Exhibit 99.1

Preliminary and Subject to Completion, dated December 21, 2015

PRELIMINARY INFORMATION STATEMENT

ONCOCYTE CORPORATION

Common Stock, no par value

This information statement is being furnished in connection with the distribution of shares of common stock, no par value, of OncoCyte Corporation (“OncoCyte”) to holders of common shares, no par value, of BioTime, Inc. (the “Distribution”).

OncoCyte is currently a 76.39 % owned subsidiary of BioTime and is engaged in the business of developing laboratory tests for the diagnosis of cancer. Following the Distribution, we will continue to be a majority owned subsidiary of BioTime but our common stock will be publicly traded and we will continue to build our own management team.

You will receive one share of OncoCyte common stock for every 20 BioTime common shares you hold as of the close of business on December 21, 2015, the “record date” of the Distribution. If you sell your BioTime common shares after the record date and before the date of the Distribution, you also will be selling your right to receive shares of OncoCyte common stock in the Distribution. The Distribution will be made in book-entry form. We expect the Distribution to occur on December 31, 2015. In this information statement we sometimes refer to the shares of OncoCyte common stock to be distributed to BioTime shareholders in the Distribution as “Distribution Shares.”

No shareholder approval of the Distribution by BioTime shareholders is required or sought and you are not being asked for a proxy to vote on the Distribution, and you are requested not to send us or BioTime a proxy.

BioTime shareholders will not be required to pay for the Distribution Shares they receive in the Distribution or to surrender or exchange BioTime common shares in order to receive their Distribution Shares or to take any other action in connection with the Distribution.

There is no current trading market for OncoCyte common stock. However, we have applied to list OncoCyte common stock on the NYSE MKT under the symbol OCX. If our listing application is not approved, we plan to arrange for the trading of our common stock on the OTC Bulletin Board no later than the completion of the Distribution.

In reviewing this information statement, you should carefully consider the matters described under “Risk Factors” for a discussion of certain factors that should be considered by recipients of our common stock. The Distribution will not qualify as a tax free reorganization for U.S. federal income tax purposes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is December , 2015.

TABLE OF CONTENTS

| |

Page

|

|

Information Statement Summary

|

4

|

| |

|

|

Questions and Answers About OncoCyte and the Distribution

|

8

|

| |

|

|

Risk Factors

|

12

|

| |

|

|

The Distribution

|

27

|

| |

|

|

Market for Our Common Equity

|

30

|

| |

|

|

Dividend Policy

|

30

|

| |

|

|

Capitalization

|

30

|

| |

|

|

Summary and Selected Financial Data

|

31

|

| |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

32

|

| |

|

|

Business

|

40

|

| |

|

|

Management

|

65

|

| |

|

|

Executive Compensation

|

72

|

| |

|

|

Security Ownership by Certain Beneficial Owners and Management

|

77

|

| |

|

|

Certain Federal Income Tax Considerations

|

81

|

| |

|

|

Shares Eligible For Future Sale

|

84

|

| |

|

|

Description of Securities

|

86

|

| |

|

|

Index to Audited Financial Statements

|

F-1

|

| |

|

|

Report of Independent Registered Public Accounting Firm

|

F-2

|

| |

|

|

Index to Unaudited Condensed Interim Financial Statements

|

F-23

|

This information statement is being furnished solely to provide information to BioTime shareholders who will receive shares of our common stock in the Distribution. It is not and is not to be construed as an inducement or encouragement to buy or sell any of our securities or any securities of BioTime. This information statement describes our business, our relationship with BioTime and how the Distribution affects BioTime and its shareholders, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of our common stock that you will receive in the Distribution. You should be aware of certain risks relating to the Distribution, our business, and ownership of our common stock, which are described under the heading “Risk Factors.”

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations and practices.

You should rely only on the information contained in this information statement. We have not, and BioTime has not, authorized any other person to provide you with information different from, or in addition to, that contained in this information statement. The information contained in this information statement is accurate only as of its date, regardless of the time of the delivery of Distribution Shares.

FOR RESIDENTS OF THE PHILIPPINES:

THESE SECURITIES ARE BEING OFFERED OR SOLD PURSUANT TO AN EXEMPT TRANSACTION UNDER SECTION 10.1(c) OF THE PHILIPPINES SECURITIES REGULATION CODE.

THE SECURITIES BEING OFFERED OR SOLD HAVE NOT BEEN REGISTERED WITH THE PHILIPPINES SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES REGULATION CODE. ANY FURTHER OFFER OR SALE THEREOF IS SUBJECT TO REGISTRATION REQUIREMENTS UNDER THE CODE UNLESS SUCH OFFER OR SALE QUALIFIES AS AN EXEMPT TRANSACTION

Industry and Market Data

This information statement contains market data and industry forecasts that were obtained from industry publications, third party market research and publicly available information. These publications generally state that the information contained therein has been obtained from sources believed to be reliable. While we believe that the information from these publications is reliable, we have not independently verified such information.

This information statement also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this information statement from our own research as well as from industry and general publications, surveys and studies conducted by third parties, some of which may not be publicly available. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

REVERSE STOCK SPLIT

On November 18, 2015, OncoCyte effected a 1-for-2 reverse stock split of its common stock. All references to common stock, warrants, contingently issuable common stock warrants, and options to purchase common stock, and all per share data and related information, including the price at which shares of common stock have been sold or may be issued, have been retroactively adjusted, where applicable, in this Information Statement to reflect the reverse stock split of OncoCyte common stock as if it had occurred at the beginning of the earliest period presented.

INFORMATION STATEMENT SUMMARY

This summary provides an overview of selected information contained elsewhere in this information statement or in our registration statement on Form 10 in their entirety, including the information discussed under “Risk Factors” and our financial statements and the related notes thereto included elsewhere in this information statement.

OncoCyte Corporation

Unless otherwise indicated herein, the terms “we,” “our,” or “us,” refer to OncoCyte Corporation.

Overview

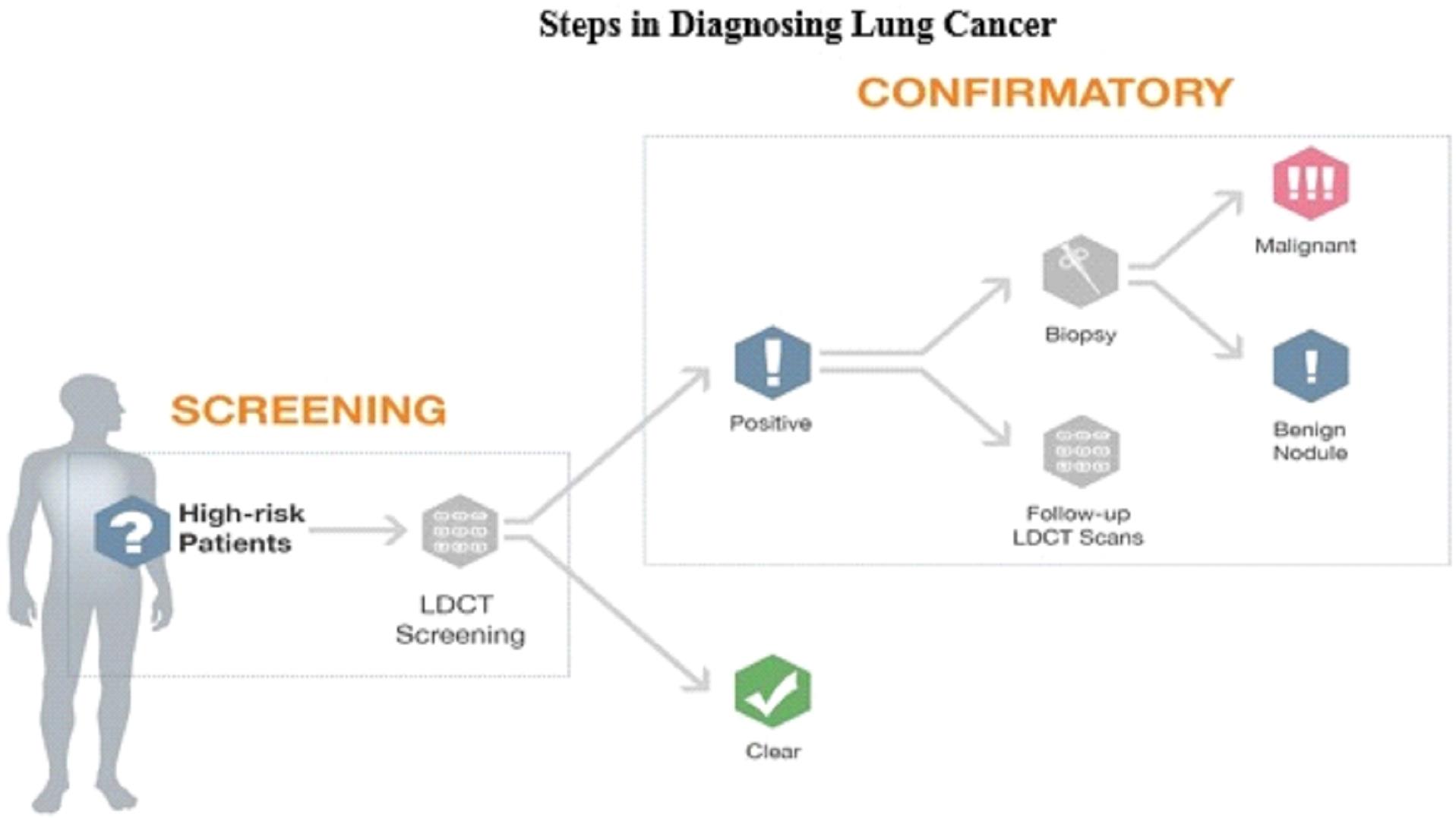

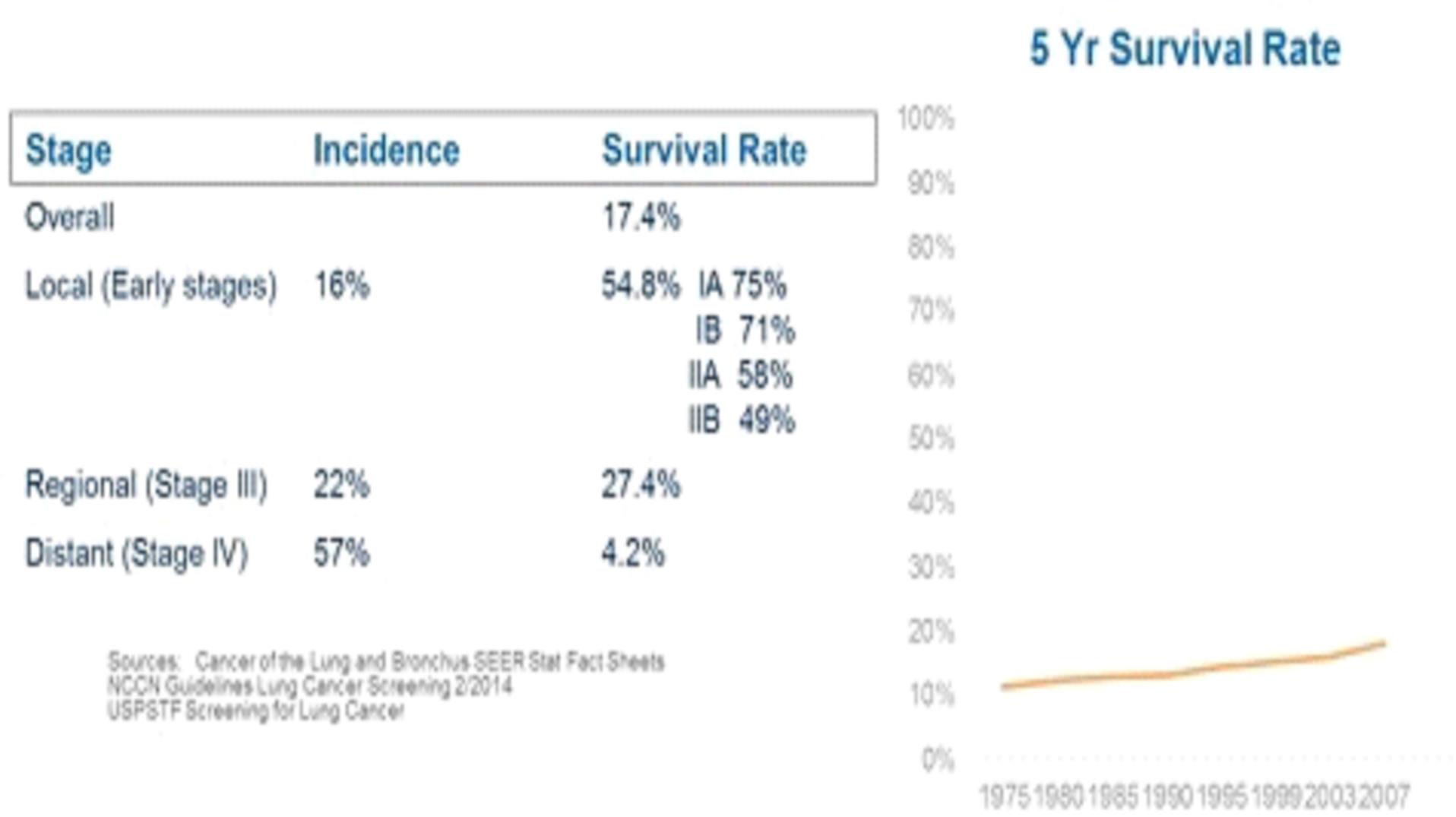

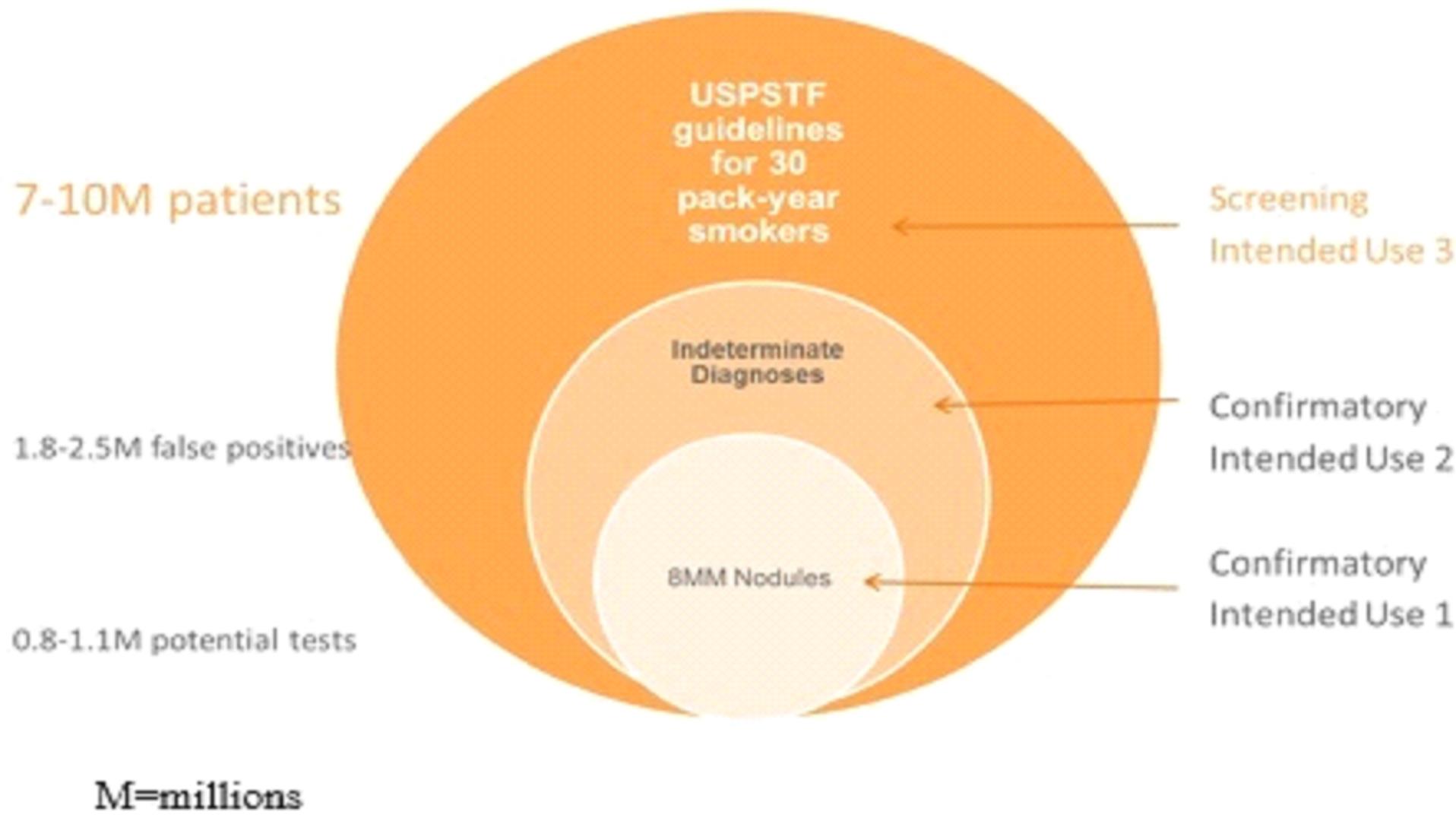

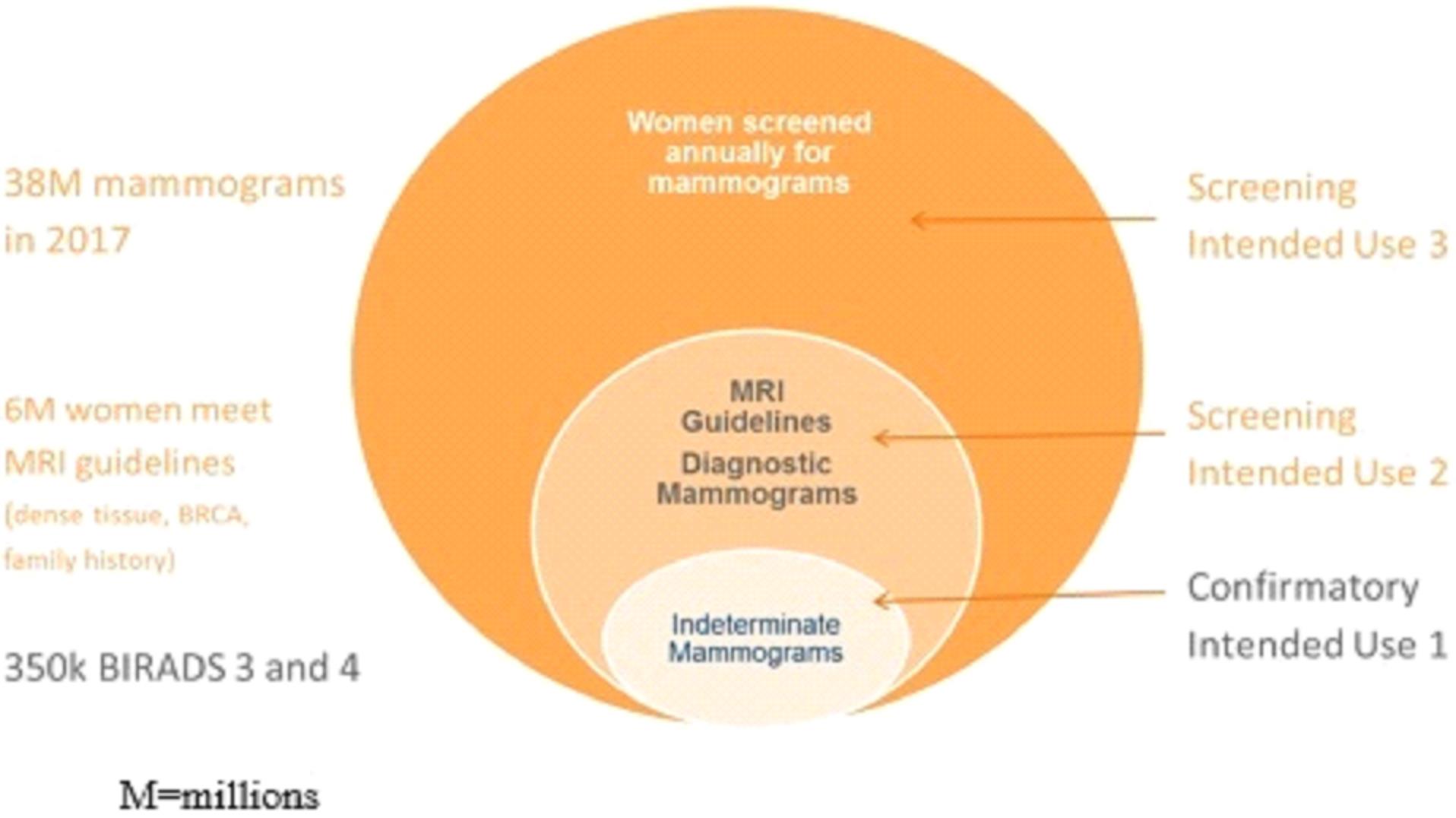

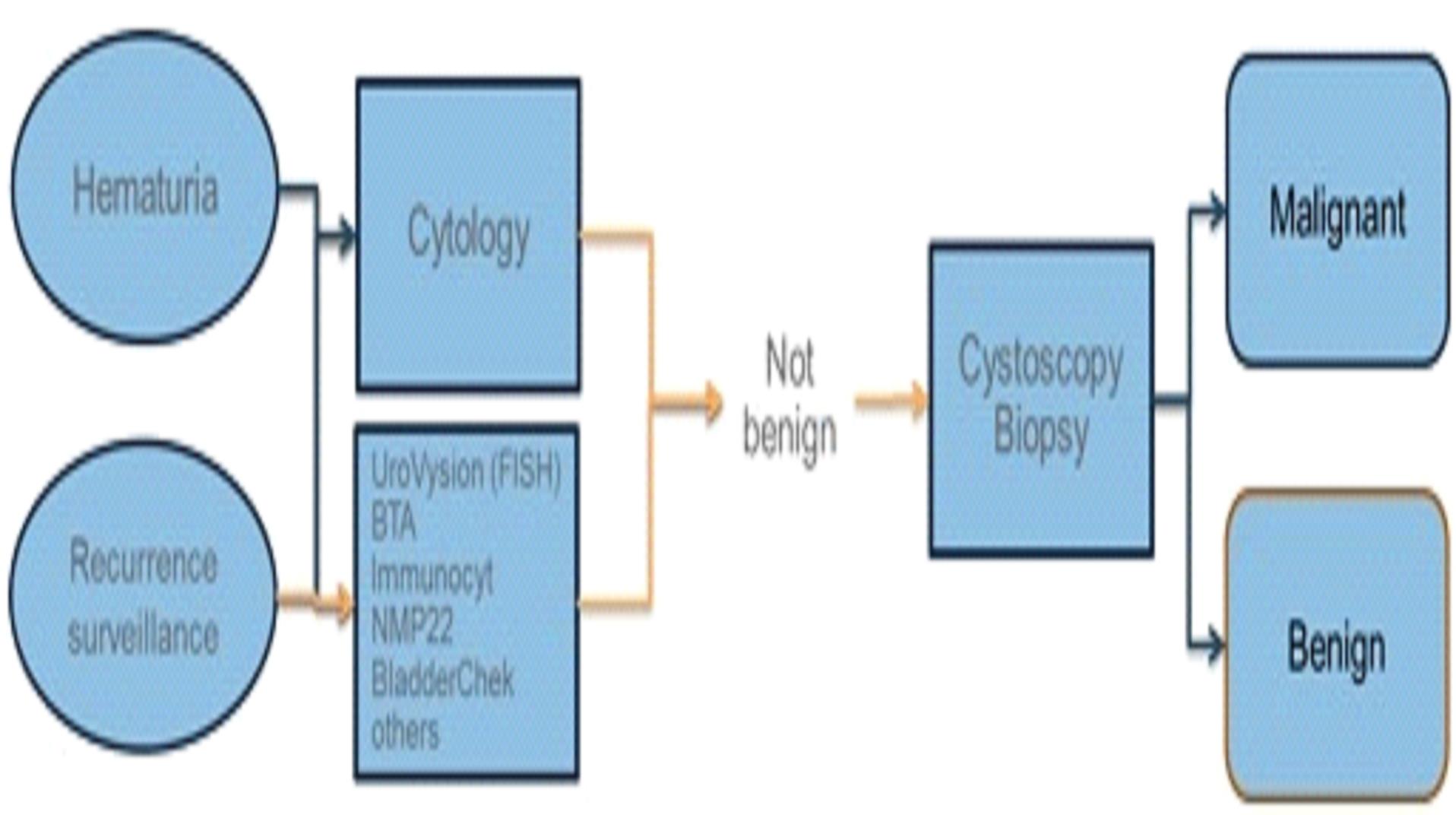

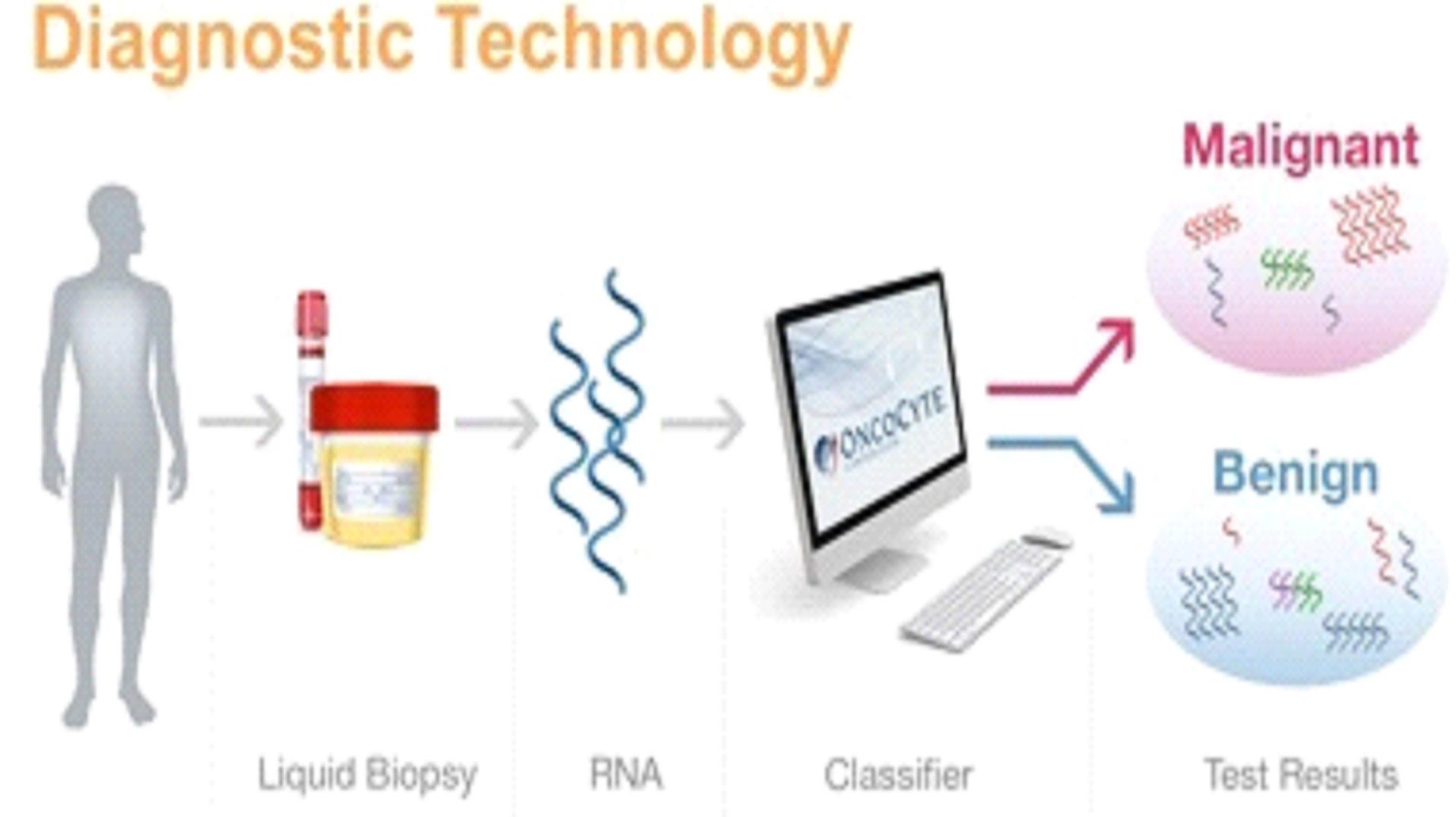

Our mission is to develop highly accurate, easy to administer, non-invasive liquid biopsy diagnostic tests in areas of high unmet need in oncology. Our initial focus will be confirmatory diagnostics that are used in conjunction with imaging to confirm initial diagnoses. In addition, we will be developing screening diagnostics as potential replacements for screening imaging procedures that do not meet the needs of patients, health care providers or payers. For some indications, we will also be pursuing the probability of recurrence of a specific cancer through the development of prognostics; or companion diagnostics that help a physician determine which therapy is the optimal treatment for the patient.

Our initial liquid biopsy diagnostic tests will be confirmatory diagnostics and are being developed to reduce false positive results associated with current diagnostic techniques. These new diagnostic tests are intended to:

| |

·

|

Improve health outcomes through early diagnoses and better prognostic capabilities;

|

|

·

|

Reduce the cost of care through the avoidance of more costly diagnostic procedures, including invasive biopsy and cystoscopic procedures; and

|

|

·

|

Improve the quality of life for cancer patients by reducing the anxiety associated with non-definitive diagnoses.

|

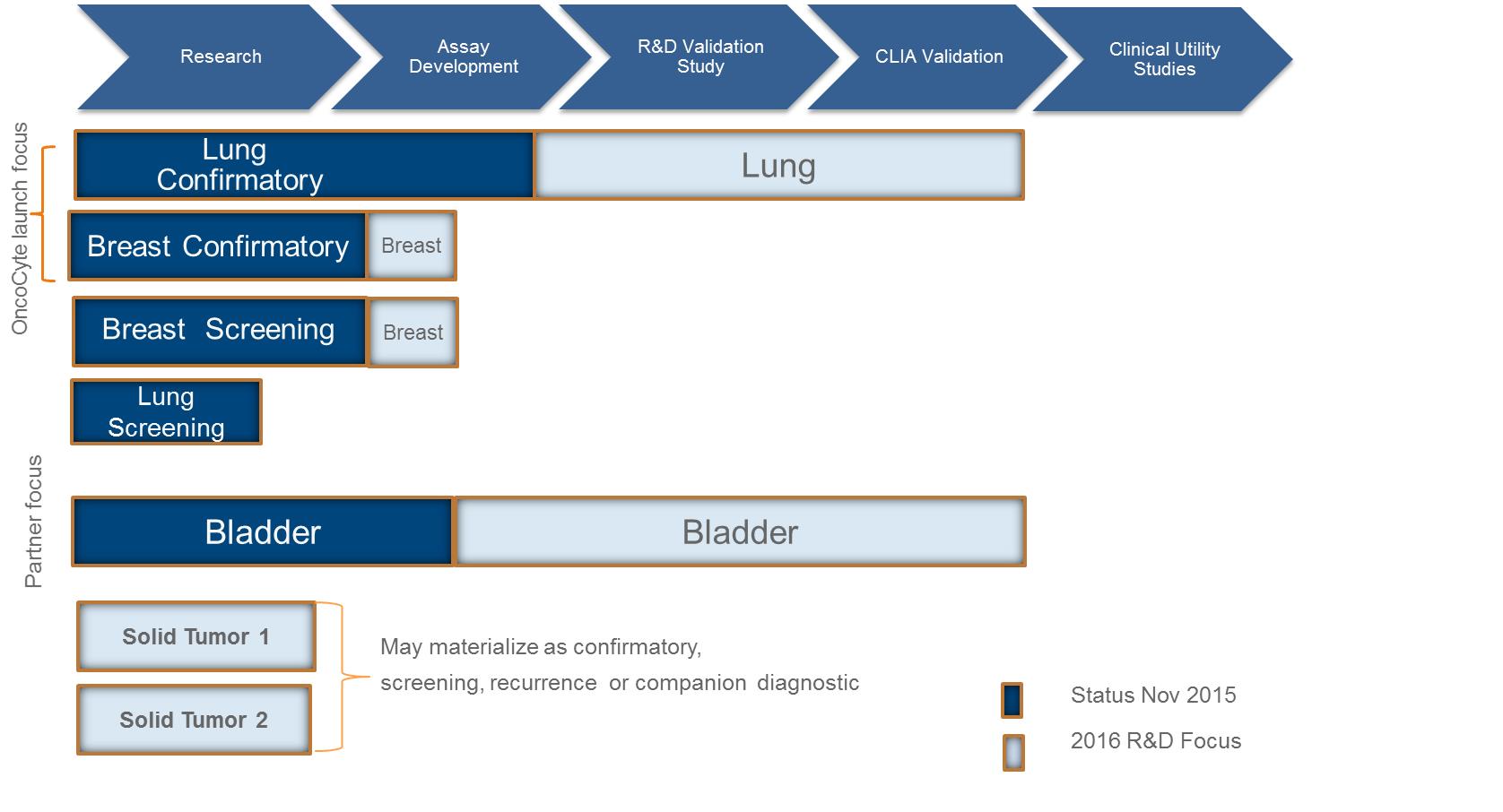

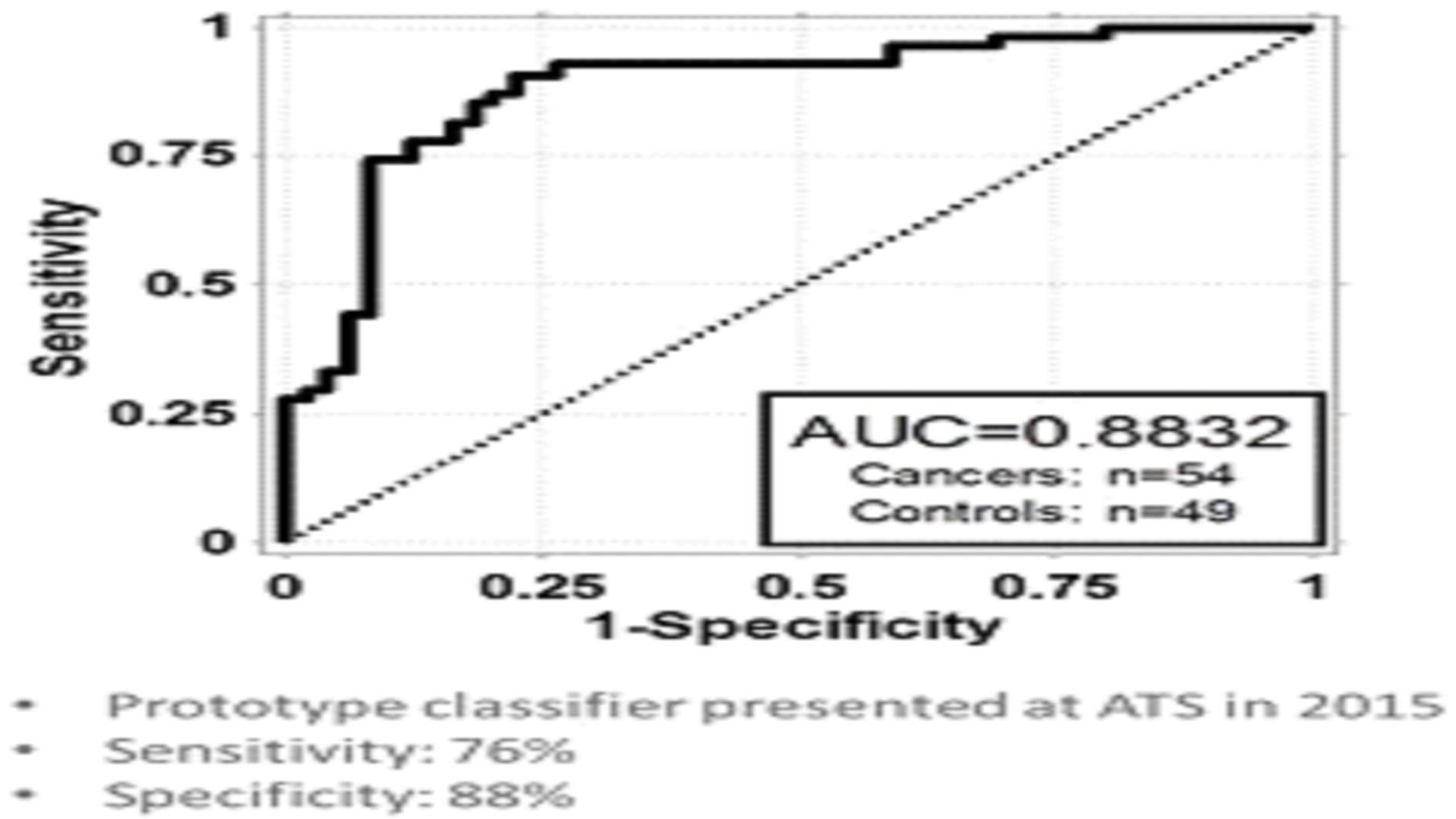

We are currently working on diagnostic tests for three types of cancer: lung cancer, breast cancer, and bladder cancer. Additionally we have early stage diagnostic research programs for other solid tumor cancers in our research and development pipeline.

Business Strategy

From our inception in late 2009 through March 2011, we focused our efforts on the development of embryonic stem cell-derived cancer therapies. In April 2011, we initiated development of molecular cancer diagnostics utilizing a discovery platform that focuses on identifying genetic markers broadly expressed in numerous types of cancer. The shift in focus from stem cell-derived cancer therapies to molecular cancer diagnostic was driven by a development focus on a unique scientific approach, the growing need for better cancer diagnostic protocols and a window of opportunity created by guidelines for lung and breast cancer screening. The diagnostic markers we have discovered thus far could address unmet needs in cancer diagnostic indications that have a strong potential to generate short- to mid-term revenues, resulting in a risk-balanced diagnostic test development strategy.

Our current development strategy for cancer diagnostic tests is to evaluate and validate specific diagnostics using methods of detecting proteins, messenger RNA (“mRNA”) or micro RNA (“miRNA”) approach based on unmet medical need, market size and ease of use. We believe that this approach allows us to have a broader look into the genetic markers that differentially express in cancer. Our development strategy will be matched to our market planning strategy to determine which:

|

·

|

Diagnostic tests to prioritize in our development program;

|

|

·

|

Diagnostic tests we should market ourselves;

|

|

·

|

Diagnostic tests we should co-market through an alliance with one or more other companies; and

|

|

·

|

Diagnostic tests we should out-license to third parties for development and/or commercialization.

|

For the near term, we plan to devote most of our financial resources to the development and commercialization of our initial laboratory diagnostic tests for certain types of cancer. While diagnostics are presently our primary focus, we may devote a portion of our resources to cancer therapeutic development based on our current technology, which pertains to homing peptides and the derivation of vascular cells engineered to deliver a toxic payload to the developing blood vessels of a malignant tumor to destroy the tumor, or based on any proof of concept and early stage clinical results that may emerge from our diagnostic work, including with our proprietary biomarkers such as Collagen Type X (“COLX”). The extent of our work in the cancer therapeutics field will depend in part on the financial resources available to us, whether from revenues from the development and commercialization of cancer diagnostics, or from funds obtained through capital transactions. Because the development of cancer therapeutics will be a longer term and more capital intensive project than diagnostic test development, in lieu of completing the development of therapeutics products ourselves, we may seek to license out the development of potential cancer therapeutics to biopharmaceutical companies focused on therapeutic development and commercialization.

Additional Information

OncoCyte Corporation is a majority-owned subsidiary of BioTime, Inc. We were incorporated in 2009 in the state of California as a subsidiary of BioTime. Our principal executive offices are located at 1301 Harbor Bay Parkway, Alameda, California 94502. Our telephone number is (510) 521-3390.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”); (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or the SEC. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

|

·

|

Reduced disclosure about our executive compensation arrangements;

|

|

·

|

No non-binding shareholder advisory votes on executive compensation or golden parachute arrangements;

|

|

·

|

Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and

|

|

·

|

Reduced disclosure of financial information in this registration statement, including two years of audited financial information and two years of selected financial information.

|

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company

Summary of the Distribution

The following is a summary of the terms of the Distribution. See “The Distribution” for a more detailed description of the matters described below.

|

Distributing company

|

|

BioTime, Inc.

|

| |

|

|

|

Company whose shares are to be distributed

|

|

OncoCyte Corporation

|

| |

|

|

|

Distribution ratio

|

|

Each holder of BioTime common shares will receive a dividend of one share of OncoCyte common stock for every 20 BioTime common shares held on the record date.

|

| |

|

|

|

Securities to be distributed

|

|

Approximately 4,744,707 shares of OncoCyte common stock, which will constitute approximately 18.69% of the OncoCyte common stock outstanding immediately after the Distribution. The number of shares that BioTime will distribute to its shareholders will be reduced to the extent that cash payments are made in lieu of the issuance of fractional shares of OncoCyte common stock, as described below. Also, the shares of OncoCyte common stock distributed to OncoCyte on account of the 619,706 BioTime common shares that OncoCyte owns will revert to the status of authorized but unissued shares upon receipt by OncoCyte and will no longer be outstanding. See “Description of Capital Stock—Common Stock.”

|

| |

|

|

|

Proposed Trading Symbol

|

|

OCX |

| |

|

|

|

Fractional shares

|

|

BioTime will not distribute any fractional shares of OncoCyte common stock to its shareholders. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds of the sales pro rata to each BioTime shareholder (other than OncoCyte) who otherwise would have been entitled to receive a fractional share in the Distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares.

|

| |

|

|

|

Record date

|

|

The record date is the close of business on December 21, 2015. Only holders of BioTime common shares as of the close of business on the record date will be entitled to receive OncoCyte common stock in the Distribution.

|

| |

|

|

|

Distribution Date

|

|

The Distribution Date will be on or about December 31, 2015.

|

| |

|

|

|

Relationship between OncoCyte and BioTime after the Distribution

|

|

After the Distribution, BioTime will continue to own, directly or through a subsidiary, approximately 14,866,888 shares of OncoCyte common stock, which will represent approximately 58.55% of the OncoCyte common stock outstanding after the Distribution. Accordingly, OncoCyte will remain a majority-owned subsidiary of BioTime immediately after the Distribution. BioTime will continue to provide OncoCyte with use of office and laboratory facilities and equipment; laboratory and office supplies; utility services to the extent the same are provided to the shared office and laboratory facilities; information technology support; human resources; technology licensing (including technology licensed from third parties) and other limited services consistent with past practices under an existing Shared Facilities Agreement. The companies may also enter into other agreements providing for the allocation of tax benefits, employee matters and liabilities arising from periods prior to the Distribution, and other aspects of the relationship between the two companies and other BioTime subsidiaries. |

|

Management of OncoCyte

|

|

OncoCyte has a board of directors (the “Board of Directors”) consisting of seven directors, three of whom qualify as “independent” directors under the rules of the NYSE MKT, and four of whom do not qualify as “independent” because they are officers of OncoCyte or BioTime or are non-independent directors of BioTime. OncoCyte will have its own executive officers, although its Chief Financial Officer will also serve as Chief Financial Officer of BioTime. See “Management.”

|

| |

|

|

|

Dividend policy

|

|

We do not plan on paying any cash dividends on our common stock in the immediate future. Instead, we will retain any income we may earn to finance our business operations. All decisions regarding the declaration and payment of dividends will be evaluated from time to time in light of our financial condition, earnings, growth prospects, other uses of cash, funding requirements, applicable law and other factors our Board of Directors deems relevant. See the section entitled “Dividend Policy.”

|

| |

|

|

|

Risk factors

|

|

You should carefully consider the matters discussed under the section entitled “Risk Factors.”

|

| |

|

|

|

Amendment or Cancellation of the Distribution

|

|

BioTime may, in its sole discretion: (a) terminate the Distribution prior to delivery of the Distribution Shares to BioTime shareholders; (b) change the Distribution Date for the Distribution to a later date; (c) change the record date prior to the Distribution of the Distribution Shares to BioTime shareholders; or (d) amend or modify the terms of the Distribution. If BioTime determines to terminate the Distribution, changes the Distribution Date or the record date, or amends or modifies the terms of the Distribution, BioTime and OncoCyte will issue a press release and each will file a Current Report on Form 8-K and OncoCyte will provide a supplement to this Information Statement disclosing the applicable changes.

|

QUESTIONS AND ANSWERS ABOUT ONCOCYTE AND THE DISTRIBUTION

Q: Why am I receiving this information statement?

A: BioTime is delivering this information statement to you because you were a holder of BioTime common shares on the record date for the Distribution.

Q: What is the Distribution?

A: The Distribution is the distribution of one share of OncoCyte common stock for every 20 common shares of BioTime that were outstanding on the record date. No action is required for you to participate in the Distribution. After the Distribution, BioTime shareholders other than BioTime subsidiaries will receive in the Distribution, approximately 17.8% of the shares of OncoCyte common stock that will be outstanding immediately upon the completion of the Distribution, while BioTime will continue to own, directly or through a subsidiary, approximately 58.55% of the outstanding OncoCyte shares. Certain current minority shareholders of OncoCyte will own the balance of the OncoCyte shares, and will acquire additional OncoCyte shares through the Distribution to the extent that they own BioTime common shares on the record date.

Q: What will I receive in the Distribution?

A: In the Distribution, BioTime shareholders will receive one share of OncoCyte common stock for every 20 BioTime common shares they own as of the record date for the Distribution. No fractional shares will be issued. Those BioTime shareholders who would otherwise be entitled to receive fractional shares will receive cash in lieu of fractional shares. For example, a BioTime shareholder who holds 110 BioTime common shares as of the record date will, after the Distribution, (i) continue to hold 110 BioTime common shares and (ii) receive 5 shares of OncoCyte common stock and cash in lieu of fractional shares. Immediately after the Distribution, BioTime shareholders will still own their BioTime common shares and they will still own an interest in BioTime’s current businesses, but they will own that interest as two separate stock investments rather than as a single investment.

Q: What is OncoCyte?

A: We are an existing majority-owned subsidiary of BioTime engaged in the business of developing laboratory tests for the diagnosis of cancer.

Q: Why is BioTime distributing OncoCyte stock to BioTime shareholders?

A: BioTime believes that creating a separate scientific and management team for OncoCyte and fostering public ownership of OncoCyte common stock will better enable OncoCyte to focus on maximizing opportunities for its cancer diagnosis business, to hire and retain scientists and managers in the future, and to access the capital markets to obtain the financing that OncoCyte will need in the long run to fund its research and product development programs, to establish a clinical testing laboratory for its diagnostic tests, and to commercialize its diagnostic tests. Both BioTime and OncoCyte believe that the Distribution will present the opportunity for enhanced performance of both BioTime and OncoCyte, and BioTime believes that the Distribution will also enhance the value of the OncoCyte common stock that BioTime continues to own, thus providing additional value to BioTime shareholders.

BioTime’s board of directors has determined that the Distribution is in the best interests of BioTime and its shareholders. The following potential benefits were considered by BioTime’s board of directors in making the determination to effect the Distribution:

|

·

|

allowing each company to separately pursue the business strategies that best suit its long-term interests;

|

|

·

|

creating separate companies that have different financial characteristics, which may appeal to different investor bases and allow for clarity on valuation of the respective businesses;

|

|

·

|

creating opportunities to more efficiently finance ongoing operations, including product development and clinical trials of new diagnostic products, establishing a clinical laboratory, and commercializing products;

|

|

·

|

creating opportunities to more efficiently finance acquisitions;

|

|

·

|

allowing each company to establish an expense structure appropriate for its business and size; and

|

|

·

|

creating effective management and employee incentives tied to each company’s performance.

|

For a further explanation of the reasons for the Distribution and more information about our business, see “The Distribution—Reasons for the Distribution” and “Business.”

Q: What is the record date for the Distribution?

A: The record date is December 21, 2015, and the determination of BioTime shares ownership for the purposes of the Distribution will be determined as of 5:00 p.m., New York City Time, on that date.

Q: When will the Distribution occur?

A: Shares of OncoCyte common stock will be distributed on or about December 31, 2015.

Q: Can BioTime decide to cancel or delay the Distribution?

A: Yes. The Distribution is conditioned upon satisfaction or waiver of certain conditions. See “The Distribution—Distribution Conditions and Termination.” BioTime also has the right to postpone or terminate the Distribution even if all of these conditions are met, if at any time BioTime’s board of directors determines, in its sole discretion that completing the Distribution would not be in the best interest of BioTime and its shareholders.

Q: What will happen to the listing of BioTime common shares?

A: Nothing. BioTime common shares will continue to be traded on the NYSE MKT and TASE under the symbol BTX.

Q: Will the Distribution affect the market price of my BioTime common shares?

A: The immediate impact of the Distribution on the market price of BioTime common shares cannot be determined. On the one hand, the establishment of an independent market value for OncoCyte common stock could enhance the value of the OncoCyte stock that BioTime will continue to own after the Distribution. On the other hand, the price of BioTime common shares could decline in view of the fact that BioTime will own a smaller portion of OncoCyte. Accordingly, the combined trading prices of BioTime common shares and OncoCyte common stock after Distribution Date may be less than or greater than the trading price of BioTime common shares prior to the Distribution. Until the market has fully analyzed the relative values of BioTime and OncoCyte after the Distribution, and a trading market for OncoCyte common stock is established, the price of both BioTime common shares and OncoCyte common stock may fluctuate significantly.

Q: What does a BioTime shareholder need to do now?

A: BioTime shareholders do not need to take any action to participate in the Distribution. The approval of the BioTime shareholders is not required or sought to effect the Distribution and BioTime shareholders have no appraisal rights in connection with the Distribution. BioTime is not seeking a proxy from any shareholders and you are requested not to send BioTime or us a proxy. BioTime shareholders will not be required to pay anything for the shares of OncoCyte common stock distributed in the Distribution or to surrender any BioTime common shares. BioTime shareholders should not send their BioTime share certificates to BioTime, OncoCyte or the distribution agent and transfer agent. BioTime shareholders will automatically receive their shares of OncoCyte common stock when the Distribution is effected and will receive cash for any fractional shares. After the Distribution, the certificates and book-entry interests representing your BioTime common shares will continue to represent interests in the BioTime businesses following the Distribution, excluding only the portion of OncoCyte distributed to BioTime shareholders. The book-entry interests representing OncoCyte common stock that BioTime shareholders receive in the Distribution will represent an equity interest in OncoCyte.

Q: Are there risks to owning OncoCyte common stock?

A: Yes. Our business is subject to both general and specific risks relating to our operations. In addition, there will be market risks associated with the ownership of OncoCyte common stock. See “Risk Factors.”

Q: What are the U.S. federal income tax consequences of the Distribution to BioTime shareholders?

A: We expect that, if the Distribution occurs during 2015, BioTime will not have overall accumulated earnings and profits or current earnings and profits (each determined for U.S. federal income tax purposes) for 2015 after giving effect to any gain realized by BioTime as result of the Distribution. If BioTime does not have either (a) overall accumulated earnings and profits or (b) current earnings and profits for the taxable year that includes the Distribution, then:

| |

·

|

if the fair market value of the shares of OncoCyte common stock received does not exceed the BioTime shareholder’s basis in the shareholder’s BioTime shares, the shareholder would recognize no taxable gain as a result of the Distribution, and would be deemed to have received a return of capital that would reduce the shareholder’s basis in the shareholder’s BioTime shares by the fair market value of the shares of common stock received; and

|

| |

·

|

if the fair market value of the shares of common stock distributed to a BioTime shareholder exceeds the BioTime shareholder’s basis in the shareholder’s BioTime shares, then the excess would be taxable as gain from the sale or exchange of property that may be taxed as a long-term or short-term capital gain depending upon the shareholder’s holding period in the BioTime shares.

|

If BioTime has overall accumulated earnings and profits or current earnings and profits for the taxable year that includes the Distribution (each as determined for U.S. federal income tax purposes), including any earnings and profits resulting from the Distribution, then:

|

·

|

the Distribution would be taxed as a dividend to a BioTime shareholder to the extent of the lesser of the shareholder’s allocable share of BioTime’s earnings and profits and the fair market value of the shares of OncoCyte common stock received by the shareholder in the Distribution; and

|

|

·

|

if the fair market value of the shares of OncoCyte common stock received by a BioTime shareholder exceeds the shareholder’s allocable share of BioTime's earnings and profits, the excess would be a return of capital that will reduce the shareholder’s basis in the shareholder’s BioTime shares by that excess and, to the extent it exceeds the BioTime shareholder’s basis in the shareholder’s BioTime shares, would be taxable as gain from the sale or exchange of property that may be taxed as a long-term or short-term capital gain depending upon the shareholder’s holding period in the BioTime shares.

|

Additional matters concerning the U.S. federal income tax consequences of the Distribution are summarized in the section of this information statement entitled “Tax Matters-Material U.S. Federal Income Tax Consequences of the Distribution.” You should consult your own tax advisor as to the particular consequences of the Distribution to you.

Q: What if I want to sell my BioTime common shares or my OncoCyte common stock?

A: You should consult with your own financial advisors, such as your stockbroker, bank or tax advisor. BioTime and OncoCyte do not make any recommendations on the purchase, retention, or sale of BioTime common shares or OncoCyte common stock. If you do decide to sell any shares, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your BioTime stock or your OncoCyte stock after it is distributed, or both.

Q: Where will I be able to trade shares of my OncoCyte common stock?

A: Currently there is no public market for OncoCyte common stock. We have applied to list OncoCyte common stock on the NYSE MKT under the symbol OCX. If our listing application is not approved, we plan to arrange to have OncoCyte common stock traded on the OTC Bulletin Board. Trading in shares of OncoCyte common stock may begin on a “when-issued” basis on or shortly before the Distribution Date, and “regular way” trading will begin on the first trading day following the Distribution Date. If trading does begin on a “when-issued” basis, you may purchase or sell OncoCyte common stock after that time, but your transaction will not settle until after the Distribution Date. On the first trading day following the Distribution Date, “when-issued” trading in respect of OncoCyte common stock will end and “regular way” trading will begin. We cannot predict the trading prices for OncoCyte common stock before or after the Distribution Date.

Q: Where can BioTime shareholders get more information?

A: Before the Distribution, if you have any questions relating to the Distribution, you should contact:

BioTime, Inc.

1301 Harbor Bay Parkway, Suite 100

Alameda, CA 94502

Attention: Dan Lawrence

Telephone: (510) 521-3390

After the Distribution, if you have any questions relating to OncoCyte common stock, you should contact:

OncoCyte Corporation

1301 Harbor Bay Parkway, Suite 100

Alameda, CA 94502

Attention: Dan Lawrence

Telephone: (510) 521-3390

Q: Who will be the distribution agent, transfer agent and registrar for OncoCyte common stock?

A: The distribution agent, transfer agent and registrar for OncoCyte common stock will be American Stock Transfer & Trust Company, LLC.

RISK FACTORS

Our business is subject to various risks, including those described below. You should consider the following risk factors, together with all of the other information included in this information statement, which could materially adversely affect our proposed operations, our business prospects, and financial condition, and the value of an investment in our business. There may be other factors that are not mentioned here or of which we are not presently aware that could also affect our business operations and prospects.

Risks Related to Our Business Operations

We are a development stage company and have incurred operating losses since inception and we do not know if we will attain profitability

Since our inception in September 2009, we have incurred operating losses and negative cash flow and we expect to continue to incur losses and negative cash flow in the future. Our net losses for the nine months ended September 30, 2015 and the years ended December 31, 2014 and 2013 were approximately $5.2 million, $5.0 million, and $3.5 million, respectively, and we had an accumulated deficit of approximately $20.6 million, $15.4 million and $10.4 million as of September 30, 2015, and December 31, 2014 and 2013, respectively. Since inception, we have financed our operations through the sale of our common stock to our current shareholders, loans from BioTime and BioTime affiliates, and sale of BioTime common shares that we hold as available-for-sale securities. Although BioTime may continue to provide administrative support to us on a reimbursable basis, there is no assurance that BioTime will provide future financing. There is no assurance that we will be able to obtain any additional financing that we may need after the completion of the Distribution, or that any such financing that may become available will be on terms that are favorable to us and our shareholders. Ultimately, our ability to generate sufficient operating revenue to earn a profit depends upon our success in developing and marketing or licensing our diagnostic tests and technology.

We will spend a substantial amount of our capital on research and development but we might not succeed in developing diagnostic tests and technologies that are useful in medicine

|

·

|

We are attempting to develop new medical diagnostic tests and technologies. The main focus of our business is on diagnostic tests for cancer. Our diagnostic tests are being developed through the use of blood and urine samples obtained in prospective and retrospective clinical trials involving humans, but none of our diagnostic tests have been used in medicine to diagnose cancer. Our technologies many not prove to be sufficiently efficacious to use in the diagnosis of cancer.

|

|

·

|

Some of our research could also have applications in new cancer therapeutics. None of our experimental therapeutic technologies have been applied in human medicine and have only been used in laboratory studies in vitro.

|

|

·

|

The experimentation we are doing is costly, time consuming, and uncertain as to its results. We incurred research and development expenses amounting to approximately $3.1 million, $4.0 million, and $2.9 million during the nine months ended September 30, 2015, and years ended December 31, 2014 and 2013, respectively. Since 2011, most of our research has been devoted to the development of our lead diagnostic tests to detect lung cancer, breast cancer, and bladder cancer.

|

|

·

|

If we are successful in developing a new technology or diagnostic test, refinement of the new technology or diagnostic test and definition of the practical applications and limitations of the technology or diagnostic test may take years and require the expenditure of large sums of money.

|

We do not currently have any diagnostic tests on the market and have not yet generated any revenues from operations

|

·

|

We need to successfully develop and market or license the diagnostic tests that we are developing in order to earn revenues in sufficient amounts to meet our operating expenses.

|

|

·

|

Without diagnostic test sales or licensing fee revenues, we will not be able to operate at a profit, and we will not be able to cover our operating expenses without raising additional capital.

|

|

·

|

Should we be able to successfully develop and market our diagnostic tests we may not be able to receive reimbursement for them from payers, such as health insurance companies, health maintenance organizations and Medicare, or any reimbursement that we receive may be lower than we anticipate.

|

Sales of any diagnostic tests that we may develop could be adversely impacted by the reluctance of physicians to adopt the use of our tests and the availability of competing diagnostic tests

|

·

|

Physicians and hospitals may be reluctant to try a new diagnostic test due to the high degree of risk associated with the application of new technologies and diagnostic test in the field of human medicine, especially if the new test differs from the current standard of care for detecting cancer in patients.

|

|

·

|

Competing tests for the initial diagnosis, reoccurrence diagnosis and optimal treatment of cancer are being manufactured and marketed by established companies and by other smaller biotechnology companies.

|

|

·

|

Currently there are two diagnostic tests for lung cancer and multiple diagnostic tests for bladder cancer on the market. There is one diagnostic product for breast cancer that has been approved in Europe. In order to compete with other diagnostic tests, particularly any that sell at lower prices, our diagnostic tests will have to provide medically significant advantages or be more cost effective.

|

|

·

|

There also is a risk that our competitors may succeed in developing safer, more accurate or more cost effective diagnostic tests that could render our diagnostic tests and technologies obsolete or noncompetitive

|

It is likely that we will need to issue additional equity or debt securities in order to raise additional capital needed to pay our operating expenses

|

·

|

We plan to continue to incur substantial research and development expenses and we anticipate that we will be incurring significant sales and marketing costs as we develop and commercialize our diagnostic test candidates. We may need to raise additional capital to pay operating expenses until we are able to generate sufficient revenues from diagnostic test sales, royalties, and license fees, and we may need to sell additional equity or debt securities to meet those capital needs.

|

|

·

|

Sales of additional equity securities by us could result in the dilution of the interests of our shareholders.

|

We need to obtain a license to certain technology in order to complete the development of our diagnostic test for lung cancer

The research and development of our lung cancer diagnostic test has been conducted primarily by The Wistar Institute of Anatomy and Biology (“Wistar”) pursuant to a Sponsored Research Agreement, as amended (the “SRA”) with us, and Wistar owns core intellectual property rights relating to that lung cancer diagnostic test. Under the SRA, we have an option to license from Wistar the data, methods, techniques, processes, and other technical information (“Wistar Inventions”) related to molecular diagnostics for lung cancer developed or discovered by the principal investigator or anyone working under her direction in the performance of the sponsored research. We have exercised our options to license certain Wistar Inventions and we and Wistar are negotiating the terms of definitive license agreements with Wistar. However, there is no assurance that we will reach agreement with Wistar on the terms of any definitive license agreements, or that the terms of any license agreements that we may enter into will be favorable to us from a commercial point of view. If we fail to reach agreement with Wistar for licenses to use any Wistar Inventions, we may not be able to complete the development of our lung cancer diagnostic test. Consequently, we may need to commence, at our expense, new research and development work without the right to use the Wistar Inventions, or, if feasible, license technology from a third party.

If we fail to meet our obligations under license agreements, we may lose our rights to key technologies on which our business depends

Our business will depend on several critical technologies that we plan to license from Wistar for our lung cancer diagnostic test. We expect that the license agreements will impose obligations on us, including payment obligations and obligations to pursue development and commercialization of diagnostic tests under the licensed patents or technology. If Wistar believes that we have failed to meet our obligations under a license agreement, Wistar could seek to limit or terminate our license rights, which could lead to costly and time-consuming litigation and, potentially, a loss of the licensed rights. During the period of any such litigation our ability to carry out the development and commercialization of potential diagnostic tests, and our ability to raise any capital that we might then need, could be significantly and negatively affected. If our license rights were restricted or ultimately lost, we would not be able to continue to use the licensed technology in our business.

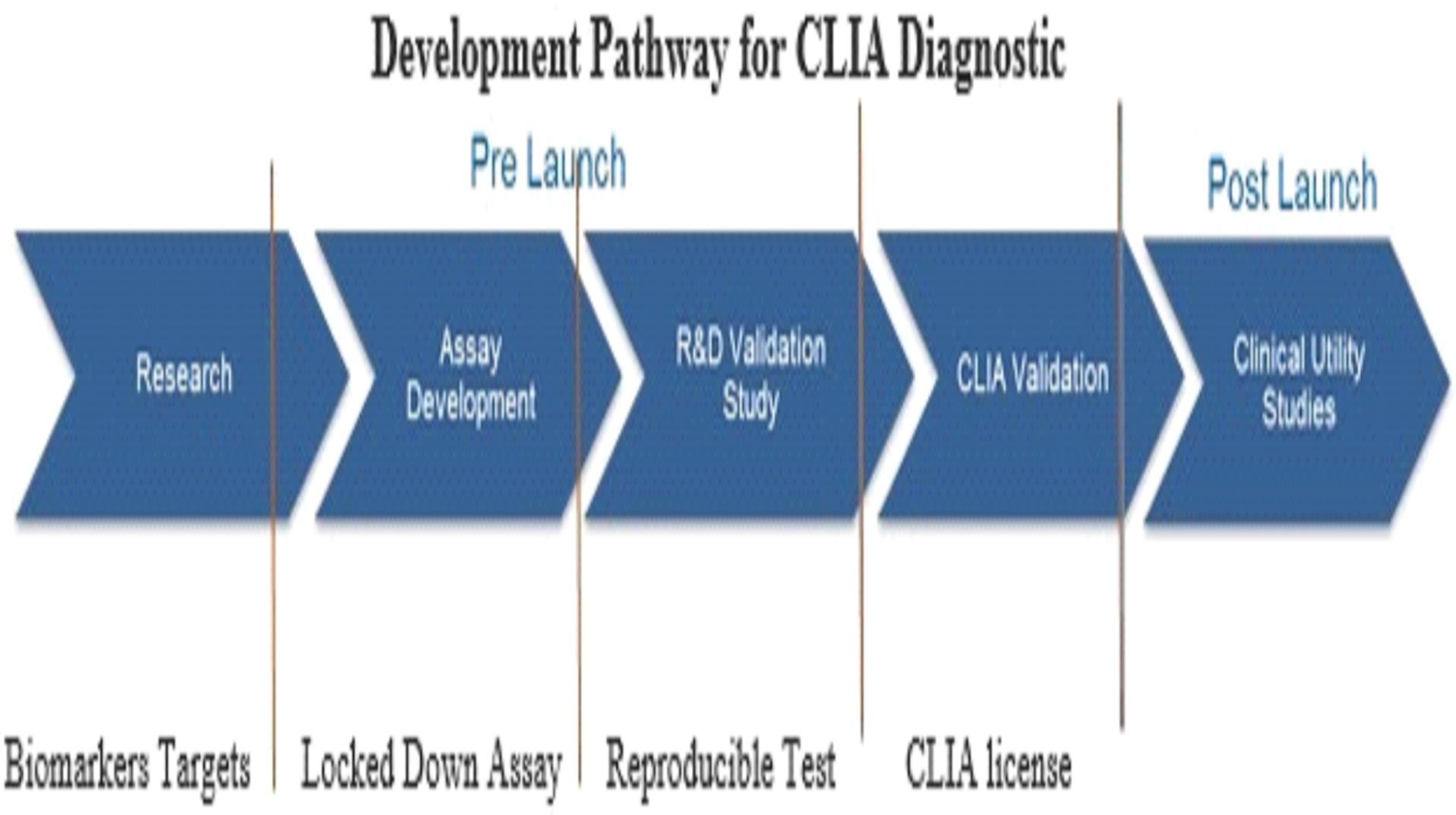

We do not yet have a certified diagnostic laboratory for use in conducting cancer diagnostic tests

We need to lease a facility, construct and equip a diagnostic laboratory, hire a staff to operate the laboratory, and obtain federal and state certification or licensing of the laboratory for use in conducting cancer diagnostic tests. We do not know how long it will take to locate and lease a suitable facility and to build and obtain the required certifications and licenses for the laboratory. Once a suitable facility is located and leased, we will need to expend a substantial part of our cash on hand and management resources to complete construction, equipping, and staffing of the laboratory.

We have limited marketing and sales resources and no distribution resources for the commercialization of any diagnostic tests that we might successfully develop

If we are successful in developing marketable diagnostic tests, we will need to build our own marketing and sales capability, which would require the investment of significant financial and management resources to recruit, train, and manage a sales force.

Our business could be adversely affected if we lose the services of the key personnel upon whom we depend

Our diagnostics program is directed primarily by our Vice President of Research, Dr. Karen Chapman. Our commercial activities are directed primarily by our Chief Executive Officer William Annett and our Vice President of Marketing, Dr. Kristine C. Mechem. The loss of Dr. Chapman, Mr. Annett, or Dr. Mechem could have a material adverse effect on our business.

Our business and operations could suffer in the event of system failures

Despite the implementation of security measures, our internal computer systems and those of our contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. Such events could cause interruption of our operations. For example, the loss of data for our diagnostic test candidates could result in delays in our regulatory filings and development efforts and significantly increase our costs. To the extent that any disruption or security breach was to result in a loss of or damage to our data, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the development of our diagnostic test candidates could be delayed.

Failure of our internal control over financial reporting could harm our business and financial results

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with accounting principles generally accepted in the U.S. Internal control over financial reporting includes maintaining records that in reasonable detail accurately and fairly reflect our transactions; providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing reasonable assurance that receipts and expenditures of our assets are made in accordance with management authorization; and providing reasonable assurance that unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements would be prevented or detected on a timely basis. Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that a misstatement of our financial statements would be prevented or detected. Our growth and entry into new diagnostic tests, technologies and markets will place significant additional pressure on our system of internal control over financial reporting. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect and prevent fraud.

We will initially rely in part on financial systems maintained by BioTime and upon services provided by BioTime personnel. BioTime will allocate certain expenses among itself, us, and BioTime’s other subsidiaries, which creates a risk that the allocations may not accurately reflect the benefit of an expenditure or use of financial or other resources by us, BioTime as our parent company, and the BioTime subsidiaries among which the allocations are made.

Risks Related to Our Industry

We will face certain risks arising from regulatory, legal, and economic factors that affect our business and the business of other companies engaged in the development and marketing of diagnostic tests for human diseases. Because we are a small company without revenues and with limited capital resources, we may be less able to bear the financial impact of these risks than larger companies that have substantial income and available capital.

We will need to obtain regulatory approval of our diagnostic test candidates and laboratory facilities

We will need to receive certification for our diagnostic laboratory under the Clinical Laboratory Improvements Amendment (“CLIA”), and we will need to obtain United States Food and Drug Administration (“FDA”) and other regulatory approvals for any in vitro diagnostics (“IVDs”) that we may develop, in order to market those diagnostic tests. The need to obtain regulatory approval to market a new diagnostic test means that:

|

·

|

The diagnostic tests that we may develop cannot be sold until the Centers for Medicare and Medicaid Services (the “CMS”) or the FDA, and corresponding foreign regulatory authorities approve the laboratory tests or the IVDs for medical use.

|

|

·

|

We will have to obtain a CLIA certificate of registration license for our laboratory for the manufacture and use of diagnostic tests and as part of the submission, our laboratory will be inspected.

|

|

·

|

In addition to meeting federal regulatory requirements, each state has its own laboratory certification and inspection requirements for a CLIA laboratory that must be met in order to sell diagnostic tests in the state.

|

|

·

|

We will have to conduct expensive and time consuming clinical trials of new diagnostic tests. The full cost of conducting and completing clinical trials necessary to obtain FDA approval of IVD tests or CLIA certification of a new laboratory diagnostic test or for gaining reimbursement from health insurance companies, health maintenance organizations, Medicare, and other third party payers cannot be presently determined but could exceed our current financial resources.

|

|

·

|

Data obtained from preclinical and clinical studies is susceptible to varying interpretations that could delay, limit or prevent regulatory agency approvals. Delays or denials of the regulatory approvals may be encountered as a result of changes in regulatory agency policy, regulations, or laws.

|

|

·

|

A diagnostic test that is approved may be subject to restrictions on use.

|

|

·

|

The FDA can withdraw approval of an FDA regulated product if problems arise

|

|

·

|

CLIA licensed laboratories can lose their licenses if problems arise during a periodic inspection.

|

The FDA may impose additional regulations for laboratory developed tests such as the ones we are developing

The FDA issued two draft guidance documents that set forth a proposed risk-based regulatory framework that would apply varying levels of FDA oversight to laboratory developed tests (“LDTs”) such as those we are developing. If the FDA implements new regulatory measures:

|

·

|

We may be required to obtain pre-market clearance or approval before selling our diagnostic tests;

|

|

·

|

As a result of required FDA pre-market review, our tests may not be cleared or approved on a timely basis, if at all;

|

|

·

|

FDA labeling requirements may limit our claims about our diagnostic tests, which may have a negative effect on orders from physicians;

|

|

·

|

The regulatory approval process may involve, among other things, successfully completing additional clinical trials and making a 510(k) submission, or filing a pre-market approval application with the FDA; and,

|

|

·

|

If regulatory actions affect any of the reagents we obtain from suppliers and use in conducting our tests, our business could be adversely affected in the form of increased costs of testing or delays, limits or prohibitions on the purchase of reagents necessary to perform our testing.

|

If the FDA regulates LDTs and requires that we seek pre-market approval, there is no assurance that we will be able to comply with FDA requirements.

It may take two years or more to conduct the clinical studies and trials necessary to obtain pre-market approval from the FDA. Even if our clinical trials are completed as planned, we cannot be certain that the results will support our test claims or that the FDA will agree with our conclusions regarding our test results. Success in early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the later trials will replicate the results of prior clinical trials and studies. If we are required to conduct pre-market clinical trials, delays in the commencement or completion of clinical testing could significantly increase our test development costs and delay commercialization. Many of the factors that may cause or lead to a delay in the commencement or completion of clinical trials may also ultimately lead to delay or denial of regulatory clearance or approval. The clinical trial process may fail to demonstrate that our tests are effective for the proposed indicated uses, which could cause us to abandon a test candidate and may delay development of other tests.

Clinical trial failures can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of our current or future diagnostic tests

Clinical trial failures or delays can occur at any stage of the trials, and may be directly or indirectly caused by a variety of factors, including but not limited to:

|

·

|

Delays in securing clinical investigators or trial sites for our clinical trials;

|

|

·

|

Delays in obtaining Institutional Review Board and other regulatory approvals to commence a clinical trial;

|

|

·

|

Slower than anticipated rates of patient recruitment and enrollment, or failing to reach the targeted number of patients due to competition for patients from other trials;

|

|

·

|

Limited or no availability of coverage, reimbursement and adequate payment from health maintenance organizations and other third party payers for the use of our diagnostic test candidates in our clinical trials;

|

|

·

|

Negative or inconclusive results from clinical trials;

|

|

·

|

Approval and introduction of new diagnostic or changes in standards of practice or regulatory guidance that render our clinical trial endpoints or the targeting of our proposed indications obsolete;

|

|

·

|

Inability to monitor patients adequately during or after treatment or problems with investigator or patient compliance with the trial protocols;

|

|

·

|

Inability to replicate in large controlled studies safety and efficacy data obtained from a limited number of patients in uncontrolled trials; and

|

|

·

|

Inability or unwillingness of medical investigators to follow our clinical protocols.

|

We will depend on Medicare and a limited number of private payers for a significant portion of our revenues, and our revenues could decline if these payers fail to provide timely and adequate payment for our diagnostic tests

We expect that a substantial portion of the patients for whom we will perform diagnostic tests will have Medicare as their primary medical insurance. Even if our planned tests are otherwise successful, reimbursement for the Medicare-covered portions of our planned tests might not, without Medicare reimbursement, produce sufficient revenues to enable us to reach profitability and achieve our other commercial objectives.

Medicare and other third-party payers may change their coverage policies or cancel future contracts with us at any time; review and adjust the rate of reimbursement; or stop paying for our tests altogether, which would reduce our total revenues. Payers have increased their efforts to control the cost, utilization, and delivery of health care services, and have undertaken measures to reduce payment rates for and decrease utilization of clinical laboratory testing. Because of the cost-trimming trends, any third-party payers that will cover and provide reimbursement for our diagnostic tests may suspend, revoke or discontinue coverage at any time, or may reduce the reimbursement rates payable to us. Any such action could have a negative impact on our revenues, which may have a material adverse effect on our financial condition, results of operations and cash flows.

Changes in healthcare laws and policies may have a material adverse effect on our financial condition, results of operations and cash flows

The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (collectively “ACA”) substantially changed the way health care is financed by both governmental and private insurers. Among the ACA’s key changes, the ACA reduced payment rates under the Medicare Clinical Laboratory Fee Schedule and established an Independent Payment Advisory Board to reduce the per capita rate of growth in Medicare spending if spending exceeds a target growth rate. Such provisions may negatively impact payment rates for our diagnostic tests.

The Protecting Access to Medicare Act of 2014 (“PAMA”) significantly altered the payment methodology under the Clinical Laboratory Fee Schedule that determines Medicare coverage for laboratory tests. Under PAMA, clinical laboratories are required to report test payment data for each Medicare-covered clinical diagnostic laboratory test and beginning in 2017, the Medicare payment rate for each clinical diagnostic laboratory test will be equal to the weighted median amount for the test from the most recent data collection period.

Congress has proposed on several occasions to impose a 20% coinsurance payment requirement on patients for clinical laboratory tests reimbursed under the Medicare Clinical Laboratory Fee Schedule, which would require us to bill patients for these amounts. In the event that Congress were to ever enact such legislation, the cost of billing and collecting for our tests could often exceed the amount actually received from the patient.

On September 25, 2015, CMS released preliminary determinations for the calendar year 2016 for the Medicare Clinical Laboratory Fee Schedule for some test codes, including some for oncology diagnostics, as had been anticipated. These preliminary determinations were based on a cross walk approach rather than a gap-fill approach. A cross walk approach matches a new code for a diagnostic against existing codes to determine the appropriate payment rate; while a gap-fill approach looks at local pricing patterns, including charges for the tests and any discounts on charges and payments determined by other payers. At this point it is not clear what methodology CMS may use in their determinations for future diagnostics.

Beginning January 1, 2017, Medicare payment for any new advanced diagnostic test will be based on the list price or charge. After the test is commercially available for two quarters, the laboratory will be required to report payment and volume information and that data will be used to set payment for the test for the following year.

|

·

|

If data shows that the list price was greater than 130% of the payment using established methodology (a weighted median), CMS will recoup the difference from the laboratory through a payment claw back.

|

|

·

|

Payment will be updated annually based on the weighted median of commercial payer reimbursement.

|

We cannot predict whether future health care initiatives will be implemented at the federal or state level, or how any future legislation or regulation may affect us. The expansion of government’s role in the U.S. health care industry as a result of the ACA, and changes to the reimbursement amounts paid by Medicare and other payers for diagnostic tests may have a materially adverse effect on our business, financial condition, results of operations and cash flows.

Because of certain Medicare billing policies, we may not receive complete reimbursement for tests provided to Medicare patients

Medicare has coverage policies that can be national or regional in scope. Coverage means that the test or assay is approved as a benefit for Medicare beneficiaries. If there is no coverage, neither the supplier nor any other party, such as a diagnostic laboratory, may receive reimbursement from Medicare for the service. Regional policies are directed by Medicare’s regional Medicare Administrative Contractors (“MACs”). Reimbursement for our diagnostic testing may be negatively impacted by California MAC’s policies.

Long payment cycles of Medicare, Medicaid and/or other third-party payors, or other payment delays, could hurt our cash flows and increase our need for working capital

Medicare and Medicaid have complex billing and documentation requirements that we will have to satisfy in order to receive payment. Failure to comply with these requirements and other laws applicable to billing may result in, among other things, non-payment, refunds, exclusion from government healthcare programs, and civil or criminal liabilities, any of which may have a material adverse effect on our revenues and earnings. Similarly, the failure of private health insurers or other private third-party payers to properly process our payment claims in a timely manner could delay our receipt of payment for our diagnostic tests and services, which may have a material adverse effect on our cash flows.

Private health insurance company policies may deny coverage or limit the amount they will reimburse us for the performance of our diagnostic tests

Patients who are not covered by Medicare will generally rely on health insurance provided by private health insurance companies. If we are considered a “non-contracted provider” by a third-party payer, that payer may not reimburse patients for diagnostic tests performed by us or doctors within the payer’s network of covered physicians may not use our services to perform diagnostic tests for their patients. As a result we may need to enter into contracts with health insurance companies or other private payers to provide diagnostic tests to their insured patients at specified rates of reimbursement which may be lower than the rates we might otherwise collect.

We may be required to comply with federal and state laws governing the privacy of health information, and any failure to comply with these laws could result in material criminal and civil penalties

The Health Insurance Portability and Accountability Act (“HIPAA”) sets forth security regulations that establish administrative, physical and technical standards for maintaining the confidentiality, integrity and availability of Protected Health Information in electronic form. We also may be required to comply with state laws that are more stringent than HIPAA or that provide individuals with greater rights with respect to the privacy or security of, and access to, their health care records. The Health Information Technology for Economic and Clinical Health Act (“HITECH”) established certain health information security breach notification obligations that require covered entities to notify each individual whose “protected health information” is breached.

We may incur significant compliance costs related to HIPAA and HITECH privacy regulations and varying state privacy regulations and varying state privacy and security laws. Given the complexity of HIPAA and HITECH and their overlap with state privacy and security laws, and the fact that these laws are rapidly evolving and are subject to changing and potentially conflicting interpretation, our ability to comply with the HIPAA, HITECH and state privacy requirements is uncertain and the costs of compliance are significant. The costs of complying with any changes to the HIPAA, HITECH and state privacy restrictions may have a negative impact on our operations. Noncompliance could subject us to criminal penalties, civil sanctions and significant monetary penalties as well as reputational damage.

We are subject to federal and state healthcare fraud and abuse laws and regulations and could face substantial penalties if we are unable to fully comply with such laws

We are subject to health care fraud and abuse regulation and enforcement by both the federal government and the states in which we conduct our business. These health care laws and regulations include the following:

|

·

|

The federal Anti-Kickback Statute;

|

|

·

|

The federal physician self-referral prohibition, commonly known as the Stark Law;

|

|

·

|

The federal false claims and civil monetary penalties laws;

|

|

·

|

The federal Physician Payment Sunshine Act requirements under the ACA; and

|

|

·

|

State law equivalents of each of the federal laws enumerated above.

|

Any action brought against us for violation of these laws or regulations, even if we successfully defend against it, could cause us to incur significant legal expenses and divert our management’s attention from the operation of our business. If our operations are found to be in violation of any of these laws and regulations, we may be subject to any applicable penalty associated with the violation, including, among others, administrative, civil and criminal penalties, damages and fines, and/or exclusion from participation in Medicare, Medicaid programs, including the California Medical Assistance Program (Medi-Cal—the California Medicaid program) or other state or federal health care programs. Additionally, we could be required to refund payments received by us, and we could be required to curtail or cease our operations.

Risks Related to Intellectual Property

If we are unable to obtain and enforce patents and to protect our trade secrets, others could use our technology to compete with us, which could limit opportunities for us to generate revenues by licensing our technology and selling diagnostic tests

|

·

|

Our success will depend in part on our ability to obtain and enforce patents and maintain trade secrets in the United States and in other countries. If we are unsuccessful in obtaining and enforcing patents, our competitors could use our technology and create diagnostic tests that compete with our diagnostic tests, without paying license fees or royalties to us.

|

|

·

|

The preparation, filing, and prosecution of patent applications can be costly and time consuming. Our limited financial resources may not permit us to pursue patent protection of all of our technology and diagnostic tests throughout the world.

|

|

·

|

Even if we are able to obtain issued patents covering our technology or diagnostic tests, we may have to incur substantial legal fees and other expenses to enforce our patent rights in order to protect our technology and diagnostic tests from infringing uses. We may not have the financial resources to finance the litigation required to preserve our patent and trade secret rights.

|

|

·

|

The Supreme Court decisions in Mayo Collaborative Services v. Prometheus Laboratories, Inc. and Association for Molecular Pathology v. Myriad Genetics may adversely impact our ability to obtain patent protection for some or all of our diagnostic tests, which use certain gene markers to indicate the presence of certain cancers. The claims in the contested patents that were the subject of the Supreme Court decision in Mayo Collaborative Services v. Prometheus Laboratories, Inc. were directed to measuring the serum level of a drug metabolite and adjusting the dosing regimen of the drug based on the metabolite level. The Supreme Court said that a patent claim that merely claimed a mathematical correlation between the blood levels of a drug metabolite and the best dosage of the drug was not patentable subject matter because it did no more than recite a correlation that occurs in nature. In Association for Molecular Pathology v. Myriad Genetics, the Supreme Court ruled that the discovery of the precise location and sequence of certain genes, mutations of which can dramatically increase the risk of breast and ovarian cancer, was not patentable. Knowledge of the gene location and sequences was used to determine the genes’ typical nucleotide sequence, which, in turn, enabled the development of medical tests useful for detecting mutations in these genes in a particular patient to assess the patient’s cancer risk. But the mere discovery of an important and useful gene did not render the genes patentable as a new composition of matter. The holdings in Mayo Collaborative Services v. Prometheus Laboratories, Inc. and Association for Molecular Pathology v. Myriad Genetics may limit our ability to obtain patent protection on diagnostic methods that merely recite a correlation between a naturally occurring event and a diagnostic outcome associated with that event. |

There is no certainty that our pending or future patent applications will result in the issuance of patents

We have filed patent applications for technology that we have developed, and we may obtain licenses for patent applications covering genes that we or our partners have discovered, that we believe will be useful in producing new diagnostic tests. We may also file additional new patent applications in the future seeking patent protection for new technology or diagnostics tests or products that we develop ourselves or jointly with others. However, there is no assurance that any of our licensed patent applications, or any patent applications that we have filed or that we may file in the future in the United States or abroad, will result in the issuance of patents.

The process of applying for and obtaining patents can be expensive and slow

|

·

|

The preparation and filing of patent applications, and the maintenance of patents that are issued, may require substantial time and money.

|

|

·

|

A patent interference proceeding may be instituted with the U.S. Patent and Trademark Office (the “USPTO”) when more than one person files a patent application covering the same technology, or if someone wishes to challenge the validity of an issued patent. At the completion of the interference proceeding, the USPTO will determine which competing applicant is entitled to the patent, or whether an issued patent is valid. Patent interference proceedings are complex, highly contested legal proceedings, and the USPTO’s decision is subject to appeal. This means that if an interference proceeding arises with respect to any of our patent applications, we may experience significant expenses and delay in obtaining a patent, and if the outcome of the proceeding is unfavorable to us, the patent could be issued to a competitor rather than to us

|

|

·

|

A derivation proceeding may be instituted by the USPTO or an inventor alleging that a patent or application was derived from the work of another inventor.

|

|

·

|

Post Grant Review under the new America Invents Act will make available opposition-like proceedings in the United States. As with the USPTO interference proceedings, Post Grant Review proceedings will be very expensive to contest and can result in significant delays in obtaining patent protection or can result in a denial of a patent application.

|

|

·

|

Oppositions to the issuance of patents may be filed under European patent law and the patent laws of certain other countries. As with USPTO interference proceedings, these foreign proceedings can be very expensive to contest and can result in significant delays in obtaining a patent or can result in a denial of a patent application.

|

Our patents may not protect our diagnostic tests from competition

|

·

|

We might not be able to obtain any patents beyond the bladder cancer marker patent that has been issued by the USPTO, and any patents that we do obtain might not be comprehensive enough to provide us with meaningful patent protection.

|

|

·

|

There will always be a risk that our competitors might be able to successfully challenge the validity or enforceability of any patent issued to us.

|

|

·

|

In addition to interference proceedings, the USPTO can reexamine issued patents at the request of a third party. Our patents may be subject to inter partes review (replacing the reexamination proceeding), a proceeding in which a third party can challenge the validity of one of our patents to have the patent invalidated. This means that patents owned or licensed by us may be subject to reexamination and may be lost if the outcome of the reexamination is unfavorable to us.

|

We may be subject to patent infringement claims that could be costly to defend, which may limit our ability to use disputed technologies, and which could prevent us from pursuing research and development or commercialization of some of our diagnostic tests, require us to pay licensing fees to have freedom to operate and/or result in monetary damages or other liability for us

The success of our business depends significantly on our ability to operate without infringing patents and other proprietary rights of others. If the technology that we use infringes a patent held by others, we could be sued for monetary damages by the patent holder or its licensee, or we could be prevented from continuing research, development, and commercialization of diagnostic tests that rely on that technology, unless we are able to obtain a license to use the patent. The cost and availability of a license to a patent cannot be predicted, and the likelihood of obtaining a license at an acceptable cost would be lower if the patent holder or any of its licensees is using the patent to develop or market a diagnostic tests with which our diagnostic test would compete. If we could not obtain a necessary license, we would need to develop or obtain rights to alternative technologies, which could prove costly and could cause delays in diagnostic test development, or we could be forced to discontinue the development or marketing of any diagnostic tests that were developed using the technology covered by the patent.

Risks Related to Our Relationship with BioTime

We are a subsidiary of BioTime, and accordingly our business is substantially controlled by BioTime

Prior to the Distribution, BioTime owned approximately 76.39% of our issued and outstanding shares of common stock, and after the Distribution will continue to own approximately 58.55% of our outstanding shares of common stock. This means that BioTime will have the voting power, through its ownership of shares of our common stock, to elect our entire Board of Directors and to control our management.

BioTime could cause corporate actions to be taken even if the interests of BioTime conflict with the interests of our other shareholders. This concentration of voting power could have the effect of deterring or preventing a change in control that might be beneficial to our other shareholders.

As the majority shareholder, BioTime will have the voting power to approve or disapprove any matter of corporate transaction presented to our shareholders for approval, including but not limited to:

|

·

|

Any amendment of our articles of incorporation or bylaws;

|

|

·

|

Any merger or consolidation of us with another company;

|

|

·

|

Any recapitalization or reorganization of our capital stock;

|

|

·

|

Any sale of assets or purchase of assets; or

|

|

·

|

A corporate dissolution or a plan of liquidation of our business.

|

We will initially rely upon BioTime for certain services and resources