PRELIMINARY OFFERING CIRCULAR DATED NOVEMBER 10, 2016

Sagoon, Inc.

1980 Teasel Ct.

Woodbridge, VA 22192

703-762-6560

www.Sagoon.com

Up to 869,564 Shares of Class C Common Stock at $23 per Share

Minimum Investment: 13 Shares ($299)

Maximum Offering: $20,000,000

See “Securities being offered” at page 43.

| Price to Public | Underwriting discount and Commissions (1) | Proceeds to Company (2) | ||||||||||

| Per share | $ | 23.00 | ||||||||||

Maximum Offering (3) | $ | 20,000,000 | $ | N/A | $ | 20,000,000 | ||||||

(1) The company does not currently intend to use commissioned sales agents or underwriters. In the event it uses commissioned sales agents or underwriters, it will file an amendment to the Offering Statement of which this Offering Circular forms a part. See "Plan of Distribution."

(2) Does not reflect payment of expenses of this offering, which are estimated to not exceed $250,000 and which include, among other things, professional fees and marketing expenses, but not state filing fees.

(3) We are also offering to exchange Class C Common Stock originally issued in private placements for Class C Common Stock in this Offering. See “Plan of Distribution” for details.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 10.

Sales of these securities will commence on approximately [date].

The company is following the “Offering Circular” format of disclosure under Regulation A.

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

This offering (the “Offering”) consists of Class C Common Stock. The Class C Common Stock has one-tenth of a vote per share, compared to one vote per share that applies to the Class A Common Stock, all of which is held by the company’s Chief Executive Officer. The Class C Common Stock is being offered on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold. There are 869,564 shares being offered at a price of $23.00 per share with a minimum purchase of 13 shares per investor. The maximum aggregate amount of the shares offered is $20,000,000 (the “Maximum Offering”). Provided that an investor purchases shares in the amount of the minimum investment (13 shares), there is no minimum number of shares that needs to be sold in order for funds to be released to the company and for this Offering to close, which may mean that the company does not receive sufficient funds to cover the cost of this Offering. The offering will terminate at the earlier of (1) the date at which the Maximum Offering amount has been sold, (2) [date], 2017, the date that is twelve months from the date of this Offering Statement being qualified by the Commission, or (3) the date at which the Offering is earlier terminated by the company in its sole discretion, which may happen at any time. The company anticipates that it will hold its initial closing on some date after the date of qualification and will hold additional closings at various times thereafter in the company’s discretion.

TABLE OF CONTENTS

In this Offering Circular, the term “Sagoon,” “the company,” “we” or “us” refers to Sagoon, Inc. and its consolidated subsidiaries.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| 2 |

Sagoon Inc. (“Sagoon” or the “company”) is a Delaware corporation that operates www.Sagoon.com, a social media platform. The company believes that Sagoon.com enables users to make a true connection with others. The company intends to generate revenues from advertising and the sale of gift cards and coupons. The company intends that eventually it will be able to provide its user base the ability to monetize time spent on the website through a revenue-sharing model.

The Offering

| Securities offered: | Up to 869,564 shares of Class C Common Stock ($20,000,000) | |

| Minimum investment: | 13 shares ($299) | |

| Exchange offer: | We are additionally offering to exchange Class C Common Stock originally issued in private placements for Class C Common Stock in this Offering and to redeem outstanding debt in exchange for the issuance of Class C Common Stock. See “Plan of Distribution.” | |

| Common Stock outstanding before the Offering1 | 3,367,100 shares | |

| Common Stock outstanding after the Offering1 2 | 4,236,664 shares | |

Classes of Common Stock: |

There are three classes of Common Stock authorized. Each share of Class A Common Stock has one vote. Class B Common Stock is non-voting. Each share of Class C Common has 1/10 of a vote. The securities offered in this Offering are Class C Common Stock and have limited voting rights. | |

| Use of proceeds: | The net proceeds of this offering will be used as working capital to build and expand the Company’s business. See “Use of Proceeds.” |

1 Includes 2,361,000 shares of Class A Common Stock held by founder and CEO Govinda Giri, 999,800 shares of Class B Common Stock issued to initial investors from a prior friends and family round, and 6,300 shares of Class C Common Stock issued to investors in a prior private offering. See “Securities being offered” for more information.

2 Assumes the sale of 869,564 shares.

| 3 |

The Company’s Business

Overview

Sagoon Inc. is a social commerce platform whose goal is to define the global standard for social media with its social path: CONNECT – SHARE – EARN.

Sagoon’s mission is to change the way people use and interact on social media today. Sagoon plans to be a pioneer in monetizing social media, enabling users to earn financial rewards while connecting with others and sharing personal experiences.

We call Sagoon a “social movement” – CONNECT – SHARE – EARN

Connect: Sagoon wants people to go beyond simply connecting and instead to build meaningful and productive relationships.

Share: Sagoon’s aim is to enrich the quality of interactions with close friends and loved ones. Users can share secrets, multimedia, and personal information.

Earn: Sagoon wants to share its earnings with its users. Users spending time with Sagoon should learn, enjoy, and eventually earn cash rewards. We think that Sagoon’s most exciting feature will eventually be its ability to provide monetary rewards to users for the time they spent on this social network.

While Sagoon has not yet generated any revenues and there can be no assurance that we will generate revenues in the future, Sagoon is currently used by 401,000 people across the globe and collectively they have invited more than a million people to join the platform (these people are on our waiting list). The largest number of our users is in Nepal, followed by India and the United States. Sagoon’s strategy is based on years of experience, which we believe will help us to gain more users internationally.

| 4 |

Supported by popular news and media in Nepal and India, we have received extensive media coverage. We currently have more than 20 full-time and part-time employees based in the United States, India and Nepal. The company’s operations and finance are managed in the United States, technical development is done in India and marketing is carried out from Nepal.

The Problem We Solve

Despite a multitude of social media sites, we believe there is no platform that builds true connections. And there is no social media site that allows its users to monetize their time on the site.

We have found most of today’s social networks were built around a time-consuming networking concept. This is no longer a novel idea and, in fact, makes millions of lives unnecessarily complicated. All too often, we see our ‘friends” on social media appearing to enjoy an expensive and exciting lifestyle. In the end, this doesn’t usually provide a solution to our needs; instead, it creates envy and social isolation.

As a result, many people are searching for new ways to engage with real friends and create more meaningful relationships, while spending their time productively.

Sagoon aims to totally change how people interact on social media, combining the features of a popular social network with an online shopping and gifting feature.

Features include:

| • | Value Sharing |

| • | Mood Talk |

| • | Private Messaging |

| • | Scheduling |

| • | Social Shopping/Gifting |

At present, Sagoon is used by people of all ages. The primary product allows for the building of social connections and the sharing of secret messages, both publicly and privately. Additionally, it provides for the organization of daily tasks and schedules and the ability to “chat” seamlessly through MoodTalk. The current features available on desktops are MyDay, Secret Sharing, MoodTalk and Contacts. The current features available on mobile devices are Secret Sharing and Contacts.

Sagoon Features Currently Available

My Day – this feature has a top section that highlights your current location whenever you log into Sagoon; local time and weather reports help travelers to plan their day, wherever they may be.

| 5 |

| · | Share Schedule – a tool for scheduling meetings and creating timetables; this can be shared with coworkers and family members so that your spouse, for example, can know where you are without wasting time or money texting or phoning. |

| · | Share To-Do List – an online tool to help track your projects, tasks and chores – again this can be shared with partners, family members, etc. |

| · | Send Reminder – a useful online tool for those of us who tend to forget tasks or appointments. |

Secret – a messaging service with a 220-character limit. Users can post messages as ‘Open Secrets,” allowing all contacts to view, like or dislike, or post secretly with a private message that will vanish after it has been read.

MoodTalk – an online “chat” tool that helps you to communicate using “moods” (happy, sad, sick, awesome, etc.), letting your moods do the talking while you chat. Chats also vanish automatically after 24 hours.

Social Smart Card

The Social Smart Card is a digital card for all the shopping and gifting needs of users that we plan to launch in 2017. It will allow Sagoon users to earn money while shopping, redeeming coupons and gifting their loved ones.

How will it work?

| · | A Payment Gateway (merchant account) will be built directly on the Sagoon platform for merchants. |

| · | Sagoon partners with vendors to offer gift card and coupons. |

| · | The company will integrate partners’ product APIs into the Social Smart Card, which would permit us to call data from our partners’ product interface and integrate that information onto our site. Potential partners that we intend to approach include companies such as Target and Sears, as well as India-based online and offline retail stores. |

| · | Every Sagoon user will receive a Sagoon Social Smart Card free when they create a Sagoon profile. |

| · | Sagoon users could use the Social Smart Card to buy from partners and send gifts to loved ones; they could also shop and redeem the amounts on their card online or on retail stores. |

In November 2014, Sagoon launched the Social Smart Card as a pilot program to test the potential market. During the pilot program, this feature was tested by over 90,000 users and attracted significant interest.

| 6 |

Why We Believe Sagoon is a Game Changer

It’s simple: revenue sharing. We believe that Sagoon’s platform will be a pioneer in its field with the innovative idea that users can make social connections while also sharing personal stories and earning money.

CONNECT – SHARE – EARN

Once launched, users will receive an online “Social Smart Card” that allows them to redeem coupons, give gifts, and also earn financial rewards – all while socializing with friends and family.

Imagine being able to earn money, just by spending time on social media. The Social Smart Card – which we anticipate we will launch in early 2017 – will allow every user to earn a percentage of Sagoon’s revenue.

Finding All Things in One Place

Sagoon combines the best features of other social media sites and apps: sharing multimedia, chatting, private messaging, shopping, and daily scheduling, all in one place – a totally new concept.

Globally, people spend between two and six hours a day on social media, checking their Facebook and Twitter accounts an average of once an hour. With Sagoon, this time will not be wasted but will potentially bring users financial rewards.

Sagoon intends to accept advertising by 2018. The company believes that this creates a spin cycle of positive outcomes: advertising attracts more users; an increased number of users attracts more advertising; and more advertising produces more revenue that is then shared by users. It’s the recipe for successful growth.

Even with the relatively limited resources of a startup, we believe that Sagoon has already defied expectations – with more than 387,000 users, sharing of more than four million messages and a waiting list of more than one million people.

The Market We Are Focused on

Our targeted market will encompass the world’s 2.2 billion social media users. Additionally, U.S. gift card spending hit $130 billion in sales in 2015, an increase of more than 6% over 2014, although close to $1 billion went unused. Total gift card volume is projected to reach $160 billion by 2018 according to CEB ToweGroup.

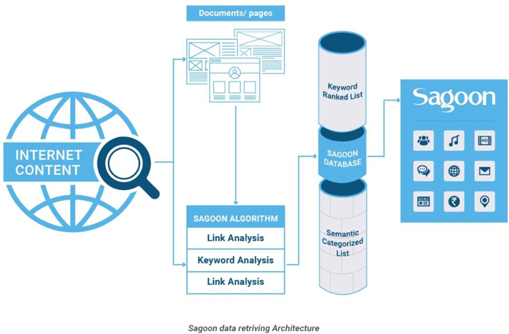

Technology

Sagoon’s technology eliminates many barriers that exist in traditional methods of computing and make its process faster and less expensive. Sagoon was developed based on the latest technology and plans to use semantic technology and Natural Language Process methods in future, which will we believe will result in significant savings in energy costs.

| 7 |

Key People

Govinda Giri, founder of Sagoon Inc. has more than 15 years of experience in Information Technology Enterprise Solutions, working with both the U.S. government and with private companies. Giri runs the company and as “chief architect” at Sagoon builds products and core technology.

Swati Dayal, co-founder, has more than eight years of experience working in the web and mobile space, and carries out the day-to-day work of Sagoon India, a private limited company wholly owned by Sagoon Inc.

In addition, Sagoon currently employs a key management team and 23 full time and six part-time employees, in New Delhi, India, and Washington, DC. The company’s marketing consulting team in Kathmandu oversees branding and public relations.

The management team continues to hire software developers and engineers to scale the business as needed.

Why Equity Crowdfunding?

The growth of Sagoon Inc. was fueled and funded by a group of believers mostly from the U.S.- and Canada-based Nepali and Indian communities through private placements. Sagoon’s business model is to share its revenue with every individual user. Sagoon does not believe that traditional funding methods fit its mission, which is to empower users by giving them an opportunity to earn money. The crowdfunding model is a perfect fit.

The launch of the JOBS Act and expansion of Regulation A makes it possible for us to raise capital from thousands of fans using an equity crowdfunding model. Through this Offering Circular, Sagoon is offering an investment opportunity to people around the world who love our products and believe in our vision, regardless of how wealthy they may be.

Selected Risks

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| · | The company has a limited operating history |

| · | The company has limited tangible assets and its continued operation requires funding |

| · | The company is dependent on its management, founders and sponsors to execute the business plan |

| 8 |

| · | The company faces significant competition |

| · | The company has incurred and intends to incur debt |

| · | The company faces development and business risks |

| · | The company’s expenses could increase without a corresponding increase in revenues |

| · | We may be unable to maintain and enhance product image |

| · | If we are unable to protect effectively our intellectual property, we may not be able to operate our business, which would impair our ability to compete |

| · | We could suffer computer, website or information system breakdown |

| · | Changes in the economy could have a detrimental impact |

| · | We could experience regulatory and legal hurdles |

| · | The company may undertake additional equity or debt financing that may dilute the shares in this offering |

| · | The company may not raise the maximum amount being offered |

| · | The company may not be able to obtain additional financing. |

| · | The offering price has been arbitrarily determined |

| · | Our management has broad discretion in application of proceeds |

| · | There is no assurance the company will be able to pay distributions to shareholders |

| · | The company’s indebtedness could adversely affect its business and limit its ability to plan for or respond to changes in its business, and the company may be unable to generate sufficient cash flow to satisfy significant debt service obligations |

| · | We will be subject to Regulation A’s ongoing reporting requirements |

| · | There is no market for the company's shares of Class C Common Stock |

| · | Your economic interest in the company may be less than your ownership interest |

| 9 |

The purchase of the company’s Class C Common Stock involves substantial risks. You should carefully consider the following risk factors, in addition to any other risks associated with this investment. The shares offered by the company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the company’s business and your investment in the shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the company is suitable in the light of your personal circumstances and the financial resources available to you.

Risks Relating to the Company’s Business

The Company Has a Limited Operating History

The company has a limited operating history and there can be no assurance that the company's proposed plan of business can be developed in the manner contemplated. If it cannot be, investors may lose all or a substantial part of their investment. The company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is no guarantee that it will ever realize any significant operating revenues or that its operations ever will be profitable. The audited financial statements of the company include a “going concern” paragraph that notes that there is substantial doubt about our ability to continue as a going concern.

The Company Has Limited Tangible Assets and Its Continued Operation Requires Funding

The company has limited tangible assets and its continued operation requires funding, even beyond the Maximum Offering amount. The company currently has only minimal assets and a significant portion of its funding will come from this offering, which is unlikely to be enough to bring the company to profitable operations. Further fundraising is likely may be necessary in order to make the company’s business plan viable. Any such fundraising (whether by future offerings of equity or debt securities, or by borrowing money) may be on terms that are better than the terms offered to investors in this offering.

The Company Is Dependent On Its Management, Founders and Sponsors to Execute the Business Plan

Sagoon is dependent on its management, founders and sponsors to execute the business plan. The success of the company will depend on its ability to compete for and retain additional qualified key personnel to enhance the growth. The company's operations and viability will be also dependent on its management team including Govinda Giri, the company’s CEO. The company's business would be adversely affected if it were unable to recruit qualified personnel when necessary or if it were to lose the services of certain key personnel and it were unable to locate suitable replacements in a timely manner. Finding and hiring such replacements, if any, could be costly and might require the company to grant significant equity awards or incentive compensation, which could have a material adverse effect on the company’s financial results and on your investment. The loss, through untimely death, unwillingness to continue or otherwise, of any such persons could have a materially adverse effect on the company and its business.

| 10 |

The Company Faces Significant Competition

We will face significant competition in the United States, India, Nepal and in all countries and markets. The company will be in direct competition with both new companies and existing companies that provide similar services, some of which currently hold a dominant position in the market. Some or all of these companies will have far more financial resources, a more established track record and more experience in the business than the company and there can be no assurance that we will be able to successfully compete.

The Company Has Incurred and Intends To Incur Debt

The company has incurred and intends to incur additional debt in connection with opening its business. Complying with obligations under such indebtedness may have a material adverse effect on the company and on your investment, especially if we are obligated to repay debt when with funds that could be used building out our operations.

The Company Faces Development and Business Risks

We will be subject to the risks generally incident to the ownership and operation of a business engaged in the operation of online business, including without limitation, fluctuations in the cost of improving and changing technology, other materials and services and the availability of financing for the company’s activities, inability to timely deliver completed products or services to customers, risk of rejection of products or services from customers, possible theft of trade secrets and/or unauthorized use of the products or services, possible trademark or patent infringement claims, both as to liability and the cost of defense of the same, and loss of or inability to attract key personnel, general and local economic conditions, the supply and demand for products and services similar to those of the company, and laws, regulations and taxes, all of which are matters beyond the company’s control, may have a material adverse effect upon the value of the company and upon the ability of the company to operate profitably. There is no assurance that the company’s efforts to profitably operate and develop its business will be successful. Companies, particularly new ones, frequently fail. If that should occur, investors in the company stand to lose their entire investment.

| 11 |

The Company’s Expenses Could Increase without a Corresponding Increase in Revenues

The company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the company’s financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to:

| · | increases in the rate of inflation; |

| · | increases in taxes and other statutory charges; |

| · | changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies; |

| · | significant increases in insurance premiums; |

| · | increases in borrowing costs; and |

| · | unexpected increases in costs of supplies, goods, equipment or distribution. |

We could also be affected by an increase in the cost of labor, utilities, internet and computer related expenses, and other expenses. The company may not be able to increase its revenues to offset these increased costs without suffering reduced revenues and operating profit, and this could have an adverse effect on your investment.

We May Be Unable to Maintain and Enhance Product Image

It is important that the company maintains and enhances the image of its existing and new products. The image and reputation of the company’s products may be impacted for various reasons, many of which may be beyond the company’s control. Such concerns, even when unsubstantiated, could be harmful to the company’s image and the reputation of its products. The company may become subject to lawsuits from customers and demanding payments from the company. These claims may not be covered by whatever insurance policies the company has in place at the time. Any resulting litigation could be costly for the company, divert management attention, and could result in increased costs of doing business, or otherwise have a material adverse effect on the company’s business, results of operations, and financial condition. Any negative publicity generated as a result of customer complaints about the company’s products could damage the company’s reputation and diminish the value of the company’s brand, which could have a material adverse effect on the Company’s business, results of operations, and financial condition, as well as your investment.

If We Are Unable To Protect Effectively Our Intellectual Property, We May Not Be Able To Operate Our Business, Which Would Impair Our Ability To Compete

With respect to intellectual property that the company owns or will own in the future, our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. The names and/or logos of company brands (whether owned by the company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest, trademark applications by the company for its brands. Similarly, domains owned and used by the company may be challenged by others who contest the ability of the company to use the domain name or URL. Patents obtained by the company could be subject to challenge, and property that should be patented by the company but is not could lead to legal and financial issues that could have a material adverse effect on the company’s financial results as well as your investment.

| 12 |

We Could Suffer Computer, Website or Information System Breakdown

Computer, website and/or information system breakdowns as well as cyber security attacks could impair our ability to service our users, leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the company’s financial results as well as your investment.

Changes in the Economy Could Have a Detrimental Impact

Changes in the general economic climate could have a detrimental impact on consumer expenditure and therefore on the company’s revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may decrease the disposable income that customers have available to spend and may adversely affect our users’ confidence and willingness to spend on gifting and shopping. Any of such events or occurrences could have a material adverse effect on the company’s financial results and on your investment.

We May Experience Regulatory and Legal Hurdles

The operation of an international online social media and e-commerce business could be subject to regulatory and legal hurdles. Any unanticipated delay or unexpected costs in obtaining or renewing any licenses, dealing with regulator issues or unanticipated hurdles which have to be overcome or expenses which have to be paid, could result in a material adverse effect on the company’s business plan and financial results and on your investment.

Risks Relating to This Offering and to Ownership of the Shares

The Company May Undertake Additional Equity or Debt Financing That May Dilute the Shares Being Offered

The company may undertake further equity or debt financing which may be dilutive to existing shareholders, including investors in this offering, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing shareholders, including you, and also reducing the value of shares subscribed for under this Offering.

The Company May Not Raise the Maximum Amount Being Offered

There is no assurance that the company will sell enough shares to meet its capital needs. If you purchase shares in this Offering, you will do so without any assurance that the company will raise enough money to satisfy the full use of proceeds the company has outlined in this Offering Circular or to meet the company’s working capital needs.

| 13 |

The Company May Not Be Able To Obtain Additional Financing.

Even if the company is successful in selling the maximum amount of shares in the Offering, the company may require additional funds to continue and grow its business. We may not be able to obtain additional financing as needed, on acceptable terms, or at all, which would force us to delay our plans for growth and implementation of our strategy, which could seriously harm our business, financial condition and results of operations. If the company needs additional funds, we may seek to obtain them primarily through additional equity or debt financings. Those additional financings could result in dilution to the company‘s current shareholders, including investors in this Offering. A portion of our notes payable in the principal amount of $66,949 and interest of $$20,947 at June 30, 2016, is currently in default and payable upon demand. This default may affect our ability to obtain additional financing.

The Offering Price Has Been Arbitrarily Determined

The offering price of the shares has been arbitrarily established by the company based upon its present and anticipated financing needs and bears no relationship to the company's present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the shares may not be indicative of the value of the shares or the company, now or in the future.

Our Management Has Broad Discretion in the Application of Proceeds

The management of the company has broad discretion to adjust the application and allocation of the net proceeds of this offering in order to address changed circumstances and opportunities. As a result, the success of the company will be substantially dependent upon the discretion and judgment of the management of the Company with respect to the application and allocation of the net proceeds hereof. Investors who purchase the shares of Class C Common Stock will have limited voting rights on this and other company matters. Shares of Class C Common Stock have limited voting rights equal to one-tenth (1/10) of one vote per share

There Is No Assurance the Company Will Be Able To Pay Distributions To Shareholders

While the company may pay distributions at some point in the future to its shareholders when and if the company is profitable, there can be no assurance that cash flow and profits will allow such distributions to ever be made.

The Company’s Indebtedness Could Adversely Affect Its Business And Limit Its Ability To Plan For Or Respond To Changes In Its Business, And The Company May Be Unable To Generate Sufficient Cash Flow To Satisfy Significant Debt Service Obligations.

We may incur long-term debt and/or short-term debt in the future, and the future indebtedness could have important consequences, including the following:

| · | increasing the company’s vulnerability to general adverse economic and industry conditions; |

| 14 |

| · | reducing the availability of the company’s cash flow for other purposes; |

| · | limiting the company’s flexibility in planning for, or reacting to, changes in the company’s business and the industry in which it operates, which would place the company’s at a competitive disadvantage compared to its competitors that may have less debt; |

| · | limiting, by the financial and other restrictive covenants in the company’s debt agreements, the company’s ability to borrow additional funds; and |

| · | having a material adverse effect on the company’s business if it fails to comply with the covenants in its debt agreements, because such failure could result in an event of default that, if not cured or waived, could result in all or a substantial amount of the company’s indebtedness becoming immediately due and payable. |

The company’s ability to repay any future indebtedness will depend on the company’s ability to generate cash, whether through cash from operations or cash raised through the issuance of additional equity or debt-based securities. To a certain extent, the company’s ability to generate cash is subject to general economic, financial, competitive, legislative, regulatory, and other factors that are beyond its control. If the company’s business does not generate sufficient cash flow from operations or if future financings are not available to it in amounts sufficient to enable the company to fund its liquidity needs, the Company’s financial condition and operating results may be adversely affected. If the company cannot meet its scheduled principal and interest payments on any debt obligations in the future, the company may need to refinance all or a portion of its indebtedness on or before maturity, sell assets, delay capital expenditures, cease operations or seek additional equity.

We will be subject to Regulation A’s ongoing reporting requirements

As a result of making an offering under Tier 2 of Regulation A, we will be required to comply with Regulation A’s ongoing disclosure and reporting obligations, including annual, semi-annual and current reports. These reports will result in the incurrence of professional fees for legal, compliance and auditing. The future costs of those professional services (or any professional services) are not reflected in the “Use of Proceeds” section.

There is No Market for the Company's Shares of Class C Common Stock

The company has not registered, is not under any obligation to register, and does not presently intend to register the shares of Class C Common Stock with any regulatory authorities at any time in the future. The shares are illiquid and may not be easily resold or pledged. No market currently exists for the Class C Common Stock, and you should not expect such market will exist at any time in the future. You probably will not be able to liquidate this investment in the event of an emergency or for any other reason. The shares of Class C Common Stock should be considered a long-term investment.

Your Economic Interest in the Company May Be Less than Your Ownership Interest

You will be acquiring a minority interest in the company, will have limited voting rights and will have little to no effective control over, or input into, the management or decisions of the Company. Subscribers to this offering may have an economic interest in the company that is less than the percentage of shares of Class C Common Stock they own compared to the overall shares of the company.

| 15 |

The term "dilution" means the reduction of any one share as a percentage of the aggregate shares outstanding. If all of the shares in this offering are fully subscribed and sold, the Shares offered herein will constitute approximately 17.6% of the total shares of the company. The company anticipates that subsequent to this offering the company may require additional capital and such capital may take the form of other stock or securities or debt convertible into stock. Such future fund raising will further dilute the percentage ownership of the shares sold herein in the company.

Immediate dilution

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares. If you invest in our Class C Common Stock, your interest will be diluted immediately to the extent of the difference between the offering price per share of our Class C Common Stock and the pro forma net tangible book value per share of our Class C Common Stock after this Offering.

As of June 30, 2016, the net tangible book value of the Company was ($636,907). Based on the number of shares of Common Stock issued and outstanding as of the date of this Offering Circular (3,360,800 shares) that equates to a net tangible book value of approximately ($0.19) per share of Common Stock on a pro forma basis. Net tangible book value per share consists of stockholders’ deficit adjusted for the accumulated deficit, divided by the total number of shares of Common Stock outstanding. Without giving effect to any changes in such net tangible book value after June 30, 2016, other than to give effect to the sale of 869,564 shares of Class C Common Stock being offered by the company in this Offering Circular for the subscription amount of $20,000,000, the pro forma net tangible book value, assuming full subscription, would be $19,363,093. Based on the total number of shares of Class C Common Stock that would be outstanding assuming full subscription (4,230,364) that equates to approximately $4.58 of tangible net book value per share.

Thus, if the Offering is fully subscribed, the net tangible book value per share of Class C Common Stock owned by our current stockholders will have immediately increased by approximately $4.77 without any additional investment on their behalf and the net tangible book value per Share for new investors will be immediately diluted by $18.42 per share. These calculations do not include the costs of the offering, and such expenses will cause further dilution.

| 16 |

The following table illustrates this per share dilution:

| Offering price per Share* | $ | 23.00 | ||

| Net Tangible Book Value per Share before Offering (based on 3,360,800 shares) | $ | (0.19 | ) | |

| Increase in Net Tangible Book Value per Share Attributable to Shares Offered in Offering (based on 869,564 shares) | $ | 4.77 | ||

| Net Tangible Book Value per Share after Offering (based on 4,230,364 shares) | $ | 4.58 | ||

| Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $ | 18.42 |

*Before deduction of offering expenses

The foregoing table does not reflect the issuance of 6,300 shares of Class C Common Stock in a private placement subsequent to June 30, 2016. Additionally, it does not reflect the conversion of Convertible Notes issued in a private placement subsequent to June 30, 2016, or the exercise of options for Common Stock granted pursuant to loan agreements, which options are exercisable at a discount which would have a further dilutive effect. See Notes 4 and 7 to the company’s financial statements as of and for the six months ended June 30, 2016 and “Interest of Management and Others in Certain Transactions.”

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| · | In June 2014 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. |

| · | In December the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| · | In June 2015 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

| 17 |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the amount of convertible notes that the company has issued (and may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

| 18 |

None of the shares being sold in this offering are being sold by security present holders.

We intend to market the shares in this offering through our own website, where this Offering Circular will be posted. The company is offering its securities in all states other than Texas, Florida, Arizona and North Dakota. In the event the company makes arrangements with a broker-dealer to sell into these states, it will file a post-qualification amendment to the Offering Statement of which this Offering Circular forms a part.

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation by the investor to the effect that, if you are not an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth (excluding your principal residence).

We will pay FundAmerica LLC escrow fees of (i) $500 account set up fee, (ii) $25 per month escrow account fee, (iii) applicable fees for fund transfers and accounting, including: (x) funds transfer fees – $0.50 per ACH transfer, $15 per domestic wire transfer, $10 per check, and other banking and vendor fees as appropriate for funds processing; (y) $5 per investment as a one-time accounting and ledgering fee upon receipt of funds; and (z) funds management fees of 25 basis points on issuers (not investors) funds, and (iv) $5 processing fee for each AML and funds transfer exception, if any (the “Escrow Fees”). We will also pay fees related to our use of FundAmerica’s technology and services in conducting this offering online, including a $500 per month account fee, a $750 per transaction API license fee, an Invest Now license fee of $35 per transaction of $500 or more, anti-money laundering check fees of $2 per domestic investor, $5 per UK investor, and $60 per non-US/non-UK investor and $45 for each bad actor check per entity and each associated person (the “Technology Fees”). We are further engaging FundAmerica Stock Transfer as our SEC registered transfer agent and will be subject to its standard published fee schedule (currently a $25 per month account fee, no setup fee, and change fees ranging from $2 to $25 per event). Collectively the escrow, technology and transfer agent fees are referred to herein as the “Administration Fees”.

| 19 |

All subscribers will be instructed by the company or its agents to transfer funds by wire or ACH transfer or other electronic funds transfer method approved by the escrow agent directly to the escrow account established for this Offering or deliver checks made payable to “Provident Trust, as Agent to Sagoon Inc. Escrow Account” which Provident Trust shall deposit into such escrow account no later than noon the next business day after receipt. The company may terminate the Offering at any time for any reason at its sole discretion.

In addition to offering Class C Common Stock for cash, we are also offering to exchange Class C Common Stock currently held by investors in previous private placements for Class C Common Stock in this Offering. We are also offering to issue shares of Class C Common Stock as consideration for the redemption of certain debt at an effective price of $2.80 per share. See “Interest of Management and Others in Certain Transactions.”

There are no plans to return funds to subscribers if all of the securities to be offered are not sold. There is no minimum subscription amount required (other than a per investor minimum purchase) to break escrow and distribute funds to the company. There will be no material delay in the payment of the proceeds of the Offering by the escrow agent to the company.

FundAmerica Stock Transfer, LLC (aka FASTransfer) is being initially appointed to serve as transfer agent to maintain stockholder information on a book-entry basis. The fees for this service are described above.

| 20 |

The maximum gross proceeds from the sale of the shares in this Offering are $20,000,000. The net proceeds from the Offering, assuming it is fully subscribed, are expected to be approximately $18,750,000 after the payment of offering costs including broker-dealer and selling commissions, legal and accounting costs, and other compliance and professional fees. The estimate of the budget for offering costs is an estimate only and the actual offering costs may differ from those expected by management.

Management of the company has wide latitude and discretion in the use of proceeds from this Offering. Ultimately, management of the company intends to use the majority of the proceeds for general working capital. At present, management’s best estimate of the use of proceeds, at various funding milestones, is set out in the chart below. However, potential investors should note that this chart contains only the best estimates of management based upon information available to them at the present time, and that the actual use of proceeds is likely to vary from this chart based upon circumstances as they exist in the future, various needs of the company at different times in the future, and the discretion of the company’s management.

A portion of the proceeds from this Offering may be used to compensate or otherwise make payments to officers or directors of the issuer. The officers and directors of the company may be paid salaries and receive benefits that are commensurate with similar companies, and a portion of the proceeds may be used to pay these ongoing business expenses.

If we sell all of the shares being offered, our net proceeds (after fee, commission and discount) will be $18,750,000. We will use these net proceeds for:

| · | Developing mobile apps (Android and IOS), launching and marketing in South Asia and the United States; |

| · | Developing the “Social Smart Card”, launching as a pilot program in Kathmandu and New Delhi, and continue adding retail vendors as our partners; |

| · | Expanding our team by more than 50 engineers and adding office space in New Delhi and Washington DC and building a key management team; |

| · | Developing a banner advertisement system and sales channels for those advertisements; |

| · | Setting up a technology lab in IIT New Delhi for further research and development for technology enhancement; and |

| · | Building an office in New Delhi. |

| 21 |

More specific anticipated uses of funds depending on the amount of money raised are set out in the table below.

| Total Raised in Offering | $ | 2,500,000 | $ | 5,000,000 | $ | 10,000,000 | $ | 20,000,000 | ||||||||

| Salaries and Wages | $ | 1,000,000 | $ | 3,000,000 | $ | 6,000,000 | $ | 10,000,000 | ||||||||

| Computers and Software | $ | 100,000 | $ | 200,000 | $ | 300,0000 | $ | 400,000 | ||||||||

| Research & Development | $ | 240,000 | $ | 240,000 | $ | 500,000 | $ | 500,000 | ||||||||

| Office Construction | - | - | - | $ | 3,000,000 | |||||||||||

| Marketing & Products Launch | $ | 100,000 | $ | 150,000 | $ | 200,000 | $ | 200,000 | ||||||||

| Office Expenses | $ | 50,000 | $ | 50,000 | $ | 200,000 | $ | 300,000 | ||||||||

| Furniture & Fixtures | $ | 100,000 | $ | 200,000 | $ | 300,000 | $ | 400,000 | ||||||||

| Server & Streaming Costs | $ | 200,000 | $ | 400,000 | $ | 700,000 | $ | 1,500,000 | ||||||||

| Travel & Tradeshows | $ | 50,000 | $ | 50,000 | $ | 50,000 | $ | 100,000 | ||||||||

| Utilities | $ | 30,000 | $ | 30,000 | $ | 50,000 | $ | 100,000 | ||||||||

| Legal | $ | 60,000 | $ | 60,000 | $ | 100,000 | $ | 100,000 | ||||||||

| Operating Reserve | $ | 245,000 | $ | 120,000 | $ | 1,025,000 | $ | 2,325,000 | ||||||||

| Offering Expenses1 | $ | 250,000 | $ | 250,000 | $ | 250,000 | $ | 250,000 | ||||||||

| Broker-Dealer Fees2 | $ | 125,000 | $ | 250,000 | $ | 500,000 | $ | 1,000,000 | ||||||||

| TOTAL | $ | 2,500,000 | $ | 5,000,000 | $ | 10,000,000 | $ | 20,000,000 |

1 Offering expenses include legal fees, accounting, advertising, travel and marketing.

Because the offering is a “best efforts” offering with no minimum offering amount other than the minimum denomination amount of $299, the company may close the offering without sufficient funds for all the intended purposes set out above, and may not even cover the expenses of the offering. In that event it will look to other sources of funds, including loans from its officers to fund its operations, although there can be no assurance that such funds will be available.

The company reserves the right to change the use of proceeds set out herein based on the needs of the ongoing business of the company and the discretion of the company’s management. The company may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation to be appropriate.

| 22 |

Sagoon Inc. was formed on December 29, 2006, as a Delaware Corporation for the general purpose of owning and operating the Sagoon website (www.Sagoon.com) and affiliated businesses. Sagoon also owns Sagoon India Private Limited, a 100% subsidiary company located in New Delhi, India and Sagoon Nepal Private Limited, a 100% subsidiary company (registration in process) located in Kathmandu, Nepal.

The name “Sagoon” is derived from Sanskrit and means “auspicious” or “ushering good results.” It is easy to pronounce, and a well-recognized term among 1.5 billion people worldwide.

Sagoon was first conceived in 2006. At this time, Govinda Giri embarked on his mission to change the way people retrieved information from the Internet. Unhappy with Internet giants Google and Yahoo displaying 10 blue search links on the user’s device, he believed that he could build a better system, offering users more choices on the first page of search results. Giri designed and built an advanced data clustering method and launched a search engine in 2009, spending only money from his own pocket.

In 2012, with the rapid development of mobile devices and Internet, Giri realized that the world was becoming a small village, with much of our offline lives having shifted to online. He observed millions of people with mobile devices clutched in their hands while trillions of items of information were fragmented and scattered in the cloud. With limited time and patience, it was little wonder that people were losing interest – clearly, people needed one place where they could get their personal needs, interests and issues addressed 24/7.

Sagoon’s concept was originally designed as a search engine that would provide customized search results to fit users’ various preferences. However, as trends in user behavior became apparent, the focus shifted to “Search vs Share” and in 2012, the business model was revamped to establish a social collaboration site, aimed at transforming the ways in which people share and interact through social media.

As Giri has stated, “A trigger point for starting Sagoon as a social commerce platform was the perceived need to build intimate relationships with family, friends and co-workers. In today’s social networks, we spend hours trawling through others’ information and in the end we don’t generally find a solution to our needs. Instead, we discover the apparently expensive and exciting lifestyle of our “friends.” This only creates envy and encourages social isolation; millions are becoming tired of it. As a result, many people are looking for a new way to engage with their loved ones, by sharing information that builds long-lasting emotional bonds.”

Giri believed that social media networks have demonstrated a need for constant positive change. The continual demand to connect, express and reach out to people in a short time through new, effective media has resulted in negative social attitudes. Giri was well aware of the detrimental capabilities of social media. The paradox of being connected while being really alone is evidenced in today’s young people, especially those in their twenties. A service that rids people of social envy, loneliness and depression - such as Sagoon - was clearly the need of the hour in Giri’s opinion.

| 23 |

In July, 2014, Sagoon version 1.0 was launched (as a private beta) in Washington, DC. In November 2015, Sagoon version 2.0 was launched (as a public beta) in Kathmandu.

Sagoon was developed as both a website and an application, its target market being the world’s 2.2 billion social media users.

Products and Services

Current Products and Services

Sagoon’s comprehensive suite of products and services supports the needs of global online users. Each product suite has unique features and a different customer presentation strategy; the purpose of each application is to strengthen relationships. The core Sagoon technology enables products to be categorized semantically with lower development costs and faster speeds. The Sagoon roadmap encompasses the following products and services:

MY DAY

My Day is your smart organizer that visualizes how your day looks. This tool is designed to simplify your daily life at home and office. It has a top section that highlights your current location whenever you log into Sagoon; local time and weather reports help travelers to plan their day, wherever they may be.

The current version of this application is live for all Sagoon users. An updated version is scheduled to be launched in the fourth quarter of 2016.

| 24 |

Share Schedule – a tool for scheduling meetings and creating timetables; this can be shared with co-workers and family members so that your spouse, for example, can know where you are without wasting time or money texting or phoning.

Share To-Do List – an online tool to help track your projects, tasks and chores – again this can be shared with partners, family members, etc.

Send Reminder – a useful online tool for those of us who tend to forget tasks or appointments. This tool sends a reminder to your loved ones, for example, to take the dog out.

SECRET

The secret is an information, experience, confession or incidence of your life which you have never disclosed publicly in words. But, if disclosed, it can make people learn something significant. This feature is designed on the idea of building a transparent society and improving the quality of a personal life.

Current version of Secret

Every moment there is always something going on around you. And sometimes no one knows it better than you. What if you could share it with others and bring change? It can be your own secret story! You are allowed to use 220 characters and up to three images to post a secret. As a user, you can post your secret under the “Open Secrets” category, allowing all of your contacts to view, like, dislike or comment on the same. While posting a secret on your timeline or sending it privately to a particular contact, you can choose to hide your identity.

The most interesting and unique aspect of sharing a secret is “tracking,” which means you can see the number and the names of locations your secret has traveled to. You can also view how many people liked/disliked your secret from those locations.

| 25 |

MOODTALK

MoodTalk is a simple chatting tool which lets your mood do the talking for you. You simply switch your mood for groups or any one friend to express what you feel. As in real life where we do not record all things we say, in MoodTalk your chats also vanish automatically after 24 hours.

There can be days when you are feeling sad or sick. You don’t want to open an email or any other chat app to share your emotional state with family or friends. What happens? You stay alone and feel lonely.

But with MoodTalk, if you are sick, you can set your Mood to “Sick,” which will be visible to everyone in your contact list, so your loved ones might start connecting with you and you can then express your feelings to them.

Upcoming Features

The following Sagoon features are currently in development and the company plans to make them available after the current Offering is closed:

Social Smart Card

The Social Smart Card is “One Card for All” - allowing users to partake in social shopping and gifting. Each Sagoon user will automatically receive a free Social Smart Card when they join Sagoon and create a profile; they will then earn a percentage on every transaction they make with the card plus a portion of the company’s revenue in return for the time they spend socializing online through the site.

| 26 |

Therefore, users will be paid for both shopping and spending time on social media – a “win-win” situation.

Sagoon Mobile App

Multiple apps on one interface giving users a reflection of their daily life in a single window.

IT’S ME

Sagoon’s “It’s Me” page will provide users with a space to showcase their true identity — for example, what interests them and who they really are. It helps potential job seekers to network with other professionals, giving them a leg up on building a better career. It’s Me is a profile page that is a mix of personal and professional, helping you network with others based on your mutual interests and needs.

| 27 |

| 28 |

Our Competitors

Our direct and indirect competitors are social media networks who offer photo-sharing features like Snapchat, Instagram and Facebook and e-commerce businesses who offer digital gift cards and coupons like Wrapp and Giftly. However, no other online social network easily combines, in one place, the ability for users to share revenue, shop, gift, schedule events, and socialize.

What We Believe Sets Us Apart

We believe the following strengths will drive our growth:

| · | Research and Development costs – Sagoon’s R&D costs are up to five times lower than those of its competitors. |

| · | Combination of products and services offered – socializing, scheduling, gifts and shopping, all on one site. |

| · | Revenue share – the ability, once we launch this program, for users to earn money for time spent socializing online and commission on online purchases. |

| · | The South Asian market – one of the largest social media markets in the world. The origins of the leadership team members give them the ability to exert influence in the South Asian market with the goal of making an impact. |

| · | Technology – Sagoon uses a data-retrieval method based on advanced mathematical formulae that support Semantic Web and Natural Language Processing (NLP). |

Sagoon’s Growth Plan: By the end of 2016, we estimate that our user base will be close to half a million; however we expect that, by running this equity crowdfunding campaign, and by launching our mobile app and social smart card, we hope to increase that figure to several million by the end of 2017.

We intend that this growth will be engendered by the increased development of business infrastructure and technology. Our ultimate goal is to establish a foothold in the social commerce market, currently worth $300 billion. We are undeterred by growing competition in this field, offering, as we do, the unique advantage of combining social media, gifting, scheduling, online shopping, and the ability to earn financial rewards all in one place.

Revenue Model: Sagoon’s revenue will be generated by the use of Social Smart Cards and coupons, with Sagoon earning up to 10% on each transaction. Eventually, we anticipate that we will realize revenue from digital banner advertising on a CPM basis. The dynamic social platform will provide social media, shopping and gifting in one place through the Social Smart Card, which will eventually give all users a share in the our earnings.

| 29 |

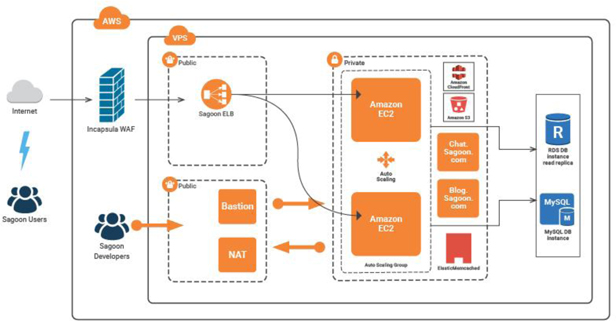

Technology

Technical requirements are quite complex, especially when building a social media network. Initially, Sagoon started using PHP, Apache2 and MySQL (for database) in the back end, and JQuery, HTML 5 and CSS in the front end. We were still in the initial phase and therefore the technology was quite basic. We didn’t even feel the need for cloud hosting. But as we launched new versions, the team felt the need for upgrading.

We replaced JQuery with Angular to smooth user experience and also introduced partial node for a better chat experience. Some other technological advancements we have brought to Sagoon are:

| · | AJAX for immediate response |

| · | Cloud hosting |

| · | MySQL optimization |

| · | Replaced Apache2 with NGINX |

| · | Mongo DB |

| · | Automated deployment |

The technological requirements keep on changing with each update we launch.

In our production environment, the process of launching any update usually starts with a brain storming discussions followed by clean documentation. Then, development starts and after its completion, testing is done by a group of certified quality analysts. After their green light, the update is rolled out to a small percentage of guest users to gauge their response. Any updates are introduced to all global users after crossing all levels of production environment.

| 30 |

At present, we are upgrading our backend to further improve the experience of users on Sagoon.

Technology Plans: Sagoon plans to eventually use semantic technology and a Natural Language Process method, which will mean very significant savings in energy costs.

Sagoon India Pvt. Ltd.

Sagoon India Pvt. Ltd (Sagoon India) is 100% owned by Sagoon Inc. Sagoon India is also managed and operated by the same management team and takes advantage of Sagoon Inc.’s infrastructure, expertise, and experienced people as we look at business development in India.

The team in India operates from the beautifully designed Regus Business Centre (pictured), located at the 5th Floor of SB Tower in Film City. Film City, Noida is home to various aspiring startups.

We are in India to reinvent the wheel. We plan to combine the experience, culture and success of Silicon Valley with incredible talent that gives India the chance to change the world. We plan to roll out the same culture of product delivery, the same business model and retail concept, the same game plan, the same investment opportunity, the same employee benefits and same successful management team as a Silicon Valley company would do. We believe we have the potential to go bigger and much better because of the size of the South Asian market compared to the U.S. market – more than 500 million Internet users at present, a figure that is projected to reach more than 700 million by 2018.

| 31 |

We have a team and an infrastructure already in place. We plan to hire and build a bigger team with key management, developers and engineers after closing this equity crowdfunding campaign.

Sagoon in the Media

Sagoon already has a strong media reputation in South Asia. We have more than 30,000 Facebook followers globally. Thousands of people visit our site on a monthly basis.

Sagoon has been featured in major national media in India and Nepal. Sagoon has appeared in Times of India, Economic Times, Himalayan Times, Kathmandu Post, Business Standard and many more, plus magazines and tech news sources.

The Social Connection, a popular show on government media channel DD News in India aired an episode in November 2014, featuring Sagoon, its vision, future plans and applications. Govinda Giri, the founder of Sagoon, discussed the negative impacts of current social networks on users and how Sagoon planned to eliminate those negative impacts.

| 32 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATION

You should read the following discussion and analysis of our financial condition and results of our operations together with our financial statements and related notes appearing at the end of this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled “Risk Factors” and elsewhere in this Offering Circular.

Sagoon Inc. was formed December 29, 2006, as a Delaware Corporation, for the general purpose of owning and operating the Sagoon website.

Results of Operations

Years Ended December 31, 2015 and 2014

Revenue. For the years ended December 31, 2015 and 2014 we generated no revenue. We anticipate that we will eventually generate revenue through advertising and commissions from selling gift cards and coupons.

Operating Expenses. Operating expenses for the years ended December 31, 2015 and 2014 were $501,372 and $385,785, respectively, a 30% increase year-over-year. The overall increase was primarily due to the ramping up of our operations. These efforts resulted in increased costs related to outsourced project development, salaries and wages, travel to and from India, web hosting and other related costs, advertising, etc. Research and development costs increased 21% to $235,958, general and administrative expenses increased 27% to $228,087 and sales and marketing increased 240% to $37,327.

Other Expense. Other expense for the years ended December 31, 2015 and 2014 was $34,812 and $15,361, respectively, which consisted primarily of interest expense on notes payable. The increase in interest expense during the year ended December 31, 2015 was a result of the increase in notes payable to third parties, the proceeds of which were used to fund operations.

Net Loss. As a result of the foregoing, net loss for the years ended December 31, 2015 and 2014 was $536,184 and $401,146, respectively.

Six Months ended June 30, 2016 and 2015

Revenues. No revenues were generated for the six months ended June 30, 2016 and June 30, 2015 (“Interim 2016” and “Interim 2015,” respectively).

| 33 |

Operating expenses. Operating expenses for Interim 2016 increased 6% to $256,321 from $242,131 in Interim 2015. A 30% increase in general and administrative expenses to $119,028 and a 27% increase in sales and marketing expenses to $24,559 were offset by a 14% decrease in research and development costs to $112,734. The overall increase was primarily due to an increase in our efforts to bring our product to market. These efforts resulted in an increase in costs related to outsourced project development, salaries and wages, travel to and from India, web hosting and other related costs, advertising, etc.

Other expense. Other expense for Interim 2016 was $32,559 and for Interim 2015 was $15,031, in both periods due to interest expense.

Net loss. As a result of the foregoing, net loss for Interim 2016 was $288,880 compared to net loss in Interim 2015 of $257,162.

Liquidity and Capital Resources

We had net cash of $29,521 and $29,273 at December 31, 2015 and June 30, 2016, respectively.

During the years ended December 31, 2015 and 2014, we used cash flows in operations in the amounts of $392,992 and $260,647, respectively. Cash used in operations in Interim 2016 was $219,798 and in Interim 2015 cash used in operations was $190,733.

Cash used in investing activities during the years ended December 31, 2015 and 2014, was $4,273 and $29,213, respectively. To date investing activities have been minimal and have consisted with the purchase of property and equipment used in our operations. Cash used in investing activities was $500 in Interim 2016 and $483 in Interim 2015.

Cash provided by financing activities during the years ended December 31, 2015 and 2014, was $416,612 and $299,426, respectively. Cash provided by financing activities was $220,050 in Interim 2016 and $211,114 in Interim 2015. Since inception, the Company has been dependent upon the sale of common stock, proceeds from notes payable and short term advances from related parties.

Our total liabilities at June 30, 2016 were $688,224. This amount included notes payable in the amount of $245,452 payable to Govinda Giri, our CEO, and to Sagoon Investment LLC (a Maryland limited liability company of which Laxman Pradhan, our Interim CFO, is the managing member) in the amount of $243,000 principal and $12,267 interest. Interest is continuing to accrue on these notes. Certain of the notes payable in the principal amount of $66,949 and interest in the amount of $20,947 at June 30, 2016, are in default and currently payable on demand.

Plan of Operations

Our plan of operations over the next twelve months consists of the following:

PRODUCT DEVELOPMENT AND SUPPORT

| · | Continue development and rollout of our desktop and mobile web services applications: |

| · | Update and improve current services: My Day, Secret Message and MoodTalk for web desktop and mobile web |

| · | Launch It’s Me - a professional and personal page. |

| · | Launch Social Smart Card - a shopping and gifting card |

| 34 |

| · | Development and rollout of first phase of mobile platform and integrated desktop services |

PRODUCT INFRASTRUCTURE AND PROPRIETARY TECHNOLOGY

| · | Develop robust technology infrastructure to support millions of users engaging and communicating through web desktop and mobile web |

| · | Develop a robust and a scalable mobile application infrastructure to support multiple vendors’ mobile devices |

| · | Develop and integrate big data structure and algorithm to support user data and communication, shopping and gifting and monetization system |

BUSINESS DEVELOPMENT, MARKETING AND OFFICE EXPANSION

| · | Expand the office space in New Delhi, India and Northern Virginia, U.S. |

| · | Develop employee benefits package, and executive compensation package |

| · | Develop partnership with retail vendors and sell channels to implement “Social Smart Card” in India and US |

| · | Run events for product launch, branding and tradeshow |

NEW OFFICE CONSTRUCTION

| · | Office for South Asia operations, new construction in Kathmandu and New Delhi |

In the event we raise the Maximum Offering Amount we estimate that we will be able to continue planned operations (including the items set out in the Plan of Operations above) for 18 months. We believe that we require approximately $3 million to conduct planned operations for the next 12 months. We believe that the resources we currently have at hand would permit planned operations for four months. We anticipate we may attempt to raise additional capital through the sale of additional securities in additional offerings, or through other methods of obtaining financing such as through loans or other debt. We cannot assure that we will have sufficient capital to finance our growth and business operations in the future or that such capital will be available on terms that are favorable to us or at all. We are currently incurring operating deficits that are expected to continue for the foreseeable future.

| 35 |

Directors, Executive Officers and Significant Employees

The directors, executive officers and significant employees of the Company as of December 31, 2016 are as follows:

| Name | Position | Age | Term of Office | Full or part time | ||||

| Executive Officers: | ||||||||

| Govinda Giri | Chief Executive Officer | 49 | 9/2013 to present | Full | ||||

| Swati Dayal | Chief Operations Officer | 29 | 9/2013 to present | Full | ||||

| Kabindra Sitoula | Chief Marketing Officer | 48 | 7/2014 to present | Part | ||||

| Mahendar Elda | Chief Technology Officer | 46 | 8/2015 to present | Part | ||||

| Laxman Pradhan | Interim Chief Financial Officer | 54 | 10/2015 to present | Part | ||||

| Directors: | ||||||||

| Govinda Giri | Director | 49 | 9/2013 to present | Full |

GOVINDA GIRI, FOUNDER AND CEO