UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number:

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of | (I.R.S. Employer | |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, as of May 8, 2024 was

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “target,” “potential,” “contemplate,” “anticipate,” “goals,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

| ● | our plans to develop and commercialize our product candidates based on adeno-associated virus, or AAV, gene therapy and our proprietary antibodies; |

| ● | our ability to continue to develop our proprietary gene therapy platform technologies, including our TRACERTM (Tropism Redirection of AAV by Cell-type-specific Expression of RNA) discovery platform and our vectorized antibody platform, our proprietary antibody program, and our gene therapy and vectorized antibody programs; |

| ● | our ability to identify and optimize product candidates and proprietary AAV capsids; |

| ● | our strategic collaborations and licensing agreements with, and funding from, our collaboration partners Neurocrine Biosciences, Inc. and Novartis Pharma AG, or Novartis, and our licensee Alexion, AstraZeneca Rare Disease (successor-in-interest to former licensee Pfizer Inc.); |

| ● | our planned clinical trials and ongoing and planned preclinical development efforts, related timelines and studies; |

| ● | our ability to enter into future collaborations, strategic alliances, or option and license arrangements; |

| ● | the timing of and our ability to submit applications and obtain and maintain regulatory approvals for our product candidates, including the ability to submit investigational new drug, or IND, applications for our programs; |

| ● | our estimates regarding revenue, expenses, contingent liabilities, future revenues, existing cash resources, capital requirements and cash runway; |

| ● | our intellectual property position and our ability to obtain, maintain and enforce intellectual property protection for our proprietary assets; |

| ● | our estimates regarding the size of the potential markets for our product candidates and our ability to serve those markets; |

| ● | our need for additional funding and our plans and ability to raise additional capital, including through equity offerings, debt financings, collaborations, strategic alliances, and option and license arrangements; |

| ● | our competitive position and the success of competing products that are or might become available for the indications that we are pursuing; |

2

| ● | the impact of government laws and regulations including in the United States, the European Union, and other important geographies such as Japan; and |

| ● | our ability to control costs and prioritize our product candidate pipeline and platform development objectives successfully in connection with our strategic initiatives. |

These forward-looking statements are only predictions, and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. You should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. We have included important factors in the cautionary statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 28, 2024, particularly in “Part I, Item 1A — Risk Factors,” and, if applicable, our Quarterly Reports on Form 10-Q, particularly in “Part II, Item 1A — Risk Factors,” that could cause actual future results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, strategic collaborations, licenses, joint ventures or investments we may make.

You should read this Quarterly Report on Form 10-Q and the documents that we have filed as exhibits to this Quarterly Report on Form 10-Q with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

We obtained the statistical and other industry and market data in this Quarterly Report on Form 10-Q and the documents we have filed as exhibits to the Quarterly Report on Form 10-Q from our own internal estimates and research, as well as from industry and general publications and research, surveys, studies and trials conducted by third parties. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, while we believe the market opportunity information included in this Quarterly Report on Form 10-Q and the documents we have filed as exhibits to the Quarterly Report on Form 10-Q is reliable and is based upon reasonable assumptions, such data involves risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” and in the documents we have filed as exhibits to the Quarterly Report on Form 10-Q. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

We own various U.S. federal trademark registrations and applications and unregistered trademarks, including our corporate logo. This Quarterly Report on Form 10-Q and the documents filed as exhibits to the Quarterly Report on Form 10-Q contain references to trademarks, service marks and trade names referred to in this Quarterly Report on Form 10-Q and the information incorporated herein, including logos, artwork, and other visual displays, that may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks or trade names. We do not intend our use or display of other companies’ trade names, service marks or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. All trademarks, service marks and trade names included or incorporated by reference into this Quarterly Report on Form 10-Q and the documents filed as exhibits to the Quarterly Report on Form 10-Q are the property of their respective owners.

3

VOYAGER THERAPEUTICS, INC.

FORM 10-Q

TABLE OF CONTENTS

4

PART I. FINANCIAL INFORMATION

Voyager Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(amounts in thousands, except share and per share data)

(unaudited)

March 31, | December 31, |

| |||||

| 2024 |

| 2023 |

| |||

Assets |

|

| |||||

Current assets: | |||||||

Cash and cash equivalents | $ | | $ | | |||

Marketable securities, current |

| |

| | |||

Accounts receivable | | | |||||

Related party collaboration receivable | | | |||||

Prepaid expenses and other current assets |

| |

| | |||

Total current assets |

| |

| | |||

Property and equipment, net |

| |

| | |||

Deposits and other non-current assets |

| |

| | |||

Marketable securities, non-current |

| |

| — | |||

Operating lease, right-of-use assets | | | |||||

Total assets | $ | | $ | | |||

Liabilities and stockholders’ equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | | $ | | |||

Accrued expenses |

| |

| | |||

Other current liabilities | | | |||||

Deferred revenue, current |

| |

| | |||

Total current liabilities |

| | | ||||

Deferred revenue, non-current |

| |

| | |||

Other non-current liabilities |

| |

| | |||

Total liabilities |

| | | ||||

Commitments and contingencies (see note 7) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $ | |||||||

Common stock, $ |

| |

| | |||

Additional paid-in capital |

| |

| | |||

Accumulated other comprehensive loss |

| ( |

| ( | |||

Accumulated deficit |

| ( |

| ( | |||

Total stockholders’ equity |

| |

| | |||

Total liabilities and stockholders’ equity | $ | | $ | | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Voyager Therapeutics, Inc.

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income

(amounts in thousands, except share and per share data)

(unaudited)

Three Months Ended | |||||||

March 31, |

| ||||||

| 2024 |

| 2023 |

| |||

Collaboration revenue | $ | |

| $ | | ||

Operating expenses: | |||||||

Research and development |

| |

| | |||

General and administrative |

| |

| | |||

Total operating expenses |

| | | ||||

Operating (loss) income | ( | | |||||

Other income: | |||||||

Interest income |

| |

| | |||

Total other income |

| |

| | |||

(Loss) income before income taxes | ( | | |||||

Income tax provision | | | |||||

Net (loss) income | $ | ( | $ | | |||

Other comprehensive (loss) income: | |||||||

Net unrealized (loss) gain on available-for-sale securities |

| ( |

| | |||

Total other comprehensive (loss) income |

| ( |

| | |||

Comprehensive (loss) income | $ | ( | $ | | |||

Net (loss) income per share, basic | $ | ( | $ | | |||

Net (loss) income per share, diluted | $ | ( | $ | | |||

Weighted-average common shares outstanding, basic |

| |

| | |||

Weighted-average common shares outstanding, diluted | | | |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Voyager Therapeutics, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(amounts in thousands, except share data)

(unaudited)

Accumulated |

| |||||||||||||||||

Other |

| |||||||||||||||||

Additional | Comprehensive |

| ||||||||||||||||

Common Stock | Paid-In | (Loss) | Accumulated | Stockholders’ | ||||||||||||||

| Shares |

| Amount |

| Capital |

| Income |

| Deficit |

| Equity |

| ||||||

Balance at December 31, 2022 | | $ | | $ | | $ | ( | $ | ( | | ||||||||

Exercises of vested stock options | | — | | — | — | | ||||||||||||

Vesting of restricted stock units | | — | — | — | — | — | ||||||||||||

Issuance of common stock in connection with the 2023 Neurocrine Collaboration Agreement | | | | — | — | | ||||||||||||

Stock-based compensation expense | — | — | | — | — | | ||||||||||||

Unrealized gain on available-for-sale securities, net of tax | — | — | — | | — | | ||||||||||||

Net income | — | — | — | — | | | ||||||||||||

Balance at March 31, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | | |||||||

Balance at December 31, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | | |||||||

Exercises of vested stock options | | — | | — | — | | ||||||||||||

Vesting of restricted stock units | | — | — | — | — | — | ||||||||||||

Issuance of common stock in connection with the 2023 Novartis Stock Purchase Agreement | | | | — | — | | ||||||||||||

Issuance of common stock and pre-funded warrants in connection with underwritten public offering | | | | — | — | | ||||||||||||

Stock-based compensation expense | — | — | | — | — | | ||||||||||||

Unrealized loss on available-for-sale securities, net of tax | — | — | — | ( | — | ( | ||||||||||||

Net loss | — | — | — | — | ( | ( | ||||||||||||

Balance at March 31, 2024 | | $ | | $ | | $ | ( | $ | ( | $ | | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

Voyager Therapeutics, Inc.

Condensed Consolidated Statements of Cash Flows

(amounts in thousands)

(unaudited)

Three Months Ended | |||||||

March 31, |

| ||||||

| 2024 |

| 2023 |

| |||

Cash flow from operating activities |

|

| |||||

Net (loss) income | $ | ( | $ | | |||

Adjustments to reconcile net (loss) income to net cash provided by operating activities: | |||||||

Stock-based compensation expense |

| |

| | |||

Depreciation |

| |

| | |||

Amortization of premiums and discounts on marketable securities | ( | ( | |||||

Loss on disposal of fixed assets | | | |||||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | | ( | |||||

Related party collaboration receivable | | ( | |||||

Prepaid expenses and other current assets |

| ( |

| | |||

Operating lease, right-of-use asset | | | |||||

Other non-current assets | ( | — | |||||

Accounts payable |

| |

| | |||

Accrued expenses |

| ( |

| ( | |||

Operating lease liabilities | | ( | |||||

Deferred revenue |

| ( |

| | |||

Net cash provided by operating activities |

| |

| | |||

Cash flow from investing activities | |||||||

Purchases of property and equipment |

| ( |

| ( | |||

Purchases of marketable securities | ( | — | |||||

Proceeds from sales and maturities of marketable securities |

| |

| | |||

Net cash (used in) provided by investing activities |

| ( |

| | |||

Cash flow from financing activities | |||||||

Proceeds from the exercise of stock options | | | |||||

Proceeds from the issuance of common stock in connection with the underwritten public offering | | — | |||||

Proceeds from the issuance of common stock in connection with the 2023 Novartis Stock Purchase Agreement | | — | |||||

Proceeds from the issuance of common stock in connection with the 2023 Neurocrine Collaboration Agreement | — | | |||||

Net cash provided by financing activities |

| |

| | |||

Net increase in cash, cash equivalents, and restricted cash |

| |

| | |||

Cash, cash equivalents, and restricted cash, beginning of period |

| |

| | |||

Cash, cash equivalents, and restricted cash, end of period | $ | | $ | | |||

Supplemental disclosure of cash and non-cash activities | |||||||

Capital expenditures incurred but not yet paid | $ | — | $ | | |||

Operating lease right-of-use asset obtained in exchange for operating lease liability | $ | | $ | — | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

VOYAGER THERAPEUTICS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Nature of business

Voyager Therapeutics, Inc. (the “Company”) is a biotechnology company whose mission is to leverage the power of human genetics to modify the course of and ultimately cure neurological diseases. The Company’s pipeline includes programs for Alzheimer’s disease; amyotrophic lateral sclerosis; Parkinson’s disease, and multiple other diseases of the central nervous system. Many of the Company’s programs are derived from its TRACER™ adeno-associated virus (“AAV”) capsid discovery platform, which the Company has used to generate novel capsids (“TRACER Capsids”) and identify associated receptors to potentially enable high brain penetration with genetic medicines following intravenous dosing. Some of the Company’s programs are wholly-owned, and some are advancing with licensees and collaborators including Alexion, AstraZeneca Rare Disease; Novartis Pharma AG, (“Novartis”); and Neurocrine Biosciences, Inc. (“Neurocrine”).

The Company has a history of incurring annual net operating losses. As of March 31, 2024, the Company had an accumulated deficit of $

As of March 31, 2024, the Company had cash, cash equivalents, and marketable securities of $

There can be no assurance that the Company will be able to obtain additional debt or equity financing on terms acceptable to the Company or generate product revenue or revenue from collaboration partners, on a timely basis or at all. The failure of the Company to obtain sufficient funds on acceptable terms when needed could have a material adverse effect on the Company’s business, results of operations, and financial condition.

2. Summary of significant accounting policies and basis of presentation

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial reporting. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. For further information, refer to the consolidated financial statements and footnotes included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 as filed with the Securities and Exchange Commission (“SEC”) on February 28, 2024. These interim condensed consolidated financial statements, in the opinion of management, reflect all normal recurring adjustments necessary for a fair presentation of the Company’s financial position and results of operations for the periods presented. Any reference in these notes to applicable guidance is meant to refer to the authoritative United States generally accepted accounting principles as found in the Accounting Standards Codification and Accounting Standards Updates of the Financial Accounting Standards Board.

Principles of Consolidation

The unaudited interim consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary as disclosed in Note 2, under the heading “Summary of Significant Accounting Policies and Basis of Presentation” within the “Notes to Consolidated Financial Statements” accompanying the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Intercompany balances and transactions have been eliminated.

9

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. On an ongoing basis, the Company’s management evaluates its estimates, which include, but are not limited to, estimates related to revenue recognition, incremental borrowing rate for leases, accrued expenses, stock-based compensation expense, and income taxes. The Company bases its estimates on historical experience and other market-specific or other relevant assumptions that it believes to be reasonable under the circumstances. Actual results may differ from those estimates or assumptions.

Summary of Significant Accounting Policies

There have been no changes in the Company's significant accounting policies as described in Note 2, “Summary of Significant Accounting Policies and Basis of Presentation” within the “Notes to Consolidated Financial Statements” accompanying the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

3. Fair value measurements

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2024 and December 31, 2023 are as follows:

Quoted Prices | Significant |

| |||||||||||

in Active | Other | Significant |

| ||||||||||

Markets for | Observable | Unobservable |

| ||||||||||

Identical Assets | Inputs | Inputs | |||||||||||

Assets |

| Total |

| (Level 1) |

| (Level 2) |

| (Level 3) |

| ||||

March 31, 2024 | (in thousands) |

| |||||||||||

Money market funds included in cash and cash equivalents |

| $ | |

| $ | |

| $ | — |

| $ | — | |

Marketable securities: | |||||||||||||

U.S. Treasury notes | | | — | — | |||||||||

U.S. Government agency securities | | | — | — | |||||||||

Corporate bonds | | — | | — | |||||||||

Commercial paper | | — | | — | |||||||||

Total money market funds and marketable securities | $ | | $ | | $ | | $ | — | |||||

December 31, 2023 | |||||||||||||

Money market funds included in cash and cash equivalents |

| $ | | $ | | $ | — | $ | — | ||||

Marketable securities: | |||||||||||||

U.S. Treasury notes | | | — | — | |||||||||

U.S. Government agency securities | | | — | — | |||||||||

Corporate bonds | | — | | — | |||||||||

Commercial paper | | — | | — | |||||||||

Total money market funds and marketable securities | $ | | $ | | $ | | $ | — | |||||

The Company measures the fair value of money market funds, U.S. Treasury notes, and U.S. Government agency securities based on quoted prices in active markets for identical securities. The Company measures the fair value of the Level 2 securities, corporate bonds and commercial paper, based on recent trades of securities in active markets or based on quoted market prices of similar instruments and other significant inputs derived from or corroborated by observable market data.

10

4. Cash, cash equivalents, restricted cash, and available-for-sale marketable securities

Cash, cash equivalents, and marketable securities included the following at March 31, 2024 and December 31, 2023:

Amortized | Unrealized | Unrealized | Fair | ||||||||||

| Cost |

| Gains |

| Losses |

| Value | ||||||

(in thousands) | |||||||||||||

As of March 31, 2024 |

|

|

|

|

|

|

|

| |||||

Money market funds included in cash and cash equivalents | $ | | $ | — | $ | — | $ | | |||||

Marketable securities: | |||||||||||||

U.S. Treasury notes | | — | ( | | |||||||||

U.S. Government agency securities | | | ( | | |||||||||

Corporate bonds | | | ( | | |||||||||

Commercial paper | | | — | | |||||||||

Total money market funds and marketable securities | $ | | $ | | $ | ( | $ | | |||||

As of December 31, 2023 |

|

|

|

|

|

|

|

| |||||

Money market funds included in cash and cash equivalents | $ | | — | — | $ | | |||||||

Marketable securities: | |||||||||||||

U.S. Treasury notes | | | ( | | |||||||||

U.S. Government agency securities | | | ( | | |||||||||

Corporate bonds | | | ( | | |||||||||

Commercial paper | | — | — |

| | ||||||||

Total money market funds and marketable securities | $ | | $ | | $ | ( | $ | | |||||

The Company had $

The Company reviews investments whenever the fair value of an investment is less than the amortized cost and evidence indicates that an investment’s carrying amount is not recoverable within a reasonable period of time. In connection with these investments, the Company evaluates whether the decline in fair value has resulted from credit losses or other factors, considering the extent to which fair value is less than amortized cost, any changes to the rating of the security by a rating agency, and adverse conditions specifically related to the security, among other factors. If this assessment indicates that a credit loss exists, the present value of cash flows expected to be collected from the security is compared to the amortized cost basis of the security. If the present value of cash flows expected to be collected is less than the amortized cost basis, a credit loss exists and an allowance for credit losses is recorded for the credit loss on the condensed consolidated balance sheet, limited by the amount that the fair value is less than the amortized cost basis. Any impairment that is not related to credit is recognized in other comprehensive loss. Changes in the allowance for credit losses are recorded as a provision for (or reversal of) credit loss expense in general and administrative expenses within the condensed consolidated statement of operations. Losses are charged against the allowance when the Company believes the uncollectability of an available-for-sale security is confirmed or when either of the criteria regarding intent or requirement to sell is met.

The Company held $

11

The following table provides a reconciliation of cash, cash equivalents, and restricted cash within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows:

As of March 31, | ||||||

2024 |

| 2023 | ||||

(in thousands) | ||||||

Cash and cash equivalents | $ | | $ | | ||

| | |||||

Total cash, cash equivalents, and restricted cash | $ | | $ | | ||

5. Accrued expenses

Accrued expenses as of March 31, 2024 and December 31, 2023 consist of the following:

As of March 31, | As of December 31, | |||||

| 2024 |

| 2023 | |||

(in thousands) | ||||||

Research and development costs | $ | | $ | | ||

Employee compensation costs |

| |

| | ||

Accrued goods and services |

| |

| | ||

Professional services | | | ||||

Total | $ | | $ | | ||

6. Lease obligation

Operating Leases

As of March 31, 2024, the Company has a lease for laboratory and office space at 75 Hayden Avenue in Lexington, Massachusetts through January 31, 2031 and a lease for additional office and laboratory space at 64 Sidney Street in Cambridge, Massachusetts through November 30, 2026.

On August 11, 2023, the Company entered into a first amendment (the “First Amendment”) to its existing lease for laboratory and office space at 75 Hayden Avenue in Lexington, Massachusetts, pursuant to which the Company agreed to lease approximately

The Company’s lease agreements require the Company to maintain a cash deposit or irrevocable letter of credit in the aggregate amount of $

During the three months ended March 31, 2024 and 2023, the Company incurred lease expenses of $

12

7. Commitments, contingencies and other liabilities

As of March 31, 2024 and December 31, 2023, other current and non-current liabilities consisted of the following:

As of March 31, | As of December 31, | |||||

2024 |

| 2023 | ||||

(in thousands) | ||||||

Other current liabilities | ||||||

| | |||||

Total other current liabilities | $ | | $ | | ||

Other non-current liabilities | ||||||

$ | | $ | | |||

Other | | | ||||

Total other non-current liabilities | $ | | $ | | ||

Other Agreements

In 2016, the Company entered into a research and development funding arrangement with a non-profit organization that provides up to $

Litigation

The Company was not a party to any material legal matters or claims as of March 31, 2024, or December 31, 2023. The Company did not have contingency reserves established for any litigation liabilities as of March 31, 2024, or December 31, 2023.

8. Significant agreements

The Company’s significant agreements are described in Note 9 of the December 31, 2023 consolidated financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2023. During the three months ended March 31, 2024, there were no material changes to the Company’s collaboration agreements or option and license agreements and

2023 Neurocrine Collaboration Agreement

In the three months ended March 31, 2024, the Company revised its estimate of research services expected to be performed under the collaboration and license agreement with Neurocrine entered into in January 2023 (the “2023 Neurocrine Collaboration Agreement”). The change in estimate resulted in additional revenue recognized of approximately $

2023 Novartis Stock Purchase Agreement

Under the stock purchase agreement entered into in December 2023 (the “2023 Novartis Stock Purchase Agreement”), Novartis purchased

13

aggregate purchase price of approximately $

2019 Neurocrine Collaboration Agreement

In February 2024, the Company announced that the joint steering committee with Neurocine selected a lead development candidate for the gene therapy program for Friedreich’s ataxia (the “FA Program”) under the collaboration and license agreement with Neurocrine entered into in January 2019 (the “2019 Neurocrine Collaboration Agreement”), which triggered a $

Related Party Collaboration Receivable

The following table presents changes in the balances of the Company’s related party collaboration receivable and contract liabilities for the 2023 Neurocrine Collaboration Agreement and the 2019 Neurocrine Collaboration Agreement during the three months ended March 31, 2024:

Balance at |

| Balance at | |||||||||||

December 31, 2023 | Additions | Deductions | March 31, 2024 | ||||||||||

(in thousands) | |||||||||||||

Related party collaboration receivables | $ | | $ | | $ | ( | $ | | |||||

Contract liabilities: | |||||||||||||

Deferred revenue | $ | | $ | | $ | ( | $ | | |||||

The change in the related party collaboration receivable balance for the three months ended March 31, 2024 is primarily driven by amounts owed to the Company for research and development services provided, offset by amounts collected during the period, for the 2023 and 2019 Neurocrine Collaboration Agreements. Deferred revenue activity for the period includes the recording of $

9. Stock-based compensation

Stock-Based Compensation Expense

Total compensation cost recognized for all stock-based compensation awards in the condensed consolidated statements of operations and comprehensive (loss) income was as follows:

Three Months Ended | |||||||

March 31, |

| ||||||

| 2024 |

| 2023 |

| |||

(in thousands) | |||||||

Research and development | $ | | $ | | |||

General and administrative |

| |

| | |||

Total stock-based compensation expense | $ | | $ | | |||

14

Stock-based compensation expense by type of award included within the condensed consolidated statements of operations and comprehensive (loss) income was as follows:

Three Months Ended | |||||||

March 31, | |||||||

| 2024 |

| 2023 | ||||

(in thousands) | |||||||

Stock options | $ | | $ | | |||

Restricted stock awards and units | | | |||||

Employee stock purchase plan awards |

| |

| | |||

Total stock-based compensation expense | $ | | $ | | |||

Restricted Stock Units

A summary of the status of and changes in unvested restricted stock unit activity under the Company’s equity award plans for the three months ended March 31, 2024 was as follows:

| Weighted | |||||

Average | ||||||

Grant Date | ||||||

Fair Value | ||||||

| Units |

| Per Unit | |||

Unvested restricted stock units as of December 31, 2023 |

| | $ | | ||

Granted |

| | $ | | ||

Vested |

| ( | $ | | ||

Forfeited |

| ( | $ | | ||

Unvested restricted stock units as of March 31, 2024 |

| | $ | | ||

Stock-based compensation of restricted stock units is based on the fair value of the Company’s common stock on the date of grant and is recognized over the vesting period. Restricted stock units granted by the Company typically vest in equal amounts, annually over

As of March 31, 2024, the Company had unrecognized stock-based compensation expense related to its unvested restricted stock units of $

Stock Options

The following is a summary of stock option activity for the three months ended March 31, 2024:

| Weighted |

| Remaining |

| Aggregate | ||||||

Average | Contractual | Intrinsic | |||||||||

Exercise | Life | Value | |||||||||

| Shares |

| Price |

| (in years) |

| (in thousands) | ||||

Outstanding at December 31, 2023 |

| | $ | | |||||||

Granted |

| | $ | | |||||||

Exercised |

| ( | $ | | |||||||

Cancelled or forfeited |

| ( | $ | | |||||||

Outstanding at March 31, 2024 |

| | $ | | $ | | |||||

Exercisable at March 31, 2024 |

| | $ | | $ | | |||||

15

As of March 31, 2024, the Company had unrecognized stock-based compensation expense related to its unvested stock options of $

10. Net (loss) income per share

The following table sets forth the outstanding potentially dilutive securities that have been excluded in the calculation of diluted net (loss) income per share because to include them would be anti-dilutive:

As of March 31, | |||||||

| 2024 |

| 2023 | ||||

Unvested restricted common stock awards |

| |

| | |||

Unvested restricted common stock units | | | |||||

Outstanding stock options |

| |

| | |||

Total |

| |

| | |||

Basic net (loss) income and diluted weighted-average shares outstanding are as follows for the three months ended March 31, 2024 and 2023:

Three Months Ended March 31, | |||||||

2024 | 2023 | ||||||

Numerator: | |||||||

Net (loss) income (in thousands) | $ | ( | $ | | |||

Denominator for basic net (loss) income per share: | |||||||

Weighted average shares outstanding-basic | | | |||||

Denominator for diluted net (loss) income per share: | |||||||

Weighted average shares outstanding-basic | | | |||||

Common stock options and restricted stock units | — | | |||||

Weighted average shares outstanding-diluted | | | |||||

Net (loss) income per share, basic: | $ | ( | $ | | |||

Net (loss) income per share, diluted: | $ | ( | $ | | |||

The pre-funded warrants issued in connection with the underwritten public offering discussed in Note 11 are included in basic and diluted weighted average shares outstanding for the three months ended March 31, 2024.

11. Underwritten public offering

On January 4, 2024, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with Citigroup Global Markets Inc. and Guggenheim Securities, LLC, as representatives of the several underwriters named therein (the “Underwriters”), relating to an underwritten public offering of

On January 9, 2024, the Company issued

16

offering expenses pursuant to the underwritten public offering. The Pre-Funded Warrants met the equity classification guidance and therefore are classified as stockholders’ equity.

12. Related-party transactions

During the three months ended March 31, 2024, the Company received scientific advisory board and other scientific advisory services from

Under each of the Company’s collaboration agreements with Neurocrine, the Company and Neurocrine have agreed to conduct research, development, and commercialization activities for certain of the Company’s AAV gene therapy product candidates. Amounts due from Neurocrine are reflected as related party collaboration receivables. As of March 31, 2024, the Company had approximately $

13. Subsequent Events

In April 2024, the Company announced that the joint steering committee with Neurocrine selected a development candidate for the glucocerebrosidase 1 gene therapy program for Parkinson’s disease and other GBA1-mediated diseases under the 2023 Neurocrine Collaboration Agreement (the “GBA1 program”). The joint steering committee selection of a development candidate for the GBA1 Program triggered a $

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q and the audited financial information and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the Securities and Exchange Commission, or the SEC, on February 28, 2024.

Our actual results and timing of certain events may differ materially from the results discussed, projected, anticipated, or indicated in any forward-looking statements. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Quarterly Report on Form 10-Q. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this Quarterly Report on Form 10-Q, they may not be predictive of results or developments in future periods.

The following information and any forward-looking statements should be considered in light of factors discussed in Part I, Item 1A,"Risk Factors" of our Annual Report on Form 10-K for the year ended December 31, 2023, and, if applicable, those included under Part II, Item 1A of our Quarterly Reports on Form 10-Q, that could cause actual future results or events to differ materially from the forward-looking statements that we make. Additional risk factors may be identified from time to time in our future filings with the SEC.

These forward-looking statements are made under the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are neither promises nor guarantees. We caution readers not to place undue reliance on any forward-looking statements made by us, which speak only as of the date they are made. We disclaim any obligation, except as specifically required by law and the rules of the SEC, to publicly update or revise any such statements to reflect any change in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

Overview

We are a biotechnology company whose mission is to leverage the power of human genetics to modify the course of and ultimately cure neurological diseases. Our pipeline includes programs for Alzheimer’s disease, or AD; amyotrophic lateral sclerosis, or ALS; Parkinson’s disease; and multiple other diseases of the central nervous system, or CNS. Many of our programs are derived from our TRACER™ (Tropism Redirection of AAV by Cell-type-specific Expression of RNA) adeno-associated virus, or AAV, capsid discovery platform, which we have used to generate novel capsids, or TRACER Capsids, and identify associated receptors to potentially enable high brain penetration with genetic medicines following intravenous dosing. Some of our programs are wholly-owned, and some are advancing with licensees and collaborators including Alexion, AstraZeneca Rare Disease, or Alexion; Novartis Pharma AG, or Novartis; and Neurocrine Biosciences, Inc., or Neurocrine.

We focus on leveraging our expertise in capsid discovery and neuropharmacology to address the delivery hurdles that have constrained the genetic medicine and neurology disciplines, with the goal of either halting or slowing disease progression or reducing symptom severity, and therefore providing clinically meaningful impact to patients. We are advancing our own proprietary pipeline of drug candidates for neurological diseases, with a focus on AD. Our wholly-owned prioritized pipeline programs include an anti-tau antibody for AD; a superoxide dismutase 1, or SOD1, silencing gene therapy for ALS; and a tau silencing gene therapy for AD. We identified a lead development candidate for our anti-tau antibody program in the first quarter of 2023, which we refer to as VY-TAU01. We submitted an investigational new drug, or IND, application to the U.S. Food and Drug Administration, or the FDA, for VY-TAU01 in March 2024 and we have obtained clearance of the IND. We expect to dose the first subject in a planned Phase 1a single ascending dose, or SAD, trial of VY-TAU01 in healthy volunteers in the coming weeks. We also expect to initiate a

18

Phase 1b multiple ascending dose, or MAD, trial of VY-TAU01 in patients with early AD in 2025, which has the potential to generate initial data for slowing the spread of pathological tau via tau positron emission tomography, or PET, imaging in 2026. We identified a lead development candidate for the SOD1 silencing gene therapy program in the fourth quarter of 2023, which we refer to as VY9323, and we expect to submit the IND application for this program in mid-2025. We promoted our tau silencing gene therapy program to a prioritized program in the first quarter of 2024, based on preclinical data demonstrating robust reductions in tau messenger RNA, or mRNA, in a murine model, and we anticipate submission of an IND in 2026. Our proprietary pipeline also includes an early research initiative to develop a gene therapy for the treatment of AD. This program seeks to combine a vectorized anti-amyloid antibody with a TRACER Capsid.

We are also working with our collaboration partners on multiple programs. In January 2019 and January 2023, we entered into collaboration and license agreements with Neurocrine. Under our agreements with Neurocrine, we are actively advancing two later preclinical stage programs: a glucocerebrosidase 1, or GBA1, gene therapy program for Parkinson’s disease and other GBA1-mediated diseases, or the GBA1 Program, and a frataxin, or FXN, gene therapy program for Friedreich’s ataxia, or the FA Program. Pursuant to such agreements, we are also working with Neurocrine on five early-stage programs for the research, development, manufacture and commercialization of gene therapies designed to address central nervous system diseases or conditions associated with rare genetic targets. We have also entered into agreements with licensees including Novartis and Alexion to license or to provide options to receive exclusive licenses to certain TRACER Capsids. In December 2023, we entered into a license and collaboration agreement with Novartis to provide Novartis certain rights regarding the development of potential gene therapy product candidates for the treatment of spinal muscular atrophy and to collaborate with Novartis to develop gene therapy product candidates for the treatment of Huntington’s disease. The joint steering committee with Neurocrine selected a development candidate for the FA Program in February 2024, and we and Neurocrine expect the FA Program to advance into first-in-human clinical trials in 2025. The joint steering committee’s selection of a development candidate for the FA Program triggered a $5.0 million milestone payment to us, which we received in March 2024. The joint steering committee with Neurocrine also selected a development candidate for the GBA1 Program in April 2024, and we and Neurocrine expect to file an IND application with the FDA for the GBA1 Program in 2025. The joint steering committee’s selection of a development candidate for the GBA1 Program triggered a $3.0 million milestone payment to us, which we expect to receive during the second quarter of 2024.

All of the gene therapies in our wholly-owned and collaborative pipeline leverage novel capsids derived from our TRACER™ Capsid discovery platform. TRACER is a broadly applicable, RNA-based screening platform that enables rapid discovery of AAV capsids with robust penetration of the blood-brain barrier and enhanced CNS tropism in multiple species, including non-human primates, or NHPs.

Overview of Our Pipeline

We have leveraged our TRACER discovery platform and other gene therapy platforms, our expertise with proprietary antibodies, vectorized small interfering RNA, or siRNA, knockdown, gene delivery and our vectorized antibody platform to assemble a pipeline of proprietary antibody, AAV gene therapy and other genetic medicine programs for the treatment of neurological diseases. We have prioritized pipeline programs for our development based on the following criteria: high unmet medical need, target validation, efficient path to human proof of biology, robust preclinical pharmacology, and strong commercial potential. Depending on the disease, we are seeking to develop AAV gene therapies that will use a gene replacement, gene silencing or vectorized antibody approach, and antibodies that will use a passive administration approach.

19

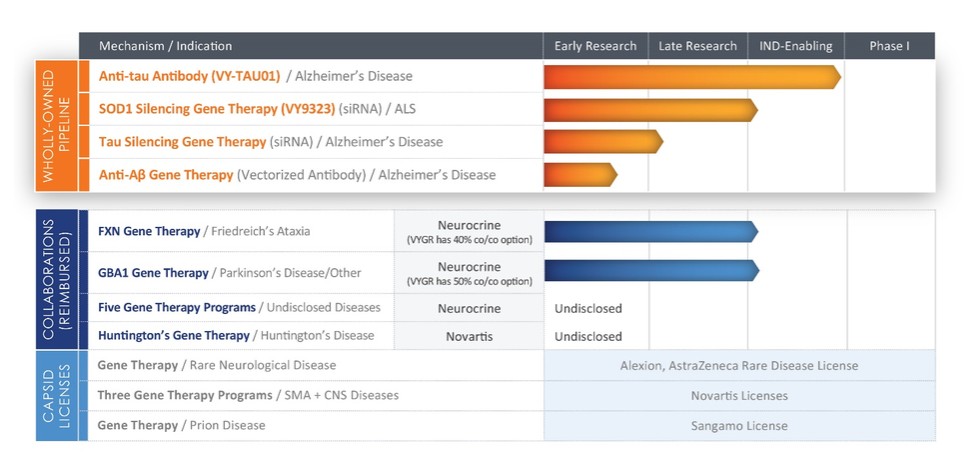

Our pipeline of programs, all of which are in preclinical development, is summarized in the table below:

Wholly-Owned Programs

Anti-Tau Antibody (VY-TAU01) for the Treatment of Alzheimer’s Disease

Disease Overview

AD is a progressive neurodegenerative disease estimated to affect 6 million people in the United States and up to 416 million people globally. The disease causes memory loss and may escalate to decreased independence, communication challenges, behavioral disorders such as paranoia and anxiety, and lack of physical control. In 2023, the total cost of caring for people living with Alzheimer’s and other dementias in the United States is estimated at $345 billion.

Our Treatment Approach

We have maintained a long-standing focus on developing proprietary and complimentary approaches to disrupt the progression of tau pathology believed to be central to AD and other tauopathies. A reduction of toxic tau aggregates may slow disease progression and cognitive decline in these diseases. We selected VY-TAU01 as our lead humanized anti-tau antibody candidate to advance against AD. We believe VY-TAU01 is differentiated from other anti-tau antibodies based on the epitope, or the part of a foreign protein or antigen that is capable of generating an immune response, it targets: VY-TAU01 targets an epitope which is located in the C-terminal, rather than the N-terminal, mid-domain, or microtubule binding region of the tau protein.

Preclinical Studies

As previously reported, our C-terminal targeting anti-tau antibody blocked the seeding/propagation of filamentous tau and demonstrated substantial reduction of induced tau pathology in a mouse model. In March 2023, we presented data at the Alzheimer's and Parkinson's Diseases, or AD/PD, 2023 Conference highlighting the differentiating characteristics resulting in the selection of lead candidate VY-TAU01. In March 2024, we presented data at the AD/PD 2024 Conference demonstrating VY-TAU01 was well-tolerated, and its serum pharmacokinetic profile was as expected in an NHP study.

20

Program Status

In January 2023, we selected VY-TAU01 as our lead humanized anti-tau antibody candidate to advance against AD. We submitted an IND application for VY-TAU01 to the FDA in March 2024, and we have obtained clearance of the IND. We expect to dose the first subject in a planned Phase 1a SAD trial in healthy volunteers in the coming weeks. A Phase 1b MAD trial in subjects with early AD is expected to be initiated in 2025. The MAD trial has the potential to generate initial data for slowing the spread of pathological tau via tau PET imaging in 2026.

SOD1 Silencing Gene Therapy Program for the Treatment of ALS (VY9323)

Disease Overview

We are developing a gene therapy leveraging a BBB-penetrant, CNS-tropic TRACER Capsid to treat ALS caused by the SOD1 mutation via a gene silencing approach. ALS is a progressive neurodegenerative disease in which the motor neurons atrophy and die, resulting in loss of the ability to speak, move, eat and, eventually, breathe. SOD1 ALS is typically fatal within approximately two to five years of symptom onset. The disease is estimated to affect approximately 20,000 people in the United States. Multiple genes have been implicated in ALS; mutations in the SOD1 gene are estimated to occur in approximately 2-3% of ALS cases, or up to 600 people in the United States. SOD1 mutations in ALS patients are thought to cause a toxic gain-of-function that leads to the degeneration of motor neurons along the entire length of the spinal cord, the brainstem, and the upper motor neurons in the cerebral cortex.

Our Treatment Approach

We believe that a therapeutic delivering a vectorized highly potent siRNA construct via intravenous administration of an AAV gene therapy may enable broad CNS knockdown of SOD1, which could potentially slow the decline of functional ability in ALS patients with the SOD1 mutation. We have selected a potent, specific vectorized siRNA transgene targeting SOD1, delivered using a novel TRACER Capsid. We believe that a Phase 1 clinical trial to demonstrate reductions in SOD1 in the cerebrospinal fluid and in neurofilament light chain in the plasma could provide evidence of target engagement and the attenuation of motor neuron loss, respectively.

Preclinical Studies

At the American Society of Gene & Cell Therapy 25th Annual Meeting in May 2022, or the ASGCT 2022 Meeting, we presented preclinical data demonstrating robust SOD1 knockdown in all levels of the spinal cord and significant improvements in motor performance, body weight, and survival in an SOD1-ALS mouse model following intravenous delivery of a vectorized siRNA using a mouse BBB-penetrant capsid. When we announced the selection of a development candidate in the fourth quarter of 2023, we disclosed that, in an NHP study, the candidate demonstrated 73% reduction of SOD1 in cervical spinal cord motor neurons following a single intravenous dose in cynomolgus macaques. The candidate also demonstrated robust knockdown of SOD1 across all levels of the spinal cord and motor cortex. Further, the candidate demonstrated an ability to transduce both neurons and astrocytes, two cell types thought to play an important role in ALS.

Program Status

We have identified a potent and specific vectorized siRNA transgene that resulted in substantially extended lifespan and motor function when delivered using a BBB-penetrant capsid in a mouse model. In December 2023, we selected VY9323 as our lead development candidate for our SOD1 program. We plan to submit an IND application to the FDA in mid-2025 for VY9323 and to initiate a Phase 1 clinical trial of VY9323 in subjects with SOD1 ALS for the program as soon as possible thereafter. We expect to evaluate the safety and biological activity of VY9323 in this Phase 1 trial.

21

Tau Silencing Gene Therapy Program for the Treatment of AD

Disease Overview

AD is a progressive neurodegenerative disease estimated to affect 6 million people in the United States and up to 416 million people globally. The disease causes memory loss and may escalate to decreased independence, communication challenges, behavioral disorders such as paranoia and anxiety, and lack of physical control. In 2023, the total cost of caring for people living with Alzheimer’s and other dementias in the United States is estimated at $345 billion.

Our Treatment Approach

We have maintained a long-standing focus on developing proprietary and complimentary approaches to disrupt the progression of tau pathology believed to be central to AD and other tauopathies. A reduction of toxic tau aggregates may slow disease progression and cognitive decline in these diseases. In addition to our aforementioned anti-tau antibody program, we are advancing a gene therapy that leverages an intravenously delivered TRACER Capsid containing a vectorized siRNA, specifically targeting tau mRNA.

Preclinical Studies

In March 2024, we presented data at the AD/PD 2024 Conference demonstrating that a single intravenous administration of our tau silencing gene therapy in mice expressing human tau resulted in broad AAV distribution across multiple brain regions and dose-dependent reductions in tau mRNA levels of up to 90%, which were associated with robust reductions in human tau protein levels across the brain.

Program Status

In the first quarter of 2024, we promoted the tau silencing gene therapy program to a prioritized program on our wholly-owned pipeline, based on its demonstration on in vivo proof-of-concept and expected advancement to IND within two to three years. We are evaluating the optimal combination of payload and capsid for this program, to enable selection of a development candidate. We expect to file an IND in 2026.

Vectorized Anti-Amyloid Antibody Early Research Program for the Treatment of AD

In August 2023, we announced an early research initiative investigating a gene therapy targeting anti-amyloid for the treatment of AD. The program combines a vectorized anti-amyloid antibody with an intravenously delivered TRACER Capsid.

Collaboration Programs

Friedreich’s Ataxia Program: VY-FXN01 (2019 Neurocrine Collaboration)

Disease Overview

Friedreich’s ataxia is a debilitating neurodegenerative disease resulting in poor coordination of legs and arms, progressive loss of the ability to walk, generalized weakness, loss of sensation, scoliosis, diabetes and cardiomyopathy as well as impaired vision, hearing and speech. The typical age of onset is 10 to 12 years, and life expectancy is severely reduced with patients generally dying of neurological and cardiac complications between the ages of 35 and 45. According to the Friedreich’s Ataxia Research Alliance, there are approximately 4,000 patients living with the disease in the United States. While one treatment for Friedreich’s ataxia has recently been approved by the FDA, we believe there remains a significant unmet need.

Friedreich’s ataxia patients have mutations of the FXN gene that reduce production of the frataxin protein, resulting in the degeneration of sensory pathways and a variety of debilitating symptoms. Friedreich’s ataxia is an autosomal recessive disorder, meaning that a person must obtain a defective copy of the FXN gene from both parents in order to develop the condition. One healthy copy of the FXN gene, or 50% of normal frataxin protein levels, is sufficient

22

to prevent the disease phenotype. We therefore believe that restoring FXN protein levels to at least 50% of normal levels by AAV gene therapy might lead to a successful therapy.

Our Treatment Approach

We are seeking to develop an AAV gene therapy approach that we believe will deliver a functional version of the FXN gene to the sensory pathways through intravenous injection. We think this approach has the potential to improve balance, ability to walk, sensory capability, coordination, strength and functional capacity of Friedreich’s ataxia patients. Most Friedreich’s ataxia patients produce low levels of the frataxin protein, which although insufficient to prevent the disease, exposes the patient’s immune system to frataxin. This reduces the likelihood that the FXN protein expressed by AAV gene therapy will trigger a harmful immune response.

Preclinical Studies

We initially conducted preclinical studies in NHPs and achieved high FXN expression levels within the target sensory ganglia, or clusters of neurons, along the spinal region following intrathecal injection. More recently, we conducted preclinical studies in NHPs with intravenous injection and achieved target FXN expression levels within sensory ganglia and the heart. The levels of FXN expression observed in the brain using an AAV vector were, on average, greater than FXN levels present in control normal human brain tissue. FXN expression was also observed in the cerebellar dentate nucleus, another area of the CNS that is often affected in Friedreich’s ataxia, and that is often considered difficult to target therapeutically.

Our Program Status

Under the collaboration and license agreement with Neurocrine entered into in January 2019, or the 2019 Neurocrine Collaboration Agreement, we are developing VY-FXN01 for the treatment of Friedreich’s ataxia. VY-FXN01 is currently in preclinical development. In February 2024, the joint steering committee with Neurocrine selected a development candidate combining an FXN gene replacement payload with a novel TRACER Capsid for its FA Program and we and Neurocrine expect to advance the FA Program into first-in-human clinical trials in 2025. The selection of a lead development candidate triggered a $5.0 million milestone payment to us, which we received in March 2024.

GBA1 Gene Replacement Program for the Treatment of Parkinson’s Disease (2023 Neurocrine Collaboration)

Disease Overview

We are developing a gene therapy leveraging a BBB-penetrant, CNS-tropic TRACER Capsid to treat diseases linked to GBA1 mutations via a gene replacement approach. Mutations in GBA1, the gene encoding the lysosomal glucocerebrosidase enzyme, or Gcase, are the most common genetic risk factor for synucleinopathies such as Parkinson’s disease. Parkinson’s disease is among the most common neurodegenerative diseases, affecting about one million patients in the United States and more than 10.0 million patients worldwide. Up to 10% of Parkinson’s disease patients have a GBA1 mutation, and these mutations increase the risk of Parkinson’s disease by approximately 20-fold. GBA1 mutations can decrease the activity of Gcase, leading to the accumulation of Gcase substrates which is linked to alpha-synuclein aggregates, which are thought to be toxic to neurons.

Our Treatment Approach

We believe that restoring Gcase activity may attenuate disease progression and potentially slow neurodegeneration. We anticipate delivering GBA1 via intravenous administration of an AAV gene therapy to enable widespread distribution to multiple affected brain regions and to avoid the need for more invasive approaches. We believe that the measurement of the Gcase substrates such as glucosylsphingosine as cerebrospinal fluid biomarkers may facilitate efficient clinical demonstration of proof-of-biology. Such substrates of the Gcase enzyme are elevated in the cerebrospinal fluid of Parkinson’s disease patients who harbor the GBA1 mutation, and we expect that substrate levels would be normalized if our gene therapy restores Gcase enzyme expression in the brain. This gene therapy may also have potential utility in idiopathic Parkinson’s disease, where there is evidence of loss of Gcase activity in the substantia

23

nigra in Parkinson’s disease patients even in the absence of GBA1 mutations as well as evidence of lysosomal dysfunction in general.

Preclinical Studies

At the ASGCT 2022 Meeting, we presented preclinical data demonstrating CNS target engagement and delivery of therapeutically relevant levels of Gcase in a GBA1 loss of function mouse model, as well as sustained expression for three or more months following intravenous administration. At the AD/PD 2023 Conference, we presented new data from additional mouse efficacy studies showing that three potential development candidates each demonstrated significant improvement in several efficacy biomarkers. We presented data at the ASGCT 2023 Meeting summarizing the mouse findings and additional data from an NHP study showing that the administration of a reporter transgene via a single, intravenous dose using two novel BBB-penetrant AAV capsids demonstrated substantially improved biodistribution and gene expression compared to conventional AAV9 in the putamen and substantia nigra, two areas of the brain that are affected in Parkinson’s disease.

Program Status

Under the collaboration and license agreement with Neurocrine entered into in January 2023, or the 2023 Neurocrine Collaboration Agreement, we are developing gene therapy products directed to the gene that encodes GBA1 for the treatment of Parkinson’s disease and other diseases associated with GBA1, or the GBA1 Program. The GBA1 Program is currently in preclinical development. In April 2024, the joint steering committee with Neurocrine selected a development candidate for the GBA1 Program and we and Neurocrine expect to file an IND application with the FDA for the GBA1 Program in 2025. Selection of the development candidate triggered a $3.0 million milestone payment, which we expect to receive in the second quarter of 2024.

HD Program (2023 Novartis Collaboration Agreement)

Disease Overview

Huntington’s disease is a fatal, inherited neurodegenerative disease that results in the progressive decline of motor and cognitive functions and a range of behavioral and psychiatric disturbances. Huntington’s disease is caused by mutations in the huntingtin, or HTT, gene. Huntington’s disease is an autosomal dominant disorder, which means that an individual is at risk of inheriting the disease if only one parent is affected. While the exact function of the HTT gene in healthy individuals is unknown, it is essential for normal development before birth. Mutations in the HTT gene ultimately lead to the production of abnormal intracellular huntingtin protein aggregates and expansions in the gene in neurons that may cause neuronal cell death.

Program Status

On December 28, 2023, or the 2023 Novartis Collaboration Agreement Effective Date, we entered into a license and collaboration agreement with Novartis, or the 2023 Novartis Collaboration Agreement. Under the 2023 Novartis Collaboration Agreement, we and Novartis have agreed to collaborate to develop AAV gene therapy products and product candidates intended for the treatment of Huntington’s disease, which we refer to as the Novartis HD Program. The Novartis HD Program is currently in preclinical development. From and after the first IND application filing for the Novartis HD Program, we and Novartis have agreed that Novartis will assume sole responsibility for the development and commercialization of gene therapy products and product candidates under the Novartis HD Program, including all further preclinical and clinical development and any commercialization of the Novartis HD Program products and product candidates.

Collaboration Programs and Licensing Agreements

2023 Novartis Collaboration Agreement

On the 2023 Novartis Collaboration Agreement Effective Date, as described above we entered into the 2023 Novartis Collaboration Agreement, with Novartis to (a) provide rights to Novartis with respect to certain TRACER Capsids for use in the research, development, and commercialization by Novartis of AAV gene therapy products and

24

product candidates, comprising such TRACER Capsids and payloads intended for the treatment of spinal muscular atrophy, or the Novartis SMA Program, and (b) collaborate to develop AAV gene therapy products and product candidates under the Novartis HD Program, in each case, leveraging TRACER Capsids and other intellectual property controlled by us.

Under the 2023 Novartis Collaboration Agreement, Novartis paid us an upfront payment of $80.0 million. We are eligible to receive specified development, regulatory, and commercialization milestone payments of up to an aggregate of $200.0 million for the Novartis SMA Program and up to an aggregate of $225.0 million for the Novartis HD Program, in each case for the first corresponding product to achieve the corresponding milestone. We are also eligible to receive (a) specified sales milestone payments of up to an aggregate of $400.0 million for the Novartis SMA Program and up to an aggregate of $375.0 million for the Novartis HD Program and (b) tiered, escalating royalties in the high single-digit to low double-digit percentages of annual net sales of the Novartis SMA Program Products and the Novartis HD Program Products. The royalties are subject to potential customary reductions, including patent claim expiration, payments for certain third-party licenses, and biosimilar market penetration, subject to specified limits. For a further description of the 2023 Novartis Collaboration Agreement, refer to Note 9, Significant Agreements, to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 under the caption “2023 Novartis Collaboration Agreement.”

2023 Novartis Stock Purchase Agreement

We and Novartis also entered into a stock purchase agreement on December 28, 2023, or the 2023 Novartis Stock Purchase Agreement, for the sale and issuance of 2,145,002 shares of our common stock, or the Novartis Shares, to Novartis at a price of $9.324 per share, for an aggregate purchase price of approximately $20.0 million. In accordance with the terms and conditions of the 2023 Novartis Stock Purchase Agreement, we issued and sold the Novartis Shares to Novartis on January 3, 2024, or the 2023 Novartis Investment Closing Date.

2023 Novartis Investor Agreement

We and Novartis also entered into an investor agreement on December 28, 2023, or the 2023 Novartis Investor Agreement, which became effective as of the 2023 Novartis Investment Closing Date, providing for standstill and lock-up restrictions.

Pursuant to the terms of the 2023 Novartis Investor Agreement, Novartis has agreed not to, without the prior written approval of us and subject to specified conditions, directly or indirectly acquire shares of our outstanding common stock, publicly seek or propose a tender or exchange offer or merger between the parties, solicit proxies or consents to vote any voting securities that we have issued, or undertake other specified actions related to the potential acquisition of additional equity interests in us. Further, Novartis has also agreed not to, and to cause its affiliates not to sell or transfer any of the Novartis Shares without our prior approval, subject to specified conditions.

2022 Novartis Option and License Agreement

On March 4, 2022, or the 2022 Novartis Option and License Effective Date, we entered into an option and license agreement with Novartis, or the 2022 Novartis Option and License Agreement. Pursuant to the 2022 Novartis Option and License Agreement, we granted Novartis options, or the Novartis License Options, to license TRACER Capsids, or the Novartis Licensed Capsids, for exclusive use with certain targets to develop and commercialize AAV gene therapy candidates comprised of Novartis Licensed Capsids and payloads directed to such targets, or the Novartis Payloads.

Under the terms of the 2022 Novartis Option and License Agreement, Novartis paid us an upfront payment of $54.0 million. Effective as of March 1, 2023, Novartis exercised its Novartis License Options to license TRACER Capsids for use in gene therapy programs against two undisclosed programs targeting specified genes, or the Initial Novartis Targets. With Novartis’ option exercise on two Initial Novartis Targets, we received a $25.0 million option exercise payment in April 2023, and are eligible to receive associated potential development, regulatory, and commercial milestone payments, as well as mid- to high-single-digit tiered royalties based on net sales of products containing the corresponding Novartis Payload, or the Novartis Licensed Products, incorporating the Novartis Licensed Capsids.

25

The two Initial Novartis Targets licensed are distinct from targets in our wholly-owned and partnered pipeline. In addition, during the research term, Novartis retains the right to expand the agreement to include options to license capsids for up to two other targets, or the Additional Novartis Targets, subject to their availability, for a fee of $18.0 million per Additional Novartis Target. Under such an expansion, we would be eligible to receive a $12.5 million license option exercise fee for each Additional Novartis Target exercised, as well as future potential milestone payments per Additional Novartis Target and tiered mid- to high-single digit royalties on the Novartis Licensed Products incorporating the Novartis Licensed Capsids.

Novartis elected not to license a capsid for one Initial Novartis Target under the 2022 Novartis Option and License Agreement prior to the expiration of the applicable Novartis License Option. As a result, the non-exclusive research license that we granted to Novartis in connection with this Initial Novartis Target has terminated, the research term for this Initial Novartis Target has expired, and we are no longer eligible to receive development, regulatory, and commercial milestone payments or royalties in connection with this Initial Novartis Target. All capsid rights with respect to that Initial Novartis Target have returned to us. For a further description of the 2022 Novartis Option and License Agreement, refer to Note 9, Significant Agreements, to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 under the caption “2022 Novartis Option and License Agreement.”

2023 Neurocrine Collaboration Agreement

In January 2023, we entered into a collaboration agreement, or the 2023 Neurocrine Collaboration Agreement, with Neurocrine for the research, development, manufacture and commercialization of certain of our AAV gene therapy products. Under the 2023 Neurocrine Collaboration Agreement, we agreed to collaborate on the conduct of four collaboration programs, which we refer to collectively as the 2023 Neurocrine Programs: the GBA1 Program, and three new programs focused on the research, development, manufacture and commercialization of gene therapies designed to address central nervous system diseases or conditions associated with rare genetic targets, or the 2023 Discovery Programs.

Under the terms of the 2023 Neurocrine Collaboration Agreement, Neurocrine paid us an upfront payment of approximately $136.0 million and approximately $39.0 million as consideration for an equity purchase of 4,395,588 shares of our common stock in February 2023. The 2023 Neurocrine Collaboration Agreement provides for aggregate development milestone payments from Neurocrine to us for the research, development, manufacture, and commercialization of gene therapy products, or the 2023 Collaboration Products, under (a) the GBA1 Program of up to $985.0 million; and (b) each of the three 2023 Discovery Programs of up to $175.0 million for each 2023 Discovery Program. We may be entitled to receive aggregate commercial milestone payments for up to two 2023 Collaboration Products under the GBA1 Program of up to $950.0 million per 2023 Collaboration Product and for one 2023 Collaboration Product under each 2023 Discovery Program of up to $275.0 million per 2023 Discovery Program.

Neurocrine has also agreed to pay us tiered royalties, based on future net sales of the 2023 Collaboration Products. Such royalty percentages, for net sales in and outside the United States, range from (a) for the GBA1 Program, the low double-digits to twenty and the high single-digits to mid-teens, respectively, and (b) for each 2023 Discovery Program, high single-digits to mid-teens and mid-single digits to low double-digits, respectively. On a country-by-country and 2023 Neurocrine Program-by-2023 Neurocrine Program basis, the parties have agreed royalty payments would commence on the first commercial sale of a 2023 Collaboration Product in such country and terminate upon the latest of (x) the expiration, invalidation or the abandonment of the last patent covering the composition of the 2023 Collaboration Product or its approved method of use in such country, (y) ten years from the first commercial sale of the 2023 Collaboration Product in such country and (z) the expiration of regulatory exclusivity in such country, or the 2023 Royalty Term. Royalty payments may be reduced by up to 50% in specified circumstances, including expiration of patent rights related to a 2023 Collaboration Product, approval of biosimilar products in a given country, or required payment of licensing fees to third parties related to the development and commercialization of any 2023 Collaboration Product. Additionally, the licenses granted to Neurocrine shall automatically convert to a fully-paid, perpetual, irrevocable royalty-free license on a country-by-country and 2023 Collaboration Product-by-2023 Collaboration Product basis upon the expiration of the 2023 Royalty Term applicable to the 2023 Collaboration Product in such country.

26

The 2023 Neurocrine Collaboration Agreement became effective on February 21, 2023. On February 23, 2023, we received the upfront payment, and the shares of our common stock were issued and sold to Neurocrine pursuant to the applicable stock purchase agreement. For a further description of the 2023 Neurocrine Collaboration Agreement, refer to Note 9, Significant Agreements, to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 under the caption “2023 Neurocrine Collaboration Agreement.”

2019 Neurocrine Collaboration

In January 2019, we entered into the 2019 Neurocrine Collaboration Agreement for the research, development and commercialization of certain of our AAV gene therapy products. Under the 2019 Neurocrine Collaboration Agreement, we agreed to collaborate on the conduct of four collaboration programs, which we refer to collectively as the 2019 Neurocrine Programs: the NBIb-1817 (VY-AADC) program for the treatment of Parkinson’s disease, or the VY-AADC Program; the FA Program, and two other undisclosed programs, which we refer to as the 2019 Discovery Programs.