Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on August 31, 2020.

Registration No. 333-248251

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sumo Logic, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 27-2234444 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Sumo Logic, Inc.

305 Main Street

Redwood City, California 94063

(650) 810-8700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ramin Sayar

President and Chief Executive Officer

Sumo Logic, Inc.

305 Main Street

Redwood City, California 94063

(650) 810-8700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Katharine A. Martin Rezwan D. Pavri Lianna C. Whittleton Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Katherine Haar Sumo Logic, Inc. 305 Main Street Redwood City, California 94063 (650) 810-8700 |

Alan F. Denenberg Stephen Salmon Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common stock, par value $0.0001 per share |

$100,000,000 | $12,980 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase solely to cover over-allotments, if any. |

| (3) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued , 2020

Shares

Common Stock

Sumo Logic, Inc. is offering shares of its common stock. This is an initial public offering and no public market currently exists for our shares. It is currently estimated that the initial public offering price per share will be between $ and $ .

We have applied to list the common stock on the Nasdaq Global Select Market under the symbol “SUMO”.

We are an “emerging growth company” as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our common stock involves risks. See the section titled “Risk Factors” beginning on page 17 to read about factors you should consider before buying shares of our common stock.

PRICE $ A SHARE

| Price to Public | Underwriting Discounts and Commissions(1) |

Proceeds to Sumo Logic |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | See the section titled “Underwriters” for a description of the compensation payable to the underwriters. |

At our request, the underwriters have reserved up to % of the shares offered by this prospectus for sale at the initial public offering price through a directed share program. See the section titled “Underwriters—Directed Share Program” for additional information.

We have granted the underwriters the right to purchase up to additional shares of our common stock to cover over-allotments.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment in New York, New York, on or about , 2020.

| MORGAN STANLEY | J.P. MORGAN | RBC CAPITAL MARKETS | JEFFERIES | |||

| WILLIAM BLAIR | COWEN | PIPER SANDLER | BTIG | |||

Prospectus dated , 2020

Table of Contents

Index to Financial Statements

Digital businesses compete in the Intelligence Economy Five requirements of digital business success Modern application Multi-cloud Continuous Continuous Data-driven architectures adoption security collaboration intelligence Digital transformation and data growth increase complexity, driving intelligence gaps Closing the gaps requires a new category of software, Continuous Intelligence Win in the Intelligence Economy with Sumo Logic Continuous Intelligence PlatformTM

Table of Contents

Index to Financial Statements

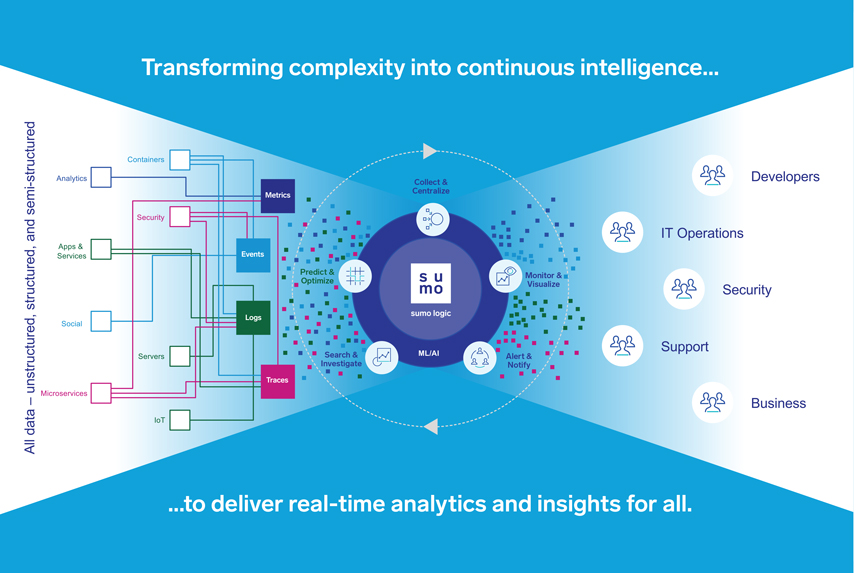

Transforming complexity into continuous intelligence. Collect & Centralize Predict & Monitor & Optimize Visualize Search & Alert & Investigate Notify .to deliver real-time analytics and insights for all.

Table of Contents

Index to Financial Statements

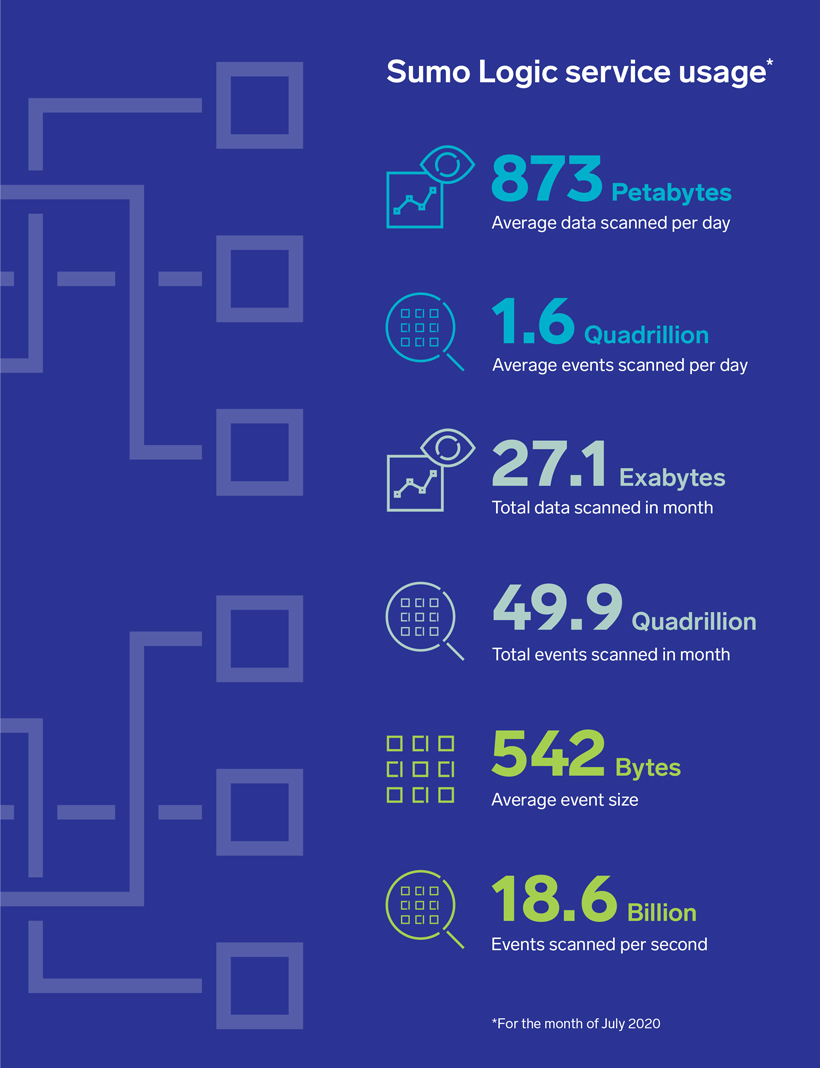

Sumo Logic service usage* 873 Petabytes Average data scanned per day 1.6 Quadrillion Average events scanned per day 27.1 Exabytes Total data scanned in month 49.9 Quadrillion Total events scanned in month 542 Bytes Average event size 18.6 Billion Events scanned per second *For the month of July 2020

Table of Contents

Index to Financial Statements

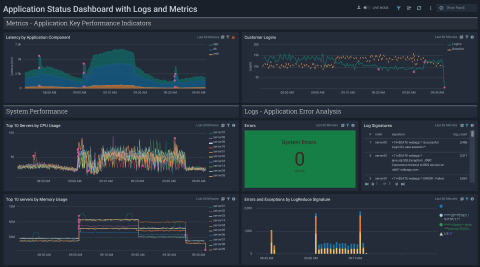

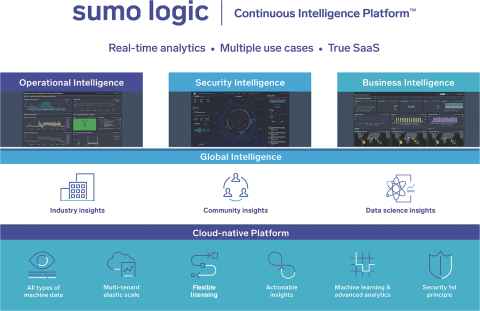

Real-time analytics Multiple use cases True SaaS Operational Intelligence Security Intelligence Business Intelligence Application Status Dashboard with Logs and Metrics LIVE MODE [From Panel] Find Insights, Signals, Entities and more… Insights Signals Entities Records Investigations Content Business Overview Done Editing [From Panel] Metrics - Application Key Performance Indicators ONLINE 08_05_2020 7 days INSIGHT RADAR INSIGHT ACTIVITY Last 60 Minutes Last 60 Minutes NEW Travel Booking Status Latency by Application Component Customer Logins 05/01 6:00 PM Records Signals Insights app Logins RECORDS Signals INSIGHTS 05/08 6:00 AM INSIGHT-3663 - Insider Threat - Lateral 7.5k 20k Movement with Increased Traffic Visitors Over Time... Last 15 Minutes Visitor Platforms Last 9 Minutes hourly Bookings Last 60 Minutes Bookie... Last 60 Minutes Bookings Last 60 Minutes db Baseline 1 B 33 k 56 web 15k 73% 20% 3% 05/02 6:00 AM Multiple signals related to lateral movement with other and... 4,000 100 (ms) 5k 172.18.20.20 ency Logins 10k 2,000 Mobile flight Lat 2.5k 5k SENSOR STATUS Signal Data bots/unk 8.84k hotel 0 PC car 0 05/02 6:00 PM 10 Mac M 0 AM A AM 08:50 AM 09:00 AM 09:10 AM 09:20 AM 09:30 AM 09:40 AM 08:50 AM 09:00 AM 09:10 AM 09:20 AM 09:30 AM 09:40 AM 14 days 9:20 ONLINE DURATION 08:40 09:00 09:20 08:50 08:50 09:10 08:40 09:00 09:10 0 05/07 6:00 AM 11 26 09 System Performance Logs - Application Error Analysis Bookings by Dollar Last 60 Minutes Bookings Last 15 Minutes Payment Transactions Last 15 Minutes This Sensor appears to be fully functional. 200k 200 65.6K 1,228 150 Top 10 Servers by CPU Usage Last 60 Minutes Errors Last 60 Minutes Log Signatures Last 60 Minutes HIGH 100 server 05/03 6:00 AM SEVERITY 0 # node signature Network 2.2.9 558 M 100k 100 32.8K 614 75 server Type Version Total Records server System Errors 1 server 14 $DATE web app : Successful 3,486 REVIEW CLOSE server Login for user session 0 0 0 0 0 server 05/06 6:00 PM 08:40 AM 08:50 AM 09:00 AM 09:10 AM 09:20 AM 09:20 AM 09:22 AM 09:24 AM 09:26 AM 09:28 AM 09:30 AM 09:32 AM 09:20 AM 09:22 AM 09:24 AM 09:26 AM 09:28 AM 09:30 AM 09:32 AM 50 server 2 server 11 $DATE webapp : 3,317 758.34 GB 0 server 0 : JDBC Total Data Total Errors success_dollars failed_dollars sum_dollars booking_success booking_failed duration_ms transactions server14 Connection timeout to RDS service on server errors rds01.webapp.com TODAY server14 05/03 6:00 PM Insight Dana Torgensen User Anomalies (SUMO) with added Beasoning a comment Behavior to 08:50 AM 09:00 AM 09:10 AM 09:20 AM 09:30 AM 09:40 AM 3 server01 11 $DATE webapp : ERROR - Failed 2,867 Flights Hotels Cars 1 of 3 Looking into this item... 6 hours ago Flight Booking Locations Last 60 Minutes Hotel Booking Locations Last 60 Minutes Car Hiring Locations Last 60 Minutes Top 10 servers by Memory Usage Last 60 Minutes Errors and Exceptions by Log Reduce Signature Last 60 Minutes 05/06 6:00 AM Dana Torgensen (SUMO) added a comment to Insight User Anomalies with Beasoning Behavior 75M server01 Looking into this item... server 01 2,000 6 hours ago server 01 [$ ]”GET / 05/04 6:00 AM 238 73 486 50M server14 HTTP/1. Insight Dana Torgensen User Anomalies (SUMO) with added Beasoning a comment Behavior to 1.4k 48 388 304 9 76 2.4k 93 650 server04 java cluster . node ... 05/05 6:00 PM 64 50 7 server 05 1,000 Looking into this item... 25M server06 1/3 6 hours ago server07 05/04 6:00 PM Dana Torgensen (SUMO) added a comment to 60 9 73 server08 05/05 6:00 AM Insight User Anomalies with Beasoning Behavior 94 29 149 server09 Looking into this item... 90 178 11 24 182 283 08:50 AM 09:00 AM 09:10 AM 09:20 AM 09:30 AM 09:40 AM 0 VIEW SENSORS 6 hours ago 08:45 AM 09:00 AM 09:15 AM Global Intelligence Industry insights Community insights Data science insights Cloud-native Platform All types of Multi-tenant Flexible Actionable Machine learning & Security 1st machine data elastic scale Licensing insights advanced analytics principle

Table of Contents

Index to Financial Statements

s u See business differently with continuous intelligence m o

Table of Contents

Index to Financial Statements

Prospectus

| Page | ||||

| 1 | ||||

| 17 | ||||

| 56 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 64 | ||||

| 68 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

71 | |||

| 102 | ||||

| 127 | ||||

| 138 | ||||

| 154 | ||||

| 159 | ||||

| 161 | ||||

| 167 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock |

170 | |||

| 175 | ||||

| 183 | ||||

| 183 | ||||

| 183 | ||||

| Reconciliation of Non-GAAP Financial Measures to Most Directly Comparable GAAP Financial Measures |

184 | |||

| F-1 | ||||

Through and including , 2020 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

Table of Contents

Index to Financial Statements

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “Sumo Logic,” “the company,” “we,” “us,” and “our” in this prospectus refer to Sumo Logic, Inc. and its consolidated subsidiaries. Our fiscal year end is January 31, and our fiscal quarters end on April 30, July 31, October 31, and January 31. Our fiscal years ended January 31, 2018, 2019, and 2020 are referred to herein as fiscal 2018, fiscal 2019, and fiscal 2020, respectively.

SUMO LOGIC, INC.

Overview

Sumo Logic empowers organizations to close the intelligence gap.

Sumo Logic is the pioneer of Continuous Intelligence, a new category of software, which enables organizations of all sizes to address the challenges and opportunities presented by digital transformation, modern applications, and cloud computing. Our Continuous Intelligence Platform enables organizations to automate the collection, ingestion, and analysis of application, infrastructure, security, and IoT data to derive actionable insights within seconds. Continuous intelligence leverages artificial intelligence and machine learning capabilities, and is provided as a multi-tenant cloud service that allows organizations to more rapidly deliver reliable applications and digital services, protect against modern security threats, and consistently optimize their business processes in real time. This empowers employees across all lines of business, development, IT, and security teams with the data and insights needed to address the technology and collaboration challenges required for modern business. With our Continuous Intelligence Platform, executives and employees have the intelligence they require to take prescriptive action in real time—a modern business imperative.

We live in the intelligence economy. Organizations can succeed or fail based on how well they understand and respond to what is happening inside their business. Reports, surveys, or monitoring alerts provided by traditional operational and security technologies and manual processes are no longer effective. Today, businesses generate data from multiple sources—every touchpoint, customer interaction, and digital connection across an entire business and ecosystem. This represents an unprecedented volume of data that is growing at an extraordinary pace, which is, at best, difficult to digest and, at worst, an impediment to driving the speed of decision-making needed to compete in today’s dynamic marketplaces.

The risk of ignorance is monumental to a business. C-suite executives and business leaders are under increasing pressure to know exactly what is happening inside their business the moment it happens. As a result, employees across organizations are increasingly accountable for the overall health and security of their businesses at all times, and can no longer credibly hide behind gaps of intelligence. Intelligence gaps are rampant inside organizations due to multiple disparate systems, departmental silos, and an antiquated set of partial solutions that add more noise, obscuring the signal of truth that organizations seek. Organizations that cannot close the intelligence gap will not only get left behind, they will get lapped. Addressing the intelligence gap by hiring more people or working longer hours is insufficient—organizations must increase their collective intelligence.

Businesses thriving in the intelligence economy are taking a completely different approach to solving the intelligence gap, by seeking out solutions that provide real-time continuous intelligence that improves how they

1

Table of Contents

Index to Financial Statements

collectively and collaboratively build, manage, and secure their digital services. Organizations that will be successful in the digital age must be able to utilize their most important resource: their data.

Our vision is to democratize machine data, making insights from this rich source available to all. Our Continuous Intelligence Platform gives our customers insights across a wide range of use cases. We help our customers: monitor and troubleshoot their applications and their cloud and on-premise infrastructure; manage audit and compliance requirements; rapidly detect and resolve modern security threats; and extract critical key performance indicators, or KPIs, from various types of machine data to gain visibility into customer behavior, engagement, and actions. We enable our customers to derive critical value from their data with advanced analytics based on our proprietary machine learning technology that identifies and predicts anomalies in real time.

Our multi-tenant, cloud-native platform was architected by big data and security experts and has been in operation continuously for nearly a decade. Our platform is built on a modern, microservices-based application and cloud architecture, leverages security-first principles, and incorporates artificial intelligence and machine learning, or AI/ML, algorithms to deliver real-time actionable insights. We started in 2010 with the mission to provide organizations with the ability to ingest and analyze complex unstructured machine data, such as logs, events, and security data for a cloud security information and event management, or SIEM, solution. However, we always had the vision to expand our data analytics capabilities to address less complex structured machine data, such as time-series metrics from applications and infrastructure, to provide a cloud-native operational intelligence solution. In 2012, when we released our service, we discovered that developers, IT operations, and security analysts were leveraging our platform to initially ingest and analyze log and event data in order to monitor and troubleshoot their mission-critical applications, systems, and services.

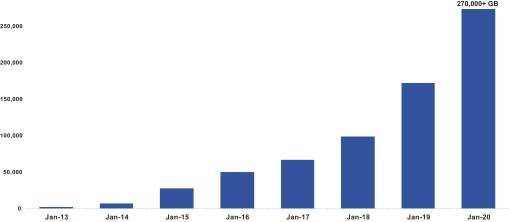

Our platform scans an average of 873 petabytes of data per day and an average of 18.6 billion events per second.1 Our platform integrates and analyzes structured, semi-structured, and unstructured machine data, both historically and in real time, to provide actionable intelligence around what happened, why it happened, and how to resolve business, technology, or cybersecurity issues.

We deliberately architected and built our analytics platform to address the technology challenges and gaps in intelligence that arise from siloed development, operations, and security teams in order to enable organizations to adopt a more modern DevSecOps operating model. DevSecOps is the philosophy of integrating security practices within the DevOps process, and involves ongoing, flexible collaboration among developers, release engineers, and security teams. DevOps is a combination of practices that automates the processes between software development and operations teams in order to build, test, and deploy modern applications faster. Ultimately, it enables teams to gain more insights and intelligence in order to release software faster, optimize processes, and better deliver digital solutions to customers. We offer a suite of solutions to address the intelligence gap: Operational Intelligence, Security Intelligence, Business Intelligence, and Global Intelligence.

We address cloud-native businesses as well as traditional on-premise businesses that are seeking to build, manage, and secure modern applications as they undertake their digital transformation and cloud adoption initiatives. We serve organizations of all sizes, from large enterprises to small and mid-market businesses, regardless of their cloud, digital transformation, security analytics, or DevSecOps maturity. Representative customers include 23andMe, Alaska Airlines, Brown University, JetBlue, Land O’Lakes, LendingTree, Major League Baseball, Netflix, PagerDuty, Petco, Pitney Bowes, Qualtrics, Salesforce.com, Twilio, ULTA Beauty, and Xero. Our customer count changed from 1,626 as of January 31, 2018 to 1,900 as of January 31, 2019, to 2,137 as of January 31, 2020, and to 2,130 as of July 31, 2020.2 Customers that had annual recurring revenue, or

| 1 | For the month of July 2020. |

| 2 | See the section titled “Business—Our Customers” for a description of how we calculate our number of customers. |

2

Table of Contents

Index to Financial Statements

ARR, greater than $100,000 or more grew from 187 as of January 31, 2018 to 234 as of January 31, 2019 to 323 as of January 31, 2020, and to 330 as of July 31, 2020.3 Customers that had ARR greater than $1 million or more grew from seven as of January 31, 2018 to 17 as of January 31, 2019 to 25 as of January 31, 2020, and to 29 as of July 31, 2020.

The power of our platform, and the benefits that it delivers to customers, has driven rapid growth in our revenue. For fiscal 2018, 2019, and 2020, our revenue was $67.8 million, $103.6 million, and $155.1 million, respectively, representing a year-over-year growth rate of 53% and 50%, respectively. For the six months ended July 31, 2019 and 2020, our revenue was $70.2 million and $96.6 million, respectively, representing a period-over-period growth rate of 38%. We generated net losses of $32.4 million, $47.8 million, $92.1 million, $29.0 million, and $35.8 million for fiscal 2018, 2019, 2020, and the six months ended July 31, 2019 and 2020, respectively, as we continued to invest in our business.

Industry Background

Nearly every business must transform into a digital business or be disrupted. Customers now expect real-time, instantaneous, always-on experiences. To meet these expectations, successful businesses need to continuously deliver updated information and improved services to their end customers, such as promotional offerings, pricing information, inventory levels, and service availability. Every business must continuously innovate.

Executives are accountable for the overall operational and financial health of the business and can no longer hide behind a gap in intelligence. This is especially true for security, as organizations must protect against breaches and reputational costs as they digitize. This accountability is not only the responsibility of executives. Employees across the organization are now expected to find ways to improve intelligence by integrating silos that exist across systems, applications, services, and processes.

Today, every company is becoming a software company by delivering more business services through modern applications, automating workflows, and leveraging data from digital signals to satisfy increasing customer expectations. To enable differentiated digital services, organizations must take a new approach to software architectures, tools, and development processes that span multiple public cloud providers while simultaneously securing their digital assets.

We believe all businesses require the following five pillars to be successful in the intelligence economy.

Modern application architectures

| • | Microservices and containers make it easier to release software faster, create greater agility, and better user experience. |

| • | New architectures increase complexity, introduce more systems to manage, and create more signals to capture and analyze. |

Multi-cloud adoption

| • | Running distributed workloads in the cloud provides scalability, flexibility, and cost-efficiency. |

| • | Multi-cloud environments create digital sprawl and challenges in managing and securing multi-cloud environments concurrently. |

| 3 | See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a description of how we calculate ARR. |

3

Table of Contents

Index to Financial Statements

Continuous security

| • | Building security into the fabric of every digital organization can guard against the threat against reputational damage, negative customer impact, and financial loss. |

| • | The perimeter-less digital world has created even more pressure and accountability for the modern security operations center, or SOC, which suffers from a lack of skilled analysts and cloud-native technologies. |

Continuous collaboration

| • | Real-time, consistent information allows individuals across DevSecOps teams and line of business users to communicate and collaborate in the agile digital world. |

| • | Organizations struggle to get a unified view of what is happening in their organizations when they are forced to use antiquated, siloed systems that only present a partial view of data and lack real-time context around what is happening broadly. |

Data-driven intelligence

| • | Massive amounts of data from every touchpoint, customer interaction, and digital connection provide differentiation to companies that can harness its insights. |

| • | Today’s businesses are overwhelmed with information they cannot digest with antiquated technologies not designed or purpose-built for the new requirements of the intelligence economy. |

Not only are these five pillars becoming more critical for success, but they also introduce additional challenges for organizations that existing solutions are not equipped to address.

Traditional Solutions Have Challenges Delivering Value

Many solutions today are not equipped to adequately address the evolving complexity of modern business.

| • | Manual processes. Organizations often attempt to solve the intelligence gap with a “do it yourself” set of open source tools. These tools can require lengthy set-up time, do not deliver intelligence quickly enough, and cannot scale with rapidly evolving complexity of the modern technology ecosystem. |

| • | On-premise solutions. On-premise solutions cannot scale to handle the volume, velocity, and variety of data ingestion required to deliver continuous intelligence. Moreover, single-tenant hosted offerings cannot elastically scale and require additional infrastructure and people to administer and maintain. |

| • | Point solutions. Point solutions used for monitoring, search, and reporting, and domain-specific security only capture partial data sets and do not capture complete information across data types. Further, these tools are not architected for cloud-scale and cannot deliver the capabilities modern businesses require. |

| • | Outdated licensing models. Tools based on traditional enterprise-wide licensing and pricing models are outdated, and often charge an effective “data tax” for increased users, access, or spikes in daily volume. These models have quickly become too expensive, rigid, and unsuitable for customers shifting to digital and cloud initiatives. |

4

Table of Contents

Index to Financial Statements

The Need for Continuous Intelligence

Organizational complexity is increasing, while organizational insights are decreasing. The result is the intelligence gap, where organizations can no longer understand what is happening inside their businesses.

The consequences of the intelligence gap include:

| • | Inability to innovate and compete in today’s dynamic intelligence economy; |

| • | Inability to proactively manage business risk and security threats; and |

| • | Inability to empower talent and maximize workforce productivity. |

Continuous intelligence bridges this gap and equips executives and users across development, IT operations, security, and other lines of business with the insights their businesses require.

Our Opportunity

We believe that as companies of all sizes and across all industries increase the amount of business they conduct digitally, they will continue to invest in solutions that help address the intelligence gap. Our platform is employed across a broad range of use cases to address this gap. Based on data from International Data Corporation, or IDC, Sumo Logic estimates its total addressable market opportunity to be approximately $55.1 billion. We calculated this estimate by aggregating 2020 projected revenue by organizations in the following IDC software categories: advanced and predictive analytics software; AI software platforms; content analytics and search software; end-user query, reporting, and analysis software; software change and configuration management; security analytics, intelligence, response, and orchestration; and IT operations management (ITOM) software, across on-premise and cloud environments.4 We believe that our platform currently addresses a significant portion of this market, and we intend to further expand our offerings to capture more of this market in the future.

Separately, we have calculated our total addressable market opportunity as approximately $49.3 billion. To arrive at this figure, we conducted a detailed process. First, we identified the total number of global companies broken down by size, which we determined by referencing independent industry data from the S&P Global Capital IQ database.5 We then segmented these companies into large enterprise, enterprise, and commercial categories based on revenue, and for commercial, a minimum number of employees. We then leveraged internal company data on current customer type and spend on our products and services to calculate average ARR for each category. Finally, we multiplied the average ARR by the number of companies within each category to determine our total addressable market opportunity.6

We define large enterprises as companies with revenue greater or equal to $1.5 billion in the last twelve months, enterprises as companies with revenue between $500 million and $1.5 billion, and commercial customers as companies with revenue between $100 million and $500 million and with greater than 250 employees.

For large enterprise customers, we applied the average ARR of our top 25 customers, which we believe represents the average spend of customers that have achieved widespread adoption of our platform across their

| 4 | IDC, Semiannual Software Tracker, 2019 H1 Forecast Release, November 14, 2019; see the section titled “Industry, Market, and Other Data” for additional information. |

| 5 | S&P Global Capital IQ database; see the section titled “Industry, Market, and Other Data” for additional information. |

| 6 | See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a description of how we calculate ARR. |

5

Table of Contents

Index to Financial Statements

organizations based on their size and use of cloud-based technology. For enterprise customers, we averaged the ARR across our top 26th to 250th customers, which we believe represents the average spend of substantial customers that have achieved moderate to high adoption of our platform, often across multiple use cases. Finally, for commercial customers, we averaged the ARR across our top 251st to 500th customers, which we believe represents the average spend of customers with more limited adoption of our platform among smaller businesses.

Our Solution

We unlock the power of data with advanced analytics based on our proprietary machine learning technology to identify and predict anomalies in real time, separating the signal from the noise, and allowing users to get continuous insights, even when they do not know what questions to ask.

We deliver analytics and insights across a wide range of use cases for a diverse user base of technical and non-technical individuals, from practitioners to executives. Our Continuous Intelligence Platform features user-friendly out-of-the-box or easily customized and personalized dashboards for a variety of purposes, and allows users to derive further insights and intelligence from integrations with domain-specific data science tools and technologies.

Our customers leverage our Continuous Intelligence Platform for four main solution areas:

| • | Operational Intelligence. We enable users to rapidly understand the root cause of poor performance in their application stack and quickly troubleshoot, resulting in faster deployment, reduced downtime, and enhanced customer experience. |

| • | Security Intelligence. Our cloud-native analytics capabilities can detect real-time threats and incidents, and provide indicators of compromise that enable analysts to accelerate investigations across their multi-cloud environments. |

| • | Business Intelligence. Our solution extracts valuable business, service, and other critical KPIs from existing data to predict and analyze customer behavior, engagement, and actions. |

| • | Global Intelligence. Given the vast volume of data we ingest and maintain, we provide a unique operational and security benchmarking service that leverages machine learning to uncover global KPIs and key risk indicators, or KRIs, allowing organizations to measure their performance, value, and risks against the broader Sumo Logic global community. |

Our Continuous Intelligence Platform is designed to collect and centralize data from a multitude of data sources by integrating seamlessly with other platforms and solutions. Our Continuous Intelligence Platform was architected to support massive scale, optimizing data ingestion, and processing, while providing powerful analytics. Our platform ingests and analyzes the machine data generated by applications, infrastructure, and microservices from cloud and on-premise environments, enabling actionable insights.

Benefits of Our Solution

| • | Ingest all types of machine data, in real time. Our platform collects data and derives insights about KPIs, KRIs, and service level indicators, or SLIs, from logs, events, metrics, metadata, traces, and other telemetry generated by machines. Customers can easily collect these disparate data sources from various technologies regardless of where they are deployed. |

| • | Predictive and proactive insights. Our proprietary advanced analytics algorithms enable a proactive and predictive approach to deriving intelligence from applications and infrastructure and responding to opportunities, instead of reacting to historical events. |

6

Table of Contents

Index to Financial Statements

| • | Accessible to everyone in an organization. Users can perform analysis and share results across teams, create dashboards to visualize insights, set alerts to notify teams of events, configure access to deliver information to appropriate audiences, and integrate with the full enterprise ecosystem of tools and business applications that need the data and intelligence generated by our platform. |

| • | Multi-tenant cloud architecture. We leverage cloud, multi-tenancy, microservices, autoscaling, and deployment automation to create an efficient and resilient platform. Our platform eliminates the need for costly and slow upgrades, management overhead, and scaling issues, as well as reduces security challenges. |

| • | Security delivered by design. Our architecture employs end-to-end encryption both in transit and at rest, security at every layer of the application, and a zero-trust execution model. Our security policies, procedures, and controls are routinely audited and attested by third parties for compliance, certification, or adherence to industry security standards and regulations, such as CSA-Star, FedRAMP In Process, HIPAA, ISO 27001, PCI/DSS Provider Level 1, and SOC 2 Type 2. |

Competitive Strengths

| • | We efficiently service and support a broad customer base. Our platform serves businesses at any stage of digital transformation through an easy-to-use interface that includes visualizations, dashboards, and alerting capabilities. We have a simple onboarding process, allowing customers to quickly realize the benefits of Sumo Logic without costly and lengthy implementation. |

| • | We address a broad range of use cases. Our Continuous Intelligence Platform can address a broad range of use cases, from operational intelligence to security intelligence to business intelligence. |

| • | Our flexible subscription packages are built for scale and value. We offer flexible, multi-tiered subscription packages for access to our platform, which encourage customers to expand their adoption by providing the flexibility to ingest and analyze large volumes of data and the ability to access a broad suite of platform features without incurring overage fees. |

| • | Powerful network effects drive adoption and platform value. Our business benefits from the investments we have made to drive powerful network effects, which further increase adoption, accelerate the value of our platform to our customers as we grow, and provide a sustainable competitive advantage. |

| • | Customer adoption flywheel. Customers typically adopt Sumo Logic with an initial use case or single project and expand across teams and use cases, creating a powerful flywheel effect. |

| • | Global intelligence flywheel. Our Continuous Intelligence Platform provides unique insights into our customers’ application architectures, processes, and the tools they use to build, run, and secure modern applications and infrastructures. This benchmarking allows us to offer deeper insights to our customers and accelerate the development of our platform, driving increased adoption. |

| • | Effective go-to-market model. Our go-to-market model is designed to effectively land customers, and expand their use of our platform over time. |

Our Growth Strategies

| • | Grow our customer base. We are focused on growing our customer base by expanding our sales and marketing efforts across the markets we serve. We are also increasing our efforts internationally to expand our market presence. |

7

Table of Contents

Index to Financial Statements

| • | Expand within our customer base. We plan to grow our relationships with existing customers by making it easier and more cost-effective to increase the data they ingest, store, and utilize in our platform. |

| • | Continue to enhance and innovate our offerings. We will continue to invest in research and development to enhance our technological innovation and support new service offerings. |

| • | Deepen our sales channels and technology partnerships. We have developed a strong ecosystem of partners, including independent software vendors, distributors, resellers, managed service providers, and managed security service providers, to help us expand in existing markets. |

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | Our revenue growth rate and financial performance in recent periods may not be indicative of future performance, and we expect our revenue growth rate to decline compared to prior fiscal years; |

| • | We have a history of net losses and we may not be able to achieve or maintain profitability in the future; |

| • | We face intense competition and could face pricing pressure from, and lose market share to, our competitors, which would adversely affect our business, financial condition, and results of operations; |

| • | The markets for our offerings are evolving, and our future success depends on the growth of these markets and our ability to adapt, keep pace, and respond effectively to evolving markets; |

| • | We may fail to cost-effectively acquire new customers or obtain renewals, upgrades, or expansions from our existing customers, which would adversely affect our business, financial condition, and results of operations; |

| • | Changes to our packaging and licensing models could adversely affect our ability to attract or retain customers; |

| • | Our results of operations vary and are unpredictable from period to period, which could cause the market price of our common stock to decline; |

| • | The recent global COVID-19 pandemic has harmed and could continue to harm our business and results of operations; |

| • | Our sales cycle can be long and unpredictable, and our sales efforts require considerable time and expense; |

| • | The loss of, or a significant reduction in use of our platform by, our largest customers would result in lower revenue and harm our results of operations; |

| • | Any actual or perceived security or privacy breach could interrupt our operations, harm our reputation and brand, result in financial exposure, and lead to loss of user confidence in us or decreased use of our platform, any of which could adversely affect our business, financial condition, and results of operations; and |

8

Table of Contents

Index to Financial Statements

| • | Upon completion of this offering, our executive officers, directors, and holders of 5% or more of our common stock will collectively beneficially own approximately % of the outstanding shares of our common stock and continue to have substantial control over us, which will limit your ability to influence the outcome of important transactions, including a change in control. |

Channels for Disclosure of Information

Investors, the media, and others should note that, following the completion of this offering, we intend to announce material information to the public through filings with the Securities and Exchange Commission, or the SEC, the investor relations page on our website, press releases, our Twitter account (@SumoLogic), our Facebook page, our LinkedIn page, public conference calls, and webcasts.

The information disclosed by the foregoing channels could be deemed to be material information. As such, we encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels.

Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

Corporate Information

We were incorporated in Delaware in 2010. Our principal executive offices are located at 305 Main Street, Redwood City, California 94063, and our telephone number is (650) 810-8700. Our website address is www.sumologic.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only. You should not consider information contained on our website to be part of this prospectus or in deciding whether to purchase shares of our common stock.

Sumo Logic, our logo, and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus are the property of Sumo Logic, Inc. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

JOBS Act

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We may take advantage of these exemptions for so long as we are an emerging growth company, which could be as long as five full fiscal years following the completion of this offering. In addition, the JOBS Act provides that an “emerging growth company” can delay adopting new or revised accounting standards until those standards apply to private companies. We have elected to use the extended transition period under the JOBS Act. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

9

Table of Contents

Index to Financial Statements

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Underwriters’ over-allotment option |

shares |

| Use of proceeds |

We estimate that the net proceeds from the sale of shares of our common stock in this offering will be approximately $ (or approximately $ if the underwriters’ over-allotment option is exercised in full), based upon the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our common stock, and enable access to the public equity markets for us and our stockholders. We intend to use the net proceeds from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. Additionally, we may use a portion of the net proceeds to acquire or invest in businesses, products, services, or technologies. However, we do not have agreements or commitments for any material acquisitions or investments at this time.7 |

| Concentration of ownership |

Upon completion of this offering, our executive officers, directors, and holders of 5% or more of our common stock will beneficially own, in the aggregate, approximately % of the outstanding shares of our common stock. |

| Directed share program |

At our request, the underwriters have reserved up to % of shares offered by this prospectus for sale at the initial public offering price through a directed share program. The sales will be administered by Morgan Stanley & Co. LLC, an underwriter in this offering. We do not know if these parties will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares of common stock.8 |

| Proposed Nasdaq trading symbol |

“SUMO” |

| 7 | See the section titled “Use of Proceeds” for additional information. |

| 8 | See the section titled “Underwriters—Directed Share Program” for additional information. |

10

Table of Contents

Index to Financial Statements

The number of shares of our common stock that will be outstanding after this offering is based on 83,889,892 shares of our common stock outstanding as of July 31, 2020, and reflects:

| • | 63,761,950 shares of redeemable convertible preferred stock that will automatically convert into 63,761,950 shares of common stock in connection with this offering pursuant to the terms of our restated certificate of incorporation, or the Capital Stock Conversion; and |

| • | 20,127,942 shares of common stock outstanding. |

The shares of our common stock outstanding as of July 31, 2020 exclude the following:

| • | 13,708 shares of our Series E redeemable convertible preferred stock issuable upon the exercise of a warrant outstanding as of July 31, 2020, with an exercise price of $7.00485 per share, which would result in the issuance of 13,708 shares of our common stock in connection with the Capital Stock Conversion and this offering; |

| • | 8,038 shares of our Series F redeemable convertible preferred stock issuable upon the exercise of a warrant outstanding as of July 31, 2020, with an exercise price of $8.07738 per share, which would result in the issuance of 8,038 shares of our common stock in connection with the Capital Stock Conversion and this offering; |

| • | 10,530 shares of our Series G redeemable convertible preferred stock issuable upon the exercise of a warrant outstanding as of July 31, 2020, with an exercise price of $11.0153 per share, which would result in the issuance of 10,530 shares of our common stock in connection with the Capital Stock Conversion and this offering; |

| • | 32,580 shares of our common stock to be issued in connection with our acquisitions of privately-held companies; |

| • | 175,061 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock outstanding as of July 31, 2020, which were assumed in connection with our acquisition of Jask Labs Inc., or Jask Labs, with a weighted-average exercise price of $9.93 per share; |

| • | 26,728,382 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock outstanding as of July 31, 2020, with a weighted-average exercise price of $4.11 per share; |

| • | 2,909,167 shares of our common stock subject to restricted stock units, or RSUs, outstanding as of July 31, 2020; |

| • | 1,500 shares of our common stock issuable upon the exercise of options to purchase shares of our common stock granted after July 31, 2020, with a weighted-average exercise price of $12.11683 per share; |

| • | 309,300 shares of our common stock subject to RSUs to be granted after July 31, 2020; and |

| • | 15,377,686 shares of our common stock reserved for future issuance under our equity compensation plans, consisting of: |

| • | 10,000,000 shares of our common stock to be reserved for future issuance under our 2020 Equity Incentive Plan, or our 2020 Plan, which will become effective prior to the completion of this offering; |

11

Table of Contents

Index to Financial Statements

| • | 3,377,686 shares of our common stock reserved for future issuance under our 2010 Stock Plan, or our 2010 Plan, which number of shares will be added to the shares of our common stock to be reserved for future issuance under our 2020 Plan upon its effectiveness, at which time we will cease granting awards under our 2010 Plan; and |

| • | 2,000,000 shares of our common stock to be reserved for future issuance under our 2020 Employee Stock Purchase Plan, or our ESPP, which will become effective prior to the completion of this offering. |

Our 2020 Plan and ESPP each provide for annual automatic increases in the number of shares reserved thereunder and our 2020 Plan also provides for increases to the number of shares that may be granted thereunder based on shares under our 2010 Plan that expire, are forfeited, or otherwise repurchased by us, as more fully described in the section titled “Executive Compensation—Employee Benefit and Stock Plans.”

Except as otherwise indicated, all information in this prospectus assumes:

| • | the Capital Stock Conversion will occur in connection with this offering; |

| • | the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the effectiveness of our amended and restated bylaws, will each occur immediately prior to the completion of this offering; |

| • | no exercise of outstanding stock options and warrants or settlement of outstanding RSUs subsequent to July 31, 2020; and |

| • | no exercise by the underwriters of their over-allotment option. |

12

Table of Contents

Index to Financial Statements

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables summarize our historical consolidated financial and other data. We have derived the summary consolidated statements of operations data for the years ended January 31, 2018, 2019, and 2020 from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the six months ended July 31, 2019 and 2020 and the consolidated balance sheet data as of July 31, 2020 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited interim consolidated financial statements on the same basis as the audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments that, in our opinion, are necessary to state fairly the financial information set forth in those statements. The summary consolidated financial data in this section are not intended to replace our consolidated financial statements and related notes. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for the six months ended July 31, 2020 are not necessarily indicative of results to be expected for the full year or any other period. The following summary consolidated financial and other data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. The last day of our fiscal year is January 31. Our fiscal quarters end on April 30, July 31, October 31, and January 31.

Consolidated Statements of Operations Data

| Year Ended January 31, | Six Months Ended July 31, |

|||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| (in thousands, except for per share data) | ||||||||||||||||||||

| Revenue |

$ | 67,828 | $ | 103,642 | $ | 155,056 | $ | 70,232 | $ | 96,617 | ||||||||||

| Cost of revenue(1) |

22,438 | 29,010 | 44,498 | 17,939 | 28,539 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

45,390 | 74,632 | 110,558 | 52,293 | 68,078 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

25,261 | 36,240 | 52,462 | 21,365 | 33,003 | |||||||||||||||

| Sales and marketing(1)(2) |

43,082 | 72,218 | 107,239 | 46,486 | 53,630 | |||||||||||||||

| General and administrative(1) |

9,606 | 14,347 | 37,263 | 13,948 | 16,589 | |||||||||||||||

| Impairment of capitalized internal-use software |

— | — | 6,689 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

77,949 | 122,805 | 203,653 | 81,799 | 103,222 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(32,559 | ) | (48,173 | ) | (93,095 | ) | (29,506 | ) | (35,144 | ) | ||||||||||

| Interest and other income, net |

568 | 1,096 | 1,982 | 885 | 73 | |||||||||||||||

| Interest expense |

(19 | ) | (105 | ) | (123 | ) | (26 | ) | (364 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(32,010 | ) | (47,182 | ) | (91,236 | ) | (28,647 | ) | (35,435 | ) | ||||||||||

| Provision for income taxes |

425 | 607 | 901 | 355 | 347 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (32,435 | ) | $ | (47,789 | ) | $ | (92,137 | ) | $ | (29,002 | ) | $ | (35,782 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to common stockholders, basic and diluted(3) |

$ | (2.92 | ) | $ | (3.88 | ) | $ | (6.18 | ) | $ | (2.13 | ) | $ | (1.93 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted(3) |

11,092 | 12,314 | 14,907 | 13,598 | 18,522 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(3) |

$ | (1.21 | ) | $ | (0.43 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted-average shares used in computing pro forma net loss per share, basic and diluted (unaudited)(3) |

76,234 | 82,284 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

13

Table of Contents

Index to Financial Statements

| (1) | Includes stock-based compensation expense as follows: |

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue(b) |

$ | 76 | $ | 52 | $ | 179 | $ | 46 | $ | 101 | ||||||||||

| Research and development(a)(b) |

933 | 1,609 | 5,940 | 1,479 | 3,878 | |||||||||||||||

| Sales and marketing(b) |

970 | 1,856 | 5,791 | 1,906 | 3,116 | |||||||||||||||

| General and administrative(b) |

851 | 3,060 | 10,124 | 3,402 | 2,628 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation |

$ | 2,830 | $ | 6,577 | $ | 22,034 | $ | 6,833 | $ | 9,723 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | See Note 11 to our consolidated financial statements included elsewhere in this prospectus for the capitalized stock-based compensation expense related to internal-use software development costs. |

| (b) | See Note 11 to our consolidated financial statements included elsewhere in this prospectus for the incremental stock-based compensation expense related to transfers of our common stock by our current and former employees to existing investors for amounts over the estimated fair value at the date of the transaction. |

| (2) | During the year ended January 31, 2020 and the six months ended July 31, 2020, we recorded sales and marketing expenses of $4.5 million and $1.5 million, respectively, for additional compensation and other costs related to the employment status of certain current and former employees. Of the aggregate $6.0 million, approximately $4.5 million is expected to be paid as part of a signed settlement agreement. For more information, see the section titled “Business—Legal Proceedings.” |

| (3) | See Note 14 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to compute the historical and pro forma net loss per share and the number of shares used in the computation of the per share amounts. |

Consolidated Balance Sheet Data

| As of July 31, 2020 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma as Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Cash and cash equivalents |

$ | 98,117 | $ | 98,117 | $ | |||||||

| Working capital(4) |

34,348 | 34,348 | ||||||||||

| Total assets |

233,488 | |

233,488 |

|

||||||||

| Deferred revenue |

82,552 | 82,552 | ||||||||||

| Long-term debt |

24,250 | 24,250 | ||||||||||

| Redeemable convertible preferred stock |

340,167 | — | ||||||||||

| Additional paid-in capital |

109,261 | 456,708 | ||||||||||

| Accumulated deficit |

(353,276 | ) | (360,235 | ) | ||||||||

| Total stockholders’ (deficit) equity |

(244,208 | ) | 96,286 | |||||||||

| (1) | The pro forma column in the consolidated balance sheet data table above reflects (a) the Capital Stock Conversion, as if such conversion had occurred on July 31, 2020, (b) the automatic conversion of outstanding warrants to purchase up to 32,276 shares of our redeemable convertible preferred stock into warrants to purchase up to 32,276 shares of our common stock and the resulting reclassification of the redeemable convertible preferred stock warrant liability to additional paid-in capital, (c) stock-based compensation expense of $7.0 million associated with RSUs subject to service-based and performance-based vesting conditions, which we will recognize upon the completion of this offering, reflected as an increase in additional paid-in-capital and accumulated deficit, as further described in Note 2 to our consolidated financial statements included elsewhere in this prospectus, and (d) the filing and effectiveness of our amended and restated certificate of incorporation in Delaware that will become effective immediately prior to the completion of this offering. |

| (2) | The pro forma as adjusted column in the balance sheet data table above gives effect to (a) the pro forma adjustments set forth above and (b) the sale and issuance by us of shares of our common stock in this offering, based upon the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease the amount of our pro forma as |

14

Table of Contents

Index to Financial Statements

| adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions payable by us. An increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our pro forma as adjusted cash and cash equivalents, working capital, total assets, and total stockholders’ equity by $ million, assuming the assumed initial public offering price remains the same, and after deducting estimated underwriting discounts and commissions payable by us. |

| (4) | Working capital is defined as current assets less current liabilities. |

Non-GAAP Financial Measures9

In addition to our financial information presented in accordance with GAAP, we believe the following non-GAAP financial measures are useful to investors in evaluating our operating performance. We use the following non-GAAP financial measures, collectively, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, may be helpful to investors because they provide consistency and comparability with past financial performance and meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. The non-GAAP financial measures are presented for supplemental informational purposes only, have limitations as analytical tools, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP and may be different from similarly-titled non-GAAP financial measures used by other companies. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business.

Non-GAAP Gross Profit and Non-GAAP Gross Margin

We define non-GAAP gross profit and non-GAAP gross margin as gross profit and gross margin, respectively, excluding stock-based compensation expense recorded to cost of revenue and amortization of acquired intangible assets. We use non-GAAP gross profit and non-GAAP gross margin in conjunction with GAAP financial measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance.

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Gross profit |

$ | 45,390 | $ | 74,632 | $ | 110,558 | $ | 52,293 | $ | 68,078 | ||||||||||

| Non-GAAP gross profit |

45,558 | 75,001 | 113,306 | 52,559 | 71,590 | |||||||||||||||

| Gross margin |

67 | % | 72 | % | 71 | % | 74 | % | 70 | % | ||||||||||

| Non-GAAP gross margin |

67 | % | 72 | % | 73 | % | 75 | % | 74 | % | ||||||||||

Non-GAAP Operating Loss and Non-GAAP Operating Margin

We define non-GAAP operating loss and non-GAAP operating margin as loss from operations and operating margin, respectively, excluding stock-based compensation expense, amortization of acquired intangible

| 9 | See the section titled “Reconciliation of Non-GAAP Financial Measures to Most Directly Comparable GAAP Financial Measures” for a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with GAAP. |

15

Table of Contents

Index to Financial Statements

assets, acquisition-related expenses, and impairment of capitalized internal-use software. We use non-GAAP operating loss and non-GAAP operating margin in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance.

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Loss from operations |

$ | (32,559 | ) | $ | (48,173 | ) | $ | (93,095 | ) | $ | (29,506 | ) | $ | (35,144 | ) | |||||

| Non-GAAP operating loss |

(29,637 | ) | (41,279 | ) | (58,798 | ) | (22,453 | ) | (22,010 | ) | ||||||||||

| Operating margin |

(48 | )% | (46 | )% | (60 | )% | (42 | )% | (36 | )% | ||||||||||

| Non-GAAP operating margin |

(44 | )% | (40 | )% | (38 | )% | (32 | )% | (23 | )% | ||||||||||

Free Cash Flow

We define free cash flow as cash used in operating activities less purchases of property and equipment and capitalized internal-use software. We believe free cash flow is a useful indicator of liquidity that provides our management, board of directors, and investors with information about our future ability to generate or use cash to enhance the strength of our balance sheet and further invest in our business and pursue potential strategic initiatives.

| Year Ended January 31, | Six Months Ended July 31, | |||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cash used in operating activities |

$ | (6,528 | ) | $ | (22,127 | ) | $ | (48,569 | ) | $ | (15,542 | ) | $ | (27,906 | ) | |||||

| Cash used in investing activities |

(2,959 | ) | (1,544 | ) | (23,385 | ) | (5,222 | ) | (1,149 | ) | ||||||||||

| Cash provided by financing activities |

74,986 | 1,654 | 108,135 | 108,501 | 25,717 | |||||||||||||||

| Free cash flow |

(8,137 | ) | (23,671 | ) | (56,225 | ) | (19,834 | ) | (29,055 | ) | ||||||||||

16

Table of Contents

Index to Financial Statements

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making a decision to invest in our common stock. Our business, financial condition, results of operations, or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the risks actually occur, our business, financial condition, results of operations, and prospects could be adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

Our revenue growth rate and financial performance in recent periods may not be indicative of future performance, and we expect our revenue growth rate to decline compared to prior fiscal years.

We have experienced rapid revenue growth in recent periods, with revenue of $67.8 million, $103.6 million, $155.1 million, $70.2 million, and $96.6 million for fiscal 2018, 2019, 2020, and the six months ended July 31, 2019 and 2020, respectively. You should not rely on our revenue for any previous quarterly or annual period as any indication of our revenue or revenue growth in future periods. As we grow our business, we expect our revenue growth rates to decline compared to prior fiscal years due to a number of reasons, which may include more challenging comparisons to prior periods as our revenue grows, slowing demand for our platform, increasing competition, a decrease in the growth of our overall market or market saturation, and our failure to capitalize on growth opportunities. In addition, our growth rates are likely to experience increased volatility, and are likely to decline, due to global societal and economic disruption as a result of the COVID-19 pandemic.

We have a history of net losses and we may not be able to achieve or maintain profitability in the future.

We have incurred net losses since our inception, and we expect to continue to incur net losses in the near future. We incurred net losses of $32.4 million, $47.8 million, $92.1 million, $29.0 million, and $35.8 million for fiscal 2018, 2019, and 2020, and the six months ended July 31, 2019 and 2020, respectively. As of July 31, 2020, we had an accumulated deficit of $353.3 million. Because the market for our platform is rapidly evolving, it is difficult for us to predict our future results of operations. We expect our operating expenses to increase significantly over the next several years, as we continue to hire additional personnel, particularly in sales and marketing and research and development, expand our operations and infrastructure, both domestically and internationally, and continue to develop our platform features. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. In addition to the expected costs to grow our business, we also expect to incur significant additional legal, accounting, and other expenses as a newly public company. If we fail to increase our revenue to sufficiently offset the increases in our operating expenses, we will not be able to achieve or maintain profitability in the future.

We face intense competition and could face pricing pressure from, and lose market share to, our competitors, which would adversely affect our business, financial condition, and results of operations.

The markets in which we operate are competitive and characterized by rapid changes in technology, customer requirements, and industry standards, and frequent introductions of improvements to existing offerings. Our business model of delivering continuous intelligence through the cloud is still relatively new and has only recently gained market traction. Moreover, many established businesses are aggressively competing against us and have offerings that have functionalities similar to those of our platform. We expect competition to increase as other established and emerging companies enter this market, as customer requirements evolve, and as new offerings and technologies are introduced. If we are unable to anticipate or effectively react to these competitive challenges, our competitive position would weaken, and our business, financial condition, and results of operations would be adversely affected.

17

Table of Contents

Index to Financial Statements

Our competitors and potential competitors include providers of tools such as analytics, enterprise and open source search, SIEM, monitoring, and other software offerings that customers may perceive as substitutes for our platform. Our primary competitors include Splunk and Elastic. Other competitors include Datadog, cloud infrastructure providers such as Amazon Web Services, Microsoft Azure, or Azure, Google Cloud Platform, or GCP, and various private companies.

Many of our existing competitors have, and some of our potential competitors could have, substantial competitive advantages, such as:

| • | greater name recognition, longer operating histories, and larger customer bases; |

| • | larger sales and marketing budgets and resources; |

| • | broader distribution and established relationships with channel partners and customers; |

| • | greater customer support resources; |

| • | greater resources to make acquisitions and enter into strategic partnerships; |

| • | lower labor and research and development costs; |

| • | larger and more mature intellectual property rights portfolios; and |

| • | substantially greater financial, technical, and other resources. |

Conditions in our market could change rapidly and significantly as a result of technological advancements, the emergence of new entrants into the market, partnering or acquisitions by our competitors, or continuing market consolidation. New start-up companies that innovate and competitors that are making significant investments in research and development may invent similar or superior offerings and technologies that compete with our offerings. Potential customers may also believe that substitute technologies which have similar functionality or features as our platform are sufficient, or they may believe that point solutions that address narrower segments overall are nonetheless adequate for their needs. Some of our current or potential competitors have made or could make acquisitions of businesses or establish cooperative relationships that may allow them to offer more directly competitive and comprehensive offerings than were previously offered and adapt more quickly to new technologies and customer needs.