Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| | |

ý | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2018 |

OR |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-137533 |

GCP Applied Technologies Inc.

|

| | |

Delaware (State of Incorporation) | | 47-3936076 (I.R.S. Employer Identification No.) |

62 Whittemore Avenue, Cambridge, Massachusetts 02140-1623

(617) 876-1400

(Address and phone number of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding at July 31, 2018 |

Common Stock, $0.01 par value per share | | 72,157,729 shares |

_______________________________________________________________________________

Presentation of Information

Unless the context requires otherwise, references to "GCP Applied Technologies Inc.", "GCP", "we", "us", "our" and "the Company" refer to GCP Applied Technologies Inc., and its consolidated subsidiaries for periods subsequent to its separation from W.R. Grace & Co. on February 3, 2016. For periods prior to February 3, 2016, these terms refer to the combined historical business and operations of W.R. Grace & Co.’s construction products and packaging technologies businesses as they were historically managed as part of W.R. Grace & Co. Unless the context requires otherwise, references to "Grace" refer to W.R. Grace & Co., and its consolidated subsidiaries, which is the Company’s former parent company. References in this Quarterly Report on Form 10-Q to the "Separation" refer to the legal separation and transfer of Grace’s construction products and packaging technologies businesses to the Company through a dividend distribution of all of the then-outstanding common stock of GCP to Grace shareholders on February 3, 2016.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GCP Applied Technologies Inc.

Consolidated Statements of Operations (unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In millions, except per share amounts) | 2018 | | 2017 | | 2018 | | 2017 |

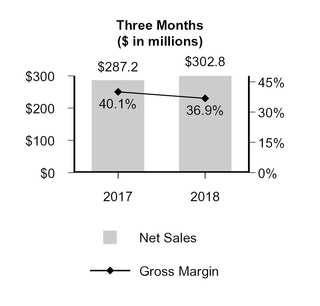

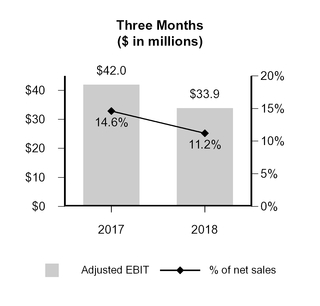

Net sales | $ | 302.8 |

| | $ | 287.2 |

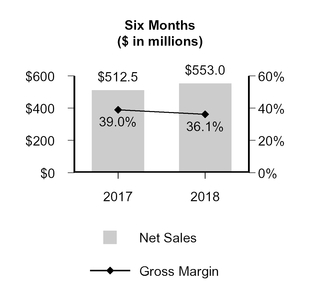

| | $ | 553.0 |

| | $ | 512.5 |

|

Cost of goods sold | 191.1 |

| | 172.2 |

| | 353.8 |

| | 312.2 |

|

Gross profit | 111.7 |

| | 115.0 |

| | 199.2 |

| | 200.3 |

|

Selling, general and administrative expenses | 77.6 |

| | 72.8 |

| | 152.5 |

| | 145.6 |

|

Research and development expenses | 5.3 |

| | 5.2 |

| | 10.2 |

| | 10.0 |

|

Interest expense and related financing costs | 66.7 |

| | 17.5 |

| | 80.5 |

| | 34.5 |

|

Repositioning expenses | 1.2 |

| | 3.7 |

| | 2.1 |

| | 5.7 |

|

Restructuring and asset impairments | (0.6 | ) | | 9.8 |

| | (1.1 | ) | | 10.9 |

|

Loss in Venezuela | — |

| | 1.6 |

| | — |

| | 1.6 |

|

Other income, net | (4.1 | ) | | (3.6 | ) | | (10.4 | ) | | (2.6 | ) |

Total costs and expenses | 146.1 |

| | 107.0 |

| | 233.8 |

| | 205.7 |

|

(Loss) income from continuing operations before income taxes | (34.4 | ) | | 8.0 |

| | (34.6 | ) | | (5.4 | ) |

Income tax benefit (expense) | 5.3 |

|

| (6.6 | ) | | (8.2 | ) | | (18.2 | ) |

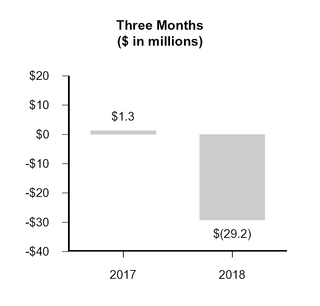

(Loss) income from continuing operations | (29.1 | ) | | 1.4 |

| | (42.8 | ) | | (23.6 | ) |

Income (loss) from discontinued operations, net of income taxes | 1.3 |

| | (6.0 | ) | | 8.5 |

| | 2.1 |

|

Net loss | (27.8 | ) | | (4.6 | ) | | (34.3 | ) | | (21.5 | ) |

Less: Net income attributable to noncontrolling interests | (0.1 | ) | | (0.1 | ) | | (0.2 | ) | | (0.1 | ) |

Net loss attributable to GCP shareholders | $ | (27.9 | ) | | $ | (4.7 | ) | | $ | (34.5 | ) | | $ | (21.6 | ) |

Amounts Attributable to GCP Shareholders: | | | | | | | |

(Loss) income from continuing operations attributable to GCP shareholders | (29.2 | ) | | 1.3 |

| | (43.0 | ) | | (23.7 | ) |

Income (loss) from discontinued operations, net of income taxes | 1.3 |

| | (6.0 | ) | | 8.5 |

| | 2.1 |

|

Net loss attributable to GCP shareholders | $ | (27.9 | ) | | $ | (4.7 | ) | | $ | (34.5 | ) | | $ | (21.6 | ) |

(Loss) Earnings Per Share Attributable to GCP Shareholders | | | | | | | |

Basic (loss) earnings per share: | | | | | | | |

(Loss) income from continuing operations attributable to GCP shareholders | $ | (0.40 | ) | | $ | 0.02 |

| | $ | (0.60 | ) | | $ | (0.33 | ) |

Income (loss) from discontinued operations, net of income taxes | $ | 0.02 |

| | $ | (0.08 | ) | | $ | 0.12 |

| | $ | 0.03 |

|

Net loss attributable to GCP shareholders(1) | $ | (0.39 | ) | | $ | (0.07 | ) | | $ | (0.48 | ) | | $ | (0.30 | ) |

Weighted average number of basic shares | 72.1 |

|

| 71.5 |

| | 72.0 |

| | 71.0 |

|

Diluted (loss) earnings per share:(2) | | | | | | | |

(Loss) income from continuing operations attributable to GCP shareholders | $ | (0.40 | ) | | $ | 0.02 |

| | $ | (0.60 | ) | | $ | (0.33 | ) |

Income (loss) from discontinued operations, net of income taxes | $ | 0.02 |

| | $ | (0.08 | ) | | $ | 0.12 |

| | $ | 0.03 |

|

Net loss attributable to GCP shareholders(1) | $ | (0.39 | ) | | $ | (0.07 | ) | | $ | (0.48 | ) | | $ | (0.30 | ) |

Weighted average number of diluted shares | 72.1 |

| | 72.7 |

| | 72.0 |

|

| 71.0 |

|

(1) Amounts may not sum due to rounding.

(2) Dilutive effect only applicable to periods where there is income from continuing operations.

The Notes to Consolidated Financial Statements are an integral part of these statements.

4

GCP Applied Technologies Inc.

Consolidated Balance Sheets (unaudited)

|

| | | | | | | |

(In millions, except par value and shares) | June 30,

2018 | | December 31,

2017 |

ASSETS | | | |

Current Assets | | | |

Cash and cash equivalents | $ | 289.3 |

| | $ | 721.5 |

|

Trade accounts receivable (including allowances of $5.3 and $5.7, respectively) | 215.8 |

| | 217.1 |

|

Inventories, net | 114.8 |

| | 106.3 |

|

Other current assets | 44.9 |

|

| 48.6 |

|

Current assets held for sale | 8.0 |

| | 19.7 |

|

Total Current Assets | 672.8 |

| | 1,113.2 |

|

Properties and equipment, net | 217.3 |

| | 216.6 |

|

Goodwill | 212.1 |

| | 198.2 |

|

Technology and other intangible assets, net | 95.2 |

| | 91.8 |

|

Deferred income taxes | 27.4 |

| | 30.2 |

|

Overfunded defined benefit pension plans | 26.3 |

| | 26.4 |

|

Other assets | 31.5 |

|

| 23.8 |

|

Non-current assets held for sale | 2.4 |

| | 2.8 |

|

Total Assets | $ | 1,285.0 |

| | $ | 1,703.0 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current Liabilities | | | |

Debt payable within one year | $ | 18.4 |

| | $ | 24.0 |

|

Accounts payable | 132.4 |

| | 134.8 |

|

Other current liabilities | 151.5 |

| | 316.2 |

|

Current liabilities held for sale | 3.5 |

| | 7.8 |

|

Total Current Liabilities | 305.8 |

| | 482.8 |

|

Debt payable after one year | 346.7 |

| | 520.3 |

|

Income taxes payable | 49.2 |

| | 58.3 |

|

Deferred income taxes | 15.5 |

| | 14.7 |

|

Unrecognized tax benefits | 43.0 |

| | 42.4 |

|

Underfunded and unfunded defined benefit pension plans | 56.1 |

| | 57.1 |

|

Other liabilities | 19.8 |

| | 35.1 |

|

Non-current liabilities held for sale | 0.3 |

| | 0.3 |

|

Total Liabilities | 836.4 |

| | 1,211.0 |

|

Commitments and Contingencies - Note 8 |

| |

|

Stockholders' Equity | | | |

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 72,156,872 and 71,754,344, respectively | 0.7 |

| | 0.7 |

|

Paid-in capital | 40.8 |

| | 29.9 |

|

Accumulated earnings | 514.2 |

| | 548.7 |

|

Accumulated other comprehensive loss | (104.4 | ) | | (85.7 | ) |

Treasury stock | (4.7 | ) | | (3.4 | ) |

Total GCP's Shareholders' Equity | 446.6 |

| | 490.2 |

|

Noncontrolling interests | 2.0 |

| | 1.8 |

|

Total Stockholders' Equity | 448.6 |

| | 492.0 |

|

Total Liabilities and Stockholders' Equity | $ | 1,285.0 |

| | $ | 1,703.0 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

GCP Applied Technologies Inc.

Consolidated Statements of Comprehensive Loss (unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In millions) | 2018 | | 2017 | | 2018 | | 2017 |

Net loss | $ | (27.8 | ) | | $ | (4.6 | ) | | $ | (34.3 | ) | | $ | (21.5 | ) |

Other comprehensive (loss) income: | | | | | | | |

Defined benefit pension and other postretirement plans, net of income taxes | (0.6 | ) | | — |

| | (0.6 | ) | | — |

|

Currency translation adjustments | (32.5 | ) | | 4.2 |

| | (18.2 | ) | | 16.8 |

|

Gain (loss) from hedging activities, net of income taxes | 0.1 |

| | (0.6 | ) | | 0.1 |

| | (0.6 | ) |

Total other comprehensive (loss) income | (33.0 | ) | | 3.6 |

| | (18.7 | ) | | 16.2 |

|

Comprehensive loss | (60.8 | ) | | (1.0 | ) | | (53.0 | ) | | (5.3 | ) |

Less: Comprehensive income attributable to noncontrolling interests | (0.1 | ) | | (0.1 | ) | | (0.2 | ) | | (0.1 | ) |

Comprehensive loss attributable to GCP shareholders | $ | (60.9 | ) | | $ | (1.1 | ) | | $ | (53.2 | ) | | $ | (5.4 | ) |

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

GCP Applied Technologies Inc.

Consolidated Statements of Stockholders' Equity (Deficit) (unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | | | | | | | | | |

(In millions) | Number of Shares | | Par Value | | Number of Shares | | Cost | | Additional Paid-in Capital | | Accumulated Earnings / (Deficit) | | Accumulated Other Comprehensive Loss | | Noncontrolling Interests | | Total Stockholders' Equity (Deficit) |

Balance, December 31, 2016 | 71.2 |

| | $ | 0.7 |

| | 0.1 |

| | $ | (2.1 | ) | | $ | 11.0 |

| | $ | (4.7 | ) | | $ | (147.6 | ) | | $ | 3.7 |

| | $ | (139.0 | ) |

Net (loss) income | — |

| | — |

| | — |

| | — |

| | — |

| | (21.6 | ) | | — |

| | 0.1 |

| | (21.5 | ) |

Issuance of common stock in connection with stock plans | 0.1 |

| | 0.1 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 0.1 |

|

Share-based compensation | — |

| | — |

| | — |

| | — |

| | 5.7 |

| | — |

| | — |

| | — |

| | 5.7 |

|

Exercise of stock options | 0.4 |

| | — |

| | — |

| | — |

| | 6.2 |

| | — |

| | — |

| | — |

| | 6.2 |

|

Share repurchases(1) | — |

| | — |

| | — |

| | (1.0 | ) | | — |

| | — |

| | — |

| | — |

| | (1.0 | ) |

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 16.2 |

| | — |

| | 16.2 |

|

Dividends and other changes in noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1.0 | ) | | (1.0 | ) |

Balance, June 30, 2017 | 71.7 |

| | $ | 0.8 |

| | 0.1 |

| | $ | (3.1 | ) | | $ | 22.9 |

| | $ | (26.3 | ) | | $ | (131.4 | ) | | $ | 2.8 |

| | $ | (134.3 | ) |

Balance, December 31, 2017 | 71.9 |

| | $ | 0.7 |

| | 0.1 |

| | $ | (3.4 | ) | | $ | 29.9 |

| | $ | 548.7 |

| | $ | (85.7 | ) | | $ | 1.8 |

| | $ | 492.0 |

|

Net (loss) income | — |

| | — |

| | — |

| | — |

| | — |

| | (34.5 | ) | | — |

| | 0.2 |

| | (34.3 | ) |

Issuance of common stock in connection with stock plans | 0.2 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Share-based compensation | — |

| | — |

| | — |

| | — |

| | 5.8 |

| | — |

| | — |

| | — |

| | 5.8 |

|

Exercise of stock options | 0.3 |

| | — |

| | — |

| | — |

| | 5.1 |

| | — |

| | — |

| | — |

| | 5.1 |

|

Share repurchases | — |

| | — |

| | 0.1 |

| | (1.3 | ) | | — |

| | — |

| | — |

| | — |

| | (1.3 | ) |

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (18.7 | ) | | — |

| | (18.7 | ) |

Balance, June 30, 2018 | 72.4 |

| | $ | 0.7 |

| | 0.2 |

| | $ | (4.7 | ) | | $ | 40.8 |

| | $ | 514.2 |

| | $ | (104.4 | ) | | $ | 2.0 |

| | $ | 448.6 |

|

________________________________

| |

(1) | For the six months ended June 30, 2017, GCP repurchased approximately 37,000 shares of Company common stock for $1.0 million in connection with its equity compensation programs. The number of such shares repurchased is not included in the table above due to rounding. |

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

GCP Applied Technologies Inc.

Consolidated Statements of Cash Flows (unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

(In millions) | 2018 | | 2017 |

OPERATING ACTIVITIES | | | |

Net loss | $ | (34.3 | ) | | $ | (21.5 | ) |

Less: Income from discontinued operations | 8.5 |

| | 2.1 |

|

Loss from continuing operations | (42.8 | ) | | (23.6 | ) |

Reconciliation to net cash (used in) provided by operating activities: | | | |

Depreciation and amortization | 20.8 |

| | 17.2 |

|

Amortization of debt discount and financing costs | 0.9 |

| | 1.6 |

|

Stock-based compensation expense | 5.3 |

| | 5.3 |

|

Unrealized gain on foreign currency | (0.8 | ) | | — |

|

Gain on termination and curtailment of pension and other postretirement plans | (0.1 | ) | | (5.1 | ) |

Currency and other losses in Venezuela | — |

| | 2.9 |

|

Deferred income taxes | (6.0 | ) | | 12.6 |

|

Loss on debt refinancing | 59.8 |

| | — |

|

Gain on disposal of property and equipment | (1.1 | ) | | (0.8 | ) |

Loss on sale of product line | — |

| | 2.1 |

|

Changes in assets and liabilities, excluding effect of currency translation: | | | |

Trade accounts receivable | (3.3 | ) | | (34.5 | ) |

Inventories | (10.7 | ) | | (11.5 | ) |

Accounts payable | 5.2 |

| | 17.1 |

|

Pension assets and liabilities, net | (0.4 | ) | | 3.1 |

|

Other assets and liabilities, net | (36.4 | ) | | (10.7 | ) |

Net cash used in operating activities from continuing operations | (9.6 | ) | | (24.3 | ) |

Net cash (used in) provided by operating activities from discontinued operations | (124.9 | ) | | 8.4 |

|

Net cash used in operating activities | (134.5 | ) | | (15.9 | ) |

INVESTING ACTIVITIES | | | |

Capital expenditures | (27.6 | ) | | (21.5 | ) |

Businesses acquired, net of cash acquired | (29.8 | ) | | (87.7 | ) |

Proceeds from sale of product line | — |

| | 2.9 |

|

Other investing activities | (2.8 | ) | | 3.1 |

|

Net cash used in investing activities from continuing operations | (60.2 | ) | | (103.2 | ) |

Net cash used in investing activities from discontinued operations | (0.2 | ) | | (3.3 | ) |

Net cash used in investing activities | (60.4 | ) | | (106.5 | ) |

FINANCING ACTIVITIES | | | |

Borrowings under credit arrangements | 53.5 |

| | 116.1 |

|

Repayments under credit arrangements | (58.4 | ) | | (15.2 | ) |

Proceeds from issuance of long term notes | 350.0 |

| | — |

|

Repayments of long term note obligations | (578.3 | ) | | — |

|

Cash paid for debt financing costs | (6.9 | ) | | — |

|

Share repurchases | (1.3 | ) | | (1.0 | ) |

Proceeds from exercise of stock options | 5.1 |

| | 5.7 |

|

Noncontrolling interest dividend | — |

| | (0.6 | ) |

Other financing activities | (0.2 | ) | | — |

|

Net cash (used in) provided by financing activities from continuing operations | (236.5 | ) | | 105.0 |

|

Net cash provided by financing activities from discontinued operations | — |

| | 0.5 |

|

Net cash (used in) provided by financing activities | (236.5 | ) | | 105.5 |

|

Effect of currency exchange rate changes on cash and cash equivalents | (0.8 | ) | | 0.9 |

|

Decrease in cash and cash equivalents | (432.2 | ) | | (16.0 | ) |

Cash and cash equivalents, beginning of period | 721.5 |

| | 163.3 |

|

Cash and cash equivalents, end of period | 289.3 |

| | 147.3 |

|

Less: Cash and cash equivalents of discontinued operations | — |

| | 19.1 |

|

Cash and cash equivalents of continuing operations, end of period | $ | 289.3 |

| | $ | 128.2 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

8

GCP Applied Technologies Inc.

Notes to Consolidated Financial Statements (unaudited)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

GCP is engaged in the production and sale of specialty construction chemicals and specialty building materials through two operating segments. Specialty Construction Chemicals ("SCC") manufactures and markets concrete admixtures and cement additives. Specialty Building Materials ("SBM") manufactures and markets sheet and liquid membrane systems that protect structures from water, air and vapor penetration, fireproofing and other products designed to protect the building envelope.

On July 3, 2017 (the "Closing Date"), GCP completed the sale of its Darex Packaging Technologies ("Darex") business to Henkel AG & Co. KGaA (“Henkel”) for $1.06 billion in cash. As discussed further below under "Discontinued Operations," the results of operations for Darex have been excluded from GCP's continuing operations and segment results for all periods presented.

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements are presented on a consolidated basis and include all of the accounts and operations of GCP and its majority-owned subsidiaries, except as noted below with respect to the Company's Venezuela subsidiary. The financial statements reflect the financial position, results of operations and cash flows of GCP in accordance with generally accepted accounting principles in the United States of America ("GAAP") and the instructions to Form 10-Q and Article 10 of SEC Regulation S-X for interim financial information.

The interim financial statements presented herein are unaudited and should be read in conjunction with the audited Consolidated Financial Statements and notes thereto contained in GCP's Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2017 (the "2017 Annual Report on Form 10-K"). The accompanying Consolidated Balance Sheet as of December 31, 2017 was derived from the audited annual consolidated financial statements as of the period then ended. Certain information and footnote disclosures typically included in GCP's annual consolidated financial statements have been condensed or omitted. The accompanying unaudited financial statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented. All such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards discussed below. All significant intercompany accounts and transactions have been eliminated. The results of operations for the three and six-months period ended June 30, 2018 are not necessarily indicative of the results of operations for the year ending December 31, 2018.

Discontinued Operations

As noted above, on July 3, 2017, the Company completed the sale of Darex to Henkel. In conjunction with this transaction and applicable GAAP, the assets and liabilities related to Darex in the applicable delayed close countries have been reclassified and reflected as "held for sale" in the accompanying unaudited Consolidated Balance Sheets as of June 30, 2018 and December 31, 2017, as discussed further in Note 15, "Discontinued Operations". Additionally, Darex results of operations and cash flows have been reclassified and reflected as "discontinued operations" in the accompanying unaudited Consolidated Statements of Operations and accompanying unaudited Consolidated Statements of Cash Flows for all periods presented.

As of December 31, 2017, $68.7 million of liability recorded for the consideration received relating to the delayed closings was recorded in “Other current liabilities” and “Other liabilities” in the accompanying unaudited Consolidated Balance Sheets. During the six months ended June 30, 2018, GCP recognized a pre-tax gain on the sale of Darex of $18.5 million, which was $10.3 million after tax, and reduced the liability related to the consideration received for the delayed close countries by $25.0 million. As of June 30, 2018, the remaining liability for the consideration received was $43.7 million.

Unless otherwise noted, the information throughout the Notes to the accompanying unaudited Consolidated Financial Statements pertains only to the continuing operations of GCP. Refer to Note 15, "Discontinued Operations" for further discussion of discontinued operations.

Notes to Consolidated Financial Statements (unaudited) - Continued

Deconsolidation of Venezuelan Operations

Prior to July 3, 2017, the Company included the results of its Venezuelan operations (“GCP Venezuela”) in the Consolidated Financial Statements using the consolidation method of accounting. Venezuelan exchange control regulations have resulted in an other-than-temporary lack of exchangeability between the Venezuelan bolivar and U.S. dollar, and have restricted GCP Venezuela’s ability to pay dividends and meet obligations denominated in U.S. dollars. These exchange regulations, combined with other regulations, have constrained availability of raw materials and have significantly limited GCP Venezuela’s ability to maintain normal production. As a result of these conditions, combined with the loss of scale in Venezuela resulting from the sale of the Company’s Darex-related operations and assets in Venezuela, GCP has deconsolidated its Venezuelan operations as of July 3, 2017 in accordance with provisions of Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 810, Consolidation. Subsequent to this date, the Company began accounting for GCP Venezuela using the cost method of accounting.

In periods subsequent to July 3, 2017, the Company’s financial results do not include the operating results of GCP Venezuela. The Company records cash and recognizes income from its Venezuelan operations in the accompanying unaudited Consolidated Financial Statements to the extent GCP is paid for inventory sold to or dividends are received from GCP Venezuela. The remaining investment on the Company's accompanying unaudited Consolidated Balance Sheets as of June 30, 2018 and December 31, 2017 is immaterial.

At the end of May 2017, the Venezuela government announced that it had completed its first auction under the new DICOM exchange mechanism at a rate of 2,010 bolivars per U.S. dollar, an increase of 176.1% from the previously published rate of 728 bolivar per U.S. dollar. As a result of the change in the exchange mechanism and devaluation of the bolivar, the Company recorded a foreign exchange remeasurement and impairment loss of $7.1 million during the three months ended June 30, 2017, of which $2.4 million was included within continuing operations and $4.7 million was included within discontinued operations. The loss of $2.4 million from continuing operations was comprised of $1.6 million recorded in “Loss in Venezuela” and $0.8 million recorded in “Cost of goods sold” within the accompanying unaudited Consolidated Statements of Operations. At the end of June 2017, the DICOM rate increased to 2,640 bolivars per U.S. dollar. As a result, the Company recorded a foreign exchange remeasurement loss of $1.2 million during the three months ended June 30, 2017, of which $0.3 million was included within continuing operations and $0.9 million was included within discontinued operations. The loss of $0.3 million from continuing operations was recorded in “Other income, net” within the accompanying unaudited Consolidated Statements of Operations.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the unaudited Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. GCP's accounting measurements that are most affected by management's estimates of future events are disclosed in its 2017 Annual Report on Form 10-K. There have been no significant changes to management's assumptions and estimates underlying those measurements as reported in these interim financial statements, except as discussed in Note 5, "Income Taxes".

Reclassifications

Certain amounts in prior period financial statements have been reclassified to conform to the current period presentation. Such reclassifications have not materially affected previously reported amounts.

Income Tax

As a global enterprise, GCP is subject to a complex array of tax regulations and is required to make assessments of applicable tax laws and judgments in estimating its ultimate income tax liability. Please refer to Note 5, "Income Taxes," for further discussion regarding estimates used in accounting for income tax matters, including unrecognized tax benefits.

Notes to Consolidated Financial Statements (unaudited) - Continued

Currency Translation

Assets and liabilities of foreign subsidiaries (other than those located in countries with highly inflationary economies) are translated into U.S. dollars at current exchange rates, while revenues, costs and expenses are translated at average exchange rates during each reporting period. The resulting currency translation adjustments are included in "Accumulated other comprehensive loss" in the accompanying unaudited Consolidated Balance Sheets. The financial statements of any subsidiaries located in countries with highly inflationary economies are remeasured as if the functional currency were the U.S. dollar. Translation adjustments recognized as a result of such remeasurements are reflected in the results of operations in the unaudited Consolidated Statements of Operations.

As of July 3, 2017, GCP deconsolidated its Venezuelan operations and, as a result, the Company's financial results no longer include the operations of GCP Venezuela, including currency translation adjustments, beyond that date.

As of June 30, 2018, GCP concluded that Argentina is a highly inflationary economy since the three-year cumulative inflation rates commonly used to evaluate Argentina’s inflation currently exceed 100%. As a result, GCP will begin accounting for its operations in Argentina as a highly inflationary economy effective July 1, 2018. The financial statements of the Company's subsidiary operating in Argentina will be remeasured as if its functional currency was that of the parent entity and therefore all remeasurement adjustments will be reflected in its results of operations effective July 1, 2018. Net sales generated by the Argentina subsidiary were $3.1 million and $6.1 million, respectively, or approximately 1% of GCP's consolidated net sales during the three and six months ended June 30, 2018. The Company is currently evaluating the impact of this guidance on its financial position and results of operations.

Contract Assets and Contract Liabilities

Contract assets consist of unbilled amounts typically resulting from sales under long-term contracts when the revenue recognized exceeds the amount billed to the customer. Contract liabilities consist of advance payments and billings for revenue not meeting the criteria to be recognized and/or in excess of costs incurred. The Company’s contract assets and liabilities resulting from its contracts in the SCC or SBM operating segments were not material as of June 30, 2018 and December 31, 2017. Additionally, the amounts recorded in the accompanying unaudited Statements of Operations for the three and six months ended June 30, 2018 related to changes in the contract assets and liabilities during the periods were immaterial.

Trade accounts receivable include amounts billed and currently due from customers. The amounts due are stated at their net estimated realizable value. The Company maintains an allowance for doubtful accounts to provide for the estimated amount of receivables that will not be collected. The allowance is based upon an assessment of customer creditworthiness, historical payment experience, the age of outstanding receivables and collateral to the extent applicable. As of June 30, 2018 and December 31, 2017, the Company’s total trade accounts receivable balance was $215.8 million and $217.1 million, respectively, of which $5.6 million and $5.6 million, respectively, was related to trade accounts receivable associated with rental revenue generated from leases within certain SCC contracts and accounted for within the provisions of ASC Topic 840, Leases ("Topic 840").

Costs to Obtain a Contract

GCP pays external sales agents certain commissions based on actual customer sales and it has determined that such amounts represent incremental costs incurred in obtaining such customer contracts. The performance obligations associated with these costs are satisfied at a point in time and accordingly the amortization period of such costs is less than one year. The Company expenses these costs as incurred in accordance with the practical expedient that allows for such treatment, as prescribed by ASC Topic 340-40, Costs to obtain or fulfill a contract.

Notes to Consolidated Financial Statements (unaudited) - Continued

Recently Issued Accounting Standards

Leases

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which is intended to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. In accordance with provisions of Topic 842, a lessee will be required to recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term, including optional payments that are reasonably certain to occur. The amendments in this update are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, with early adoption permitted. As of June 30, 2018, GCP initiated the evaluation of the potential impact of adopting Topic 842 on its financial position, results of operations and related disclosures, but has not yet completed such assessment or determined whether it will elect the practical expedients upon transition. GCP established the project plan and launched the process to establish the implementation team which will analyze its current portfolio of contracts to determine the impact of adopting Topic 842 on the Company's financial position, results of operations and related disclosures. The implementation team will also be responsible for evaluating and designing the necessary changes to the Company’s business processes, policies, systems and controls to support recognition and disclosure under the new guidance.

Other new pronouncements issued but not effective until after June 30, 2018 are not expected to have a material impact on the Company's financial position, results of operations or liquidity.

Recently Adopted Accounting Standards

Revenue from Contracts with Customers

In May 2014, the FASB issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606). This update is intended to remove inconsistencies and weaknesses in revenue requirements; provide a more robust framework for addressing revenue issues; improve comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets; provide more useful information to users of financial statements through improved disclosure requirements; and simplify the preparation of financial statements by reducing the number of requirements to which an entity must refer. The revised standard allows for two methods of adoption: (a) full retrospective adoption, in accordance with which the standard is applied to all periods presented, or (b) modified retrospective adoption, in accordance with which the cumulative effect of applying the new standard is recognized as an adjustment to the opening retained earnings balance.

GCP has adopted Topic 606 effective January 1, 2018 using the modified retrospective approach. Under this transition method, GCP has elected to apply the guidance to all open contracts that are not completed or that are active as of January 1, 2018, and has elected not to retrospectively restate any of its contracts for modifications that occurred prior to the date of adoption of Topic 606. Accordingly, such modifications are reflected in the amounts reported for satisfied and unsatisfied performance obligations, transaction price of such performance obligations, and allocations of the transaction price among contract components, as of the date of the initial application. The impact of applying this practical expedient is immaterial to the Company’s accompanying unaudited Consolidated Financial Statements.

The impact of the adoption of Topic 606 on the Company's three and six months ended June 30, 2018 net sales, loss from continuing operations before income taxes, and loss from continuing operations was immaterial. The cumulative impact on the Company's retained earnings at January 1, 2018 was also not material.

Stock Compensation

In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718), which provides guidance related to the changes to the terms or conditions of a share-based payment award that require an application of modification accounting pursuant to Topic 718. GCP adopted the standard effective January 1, 2018 which did not have a material impact on its financial position as of June 30, 2018 and results of operations for the three and six months ended June 30, 2018.

Notes to Consolidated Financial Statements (unaudited) - Continued

Statement of Cash Flows

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Payments, which addresses a number of specific cash flow presentation issues with the objective of reducing existing diversity in practice. GCP adopted the standard effective January 1, 2018 and classified within the cash flows from financing activities a $53.3 million payment related to the redemption premium on the extinguishment of its 9.5% Senior Notes, consistent with the provisions of the guidance. Such payment was included in "Repayments of long term note obligations" in the accompanying unaudited Consolidated Statements of Cash Flows. Please refer to Note 4, "Debt and Other Borrowings" for further discussion of this transaction. There was no other material impact on the Company's unaudited Consolidated Statements of Cash Flows for the six months ended June 30, 2018 as a result of the standard adoption.

Income Taxes

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory. This ASU requires recognition of the current and deferred income tax effects of an intra-entity asset transfer, other than inventory, when the transfer occurs, as opposed to current GAAP, which requires companies to defer the income tax effects until the asset has been sold to an outside party. GCP adopted the standard effective January 1, 2018. It did not have a material impact on the Company's financial position as of June 30, 2018 and results of operations for the three and six months ended June 30, 2018.

Other

During the three and six months ended June 30, 2018, except as discussed above, there were no material changes to the Company's significant accounting and financial reporting policies from those reflected in the Annual Report on Form 10-K for the year ended December 31, 2017. For further information with regard to the Company’s Significant Accounting Policies, please refer to Note 1, "Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies," to the Company’s Consolidated Financial Statements included in the 2017 Annual Report on Form 10-K.

2. Revenue from Contracts with Customers

Short-Term Arrangements

The majority of the Company’s revenue is generated from short-term arrangements associated with the production and sale of concrete admixtures and cement additives within its SCC operating segment, as well as sheet and liquid membrane systems and other specialty products designed to protect the building envelope within its SBM operating segment. The products sold are priced based on the costs of producing goods and the value delivered to the customer. In these arrangements, the customer generally pays GCP for the contract price agreed upon within a short period of time, which is between thirty and sixty days. For such arrangements, the transfer of control takes place at a point in time when products are shipped to the customer. The evaluation of transfer of control for these goods does not involve significant judgment. Revenue from these contracts with customers is therefore typically recognized upon shipment of the product or delivery at the customer’s site depending on the shipping terms, provided the transaction price can be estimated appropriately and the Company expects to collect the consideration to which it is entitled in exchange for the products it ships.

The Company generates revenue from short-term arrangements within its SCC operating segment which involve selling concrete admixtures and providing dispensers to customers. GCP has determined that the dispensers represent a lease and has allocated revenue between the lease and non-lease components based on the relative stand-alone selling price of each component which is determined based on a cost plus a reasonable margin approach for the lease component and standalone selling prices for the non-lease component. The Company recognizes revenue for the non-lease component at a point of time when the control is transferred to the customer. The lease component is considered a short-term obligation which is generally 30 days or less. The Company recognizes revenue for the lease component over the term of the lease in accordance with provisions of Topic 840. GCP records dispensers as fixed assets and depreciates them over their estimated useful life.

Notes to Consolidated Financial Statements (unaudited) - Continued

Long-Term Arrangements

The Company generates revenue from long-term arrangements within its SCC operating segment, which generally consist of VERIFI® and Ductilcrete sales arrangements.

VERIFI® sales arrangements involve installing equipment on the customers’ trucks and at their plants, as well as performing slump management and truck location tracking services. The Company has determined that the installed equipment represents a lease. The Company allocates the transaction price in a VERIFI® sales arrangement between the lease and non-lease components based on valuation techniques that estimate a relative stand-alone selling price of each component. The services included within the non-lease component represent the Company’s stand-ready promise to perform a series of daily distinct services, which is combined into a single performance obligation. The Company recognizes revenue associated with such services over time since the customer simultaneously receives and consumes the benefits provided by such services. The transaction price in a VERIFI® sales arrangement consists of installation fees and slump management fees which are dependent on the quantity of materials poured and represent variable consideration. The Company records the amount of variable consideration at the time of the transfer of services to its customers, which is constrained by the amount for which a significant revenue reversal is not probable to occur. Revenue for the lease component is recognized over the term of the lease in accordance with provisions of Topic 840. Revenue generated from VERIFI® sales arrangements represented less than 10% of the Company's consolidated revenue during the three and six months ended June 30, 2018.

Ductilcrete sales arrangements include licenses without significant standalone functionality and usage fees received upfront, both of which represent separate performance obligations for which revenue is recognized over the period of related services. Additional performance obligations included in these arrangements are related to other fees and product sales for which revenue is recognized at a point in time once such performance obligations are satisfied. Revenue generated from Ductilcrete sales arrangements represented less than 10% of the Company's consolidated revenue during the three and six months ended June 30, 2018.

Lease elements within sales arrangements

Certain sales arrangements within the SCC operating segment related to VERIFI® and certain admixture contracts include lease components, as discussed above. Revenue for the lease components are recognized over the term of the leases in accordance with provisions of Topic 840.

During the three and six months ended June 30, 2018, the Company recognized revenue of $8.7 million and $16.4 million related to the lease components of the arrangements within the SCC operating segment.

Other revenue considerations

The Company generally provides warranties that its products will function as intended. GCP accrues a general warranty liability at the time of sale based on historical experience and on a transaction-specific basis according to individual facts and circumstances.

The Company accepts returns for certain products sales. These returns are at the discretion of the Company and typically are only granted within six months from the date of sale. GCP accrues for these returns at the time of the sale based on historical experience and records them as a reduction of transaction price.

Certain long-term agreements with customers may include one-time, upfront payments made to customers. GCP defers these costs and recognizes them as assets which get amortized over the term of the agreement as a reduction of gross sales.

Certain customer arrangements include conditions for volume rebates. GCP records a rebate allowance and reduces transaction price for anticipated selling price adjustments at the time of sale. GCP regularly reviews and estimates rebate accruals based on actual and anticipated sales patterns. The Company also evaluates contracts with customers that contain early payment discounts and reduces transaction price by the amount not expected to be collected due to such discounts in any given period.

Notes to Consolidated Financial Statements (unaudited) - Continued

The Company does not include any taxes (i.e. sales, use, value added and some excise taxes) in the transaction price that is allocated among its products or services. The Company has elected to account for shipping and handling costs as fulfillment activities under the provisions of Topic 606 allowing it to continue its current treatment of the associated revenue and costs under the new standard. GCP expenses shipping and handling costs in the period they are incurred and presents them within "Cost of goods sold" in the accompanying unaudited Consolidated Statements of Operations.

The Company’s revenue is principally recognized as goods and services are delivered and performance obligations are satisfied upon delivery. The Company has certain long-term arrangements resulting in remaining obligations for which the work has not been performed or has been partially performed. As of June 30, 2018, the aggregate amount of the transaction price allocated to remaining performance obligations was $4.3 million, including the estimated transaction price to be earned as revenue over the remaining term of these contracts, which is generally one to five years.

3. Inventories, net

Inventories are stated at the lower of cost or net realizable value. Cost is determined on a first-in, first-out ("FIFO") basis. GCP provides reserves for excess, obsolete or damaged inventories based on their expected selling price, net of completion and disposal costs.

The following is a summary of inventories presented on GCP's accompanying unaudited Consolidated Balance Sheets at June 30, 2018 and December 31, 2017:

|

| | | | | | | |

(In millions) | June 30,

2018 | | December 31,

2017 |

Raw materials | $ | 47.3 |

| | $ | 41.9 |

|

In process | 4.6 |

| | 3.5 |

|

Finished products and other | 62.9 |

| | 60.9 |

|

Total inventories, net | $ | 114.8 |

| | $ | 106.3 |

|

The "Finished products and other" category presented in the table above includes "other" inventories, which consist of finished products purchased rather than produced by GCP of $11.8 million and $11.1 million, respectively, as of June 30, 2018 and December 31, 2017.

Notes to Consolidated Financial Statements (unaudited) - Continued

4. Debt and Other Borrowings

Components of Debt

The following is a summary of obligations under senior notes and other borrowings at June 30, 2018 and December 31, 2017:

|

| | | | | | | |

(In millions) | June 30,

2018 | | December 31,

2017 |

5.5% Senior Notes due in 2026, net of unamortized debt issuance costs of $4.6 million at June 30, 2018 | $ | 345.4 |

| | $ | — |

|

9.5% Senior Notes due in 2023, net of unamortized debt issuance costs of $6.4 million at December 31, 2017 | — |

| | 518.6 |

|

Revolving credit facility due 2023(1) | — |

| | — |

|

Other borrowings(2) | 19.7 |

| | 25.7 |

|

Total debt | 365.1 |

| | 544.3 |

|

Less debt payable within one year | 18.4 |

| | 24.0 |

|

Debt payable after one year | $ | 346.7 |

| | $ | 520.3 |

|

Weighted average interest rates on total debt obligations | 5.7 | % | | 9.4 | % |

| |

(1) | Represents borrowings under the Revolving Credit Facility with an aggregate available principal amount of $350.0 million and $250.0 million as of June 30, 2018 and December 31, 2017, respectively. |

| |

(2) | Represents borrowings under various lines of credit and other borrowings, primarily by non-U.S. subsidiaries. |

The principal maturities of debt obligations outstanding, net of debt issuance costs, were as follows at June 30, 2018:

|

| | | | |

(In millions) | | |

Year ending December 31, | | Amount |

2018 | | $ | 18.4 |

|

2019 | | 0.9 |

|

2020 | | 0.5 |

|

2021 | | — |

|

2022 | | — |

|

Thereafter | | 345.3 |

|

Total debt | | $ | 365.1 |

|

Notes to Consolidated Financial Statements (unaudited) - Continued

Debt Refinancing

On April 10, 2018, GCP redeemed its then existing 9.5% Senior Notes with an aggregate principal amount of $525.0 million due in 2023 (the “9.5% Senior Notes”). On April 10, 2018, the Company also issued 5.5% Senior Notes with an aggregate principal amount of $350.0 million maturing on April 15, 2026 (the "5.5% Senior Notes") and amended its Credit Agreement to, among other things, (i) increase the aggregate principal amount available under its revolving credit facility to $350.0 million, (ii) extend the maturity date of the revolving credit facility thereunder to April 2023 and (iii) make certain other changes to the covenants and other provisions therein. Additionally, the Company borrowed $50.0 million in aggregate principal amount of revolving loans under the Credit Agreement on April 10, 2018 which was fully repaid during the second quarter of 2018. The aggregate cash payment of $587.9 million, which consisted of: (i) proceeds of $350.0 million from the issuance of the 5.5% Senior Notes, net of loan origination fees of $3.1 million, (ii) borrowings of $50.0 million under the Credit Agreement, and (iii) a cash payment of $191.0 million was used to redeem all of the then outstanding 9.5% Senior Notes in accordance with the terms of the indenture governing the 9.5% Senior Notes.

The redemption of the 9.5% Senior Notes was accounted for as a debt extinguishment in accordance with provisions of ASC Topic 470-50, Debt Modifications and Extinguishments. During the three and six months ended June 30, 2018, GCP recognized a loss on debt extinguishment of $59.4 million which was included in "Interest expense and related financing costs" in the accompanying unaudited Consolidated Statements of Operations. In connection with the redemption of the 9.5% Senior Notes with then outstanding principal balance of $525.0 million, GCP paid total cash proceeds of $587.9 million, including $53.3 million of a redemption premium and $9.6 million of accrued interest unpaid thereon through the redemption date, and wrote off $6.1 million of previously deferred debt issuance costs.

The amendment to the Credit Agreement among GCP and a syndicate of financial institutions resulted in an increase in a maximum borrowing capacity under the Revolving Credit Facility from $250.0 million to $350.0 million and extension of the maturity date to April 2023. During the three months ended June 30, 2018, GCP wrote off $0.4 million of deferred debt issuance costs related to a financial institution that exited the syndicate upon amendment of the Credit Agreement. As of June 30, 2018, debt issuance costs of $4.5 million related to the financial institutions that remained in the syndicate are presented within "Other assets" in the accompanying unaudited Consolidated Balance Sheets and amortized over the term of the Revolving Credit Facility.

Total loss recognized on the debt refinancing transaction was $59.8 million which was included in "Interest expense and related financing costs" in the accompanying unaudited Consolidated Statements of Operations and consisted of $59.4 million related to the extinguishment of the 9.5% Senior Notes and $0.4 million related to a deferred issuance costs write- off in connection with the amendment of the Credit Agreement.

5.5% Senior Notes

On April 10, 2018, GCP issued 5.5% Senior Notes with an aggregate principal amount of $350.0 million maturing on April 15, 2026. The 5.5% Senior Notes were issued at $346.9 million, or 99.1% of their par value, resulting in a discount of $3.1 million, or 0.9%, which represented loan origination fees paid at the closing. The Company incurred additional deferred financing costs of $1.6 million during the three months ended June 30, 2018. Interest is payable semi-annually in arrears on April 15 and October 15 of each year, commencing on October 15, 2018. An interest payment of $9.9 million is due and payable on October 15, 2018.

The 5.5% Senior Notes were issued pursuant to an Indenture (the “Indenture”), by and among GCP, the guarantors party thereto (the “Note Guarantors”) and Wilmington Trust, National Association, as trustee. The 5.5% Senior Notes and the related guarantees rank equally with all of the existing and future unsubordinated indebtedness of GCP and the Note Guarantors and senior in right of payment to any existing and future subordinated indebtedness of GCP and the Note Guarantors. The 5.5% Senior Notes and related guarantees are effectively subordinated to any secured indebtedness of GCP or the Note Guarantors, as applicable, to the extent of the value of the assets securing such indebtedness and structurally subordinated to all existing and future indebtedness and other liabilities of GCP’s non-guarantor subsidiaries.

Notes to Consolidated Financial Statements (unaudited) - Continued

Subject to certain conditions stated in the Indenture, GCP may, at its option and at any time and from time to time prior to April 15, 2021, redeem the 5.5% Senior Notes in whole or in part at a redemption price equal to: (i) 100% of their principal amount redeemed, plus (ii) the applicable premium, as defined in the Indenture, plus (iii) accrued and unpaid interest, if any, to, but excluding, the applicable redemption date. In addition, GCP may, at its option, redeem up to 40% of the outstanding principal amount of the 5.5% Senior Notes at any time and from time to time prior to April 15, 2021 with the net cash proceeds from certain equity offerings at a redemption price equal to: (i) 105.5% of the principal amount redeemed, plus (ii) accrued and unpaid interest, if any, to, but excluding, the applicable redemption date. At any time and from time to time on or after April 15, 2021, GCP may, at its option, redeem the 5.5% Senior Notes in whole or in part at the redemption price equal: (i) 102.8% of the par value if redeemed after April 15, 2021, (ii) 101.4% of the par value if redeemed after April 15, 2022, and (iii) 100.0% of the par value if redeemed after April 15, 2023 and thereafter. Upon occurrence of a change of control, as defined in the Indenture, GCP will be required to make an offer to repurchase the 5.5% Senior Notes at a price equal to 101.0% of their aggregate principal amount repurchased plus accrued and unpaid interest, if any, to, but excluding, the date of repurchase.

The Indenture contains covenants that limit the ability of GCP and its subsidiaries, subject to certain exceptions and qualifications set forth therein, to (i) create or incur liens on certain assets, (ii) incur additional debt, (iii) make certain investments and acquisitions, (iv) consolidate, merge, or convey, transfer, or lease all or substantially all of their assets, (v) sell certain assets, (vi) pay dividends on or make distributions in respect of GCP’s capital stock or make other restricted payments, (vii) enter into certain transactions with GCP’s affiliates and (viii) place restrictions on distributions from and other actions by subsidiaries. As of June 30 2018, the Company was in compliance with all covenants and conditions under the Indenture.

The Indenture provides for customary events of default which are subject in certain cases to customary grace periods and include, among others: (i) nonpayment of principal or interest, (ii) breach of other agreements in the Indenture, (iii) failure to pay certain other indebtedness, (iv) certain events of bankruptcy or insolvency, (v) failure to discharge final judgments aggregating in excess of $50.0 million rendered against GCP or certain of its subsidiaries, (vi) and failure of the guarantee of the 5.5% Senior Notes by any of GCP’s significant subsidiaries to be in full force and effect. There are no events of default under the Indenture as of June 30, 2018.

Credit Agreement

On February 3, 2016, GCP entered into a Credit Agreement that provides for senior secured credit facilities (the “Credit Facilities”) in an aggregate principal amount of $525.0 million, which consisted of: (i) the term loan (the "Term Loan") with an aggregate principal amount of $275.0 million and (ii) a revolving credit facility (the "Revolving Credit Facility") of $250.0 million due in 2021. During 2017, the Company fully repaid the outstanding principal balance on the Term Loan together with accrued and unpaid interest and extinguished the Term Loan under the Credit Agreement.

On April 10, 2018, GCP entered into an amendment to its Credit Agreement and borrowed $50.0 million in aggregate principal amount of revolving loans under the Credit Agreement, as discussed above, which was fully repaid prior to June 30, 2018.

The Credit Agreement contains conditions that would require mandatory principal payments in advance of the maturity date of the Revolving Credit Facility, as well as certain customary affirmative and negative covenants and events of default, as described in Note 5, "Debt and Other Financial Instruments," to the Company's Consolidated Financial Statements included in the 2017 Annual Report in the Form 10-K. The Company was in compliance with all covenant terms as of June 30, 2018 and December 31, 2017. There are no events of default as of June 30, 2018 and December 31, 2017.

The Revolving Credit Facility is secured on a first priority basis by a perfected security interest in, and mortgages on substantially all U.S. tangible and intangible personal property, financial assets and real property owned by the Company in Chicago, Illinois and Mount Pleasant, Tennessee; a pledge of 100% of the equity of each material U.S. subsidiary of the Company; and 65% of the equity of a U.K. holding company.

Notes to Consolidated Financial Statements (unaudited) - Continued

The interest rate per annum applicable to the Revolving Credit Facility is equal to, at GCP’s option, either: (i) a base rate plus a margin ranging from 0.5% to 1.0%, or (ii) LIBOR plus a margin ranging from 1.5% to 2.0%, based upon the total leverage ratio of GCP and its restricted subsidiaries in both scenarios. During the three months ended June 30, 2018, the weighted average interest rate paid on the Revolving Credit Facility was 3.4%. During the three months ended June 30, 2018, GCP made aggregate payments of $50.0 million on the Revolving Credit Facility. As of June 30, 2018, there were no outstanding borrowings on the Revolving Credit Facility and approximately $7.0 million in outstanding letters of credit, which resulted in available credit of $343.0 million under the Revolving Credit Facility. As of December 31, 2017, there were no outstanding borrowings under the Revolving Credit Facility. During each of the three and six months ended June 30, 2018, interest payment made on the Revolving Credit Facility was $0.2 million.

9.5% Senior Notes

On January 27, 2016, GCP issued $525.0 million aggregate principal amount of 9.5% Senior Notes maturing in 2023. Interest was payable semi-annually in arrears on February 1 and August 1 of each year. The 9.5% Senior Notes became callable at a premium over their face amount on February 1, 2019 and were redeemable prior to February 1, 2019 at a price that reflected a yield to the first call that was equivalent to the applicable Treasury bond yield plus 0.5 percentage points.

On April 10, 2018, GCP redeemed all of the then outstanding 9.5% Senior Notes, as described above, and paid $9.6 million of accrued interest unpaid thereon through their redemption date.

The 9.5% Senior Notes were subject to covenants that limited GCP's and certain of its subsidiaries’ ability, subject to certain exceptions and qualifications, to (i) create or incur liens on assets; (ii) incur additional debt; (iii) sell certain assets; and (iv) make certain investments and acquisitions, merge or sell or otherwise dispose of all or substantially all assets.

Debt Issuance Costs

GCP recognizes expenses directly associated with obtaining the Revolving Credit Facility as debt issuance costs which are presented within "Other assets" in the accompanying unaudited Consolidated Balance Sheets. Such costs are amortized over the term of the Revolving Credit Facility and included in “Interest expense and related financing costs” in the accompanying unaudited Consolidated Statements of Operations. Debt issuance costs related to the Revolving Credit Facility were $4.5 million as of June 30, 2018 and $3.2 million as of December 31, 2017. During the three months ended June 30, 2018, GCP wrote off $0.4 million of previously deferred debt issuance costs related to a financial institution that exited the syndicate upon amendment of the Credit Agreement. During the three months ended June 30, 2018, GCP incurred debt issuance costs of $2.2 million related to the Revolving Credit Facility upon amendment of the Credit Agreement.

Debt issuance costs of $4.7 million, including loan origination fees of $3.1 million paid at the closing, are directly associated with obtaining the 5.5% Senior Notes and presented as a reduction of the principal balance in the accompanying unaudited Consolidated Balance Sheets. Such costs are amortized over the term of the 5.5% Senior Notes using the effective interest rate method and included in “Interest expense and related financing costs” in the accompanying unaudited Consolidated Statements of Operations. At June 30, 2018, debt issuance costs related to the 5.5% Senior Notes were $4.6 million.

During the three months ended June 30, 2018, GCP wrote off $6.1 million of previously deferred debt issuance costs related to the 9.5% Senior Notes in connection with their redemption.

Notes to Consolidated Financial Statements (unaudited) - Continued

Debt Fair Value

At June 30, 2018, the carrying amounts and fair values of GCP's debt were as follows:

|

| | | | | | | | | | | | | | | |

| June 30, 2018 | | December 31, 2017 |

(In millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

9.5% Senior Notes due in 2023 | $ | — |

| | $ | — |

| | $ | 518.6 |

| | $ | 584.5 |

|

5.5% Senior Notes due in 2026 | 345.4 |

| | 344.2 |

| | — |

| | — |

|

Other borrowings | 19.7 |

| | 19.7 |

| | 25.7 |

| | 25.7 |

|

Total debt | $ | 365.1 |

| | $ | 363.9 |

| | $ | 544.3 |

| | $ | 610.2 |

|

Fair value is determined based on Level 2 inputs, including expected future cash flows discounted at market interest rates, estimated current market prices and quotes from financial institutions. The decrease in fair value as of June 30, 2018 was primarily due to the call rates defined in the bond redemption schedule.

5. Income Taxes

The income tax (benefit) expense attributable to continuing operations during the three months ended June 30, 2018 and 2017 was ($5.3 million) and $6.6 million, respectively, representing effective tax rates of 15.4% and 82.5%, respectively. The difference between the provision for income taxes at the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the three months ended June 30, 2018 is primarily attributable to the effect of tax rates in foreign jurisdictions of $0.7 million, state taxes of $0.4 million and permanent book to tax differences of $0.8 million. The difference in income tax at the U.S. federal income tax rate of 35.0% versus actual for the three months ended June 30, 2017 was primarily due to $4.6 million of tax expense on undistributed foreign earnings.

The income tax expense attributable to continuing operations during the six months ended June 30, 2018 and 2017 was $8.2 million and $18.2 million, respectively, representing effective tax rates of (23.7)% and (337.0)%, respectively. The difference between the provision for income taxes at the U.S. federal income tax rate of 21.0% and GCP’s overall income tax rate for the six months ended June 30, 2018 is primarily attributable to first quarter changes in estimate related to the 2017 Tax Act in the amount of $12.5 million, as well as the effect of valuation allowances of $1.0 million, tax rates in foreign jurisdictions of $0.7 million, state taxes $0.4 million and permanent book to tax differences of $0.8 million. The difference in income tax at the U.S. federal income rate of 35.0% versus actual for the six months ended June 30, 2017 was primarily due to income tax valuation allowance of $13.9 million and $6.5 million of tax expense on undistributed foreign earnings.

During the three and six months ended June 30, 2018, GCP recorded income tax expense attributable to discontinued operations of $0.7 million and $7.9 million, and in 2017 $2.1 million and $0.3 million, respectively. Please refer to Note 15, "Discontinued Operations," to the accompanying unaudited Consolidated Financial Statements for further details regarding the Darex transaction.

Tax Reform

During the year ended December 31, 2017, the Company recorded a provisional net charge of $81.7 million related to the provisions of the 2017 Tax Act, which was comprised of a $70.5 million Transition Toll Tax and an $11.2 million revaluation of net deferred tax assets. Changes in tax rates and tax laws are accounted for in the period of enactment.

During the three and six months ended June 30, 2018, the Company recorded an increase to the provisional net charge related to the 2017 Tax Act provisions of $0.0 million and $12.5 million, respectively. This change consisted of a decrease of $5.2 million related to the 2017 Transition Toll Tax, an increase of $17.4 million related to capital gain treatment triggered in 2017 due to the 2017 Tax Act, and an increase of $0.3 million deferred tax expense related to executive compensation, all recorded during the first quarter. There were no adjustments to the provisional net charge recorded during the second quarter of 2018.

Notes to Consolidated Financial Statements (unaudited) - Continued

The Company's preliminary estimate of the Transition Toll Tax and the remeasurement of its deferred tax assets and liabilities is subject to the finalization of management’s analysis related to certain matters, such as developing interpretations of the provisions of the 2017 Tax Act, changes to certain estimates and amounts related to the earnings and profits of certain subsidiaries and the filing of the Company's tax returns. U.S. Treasury regulations, administrative interpretations or court decisions interpreting the 2017 Tax Act may require further adjustments and changes in our estimates.

The 2017 final determination of the Transition Toll Tax and remeasurement of our deferred assets and liabilities will be completed as additional information becomes available, but no later than one year from the enactment of the 2017 Tax Act.

The 2017 Tax Act subjects a U.S. shareholder to tax on Global Intangible Low Taxed Income (GILTI) earned by foreign subsidiaries. The Company has not determined its accounting policy with respect to GILTI and has therefore included the estimate of current year GILTI as a period cost and included it as part of the estimated 2018 annual effective tax rate. The 2018 estimated annual effective tax rate also includes the 2018 impact of all other U.S. tax reform provisions that were effective on January 1, 2018.

For additional information related to the 2017 Tax Act, please refer to Note 6, "Income Taxes," to the Company's Consolidated Financial Statements included in the 2017 Annual Report on Form 10-K.

Repatriation

As of December 31, 2017, no provision has been made for income taxes on certain undistributed earnings of foreign subsidiaries the Company provisionally intends to permanently reinvest or that may be remitted substantially tax-free. Due to the transition tax on deemed repatriation required by the 2017 Tax Act, the Company has been subject to tax on substantially all of its previously undistributed earnings from foreign subsidiaries, which it provisionally recorded in the fourth quarter of 2017. Beginning in 2018, the Act will generally provide a 100% deduction for U.S. federal tax purposes of all dividends received by the Company from its foreign subsidiaries. However, the Company is currently evaluating the potential foreign and U.S. state tax liabilities that would result from future repatriations, if any, and how the 2017 Tax Act will affect the Company's existing accounting position with regard to its indefinite reinvestment of undistributed foreign earnings assertion. The Company expects to complete this evaluation and determine the impact the legislation may have on its indefinite reinvestment assertion within the measurement period provided by SAB 118.

During the three and six months ended June 30, 2017, GCP determined it could no longer assert it was indefinitely reinvested in Mexico and Venezuela because these entities were anticipated to be sold as part of the Darex transaction. The tax associated with its outside book and tax basis differences in Mexico and Venezuela was recorded during the quarters as a discrete item resulting in a tax expense of $4.6 million and $6.5 million, respectively.

GCP will continually analyze and evaluate its cash needs to determine the appropriateness of its indefinite reinvestment assertion, including further assessment under the 2017 Tax Act. The Company considers its assertion of indefinite reinvestment provisional as of June 30, 2018.

Valuation Allowance

In evaluating GCP's ability to realize its deferred tax assets, GCP considers all reasonably available positive and negative evidence, including recent earnings experience, expectations of future taxable income and the tax character of that income, the period of time over which temporary differences become deductible and the carryforward and/or carryback periods available to GCP for tax reporting purposes in the related jurisdiction. In estimating future taxable income, GCP relies upon assumptions and estimates about future activities, including the amount of future federal, state and foreign pretax operating income that GCP will generate; the reversal of temporary differences; and the implementation of feasible and prudent tax planning strategies. GCP records a valuation allowance to reduce deferred tax assets to the amount that it believes is more likely than not to be realized.

During the three and six months ended June 30, 2018, GCP incurred income tax expense of $0.2 million and $1.0 million related to changes in valuation allowance.

Notes to Consolidated Financial Statements (unaudited) - Continued

During the six months ended June 30, 2017, GCP determined it is more likely than not a portion of its deferred tax assets will not be realized. As a result, GCP recorded valuation allowances on those deferred tax assets during the period as discrete items, as they are significant, unusual and infrequent in nature. The allowances recorded relate to $4.3 million of U.S. foreign tax credit carryovers, $9.1 million of Brazil deferred tax assets, and $0.4 million of Turkey deferred tax assets, respectively, relating primarily to net operating loss carryovers. The determination to record the valuation allowances in the first quarter was made predominantly due to the anticipated sale of Darex and its impact on future taxable income and the ability to utilize those tax assets.

In connection with the Separation, GCP and Grace entered into various agreements that govern the relationship between the parties going forward, including a tax matters agreement (the "Tax Sharing Agreement"). Under the Tax Sharing Agreement, which was entered into on the distribution date, GCP and Grace will indemnify and hold each other harmless in accordance with the principles outlined therein.

During the six months ended June 30, 2017, GCP reached a proposed favorable settlement with the Canada Revenue Agency for tax years 2007 through 2015. As a result, a tax benefit of $1.5 million, primarily for an anticipated refund of previously paid tax, was recorded during the period. GCP is required to pay Grace for the amount of the expected tax refund pursuant to the Tax Sharing Agreement. GCP also recorded a charge to its U.S. deferred tax assets of $1.6 million related to the settlement due to the reduction of its step-up in tax basis. Both adjustments were recorded as discrete tax items. During the six months ended June 30, 2018, GCP filed amended tax returns with the Canada Revenue Agency reflecting the anticipated refunds.

As discussed in note 4, Debt and Other Borrowings, GCP recognized a loss during the three months ended June 30, 2018 of $59.8 million associated with its debt refinancing. Because this loss is unusual and infrequent in nature, the tax effect of the loss was recorded as a discrete tax item in the second quarter. The tax benefit recorded associated with the loss is $13.0 million.

6. Pension Plans and Other Postretirement Benefit Plans

Pension Plans

GCP sponsors certain defined benefit pension plans, primarily in the U.S. and the U.K., in which GCP employees participate. GCP records an asset or a liability to recognize the funded status of these pension plans in its accompanying unaudited Consolidated Balance Sheets.

The following table presents the funded status of GCP's overfunded, underfunded and unfunded defined pension plans related to continuing operations: |

| | | | | | | |

(In millions) | June 30,

2018 | | December 31,

2017 |

Overfunded defined benefit pension plans | $ | 26.3 |

| | $ | 26.4 |

|

Underfunded defined benefit pension plans | (25.2 | ) | | (26.6 | ) |

Unfunded defined benefit pension plans | (30.9 | ) | | (30.5 | ) |

Total underfunded and unfunded defined benefit pension plans | (56.1 | ) | | (57.1 | ) |

Pension liabilities included in other current liabilities | (1.1 | ) | | (1.0 | ) |

Net funded status | $ | (30.9 | ) | | $ | (31.7 | ) |

Overfunded plans include several advance-funded plans for which the fair value of the plan assets exceeds the projected benefit obligation (the "PBO"). The overfunded status is reflected as assets in "Overfunded defined benefit pension plans" in the accompanying unaudited Consolidated Balance Sheets. Underfunded plans include a group of advance-funded plans that are underfunded on a PBO basis. Unfunded plans include several plans that are funded on a pay-as-you-go basis, and therefore, the entire PBO is unfunded. As of June 30, 2018 and December 31, 2017, the underfunded and unfunded plans are included as liabilities in the accompanying unaudited Consolidated Balance Sheets.

Notes to Consolidated Financial Statements (unaudited) - Continued

During the three months ended June 30, 2018, the Company amended a defined benefit pension plan at one non-U.S. location resulting in a curtailment gain of $0.1 million and a mark-to-market remeasurement gain of $0.3 million. During the three months ended June 30, 2017, certain pension plans were curtailed and/or terminated resulting in a curtailment gain of $5.1 million and a mark-to-market gain of $0.1 million. These amounts are presented in "Other income, net" in the accompanying unaudited Consolidated Statements of Operations for the three and six months ended June 30, 2018 and 2017, respectively.

Components of Net Periodic Benefit Cost

The components of GCP's net periodic benefit cost for the three and six months ended June 30, 2018 and 2017 are as follows:

|

| | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2018 | | 2017 |

| Pension | | | Pension |

(In millions) | U.S. | | Non-U.S. | | | U.S. | | Non-U.S. |

Service cost | $ | 2.0 |

| | $ | 0.8 |