Exhibit 99.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2018 (January 4, 2018)

GLOBAL PARTNER ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37523 | 47-4078206 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S.

Employer Identification Number) |

1 Rockefeller Plaza, 11th Floor New York, New York |

10020 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (917) 244-4880

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 8, 2018, Global Partner Acquisition Corp. (the “Company” or “GPAC”) entered into Amendment No. 1 (the “Amendment”) to the Agreement and Plan of Merger, dated as of November 2, 2017 (the “Merger Agreement”), by and among PRPL Acquisition, LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company (“Merger Sub”), Purple Innovation, LLC, a Delaware limited liability company (“Purple”), InnoHold, LLC, a Delaware limited liability company and the sole equity holder of Purple, and Global Partner Sponsor I LLC, solely in its capacity thereunder as the representative of GPAC after the consummation of the transactions contemplated by the Merger Agreement. Pursuant to the Merger Agreement, the Company will acquire Purple’s business through a merger of Merger Sub with and into Purple, with Purple being the survivor in the merger (the “Business Combination,” and together with the other transactions contemplated by the Merger Agreement (the “Transactions”).

The Amendment modifies the Merger Agreement to, among other things, change the definition of: (i) “Enterprise Value” from $900,000,000 to $500,000,000, subject to certain adjustments set forth under the Merger Agreement, (ii) “Minimum Cash” to $100,000,000 or such other amount as the Company and Purple may agree in writing on or prior to the closing of the Business Combination, and (iii) “Post-Closing Parent Cash” to $40,000,000 or such other amount as the Company and Purple may agree in writing on or prior to the closing of the Business Combination. In addition, the Amendment extends the date by which the parties are required to close the Business Combination to February 5, 2018 or such later date as permitted by the Company’s amended and restated certificate of incorporation, as amended, but not later than May 6, 2018. The Amendment also includes changes to the forms of the Company’s second amended and restated certificate of incorporation and the Agreement to Assign Sponsor Warrants, which are set forth as Exhibit D-1 and Exhibit O, respectively, of the Merger Agreement.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached as Exhibit 2.1 hereto, and is incorporated herein by reference. For the full text and a detailed discussion of the Merger Agreement, see the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on November 3, 2017.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 4, 2018, the Company received written notice (the “Notice”) from the Listing Qualifications Department (the “Staff”) of The NASDAQ Stock Market LLC (“Nasdaq”) indicating that, based upon the Company’s non-compliance with Nasdaq Listing Rule 5620(a), which requires an issuer to hold an annual meeting of shareholders no later than one year after the end of the Company's fiscal year-end (the “Annual Meeting Rule”), the Company would be required to submit a plan to regain compliance with the Annual Meeting Rule for the Staff’s consideration by no later than February 20, 2018. The Notice has no immediate impact on the listing of or trading in the Company’s securities on Nasdaq.

The Company intends to timely submit a compliance plan for the Staff’s review. If the Staff accepts the plan, the Staff may grant the Company an extension of up to 180 calendar days from the Company’s fiscal year end, or until June 29, 2018, to evidence compliance with the Annual Meeting Rule. If the Staff does not accept the Company’s plan, the Company would be entitled to request a hearing, at which hearing it would present its plan to a Nasdaq Hearings Panel and request the continued listing of its securities on Nasdaq pursuant to and pending the completion of such plan. During the pendency of the hearing process, the Company’s securities would continue to be listed on Nasdaq.

| 1 |

Item 7.01 Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is an updated investor presentation (the “Investor Presentation”) that will be used by the Company in making presentations to certain of its stockholders and other persons with respect to the Business Combination.

The Investor Presentation is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On January 8, 2018, the Company issued a joint press release with Purple announcing the execution of the Amendment. The joint press release of the Company and Purple is attached as Exhibit 99.2 hereto and is incorporated into this Item 8.01 by reference.

Forward-Looking Statements

Certain statements made herein are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “may”, “seek,” “target” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include the timing of the Business Combination; the ability of GPAC and Purple to consummate the Transactions; the business plans, objectives, expectations and intentions of the parties once the Transactions are complete; and GPAC’s and Purple’s future results of operations, business strategies, competitive position, industry environment and potential growth opportunities. These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, our actual results may differ materially from our expectations or projections.

The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; the outcome of any legal proceedings that may be instituted against Purple or GPAC following the announcement of the proposed Business Combination and the other Transactions contemplated thereby; the inability to complete the proposed Business Combination or the other Transactions due to the failure to obtain approval of the stockholders of GPAC, or other conditions to closing in the Merger Agreement; the inability to maintain the listing of GPAC’s common stock and warrants on The NASDAQ Capital Market or any other stock exchange following the proposed Business Combination; the risk that the proposed Business Combination or the other Transactions may disrupt current plans and operations as a result of the announcement and consummation of the Transactions described herein; the inability to recognize the anticipated benefits of the proposed Business Combination or the other Transactions, which may be affected by, among other things, competition and the inability of the combined business to grow and manage growth profitably; Purple’s ability to execute its plans to develop and market new products and the timing and costs of these development programs; Purple’s estimates of the size of the markets for its products; the rate and degree of market acceptance of Purple’s products; the success of other competing cushioning and bedding technologies that exist or may become available; Purple’s ability to identify and integrate acquisitions; the performance of Purple’s products; rising costs adversely affecting Purple’s profitability; costs related to the proposed Business Combination or the other Transactions; the intense competition in the industry; the possibility that Purple or GPAC may be adversely affected by other economic, business, and/or competitive factors; the risk of loss of key personnel or inability to recruit talent; and other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the SEC by GPAC and Purple.

| 2 |

Additional information concerning these and other factors that may impact our expectations and projections can be found in our periodic filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in the preliminary proxy statement and, when available, the definitive proxy statement, filed by GPAC with the SEC. Our SEC filings are available publicly on the SEC’s website at www.sec.gov. GPAC and Purple disclaim any obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Additional Information about the Transactions and Where to Find It

In connection with the Business Combination and the other Transactions, GPAC will file preliminary and definitive proxy statements with the SEC and will mail a definitive proxy statement and other relevant documents to its stockholders. Investors and security holders of GPAC are advised to read the preliminary proxy statement, and amendments thereto, and, when available, the definitive proxy statement, in connection with GPAC’s solicitation of proxies for its stockholders’ meeting to be held to approve the Business Combination and the other Transactions because the proxy statements will contain important information about the Business Combination and the other Transactions and the parties to it. The definitive proxy statement will be mailed to stockholders of GPAC as of a record date to be established for voting on the Business Combination and the other Transactions. Stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to: Global Partner Acquisition Corp., c/o Andrew Cook, 1 Rockefeller Plaza, 11th Floor, New York, New York 10020, e-mail: info@globalpartnerac.com.

Participants in the Solicitation

GPAC, Purple, and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of GPAC stockholders in connection with the Business Combination and the other Transactions. Information regarding the participants is available in the preliminary proxy statement filed by GPAC with the SEC on December 15, 2017. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is contained in the preliminary proxy statement, which can be obtained free of charge from the sources indicated above.

Disclaimer

This report shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Item 9.01 Financial Statements and Exhibits.

We incorporate by reference herein the Exhibit Index following the signature page to this Current Report on Form 8-K.

| 3 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 8, 2018

| GLOBAL PARTNER ACQUISITION CORP. | ||

| By: | /s/ Paul Zepf | |

| Name: Paul Zepf | ||

| Title: Chief Executive Officer | ||

| 4 |

EXHIBIT INDEX

5

Exhibit 2.1

FIRST AMENDMENT TO MERGER AGREEMENT

This First Amendment (this “Amendment”), dated as of January 8, 2018 to the Agreement and Plan of Merger dated as of November 2, 2017 by and among Global Partner Acquisition Corp., a Delaware corporation (“Parent”), (ii) PRPL Acquisition, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Parent (“Merger Sub”), (iii) Purple Innovation, LLC., a Delaware limited liability company (“Company”), (iv) InnoHold, LLC, a Delaware limited liability company (“InnoHold”), and (v) Global Partner Sponsor I LLC, a Delaware limited liability company, in the capacity as the representative of the Parent (the “Parent Representative”) (the “Merger Agreement”). Parent, Merger Sub, Company, InnoHold and Parent Representative are hereinafter sometimes individually referred to as a “Party” and collectively, as the “Parties.”

WITNESSETH:

| A. | The Parties are each signatories to the Merger Agreement; and |

| B. | The Parties desire to amend the Merger Agreement as provided for herein, with the effect that the Merger shall be undertaken on and subject to terms and subject to the conditions set forth in the Merger Agreement and this Amendment and otherwise in accordance with Delaware law. |

NOW, THEREFORE, in consideration of the premises set forth above, which are incorporated in this Amendment as if fully set forth below, and the representations, warranties, covenants and agreements contained in the Merger Agreement, and intending to be legally bound hereby, and in accordance with Section 9.3 of the Merger Agreement, the Parties hereby agree to amend the Merger Agreement as follows:

| 1. | Unless otherwise expressly defined herein, all capitalized terms used in this Amendment shall have the same meaning as they are defined in the Merger Agreement. |

| 2. | Paragraph (b)(ii) of Section 5.2 of the Merger Agreement is hereby amended to read in its entirety as follows: |

“(ii) except for the issuance of additional shares of common stock of the Parent, authorize for issuance, issue, grant, sell, pledge, dispose of or propose to issue, grant, sell, pledge or dispose of any of its equity securities or any options, warrants, commitments, subscriptions or rights of any kind to acquire or sell any of its equity securities, or other securities, including any warrants and any other securities convertible into or exchangeable for any of its equity securities or other security interests of any class and any other equity-based awards, or engage in any hedging transaction with a third Person with respect to such securities;”

| 1 |

| 3. | The final sentence in Section 6.2 of the Merger Agreement is hereby deleted in its entirety and replaced by the following: |

“Notwithstanding anything to the contrary contained in this Agreement, the Parent shall be entitled to postpone or adjourn the Parent Stockholder Meeting (a) to ensure that any supplement or amendment to the Proxy Statement that the board of directors of Parent has determined in good faith is required by applicable Law is disclosed to the Parent Stockholders and for such supplement or amendment to be promptly disseminated to the Parent Stockholders prior to the Parent Stockholder Meeting, (b) if, as of the time for which the Parent Stockholder Meeting is originally scheduled (as set forth in the Proxy Statement), there are insufficient shares of Parent Common Stock represented (either in person or by proxy) to constitute a quorum necessary to conduct the business to be conducted at the Parent Stockholder Meeting, or (c) by ten (10) Business Days in order to solicit additional proxies from stockholders in favor of the adoption of the Required Approval Matters; provided, that in the event of a postponement or adjournment pursuant to clauses (a) or (b) above, the Parent Stockholder Meeting shall be reconvened as promptly as practicable following such time as the matters described in such clauses have been resolved, and in no event shall the Parent Stockholder Meeting be reconvened on a date that is later than February 5, 2018 or such later date as the Parent may be permitted to consummate an initial Business Combination pursuant to its Amended and Restated Certificate of Incorporation, as may be amended from time to time, but in no event later than May 6, 2018.”

| 4. | Section 7.1(f) of the Merger Agreement is hereby deleted in its entirety and is replaced by the provision set forth below: |

“(f) Minimum Cash. At Closing, the Net Parent Cash shall be no less than One Hundred Million Dollars ($100,000,000) or such other amount as the Parent and the Company may agree in writing on or prior to the Closing (“Minimum Parent Cash”).”

| 5. | Section 9.1(b) of the Merger Agreement is hereby amended by deleting the date “January 31, 2018” in such section and substituting in its place “February 5, 2018 or such later date as the Parent may be permitted to consummate an initial Business Combination pursuant to its Amended and Restated Certificate of Incorporation, as may be amended from time to time, but in no event later than May 6, 2018.” |

| 6. | The following definitions set forth in Section 10.14 of the Merger Agreement are hereby deleted in their entirety replaced by the definitions set forth below: |

| a. | The term “Enterprise Value” is amended to read in its entirety as follows: |

“Enterprise Value” shall mean Five Hundred Million Dollars ($500,000,000); provided, however, that if on or prior to the Closing the Company markets or consummates a Permitted Transaction in which the aggregate enterprise value of the Company (including any private company discount) shall be less than Five Hundred Million Dollars ($500,000,000), the Enterprise Value of the Company, for the purposes of determining the Merger Consideration, shall be reduced dollar for dollar by the amount that such enterprise value in the Permitted Transaction is less than the Five Hundred Million Dollars ($500,000,000).”

| b. | The term “Post-Closing Parent Cash” is amended to read in its entirety as follows: |

“Post-Closing Parent Cash” shall mean $40,000,000 or such other amount as the Parent and the Company may agree in writing on or prior to the Closing.”

| 2 |

| 7. | The Parties hereto agree that, notwithstanding the provisions of Sections 6.10(a) and 7.2(j) of the Merger Agreement, the employment arrangements between the Company and Sam Bernards need not be amended or revised prior to the consummation of the Business Combination. |

| 8. | The Form of Amended and Restated Certificate of Incorporation of the Parent attached to the Merger Agreement as Exhibit D-1 is hereby deleted and replaced in its entirety by Exhibit D-1 annexed hereto. |

| 9. | The Agreement to Assign Sponsor Warrants attached to the Merger Agreement as Exhibit O is hereby deleted and is replaced in its entirety by Exhibit O annexed hereto. |

| 10. | Except as expressly provided in this Amendment, all of the terms and provisions in the Merger Agreement and the Related Agreements are and shall remain in full force and effect, on the terms and subject to the conditions set forth therein. This Amendment does not constitute, directly or by implication, an amendment, modification or waiver of any provision of the Merger Agreement or any Related Agreement, or any other right, remedy, power or privilege of any party to the Merger Agreement, except as expressly set forth herein. Any reference to the Merger Agreement in the Merger Agreement or any other agreement, document, instrument or certificate entered into or issued in connection therewith shall hereinafter mean the Merger Agreement, as amended or modified, or the provisions thereof waived, by this Amendment (or as the Merger Agreement may be further amended or modified after the date hereof in accordance with the terms thereof). The Merger Agreement, as amended and modified by this Amendment, and the documents or instruments attached hereto or referenced herein, constitutes the entire agreement between the parties with respect to the subject matter of the Merger Agreement, as amended by this Closing Agreement, and supersedes all prior agreements and understandings, both oral and written, between the parties with respect to its subject matter. The provisions of Article X of the Merger Agreement are hereby incorporated herein by reference and apply to this Amendment as if all references to the “Agreement” contained therein were instead references to this Amendment. |

| 3 |

IN WITNESS WHEREOF, each Party hereto has caused this Amendment to be signed and delivered by its respective duly authorized officer as of the date first above written.

[Signature Page to First Amendment to Merger Agreement]

| GLOBAL PARTNER ACQUISITION CORP. | ||

| By: | /s/ Paul Zepf | |

| Name: Paul Zepf | ||

| Title: Chief Executive Officer | ||

| PURPLE INNOVATION, LLC | ||

| By: | /s/ Sam Bernards | |

| Name: Sam Bernards | ||

| Title: Chief Executive Officer | ||

| PRPL ACQUISITION LLC | ||

| By: | Global Partner Acquisition Corp., its sole member | |

| By: | /s/ Paul Zepf | |

| Name: Paul Zepf | ||

| Title: Chief Executive Officer | ||

| GLOBAL PARTNER SPONSOR I LLC, solely in its capacity as the Parent Representative | ||

| By: | /s/ Paul Zepf | |

| Name: Paul Zepf | ||

| Title: Manager | ||

| INNOHOLD, LLC | ||

| By: | /s/ Terry Pearce | |

| Name: Terry Pearce | ||

| Title: Manager | ||

| By: | /s/ Tony Pearce | |

| Name: Tony Pearce | ||

| Title: Manager | ||

EXHIBIT D-1

Form of Amended and Restated Certificate of Incorporation of the Parent

SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

GLOBAL PARTNER ACQUISITION CORP.

[●], 2018

Global Partner Acquisition Corp., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), DOES HEREBY CERTIFY AS FOLLOWS:

1. The name of the Corporation is “Global Partner Acquisition Corp.”. The original certificate of incorporation was filed with the Secretary of State of the State of Delaware on May 19, 2015 (the “Original Certificate”).

2. The Original Certificate was restated, integrated and amended by the provisions of the Amended and Restated Certificate of Incorporation (the “First Amended and Restated Certificate”) which was duly adopted by the Board of Directors of the Corporation (the “Board”) and the stockholders of the Corporation in accordance with Sections 228, 242 and 245 of the General Corporation Law of the State of Delaware (as amended, the “DGCL”) on July 29, 2015.

3. This Second Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”) was duly adopted by the Board and the stockholders of the Corporation in accordance with Sections 242 and 245 of the DGCL.

4. This Amended and Restated Certificate integrates and amends and restates provisions of the First Amended and Restated Certificate. Certain capitalized terms used in this Amended and Restated Certificate are defined where appropriate herein.

5. The text of the First Amended and Restated Certificate, as amended, is hereby restated and amended in its entirety to read as follows:

ARTICLE I

NAME

The name of the Corporation is Purple Innovation, Inc.

ARTICLE II

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware (the “DGCL”). In addition to the powers and privileges conferred upon the Corporation by law and those incidental thereto, the Corporation shall possess and may exercise all the powers and privileges that are necessary or convenient to the conduct, promotion or attainment of the business or purposes of the Corporation.

| Ex D-1 |

ARTICLE III

REGISTERED AGENT

The address of the registered office of the Corporation in the State of Delaware is 2711 Centerville Road, Suite 400, Wilmington, DE 19808, New Castle County, and the name of the Corporation’s registered agent at such address is Corporation Service Company.

ARTICLE IV

CAPITALIZATION

Section 4.1 Authorized Capital Stock. The total number of shares of all classes of capital stock which the Corporation is authorized to issue is Three Hundred and Five Million (305,000,000) shares, consisting of (a) Two Hundred and Ten Million (210,000,000) shares of class A common stock, par value $0.0001 per share (the “Class A Common Stock”), (b) Ninety Million (90,000,000) shares of class B common stock, par value $0.0001 per share (the “Class B Common Stock” and, together with the Class A Common Stock, the “Common Stock”) and (c) Five Million (5,000,000) shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”). Subject to the rights of the holders of any one or more series of Preferred Stock then outstanding, the number of authorized shares of any of the Class A Common Stock, Class B Common Stock or Preferred Stock may be increased or decreased, in each case by the affirmative vote of the holders of a majority in voting power of the stock of the Corporation entitled to vote thereon irrespective of the provisions of Section 242(b)(2) of the General Corporation Law, and no vote of the holders of any of the Class A Common Stock, Class B Common Stock or Preferred Stock voting separately as a class will be required therefor. Notwithstanding the foregoing, the number of authorized shares of any particular class may not be decreased below the number of shares of such class then outstanding plus, in the case of Class A Common Stock, the number of shares of Class A Common Stock issuable in connection with (i) the exchange of Class B Common Stock and Class B Units (as defined in Article XI) pursuant to the Exchange Agreement (as defined in Article XI) and (ii) the exercise of outstanding options, warrants, exchange rights, conversion rights or similar rights for Class A Common Stock.

Section 4.2 Renaming of Existing Common Stock. Upon this Amended and Restated Certificate becoming effective pursuant to the DGCL, each share of the Corporation’s common stock, par value $0.0001 per share, issued and outstanding or held in treasury, shall automatically and without any action on the part of the holder thereof be renamed as and become one share of Class A Common Stock.

Section 4.3 Preferred Stock. The Preferred Stock may be issued from time to time in one or more series. The Board is hereby expressly authorized to provide for the issuance of shares of the Preferred Stock in one or more series and to establish from time to time the number of shares to be included in each such series and to fix the voting rights, if any, designations, powers, preferences and relative, participating, optional and other special rights, if any, of each such series and any qualifications, limitations and restrictions thereof, as shall be stated in the resolution or resolutions adopted by the Board providing for the issuance of such series and included in a certificate of designations (a “Preferred Stock Designation”) filed pursuant to the DGCL, and the Board is hereby expressly vested with the authority to the full extent provided by law, now or hereafter, to adopt any such resolution or resolutions.

| Ex D-2 |

Section 4.4 Common Stock.

(a) Voting Rights.

(1) Each holder of Class A Common Stock, as such, will be entitled to one vote for each share of Class A Common Stock held of record by the holder on all matters on which stockholders generally are entitled to vote.

(2) Each holder of Class B Common Stock, as such, will be entitled to one vote for each share of Class B Common Stock held of record by the holder on all matters on which stockholders are generally entitled to vote.

(3) Except as otherwise required by the DGCL or this Amended and Restated Certificate, the holders of Common Stock will vote together as a single class on all matters (or, if any holders of Preferred Stock are entitled to vote together with the holders of Common Stock, as a single class with the holders of such Preferred Stock).

(4) Except as otherwise required by law or this Amended and Restated Certificate (including any Preferred Stock Designation), at any annual or special meeting of the stockholders of the Corporation, the holders of the Common Stock shall have the exclusive right to vote for the election of directors and on all other matters properly submitted to a vote of the stockholders. Notwithstanding the foregoing, except as otherwise required by law or this Amended and Restated Certificate (including a Preferred Stock Designation), the holders of the Common Stock shall not be entitled to vote on any amendment to this Amended and Restated Certificate (including any amendment to any Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of the Preferred Stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to this Amended and Restated Certificate (including any Preferred Stock Designation) or the DGCL.

(b) Dividends and Distributions.

(1) Subject to the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of the Class A Common Stock shall be entitled to receive dividends and other distributions (payable in cash, property or capital stock of the Corporation) when, as and if declared thereon by the Board from time to time out of any assets or funds of the Corporation legally available therefor, and shall share equally on a per share basis in such dividends and distributions.

(2) Except as set forth in Section 4.4(b)(3) with respect to stock dividends, dividends and other distributions shall not be declared or paid on the Class B Common Stock.

| Ex D-3 |

(3) In no event will any stock dividends, stock splits, reverse stock splits, combinations of stock, reclassifications or recapitalizations be declared or made on any Class A Common Stock or Class B Common Stock, as the case may be, unless contemporaneously therewith (a) all shares of Class A Common Stock and Class B Common Stock at the time outstanding are treated in the same proportion and the same manner and (b) the stock dividend, stock split, reverse stock split, combination of stock, reclassification or recapitalization has been reflected in the same economically equivalent manner with respect to all Class A Units (as defined in Article XI) and Class B Units. Stock dividends with respect to Class A Common Stock may be paid only with Class A Common Stock. Stock dividends with respect to Class B Common Stock may be paid only with Class B Common Stock; provided, that the deemed transfer and retirement of shares of Class B Common Stock to the Corporation in accordance with terms and conditions of the Exchange Agreement shall not be a transaction subject to this Section 4.4(b)(3).

(c) Liquidation, Dissolution or Winding Up. Subject to the rights, if any, of the holders of any outstanding series of the Preferred Stock, and to the rights of the holders of Class B Common Stock to exchange their shares of Class B Common Stock and Class B Units for shares of Class A Common Stock in accordance with the Exchange Agreement (or for the consideration payable in respect of shares of Class A Common Stock in such voluntary or involuntary liquidation, dissolution or winding up), in the event of any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, after payment or provision for payment of the debts and other liabilities of the Corporation, the holders of (i) the Class A Common Stock shall be entitled to receive all the remaining assets of the Corporation available for distribution to its stockholders, ratably in proportion to the number of shares of the Class A Common Stock held by them, and (ii) the Class B Common Stock shall not be entitled to receive any amount of the remaining assets. Except as otherwise provided above with respect to the exchange rights of holders of the Class B Common Stock under the terms of the Exchange Agreement, the holders of shares of Class B Common Stock, as such, will not be entitled to receive, with respect to such shares, any assets of the Corporation, in the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

(d) Transfer of Class B Common Stock.

(1) A holder of Class B Common Stock may only transfer such Class B Common Stock (or a fraction thereof) to a transferee if the holder also transfers a corresponding number of Class B Units to the transferee (as such number may be adjusted to reflect equitably any stock split, subdivision, combination or similar change with respect to the Class B Units or Class B Common Stock).

(2) Any purported transfer of shares of Class B Common Stock in violation of the restriction described in Section 4.4(d)(1) (the “Restriction”) shall be null and void. If, notwithstanding the foregoing prohibition, a person shall, voluntarily or involuntarily, purportedly become or attempt to become, the purported owner (“Purported Owner”) of shares of Class B Common Stock in violation of the Restriction, then the Purported Owner shall not obtain any rights in and to such shares of Class B Common Stock (the “Restricted Shares”), and the purported transfer of the Restricted Shares to the Purported Owner shall not be recognized by the Corporation’s transfer agent (the “Transfer Agent”).

| Ex D-4 |

(3) Upon a determination by the Board that a person has attempted or may attempt to transfer or to acquire Restricted Shares in violation of the Restriction, the Board may take such action as it deems advisable to refuse to give effect to such transfer or acquisition on the books and records of the Corporation, including without limitation to cause the Transfer Agent to maintain the Purported Owner’s transferor as the record owner of the Restricted Shares, and to institute proceedings to enjoin or rescind any such transfer or acquisition.

(e) Legends. All certificates or book entries representing shares of Class B Common Stock (or fractions thereof), as the case may be, shall bear a legend substantially in the following form:

THE SECURITIES REPRESENTED BY THIS [CERTIFICATE][BOOK ENTRY] ARE SUBJECT TO THE RESTRICTIONS (INCLUDING RESTRICTIONS ON TRANSFER) SET FORTH IN THE CERTIFICATE OF INCORPORATION (A COPY OF WHICH IS ON FILE WITH THE SECRETARY OF THE CORPORATION AND SHALL BE PROVIDED FREE OF CHARGE TO ANY STOCKHOLDER MAKING A REQUEST THEREFOR).

(f) Fractional Shares. The Class B Common Stock may be issued and transferred in fractions of a share which shall entitle the holder to exercise voting rights and to have the benefit of all other rights of holders of Class B Common Stock. Subject to the Restriction, holders of shares of Class B Common Stock (or fractions thereof) shall be entitled to transfer fractions thereof and the Corporation shall, and shall cause any transfer agent with respect to the Class B Common Stock to, facilitate any such transfers, including by issuing certificates or making book entries representing any such fractional shares.

(g) Transfer Taxes. The issuance of shares of Class A Common Stock upon the exchange of Class B Common Stock and Class B Units under the terms of the Exchange Agreement will be made without charge to the holders of the shares of Class B Common Stock and of the Class B Units for any stamp or other similar tax in respect of the issuance, unless any such shares of Class A Common Stock are to be issued in a name other than that of the then record holder of the shares of Class B Common Stock and Class B Units being exchanged, in which case the Person or Persons requesting the issuance thereof will pay to the Corporation the amount of any tax that may be payable in respect of any transfer involved in the issuance or will establish to the reasonable satisfaction of the Corporation that the tax has been paid or is not payable.

Section 4.5 Rights and Options. The Corporation has the authority to create and issue rights, warrants and options entitling the holders thereof to purchase shares of any class or series of the Corporation’s capital stock or other securities of the Corporation, and such rights, warrants and options shall be evidenced by instrument(s) approved by the Board. The Board is empowered to set the exercise price, duration, times for exercise and other terms and conditions of such rights, warrants or options; provided, however, that the consideration to be received for any shares of capital stock subject thereto may not be less than the par value thereof.

| Ex D-5 |

ARTICLE V

BOARD OF DIRECTORS

Section 5.1 Board Powers. The business and affairs of the Corporation shall be managed by, or under the direction of, the Board. In addition to the powers and authority expressly conferred upon the Board by statute, this Amended and Restated Certificate or the Amended and Restated Bylaws (“Bylaws”) of the Corporation, the Board is hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation, subject, nevertheless, to the provisions of the DGCL, this Amended and Restated Certificate and any Bylaws adopted by the stockholders; provided, however, that no Bylaws hereafter adopted by the stockholders shall invalidate any prior act of the Board that would have been valid if such Bylaws had not been adopted.

Section 5.2 Number, Election and Term.

(a) The number of directors of the Corporation at the time this Amended and Restated Certificate of Incorporation becomes effective, until such time as such number may be changed pursuant to the succeeding sentence, shall be fixed at seven (7). The number of directors of the Corporation, other than those who may be elected by the holders of one or more series of the Preferred Stock voting separately by class or series, shall be fixed from time to time exclusively by the Board pursuant to a resolution adopted by a majority of the Whole Board. For purposes of this Amended and Restated Certificate, “Whole Board” shall mean the total number of directors the Corporation would have if there were no vacancies.

(b) A director shall hold office until the next annual meeting and until his or her successor has been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification or removal.

(c) Unless and except to the extent that the Bylaws shall so require, the election of directors need not be by written ballot.

Section 5.3 Newly Created Directorships and Vacancies. Newly created directorships resulting from an increase in the number of directors and any vacancies on the Board resulting from death, resignation, retirement, disqualification, removal or other cause may be filled solely by a majority vote of the remaining directors then in office, even if less than a quorum, or by a sole remaining director (and not by stockholders), and any director so chosen shall hold office for the remainder of the full term to which the new directorship was added or in which the vacancy occurred and until his or her successor has been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification or removal.

Section 5.4 Removal. Subject to Section 5.5 hereof, any or all of the directors may be removed from office at any time, with or without cause by the affirmative vote of holders of a majority of the voting power of all of the then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class.

| Ex D-6 |

Section 5.5 Preferred Stock — Directors. Notwithstanding any other provision of this Article V, and except as otherwise required by law, whenever the holders of one or more series of the Preferred Stock shall have the right, voting separately by class or series, to elect one or more directors, the term of office, the filling of vacancies, the removal from office and other features of such directorships shall be governed by the terms of such series of the Preferred Stock as set forth in this Amended and Restated Certificate (including any Preferred Stock Designation) and such directors shall not be included in any of the classes created pursuant to this Article V unless expressly provided by such terms.

ARTICLE VI

BYLAWS

In furtherance and not in limitation of the powers conferred upon it by law, the Board shall have the power to adopt, amend, alter or repeal the Bylaws. The affirmative vote of a majority of the Whole Board shall be required to adopt, amend, alter or repeal the Bylaws pursuant to the preceding sentence. The Bylaws also may be adopted, amended, altered or repealed by the stockholders; provided, however, that in addition to any vote of the holders of any class or series of capital stock of the Corporation required by law or by this Amended and Restated Certificate (including any Preferred Stock Designation), the affirmative vote of the holders of at least a majority of the voting power of all then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required for the stockholders to adopt, amend, alter or repeal the Bylaws, and provided further, however, that (i) no Bylaws hereafter adopted by the stockholders shall invalidate any prior act or the Board that would have been valid had such Bylaws not been adopted and (ii) any provision of the Bylaws which states that it may be changed by the unanimous vote of the entire or whole Board of Directors may only be changed by the Board by such vote.

ARTICLE VII

MEETINGS OF STOCKHOLDERS

Section 7.1 Meetings. Subject to the rights of the holders of any outstanding series of the Preferred Stock, and to the requirements of applicable law, special meetings of stockholders of the Corporation may be called only by the Chairman of the Board, Chief Executive Officer of the Corporation, or the Board pursuant to a resolution adopted by a majority of the Whole Board.

Section 7.2 Advance Notice. Advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner provided in the Bylaws.

Section 7.3 No Action by Written Consent. Any action required or permitted to be taken by the stockholders of the Corporation must be effected by a duly called annual or special meeting of such holders, and may not be effected by written consent of the stockholders.

| Ex D-7 |

ARTICLE VIII

LIMITED LIABILITY; INDEMNIFICATION

Section 8.1 Limitation of Director Liability. A director of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as the same exists or may hereafter be amended. Any amendment, modification or repeal of the foregoing sentence shall not adversely affect any right or protection of a director of the Corporation hereunder in respect of any act or omission occurring prior to the time of such amendment, modification or repeal.

Section 8.2 Indemnification and Advancement of Expenses.

(a) To the fullest extent permitted by applicable law, as the same exists or may hereafter be amended, the Corporation shall indemnify and hold harmless each person who is or was made a party or is threatened to be made a party to or is otherwise involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”) by reason of the fact that he or she is or was a director or officer of the Corporation or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust, other enterprise or nonprofit entity, including service with respect to an employee benefit plan (an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent, or in any other capacity while serving as a director, officer, employee or agent, against all liability and loss suffered and expenses (including, without limitation, attorneys’ fees, judgments, fines, ERISA excise taxes and penalties and amounts paid in settlement) reasonably incurred by such indemnitee in connection with such proceeding. The Corporation shall to the fullest extent not prohibited by applicable law pay the expenses (including attorneys’ fees) incurred by an indemnitee in defending or otherwise participating in any proceeding in advance of its final disposition; provided, however, that, to the extent required by applicable law, such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt of an undertaking, by or on behalf of the indemnitee, to repay all amounts so advanced if it shall ultimately be determined that the indemnitee is not entitled to be indemnified under this Section 8.2 or otherwise. The rights to indemnification and advancement of expenses conferred by this Section 8.2 shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators. Notwithstanding the foregoing provisions of this Section 8.2(a), except for proceedings to enforce rights to indemnification and advancement of expenses, the Corporation shall indemnify and advance expenses to an indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board.

(b) The rights to indemnification and advancement of expenses conferred on any indemnitee by this Section 8.2 shall not be exclusive of any other rights that any indemnitee may have or hereafter acquire under law, this Amended and Restated Certificate, the Bylaws, an agreement, vote of stockholders or disinterested directors, or otherwise.

| Ex D-8 |

(c) Any repeal or amendment of this Section 8.2 by the stockholders of the Corporation or by changes in law, or the adoption of any other provision of this Amended and Restated Certificate inconsistent with this Section 8.2, shall, unless otherwise required by law, be prospective only (except to the extent such amendment or change in law permits the Corporation to provide broader indemnification rights on a retroactive basis than permitted prior thereto), and shall not in any way diminish or adversely affect any right or protection existing at the time of such repeal or amendment or adoption of such inconsistent provision in respect of any proceeding (regardless of when such proceeding is first threatened, commenced or completed) arising out of, or related to, any act or omission occurring prior to such repeal or amendment or adoption of such inconsistent provision.

(d) This Section 8.2 shall not limit the right of the Corporation, to the extent and in the manner authorized or permitted by law, to indemnify and to advance expenses to persons other than indemnitees.

ARTICLE IX

AMENDMENT OF AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

The Corporation reserves the right to amend, alter, change or repeal any provision contained in this Amended and Restated Certificate (including any Preferred Stock Designation), in the manner now or hereafter prescribed by this Amended and Restated Certificate and the DGCL.

ARTICLE X

EXCLUSIVE FORUM

Section 10.1. Unless the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by law, be the sole and exclusive forum for any stockholder (including a beneficial owner) of the Corporation to bring (i) any derivative action, suit or proceeding brought or purporting to be brought on behalf of the Corporation, (ii) any action, suit or proceeding asserting a claim of breach of a fiduciary duty owed by any current or former director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, creditors or other constituents, (iii) any action, suit or proceeding asserting a claim against the Corporation or any of its current or former directors, officers or employees arising pursuant to any provision of the DGCL, this Amended and Restated Certificate or the Bylaws or as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware or (iv) any action, suit or proceeding asserting a claim against the Corporation or any of its current or former directors, officers or employees governed by the internal affairs doctrine, except for, as to each of clauses (i) through (iv), any claim as to which the Court of Chancery determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the indispensable party does not consent to the personal jurisdiction of the Court of Chancery within ten days following such determination), which is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery or for which the Court of Chancery does not have subject matter jurisdiction.

| Ex D-9 |

Section 10.2. Personal Jurisdiction. If any action the subject matter of which is within the scope of Section 10.1 immediately above is filed in a court other than a court located within the State of Delaware (a “Foreign Action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce Section 10.1 immediately above (an “Enforcement Action”) and (ii) having service of process made upon such stockholder in any such Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

Section 10.3. If any provision of this Article X shall be held to be invalid, illegal or unenforceable as applied to any person or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provision in any other circumstance to such person and of the remaining provisions of this Article X (including, without limitation, each portion of any sentence of this Article X containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) to such person, and the application of such provision to other persons and circumstances, shall not in any way be affected or impaired thereby. Any person purchasing or otherwise acquiring or holding any interest in shares of capital stock of the Corporation shall be deemed to have received notice of and consented to the provisions of this Article X.

ARTICLE XI

DEFINITIONS

As used in this Amended and Restated Certificate, the term:

| (a) | “Business Combination” means a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination, involving the Corporation and one or more businesses. |

| (b) | “Class A Units” has the meaning set forth in the Purple LLC Agreement. |

| (c) | “Class B Units” has the meaning set forth in the Purple LLC Agreement. |

| (d) | “Exchange Agreement” means that certain Exchange Agreement to be entered into in connection with the closing of the transactions contemplated by the Merger Agreement, as the same may be amended, restated, supplemented and/or otherwise modified from time to time. |

| (e) | “Merger Agreement” means that certain Merger Agreement dated as of November 2, 2017 by and among the Corporation, Purple Innovation, LLC, InnoHold, LLC, PRPL Acquisition, LLC and the Parent Representative (as defined therein), as the same may be amended, restated, supplemented and/or otherwise modified from time to time. |

| (f) | “Purple LLC Agreement” means that certain Second Amended and Restated Limited Liability Company Agreement of Purple Innovation, LLC, to be entered into in connection with the closing of the transactions contemplated by the Merger Agreement, as the same may be amended, restated, supplemented and/or otherwise modified from time to time. |

| Ex D-10 |

ARTICLE XII

BUSINESS COMBINATION REQUIREMENTS; EXISTENCE

Section 12.1 General.

(a) The provisions of this Article XII shall apply during the period commencing upon the effectiveness of this Amended and Restated Certificate and terminating upon the consummation of the Corporation’s initial Business Combination and no amendment to this Article XII shall be effective prior to the consummation of the initial Business Combination unless approved by the affirmative vote of the holders of at least sixty-five percent (65%) of all then outstanding shares of the Common Stock.

(b) Immediately after the consummation of the Corporation’s initial public offering of securities (the “Offering”), a certain amount of the net offering proceeds received by the Corporation in the Offering (including the proceeds of any exercise of the underwriters’ over-allotment option) and certain other amounts specified in the Corporation’s registration statement on Form S-1, as initially filed with the Securities and Exchange Commission on June 12, 2015, as amended (the “Registration Statement”), shall be deposited in a trust account (the “Trust Account”), established for the benefit of the Public Stockholders (as defined below) pursuant to a trust agreement described in the Registration Statement. Except for the withdrawal of interest to pay taxes, none of the funds held in the Trust Account (including the interest earned on the funds held in the Trust Account) will be released from the Trust Account until the earlier of (i) the completion of the initial Business Combination and (ii) the redemption of 100% of the Offering Shares (as defined below) if the Corporation is unable to complete its initial Business Combination by November 6, 2017 (or February 5, 2018 if the Corporation has executed a definitive agreement for a Business Combination by November 6, 2017). Holders of shares of the Corporation’s Common Stock included as part of the units sold in the Offering (the “Offering Shares”) (whether such Offering Shares were purchased in the Offering or in the secondary market following the Offering and whether or not such holders are affiliates of Global Partner Sponsor I LLC, (the “Sponsor”) or officers or directors of the Corporation) are referred to herein as “Public Stockholders.”

Section 12.2 Redemption and Repurchase Rights.

(a) Prior to the consummation of the initial Business Combination, the Corporation shall provide all holders of Offering Shares with the opportunity to have their Offering Shares redeemed or repurchased upon the consummation of the initial Business Combination pursuant to, and subject to the limitations of, Sections 12.2(b) and 12.2(c) (such rights of such holders to have their Offering Shares redeemed or repurchased pursuant to such Sections, the “Redemption Rights”) hereof for cash equal to the applicable redemption or repurchase price per share determined in accordance with Section 12.2(b) hereof (the “Redemption Price”); provided, however, that the Corporation shall not redeem or repurchase Offering Shares to the extent that such redemption or repurchase would result in the Corporation having net tangible assets (as determined in accordance with Rule 3a51-1(g)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of less than $5,000,001 (such limitation hereinafter called the “Redemption Limitation”). Notwithstanding anything to the contrary contained in this Amended and Restated Certificate, there shall be no Redemption Rights or liquidating distributions with respect to any warrant issued pursuant to the Offering.

| Ex D-11 |

(b) (i) Repurchase Rights. Unless the Corporation offers to redeem the Offering Shares as described in Section 12.2(b)(ii), it shall offer to repurchase the Offering Shares pursuant to a tender offer in accordance with Rule 13e-4 and Regulation 14E of the Exchange Act (such rules and regulations hereinafter called the “Tender Offer Rules”) which it shall commence prior to the consummation of the initial Business Combination and shall file tender offer documents with the Securities and Exchange Commission that contain substantially the same financial and other information about the initial Business Combination and the Redemption Rights as is required under Regulation 14A of the Exchange Act (such rules and regulations hereinafter called the “Proxy Solicitation Rules”), even if such information is not required under the Tender Offer Rules. If the Corporation offers to repurchase the Offering Shares (and has not otherwise withdrawn the tender offer), the Redemption Price per share of the Common Stock payable to holders of the Offering Shares tendering their Offering Shares pursuant to such tender offer shall be equal to, subject to the Redemption Limitation, the quotient obtained by dividing: (i) the aggregate amount on deposit in the Trust Account as of two business days prior to the date of the commencement of the tender offer, including interest (which interest shall be net of taxes payable), by (ii) the total number of then outstanding Offering Shares.

(ii) Redemption Rights. If a stockholder vote is required by law to approve the proposed initial Business Combination or the Corporation decides to hold a stockholder vote on the proposed initial Business Combination for business or other legal reasons, the Corporation shall offer to redeem the Offering Shares at a Redemption Price per share of the Common Stock payable to holders of the Offering Shares exercising their Redemption Rights (irrespective of whether they voted in favor or against the Business Combination) equal to, subject to the Redemption Limitation, the quotient obtained by dividing (a) the aggregate amount on deposit in the Trust Account as of two business days prior to the consummation of the initial Business Combination, including interest (which interest shall be net of taxes payable), by (b) the total number of then outstanding Offering Shares.

(c) If the Corporation offers to redeem the Offering Shares in conjunction with a stockholder vote on an initial Business Combination pursuant to a proxy solicitation, a Public Stockholder, together with any affiliate of such stockholder or any other person with whom such stockholder is acting in concert or as a “group” (as defined under Section 13(d)(3) of the Exchange Act), shall be restricted from seeking Redemption Rights with respect to 10% or more of the Offering Shares.

(d) In the event that the Corporation has not consummated a Business Combination by November 6, 2017 (or February 5, 2018 if the Corporation has executed a definitive agreement for a Business Combination by November 6, 2017), the Corporation shall (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter subject to lawfully available funds therefor, redeem 100% of the Offering Shares in consideration of a per-share price, payable in cash, equal to the quotient obtained by dividing (A) the aggregate amount then on deposit in the Trust Account, including interest (which interest shall be net of taxes payable and less up to $50,000 of such net interest to pay dissolution expenses), by (B) the total number of then outstanding Offering Shares, which redemption will completely extinguish rights of the Public Stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of the remaining stockholders and the Board in accordance with applicable law, dissolve and liquidate, subject in each case to the Corporation’s obligations under the DGCL to provide for claims of creditors and other requirements of applicable law.

| Ex D-12 |

(e) If the Corporation offers to redeem the Offering Shares in conjunction with a stockholder vote on an initial Business Combination, the Corporation shall consummate the proposed Business Combination only if (i) such initial Business Combination is approved by the affirmative vote of the holders of a majority of the shares of the Common Stock that are voted at a stockholder meeting held to consider such initial Business Combination and (ii) the Redemption Limitation is not exceeded.

Section 12.3 Distributions from the Trust Account.

(a) A Public Stockholder shall be entitled to receive funds from the Trust Account only as provided in Sections 12.2(a), 12.2(b), 12.2(d) or 12.7 hereof. In no other circumstances shall a Public Stockholder have any right or interest of any kind in or to distributions from the Trust Account, and no stockholder other than a Public Stockholder shall have any interest in or to the Trust Account.

(b) Each Public Stockholder that does not exercise its Redemption Rights shall retain its interest in the Corporation and shall be deemed to have given its consent to the release of the remaining funds in the Trust Account to the Corporation, and following payment to any Public Stockholders exercising their Redemption Rights, the remaining funds in the Trust Account shall be released to the Corporation.

(c) The exercise by a Public Stockholder of the Redemption Rights shall be conditioned on such Public Stockholder following the specific procedures for redemptions set forth by the Corporation in any applicable tender offer or proxy materials sent to the Corporation’s Public Stockholders relating to the proposed initial Business Combination. Payment of the amounts necessary to satisfy the Redemption Rights properly exercised shall be made as promptly as practical after the consummation of the initial Business Combination.

Section 12.4 Share Issuances. Prior to the consummation of the Corporation’s initial Business Combination, the Corporation shall not issue any additional shares of capital stock of the Corporation that would entitle the holders thereof to receive funds from the Trust Account or vote on any Business Combination.

Section 12.5 Transactions with Affiliates. In the event the Corporation enters into an initial Business Combination with a target business that is affiliated with the Sponsor, or the directors or officers of the Corporation, the Corporation, or a committee of the independent directors of the Corporation, shall obtain an opinion from an independent investment banking firm that is a member of the Financial Industry Regulatory Authority or a qualified independent accounting firm that such Business Combination is fair to the Corporation from a financial point of view.

Section 12.6 No Transactions with Other Blank Check Companies. The Corporation shall not enter into a Business Combination with another blank check company or a similar company with nominal operations.

Section 12.7 Additional Redemption Rights. If, in accordance with Section 9.1(a), any amendment is made to Section 9.2(d) that would affect the substance or timing of the Corporation’s obligation to redeem 100% of the Offering Shares if the Corporation has not consummated a Business Combination by November 6, 2017 (or February 5, 2018 if the Corporation has executed a definitive agreement for a Business Combination by November 6, 2017), the Public Stockholders shall be provided with the opportunity to redeem their Offering Shares upon the approval of any such amendment, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (which interest shall be net of taxes payable), divided by the number of then outstanding Offering Shares; provided, however, that any such redemption shall be subject to the Redemption Limitation.

Section 12.8 Minimum Value of Target. So long as the Corporation’s securities are listed on the Nasdaq Stock Market, the Corporation’s Business Combination must occur with one or more target businesses that together have a fair market value of at least 80% of the assets held in the Trust Account (excluding the deferred underwriting commissions and taxes payable on the income earned on the Trust Account) at the time of the agreement to enter into the Business Combination.

[Signature page to follow]

| Ex D-13 |

IN WITNESS WHEREOF, Global Partner Acquisition Corp. has caused this Amended and Restated Certificate to be duly executed in its name and on its behalf by an authorized officer as of the date first set forth above.

| GLOBAL PARTNER ACQUISITION CORP. | ||

| By: | ||

| Name: | ||

| Title: | ||

EXHIBIT O

Agreement to Assign Sponsor Warrants

[___], 2018

InnoHold, LLC

123 E. 220 N

Alpine, UT 84004

Global Partner Acquisition Corp.

One Rockefeller Plaza, 11th Floor

New York, NY 10020

Attention: Paul J. Zepf

E-mail: pzepf@globalpartnerac.com

Continental Stock Transfer & Trust Company

As Warrant Agent

17 Battery Place

New York, NY 10004

Attention: Compliance Department

Ladies and Gentlemen:

Reference is made to that certain (i) agreement and plan of merger by and among Global Partner Acquisition Corp. (the “Company”), PRPL Acquisition LLC, a wholly owned subsidiary of the Company, Purple Innovation, LLC, InnoHold, LLC (“InnoHold”), and Global Sponsor I LLC, in its capacity as Parent Representative, dated as of November 2, 2017, as amended (the “Merger Agreement”), and (ii) that certain warrant agreement (the “Warrant Agreement”) dated as of July 29, 2015, by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agent”, also referred to therein as the “Transfer Agent”). Unless otherwise defined herein, capitalized terms used herein shall have the meanings ascribed thereto in the Warrant Agreement.

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Global Sponsor I LLC (“Sponsor”), the Company and the Warrant Agent hereby agree with InnoHold as follows:

| 1. | Subject to and effective on the Closing, the Sponsor agrees to transfer and assign to InnoHold all of its right, title and interest in and to the 12,815,000 Private Placement Warrants (as defined in the Warrant Agreement) held by the Sponsor, or such lesser number of Private Placement Warrants as the Sponsor and InnoHold may agree in writing on or prior to the Closing. InnoHold acknowledges and agrees that the total number of outstanding Warrants is 12,815,000, and that there are or may be other holders of Private Placement Warrants in addition to InnoHold. |

| 2. | Notwithstanding anything to the contrary in the Warrant Agreement, in consideration of the assignment of the Private Placement Warrants pursuant hereto, InnoHold hereby agrees as follows: |

| a. | Not less than all of the outstanding Warrants may be redeemed, at the option of the Company, at any time while they are exercisable and prior to their expiration, at the office of the Warrant Agent, upon notice to the Registered Holders of the Warrants, as described in Section 6.2 below, at the price of $0.01 per Warrant (the “Redemption Price”), provided that the last sales price of the Class A Common Stock reported has been at least $24.00 per share (subject to adjustment in compliance with Section 4 of the Warrant Agreement), on each of twenty (20) trading days within the thirty (30) trading-day period ending on the third Business Day prior to the date on which notice of the redemption is given and provided that there is an effective registration statement covering the shares of Common Stock issuable upon exercise of the Warrants, and a current prospectus relating thereto, available throughout the 30-day Redemption Period (as defined in (b) below) or the Company has elected to require the exercise of the Warrants on a “cashless basis” pursuant to subsection 3.3.1 of the Warrant Agreement. |

| Ex O-1 |

| b. | In the event that the Company elects to redeem all of the Warrants, the Company shall fix a date for the redemption (the “Redemption Date”). Notice of redemption shall be mailed by first class mail, postage prepaid, by the Company not less than thirty (30) days prior to the Redemption Date (such 30-day period, the “Redemption Period”) to the Registered Holders of the Warrants to be redeemed at their last addresses as they shall appear on the registration books. Any notice mailed in the manner herein provided shall be conclusively presumed to have been duly given whether or not the Registered Holder received such notice. |

| c. | On and after the Redemption Date, the record holders of the Warrants shall have no further rights except to receive, upon surrender of the Warrants, the Redemption Price. |

| d. | The Warrants may be exercised, for cash or on a “cashless basis” in accordance with Section 2.5 of the Warrant Agreement. pursuant to subsection 3.3.1(c) of the Warrant Agreement, |

| 3. | The parties hereto hereby agree that, for the purposes of this Agreement, all references to “Sponsor” in the Warrant Agreement shall be deemed to refer to InnoHold and its Permitted Transferees. |

| 4. | This Agreement constitutes the entire agreement and understanding of the parties hereto in respect of the subject matter hereof and supersedes all prior understandings, agreements, or representations by or among the parties hereto, written or oral, to the extent they relate in any way to the subject matter hereof. This Agreement may not be changed, amended, modified or waived to any particular provision, except by a written instrument executed by all parties hereto. |

| 5. | No party hereto may assign either this Agreement or any of its rights, interests, or obligations hereunder without the prior written consent of the other party. Any purported assignment in violation of this paragraph shall be void and ineffectual and shall not operate to transfer or assign any interest or title to the purported assignee. This Agreement shall be binding on the undersigned and their respective successors and assigns. |

| 6. | This Agreement shall be construed and interpreted in a manner consistent with the provisions of the Merger Agreement. The provisions set forth in Sections 10.2, 10.3, 10.5, 10.7, 10.8, 10.10 and 10.13 of the Merger Agreement, as of the date hereof, are hereby incorporated by reference into, and shall be deemed to apply to, this Agreement as if all references to the “Agreement” in such sections were instead references to this Agreement. |

| 7. | Any notice, consent or request to be given in connection with any of the terms or provisions of this Agreement shall be in writing and shall be sent in the same manner as provided in the Merger Agreement. Notices to Sponsor shall be sent to the address of the Purchaser Representative set forth in Section 10.1 of the Merger Agreement as of the date hereof, and as it may be changed in accordance with Section 10.1 of the Merger Agreement so long as Sponsor remains the Purchaser Representative. |

| 8. | This Agreement shall terminate at such time, if any, as the Merger Agreement is terminated in accordance with its terms, and upon such termination this Agreement shall be null and void and of no effect whatsoever, and the parties hereto shall have not obligations under this Agreement. |

[Signature page follows]

| Ex O-2 |

Please indicate your agreement to the foregoing by signing in the space provided below.

GLOBAL PARTNER SPONSOR I LLC

| ||

| By: | ||

| Name: | ||

| Title: | ||

INNOHOLD, LLC

| By: | ||

| Name: | ||

| Title: |

GLOBAL PARTNER ACQUISITION CORP.

| By: | ||

| Name: | ||

| Title: |

|

CONTINENTAL STOCK TRANSFER AND TRUST COMPANY As Warrant Agent | ||

| By: | ||

| Name: | ||

| Title: | ||

Exhibit 99.1

Exhibit 99.2

GLOBAL PARTNER ACQUISITION CORP. AND PURPLE

INNOVATION, LLC ANNOUNCE REVISED MERGER AGREEMENT

FOR IMMEDIATE RELEASE

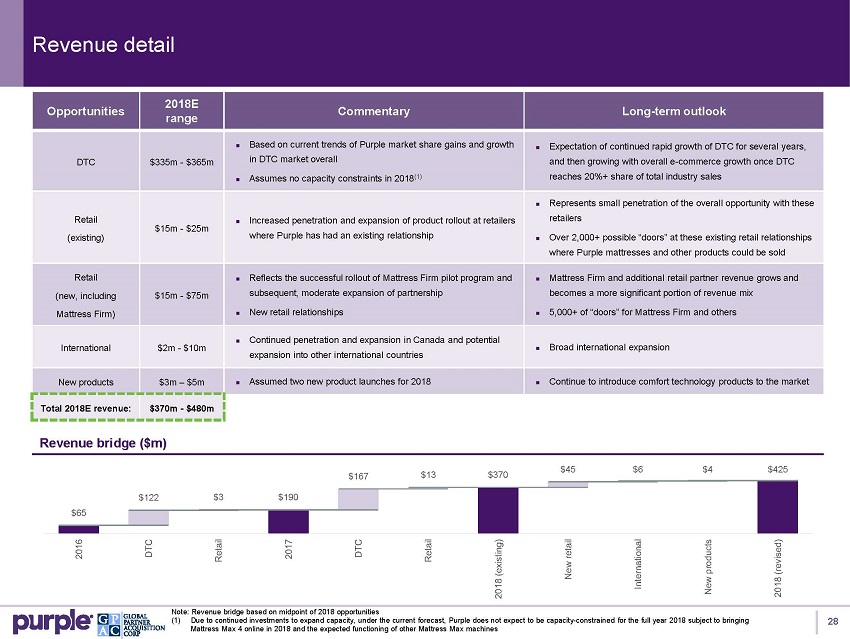

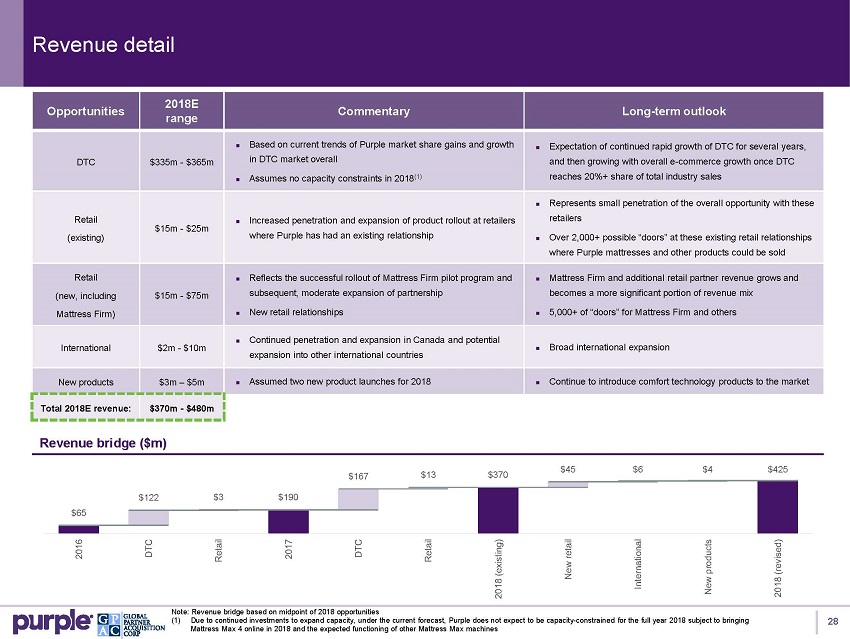

Alpine, Utah and New York, New York, January 8, 2018 -- Global Partner Acquisition Corp. (“GPAC”) (NASDAQ: GPAC, GPACU, GPACW) and Purple Innovation, LLC (“Purple”) today announced that they have amended their definitive merger agreement pursuant to which Purple will become a subsidiary of GPAC. Among other things, the amendment reflects an updated enterprise value of Purple of approximately $500 million. The consummation of the proposed business combination will be subject to the terms and conditions set forth in the amended merger agreement. In addition, GPAC and Purple have prepared an updated investor presentation outlining the updated transaction. GPAC has filed the amendment to the merger agreement and the investor presentation with the Securities and Exchange Commission (“SEC”) under cover of Form 8-K.

GPAC expects to file an amended preliminary proxy statement with the SEC this week to reflect the terms of the proposed business combination as revised by the amendment to the merger agreement. Subject to review of the proxy statement by the SEC, GPAC expects to commence mailing the definitive proxy statement relating to the special meeting of its stockholders to consider the proposed business combination and related matters (the “Special Meeting”) on or about January 17, 2018. GPAC’s stockholders of record at the close of business on January 10, 2018 are entitled to receive notice of the Special Meeting and to vote the shares of common stock of GPAC owned by them at the Special Meeting, which GPAC anticipates holding on or about February 2, 2018. Both GPAC and Purple remain focused on completing the proposed business combination by February 5, 2018.

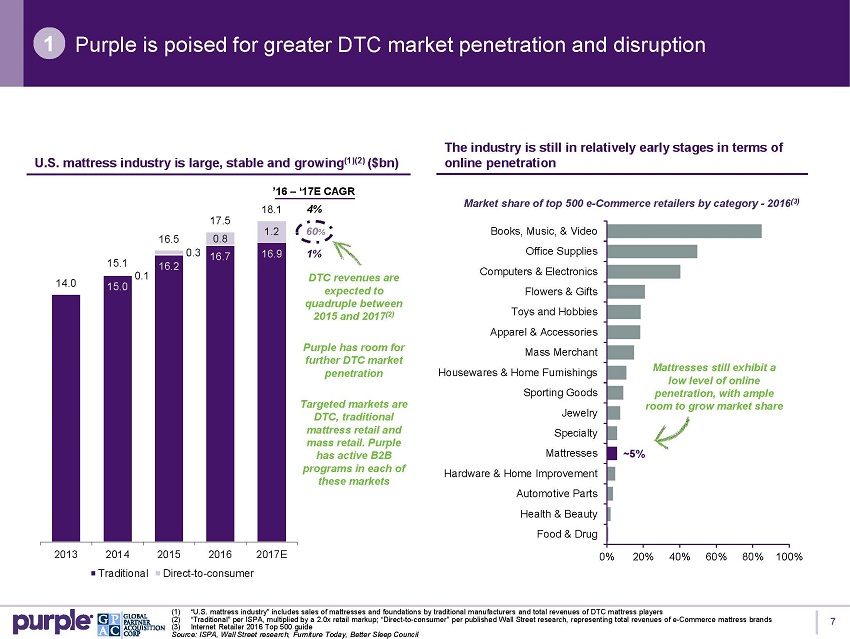

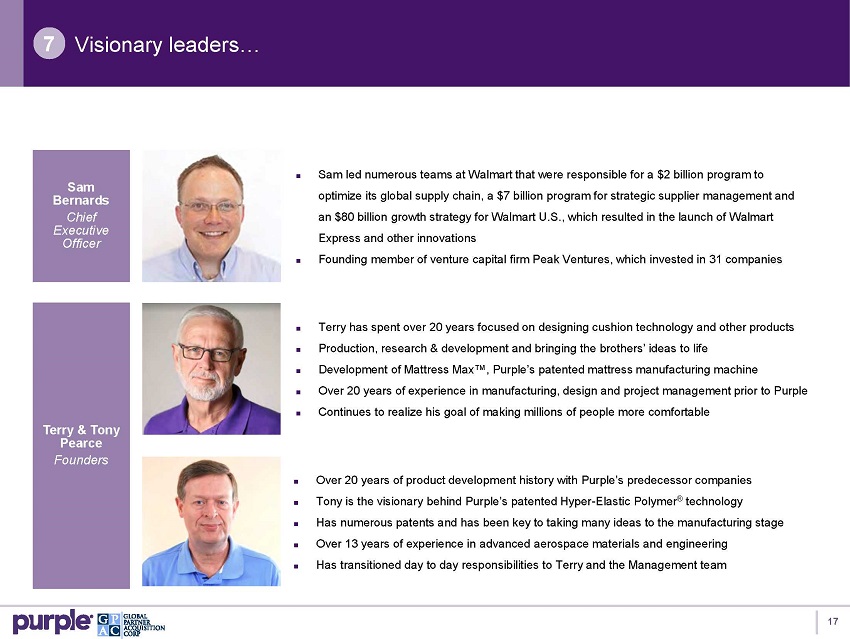

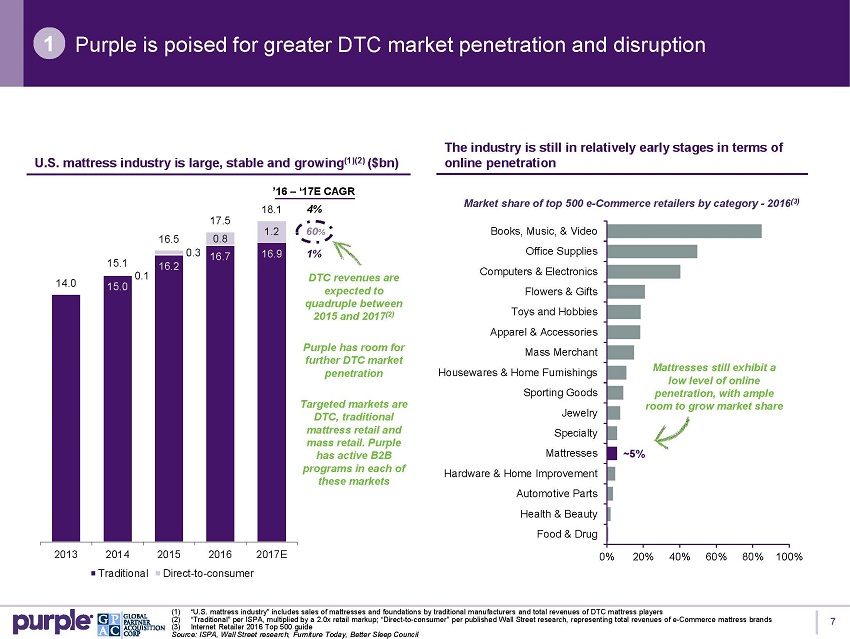

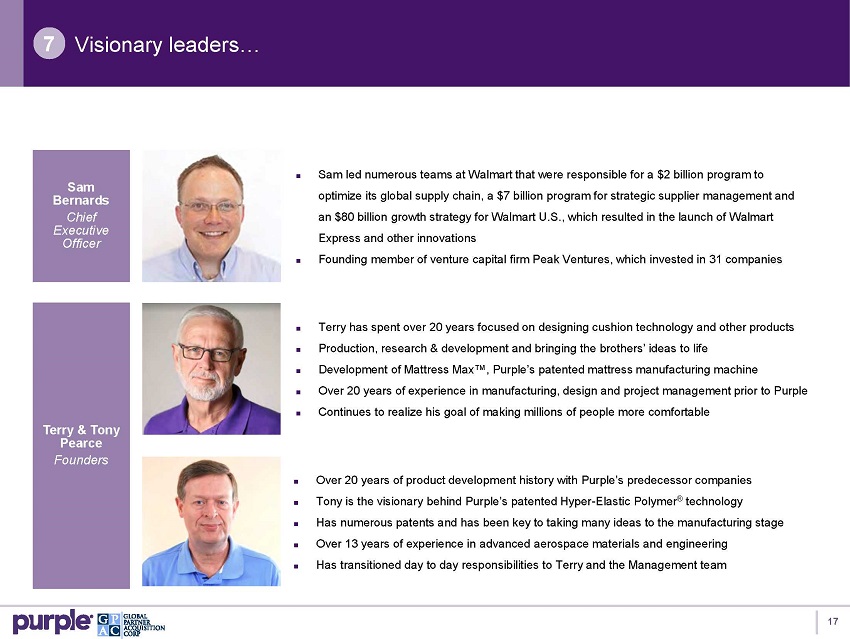

About Purple

Purple is a leading comfort technology company with a vision to improve how people sleep, sit and stand. Purple offers a range of mattress, bedding and cushioning products. Purple’s products are the result of over 20 years of innovation and investment by the founders in proprietary and patented comfort technologies and the development of its own manufacturing processes. Purple’s Hyper-Elastic Polymer® technology underpins many of its comfort products and provides a range of benefits that differentiate its offerings from other competitors’ products.

Purple has core competencies in design, development and manufacturing, with decades of accumulated knowledge that enables it to create all aspects of its innovative products. Purple has vertically integrated its operations including research and development, marketing and manufacturing, resulting in an ability to rapidly test, learn, adapt and scale product offerings. Purple’s combination of patents and intellectual property, proprietary and patented manufacturing equipment, production processes and decades of acquired knowledge create a distinct advantage over competitors that rely on commoditized technologies and outsourced manufacturing.

Purple has not only developed transformative products and technologies, but also a brand that drives high customer engagement. To date, Purple’s videos have been seen more than 950 million times across Facebook and YouTube alone with over 600,000 fans and subscribers across social media.

About Global Partner Acquisition Corp.

Global Partner Acquisition Corp. is a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination. GPAC’s units began trading on The NASDAQ Capital Market on July 30, 2015 and its securities trade on NASDAQ under the ticker symbols GPAC, GPACW and GPACU.

Forward Looking Statements