ff_ex992

TSX:

FF | OTCQX: FFMGF | FRANKFURT: FMG

MANAGEMENT’S

DISCUSSION & ANALYSIS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021

Suite 2070 – 1188 West Georgia Street, Vancouver, British

Columbia V6E 4A2

www.firstmininggold.com |

1-844-306-8827

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

TABLE OF CONTENTS

|

COMPANY

OVERVIEW AND STRATEGY

|

2

|

|

2021

HIGHLIGHTS

|

2

|

|

SELECTED

FINANCIAL INFORMATION

|

4

|

|

ONTARIO

MINERAL PROPERTY PORTFOLIO LOCATIONS (1)

|

5

|

|

MINERAL

PROPERTY PORTFOLIO GOLD RESERVES (1)

|

6

|

|

MINERAL

PROPERTY PORTFOLIO GOLD RESOURCES (1)

|

7

|

|

MINERAL

PROPERTY PORTFOLIO REVIEW

|

8

|

|

SELECTED

QUARTERLY FINANCIAL INFORMATION

|

18

|

|

RESULTS

OF CONTINUING OPERATIONS

|

19

|

|

FINANCIAL

CONDITION, LIQUIDITY AND CAPITAL RESOURCES

|

21

|

|

FINANCIAL

INSTRUMENTS

|

22

|

|

RELATED

PARTY TRANSACTIONS

|

22

|

|

OFF-BALANCE

SHEET ARRANGEMENTS

|

22

|

|

NON-IFRS

MEASURES

|

23

|

|

ACCOUNTING

POLICIES

|

23

|

|

CRITICAL

ACCOUNTING ESTIMATES

|

23

|

|

CRITICAL

ACCOUNTING JUDGMENTS

|

23

|

|

ACCOUNTING

STANDARDS ISSUED BUT NOT YET APPLIED

|

24

|

|

RISKS

AND UNCERTAINTIES

|

24

|

|

QUALIFIED

PERSONS

|

27

|

|

SECURITIES

OUTSTANDING

|

27

|

|

MANAGEMENT’S

REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

|

28

|

|

FORWARD-LOOKING

INFORMATION

|

29

|

|

CAUTIONARY

NOTE TO U.S. INVESTORS REGARDING MINERAL RESOURCE AND MINERAL

RESERVE ESTIMATES

|

30

|

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

GENERAL

This

Management’s Discussion and Analysis (“MD&A”) should be read in

conjunction with the unaudited condensed interim consolidated

financial statements of First Mining Gold Corp. (the

“Company” or

“First Mining”)

for the three and nine months ended September 30, 2021, which are

prepared in accordance with International Financial Reporting

Standards (“IFRS”) as applicable to the

preparation of interim financial statements, including

International Accounting Standard IAS 34 Interim Reporting. The

unaudited condensed interim consolidated financial statements

should also be read in conjunction with the Company’s audited

consolidated financial statements for the year ended December 31,

2020, which are prepared in accordance with IFRS as issued by the

International Accounting Standards Board. These documents along

with additional information on the Company, including the

Company’s Annual Information Form for the year ended December

31, 2020, are available under the Company’s SEDAR profile at

www.sedar.com,

on EDGAR at www.sec.gov.,

and on the Company’s website at www.firstmininggold.com.

In this

MD&A, unless the context otherwise requires, references to the

“Company”, “First Mining”,

“we”, “us”, and “our” refer to

First Mining Gold Corp. and its subsidiaries.

This

MD&A contains “forward-looking statements” and

“forward-looking information” within the meaning of

applicable Canadian securities laws. See the section of this

MD&A titled “Forward-Looking Information” for

further details. In addition, this MD&A has been prepared

in accordance with the requirements of Canadian securities laws,

which differ in certain material respects from the disclosure

requirements of United States securities laws, particularly with

respect to the disclosure of mineral reserves and mineral

resources. See the section of this MD&A titled

“Cautionary Note to U.S.

Investors Regarding Mineral Resource and Mineral Reserve

Estimates” for further details.

This

MD&A contains disclosure of certain non-IFRS financial

measures. Non-IFRS measures do not have any standardized meaning

prescribed under IFRS. See the section of this MD&A entitled

“Non-IFRS

Measures” for further details.

All

dollar amounts included in this MD&A are expressed in Canadian

dollars unless otherwise noted. This MD&A is dated as of

November 10, 2021 and all information contained in this MD&A is

current as of November 9, 2021.

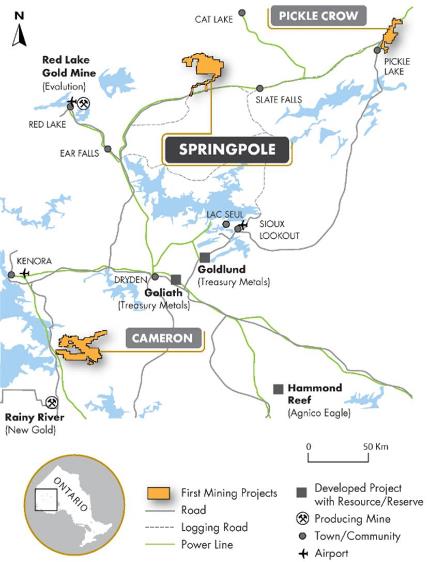

COMPANY OVERVIEW AND STRATEGY

First

Mining is a Canadian gold developer focused on the development and

permitting of the Springpole gold project (the “Springpole Gold Project” or

“Springpole”) in northwestern

Ontario. Springpole is one of the largest undeveloped

gold projects in Canada. A Pre-Feasibility Study

(“PFS”) was

recently completed on the project and permitting is on-going with

submission of an Environmental Impact Statement

(“EIS”) for the

Project targeted in early 2022. In addition, the Company continues

the advancement of its portfolio of mining projects in Canada. The

Company also holds an approximate 15.4% equity position in

Treasury Metals Inc. (“Treasury Metals”) (TSX: TML) which

is advancing the Goliath Gold Complex gold project, in northwestern

Ontario, towards construction. First Mining’s portfolio of

gold projects in eastern Canada also includes the Pickle Crow

(being advanced in partnership with Auteco Minerals Ltd.

(“Auteco”) (ASX:

AUT), Hope Brook (being advanced in partnership with Big Ridge Gold

Corp. (“Big

Ridge”) (TSXV: BRAU), Cameron, Duparquet, Duquesne,

and Pitt gold projects.

The

following highlights the Company’s developments during fiscal

2021 (including subsequent events up to November 9,

2021).

Project Highlights

Springpole

●

Announced results of a positive PFS in January

2021. Post-tax net present value at a 5% discount rate

(“NPV5%”)

of US$995 million, post-tax internal rate of return

(“IRR”) of 29% and post-tax payback of 2.4 years

on initial capital of US$718 million.

●

Progressed

environmental fieldwork into 2021 and submitted the amended

proposed Terms Of Reference to Ontario’s Ministry of the

Environment, Conservation and Parks (“MECP”) in April 2021, with

anticipated Ministry approval in November 2021.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

●

Continued

engagement with local indigenous rightsholders and stakeholders of

the Springpole Gold Project.

●

Announced Birch-Uchi greenstone belt consolidation

through multiple transactions which gives the Company control over

approximately 71,000 hectares

of this prospective region which hosts

several past-producing mines including the newly acquired Sol

d’Or mine where there has been demonstrated historical,

high-grade exploration potential. First Mining intends to

undertake a comprehensive regional exploration program over the

next twelve months for the first time since our acquisition of

Springpole in 2015 and will be incorporating these newly acquired

and optioned claims into the program.

Cameron

●

On July 28, 2021,

the Company announced that it had entered into an exploration

agreement with Animakee Wa Zhing #37

First Nation in respect of the Cameron Gold

Project.

●

In December 2020,

First Mining acquired the East Cedartree claims from Metalore

Resources Limited (“Metalore”), thereby consolidating

the Company’s land holdings in the area into a single

contiguous block and adding a further 3,200 hectares to the 49,574

hectares that the Company already held in the area. In connection

with this acquisition, First Mining paid $3.0 million in cash to

Metalore, and issued 3 million common shares of First Mining

(“First Mining

Shares”) to Metalore (with such shares subject to a

statutory hold period of four months plus one day from the closing

date of the transaction).

Pickle Crow

●

In March 2021,

Auteco completed all expenditure requirements set out in the

earn-in agreement entered into between First Mining and Auteco

dated March 12, 2020 (the “Auteco Earn-In Agreement”) in

respect of Stage 1 of Auteco’s earn-in to the Pickle Crow

Gold Project (“Pickle

Crow”). Following the issuance of 100,000,000 Auteco

shares to First Mining on June 9, 2021, Auteco satisfied all

requirements under the Auteco Earn-In Agreement in respect of Stage

1 of the earn-in, and earned a 51% interest in PC Gold Inc.

(“PC Gold”),

First Mining’s wholly-owned subsidiary that owns Pickle Crow.

Concurrently, the parties executed a joint venture

shareholders’ agreement (the “Auteco JV Agreement”)

in respect of PC Gold.

●

In

August 2021, the Company announced that Auteco had completed Stage

2 of its earn-in to the Pickle Crow Gold Project, and as a result,

Auteco increased its share ownership in PC Gold from 51% to 70% per

the terms of the Auteco Earn-In Agreement. In connection with the

completion of Stage 2 of the earn-in, First Mining received a

$1,000,000 cash payment from Auteco.

Hope Brook

●

In April 2021, the

Company announced that Big Ridge Gold Corp. (“Big Ridge”) (TSX-V:BRAU) had

entered into an earn-in agreement with First Mining (the

“Big Ridge Earn-In

Agreement”) pursuant to which Big Ridge can earn up to

an 80% interest in First Mining’s Hope Brook Gold Project

(“Hope Brook”)

located in Newfoundland, Canada through a two-stage earn-in over

five years by incurring a total of $20 million in qualifying

expenditures, issuing up to 36,500,000 shares of Big Ridge to First

Mining and making a $500,000 cash payment to First Mining. First

Mining will retain a 1.5% net smelter return (“NSR”) royalty on Hope Brook, of

which 0.5% can be bought back by Big Ridge for $2

million.

●

Upon

closing the transaction, Big Ridge issued 11,500,000 shares to the

Company pursuant to the terms of the Big Ridge Earn-In Agreement,

and as a result, the Company owned approximately 19.8% of the

outstanding common shares of Big Ridge immediately after such share

issuance. The Company’s share ownership interest in Big Ridge

was subsequently diluted to 14% on June 30, 2021, following a

$5,000,000 flow-through financing by Big Ridge.

Corporate Highlights

●

Investments

position of $17.3 million and a significant portfolio of equity

interests in Treasury Metals, PC Gold and Big Ridge with a combined

carrying value of $39.3 million as at September 30,

2021.

●

September 30, 2021 period-end cash balance of

$30.3 million.

●

On September 29,

2021, the Company filed a final short form base shelf prospectus in

Canada, and a registration statement on Form F-10 in the US, which

will allow First Mining to undertake offerings of various

securities listed in the shelf prospectus up to an aggregate total

of $100,000,000.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

●

On October 12,

2021, the Company announced the appointment of James Maxwell as

Vice President, Exploration, who will lead the Company’s

exploration efforts to surface the significant geological potential

across its portfolio of gold projects.

●

On

July 15, 2021, the Company completed a distribution of shares and

warrants of Treasury Metals to the Company’s shareholders of

record as of July 14, 2021 based upon the final allocation ratios

that were announced by the Company on July 14, 2021. The combined

value of the distribution was approximately $20.8 million, and

First Mining retains an approximate 15.4% interest in Treasury

Metals following the distribution.

COVID-19 Response

In

response to the onset of the COVID-19 novel coronavirus

(“COVID-19”)

pandemic, the Company adopted a series of robust COVID-19 risk

mitigation policies incorporating recommendations set by the

provincial Governments of Ontario and British Columbia, and by the

Government of Canada. To date, First Mining has not had any cases

of COVID-19 at any of the camp operations at its projects or at its

head office in Vancouver. The health and safety of First

Mining’s workforce, their families and the communities in

which the Company operates is First Mining’s primary

concern.

SELECTED FINANCIAL INFORMATION

|

Financial Results (in $000s Except for per Share

Amounts):

|

For the nine months ended September 30,

|

|

|

|

|

|

|

Mineral Property

Cash Expenditures(1)

|

$11,241

|

$9,474

|

$4,096

|

|

Net

Loss

|

(31,867)

|

(33,345)

|

(4,686)

|

|

Total Cash Used in

Operating Activities(3)

|

(5,503)

|

(3,497)

|

(3,163)

|

|

Basic and Diluted

Net Loss Per Share

(in

Dollars)(4)

|

$(0.05)

|

$(0.05)

|

$(0.01)

|

|

Financial Position (in $000s):

|

|

|

|

|

|

|

|

|

|

Cash and Cash

Equivalents

|

$30,348

|

$28,901

|

$5,902

|

|

Working Capital(2)

|

41,109

|

9,201

|

5,780

|

|

Investments

|

17,331

|

18,425

|

1,775

|

|

Mineral

Properties

|

165,073

|

179,429

|

252,815

|

|

Investment in

Treasury Metals Inc.

|

16,260

|

63,812

|

-

|

|

Investment in PC

Gold Inc.

|

21,570

|

-

|

-

|

|

Investment in Big

Ridge Gold Corp.

|

1,569

|

-

|

-

|

|

|

|

|

|

|

Total

Assets

|

260,510

|

301,213

|

268,020

|

|

Total Non-current

Liabilities

|

$24,116

|

$16,835

|

$3,139

|

(1)

This

represents mineral property expenditures per consolidated

statements of cash flows.

(2)

This is a non-IFRS measurement with no

standardized meaning under IFRS and may not be comparable to

similar financial measures presented by other issuers. For further

information please see the section in this MD&A titled

“Non-IFRS

Measures”.

(3)

Per

the consolidated statement of cash flows in each corresponding

period.

(4)

The

basic and diluted loss per share calculations result in the same

amount due to the anti-dilutive effect of outstanding stock options

and warrants.

Net Loss - Fluctuations in net loss are typically caused by

non-cash items. Removing the impact of these non-cash items

illustrates that the income statement loss on operational

activities was relatively consistent over the prior periods

presented at an average of approximately $3.0 million, however

increased in the nine months ended September 30, 2021, mostly due

to professional fees associated with the Treasury Metals

distribution and a marketing campaign.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

Cash and Cash Equivalents - the

increase in 2021 was primarily attributable to proceeds from the

sales of shares of First Majestic Silver Corp.

(“First

Majestic”) that were

issued to the Company pursuant to the silver purchase agreement

that First Mining entered into with First Majestic on June 10, 2020

(the “Silver Purchase

Agreement”) and the

US$3,750,000 cash payment that the Company received from First

Majestic pursuant to the terms of the Silver Purchase Agreement,

partially offset by cash used in operational activities and

investing activities at the projects. See the section in this

MD&A entitled “Financial Condition, Liquidity

and Capital Resources”.

Total Assets – decreased relative to December 2020 mainly due to the

distribution of Treasury Metals Shares and Warrants, and the

non-cash impairment recorded on the equity accounted Treasury

Metals investment.

ONTARIO MINERAL PROPERTY PORTFOLIO

LOCATIONS (1)

(1)

Pickle

Crow is subject to the Auteco Earn-In Agreement pursuant to which

Auteco is the operator of the project and owns 70% of PC Gold, the

joint venture company that owns the project. (PC Gold was formerly

a wholly-owned subsidiary of First Mining until Auteco completed

stage 1 of its earn-in to PC Gold).

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

MINERAL PROPERTY PORTFOLIO GOLD

RESERVES (1)

The

Springpole Gold Project is the only project owned by First Mining

that has Mineral Reserves attributed to it. The Mineral Reserves

for Springpole are based on the conversion of Indicated Mineral

Resources within the current pit design. The Mineral Reserves for

the Springpole Gold Project are shown below (for further details,

see the technical report entitled “NI 43-101 Technical Report

and Pre-Feasibility Study on the Springpole Gold Project, Ontario

Canada” dated February 26, 2021, which was prepared by AGP

Mining Consultants Inc. (“AGP”) in accordance with National

Instrument 43-101 Standards of

Disclosure for Mineral Projects (“NI 43-101”) and is available under

First Mining’s SEDAR profile at www.sedar.com):

Springpole Proven and Probable Reserves

|

Category

|

Tonnes (Mt)

|

Grade

Au (g/t)

|

Grade

Ag (g/t)

|

Contained Metal

Au (Moz)

|

Contained Metal

Ag (Moz)

|

|

Proven

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

|

Probable

|

121.6

|

0.97

|

5.23

|

3.8

|

20.5

|

|

Total

|

121.6

|

0.97

|

5.23

|

3.8

|

20.5

|

Notes:

(1)

The

Mineral Reserve estimate has an effective date of December 30, 2020

and is based on the Mineral Resource estimate that has an effective

date of July 30, 2020.

(2)

The Mineral Reserve estimate was completed under

the supervision of Gordon Zurowski, P.Eng., of AGP, a Qualified

Person as defined under NI 43-101.

(3)

Mineral Reserves are stated within the final

design pit based on a US$878/oz gold (“Au”) pit shell with a US$1,350/oz Au price for

revenue.

(4)

The

equivalent cut-off grade was 0.34 g/t Au for all pit

phases.

(5)

The

mining cost averaged $2.75/t mined, processing cost averaged

$14.50/t milled, and the G&A cost averaged $1.06/t milled. The

process recovery for gold averaged 88% and the silver recovery was

93%.

(6)

The

exchange rate assumption applied was $1.30 equal to

US$1.00.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

MINERAL PROPERTY PORTFOLIO GOLD

RESOURCES (1)

|

Project

|

|

|

|

Contained Gold Ounces (oz)

|

Contained Silver Ounces (oz)

|

|

Measured

Resources

|

|

Cameron Gold

Project(2)

|

3,360,000

|

2.75

|

-

|

297,000

|

-

|

|

Duparquet Gold

Project(3)

|

18,470

|

1.52

|

-

|

901

|

-

|

|

Indicated

Resources

|

|

Springpole Gold

Project(4)

|

151,000,000

|

0.94

|

5.00

|

4,600,000

|

24,300,000

|

|

Hope Brook Gold

Project

|

5,500,000

|

4.77

|

-

|

844,000

|

-

|

|

Cameron Gold

Project(5)

|

2,170,000

|

2.40

|

-

|

167,000

|

-

|

|

Duparquet Gold

Project(3)

|

7,122,070

|

1.73

|

-

|

396,134

|

-

|

|

Duquesne Gold

Project

|

1,859,200

|

3.33

|

-

|

199,161

|

-

|

|

Inferred

Resources

|

|

Springpole Gold

Project(4)

|

16,000,000

|

0.54

|

2.80

|

300,000

|

1,400,000

|

|

Hope Brook Gold

Project

|

836,000

|

4.11

|

-

|

110,000

|

-

|

|

Cameron Gold

Project(6)

|

6,535,000

|

2.54

|

-

|

533,000

|

-

|

|

Pickle Crow Gold

Project (30%) (7)

|

2,835,600

|

4.10

|

-

|

369,150

|

-

|

|

Duparquet Gold

Project(3)

|

4,066,284

|

1.85

|

-

|

242,312

|

-

|

|

Duquesne Gold

Project

|

1,563,100

|

5.58

|

-

|

280,643

|

-

|

|

Pitt Gold

Project

|

1,076,000

|

7.42

|

-

|

257,000

|

-

|

|

|

|

Total

Measured Resources

|

3,378,470

|

2.74

|

-

|

297,901

|

-

|

|

Total

Indicated Resources

|

167,651,270

|

1.14

|

5.00

|

6,206,295

|

24,300,000

|

|

Total

Measured and Indicated Resources

|

171,029,740

|

1.18

|

5.00

|

6,504,196

|

24,300,000

|

|

Total

Inferred Resources

|

32,911,984

|

1.96

|

3.10

|

2,092,105

|

1,120,000

|

(1)

The Mineral Resources set out in this table are

based on the technical report for the applicable property, the

title and date of which are set out under the applicable property

description within the section “Mineral Property Portfolio

Review” in this MD&A

or in the Company’s AIF for the year ended December 31, 2020,

which is available under the Company’s SEDAR profile at

www.sedar.com.

(2)

Comprised

of 2,670,000 tonnes of pit-constrained (0.55 g/t Au cut-off)

Measured Mineral Resources at 2.66 g/t Au, and 690,000 tonnes of

underground (2.00 g/t Au cut-off) Measured Mineral Resources at

3.09 g/t Au.

(3)

The

Company owns 100% of the Central Duparquet Property, and a 10%

indirect interest in the Duparquet Gold Project. The Measured,

Indicated and Inferred Mineral Resources for Duparquet shown in the

above table reflect both of these ownership interests.

(4)

Springpole Mineral Resources are inclusive of

Mineral Reserves. Open pit mineral resources are reported at a

cut-off grade of 0.30 g/t Au. Cut-off grades are based on a price

of US$1,550/oz Au and $20/oz silver (“Ag”), and processing recovery of 88% Au and

93% Ag. The estimated Life of Mine (“LOM”) strip ratio for the resource estimate is

2.36. Silver Mineral Resources shown in separate column with grade

representing g/t Ag, and contained ounces representing

Ag.

(5)

Comprised

of 820,000 tonnes of pit-constrained (0.55 g/t Au cut-off)

Indicated Mineral Resources at 1.74 g/t Au, and 1,350,000 tonnes of

underground (2.00 g/t Au cut-off) Indicated Mineral Resources at

2.08 g/t Au.

(6)

Comprised

of 35,000 tonnes of pit-constrained (0.55 g/t Au cut-off) Inferred

Mineral Resources at 2.45 g/t Au, and 6,500,000 tonnes of

underground (2.00 g/t Au cut-off) Inferred Mineral Resources at

2.54 g/t Au.

(7)

The Pickle Crow Gold Project contains total

Inferred Mineral Resources of 9,452,000 tonnes at 4.10 g/t Au, for

a total of 1,230,500 ounces Au. This is comprised of 1,887,000

tonnes of pit-constrained (0.50 g/t Au cut-off) Inferred Mineral

Resources at 1.30 g/t Au, and 7,565,000 tonnes of underground

Inferred Mineral Resources that consist of: (i) a bulk tonnage,

long-hole stoping component (2.00 g/t Au cut-off); and (ii) a

high-grade cut-and-fill component (2.60 g/t Au cut-off) over a

minimum width of 1 metre. First

Mining owns 30% of the Pickle Crow Gold Project, and 70% is owned

by Auteco Minerals Ltd. The Inferred Mineral Resources for Pickle

Crow shown in the above table reflects First Mining’s

percentage ownership interest in the Pickle Crow Gold

Project.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

MINERAL PROPERTY PORTFOLIO REVIEW

First

Mining has properties located in Canada and the United States. The

following section discusses the Company’s priority and other

significant projects.

As

at September 30, 2021 and December 31, 2020, the Company had

capitalized the following acquisition, exploration and evaluation

costs to its mineral properties:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2019

|

$76,775

|

$27,374

|

$7,217

|

$20,071

|

$19,263

|

$98,894

|

$3,221

|

$252,815

|

|

2020

acquisition and capitalized net expenditures

|

11,132

|

4,501

|

12

|

541

|

5,723

|

1,609

|

114

|

23,632

|

|

Disposal,

impairment or reclassification

|

-

|

-

|

-

|

-

|

-

|

(100,503)

|

3,485

|

(97,018)

|

|

Balance December 31, 2020

|

$87,907

|

$31,875

|

$7,229

|

$20,612

|

$24,986

|

$-

|

$6,820

|

$179,429

|

|

2021

acquisition and capitalized net expenditures

|

11,966

|

343

|

11

|

100

|

3,273

|

-

|

1,110

|

16,803

|

|

Disposal,

impairment or deconsolidation

|

-

|

-

|

-

|

(2,685)

|

(28,259)

|

-

|

(215)

|

(31,159)

|

|

Balance September 30, 2021

|

$99,873

|

$32,218

|

$7,240

|

$18,027

|

$-

|

$-

|

$7,715

|

$165,073

|

(1)

Other mineral properties as at

September 30, 2021 and December 31, 2020 include: (i) the mining

claims and concessions located in the Township of Duparquet,

Quebéc, which are near the Company’s Duquesne gold

project; (ii) the cash and share payments that the Company has made

to date pursuant to (a) the option agreement that the Company

entered into with Exiro Minerals Corp. (“Exiro”)

on February 18, 2021 with respect to Exiro’s Swain Post

property in northwestern Ontario, (b) the earn-in agreement that

the Company and its wholly-owned subsidiary Gold Canyon entered

into with Whitefish Exploration Inc. (“Whitefish”)

on April 22, 2021 with respect to Whitefish’s Swain Lake

property in northwestern Ontario., (c) the earn-in agreement that

the Company and its wholly-owned subsidiary Gold Canyon entered

into with ALX Resources Corp. (“ALX”)

on September 7, 2021 with respect to ALX’s Vixen North, Vixen

South and Vixen West properties in northwestern Ontario; (iii) a

1.5% NSR Royalty under the terms of an NSR Royalty Agreement dated

August 7, 2020 between the Company, Treasury Metals and Goldlund

Resources Inc., a wholly-owned subsidiary of Treasury Metals, which

was reclassified from “Goldlund” to

“Others” during the year ended December 31, 2020; and

(iv) the cash and share payments that the Company has received to

date pursuant to the option agreement that the Company entered into

with Momentum Minerals Ltd. (“Momentum”)

with respect to the Company’s Turquoise Canyon property in

Nevada (Momentum was subsequently acquired by IM Exploration Inc.

on July 6, 2021 – IM Exploration Inc. was renamed to Westward

Gold Inc. on October 7, 2021).

CANADIAN GOLD PROJECTS

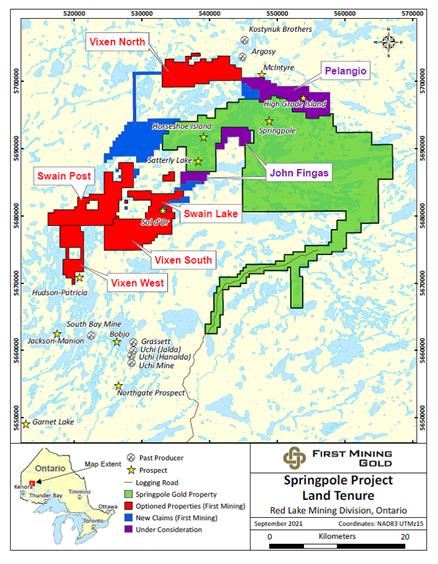

Springpole Gold Project, Ontario

The

Springpole Gold Project covers an area of 41,943 hectares in

northwestern Ontario, consisting of 30 patented mining claims, 282

contiguous mining claims and thirteen mining leases. The project is

located approximately 110 kilometres (“km”) northeast of the Municipality

of Red Lake in northwestern Ontario and is situated within the

Birch-Uchi Greenstone Belt. The large, open pittable resource is

supported by significant infrastructure, including a 38-person

onsite camp, winter road access, a logging road within 15 km of the

camp, and nearby power lines within 40 km. The Springpole Gold

Project is located within an area that is covered by Treaty Three

and Treaty Nine First Nations Agreements. With approximately 4.6

million ounces of gold, and 24 million ounces of silver, in the

Indicated Mineral Resource category, the Springpole Gold Project is

one of the largest undeveloped gold projects in Ontario1.

___________________

1 Source: S&P Market Intelligence database as

of October 16, 2021. Ranking among undeveloped primary gold

resources per jurisdiction.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

During

the nine months ended September 30, 2021, the most significant

expenditures at the Springpole Gold Project were:

●

$3,175,000

in connection with ongoing environmental permitting and community

consultations;

●

$2,017,000

in connection with land tenure and advanced royalty

acquisitions;

●

$1,732,000

for site employees’, contractors’ salaries and

management salaries allocations;

●

$1,303,000

in connection with the Springpole PFS;

●

$1,126,000

in connection with drilling activities; and

●

$585,000

in connection with fuel charges.

During

the nine-months ended September 30, 2021, and up to the date of

this MD&A, the most significant operational developments at the

Springpole Gold Project were:

1.

Completion of Pre-Feasibility Study

On

January 20, 2021, First Mining announced the results of a positive

PFS for the Springpole Gold Project. The PFS evaluates recovery of

gold and silver from a 30,000 tonne-per-day (“tpd”) open pit operation at

Springpole, with a process plant that will include crushing,

grinding, and flotation, with fine grinding of the flotation

concentrate and agitated leaching of both the flotation concentrate

and the flotation tails followed by a carbon-in-pulp recovery

process to produce doré bars. For full details regarding the

PFS for the Springpole Gold Project, see the technical report,

entitled “NI 43-101 Technical Report and Pre-Feasibility

Study on the Springpole Gold Project, Ontario Canada” dated

February 26, 2021, which was prepared by AGP in accordance with NI

43-101 and is available under First Mining’s SEDAR profile at

www.sedar.com.

PFS Highlights

●

US$1.5 billion pre-tax NPV5%

at US$1,600 per ounce

(“oz”) Au, increasing to US$1.9 billion at

US$1,800/oz Au

●

US$995 million post-tax NPV5%

at US$1,600/oz Au, increasing to

US$1.3 billion at US$1,800/oz Au

●

36.4%

pre-tax IRR; 29.4% after-tax IRR at US$1,600/oz Au

●

LOM

of 11.3 years, with primary mining and processing during the first

9 years and processing lower-grade stockpiles for the balance of

the mine life

●

After-tax

payback of 2.4 years

●

Declaration

of Mineral Reserves: Proven and Probable Reserves of 3.8 Moz Au,

20.5 Moz Ag (121.6 Mt at 0.97 g/t Au, 5.23 g/t Ag)

●

Initial

capital costs estimated at US$718 million, sustaining capital costs

estimated at US$55 million, plus US$29 million in closure

costs

●

Average

annual payable gold production of 335 koz (Years 1 to 9); 287 koz

(LOM)

●

Total cash costs of US$558/oz (Years 1 to 9); and

US$618/oz (LOM)(1)

●

All-in sustaining costs

(“AISC”)

of US$577/oz (Years 1 to 9), and AISC US$645

(LOM)(2)

Note: Base case parameters assume a gold price of US$1,600/oz and a

silver price of US$20/oz, and an exchange rate ($ to US$) of 0.75.

All currencies in the PFS are reported in U.S. dollars unless

otherwise specified. NPV calculated as of the commencement of

construction and excludes all pre-construction costs.

(1) Total cash costs consist of mining costs, processing costs,

mine-level general and administrative (“G&A”) costs, treatment and

refining charges and royalties.

(2) AISC consists of total cash costs plus sustaining and closure

costs.

Economic Sensitivities

The

economics and cash flows of the Springpole Gold Project are highly

sensitive to changes to the gold price.

Springpole Economic Sensitivity to Gold Price (base case in bold)

|

Gold Price (US$/oz)

|

$1,400

|

$1,600

|

$1,800

|

$2,000

|

|

Pre-Tax

NPV5%

|

US$1.04

billion

|

US$1.48 billion

|

US$1.92

billion

|

US$2.36

billion

|

|

Pre-Tax

IRR

|

28.9%

|

36.4%

|

43.2%

|

49.5%

|

|

After-Tax

NPV5%

|

US$690

million

|

US$995 million

|

$1.30

billion

|

$1.60

billion

|

|

After-Tax

IRR

|

23.3%

|

29.4%

|

35.0%

|

40.1%

|

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

Springpole Economic Sensitivity to Initial Capital Costs

(base case in

bold)

|

Initial Capital Costs

|

+10%

|

US$718 million

|

-10%

|

|

Pre-Tax

NPV5%

|

US$1.34

billion

|

US$1.48 billion

|

US$1.61

billion

|

|

Pre-Tax

IRR

|

30.1%

|

36.4%

|

44.1%

|

|

After-Tax

NPV5%

|

US$875

million

|

US$995 million

|

US$1,102

million

|

|

After-Tax

IRR

|

23.8%

|

29.4%

|

36.3%

|

Springpole Economic Sensitivity to Operating Costs

(base case in

bold)

|

Operating Costs

|

+10%

|

US$2.21 billion

|

-10%

|

|

Pre-Tax

NPV5%

|

US$1.33

billion

|

US$1.48 billion

|

US$1.63

billion

|

|

Pre-Tax

IRR

|

34.1%

|

36.4%

|

38.6%

|

|

After-Tax

NPV5%

|

US$890

million

|

US$995 million

|

US$1,098

million

|

|

After-Tax

IRR

|

27.6%

|

29.4%

|

31.3%

|

The

Mineral Resources defined in the PFS do not reflect the significant

opportunities that are available for resource expansion or

discovery of additional ore bodies in the Springpole district, and

readers are cautioned that Mineral Resources that are not Mineral

Reserves do not have demonstrated economic viability. First Mining

believes that the Springpole Gold Project has several avenues for

resource expansion, both within the existing property footprint and

regionally in the under-explored Birch Uchi Greenstone belt. First

Mining plans to undertake approximately 10,000 m of diamond

drilling at the Springpole Gold Project in 2021 for metallurgy,

exploration, condemnation, and geotechnical purposes, and will

continue to review other exploration opportunities in the area. As

at September 30, 2021, 5,654 m of metallurgical drilling, 3,022 m

of geotechnical drilling and 705 m of exploration had been

completed, for a total of 9,381 m.

Project Enhancement Opportunities

The PFS

identified several opportunities to enhance the economics of the

Springpole Gold Project, and they will be investigated as First

Mining continues to advance the project. These opportunities

include:

●

Existing Resource

Upgrades. Inferred Mineral

Resources are contained within the existing pit design, and with

additional infill drilling, these resources may potentially support

conversion of some or all of this material into Indicated Mineral

Resources that could be converted to Probable Mineral Reserves and

evaluated in a Feasibility Study (“FS”).

●

Mine Plan

Optimization. Refined pit optimization parameters could result

in better optimized open pit limits which could reduce the overall

strip ratio.

●

Process Optimization.

Continued efforts to investigate

opportunities to improve the metal recoveries through further

metallurgical testing and refining milling processes, as well as

other process optimizations.

●

Further Geotechnical

Studies. A better

hydrogeological and geotechnical understanding may increase pit

slope angles, potentially reducing costs associated with mining

waste material.

●

Additional

Mineralization. There are geophysical and geological targets in

the area around the current resource, where additional drilling has

the potential to identify additional mineralization that could

support Mineral Resource estimation with upside potential for the

LOM.

2.

Silver Stream transaction with First Majestic Silver

Corp.

On June

10, 2020, First Mining entered into the Silver Purchase Agreement

with First Majestic pursuant to which First Majestic agreed to pay

First Mining total consideration of US$22.5 million (the

“Advance

Payment”) in three tranches for the right to purchase

50% of the payable silver produced from the Springpole Gold Project

for the life of the project (the “Silver Stream”). The transaction

closed on July 2, 2020, and under the terms of the

transaction:

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

●

US$10 million was paid by First Majestic on

closing the transaction, with US$2.5 million paid in cash and the

remaining US$7.5 million was satisfied by the issuance to First

Mining of 805,698 common shares of First Majestic (the

“First

Majestic Shares”);

●

US$7.5 million was paid by First Majestic upon

First Mining publicly announcing the completion of a positive PFS

for the Springpole Gold Project, with US$3.75 million paid in cash

and the remaining US$3.75 million was satisfied by the issuance to

First Mining of 287,300 First Majestic Shares (the number of First

Majestic shares issued was based on the 20-day volume-weighted

average trading price (“VWAP”) of the First Majestic Shares on the TSX

at the time); and

●

US$5 million is payable by First Majestic upon

First Mining receiving approval of a federal or provincial

Environmental Assessment (“EA”) for the Springpole Gold Project, with

US$2.5 million payable in cash and US$2.5 million payable in First

Majestic Shares (based on 20-day VWAP of the First Majestic Shares

on the TSX at the time).

In

addition, upon closing the transaction on July 2, 2020, First

Mining issued 30 million common share purchase warrants

(“First Mining

Warrants”) to First Majestic pursuant to the terms of

the Silver Purchase Agreement. Each First Mining Warrant entitles

First Majestic to purchase one First Mining Share at an exercise

price of $0.40 for a period of five years. As a result of the

Treasury Metals distribution that was completed on July 15, 2021,

pursuant to the adjustment provisions of the First Mining Warrants,

the exercise price of these warrants was reduced, and the number of

these warrants was increased.

In the

event of default, First Majestic may terminate the Silver Purchase

Agreement and the Advance Payment received by First Mining at that

time would become repayable. The Silver Stream has an initial term

of 40 years from July 2, 2020. The term is automatically extended

by successive 10-year periods as long as the life of mine continues

for the Springpole Gold Project.

Upon

receipt of its share of silver production, First Majestic will make

cash payments to First Mining for each ounce of silver paid to

First Majestic under the Silver Purchase Agreement equal to 33% of

the lesser of the average spot price of silver for the applicable

calendar quarter, and the spot price of silver at the time of

delivery, subject to a price cap of US$7.50 per ounce of silver

(the “Price

Cap”). The Price Cap is subject to annual inflation

escalation of 2%, commencing at the start of the third year of

production. First Mining has the right to repurchase 50% of the

Silver Stream for US$22.5 million at any time prior to the

commencement of production at Springpole.

The

proceeds received by First Mining will primarily be used to advance

the Springpole Gold Project through the PFS/FS process and will

also be used to advance the project through the federal and

provincial EA processes.

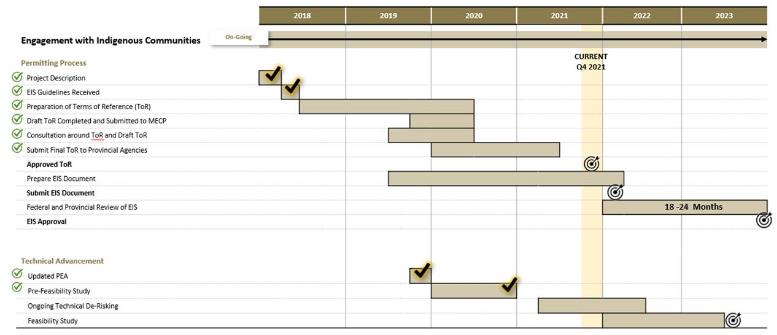

3.

Environmental Permitting and Baseline Data

First

Mining continues to advance the Springpole Gold Project through the

federal and provincial EA 2021 that bolsters the environmental data

set that is being used for the preparation of a draft Environmental

Assessment for consultation in 2022. The supplemental environmental

field work program was designed and implemented by Wood plc. Wood

plc has successfully undertaken several mining environmental

assessments in Ontario. First Mining also consolidated the various

technical scopes required for the environmental assessment under

the expertise of Wood plc. First Mining has successfully advanced

the development of the Terms of Reference for the provincial

environmental assessment.

The

final Terms of Reference was submitted to the Ministry of

Environment, Conservation and Parks in April 2021 following a

comprehensive consultation process with local Indigenous

communities and government agencies. Approval of the Terms of

Reference is expected in November 2021. Following approval of the

Terms of Reference First Mining will complete and submit a

coordinated draft environmental assessment (“EA”)

document to the federal and provincial regulators.

Consultation

on the draft EA with Indigenous communities, agencies and

stakeholders will take place throughout 2022, with submission of a

final EA expected to occur in 2023.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

The Springpole permitting timeline is as follows:

Community

consultation and engagement with local Indigenous communities and

other stakeholders is important to First Mining and will continue

throughout the EA process. To date First Mining has signed

consultation agreements with Mishkeegogamang First Nation and

Métis Nation of Ontario, and has established a formal

Environment Committee with Cat Lake First Nation, Slate Falls First

Nation and Lac Seul First Nation which has been tasked with the

review of EA documents for those three communities. All EA-related

materials are publicly available through First Mining’s

website.

4.

Regional land acquisitions – Birch-Uchi Greenstone

Belt

On February 18, 2021, the Company entered into a three-year

option agreement pursuant to which First Mining may earn a 100%

interest in Exiro’s Swain Post property located in

northwestern Ontario through future cash and share payments of

approximately $250,000 to Exiro during the term of the option, and

by completing all assessment work requirements on the property

during the option term. The Swain Post property comprises 237

single cell mining claims covering nearly 5,000 hectares. It is

located approximately 5 km west of First Mining’s

western-most property boundary at Springpole.

On April 29, 2021, the Company and its wholly-owned subsidiary,

Gold Canyon, entered into an earn-in agreement with Whitefish which

gives First Mining the right to earn, through Gold Canyon, an

initial 70% interest in the Swain Lake property by making cash

payments totaling $200,000 and share payments totaling $425,000,

and by incurring at least $500,000 worth of expenditures on the

Swain Lake property during the first 3 years of the earn-in term.

Upon completing the first stage of the earn-in, First Mining will

hold, through Gold Canyon, a 70% interest in the Swain Lake

property and will have an additional period of 2 years within which

to acquire the remaining 30% of the property by paying $1 million

in cash to Whitefish and by issuing $1 million worth of First

Mining Shares to Whitefish. If the second stage of the earn-in is not

completed, Whitefish and Gold Canyon will enter into a joint

venture agreement with respect to the Swain Lake

property.

The

Swain Lake property comprises 82 single cell mining claims covering

1,640 hectares. It is located approximately 2 km from First

Mining’s western-most property boundary at Springpole and

immediately to the east of the Swain Post property.

On

September 7, 2021, the Company and its wholly-owned subsidiary,

Gold Canyon, entered into an earn-in agreement with ALX which gives

First Mining the right to earn, through Gold Canyon, an initial 70%

interest in ALX’s Vixen North, Vixen South and Vixen West

properties in northwestern Ontario (collectively, the

“Vixen

Properties”) by making cash payments totaling $550,000

and share payments totaling $400,000, and by incurring at least

$500,000 worth of expenditures on the Vixen Properties during the

first 3 years of the earn-in term. Upon completing the first stage

of the earn-in, First Mining will hold, through Gold Canyon, a 70%

interest in the Vixen Properties and will have an additional period

of 2 years within which to acquire the remaining 30% of the

properties by paying $500,000 in cash to ALX and by issuing

$500,000 worth of First Mining Shares to ALX. If the second stage

of the earn-in is not completed, ALX and Gold Canyon will enter

into a joint venture agreement with respect to the Vixen

Properties.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

Subsequent

to the end of the quarter, on October 4, 2021, the

Company announced it had entered into an earn-in agreement with

Pelangio Exploration Inc. (“Pelangio”)

which gives First Mining the right to earn, through Gold Canyon,

up to an 80% interest in

Pelangio’s Birch Lake and Birch Lake West properties

(collectively, the “Birch Lake

Properties”)

over the course of two stages and a period of six years. Initially,

First Mining (through Gold Canyon), may earn a 51% interest in the

Birch Lake Properties by making cash payments totaling

$350,000 and share payments totaling 1,300,000 and by incurring at

least $1,750,000 worth of expenditures on the Birch Lake Properties

during the first 4 years of the earn-in term. Upon completing the

first stage of the earn-in, First Mining will have an additional

period of 2 years within which to acquire a further 29% interest in

the Birch Lake Properties by paying $400,000 to Pelangio in cash or

First Mining Shares (at First Mining’s sole discretion) and

by incurring an additional $1,750,000 worth of expenditures on the

Birch Lake Properties. Upon completing the second earn-in stage,

First Mining will hold a 80% interest in the Birch Lake Properties,

and Gold Canyon and Pelangio will enter into a joint venture

agreement with respect to the properties (if First Mining notifies

Pelangio at any time after exercising the first earn-in that it

will not complete the second earn-in stage, the joint venture will

be formed as of the date of such notice, and First Mining will

hold, through Gold Canyon, a 51% interest in the Birch Lake

Properties).

The Birch Lake Properties include the High Grade Island Prospect,

which is located to the northeast of First Mining’s

Springpole Gold Project. The Birch Lake Properties cover

approximately 3,700 hectares.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

Cameron Gold Project, Ontario

The

Cameron Gold Project covers an area of 49,574 hectares in northern

Ontario and comprises 24 patented claims, 1,790 mining claims, 4

mining leases, and 7 Licenses of Occupation. The Cameron Gold

Project deposit is a greenstone‐hosted gold deposit and the

mineralization is mainly hosted in mafic volcanic rocks within a

northwest trending shear zone (Cameron Lake Shear Zone) which dips

steeply to the northeast. A technical report for the Cameron Gold

Project titled “Technical Report on the Cameron Gold Deposit,

Ontario, Canada” and dated January 17, 2017, was prepared by

Optiro Pty Limited in accordance with NI 43-101 and is available

under the Company’s SEDAR profile at www.sedar.com.

There is year-round road access to the property from the nearby

highway and power lines within 20 km.

During

the nine months ended September 30, 2021, the most significant

expenditures at the Cameron Gold Project were:

●

$88,000

for site employees’ salaries and management salary

allocations;

●

$56,000

in connection with exploration and technical consulting;

and

●

$32,000

for provincial and municipal taxes.

On

December 3, 2020, the Company entered into an asset purchase

agreement with Metalore to acquire its East Cedartree claims. The

transaction closed on December 9, 2020. Under the terms of the

transaction, First Mining paid Metalore $3 million in cash and

issued 3 million First Mining Shares to Metalore. The East

Cedartree claims contain an existing Mineral Resource estimate that

was prepared in accordance with NI 43-101 and encompass a highly

favourable geological setting for new gold discoveries in close

proximity to the existing deposits at the Company’s Cameron

and West Cedartree properties. The acquisition of the East

Cedartree claims consolidates First Mining’s land holdings at

Cameron into a single contiguous block and adds a further 3,200

hectares to the 49,574 hectares that First Mining already holds in

the district. As a result of the acquisition of the East Cedartree

claims, the Cameron Gold Project now covers an area of 52,774

hectares and comprises 24 patented claims, 2,002 mining claims, 4

mining leases, and 7 Licenses of Occupation.

Following

First Mining’s recent hire of a Vice President, Exploration,

the Company’s plans at Cameron are to undertake an

approximate 4,000 metre drill program at the project in 2022 in

order to extent extend our local understanding of the local geology

and identify new drill targets on the project and, in particular at

the East Cedartree claims, which the Company acquired at the end of

2020. In addition, the Company will continue local community

consultations and ongoing environmental permitting

activities with

respect to Cameron.

Pickle Crow Gold Project, Ontario

The

Pickle Crow Gold Project covers an area of 19,033 hectares and

comprises 104 patented claims and 932 mining claims. The area is

located in northwestern Ontario and is covered by the Treaty Nine

First Nations Agreement. A technical report for the Pickle Crow

Gold Project titled “An Updated Mineral Resource Estimate for

the Pickle Crow Property, Patricia Mining Division, Northwestern

Ontario, Canada” and dated June 15, 2018, was prepared by

Micon International Limited in accordance with NI 43-101 and is

available under the Company’s SEDAR profile at www.sedar.com.

Extensive infrastructure in place or proximal to the Pickle Crow

Gold Project includes a 200 tpd gravity mill on site, generators

and fuel storage and gravel road access to the property, and the

property is within 10 km of a regional airport at Pickle Lake. The

Pickle Crow Gold Project was a former high-grade operating mine

until the late 1960s.

Earn-In Agreement with Auteco Minerals

On March 12, 2020, the Company and Auteco executed the Auteco

Earn-In Agreement, pursuant to which Auteco, through one of

its subsidiaries, can earn an 80% interest in PC Gold, First Mining’s then wholly-owned subsidiary

that owns Pickle Crow, through a two-stage earn-in over five

years by incurring a total of $10,000,000 million in qualifying

expenditures, issuing up to 125 million shares of Auteco to First

Mining and making $4,100,000 in cash payments to First Mining.

First Mining will retain a 2.0% NSR royalty on Pickle Crow (the

“Pickle Crow

NSR”), of which 1.0% can be bought back by Auteco for

US$2,500,000. A more detailed summary of the earn-in arrangement is

set out in the news release dated March 12, 2020.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

During the year ended December 31, 2020, the Company received the

scheduled cash consideration of $100,000 and 25,000,000 shares of

Auteco with a fair value on receipt of $740,000 under the terms of

the Auteco Earn-in Agreement. In the three-months ended March 31,

2021, Auteco confirmed to the Company that it had completed the

Stage 1 earn-in exploration expenditure requirement of $5,000,000.

Auteco held a meeting of its shareholders in May 2021 to approve

the issuance of 100,000,000 Auteco shares to First Mining, and

having obtained shareholder approval and listing approval from the

Australian Securities Exchange (the “ASX”), Auteco issued the 100,000,000 Auteco

shares to First Mining on June 9, 2021. As a result, Auteco earned,

through a subsidiary, an initial 51% interest in PC Gold, First

Mining’s previously wholly-owned subsidiary, and First Mining

and the Auteco subsidiary executed the Auteco JV Agreement

in respect of PC Gold. On August 30, 2021, the Company announced

that Auteco had completed the Stage two requirements of the earn-in

by paying $1,000,000 in cash to First Mining and incurring

$5,000,000 in exploration expenditures, and as a result Auteco,

through its subsidiary, had increased its ownership interest in PC

Gold to 70%, and the parties entered into a royalty agreement with

respect to the Pickle Crow NSR.

Auteco has an option to acquire an additional 10% equity interest

in PC Gold (the “Buy-In Right”), exercisable any time

following completion of the Stage 2 earn-In, by paying First Mining

$3,000,000 in cash. First Mining’s then remaining

residual 20% interest in PC Gold (and thereby, Pickle Crow) would

be carried until a construction decision in respect of Pickle Crow,

which is to be made after a final feasibility study and following

Auteco having arranged sufficient financing to achieve commercial

production. If Auteco should fail to meet such requirements

within the applicable time periods, the Auteco Earn-In

Agreement will terminate and Auteco will be entitled to retain any

interest which it has earned-in to prior to the date of termination.

Following

the completion of the Stage 1 earn-in by Auteco, First

Mining’s percentage ownership of the subsidiary PC Gold was

diluted from 100% to 49%, which resulted in a loss of control and a

deconsolidation of PC Gold from First Mining’s financial

statements. First Mining has determined that its investment in the

common shares of PC Gold gives it significant influence over PC

Gold, resulting in PC Gold being recorded on First Mining’s

financial statements using the equity method of accounting as an

investment in associate. The initial recognition of the investment

in associate was accounted for at a fair value using a peer group

analysis of comparable $/oz prices of the Pickle Crow Gold Project.

The gain/loss on deconsolidation was calculated as a result of

derecognizing the net assets of PC Gold and recognizing the fair

value of the investment in associate net of the Buy-In Right held

by Auteco. The investment in associate was assessed for impairment

indicators relating to the underlying assets of PC Gold in

accordance with IAS 36 and IFRS 6.

At the

time of deconsolidation of PC Gold in Q2 2021, management estimated

a fair value for the Stage 2 and final Auteco earn in options of

$17,306,000 based on the

portion of the fair value of the PC Gold investment that the

Company would be required divest net of any future proceeds from

Auteco. Following completion of the Stage 2 earn-in in Q3

2021 the Stage 2 option

liability of $12,959,000 was settled and the Company delivered the

additional 19% interest in PC Gold to Auteco from the Option

– PC Gold balance which represented the fair value loss on

the reduced 30% PC Gold ownership. A corresponding reduction in the

equity accounted investment in PC Gold was also recorded as a

result of this dilution. The $4,347,000 balance as at September 30,

2021 represents the additional net dilution which would result from

Auteco completing its additional 10% equity interest. Following

receipt of $3,000,000 under this option First Mining’s

ownership would reduce to 20%.

On February 28, 2019, PC Gold received a letter from the Acting

Director, Mine Rehabilitation, at the Ontario Ministry of Energy,

Northern Development and Mines (“MENDM”), which required the Company to submit a

schedule for the development of a closure plan amendment for the

Pickle Crow Gold Project. The Company complied with the requirement

and submitted the schedule for the development of a closure plan

amendment on March 29, 2019. The submission of a closure plan

amendment complete with cost estimates was initially due on

November 1, 2019. PC Gold has been granted an extension and is

working with the Ministry towards the filing of the closure plan in

2021. PC Gold has engaged consultants to assist with developing

this plan. With a shareholder’s agreement now in place with

respect to PC Gold, the Company and Auteco will be responsible for

their pro rata share of any bond requirements for the mine closure

plan for the Pickle Crow Gold Project.

Hope Brook Gold Project, Newfoundland

The

Hope Brook Gold Project covers an area of 26,650 hectares in

Newfoundland, including six mineral licenses, with a deposit hosted

by pyritic silicified zones occurring within a deformed,

strike-extensive advanced argillic alteration zone. A technical

report for the Hope Brook Gold Project titled “2015 Mineral

Resource Estimate Technical Report for the Hope Brook Gold Project,

Newfoundland and Labrador, Canada” and dated November 20,

2015, was prepared by Mercator Geological Services Limited in

accordance with NI 43-101 and is available under the

Company’s SEDAR profile at www.sedar.com.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

The

resource covers 1.5 km of an 8 km mineralized structure.

Substantial infrastructure at the property includes a ramp to 350

metres (“m”)

below surface with vent raise, line-power to site, commercial barge

and landing craft ramp, air strip, and a strong local labour force.

The Hope Brook Gold Project was a former operating gold mine that

produced 752,163 oz Au from 1987 to 1997.

Earn-In Agreement with Big Ridge Gold

On

April 6, 2021, First Mining announced that it had entered into the

Big Ridge Earn-In Agreement pursuant to which Big Ridge may earn up

to an 80% interest in Hope Brook.

Pursuant

to the agreement, Big Ridge can earn an 80% interest in Hope Brook

through a two-stage earn-in over five years by incurring a total of

$20 million in qualifying expenditures, issuing up to 36,500,000

shares of Big Ridge to First Mining and making a $500,000 cash

payment to First Mining. First Mining will retain a 1.5% NSR

royalty on Hope Brook, of which 0.5% can be bought back by Big

Ridge for $2 million. First Mining will also have the right to

nominate one member to the Board of Directors of Big Ridge (the

“Big Ridge

Board”) on closing, and thereafter, First Mining will

be entitled to have one of its nominees on the Big Ridge Board for

so long as First Mining owns at least 10% of the issued and

outstanding shares of Big Ridge.

In the

period ended September 30, 2021, the Company received $500,000 and

11,500,000 shares of Big Ridge upon closing the transaction, which

were credited against the Hope Brook project mineral property on

the Company’s Statement of Financial Position as at September

30, 2021. In addition, Ken Enquist, the Company’s COO, was

appointed to the Big Ridge Board as the Company’s nominee

under the terms of the Big Ridge Earn-In Agreement.

Other Mineral Properties and Mineral Property

Interests

The

following table sets out the Company’s remaining projects by

region. These projects are 100%-owned by the Company with the

exception of the Duparquet Gold Project in which the Company has a

10% indirect ownership interest in the Duparquet Gold Project and a

100% interest in the Central Duparquet Property.

|

Canada

|

USA

|

|

Duquesne,

Québec (1)

|

Turquoise

Canyon, Nevada (2)

|

|

Pitt,

Québec

|

|

|

Duparquet,

Québec

|

|

|

Horseshoe

Island, Ontario

|

|

(1) In connection with an agreement entered into by Clifton

Star Resources Inc. ("Clifton

Star") on July 31, 2012, prior to its acquisition by First

Mining, Clifton Star purchased 0.5% of a 3% NSR royalty on the

Duquesne Gold Project for $1,000,000 in cash. Per the terms of this

agreement, beginning June 2019, the remaining 2.5% NSR must be

purchased over the ensuing five years in tranches of 0.5% for

$1,000,000 for each tranche. Management is currently in discussions

with the royalty owners regarding potential amendments to the

timing and amount of any future payments related to this royalty

repurchase.

(2) Property under option agreement with Westward Gold Inc. The $25,000 cash

and $216,000 in share payments that the Company has received to

date was pursuant to the option agreement that the Company entered

into with Momentum Minerals Ltd. (“Momentum”) (Momentum was subsequently acquired by IM

Exploration Inc. on July 6, 2021, and IM Exploration Inc. was

renamed to Westward Gold Inc. on October 7,

2021).

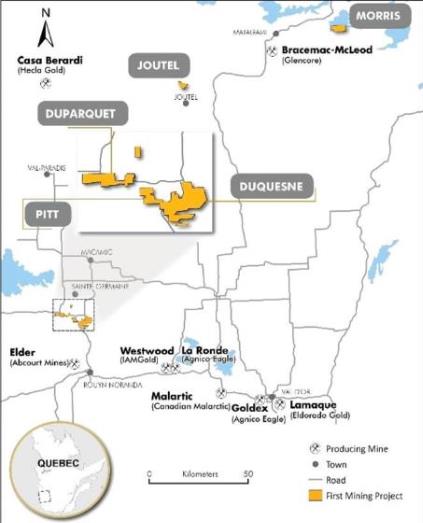

Mineral Property Interest – Duparquet Gold Project,

Québec

The

Company, through its wholly-owned subsidiary Clifton Star, has a

10% equity interest in the shares of Beattie Gold Mines Ltd.,

2699681 Canada Ltd., and 2588111 Manitoba Ltd. which directly or

indirectly own various mining concessions and surface rights,

collectively known as the Duparquet Gold Project.

The

Duparquet Gold Project has a large open-pittable resource, as well

as underground and tailings resource. The Company’s interest

in the Duparquet Gold Project was acquired through our acquisition

of Clifton Star in 2016. The Duparquet Gold Project covers an area

of 1,147 hectares and is located in the Abitibi Region of

Québec, one of the world's most prolific gold producing

regions. A technical report for the Duparquet Gold Project entitled

“Technical Report and Prefeasibility Study for the Duparquet

Project” and with an effective date of March 26, 2014, was

completed by InnovExplo in accordance with NI 43-101 and was filed

on SEDAR by Clifton Star on May 23, 2014. The 2014 PFS for the

Duparquet Gold Project includes pre-production capital costs of

$394 million, a pay-back period of 4.3 years and pre-tax

NPV5%

of $222 million at US$1,300 per ounce of gold.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

In

addition to the 10% indirect interest in the Duparquet Gold

Project, the Company also holds a 100% interest in the adjoining

Central Duparquet Property, which was purchased on January 20,

2017. This additional ground comprises 16 claims covering 339 ha.

Infrastructure includes site roads, access to electrical power 15

km away, tailings storage facility and water management solutions

and ancillary site buildings.

Québec Mineral Property Portfolio Locations

NSRs owned by or available to First Mining

Through

recent transactions, First Mining has created the following

portfolio of twenty existing and potential NSR gold royalties on

certain of our mineral properties and property interests. The

Company is currently evaluating potential strategic opportunities

available to enhance and optimize the value of the royalty

portfolio.

|

Royalty

|

NSR Rate

|

Key Terms

|

|

Pickle

Crow (Ontario, Canada)

|

2.00%

|

1.00%

buy-back for US$2.5 million

|

|

Hope

Brook (Newfoundland, Canada)

|

1.50%

|

0.5%

buy-back for $2.0 million

|

|

Goldlund

(Ontario, Canada)

|

1.50%

|

0.5%

buy-back for $5.0 million

|

|

Mexican

Projects (1)

(11

including Las Margaritas)

|

1.00%

|

1.00%

buy-back for US$1.0 million on each project

|

|

Turquoise

Canyon (Nevada, USA)

|

2.00%

|

1.00%

buy-back for US$1.0 million

|

|

Joutel,

Québec

|

1.00%

|

No

buy-back option

|

|

Morris,

Québec

|

1.00%

|

No

buy-back option

|

|

Ronguen

(Burkina Faso)

|

1.00%

|

1.00%

buy-back for US$1.0 million

|

|

Pompoi

(Burkina Faso)

|

1.50%

|

1.50%

buy-back for $1.5 million

|

|

Lac

Virot Iron Ore (Labrador, Canada)

|

2.00%

|

1.00%

buy-back for $1.0 million

|

(1)

The

Mexican projects NSRs include: Sonora - Miranda, Apache, Socorro,

San Ricardo, Los Tamales, Puertecitos, Batacosa; Durango –

Las Margaritas; Oaxaca – Geranio, Lachatao, El

Roble.

Note that the Hope Brook NSR in the above table will only be

granted to us upon Big Ridge successfully completing its Stage 1

Earn-in -it is not in existence as of the date of this MD&A.

For further information on all of the Company’s mineral

properties, see the Company’s AIF for the year ended December

31, 2020 which is available under the Company’s SEDAR profile

at www.sedar.com,

as an exhibit to the Company’s Form 40-F on EDGAR at

www.sec.gov.

|

FIRST MINING GOLD CORP.

|

Management’s Discussion & Analysis

|

|

(Expressed in Canadian dollars, unless otherwise

indicated)

|

For the three and nine months ended September 30, 2021

|

SELECTED QUARTERLY FINANCIAL INFORMATION

Financial

Results (in $000s Except for per Share Amounts):

|

|

|

2021-Q3

|

2021-Q2

|

2021-Q1

|

2020-Q4

|

2020-Q3

|

2020-Q2

|

2020-Q1

|

2019-Q4

|

|

Net

Income (Loss)

|

$2,419

|

$(1,283)

|

$(33,001)

|

$530

|

$(12,352)

|

$(19,531)

|

$(1,462)

|

$(2,274)

|

|

Impairment of

non-current assets

|

-

|

-

|

23,555

|

-

|

2,372

|

22,498

|

-

|

-

|

|

Total cash used in

operating activities (2)

|

(1,689)

|

(1,940)

|

(1,874)

|

(725)

|

(1,056)

|

(1,128)

|

(1,313)

|

(1,037)

|

|

Basic and Diluted

Net Income (Loss) Per Share (in dollars) (3)

|

0.00

|

(0.00)

|

(0.05)

|

0.00

|

(0.02)

|

(0.03)

|

(0.00)

|

(0.00)

|

|

Financial

Position (in $000s):

|

|

Cash and Cash

Equivalents

|

30,348

|

33,762

|

39,174

|

28,901

|

32,477

|

6,475

|

10,497

|

5,902

|

|

Working Capital

(1)

|

41,109

|

34,898

|

19,893

|

9,201

|

14,324

|

8,596

|

9,946

|

5,780

|

|

Investments

|

17,331

|

20,450

|

13,907

|

18,425

|

24,016

|

5,601

|

1,398

|

1,775

|

|

Mineral

Properties

|

165,073

|

160,322

|

186,761

|

179,429

|

168,188

|

159,630

|

256,532

|

252,815

|

|

Investment in

Treasury Metals Inc.

|

16,260

|

16,236

|

39,867

|

63,812

|

62,833

|

-

|

-

|

-

|

|

Investments in PC

Gold Inc.

|

21,570

|

35,999

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Investment in Big

Ridge Gold Corp.