UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| (Exact name of registrant as specified in its charter) |

www.brewbilt.com

| (State

or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S.

Employer Identification No.) | ||

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| x | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

o

On June 30, 2021, the last business day of the registrants most recently completed second quarter, the aggregate market value of the Common

Stock held by non-affiliates of the registrant was $

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

As of March 28, 2021, the Registrant had shares of common stock issued and outstanding.

Documents incorporated by reference: None

1

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common stock” refer to the common shares in our capital stock.

As used in this Annual Report, the terms “we,” “us,” “Company,” “our”, and “BrewBilt” mean BrewBilt Manufacturing, Inc., unless otherwise indicated.

PART I

ITEM 1. BUSINESS

Company Overview

Located in Grass Valley, CA, BrewBilt is one of the only California companies that custom designs, hand crafts, and integrates brewing, fermentation and distilling systems for the craft beer industry using “Best in Class” American made stainless steel. Founded by Jeff Lewis in 2014 with a vision of creating a profitable company by hiring excellent local craftsmen, designing and building products to exceed customers’ expectations Mr. Lewis now has over 20 years of experience as a craft beer brewer, a custom tank/vessel designer, fabrication and integration expert and business owner who initially founded Portland Kettle Works.

BrewBilt has strong relationships with suppliers of raw materials, equipment, and services globally, in addition an aggressive referral network of satisfied customers nationwide. An Advisory Board consisting of successful business leaders that provide valuable product feedback and business expertise to management. The craft brewing & spirits industries continue to grow worldwide. California is where craft brewing began and now has over 950 operating breweries – being centrally located in this booming market was a large draw for BrewBilt to locate its manufacturing facility in the Sierra foothills.

All BrewBilt products are designed and fabricated as “food grade” quality which enables the company to build vessels for food and beverage processing. BrewBilt buys materials and components mostly from suppliers which enables BrewBilt to closely monitor quality, while the company’s revenues are generated from sales to customers throughout the world a great deal of specific interest in coming from Mexico, Japan, Europe, and Australia.

3

In July of 2016, BrewBilt moved from the small facility in Nevada City, CA to lease an eight thousand (8,000) square foot manufacturing facility in Grass Valley, CA. This facility was purchased by BrewBilt in January 2018 and upgraded with substantial tenant improvements. BrewBilt obtains the majority of its leads through customer referrals and from online marketplaces. The company’s website has expanded to include online sales and online educational/marketing videos that feature the company and its expanded product line of brewing accessories. BrewBilt has also created distribution sales agreements with individuals and companies to represent BrewBilt in both the domestic and international markets.

Merger Transaction

On November 22, 2019, Vet Online Supply and Brewbilt Manufacturing (“BrewBilt”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) and completed a merger, whereby Brewbilt merged with and into Vet Online Supply, with BrewBilt remaining as the surviving entity (the “Merger”). Under U.S. generally accepted accounting principles, the merger is treated as a “reverse merger” under the purchase method of accounting, with BrewBilt as the accounting acquirer.

Pursuant with the Merger Asset Purchase Agreement, the Board of Directors has authorized that BrewBilt shall sell, assign and transfer all of its right, title and interest to its IP, fixed assets and “know how” to the Company (collectively, the “Seller’s Assets”). Vet Online Supply and BrewBilt mutually agreed that BrewBilt assign certain assets and provide the “Know-How” regarding the designing and building of the finest craft brewing equipment in the industry today. As consideration for the IP, fixed assets and the “Know How”, the Company issued, $5,000,000 worth of Convertible Preferred Series A Stock within thirty (30) days from the date of the agreement. The number of Convertible Preferred Series A shares issued was 500,000 shares at a price of $10. per share which are convertible pursuant the conversion rights as specified in the Articles of Incorporation and certificate of designation for VTNL. BrewBilt designated that the said stock be issued in the name of its President, Jeffrey Lewis.

The Board of Directors dismissed Daniel Rushford as an officer and director, specifically as the Chief Executive Officer, Chairman of the Board, and Corporate (President) of the Company effective November 22, 2019. Effective November 22, 2019, Daniel Rushford had a new revised Employment Agreement which appointed him as Manager of the CBD Pet Supply Division, a non-director/officer position which includes returning to Treasury 1,000 Preferred Series B Control Shares, and an annual salary of $36,000. Unpaid wages will accrue interest at 6% per annum and may be converted to restricted common stock at fair market value at the time of conversion. His employment agreement was not renewed in 2020.

The Board of Directors appointed Jeffrey Lewis as the new Chief Executive Officer, Chairman of the Board, Corporate President, Secretary, and Treasurer of the Company, effective November 22, 2019. Jeffrey was provided with an Employment Agreement that included the issuance of 1,000 Preferred Series B Control Shares, and an annual salary of $200,000. Unpaid wages will accrue interest at 6% per annum and may be converted to restricted common stock at fair market value at the time of conversion.

Jeffrey Lewis is 48 years old. As the founder of BrewBilt Manufacturing, a multiple million-dollar sales and manufacturing company, he has 20 years of experience managing engineering, design and fabrication teams that custom design and fabricate integrated stainless-steel distillation and brewing systems for the beverage, cannabis and hemp industries.

Our Market Opportunity

The craft beer industry offers a value of $94.1 billion in the United States, yet it is still an area of the economy which offers growth potential. As the craft beer market matures, the smaller players are being squeezed out, and the more established breweries are consolidating and gaining market share.

In response to this industry trend, BrewBilt is shifting our marketing focus to larger brewing systems that are in higher demand as these successful breweries expand their production volumes with bigger equipment. These targeted customers are less price sensitive than the small startups and more willing to pay top dollar for the quality and reliability that BrewBilt is known for in the craft beer industry.

4

BrewBilt systems are engineered for high efficiency and consistency, which are critical factors for regional breweries and microbreweries, which make up for 66% and 19% of US craft beer production, respectively.

There are five distinct craft beer industry market segments: regional brewers, microbreweries, brewpubs, taprooms, and contract brewers.

Essential Craft Beer Industry Statistics

As of the writing of this information, 2021 industry numbers have not been released.

California had the largest output for the craft beer industry in 2020, offering $9.7 billion in total impact. Pennsylvania finished in second during the year, with a $5.6 billion impact. They were followed by Texas ($5.4 billion), New York ($4.9 billion), and Florida ($3.8 billion). The overall beer market in the United States has a value of $94.1 billion. Although the craft beer segment has a 12.3% share of the total beer volume in the country, it represents 23.6% of the total dollar sales that were achieved in 2020. The dollar sales of craft beer products in the United States was down 22% in 2020, which was a result of pandemic sales being shifted from taprooms to retail for at-home consumption. However, on-site sales are already rebounding strongly in 2022. Adults in the United States consume an average of 19.8 gallons of beer each year, according to the National Beer Wholesalers Association. About 36% of registered breweries in the United States are listed as a brewpub. That means the products they create for consumers are meant for direct sales that occur on their premises. The average brewery with this classification will produce about 1,000 barrels of beer each year. 95% of the breweries which are operating in the United States today produced less than 15,000 barrels of beer each year. That classifies the operation as a microbrewery if 75% or more of the beer the company produces is sold off-site. About 40% of the sales that occur each year for the craft beer industry happen during the months of June, July, or August. Almost 90% of adults over the age of 21 in the United States live within 10 miles of at least one brewery. Most of these operations qualify as a craft beer producer. There are more than 950 different craft breweries operating in California right now, making it the largest source of products for the industry today.

Industry Overview

Overall U.S. beer volume sales were down 3% in 2020, while craft brewer volume sales declined 9%, lowering small and independent brewers’ share of the U.S. beer market by volume to 12.3%.

Retail dollar sales of craft decreased 22%, to $22.2 billion, and now account for just under 24% of the $94 billion U.S. beer market (previously $116 billion). The primary reason for the larger dollar sales decline was the shift in beer volume from bars and restaurants to packaged sales.

Recent U.S. Brewery Count

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2019 to 2020 % Change | |

| Craft | 4,803 | 5,713 | 6,661 | 7,618 | 8,391 | 8,764 | 4.4% |

| Regional Craft Breweries | 178 | 186 | 202 | 230 | 240 | 220 | -8.3% |

| Microbreweries | 2,684 | 3,319 | 3,956 | 4,518 | 1,821 | 1,854 | 1.8% |

| Taprooms | 3,159 | 3,471 | 9.9% | ||||

| Brewpubs | 1,941 | 2,208 | 2,503 | 2,870 | 3,171 | 3,219 | 1.5% |

| Large/Non-Craft | 44 | 67 | 106 | 104 | 111 | 120 | 8.1% |

| Total U.S. Breweries | 4,847 | 5,780 | 6,767 | 7,722 | 8,502 | 8,884 | 4.5% |

5

Historical Craft Brewery Production by Category

U.S. Craft Brewery Count by Category

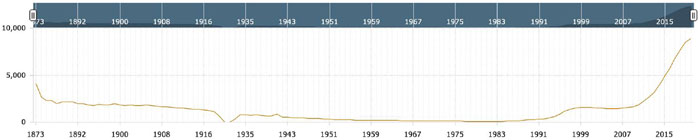

Historical U.S. Brewery Count

Slide the bar at the top of the graph to see number of breweries from 1873 to present day.

Competition

BrewBilt competes against a number of companies, most of which are selling mass produced equipment from China made from less costly, inferior quality Chinese steel which often is not food grade quality. While this broader market is very competitive, there continues to be little competition and strong market demand for higher quality, custom designed, hand-crafted systems that BrewBilt produces with American labor.

6

Employees and Consultants

As of the date of this filing, BrewBilt has 15 employees. Our suppliers include various consultants for manufacturing, new business development and marketing, in addition to legal and accounting support.

ITEM 1A. RISK FACTORS

The Company is a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and is not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

In January 2018, BrewBilt began leasing an eight thousand square foot manufacturing facility located at 110 Spring Hill Dr #10, Grass Valley, CA 95945.

ITEM 3. LEGAL PROCEEDINGS

In the ordinary course of business, the Company may become involved in legal proceedings from time to time. The Company is not currently party to any legal proceedings, nor is it aware of any material pending legal proceedings.

ITEM 4. MINE SAFTEY DISCLOSURES

Not applicable to our operations.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is currently quoted on the OTC Markets. Our common stock has been quoted on the OTC Markets under the symbol “BBRW”. Because we are quoted on the OTC Markets, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The following table sets forth the high and low closing prices for our common stock per quarter as reported by the OTCQB for the period from January 1, 2021 through December 31, 2021, and January 1, 2020 through December 31, 2020, based on our fiscal year end December 31. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

| For the Year Ended December 31 | ||||||||

| 2021 | 2020 | |||||||

| High | Low | High | Low | |||||

| First Quarter | 0.0178 | 0.0021 | 0.0373 | 0.0024 | ||||

| Second Quarter | 0.0051 | 0.0022 | 0.0536 | 0.0027 | ||||

| Third Quarter | 0.0027 | 0.0013 | 0.0081 | 0.0032 | ||||

| Fourth Quarter | 0.0023 | 0.0005 | 0.0040 | 0.0013 | ||||

7

Penny Stock Regulations Restrictions on Marketability

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws, (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price, (d) contains a toll-free telephone number for inquiries on disciplinary actions, (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks, and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock, (b) the compensation of the broker-dealer and its salesperson in the transaction, (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock, and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock once we obtain a listing on a regulated market. Therefore, stockholders may have difficulty selling their shares of our common stock.

Record Holders

The Company’s common shares are issued in registered form. Vstock Transfer LLC, 18 Lafayette Place Woodmere, NY, 11598, (212) 828-8436, is the registrar and transfer agent for the Company’s common shares.

As of December 31, 2021, there were 8,109,531,693 shares of the registrant’s $0.001 par value common stock issued and outstanding, which were held by 34 shareholders of record.

Dividends

The Company has not declared any dividends on its common stock since the Company’s inception. There is no restriction in the Company’s Articles of Incorporation and Bylaws that will limit its ability to pay dividends on its common stock. However, the Company does not anticipate declaring and paying dividends to its shareholders in the near future.

Securities authorized for issuance under equity compensation plans

We have no compensation plans under which our equity securities are authorized for issuance.

8

Performance graph

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Recent Sales of Unregistered Securities

On December 1, 2021, the Company issued 10,000 shares of Series A Convertible Preferred stock at $10 per share to Bennett Buchanan, pursuant to his Consulting Agreement dated November 1, 2021.

On December 8, 2021, the Company issued 500,000 shares of Series A Convertible Preferred stock at $10 per share to Jef Lewis, pursuant to his Employment Agreement dated October 1, 2021.

On December 27, 2021, the Company issued 100,000 of Preferred Series A shares to Mr. Berry for his four years of service as a Director for the company.

During the three months ended December 31, 2021, 77,280 shares of Convertible Series A Preferred stock were converted to 895,000,000 common shares in accordance with the conversion terms. The issuances resulted in a loss on conversion of $354,200, which was recorded to the statement of operations.

During the three months ended December 31, 2021, warrant holders exercised the warrants and the Company issued 313,958,333 shares of common stock through a cashless exercise of the warrants in accordance with the conversion terms.

During the three months ended December 31, 2021, the holders of a convertible notes converted $256,500 of principal, $18,874 of accrued interest and $1,750 in conversion fees into 462,272,239 shares of common stock. The common stock was valued at $500,149 based on the market price of the Company’s stock on the date of conversion.

Recent issuances of unregistered securities subsequent to our fiscal year ended of December 31, 2021

On January 3, 2022, the holder of a convertible note converted a total of $39,867 of principal and interest into 398,670,000 shares of our common stock.

On January 6, 2022, the holder of a convertible note converted a total of $20,000 of principal and interest into 100,000,000 shares of our common stock.

On January 13, 2022, the holder of a convertible note converted a total of $42,954 of principal and interest into 429,540,000 shares of our common stock.

On January 17, 2022, 50,000 shares of Convertible Preferred Series A stock was issued to South Pacific Traders Oy pursuant to a Distribution Agreement. The share were classified as shares payable during the period ending December 31, 2021.

On January 21, 2022, 15,104 shares of Convertible Preferred Series A stock was converted into 430,313,390 shares of common stock.

On January 25, 2022, the holder of a convertible note converted a total of $25,200 of principal and interest into 200,000,000 shares of our common stock.

On January 31, 2022, the holder of a convertible note converted a total of $46,096 of principal and interest into 460,963,300 shares of our common stock.

On February 11, 2022, the holder of a convertible note converted a total of $50,554 of principal and interest into 505,438,000 shares of our common stock.

On February 14, 2022, the holder of a convertible note converted a total of $45,938 of principal and interest into 255,208,333 shares of our common stock.

9

On February 18, 2022, 8,616 shares of Convertible Preferred Series A stock was converted into 478,666,667 shares of common stock.

On February 23, 2022, the holder of a convertible note converted a total of $27,170 of principal and interest into 543,394,200 shares of our common stock.

On March 2, 2022, the holder of a convertible note converted a total of $54,339 of principal and interest into 543,390,000 shares of our common stock.

On March 14, 2022, the holder of a convertible note converted a total of $14,621 of principal and interest into 348,116,068 shares of our common stock.

Issuer Repurchases of Equity Securities

None.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future, and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Results for the Year Ended December 31, 2021 Compared to the Year Ended December 31, 2020

Revenues:

The Company’s revenues were $774,388 for the year ended December 31, 2021 compared to $1,379,580 for the year ended December 31, 2020. The decrease is due to fewer projects being completed and delivered to customers. The company had multiple large orders sold during the year which have longer production times. In addition, the average revenue per job for the customer orders that were completed were lower during the year ended December 31, 2021 compared to December 31, 2020. This is due to an increase in pass-through sales rather than jobs that required fabrication.

Cost of Sales:

The Company’s cost of materials was $419,098 for the year ended December 31, 2021, compared to $455,360 for the year ended December 31, 2020. The increase in costs in relation to revenue was due to an increase in raw material costs as a result of supply chain issues and the continuing impact of COVID-19. The company also had a higher number of smaller customer orders with low profit margins. COVID-19 related safety measures also resulted in a reduction of manufacturing productivity.

10

Operating Expenses:

Operating expenses consisted primarily of consulting fees, professional fees, salaries and wages, office expenses and fees associated with preparing reports and SEC filings relating to being a public company. Operating expenses for the year ended December 31, 2021 and December 31, 2020 were $7,661,953 and $9,905,885, respectively. Although the company had an increase in G&A expenses and salaries and wages in 2021, the decrease in overall expenses was due to a reduction in share-based compensation pursuant to Licensing and Distribution Agreements that were executed in 2020.

Other Income (Expense):

Other income (expense) for the years ended December 31, 2021 and 2020 was $(4,390,446) and $(7,343,185), respectively. Other income (expense) consisted of gain or loss on derivative valuation, gain or loss on disposal of assets, loss on conversions, debt forgiveness and interest expense. The gain or loss on derivative valuation is directly attributable to the change in fair value of the derivative liability. Interest expense is primarily attributable the initial interest expense associated with the valuation of derivative instruments at issuance and the accretion of the convertible debentures over their respective terms. The variance primarily resulted from the fluctuation of the Company’s stock price which impacted the valuation of the derivative liabilities on the convertible debt.

Net Loss:

Net loss for the year ended December 31, 2021 was $11,697,109 compared with $16,324,850 for the year ended December 31, 2020. The decreased loss can be explained by the decrease in share-based consulting fees and the decrease in derivative expenses in the year ended December 31, 2021.

Liquidity and Capital Resources

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As of December 31, 2021, the Company has a shareholders’ deficit of $16,138,003 since its inception, working capital deficit of $3,085,906, negative cash flows from operations, and has limited business operations, which raises substantial doubt about the Company’s ability to continue as going concern. The ability of the Company to meet its commitments as they become payable is dependent on the ability of the Company to obtain necessary financing or achieving a profitable level of operations. There is no assurance the Company will be successful in achieving these goals.

| December 31, 2021 | December 31, 2020 | |||||||

| $ | $ | |||||||

| Current Assets | 1,318,748 | 223,729 | ||||||

| Current Liabilities | 4,404,654 | 4,281,072 | ||||||

| Working Capital (Deficit) | (3,085,906 | ) | (4,057,343 | ) | ||||

The overall working capital (deficit) decreased from $(4,057,343) at December 31, 2020 to $(3,085,906) at December 31, 2021 due to an increase in cash and raw material purchases and a decrease in derivative liabilities and accrued liabilities.

The Company requires additional capital to fully execute its marketing program and increase revenues. Presently we are relying on short term loans from our sole officer and director to meet operational shortfalls. There can be no assurance that continued funding will be available on satisfactory terms. We intend to raise additional capital through the sale of equity, loans or other short-term financing options.

| December 31, 2021 $ | December 31, 2020 $ | |||||||

| Cash Flows from (used in) Operating Activities | (1,316,469 | ) | (964,667 | ) | ||||

| Cash Flows from (used in) Investing Activities | (185,289 | ) | (33,823 | ) | ||||

| Cash Flows from (used in) Financing Activities | 1,648,177 | 1,069,810 | ||||||

| Net Increase (decrease) in Cash During Period | 146,419 | 71,320 | ||||||

11

During the year ended December 31, 2021, cash used in operating activities was $1,316,469 compared to $964,667 for the year ended December 31, 2020. The variance primarily resulted from the change in fair value of derivative liabilities, an increase in operating assets and a decrease in operating liabilities during the year ended December 31, 2021.

During the year ended December 31, 2021, cash used in investing activities was $(185,289) compared to $(33,823) for the year ended December 31, 2020. The increase in cash used in investing activity is due to an increase in fixed assets purchases in 2021.

During the years ended December 31, 2021, cash from financing activities was $1,648,177 compared to $1,069,810 for the year ended December 31, 2020. The increase in cash from financing activity is due to an increase in proceeds from convertible debt and promissory notes during the year ended December 31, 2021.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Significant Accounting Policies

Our discussion and analysis of our results of operations and liquidity and capital resources are based on our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates and judgments, including those related to revenue recognition, allowance for doubtful accounts, warranty liabilities, share-based payments, income taxes and litigation. We base our estimates on historical and anticipated results and trends and on various other assumptions that we believe are reasonable under the circumstances, including assumptions as to future events. These estimates form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. By their nature, estimates are subject to an inherent degree of uncertainty. Actual results that differ from our estimates could have a significant adverse effect on our operating results and financial position. We believe that the significant accounting policies and assumptions as detailed in Note 1 to the financial statements contained herein may involve a higher degree of judgment and complexity than others.

Emerging Growth Company

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

12

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company does not hold any assets or liabilities requiring disclosure under this item.

13

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

BREWBILT MANUFACTURING INC.

FINANCIAL STATEMENTS

Table of Contents

14

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of BrewBilt Manufacturing, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of BrewBilt Manufacturing, Inc. as of December 31, 2021 and 2020, the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2020, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company’s significant operating losses raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/S/

BF Borgers CPA PC

PCAOB

ID Number :

We

have served as the Company’s auditor since 2015

March 31, 2022

15

| BREWBILT MANUFACTURING INC. |

| CONSOLIDATED BALANCE SHEETS |

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | $ | ||||||

| Accounts receivable | ||||||||

| Earnings in excess of billings | ||||||||

| Inventory | ||||||||

| Prepaid expenses | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Property, plant, and equipment, net | ||||||||

| Intangibles, net | ||||||||

| Right-of-use asset | ||||||||

| Security deposit | ||||||||

| Other assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued interest | ||||||||

| Accrued liabilities | ||||||||

| Billings in excess of revenue | ||||||||

| Current operating lease liabilities | ||||||||

| Convertible notes payable, net of discount | ||||||||

| Derivative liabilities | ||||||||

| Liability for unissued shares | ||||||||

| Promissory notes payable, net of discount | ||||||||

| Related party liabilities | ||||||||

| Total Current Liabilities | ||||||||

| Long term debt | ||||||||

| Non-current operating lease liabilities | ||||||||

| Total Liabilities | ||||||||

| Series A convertible preferred stock: $ par value; shares authorized; shares issued and outstanding at December 31, 2021; shares issued and outstanding at December 31, 2020 | ||||||||

| Convertible preferred stock payable | ||||||||

| Commitments and contingencies | ||||||||

| Stockholders’ Deficit: | ||||||||

| Preferred stock, Series B: $ par value; shares authorized; shares issued and outstanding at December 31, 2021; shares issued and outstanding at December 31, 2020 | ||||||||

| Common stock, $ par value; authorized; shares issued and outstanding at December 31, 2021; shares issued and outstanding at December 31, 2020 | ||||||||

| Additional paid in capital | ( | ) | ( | ) | ||||

| Retained earnings | ( | ) | ( | ) | ||||

| Total stockholders’ deficit | ( | ) | ( | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

16

| BREWBILT MANUFACTURING INC. |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| Years ended | ||||||||

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Sales | $ | $ | ||||||

| Cost of sales | ||||||||

| Gross profit | ||||||||

| Operating expenses: | ||||||||

| Consulting fees | ||||||||

| Depreciation and amortization | ||||||||

| G&A expenses | ||||||||

| Professional fees | ||||||||

| Salaries and wages | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other income (expense): | ||||||||

| Other income | ||||||||

| Debt forgiveness | ||||||||

| Derivative expenses | ( | ) | ( | ) | ||||

| Loss on conversion | ( | ) | ( | ) | ||||

| Loss on disposal of assets | ( | ) | ||||||

| Interest expense | ( | ) | ( | ) | ||||

| Total other expenses | ( | ) | ( | ) | ||||

| Net loss before income taxes | ( | ) | ( | ) | ||||

| Income tax expense | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Per share information | ||||||||

| Weighted number of common shares outstanding, basic and diluted | ||||||||

| Net loss per common share | $ | ( | ) | $ | ( | ) | ||

The accompanying notes are an integral part of these financial statements

17

| BREWBILT MANUFACTURING INC. |

| CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (DEFICIT) |

| Convertible Preferred Stock | Preferred Stock | Additional | Retained | Total | ||||||||||||||||||||||||||||||||||||

| Series A | Shares | Series B | Common Stock | Paid-In | Earnings | Shareholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Payable | Shares | Amount | Shares | Amount | Capital | (Deficit) | Equity | |||||||||||||||||||||||||||||||

| Balance at December 31, 2019 | $ | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | |||||||||||||||||||||||||||||

| Conversion of convertible notes payable to stock | — | — | ||||||||||||||||||||||||||||||||||||||

| Derivative settlements | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Cancellation of stock issued for services | — | — | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||

| Common stock converted to preferred stock | — | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||

| Preferred stock converted to common stock | ( | ) | ( | ) | — | |||||||||||||||||||||||||||||||||||

| Preferred stock issued for services | — | — | ||||||||||||||||||||||||||||||||||||||

| Preferred stock issued per agreement | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Preferred stock transferred from related party to settle debt | — | — | — | |||||||||||||||||||||||||||||||||||||

| Related party debt settled to additional paid in capital | — | — | — | |||||||||||||||||||||||||||||||||||||

| Warrant exercise | — | — | ( | ) | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

| Conversion of convertible notes payable to stock | — | — | ||||||||||||||||||||||||||||||||||||||

| Conversion of promissory notes to stock | — | — | ||||||||||||||||||||||||||||||||||||||

| Derivative settlements | — | — | — | |||||||||||||||||||||||||||||||||||||

| Preferred stock converted to common stock | ( | ) | ( | ) | — | |||||||||||||||||||||||||||||||||||

| Preferred stock issued for services | — | — | ||||||||||||||||||||||||||||||||||||||

| Preferred stock cancelled for services | ( | ) | ( | ) | — | — | ||||||||||||||||||||||||||||||||||

| Preferred shares to be issued for services | — | — | — | |||||||||||||||||||||||||||||||||||||

| Preferred stock issued to settle debt | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Warrant exercise | — | — | ( | ) | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements

18

| BREWBILT MANUFACTURING INC. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| Years ended | ||||||||

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Amortization of convertible debt discount | ||||||||

| Change in derivative liability | ||||||||

| Common stock issued for services | ||||||||

| Debt forgiveness | ( | ) | ||||||

| Depreciation and amortization of fixed assets | ||||||||

| Loss on conversion | ||||||||

| Gain on obsolete inventory | ||||||||

| Preferred stock issued for consulting services | ||||||||

| Preferred stock issued for wages and salaries | ||||||||

| Preferred stock issued to settle liabilities | ( | ) | ||||||

| Decrease (increase) in operating assets | ||||||||

| Accounts receivable | ||||||||

| Deposits | ( | ) | ||||||

| Earnings in excess of billings | ( | ) | ||||||

| Inventory | ( | ) | ( | ) | ||||

| Prepaid expenses | ( | ) | ||||||

| Other assets | ( | ) | ||||||

| Increase (decrease) in operating liabilities | ||||||||

| Accounts payable | ( | ) | ( | ) | ||||

| Accrued interest | ||||||||

| Accrued liabilities | ( | ) | ||||||

| Billings in excess of revenues | ( | ) | ||||||

| Net cash (used in) provided by operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities | ||||||||

| Property, plant and equipment, additions | ( | ) | ( | ) | ||||

| Property, plant and equipment, proceeds | ||||||||

| Net cash (used in) provided by investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Long term debt | ( | ) | ||||||

| Proceeds from convertible debt | ||||||||

| Proceeds from promissory notes | ||||||||

| Related party liabilities | ( | ) | ||||||

| Net cash (used in) provided for financing activities | ||||||||

| Net increase in cash | ||||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest | $ | $ | ||||||

| Schedule of non-cash investing & financing activities | ||||||||

| Stock issued for note payable conversion | $ | $ | ||||||

| Stock issued for promissory note conversion | $ | $ | ||||||

| Derivative settlements | $ | $ | ( | ) | ||||

| Discount from derivative | $ | $ | ||||||

| Common stock converted to preferred stock | $ | $ | ( | ) | ||||

| Preferred stock converted to common stock | $ | $ | ||||||

| Preferred stock issued to settle liabilities | $ | $ | ||||||

| Cashless warrant exercise | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

19

1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Description of Business

Located in Grass Valley, CA, BrewBilt is one of the only California companies that custom designs, hand crafts, and integrates brewing, fermentation and distilling systems for the craft beer industry using “Best in Class” American made stainless steel. Founded by Jeff Lewis in 2014 with a vision of creating a profitable company by hiring excellent local craftsmen, designing and building products to exceed customers’ expectations Mr. Lewis now has over 20 years of experience as a craft beer brewer, a custom tank/vessel designer, fabrication and integration expert and business owner who initially founded Portland Kettle Works.

BrewBilt has strong relationships with suppliers of raw materials, equipment, and services globally, in addition an aggressive referral network of satisfied customers nationwide. An Advisory Board consisting of successful business leaders that provide valuable product feedback and business expertise to management. The craft brewing & spirits industries continue to grow worldwide. California is where craft brewing began and now has over 950 operating breweries – being centrally located in this booming market was a large draw for BrewBilt to locate its manufacturing facility in the Sierra foothills.

All BrewBilt products are designed and fabricated as “food grade” quality which enables the company to build vessels for food and beverage processing. BrewBilt buys materials and components mostly from suppliers which enables BrewBilt to closely monitor quality, while the company’s revenues are generated from sales to customers throughout the world a great deal of specific interest in coming from Mexico, Japan, Europe, and Australia.

In July of 2016, BrewBilt moved from the small facility in Nevada City, CA to lease an eight thousand (8,000) square foot manufacturing facility in Grass Valley, CA. This facility was purchased by BrewBilt in January 2018 and upgraded with substantial tenant improvements. BrewBilt obtains the majority of its leads through customer referrals and from online marketplaces. The company’s website has expanded to include online sales and online educational/marketing videos that feature the company and its expanded product line of brewing accessories. BrewBilt has also created distribution sales agreements with individuals and companies to represent BrewBilt in both the domestic and international markets.

`Amendments to Previously Reported Annual Financial Information

The Company’s previously issued financial statements for the year ended December 31, 2020, as included in its Form 10-K filed on March 31, 2021, have been restated since the Company improperly classified the Series A preferred stock in permanent equity as opposed to liability pursuant to ASC 480-10-25-14(A), since the financial instrument embodies an unconditional obligation to transfer a variable number of shares and the monetary value of such obligation is based solely on a fixed amount known at inception.

Financial Statement Presentation

The audited financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Business Combinations

As per ASC 805-50 a common-control transaction does not meet the definition of a business combination because there is no change in control over the net assets. The accounting for these transactions is addressed in the “Transactions Between Entities Under Common Control”. The net assets are derecognized by the transferring entity and recognized by the receiving entity at the historical cost of the parent of the entities under common control. Any difference between the proceeds transferred or received and the carrying amounts of the net assets is recognized in equity in the transferring and receiving entities’ separate financial statements and eliminated in consolidation. The change in accounting principle is applied retroactively for all periods presented.

20

Fiscal year end

The Company has selected December 31 as its fiscal year end.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported therein. Due to the inherent uncertainty involved in making estimates, actual results reported in future periods may be based upon amounts that differ from these estimates.

Cash Equivalents

The Company considers all highly liquid investments with maturities of 90 days or less from the date of purchase to be cash equivalents.

COVID-19

The Company began seeing the impact of the COVID-19 pandemic on its business in early March 2020. The direct financial impact of the pandemic has primarily shown in significantly reduced production from the on-premises channel and higher labor and safety-related costs at the Company’s manufacturing facility. In addition to these direct financial impacts, COVID-19 related safety measures resulted in a reduction of manufacturing productivity. The Company will continue to assess and manage this situation and will provide a further update in each quarterly earnings release, to the extent that the effects of the COVID-19 pandemic are then known more clearly.

Revenue Recognition and Related Allowances

The

Company recognizes revenue when obligations under the terms of a contract with its customer are satisfied; generally, this occurs with

the transfer of control of its products. Revenue is measured as the amount of consideration expected to be received in exchange for transferring

products. If the conditions for revenue recognition are not met, the Company defers the revenue and related cost of sales until all conditions

are met. As of December 31, 2021 and December 31, 2020, the Company has deferred $

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are stated at the amount that management expects to collect from outstanding balances. Bad debts and allowances are provided based on historical experience and management’s evaluation of outstanding accounts receivable. Management evaluates past due or delinquency of accounts receivable based on the open invoices aged on due date basis. The allowance for doubtful accounts at December 31, 2021 and December 31, 2020 is $0.

Inventories

Inventories

consist of raw materials, work in process and finished goods. Raw materials, which principally consist of raw stainless steel, raw stainless

tubing, motors, pumps, and fittings, are stated at the lower of cost, determined on the first-in, first-out basis, or net realizable

value. During the years ended December 31, 2021 and December 31, 2020, the Company wrote off $

Goodwill

The excess of the cost over the fair value of net assets of acquired in the Merger is recorded as goodwill. Goodwill is not subject to amortization, but is reviewed for impairment annually, or more frequently whenever events or changes in circumstances indicate the carrying value of goodwill may not be recoverable. An impairment charge would be recorded to the extent the carrying value of goodwill exceeds its estimated fair value. The testing of goodwill under established guidelines for impairment requires significant use of judgment and assumptions. Changes in forecasted operations and other assumptions could materially affect the estimated fair values. Changes in business conditions could potentially require adjustments to these asset valuations.

21

Capitalized Distribution Fees

The Company records its intangible assets at cost in accordance with ASC 350, Intangibles – Goodwill and Other. The Company reviews the intangible assets for impairment on an annual basis or if events or changes in circumstances indicate it is more likely than not that they are impaired. These events could include a significant change in the business climate, legal factors, a decline in operating performance, competition, sale, or disposition of a significant portion of the business, or other factors. If the review indicates the impairment, an impairment loss would be recorded for the difference of the value recorded and the new value. For the years ended December 31, 2021, and 2020, there were no impairment losses recognized for intangible assets.

Warranty

The

Company is a manufacturer of products which are shipped to our customers directly from the Company. For products that are made from raw

materials, the Company offers a 6-year limited warranty. The parts provided by outside vendors as finished goods that are added to a

system produced by the Company as components, have a manufacturers’ warranty that is passed on to the end user of the complete

system. To date, BrewBilt has spent less than $5,000 over the past 5 years for repairs (under warranty) on products they have built,

with most of the costs going to cover travel and lodging expenses. As of December 31, 2021 and December 31, 2020, the Company has recorded

a liability of $

Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses are carried at amortized cost and represent liabilities for goods and services provided to the Company prior to the end of the fiscal year that are unpaid and arise when the Company becomes obliged to make future payments in respect of the purchase of these goods and services.

Fair Value of Financial Instruments

Fair value is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity. In addition, the fair value of liabilities should include consideration of non-performance risk including our own credit risk.

In addition to defining fair value, the standard expands the disclosure requirements around fair value and establishes a fair value hierarchy for valuation inputs is expanded. The hierarchy prioritizes the inputs into three levels based on the extent to which inputs used in measuring fair value are observable in the market. Each fair value measurement is reported in one of the three levels, and which is determined by the lowest level input that is significant to the fair value measurement in its entirety.

These levels are:

Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

22

Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.

Financial assets and liabilities measured at fair value on a recurring basis:

| Input | December 31, 2021 | December 31, 2020 | ||||||||

| Level | Fair Value | Fair Value | ||||||||

| Derivative Liability | 3 | $ | $ | |||||||

| Total Financial Liabilities | $ | $ | ||||||||

In management’s opinion, the fair value of convertible notes payable and advances payable is approximate to carrying value as the interest rates and other features of these instruments approximate those obtainable for similar instruments in the current market. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, exchange or credit risks arising from these financial instruments. As of December 31, 2021 and December 31, 2020, the balances reported for cash, accounts receivable, prepaid expenses, accounts payable, and accrued liabilities, approximate the fair value because of their short maturities.

Debt issuance costs and debt discounts

Debt issuance costs and debt discounts are being amortized over the lives of the related financings on a basis that approximates the effective interest method. Costs and discounts are presented as a reduction of the related debt in the accompanying consolidated balance sheets.

Income Taxes

The Company records deferred taxes in accordance with FASB ASC No. 740, Income Taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and loss carryforwards and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

As of the date of this filing, the Company is not current in filing their tax returns. The last return filed by the Company was December 31, 2019, and the Company has not accrued any potential penalties or interest from that period forward. The Company will need to file returns for the year ending December 31, 2021 and 2020, which is still open for examination.

In accordance with ASC Topic 280 – “Earnings Per Share”, the basic loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted loss per common share is computed similar to basic loss per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

Recent Accounting Pronouncements

Although there were new accounting pronouncements issued or proposed by the FASB during the year ended December 31, 2021 and through the date of filing of this report, the Company does not believe any of these accounting pronouncements has had or will have a material impact on its financial position or results of operations.

23

NOTE 2 – GOING CONCERN

The

accompanying financial statements have been prepared assuming the Company will continue as a going concern. As of December 31, 2021,

the Company has a shareholders’ deficit of $

The Company does not have sufficient cash to fund its desired production for the next 12 months. The Company has arranged financing and intends to utilize the cash received to cover ongoing operational expenses. The Company plans to seek additional financing if necessary, in private or public equity offering(s) to secure future funding for operations. There can be no assurance the Company will be successful in raising additional funding. If the Company is not able to secure additional funding, the implementation of the Company’s business plan will be impaired. There can be no assurance that such additional financing will be available to the Company on acceptable terms or at all.

NOTE 3 – PREPAID EXPENSES

Prepaid fees represent amounts paid in advance for future contractual benefits to be received. Contracting expenses paid in advance are recorded as a prepaid asset and then amortized to the statements of operations when services are rendered, or over the life of the contract using the straight-line method.

As of December 31, 2021 and December 31, 2020, prepaid expenses consisted of the following:

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Prepaid insurance expenses | $ | $ | ||||||

| Prepaid consulting expenses | ||||||||

| Prepaid rent expense | ||||||||

| $ | $ | |||||||

On September 15, 2021, Bennett Buchanan was appointed to serve as a director of BrewBilt Manufacturing, Inc. In connection with Mr. Buchanan’s appointment, the Company agreed to repurchase 10,000 shares of Series A Convertible Preferred Stock from Mr. Buchanan issued to him under his Consulting Agreement dated January 1, 2021, for an aggregate purchase price of $100,000, payable in five installments of $20,000 each over the six month period following his appointment as a director. During the year ended December 31, 2021, the company recorded payments of $40,000 in connection with this agreement. It has recognized $80,000 in consulting fees in 2021 and will recognize $20,000 in the first quarter of 2022.

NOTE 4 – PROPERTY AND EQUIPMENT

Property and equipment consisted of the following at December 31, 2021 and December 31, 2020:

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Computer Equipment | $ | $ | ||||||

| Leasehold Improvements | ||||||||

| Machinery | ||||||||

| Software | ||||||||

| Vehicles | ||||||||

| Less accumulated amortization | ( | ) | ( | ) | ||||

| Less accumulated depreciation | ( | ) | ( | ) | ||||

| $ | $ | |||||||

24

During

the year ended December 31, 2021, the company recorded fixed assets additions of $

NOTE 5 – LEASES

The Company adopted the new lease guidance effective January 1, 2019 using the modified retrospective transition approach, applying the new standard to all of its leases existing at the date of initial application which is the effective date of adoption. Consequently, financial information will not be updated, and the disclosures required under the new standard will not be provided for dates and periods before January 1, 2019. We elected the package of practical expedients which permits us to not reassess (1) whether any expired or existing contracts are or contain leases, (2) the lease classification for any expired or existing leases, and (3) any initial direct costs for any existing leases as of the effective date. We did not elect the hindsight practical expedient which permits entities to use hindsight in determining the lease term and assessing impairment. The adoption of the lease standard did not change our previously reported consolidated statements of operations and did not result in a cumulative catch-up adjustment to opening equity.

The interest rate implicit in lease contracts is typically not readily determinable. As such, the Company utilizes its incremental borrowing rate, which is the rate incurred to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. In calculating the present value of the lease payments, the Company elected to utilize its incremental borrowing rate based on the remaining lease terms as of the January 1, 2019 adoption date.

Operating Leases

Operating lease ROU assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at the commencement date. The operating lease ROU asset also includes any lease payments made and excludes lease incentives and initial direct costs incurred, if any. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Our lease has a remaining lease term of less than 4 years.

The Company has elected the practical expedient to combine lease and non-lease components as a single component. The lease expense is recognized over the expected term on a straight-line basis. Operating leases are recognized on the balance sheet as right-of-use assets, current operating lease liabilities and non-current operating lease liabilities.

The new standard also provides practical expedients and certain exemptions for an entity’s ongoing accounting. We have elected the short-term lease recognition exemption for all leases that qualify. This means, for those leases where the initial lease term is one year or less or for which the ROU asset at inception is deemed immaterial, we will not recognize ROU assets or lease liabilities. Those leases are expensed on a straight-line basis over the term of the lease.

On January 1, 2018, the Company entered into a standard office lease for approximately 8,000 square feet of space, located in the Wolf Creek Industrial Building at 110 Spring Hill Dr. #10 Grass Valley, CA 95945. The lease has a term of 10 years, from January 1, 2018 through January 1, 2028, with a monthly rent of $4,861.

On January 1, 2020, the Company terminated the lease agreement dated January 1, 2018, and entered into a new office lease for the same space located in the Wolf Creek Industrial Building at 110 Spring Hill Dr. #10 Grass Valley, CA 95945. The lease has a term of 5 years, from January 1, 2020 through December 31, 2025, with a monthly rent of $4,861.

25

As of December 31, 2021 and December 31, 2020, ROU assets and lease liabilities related to our operating lease is as follows:

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Right-of-use assets | $ | $ | ||||||

| Current operating lease liabilities | ||||||||

| Non-current operating lease liabilities | ||||||||

The following is a schedule, by years, of future minimum lease payments required under the operating lease:

| Years Ending | |||||

| December 31, | Operating Lease | ||||

| 2022 | $ | ||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| Total | |||||

| Less imputed interest | |||||

| Total liability | $ | ||||

NOTE 6 – INTANGIBLES

On August 20, 2021, the company entered into an Exclusive Distribution Agreement with South Pacific Traders Oy. Pursuant to the agreement, the company will issue 50,000 Convertible Preferred Series A shares at $10 per share. South Pacific Traders will market BrewBilt Manufacturing equipment to the European Community and United Kingdom. Management determined that the 50,000 Convertible Series A Preferred to be issued as consideration for the exclusive distribution agreement is a finite-lived intangible asset and will be amortized over the five year term of the agreement. The share were issued subsequent to the reporting period and therefore recorded as convertible preferred stock payable.

NOTE 7 – ACCRUED LIABILITIES

As of December 31, 2021 and December 31, 2020, accrued liabilities were comprised of the following:

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Accrued liabilities | ||||||||

| Accrued wages | $ | $ | ||||||

| Credit card | ||||||||

| Customer deposits | ||||||||

| Sales tax payable | ||||||||

| Warranty | ||||||||

| Total accrued expenses | $ | $ | ||||||

NOTE 8 – BILLINGS IN EXCESS OF REVENUE AND EARNINGS IN EXCESS OF BILLINGS

Billings in excess of revenue is related to contracted amounts that have been invoiced to customers for which remaining performance obligations must be completed before the Company can recognize the revenue. Earnings in excess of billings is related to the cost of sales associated with the customer jobs that are incomplete.

26

Changes in unearned revenue for the periods ended December 31, 2021 and December 31, 2020 were as follows:

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Unearned revenue, beginning of the period | $ | $ | ||||||

| Billings in excess of revenue during the period | ||||||||

| Recognition of unearned revenue in prior periods | ( | ) | ( | ) | ||||

| Unearned revenue, end of the period | $ | $ | ||||||

As

of December 31, 2021 and December 31, 2020, the Company has recorded $

NOTE 9 – CONVERTIBLE NOTES PAYABLE

As of December 31, 2021 and December 31, 2020, notes payable were comprised of the following:

| Original | Original | Due | Interest | Conversion | December 31, | December 31, | ||||||||||||||

| Note Amount | Note Date | Date | Rate | Rate | 2021 | 2020 | ||||||||||||||

| Auctus Fund #11 | Variable | |||||||||||||||||||

| CBP #3 | Variable | |||||||||||||||||||

| CBP #4 | Variable | |||||||||||||||||||

| EMA Financial #6 | Variable | |||||||||||||||||||

| EMA Financial #7 | Variable | |||||||||||||||||||

| Emerging Corp Cap #1 | Variable | |||||||||||||||||||

| Emerging Corp Cap #2 | Variable | |||||||||||||||||||

| GPL Ventures #1 | Variable | |||||||||||||||||||

| GPL Ventures #3 | 0.001 | |||||||||||||||||||

| Mammoth Corp #1 | Variable | |||||||||||||||||||

| Mammoth Corp #2 | Variable | |||||||||||||||||||

| Mast Hill Fund | 0.0015 | |||||||||||||||||||

| Optempus #1 | Variable | |||||||||||||||||||

| Optempus #2 | Variable | |||||||||||||||||||

| Optempus #3 | Variable | |||||||||||||||||||

| Optempus #4 | Variable | |||||||||||||||||||

| Power Up Lending #14 | Variable | |||||||||||||||||||

| Power Up Lending #15 | Variable | |||||||||||||||||||

| Power Up Lending #16 | Variable | |||||||||||||||||||

| Power Up Lending #17 | Variable | |||||||||||||||||||

| Power Up Lending #23 | Variable | |||||||||||||||||||

| Power Up Lending #24 | Variable | |||||||||||||||||||

| Power Up Lending #25 | Variable | |||||||||||||||||||

| Tri-Bridge #2 | Variable | |||||||||||||||||||

| Tri-Bridge #3 | Variable | |||||||||||||||||||

| Tri-Bridge #4 | Variable | |||||||||||||||||||

| Tri-Bridge #5 | 0.001 | |||||||||||||||||||

| $ | $ | |||||||||||||||||||

| Debt discount | ( | ) | ( | ) | ||||||||||||||||

| Financing costs/Original issue discount | ( | ) | ( | ) | ||||||||||||||||

| Notes payable, net of discount | $ | $ | ||||||||||||||||||

27

During

the year ending December 31, 2021, the Company received proceeds from new convertible notes of $

During

the year ended December 31, 2021, the Company recorded interest expense of $

As of December 31, 2021, we have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities.

NOTE 10 – PROMISSORY NOTES PAYABLE

On

June 19, 2020, the Company received funding pursuant to a promissory note in the amount for $

On

January 5, 2021, the Company received funding pursuant to a promissory note in the amount for $

On

July 15, 2021, the Company received funding pursuant to a promissory note in the amount of $

On

September 14, 2021, the Company received funding pursuant to a promissory note in the amount of $

NOTE 11 – DERIVATIVE LIABILITIES

During the year ended December 31, 2021, the Company valued the embedded conversion feature of the convertible notes and warrants. The Company uses the Black-Scholes option pricing model to estimate fair value for those instruments convertible into common shares at inception, at conversion or extinguishment date, and at each reporting date.

28

The following table represents the Company’s derivative liability activity for the embedded conversion features for the years ended December 31, 2021 and December 30 2020:

| December 31, | December 31, | |||||||