Use these links to rapidly review the document

Prospectus

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-214197

PROSPECTUS SUPPLEMENT

(To prospectus dated November 9, 2016)

Nabriva Therapeutics AG

Rights Offering for up to 588,127 Common Shares

Including Common Shares Represented by American Depositary Shares

Offering of American Depositary Shares Representing Common Shares

Not Subscribed for in the Rights Offering

We are offering to our common shareholders rights to subscribe for new common shares and, through The Bank of New York Mellon, our depositary and the ADS rights agent, are offering to holders of American Depositary Shares, or ADSs, non-transferable rights to subscribe for new ADSs pursuant to a rights offering. Except to the extent otherwise provided under Austrian law, the common share rights will be non-transferable. We expect to issue up to 588,127 common shares in this offering, including common shares represented by ADSs. Each ADS represents one tenth (1/10) of a common share, nominal value €1.00 per share.

Offering to Holders of ADSs

Holders of ADSs will receive 0.276 ADS rights for each ADS owned of record on November 29, 2016. One ADS right will entitle an ADS holder to subscribe for and purchase one new ADS at the U.S. dollar equivalent of €4.014 per ADS. Based on a euro-to-U.S. dollar exchange rate of €1.00 to $1.0588, we estimate that subscription price at $4.25 per ADS. To subscribe for new ADSs, a holder of ADS rights must pay to The Bank of New York Mellon $4.68 per ADS so subscribed, which represents 110% of the estimated subscription price to account for currency conversion expense, ADS issuance fees payable to the depositary and potential fluctuations in the exchange rate between the euro and the U.S. dollar. On or about December 13, 2016, the ADS rights agent will determine the actual U.S. dollar ADS subscription price by converting the euro subscription price into U.S. dollars at an exchange rate assigned by it on that date. Fractional ADS rights will not be issued, and ADS right entitlements will be reduced to the next smaller whole number of ADS rights. The ADS rights will expire at 5:00 p.m. (New York City time) on December 12, 2016. See "Description of the Offering—Offering to Holders of ADSs."

Offering to Holders of Common Shares

Holders of common shares will have the common share right to subscribe for and purchase 0.276 new common shares, at a subscription price of €40.14 per new common share, for each common share owned of record on November 29, 2016, which we refer to as the common share subscription ratio. No fractional common shares will be issued and common share right entitlements will be reduced to the next smaller whole number of common shares. Rights to subscribe for new common shares will expire at 5:00 p.m. (Vienna time) on December 14, 2016. See "Description of the Offering—Offering to Holders of Common Shares."

Potential Offering of ADSs Representing Unsubscribed Common Shares

If any new common shares are not subscribed for pursuant to the common share rights and ADS rights described above, following the expiration of the offering of such common share rights and ADS rights, we may, at the discretion of Cantor Fitzgerald & Co., based on market conditions and demand, enter into an underwriting agreement pursuant to which Cantor Fitzgerald & Co. would agree to subscribe for and purchase up to all of the unsubscribed common shares at a purchase price of €40.14 per common share for purposes of resale of ADSs representing the unsubscribed common shares. However, entry into an underwriting agreement for all or a portion of the unsubscribed shares remains at the discretion of Cantor Fitzgerald & Co. and Cantor Fitzgerald & Co. is not obligated to purchase all or any of the unsubscribed common shares. In the event that Cantor Fitzgerald & Co. and we do enter into an underwriting agreement for unsubscribed shares, Cantor Fitzgerald & Co. may sell ADSs at variable prices, which may be more or less than the purchase price.

In addition, certain of our existing principal shareholders and their affiliated entities, holding approximately 39.7% of our outstanding share capital, have indicated an interest in purchasing up to an aggregate of approximately $17.5 million of the securities we are offering. However, indications of interest are not binding agreements or commitments to subscribe and purchase. These shareholders may determine to subscribe for and purchase fewer common shares and/or ADSs than they indicate an interest in subscribing for and purchasing or not to subscribe for any common shares and/or ADSs in the rights offering or in the potential offering of ADSs representing any unsubscribed common shares. In addition, because these investors are only entitled to subscribe for and purchase their pro rata portion of any new common shares or ADSs offered as part of the offerings of ADS rights and common share rights, any purchases above this pro rata amount would occur through the potential offering of ADSs representing any unsubscribed shares. Following the expiration of the offering of ADS rights and common share rights, Cantor Fitzgerald & Co. may determine not to proceed with the potential offering of ADSs representing unsubscribed common shares or may determine to sell fewer ADSs representing unsubscribed common shares to any of these shareholders or not to sell any such ADSs to these shareholders.

We estimate that we will receive gross proceeds from this offering of approximately $25.0 million, assuming the (i) full exercise of subscription rights for the common shares and ADSs offered in this offering and (ii) issuance and sale of an aggregate of 588,127 common shares, including the sale of 114,658 common shares at the subscription price of €40.14 per new common share and 4,734,690 ADSs, representing 473,469 common shares, at the estimated subscription price of $4.25 per new ADS, assuming a euro-to-U.S. dollar exchange rate of €1.00 to $1.0588. In consideration for services provided to us in connection with the offering of ADS rights and common share rights, we have agreed to pay Cantor Fitzgerald & Co. a financial advisory fee equal to 8.0% of the U.S. dollar gross proceeds raised from this offering (including proceeds from the sale of ADSs in the potential offering of ADSs representing unsubscribed common shares). We expect that our aggregate expenses in connection with this offering, including estimated fees and offering expenses payable by us, will be approximately $4.1 million. As a result, we estimate that the net proceeds to us from this offering, based on the assumptions above, would be approximately $20.9 million. See "Use of Proceeds."

The ADSs are listed on the NASDAQ Global Market under the symbol "NBRV." On November 28, 2016, the last reported sale price of the ADSs on the NASDAQ Global Market was $4.25 per ADS. Our common shares are not listed on any national securities market or exchange. The ADS rights and, except to the extent otherwise provided under Austrian law, common share rights will not be transferable and will not be listed on any national securities market or exchange.

For information regarding this offering, please contact Georgeson LLC, the information agent, toll free at (866) 278-8941 or by e-mail at Nabriva@georgeson.com from 9:00 a.m. to 9:00 p.m., New York City time, Monday to Friday.

We are an "emerging growth company" as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to rely on certain reduced public company disclosure requirements.

Investing in the common shares or ADSs involves a high degree of risk. Please read "Risk Factors" beginning on page S-12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the common shares and ADSs is expected to be made on or about December 19, 2016.

Cantor Fitzgerald & Co.

November 29, 2016

TABLE OF CONTENTS

Prospectus Supplement

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have not and Cantor Fitzgerald & Co. has not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and Cantor Fitzgerald & Co. take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and in any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the date of those respective documents. It is important for you to read and consider all of the information contained in this prospectus supplement and in the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled "Where You Can Find Additional Information" and "Incorporation by Reference" in this prospectus supplement and in the accompanying prospectus.

Other than in the United States, no action has been taken by us or Cantor Fitzgerald & Co. that would permit a public offering of the securities offered by this prospectus in any jurisdiction where action for that purpose is required. The securities offered by this prospectus may not be offered or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in any jurisdiction in which such an offer or a solicitation is unlawful.

S-ii

Unless the context specifically indicates otherwise, references in this prospectus supplement to "Nabriva Therapeutics AG," "Nabriva," "we," "our," "ours," "us," "our company" or similar terms refer to Nabriva Therapeutics AG together with its subsidiaries. The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

We present our consolidated financial statements in euros. All references in this prospectus to "$" are to U.S. dollars and all references to "€" are to euros. Solely for convenience and unless otherwise indicated, certain euro amounts have been translated into U.S. dollars at the rate of €1.00 to $1.1161, the exchange rate at the European Central Bank on September 30, 2016. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or any other exchange rate as of that or any other date.

S-iii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking statements that involve substantial risks and uncertainties. All statements contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, other than statements of historical fact, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "predict," "project," "target," "potential," "will," "would," "could," "should," "continue," and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements in this prospectus supplement include, among other things, statements about:

- •

- the timing and conduct of our clinical trials of our lead product candidate, lefamulin, including statements regarding the timing and

completion of the trials, and the period during which the results of the trials will become available;

- •

- our expectations regarding how far into the future our cash on hand, together with the net proceeds from this offering, will fund our ongoing

operations;

- •

- our expectation to reach 60% enrollment for our first Phase 3 clinical trial of lefamulin for community-acquired bacterial pneumonia, or

CABP, by the end of 2016 and complete an interim data analysis in early 2017;

- •

- the timing of and our ability to submit applications for, obtain and maintain marketing approval of lefamulin;

- •

- the potential receipt of revenues from future sales of lefamulin;

- •

- our plans to pursue development of lefamulin for additional indications other than CABP;

- •

- our plans to pursue research and development of other product candidates;

- •

- our ability to establish and maintain arrangements for manufacture of our product candidates;

- •

- our sales, marketing and distribution capabilities and strategy;

- •

- our ability to successfully commercialize lefamulin and our other product candidates;

- •

- the potential advantages of lefamulin and our other product candidates;

- •

- our estimates regarding the market opportunities for lefamulin and our other product candidates;

- •

- the rate and degree of market acceptance and clinical benefit of lefamulin and our other product candidates;

- •

- our ability to establish and maintain collaborations;

- •

- our ability to acquire or in-license additional products, product candidates and technologies;

- •

- our current belief that it is more likely than in past years that as of December 31, 2016 we will be classified as a passive foreign

investment company, or PFIC, and our current intention to make available the information necessary to permit a U.S. holder to make a valid "QEF election";

- •

- our loss of "foreign private issuer" status as of January 1, 2017;

- •

- our future intellectual property position;

S-iv

- •

- our estimates regarding future expenses, capital requirements and needs for additional financing;

- •

- our ability to effectively manage our anticipated growth;

- •

- our ability to attract and retain qualified employees and key personnel;

- •

- our expected use of proceeds from this offering; and

- •

- other risks and uncertainties, including those described in the "Risk Factors" section of this prospectus supplement.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein, particularly in the "Risk Factors" section of this prospectus supplement, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

S-v

This summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference herein and therein. This summary does not contain all of the information you should consider before buying the ADSs or our common shares. You should read the entire prospectus supplement and the accompanying prospectus carefully, especially the risks described in "Risk Factors," in this prospectus supplement, along with our financial statements and the related notes and the other information incorporated by reference in this prospectus supplement and the accompanying prospectus, before deciding to invest in the ADSs or our common shares.

Our Company

We are a clinical stage biopharmaceutical company engaged in the research and development of novel anti-infective agents to treat serious infections, with a focus on the pleuromutilin class of antibiotics. We are developing our lead product candidate, lefamulin, to be the first pleuromutilin antibiotic available for systemic administration in humans. We are developing both intravenous, or IV, and oral formulations of lefamulin for the treatment of community-acquired bacterial pneumonia, or CABP, and intend to develop lefamulin for additional indications other than pneumonia. We have completed a Phase 2 clinical trial of lefamulin for acute bacterial skin and skin structure infections, or ABSSSI. Based on the clinical results of lefamulin for ABSSSI, as well as its rapid tissue distribution, including substantial penetration into lung tissue and fluids, we initiated two international, pivotal Phase 3 clinical trials of lefamulin for the treatment of moderate to severe CABP.

We initiated the first of these trials in September 2015 and initiated the second trial in April 2016. These are the first clinical trials we have conducted with lefamulin for the treatment of CABP. Both trials are designed to follow draft guidance published by the U.S. Food and Drug Administration, or FDA, for the development of drugs for CABP and guidance from the European Medicines Agency, or EMA, for the development of antibacterial agents. Based on our estimates regarding patient enrollment, we expect to have top-line data available for both trials in the second half of 2017. If the results of these trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulin for the treatment of CABP in both the United States and Europe in 2018. We believe that lefamulin is well suited for use as a first-line empiric monotherapy for the treatment of CABP because of its novel mechanism of action, spectrum of activity, including against multi-drug resistant pathogens, achievement of substantial drug concentrations in lung tissue and fluids, availability as both an IV and oral formulation and favorable safety and tolerability profile.

The FDA has designated each of the IV and oral formulations of lefamulin as a qualified infectious disease product, or QIDP, which provides for the extension of statutory exclusivity periods in the United States for an additional five years upon FDA approval of the product for the treatment of CABP, and granted fast track designation to these formulations of lefamulin. Fast track designation is granted by the FDA to facilitate the development and expedite the review of drugs that treat serious conditions and fill an unmet medical need. The fast track designation for the IV and oral formulations of lefamulin will allow for more frequent interactions with the FDA, the opportunity for a rolling review of any new drug application, or NDA, we submit and eligibility for priority review and a shortening of the FDA's goal for taking action on a marketing application from ten months to six months.

We believe that pleuromutilin antibiotics can help address the major public health threat posed by bacterial resistance, which the World Health Organization, or WHO, characterized in 2010 as one of the three greatest threats to human health. Increasing resistance to antibiotics used to treat CABP is a growing concern and has become an issue in selecting the appropriate initial antibiotic treatment prior

S-1

to determining the specific microbiological cause of the infection, referred to as empiric treatment. For example, the U.S. Centers for Disease Control and Prevention, or CDC, has classified Streptococcus pneumoniae, the most common respiratory pathogen, as a serious threat to human health as a result of increasing resistance to currently available antibiotics. In addition, the CDC recently reported on the growing evidence of widespread resistance to macrolides, widely used antibiotics that disrupt bacterial protein synthesis, in Mycoplasma pneumoniae, a common cause of CABP that is associated with significant morbidity and mortality. Furthermore, Staphylococcus aureus, including methicillin-resistant S. aureus, or MRSA, which has also been designated as a serious threat to human health by the CDC, has emerged as a more common cause of CABP in some regions of the world, and a possible pathogen to be covered with empiric therapy. In recognition of the growing need for the development of new antibiotics, recent regulatory changes, including priority review and regulatory guidance enabling smaller clinical trials, have led to renewed interest from the pharmaceutical industry in anti-infective development. For example, the Food and Drug Administration Safety and Innovation Act became law in 2012 and included the Generating Antibiotic Incentives Now Act, or the GAIN Act, which provides incentives, including access to expedited FDA review for approval, fast track designation and five years of potential data exclusivity extension for the development of new QIDPs.

As a result of increasing resistance to antibiotics and the wide array of potential pathogens that cause CABP, the current standard of care for hospitalized patients with CABP usually involves first-line empiric treatment with a combination of antibiotics to address all likely bacterial pathogens or monotherapy with a fluoroquinolone antibiotic. Combination therapy presents the logistical challenge of administering multiple drugs with different dosing regimens and increases the risk of drug-drug interactions and the potential for serious side effects. Fluoroquinolones are associated with safety and tolerability concerns and are typically administered in combination with other antibiotics if community-acquired MRSA is suspected. In addition, many currently available antibiotic therapies are only available for IV administration and are prescribed for seven to 14 days, meaning continued treatment requires prolonged hospitalization or a switch to a different antibiotic administered orally, with the attendant risk that the patient might respond differently.

Pleuromutilins are semi-synthetic compounds derived from a naturally occurring antibiotic and inhibit bacterial growth by binding to a specific site on the bacterial ribosome that is responsible for bacterial protein synthesis. We have developed an understanding of how to optimize characteristics of the pleuromutilin class, such as antimicrobial spectrum, potency, absorption following oral administration and tolerability, which in turn led to our selection and development of lefamulin, our lead product candidate. We have completed a Phase 2 clinical trial for ABSSSI in which the IV formulation of lefamulin achieved a high cure rate against multi-drug resistant Gram-positive bacteria, including MRSA. In addition, in preclinical studies, lefamulin showed potent antibacterial activity against a variety of Gram-positive bacteria, Gram-negative bacteria and atypical bacteria, including multi-drug resistant strains. The preclinical studies and clinical trials we have conducted to date suggest that lefamulin's novel mechanism of action is responsible for the lack of cross resistance observed with other antibiotic classes and may result in slow development of bacterial resistance to lefamulin over time. As a result of the favorable safety and tolerability profile we have observed in our clinical trials to date, we believe lefamulin has the potential to present fewer complications relative to the use of current therapies. Based on our research, we also believe that the availability of both IV and oral formulations of lefamulin, and an option to switch to oral treatment, could reduce the length of a patient's hospital stay and the overall cost of care.

We have evaluated lefamulin in more than 440 patients and subjects in seventeen completed Phase 1 clinical trials and a Phase 2 clinical trial in ABSSSI. In our Phase 1 clinical trials, we have characterized the clinical pharmacology of the IV formulation of lefamulin and shown oral bioavailability of a tablet formulation of lefamulin with rapid tissue distribution, including substantial penetration into lung tissue and fluids. In our Phase 2 clinical trial evaluating the safety and efficacy of

S-2

two different doses of the IV formulation of lefamulin administered over five to 14 days compared to the antibiotic vancomycin in patients with ABSSSI, the clinical success rate at test of cure, or TOC, for lefamulin was similar to that of vancomycin. Lefamulin has been well tolerated in all our clinical trials to date when administered by IV and oral routes. The frequency of adverse events that we observed in our Phase 2 clinical trial in ABSSSI was similar for patients treated with IV lefamulin and patients treated with vancomycin.

Based on the clinical results of lefamulin for the treatment of ABSSSI, as well as its rapid tissue distribution, including substantial penetration into lung tissue and fluids, we are evaluating lefamulin for the treatment of moderate to severe CABP in two international Phase 3 clinical trials. We are initially pursuing the development of lefamulin for CABP because of the limited development of new antibiotic classes for this indication over the past 15 years, our belief that there exists a significant unmet medical need for a first-line empiric monotherapy that addresses the growing development and spread of bacterial resistance, as well as recently clarified FDA guidance regarding the approval pathway. We initiated the first of these trials in September 2015 and the second trial in April 2016. We are also characterizing the clinical pharmacology of lefamulin in several additional Phase 1 clinical trials.

We plan to pursue a number of additional opportunities for lefamulin, including a development program for use in pediatric patients and potentially for the treatment of ABSSSI. In addition, as an antibiotic with potent activity against a wide variety of multi-drug resistant pathogens, including MRSA, we plan to explore development of lefamulin in other indications, including ventilator-associated bacterial pneumonia, or VABP, hospital-acquired bacterial pneumonia, or HABP, sexually transmitted infections, or STIs, osteomyelitis and prosthetic joint infections. Through our research and development efforts, we have also identified a topical pleuromutilin product candidate, BC-7013, which has completed a Phase 1 clinical trial.

We own exclusive, worldwide rights to lefamulin. Lefamulin is protected by issued patents in the United States, Europe and Japan covering composition of matter, which are scheduled to expire no earlier than 2028. We also have been granted patents for lefamulin relating to process and pharmaceutical crystalline salt forms in the United States, which are scheduled to expire no earlier than 2031. In addition, we own a family of pending patent applications directed to pharmaceutical compositions of lefamulin, which if issued would be scheduled to expire no earlier than 2036.

Our Strategy

Our goal is to become a fully integrated biopharmaceutical company focused on the research, development and commercialization of novel anti-infective products. The key elements of our strategy to achieve this goal are:

- •

- Complete Phase 3 clinical development of lefamulin for

CABP. We are devoting a significant portion of our financial resources and business efforts to completing the clinical development of lefamulin

for the treatment of CABP. We initiated two international Phase 3 clinical trials of lefamulin for the treatment of moderate to severe CABP. We initiated the first of these trials in September

2015 and the second trial in the April 2016. Based on our estimates regarding patient enrollment, we expect to have top-line data available for both trials in the second half of 2017. If the results

of these trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulin for the treatment of CABP in

both the United States and Europe in 2018.

- •

- Maximize the commercial potential of lefamulin for CABP. We own exclusive, worldwide rights to lefamulin. We expect that our initial target patient population for lefamulin will consist of patients with moderate to severe CABP. If lefamulin receives marketing approval from the FDA for the treatment of CABP, we plan to commercialize it in the United States with our own

S-3

- •

- Pursue the continued development of lefamulin in additional

indications. We plan to pursue the continued development of lefamulin for indications in addition to CABP. For example, we intend to further

pursue the development of lefamulin for use in pediatric patients and potentially for the treatment of ABSSSI. In addition, we are evaluating whether to pursue studies of lefamulin in patients with

VABP or HABP. We believe that lefamulin's product profile also provides the opportunity to expand to other indications beyond pneumonia. For example, investigation of the tolerability of higher single

doses of lefamulin could also support use of lefamulin for the treatment of STIs. In addition, we plan to explore longer duration of treatment with lefamulin to support development of a treatment for

osteomyelitis and prosthetic joint infections. We believe that lefamulin would be differentiated from other treatment options for each of these potential uses because of lefamulin's novel mechanism of

action, spectrum of activity, including activity against multi-drug resistant pathogens, achievement of substantial concentrations in relevant tissues, availability as both an IV and oral formulation

and favorable safety and tolerability profile.

- •

- Advance the development of other pleuromutilin product candidates and possibly compounds in other

classes. We are currently focused on developing additional pleuromutilin product candidates through our deep understanding of this class of

antibiotics. Our product candidate BC-7013 has completed a Phase 1 clinical trial. We believe that this pleuromutilin compound is well suited for the topical treatment of a variety of

Gram-positive infections, including uncomplicated skin and skin structure infections, or uSSSIs. In addition, other topical pleuromutilins from our research program have shown potent in vitro activity

against Clostridium difficile and Helicobacter

pylori. We also are actively pursuing an in-house discovery program to sustain and expand our pipeline with additional product candidates. Furthermore, we own diverse libraries

of compounds in other antibacterial classes, such as ß-lactams and acremonic acids, which are a potential basis for the discovery and development of novel antibacterial agents.

- •

- Evaluate business development opportunities and potential collaborations. We plan to evaluate the merits of entering into collaboration agreements with other pharmaceutical or biotechnology companies that may contribute to our ability to efficiently advance our product candidates, build our product pipeline and concurrently advance a range of research and development programs. Potential collaborations may provide us with funding and access to the scientific, development, regulatory and commercial capabilities of the collaborators. We also plan to encourage local and international government entities and non-government organizations to provide additional funding and support for our development programs. We may expand our product pipeline through opportunistically in-licensing or acquiring the rights to complementary products, product candidates and technologies for the treatment of a range of infectious diseases.

targeted hospital sales and marketing organization that we plan to establish. We believe that we will be able to effectively communicate lefamulin's differentiating characteristics and key attributes to clinicians and hospital pharmacies with the goal of establishing favorable formulary status for lefamulin. If lefamulin receives marketing approval outside the United States for the treatment of CABP, we expect to utilize a variety of types of collaboration, distribution and other marketing arrangements with one or more third parties to commercialize lefamulin in such markets. We also plan to develop a formulation of lefamulin appropriate for pediatric use for CABP.

S-4

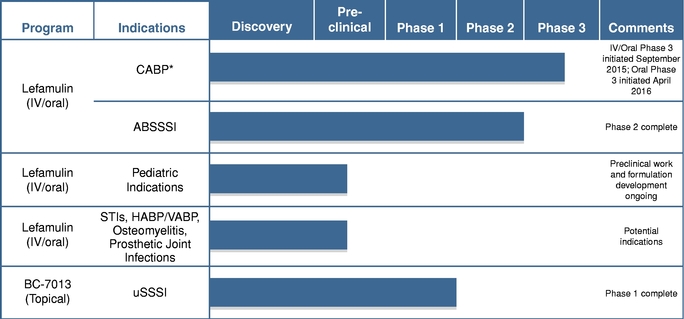

Our Product Development Pipeline

The following table summarizes the indications for which we are developing our product candidates and the status of development.

- *

- We have initiated two international Phase 3 clinical trials of lefamulin for the treatment of moderate to severe CABP. However, we have not previously conducted any clinical trials of lefamulin specifically for CABP. Our completed Phase 2 clinical trial evaluated lefamulin in patients with ABSSSI. We have obtained input from the FDA and select European authorities, including reaching agreement with the FDA on a Special Protocol Assessment, or SPA, regarding the study design of our first Phase 3 clinical trial, in anticipation of submitting applications for marketing approval for lefamulin for the treatment of CABP in both the United States and Europe in 2018, if both Phase 3 trials are successful.

Our Corporate Information

We were incorporated in October 2005 in Austria under the name Samisa Beteiligungsverwaltungs GmbH, a limited liability company organized under Austrian law, as a spin-off from Sandoz GmbH. In February 2006, we changed our name to Nabriva Therapeutics Forschungs GmbH and commenced operations. In 2007, we transformed into a stock corporation (Aktiengesellschaft) under the name Nabriva Therapeutics AG. We are incorporated under the laws of the Republic of Austria and registered at the Commercial Register of the Commercial Court of Vienna. Our executive offices are located at Leberstrasse 20, 1110 Vienna, Austria, and our telephone number is +43 (0)1 740 930. Our U.S. operations are conducted by our wholly-owned subsidiary, Nabriva Therapeutics US, Inc., a Delaware corporation established in August 2014 and located at 1000 Continental Drive, Suite 600, King of Prussia, PA 19406. Our American Depositary Shares have traded on the NASDAQ Global Market under the symbol "NBRV" since our initial public offering in the United States in September 2015.

Our website address is www.nabriva.com. The information contained on, or that can be accessed from, our website does not form part of this prospectus supplement. Our agent for service of process in the United States is CT Corporation System, 111 Eighth Avenue, New York, New York 10011.

S-5

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

- •

- an exemption from compliance with the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act of 2002 on the design and

effectiveness of our internal controls over financial reporting;

- •

- an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm

rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

- •

- reduced disclosure about the company's executive compensation arrangements; and

- •

- exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a shareholder approval of any golden parachute arrangements.

We may take advantage of these provisions until December 31, 2020 or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur of: the last day of the fiscal year in which we have more than $1 billion in annual revenues; the date we qualify as a "large accelerated filer," with at least more than $700 million in market value of our share capital held by non-affiliates; or the issuance by us of more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We have taken advantage of some reduced reporting burdens in this prospectus supplement. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. Since we currently report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, we have irrevocably elected not to avail ourselves of delayed adoption of new or revised accounting standards and, therefore, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB. Furthermore, beginning on January 1, 2017, when we expect to prepare our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, rather than IFRS, we will also adopt new or revised U.S. GAAP accounting standards on the relevant dates on which adoption of such standards is required for other public companies that are not emerging growth companies.

Implications of Being a Foreign Private Issuer

While we are a foreign private issuer, we are exempt from compliance with certain laws and regulations of the U.S. Securities and Exchange Commission, or SEC, and certain regulations of The NASDAQ Stock Market, including the proxy rules, the short-swing profits recapture rules and certain governance requirements, such as independent director oversight of the nomination of directors and executive compensation. In addition, we are not required to file annual, quarterly and current reports and financial statements with the SEC as frequently or as promptly as U.S. companies registered under the Securities Exchange Act of 1934, as amended. We determined that, as of June 30, 2016, we no longer qualified as a "foreign private issuer" under the rules and regulations of the SEC. As a result, beginning on January 1, 2017, we will no longer be entitled to "foreign private issuers" exemptions.

S-6

This summary highlights certain information contained elsewhere in this prospectus supplement. This summary does not contain all of the information that you should consider before deciding to purchase our securities. We urge you to read the entire prospectus supplement and the accompanying prospectus carefully, including the "Risk Factors" and "Special Note Regarding Forward-Looking Statements" sections, along with our consolidated financial statements and the notes to those financial statements.

Offering to Holders of ADSs |

||

ADS rights offering |

ADS holders will receive 0.276 ADS rights for each ADS owned on the ADS record date. One ADS right will entitle an ADS holder to subscribe for and purchase one new ADS. Fractional ADS rights will not be issued, and ADS right entitlements will be reduced to the next smaller whole number of ADS rights. |

|

ADS record date |

5:00 p.m. (New York City time) on November 29, 2016. |

|

ADS rights exercise period |

From November 30, 2016 through 5:00 p.m. (New York City time) on December 12, 2016. |

|

ADS trading price |

On November 28, 2016, the last reported sale price of the ADSs on the NASDAQ Global Market was $4.25 per ADS. |

|

ADS subscription price |

The estimated subscription price is $4.25 per ADS, which is the subscription price of €40.14 per common share for one tenth (1/10) of a common share translated into U.S. dollars at the rate of €1.00 to $1.0588, the exchange rate at the European Central Bank on November 28, 2016. On or about December 13, 2016, the ADS rights agent will determine the actual U.S. dollar ADS subscription price by converting the euro subscription price into U.S. dollars at an exchange rate assigned by it on that date. |

|

|

The ADS rights agent may convert currency itself or through any of its affiliates and, in those cases, acts as principal for its own account and not as an agent, fiduciary or broker on behalf of any other person and earns revenue, including, without limitation, fees and spreads that it will retain for its own account. The spread is the difference between the exchange rate assigned to the currency conversion made by the ADS rights agent and the rate that agent or its affiliate receives in an offsetting foreign currency trade. The ADS rights agent makes no representation that the exchange rate used or obtained in any currency conversion will be the most favorable rate that could be obtained at the time or that the method by which that rate will be determined will be the most favorable to ADS holders, except that the ADS rights agent will agree to act without gross negligence or willful misconduct. |

|

ADS subscription ratio |

0.276 ADS rights for each ADS held on the ADS record date. |

S-7

Estimated ADS subscription payment |

In order to exercise your ADS rights, you must pay to the ADS rights agent the ADS subscription payment of $4.68 per ADS, which represents 110% of the estimated subscription price to account for potential fluctuations in the exchange rate between the euro and the U.S. dollar, currency conversion expenses and an ADS issuance fee of the depositary of $0.05 per new ADS. |

|

|

If the actual U.S. dollar ADS subscription price (plus the ADS issuance fee and the currency conversion expense) is less than the ADS subscription payment, the ADS rights agent will refund such excess amount to the subscribing ADS holder without interest. However, if the amount of the ADS subscription payment you paid to the ADS rights agent is, for any reason, including due to currency exchange rate fluctuations, insufficient to pay the subscription price in euro plus conversion expenses and ADS issuance fees for all of the ADSs you are subscribing for, the ADS rights agent will require you to pay the deficiency as a condition to receiving your new ADSs, or will instruct the depositary to subscribe on your behalf for only the number of whole ADSs that can be subscribed for with the amount you have paid and the ADS rights agent will refund to you as soon as practicable the excess amount without interest. |

|

Procedure for exercising ADS rights |

If you hold ADSs directly, you may exercise your ADS rights during the ADS rights exercise period by delivering a properly completed and signed ADS subscription form and full payment of the ADS subscription payment for the new ADSs to the ADS rights agent, to be received prior to 5:00 p.m. (New York City time) on December 12, 2016. |

|

|

If you hold ADSs through a broker or other securities intermediary and wish to exercise your ADS rights, you should contact your securities intermediary and instruct it to subscribe on your behalf through the automated system of The Depository Trust Company, or DTC, prior to 5:00 p.m. (New York City time) on December 12, 2016, also referred to as the ADS rights expiration time. Your intermediary will charge the applicable ADS subscription payment to your account. Your broker or other securities intermediary may set a cutoff date and time to receive instructions that is earlier than the ADS rights expiration time stated above. You should contact your securities intermediary to determine the cutoff date and time that applies to you. |

|

|

We provide more details on how to exercise ADS rights under "Description of the Offering—Offering to Holders of ADSs." |

|

Transferability |

Rights to purchase ADSs in the ADS rights offering are not transferrable. |

S-8

Exercise of ADS rights irrevocable |

The exercise of ADS rights is irrevocable and may not be cancelled or modified. |

|

Unexercised rights |

If you do not exercise your ADS rights within the ADS rights exercise period, they will expire and have no further value. |

|

Depositary and ADS rights agent |

The Bank of New York Mellon. |

|

Listing |

The ADSs are listed on the NASDAQ Global Market under the symbol "NBRV." |

|

Delivery of new ADSs |

The depositary will deliver new ADSs subscribed for in the rights offering as soon as practicable after confirmation of receipt of the underlying new common shares by the depositary's custodian, which is expected to be on or about December 19, 2016. |

|

ADS issuance fee |

Subscribing holders will be charged an ADS issuance fee of $0.05 per new ADS issued, payable to the depositary. The ADS rights agent will deduct the ADS issuance fee from the ADS subscription payment in respect of each holder's subscription. |

|

New ADSs |

Each ADS represents one tenth (1/10) of a common share, nominal value €1.00 per share. |

|

|

The depositary will hold the common shares underlying the ADSs. ADS holders will have rights as provided in the deposit agreement. ADS holders may surrender their ADSs and withdraw the underlying common shares. The depositary will charge ADS holders fees for, among other acts, any surrender of ADSs for the purpose of withdrawal. We and the depositary may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the terms of the deposit agreement as then in effect. |

|

|

To better understand the terms of the ADSs, you should carefully read "Description of American Depositary Shares" in the accompanying prospectus. You should also read the deposit agreement, which is an exhibit to the registration statement of which this prospectus supplement forms a part. |

|

Information agent |

For information regarding this offering, please contact Georgeson LLC, the information agent, toll free at (866) 278-8941 or by e-mail at Nabriva@georgeson.com from 9:00 a.m. to 9:00 p.m., New York City time, Monday to Friday. |

|

For additional information regarding the rights offering to holders of ADSs, see "Description of the Offering—Offering to Holders of ADSs," which also contains a summary timetable containing important dates relating to the ADS rights offering. |

||

S-9

Offering to Holders of Common Shares |

|

|

Common share rights offering |

Holders of common shares will have the common share right to subscribe for and purchase 0.276 new common shares, at a subscription price of €40.14 per new common share, for each common share held on the common share record date, which we refer to as the common share subscription ratio. No fractional common shares will be issued and common share right entitlements will be reduced to the next smaller whole number of common shares. |

|

Common share record date |

November 29, 2016. |

|

Common share rights exercise period |

From November 30, 2016 through 5:00 p.m. (Vienna time) on December 14, 2016. |

|

Common share subscription price |

€40.14 per common share. |

|

Common share subscription ratio |

0.276 new common shares for each common share held on the common share record date. |

|

Procedure for exercising common share rights |

You may exercise your common share rights by delivering to us, at our executive offices at Leberstrasse 20, 1110 Vienna, Austria, a properly completed subscription form before 5:00 p.m. (Vienna time) on December 14, 2016. To validly subscribe for new common shares pursuant to your common share rights, we must receive the subscription price for your new common shares in full before 5:00 p.m. (Vienna time) on December 14, 2016. |

|

Transferability |

Rights to purchase common shares in the common share rights offering, except to the extent otherwise provided under Austrian law, will not be transferrable. |

|

Exercise of common share rights irrevocable |

The exercise of common share rights is irrevocable and may not be cancelled or modified. |

|

Unexercised rights |

If you do not exercise your common share rights within the common share rights exercise period, they will expire and have no further value. |

|

Listing |

The common shares and the common share rights are not listed on any national securities market or exchange. |

|

Delivery of new common shares |

We expect to deliver the new common shares subscribed in this rights offering on or about December 19, 2016. |

|

Information agent |

For information regarding this offering, please contact Georgeson LLC, the information agent, toll free at (866) 278-8941 or by e-mail at Nabriva@georgeson.com from 9:00 a.m. to 9:00 p.m., New York City time, Monday to Friday. |

S-10

For additional information regarding the rights offering to holders of our common shares, see "Description of Offering—Offering to Holders of Common Shares, " which also contains a summary timetable containing important dates relating to the common share rights offering. |

||

Tax Considerations |

|

|

Tax Considerations |

Although a final determination regarding our passive foreign investment company, or PFIC, status for our tax year ending December 31, 2016 cannot be made until our year-end results are known, it currently appears that there is a higher likelihood than in prior years that we may be a PFIC for the 2016 tax year. If we are characterized as a PFIC, our U.S. securityholders may suffer adverse tax consequences. See "Taxation—Taxation in the United States—Taxation of Rights Shares and ADSs—Passive Foreign Investment Company Considerations" for more information." |

|

Potential Offering of ADSs Represented by Unsubscribed Common Shares |

|

|

Potential Offering of ADSs Represented by Unsubscribed Common Shares |

If any new common shares are not subscribed for pursuant to the common share rights and ADS rights described in this prospectus supplement, following the expiration of the offering of such common share rights and ADS rights, we may, at the discretion of Cantor Fitzgerald & Co., based on market conditions and demand, enter into an underwriting agreement pursuant to which Cantor Fitzgerald & Co. would agree to subscribe for and purchase up to all of the unsubscribed common shares at a purchase price of €40.14 per common share for purposes of resale of ADSs representing the unsubscribed common shares. However, entry into an underwriting agreement for all or a portion of the unsubscribed shares remains at the discretion of Cantor Fitzgerald & Co., and Cantor Fitzgerald & Co. is not obligated to purchase all or any of the unsubscribed common shares. In the event that Cantor Fitzgerald & Co. and we do enter into an underwriting agreement for unsubscribed shares, Cantor Fitzgerald & Co. may sell ADSs at variable prices, which may be more or less than the purchase price. |

|

S-11

Investing in the ADSs or common shares involves a high degree of risk. In addition to the other information contained in this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference herein and therein, you should carefully consider the risks discussed below before making a decision about investing in the ADSs or the common shares. The risks and uncertainties discussed below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of these risks occur, our business, financial condition, results of operations and future growth prospects could be materially and adversely affected. In these circumstances, you may lose all or part of your investment.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred significant losses since our inception. We expect to incur losses for at least the next several years and may never generate profits from operations or maintain profitability.

Since inception, we have incurred significant operating losses. Our net loss was €35.4 million for the nine months ended September 30, 2016, €28.7 million for the year ended December 31, 2015 and €13.4 million for the year ended December 31, 2014. We generated a net profit of €11.2 million for the year ended December 31, 2013, primarily from the recognition of non-recurring income of €20.9 million as a result of the repurchase of a $25.0 million loan for €1.00 in connection with the termination by Forest Laboratories Inc., or Forest, of a stock purchase agreement and a decision by Forest not to exercise a related right to acquire us. As of September 30, 2016, we had accumulated losses of €161.0 million. To date, we have financed our operations primarily through the sale of our equity securities including our initial public offering of American Depositary Shares, or ADSs, and private placements of our common shares, convertible loans and research and development support from governmental grants and loans. We have devoted substantially all of our efforts to research and development, including clinical trials. We have not completed development of any drugs. We expect to continue to incur significant expenses and increasing operating losses for at least the next several years. The net losses we incur may fluctuate significantly from quarter to quarter and year to year.

We anticipate that our expenses will increase substantially as we progress our two international Phase 3 clinical trials of our lead product candidate, lefamulin, for the treatment of community-acquired bacterial pneumonia, or CABP. We initiated the first of these trials in September 2015 and the second trial in April 2016. If the results of these two trials are favorable, including achievement of the primary efficacy endpoints of the trials, we expect to submit applications for marketing approval for lefamulin for the treatment of CABP in both the United States and Europe in 2018. We also plan to further characterize the clinical pharmacology of lefamulin. If we obtain marketing approval of lefamulin for CABP or another indication, we also expect to incur significant sales, marketing, distribution and manufacturing expenses.

In addition, our expenses will increase if and as we:

- •

- initiate or continue the research and development of lefamulin for additional indications and of our other product candidates;

- •

- seek to discover and develop additional product candidates;

- •

- seek marketing approval for any product candidates that successfully complete clinical development;

- •

- ultimately establish a sales, marketing and distribution infrastructure and scale up manufacturing capabilities to commercialize any product

candidates for which we receive marketing approval;

- •

- in-license or acquire other products, product candidates or technologies;

S-12

- •

- maintain, expand and protect our intellectual property portfolio;

- •

- expand our physical presence in the United States; and

- •

- add operational, financial and management information systems and personnel, including personnel to support our product development, our operations as a public company and our planned future commercialization efforts.

Our ability to generate profits from operations and remain profitable depends on our ability to successfully develop and commercialize drugs that generate significant revenue. Based on our current plans, we do not expect to generate significant revenue unless and until we obtain marketing approval for, and commercialize, lefamulin. We do not expect to obtain marketing approval before 2018, if at all. This will require us to be successful in a range of challenging activities, including:

- •

- completing enrollment for our Phase 3 clinical trails of lefamulin for the treatment of CABP and completing both trials as and when we

expect;

- •

- obtaining favorable results from our Phase 3 clinical trials of lefamulin for the treatment of CABP;

- •

- subject to obtaining favorable results from our Phase 3 clinical trials, applying for and obtaining marketing approval for lefamulin;

- •

- establishing sales, marketing and distribution capabilities to effectively market and sell lefamulin in the United States;

- •

- establishing collaboration, distribution or other marketing arrangements with third parties to commercialize lefamulin in markets outside the

United States;

- •

- protecting our rights to our intellectual property portfolio related to lefamulin;

- •

- contracting for the manufacture of and obtaining commercial quantities of lefamulin; and

- •

- negotiating and securing adequate reimbursement from third-party payors for lefamulin.

We may never succeed in these activities and, even if we do, may never generate revenues that are significant enough to generate profits from operations. Even if we do generate profits from operations, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to generate profits from operations and remain profitable would decrease the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our product offerings or continue our operations. A decline in the value of our company could also cause our shareholders to lose all or part of their investment.

We will need substantial additional funding. If we are unable to raise capital when needed or on acceptable terms, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect our research and development and other expenses to increase substantially in connection with our ongoing activities, particularly as we continue the development of and potentially seek marketing approval for lefamulin and, possibly, other product candidates and continue our research activities. Our expenses will increase if we suffer any delays in our Phase 3 clinical program for lefamulin for CABP, including delays in enrollment of patients. If we obtain marketing approval for lefamulin or any other product candidate that we develop, we expect to incur significant commercialization expenses related to product sales, marketing, distribution and manufacturing. Furthermore, we expect to continue to incur additional costs associated with operating as a public company. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could

S-13

be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

If the gross proceeds from this offering are $20.0 million or more, we estimate that such funds, after deducting estimated fees and offering expenses payable by us, together with our existing cash, cash equivalents, marketable securities and term deposits, will be sufficient to enable us to fund our operating expenses and capital expenditure requirements at least into the second quarter of 2018. If the gross proceeds from this offering are $5.0 million or more, we estimate that such funds, after deducting estimated fees and offering expenses payable by us, together with our existing cash, cash equivalents, marketable securities and term deposits, will be sufficient to enable us to fund our operating expenses and capital expenditure requirements at least into the first quarter of 2018. If the gross proceeds from this offering are less than such amounts, our capital resources may not be sufficient to enable us to fund our operating expenses and capital expenditure requirements for the time periods indicated. We have based these estimates on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect. These estimates assume, among other things, that we do not obtain any additional funding through grants and clinical trial support, collaboration agreements or debt financings.

Our future capital requirements will depend on many factors, including:

- •

- the progress, costs and results of our ongoing Phase 3 clinical trials of lefamulin;

- •

- the costs and timing of process development and manufacturing scale-up activities associated with lefamulin;

- •

- the costs, timing and outcome of regulatory review of lefamulin;

- •

- the costs of commercialization activities for lefamulin if we receive, or expect to receive, marketing approval, including the costs and timing

of establishing product sales, marketing, distribution and outsourced manufacturing capabilities;

- •

- subject to receipt of marketing approval, revenue received from commercial sales of lefamulin;

- •

- the costs of developing lefamulin for the treatment of additional indications;

- •

- our ability to establish collaborations on favorable terms, if at all;

- •

- the scope, progress, results and costs of product development of BC-7013 and any other product candidates that we may develop;

- •

- the extent to which we in-license or acquire rights to other products, product candidates or technologies;

- •

- the costs of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights and defending

against intellectual property-related claims;

- •

- the continued availability of Austrian governmental grants;

- •

- the rate of the expansion of our physical presence in the United States; and

- •

- the costs of operating as a public company in the United States.

Conducting clinical trials is a time consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain marketing approval and achieve product sales. Our commercial revenues, if any, will be derived from sales of lefamulin or any other products that we successfully develop, none of which we expect to be commercially available for several years, if at all. In addition, if approved, lefamulin or any other product candidate that we develop, in-license or acquire may not achieve commercial success. Accordingly, we will need to obtain substantial additional financing to achieve our business objectives.

S-14

Adequate additional financing may not be available to us on acceptable terms, or at all. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

Raising additional capital may cause dilution to our security holders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, and funding from local and international government entities and non-government organizations in the disease areas addressed by our product candidates and marketing, distribution or licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a security holder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. In addition, debt service obligations under any debt financings may limit the availability of our cash for other purposes, and we may be unable to make interest payments or repay the principal of such debt financings when due.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

Our operations to date have been limited to organizing and staffing our company, developing and securing our technology, raising capital and undertaking preclinical studies and clinical trials of our product candidates. We have not yet demonstrated our ability to successfully complete development of any product candidates, obtain marketing approvals, manufacture a commercial scale product, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, any predictions you make about our future success or viability may not be as accurate as they could be if we had a longer operating history.

In addition, as a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition from a company with a research and development focus to a company capable of supporting commercial activities. We may not be successful in such a transition.

We have relied on, and expect to continue to rely on, certain government grants and funding from the Austrian government. Should these funds cease to be available, or our eligibility be reduced, or if we are required to repay any of these funds, this could impact our ongoing need for funding and the timeframes within which we currently expect additional funding will be required.

As a company that carries out extensive research and development activities, we benefit from the Austrian research and development support regime, under which we are eligible to receive a research premium from the Austrian government equal to 12% (10%, in the case of fiscal years prior to 2016) of a specified research and development cost base. Qualifying expenditures largely comprise research

S-15

and development activities conducted in Austria, however, the research premium is also available for certain related third-party expenses with additional limitations. We received research premiums of €3.8 million for the year ended December 31, 2015 and €1.0 million for the year ended December 31, 2014. For the year ended December 31, 2013, we received research premiums of €1.4 million, which included research premium adjustments of €0.5 million for the years ended December 31, 2012 and 2011. We anticipate that our qualifying expenditures will continue to increase as a result of our ongoing Phase 3 clinical trials of lefamulin. However, as we increase our personnel and expand our business outside of Austria, we may not be able to continue to claim research premiums to the same extent as we have in previous years, as some research and development activities may no longer be considered to occur in Austria. As research premiums that have been paid out already may be audited by the tax authorities, there is a risk that parts of the submitted cost base may not be considered as eligible and therefore repayments may have to be made.

Risks Related to Product Development and Commercialization

We depend heavily on the success of our lead product candidate, lefamulin, which we are developing for CABP and other indications. If we are unable to complete our Phase 3 clinical program for lefamulin for CABP as and when expected and obtain marketing approvals for lefamulin, or if thereafter we fail to commercialize lefamulin or experience significant delays in doing so, our business will be materially harmed.

We have invested a significant portion of our efforts and financial resources in the development of lefamulin. There remains a significant risk that we will fail to successfully develop lefamulin for CABP or any other indication. We do not expect to have top-line data from our Phase 3 clinical program for lefamulin for the treatment of CABP available until the second half of 2017. The timing of the availability of such top-line data and the completion of our Phase 3 clinical program is dependent, in part, on our ability to locate and enroll a sufficient number of eligible patients in our Phase 3 clinical program on a timely basis. A significant delay in enrollment would result in delays to our development timeline and additional development costs beyond what we have budgeted. If we ultimately obtain favorable results from our Phase 3 clinical program for lefamulin for CABP, we do not expect to submit applications for marketing approval for lefamulin for this indication until 2018.

Our ability to generate product revenues, which may not occur for several years, if ever, will depend heavily on our obtaining marketing approval for and commercializing lefamulin. The success of lefamulin will depend on a number of factors, including the following:

- •

- completing our ongoing Phase 3 clinical trials as and when expected;

- •

- obtaining favorable results from clinical trials;

- •

- making arrangements with third-party manufacturers for commercial supply and receiving regulatory approval of our manufacturing processes and

our third-party manufacturers' facilities from applicable regulatory authorities;

- •

- receipt of marketing approvals from applicable regulatory authorities for lefamulin for the treatment of CABP;

- •

- launching commercial sales of lefamulin, if and when approved, whether alone or in collaboration with third parties;

- •

- acceptance of lefamulin, if and when approved, by patients, the medical community and third-party payors;

- •

- effectively competing with other therapies;

- •

- maintaining a continued acceptable safety profile of lefamulin following approval;

- •

- obtaining and maintaining patent and trade secret protection and regulatory exclusivity; and

- •

- protecting our rights in our intellectual property portfolio.

S-16

Successful development of lefamulin for the treatment of additional indications, if any, or for use in other patient populations and our ability, if it is approved, to broaden the label for lefamulin will depend on similar factors.

If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize lefamulin for CABP or for any additional indications, which would materially harm our business.

If clinical trials of lefamulin or any of our other product candidates fail to demonstrate safety and efficacy to the satisfaction of the U.S. Food and Drug Administration, or FDA, regulatory authorities in the European Union, or other regulatory authorities or do not otherwise produce favorable results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of lefamulin or any other product candidate.

Before obtaining marketing approval from regulatory authorities for the sale of any product candidate, we must complete preclinical development and early clinical trials, including Phase 1 clinical trials, in addition to extensive later-stage Phase 3 clinical trials, to demonstrate the safety and efficacy of our product candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. The design of a clinical trial can determine whether its results will support approval of a product, and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced or completed. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their products.