Document

UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016, or |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 1-37393

SPX FLOW, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

Delaware | 47-3110748 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

13320 Ballantyne Corporate Place Charlotte, NC | 28277 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code (704) 752-4400

(Former Name, Former Address, and Former Fiscal Year, if Changed Since Last Report)

|

| | |

| Title of Each Class | Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(b) of the Act: | Common Stock, Par Value $0.01 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: | None | N/A |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ý No o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): |

|

| | |

Large Accelerated Filer x | | Accelerated Filer o |

| | |

Non-Accelerated Filer o | | Smaller Reporting Company o |

(Do not check if a smaller reporting company) | | |

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No |

The aggregate market value of the voting stock held by non-affiliates of the registrant as of July 2, 2016 was approximately $1,040 million. The determination of affiliate status for purposes of the foregoing calculation is not necessarily a conclusive determination for other purposes.

Common shares outstanding as of February 3, 2017 were 42,297,268.

|

|

Documents incorporated by reference: Portions of the registrant’s definitive proxy statement to be filed within 120 days of the close of the registrant’s fiscal year in connection with the registrant’s Annual Meeting to be held on May 10, 2017 (the "Proxy Statement") are incorporated by reference into Part III of this Annual Report on Form 10-K. |

SPX FLOW, INC. AND SUBSIDIARIES

FORM 10-K INDEX

PART I

ITEM 1. Business

(All currency and share amounts are in millions)

FORWARD-LOOKING STATEMENTS

Some of the statements in this document and any documents incorporated by reference, including any statements as to operational and financial projections, constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our businesses’ or our industries’ actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. Such statements may address our plans, our strategies, our prospects, or changes and trends in our business and the markets in which we operate under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”) or in other sections of this document. In some cases, you can identify forward-looking statements by terminology such as “may,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential” or “continue” or the negative of those terms or similar expressions. Particular risks facing us include business, internal operations, legal and regulatory risks, costs of raw materials, pricing pressures, pension funding requirements and changes in the economy. These statements are only predictions. Actual events or results may differ materially because of market conditions in our industries or other factors, and forward-looking statements should not be relied upon as a prediction of actual results. In addition, management’s estimates of future operating results are based on our current complement of businesses, which is subject to change as management selects strategic markets.

All the forward-looking statements in this document are qualified in their entirety by reference to the factors discussed under the heading “Risk Factors” and in any documents incorporated by reference herein that describe risks and factors that could cause results to differ materially from those projected in these forward-looking statements. We caution you that these risk factors may not be exhaustive. We operate in a continually changing business environment and frequently enter into new businesses and product lines. We cannot predict these new risk factors, and we cannot assess the impact, if any, of these new risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements. Accordingly, you should not rely on forward-looking statements as a prediction of actual results. We undertake no obligation to update or publicly revise any forward-looking statements to reflect events or circumstances that arise after the date of this document.

BUSINESS

Our Business

SPX FLOW, Inc. and its consolidated subsidiaries (“SPX FLOW,” ‘‘the Company,’’ “we,” “us,” or “our”) operate in three business segments and were wholly-owned by SPX Corporation (the “former Parent”) until September 26, 2015, at which time the former Parent distributed 100% of our outstanding common stock to its shareholders through a tax-free spin-off transaction (the “Spin-Off”). Since that time we have been an independent, publicly-traded company on the NYSE under the ticker symbol FLOW.

We are a global supplier of highly specialized, engineered solutions with operations in over 30 countries and sales in over 150 countries around the world. Our solutions play a role in helping to meet the global demand in the end markets we serve. Our total revenue in 2016 was $2.0 billion, with approximately 39%, 35%, and 26% from sales into the Americas, EMEA, and Asia Pacific regions, respectively.

We serve the food and beverage, power and energy and industrial markets. Our product portfolio of pumps, valves, mixers, filters, air dryers, hydraulic tools, homogenizers, separators and heat exchangers, along with the related aftermarket parts and services, supports global industries, including food and beverage, oil and gas, power generation (including nuclear and conventional), chemical processing, compressed air and mining. From an end market perspective, in 2016, approximately 37% of our revenues were from sales into the food and beverage end markets, approximately 28% were from sales into the power and energy end markets, and approximately 35% were from sales into the industrial end markets. Our core strengths include product breadth, global capabilities and the ability to create custom-engineered solutions for diverse flow processes.

Over the past several years, we have strategically expanded our scale, relevance to customers, and global capabilities. We believe there are attractive opportunities to continue to expand our business.

Following our Spin-Off from the former Parent, we are aggressively executing a multi-year plan to transition our enterprise to an operating company. As part of this plan, we announced our intent to further optimize our global footprint, streamline business processes and reduce selling, general and administrative expense through a global realignment program. The realignment program is intended to reduce costs across operating sites and corporate and global functions, in part by making structural changes and process enhancements which allow us to operate more efficiently. We have made significant progress reducing our cost structure through 2016, realigning our footprint and streamlining our functional support globally.

We have aligned our segment teams to focus primarily on developing intimate customer relationships and expanding our relevance to customers within each end market. The key areas our end market teams are emphasizing include (i) product management, (ii) channel development, (iii) engineering customer solutions and (iv) project execution and delivery. We made substantial progress in certain of these areas during 2016 and have plans to further streamline support functions to simplify and reduce our cost structure. Our ultimate goal is to create a more customer-centric, service-oriented organization and deliver greater value to our customers, investors and employees.

REPORTABLE SEGMENTS

Our business is organized into three reportable segments — Food and Beverage, Power and Energy and Industrial. The following summary describes the products and services offered by each of our reportable segments:

Food and Beverage: Our Food and Beverage reportable segment had revenues of $728.3, $869.8, and $965.3 in 2016, 2015 and 2014, respectively, and backlog of $295.7 and $321.3 as of December 31, 2016 and 2015, respectively. Approximately 91% of the segment's backlog as of December 31, 2016 is expected to be recognized as revenue during 2017. The Food and Beverage reportable segment operates in a regulated, global industry with customers who demand highly engineered, turn-key solutions. Key demand drivers include dairy consumption, emerging market capacity expansion, sustainability and productivity initiatives, customer product innovation and food safety. Key products for the segment include mixing, drying, evaporation and separation systems and components, heat exchangers, and reciprocating and centrifugal pump technologies. We also design and construct turn-key systems that integrate many of these products for our customers. Our core brands include Anhydro, APV, Bran+Luebbe, Gerstenberg Schroeder, LIGHTNIN, Seital and Waukesha Cherry-Burrell. The segment's primary competitors are Alfa Laval AB, Fristam Pumps, GEA Group AG, Krones AG, Südmo, Tetra Pak International S.A., and various regional companies.

Power and Energy: Our Power and Energy reportable segment had revenues of $562.7, $750.2 and $968.8 in 2016, 2015 and 2014, respectively, and backlog of $323.9 and $407.0 as of December 31, 2016 and 2015, respectively. Approximately 79% of the segment's backlog as of December 31, 2016 is expected to be recognized as revenue during 2017. The Power and Energy reportable segment primarily serves customers in the oil and gas industry and, to a lesser extent, the nuclear and other conventional power industries. A large portion of the segment's revenues are concentrated in oil extraction, production and transportation at existing wells, and in pipeline applications. The underlying driver of this segment includes demand for power and energy. Key products for the segment include pumps, valves and the related accessories, while the core brands include APV, Bran+Luebbe, ClydeUnion Pumps, Copes-Vulcan, Dollinger Filtration, LIGHTNIN, M&J Valve, Plenty, and Vokes. The segment's primary competitors are Cameron, Ebara Fluid Handling, Flowserve Corporation, ITT Goulds Pumps, KSB AG, and Sulzer Ltd.

Industrial: Our Industrial reportable segment had revenues of $705.0, $768.5 and $835.5 in 2016, 2015 and 2014, respectively, and backlog of $164.5 and $176.7 as of December 31, 2016 and 2015, respectively. Approximately 90% of the segment's backlog as of December 31, 2016 is expected to be recognized as revenue during 2017. The Industrial reportable segment primarily serves customers in the chemical, air treatment, mining, pharmaceutical, marine, shipbuilding, infrastructure construction, general industrial and water treatment industries. Key demand drivers of this segment are tied to macroeconomic conditions and growth in the respective end markets we serve. Key products for the segment are air dryers, filtration equipment, mixers, pumps, hydraulic technologies and heat exchangers. Core brands include Airpel, APV, Bolting Systems, Delair, Deltech, Hankison, Jemaco, Johnson Pump, LIGHTNIN, Power Team, and Stone. The segment's primary competitors are Alfa Laval AB, Chemineer Inc., EKATO, Actuant, Enerpac, IDEX Viking Pump, KSB AG, Parker Domnick Hunter and various regional companies.

See Note 4 to our consolidated and combined financial statements for more information on the results of our reportable segments, including revenues by geographic area.

Acquisitions

We did not acquire any businesses in 2016. As part of our long-term strategy, we plan to evaluate potential acquisitions that (a) are complementary to our existing products and services, (b) increase our relevance to customers and our capabilities to serve them, (c) expand our global capabilities and accelerate our localization strategy and (d) expand our end market reach.

International Operations

We are a multinational corporation with operations in over 30 countries. Sales outside the United States were $1,298.8, $1,552.0 and $1,835.7 in 2016, 2015 and 2014, respectively.

See Note 4 to our consolidated and combined financial statements for more information on our international operations.

Research and Development

We are actively engaged in research and development programs designed to improve existing products and manufacturing methods and to develop new products to better serve our current and future customers. We place particular emphasis on the development of new products that are compatible with, and build upon, our manufacturing and marketing capabilities. We expensed $19.4, $19.1 and $19.8 in 2016, 2015 and 2014, respectively, of research activities relating to the development and improvement of our products.

Intellectual Property

We own approximately 160 domestic and 260 foreign patents, including 35 patents that were issued in 2016, covering a variety of our products and manufacturing methods. We also own a number of registered trademarks. Although in the aggregate our patents and trademarks are of considerable importance in the operation of our business, we do not consider any single patent or trademark to be of such importance that its absence would adversely affect our ability to conduct business as presently constituted. We are both a licensor and licensee of patents. For more information, please refer to "Risk Factors."

Raw Materials

We purchase a wide variety of raw materials, including steel, titanium, copper, nickel and petroleum-based products. Where appropriate, we may enter into long-term supply arrangements or fixed-cost contracts to lower the overall cost of raw materials. In addition, due to our diverse product and service offering, as well as the wide geographic dispersion of our production facilities, we use numerous sources for the raw materials needed in our operations. However, we are not dependent on any one supplier or a limited number of suppliers. Lastly, we continue to centralize certain aspects of supply chain management in an effort to ensure adequate materials are available for production at low cost.

Competition

The markets we serve are highly competitive and fragmented. Our competitors are diverse, ranging from large multi-nationals to regional and local companies. Our principal global competitors include Alfa Laval AB, Flowserve Corporation, GEA Group AG, IDEX Corporation, ITT Goulds Pumps, Sulzer Ltd., and Tetra Pak International S.A. We do not have any one competitor with all the same product offerings, nor do we have any one competitor which serves all the same end markets.

Our ability to compete effectively depends on a variety of factors including breadth of product offering, product quality, engineering strength, brand reputation, lead times, global capabilities, service capabilities, and cost. As many of our products are sold through distributors and independent representatives, our success also depends on building and partnering with a strong channel network.

Environmental Matters

See "MD&A — Critical Accounting Policies and Use of Estimates — Contingent Liabilities," "Risk Factors" and Note 13 to our consolidated and combined financial statements for information regarding environmental matters.

Employment

As of December 31, 2016, we had over 7,000 employees. Less than 1% of our U.S. employees are covered under collective bargaining agreements, while certain of our non-U.S. employee groups are covered by various collective labor

arrangements. While we generally have experienced satisfactory labor relations, we are subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes.

Executive Officers

See Part III, Item 10 of this report for information about our executive officers.

Other Matters

No customer or group of customers that, to our knowledge, are under common control, accounted for more than 10% of our consolidated and combined revenues for any period presented.

Our businesses maintain sufficient levels of working capital to support customer requirements, particularly inventory. We believe our businesses' sales and payment terms are generally similar to those of our competitors.

The results of many of our businesses closely follow changes in the industries and end markets they serve. In addition, certain of our businesses have seasonal fluctuations. In aggregate, our businesses tend to be stronger in the second half of the calendar year. Additionally, timing of revenue recognition on large Food and Beverage systems projects, Power and Energy projects and large Industrial orders may cause significant fluctuations in financial performance from period to period.

Our website address is www.spxflow.com. Information on our website is not incorporated by reference herein. We file reports with the U.S. Securities and Exchange Commission (the "SEC"), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and certain amendments to these reports. Copies of these reports are available free of charge on our website as soon as reasonably practicable after we file the reports with the SEC. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Additionally, you may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

ITEM 1A. Risk Factors

You should consider the risks described below and elsewhere in our documents filed with the SEC before investing in any of our securities. We may amend, supplement or add to the risk factors described below from time to time in future reports filed with the SEC.

Difficulties presented by international economic, political, legal, accounting and business factors could negatively affect our business.

In 2016, approximately 65% of our revenues were generated outside the United States, and approximately 27% of our revenues were generated from sales into emerging markets. We manage businesses with manufacturing facilities worldwide. Our reliance on non-U.S. revenues and non-U.S. manufacturing bases exposes us to a number of risks, including:

| |

• | Significant competition could come from local or long-term participants in non-U.S. markets who may have significantly greater market knowledge and substantially greater resources than we do; |

| |

• | Local customers may have a preference for locally-produced products; |

| |

• | Credit risk or financial condition of local customers and distributors could affect our ability to market our products or collect receivables; |

| |

• | Regulatory or political systems or barriers may make it difficult or impossible to enter or remain in new markets. In addition, these barriers may impact our existing businesses, including making it more difficult for them to grow; |

| |

• | Local political, economic and social conditions, including the possibility of hyperinflationary conditions, political instability, nationalization of private enterprises, or unexpected changes relating to currency could adversely impact our operations; |

| |

• | Customs and tariffs may make it difficult or impossible for us to move our products or assets across borders in a cost-effective manner; |

| |

• | Complications related to shipping, including delays due to weather, labor action, or customs, may impact our profit margins or lead to lost business; |

| |

• | Government embargoes or foreign trade restrictions such as anti-dumping duties, as well as the imposition of trade sanctions by the United States or the European Union against a class of products imported from or sold and exported to, or the loss of "normal trade relations" status with, countries in which we conduct business, could significantly increase our cost of products imported into the United States or Europe or reduce our sales and harm our business; |

| |

• | Environmental and other laws and regulations could increase our costs or limit our ability to run our business; |

| |

• | Our ability to obtain supplies from foreign vendors and ship products internationally may be impaired during times of crisis or otherwise; |

| |

• | Local, regional or worldwide hostilities could impact our operations; and |

| |

• | Distance, language and cultural differences may make it more difficult to manage our business and employees and to effectively market our products and services. |

Any of the above factors or other factors affecting social and economic activity in emerging markets or affecting the movement of people and products into and from these countries to our major markets, including North America and Europe, could have a significant negative effect on our operations.

Our global operations could be negatively impacted by the economic and political instability caused by the United Kingdom ("UK") vote to leave the European Union ("EU").

The UK held a referendum on June 23, 2016 on its membership in the EU. A majority of UK voters voted to exit the EU (“Brexit”), and negotiations will commence to determine the future terms of the UK’s relationship with the EU, subject to a negotiation period that could last up to two years after the UK government formally initiates the withdrawal process, including the terms of trade between the UK and the EU. Brexit has created instability and volatility in the global markets and could adversely affect European or worldwide economic or market conditions. Although it is unknown what those terms will be, they may impair the ability of our operations in the EU to transact business in the future in the UK, and similarly the ability of our UK operations to transact business in the future in the EU. Specifically, it is possible that there will be greater restrictions on imports and exports between the UK and EU countries and increased regulatory complexities. These changes may adversely affect our operations and financial results. In addition, Brexit could lead to legal uncertainty and potentially divergent national laws and regulations as the UK determines which EU laws to replace or replicate. Further, among other things, Brexit could reduce capital spending in the UK and the EU, which could result in decreased demand for our products. Any of these effects of Brexit, and others we cannot anticipate, could adversely affect our business, business opportunities, financial condition, results of operations and cash flows.

Many of the markets in which we operate are cyclical or are subject to industry events, and our results have been and could be affected as a result.

Many of the markets in which we operate are subject to general economic cycles or industry events. We have significant exposure to companies operating in or selling to oil and gas markets. Declines in the price of oil have depressed demand in these markets, and continued low oil prices may continue or exacerbate the decline in this market. Other of our markets, including food and beverage, chemical, mining, and petrochemical, particularly chemical companies and general industrial companies, are to varying degrees cyclical and have experienced, and may continue to experience, periodic downturns. Cyclical changes and specific industry events could also affect sales of products in our other businesses. Downturns in the business cycles of our different operations may occur at the same time, which could exacerbate any adverse effects on our business. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Reportable Segments."

Contract timing on large construction projects, including food and beverage systems and projects in the oil and gas industries, may cause significant fluctuations in revenues and profits from period to period.

In addition, certain of our businesses have seasonal fluctuations. Historically, some of our key businesses tend to be stronger in the second half of the year.

Our business depends on capital investment and maintenance expenditures by our customers.

Demand for most of our products and services depends on the level of new capital investment and planned maintenance expenditures by our customers. The level of capital expenditures by our customers fluctuates based on planned expansions, new builds, and repairs, general economic conditions, availability of credit, and expectations of future market behavior. Any of these

factors, individually or in the aggregate, could have a material adverse effect on our customers and, in turn, our business, financial condition, results of operations and cash flows.

Our customers could be impacted by commodity availability and price fluctuations.

A number of factors outside our control, including fluctuating commodity prices, impact the demand for our products. Increased commodity prices may increase our customers' cost of doing business, thus causing them to delay or cancel large capital projects.

On the other hand, declining commodity prices may cause mines, oil refineries, oil and gas extraction fields and other customers to delay or cancel projects relating to the production of such commodities. Also, oversupply could cause manufacturers to cut back on expenditures. Reduced demand for our products and services could result in the delay or cancellation of existing orders or lead to excess manufacturing capacity, which unfavorably impacts our absorption of fixed manufacturing costs. This reduced demand may also erode average selling prices in the relevant market.

Our ordinary course and future restructuring activities, including our global realignment program, could result in additional costs and operational difficulties which may affect our business.

We face risks relating to our efforts to reduce global costs, including those designed to reduce headcount and consolidate our manufacturing footprint. In addition to the typical risks we face, our global realignment program is designed to further optimize our global footprint, streamline business processes and reduce selling, general and administrative expense across operating sites and corporate and global functions over the next year. The financial costs and savings associated with the realignment program are expected to continue to be well in excess of our historical, ordinary course restructuring activities. Consequently, charges to earnings as a result of these activities can vary significantly from period to period and, as a result, we may experience fluctuations in our reported cash flows, results of operations or earnings per share due to the timing of restructuring actions.

We risk the loss of valuable employees, operational difficulties, product quality, higher than expected restructuring costs, and difficulties arising from negotiations with work councils and other labor groups. We also risk disruption to our customer relationships if we are unable to meet our commitments to them. Further, these actions may take longer than anticipated, prove more costly than expected and distract management from other activities. Finally, we may not fully realize the expected benefits of these activities.

The price and availability of raw materials may adversely affect our business.

We are exposed to a variety of risks relating to the price and availability of raw materials. In recent years, we have faced volatility in the prices of many of our key raw materials, including petroleum-based products, steel and copper. Increases in the prices of raw materials or shortages or allocations of materials may have a material adverse effect on our financial position, results of operations or cash flows, as we may not be able to pass cost increases on to our customers, or our sales may be reduced. We are subject to long-term supplier contracts that may increase our exposure to pricing fluctuations.

Credit and counterparty risks could harm our business.

The financial condition of our customers could affect our ability to market our products or collect receivables. In addition, financial difficulties faced by our customers may lead to cancellation or delay of orders.

Our customers may suffer financial difficulties that make them unable to pay for a project when completed or as payment milestones become due, or they may decide not to pay us, either as a matter of corporate decision-making or in response to changes in local laws and regulations. We cannot assure you that expenses or losses for uncollectible amounts will not have a material adverse effect on our revenues, earnings and cash flows.

Failure to protect or unauthorized use of our intellectual property may harm our business.

Despite our efforts to protect our proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. The steps we have taken may not prevent unauthorized use of our technology or knowledge, particularly in foreign countries where the laws may not protect our proprietary rights to the same extent as in the United States. Costs incurred to defend our rights may be material.

If we are unable to protect our information systems against data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.

We are increasingly dependent on information technology ("IT") networks and systems, including the Internet, to process, transmit and store electronic information. In particular, we depend on such IT infrastructure for electronic communications among

our locations around the world and between our personnel and suppliers and customers, and we rely on the systems and services of a variety of vendors to meet our data processing and communication needs. Despite our implementation of security measures, cybersecurity threats, such as malicious software, phishing attacks, computer viruses and attempts to gain unauthorized access, cannot be completely mitigated. Security breaches of our, our customers' and our vendors' IT infrastructure can create system disruptions, shutdowns or unauthorized disclosure of confidential information, including our intellectual property, trade secrets, customer information or other confidential business information. If we are unable to prevent, detect or adequately respond to such breaches, our operations could be disrupted, our competitiveness could be adversely affected or we may suffer financial damage or loss because of lost or misappropriated information. Such incidents also could require significant management attention and resources and result in increased costs.

Currency conversion risk could have a material impact on our reported results of business operations.

Our operating results are translated into U.S. dollars for reporting purposes. The strengthening or weakening of the U.S. dollar against other currencies in which we conduct business could result in unfavorable translation effects as the results of transactions in foreign countries are translated into U.S. dollars. Increased strength of the U.S. dollar will increase the effective price of our products sold in U.S. dollars into other countries, which may have a material adverse effect on sales or require us to lower our prices, and also decrease our reported revenues or margins related to sales conducted in foreign currencies to the extent we are unable or determine not to increase local currency prices. Likewise, decreased strength of the U.S. dollar could have a material adverse effect stemming from the cost of materials and products purchased overseas.

Failure to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act or other applicable anti-bribery laws could have an adverse effect on our business.

The U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business. Recent years have seen a substantial increase in anti-bribery law enforcement activity with more frequent and aggressive investigations and enforcement proceedings by both the Department of Justice and the SEC, increased enforcement activity by non-U.S. regulators and increases in criminal and civil proceedings brought against companies and individuals. Our policies mandate compliance with anti-bribery laws. However, we operate in certain countries that are recognized as having governmental and commercial corruption. Our internal control policies and procedures may not always protect us from reckless or criminal acts committed by our employees or third-party intermediaries. Violations of these anti-bribery laws may result in criminal or civil sanctions, which could have a material adverse effect on our business, financial condition and results of operations.

We could experience operational difficulties and additional expense related to further implementations of Enterprise Resource Planning ("ERP") software.

We are engaged in a significant, multi-year process of upgrading, and where necessary, implementing, a standard ERP software program across certain of our business locations. Our expanded ERP software platform has involved, and will continue to involve, substantial expenditures on system hardware and software, as well as design, development and implementation activities. Operational disruptions during the course of these activities could materially impact our operations. For example, our ability to forecast sales demand, ship products, manage our product inventory, and record and report financial and management information on a timely and accurate basis could be impaired if there are significant problems implementing the expansion.

Additionally, our cost estimates related to our new ERP system are based on assumptions which are subject to wide variability, requiring a great deal of judgment.

Changes in tax laws and regulations or other factors could cause our income tax rate to increase, potentially reducing our earnings and adversely affecting our cash flows.

As a global manufacturing company, we are subject to taxation in various jurisdictions around the world. In preparing our financial statements, we calculate our effective income tax rate based on current tax laws and regulations and the estimated taxable income within each of these jurisdictions. Our future effective income tax rate, however, may be higher due to numerous factors, including changes in tax laws or regulations. An effective income tax rate significantly higher than our expectations could have an adverse effect on our business, results of operations and liquidity.

We seek to optimize our tax footprint across all operations in U.S. and non-U.S. jurisdictions alike. These benefits are contingent upon existing tax laws and regulations in the U.S. and in the countries in which our international operations are located. Future changes in domestic or international tax laws and regulations could adversely affect our ability to continue to realize these tax benefits. Political leaders in the U.S. have called for comprehensive tax reform which, among other things, might change certain U.S. tax rules impacting the way U.S. based multinationals are taxed on foreign income or may require previously earned but untaxed foreign earnings and profits to be taxed immediately but at a rate lower than the current 35% U.S. Federal tax rate.

Additionally, in 2015, the Organisation for Economic Co-operation and Development ("OECD"), an international association of 34 countries, including the U.S., released the final reports from its Base Erosion and Profit Shifting ("BEPS") Action Plans. The BEPS recommendations covered a number of issues, including country-by-country reporting, permanent establishment rules, hybrid mismatch rules, anti-tax avoidance rules, transfer pricing rules and tax treaties. Recently, the European Commission ("EC") concluded its investigations into tax ruling practices of certain EU member countries. The EC concluded that certain member countries had granted unlawful rulings that artificially reduced tax burdens and has ordered the recovery of the unpaid taxes. Future tax reform resulting from these developments may result in changes to long-standing tax principles, which could adversely affect our effective tax rate or result in higher cash tax liabilities.

Our effective tax rate could also be adversely affected by different and evolving interpretations of existing law or regulations, which in turn would negatively impact our operating and financial results as a whole. Additionally, our effective tax rate could also be adversely affected if there is a change in international operations, our tax structure and how our operations are managed and structured, which could have a material adverse effect on our business, financial condition and results of operations.

Cost overruns, delays, penalties or liquidated damages could negatively impact our results, particularly with respect to long-term fixed-price contracts.

Substantially all our revenues are recorded and earned under fixed-price arrangements. A portion of our revenues and earnings is generated through long-term contracts. We recognize revenues for the majority of these long-term contracts using the percentage-of-completion method of accounting whereby revenues and expenses, and thereby profit, in a given period are determined based on our estimates as to the project status and the costs remaining to complete a particular project. During 2016, 2015 and 2014, approximately 17.0%, 20.5% and 20.7%, respectively, of our total revenues were recorded under the percentage-of-completion method.

Estimates of total revenues and cost at completion are subject to many variables, including the length of time to complete a contract. In addition, contract delays may negatively impact these estimates and our revenues and earnings results for affected periods.

To the extent that we underestimate the remaining cost or time to complete a project, we may overstate the revenues and profit in a particular period. Further, certain of these contracts provide for penalties or liquidated damages for failure to timely perform our obligations under the contract, or require that we, at our expense, correct and remedy to the satisfaction of the other party certain defects. Because substantially all of our long-term contracts are at a fixed price, we face the risk that cost overruns, delays, penalties or liquidated damages may exceed, erode or eliminate our expected profit margin, or cause us to record a loss on our projects.

The loss of key personnel and an inability to attract and retain qualified employees could have a material adverse effect on our operations.

We are dependent on the continued services of our leadership team. The loss of these personnel without adequate replacement could have a material adverse effect on our operations. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience in many locations in order to operate our business successfully. From time to time, there may be a shortage of skilled labor, which may make it more difficult and expensive for us to attract and retain qualified employees. If we were unable to attract and retain sufficient numbers of qualified individuals or our costs to do so were to increase significantly, our operations could be materially adversely affected.

We operate in highly competitive markets. Our failure to compete effectively could harm our business.

We sell our products in highly competitive markets, which could result in pressure on our profit margins and limit our ability to maintain or increase the market share of our products. We compete on a number of fronts, including on the basis of product offerings, technical capabilities, quality, service and pricing. We have a number of competitors with substantial technological and financial resources, brand recognition and established relationships with global service providers. Some of our competitors have low cost structures, support from local governments, or both. In addition, new competitors may enter the markets in which we participate. Competitors may be able to offer lower prices, additional products or services or a more attractive mix of products or services, or services or incentives that we cannot or will not match. These competitors may be in a stronger position to respond quickly to new or emerging technologies and may be able to undertake more extensive marketing campaigns, and make more attractive offers to potential customers, employees and strategic partners. In addition, competitive environments in slow-growth markets, to which some of our businesses have exposure, have been inherently more influenced by pricing and domestic and global economic conditions. To remain competitive, we must invest in manufacturing, marketing, customer service and support and our distribution networks. We cannot assure you that we will have sufficient resources to continue to make the investment required to maintain or increase our market share or that our investments will be successful. If we do not compete successfully, our business, financial condition, results of operations and cash flows could be materially adversely affected.

Our strategy to outsource various elements of the products and services we sell subjects us to the business risks of our suppliers and subcontractors, which could have a material adverse impact on our operations.

In areas where we depend on third-party suppliers and subcontractors for outsourced products, components or services, we are subject to the risk of customer dissatisfaction with the quality or performance of the products or services we sell due to supplier or subcontractor failure. In addition, business difficulties experienced by a third-party supplier or subcontractor can lead to the interruption of our ability to obtain outsourced products or services and ultimately our inability to supply products or services to our customers. Third-party supplier and subcontractor business interruptions can include, but are not limited to, work stoppages, union negotiations and other labor disputes. Current or future economic conditions could also impact the ability of suppliers and subcontractors to access credit and, thus, impair their ability to provide us quality products or services in a timely manner, or at all.

We are subject to laws, regulations and potential liability relating to claims, complaints and proceedings, including those relating to environmental and other matters.

We are subject to various laws, ordinances, regulations and other requirements of government authorities in the United States and other nations. With respect to acquisitions, divestitures and continuing operations, we may acquire or retain liabilities of which we are not aware, or which are of a different character or magnitude than expected. Additionally, changes in laws, ordinances, regulations or other governmental policies may significantly increase our expenses and liabilities.

In addition, costs associated with regulatory compliance can be difficult to predict. If we underestimate the time or costs required to comply with our legal and regulatory obligations, our actual costs may significantly exceed our projections, which could impact our results of operations.

We are subject to domestic and international environmental protection laws and regulations with respect to our business operations and are operating in compliance with, or taking action aimed at ensuring compliance with, these laws and regulations. We cannot assure you that our compliance obligations with environmental protection laws and regulations, individually or in the aggregate, will not have a material adverse effect on our financial position, results of operations or cash flows.

Numerous claims, complaints and proceedings arising in the ordinary course of business, including those relating to litigation matters (e.g., class actions, derivative lawsuits and contracts, intellectual property and competitive claims), environmental matters, and risk management matters (e.g., product and general liability, personal injury claims, automobile, and workers' compensation claims), have been filed or are pending against us and certain of our subsidiaries. From time to time, we face actions by governmental authorities, both in and outside the United States. Additionally, we may become subject to significant claims of which we are currently unaware or the claims of which we are aware may result in our incurring a significantly greater liability than we anticipate. Our insurance may be insufficient or unavailable (e.g., because of insurer insolvency, a significant adverse change in claim experience, or insurance coverage is not available in applicable insured periods) to protect us against potential loss exposures.

We devote significant time and expense to defend against the various claims, complaints and proceedings brought against us, and we cannot assure you that the expenses or distractions from operating our businesses arising from these defenses will not increase materially.

We cannot assure you that our accruals and rights to indemnity and insurance will be sufficient, that recoveries from insurance or indemnification claims will be available or that any of our current or future claims or other matters will not have a material adverse effect on our financial position, results of operations or cash flows.

See "Management's Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies and Use of Estimates-Contingent Liabilities" and Note 13 to our consolidated and combined financial statements for further discussion.

If the fair value of any of our reporting units is insufficient to recover the carrying value of the goodwill and other intangibles of the respective reporting unit, a material non-cash charge to earnings could result.

At December 31, 2016, we had goodwill and other intangible assets, net, of $1,066.8. We conduct annual impairment testing to determine if we will be able to recover all or a portion of the carrying value of goodwill and indefinite-lived intangibles. In addition, we review goodwill and indefinite-lived intangible assets for impairment more frequently if impairment indicators arise. If the fair value is insufficient to recover the carrying value of our reporting units and indefinite-lived intangibles, we may be required to record a material non-cash charge to earnings.

The fair values of our reporting units generally are based on discounted cash flow projections that are believed to be reasonable under current and forecasted circumstances, the results of which form the basis for making judgments about the

recoverability of carrying values of the reported net assets of our reporting units. Other considerations are also incorporated, including comparable price multiples. Many of our businesses closely follow changes in the industries and end markets that they serve. For example, following declines in the price of oil and the resultant impact on oil markets, the results of our goodwill impairment test conducted during the second quarter of 2016 indicated the estimated fair value of our Power and Energy reporting unit was less than its carrying value, and we recorded a goodwill impairment charge of $252.8. We also recorded intangible asset impairment charges of $115.9, $30.9 and $26.8 related to customer relationships, technology assets and trademarks, respectively, during the same quarter. Accordingly, we consider estimates and judgments that affect future cash flow projections, including principal methods of competition such as volume, price, service, product performance and technical innovations and estimates associated with cost reduction initiatives, capacity utilization, and assumptions for inflation and foreign currency changes. We monitor impairment indicators across all of our businesses. Significant changes in market conditions and estimates or judgments used to determine expected future cash flows that indicate a reduction in carrying value may give rise to impairments in the period that the change becomes known.

We are subject to potential work stoppages, labor disputes and other matters associated with our labor force, which may adversely impact our operations and cause us to incur incremental costs.

We have various collective labor arrangements covering certain U.S. and non-U.S. employee groups. We are subject to potential work stoppages and other potential labor disputes. Further, we may be subject to work stoppages, which are beyond our control, at our suppliers or customers.

Our technology is important to our success, and failure to develop new products may result in a significant competitive disadvantage.

We believe the development of our intellectual property rights is critical to the success of our business. In order to maintain our market positions and margins, we need to continually develop and introduce high quality, technologically advanced and cost-effective products on a timely basis, in many cases in multiple jurisdictions around the world. The failure to do so could result in a significant competitive disadvantage.

Our current and planned products may contain defects or errors that are detected only after delivery to customers. If that occurs, our reputation may be harmed and we may face additional costs.

We cannot assure you that our product development, manufacturing and integration testing will be adequate to detect all defects, errors, failures and quality issues that could impact customer satisfaction or result in claims against us with regard to our products. As a result, we may have, and from time to time have had, to replace certain components and/or provide remediation in response to the discovery of defects in products that are shipped. The occurrence of any defects, errors, failures or quality issues could result in cancellation of orders, product returns, diversion of our resources, legal actions by our customers or our customers' end users and other losses to us or to any of our customers or end users, and could also result in the loss of or delay in market acceptance of our products and loss of sales, which would harm our business and adversely affect our revenues and profitability.

Increases in the number of shares of our outstanding common stock could adversely affect our common stock price or dilute our earnings per share.

Sales of a substantial number of shares of common stock into the public market, or the perception that these sales could occur, could have a material adverse effect on our stock price. As of December 31, 2016, we had the ability to issue up to an additional 1.9 shares as restricted stock shares, restricted stock units, or stock options under our SPX FLOW Stock Compensation Plan. Additionally, we may issue a significant number of additional shares, in connection with acquisitions or otherwise. We also may issue a significant number of additional shares through other mechanisms. Additional shares granted and/or issued would have a dilutive effect on our earnings per share.

Provisions in our corporate documents and Delaware law may delay or prevent a change in control of our company, and accordingly, we may not consummate a transaction that our shareholders consider favorable.

Provisions of our Certificate of Incorporation and By-laws may inhibit changes in control of our company not approved by our Board. These provisions include, for example: a staggered board of directors; a prohibition on shareholder action by written consent; a requirement that special shareholder meetings be called only by our Chairman, President or Board; advance notice requirements for shareholder proposals and nominations; limitations on shareholders' ability to amend, alter or repeal the By-laws; enhanced voting requirements for certain business combinations involving substantial shareholders; the authority of our Board to issue, without shareholder approval, preferred stock with terms determined in its discretion; and limitations on shareholders' ability to remove directors. In addition, we are afforded the protections of Section 203 of the Delaware General Corporation Law, which could have similar effects. In general, Section 203 prohibits us from engaging in a "business combination"

with an "interested shareholder" (each as defined in Section 203) for at least three years after the time the person became an interested shareholder unless certain conditions are met. These protective provisions could result in our not consummating a transaction that our shareholders consider favorable or discourage entities from attempting to acquire us, potentially at a significant premium to our then-existing stock price.

Our indebtedness may affect our business and may restrict our operating flexibility.

At December 31, 2016, we had $1,108.8 in total indebtedness. On that same date, we had $372.9 of borrowing capacity under our revolving credit facilities, after giving effect to borrowings of $68.0 under the domestic revolving loan facility and $9.1 reserved for outstanding letters of credit, and $3.0 of available borrowing capacity under our trade receivables financing arrangement after giving effect to borrowings of $21.2. Our trade receivables financing arrangement provides for a total commitment of $50.0 from associated lenders, depending upon our trade receivables balance and other factors. In addition, at December 31, 2016, we had $275.6 of available issuance capacity under our foreign credit instrument facilities after giving effect to $224.4 reserved for outstanding letters of credit. At December 31, 2016, our cash and equivalents balance was $215.1. See MD&A and Note 10 to our consolidated and combined financial statements for further discussion. We may incur additional indebtedness in the future, including indebtedness incurred to finance, or assumed in connection with, acquisitions. We may renegotiate or refinance our senior credit facilities, senior notes or other debt facilities, or enter into additional agreements that have different or more stringent terms. The level of our indebtedness could:

| |

• | Impact our ability to obtain new, or refinance existing, indebtedness on favorable terms or at all; |

| |

• | Limit our ability to obtain, or obtain on favorable terms, additional debt financing for working capital, capital expenditures or acquisitions; |

| |

• | Limit our flexibility in reacting to competitive and other changes in the industry and economic conditions; |

| |

• | Limit our ability to pay dividends on our common stock; |

| |

• | Coupled with a substantial decrease in net operating cash flows due to economic developments or adverse developments in our business, make it difficult to meet debt service requirements; and |

| |

• | Expose us to interest rate fluctuations to the extent existing borrowings are, and any new borrowings may be, at variable rates of interest, which could result in higher interest expense and interest payments in the event of increases in interest rates. |

Our ability to make scheduled payments of principal or pay interest on, or to refinance, our indebtedness and to satisfy our other debt obligations will depend upon our future operating performance, which may be affected by general economic, financial, competitive, legislative, regulatory, business and other factors beyond our control. In addition, we cannot assure you that future borrowings or equity financing will be available for the payment or refinancing of our indebtedness. If we are unable to service our indebtedness, whether in the ordinary course of business or upon an acceleration of such indebtedness, we may pursue one or more alternative strategies, such as restructuring or refinancing our indebtedness, selling assets, reducing or delaying capital expenditures, revising implementation of or delaying strategic plans or seeking additional equity capital. Any of these actions could have a material adverse effect on our business, financial condition, results of operations and stock price. In addition, we cannot assure that we would be able to take any of these actions, that these actions would enable us to continue to satisfy our capital requirements, or that these actions would be permitted under the terms of our various debt agreements.

Numerous banks in many countries are syndicate members in our credit facility. Failure of one or more of our larger lenders, or several of our smaller lenders, could significantly reduce availability of our credit, which could harm our liquidity.

We may not be able to finance future needs or adapt our business plan to react to changes in economic or business conditions because of restrictions placed on us by our senior credit facilities and any existing or future instruments governing our other indebtedness.

Our senior credit facilities, the indentures governing our senior notes and agreements governing our other indebtedness contain, or future or revised instruments may contain, various restrictions and covenants that limit our ability to make distributions or other payments to our investors and creditors unless certain financial tests or other criteria are satisfied. We also must comply with certain specified financial ratios and tests. Our subsidiaries may also be subject to restrictions on their ability to make distributions to us. In addition, our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness contain or may contain additional affirmative and negative covenants. Material existing restrictions are described more fully in the MD&A and Note 10 to our consolidated and combined financial statements. Each of these restrictions could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities, such as acquisitions.

If we do not comply with the covenants and restrictions contained in our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness, we could default under those agreements, and the debt, together with accrued interest, could be declared due and payable. If we default under our senior credit facilities, the lenders could cause all our outstanding debt obligations under our senior credit facilities to become due and payable or require us to repay the indebtedness under these facilities. If our debt is accelerated, we may not be able to repay or refinance our debt. In addition, any default under our senior credit facilities, indentures governing our senior notes or agreements governing our other indebtedness could lead to an acceleration of debt under other debt instruments that contain cross-acceleration or cross-default provisions. If the indebtedness under our senior credit facilities is accelerated, we may not have sufficient assets to repay amounts due under our senior credit facilities, senior notes or other debt securities then outstanding. Our ability to comply with these provisions of our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness will be affected by changes in the economic or business conditions or other events beyond our control. Complying with our covenants may also cause us to take actions that are not favorable to us and may make it more difficult for us to successfully execute our business strategy and compete, including against companies that are not subject to such restrictions.

Risks Related to our Spin-Off in 2015

We may not be able to engage in certain corporate transactions.

To preserve the intended tax-free treatment of the Spin-Off, under our Tax Matters Agreement with our former Parent, for a period of two years following the Spin-Off, we generally will be prohibited from taking certain actions that would prevent the Spin-Off from qualifying as a transaction that generally is tax-free to our former Parent and its shareholders, for U.S. federal income tax purposes, under Sections 355 and 368(a)(1)(D) of the Code.

These restrictions, which generally relate to acquisitions of our stock and similar transactions, may limit our ability to pursue certain strategic transactions or other transactions that we may otherwise believe to be in the best interests of our shareholders or that might increase the value of our business.

In connection with our Spin-Off, our former Parent will indemnify us for certain liabilities and we will indemnify our former Parent for certain liabilities. If we are required to act on these indemnities to our former Parent, we may need to divert cash to meet those obligations and our financial results could be negatively impacted. The indemnity from our former Parent may not be sufficient to insure us against the full amount of liabilities for which we will be allocated responsibility, and our former Parent may not be able to satisfy its indemnification obligations in the future.

Pursuant to the Separation and Distribution Agreement, the Employee Matters Agreement and the Tax Matters Agreement between us and our former Parent, it has agreed to indemnify us for certain liabilities, and we have agreed to indemnify our former Parent for certain liabilities, in each case for uncapped amounts. Such indemnities may be significant and could negatively impact our business, particularly our indemnity to our former Parent regarding the intended tax-free treatment of the Spin-Off. Third parties could also seek to hold us responsible for any of the liabilities that our former Parent has agreed to retain. Further, the indemnity from our former Parent may not be sufficient to protect us against the full amount of such liabilities, and our former Parent may not be able to fully satisfy its indemnification obligations. Moreover, even if we ultimately succeed in recovering from our former Parent any amounts for which we are held liable, we may be temporarily required to bear these losses ourselves. Each of these risks could negatively affect our business, financial condition, results of operations and cash flows.

The Spin-Off may expose us to potential liabilities arising out of state and federal fraudulent conveyance laws and legal dividend requirements.

The Spin-Off is subject to review under various state and federal fraudulent conveyance laws. Fraudulent conveyance laws generally provide that an entity engages in a constructive fraudulent conveyance when (1) the entity transfers assets and does not receive fair consideration or reasonably equivalent value in return, and (2) the entity (a) is insolvent at the time of the transfer or is rendered insolvent by the transfer, (b) has unreasonably small capital with which to carry on its business, or (c) intends to incur or believes it will incur debts beyond its ability to repay its debts as they mature. An unpaid creditor or an entity acting on behalf of a creditor (including, without limitation, a trustee or debtor-in-possession in a bankruptcy by us or our former Parent or any of our respective subsidiaries) may bring a lawsuit alleging that the Spin-Off or any of the related transactions constituted a constructive fraudulent conveyance. If a court accepts these allegations, it could impose a number of remedies, including, without limitation, voiding our claims against our former Parent, requiring our shareholders to return to our former Parent some or all of the shares of our common stock issued in the Spin-Off, or providing our former Parent with a claim for monetary damages against us in an amount equal to the difference between the consideration received by our former Parent and the fair market value of our company at the time of the Spin-Off.

The measure of insolvency for purposes of the fraudulent conveyance laws will vary depending on which jurisdiction's law is applied. Generally, an entity would be considered insolvent if (1) the present fair saleable value of its assets is less than

the amount of its liabilities (including contingent liabilities); (2) the present fair saleable value of its assets is less than its probable liabilities on its debts as such debts become absolute and matured; (3) it cannot pay its debts and other liabilities (including contingent liabilities and other commitments) as they mature; or (4) it has unreasonably small capital for the business in which it is engaged. We cannot assure you what standard a court would apply to determine insolvency or that a court would determine that we, our former Parent or any of our respective subsidiaries were solvent at the time of or after giving effect to the Spin-Off.

The distribution of our common stock is also subject to review under state corporate distribution statutes. Under the General Corporation Law of the State of Delaware (the "DGCL"), a corporation may only pay dividends to its shareholders either (1) out of its surplus (net assets minus capital) or (2) if there is no such surplus, out of its net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year.

Although we believe that we and our former Parent were each solvent at the time of the Spin-Off (including immediately after the distribution of shares of SPX FLOW common stock), that we are able to repay our debts as they mature and have sufficient capital to carry on our businesses, and that the distribution was made entirely out of surplus in accordance with Section 170 of the DGCL, we cannot assure you that a court would reach the same conclusions in determining whether our former Parent or we were insolvent at the time of, or after giving effect to, the Spin-Off, or whether lawful funds were available for the separation and the distribution to our former Parent's shareholders.

A court could require that we assume responsibility for obligations allocated to our former Parent under the Separation and Distribution Agreement.

Under the Separation and Distribution Agreement, both we and our former Parent are responsible for the debts, liabilities and other obligations related to the business or businesses which it owns and operates. Although we do not expect to be liable for any obligations that are not allocated to us under the Separation and Distribution Agreement, a court could disregard the allocation agreed to between the parties, and require that we assume responsibility for obligations allocated to our former Parent (including, for example, environmental liabilities), particularly if our former Parent were to refuse or were unable to pay or perform the allocated obligations.

We are subject to continuing contingent tax liabilities of our former Parent.

Under the Code and U.S. Treasury Regulations, each corporation that was a member of our former Parent's consolidated group for U.S. federal income tax purposes during any taxable period (or portion thereof) ending on or before the effective time of the Spin-Off is jointly and severally liable for the entire U.S. federal income tax liability of our former Parent's consolidated group for that taxable period subsequent to the year ended December 31, 2011. Our Tax Matters Agreement with our former Parent generally allocates economic responsibility for taxes of our former Parent's consolidated group to our former Parent. However, if our former Parent is unable to pay any such taxes, we could be liable for the entire amount of such taxes, which would include taxes arising out of the Spin-Off if our former Parent were to take an action (over which we may have no control) that causes the Spin-Off to be taxable to our former Parent.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

The following is a summary of our principal properties, including manufacturing, engineering, and sales offices as of December 31, 2016:

|

| | | | | | | | | | |

| | | | | Approximate Square Footage |

| Location | | No. of Facilities | | Owned | | Leased |

| | | | | (in millions) |

Food and Beverage | 3 U.S. states and 10 foreign countries | | 19 |

| | 0.7 |

| | 1.1 |

|

Power and Energy | 5 U.S. states and 9 foreign countries | | 26 |

| | 1.9 |

| | 0.6 |

|

Industrial | 6 U.S. states and 13 foreign countries | | 30 |

| | 1.0 |

| | 0.6 |

|

Total | | | 75 |

| | 3.6 |

| | 2.3 |

|

In addition to manufacturing plants, we own our corporate office in Charlotte, NC, and lease our Asia Pacific center in Shanghai, China, our European shared service center in Manchester, United Kingdom and various sales, service and other

locations throughout the world. We consider these properties, as well as the related machinery and equipment, to be well maintained and suitable and adequate for their intended purposes.

The following table lists the locations of our primary manufacturing facilities as of December 31, 2016:

|

| | | | |

Americas | | EMEA | | Asia Pacific |

Burlington, Canada | | Annecy, France | | Ahmedabad, India |

Delavan, WI | | Assen, Netherlands | | Busan, South Korea |

Goldsboro, NC | | Brixworth, U.K. | | Jaipur, India |

Houston, TX | | Budapest, Hungary | | New Delhi, India |

McKean, PA | | Bydgoszcz, Poland | | Xidu, China |

Newport, NC | | Ekero, Sweden | | |

Ocala, FL | | Erpe-Mere, Belgium | | |

Rochester, NY | | Etten-Leur, Netherlands | | |

Rockford, IL | | Eygelshoven, Netherlands | | |

Sao Paulo, Brazil | | Glasgow, U.K. | | |

| | Killarney, Ireland | | |

| | Kolding, Denmark* | | |

| | Moers, Germany | | |

| | Newbury, U.K. | | |

| | Norderstedt, Germany | | |

| | Orebro, Sweden | | |

| | Penistone, U.K. | | |

| | Santorso, Italy | | |

| | Silkeborg, Denmark | | |

| | Unna, Germany* | | |

| | | | |

*Facility expected to be exited in 2017 as part of the Company's global realignment program. |

ITEM 3. Legal Proceedings

We are subject to legal proceedings and claims that arise in the normal course of business. We believe these matters are either without merit or of a kind that should not have a material effect, individually or in the aggregate, on our financial position, results of operations or cash flows; however, we cannot assure you that these proceedings or claims will not have a material effect on our financial position, results of operations or cash flows.

See "Risk Factors," "MD&A — Critical Accounting Policies and Estimates — Contingent Liabilities," and Note 13 to our consolidated and combined financial statements for further discussion of legal proceedings.

ITEM 4. Mine Safety Disclosures

Not applicable.

PART II

ITEM 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "FLOW."

The number of shareholders of record of our common stock as of February 3, 2017 was 3,373.

The following table sets forth the reported high and low trading prices for our common stock for each quarterly period during the year 2016 and the fourth quarter of fiscal 2015, beginning September 28, 2015, the date that our common stock began open trading, as reported on the NYSE.

|

| | | | | | | |

| High | | Low |

2016: | | | |

4th Quarter | $ | 33.86 |

| | $ | 22.34 |

|

3rd Quarter | 31.06 |

| | 23.50 |

|

2nd Quarter | 31.58 |

| | 23.71 |

|

1st Quarter | 28.56 |

| | 14.85 |

|

| | | |

| High | | Low |

2015: | | | |

4th Quarter | $ | 42.06 |

| | $ | 25.49 |

|

Any dividends in future periods, including declaration, record and payment dates, will be at the discretion of our Board of Directors and will depend on, among other things, our results of operations, ongoing capital needs, financial condition and other factors that the Board of Directors may deem relevant, as well as our ability to declare and pay dividends.

Issuer Purchases of Equity Securities

The following table summarizes the repurchases of common stock during the three months ended December 31, 2016:

|

| | | | | | | | | | | | |

Period | | Total Number of Shares Purchased(1) | | Average Price Per Share | | Total Number of Shares Purchased as Part of a Publicly Announced Plan or Program | | Maximum Approximate Dollar Value of Shares That May Yet be Purchased Under the Plan or Program |

10/2/16 - 10/31/16 | | 5,402 |

| | $ | 27.95 |

| | — |

| | |

11/1/16 - 11/30/16 | | 2,617 |

| | 26.34 |

| | — |

| | |

12/1/16 - 12/31/16 | | 11,235 |

| | 31.77 |

| | — |

| | |

Total | | 19,254 |

| | | | — |

| | |

(1) Reflects the surrender to us of shares of common stock to satisfy tax withholding obligations in connection with the vesting of restricted stock units. |

Company Performance

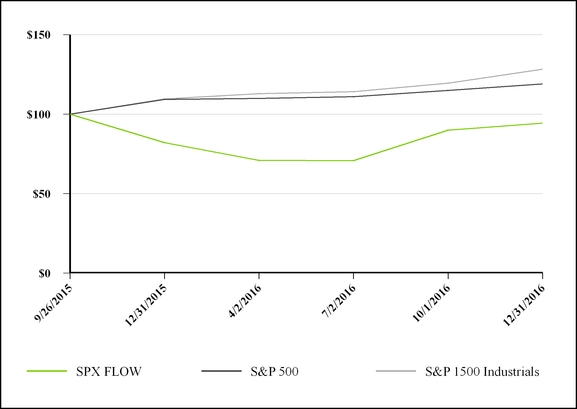

This graph shows a comparison of cumulative total returns for SPX FLOW, the S&P 500 Index and the S&P Composite 1500 Industrials Index beginning on September 28, 2015, the date that our common stock began open trading, assuming an initial investment of $100.

|

| | | | | | | | | | | |

| SPX FLOW | | S&P 500 | | S&P 1500 Industrials |

9/26/2015 | $ | 100.00 |

| | $ | 100.00 |

| | $ | 100.00 |

|

12/31/2015 | $ | 82.10 |

| | $ | 109.20 |

| | $ | 109.60 |

|

4/2/2016 | $ | 70.88 |

| | $ | 109.80 |

| | $ | 112.92 |

|

7/2/2016 | $ | 70.79 |

| | $ | 110.99 |

| | $ | 114.10 |

|

10/1/2016 | $ | 90.03 |

| | $ | 114.85 |

| | $ | 119.48 |

|

12/31/2016 | $ | 94.29 |

| | $ | 118.97 |

| | $ | 128.34 |

|

ITEM 6. Selected Financial Data

The following table presents our selected historical consolidated and combined financial data as of and for each of the years in the five-year period ended December 31, 2016. Our historical consolidated and combined financial statements, prior to the Spin-Off, included certain expenses of our former Parent that were charged to us for certain corporate centralized functions and programs, including information technology, payroll services, shared services for accounting, supply chain and manufacturing operations, and business and health insurance coverage. In addition, for purposes of preparing the consolidated and combined financial statements prior to the Spin-Off, a portion of our former Parent’s total corporate costs were allocated to such financial statements, with the allocations related primarily to (i) the support provided by our former Parent's executive management, finance and accounting, legal, risk management, and human resource functions and (ii) costs associated with our former Parent's Charlotte, NC corporate headquarters and its Asia Pacific corporate center in Shanghai, China. Our historical consolidated and combined financial statements, prior to the Spin-Off, also do not reflect the allocation of certain assets and liabilities between our former Parent and us. Consequently, the financial information included here may not necessarily reflect our financial position, results of operations and cash flows in the future or what our financial condition, results of operations and cash flows would have been had we been an independent, publicly-traded company during the historical periods presented.