi-20210331000164444012/312021Q1FALSEP1Y00016444402021-01-012021-03-31xbrli:shares00016444402021-04-29iso4217:USD00016444402020-01-012020-03-31iso4217:USDxbrli:shares00016444402021-03-3100016444402020-12-310001644440us-gaap:CommonStockMember2019-12-310001644440us-gaap:TreasuryStockMember2019-12-310001644440us-gaap:AdditionalPaidInCapitalMember2019-12-310001644440us-gaap:RetainedEarningsMember2019-12-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001644440us-gaap:NoncontrollingInterestMember2019-12-3100016444402019-12-310001644440us-gaap:RetainedEarningsMember2020-01-012020-03-310001644440us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001644440us-gaap:CommonStockMember2020-01-012020-03-310001644440us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001644440us-gaap:TreasuryStockMember2020-01-012020-03-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001644440us-gaap:CommonStockMember2020-03-310001644440us-gaap:TreasuryStockMember2020-03-310001644440us-gaap:AdditionalPaidInCapitalMember2020-03-310001644440us-gaap:RetainedEarningsMember2020-03-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001644440us-gaap:NoncontrollingInterestMember2020-03-3100016444402020-03-310001644440us-gaap:CommonStockMember2020-12-310001644440us-gaap:TreasuryStockMember2020-12-310001644440us-gaap:AdditionalPaidInCapitalMember2020-12-310001644440us-gaap:RetainedEarningsMember2020-12-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001644440us-gaap:NoncontrollingInterestMember2020-12-310001644440us-gaap:RetainedEarningsMember2021-01-012021-03-310001644440us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001644440us-gaap:CommonStockMember2021-01-012021-03-310001644440us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001644440us-gaap:TreasuryStockMember2021-01-012021-03-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001644440us-gaap:CommonStockMember2021-03-310001644440us-gaap:TreasuryStockMember2021-03-310001644440us-gaap:AdditionalPaidInCapitalMember2021-03-310001644440us-gaap:RetainedEarningsMember2021-03-310001644440us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001644440us-gaap:NoncontrollingInterestMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-01-012021-03-31gcpwi:segment0001644440us-gaap:DiscontinuedOperationsDisposedOfBySaleMembergcpwi:DarexPackagingTechnologiesBusinessMember2017-07-030001644440gcpwi:VERIFISalesArrangementsMember2021-01-012021-03-310001644440gcpwi:VERIFISalesArrangementsMember2020-01-012020-03-3100016444402021-04-012021-03-3100016444402021-04-01srt:MinimumMember2021-03-310001644440srt:MaximumMember2021-04-012021-03-310001644440gcpwi:PurchasedFinishedGoodsMember2021-03-310001644440gcpwi:PurchasedFinishedGoodsMember2020-12-31gcpwi:derivative_instrument0001644440us-gaap:ForwardContractsMember2021-03-31iso4217:EUR0001644440gcpwi:ForwardContractMaturing2021Member2021-03-310001644440gcpwi:ForwardContractMaturing2022Member2021-03-310001644440gcpwi:ForwardContractMaturing2024Member2021-03-310001644440gcpwi:ForwardContractMaturing2023Member2021-03-310001644440us-gaap:ForwardContractsMember2020-12-310001644440us-gaap:ForwardContractsMember2021-01-012021-03-310001644440us-gaap:ForwardContractsMember2020-01-012020-03-31xbrli:pure0001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:SeniorNotesMember2021-03-310001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:SeniorNotesMember2020-12-310001644440us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-03-310001644440us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-310001644440us-gaap:NotesPayableOtherPayablesMember2021-03-310001644440us-gaap:NotesPayableOtherPayablesMember2020-12-310001644440gcpwi:LineOfCreditAndOtherMember2021-03-310001644440gcpwi:LineOfCreditAndOtherMember2020-12-310001644440us-gaap:SubsequentEventMembergcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:SeniorNotesMember2021-04-152021-04-150001644440us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2020-12-310001644440us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2021-03-310001644440us-gaap:LineOfCreditMember2021-03-310001644440us-gaap:LineOfCreditMember2020-12-310001644440us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-01-012020-03-310001644440us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-01-012021-03-310001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2021-03-310001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-12-310001644440gcpwi:FivePointFivePercentSeniorNotesDuein2026Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001644440us-gaap:NotesPayableOtherPayablesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310001644440us-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001644440us-gaap:NotesPayableOtherPayablesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001644440us-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001644440us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310001644440us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001644440us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001644440us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001644440gcpwi:IQHQLPMember2020-07-310001644440us-gaap:PensionPlansDefinedBenefitMember2021-03-310001644440us-gaap:PensionPlansDefinedBenefitMember2020-12-310001644440us-gaap:UnderfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-03-310001644440us-gaap:UnderfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001644440us-gaap:UnfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-03-310001644440us-gaap:UnfundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001644440country:US2021-01-012021-03-310001644440us-gaap:ForeignPlanMember2021-01-012021-03-310001644440country:US2020-01-012020-03-310001644440us-gaap:ForeignPlanMember2020-01-012020-03-310001644440country:USus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310001644440country:USus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-310001644440us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310001644440us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-3100016444402018-01-012018-01-010001644440gcpwi:AmendedCreditAgreementMemberus-gaap:FinancialStandbyLetterOfCreditMember2021-03-310001644440gcpwi:AmendedCreditAgreementMemberus-gaap:FinancialStandbyLetterOfCreditMember2020-12-3100016444402021-03-302021-03-3000016444402020-07-300001644440srt:MinimumMember2019-07-310001644440srt:MaximumMember2019-07-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Memberus-gaap:EmployeeSeveranceMember2021-03-310001644440gcpwi:AssetImpairmentWriteOffsMembergcpwi:RestructuringPlanAndRepositioningPlan2019Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Memberus-gaap:OtherRestructuringMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:RestructuringCostsMember2021-03-310001644440gcpwi:RepositioningCostMembergcpwi:RestructuringPlanAndRepositioningPlan2019Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Member2021-03-310001644440us-gaap:EmployeeSeveranceMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:AssetImpairmentWriteOffsMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440us-gaap:OtherRestructuringMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringCostsMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RepositioningCostMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membersrt:MinimumMemberus-gaap:EmployeeSeveranceMember2021-03-310001644440srt:MaximumMembergcpwi:RestructuringPlanAndRepositioningPlan2021Memberus-gaap:EmployeeSeveranceMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:AssetImpairmentWriteOffsMembersrt:MinimumMember2021-03-310001644440srt:MaximumMembergcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:AssetImpairmentWriteOffsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Memberus-gaap:OtherRestructuringMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membersrt:MinimumMembergcpwi:RestructuringCostsMember2021-03-310001644440srt:MaximumMembergcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:RestructuringCostsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:RepositioningCostMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membersrt:MinimumMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membersrt:MaximumMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Memberus-gaap:EmployeeSeveranceMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:AssetImpairmentWriteOffsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:RestructuringCostsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:SpecialtyConstructionChemicalsMembergcpwi:RestructuringCostsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:RestructuringCostsMembergcpwi:SpecialtyBuildingMaterialsMember2021-03-310001644440gcpwi:SpecialtyConstructionChemicalsMembergcpwi:RestructuringCostsMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringCostsMembergcpwi:SpecialtyBuildingMaterialsMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringCostsMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Membergcpwi:CorporateSegmentMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:SpecialtyConstructionChemicalsMembergcpwi:RestructuringCostsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:RestructuringCostsMembergcpwi:SpecialtyBuildingMaterialsMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:RestructuringCostsMembergcpwi:CorporateSegmentMember2021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019RepositioningActivitiesMember2021-01-012021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019Phase2RepositioningActivitiesMember2021-01-012021-03-310001644440gcpwi:RepositioningCostMember2021-01-012021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019CapitalExpendituresMember2021-01-012021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019Phase2CapitalExpendituresMember2021-01-012021-03-310001644440gcpwi:CapitalExpendituresMember2021-01-012021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019RepositioningActivitiesMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019Phase2RepositioningActivitiesMember2020-01-012020-03-310001644440gcpwi:StrategicAlternativesPlanMember2020-01-012020-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2018Member2020-01-012020-03-310001644440gcpwi:A2017RestructuringAndRepositioningPlanMember2020-01-012020-03-310001644440gcpwi:RepositioningCostMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019CapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019Phase2CapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlanStrategicAlternativesCapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2018CapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2017CapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:CapitalExpendituresMember2020-01-012020-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019CapitalExpendituresMember2021-03-310001644440gcpwi:RestructuringAndRepositioningPlan2019Phase2CapitalExpendituresMember2021-03-310001644440gcpwi:SpecialtyConstructionChemicalsMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001644440gcpwi:SpecialtyConstructionChemicalsMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001644440gcpwi:SpecialtyBuildingMaterialsMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001644440gcpwi:SpecialtyBuildingMaterialsMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001644440us-gaap:CorporateNonSegmentMember2021-01-012021-03-310001644440us-gaap:CorporateNonSegmentMember2020-01-012020-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:EmployeeSeveranceAndOtherMember2020-12-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:EmployeeSeveranceAndOtherMember2020-12-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Memberus-gaap:OtherRestructuringMember2020-12-310001644440gcpwi:EmployeeSeveranceAndOtherMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2020-12-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2018Membergcpwi:EmployeeSeveranceAndOtherMember2020-12-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:EmployeeSeveranceAndOtherMember2021-01-012021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:EmployeeSeveranceAndOtherMember2021-01-012021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Memberus-gaap:OtherRestructuringMember2021-01-012021-03-310001644440gcpwi:EmployeeSeveranceAndOtherMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-01-012021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2018Membergcpwi:EmployeeSeveranceAndOtherMember2021-01-012021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:EmployeeSeveranceAndOtherMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:EmployeeSeveranceAndOtherMember2021-03-310001644440gcpwi:EmployeeSeveranceAndOtherMembergcpwi:RestructuringPlanAndRepositioningPlanPhase22019Member2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2018Membergcpwi:EmployeeSeveranceAndOtherMember2021-03-310001644440gcpwi:RestructuringPlanAndRepositioningPlan2021Membergcpwi:AssetImpairmentWriteOffsMember2021-01-012021-03-310001644440gcpwi:AssetImpairmentWriteOffsMembergcpwi:RestructuringPlanAndRepositioningPlan2019Membergcpwi:SpecialtyConstructionChemicalsMember2021-01-012021-03-310001644440us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-03-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310001644440us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-03-310001644440us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-01-012020-03-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001644440us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310001644440us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-03-310001644440us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310001644440us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001644440us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-03-310001644440us-gaap:EmployeeStockOptionMember2021-03-310001644440gcpwi:RestrictedStockUnitsRSUsAndPerformanceSharesMember2021-03-310001644440us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001644440gcpwi:RestrictedStockUnitsRSUsAndPerformanceSharesMember2021-01-012021-03-310001644440us-gaap:RestrictedStockUnitsRSUMember2020-12-310001644440us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-310001644440us-gaap:RestrictedStockUnitsRSUMember2021-03-310001644440us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-03-310001644440us-gaap:PerformanceSharesMember2021-01-012021-03-310001644440srt:MinimumMemberus-gaap:PerformanceSharesMember2021-01-012021-03-310001644440srt:MaximumMemberus-gaap:PerformanceSharesMember2021-01-012021-03-310001644440us-gaap:PerformanceSharesMember2020-01-012020-03-310001644440us-gaap:PerformanceSharesMember2020-12-310001644440us-gaap:PerformanceSharesMember2021-03-310001644440us-gaap:OtherNoncurrentAssetsMembersrt:AffiliatedEntityMember2021-01-012021-03-310001644440us-gaap:OtherCurrentLiabilitiesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001644440gcpwi:SpecialtyConstructionChemicalsMember2021-01-012021-03-310001644440gcpwi:SpecialtyConstructionChemicalsMember2020-01-012020-03-310001644440gcpwi:SpecialtyBuildingMaterialsMember2021-01-012021-03-310001644440gcpwi:SpecialtyBuildingMaterialsMember2020-01-012020-03-310001644440us-gaap:OperatingSegmentsMember2021-01-012021-03-310001644440us-gaap:OperatingSegmentsMember2020-01-012020-03-310001644440us-gaap:MaterialReconcilingItemsMember2021-01-012021-03-310001644440us-gaap:MaterialReconcilingItemsMember2020-01-012020-03-310001644440country:US2021-01-012021-03-310001644440country:US2020-01-012020-03-310001644440gcpwi:CanadaAndOtherNorthAmericaMember2021-01-012021-03-310001644440gcpwi:CanadaAndOtherNorthAmericaMember2020-01-012020-03-310001644440srt:NorthAmericaMember2021-01-012021-03-310001644440srt:NorthAmericaMember2020-01-012020-03-310001644440us-gaap:EMEAMember2021-01-012021-03-310001644440us-gaap:EMEAMember2020-01-012020-03-310001644440srt:AsiaPacificMember2021-01-012021-03-310001644440srt:AsiaPacificMember2020-01-012020-03-310001644440srt:LatinAmericaMember2021-01-012021-03-310001644440srt:LatinAmericaMember2020-01-012020-03-310001644440srt:ScenarioPreviouslyReportedMember2020-01-012020-03-310001644440srt:RestatementAdjustmentMember2020-01-012020-03-310001644440srt:ScenarioPreviouslyReportedMember2019-12-310001644440srt:RestatementAdjustmentMember2019-12-310001644440srt:ScenarioPreviouslyReportedMember2020-03-310001644440srt:RestatementAdjustmentMember2020-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | | | | | | | |

| ☒ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Quarterly Period Ended | March 31, 2021 |

| OR |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Commission File Number | 1-37533 |

GCP Applied Technologies Inc.

| | | | | | | | |

| Delaware | | 47-3936076 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

62 Whittemore Avenue, Cambridge, Massachusetts 02140-1623

(617) 876-1400

(Address and phone number of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ý | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Class | | Trading Symbol | | Exchange on which registered |

| Common Stock, $0.01 par value per share | | GCP | | New York Stock Exchange |

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at April 29, 2021 |

| Common Stock, $0.01 par value per share | | 73,327,077 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GCP Applied Technologies Inc.

Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions, except per share amounts) | 2021 | | 2020 | | | | |

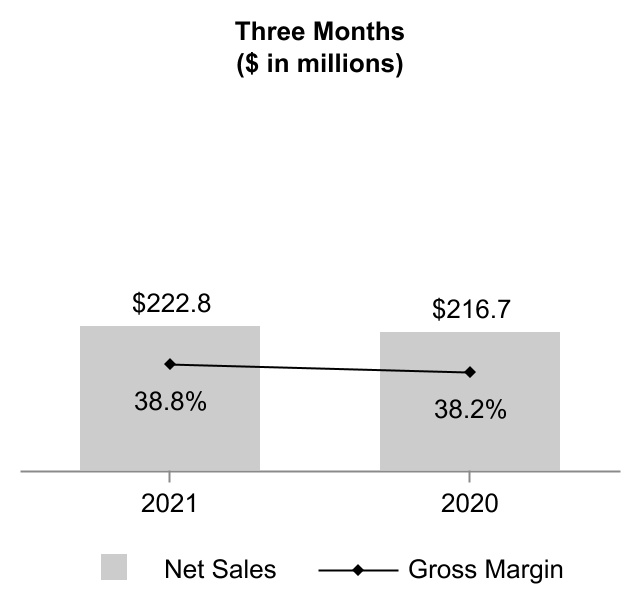

| Net sales | $ | 222.8 | | | $ | 216.7 | | | | | |

| Cost of goods sold | 136.3 | | | 133.9 | | | | | |

| Gross profit | 86.5 | | | 82.8 | | | | | |

| Selling, general and administrative expenses | 66.6 | | | 68.1 | | | | | |

| Research and development expenses | 4.5 | | | 4.9 | | | | | |

| Interest expense and related financing costs | 5.6 | | | 5.7 | | | | | |

| Repositioning expenses | 1.3 | | | 2.7 | | | | | |

| Restructuring expenses and asset write offs | 7.6 | | | 3.1 | | | | | |

| | | | | | | |

| Other income, net | (1.7) | | | (2.2) | | | | | |

| Total costs and expenses | 83.9 | | | 82.3 | | | | | |

| Income from continuing operations before income taxes | 2.6 | | | 0.5 | | | | | |

| (Provision for) benefit from income taxes | (1.0) | | | 1.6 | | | | | |

| Income from continuing operations | 1.6 | | | 2.1 | | | | | |

| Loss from discontinued operations, net of income taxes | — | | | (0.3) | | | | | |

| Net income | 1.6 | | | 1.8 | | | | | |

| Less: Net income attributable to noncontrolling interests | (0.1) | | | (0.1) | | | | | |

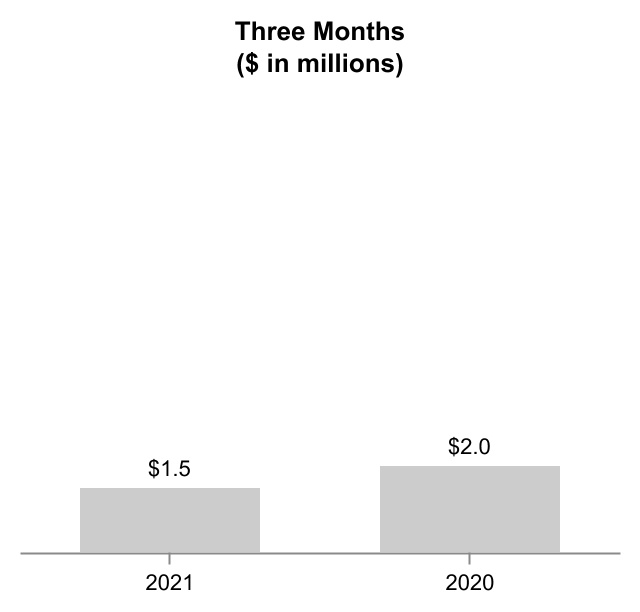

| Net income attributable to GCP shareholders | $ | 1.5 | | | $ | 1.7 | | | | | |

| Amounts Attributable to GCP Shareholders: | | | | | | | |

| Income from continuing operations attributable to GCP shareholders | 1.5 | | | 2.0 | | | | | |

| Loss from discontinued operations, net of income taxes | — | | | (0.3) | | | | | |

| Net income attributable to GCP shareholders | $ | 1.5 | | | $ | 1.7 | | | | | |

| Earnings (Loss) Per Share Attributable to GCP Shareholders | | | | | | | |

Basic earnings (loss) per share:(2) | | | | | | | |

| Income from continuing operations attributable to GCP shareholders | $ | 0.02 | | | $ | 0.03 | | | | | |

| Loss from discontinued operations, net of income taxes | $ | — | | | $ | — | | | | | |

Net income attributable to GCP shareholders(1) | $ | 0.02 | | | $ | 0.02 | | | | | |

| Weighted average number of basic shares | 73.2 | | | 72.9 | | | | | |

Diluted earnings (loss) per share:(2) | | | | | | | |

| Income from continuing operations attributable to GCP shareholders | $ | 0.02 | | | $ | 0.03 | | | | | |

| Loss from discontinued operations, net of income taxes | $ | — | | | $ | — | | | | | |

Net income attributable to GCP shareholders(1) | $ | 0.02 | | | $ | 0.02 | | | | | |

| Weighted average number of diluted shares | 73.4 | | | 73.0 | | | | | |

______________________________

(1)Amounts may not sum due to rounding.

(2)Dilutive effect is only applicable to the periods during which GCP generated net income from continuing operations.

The Notes to Consolidated Financial Statements are an integral part of these statements.

3

GCP Applied Technologies Inc.

Consolidated Statements of Comprehensive Loss (unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions) | 2021 | | 2020 | | | | |

| Net income | $ | 1.6 | | | $ | 1.8 | | | | | |

| Other comprehensive loss: | | | | | | | |

Defined benefit pension and other postretirement plans, net of income taxes | — | | | 0.1 | | | | | |

Currency translation adjustments, net of income taxes | (8.0) | | | (33.8) | | | | | |

| Gain from hedging activities, net of income taxes | — | | | 0.2 | | | | | |

| Total other comprehensive loss | (8.0) | | | (33.5) | | | | | |

| Comprehensive loss | (6.4) | | | (31.7) | | | | | |

Less: Comprehensive income attributable to noncontrolling interests | (0.1) | | | (0.1) | | | | | |

| Comprehensive loss attributable to GCP shareholders | $ | (6.5) | | | $ | (31.8) | | | | | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

4

GCP Applied Technologies Inc.

Consolidated Balance Sheets (unaudited)

| | | | | | | | | | | |

| (In millions, except par value and shares) | March 31,

2021 | | December 31,

2020 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 472.9 | | | $ | 482.7 | |

Trade accounts receivable, net of allowance for credit losses of $6.7 million and $7.0 million, respectively | 161.9 | | | 169.4 | |

| Inventories, net | 117.1 | | | 98.4 | |

| Other current assets | 43.9 | | | 41.2 | |

| | | |

| Total Current Assets | 795.8 | | | 791.7 | |

| Properties and equipment, net | 216.6 | | | 225.6 | |

| Operating lease right-of-use assets | 37.7 | | | 40.0 | |

| Goodwill | 212.8 | | | 215.0 | |

| Technology and other intangible assets, net | 68.1 | | | 70.9 | |

| Deferred income taxes | 9.6 | | | 9.6 | |

| Overfunded defined benefit pension plans | 30.0 | | | 29.7 | |

| Other assets | 35.2 | | | 35.1 | |

| | | |

| Total Assets | $ | 1,405.8 | | | $ | 1,417.6 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current Liabilities | | | |

| Debt payable within one year | $ | 2.4 | | | $ | 2.8 | |

| Operating lease obligations payable within one year | 7.6 | | | 8.0 | |

| | | |

| Accounts payable | 94.0 | | | 87.8 | |

| Other current liabilities | 113.4 | | | 125.8 | |

| | | |

| Total Current Liabilities | 217.4 | | | 224.4 | |

| Debt payable after one year | 349.0 | | | 348.9 | |

| | | |

| Income taxes payable | 28.4 | | | 28.4 | |

| Deferred income taxes | 14.8 | | | 14.9 | |

| Operating lease obligations | 25.4 | | | 26.2 | |

| Unrecognized tax benefits | 41.2 | | | 41.0 | |

| Underfunded and unfunded defined benefit pension plans | 63.0 | | | 62.9 | |

| Other liabilities | 16.0 | | | 16.8 | |

| | | |

| Total Liabilities | 755.2 | | | 763.5 | |

| Commitments and Contingencies - Note 10 | | | |

| Stockholders' Equity | | | |

| | | |

Preferred stock, par value $0.01; 50,000,000 shares authorized, no shares issued or outstanding | — | | | — | |

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 73,251,641 and 73,082,066, respectively | 0.7 | | | 0.7 | |

| Paid-in capital | 65.5 | | | 61.9 | |

| Accumulated earnings | 711.8 | | | 710.3 | |

| Accumulated other comprehensive loss | (118.5) | | | (110.5) | |

| Treasury stock | (11.4) | | | (10.7) | |

| Total GCP's Shareholders' Equity | 648.1 | | | 651.7 | |

| Noncontrolling interests | 2.5 | | | 2.4 | |

| Total Stockholders' Equity | 650.6 | | | 654.1 | |

| Total Liabilities and Stockholders' Equity | $ | 1,405.8 | | | $ | 1,417.6 | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

GCP Applied Technologies Inc.

Consolidated Statements of Stockholders' Equity (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | | | | | | | | | | | |

| (In millions) | Number of Shares(1) | | Par Value | | Number of Shares(1) | | Cost | | Additional Paid-in Capital | | Accumulated Earnings | | | | Accumulated Other Comprehensive Loss | | Noncontrolling Interests | | Total Stockholders' Equity |

| Balance, December 31, 2019 | 73.2 | | | $ | 0.7 | | | 0.3 | | | $ | (8.6) | | | $ | 53.4 | | | $ | 610.1 | | | | | $ | (117.0) | | | $ | 2.4 | | | $ | 541.0 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 1.7 | | | | | — | | | 0.1 | | | 1.8 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Issuance of common stock in connection with stock plans(1) | 0.1 | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 0.5 | | | — | | | | | — | | | — | | | 0.5 | |

Exercise of stock options (1) | — | | | — | | | — | | | — | | | 0.4 | | | — | | | | | — | | | — | | | 0.4 | |

| | | | | | | | | | | | | | | | | | | |

Share repurchases(3) | — | | | — | | | 0.1 | | | (0.3) | | | — | | | — | | | | | — | | | — | | | (0.3) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | | | (33.5) | | | — | | | (33.5) | |

| | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2020 | 73.3 | | | $ | 0.7 | | | 0.4 | | | $ | (8.9) | | | $ | 54.3 | | | $ | 611.8 | | | | | $ | (150.5) | | | $ | 2.5 | | | $ | 509.9 | |

| Balance, December 31, 2020 | 73.5 | | | $ | 0.7 | | | 0.4 | | | $ | (10.7) | | | $ | 61.9 | | | $ | 710.3 | | | | | $ | (110.5) | | | $ | 2.4 | | | $ | 654.1 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 1.5 | | | | | — | | | 0.1 | | | 1.6 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Issuance of common stock in connection with stock plans(1) | 0.1 | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | — | |

Share-based compensation(2) | — | | | — | | | — | | | — | | | 1.4 | | | — | | | | | — | | | — | | | 1.4 | |

Exercise of stock options (1) | 0.1 | | | — | | | — | | | — | | | 2.2 | | | — | | | | | — | | | — | | | 2.2 | |

| | | | | | | | | | | | | | | | | | | |

Share repurchases(3) | — | | | — | | | 0.1 | | | (0.7) | | | — | | | — | | | | | — | | | — | | | (0.7) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | | | (8.0) | | | — | | | (8.0) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2021 | 73.7 | | | $ | 0.7 | | | 0.5 | | | $ | (11.4) | | | $ | 65.5 | | | $ | 711.8 | | | | | $ | (118.5) | | | $ | 2.5 | | | $ | 650.6 | |

________________________________

(1)The par value of common shares issued may not be included in the table due to rounding. Total share amounts for common stock and treasury stock may not sum due to rounding.

(2)During the three months ended March 31, 2021, $0.7 million of the stock-based compensation expense is included in "Restructuring expenses and asset write offs" related to accelerated vesting of stock options, RSUs and PBUs.

(3)Refer to Note 14, “Stock Incentive Plans”, for further information.

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

GCP Applied Technologies Inc.

Consolidated Statements of Cash Flows (unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| (In millions) | 2021 | | 2020 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 1.6 | | | $ | 1.8 | |

| Less: Loss from discontinued operations | — | | | (0.3) | |

| Income from continuing operations | 1.6 | | | 2.1 | |

| Reconciliation to net cash provided by operating activities: | | | |

| Depreciation and amortization | 11.3 | | | 11.0 | |

| Amortization of debt discount and financing costs | 0.4 | | | 0.4 | |

| Stock-based compensation expense | 1.0 | | | 0.8 | |

| Unrealized (gain) loss on foreign currency | (2.3) | | | 0.5 | |

| | | |

| | | |

| Deferred income taxes | (0.2) | | | (4.9) | |

| | | |

| Loss (gain) on disposal of property and equipment | 1.1 | | | (0.1) | |

| | | |

| Changes in assets and liabilities, excluding effect of currency translation: | | | |

| Trade accounts receivable | 5.0 | | | 17.4 | |

| Inventories | (19.9) | | | (11.4) | |

| Accounts payable | 9.9 | | | 6.6 | |

| Pension assets and liabilities, net | 1.1 | | | 1.0 | |

| | | |

| Other assets and liabilities, net | (8.3) | | | (9.1) | |

| Net cash provided by operating activities from continuing operations | 0.7 | | | 14.3 | |

| Net cash used in operating activities from discontinued operations | — | | | (0.9) | |

| Net cash provided by operating activities | 0.7 | | | 13.4 | |

| INVESTING ACTIVITIES | | | |

| Capital expenditures | (8.1) | | | (9.2) | |

| | | |

| | | |

| Other investing activities | — | | | 0.4 | |

| Net cash used in investing activities from continuing operations | (8.1) | | | (8.8) | |

| | | |

| | | |

| FINANCING ACTIVITIES | | | |

| | | |

| Repayments under credit arrangements | (0.3) | | | — | |

| | | |

| Payments on finance lease obligations | (0.2) | | | (0.2) | |

| | | |

| | | |

| | | |

| Payments of tax withholding obligations related to employee equity awards | (0.7) | | | (0.3) | |

| Proceeds from exercise of stock options | 1.8 | | | 0.4 | |

| | | |

| | | |

| Net cash provided by (used in) financing activities from continuing operations | 0.6 | | | (0.1) | |

| | | |

| | | |

| Effect of currency exchange rate changes on cash and cash equivalents | (3.0) | | | (9.3) | |

| Decrease in cash and cash equivalents | (9.8) | | | (4.8) | |

| Cash and cash equivalents, beginning of period | 482.7 | | | 325.0 | |

| Cash and cash equivalents, end of period | $ | 472.9 | | | $ | 320.2 | |

| | | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| | | |

| | | |

| Supplemental disclosure of non-cash investing activities: | | | |

| Property and equipment purchases unpaid and included in accounts payable | $ | 3.0 | | | $ | 5.5 | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

GCP Applied Technologies Inc.

Notes to Consolidated Financial Statements (unaudited)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

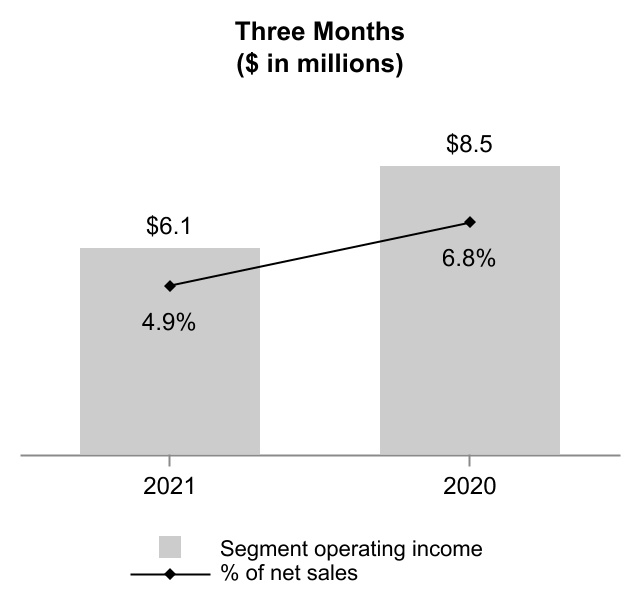

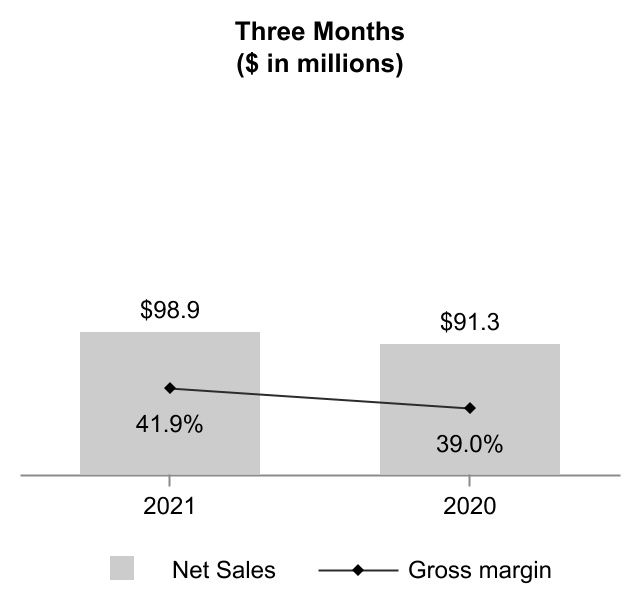

GCP Applied Technologies Inc. ("GCP", or the "Company") is engaged in the production and sale of specialty construction chemicals and specialty building materials through two operating segments. Specialty Construction Chemicals ("SCC") manufactures and markets concrete admixtures and cement additives and supplies in-transit monitoring systems for concrete producers. Specialty Building Materials ("SBM") manufactures and markets sheet and liquid membrane systems that protect structures from water, air and vapor penetration, fireproofing and other products designed to protect the building envelope.

On July 3, 2017 (the "Closing Date"), GCP completed the sale of its Darex Packaging Technologies ("Darex") business to Henkel AG & Co. KGaA (“Henkel”) for $1.06 billion in cash. The agreement with Henkel governing the Disposition (the “Amended Purchase Agreement”) provided for a series of delayed closings in certain non-U.S. jurisdictions. Darex results of operations and cash flows have been reclassified and reflected as "discontinued operations" in the accompanying unaudited Consolidated Statements of Operations and unaudited Consolidated Statements of Cash Flows for all periods presented. Unless otherwise noted, the information throughout the Notes to the accompanying unaudited Consolidated Financial Statements pertains only to the continuing operations of GCP.

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements are presented on a consolidated basis and include all of the accounts and operations of GCP and its majority-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. The financial statements reflect the financial position, results of operations and cash flows of GCP in accordance with generally accepted accounting principles in the United States ("U.S. GAAP") and with the instructions to Form 10-Q and Article 10 of SEC Regulation S-X for interim financial information.

The interim financial statements presented herein are unaudited and should be read in conjunction with the audited Consolidated Financial Statements and notes thereto contained in GCP's Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2020 (the "2020 Annual Report on Form 10-K"). The Consolidated Balance Sheet as of December 31, 2020 was derived from the audited annual consolidated financial statements as of the period then ended. Certain information and footnote disclosures typically included in GCP's annual consolidated financial statements have been condensed or omitted. The unaudited financial statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented. All such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards discussed below. The results of operations for the three months ended March 31, 2021 are not necessarily indicative of the results of operations for the year ending December 31, 2021.

Revisions of Previously Issued Consolidated Financial Statements

In connection with the preparation of the consolidated financial statements for the year ended December 31, 2020, the Company identified freight expense accrual and other errors in its previously filed unaudited quarterly consolidated financial statements for the first three quarterly periods of 2020.

The Company considered the guidance in ASC Topic 250, Accounting Changes and Error Corrections (“ASC 250”), ASC Topic 250-10-S99-1, Assessing Materiality, and ASC Topic 250-10-S99-2, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, (“ASC 250-10-S99-2”) in evaluating whether the Company’s previously issued unaudited consolidated financial statements were materially misstated. The Company concluded the errors were not material individually or in the aggregate to the previously issued consolidated financial statements. In accordance with ASC 250-10-S99-2, the Company has corrected these errors by revising previously filed unaudited quarterly consolidated financial statements as of and for the three months ended March 31, 2020 in connection with the filing of this Form 10-Q.

Notes to Consolidated Financial Statements (unaudited) - Continued

The accompanying footnotes have been corrected to reflect the impact of the revisions of the previously filed unaudited quarterly consolidated financial statements as of and for the three months ended March 31, 2020. Please refer to Note 18, “Revisions of Previously Issued Consolidated Financial Statements” for reconciliations between as previously reported and as revised quarterly amounts, respectively.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. The Company assesses the estimates on an ongoing basis and records changes in estimates in the period they occur and become known. GCP's accounting measurements that are most affected by management's estimates of future events are disclosed in its 2020 Annual Report on Form 10-K. Actual results could differ from those estimates.

On March 11, 2020, the World Health Organization declared the outbreak of the novel strain of coronavirus ("COVID-19") a global pandemic and recommended a number of restrictive measures to contain the spread. Many governments in the regions where GCP generates the majority of its revenue have adopted such policies. GCP has been closely monitoring the impact of COVID-19 and working to manage the effects on its business globally. Despite progress in vaccination efforts, it is difficult to estimate with reasonable certainty at this time the duration and extent of the impact of the pandemic on the global economy, the Company's business, financial position and results of operations. GCP has made certain estimates within its financial statements related to the impact of COVID-19, including allowances for credit losses related to the estimated amount of receivables not expected to be collected and excess, obsolete or damaged inventories, future expected cash flows related to impairment assessments of goodwill and long-lived assets, incentive compensation accruals, contingent liabilities, and sales allowances related to volume rebates recognized based on anticipated sales volume. There may be changes to the Company's estimates in future periods due to uncertainty associated with the impact of COVID-19, the extent of which will depend largely on future developments, including new information which may emerge concerning the resurgence of the pandemic, as well as additional and unanticipated actions by government authorities to further contain the spread of COVID-19, which may result in extended ongoing business disruptions.

Income Tax

As a global enterprise, GCP is subject to a complex array of tax regulations and needs to make assessments of applicable tax law and judgments in estimating its ultimate income tax liability. Income tax expense and income tax balances represent GCP’s federal, state and foreign income taxes as an independent company. GCP files a U.S. consolidated income tax return, along with foreign and state corporate income tax filings, as required. Please refer to Note 7, "Income Taxes," for details regarding estimates used in accounting for income tax matters, including unrecognized tax benefits.

Reclassifications

Certain amounts in prior period financial statements have been reclassified to conform to the current period presentation. Such reclassifications have not materially affected previously reported amounts.

Notes to Consolidated Financial Statements (unaudited) - Continued

Recently Adopted Accounting Standards

In December 2019, the Financial Accounting Standards Board ("FASB") amended Accounting Standards Codification ("ASC") 740, Income Taxes (issued under Accounting Standards Update ("ASU") 2019-12, Simplifying the Accounting for Income Taxes). This amendment removes certain exceptions to the general principles of ASC 740, and clarifies and amends the existing guidance to improve consistent application. GCP adopted the guidance effective January 1, 2021. The adoption did not have a material impact on its results of operations, financial position and cash flows.

Other

During the three months ended March 31, 2021, except as discussed above, there were no material changes to the Company's significant accounting and financial reporting policies from those reflected in the Annual Report on Form 10-K for the year ended December 31, 2020. For further information with regard to the Company’s Significant Accounting Policies, please refer to Note 1, "Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies," to the Company’s Consolidated Financial Statements included in the 2020 Annual Report on Form 10-K.

2. Revenue from Lessor Arrangements and Contracts with Customers

The majority of the Company’s revenue is generated from short-term arrangements associated with the production and sale of concrete admixtures and cement additives within its SCC operating segment, as well as sheet and liquid membrane systems and other specialty products designed to protect the building envelope within its SBM operating segment. For such arrangements, the transfer of control takes place at a point in time when products are shipped to the customer. Short-term arrangements within its SCC operating segment involve selling concrete admixtures and providing dispensers to customers. Such arrangements contain a lease element due to the customer's right to control the use of dispensers over a period of time in exchange for consideration.

The Company generates revenue from long-term arrangements within its SCC operating segment, which generally consist of VERIFI® and Ductilcrete sales arrangements.

VERIFI® sales arrangements involve installing equipment on the customers’ trucks and at their plants, as well as performing slump management and truck location tracking services. The Company recognizes lease and service revenue for these arrangements. Revenue generated from VERIFI® sales arrangements represented less than 10% of the Company's consolidated revenue during the three and three months ended March 31, 2021 and 2020.

During the three months ended March 31, 2021 and 2020, the Company recognized lease revenue of $9.4 million and $8.8 million, respectively, and service revenue of $2.0 million and $1.4 million, respectively. Lease revenue consists of dispenser lease revenue of $6.1 million, as well as an allocated portion of VERIFI® fixed fees and variable slump management fees. Service revenue consists of an allocated portion of VERIFI® fixed fees and variable slump management fees. Lease and service revenue is included within "Net Sales" in the accompanying unaudited Consolidated Statements of Operations.

Revenue generated from Ductilcrete sales arrangements represented less than 10% of the Company's consolidated revenue during the three months ended March 31, 2021 and 2020.

The Company’s revenue is principally recognized as goods and services are delivered and performance obligations are satisfied upon delivery. The Company has certain long-term arrangements resulting in remaining obligations for which the work has not been performed or has been partially performed. As of March 31, 2021, the aggregate amount of the transaction price allocated to remaining performance obligations was $9.4 million, including the estimated transaction price to be earned as revenue over the remaining term of these contracts, which is generally one to five years. The Company’s contract assets and liabilities resulting from its contracts in the SCC or SBM operating segments were not material as of March 31, 2021 and December 31, 2020. Additionally, the amounts recorded in the accompanying unaudited Consolidated Statements of Operations during the three months ended March 31, 2021 and 2020 related to changes in the contract assets and liabilities were not material.

Notes to Consolidated Financial Statements (unaudited) - Continued

For further information on revenue recognition related to product sale arrangements, please refer to Note 2, "Revenue from Lessor Arrangements and Contracts with Customers", to the Company’s Consolidated Financial Statements included in the 2020 Annual Report on Form 10-K.

3. Inventories, net

The following is a summary of inventories presented in the accompanying unaudited Consolidated Balance Sheets at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

| Raw materials | $ | 50.6 | | | $ | 41.3 | |

| In process | 4.4 | | | 4.2 | |

| Finished products and other | 62.1 | | | 52.9 | |

| | | |

| Total inventories, net | $ | 117.1 | | | $ | 98.4 | |

The "Finished products and other" category presented in the table above includes "other" inventories, which consist of finished products purchased rather than produced by GCP of $10.0 million and $9.1 million, respectively, as of March 31, 2021 and December 31, 2020.

Notes to Consolidated Financial Statements (unaudited) - Continued

4. Derivative Instruments

The Company uses derivative instruments to partially offset its business exposure to foreign currency risk on net investments in certain foreign subsidiaries. The Company enters into foreign currency forward contracts to offset a portion of the changes in the carrying amounts of its net investments in foreign operations due to fluctuations in foreign currency exchange rates. As of March 31, 2021, the Company was a party to four forward contracts with an aggregate notional amount of €40.0 million to hedge foreign currency exposure on net investments in certain of its European subsidiaries whose functional currency is the Euro. These forward contracts are designated as hedging instruments and recognized at fair value as assets or liabilities in the accompanying unaudited Consolidated Balance Sheets. Each contract has a notional amount of €10.0 million and matures annually starting on June 14, 2021 through June 17, 2024. The forward contracts are designated and qualify as net investment hedges for which effectiveness is assessed based on the spot rate method. Please refer to Note 4, "Derivative Instruments", to the Company’s Consolidated Financial Statements included in the 2020 Annual Report on Form 10-K for further information on net investment hedges.

The following table summarizes the fair value of the Company’s derivative instruments designated as net investment hedges as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | |

| (In millions) | | March 31, 2021 | | December 31, 2020 |

Derivative assets(1): | | | | |

| Foreign exchange forward contracts | | $ | 0.8 | | | $ | — | |

Derivative liability(1): | | | | |

| Foreign exchange forward contracts | | $ | (0.6) | | | $ | (1.8) | |

__________________________

(1)The fair value of derivative instruments is measured based on expected future cash flows discounted at market interest rates using observable market inputs and classified as Level 2 within the fair value hierarchy. As of March 31, 2021, fair value of derivative assets of $0.2 million and $0.6 million, respectively, is recorded within "Other Current Assets" and "Other Assets" in the accompanying unaudited Consolidated Balance Sheets, and fair value of derivative liability of $0.6 million is recorded within "Other Liabilities" in the accompanying unaudited Consolidated Balance Sheets. As of December 31, 2020, fair value of derivative liabilities of $0.4 million and $1.4 million, respectively, is recorded within "Other Current Liabilities" and "Other Liabilities" in the accompanying unaudited Consolidated Balance Sheets.

The following table summarizes the amounts recorded in the Company's accompanying unaudited Consolidated Statements of Operations and Consolidated Statements of Comprehensive Loss related to forward contracts designated as net investment hedges for the three months ended March 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 | | Three Months Ended March 31, 2020 |

| (In millions) | Other Income, net | | Cumulative Translation Adjustments(1) | | Other Income, net | | Cumulative Translation Adjustments(1) |

| Gain on foreign exchange forward contracts | $ | 0.2 | | | $ | 1.4 | | | $ | 0.3 | | | $ | 1.3 | |

_______________________

(1)The amounts are presented net of tax expense of $0.4 million during each of the three months ended March 31, 2021 and 2020.

Notes to Consolidated Financial Statements (unaudited) - Continued

5. Debt and Other Borrowings

Components of Debt and Other Borrowings

The following is a summary of obligations under senior notes and other borrowings at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

5.5% Senior Notes due in 2026, net of unamortized debt issuance costs of $3.2 million and $3.3 million, respectively, at March 31, 2021 and December 31, 2020 | $ | 346.8 | | | $ | 346.6 | |

Revolving credit facility due 2023(1) | — | | | — | |

Other borrowings(2) | 4.6 | | | 5.1 | |

| Total debt | 351.4 | | | 351.7 | |

| Less: debt payable within one year | 2.4 | | | 2.8 | |

| Debt payable after one year | $ | 349.0 | | | $ | 348.9 | |

| Weighted average interest rates on total debt obligations | 5.5 | % | | 5.5 | % |

__________________________

(1)Represents borrowings under the Revolving Credit Facility with an aggregate available principal amount of $350.0 million as of March 31, 2021 and December 31, 2020.

(2)Represents borrowings of $1.7 million and $2.1 million, respectively, at March 31, 2021 and December 31, 2020, under various lines of credit and other borrowings, primarily by non-U.S. subsidiaries, as well as $2.9 million and $3.0 million, respectively, of finance lease obligations.

The principal maturities of debt obligations outstanding, net of debt issuance costs, were as follows at March 31, 2021:

| | | | | | | | |

| (In millions) | | Amount |

| Remainder of 2021 | | $ | 2.3 | |

| 2022 | | 0.8 | |

| 2023 | | 0.7 | |

| 2024 | | 0.7 | |

| 2025 | | 0.1 | |

| Thereafter | | 346.8 | |

| Total debt | | $ | 351.4 | |

5.5% Senior Notes

GCP's outstanding 5.5% Senior Notes have an aggregate principal amount of $350.0 million maturing on April 15, 2026. Interest on the 5.5% Senior Notes is payable semi-annually in arrears on April 15 and October 15 of each year. The Company made an interest payment of $9.6 million on April 15, 2021.

The Indenture contains certain customary affirmative and negative covenants and events of default, as described in Note 8, "Debt and Other Borrowings," to the Company's Consolidated Financial Statements included in the 2020 Annual Report in the Form 10-K. The Company was in compliance with all covenants and conditions under the Indenture as of March 31, 2021. There are no events of default under the Indenture as of March 31, 2021.

Credit Agreement

As of March 31, 2021 and December 31, 2020, there were no outstanding borrowings on the Revolving Credit Facility. There were $2.6 million in outstanding letters of credit which resulted in available credit of $347.4 million as of March 31, 2021 and December 31, 2020. There were no interest payments on the Revolving Credit Facility during the three months ended March 31, 2021 and 2020.

Notes to Consolidated Financial Statements (unaudited) - Continued

The Credit Agreement contains conditions that would require mandatory principal payments in advance of the maturity date of the Revolving Credit Facility, as well as certain customary affirmative and negative covenants and events of default, as described in Note 8, "Debt and Other Borrowings," to the Company's Consolidated Financial Statements included in the 2020 Annual Report in the Form 10-K. The Company was in compliance with all covenant terms as of March 31, 2021. There are no events of default as of March 31, 2021.

Debt Issuance Costs

GCP recognizes expenses directly associated with obtaining the Revolving Credit Facility as debt issuance costs which are presented within "Other assets" in the accompanying unaudited Consolidated Balance Sheets. Such costs are amortized over the term of the Revolving Credit Facility and included in “Interest expense and related financing costs” in the accompanying unaudited Consolidated Statements of Operations. As of March 31, 2021 and December 31, 2020, the remaining unamortized debt issuance costs related to the Revolving Credit Facility were $1.9 million and $2.2 million, respectively.

Debt Fair Value

The carrying amount and fair value of GCP's debt and other borrowings were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| | | | | | | |

| | | | | | | |

| | | | | | | |

5.5% Senior Notes due in 2026 | $ | 346.8 | | | $ | 360.1 | | | $ | 346.6 | | | $ | 362.0 | |

| Other borrowings | 4.6 | | | 4.6 | | | 5.1 | | | 5.1 | |

| Total debt | $ | 351.4 | | | $ | 364.7 | | | $ | 351.7 | | | $ | 367.1 | |

Fair value is determined based on Level 2 inputs, including expected future cash flows (discounted at market interest rates), estimated current market prices, and quotes from financial institutions. As of March 31, 2021, the fair value was higher than the carrying amount due to higher bond market prices. The carrying amount represents the aggregate principal amount at maturity reduced by the unamortized debt issuance costs.

Notes to Consolidated Financial Statements (unaudited) - Continued

6. Lessee Arrangements

The Company leases manufacturing and office facilities, as well as certain vehicles and equipment under operating leases.

The following table summarizes components of lease expense for the three months ended March 31, 2021 and 2020:

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| (In millions) | 2021 | | 2020 | | | | |

| Operating lease expense | $ | 4.3 | | | $ | 3.2 | | | | | |

| Variable lease expense | 1.0 | | | 1.1 | | | | | |

| Short-term lease expense | 0.6 | | | 0.6 | | | | | |

| Total lease expense | $ | 5.9 | | | $ | 4.9 | | | | | |

The following table summarizes supplemental cash flow information related to leases during the three months ended March 31, 2021 and 2020:

| | | | | | | | | | | |

| Three months ended March 31, |

| (In millions) | 2021 | | 2020 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | |

| Operating cash flows from operating leases | $ | 2.6 | | | $ | 3.2 | |

| | | |

| | | |

| Operating lease right of use assets obtained in exchange for new lease obligations | 1.4 | | | 7.7 | |

| | | |

| | | |

On July 31, 2020, GCP sold its corporate headquarters located at 62 Whittemore Avenue, Cambridge, Massachusetts to IQHQ, L.P and entered into a leaseback transaction with the buyer in conjunction with the sale. The lease of GCP's corporate headquarters is classified as an operating lease and has an initial rent-free term of eighteen months. Fair value of free rent of $8.6 million was recognized as an Operating Lease Right-of-Use Asset as a result of a non-cash transaction.

7. Income Taxes

Income taxes attributable to continuing operations during the three months ended March 31, 2021 and 2020 was an income tax expense (benefit) of $1.0 million and $(1.6) million, respectively, representing effective tax rates of 38.5% and (320.0)%, respectively.

The difference between the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the three months ended March 31, 2021, was primarily due to income tax expense on unrecognized tax benefits of $0.3 million.

The difference between the U.S. federal income tax rate of 21.0% and GCP's overall income tax rate for the three months ended March 31, 2020 was primarily due to benefits recognized as a result of the Coronavirus Aid Relief and Economic Security (“CARES”) Act. The CARES Act allowed for accelerated interest and depreciation deductions which caused GCP to estimate net operating losses in 2019 and 2020. Under the CARES Act, those losses can be carried back to offset prior taxable income that was taxed at the U.S. federal income tax rate of 35%. This resulted in an income tax benefit of $2.8 million, offset by increases in unrecognized tax benefits of $0.4 million and valuation allowance expense of $0.6 million.

Repatriation

In general, it is GCP's practice and intention to permanently reinvest the earnings of its foreign subsidiaries and repatriate earnings only when the tax impact is efficient.

Notes to Consolidated Financial Statements (unaudited) - Continued

Valuation Allowance

In evaluating GCP's ability to realize its deferred tax assets, GCP considers all reasonably available positive and negative evidence, including recent earnings experience, expectations of future taxable income and the tax character of that income, the period of time over which temporary differences become deductible and the carryforward and/or carryback periods available to GCP for tax reporting purposes in the related jurisdiction. In estimating future taxable income, GCP relies upon assumptions and estimates about future activities, including the amount of future federal, state and foreign pretax operating income that GCP will generate; the reversal of temporary differences; and the implementation of feasible and prudent tax planning strategies. GCP records a valuation allowance to reduce deferred tax assets to the amount that it believes is more likely than not to be realized.

During the three months ended March 31, 2021 GCP incurred no income tax expense for valuation allowances. During the three months ended March 31, 2020, GCP incurred income tax expense for valuation allowances of $0.6 million recorded against deferred tax assets for net operating losses primarily in Argentina and Australia

Tax Sharing Agreement

In connection with the legal separation and transfer of W.R. Grace & Co.'s ("Grace") construction products and packaging technologies businesses to the Company through a dividend distribution of all of the then-outstanding common stock of GCP to Grace shareholders on February 3, 2016 (the "Separation"), GCP and Grace entered into various agreements that govern the relationship between the parties going forward, including a tax matters agreement (the "Tax Sharing Agreement"). Under the Tax Sharing Agreement, GCP and Grace will indemnify and hold each other harmless in accordance with the principles outlined therein. Please refer to Note 16, "Related Party Transactions and Transactions with Grace" for further information on the Tax Sharing Agreement.

8. Pension Plans and Other Postretirement Benefit Plans

Pension Plans

GCP sponsors defined benefit pension plans, primarily in the U.S. and the U.K., in which GCP employees and former employees participate. GCP records an asset or a liability to recognize the funded status of these pension plans in its accompanying unaudited Consolidated Balance Sheets.

The following table presents the funded status of GCP's overfunded, underfunded and unfunded defined pension plans:

| | | | | | | | | | | |

| (In millions) | March 31, 2021 | | December 31, 2020 |

| Overfunded defined benefit pension plans | $ | 30.0 | | | $ | 29.7 | |

| Underfunded defined benefit pension plans | (34.2) | | | (33.3) | |

| Unfunded defined benefit pension plans | (28.8) | | | (29.6) | |

| Total underfunded and unfunded defined benefit pension plans | (63.0) | | | (62.9) | |

| Pension liabilities included in other current liabilities | (1.4) | | | (1.4) | |

| Net funded status | $ | (34.4) | | | $ | (34.6) | |

Components of Net Periodic Benefit Cost

The components of GCP's net periodic benefit cost for the three months ended March 31, 2021 and 2020 are as follows:

Notes to Consolidated Financial Statements (unaudited) - Continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| Pension | | Pension |

| (In millions) | U.S. | | Non-U.S. | | Total | | U.S. | | Non-U.S. | | Total |

| Service cost | $ | 1.5 | | | $ | 0.3 | | | $ | 1.8 | | | $ | 1.5 | | | $ | 0.2 | | | $ | 1.7 | |

| Interest cost | 1.2 | | | 0.7 | | | 1.9 | | | 1.3 | | | 1.1 | | | 2.4 | |

| Expected return on plan assets | (1.5) | | | (0.8) | | | (2.3) | | | (1.6) | | | (1.2) | | | (2.8) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Net periodic benefit cost (1) | $ | 1.2 | | | $ | 0.2 | | | $ | 1.4 | | | $ | 1.2 | | | $ | 0.1 | | | $ | 1.3 | |

| | | | | | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

________________________________

(1)Service cost component of net periodic benefit cost is included in "Selling, general and administrative expenses" and "Cost of goods sold" in the accompanying unaudited Consolidated Statements of Operations. All other components of net periodic benefit costs are presented in "Other income, net," within the accompanying unaudited Consolidated Statements of Operations.

Pension Contributions and Funding

GCP intends to satisfy its funding obligations under the U.S. qualified pension plans and to comply with all of the requirements of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). For ERISA purposes, funded status is calculated on a different basis than under U.S. GAAP. GCP made contributions of $0.2 million and $0.1 million, respectively, to the U.S. pension plans during the three months ended March 31, 2021 and 2020.

GCP intends to fund non-U.S. pension plans based on applicable legal requirements, as well as actuarial and trustee recommendations. During the three months ended March 31, 2021 and 2020, GCP contributed $0.2 million and $0.5 million, respectively, to these non-U.S. plans.

Defined Contribution Retirement Plan

GCP sponsors a defined contribution retirement plan for its employees in the U.S. which is a qualified plan under section 401(k) of the U.S. tax code. Under this plan, GCP contributes an amount equal to 100% of employee contributions, up to 6% of an individual employee's salary or wages. Additionally, GCP contributes up to 2% of a full amount of applicable employee compensation subject to a three year vesting requirement. Applicable employees include those beginning employment with GCP on or after January 1, 2018 who are not eligible to participate in the GCP Applied Technologies Inc. Retirement Plan for Salaried Employees, which was closed to new hires effective January 1, 2018. GCP's costs related to this benefit plan amounted to $1.0 million and $1.3 million, respectively, during the three months ended March 31, 2021 and 2020. These costs are included in "Selling, general and administrative expenses" and "Cost of goods sold" in the accompanying unaudited Consolidated Statements of Operations.

Notes to Consolidated Financial Statements (unaudited) - Continued

9. Other Balance Sheet Information

The following is a summary of other current assets at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

| Other Current Assets: | | | |

| Non-trade receivables | $ | 19.2 | | | $ | 20.4 | |

| Prepaid expenses and other current assets | 15.6 | | | 11.1 | |

| Income taxes receivable | 9.1 | | | 9.7 | |

| | | |

| Total other current assets | $ | 43.9 | | | $ | 41.2 | |

The following is a summary of other current liabilities at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| (In millions) | March 31,

2021 | | December 31,

2020 |

| Other Current Liabilities: | | | |

| Accrued customer volume rebates | $ | 15.2 | | | $ | 24.4 | |

Accrued compensation(1) | 18.3 | | | 25.0 | |

| Income taxes payable | 6.7 | | | 7.1 | |

| Accrued interest | 8.8 | | | 4.0 | |

| Pension liabilities | 1.4 | | | 1.4 | |

| Restructuring liability | 16.7 | | | 18.0 | |

| Other accrued liabilities | 46.3 | | | 45.9 | |

| Total other current liabilities | $ | 113.4 | | | $ | 125.8 | |

| | | |

________________________________

(1)Accrued compensation presented in the table above includes salaries and wages, as well as estimated amounts due under the annual employee incentive programs.

10. Commitments and Contingencies

GCP enters into certain purchase commitments and is a party to many contracts containing guarantees and indemnification obligations, as described in Note 12, "Commitments and Contingencies" to the Company's Consolidated Financial Statements included in the 2020 Annual Report in the Form 10-K. There have been no material changes to these commitments and obligations during the three months ended March 31, 2021, except as described below. Although the outcome of each of the matters related to loss contingencies and obligations cannot be predicted with certainty, GCP has assessed the risk and has made accounting estimates and disclosures as required under U.S. GAAP.

Environmental Matters

GCP is subject to loss contingencies resulting from extensive and evolving federal, state, local and foreign environmental laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. GCP recognizes accrued liabilities for anticipated costs associated with response efforts if, based on the results of the assessment, it concluded that a probable liability has been incurred and the cost can be reasonably estimated. As of March 31, 2021 and December 31, 2020, GCP did not have any material environmental liabilities.

GCP's environmental liabilities are reassessed whenever circumstances become better defined or response efforts and their costs can be better estimated. These liabilities are evaluated based on currently available information, including the progress of remedial investigations at each site, the current status of discussions with regulatory authorities regarding the method and extent of remediation at each site, existing technology, prior experience in contaminated site remediation and the apportionment of costs among potentially responsible parties.

Notes to Consolidated Financial Statements (unaudited) - Continued

Financial Assurances

Financial assurances have been established for a variety of purposes, including insurance, environmental matters and other matters. At March 31, 2021 and December 31, 2020, GCP had gross financial assurances issued and outstanding of $6.1 million and $6.8 million, respectively, which were composed of standby letters of credit. The letters of credit are related primarily to customer advances and other performance obligations as of March 31, 2021 and December 31, 2020. These arrangements guarantee the refund of advance payments received from customers in the event that the product is not delivered or warranty obligations are not fulfilled in accordance with the contract terms. These obligations could be called by the beneficiaries at any time before the expiration date of the particular letter of credit if the Company fails to meet certain contractual requirements.

Lawsuits and Investigations

Henkel AG & Co. KGaA Matters

In July 2017, GCP completed the sale of its Darex business to Henkel AG & Co. KGaA (the "Henkel"). The Purchase and Sale Agreement with Henkel regarding the sale of the Darex Business dated July 3, 2017, (the “SAPA”) contains obligations for the Company as sellers to indemnify Henkel as buyer for certain matters, such as breaches of representations and warranties, taxes, as well as certain covenants and liabilities.

On March 30, 2021, Henkel filed suit in the United States District Court for the District of Delaware against the Company, seeking indemnification for alleged breaches of representations and warranties under the SAPA. Henkel is seeking damages of approximately $11 million, which consist of a claim amount of approximately $16 million, net of a contractual deductible of $5 million. The Company believes that it has meritorious defenses against the plaintiff’s claims and intends to defend this action vigorously. Although the Company does not believe that resolution of this matter will have a material adverse effect on its business or financial condition, at this time, based on available information regarding this litigation, the Company is unable to reasonably assess the ultimate outcome of this case or determine an estimate, or a range of estimates, of potential losses, if any, that might result from an adverse resolution of this matter.

Other Matters

From time to time, GCP and its subsidiaries are parties to, or targets of, lawsuits, claims, investigations and proceedings which are managed and defended in the ordinary course of business. While GCP is unable to predict the outcome of these matters, it does not believe, based upon currently available facts, that the ultimate resolution of any of such pending matters, except as disclosed above, will have a material adverse effect on its overall financial condition, results of operations or cash flows for the three months ended March 31, 2021. However, the results of such pending legal matters and claims cannot be predicted with sufficient certainty since unfavorable resolutions are possible and could materially affect GCP's financial position, results of operations, or cash flows. In the event of unexpected subsequent developments and due to the inherent unpredictability of these matters, there can be no assurance that the Company’s assessment of any claim will reflect the ultimate outcome. An adverse outcome in certain matters could, from time to time, have a material adverse effect on GCP's consolidated financial position, results of operations and cash flows in particular quarterly or annual periods.

Notes to Consolidated Financial Statements (unaudited) - Continued

11. Stockholders' Equity

Share Repurchase Program

On July 30, 2020, the Board of Directors (the “Board”) of GCP authorized a program to repurchase up to $100 million of the Company’s common stock which is effective through July 30, 2022. Share repurchases under the program may be made from time to time at the Board's discretion through open market purchases or privately negotiated transactions in accordance with applicable federal securities laws, including Rule 10b-18 of the Exchange Act. The share repurchase program is subject to a periodic review by the Board and may be suspended periodically or discontinued at any time. The Company plans to fund repurchases from its existing cash balance. No shares were repurchased by the Company during the three months ended March 31, 2021.

12. Restructuring and Repositioning Expenses, Asset Write Offs

GCP's Board of Directors (the "Board") approves all major restructuring and repositioning programs. Major restructuring programs may involve reorganizations, the discontinuation of significant product lines, the shutdown of significant facilities, or other major strategic initiatives. From time to time, GCP takes additional restructuring actions, including involuntary employee terminations that are not a part of a major program. Repositioning activities generally represent major strategic or transformational actions to enhance the value and performance of the Company, improve business efficiency or optimize the Company’s footprint.

Repositioning expenses associated with the Plans discussed below, as well as a review of strategic, financial and operational alternatives, are primarily related to consulting, professional services, and other employee-related costs associated with the Company’s organizational realignment and advancing its technology strategy. Due to the scope and complexity of the Company’s repositioning activities, the range of estimated repositioning expenses and capital expenditures could increase or decrease and the timing of incurrence could change.

2021 Restructuring and Repositioning Plan (the “2021 Plan”)

On March 30, 2021, the Board approved a business restructuring and repositioning plan (the “2021 Plan”) related to the relocation of the Company’s corporate headquarters to the Atlanta, Georgia area, the closure of its Cambridge, Massachusetts campus, the build-out of a new global research and development center near the Boston /Cambridge area, as well as the consolidation of other regional facilities and offices, including an organizational redesign, which is expected to lower costs. The program is expected to be completed by June 30, 2022.

2019 Phase 2 Restructuring and Repositioning Plan (the “2019 Phase 2 Plan")

On July 31, 2019, the Board approved a business restructuring and repositioning plan to further optimize the design and footprint of the Company's global organization, primarily with respect to its general administration and business support functions, and streamline cross-functional activities (the “2019 Phase 2 Plan”). The 2019 Phase 2 Plan is expected to result in the net reduction of approximately 8%-10% of the Company's workforce. The program was substantially completed as of March 31, 2021.

2019 Restructuring and Repositioning Plan (the “2019 Plan”)