Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Nabriva Therapeutics plc | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

June 25, 2020

Dear Nabriva Therapeutics plc Shareholder:

You are cordially invited to our Annual General Meeting of Shareholders on Wednesday, July 29, 2020, beginning at 5:00 p.m. Irish time (12:00 p.m., Eastern Time), at 25-28 North Wall Quay, Dublin 1, Ireland. The enclosed notice of Annual General Meeting of Shareholders sets forth the proposals that will be presented at the meeting, which are described in more detail in the enclosed proxy statement.

We are monitoring the emerging public health impact of the COVID-19 pandemic. The health and well-being of our shareholders, employees and directors are paramount. We are monitoring guidance issued by the Irish Health Service Executive, the Irish government, the U.S. Center for Disease Control and Prevention and the World Health Organization. Based on latest available public health guidance, we expect that the Annual General Meeting of Shareholders will proceed under very constrained circumstances given current restrictions on public gatherings.

Shareholder contributions at the Annual General Meeting of Shareholders are valued, however, shareholders are strongly encouraged to vote their shares by proxy as the preferred means of fully and safely exercising their rights. Personal attendance at the Annual General Meeting of Shareholders may present a health risk to shareholders and others. In particular, we advise that shareholders who are experiencing any COVID-19 symptoms or anyone who has been in contact with any person experiencing any COVID-19 symptoms should not attend the Annual General Meeting of Shareholders in person.

We may take additional procedures or limitations on meeting attendees, including limiting seating, requiring health screenings and other reasonable or required measures in order to enter the building. There is also the possibility that we may change the venue or delay, postpone or adjourn the Annual General Meeting. In the event that such a change is necessitated due to public health recommendations regarding containment of COVID-19, we will communicate this to shareholders with as much notice as possible by press release (which we will also file with the SEC). We recommend that shareholders keep up-to-date with the latest public health guidance regarding travel, self-isolation and health and safety precautions. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Georgeson LLC, by telephone at 866-821-2550.

Our board of directors recommends that you vote "FOR" Proposals 1, 2, 3 and 4 as set forth in the proxy statement.

Thank you for your ongoing support and continued interest in Nabriva Therapeutics.

|

Very truly yours, | |

|

||

|

Daniel Burgess | |

|

Chairman of the Board of Directors |

This proxy statement, the enclosed proxy card and our 2019 annual report to shareholders were first made available to shareholders on or about June 25, 2020. Our Irish Statutory Financial Statements for the year ended December 31, 2019 will be made available to shareholders on or about July 3, 2020.

NABRIVA THERAPEUTICS PLC

25-28 North Wall Quay

Dublin 1, Ireland

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on Wednesday, July 29, 2020

The 2020 Annual General Meeting of Shareholders (the "AGM") of Nabriva Therapeutics plc, an Irish public limited company (the "Company"), will be held on July 29, 2020, beginning at 5:00 p.m., Irish time (12:00 p.m., Eastern Time), at 25-28 North Wall Quay, Dublin 1, Ireland. We are monitoring the emerging public health impact of the COVID-19 pandemic. We may take additional procedures or limitations on meeting attendees, including limiting seating, requiring health screenings and other reasonable or required measures in order to enter the building. There is also the possibility that we may change the venue or delay, postpone or adjourn the Annual General Meeting. In the event that such a change is necessitated due to public health recommendations regarding containment of COVID-19, we will communicate this to shareholders with as much notice as possible by press release (which we will also file with the SEC). The AGM will be held to receive the Company's Irish statutory financial statements for the fiscal year ended December 31, 2019 and the reports of the directors and auditors thereon, to review the affairs of the Company and to consider and vote upon the following matters:

- 1.

- To

elect, by separate resolutions, the seven director nominees named in this proxy statement to our board of directors to serve until the Company's 2021 Annual

General Meeting of Shareholders;

- 2.

- To

ratify, in a non-binding advisory vote, the selection of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending

December 31, 2020 and to authorize, in a binding vote, the board of directors, acting through the audit committee, to set the independent registered public accounting firm's remuneration;

- 3.

- To

approve the adoption of the Company's 2020 Share Incentive Plan, as amended;

- 4.

- To

approve, subject to and conditional upon the board of directors determining, in its sole discretion, that a reverse stock split is necessary for the Company to

comply with the minimum $1.00 per share requirement pursuant to Nasdaq Listing Rule 5450(a)(1) (the "Bid Price Rule"), a reverse stock split (i.e., a consolidation of share capital under

Irish law) whereby every 10 ordinary shares of $0.01 (nominal value) each in the authorized and unissued and authorized and issued share capital of the Company be consolidated into 1 ordinary

share of $0.10 (nominal value) each, and the subsequent reduction in the nominal value of the ordinary shares in the authorized and unissued and authorized and issued share capital of the Company from

$0.10 each to $0.01 each; and

- 5.

- To transact such other business as may properly come before the AGM or any adjournment or postponement thereof.

Proposals 1, 2, 3 and 4 above are ordinary resolutions requiring a simple majority of the votes cast at the meeting to be approved. All proposals are more fully described in this proxy statement. There is no requirement under Irish law that the Company's Irish Statutory Financial Statements for the fiscal year ended December 31, 2019, or the directors' and auditor's reports thereon be approved by the shareholders, and no such approval will be sought at the AGM.

Shareholders of record at the close of business on June 5, 2020 will be entitled to notice of and to vote at the AGM or any adjournment or postponement thereof.

| By order of the Board of Directors, | ||

|

||

| Daniel Burgess Chairman of the Board of Directors |

||

Dublin, Ireland June 25, 2020 |

YOU MAY OBTAIN ADMISSION TO THE AGM BY IDENTIFYING YOURSELF AT THE AGM AS A SHAREHOLDER AS OF THE RECORD DATE. IF YOU ARE A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. IF YOU ARE A BENEFICIAL (BUT NOT RECORD) OWNER, A COPY OF AN ACCOUNT STATEMENT FROM YOUR BANK, BROKER OR OTHER NOMINEE SHOWING SHARES HELD FOR YOUR BENEFIT ON JUNE 5, 2020 WILL BE ADEQUATE IDENTIFICATION.

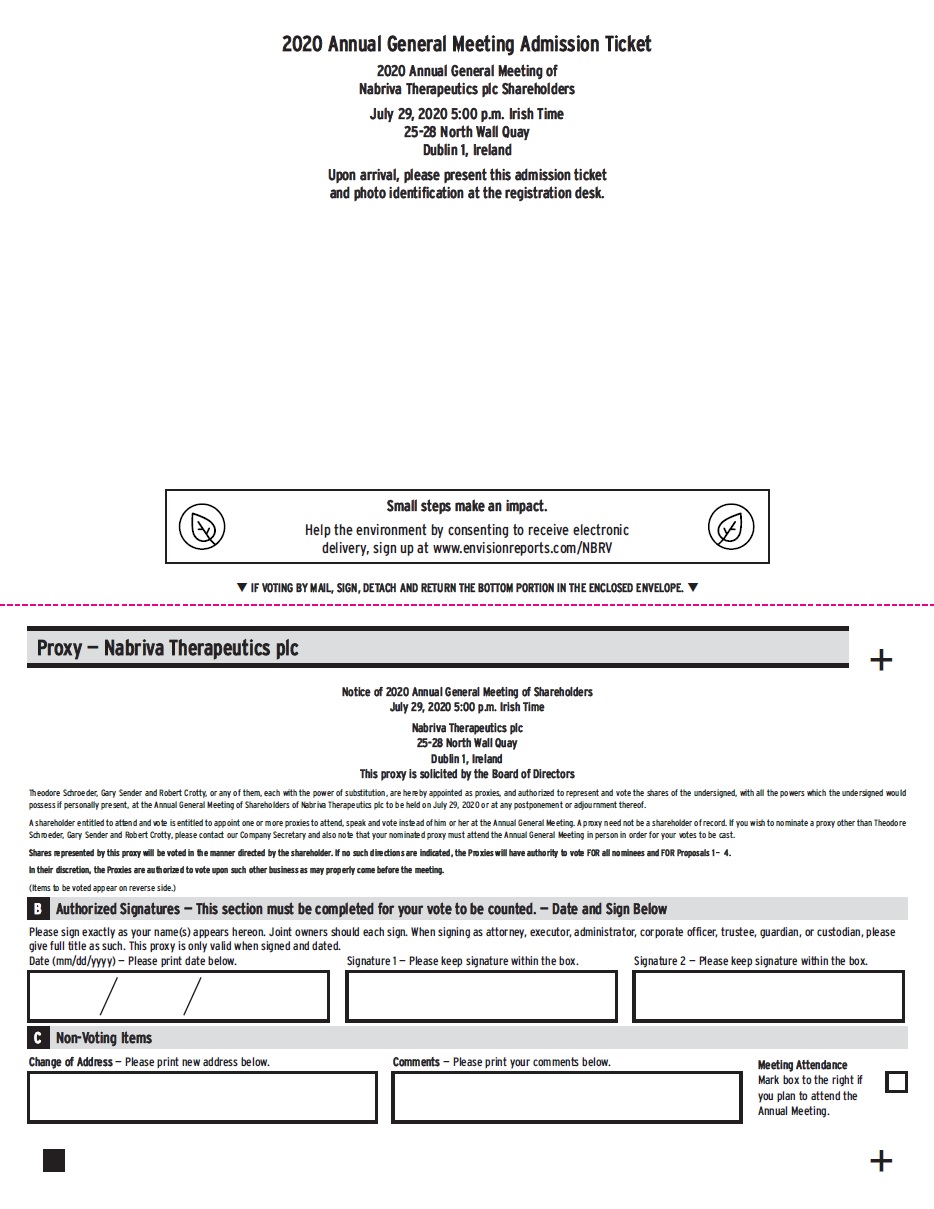

WHETHER OR NOT YOU EXPECT TO ATTEND THE AGM, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE AGM. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES. ALTERNATIVELY, YOU MAY SUBMIT YOUR VOTE VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD.

A SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE AGM IS ENTITLED, USING THE PROXY CARD PROVIDED, TO APPOINT ONE OR MORE PROXIES TO ATTEND, SPEAK AND VOTE INSTEAD OF HIM OR HER AT THE AGM. A PROXY NEED NOT BE A SHAREHOLDER OF RECORD.

NABRIVA THERAPEUTICS PLC

25-28 North Wall Quay

Dublin 1, Ireland

PROXY STATEMENT FOR THE ANNUAL GENERAL MEETING OF

SHAREHOLDERS TO BE HELD ON WEDNESDAY, JULY 29, 2020

Important Notice Regarding the Availability of Proxy Materials

for the Annual General Meeting of Shareholders

to be held on July 29, 2020

This proxy statement, our 2019 annual report to

shareholders and our Irish Statutory Financial Statements for the year

ended December 31, 2019 are available at www.envisionreports.com/nbrv

for viewing, downloading and printing.

A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2019 as filed with the Securities and Exchange Commission, or SEC, except for exhibits, and our Irish Statutory Financial Statements for the year ended December 31, 2019 will be furnished without charge to any shareholder upon written or oral request to the Company at 25-28 North Wall Quay, Dublin 1, Ireland, Attention: Secretary, Telephone: (610) 816-6640.

Information about the AGM and Voting

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the "board of directors" or the "board") of Nabriva Therapeutics plc (the "Company," "Nabriva," "we" or "us") for use at the 2020 Annual General Meeting of Shareholders (the "AGM") to be held on July 29, 2020, beginning at 5:00 p.m., Irish time (12:00 p.m., Eastern Time), at 25-28 North Wall Quay, Dublin 1, Ireland, and at any adjournment or postponement thereof. We are monitoring the emerging public health impact of the COVID-19 pandemic. We may take additional procedures or limitations on meeting attendees, including limiting seating, requiring health screenings and other reasonable or required measures in order to enter the building. There is also the possibility that we may change the venue or delay, postpone or adjourn the Annual General Meeting. In the event that such a change is necessitated due to public health recommendations regarding containment of COVID-19, we will communicate this to shareholders with as much notice as possible by press release (which we will also file with the SEC). On June 5, 2020, the record date for the determination of shareholders entitled to vote at the AGM, there were issued, outstanding and entitled to vote an aggregate of 142,965,483 of our ordinary shares, nominal value $0.01 per share ("ordinary shares"). Each ordinary share entitles the record holder thereof to one vote on each of the matters to be voted on at the AGM.

Throughout this proxy statement, unless the context requires otherwise, all references to Nabriva Therapeutics plc, its board of directors, board committees, executive officers and directors, to its compensation and other policies, programs and reports on or prior to June 23, 2017 (the effective date of our Redomiciliation from Austria to Ireland), refer to those of our predecessor, Nabriva Therapeutics AG, together with its subsidiaries, which we refer to as Nabriva Austria.

Your vote is important no matter how many shares you own. Please take the time to vote. Take a moment to read the instructions below. Choose the way to vote that is easiest and most convenient for you, and cast your vote as soon as possible.

1

If you are the "record holder" of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may vote in one of four ways:

- (1)

- You may vote over the Internet. You may vote your shares by following the "Vote by Internet"

instructions on the enclosed proxy card. If you vote by Internet, your use of that system, and specifically the entry of your pin number/other unique identifier, will be deemed to constitute your

appointment, in writing and under hand, and for all purposes of the Irish Companies Act of 2014, of each of Theodore Schroeder, Gary Sender and Robert Crotty, and/or each of their duly appointed

substitutes if applicable, as your proxy to vote your shares on your behalf in accordance with your Internet instructions. The internet voting facilities for eligible shareholders of record will close

at 6:00 a.m., Irish time (1:00 a.m., Eastern Time), on the day of the AGM.

- (2)

- You may vote by telephone. You may vote your shares by following the "Vote by Phone" instructions on the

enclosed proxy card. If you vote by telephone, you do not need to vote over the Internet or complete and mail your proxy card. If you vote by telephone, your use of that telephone system, and

specifically the entry of your pin number/other unique identifier, will be deemed to constitute your appointment, in writing and under hand, and for all purposes of the Irish Companies Act of 2014, of

each of Theodore Schroeder, Gary Sender and Robert Crotty, and/or each of their duly appointed substitutes if applicable, as your proxy to vote your shares on your behalf in accordance with your

telephone instructions. The telephone voting facilities for eligible shareholders of record will close at 6:00 a.m., Irish time (1:00 a.m., Eastern Time), on the day of the AGM.

- (3)

- You may vote by mail. You may vote by completing, dating and signing the proxy card delivered with this

proxy statement and promptly mailing it in the enclosed postage-paid envelope. If you vote by mail, you do not need to vote over the Internet or by telephone. We must receive the completed proxy card

by 12:00 p.m., Irish time (7:00 a.m., Eastern Time), on the day of the AGM.

- (4)

- You may vote in person. If you attend the AGM, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the AGM. Ballots will be available at the AGM.

All proxies that are executed and delivered by mail or in person, or are otherwise submitted over the Internet or by telephone will be voted on the matters set forth in the accompanying Notice of Annual General Meeting of Shareholders in accordance with the shareholders' instructions. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the board of directors' recommendations on such proposals as set forth in this proxy statement. All proxies will be forwarded to the Company's registered office electronically.

After you have submitted a proxy, you may still change your vote and revoke your proxy prior to the AGM by doing any one of the following things:

- •

- submitting a new proxy by following the "Vote by Internet" or "Vote by Phone" instructions on the enclosed proxy card at a date later than your

previous vote but prior to the voting deadline (which is 6:00 a.m., Irish time (1:00 a.m., Eastern Time), on the day of the AGM);

- •

- signing another proxy card and either arranging for delivery of that proxy card by mail by 12:00 p.m., Irish time (7:00 a.m.,

Eastern Time), on the day of the AGM, or by delivering that signed proxy card in person at the AGM;

- •

- giving our Secretary a written notice before or at the AGM that you want to revoke your proxy; or

- •

- voting in person at the AGM.

2

Your attendance at the AGM alone will not revoke your proxy.

If the shares you own are held in "street name" by a bank, broker or other nominee record holder, which we collectively refer to in this proxy statement as "brokerage firms," your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which, if available, would be provided by your brokerage firm on the voting instruction form that it delivers to you. Because most brokerage firms are member organizations of the New York Stock Exchange, or NYSE, the rules of the NYSE will likely govern how your brokerage firm would be permitted to vote your shares in the absence of instruction from you. Under the current rules of the NYSE, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain "discretionary" items, but will not be allowed to vote your shares with respect to certain "non-discretionary" items. The ratification of KPMG LLP as our independent registered public accounting firm and the authorization of the board of directors, acting through the audit committee, to set the independent registered public accounting firm's remuneration (Proposal 2) is a discretionary item under the NYSE rules, and your brokerage firm will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name. The election of the board of directors (Proposal 1), approval of the adoption of the Company's 2020 Share Incentive Plan, as amended (Proposal 3) and approval, subject to and conditional upon our board of directors determining, in its sole discretion, that a reverse stock split is necessary for the Company to comply with the Bid Price Rule (as defined below under "Proposal 4: To Approve a Reverse Stock Split—Background to and Reasons for the Reverse Stock Split Proposal"), of the consolidation of every 10 ordinary shares of $0.01 each in the authorized but unissued and in the authorized and issued share capital of the Company into 1 ordinary share of $0.10 each and the subsequent reduction in the nominal value of the ordinary shares from $0.10 each to $0.01 each (the "Reverse Stock Split Proposal") (Proposal 4) are "non-discretionary" items, meaning that if you do not instruct your brokerage firm on how to vote with respect to Proposals 1, 3, or 4, your brokerage firm will not vote with respect to that proposal and your shares will be counted as "broker non-votes." "Broker non-votes" are shares that are held in "street name" by a brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

If your shares are held in street name, you must bring an account statement from your brokerage firm showing that you are the beneficial owner of the shares as of the record date (June 5, 2020) to be admitted to the AGM. To be able to vote your shares held in street name at the AGM, you will need to obtain a proxy card from the holder of record.

The holders of a majority of our ordinary shares issued and outstanding and entitled to vote at the AGM will constitute a quorum for the transaction of business at the AGM. Ordinary shares represented in person or by proxy (including "broker non-votes" (as described above) and shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the AGM. The following votes are required for approval of the proposals being presented at the AGM:

Proposal 1: To Elect the Board of Directors. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the election of a director nominee.

3

Proposal 2: To Ratify, in a Non-Binding Advisory Vote, the Selection of KPMG LLP as the Company's Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2020 and to Authorize, in a Binding Vote, the Board of Directors, Acting Through the Audit Committee, to set the Auditor's Remuneration. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the current fiscal year and to authorize the board of directors, acting through the audit committee, to set the auditor's remuneration.

Proposal 3: To Approve the Adoption of the Company's 2020 Share Incentive Plan, As Amended. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the approval of the adoption of the Company's 2020 Share Incentive Plan, as amended.

Proposal 4: To Approve a Reverse Stock Split. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the approval of the reverse stock split. The implementation of the reverse stock split is subject to and conditional upon our board of directors determining, in its sole discretion, that a reverse stock split is necessary for the Company to comply with the Bid Price Rule.

Shares that abstain from voting as to a particular matter and shares held in "street name" by brokerage firms who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter will not be counted as votes in favor of such matter, and will also not be counted as shares voting on such matter. Accordingly, abstentions and "broker non-votes" will have no effect on the voting on the proposals referenced above.

We have engaged the services of Georgeson LLC to assist in the solicitation of proxies for the Annual General Meeting at an estimated cost of approximately $8,500, plus reimbursement of certain expenses and fees for additional services requested. Proxies may be solicited by Georgeson LLC by mail, telephone, e-mail and in person.

4

Set forth below are the names and certain biographical information about each member of our board of directors as of June 1, 2020. Each director was elected by our shareholders at the 2019 Annual General Meeting of the Company.

All current members of the board of directors are standing for election at the AGM. The information presented includes each director's principal occupation and business experience for at least the past five years and the names of other public companies of which he or she has served as a director during the past five years. We believe that all of our directors possess the attributes and characteristics described in "—Board Processes—Director Nomination Process." There are no family relationships between or among any of our executive officers or directors.

Name

|

Age | Position | ||

|---|---|---|---|---|

Daniel Burgess(1)(3) |

58 | Director, Chairman of the Board | ||

Theodore Schroeder |

65 | Director, Chief Executive Officer | ||

Colin Broom, MD |

64 | Director | ||

Carrie Bourdow(2) |

57 | Director | ||

Charles A. Rowland, Jr.(1)(2) |

61 | Director | ||

George H. Talbot, MD(3) |

72 | Director | ||

Stephen Webster(1)(3) |

59 | Director |

- (1)

- Member

of the audit committee.

- (2)

- Member

of the compensation committee.

- (3)

- Member of the nominating and corporate governance committee.

Daniel Burgess has served on our board of directors since June 23, 2017. Mr. Burgess was a member of the supervisory board of Nabriva Austria and served as its chairman from October 2016 until the Redomiciliation. Mr. Burgess has been a venture partner at SV Health Investors (SV) since 2014. Mr. Burgess has also served as the president and the chief executive officer of Therini Bio, Inc., a private therapeutics company, since May 2019. He was previously president and chief executive officer of Rempex Pharmaceuticals, an antibiotics company he co-founded in 2011 and that was subsequently sold to The Medicines Company (now Novartis AG) in 2013. Prior to this, Mr. Burgess was president and chief executive officer of Mpex Pharmaceuticals from 2007 until its acquisition by Aptalis Inc. (now AbbVie Inc.) in 2011. Prior to his time at Mpex, Mr. Burgess served in various senior operating roles for other biotechnology companies. In addition, he serves as a member of the boards of directors of Cidara Therapeutics, Inc., a public biotechnology company; Arbutus Biopharma Corp., a public biotechnology company; and several private healthcare companies. Mr. Burgess was a member of the board of directors of Santarus, Inc., from 2004 until its acquisition in 2014 by Salix Pharmaceuticals Inc., a publicly traded pharmaceutical company. He received his B.A. in economics from Stanford University and an M.B.A. from Harvard University. We believe Mr. Burgess is qualified to serve as a director because of his expertise and experience as an executive in the pharmaceutical industry, his service on other boards of directors and his educational background.

Theodore Schroeder has served on our board of directors and as chief executive officer since July 24, 2018. During the last 30 years, Mr. Schroeder has been focused on drug development and commercialization in both large and small pharmaceutical companies. Most recently, he served as president, chief executive officer and director of Zavante Therapeutics from June 2015 until its acquisition by Nabriva Therapeutics in July 2018. Mr. Schroeder co-founded Cadence Pharmaceuticals in 2004 and previously held leadership roles at Elan Pharmaceuticals, Dura Pharmaceuticals and earlier

5

in his career, Bristol-Myers Squibb. He currently serves on the board of Cidara Therapeutics, Otonomy and Collegium Pharmaceutical. He is a former chair of BIOCOM, the California life sciences trade association and in 2014, he was named the EY Entrepreneur of the Year for the San Diego region and was listed as a national finalist. He received a bachelor's degree in management from Rutgers University. We believe Mr. Schroeder is qualified to serve as a director because of his expertise and experience as an executive in the pharmaceutical industry, his service on other boards of directors and his educational background.

Colin Broom has served on our board of directors since June 23, 2017. Dr. Broom has served as the chief executive officer of Pulmotect, Inc., a private biotechnology company, since September 2019. Dr. Broom was previously our chief executive officer from April 12, 2017 until July 24, 2018, and the chief executive officer of Nabriva Austria from August 2014 until the Redomiciliation. Prior to joining Nabriva Austria, he served as chief scientific officer at ViroPharma Incorporated from 2004 until it was acquired by Shire plc in 2014. Dr. Broom served as vice president of clinical development and medical affairs in Europe for Amgen Inc. from 2000 to 2003 and previously held several leadership positions with Hoechst Marion Roussel (now Sanofi), SmithKline Beecham and Glaxo (now GlaxoSmithKline). Dr. Broom served as a member of the board of directors of NPS Pharmaceuticals, Inc. from 2009 until its acquisition by Shire in 2015. He is a member of the U.K. Royal College of Physicians and a fellow of the Faculty of Pharmaceutical Medicine. Dr. Broom received his B.Sc. from University College, London and M.B.B.S. from St. George's Hospital Medical School, London. We believe that Dr. Broom is qualified to serve as a director due to his extensive experience in all stages of drug development and commercialization.

Carrie Bourdow has served on our board of directors since June 23, 2017. Ms. Bourdow has been the president, the chief executive officer, and member of the board of directors of Trevena, Inc., a publicly-traded biopharmaceutical company, since October 2018. She has served in various senior positions at Trevena since May 2015. She joined Trevena as chief commercial officer and was appointed executive vice president and chief operating officer in January 2018. Prior to joining Trevena, Ms. Bourdow was vice president of marketing at Cubist Pharmaceuticals, Inc., from 2013 until its acquisition by Merck & Co., Inc. in January 2015. At Cubist, Ms. Bourdow led launch strategy, marketing, reimbursement, and operations for acute care hospital pharmaceuticals. Prior to Cubist, Ms. Bourdow served for more than 20 years at Merck & Co., Inc., where she held positions of increasing responsibility across multiple therapeutic areas. Ms. Bourdow also serves as a director of Sesen Bio, Inc., a publicly traded pharmaceutical company. Ms. Bourdow holds a B.A. degree from Hendrix College and an M.B.A. from Southern Illinois University. We believe Ms. Bourdow is qualified to serve as a director due to her extensive experience in the biopharmaceutical industry, including her experience with anti-infectives and with the commercialization of new drugs.

George H. Talbot has served on our board of directors since June 23, 2017. Dr. Talbot previously served on the supervisory board of Nabriva Austria from 2009 until the Redomiciliation. Dr. Talbot has been the principal at Talbot Advisors LLC, a biopharmaceutical company consultancy, since 2007 and prior to that, from 2000 to 2006. From 2006 to 2007, he served as chief medical officer and executive vice president of Cerexa, Inc. prior to its acquisition by Forest Laboratories, Inc. Dr. Talbot also worked closely with Calixa Therapeutics, Inc. and Durata Therapeutics, Inc., prior to their acquisitions by Cubist Pharmaceuticals, Inc. and Actavis plc, respectively. He was an initial member of the Infectious Diseases Society of America's Antimicrobial Availability Task Force ("Bad Bugs, No Drugs") and recently completed a seven-year tenure as co-chair of the Foundation for the National Institutes of Health (FNIH) Biomarkers Consortium Projects for Endpoint Development in Acute Bacterial Skin and Skin Structure Infections, Community-acquired Bacterial Pneumonia, and Hospital-acquired Bacterial Pneumonia/Ventilator-associated Bacterial Pneumonia, which made evidence-based recommendations to the Food and Drug Administration for its Guidance development in these indications. Dr. Talbot received his B.A. from Wesleyan University, his M.D. from the Yale University

6

School of Medicine, and his Infectious Diseases fellowship training at the University of Pennsylvania. After serving as a faculty member of the Infectious Diseases Section at the University of Pennsylvania, he joined the anti-infectives group at Rhone-Poulenc-Rorer in 1990. We believe that Dr. Talbot is qualified to serve as a director due to his education, training and extensive experience in the biopharmaceutical industry.

Charles A. Rowland, Jr. has served on our board of directors since June 23, 2017. Mr. Rowland previously served on the supervisory board of Nabriva Austria from January 2015 until the Redomiciliation. Mr. Rowland served as chief executive officer of Aurinia Pharmaceuticals Inc. from April 2016 to January 2017. Mr. Rowland previously served as vice president and chief financial officer of ViroPharma Incorporated from 2008 until it was acquired by Shire plc in 2014. Prior to joining ViroPharma, Mr. Rowland served as executive vice president and chief financial officer, as well as interim co-chief executive officer, for Endo Pharmaceuticals Inc. from 2006 to 2008 and chief financial officer at Biovail Corporation from 2004 to 2006. He previously held finance and operational positions of increasing responsibility at Breakaway Technologies, Inc., Pharmacia, Novartis International AG and Bristol-Myers Squibb Company. Mr. Rowland currently serves as a member of the board of directors for Blueprint Medicines Corporation, a public biopharmaceutical company, Viking Therapeutics, a public, clinical-stage biopharmaceutical company, and Orchard Therapeutics, a public, clinical-stage biopharmaceutical company. In addition, Mr. Rowland serves as a member of the board of directors for Generation Bio, a privately held biopharmaceutical company. Previously, he served on the board of directors at Idenix Pharmaceuticals, Inc., Vitae Pharmaceuticals, Inc., Bind Therapeutics Inc. and Aurinia Pharmaceuticals Inc. Mr. Rowland received his B.S. from Saint Joseph's University and M.B.A. from Rutgers University. We believe that Mr. Rowland is qualified to serve as a director due to his extensive experience in pharmaceutical operations and all areas of finance and accounting.

Stephen Webster has served on our board of directors since June 23, 2017. Mr. Webster previously served on the supervisory board of Nabriva Austria from October 2016 until the Redomiciliation. Mr. Webster served as the chief financial officer of Spark Therapeutics from July 2014 until its acquisition by Roche Holdings, Inc. in December 2019. He was previously senior vice president and chief financial officer of Optimer Pharmaceuticals, Inc. from June 2012 until its acquisition by Cubist Pharmaceuticals in November 2013. Prior to this, Mr. Webster served as senior vice president and chief financial officer of Adolor Corporation, also acquired by Cubist, from 2008 to 2011. Previously, Mr. Webster served as managing director, Investment Banking Division, Health Care Group for Broadpoint Capital Inc. (formerly First Albany Capital). He also was a co-founder and served as president and chief executive officer of Neuronyx, Inc. Prior to this, Mr. Webster held positions of increasing responsibility, including as director, Investment Banking Division, Health Care Group, for PaineWebber Incorporated. Mr. Webster is currently a member of the board of directors of Viking Therapeutics, Inc. and NextCure, Inc. He holds an A.B. in economics from Dartmouth College and an M.B.A. from the University of Pennsylvania. We believe that Mr. Webster is qualified to serve as a director due to his extensive experience in the biopharmaceutical industry, particularly his service as a chief financial officer and in other executive management roles.

Board Composition

Our articles of association provide that the number of directors on our board will be not less than two and not more than twelve, with the exact number determined by the board. Our board of directors is currently authorized for eight members. Our directors hold office for a term continuing until the next annual general meeting of shareholders or until the earlier of their resignation or removal.

Our articles of association provide that the authorized number of directors may be changed only by resolution of our board of directors. Under the Irish Companies Act of 2014, and notwithstanding anything contained in our articles of association or in any agreement between us and a director, our shareholders may, by an ordinary resolution, remove a director from office before the expiration of his

7

or her term at a meeting held on no less than 28 days' notice and at which the director is entitled to be heard. Our articles of association also provide that the office of a director will be vacated in certain circumstances including if the director is restricted or disqualified to act as a director under the Irish Companies Act of 2014, resigns his or her office by notice in writing, or is requested to resign in writing by not less than a majority of the other directors. Our board of directors may fill any vacancy occurring on the board of directors. If the board of directors fills a vacancy, the director shall hold office until the next election of directors and until his or her successor shall be elected.

Board Determination of Independence

Applicable Nasdaq rules require a majority of a listed company's board of directors to be comprised of independent directors within one year of listing. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and corporate governance committees be independent under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act, and compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. Under applicable Nasdaq rules, a director will only qualify as an "independent director" if, in the opinion of the listed company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. To be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries. In order to be considered independent for purposes of Rule 10C-1, the board must consider, for each member of a compensation committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director's ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by such company to the director; and (2) whether the director is affiliated with the company or any of its subsidiaries or affiliates.

In April 2020, our board of directors undertook a review of the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board has determined that each of our directors, with the exception of Colin Broom and Theodore Schroeder, is an "independent director" as defined under applicable Nasdaq rules, including, in the case of all the members of our audit committee, the independence criteria set forth in Rule 10A-3 under the Exchange Act, and in the case of all the members of our compensation committee, the independence criteria set forth in Rule 10C-1 under the Exchange Act. In making such determination, our board considered the relationships that each such director has with us, including each of the transactions described below in "—Board Policies—Related Person Transactions—Certain Relationships and Related Transactions," and all other facts and circumstances that our board deemed relevant in making such independence determinations. Mr. Schroeder is not an independent director because he is our chief executive officer, and Dr. Broom is not an independent director because he was employed as our chief executive officer during the past three years.

8

Mr. Burgess serves as chairman of our board of directors and Mr. Schroeder serves as our chief executive officer. We believe that having an independent director serve as our chairman allows our chief executive officer to focus on our business, while allowing the chairman of the board to fulfill a fundamental leadership role of providing advice to and independent oversight of our board.

Our chief executive officer devotes a substantial amount of time and effort to his position. The chairman of the board role requires significant additional commitment, particularly as the board's oversight responsibilities continue to grow. Our board is committed to practicing good corporate governance and believes that having an independent non-executive director serving as chairman is the appropriate leadership structure for the company. The nominating and corporate governance committee periodically assesses the board's leadership structure and whether the board's leadership structure is appropriate given the specific characteristics or circumstances of the company at that time.

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee, each of which operates under a charter that has been approved by our board. Copies of the committee charters are posted under the heading "Corporate Governance" on the Investor section of our website, which is located at http://investors.nabriva.com.

Audit Committee

Our audit committee consists of Daniel Burgess, Charles A. Rowland, Jr. and Stephen Webster, and Stephen Webster is the chair of the audit committee. The audit committee oversees our accounting and financial reporting processes and the audits of our consolidated financial statements. The audit committee is responsible for, among other things:

- •

- making recommendations to our board regarding the ratification by the annual general meeting of shareholders of our independent auditors;

- •

- overseeing the work of the independent auditors, including resolving disagreements between management and the independent auditors relating to

financial reporting;

- •

- pre-approving all audit and non-audit services permitted to be performed by the independent auditors;

- •

- reviewing the independence and quality control procedures of the independent auditors;

- •

- reviewing and approving all proposed related-party transactions;

- •

- discussing the annual audited consolidated and statutory financial statements with management;

- •

- annually reviewing and reassessing the adequacy of our audit committee charter;

- •

- meeting separately with the independent auditors to discuss critical accounting policies, recommendations on internal controls, the auditor's

engagement letter and independence letter and other material written communications between the independent auditors and the management; and

- •

- attending to such other matters as are specifically delegated to our audit committee by our board from time to time.

Our board of directors has determined that Charles A. Rowland, Jr. is an "audit committee financial expert" as defined in the applicable SEC rules.

9

Our audit committee met five times in 2019.

Compensation Committee

Our compensation committee consists of Carrie Bourdow and Charles A. Rowland, Jr., and Charles A. Rowland, Jr. is the chair of the compensation committee. The compensation committee assists the board in reviewing and approving or recommending our compensation structure, including all forms of compensation relating to our directors and management. The compensation committee is responsible for, among other things:

- •

- reviewing and making recommendations to the board with respect to compensation of our board of directors and management;

- •

- reviewing and approving the compensation, including equity compensation, change-of-control benefits and severance arrangements, of our chief

executive officer, chief financial officer and such other members of our management as it deems appropriate;

- •

- overseeing the evaluation of our management;

- •

- reviewing periodically and making recommendations to our board with respect to any incentive compensation and equity plans, programs or similar

arrangements;

- •

- exercising the rights of our board under any equity plans, except for the right to amend any such plans unless otherwise expressly authorized

to do so; and

- •

- attending to such other matters as are specifically delegated to our compensation committee by our board from time to time.

Our compensation committee met eight times in 2019.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Daniel Burgess, George H. Talbot and Stephen Webster, and Daniel Burgess is the chair of the nominating and corporate governance committee. The nominating and corporate governance committee assists the board in selecting individuals qualified to become our directors and in determining the composition of the board and its committees. The nominating and corporate governance committee is responsible for, among other things:

- •

- recommending to the board persons to be nominated for election or re-election to the board at any meeting of shareholders;

- •

- overseeing the board's annual review of its own performance and the performance of its committees; and

- •

- developing and recommending to the board a set of corporate governance guidelines.

Our nominating and corporate governance committee met five times in 2019.

Compensation Committee Interlocks and Insider Participation

For the fiscal year ended December 31, 2019, the members of our compensation committee were Carrie Bourdow, Mark Corrigan and Charles Rowland, Jr. No member of our compensation committee is, or has been, an officer or employee of ours or any subsidiary of ours. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity that had one or more executive officers serving as a director or member of our compensation committee during the year ended December 31, 2019.

10

Our board of directors met nine times in 2019. During 2019, each director attended at least 75% of the aggregate of the number of board meetings held during his or her term, and of the meetings held by all committees of the board on which he or she then served.

Our directors are expected to attend our annual general meeting of shareholders. In July 2019, all of our then-current directors attended the Annual General Meeting of Shareholders in person.

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board oversees risk management activities relating to business strategy, acquisitions, capital raising and allocation, organizational structure and certain operational risks; our audit committee oversees risk management activities related to financial controls and legal and compliance risks; our nominating and corporate governance committee oversees risk management activities relating to board composition; and our compensation committee oversees risk management activities relating to our compensation policies and practices and management succession planning. Each committee reports to the full board on a regular basis, including reports with respect to the committee's risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full board discuss such risks.

Director Nomination Process

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates may include requests to directors and others for recommendations, evaluation of the performance on our board and its committees of any existing directors being considered for nomination, consideration of biographical information and background material relating to potential candidates and, particularly in the case of potential candidates who are not then serving on our board, interviews of selected candidates by members of the committee and our board.

In considering whether to recommend any candidate for inclusion in our board's slate of recommended director nominees, our nominating and corporate governance committee applies the criteria set forth in our corporate governance guidelines described below under "—Corporate Governance Guidelines". Consistent with these criteria, our nominating and corporate governance committee expects every nominee to have the following attributes or characteristics, among others: integrity, honesty, adherence to high ethical standards, business acumen, good judgment and a commitment to understand our business and industry.

The nominating and corporate governance committee did not engage a search firm to identify and evaluate potential director candidates in 2019.

All of the director nominees are currently members of our board of directors. The nominee biographies under "—Board of Directors" indicate the experience, qualifications, attributes and skills of each of our current directors that led our nominating and corporate governance committee and our board to conclude such director should continue to serve as one of our directors. Our nominating and corporate governance committee and our board believe that each of the nominees has the individual attributes and characteristics required of each of our directors, and that the nominees as a group possess the skill sets and specific experience desired for our board.

11

Our nominating and corporate governance committee considers the value of diversity when selecting nominees, and believes that our board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. The committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

Shareholders may recommend individuals for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials, and information with respect to the shareholder or group of shareholders making the recommendation, including the number of ordinary shares owned by such shareholder or group of shareholders, to us at Nabriva Therapeutics plc, 25-28 North Wall Quay, Dublin 1, Ireland, Attention: Secretary. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our articles of association and must be received by us no later than the date referenced below in "Other Matters—Deadline for Submission of Shareholder Proposals for 2021 Annual General Meeting of Shareholders." Assuming appropriate biographical and background material has been provided on a timely basis, the nominating and corporate governance committee will evaluate shareholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Communications with Our Directors

Our board of directors will give appropriate attention to written communications that are submitted by shareholders and will respond if and as appropriate. The chairman of the board, or otherwise the chair of the nominating and corporate governance committee, is primarily responsible for monitoring communications from shareholders and other interested parties and provides copies or summaries of such communications to the other directors as he considers appropriate. Shareholders who wish to communicate with our board of directors may do so by addressing such communications to Board of Directors, c/o Secretary, Nabriva Therapeutics plc, 25-28 North Wall Quay, Dublin 1, Ireland. Communications will be forwarded to other directors if they relate to substantive matters that the chairman of the board or chair of the nominating and corporate governance committee considers appropriate for attention by the other directors.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of the company and its shareholders. The guidelines provide that:

- •

- our board's principal responsibility is to oversee the management of the company;

- •

- a majority of the directors must be independent directors;

- •

- the independent directors meet in executive session at least twice a year;

- •

- directors have full and free access to management and, as necessary, independent advisors;

- •

- new directors participate in an orientation program; and

- •

- our board will conduct a periodic self-evaluation to determine whether it and its committees are functioning effectively.

A copy of the corporate governance guidelines is posted under the heading "Corporate Governance" on the Investor Relations section of our website, which is located at http://investors.nabriva.com.

12

Related Person Transactions

Our board of directors has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which the company is a participant, the amount involved exceeds the lesser of $120,000 and one percent of the average of the our total assets at year-end for the last two completed fiscal years and one of our executive officers, directors, director nominees or 5% shareholders, or their immediate family members, each of whom we refer to as a "related person," has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a "related person transaction," the related person must report the proposed related person transaction to our chief financial officer or general counsel. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by our audit committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the committee will review, and, in its discretion, may ratify the related person transaction. The policy also permits the chair of the audit committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee after full disclosure of the related person's interest in the transaction. As appropriate for the circumstances, the audit committee will review and consider:

- •

- the related person's interest in the related person transaction;

- •

- the approximate dollar value of the amount involved in the related person transaction;

- •

- the approximate dollar value of the amount of the related person's interest in the transaction without regard to the amount of any profit or

loss;

- •

- whether the transaction was undertaken in the ordinary course of our business;

- •

- whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party;

- •

- the purpose of, and the potential benefits to us of, the transaction; and

- •

- any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of such transaction.

Our audit committee may approve or ratify the transaction only if it determines that, under all of the circumstances, the transaction is in our best interests. Our audit committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC's related person transaction disclosure rule, our board of directors has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy:

- •

- interests arising solely from the related person's position as an executive officer of another entity, whether or not the person is also a director of the entity, that is a participant in the transaction where the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive

13

- •

- a transaction that is specifically contemplated by provisions of our memorandum and articles of association.

any special benefits as a result of the transaction and the amount involved in the transaction is less than the greater of $200,000 or 5% of the annual gross revenues of the company receiving payment under the transaction; and

The policy provides that transactions involving compensation of our executive officers shall be reviewed and approved by our compensation committee in the manner specified in the compensation committee's charter.

In addition, under our Code of Business Conduct and Ethics, our directors, executive officers and employees have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest.

Certain Relationships and Related Transactions

Since January 1, 2018, we have engaged in the following transactions with our executive officers, directors and holders of more than 5% of our voting securities, and affiliates of our executive officers, directors and 5% shareholders. We believe that all of the transactions described below were made on terms no less favorable to us than could have been obtained from unaffiliated third parties:

June 2020 Financing

In June 2020, we entered into a securities purchase agreement with certain institutional investors pursuant to which we agreed to issue and sell in a registered direct offering an aggregate of 41,445,373 ordinary shares and accompanying warrants to purchase up to an aggregate of 41,445,373 ordinary shares. Each share in the offering was issued and sold together with an accompanying warrant at a combined price of $0.91686. Each warrant has an exercise price of $0.792 per share, was immediately exercisable following the date of issuance and expires on the two-year anniversary of the date of issuance. In connection with such offering, entities affiliated with FMR LLC, a beneficial owner of more than 5% of our voting securities, purchased an aggregate of 8,724,997 ordinary shares and accompanying warrants to purchase up to 8,724,997 ordinary shares at a purchase price of $0.91686 per ordinary share and accompanying warrant for an aggregate purchase price of $7,999,601.

July 2018 Financing

In July 2018, we completed an underwritten public offering for the sale of an aggregate of 18,181,818 ordinary shares. In connection with such offering, the 5% shareholders and directors listed below, purchased an aggregate of 8,765,000 ordinary shares at a purchase price of $2.75 per ordinary share.

5% Shareholders:

|

Number of Shares Acquired |

|||

|---|---|---|---|---|

Entities affiliated with Vivo Capital |

2,545,000 | |||

Novo A/S |

1,815,000 | |||

Longitude Ventures Partners |

1,815,000 | |||

Frazier Healthcare Partners |

1,815,000 | |||

OrbiMed Private Investments V, L.P. |

725,000 | |||

Daniel Burgess |

36,000 | |||

George H. Talbot |

14,500 | |||

14

At-the-Market Offering

In March 2018, Wellington Management Group LLP, purchased an aggregate of 3,414,100 of our ordinary shares at a purchase price of $5.50 per share under our "at-the-market" offering program for an aggregate purchase price of $18,777,550. Following such purchase, Wellington Management Group LLP beneficially owned more than 5% of our outstanding share capital.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is applicable to all of our directors, officers and employees and is available on our website at http://investors.nabriva.com/corporate-governance/governance-overview. Our Code of Business Conduct and Ethics provides that our directors, officers and employees are expected to avoid any action, position or interest that conflicts with the interests of our company or gives the appearance of a conflict. We expect that any amendment to this code, or any waivers of its requirements, will be disclosed on our website. Information contained on, or that can be accessed through, our website is not incorporated by reference into this document, and you should not consider information on our website to be part of this document.

15

The following table sets forth information regarding our executive officers as of June 1, 2020:

Name

|

Age | Position | ||

|---|---|---|---|---|

| Theodore Schroeder | 65 | Chief Executive Officer | ||

| Robert Crotty | 46 | General Counsel and Secretary | ||

| Steven Gelone | 52 | President and Chief Operating Officer | ||

| Francesco Maria Lavino | 47 | Chief Commercial Officer | ||

| Jennifer Schranz | 55 | Chief Medical Officer | ||

| Gary Sender | 58 | Chief Financial Officer |

In addition to the biographical information for Mr. Schroeder, which is set forth above under "Corporate Governance—Board of Directors," set forth below is certain biographical information about Drs. Gelone and Schranz and Messrs. Crotty, Lavino and Sender:

Robert Crotty has served as our general counsel and secretary since June 23, 2017. Mr. Crotty joined Nabriva Austria as general counsel and secretary prior to the Redomiciliation on June 14, 2017. Previously, Mr. Crotty served as vice president, general counsel, chief compliance officer and secretary of Vernalis Therapeutics, Inc. from January 2016 to June 2017. Prior to joining Vernalis, Mr. Crotty held several positions at Dendreon Corporation from April 2012 to July 2015, including president, general counsel and secretary from February 2015 to July 2015, executive vice president, general counsel and secretary from March 2014 to February 2015, and vice president, assistant general counsel and assistant secretary from April 2012 to February 2014. Before Dendreon, Mr. Crotty was senior counsel at NPS Pharmaceuticals from 2009 until 2012 and at ImClone Systems, Inc. from 2006 to 2009. Prior to going in-house, Mr. Crotty was an associate at Morgan, Lewis & Bockius and Norton Rose Fulbright. Mr. Crotty received his B.A. from Princeton University and J.D. from University of Pennsylvania.

Steven Gelone has served as our president and chief operating officer since July 24, 2018. Dr. Gelone previously served as Nabriva Austria's chief development officer and head of business development from 2014 until the Redomiciliation, our chief development officer from the Redomiciliation until June 30, 2017 and our chief scientific officer from June 30, 2017 until July 24, 2018. Prior to joining Nabriva Austria, he served as head of clinical research and development at Spark Therapeutics, Inc. in 2014 and vice president of clinical and preclinical development at ViroPharma Incorporated from 2005 to 2014. Dr. Gelone also served as director of medical affairs at Vicuron Pharmaceuticals from 2002 to 2003 and director of clinical pharmacology and experimental medicine at GlaxoSmithKline Pharmaceuticals from 2000 to 2002. Dr. Gelone received his B.S. Pharm. and Pharm.D. from Temple University.

Francesco Maria Lavino has served as our chief commercial officer since July 10, 2017. Previously, Mr. Lavino served as associate vice president and global brand leader for the anti-infective portfolio at Merck & Co. from September 2015 to July 2017. Prior to Merck, Mr. Lavino was vice president of international marketing for Cubist Pharmaceuticals from December 2013 until September 2015. Before joining Cubist, Mr. Lavino spent 10 years with Merck & Co. in various roles, including serving as executive director and global brand leader for Merck's anti-fungal portfolio from January 2011 to November 2013. Mr. Lavino began his career in pharmaceutical sales at UCB S.A. and 3M Company in Italy. He has a B.A. in Pharmacy from the Federico II University of Napoli, Italy and an M.B.A. from SDA Bocconi School of Management in Milan, Italy.

Jennifer Schranz has served as our chief medical officer since March 21, 2018. Previously, Dr. Schranz served as vice president, clinical research and development, global development team lead, for hereditary angioedema at Shire plc from January 2014 until March 2018. Prior to Shire, Dr. Schranz served as vice president of clinical development for ViroPharma, Inc. from March 2011 until January

16

2014. Before joining ViroPharma, Dr. Schranz was vice president, clinical research at Cempra, Inc., where she was responsible for clinical and regulatory strategy. Earlier in her career, Dr. Schranz worked in clinical development and medical affairs at several pharmaceutical companies, including Wyeth (now Pfizer), Vicuron Pharmaceuticals, Inc. (now Pfizer), GlaxoSmithKline plc, and Merck & Co. Inc. Dr. Schranz completed two years of biology and psychology at McMaster University prior to acceptance and subsequent completion of an M.D. from the University of Toronto, where she completed her internal medicine training and was a fellow in infectious diseases.

Gary Sender has served as our chief financial officer since April 12, 2017. Mr. Sender previously served as our chief financial officer from May 2016 until the Redomiciliation. Prior to joining Nabriva Austria, he served as chief financial officer and executive vice president at Synergy Pharmaceuticals from 2015 to 2016. From 2009 until 2015, Mr. Sender served as senior vice president, Finance at Shire plc., supporting its Specialty Pharmaceuticals business and subsequently its Global Commercial businesses. At Shire he was responsible for financial management and support of all commercial areas of Shire's Specialty Pharmaceutical and Rare Disease businesses, with an emphasis on resource allocation, financial forecasting, business cases and mergers and acquisitions. Prior to joining Shire, Mr. Sender was the founding CFO of Tengion, Inc. Mr. Sender also spent 15 years in a number of leadership roles within Merck. Mr. Sender is currently a member of the board of directors of Schrödinger, Inc. Mr. Sender received his B.S. from Boston University and an M.B.A from Carnegie-Mellon University.

17

EXECUTIVE AND DIRECTOR COMPENSATION

The following discussion provides the amount of compensation paid, and benefits in-kind granted, by us and our subsidiaries to the members of our board of directors and certain executives for services provided in all capacities to us and our subsidiaries for the year ended December 31, 2019.

Executive and Director Compensation Processes

Our executive compensation program is administered by the compensation committee of our board of directors, subject to the oversight and approval of our full board of directors. Our compensation committee reviews our executive compensation practices on an annual basis and based on this review approves, or, as appropriate, makes recommendations to our board of directors for approval of our executive compensation program.

In designing our executive compensation program, our compensation committee considers publicly available compensation data for national and regional companies in the biotechnology/pharmaceutical industry to help guide its executive compensation decisions at the time of hiring and for subsequent adjustments in compensation. Since 2016, our compensation committee has retained Radford, part of the Rewards Solutions practice of Aon plc, as its independent compensation consultant, to provide comparative data on executive compensation practices in our industry and to advise on our executive compensation program generally. The committee also has retained Radford for guidelines and review of non-employee director compensation. Although our compensation committee considers the advice and guidelines of Radford as to our executive compensation program, our compensation committee ultimately makes its own decisions about these matters. In the future, we expect that our compensation committee will continue to engage independent compensation consultants to provide additional guidance on our executive compensation programs and to conduct further competitive benchmarking against a peer group of publicly traded companies. In 2019, the total amount paid to Radford for its executive and director compensation consulting services was $150,396.75.

Outside of services provided for the compensation committee, Radford provided nominal additional services to the company in 2019 related to benchmarking data with respect to certain non-executive positions in an effort to ensure that our compensation practices are competitive so that we can attract, reward, motivate and retain employees at all levels of our organization. The total amount paid to Radford in connection with these additional engagements was less than $120,000 in 2019.

In addition, in 2010, Aon Risk Services, an affiliate of Radford, provided services as an insurance broker for various insurance policies including our products liability insurance, directors' and officers' liability insurance and other commercial business insurance. In 2019, Aon Risk Services received an aggregate of approximately $225,707 in connection with such services.

The compensation committee regularly evaluates the nature and scope of the services provided by Radford. The compensation committee approved the 2019 executive and director compensation consulting services described above. Although the compensation committee was aware of the other services performed by Aon Risk Services, and considered any potential conflict with Radford's independence, the compensation committee did not review such other services as those services were reviewed and approved by management in the ordinary course of business.

In order to ensure that Radford is independent, Radford is only engaged by, takes direction from, and reports to, the compensation committee and, accordingly, only the compensation committee has

18

the right to terminate or replace Radford at any time. Further, Radford maintains certain internal controls within Aon plc which include, among other things:

- •

- All Radford and Aon staff are required to review and complete courses covering the company's Code of Conduct, which forbids Radford and Aon

staff from trading in a client's stock as well as the treatment of confidential client information;

- •

- Radford maintains a separate account management structure and database of contacts to protect the confidentiality of client lists and contacts;

- •

- Radford is not reliant on any one client for meeting performance expectations during the year, thereby minimizing any account concentration

risk for an account manager, which could impair objectivity;

- •

- Radford's survey data are maintained on a separate IT platform to protect and secure the confidential nature of client information and the

relationships where Radford provides services; and

- •

- Radford's staff is not directly compensated for any cross-selling of Aon product or service.

The compensation committee reviewed information regarding the independence and potential conflicts of interest of Radford, taking into account, among other things, the factors set forth in the Nasdaq listing standards. Based on such review, the compensation committee concluded that the engagement of Radford did not raise any conflict of interest.

Our director compensation program is administered by our board of directors with the assistance of the compensation committee. The compensation committee conducts an annual review of director compensation and makes recommendations to the board of directors with respect thereto.

Our "named executive officers" for the year ended December 31, 2019 were as follows: Mr. Schroeder, our chief executive officer, Dr. Schranz, our chief medical officer and Dr. Gelone, our president and chief operating officer. The following table sets forth information regarding compensation awarded to, earned by or paid to our named executive officers for the periods presented.

Name and principal position

|

Year | Salary($) | Share Awards ($)(1) |

Option Awards ($)(1) |

Non-Equity Incentive Plan Compensation ($)(2) |

All Other Compensation ($)(3) |

Total ($) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Theodore Schroeder |

2019 | 560,000 | 310,175 | 478,367 | 119,250 | 28,372 | 1,496,164 | |||||||||||||||

Chief Executive Officer |

2018 | 220,360 | 529,500 | 1,739,100 | — | 20,380 | 2,509,340 | |||||||||||||||

Jennifer Schranz |

2019 |

436,200 |

99,750 |

261,555 |

151,200 |

33,450 |

982,155 |

|||||||||||||||

Chief Medical Officer |

||||||||||||||||||||||

Steven Gelone |

2019 |

472,100 |

200,925 |

309,859 |

181,420 |

13,976 |

1,178,280 |

|||||||||||||||

President and Chief Operating Officer |

2018 | 426,104 | 225,255 | 546,738 | 126,822 | 15,116 | 1,340,035 | |||||||||||||||

- (1)

- The

amounts reported in the "Share Awards" and "Option Awards" columns reflect the aggregate grant-date fair value of share-based compensation awarded during the

year computed in accordance with the provisions of ASC Topic 718. See Note 11 to the consolidated financial statements included in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2019 regarding assumptions underlying the valuation of equity awards.

- (2)

- The

amounts reported in the "Non-Equity Incentive Plan Compensation" column represent awards to our named executive officers under our annual cash bonus program.

- (3)

- The compensation included in the "All Other Compensation" column consists of amounts we contributed to our 401(k) plan and medical insurance premiums paid by us on behalf of such individual.

19

Narrative Disclosure to Summary Compensation Table

Base Salary

In 2019, we paid annualized base salaries of $560,000 to Mr. Schroeder; $436,200 to Dr. Schranz; and $472,100 to Dr. Gelone. In 2018, we paid annualized base salaries of $530,000 to Mr. Schroeder; $400,000 to Dr. Schranz; and $450,000 to Dr. Gelone upon the closing of the Zavante acquisition.

In January 2020, our board of directors, following approval and recommendation from the compensation committee and consistent with the recommendations of the compensation committee's independent compensation consultant, approved an increase to the base salaries of our named executive officers for 2020 as follows: $576,800 for Mr. Schroeder, $449,300 for Dr. Schranz and $486,300 for Dr. Gelone. The board also approved 2020 base salaries for Mr. Crotty, our general counsel and secretary, of $392,200, Mr. Lavino, our chief commercial officer, of $384,500 and Mr. Sender, our chief financial officer, of $409,200, which also were consistent with the recommendation of the compensation committee's independent consultant.

None of our named executive officers is currently party to an employment agreement or other agreement or arrangement that provides for automatic or scheduled increases in base salary.

Annual Performance-Based Compensation

Our executive officers, which include the named executive officers, participate in our performance-based bonus program. All annual cash bonuses for our executives under the performance-based bonus program are tied to the achievement of strategic and operational corporate goals for the company, which are set by the compensation committee and approved by the board. There are no discretionary individual goals under the bonus program. The 2019 strategic and operational goals for Nabriva related to the following objectives:

- •

- regulatory approvals

- •

- commercialization of our product candidates

- •

- finance, specifically fundraising;

- •

- business development;

- •

- operating infrastructure; and,

- •

- chemistry, manufacturing, and control (CMC).