CONTENTS

2016 Annual Information Form – Page 2

CONTENTS (continued)

2016 Annual Information Form – Page 3

Important information about this document

|

This annual information form (“AIF”) provides important information about the Company. It describes, among other things, our history, our markets, our exploration and development projects, our mineral resources, sustainability, our regulatory environment, the risks we face in our business and the market for our shares. |

Throughout this document, the terms we, us, our, the Company and First Mining mean First Mining Finance Corp. and its subsidiaries, in the context. |

Information on our website is not part of this AIF, nor is it incorporated by reference herein. Our filings on SEDAR are also not part of this AIF, nor are they incorporated by reference herein.

Reporting currency and financial information

The financial currency of the Company is Canadian dollars. Unless we have specified otherwise, all dollar amounts (“$”) referred to in this AIF are in Canadian dollars. Any references to “US$” mean United States (US) dollars.

All financial information presented in this AIF has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Caution about forward-looking information

This AIF includes statements and information about our expectations for the future. When we discuss our strategy, business prospects and opportunities, plans and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under applicable securities laws. We refer to them in this AIF as forward-looking information.

Key things to understand about the forward-looking information in this AIF:

| • |

It typically includes words and phrases about the future, such as expect, believe, estimate, anticipate, plan, intend, predict, goal, target, forecast, project, scheduled, potential, strategy and proposed (see examples listed below). | |

| • |

It is based on a number of material assumptions, including those we have listed below, which may prove to be incorrect. | |

| • |

Actual results and events may be significantly different from what we currently expect, because of the risks associated with our business. We list a number of these material risks on the next page. We recommend you also review other parts of this AIF, including the section “Risks that can affect our business” starting on page 74, which discuss other material risks that could cause our actual results to differ from current expectations. |

Forward-looking information is designed to help you understand management’s current views of our near and longer term prospects. It may not be appropriate for other purposes. We will not update or revise this forward-looking information unless we are required to do so by applicable securities laws.

Examples of forward-looking information in this AIF

| • | statements regarding future acquisitions of mineral properties | |

| • | our intention to acquire mineral assets in geopolitically safe areas of the Americas | |

| • | our objective of entering into agreements with other parties to advance our projects | |

| • | our plan to retain a residual interest in projects in the form of royalties, metal streams, minority interests or equity positions |

2016 Annual Information Form – Page 4

| • | statements relating to our vision and strategy | |

| • | our intention to eventually pay a dividend to our shareholders | |

| • | statements relating to the criteria we will use when assessing potential acquisitions | |

| • | our belief that we will continue to be able to locate and retain professionals with the necessary specialized skills and knowledge | |

| • | statements regarding shifts in gold demand, increases in the number of urban consumers in China and India and increases in disposable income | |

| • | statements regarding higher average gold price in 2016 leading to an increase in capital spending in 2017 | |

| • | our intention to continue to make expenditures to ensure compliance with applicable laws and regulations | |

| • | our expectation that we will release a new NI 43-101 (as defined herein) compliant preliminary economic assessment for the Springpole Project (as defined herein) around mid-2017 | |

| • | our intentions and expectations regarding exploration at any of our mineral properties | |

| • | forecasts relating to mining, development and other activities at our operations | |

| • | forecasts relating to market developments and trends in global supply and demand for gold | |

| • | future royalty and tax payments and rates | |

| • | future work on our non-material properties | |

| • | our mineral reserve and mineral resource estimates |

Material risks

|

• |

exploration, development and production risks |

|

|

• |

global financial conditions |

|

| • | commodity price fluctuations | |

| • | availability of capital and financing on acceptable terms | |

|

• |

our mineral reserve and resource estimates may not be reliable, or we may encounter unexpected or challenging geological, hydrological or mining conditions |

|

|

|

• |

our exploration plans may be delayed or may not succeed |

|

|

• |

we may not be able to obtain or maintain necessary permits or approvals from government authorities |

|

• |

we may be affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays expenses, or our tax expense estimates, may prove to be inaccurate |

• |

there may be defects in, or challenges to, title to our properties |

|

• |

we may be unable to enforce our legal rights under our existing agreements, permits or licences, or may be subject to litigation or arbitration that has an adverse outcome |

|

• |

accidents or equipment breakdowns may occur |

|

| • | cyclical nature of the mining industry | |

|

• |

there may be changes to government regulations or policies, including tax and trade laws and policies |

|

• |

we may be adversely affected by changes in foreign currency exchange rates, interest rates or tax rates |

• |

our estimates of production, purchases, costs,

decommissioning or reclamation

|

|

| • | uncertainties and costs related to determining whether mineral resources or mineral reserves exist on a property |

2016 Annual Information Form – Page 5

| • |

natural phenomena, including inclement weather, fire, flood and earthquakes |

|

|

|

||

| • |

our operations or the operations of third parties to whom we transfer properties in which we retain an interest may be disrupted due to problems with our own or our customers’ facilities, the unavailability of reagents or equipment, equipment failure, lack of tailings capacity, labour shortages, ground movements, transportation disruptions or accidents or other exploration and development risk |

• |

future sales by existing shareholders could reduce the market price of our shares |

|

|

|

|

• |

a substantial number of our shares are held by an exchange traded fund which is in a position to exercise influence over matters requiring shareholder approval, among other things |

|

Material assumptions

| • |

the assumptions regarding market conditions

upon which we have based our capital expenditure expectations |

|

| • | the availability of additional capital and financing on acceptable terms, or at all | |

| • |

our mineral reserve and resource estimates and the assumptions upon which they are based are reliable | |

| • | the success of our exploration plans | |

| • | our expectations regarding spot prices and realized prices for gold and other precious metals | |

| • | market developments and trends in global supply and demand for gold meeting expectations | |

| • | our expectations regarding tax rates and payments, foreign currency exchange rates and interest rates | |

| • | our reclamation expenses | |

| • | the geological conditions at our properties |

• |

our ability to comply with current and future environmental, safety and other regulatory requirements, and to obtain and maintain required regulatory approvals without undue delay | |

• |

our operations or the operations of third parties who own properties in which we have an interest are not significantly disrupted as a result of natural disasters, governmental or political actions, litigation or arbitration proceedings, the unavailability of reagents, equipment, operating parts and supplies critical to our activities, equipment failure, labour shortages, ground movements, transportation disruptions or accidents or other exploration and development risks | |

• |

our ability to support stakeholders necessary to develop our mineral projects | |

• |

the accuracy of geological, mining and metallurgical estimates | |

• |

maintaining good relationships with the communities in which we operate |

2016 Annual Information Form – Page 6

National Instrument 43-101 definitions

Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions in NI 43-101 are adopted from those given by the Canadian Institute of Mining Metallurgy and Petroleum (“CIM”).

| Mineral Resource |

The term “mineral resource” refers to a concentration or occurrence of diamonds, natural, solid, inorganic or fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

|

| |

| Measured Mineral Resource |

The term “measured mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

|

| |

| Indicated Mineral Resource |

The term “indicated mineral resource” refers to that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

|

| |

| Inferred Mineral Resource |

The term “inferred mineral resource” refers to that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

|

| |

| Qualified Person |

The term “qualified person” refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. |

2016 Annual Information Form – Page 7

Glossary of units

| Unit | Abbreviation |

| centimetre(s) | cm |

| cubic metre(s) | m3 |

| day | d |

| degree(s) | ° |

| foot/feet (as context requires) | ft. |

| gram(s) | g |

| grams per tonne | g/t |

| hectare(s) | ha |

| kilogram(s) | kg |

| kilometre(s) | km |

| metre(s) | m |

| micrometre(s) | µm |

| million ounces | Moz. |

| million tonnes | Mt |

| ounce(s) | oz. |

| ounce(s) per tonne | oz./t |

| parts per million | ppm |

| square kilometre(s) | km2 |

| square metre(s) | m2 |

| tonne(s) | t |

| tonnes per cubic metre | t/m3 |

Glossary of elements

| Element | Abbreviation |

| copper | Cu |

| gold | Au |

| silver | Ag |

2016 Annual Information Form – Page 8

Cautionary note to US investors

Technical disclosure contained or incorporated by reference in this AIF has not been prepared in accordance with the requirements of United States securities laws and uses terms that comply with reporting standards in Canada with certain estimates prepared in accordance with NI 43-101.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in this AIF have been prepared in accordance with NI 43-101 and the CIM Classification System.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and mineral reserve and resource information contained or incorporated by reference in this AIF may not be comparable to similar information disclosed by US companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”.

Under US standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made and volumes that are not “reserves” should not be disclosed. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under SEC standards. Accordingly, mineral reserve estimates included in this AIF may not qualify as “reserves” under SEC standards. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by US standards in documents filed with the SEC.

Our US investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under reporting standards in Canada differ in certain respects from the standards of the SEC. Accordingly, information concerning mineral deposits set forth or incorporated by reference herein may not be comparable with information made public by companies that report in accordance with US standards.

2016 Annual Information Form – Page 9

About First Mining

Headquartered in Vancouver, British Columbia, we are a new "mineral property bank" business concept initiated by our Chairman, Mr. Keith Neumeyer. Our business model is to acquire high-quality mineral assets in geopolitically safe areas of the Americas and either advance them or hold (ie. “bank”) them until a time when capital markets for commodities and mining improves.

At that point we would endeavor to add value for our shareholders, including potentially entering into agreements with other parties who would move the projects forward through development, and we would retain a residual interest in the projects. The residual interests may be in the form of royalties, metal streams, minority interests or equity positions in the party that is moving the project forward.

|

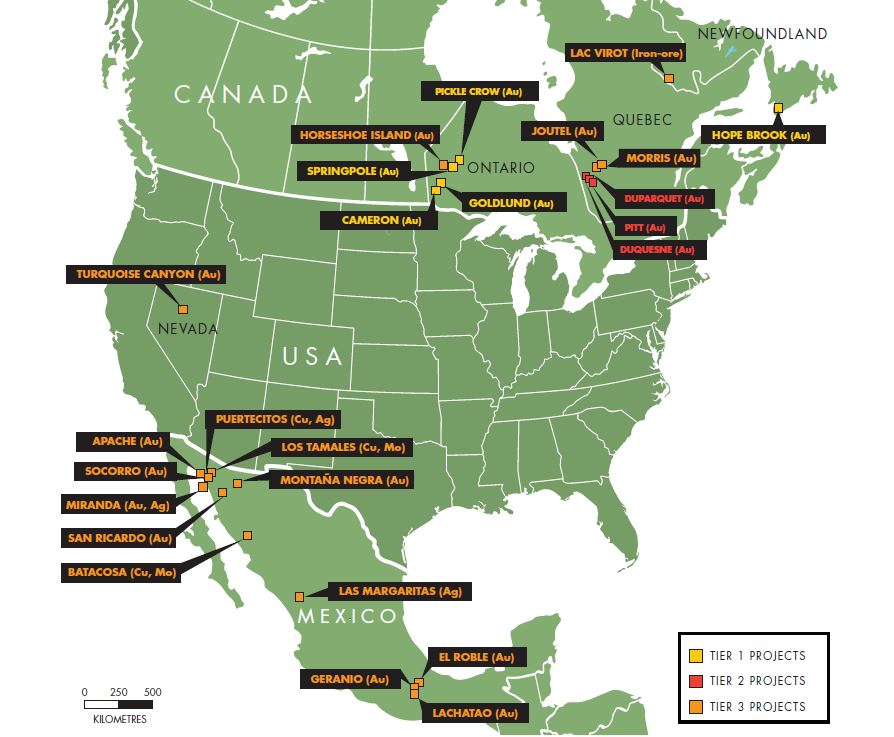

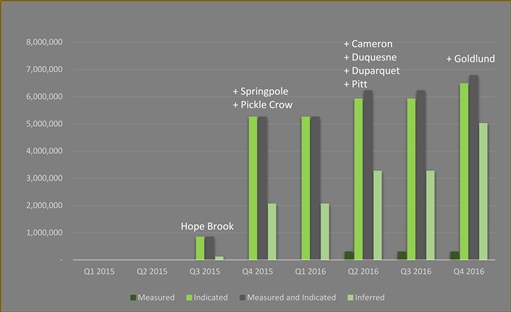

Since listing on the TSX-V in April 2015, First Mining has completed eight transactions, and as a result we have accumulated approximately 6.8 million ounces of gold Measured and Indicated Resources and approximately 5.0 million ounces of gold Inferred Resources across our entire property portfolio, which comprises of 25 mineral assets in Canada, Mexico and the United States. |

First Mining Finance Corp. | ||

| (TSX-V: FF; OTC-QX: FFMG; Frankfurt: FMG) | |||

| Head Office: | Registered & Records Office: | ||

| First Mining Finance Corp. | McCullough O’Connor Irwin LLP | ||

| Suite 1805, Cathedral Place | Suite 2600, Oceanic Plaza | ||

| 925 West Georgia Street | 1066 West Hastings Street | ||

| Vancouver, BC V6C 3L2 | Vancouver, BC V6E 3X1 | ||

| Canada | Canada | ||

| Telephone: 604.639.8848 | |||

Vision and strategy

Our vision is to build one of the largest portfolios of exploration and development projects in the Western Hemisphere. To achieve this goal, our strategy is to:

| • | acquire high quality mineral projects that have had multi-millions of dollars invested on exploration and development, but at a fraction of the cost; | |

| • | add internal, organic value by de-risking some of our assets through exploration, drilling, calculating resource estimates, conducting economic studies and other activities; | |

| • | utilize our management team’s expertise to identify acquisition targets and hold our assets until we are able to monetize them in the form of re-sales, joint ventures, royalty structures or a combination of such revenue-type models; and | |

| • | ultimately pay a dividend to our shareholders. |

We consider the following criteria when assessing potential acquisition targets:

| • |

Quality of asset – we consider factors such as economics, grade, size and exploration potential, metallurgy and mineability (eg. strip ratio) when assessing a new mineral property. | |

|

| ||

| • |

Location – we are focused on assets located in politically stable and mining friendly jurisdictions. | |

|

| ||

| • |

Availability of infrastructure – we consider whether the project has good access to power, water, highways, ports and a labour force. | |

|

| ||

| • |

Holding costs – we take into account the holding costs (eg. assessment work requirements) and annual taxes payable on the mineral claims when deciding whether to acquire a new mineral property. | |

| • | Valuation – until recently, our focus has been on significantly undervalued gold assets, most of which have had an enterprise value of less than US$10 per ounce of gold. |

2016 Annual Information Form – Page 10

General overview of our business

We are in the exploration and development stage of our corporate development, and we do not own any producing properties. Consequently, we have no current operating income or cash flow from our properties, nor have we had any income from operations in the past three financial years. At this time, our operations are primarily funded by equity subscriptions.

An investment in First Mining is speculative and involves a high degree of risk due to the nature of our business and the present stage of exploration of our mineral properties. We encourage readers to carefully consider the risk factors that are set out in this AIF in the section “Risks that can affect our business” which starts on page 74.

Principal products

We are currently in the exploration stage and do not produce, develop or sell mineral products. Our principal focus is primarily on gold.

Specialized skills and knowledge

Our business requires individuals with specialized skills and knowledge in the areas of geology, drilling, geophysics, geochemistry, metallurgy and mineral processing, implementation of exploration programs, mining engineering, accounting, and compliance. To date, we have been able to locate and retain such professionals in Canada and in the USA, and we believe we will be able to continue to do so.

Competitive conditions

We operate in a very competitive industry and compete with other companies in the mineral exploration and mining industry in all phases of exploration and development, including: (a) seeking out and acquiring mineral exploration and development properties; (b) obtaining the resources necessary to identify and evaluate mineral properties and to conduct exploration and development activities on such properties; and (c) raising the capital necessary to fund our operations.

As a result of this competition, we may at times compete with other companies that have greater financial resources and technical facilities, and we may be unable to acquire properties of interest in the future on terms we consider to be acceptable, or to attract or retain qualified personnel. As well, we cannot assure you that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favourable to us.

Cycles

The mining business is subject to commodity price cycles. The gold market, late in 2010, made significant gains in terms of US dollars but remained volatile throughout 2011 and suffered significant declines in 2013 and 2014. The financial markets for mining in general and mineral exploration and development in particular, continued to be very weak through to 2016. If the global economy stalls and commodity prices decline as a consequence, a continuing period of lower prices could significantly affect the economic potential of many of our current properties and may result in First Mining ceasing work on, or dropping its interest in, some or all of our properties. As we do not carry on production activities, our ability to fund ongoing exploration is affected by the availability of financing (and particularly equity financing) which, in turn, is affected by the strength of the economy and other general economic factors.

In addition, our mineral exploration activities may be subject to seasonality due to adverse weather conditions at our project sites. Drilling and other exploration activities on our properties may be restricted during the winter season as a result of various weather related factors including, without limitation, inclement weather, snow covering the ground, frozen ground and restricted access due to snow, ice or other weather related factors.

2016 Annual Information Form – Page 11

Gold market fundamentals and trends1

Demand

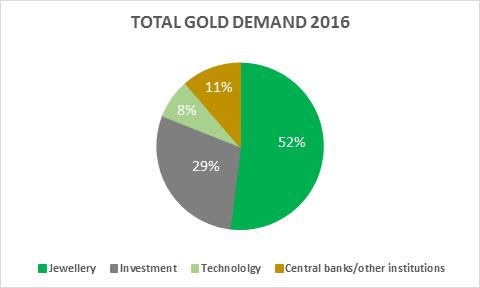

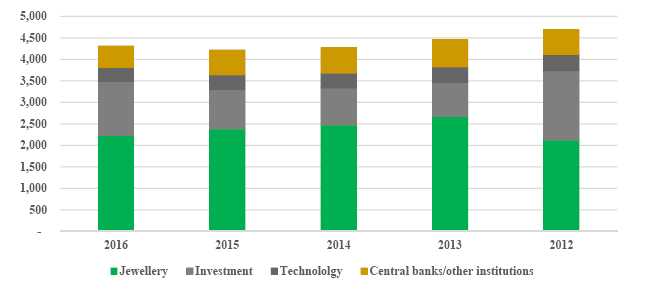

Gold has emotional, cultural and financial value worldwide, and this supports demand across generations. It is fashioned into jewellery, it is used to manage risk in financial portfolios and protect the wealth of nations, and it is found in smart phones and cutting-edge medical diagnostics. These diverse uses for gold (in jewellery and technology, and by central banks and investors), mean that, across the decades, different sectors in the gold market have risen in prominence at different points in the global economic cycle. This self-balancing nature of the gold market typically means that there is a sustained base level of demand.

Gold demand in 2016 gained 2% to reach a three-year high of 4,308.7 t, and the price of gold ended the year up by 8%. Annual inflows into ETFs reached 531.9 t, the second highest on record. Declines in jewellery and central bank purchases offset this growth. Annual bar and coin demand was broadly stable at 1,029.2 t, helped by a surge in the last quarter of 2016.

Jewellery

A dominant area of demand for gold has always been jewellery. Prized for its value and beauty, gold jewellery has a universal status that remains constant. Between 2011 and 2015, the jewellery industry has, on average, accounted for around 50% of global gold demand, but the source of this demand has shifted in line with the new dynamics of economic growth and wealth in the world.

India and China are the two largest markets for gold jewellery, together representing over half of global consumer demand. Part of the large appetite for jewellery in these countries is driven by the cultural role gold plays; it is considered auspicious to buy gold at key festivals and events. Limited access to financial assets means gold has an important parallel status as a store of value. In both India and China, gold jewellery is a desirable possession as well as an investment to be passed down through generations.

________________________________________

1 All of

the information contained in this section “Gold market fundamentals and

trends” has been sourced from articles on the World Gold Council’s website,

www.gold.org. First Mining has not independently verified any of this

information and makes no assurances as to its accuracy. Readers should visit the

World Gold Council’s website for comprehensive details regarding the discussion

contained in this section.

2016 Annual Information Form – Page 12

2016 saw a seven-year low for jewellery demand. Rising prices for much of the year, regulatory and fiscal hurdles in India, and China’s softening economy were key reasons for weakness in the sector. Overall, however, gold demand by the jewellery industry currently shows no signs of abating, driven by growing wealth and demographic shifts: by 2020 India and China combined will have one billion new urban consumers. These aspirational populations in Asia are also experiencing a rise in disposable income, which is driving gold demand.

Investment

Gold has unique qualities that enhance risk management and capital preservation for institutional and private investors the world over. Research has shown that a modest allocation to gold makes a valuable contribution to the performance of a portfolio by protecting against downside risk without reducing long term returns. These qualities are considered to be particularly important during periods of financial stress. However, gold’s effectiveness in stabilising returns and protecting capital is just as relevant regardless of economic environment. Today, investment in gold accounts for about a third of global demand. This demand is made up of direct ownership of gold bars and coins, or indirect ownership via Exchange-Traded Funds (“ETFs”) and similar products.

Investment demand for gold in 2016 was up by 70%, reaching its highest level since 2012. The past year also represented the second best year for gold ETFs on record since 2009, with demand from gold-backed ETFs and similar products reaching 531.9 t. The last quarter of 2016 did see 193.1 t of outflows from the gold ETFs.

Global demand for gold bars and coins was, for the most part, stable. China’s gold bar and coin demand was its strongest since 2013, and demand in the United States reached 93.2t, its highest level since 2010. Conversely, India’s gold market suffered in 2016, gold bar and coin demand in the Middle East fell to its lowest level on record (18.1 t), and in East Asia it fell by 7%.

Central Bank Purchasing

Central banks’ behaviour with respect to gold has fundamentally shifted over the past few years. This reflects a combination of slowing sales from European central banks and large purchases from emerging market countries in Latin America, the Middle East and Asia. Since 2010, central banks have been net buyers of gold, and their demand has expanded rapidly, growing from less than 2% of total world demand in 2010 to 14% in 2014.

This change in behaviour is a clear acknowledgement of the benefits that gold can bring to a reserve portfolio. Some banks have bought gold to diversify their portfolios, especially from US$ denominated assets, with which gold has a strong negative correlation. Others have bought gold as a hedge against tail risks or because of its inflation-hedging characteristics (gold has a long history of maintaining its purchasing power). Gold plays a prominent role in reserve asset management, as it is one of the few assets that is universally permitted by the investment guidelines of the world’s central banks. This is in part due to the gold market being deep and liquid, which is a key characteristic required by reserve asset managers.

2016 was the seventh consecutive year of net purchases of gold by central banks, albeit the lowest annual total since 2010. In total, central banks bought 383.6 t on a net basis during the year, 33% lower than in 2015. The slowdown in purchases and increase in sales can be partly attributed to pressure on FX reserves.

Buying in 2016 was led by Russia, China and Kazakhstan. Together, they accounted for around 80% of the full-year figure. Qatar joined the ranks of central banks adding to gold holdings, increasing its reserves by a net 6.8 t between January and October. Net buying was strongest in the last quarter of 2016, when central banks accumulated over 114 t of gold, despite a stronger US dollar.

2016 Annual Information Form – Page 13

Demand for Gold in Technology

Around 9% of global demand for gold is for technical applications. The electronics industry accounts for the majority of this, where gold’s conductivity and resistance to corrosion make it the material of choice for manufacturers of high-specification components. In addition, the metal’s excellent biocompatibility means that it continues to be used in dentistry.

Beyond electronics and dentistry, gold is used across a variety of high-technology industries, in complex and difficult environments, including the space industry, and in fuel cells. Gold’s catalytic properties are also beginning to create demand from both within the automotive sector (as the metal has now been proven to be a commercially viable alternative to other materials in catalytic converters), and within the chemical industry.

A range of healthcare and catalytic applications for gold is currently being developed as the field of nanotechnology expands. While this demand is still small in tonnage terms, the growing number of patents being published relating to gold nanotechnology suggests many new applications will be developed in the coming years.

Despite an upturn late in the year, annual demand for gold in technology fell 3% in 2016, from 332.0 t to 322.5t. First quarter weakness, caused by global economic uncertainty, higher gold prices and substitution, squeezed the full year total. The last quarter of 2016, however, was a bright spot, with quarterly demand hitting its highest level since the second quarter of 2015. Gold used in electronics rose 4% year-over-year to 66.9 t in the last quarter of 2016, boosted by increased demand for gold bonding wire and Printed Circuit Boards (“PCBs”). While demand slowed in the LED and wireless sectors, rampant growth in the gold bonding wire and PCB industries lifted the quarterly total to positive territory.

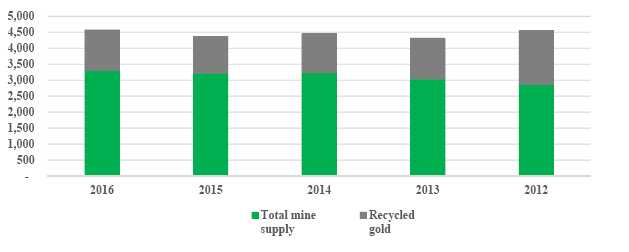

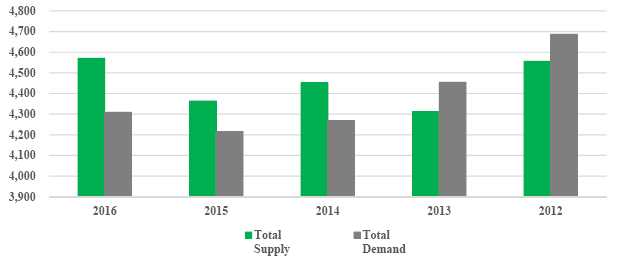

Total Gold Demand (Tonnes)

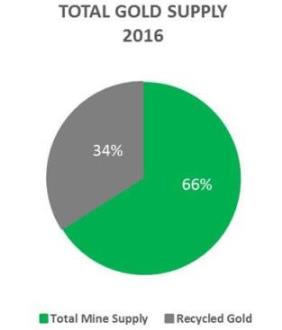

Supply

Over the past 10 years, the annual total supply of gold has averaged around 4,000 t. In 2016, the total global supply of gold was 4,571 t, with global demand at 4,309 t for the year. In the last quarter of 2016, global gold supply was 1,036 t (demand for gold for the same period was 994 t).

While many people are aware that gold is sourced from the earth through mining, this is not the only way in which gold is supplied to the market. Total mine supply (the sum of mine production and net producer hedging) accounts for two thirds of total gold supply. Recycled gold accounts for the remaining third.

2016 Annual Information Form – Page 14

Mine production

The sources of mine production have become as geographically diverse as gold demand. China was the largest producer in the world in 2015, accounting for around 14% of total production. Asia as a whole produces 23% of all newly-mined gold. Central and South America produce around 17% of the total, with North America supplying around 16%. Around 19% of production comes from Africa and 14% from the CIS region.

Mined gold totalled 3,236 t in 2016, virtually unchanged from 2015. Gold production peaked in the third quarter, when 850.4 t was brought on to the market, before falling back to 810.9 t in the last quarter of 2016. However, 2016 did signal a renewed vigour for exploration. In November, a Moody's report predicted that the higher average gold price in 2016 will spur an increase in capital spending over the coming year. SNL Metals & Mining, in its recent Gold Mined Supply Report, also highlighted renewed interest in exploration in the latter part of 2016.2

Producer hedging

There are times when gold producers will want to lock in a future price for their gold – for example, so that they can ensure a return appropriate to their current production costs. The gold sold into the market adds to supply in the short term. It brings metal on to the active market – and allows mining companies to sell metal ahead of their production schedules.

2016 saw a near-doubling of annual net producer hedging, to 26.3 t from 13.5 t. Gold producers, who have struggled with the falling gold price in recent years, saw an opportunity to secure cash flow at higher prices.

The first and second halves of 2016 were polar opposites. In the first half, net hedging was a feature of the market (70.4 t), as strong price gains (around 25% by mid-year) prompted some miners to act. Currency movements had driven the gold price up to record levels in some key producer currencies. But in the second half of the year the gold price struggled to hold onto these gains, leading to a shift in tone with producers less keen to hedge in a falling price environment. Net de-hedging (of 44.1 t) was a feature of the second half of 2016.

Recycled gold

Because gold is virtually indestructible, all the gold ever mined still exists, apart from a small amount which has been lost. Gold is recoverable from most of its uses and capable of being melted down, re-refined and reused. Recycled gold therefore plays an important part in the dynamics of the gold market. While gold mine production is relatively inelastic, the gold recycling industry provides an easily-traded supply of gold when it is needed, thereby helping to stabilise the gold price.

________________________________

2 Gold Mined

Supply December 2016: Short-term plans, short-sighted benefits, SNL Metals &

Mining, December 2016.

2016 Annual Information Form – Page 15

The growth in recycling in 2016, up 17% from 1,116.5 t to 1,308.5 t, was concentrated in the first three quarters of the year. At its peak, gold was almost 30% up from end-2015 levels, and these higher gold prices created an environment in which recycling thrived.

Total Gold Supply (Tonnes)

Total Gold Supply & Demand (Tonnes)

Economic dependence

Our business is dependent on the acquisition, exploration, development and operation of mineral properties. We are not dependent on any contract to sell our products or services or to purchase the major part of our requirements for goods, services or raw materials, or on any franchise or licence or other agreement to use a patent, formula, trade secret, process or trade name upon which our business depends.

2016 Annual Information Form – Page 16

Employees

As of the date of this AIF, we have 13 full-time employees and 2 part-time employees, and we utilize consultants and contractors as needed to carry on many of our activities and, in particular, to supervise and carry out the work programs at our mineral projects.

Environmental protection

We are subject to the laws and regulations relating to environmental matters in all jurisdictions in which we operate, including provisions relating to property reclamation, discharge of hazardous materials and other matters.

We may also be held liable should environmental problems be discovered that were caused by former owners and operators of our projects. We conduct our mineral exploration activities in compliance with applicable environmental protection legislation. Our mineral properties have not created any significant disturbance as far as we know, and we do not consider any of our properties to be a financial risk to First Mining. In addition, we are not aware of any existing environmental concerns related to any of our properties that may result in material liability to First Mining. From a financial reporting perspective, there were no reclamation liability amounts recorded in our audited annual financial statements for the year ended December 31, 2016, given that the nature of any reclamation work in relation to our mineral properties is not material to First Mining at this time. We are also not aware of any existing environmental problems related to any of our properties that may result in material liability to First Mining.

If needed, and to the extent that it can be done economically, we make and will continue to make expenditures to ensure compliance with applicable laws and regulations. New environmental laws and regulations, amendments to existing laws and regulations, or more stringent implementation of existing laws and regulations could have a material adverse effect on us, both financially and operationally, by potentially increasing capital and/or operating costs and delaying or preventing the development of our mineral properties.

We believe that the policies and procedures implemented by our executive management team provide a safe working environment for all of our employees, consultants, contractors and stakeholders. We recognize that safety and environmental due diligence are significant components that enable long-term sustainability of our operations and support our objective of projects being completed in a cost effective and timely manner with excellent quality control.

Bankruptcy and similar procedures

There are no bankruptcies, receivership or similar proceedings against us, nor are we aware of any such pending or threatened proceedings. We have not commenced any bankruptcy, receivership or similar proceedings during our history.

Foreign operations

We currently hold an interest in certain non-material, Tier 3 exploration stage mineral resource properties located in Mexico and the United States. Such properties are exposed to various degrees of political, economic and other risks and uncertainties. See “Risks that can affect our business” starting on page 74.

2016 Annual Information Form – Page 17

Reorganizations

On March 30, 2015, we completed our “Qualifying Transaction” (as such term is defined under the policies of the TSX-V) and acquired all of the issued and outstanding common shares of KCP Minerals Inc. (formerly known as Sundance Minerals Ltd.) (“Sundance”) (the “Sundance Acquisition”). In connection with the Sundance Acquisition, we changed our name to “First Mining Finance Corp.”, completed a four-to-one (4:1) share consolidation and continued under the laws of the province of British Columbia pursuant to the provisions of the Business Corporations Act (British Columbia) (the “BCBCA”).

Major developments

| 2014 | |

| • |

Prior to the Sundance Acquisition, we were a “capital pool company” (as defined in the policies of the TSX-V). Our principal business was the identification and evaluation of assets or businesses with a view to completing a Qualifying Transaction. We did not commence commercial operations and had no assets other than a minimal amount of cash. |

|

2015 |

|

|

|

|

|

March |

|

|

|

|

|

• |

We completed the Sundance Acquisition as our “Qualifying Transaction” pursuant to the policies of the TSX-V and became a Tier 2 Mining Issuer listed on the TSX-V. |

|

May |

|

|

|

|

|

• |

We entered into a definitive arrangement agreement with Coastal Gold Corp. (“Coastal Gold”), holder of the Hope Brook property (the “Hope Brook Property”) located in southwestern Newfoundland, pursuant to which we would acquire all of Coastal Gold’s outstanding shares by way of a court-approved plan of arrangement (the “Coastal Gold Arrangement”). |

|

July |

|

|

|

|

|

• |

We completed the acquisition of Coastal Gold pursuant to the Coastal Gold Arrangement. Under the transaction, each Coastal Gold shareholder received 0.1625 of a share of First Mining for each Coastal Gold share they held. As a result of the transaction, we acquired the Hope Brook Property. |

|

|

|

|

• |

Mr. Derek Iwanaka joined First Mining as Vice President, Investor Relations. |

|

|

|

|

September |

|

|

|

|

|

• |

We entered into a definitive arrangement agreement with Gold Canyon Resources Inc. (“Gold Canyon”), holder of the Springpole property (the “Springpole Property”) located in the Red Lake Mining District of Ontario, pursuant to which we would acquire all of Gold |

|

|

|

|

• |

Canyon’s outstanding shares by way of a court-approved plan of arrangement (the “Gold Canyon Arrangement”). |

|

2015 |

|

|

||

|

September (continued) |

|

|

||

• |

We entered into a definitive arrangement agreement with PC Gold Inc. (“PC Gold”), holder of the Pickle Crow property (the “Pickle Crow Property”) located in Northwestern Ontario, pursuant to which we would acquire all of PC Gold’s outstanding shares by way of a court-approved plan of arrangement (the “Gold Canyon Arrangement”). |

|

|

||

November |

||

|

• | We completed the acquisition of Gold Canyon pursuant to the Gold Canyon Arrangement. Under the transaction, each Gold Canyon shareholder received one share of First Mining for each Gold Canyon share they held. As a result of the transaction, we acquired the Springpole Property. |

|

||

• |

We completed the acquisition of PC Gold pursuant to the PC Gold Arrangement. Under the transaction, each PC Gold shareholder received 0.2571 of a share of First Mining for each PC Gold share they held. As a result of the transaction, we acquired the Pickle Crow Property. |

|

|

|

|

• |

We entered into a definitive arrangement agreement with Goldrush Resources Ltd. (“Goldrush”), holder of two royalty interests on two gold projects in Burkina Faso, West Africa, pursuant to which we would acquire all of Goldrush’s outstanding shares by way of a court-approved plan of arrangement (the “Goldrush Arrangement”). |

|

2016 Annual Information Form – Page 18

Major developments (continued)

|

2016 |

|

|

|

|

|

January |

|

|

|

|

|

• |

We completed the acquisition of Goldrush pursuant to the Goldrush Arrangement and, as a result, we acquired their treasury of approximately $3.4 million. Under the transaction, each Goldrush shareholder received 0.0714 of a share of First Mining for each Goldrush share they held. |

| February | |

|

• |

We entered into a definitive arrangement agreement with Clifton Star Resources Inc. (“Clifton Star”) pursuant to which we would acquire all of Clifton Star’s outstanding shares by way of a court-approved plan of arrangement (the “Clifton Star Arrangement”). |

|

March |

|

| • | We entered into a purchase agreement with Brionor Resources Inc. (“Brionor”) pursuant to which we agreed to acquire the Pitt gold property (the “Pitt Property”). |

| April | |

• |

We completed our acquisition of Clifton Star pursuant to the Clifton Star Arrangement. Under the transaction, each Clifton Star shareholder received one First Mining share for each Clifton Star share they held. As a result of the transaction, we acquired the Québec mineral properties that were held by Clifton Star, namely a 100% interest in the Duquesne gold project (the “Duquesne Project”), a 100% interest in four early-stage precious and base metals projects, and a 10% indirect interest in the Duparquet gold project (the “Duparquet Project”). In addition, we acquired Clifton Star’s treasury of approximately $11 million in cash. Following the transaction, Michel Bouchard, Clifton Star’s former President and CEO, joined our Board. |

| • | We completed our purchase of the Pitt Property from Brionor for $1.25 million, of which $250,000 was paid in cash and the remaining $1 million was satisfied through the issuance to Brionor of 2,535,293 First Mining shares (based on the 20-day VWAP of Brionor’s shares as of March 6, 2016). |

|

May |

|

|

|

|

| • | We entered into a share purchase agreement with Chalice Gold Mines Limited (“Chalice”), pursuant to which we agreed to acquire all of the shares of Cameron Gold Operations Ltd. (“Cameron Gold”), a wholly-owned subsidiary of Chalice and owner of the Cameron gold project in Ontario (the “Cameron Project”). |

|

• |

We entered into an amalgamation agreement with Tamaka Gold Corporation (“Tamaka”), a privately held mineral exploration company that held a 100% interest in the Goldlund gold project in Ontario (the “Goldlund Project”), pursuant to which Tamaka would become a wholly-owned subsidiary of First Mining (the “Tamaka Amalgamation”). |

2016 |

||

June |

||

• |

We completed our acquisition of Cameron Gold. In connection with the transaction, we issued 32,260,836 First Mining shares to Chalice. Under the terms of the transaction, Chalice agreed not to sell more than 4,032,604 First Mining shares in any month after the expiry of the four month hold period on October 10, 2016, unless the sale is in a single block to a purchaser acceptable to First Mining. In addition, we issued Chalice a 1% net smelter returns (“NSR”) royalty on certain claims within the Cameron Project, and we have a right to repurchase 0.5% of the NSR royalty for $1 million. |

|

• |

We completed the Tamaka Amalgamation, which resulted in Tamaka becoming a wholly-owned subsidiary of First Mining. Under the transaction, former Tamaka shareholders received an aggregate of approximately 92.5 million First Mining shares. In addition, under the terms of the transaction, certain Tamaka shareholders who held in the aggregate approximately 39.6% of the outstanding Tamaka shares have deposited the First Mining shares that they received under the transaction into escrow. 5,931,658 of these escrowed First Mining shares will be released from escrow on June 17, 2017, and every six months thereafter a further 5,931,658 First Mining shares will be released from escrow, until the final escrow release on June 17, 2019. |

|

| • | Mr. Samir Patel was appointed as our new Corporate Counsel and Corporate Secretary, and Mr. Bill Tanaka joined the Company as Vice President, Technical Services. |

|

| • | We granted 10,595,000 stock options to directors, officers, employees and consultants of First Mining, with an exercise price of $0.75 and exercisable for five years. Certain of these options are subject to vesting provisions in accordance with the rules and policies of the TSX-V. | |

August |

||

|

||

• |

We closed a non-brokered private placement (the “Private Placement”) of units (the “Units”) under which we raised gross proceeds of $27 million. We issued 33,750,000 Units with each Unit consisting of one First Mining share and one-half of a common share purchase warrant to purchase a First Mining share at $1.10 for a period of three years following the closing of the Private Placement. Certain of our directors and officers subscribed for an aggregate of 1,139,659 Units in the Private Placement. | |

2016 Annual Information Form – Page 19

Major developments (continued)

2016 |

|

|

|

|

September |

|

|

|

|

|

• |

We completed the sale of all of the outstanding shares of one of our Mexican subsidiaries, Minera Terra Plata S.A. de C.V. (“Terra Plata”), which owns the Peñasco Quemado, La Frazada and Pluton properties (the “Mexican Silver Properties”) located in Mexico to Silver One Resources Inc. (“Silver One”), formerly BRS Ventures Ltd. As a result of the transaction, Terra Plata became a wholly-owned subsidiary of Silver One, and Silver One acquired ownership of the Mexican Silver Properties. As consideration, we received six million common shares of Silver One, and we retained a 2.5% NSR royalty on the Mexican Silver Properties. Silver One may buy back 1.5% of this NSR royalty by paying US$1 million to us. |

|

|

|

|

• |

Mr. Andrew Marshall was appointed as our new Chief Financial Officer. |

|

|

|

October |

|

|

|

|

|

• |

We commenced a metallurgical drill program at our Springpole gold project, comprised of up to four drill holes totaling approximately 1,500 m. The intent of the metallurgical testing program is to determine the optimal grind size and processing flow sheet so as to maximize metallurgical recoveries. The results from this metallurgical testing program are expected to be incorporated into a new Preliminary Economic Assessment (“PEA”) for Springpole. |

|

2016 |

|

|

|

|

|

November |

|

|

|

|

• |

We commenced of a diamond drilling program at our Pickle Crow gold project, comprised of up to eight drill holes totaling approximately 1,100 m. |

|

|

|

|

|

December |

|

|

|

|

|

• |

We provided an update of our exploration and corporate activities, and informed our investors that our Board has approved a $21 million exploration and development budget for 2017, which contemplated approximately 47,000 m of infill and exploration drilling at our priority Canadian asset. |

Recent developments

2017 |

|

|

|

|

January |

|

|

|

|

|

• |

We announced the filing of an amended technical report for the Pitt Gold Project entitled “NI 43-101 Technical Report and Review of the Preliminary Resource Estimate for the Pitt Gold Project, Duparquet Township, Abitibi Region, Québec, Canada”, and dated January 5, 2017. |

|

|

|

|

• |

We announced the release of an initial mineral resource estimate for our Goldlund Gold Project located near the town of Sioux Lookout in northwestern Ontario. |

|

|

|

|

• |

We announced the commencement of a 27,000 m drilling campaign at our Goldlund Gold Project, focused on in-fill and resource expansion of Zone Seven, and the signing of definitive asset purchase agreements to purchase certain mineral claims located in Ontario and Québec. |

|

|

|

|

February |

|

|

|

|

|

• |

We announced the completion of our Fall 2016 drilling |

|

2017 |

|

|

|

|

|

February (continued) |

|

|

|

|

program at our Pickle Crow Project, which consisted of nine holes comprising approximately 1,300 m of drilling, and the completion of a metallurgical diamond drill program at our Springpole Gold Project located in northwestern Ontario. |

||

|

|

|

• |

We announced the filing of a technical report outlining the initial resource estimate for our Goldlund Gold Project entitled Technical Report and Resource Estimation Update on the Goldlund Project”, and dated January 23, 2017. |

|

|

|

|

• |

We announced the completion of the acquisition of certain mineral claims located in Ontario and Québec, and the grant of 10,630,000 stock options to directors, officers, employees and consultants of First Mining, with an exercise price of $0.85 and exercisable for five years. Certain of these options are subject to vesting provisions in accordance with the rules and policies of the TSX-V. |

|

2016 Annual Information Form – Page 20

Recent developments (continued)

| 2017 |

March

| • | We announced the release of an updated mineral resource estimate for our Cameron Gold Project located near the town of Sioux Narrows in northwestern Ontario. |

Significant acquisitions

We have not completed any significant acquisitions during our most recently completed financial year.

How First Mining was formed

We were incorporated on April 4, 2005 in the Province of Alberta, Canada pursuant to the Business Corporations Act (Alberta) under the name “Parkdale Petroleum Ltd.” and changed our name on May 3, 2005 to “Albion Petroleum Ltd.” (“Albion”). Albion was initially listed as a “capital pool company” (“CPC”) on the TSX-V on September 30, 2005 under the policies of the TSX-V. As a CPC, Albion’s only business had been to identify and evaluate businesses or assets with a view to completing a “Qualifying Transaction” (as that term is defined in TSX-V Policy 2.4).

On July 1, 2014, Albion and Sundance entered into an arrangement agreement whereby Albion agreed to acquire all of the issued and outstanding shares of Sundance in exchange for shares of the resulting entity. On March 11, 2015, Sundance was renamed as KCP Minerals Inc. (“KCP”), and on March 30, 2015, Albion consolidated all of its issued and outstanding shares on a four-for-one basis. Subsequently, Albion acquired all of the issued and outstanding shares of KCP on a one-for-one basis, constituting its Qualifying Transaction.

Immediately following the completion of the transaction, Albion was renamed as “First Mining Finance Corp.” On March 30, 2015, First Mining was continued under the laws of the Province of British Columbia, Canada pursuant to the BCBCA, and as a result, First Mining is now governed by the laws of the Province of British Columbia.

We are a reporting issuer in the province of British Columbia (our principal reporting jurisdiction) and in each of the other provinces of Canada.

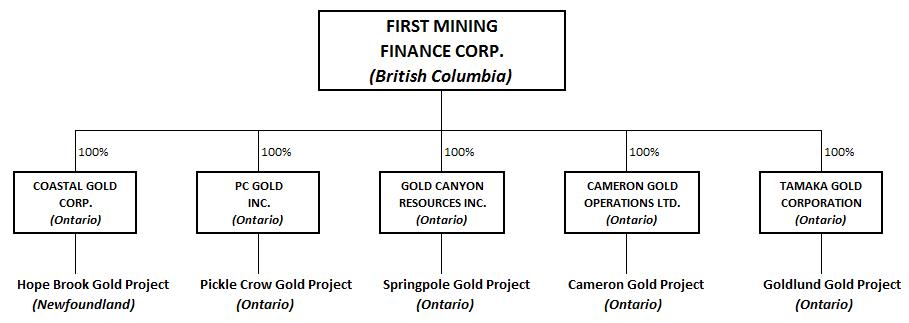

| We currently have the following material wholly-owned subsidiaries: |

For more information | |

| • | Gold Canyon Resources Inc., a company incorporated under the BCBCA. | |

| • | Tamaka Gold Corporation, a company incorporated under the Business Corporations Act (Ontario) ("OBCA"). | |

| • | PC Gold Inc., a company incorporated under the OBCA | |

| . | ||

| • | Cameron Gold Operations Ltd., a company incorporated under the OBCA. | |

| • | Coastal Gold Corp., a company incorporated under the OBCA. | |

Our other subsidiaries, which each have total assets and revenues less than 10%, and in the aggregate less than 20%, of our total consolidated assets or our total consolidated revenue, are excluded from the above list.

2016 Annual Information Form – Page 21

Corporate organization chart

The following diagram shows our current corporate structure and material subsidiaries, including the properties held by the various subsidiaries:

Note:

| • |

Our other subsidiaries, which each have total assets and revenues less than 10%, and in the aggregate less than 20%, of our total consolidated assets or our total consolidated revenue, are excluded from the above chart. |

Our projects

We have interests in mineral properties located in Canada, Mexico and the United States. As at December 31, 2016, these properties were carried on our balance sheet as assets with a total book value of approximately $228 million. The book value consists of acquisition costs plus cumulative expenditures on properties for which the Company has future exploration plans. The current book value is not necessarily the same as the total expenditures on each property by the Company, as part of the expenditures on some properties have been written down. The book value is also not necessarily the fair market value of the properties.

Our material and non-material projects are set out below.

Material projects

| • | Springpole Property (Ontario)................................................. | p. 23 | |

| • | Goldlund Property (Ontario).................................................... | p. 33 | |

| • | Cameron Property (Ontario).................................................... | p. 42 | |

| • | Pickle Crow Property (Ontario)............................................... | p. 52 | |

| • | Hope Brook Property (Newfoundland & Labrador)................ | p. 63 |

Non-material projects

| • | Canada...............................… | p. 70 | |

| • | Mexico..............................…. | p. 70 | |

| • | United States…..................... | p. 74 |

2016 Annual Information Form – Page 22

Springpole

Technical report

The Springpole Property project (the “Springpole Project”) description is based on the project’s technical report: Preliminary Economic Assessment for the Springpole Project, Ontario, Canada (effective date March 24, 2013, as amended October 7, 2016) (the “Springpole Technical Report”). The report was prepared for us in accordance with NI 43-101, by or under the supervision of Dr. Gilles Arseneau, Ph.D., P.Geo.; Dr. Adrian Dance, Ph.D., P.Eng.; John Duncan, P.Eng.; Christopher Elliot, FAusIMM; Mark Liskowich, P.Geo.; Bruce Murphy, FSAIMM; Michael Royle, P.Geo.; Dr. Maritz Rykaart, Ph.D., P.Eng.; and Dino Pilotto, P.Eng.; all qualified persons within the meaning of NI 43-101. The following description has been prepared under the supervision of Chris Osterman, P.Geo. who is a qualified person within the meaning of NI 43-101, but is not independent of us.

The conclusions, projections and estimates included in this description are subject to the qualifications, assumptions and exclusions set out in the Springpole Technical Report, except as such qualifications, assumptions and exclusions may be modified in this AIF. We recommend you read the Springpole Technical Report in its entirety to fully understand the project. You can download a copy from our SEDAR profile (www.sedar.com), or from our website (www.firstminingfinance.com).

Project description, location and access

The Springpole Project lies approximately 110 km northeast of the Municipality of Red Lake in northwest Ontario, Canada. The latitude and longitude coordinates for the project are:

| • | Latitude N51° 23′ 44.3″ | |

| • | Longitude W92° 17′ 37.4″ |

The Universal Transverse Mercator map projection based on the World Geodetic System 1984 (WGS84) zone 15N is:

| • | Easting 549,183 | |

| • | Northing 5,693,578 | |

| • | Average Elevation 395 m |

During late spring, summer, and early fall, the Springpole Project is accessible by floatplane direct to Springpole Lake or Birch Lake. All fuel, food, and material supplies are flown in from Red Lake or Pickle Lake, Ontario, or from Winnipeg, Manitoba, with flight distances of 110 km, 167 km, and 370 km, respectively. The closest road access at present is the landing at the old South Bay Mine on Confederation Lake, approximately 50 km away by air. During winter, an ice road approximately 85 km long is constructed from the South Bay landing point on Confederation Lake to a point about 1 km from Springpole Lake camp. During breakup in spring and freeze-up in fall, access to the Springpole Property is by helicopter.

Gold Canyon acquired ownership of five patented claims in 1993 and six unpatented mining claims and related Crown leases for surface rights in 2011. The five patented claims are fee simple parcels with mining and surface rights attached to all five claims registered with the Land Registry Office, Kenora, Ontario. A total of 300 contiguous unpatented mining claims make up the greater area of the Springpole Project and have been staked directly by Gold Canyon.

Through Gold Canyon, we lease 10 patented claims which are fee simple parcels with mining and surface rights attached to registered, together with the notices of lease, with the Land Registry Office in Kenora, Ontario. The lease is for a term of 21 years less one day and terminates on April 14, 2031. Under the lease, we are obligated to pay all applicable property taxes related to the 10 patented claims during the lease term together with advance royalty payments on a sliding scale of $50,000 per year (2011-2016), $60,000 (2016-2021), and $80,000 (2021-2031). These payments are to be credited to future NSR payables, if any. We have an option to acquire these 10 patented claims and would be required to do so upon the commencement of commercial production on these or certain adjoining patented claims. This option term is renewable for a further period of five years by providing notice and a $25,000 payment. The consideration payable is, at our option on exercise or at the option of the leaseholder upon commencement of commercial production, either (a) $5 million with the leaseholder retaining a 1% NSR or (b) $4 million with the leaseholder retaining a 2% NSR. We have a right of first refusal on any sale of the remaining royalty interest on certain terms and conditions.

2016 Annual Information Form – Page 23

Through Gold Canyon, we also have an option and lease to a further 15 patented claims which are fee simple parcels with mining and surface rights attached and registered, together with the notice of option and lease, with the Land Registry Office, Kenora, Ontario. The option can be exercised by us before expiry of the earlier option period by confirmation of good standing of the agreement and payment of a $50,000 renewal fee. We are required to make option payments in the aggregate amount of $35,000 per year and to expend an aggregate of $300,000 on mining operations in each option term as a condition of any renewal and to pay all property taxes related to these patented claims. We have an option to acquire the 15 claims and would be required to do so upon the commencement of commercial production at any time during the option period by payment of an aggregate of $2 million. Upon exercise of the purchase option, we must also acquire the cabin on the property for the lesser of fair market value or $20,000.

Underlying royalties which affect the Springpole Property are:

| • | 3% NSR on five patented claims payable to Jubilee Gold Exploration Ltd. (“Jubilee Gold”) upon commencement of commercial production with advance royalty payments of $70,000 per year, adjusted using the yearly Consumer Price Index. We have an option to acquire 1% of the NSR for $1,000,000 at any time, and a right of first refusal on any sale of the NSR. We can terminate the royalty obligations at any time by transferring the five patented claims back to Jubilee Gold; | |

| • | 3% NSR on 10 leased patented claims payable to a leaseholder upon commencement of commercial production with advance royalty payments on a sliding scale of $50,000 per year (2011-2016), $60,000 per year (2016-2021), and $80,000 per year (2021-2031). We have a right to acquire up to 2% of the NSR for $1,000,000 per 1% at any time; | |

| • | 3% NSR on 15 patented claims (held by us pursuant to an option and lease) is payable to an optionor and leaseholder during the option term upon commencement of commercial production or a 1% NSR if the purchase option is exercised prior to commercial production. We have a right to acquire the remaining 1% NSR by a payment of $500,000; and | |

| • | 3% NSR on six unpatented mining claims payable to an individual vendor upon commencement of commercial production with advance royalty payments of $50,000 per year. We have an option to acquire all or a portion of the NSR at a rate of $500,000 per 1% of the NSR. |

We are required to purchase a vacation home owned by a vendor that is located on the Springpole Property upon commencement of commercial production.

Subsequent to their acquisition, the Crown leases were to expire. Gold Canyon subsequently received the lease renewal from the Crown Lands Office.

To keep an unpatented mining claim current, the mining claim holder must perform $400 per mining claim unit worth of approved assessment work per year, immediately following the initial staking date. The claim holder has two years to file one year worth of assessment work.

Surface rights are separate from mining rights. Should any method of mining be appropriate, other than those claims for which Crown leases were issued, the surface rights would need to be secured.

2016 Annual Information Form – Page 24

History

Gold exploration on the property was carried out during two main periods, one during the 1920s to 1940s, and a second period from 1985 to the present.

Between 1933 and 1936, extensive trenching and prospecting was conducted on the Springpole Property, including 10 short holes totalling 458.5 m. Limited trenching and prospecting was competed in 1945.

The area remained dormant until 1985. On the 30 patented claims line cutting was done at both 30.5 m centres and 61 m centres. Subsequently, geological mapping, humus geochemistry, and ground geophysics were conducted over the grids.

From 1986 through 1989, 118 diamond drill holes were completed in seven drill phases totalling 38,349 m. In addition, during 1986 and 1987, approximately 116,119 m2 of mechanical stripping was carried out and four petrographic reports were produced.

From 1989 through 1992, an induced polarization survey over the central portion of the Portage zone under Springpole Lake was conducted and the Springpole Property was tested with eighteen core holes totalling 6,195 m. The majority of the drilling was conducted on the Portage zone. At the same time, a seven core hole drill program was completed around the east margins of Springpole Lake and lake-bottom sediment sampling of Springpole Lake east of Johnson Island was completed.

During 1995, an exploration program consisting of remapping of the main area, of some of the existing drill core, and a reinterpretation of the geology was carried. During the 1995 and 1996 programs, an additional 69 hole were drilled totalling 15,085 m on the Springpole Project proper and two drill holes on Johnson Island. By late 1996, Gold Canyon acquired 100% of the Springpole Property. Gold Canyon continued exploration in 1997 and 1998 with another 51 core holes totalling 5,642 m.

In the summer of 1998 a lake bottom sediment sampling program was conducted in several areas of the Springpole Property.

During 2004, 2005, and 2006, diamond drilling programs were conducted on the property by Gold Canyon.

In the fall of 2007, Gold Canyon embarked on a limited exploration program to further investigate the Fluorite zone that was previously identified.

From early August through to the end of October 2009, Gold Canyon re-logged and re-sampled a portion of the historic drill core stored at Gold Canyon’s project site and temporary tent camp.

During the spring and summer of 2010, a total of 8,664.2 m of HQ core drilling was completed in 23 drill holes.

In the winter of 2010, a total of six diamond drill holes were drilled for a total of 1,774.5 m of HQ drilling.

In 2011, Gold Canyon carried out a drill program which totaled 28,750 m in 80 diamond core holes.

A 2012 drill program began in-filling the Portage zone based upon results of the 2011 drill program. The 2012 drill program totaled 38,069 m in 87 diamond core holes.

In 2013, Gold Canyon commissioned SRK Consulting (Canada) Inc. to complete a preliminary economic assessment on the Springpole Property.

Geological setting, mineralization and deposit types

The Springpole Gold Property is within the Archean-aged Birch-Uchi Greenstone Belt. Studies of the southern part of the Birch-Uchi greenstone belt have revealed a long, multistage history of crustal development. Based on mapping, lithogeochemistry, and radiometric dating, the supracrustal rocks of the greenstone belt were subdivided into three stratigraphic group-scale units (listed in decreasing age): the Balmer, Woman and Confederation assemblages. This three-part subdivision was applied to most of the Uchi Subprovince. The Confederation assemblage is thought to be a continental margin (Andean-type) arc succession, versus the less certain tectono-stratigraphic context of the other assemblages. Some relatively small conglomeratic units likely form a synorogenic, discontinuously distributed, post-Confederation assemblage in the Birch-Uchi greenstone belt.

2016 Annual Information Form – Page 25

The northern margin of the Birch-Uchi greenstone belt forms a pattern of sub-regional scale cusps of supracrustal strata alternating with batholiths. Basaltic units are prominent around the periphery of the greenstone belt and may be part of the Woman assemblage but the accuracy of this stratigraphic assignment is unknown. It is suggested that Confederation assemblage age rocks make up the bulk of the greenstone belt.

The Springpole Property is underlain by a polyphase alkali, trachyte intrusive displaying autolithic breccia. The intrusive is comprised of a system of multiple phases of trachyte that is believed to be part of the roof zone of a larger syenite intrusive; fragments displaying phaneritic textures were observed from deeper drill cores in the southeast portion of the Portage zone. Early intrusive phases consist of megacrystic feldspar phenocrysts of albite and orthoclase feldspar in an aphanitic groundmass. Successive phases show progressively finer grained porphyritic texture while the final intrusive phases are aphanitic. Within the country rocks to the north and east are trachyte and lamprophyre dikes and sills that source from the trachyte- or syenite-porphyry intrusive system.

The main intrusive complex appears to contain many of the characteristics of alkaline, porphyry style mineralization associated with diatreme breccias (e.g. Cripple Creek, Colorado). This style of mineralization is characterized by the Portage zone and portions of the East Extension zone where mineralization is hosted by diatreme breccia in aphanitic trachyte. It is suspected that the ductile shearing and brittle faulting have played a significant role in redistributing structurally controlled blocks of the mineralized rock. Diamond drilling in the winter of 2010 revealed a more complex alteration with broader, intense zones of potassic alteration replacing the original rock mass with biotite and pyrite. In the core area of the deposit where fine grained disseminated gold mineralization occurs with biotite, the primary potassic alteration mineral, gold displays a good correlation with potassium/rubidium.

Exploration

No exploration activity is currently underway at the Springpole Project, however, we did drill four representative holes in 2016 to provide material for additional metallurgical testing.

Drilling

During the winters of 2007 and 2008 Gold Canyon conducted drill programs that completed 21 holes totalling 3,159 m, 11 holes totalling 2,122 m, and 7 holes totalling 2,452 m of diamond core drilling, respectively.

During the winter of 2010, a total of six diamond drill holes were drilled for a total of 1,774.5 m of HQ drilling. Two drill holes were not completed and both holes ended in altered and mineralized rock. The drill program revealed a more complex alteration with broader, intense zones of potassic alteration replacing the original rock mass with biotite and pyrite. During the spring and summer of 2010, a total of 8,664.2 m of HQ core drilling was completed in 23 drill holes, averaging 44.23 m of drilling per 24-hour shift, including time for moving the drill between drill sites.

The 2011 drill program totaled 28,750 m in 80 diamond core holes. Five of the diamond core holes were drilled for the purpose of metallurgical testing. All these holes were twins of previously drilled holes.

The 2012 drill program began in-filling the Portage zone based upon results of the 2011 drill program. The goal was to in-fill areas where inferred mineral resource had been defined in the February 2012 mineral resource update and to expand the mineral resource area to the southeast. The 2012 drill program totaled 38,069 m in 87 diamond core holes.

2016 Annual Information Form – Page 26

Sampling, analysis and data verification

Detailed descriptions of the drill core were carried out under the supervision of a senior geologist, a member in good standing of the Association of Professional Geologists of Ontario and American Institute of Professional Geologists. The core logging was carried out on-site in a dedicated core logging facility. Drill log data were recorded onto paper logs that were later scanned and digitized.

Core was laid out 30 to 40 boxes at a time. First, the core was photographed in 15 m batches prior to logging or sampling. This is followed by a geotechnical log that records quantitative and qualitative engineering data including detailed recovery data and rock quality designation. Any discrepancies between marker blocks and measured core length were addressed and resolved at this stage. The core was then marked up for sampling.

For the 2010 and 2011 drill programs, all the drill core intervals were sampled using sample intervals of 1 m. During the 2012 drilling program, Gold Canyon changed its standard sample length from 1 to 2 m lengths. However, in zones of poor recovery, 1.5 m or 3 m samples were sometimes collected. Samples over the standard sample length were typically half core samples and whole core was generally only taken in intervals of poor core recovery across the sampled interval. Sampling marks were made on the core and sample tickets were stapled into the core boxes at the beginning of each sample interval. Quality control samples were inserted into the sample stream.

Inserting quality control samples involved the addition of certified blanks, certified gold standards, and field and laboratory duplicates. Field duplicates were collected by quartering the core in the sampling facility on-site. Laboratory duplicates were collected by splitting the first coarse reject and crushing and then generating a second analytical pulp. Blank, standards and duplicates made up 10% of the total sample stream. Sample tickets were marked blank, field or laboratory duplicate, or standard, and a sample tag was stapled into the core box within the sample stream.

Geological descriptions were recorded for all core recovered. Separate columns in the log allow description of the lithology, alteration style, intensity of alteration, relative degree of alteration, sulphide percentage, rock colour, vein type, and veining density. A separate column was reserved for written notes on lithology, mineralization, structure, vein orientations/relations etc. The header page listed the hole number, collar coordinates, final depth, start/end dates, and the name of the core logging geologist.

Following the logging and core marking procedures described above, the core was passed to the sampling facility. Core sampling was performed by experienced sampling technicians from Ackewance Exploration & Services (“Ackewance”) of Red Lake, Ontario, and quality control was maintained through regular verification by on-site geologists. Core was broken, as necessary, into manageable lengths. Pieces were removed from the box without disturbing the sample tags, were cut in half lengthwise with a diamond saw, and then both halves were carefully repositioned in the box. When a complete hole was processed in this manner, one half was collected for assay while the other half remained in the core box as a witness. The remaining core in the boxes was then photographed at 51 cm (20 inch) intervals. All logs and photographs were then submitted to the senior geologist/project manager for review and were archived. Data were backed up.