UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

Or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

|

☐ |

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

|

Class of Stock |

|

Shares Outstanding as of May 12, 2022 |

|

|

|

Class A common stock, par value $0.01 per share |

|

|

|

|

|

Class B common stock, par value $0.01 per share |

|

|

|

|

vTv THERAPEUTICS INC. AND SUBSIDIARIES

INDEX TO FORM 10-Q

FOR THE QUARTER ENDED March 31, 2022

|

|

|

|

|

PAGE |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Item 1. |

|

Condensed Consolidated Balance Sheets as of March 31, 2022, (Unaudited) and December 31, 2021 |

|

4 |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

20 |

|

|

|

|

|

|

|

Item 3. |

|

|

28 |

|

|

|

|

|

|

|

|

Item 4. |

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Item 1. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 1A. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 2. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 3. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 4. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 5. |

|

|

29 |

|

|

|

|

|

|

|

|

Item 6. |

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

31 |

|

2

PART I – FINANCIAL INFORMATION

The financial statements and other disclosures contained in this report include those of vTv Therapeutics Inc. (“we”, the “Company” or the “Registrant”), which is the registrant, and those of vTv Therapeutics LLC (“vTv LLC”), which is the principal operating subsidiary of the Registrant. Unless the context suggests otherwise, references in this Quarterly Report on Form 10-Q to the “Company”, “we”, “us” and “our” refer to vTv Therapeutics Inc. and its consolidated subsidiaries.

3

vTv Therapeutics Inc.

Condensed Consolidated Balance Sheets

(in thousands, except number of shares and per share data)

|

|

March 31, |

|

|

December 31, |

|

||

|

|

2022 |

|

|

2021 |

|

||

|

|

(Unaudited) |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

|

|

|

$ |

|

|

|

Accounts receivable |

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

|

Current deposits |

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

|

|

|

|

|

|

|

Long-term investments |

|

|

|

|

|

|

|

|

Total assets |

$ |

|

|

|

$ |

|

|

|

Liabilities, Redeemable Noncontrolling Interest and Stockholders’ Deficit |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

$ |

|

|

|

$ |

|

|

|

Current portion of operating lease liabilities |

|

|

|

|

|

|

|

|

Current portion of contract liabilities |

|

|

|

|

|

|

|

|

Current portion of notes payable |

|

— |

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

Operating lease liabilities, net of current portion |

|

|

|

|

|

|

|

|

Warrant liability, related party |

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

|

|

Class A Common Stock, $ shares outstanding as of March 31, 2022, and December 31, 2021 |

|

|

|

|

|

|

|

|

Class B Common Stock, $ outstanding as of March 31, 2022, and December 31, 2021 |

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

Accumulated deficit |

|

( |

) |

|

|

( |

) |

|

Total stockholders’ deficit attributable to vTv Therapeutics Inc. |

|

( |

) |

|

|

( |

) |

|

Total liabilities, redeemable noncontrolling interest and stockholders’ deficit |

$ |

|

|

|

$ |

|

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

vTv Therapeutics Inc.

Condensed Consolidated Statements of Operations - Unaudited

(in thousands, except number of shares and per share data)

|

|

Three Months Ended |

|

|||||

|

|

March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

Revenue |

$ |

|

|

|

$ |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

|

|

|

|

|

|

Operating loss |

|

( |

) |

|

|

( |

) |

|

Other expense |

|

( |

) |

|

|

— |

|

|

Other income (expense) – related party |

|

|

|

|

|

( |

) |

|

Interest income |

|

— |

|

|

|

|

|

|

Interest expense |

|

( |

) |

|

|

— |

|

|

Loss before income taxes and noncontrolling interest |

|

( |

) |

|

|

( |

) |

|

Income tax provision |

|

|

|

|

|

|

|

|

Net loss before noncontrolling interest |

|

( |

) |

|

|

( |

) |

|

Less: net loss attributable to noncontrolling interest |

|

( |

) |

|

|

( |

) |

|

Net loss attributable to vTv Therapeutics Inc. |

$ |

( |

) |

|

$ |

( |

) |

|

Net loss attributable to vTv Therapeutics Inc. common shareholders |

$ |

( |

) |

|

$ |

( |

) |

|

Net loss per share of vTv Therapeutics Inc. Class A Common Stock, basic and diluted |

$ |

( |

) |

|

$ |

( |

) |

|

Weighted-average number of vTv Therapeutics Inc. Class A Common Stock, basic and diluted |

|

|

|

|

|

|

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

5

vTv Therapeutics Inc.

Condensed Consolidated Statement of Changes in Redeemable Noncontrolling Interest and Stockholders’ Deficit - Unaudited

(in thousands, except number of shares)

|

For the three months ended March 31, 2022 |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Class A Common Stock |

|

|

Class B Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Redeemable Noncontrolling Interest |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders' Deficit |

|

||||||||||

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

) |

|

$ |

(9,740 |

) |

||

|

|

|

(2,417 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

( |

) |

|

|

(7,007 |

) |

||

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

476 |

|

|

|

|

|

|

|

476 |

|

||

noncontrolling interest |

|

(8,178 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

8,178 |

|

||

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

) |

|

$ |

(8,093 |

) |

||

|

For the three months ended March 31, 2021 |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Class A Common Stock |

|

|

Class B Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Redeemable Noncontrolling Interest |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Additional Paid-in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders' Deficit |

|

||||||||||

|

Balances at December 31, 2020 |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

) |

|

$ |

(80,102 |

) |

||

|

Net loss |

|

(1,701 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

( |

) |

|

|

(4,241 |

) |

||

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

436 |

|

|

|

|

|

|

|

436 |

|

||

|

Exchange of Class B Common Stock for Class A Common Stock |

|

|

|

|

|

361 |

|

|

|

|

|

|

|

(361 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

||

|

Exercise of stock options |

|

|

|

|

|

20,833 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

|

47 |

|

||

|

Issuance of Class A Common Stock under LPC Agreement |

|

|

|

|

|

|

|

|

|

35 |

|

|

|

— |

|

|

|

|

|

|

|

8,003 |

|

|

|

|

|

|

|

8,038 |

|

||

|

Change in redemption value of noncontrolling interest |

|

(19,547 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

19,547 |

|

||

|

Balances at March 31, 2021 |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

) |

|

$ |

(56,275 |

) |

||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

6

vTv Therapeutics Inc.

Condensed Consolidated Statements of Cash Flows - Unaudited

(in thousands)

|

|

|

Three Months Ended March 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss before noncontrolling interest |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss before noncontrolling interest to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

|

|

|

|

|

|

|

Change in fair value of investments |

|

|

|

|

|

|

— |

|

|

Change in fair value of warrants, related party |

|

|

( |

) |

|

|

|

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

— |

|

|

|

|

|

|

Prepaid expenses and other assets |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

|

|

|

|

|

( |

) |

|

Contract liabilities |

|

|

— |

|

|

|

( |

) |

|

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of Class A Common Stock, net of offering costs |

|

|

— |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

— |

|

|

|

|

|

|

Repayment of notes payable |

|

|

( |

) |

|

|

( |

) |

|

Net cash (used in) provided by financing activities |

|

|

( |

) |

|

|

|

|

|

Net (decrease) increase in cash, cash equivalents and restricted cash and cash equivalents |

|

|

( |

) |

|

|

|

|

|

Total cash, cash equivalents and restricted cash and cash equivalents, beginning of period |

|

|

|

|

|

|

|

|

|

Total cash, cash equivalents and restricted cash and cash equivalents, end of period |

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash activities: |

|

|

|

|

|

|

|

|

|

Change in redemption value of noncontrolling interest |

|

$ |

( |

) |

|

$ |

( |

) |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

7

vTv Therapeutics Inc.

Notes to Condensed Consolidated Financial Statements – Unaudited

(dollar amounts are in thousands, unless otherwise noted)

|

Note 1: |

Description of Business, Basis of Presentation and Going Concern |

Description of Business

vTv Therapeutics Inc. (the “Company,” the “Registrant,” “we” or “us”) was incorporated in the state of Delaware in April 2015. The Company is a clinical-stage pharmaceutical company focused on treating metabolic diseases to minimize their long-term complications through end-organ protection.

Principles of Consolidation

vTv Therapeutics Inc. is a holding company, and its principal asset is a controlling equity interest in vTv Therapeutics LLC (“vTv LLC”), the Company’s principal operating subsidiary, which is a clinical stage biopharmaceutical company engaged in the discovery and development of orally administered small molecule drug candidates to fill significant unmet medical needs.

The Company has determined that vTv LLC is a variable-interest entity (“VIE”) for accounting purposes and that vTv Therapeutics Inc. is the primary beneficiary of vTv LLC because (through its managing member interest in vTv LLC and the fact that the senior management of vTv Therapeutics Inc. is also the senior management of vTv LLC) it has the power and benefits to direct all of the activities of vTv LLC, which include those that most significantly impact vTv LLC’s economic performance. vTv Therapeutics Inc. has therefore consolidated vTv LLC’s results pursuant to Accounting Standards Codification Topic 810, “Consolidation” in its Condensed Consolidated Financial Statements. As of March 31, 2022, various holders own non-voting interests in vTv LLC, representing a

Going Concern and Liquidity

To date, the Company has not generated any product revenue and has not achieved profitable operations. The continuing development of our drug candidates will require additional financing. From its inception through March 31, 2022, the Company has funded its operations primarily through a combination of private placements of common and preferred equity, research collaboration agreements, upfront and milestone payments for license agreements, debt and equity financings and the completion of its IPO in August 2015. As of March 31, 2022, the Company had an accumulated deficit of $

As of March 31, 2022, the Company’s liquidity sources included cash and cash equivalents of $

8

number of registered shares. However, the ability to use these sources of capital is dependent on a number of factors, including the prevailing market price of and the volume of trading in the Company’s Class A Common Stock. See Note 9 for further details.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. If we are unable to raise additional capital as and when needed, or upon acceptable terms, such failure would have a significant negative impact on our financial condition.

The Company’s financial statements have been prepared assuming the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. The Consolidated Financial Statements do not include adjustments to reflect the possible future effects on the recoverability and classification of recorded assets or the amounts of liabilities that might be necessary should the Company be unable to continue as a going concern.

|

Note 2: |

Summary of Significant Accounting Policies |

Unaudited Interim Financial Information

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The accompanying Condensed Consolidated Balance Sheet as of March 31, 2022, Condensed Consolidated Statements of Operations for the three months ended March 31, 2022 and 2021, Condensed Consolidated Statement of Changes in Redeemable Noncontrolling Interest and Stockholders’ Deficit for the three months ended March 31, 2022 and 2021 and Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2022 and 2021 are unaudited. These unaudited financial statements have been prepared in accordance with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. These financial statements should be read in conjunction with the audited financial statements and the accompanying notes for the year ended December 31, 2021 contained in the Company’s Annual Report on Form 10-K. The unaudited interim financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments (consisting of normal recurring adjustments) necessary to state fairly the Company’s financial position as of March 31, 2022, the results of operations for the three months ended March 31, 2022 and 2021 and cash flows for the three months ended March 31, 2022 and 2021. The December 31, 2021 Condensed Consolidated Balance Sheet included herein was derived from the audited financial statements but does not include all disclosures or notes required by GAAP for complete financial statements.

The financial data and other information disclosed in these notes to the financial statements related to the three months ended March 31, 2022 and 2021 are unaudited. Interim results are not necessarily indicative of results for an entire year.

The Company does not have any components of other comprehensive income recorded within its Condensed Consolidated Financial Statements, and, therefore, does not separately present a statement of comprehensive income in its Condensed Consolidated Financial Statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the grant date fair value of equity awards, the fair value of warrants to purchase shares of its Class A Common Stock, the fair value of the Class B Common Stock, the useful lives of property and equipment, the fair value of derivative liabilities, and the fair value of the Company’s debt, among others. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

Concentration of Credit Risk

Financial instruments that potentially expose the Company to concentrations of credit risk consist principally of cash on deposit with one financial institution. The balances of these cash accounts frequently exceed insured limits.

Cash and Cash Equivalents

The Company considers any highly liquid investments with an original maturity of three months or less to be cash and cash equivalents.

9

Investments

Investments in entities in which the Company has no control or significant influence, is not the primary beneficiary, and have a readily determinable fair value are classified as equity investments with readily determinable fair value. The investments are measured at fair value based on a quoted market price per unit in active markets multiplied by the number of units held without consideration of transaction costs (Level 1). Gains and losses are recorded in other income (expense), net on the Consolidated Statements of Operations.

Equity investments without readily determinable fair value include ownership rights that do not provide the Company with control or significant influence and these investments do not have readily determinable fair values. The Company has elected to measure its equity investments without readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or similar investment.

Revenue Recognition

The Company uses the revenue recognition guidance established by ASC Topic 606, “Revenue From Contracts With Customers” (“ASC Topic 606”).

The majority of the Company’s revenue results from its license and collaboration agreements associated with the development of investigational drug products. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. For each contract meeting these criteria, the Company identifies the performance obligations included within the contract. A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. The Company then recognizes revenue under each contract as the related performance obligations are satisfied.

The transaction price under the contract is determined based on the value of the consideration expected to be received in exchange for the transferred assets or services. Development, regulatory and sales milestones included in the Company’s collaboration agreements are considered to be variable consideration. The amount of variable consideration expected to be received is included in the transaction price when it becomes probable that the milestone will be met. For contracts with multiple performance obligations, the contract’s transaction price is allocated to each performance obligation using the Company’s best estimate of the standalone selling price of each distinct good or service in the contract. The primary method used to estimate standalone selling price is the expected cost plus margin approach. Revenue is recognized over the related period over which the Company expects the services to be provided using a proportional performance model or a straight-line method of recognition if there is no discernable pattern over which the services will be provided.

Research and Development

Major components of research and development costs include cash and share-based compensation, costs of preclinical studies, clinical trials and related clinical manufacturing, costs of drug development, costs of materials and supplies, regulatory and compliance costs, fees paid to consultants and other entities that conduct certain research and development activities on the Company’s behalf, facilities costs, and overhead costs. Research and development costs are expensed as incurred.

The Company records accruals based on estimates of the services received, efforts expended, and amounts owed pursuant to contracts with numerous contract research organizations. In the normal course of business, the Company contracts with third parties to perform various clinical study activities in the ongoing development of potential products. The financial terms of these agreements are subject to negotiation and variation from contract to contract and may result in uneven payment flows. Payments under the contracts depend on factors such as the achievement of certain events and the completion of portions of the clinical study or similar conditions. The objective of the Company’s accrual policy is to match the recording of expenses in its financial statements to the actual services received and efforts expended. As such, expense accruals related to clinical studies are recognized based on the Company’s estimate of the degree of completion of the event or events specified in the specific clinical study.

The Company records nonrefundable advance payments it makes for future research and development activities as prepaid expenses. Prepaid expenses are recognized as expense in the Condensed Consolidated Statements of Operations as the Company receives the related goods or services.

Research and development costs that are reimbursed under a cost-sharing arrangement are reflected as a reduction of research and development expense.

Recently Issued Accounting Pronouncements

There have been no recently issued accounting pronouncements which are expected to have a material impact on the Company’s financial statements.

10

|

Note 3: |

Collaboration Agreements |

Reneo License Agreement

The Company is party to a license agreement with Reneo Pharmaceuticals, Inc. (“Reneo”) (the “Reneo License Agreement”), under which Reneo obtained an exclusive, worldwide, sublicensable license to develop and commercialize the Company’s peroxisome proliferation activated receptor delta (PPAR-δ) agonist program, including the compound HPP593, for therapeutic, prophylactic or diagnostic application in humans.

The Company has fully allocated the transaction price to the license and the technology transfer services, which represents a single combined performance obligation because they were not capable of being distinct on their own. The revenue related to this performance obligation was recognized on a straight-line basis over the technology transfer service period.

The revenue related to this performance obligation has been fully recognized and

Huadong License Agreement

The Company is party to a License Agreement with Hangzhou Zhongmei Huadong Pharmaceutical Co., Ltd. (“Huadong”) (the “Huadong License Agreement”), under which Huadong obtained an exclusive and sublicensable license to develop and commercialize the Company’s glucagon-like peptide-1 receptor agonist (“GLP-1r”) program, including the compound TTP273, for therapeutic uses in humans or animals, in China and certain other pacific rim countries, including Australia and South Korea (collectively, the “Huadong License Territory”). Additionally, under the Huadong License Agreement, the Company obtained a non-exclusive, sublicensable, royalty-free license to develop and commercialize certain Huadong patent rights and know-how related to the Company’s GLP-1r program for therapeutic uses in humans or animals outside of the Huadong License Territory.

On January 14, 2021, the Company entered into the First Huadong Amendment which eliminated the Company’s obligation to sponsor a multi-region clinical trial (the “Phase 2 MRCT”), and corresponding obligation to contribute up to $

Prior to the First Amendment, the Company had allocated a portion of the transaction price to the obligation to sponsor and conduct a portion of the Phase 2 MRCT. Upon the removal of this performance obligation, the Company evaluated the impact of the modification under the provisions of ASC Topic 606 and performed a reallocation of the transaction price among the remaining performance obligations. This resulted in the recognition of approximately $

The significant performance obligations under this license agreement, as amended, were determined to be (i) the exclusive license to develop and commercialize the Company’s GLP-1r program, (ii) technology transfer services related to the chemistry and manufacturing know-how for a defined period after the effective date, (iii) the Company’s obligation to participate on a joint development committee (the “JDC”), and (iv) other obligations considered to be de minimis in nature.

The Company has determined that the license and technology transfer services related to the chemistry and manufacturing know-how represent a combined performance obligation because they were not capable of being distinct on their own. The Company also determined that there was no discernable pattern in which the technology transfer services would be provided during the transfer service period. As such, the Company recognized the revenue related to this combined performance obligation using the straight-line method over the transfer service period. This combined performance obligation was considered complete as of March 31, 2021. The Company recognized $

A portion of the transaction price allocated to the obligation to participate in the joint development committee (the “JDC”) to oversee the development of products and the Phase 2 MRCT in accordance with the development plan remained deferred as of March 31, 2022 and revenue will be recognized using the proportional performance model over the period of the Company’s participation on the JDC. The unrecognized amount of the transaction price allocated to this performance obligation as of March 31, 2022 was de minimis.

11

There have been

Newsoara License Agreement

The Company is party to a license agreement with Newsoara Biopharma Co., Ltd., (“Newsoara”) (the “Newsoara License Agreement”) under which Newsoara obtained an exclusive and sublicensable license to develop and commercialize the Company’s phosphodiesterase type 4 inhibitors (“PDE4”) program, including the compound HPP737, in China, Hong Kong, Macau, Taiwan and other pacific rim countries (collectively, the “Newsoara License Territory”). Additionally, under the Newsoara License Agreement, the Company obtained a non-exclusive, sublicensable, royalty-free license to develop and commercialize certain Newsoara patent rights and know-how related to the Company’s PDE4 program for therapeutic uses in humans outside of the Newsoara License Territory.

The Company has fully allocated the transaction price to the license and the technology transfer services which represents a single performance obligation because they were not capable of being distinct on their own. The Company recognized revenue for this performance obligation using the straight-line method over the transfer service period. The revenue for this performance obligation has been fully recognized as of March 31, 2022.

Anteris License Agreement

On December 11, 2020, we entered into a license agreement with Anteris Bio, Inc. (“Anteris”) (the “Anteris License Agreement”), under which Anteris obtained a worldwide, exclusive and sublicensable license to develop and commercialize the Company’s Nrf2 activator, HPP971.

Under the terms of the Anteris License Agreement, Anteris paid the Company an initial license fee of $

Pursuant to the terms of the Anteris License Agreement, the Company was required to provide technology transfer services for a 30 day period after the effective date. In accordance with ASC Topic 606, the Company identified all of the performance obligations at the inception of the Anteris License Agreement. The significant obligations were determined to be the license and the technology transfer services. The Company has determined that the license and technology transfer services represent a single performance obligation because they were not capable of being distinct on their own. The transaction price has been fully allocated to this combined performance obligation and consisted of the $

JDRF Agreement

In August 2017, the Company entered into a research and collaboration agreement with JDRF International (the “JDRF Agreement”) to support the funding of the Simplici-T1 Study, a Phase 2 study to explore the effects of TTP399 in patients with type 1 diabetes. The JDRF Agreement was amended in June 2021 to provide additional funding for the Company’s mechanistic study exploring the effects of TTP399 on ketone body formation during a period of insulin withdrawal in people with type 1 diabetes. According to the terms of the JDRF Agreement, JDRF will provide research funding of up to $

Payments that the Company receives from JDRF under this agreement will be recorded as restricted cash and current liabilities and recognized as an offset to research and development expense, based on the progress of the project, and only to the extent that the restricted cash is utilized to fund such development activities. As of March 31, 2022, the Company had received funding under this agreement of $

12

Contract Liabilities

Contract liabilities related to the Company’s collaboration agreements consisted of the following (in thousands):

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

Current portion of contract liabilities |

$ |

|

|

|

$ |

|

|

|

Total contract liabilities |

$ |

|

|

|

$ |

|

|

|

Note 4: |

Share-Based Compensation |

The Company has issued non-qualified stock option awards to management, other key employees, consultants and non-employee directors. These option awards vest ratably over a period and the option awards expire after a term of

On February 27, 2022, Ms. Deepa Prasad notified the Board of Directors (the “Board”) of vTv Therapeutics Inc. (the “Company”) of her decision to resign from her positions as Chief Executive Officer, President and Board member, effective as of March 29, 2022, and has agreed to continue serving in those roles until the earlier of the completion of a certain Company milestone or March 29, 2022 (the “Effective Date”). Ms. Prasad has agreed to serve as a Strategic Advisor to the Company for six months after the Effective Date. Ms. Prasad will retain

The following table summarizes the activity related to the stock option awards for the three months ended March 31, 2022:

|

|

Number of Shares |

|

|

Weighted- Average Exercise Price |

|

||

|

Awards outstanding at December 31, 2021 |

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

|

|

|

Forfeited |

|

( |

) |

|

|

|

|

|

Awards outstanding at March 31, 2022 |

|

|

|

|

$ |

|

|

|

Options exercisable at March 31, 2022 |

|

|

|

|

$ |

|

|

|

Weighted average remaining contractual term |

|

|

|

|

|

|

|

|

Options vested and expected to vest at March 31, 2022 |

|

|

|

|

$ |

|

|

|

Weighted average remaining contractual term |

|

|

|

|

|

|

|

Compensation expense related to the grants of stock options is included in research and development and general and administrative expense as follows (in thousands):

|

|

Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

Research and development |

$ |

|

|

|

$ |

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

Total share-based compensation expense |

$ |

|

|

|

$ |

|

|

|

Note 5: |

Investments |

In connection with the Reneo and Anteris License Agreements, the Company has received equity ownership interests of less than

Reneo completed its initial public offering in April 2021. Prior to Reneo becoming a publicly traded company, the Company’s investment in Reneo did not have a readily determinable fair value and was measured at cost less impairment, adjusted for any changes in observable prices, under the measurement alternative. Subsequent to Reneo’s initial public offering, the Company’s

13

investment in Reneo is considered to have a readily determinable fair value and, as such, is adjusted to its fair value each period with changes in fair value recognized as a component of net loss.

The Company’s investment in Anteris does not have a readily determinable fair value and is measured at cost less impairment, adjusted for any changes in observable prices.

The Company’s investments consist of the following:

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

Equity investment with readily determinable fair value: |

|

||||||

|

Reneo common stock |

$ |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Equity investment without readily determinable fair values assessed under the measurement alternative: |

|

||||||

|

Anteris preferred stock |

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

$ |

|

|

No adjustments have been made to the value of the Company’s investment in Anteris since its initial measurement either due to impairment or based on observable price changes. The Company recognized an unrealized loss on its investment in Reneo of $

|

Note 6: |

Commitments and Contingencies |

Legal Matters

From time to time, the Company is involved in various legal proceedings arising in the normal course of business. If a specific contingent liability is determined to be probable and can be reasonably estimated, the Company accrues and discloses the amount. The Company is not currently a party to any material legal proceedings.

Novo Nordisk

In February 2007, the Company entered into an Agreement Concerning Glucokinase Activator Project with Novo Nordisk A/S (the “Novo License Agreement”) whereby the Company obtained an exclusive, worldwide, sublicensable license under certain Novo Nordisk intellectual property rights to discover, develop, manufacture, have manufactured, use and commercialize products for the prevention, treatment, control, mitigation or palliation of human or animal diseases or conditions. As part of this license grant, the Company obtained certain worldwide rights to Novo Nordisk’s GKA program, including rights to preclinical and clinical compounds such as TTP399. This agreement was amended in May 2019 to create milestone payments applicable to certain specific and non-specific areas of therapeutic use. Under the terms of the Novo License Agreement, the Company has additional potential developmental and regulatory milestone payments totaling up to $

|

Note 7: |

Leases |

The Company leases office space for its headquarters location under an operating lease. This lease commenced in November 2019 after the completion of certain tenant improvements made by the lessor. The lease includes an option to renew for a five-year term as well as an option to terminate after three years, neither of which have been recognized as part of its related right of use assets or lease liabilities as their election is not considered reasonably certain. Further, this lease does not include any material residual value guarantee or restrictive covenants.

At each of March 31, 2022 and December 31, 2021, the weighted average incremental borrowing rate for the operating leases held by the Company was

14

Maturities of lease liabilities for the Company’s operating leases as of March 31, 2022 were as follows (in thousands):

|

2022 (remaining nine months) |

$ |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

— |

|

|

Thereafter |

|

— |

|

|

Total lease payments |

|

|

|

|

Less: imputed interest |

|

( |

) |

|

Present value of lease liabilities |

$ |

|

|

Operating lease cost and the related operating cash flows for the three months ended March 31, 2022 and 2021 were immaterial amounts.

|

Note 8: |

Redeemable Noncontrolling Interest |

The Company is subject to the Exchange Agreement with respect to the vTv Units representing the

The redeemable noncontrolling interest is recognized at the higher of (1) its initial fair value plus accumulated earnings/losses associated with the noncontrolling interest or (2) the redemption value as of the balance sheet date. At March 31, 2022 and December 31, 2021, the redeemable noncontrolling interest was recorded based on the redemption value as of the balance sheet date of $

Changes in the Company’s ownership interest in vTv LLC while the Company retains its controlling interest in vTv LLC are accounted for as equity transactions, and the Company is required to adjust noncontrolling interest and equity for such changes.

|

|

For the Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

Net loss attributable to vTv Therapeutics Inc. common shareholders |

$ |

( |

) |

|

$ |

( |

) |

|

Decrease/(Increase) in vTv Therapeutics Inc. accumulated deficit for purchase of LLC Units as a result of common stock issuances |

|

|

|

|

|

( |

) |

|

Change from net loss attributable to vTv Therapeutics Inc. common shareholders and transfers to noncontrolling interest |

$ |

( |

) |

|

$ |

( |

) |

|

Note 9: |

Stockholders’ Equity |

Amendment to Certificate of Incorporation

On May 4, 2021, the Company filed an amendment to its Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to increase the number of shares of Class A Common Stock that the Company is authorized to issue from

15

ATM Offering

In April 2020, the Company entered into the Sales Agreement with Cantor as the sales agent, pursuant to which the Company may offer and sell, from time to time, through Cantor, shares of its Class A Common Stock, par value $

On January 14, 2021, and June 25, 2021, the Company filed a prospectus supplement in connection with the ATM Offering to increase the size of the at-the-market offering pursuant to which the Company may offer and sell, from time to time, through or to Cantor, as sales agent or principal, shares of the Company’s Class A Common Stock, by an aggregate offering price of $

During the three months ended March 31, 2022, and 2021, the Company did

Lincoln Park Capital Transaction

On November 24, 2020, the Company entered into the LPC Purchase Agreement and a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company has the right to sell to Lincoln Park shares of the Company’s Class A Common Stock having an aggregate value of up to $

During the three months March 31, 2022, the Company did

|

Note 10: |

Related-Party Transactions |

MacAndrews & Forbes Incorporated

As of March 31, 2022, subsidiaries and affiliates of MacAndrews & Forbes Incorporated (collectively “MacAndrews”) indirectly controlled

The Company has entered into several agreements with MacAndrews or its affiliates as further detailed below:

Letter Agreements

The Company has previously entered into the Letter Agreements with MacAndrews. Under the terms of the Letter Agreements, the Company has the right to sell to MacAndrews shares of its Class A Common Stock at a specified price per share, and MacAndrews has the right (exercisable up to three times) to require the Company to sell to it shares of Class A Common Stock at the same price. In addition, in connection with and as a commitment fee for the entrance into certain of these Letter Agreements, the Company also issued MacAndrews warrants (the “Letter Agreement Warrants”) to purchase additional shares of the Company’s Class A Common Stock.

The Letter Agreement Warrants have been recorded as warrant liability, related party within the Company’s Condensed Consolidated Balance Sheets based on their fair value. The issuance of the Letter Agreement Warrants was considered to be a cost of equity recorded as a reduction to additional paid-in capital.

Exchange Agreement

The Company and MacAndrews are party to an exchange agreement (the “Exchange Agreement”) pursuant to which the vTv Units (along with a corresponding number of shares of the Class B Common Stock) are exchangeable for (i) shares of the Company’s Class A Common Stock on a -for-one basis or (ii) cash (based on the fair market value of the Class A Common Stock as determined pursuant to the Exchange Agreement), at the Company’s option (as the managing member of vTv LLC), subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. Any decision to require an exchange for cash rather than shares of Class A Common Stock will ultimately be determined by the entire board of directors of vTv Therapeutics Inc. (the “Board of Directors”). As of March 31, 2022, MacAndrews had not exchanged any shares under the provisions of the Exchange Agreement.

16

Tax Receivable Agreement

As no shares have been exchanged by MacAndrews pursuant to the Exchange Agreement (discussed above), the Company has not recognized any liability nor has it made any payments pursuant to the Tax Receivable Agreement as of March 31, 2022.

Investor Rights Agreement

The Company is party to an investor rights agreement with M&F, as successor in interest to vTv Therapeutics Holdings (the “Investor Rights Agreement”). The Investor Rights Agreement provides M&F with certain demand, shelf and piggyback registration rights with respect to its shares of Class A Common Stock and also provides M&F with certain governance rights, depending on the size of its holdings of Class A Common Stock. Under the Investor Rights Agreement, M&F was initially entitled to nominate a majority of the members of the Board of Directors and designate the members of the committees of the Board of Directors.

|

Note 11: |

Income Taxes |

The Company is subject to U.S. federal income taxes as well as state taxes. The Company’s income tax provision for the three months ended March 31, 2022, was $

Management has evaluated the positive and negative evidence surrounding the realization of its deferred tax assets, including the Company’s history of losses, and under the applicable accounting standards determined that it is more-likely-than-not that the deferred tax assets will not be realized. The difference between the effective tax rate of the Company and the U.S. statutory tax rate of

As discussed in Note 9, the Company is party to a tax receivable agreement with a related party which provides for the payment by the Company to M&F (or certain of its transferees or other assignees) of

|

Note 12: |

Net Loss per Share |

Basic loss per share is computed by dividing net loss attributable to vTv Therapeutics Inc. by the weighted-average number of shares of Class A Common Stock outstanding during the period. Diluted loss per share is computed giving effect to all potentially dilutive shares. Diluted loss per share for all periods presented is the same as basic loss per share as the inclusion of potentially issuable shares would be antidilutive.

A reconciliation of the numerator and denominator used in the calculation of basic and diluted net loss per share of Class A Common Stock is as follows (in thousands, except share and per share amounts):

|

|

For the Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

Numerator: |

|

|

|

|

|

|

|

|

Net loss |

$ |

( |

) |

|

$ |

( |

) |

|

Less: Net loss attributable to noncontrolling interests |

|

( |

) |

|

|

( |

) |

|

Net loss attributable to common shareholders of vTv Therapeutics Inc., basic and diluted |

|

( |

) |

|

|

( |

) |

|

Denominator: |

|

|

|

|

|

|

|

|

Weighted-average vTv Therapeutics Inc. Class A Common Stock, basic and diluted |

|

|

|

|

|

|

|

|

Net loss per share of vTv Therapeutics Inc. Class A Common Stock, basic and diluted |

$ |

( |

) |

|

$ |

( |

) |

17

Potentially dilutive securities not included in the calculation of diluted net loss per share are as follows:

|

|

March 31, 2022 |

|

|

March 31, 2021 |

|

||

|

Class B Common Stock (1) |

|

|

|

|

|

|

|

|

Common stock options granted under the Plan |

|

|

|

|

|

|

|

|

Common stock warrants |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

(1) |

|

|

Note 13: |

Fair Value of Financial Instruments |

The carrying amount of certain of the Company’s financial instruments, including cash and cash equivalents, net accounts receivable, accounts payable, and other accrued liabilities, approximate fair value due to their short-term nature.

During the year ended December 31, 2021, Reneo completed its initial public offering. As a result, the fair value of the Company’s investment in Reneo’s common stock now has a readily determinable market value and is no longer eligible for the practical expedient for investments without readily determinable fair market values.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The Company evaluates its financial assets and liabilities subject to fair value measurements on a recurring basis to determine the appropriate level in which to classify them for each reporting period. This determination requires significant judgments.

|

|

Balance at March 31, 2022 |

|

|

Quoted Prices in Active Markets for Identical Assets (Level 1) |

|

|

Significant Other Observable Inputs (Level 2) |

|

|

Significant Unobservable Inputs (Level 3) |

|

||||

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity securities with readily determinable fair value |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability, related party (1) |

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Total |

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

|

Balance at December 31, 2021 |

|

|

Quoted Prices in Active Markets for Identical Assets (Level 1) |

|

|

Significant Other Observable Inputs (Level 2) |

|

|

Significant Unobservable Inputs (Level 3) |

|

||||

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity securities with readily determinable fair value |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability, related party (1) |

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Total |

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

(1) |

Fair value determined using the Black-Scholes option pricing model. Expected volatility is based on the historical volatility of the Company’s common stock over the most recent period. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of valuation. |

18

|

|

Changes in Level 3 instruments for the three months ended March 31, |

|

|||||||||||||||||

|

|

Balance at January 1 |

|

|

Net Change in fair value included in earnings |

|

|

Purchases / Issuance |

|

|

Sales / Repurchases |

|

|

Balance at March 31, |

|

|||||

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability, related party |

$ |

|

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Total |

$ |

|

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability, related party |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

There were

The fair value of the Letter Agreement Warrants was determined using the Black-Scholes option pricing model or option pricing models based on the Company’s current capitalization. Expected volatility is based on the historical volatility of the Company’s common stock over the most recent period. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of valuation.

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

|

|

Range |

Weighted Average |

|

|

Range |

Weighted Average |

|

|

Expected volatility |

|

|

|

|

|

|

|

|

Risk-free interest rate |

|

|

|

|

|

|

|

The weighted average expected volatility and risk-free interest rate was based on the relative fair values of the warrants.

Changes in the unobservable inputs noted above would impact the amount of the liability for the Letter Agreement Warrants. Increases (decreases) in the estimates of the Company’s annual volatility would increase (decrease) the liability and an increase (decrease) in the annual risk-free rate would increase (decrease) the liability.

|

Note 14: |

Subsequent Events |

The Company evaluated subsequent events through May 12, 2022 and determined that there have been no events that have occurred that would require adjustments to our disclosures or the unaudited condensed consolidated financial statements.

19

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

As used in this Quarterly Report on Form 10-Q, the “Company”, the “Registrant”, “we” or “us” refer to vTv Therapeutics Inc. and “vTv LLC” refers to vTv Therapeutics LLC. The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes that appear elsewhere in this report. In addition to historical financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, assumptions and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this report under “Part II, Other Information—Item 1A, Risk Factors.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies and operations, financing plans, potential growth opportunities, potential market opportunities, potential results of our drug development efforts or trials, and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s plans, estimates, assumptions and beliefs only as of the date of this report. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Company Overview

We are a clinical-stage pharmaceutical company focused on treating metabolic and inflammatory diseases to minimize their long- term complications and improve the lives of patients. We have an innovative pipeline of first-in-class small molecule clinical and pre- clinical drug candidates. Our lead program is TTP399, an orally administered, small molecule, liver-selective glucokinase activator (“GKA”) for the treatment of type 1 diabetes.

Recent Developments

Based upon the positive results of our Simplici-T1 Study, we requested Breakthrough Therapy Designation (“BTD”) with the FDA which was granted in April 2021. In October 2021, we began to implement a strategy to focus our efforts on the continued development of TTP399 as a potential treatment for patients with type 1 diabetes (“T1D”).

After several meetings with the FDA BTD-team, the Company is planning two pivotal, placebo-controlled clinical trials of TTP399 in subjects with T1D. The studies will recruit a total of approximately 1000 patients and at least one of the studies will be one year of treatment. The FDA confirmed that the effect size of TTP399 on events of hypoglycemia as demonstrated in the Phase 2 SimpliciT-1 Study is clinically meaningful and has agreed on the primary endpoint for the studies as the difference between placebo and TTP399-treated group in number of hypoglycemia events.

The results of the mechanistic study provided additional evidence to support the idea that treatment with TTP399 will not increase the risk of diabetic ketoacidosis (“DKA”) in patients with T1D. The data demonstrate that in contrast to agents such as SGLT2 inhibitors and GLP‐1RAs, TTP399 does not increase the risk of ketoacidosis when used as an adjunctive therapy to insulin in individuals with T1D. Moreover, these findings support prior studies that demonstrate that TTP399 improves glucose control and reduces hypoglycemia and suggests a protective effect of TTP399 against acidosis in people with T1D. Thus, accumulating data suggest that TTP399 has robust potential as an adjunctive therapy for T1D. Full study results will be published in the Diabetes Obesity and Metabolism journal in conjunction with the 82nd American Diabetes Association Scientific Sessions on June 6th, 2022.

20

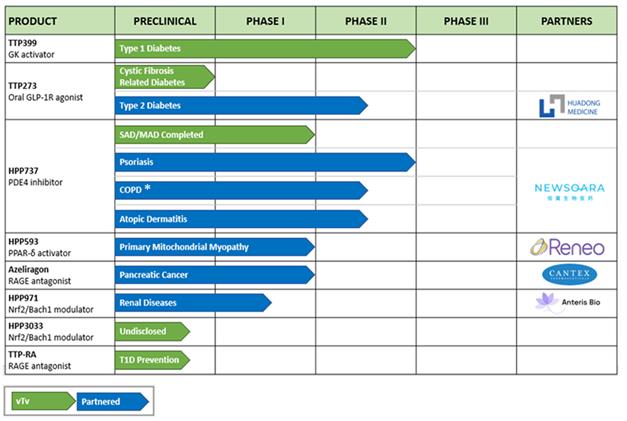

The following table summarizes our drug candidates, their partnership status and their respective stages of development:

* Chronic obstructive pulmonary disease

Our Type 1 Diabetes Program – TTP399

The Company is planning two pivotal, placebo-controlled clinical trials of TTP399 in subjects with T1D and has engaged with the Food and Drug Administration (FDA) on the optimal clinical trial designs for these studies. The studies will recruit a total of approximately 1000 patients and at least one of the studies will be one year of treatment. The FDA and the company have agreed on the primary endpoint for the studies as the difference between placebo and TTP399-treated group in number of hypoglycemia events. These pivotal studies are expected to start in 3Q 2022.

In October 2021, we announced positive results of a mechanistic study of TTP399 in patients with T1D. The study demonstrated that patients with T1D taking TTP399 experienced no increase in ketone levels relative to placebo during a period of acute insulin withdrawal, indicating no increased risk of ketoacidosis. Consistent with previous clinical studies, improved fasting plasma glucose levels and fewer hypoglycemic events were observed in the TTP399 treated group during the week of treatment prior to the insulin withdrawal test. The U.S. Food and Drug Administration (“FDA”) has declined to approve SGLT2 inhibitors as an adjunctive therapy in T1D, with concerns over the potential risks of diabetic ketoacidosis (“DKA”) in focus. DKA can lead to hospitalization and, if untreated, death. In order to address these concerns, vTv, following the FDA’s recommendation, conducted this mechanistic study to demonstrate that treatment with TTP399, a liver-selective glucokinase activator, will not result in increased production of ketones, a precursor to ketoacidosis.

In April 2021, we announced that the FDA granted BTD for TTP399 as an adjunctive therapy to insulin for the treatment of T1D. This designation provides a sponsor with added support and the potential to expedite development and review timelines for a promising new investigational medicine.

Holding Company Structure

vTv Therapeutics Inc. is a holding company, and its principal asset is a controlling equity interest in vTv Therapeutics LLC (“vTv LLC”), the principal operating subsidiary. We have determined that vTv LLC is a variable-interest entity (“VIE”) for accounting purposes and that vTv Therapeutics Inc. is the primary beneficiary of vTv LLC because (through its managing member interest in vTv LLC and the fact that the senior management of vTv Therapeutics Inc. is also the senior management of vTv LLC) it has the power to direct all of the activities of vTv LLC, which include those that most significantly impact vTv LLC’s economic performance. vTv Therapeutics Inc. has therefore consolidated vTv LLC’s results under the VIE accounting model in its consolidated financial statements.

21

Financial Overview

Revenue

To date, we have not generated any revenue from drug sales. Our revenue has been primarily derived from up-front proceeds, milestones and research fees under collaboration and license agreements.

In the future, we may generate revenue from a combination of product sales, license fees, milestone payments and royalties from the sales of products developed under licenses of our intellectual property. We expect that any revenue we generate will fluctuate from quarter to quarter as a result of the timing and amount of license fees, milestone and other payments, and the amount and timing of payments that we receive upon the sale of our products, to the extent any are successfully commercialized. If we fail to complete the development of our drug candidates in a timely manner or obtain regulatory approval for them, our ability to generate future revenue and our results of operations and financial position will be materially adversely affected.

Research and Development Expenses

Since our inception, we have focused our resources on our research and development activities, including conducting preclinical studies and clinical trials, manufacturing development efforts and activities related to regulatory filings for our drug candidates. We recognize research and development expenses as they are incurred. Our direct research and development expenses consist primarily of external costs such as fees paid to investigators, consultants, central laboratories and clinical research organizations (“CRO(s)”) in connection with our clinical trials, and costs related to acquiring and manufacturing clinical trial materials. Our indirect research and development costs consist primarily of cash and share-based compensation costs, the cost of employee benefits and related overhead expenses for personnel in research and development functions. Since we typically use our employee and infrastructure resources across multiple research and development programs such costs are not allocated to the individual projects.

From our inception, including our predecessor companies, through March 31, 2022, we have incurred approximately $603.2 million in research and development expenses.

Our research and development expenses by project for the three months ended March 31, 2022 and 2021 were as follows (in thousands):

|

|

Three Months Ended March 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

|

Direct research and development expense: |

|

|

|

|

|

|

|

|

Azeliragon |

$ |

40 |

|

|

$ |

712 |

|

|

TTP399 |

|

2,496 |

|

|

|

268 |

|

|

HPP737 |

|

53 |

|

|

|

1,055 |

|

|

Other projects |

|

13 |

|

|

|

76 |

|

|

Indirect research and development expense |

|

531 |

|

|

|

992 |

|

|

Total research and development expense |

$ |

3,133 |

|

|

$ |

3,103 |

|

We plan to continue to incur significant research and development expenses for the foreseeable future as we continue the development of TTP399 and further advance the development of our other drug candidates, subject to the availability of additional funding.