UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

Sam Lee Laundry LLC

(Exact name of issuer as specified in its charter)

California

(State of other jurisdiction of incorporation or organization)

224

28th Street

San Francisco, CA 94131

Phone: (415) 828-2301

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

David L. Gluck

General Manager

224 28th Street

San Francisco, CA 94131

Phone: (415) 828-2301

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Laura Anthony, Esq.

Legal & Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 561-514-0936

Fax: 561-514-0832

| 7990 | 47-2776115 | |

| (Primary

Standard Industrial Classification Code Number) |

|

(I.R.S.

Employer Identification Number) |

This Offering Circular shall only be qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the terms of Regulation A.

PRELIMINARY OFFERING CIRCULAR

Form 1-A

SAM LEE LAUNDRY LLC

David L. Gluck, General Manager

224 28th Street

San Francisco, CA 94131

(415) 828-2301

www.________________.com

Best Efforts Offering

of 200 Units of Series B Limited Liability Company Interests

$5,000 per Unit

Sam Lee Laundry LLC is a theatrical production company and is not engaged

in any business related to the laundering or cleaning of clothes.

See additional disclosures on page 17 of this Offering Circular

These securities are offered on a “best efforts”

basis. There is no minimum required sale. We have made no arrangements to place subscription proceeds or funds in an escrow, trust

or similar account, which means that the proceeds or funds from the sale of units will be immediately available to us for use

in our operations and once received and accepted, are irrevocable. These securities are being offered for cash only, directly

by the Company with no underwriter or broker-dealer. No commissions are payable to any salespersons, brokers, or dealers. No securities

owned by current securityholders are included in this offering. No public market currently exists for these securities.

| Underwriting Discounts | Proceeds to | Proceeds to | ||||||

| Price to Public | And Commissions | Issuer | Other Persons | |||||

| Per Unit: | $5,000 | None | $5,000 | None | ||||

| Total Minimum: | None | None | None | None | ||||

| Total Maximum: | $1,000,000 | None | $1,000,000 | None |

Fractional units may be issued. The minimum required purchase by any investor is $2,000.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THE ATTORNEY GENERAL OF THE STATE OF CALIFORNIA HAS NOT REVIEWED THIS DOCUMENT OR ANY OTHER DOCUMENT SUBMITTED TO INVESTORS IN CONNECTION WITH THIS OFFERING FOR THE ADEQUACY OF ITS DISCLOSURE AND DOES NOT PASS ON THE MERITS OF THIS OFFERING.

THESE SECURITIES INVOLVE A HIGH DEGREE OF RISK AND PROSPECTIVE PURCHASERS SHOULD BE PREPARED TO SUSTAIN A LOSS OF THEIR ENTIRE INVESTMENT. See “Risk Factors” BEGINNING ON page 6 of this OFFERING Circular.

The proposed sale will begin as soon as practicable after this Offering Circular has been qualified by the Securities and Exchange Commission and the relevant state regulators, as necessary. This offering will close upon the earlier of (1) the sale of the maximum number of units of Series B limited liability company interests offered hereby, (2) one year from the date this offering begins, or (3) a date prior to one year from the date this offering begins that is so determined by our managing members.

DATE OF OFFERING CIRCULAR: _________________, 2016

| 1 |

THERE IS AT THIS TIME, NO PUBLIC MARKET FOR THE SECURITIES

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SECURITIES AND EXCHANGE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES BEING OFFERED ARE EXEMPT FROM REGISTRATION. THE SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THESE LAWS. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE REGULATORY AUTHORITY NOR HAS THE COMMISSION OR ANY STATE REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, THE COMPANY ENCOURAGES YOU TO REVIEW RULE 251 (d)(2)(i)(C) OF REGULATION A.

THE COMPANY IS FOLLOWING THE “OFFERING CIRCULAR” FORMAT

OF DISCLOSURE UNDER REGULATION A

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL OR ANY PERSON TO WHO IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED PRIOR TO THE TIME AN OFFERING CIRCULAR WHICH IS NOT DESIGNATED AS A PRELIMINARY OFFERING CIRCULAR IS DELIVERED AND THE OFFERING STATEMENT FILED WITH THE COMMISSION BECOMES QUALIFIED.

NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THERE AS HAS BEEN NO CHANGE IN THE AFFAIRS OF OUR COMPANY SINCE THE DATE HEREOF. INFORMATION CONTAINED IN THE PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT.

THE OFFERING PRICE OF THE SECURITIES IN WHICH THIS OFFERING CIRCULAR RELATES HAS BEEN DETERMINED BY THE COMPANY AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE COMPANY OR ANY OTHER RECOGNIZED CRITERIA OF VALUE.

NASAA UNIFORM LEGEND:

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY THE FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

| 2 |

TABLE OF CONTENTS

| 3 |

This Offering Circular describes the offer and sale by us of units of Series B limited liability company interests (“Series B Units”) pursuant to the exemption from registration provided by Section 3(b) of the Securities Act and Regulation A promulgated thereunder.

This Offering Circular speaks only as of the date hereof.

We will amend this Offering Circular whenever the information it contains has become false or misleading in light of existing circumstances and for other purposes, such as to disclose material developments related to the Series B Units, to update required financial statements or if there has been a fundamental change in the information initially presented. We will file an amended Offering Circular as part of an amendment to our Form 1-A, which we will file with the SEC, state regulators or other appropriate regulatory bodies. Our amended Offering Circular will be posted on our website when the amendment has been qualified by the SEC. Although the issuer is not using a selling agent or finder in connection with this offering, it will use a website as an online portal and information management tool in connection with the offering. The website is owned and operated by the issuer and can be viewed at http://www._________________.com.

The Series B Units are not available for offer and sale to residents of every state. Our website will indicate the states where residents may purchase Series B Units. We will post on our website any special suitability standards or other conditions applicable to purchases of the Series B Units in certain states that are not otherwise set forth in this Offering Circular.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

This Offering Circular, together with Financial Statements, consists of a total of approximately 34 pages.

IMPORTANT NOTICE TO INVESTORS

The following summary highlights information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all of the information that you should consider before investing in Series B Units. You should carefully read the entire Offering Circular; especially the section concerning the risks associated with the investment in common stock, discussed under “Risk Factors.”

Unless we state otherwise the terms “we”, “us”, “our”, “Company”, “Sam Lee Laundry”, “management”, or similar terms collectively refer to Sam Lee Laundry LLC, a California limited liability company.

Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

THE COMPANY AND BUSINESS SUMMARY

The Company

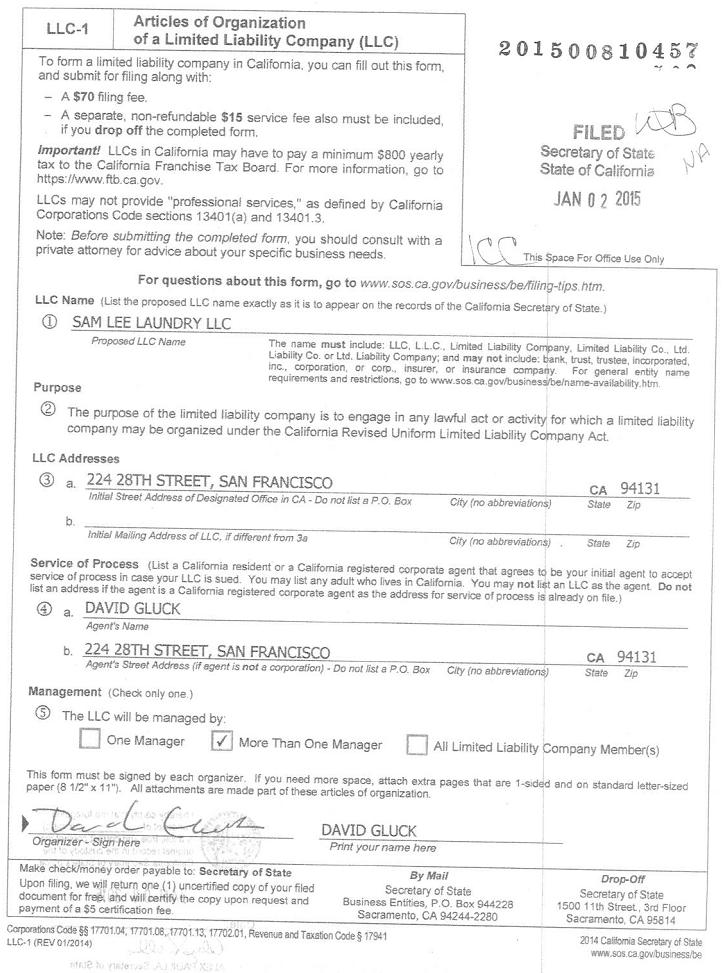

Sam Lee Laundry was organized on January 2, 2015, pursuant to the laws of the State of California, for the purpose of producing and promoting the theatrical entertainment currently titled “The Speakeasy” (the “Play”) in the City and County of San Francisco. Our managing members are Geoffrey N. Libby, Nicholas A. Olivero, and Silverwolf Group LLC (“Silverwolf”) providing the services of David L. Gluck (collectively, “Managing Members”). Mr. Gluck is the sole member of Silverwolf. The Play is an immersive theatre experience that takes place within a simulated 1923 speakeasy. The concept of the Play was created by Mr. Olivero. The Play was previously produced by Joe’s Clock Shop LLC from January 2014 to June 2014, in San Francisco. The Managing Members, with others, were also the managing members of Joe’s Clock Shop LLC, which was dissolved at the end of 2014.

| 4 |

Key Partners

We intend to produce the Play at a new theatrical venue, currently under development at 644 Broadway, San Francisco, California (the “Theater”). Boxcar Theatre Inc. (“Boxcar”) is a California nonprofit corporation that has secured a 25-year lease on the Theater, and has agreed to provide the Theater for performances the Play on an open-ended basis. We will produce the Play in association with Boxcar, which will serve as “presenter” of the Play, and will provide the venue, box office services, and food and beverage operations. We will serve as “producer” of the Play, and will provide all creative elements, production management, and promotion. The two companies will share revenue generated by the Play in accordance with the Theatrical Production Agreement executed among them. As provided for in the Theatrical Production Agreement, we will make a cash payment of $500,000 to Boxcar to support development of the venue. Boxcar will finance the remainder the venue development costs through fundraising, borrowing, and retained earnings. Mr. Olivero is the founder and artistic director of Boxcar.

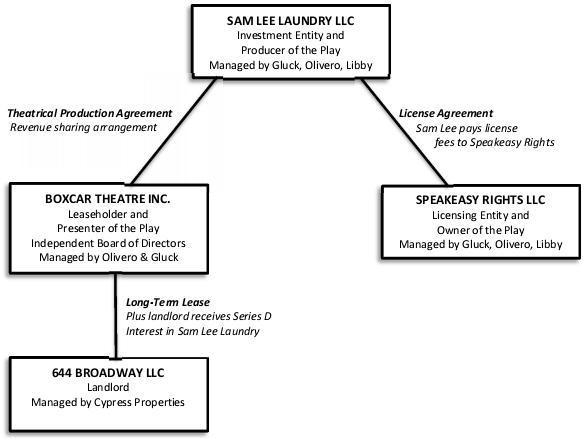

We have licensed the Play from its owner, Speakeasy Rights LLC (“Speakeasy Rights”) pursuant to a license agreement. See “Description of Business—Material Agreements.” Our Managing Members are also the managing members of Speakeasy Rights. A diagram demonstrating our relationships with Boxcar, Speakeasy Rights, and other key entities is included below:

Previous Offering

On May 1, 2015, we commenced a private offering of $1,500,000 in units of Series A limited liability company interests (the “Series A Units”) at a price of $30,000 per unit. We issued an aggregate of 27.67 Series A Units in the Series A offering, which closed on January 31, 2016, and received $830,000 in proceeds, including $90,000 in Series A Units purchased by the Managing Members and their spouses. Investors in Series A Units received a 1% interest in Sam Lee Laundry for each full unit investment of $30,000 (Company valuation of $3 million). Investors in Series B Units will receive a 0.1% interest in Sam Lee Laundry for each full unit investment of $5,000 (Company valuation of $5 million). No holder of Series A Units is selling its interest in Sam Lee Laundry as part of this offering.

Currently, there is no public market for these securities, and we expect that none will arise and that there will be little or no ability for investors to resell the Series B Units. We will return capital contributions to each holder of Series B Units upon the cessation of operations, or upon the request of a holder of Series B Units to withdraw as a member of Sam Lee Laundry, subject to certain restrictions as detailed in the section entitled “Securities Being Offered”.

High Degree of Risk

Given the nature of the theatrical production industry, and other factors, these securities carry a high degree of risk, and investors should be prepared to sustain a loss of their entire investment. See “Risk Factors” beginning on page 6.

| 5 |

THE OFFERING

| Securities offered by the Company | 200 units of Series B limited liability company interests | |

| Offering price per unit | Fixed price of $5,000 per Series B Unit for the duration of the offering. The minimum investment is $2,000 and fractional units may be issued. | |

| Number of units outstanding before the offering | No Series B Units are outstanding. We previously issued 27.67 Series A Units, equal to a cumulative 27.67% interest in Sam Lee Laundry. See “Securities Being Offered” for a discussion of the differences between security classes. | |

| Minimum number of units to be sold in this offering |

None. However, the minimum investment is $2,000 and fractional units may be issued. | |

| Market for these securities | There is presently no public market for these securities. | |

| Use of proceeds | We intend that the proceeds from this offering will be used to pay for production expenses related to the presentation of the Play at the Theater in San Francisco. We have made no arrangements to place subscription proceeds or funds in an escrow, trust or similar account, which means that the proceeds or funds from the sale of Series B Units will be immediately available to us for use in our operations and once received and accepted, are irrevocable. | |

| Termination of the offering | This offering will close upon the earlier of (1) the sale of the maximum number of Series B Units offered hereby, (2) one year from the date this offering begins, or (3) a date prior to one year from the date this offering begins that is so determined by the Managing Members. |

An investment in our Series B Units involves high degree of risk. You should carefully consider each of the following risks and all of the information set forth in this Offering Circular before deciding to invest in our Series B Units. If any of the following risks and uncertainties develops into an actual event, our business financial condition, results of operations and cash flows could be materially adversely affected. You may lose all or part of your investment. In connection with the forward-looking cautionary statements that appear in this Offering Circular you should also carefully review the cautionary statement referred to under “Cautionary Statement Concerning Forward Looking Statements.”

RISKS RELATING TO OUR COMPANY

We are a new business.

We were formed on January 2, 2015 and have not yet commenced performances of the Play. We are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our financial objectives and that the value of our Series B Units could decline substantially. In our first year of operation, we recorded a loss, having received no revenue and having incurred $51,893 in expenses.

Ticket sales are very difficult to predict.

Our financial projections depend upon a forecast of ticket sales that is based on the size of the venue, and the production history of the Play. However, the availability of a certain number of tickets for the Play does not mean that the majority of those tickets will be sold. Actual ticket sales depend upon a variety of factors, many of which are difficult to predict. These factors include: public awareness of the Play, public interest in the Play, affordability of tickets, competition from other theatrical offerings, and competition from a wide range of non-theatrical entertainment choices.

Based on a capitalization of $1,500,000, and given the capacity of the Theater, the prevailing theatrical ticket prices in San Francisco, and the anticipated running costs, we must run the Play for 36 weeks (following the official opening) to a full capacity house in order recoup the full capitalization, or for a longer period if presented to less than full house capacity, or to recoup a higher capitalization. There is no guarantee that the Play will achieve these benchmarks.

| 6 |

Ticket prices may be reduced below projected levels.

Our financial projections depend upon an initial average ticket price of $100, and subsequent price increases. While this pricing is consistent with that of other high-end theatrical offerings in San Francisco, New York, London, and other centers of commercial theatre, nonetheless it positions the Play as a “luxury good.” Not all residents of, or visitors to, San Francisco will consider this price affordable. In the event of a significant macro-economic downturn, even fewer potential ticket buyers may consider this price affordable.

We may find it necessary to reduce ticket prices in order to maintain public interest in the Play. We may do so by reducing the base ticket price or offering discounted tickets. Under such circumstances, it is likely that the profitability of the Play will be reduced, and if the Play has not already recouped at the time of the pricing decrease, the time to recoupment may be longer.

Boxcar may lose its tax exempt status.

As a tax-exempt organization, Boxcar enjoys certain benefits that contribute to the profitability of the Play, including exemption from local business payroll taxes, reduced local licensing fees (including liquor license), and eligibility for grants and other forms of public support. However, there is no guarantee that Boxcar will maintain its tax-exempt status for the duration of this project. The Internal Revenue Service or the California Franchise Tax Board may revoke Boxcar’s tax-exempt status for a variety of reasons, including failure to file required information returns, or in the event that Boxcar is deemed insufficiently independent from us that it no longer serves a broad public purpose. Should Boxcar’s tax exempt status be revoked for any reason, Boxcar’s expenses may increase, and our share of revenue from the Play may be reduced, which could reduce net profits and delay the repayment of the capital contributions of holders of Series B Units.

Boxcar has not yet secured a liquor license.

Boxcar has not yet submitted an application for an alcoholic beverage license for the Theater to the California Bureau of Alcoholic Beverage Control. If Boxcar is not able to obtain such license prior to the commencement of performances, or at any particular time, we anticipate that Boxcar shall: (a) acquire an alcoholic beverage license on the secondary market; or (b) hire a third party to operate the bar under its own license. Under any such circumstances, we would expect that our share of bar revenue may be lower than projected, net profits may be reduced, and recoupment of all capital contributions may be extended or prevented.

Boxcar has not yet secured other required licenses, including Health Department and Entertainment Commission licenses.

In addition to an alcohol beverage license, Boxcar must secure several other certificates and licenses before performances of the Play can commence at the Theater. These licenses include a Certificate of Occupancy from the San Francisco Department of Building Inspection, a Certificate of Public Assembly from the San Francisco Fire Department, a license to operate food and beverage service from the San Francisco Health Department of Public Health, and an entertainment license from the San Francisco Entertainment Commission. Delays in obtaining any of these licenses could adversely affect our ability to open the Play within the projected time frame.

Construction projects often experience delays and cost overruns.

Our time line and plan of operations is predicated upon the completion of leasehold improvements at the Theater within certain cost and scheduling parameters. Construction cost overruns and/or scheduling delays could adversely affect our ability to open the Play within the projected time frame, or at all, and could cause us, Boxcar, or both, to engage in borrowing which could reduce net profits and delay the repayment of the capital contributions of holders of Series B Units.

Classification of performers as independent contractors may be disallowed by the California Employment Development Department (the “EDD”).

In the Bay Area, some theatre companies operate under the auspices of one or more contracts with Actors Equity Association, the labor union representing professional actors. Many theatre companies do not operate under such union contracts. It is common practice in this region for non-union theatre companies to classify performers as independent contractors rather than payroll employees. We intend to follow this common industry practice by paying non-unionized performers on an independent contractor basis.

| 7 |

We are aware that in recent years, several theatres in the Bay Area have been subject to audit by the EDD, and that some such audits have resulted in letters of determination, fines and penalties related to this practice. In the event that we receive an audit by EDD, we may be required to reclassify non-unionized performers as employees, and this change (as well as possible fines or penalties) could result in a substantial increase in operating costs that could adversely affect our ability to achieve our financial objectives.

Our ability to achieve our financial objectives depends on the ability of our Managing Members to manage our operations. If we were to lose one or more of our Managing Members, our ability to achieve our objectives may be severely harmed.

In the event that one or more of our Managing Members resigned or otherwise left Sam Lee Laundry, we might not be able to secure the services of a similarly qualified professional to take his place. If he were not replaced, the remaining Managing Members might not be sufficiently effective to continue managing Sam Lee Laundry in such a way that it achieves its financial objectives. We do not maintain key man life insurance for any of the Managing Members, and so would receive no financial compensation in the event of the death of a Managing Member.

Managing Members are not required to devote their full-time efforts to Sam Lee Laundry.

Although all of the Managing Members are full-time employees as of the date of this Offering Circular, the Managing Members are not obliged to devote their full time and efforts to our activities and may participate in other business activities, including other theatrical ventures. It is the stated intention of the Managing Members to open additional productions of the Play in other cities, and to exploit the underlying material in other media, and to produce other plays in San Francisco and elsewhere. Doing so would likely decrease the Managing Members’ level of involvement with Sam Lee Laundry, and confer increased responsibility on our staff.

Such additional productions and other business activities would not be conducted by us, and the Managing Members would be under no obligation to account for their time devoted to, or compensation arising from, these activities. We and holders of Series B Units would have no right to be a participant, investor, or other beneficiary of these activities.

The compensation we pay to the Managing Members was determined without independent assessment on our behalf, and these terms may be less advantageous to us than if such terms had been the subject of arm’s-length negotiations.

The compensation we pay to the Managing Members was not entered into on an arm’s-length basis with an unaffiliated third party. As a result, the form and amount of such compensation may be less favorable to us than they might have been had these been entered into through arm’s-length transactions with an unaffiliated third party.

Managing Members may receive compensation while the business is losing money.

Each Managing Member is entitled to receive a weekly “Producer Fee,” as provided for in the Operating Agreement. In addition, the Managing Members may receive other fees related to the services they provide to the production of the Play. These fees may be paid regardless of whether we realize any profit.

The Managing Members are also owners of Speakeasy Rights, the licensing company that holds the rights to all the intellectual property associated with the Play. In this capacity, the Managing Members will receive a portion of all licensing fees paid by Sam Lee Laundry. The License Agreement requires us to pay a percentage of net ticket sales, regardless of whether the Play is profitable.

Because of these arrangements, it is in the financial interest of the Managing Members to continue to present the Play regardless of whether doing so will cause us to realize any profit. Continuing to perform the Play while it is losing money may result in financial losses and decreases in operating reserves and/or capital accounts of holders of Series B Units.

The Managing Members’ liability will be limited.

Pursuant to the terms of the Operating Agreement, absent gross misconduct, fraud or criminal activity, the Managing Members are not be liable to us or any members for any damages, losses, liabilities or expenses. Therefore, holders of Series B Units will have limited recourse against the Managing Members. The Operating Agreement also provides that we will indemnify the Managing Members for losses arising from or out of the performance of their duties to us under the Operating Agreement, unless such loss has arisen as a result of their gross misconduct, fraud or criminal activity.

Our unitholders do not elect the Managing Members and will have limited ability to influence our business.

Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business and therefore, limited ability to influence decisions regarding our business. Furthermore, if our unitholders are dissatisfied with the performance of our Managing Members, they will have no ability to remove or replace our Managing Members.

| 8 |

Boxcar may use the Theater for other projects that provide no financial benefit to us.

In accordance with the Theatrical Production Agreement between Boxcar and us, we have the right to use the Theater for any number of performances and rehearsal per week, and Boxcar has the right to use the Theater for any purpose whatsoever during those times when it is not in use by us. Regardless of our financial contribution to the development of the venue, Boxcar may produce ticketed, paid performances of any nature, and may retain any resulting earnings in full. Boxcar may also use the Theater for non-revenue-generating activities such as readings, rehearsals, and development work for other projects, without including us in any potential future earnings from such activities.

RISKS RELATING TO OUR INDUSTRY

Theatrical production is a high-risk industry.

The majority of Broadway and off-Broadway commercial theatre productions fail to recoup their production costs. Of the ones that do, many do not realize significant profits. Commercial theatre projects outside of New York are comparably risky.

There is no assurance that the Play will be an economic success, even if the Play receives critical acclaim. The success of any previous production of the Play in no way predicts that any subsequent production of the Play will experience similar success. Many factors beyond artistic merit contribute to the success or failure of a theatrical enterprise, including venue location and size, ticket prices, media response, external market factors and marketing activities.

RISKS RELATING TO AN INVESTMENT IN OUR SERIES B UNITS

We established the offering price for our Series B Units on an arbitrary basis, and the offering price may not accurately reflect the value of our assets.

The price of the Series B Units offered has been arbitrarily established by our Managing Members, taking into consideration matters such as the state of our business development, the general condition of the industry in which we compete, and the potential return on investment. The offering price bears little relationship to our assets, net worth or any other objective criteria.

All capital contributions are available for immediate use.

All capital contributions shall be subject to immediate use by us, and you have no right of refund. There is no required minimum capitalization before we can use your funds. We may expend your capital contribution before having fully secured the funds necessary to open the production. If the production is abandoned due to failure to adequately capitalize Sam Lee Laundry, or for any other reason, your capital contribution may be lost without there having been an opening of the production which is the subject of the investment.

Managing Members may decide to close the Play at any time.

The Managing Members have the sole and unconditional right to close the Play and cease operation of Sam Lee Laundry, at any time and for any reason, either before or after the commencement of performances. A decision to close the Play prior to the recoupment of all capital contributions could result in investors losing some or all of their investment.

The amount of any distributions we may make is uncertain.

We will only make distributions once net income exceeds the sum of all capital contributions of holders of Series A Units and Series B Units. There is no guarantee that we will achieve net income at this level. If we do earn this level of income, there is no guarantee that we will continue to operate profitably. Even if we are profitable, we may not distribute all of our profits.

Holders of Series B Units may not be able to recover the full value of their capital contributions when they withdraw from our Company.

Our Operating Agreement provides that any unitholder may request the balance of his or her capital account and withdraw from Sam Lee Laundry at any time. However, depending on our profitability, the balance of that capital account may not be equal to the full value of the unitholder’s original capital contribution. As we realize gross profits, such profits are credited on a pro-rata basis to the capital accounts of all unitholders the capital account balance do not equal the full value of all capital contributions until we realize gross profits equal to the total capitalization.

| 9 |

In addition, the Operating Agreement allows us to reduce the value of all capital accounts pro rata, if we deem it necessary to apply a portion of the capital accounts in response to losses by our company. The circumstances of such losses may be ordinary business losses, such as a seasonal decline in revenue, or they may be unusual circumstances such as an adverse legal judgment or business interruption due to natural disaster. If the capital accounts are reduced in this way, the full value of a unitholder’s capital contribution may not be available for withdrawal.

Further, the Operating Agreement allows for reduction of capital accounts and distribution of funds to unitholders in the event of a “dry tax liability.” Such distributions would be classified as ordinary distributions rather than a return of capital (if such treatment is permitted by law), and the capital account reductions would be restored in subsequent accounting periods.

Therefore, there are several circumstances under which a unitholder would not receive the full value of his or her capital contribution upon withdrawing from Sam Lee Laundry: (1) If cumulative profits had not totaled the full capitalization of our company; (2) if capital accounts had been reduced to cover our losses; and (3) if capital accounts had been reduced to prevent a “dry tax liability.”

Holders of Series B Units may be subject to dilution in the event that the production is transferred to a different venue.

The Operating Agreement, along with the License Agreement with Speakeasy Rights, provide that we will transfer the production to a larger venue in the event that the Managing Members deem it in our best interest to do so. The Operating Agreement provides that we will accrue a production transfer reserve for this purpose. However, in the event that the cost of the transfer exceeds the amount of the production transfer reserve, the Managing Members have the right to conduct another equity offering. Such an offering would have the effect of diluting the interests of holders of Series A Units and Series B Units, in accordance with a formula detailed in the Operating Agreement. All unitholders would have the option of either (a) accepting the dilution, (b) making an additional capital contribution to maintain their interest, or (c) withdrawing from Sam Lee Laundry and receiving the balance of their capital accounts. The interests of the Managing Members would not be subject to dilution in the event of such an offering.

Holders of Series B Units do not benefit from any other uses of the creative material of the Play.

The Play was created by Nick Olivero and a team of writers, designers, and directors, for its initial production in 2014. Subsequently, all the creative material was acquired by Speakeasy Rights, a licensing company owned by our Managing Members. Speakeasy Rights has continued to develop the creative material, hiring writers, dramaturgs and other creative personnel, to prepare the Play for future productions. We have not contributed any funds to the development of the Play.

We have licensed the Play from Speakeasy Rights, for an open-ended run beginning no later than December 31, 2016, in the City and County of San Francisco. Speakeasy Rights maintains all other rights in the material, including the right to license the Play for any number of additional productions in any other geography, and to exploit the material in any other medium, including without limitation audio and video recordings, film and television productions, live events, games, and merchandise.

Our license allows us to create, sell and profit from any merchandise sold at the Theater. However, we cannot create additional productions of the Play, nor our own recordings, films, TV programs, games, etc., based on the Play. In accordance with the terms of the license, we and our unitholders do not receive any revenue from the disposition by Speakeasy Rights of any rights in the Play to any third party.

We have the right to recall distributions.

In the event of a restatement of prior financial results, or in the event of losses either from ordinary business operations or from extraordinary events, we have the right to recall any portion or all of previous profit distributions. We have no right to require additional involuntary capital contributions beyond the original subscription amount of any holder of Series B Units.

Repayment of loans has priority over repayment of holders of Series B Units.

In the event that either (1) the capital contributions raised through this offering are insufficient to produce the Play, or (2) the funds secured by Boxcar are inadequate to complete the development of the venue, then the Managing Members may advance or cause to be advanced, or may borrow on our behalf additional funds, with or without interest. Such advances or loans are to be repaid prior to the repayment of the capital contribution of any holder of Series B Units, and might result in a delay in the repayment of capital contributions, or in a complete loss to unitholders if such loans or advances equal or exceed the profits from the production of the Play.

| 10 |

Our company may use its assets to secure loans for itself or for Boxcar.

In the event that we deem it necessary to secure a loan, either to produce the Play or to complete development of the venue, we may provide our assets as collateral for such loan. These assets may include fixed assets, such as theatre equipment, and financial assets, such as cash deposits, reserves, and capital account balances. Our inability to pay off any such loan may result in the forfeiture of such assets. In the event of a total liquidation of Sam Lee Laundry, these assets would not be available for repayment of the capital contributions of holders of Series B Units.

Our investment in venue development will not be recoverable.

A portion of the proceeds raised from this offering shall be expended on leasehold improvements and capital equipment that shall immediately become the property of Boxcar. In the event that we cease operations prior to the recoupment of all capital contributions, holders of Series B Units shall not be entitled to liquidate such assets for the purpose of recovering their investments in our company, or for any other purpose.

Financial statements may be unaudited.

Holders of Series B Units shall be provided with unaudited financial statements only, unless we are compelled by a government agency to provide audited financial statements. Unitholders shall have the right to audit our accounts at their own expense. In the event that a financial audit occurs, prior accounting results may be restated, tax filings may be amended, and net profit distributions may be recalled by us.

There is unlikely to be any secondary market for the Series B Units, nor the possibility of capital appreciation.

No market presently exists for resale of the Series B Units and it is unlikely that one will develop. Holders of Series B Units may not assign their Series B Units without the consent of the Managing Members. This offering does not provide a mechanism for revaluation of Sam Lee Laundry, nor for capital appreciation of the Series B Units. It is unlikely that the sale, assignment, acquisition or other disposition of the Series B Units will result in appreciation of any unitholder’s capital contribution. We do not intend to have the Series B Units quoted on any OTC Markets platform or listed on an exchange, such as The Nasdaq Stock Market, at any point in the future.

The reduced disclosure requirements applicable to us may make our Series B Units less attractive to investors.

As an issuer utilizing Tier 1 of Regulation A promulgated under the Securities Act, we will not be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless we elect to become subject to the Exchange Act, we will not be required to file annual reports on Form 10-K, quarterly reports on Form 10-Q or current reports on Form 8-K with respect to our business and financial condition. As of the date of this Offering Circular, we do not intend to elect to become subject to the Exchange Act. Potential investors may not view reports under Regulation A as sufficient for investment purposes or such reports may otherwise cause potential investors to not be interested in investing in the Series B Units, each of which would have a negative effect on the price of our Series B Units and our investors’ ability to sell their Series B Units.

Our Managing Members do not have any prior experience conducting a “best efforts” offering.

None of our Managing Members have ever conducting a best-efforts offering, or raised any money in a Regulation A offering. We are selling the Series B Units directly, without benefit of an underwriter. Consequently, we may not be able to raise the funds needed to commence business operations. Because the best efforts offering does not require a minimum amount to be raised, if we are not able to raise sufficient funds, we may not be able to commence performances of the Play, and your investment may be adversely affected. Our inability to successfully conduct a best-efforts offering could be the basis of your losing your entire investment in us.

RISKS RELATING TO FEDERAL, STATE, AND LOCAL TAXATION

We will be subject to corporate-level income tax if we are unable to qualify as a partnership under the Internal Revenue Code of 1986, as amended. Our distributions to you would then be substantially reduced and the value of our Series B Units would be adversely affected.

The value of your investment in our Series B Units depends in part on our being treated as a partnership for U.S. federal income tax purposes. We may not qualify for such treatment, or current law may change so as to cause, in either event, us to be treated as a corporation for U.S. federal income tax purposes or otherwise subject to U.S. federal income tax. We have not requested, and do not plan to request, a ruling from the Internal Revenue Service (the “IRS”) on this or any other matter affecting us.

If we were treated as a corporation for U.S. federal income tax purposes, we would pay U.S. federal income tax on our taxable income at the corporate tax rate. Distributions to you would generally be taxed again as corporate dividends, and no income, gains, losses, deductions or credits would flow through to you. Because a tax would be imposed upon us as a corporation, our distributions to you would be substantially reduced, likely causing a substantial reduction in the value of our Series B Units.

| 11 |

California law may change, causing us to be treated as a corporation for state income tax purposes or otherwise subjecting us to entity level taxation. For example, certain states have and continue to evaluate ways to subject partnerships to entity level taxation through the imposition of state income, franchise or other forms of taxation. If California were to impose a tax upon us as an entity, our distributions to unitholders would be reduced.

You may be subject to U.S. federal income tax on your share of our taxable income, regardless of whether you receive any cash distributions from us.

You may be subject to U.S. federal, state, local and possibly, in some cases, foreign income taxation on your allocable share of our items of income, gain, loss, deduction and for each of our taxable years ending with or within your taxable year, regardless of whether or not you receive cash dividends from us. You may not receive cash dividends equal to your allocable share of our net taxable income or even the tax liability that results from that income. This is especially likely during the first two years of operation, due to the fact that prior to recoupment, cash distributions will not be made, and all profits will be retained by us and credited to unitholders’ capital accounts. Nonetheless, these profits will be reported as taxable income.

Subsequent to the recoupment period, there may continue to be differences in taxable net income and cash distributions. These differences may be due to accrual accounting practices, including capitalization/depreciation of fixed assets, amortization of intangible assets, and accrual of future expenses. There may also be differences due to the accumulation and release of reserves, and changes to unitholders’ capital accounts.

Tax gain or loss on disposition of our Series B Units could be more or less than expected.

If you sell your Series B Units, you will recognize a gain or loss equal to the difference between the amount realized and the adjusted tax basis in those units. Prior dividends to you in excess of the total net taxable income allocated to you, which decreased the tax basis in your Series B Units, will in effect become taxable income to you if the Series B Units are sold at a price greater than your tax basis in those units, even if the price is less than the original cost. A substantial portion of the amount realized, whether or not representing gain, may be ordinary income to you.

Non-U.S. persons face unique U.S. tax issues from owning Series B Units that may result in adverse tax consequences to them.

Our income, or some portion of our income, may be treated as effectively connected income (“ECI”) with respect to non-U.S. holders. To the extent our income is treated as ECI, non-U.S. holders generally would be subject to withholding tax on their allocable shares of such income, would be required to file a U.S. federal income tax return for such year reporting their allocable shares of income effectively connected with such trade or business and any other income treated as ECI, and would be subject to U.S. federal income tax at regular U.S. tax rates on any such income (state and local income taxes and filings may also apply in that event). Non-U.S. holders that are corporations may also be subject to a 30% branch profits tax on their allocable share of such income. In addition, certain income from U.S. sources that is not ECI allocable to non-U.S. holders will be reduced by withholding taxes imposed at the highest effective applicable tax rate.

Tax-exempt entities face unique tax issues from owning Series B Units that may result in adverse tax consequences to them.

In light of our intended activities, we may derive income that constitutes unrelated business taxable income (“UBTI”). Consequently, a holder of Series B Units that is a tax-exempt organization may be subject to “unrelated business income tax” to the extent that its allocable share of our income consists of UBTI. A tax-exempt partner of a partnership could be treated as earning UBTI if the partnership regularly engages in a trade or business that is unrelated to the exempt function of the tax-exempt partner, if the partnership derives income from debt-financed property or if the partnership interest itself is debt-financed.

Unitholders will be subject to state and local taxes and return filing requirements as a result of investing in our Series B Units.

In addition to U.S. federal income taxes, our unitholders will be subject to other taxes, including state and local taxes, unincorporated business taxes and estate, inheritance or intangible taxes that are imposed by the various jurisdictions in which we do business or own property now or in the future, even if our unitholders do not reside in any of those jurisdictions. Our unitholders likely will be required to file state and local income tax returns and pay state and local income taxes in some or all of these jurisdictions. Further, unitholders may be subject to penalties for failure to comply with those requirements. It is the responsibility of each unitholder to file all U.S. federal, state and local tax returns that may be required of such unitholder.

| 12 |

If you invest in our securities, your interest will be diluted to the extent of the difference between the offering price per Series B Unit and the as-adjusted net tangible book value per Series B Unit after this offering. The net tangible book value of our company as of January 31, 2016 was $370,160. As of that date, a total of 27.67 units of Series A Units had been issued at a price of $30,000 per unit (representing total proceeds to us of $830,000), and the Series A Unit offering was closed. The book value for each Series A Unit on that date was $13,379, representing dilution of 55.4% for holders of Series A Units.

Without giving effect to any changes in the net tangible book value after January 31, 2016 other than the sale of 200 Series B units in this offering at a price of $5,000 per Series B Unit, our pro forma net tangible book value as of January 31, 2016 would be $1,370,160. Holders of Series A Units would own a 27.67% interest in our company, and holders of Series B Units would hold a 20% interest in our company. The net tangible book value would be allocated $795,241 (58.04% of total) to Series A Units and $574,919 (41.96% of total) to Series B Units. The net tangible book value per unit would be $28,743 per Series A Unit and $2,875 per Series B Unit. Dilution in net tangible book value per unit represents the difference between the amount per unit by the purchasers of our Series B Units in this offering and the net tangible book value per unit immediately afterwards. Immediate dilution for holders of Series B Units would be 42.5%, while holders of Series A Units will realize a decrease of their dilution from 55.4% to 4.2%. The following table illustrates this per unit dilution:

| Net tangible book value as of January 31, 2016 | $ | 370,160 | ||

| Net tangible book price per Series A Unit as of January 31, 2016 (27.67 units outstanding) | 13,379 | |||

| Dilution in Series A Units ($30,000 offering price) | 55.4 | % | ||

| Adjusted net tangible book value after this offering | $ | 1,370,160 | ||

| Allocated to Series A Units (58.04% of total) | 795,241 | |||

| Allocated to Series B Units (41.96% of total) | 574,919 | |||

| Adjusted net tangible book value per Series A Unit after this offering | $ | 28,743 | ||

| Dilution in Series A Units ($30,000 offering price) | 4.2 | % | ||

| Adjusted net tangible book price per Series B Unit after this offering | $ | 2,875 | ||

| Dilution in Series B Units ($5,000 offering price) | 42.5 | % |

The following table summarizes the differences between the existing shareholders and the new investors with respect to the number of units purchased, the total consideration paid, and the average price per share paid, both on a minimum and maximum offering basis:

Subsequent to the Offering:

| Average | ||||||||||||||||||||

| Units Purchased | Total Consideration | Price Per | ||||||||||||||||||

| Number | Interest | Amount | Percent | Unit | ||||||||||||||||

| Series A Unit Holders* | 27.67 | 27.67 | % | $ | 830,000 | 45.4 | % | $ | 30,000 | |||||||||||

| Series B Unit Holders | 200.00 | 20.00 | % | $ | 1,000,000 | 54.6 | % | $ | 5,000 | |||||||||||

| TOTAL | 227.67 | 47.67 | % | $ | 1,830,000 | 100.0 | % | $ | 8,038 | |||||||||||

*The Managing Members are also holders of Series A Units, having purchased 3.0 Series A Units at $30,000 per unit.

Unitholders may also be subject to dilution due to future actions by our company. The Operating Agreement authorizes us to conduct an additional offering for the purpose of transferring the production to a larger venue. Under such circumstances, we will issue additional limited liability company interests, and the percentage of our company that you own will go down, even though the value of our company may go up. You will own a smaller piece of a larger company.

This Offering Circular relates to 200 Series B Units offered by us. These securities are being offered directly by Sam Lee Laundry, without use of an underwriter, and will be sold at a fixed price of $5,000 per Series B Unit for the duration of the offering. The minimum investment is $2,000 and fractional units may be issued. No discounts or commissions shall be paid to dealers. No securities shall be distributed through brokers or dealers. None of the securities being offered are for the account of securityholders. There is no minimum required sale of these securities, and all capital contributions are available for our immediate use, with no right of refund to unitholders.

| 13 |

These securities will be offered on the website, www.____________________.com. Purchasers may review and sign documents digitally, and may pay for their purchases by entering ACH banking transfer information or debit or credit card details, or by mailing a signed Subscription Agreement, along with a check payable to Sam Lee Laundry LLC, to the offices of Silverwolf Group LLC, 224 28th Street, San Francisco, CA 94131. Offers to subscribe to limited liability company interests are subject to acceptance by the Managing Members. We will issue an email confirmation upon receipt of funds.

There is No Current Market for Our Series B Units

There is currently no market for our Series B Units. The Series B Units are not traded or listed on any exchange. We cannot give you any assurance that the securities you purchase will ever have a market or that if a market for our Series B Units ever develops, that you will be able to sell your Series B Units. In addition, even if a public market for our Series B Units develops, there is no assurance that a secondary public market will be sustained.

The Offering will be Sold by Our Managing Members

We are offering up to a total of 200 Series B Units. In our sole discretion, we have the right to terminate the offering at any time, even before all Series B Units have been sold. There are no specific events which might trigger our decision to terminate the offering.

The Series B Units will be offered on a direct primary, self-underwritten basis (that is without the use of a broker-dealer) by us and our Managing Members during the offering period. However, we reserve the right to engage a registered broker dealer to sell the securities on our behalf. We will begin sales of our Series B Units on the date that this Offering Circular is deemed qualified by the SEC through and including the date on which all of the Series B Units are sold (the “Offering Period”). Our Managing Members shall be able, in their discretion, to terminate the offering at any time. Within the Offering Period, we may accept some or all of the subscriptions received as of the date received.

The Series B Units will be sold at a fixed price of $5,000 per Series B Unit. The minimum amount of Series B Units to be purchased by subscription agreement is $2,000 and fractional units may be issued. Subscriptions, once received and accepted, are irrevocable. Any subscription may be rejected by us in whole or in part, but no subscription may be revoked by the subscriber except as provided for in this Offering Circular. If a subscription is not accepted, the subscription amount will be returned without interest. We reserve the right to accept or reject your subscription in whole or in part. Our acceptance of your Subscription Agreement is effective when we countersign it for the amount of Series B Units we set forth next to our signature depending on the investment amount. If we accept your Subscription Agreement, we will provide you with a confirmation of your purchase. If we do not accept your subscription, your purchase payment will be returned to you, without interest, within 30 days of our non-acceptance.

We cannot assure you that all or any of the Series B Units offered under this Offering Circular will be sold. No one has committed to purchase any of the securities offered. Therefore, we may sell only a nominal amount of Series B Units, in which case our ability to execute our business plan might be negatively impacted. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason. Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions.

We will sell the Series B Units in this offering through our Managing Members, who intend to offer them to friends, family members and business acquaintances using this Offering Circular and a subscription agreement as the only materials to offer potential investors. The Managing Members that offer Series B Units on our behalf may be deemed to be underwriters of this offering within the meaning of Section 2(11) of the Securities Act. We reserve the right to use licensed broker/dealers and pay the brokers a cash commission of up to 10% of the proceeds raised by that broker. The Managing Members engaged in the sale of the securities will receive no commission from the sale of the securities nor will they register as broker-dealers pursuant to Section 15 of the Exchange Act in reliance upon Rule 3a4-1. Rule 3a4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer. Each of Messrs. Gluck, Olivero and Libby satisfies the requirements of Rule 3a4-1 in that:

| ● | He is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act, at the time of his participation; | |

| ● | He is not compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; | |

| ● | He is not, at the time of his participation, an associated person of a broker- dealer; and | |

| ● | He meets the conditions of Paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and (C) does not participate in selling and offering of securities for any issuer more than once every 12 months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). |

| 14 |

As long as we satisfy all of these conditions, we believe that we satisfy the requirements of Rule 3a4-1 of the Exchange Act.

As our Managing Members will sell the securities being offered pursuant to this offering, Regulation M prohibits us and our Managing Members from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our Managing Members from bidding for or purchasing any securities or attempting to induce any other person to purchase any securities, until the distribution of our securities pursuant to this offering has ended.

Deposit of Offering Proceeds

This is a direct primary, self-underwritten basis offering, so we are not required to sell any specific number or dollar amount of securities, but will use our best efforts to sell the securities offered. We have made no arrangements to place subscription funds in an escrow, trust or similar account, which means that all funds collected for subscriptions will be immediately available to us for use in the implementation of our business plan.

ERISA Considerations

Special considerations apply when contemplating the purchase of our Series B Units on behalf of employee benefit plans that are subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), plans, individual retirement accounts (“IRAs”) and other arrangements that are subject to Section 4975 of the Code, or provisions under any federal, state, local, non-U.S. or other laws or regulations that are similar to such provisions of the Code or ERISA, and entities who underlying assets are considered to include “plan assets” of any such plan, account or arrangement (each, a “Plan”). A person considering the purchase of our shares on behalf of a Plan is urged to consult with tax and ERISA counsel regarding the effect of such purchase and, further, to determine that such a purchase will not result in a prohibited transaction under ERISA, the Code or a violation of some other provision of ERISA, the Code or other applicable law. We will rely on such determination made by such persons, although no Series B Units will be sold to any Plans if management believes that such sale will result in a prohibited transaction under ERISA or the Code.

The estimated cost of this offering is approximately $50,000. This cost will be paid directly by us, and no proceeds of the offering are expected to be used for this purpose. This offering of 200 units of Series B Units will raise a maximum of $1,000,000 in proceeds. The previous offering of Series A Units raised $830,000 in proceeds. Proceeds from the sale of Series A Units and Series B Units will be combined and applied to expenses as follows:

| ● | The first $1,000,000 will be used to fund the production budget for the Play, | |

| ● | The next $500,000 will be provided to Boxcar to support venue development expenses, and | |

| ● | Any amount over $1,500,000 will be retained by us as a general reserve. |

Production Budget. The Managing Members anticipate that the Play can be produced at the Theater for $1,000,000. The present estimates of pre-production and production expenses are as follows:

| This Offering | Full Budget | |||||||

| Physical Production | $ | 200,000 | $ | 410,000 | ||||

| Technical Staffing | — | 112,000 | ||||||

| Marketing Expenses (note 1) | 40,000 | 80,000 | ||||||

| Performer Rehearsal Fees | 30,000 | 60,000 | ||||||

| Producer Fees | — | 52,000 | ||||||

| Creative Fees | 27,000 | 54,000 | ||||||

| Legal, Accounting, and Tax | 25,000 | 32,000 | ||||||

| Office Supplies, Hospitality, and Other | 8,000 | 12,000 | ||||||

| Preview Expense | 26,000 | 26,000 | ||||||

| Theater Occupancy | 14,000 | 15,000 | ||||||

| Theater Staffing | — | 12,000 | ||||||

| Advance Against License Fee | — | 50,000 | ||||||

| Production Contingency | 50,000 | 85,000 | ||||||

| TOTAL PRODUCTION BUDGET | 420,000 | 1,000,000 | ||||||

| Support for Venue Development | 250,000 | 500,000 | ||||||

| General Reserves | 330,000 | 330,000 | ||||||

| TOTAL USE OF FUNDS | 1,000,000 | 1,830,000 | ||||||

| 15 |

Note 1. We have received a pledge of in-kind marketing support from Swirl, a San Francisco-based creative agency that will undertake our graphical identity, digital presence, and promotional plan. We estimate the value of these contributed services at $200,000. In addition, we have budgeted $80,000 for other marketing expenses.

The above represents our best estimate of our allocation of offering proceeds based upon our current business operations, business plans and current economic and business conditions. It is subject to reallocation among the categories listed above. We reserve the right to make such changes in the above allocations as the Managing Members deem necessary or advisable. There is no assurance that the total actual production requirements will not exceed the total use of funds as indicated above.

Venue Development. The Managing Members anticipate that we will provide $500,000 to Boxcar for the purpose of completing leasehold improvements and purchasing equipment necessary to prepare the Theater for the Play. Boxcar has provided the present estimates of the venue development expenses:

| Commercial Contractors | $ | 1,390,000 | ||

| Architect | 109,000 | |||

| Owner-Supplied Fixtures | 88,000 | |||

| Design Consultants | 79,000 | |||

| Building Permits | 45,000 | |||

| Façade / Signage | 37,500 | |||

| Insurance | 1,500 | |||

| Construction Contingency | 250,000 | |||

| TOTAL VENUE DEVELOPMENT | $ | 2,000,000 |

Boxcar has provided the following estimate of the sources of funds to complete development of the venue:

| Sam Lee Laundry | $ | 500,000 | ||

| Landlords’ Tenancy Improvement Allowance | 225,000 | |||

| Boxcar Retained Earnings | 75,000 | |||

| SF Nonprofit Displacement Mitigation Fund | 50,000 | |||

| Wells Fargo Line of Credit | 50,000 | |||

| Advance Against Ticket Sales | 100,000 | |||

| California Bank of Commerce | 1,000,000 | |||

| TOTAL VENUE DEVELOPMENT | $ | 2,000,000 |

As of the date of this Offering Circular, all of these sources of funds have been secured or committed, with three exceptions:

| ● | The funds to be provided by Sam Lee Laundry, which depend upon the success of the Series B Unit offering, | |

| ● | The advance against sales, which will be secured following commencement of ticket sales for the Play, and | |

| ● | The California Bank of Commerce loan, which is currently in the underwriting phase based on a set of terms offered by the bank and accepted by us. |

Nothing contained in the venue development budget set forth above shall limit the right of Boxcar to make such changes in the above allocations as it may deem necessary or advisable. There is no assurance that the total actual venue development requirements will not exceed the total budget as indicated above, or that the total sources of funding will be less than indicated above.

Shortfall of Proceeds. In the event that substantially less than the maximum proceeds are obtained by this offering, our plan is to proceed with the production of the Play and to take the following measures:

| 1. | Reduce the general reserve, | |

| 2. | Reduce expenses for physical production, | |

| 3. | Defer payment of creative fees and producer fees, | |

| 4. | Apply advance ticket sales revenue to production expenses, and | |

| 5. | Borrow funds from the Managing Members or from others, as provided for in the Operating Agreement. |

| 16 |

The use of these measures could delay the repayment of the capital contributions of the unitholders and/or reduce net profits.

Producer fees of $54,000 shall be paid to our Managing Members. This is the only portion of the proceeds of the Series A Unit and Series B Unit offerings that will be used to compensate the Managing Members of officers of the issuer.

The business of the Company is to produce and promote the theatrical entertainment titled “The Speakeasy,” at a venue located at 644 Broadway, San Francisco, CA 94133, or at another venue in the City and County of San Francisco. Public performances are currently scheduled to begin on June 17, 2016, and will continue indefinitely, based on the profitability of the production and other factors. The name of the Company, Sam Lee Laundry LLC, relates to one of the two “false front businesses” that will serve as entrances to the venue for the Play.

The Play

“The Speakeasy” is an immersive theatrical experience set in the context of a Prohibition-era speakeasy, offering music, dance, and theatrical performance. It is staged in a non-traditional theatre venue, consisting of multiple rooms over a floor plan of approximately 9,000 square feet. There is no assigned seating and the audience is free to roam the environment and engage with their choice of theatrical elements and characters. An illicit bar, a crooked casino, and a vaudeville cabaret are among the settings in which patrons encounter characters typical of the 1920s: World War I veterans, suffragettes and early feminists, bootleggers and con men, traveling salesmen, flappers, bar flies, Ku Klux Klansmen, temperance crusaders, and more. The experience is “immersive,” meaning audience members not only observe the goings-on but participate as denizens of the Speakeasy, by drinking and dining, taking part in games of chance and skill, and interacting with the performers.

In keeping with post-World War I cultural history, the Play addresses themes of freedom and restriction. Much of the material for the Play comes from the public domain, including music from the era and true accounts of the day. The acting text is all original, and created specifically for this production. The speakeasy cabaret will feature historic vaudeville sketches, period dances including the Charleston, and period jazz and swing music. A live house band will accompany a chorus of singing and dancing girls. Cabaret acts will include a torch song chanteuse, magician, ventriloquist, and a vaudevillian comedy duo.

The Play is fully scripted, but changes nightly depending on the response of the audience. Acting moments play out simultaneously in as many as six different locations throughout the speakeasy environment, making it impossible for spectators to witness the full scope of the production in one visit, or even two or three. The scale and variability of the experience encourages patrons to return for multiple visits.

Production History

The original story and concept for the Play was created by Mr. Olivero in 2006. During 2012-2013, Mr. Olivero further developed the concept and created the script in collaboration with a group of writers, designers, directors, music directors, and choreographers.

The Play was initially produced from January 10, 2014 to June 21, 2014, for a total of 75 performances, at the Boxcar Theatre Studios, located at 125A Hyde Street in San Francisco. The production company was Joe’s Clock Shop LLC (“Joe’s Clock Shop”), a California limited liability company organized for the purpose of developing, producing, and promoting the Play. The managing members of Joe’s Clock Shop were Mr. Olivero, Mr. Libby, Peter Ruocco, and Silverwolf (for the services of Mr. Gluck). The maximum capitalization of Joe’s Clock Shop was $200,000. Fourteen individuals subscribed as investor members. The offering failed to achieve full capitalization, but nonetheless commenced performances as scheduled. Boxcar served as presenter of the Play, under a revenue-sharing arrangement with Joe’s Clock Shop LLC that was similar to the current agreement between Boxcar and Sam Lee Laundry.

Performances of the Play at Boxcar Theatre Studios were attended by 8,305 ticket holders, accounting for more than 98% of the entire ticket inventory at the 117-person capacity venue. At times during the run of the play, tickets were sold out as much as ten weeks in advance. Sales were attributable largely to word of mouth and substantial free-media coverage, with Joe’s Clock Shop engaging in no paid advertising. The production fully recouped within 14 weeks, and was able to provide a 56.35% overall return to its investors. The Play closed in connection with the sale of the building that houses the theater, when the outgoing owner declined to extend Boxcar’s lease on the premises. Joe’s Clock Shop was dissolved at the end of 2014 and all cash (except for a small contingency) was distributed to the members of the company.

The financial results of the initial production of the Play are in no way predictive of the financial results of any subsequent production of the Play. Many factors contribute to the success or failure of a theatrical enterprise, and differing productions of the same Play often yield different results. As of January 31, 2016, nine of the 14 Joe’s Clock Shop investors have subscribed as investor members of Sam Lee Laundry.

| 17 |

Media Response

The initial production was widely covered by regional print, broadcast, and online media. The glossy Bay Area monthly magazine 7x7 Magazine named the production “Best of 2014” in the “underground theater” category. The national online travel publication Food Republic included “The Speakeasy” in its round up of the five immersive dinner theatre experiences throughout the United States. The culture critic for the Bay Area online magazine The Bold Italic declared, “The Speakeasy is everything I love about San Francisco.”

Some media response was less complimentary. The San Francisco Chronicle expressed disappointment that the play included several somber theatrical moments, including the recreation of a mustard gas attack on American troops entrenched in France during World War I, and lamented that such material detracted from what would other be a bubbly and delightful evening.

New Production

For the upcoming production, Mr. Olivero is leading a complete re-working of the script to incorporate many of the lessons learned from the initial production. Story arcs will be tightened to provide audience members with greater emotional rewards. New meta-theatrical moments will be created to heighten audience members’ awareness that they are traveling through a land of imagination. The creative team is also seeking to create more moments when a single actor interacts with a single audience member, and more opportunities for audience participation, with the goal that every audience member has an experience uniquely his or her own, every night.

The new venue at 644 Broadway will accommodate as many as 250 audience members at each performance. The approximately 9,000 square foot floor plan represents an almost three-fold increase in size over the venue for the previous production, which comprised about 3,300 square feet. The new venue will have ten bathrooms, as well as state-of-the-art lighting, sound, and HVAC systems, and is being renovated from a raw shell to meet the specific design requirements of immersive theatre. Painstaking attention is being paid to ensure that every detail, from tin ceilings and soft wood floors to Victorian gas lamps and high-tank toilets, are historically consistent with the 1920s milieu.

Related Programming

In conjunction with the Play, we plan to implement additional programming that is related to the Play’s content and that makes use of the new venue. The potential earnings from these events have been excluded from the Company’s financial projections, and provide an opportunity to exceed our profitability goals.

“Neo-Vaudeville Cabaret” will be a late-night performance event that features a lineup of rotating variety acts showcasing diverse contemporary art forms. The lineup will range from standup comedy and burlesque, to beat box flute and electronic looping cello, to tribal fusion belly dance and aerial tissue performances. The Neo-Vaudeville Cabaret will be distinctly different from the cabaret performances during the Play, which are intended to recreate authentic 1920s Vaudeville acts such as ventriloquism, magic, juggling, and opera.

“Club 1923” will be a pop-up 1920s theme party that takes place in a variety of locations throughout San Francisco. It will feature a format that parallels the Play, including cocktails, cabaret performances, and casino-style gaming, but without the Play’s theatrical content. Boxcar successfully presented seventy-five Club 1923 events during 2015, and developed a following of patrons who enjoyed dressing in period costume and spending a night out with friends in an impromptu 1920s-themed nightclub.

An annual 1920s-themed New Year’s Eve party will also be part of the satellite programming. At the end of 2016, we will “ring in” 1927 instead of 2017, and move one year forward in each successive year, until at the end of 2019 we will ring in 1920 again. A “year in review” performance will help audience members connect with the people and events of the 1920s. Other theme parties, including an annual Halloween masquerade, are likely additions to the programming calendar.

Material Agreements