UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23051 |

Nuveen High Income 2020 Target Term Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| ||

| Closed-End Funds |

| Nuveen | ||

| Closed-End Funds |

|

|

Semi-Annual Report June 30, 2016

| |||||

| JHY | ||||||

| Nuveen High Income 2020 Target Term Fund | ||||||

| JHD | ||||||

| Nuveen High Income December 2019 Target Term Fund | ||||||

| JHA | ||||||

| Nuveen High Income December 2018 Target Term Fund | ||||||

|

|

||||||||||||

|

|

||||||||||||

| Life is Complex | ||||||||||||

| Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | ||||||||||||

| Free e-Reports right to your e-mail! | ||

| www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account. | ||

| or | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. | |

|

| ||||||

of Contents

| 4 | ||||

| 5 | ||||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 20 | ||||

| 21 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| NUVEEN | 3 |

to Shareholders

| 4 | NUVEEN |

Comments

Nuveen High Income 2020 Target Term Fund (JHY)

Nuveen High Income December 2019 Target Term Fund (JHD)

Nuveen High Income December 2018 Target Term Fund (JHA)

Nuveen High Income 2020 Target Term Fund (JHY), Nuveen High Income December 2019 Target Term Fund (JHD) and Nuveen High Income December 2018 Target Term Fund (JHA) are newly organized closed-end funds that are advised by Nuveen Fund Advisors, LLC (NFAL) and feature portfolio management by Nuveen Asset Management, LLC (NAM), both affiliates of Nuveen Investments, Inc. The Funds’ portfolio managers are John T. Fruit, CFA, and Jeffrey T. Schmitz, CFA.

Here they discuss their management strategy and the performance of the Funds for the six-month reporting period through June 30, 2016 for JHY and JHA and for the abbreviated reporting period since the Fund’s inception on May 10, 2016 through June 30, 2016 for JHD.

Nuveen High Income 2020 Target Term Fund (JHY)

What strategies were used to manage the Fund during the reporting period and how did these strategies influence performance?

The Fund has an objective to provide a high level of current income and to return the original $9.85 net asset value (NAV) per common share on or about November 1, 2020. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% of its managed assets will be in securities rated CCC+/Caa1 or lower at the time of investment and up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about November 1, 2020, the Fund intends to utilize various

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

| NUVEEN | 5 |

Portfolio Managers’ Comments (continued)

portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than May 1, 2021. The Fund also uses leverage.

How did the Fund perform during the six-month reporting period ended June 30, 2016?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month and since inception periods ended June 30, 2016. For the six-month reporting period ended June 30, 2016, the Fund outperformed the Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

In the first five weeks of 2016, the environment for the high yield market was similar to the past five quarters, which is to say reflective of weak trading patterns, wider spreads and lower prices, especially among the energy and commodity sectors. Investors began 2016 increasingly concerned that global pressures were finally dragging the U.S. economy into recession. On top of that, oil prices slid another 25% while high yield spreads widened further, reaffirming oil as a key driver of risk sentiment in high yield. However, by early February 2016, oil prices started to rebound and stability in certain economic data gave investors’ confidence that the growth scare that had gripped the market had passed. These factors, plus a delay in Fed rate hikes, were responsible for a reopening of capital markets and helped along the sharp recovery in the more stressed portions of the credit markets, particularly the energy and basic materials sectors. As the reporting period progressed, the high yield market continued its upward momentum as fears of a hard landing in China faded, oil markets found longer term support and high-yield fundamentals were firm, with both earnings growth and net leverage showing positive trends.

Credit performance within the Fund performed generally in line with the overall market, weakening during the first five weeks of 2016 but then rebounding strongly throughout the remainder of the period. The sell-off within the high yield market during the latter part of 2015 and into the early part of the 2016 was historic in its severity as high yield spreads widened to more than 1000 basis points (Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index) in February 2016, fully 400 basis points wider than where they had been six months earlier. The widening of credit spreads caused the Fund’s NAV to fall well below its offering price; however, by the end of the reporting period, the Fund had recouped essentially all of the earlier mark-to-market losses. Early in the reporting period, as the price of oil continued on its sharp downward path, we eliminated some energy credits at a loss, erring on the side of caution to prevent even further losses. We also decided to accept modest losses from our holdings of Valeant Pharmaceuticals International after the company encountered various corporate governance issues. In other instances, however, we were able to take advantage of the market downturn, adding bonds at attractive yields and/or steep discounts to par. We were also able to monetize some holdings at a gain, helping to offset some of the realized and mark-to-market losses.

Despite the shaky start in 2016, market averages went on to post solid gains during the six-month reporting period. For example, the Fund’s benchmark, the Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index, gained 8.21% year-to-date through June 30, 2016. The strong six-month returns were driven by two key market developments, the first of which was the outsized gains witnessed among the metals/mining and energy sectors. The second was the strong performance of “fallen angels” (i.e. former investment grade issuers downgraded to junk status), even though they represent only 5% of the index. This year’s fallen angels in the energy space have been strong outperformers, as the downgraded issues experienced extreme sell-offs as they exited the investment grade universe and then subsequently recovered.

In terms of the performance of JHY, its portfolio is invested in a diversified portfolio of high yield issues within the quality and maturity constraints spelled out above and in the prospectus. We actively manage the Fund, which means we have the ability to sell issues that no longer fit a minimum threshold for creditworthiness or simply to rotate to issues that we believe offer greater safety or better value. The Fund’s focus on shorter-dated maturities, coupled with limitations to both CCC rated securities and the troubled energy and mining sectors, helped to buffer the portfolio during

| 6 | NUVEEN |

the bouts of high yield market volatility late last year and early this year. Despite that, however, the severe weakness among energy and basic material credits led us to accept modest realized losses earlier in the reporting period. The strong rebound in credit performance throughout the latter portion of the reporting period, however, helped the Fund to outperform the index and for its NAV to end the reporting period higher than where it started.

The overall market continued to experience little default activity outside of the commodity space. However, when including commodities and looking across the entire market, the year-to-date default rate has surpassed 2015’s default volume of $38 billion. Notably, 85% of default activity has come within the energy and metals/mining industries, and has caused Moody’s speculative-grade default rate to recently tick up to 4.5%, surpassing its long-term average of 4.2% for the first time since August 2010. For the remainder of 2016, we expect the overall default rate to tick gradually higher to around 5%, led by continuing defaults within the energy space. However, we believe the recent easing of credit market conditions and revival of new issuance will help lead the default rate lower in 2017.

Nuveen High Income December 2019 Target Term Fund (JHD)

What key strategies were used to manage the Fund during this abbreviated reporting period since the Fund’s inception on May 10, 2016 through June 30, 2016?

The Fund launched on May 10, 2016 with an objective to provide a high level of current income and to return the original $9.86 net asset value (NAV) per common share on or about December 1, 2019. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% of its managed assets will be in securities rated CCC+/Caa1 or lower at the time of investment and up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about December 1, 2019, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than June 1, 2020. The Fund also uses leverage.

How did the Fund perform during the abbreviated reporting period ended June 30, 2016?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the since inception period ended June 30, 2016. For the abbreviated reporting period ended June 30, 2016, the Fund underperformed the Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV. As noted, however, this reporting period was quite short and the management team was in the process of investing the Fund’s assets. Therefore, the comparison to the Fund’s benchmark is less meaningful.

During the abbreviated performance period, the high yield market continued its upward momentum as fears of a hard landing in China faded, oil markets found longer term support and high yield fundamentals were firm, with both earnings growth and net leverage showing positive trends. Since the Fund’s inception on May 10, 2016, we have worked to invest the proceeds from the initial public offering in a diversified portfolio of high yield issues within the quality and maturity constraints spelled out above and in the prospectus. We actively manage the Fund, which means we have the

| NUVEEN | 7 |

Portfolio Managers’ Comments (continued)

ability to sell issues that no longer fit a minimum threshold for creditworthiness or simply to rotate to issues that we believe offer greater safety or better value. The Fund’s focus on shorter-dated maturities, coupled with limitations to both CCC rated securities and the troubled energy and mining sectors, should help to buffer portfolio volatility during periods of a weakening economy or other macro-related risks, which may result in a widening of credit spreads within the overall high yield market.

The initial invest-up of JHD’s portfolio occurred during a period of strong recovery for the high yield market, however by the end of the reporting period, we had finished investing the Fund’s initial proceeds in a portfolio of securities that we believe are consistent with the objectives that we set out to achieve. The Fund’s top sector concentrations were in communications, consumer cyclical, consumer non-cyclical and capital goods.

Nuveen High Income December 2018 Target Term Fund (JHA)

What strategies were used to manage the Fund during the reporting period and how did these strategies influence performance?

The Fund has an objective to provide a high level of current income and to return the original $9.86 net asset value (NAV) per common share on or about December 1, 2018. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% of its managed assets will be in securities rated CCC+/Caa1 or lower at the time of investment and up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about December 1, 2018, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than June 1, 2019. The Fund also uses leverage.

How did the Fund perform during the six-month reporting period ended June 30, 2016?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month and since inception periods ended June 30, 2016. For the six-month reporting period ended June 30, 2016, the Fund underperformed the Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

In the first five weeks of 2016, the environment for the high yield market was similar to the past five quarters, which is to say reflective of weak trading patterns, wider spreads and lower prices, especially among the energy and commodity sectors. Investors began 2016 increasingly concerned that global pressures were finally dragging the U.S. economy into recession. On top of that, oil prices slid another 25% while high yield spreads widened further, reaffirming oil as a key driver of risk sentiment in high yield. However, by early February 2016, oil prices started to rebound and stability in certain economic data gave investors’ confidence that the growth scare that had gripped the market had passed. These factors, plus a delay in Fed rate hikes, were responsible for a reopening of capital markets and helped along the sharp recovery in the more stressed portions of the credit markets, particularly the energy and basic materials sectors. As the

| 8 | NUVEEN |

reporting period progressed, the high yield market continued its upward momentum as fears of a hard landing in China faded, oil markets found longer term support and high yield fundamentals were firm, with both earnings growth and net leverage showing positive trends.

Credit performance within the Fund performed generally in line with the overall market, weakening during the first five weeks of 2016 but then rebounding strongly throughout the remainder of the reporting period. The sell-off within the high yield market during the latter part of 2015 and into the early part of the 2016 was historic in its severity as high yield spreads widened to more than 1000 basis points (Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index) in February 2016, fully 400 basis points wider than where they had been six months earlier. The widening of credit spreads caused the Fund’s NAV to fall well below its offering price, however, by the end of the reporting period, the Fund had recouped essentially all of the earlier mark-to-market losses. Early in the reporting period, as the price of oil continued on its sharp downward path, we eliminated some energy exposure at a loss, erring on the side of caution to prevent even further losses. We also decided to accept modest losses in the holdings of an underperforming satellite company. In other instances, however, we were able to take advantage of the market downturn, adding bonds at attractive yields and/or steep discounts to par. We were also able to monetize some holdings at a gain, helping to offset some of the realized and mark-to-market losses.

Despite the shaky start in 2016, market averages went on to post solid gains during the six-month reporting period. The Fund’s benchmark, the Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index, gained 8.21% year-to-date through June 30, 2016. The strong six-month returns were driven by two key market developments, the first of which was the outsized gains witnessed among the metals/mining and energy sectors. The second was the strong performance of “fallen angels” (i.e. former investment grade issuers downgraded to junk status), even though they represent only 5% of the index. This year’s fallen angels in the energy space have been strong outperformers, as the downgraded issues experienced extreme sell-offs as they exited the investment grade universe and then subsequently recovered once gravitating to high yield.

In terms of the performance of JHA, its portfolio is invested in a diversified portfolio of high yield issues within the quality and maturity constraints spelled out above and in the prospectus. We actively manage the Fund, which means we have the ability to sell issues that no longer fit a minimum threshold for creditworthiness or simply to rotate to issues that we believe offer greater safety or better value. The Fund’s focus on shorter-dated maturities, coupled with limitations to both CCC rated securities and the troubled energy and mining sectors, helped to buffer the portfolio during the bouts of high yield market volatility in late 2015 and early in the reporting period. The Fund lagged the performance of the benchmark for the reporting period, owing to the same facts as noted above, that being less exposure to the higher volatility sectors that rallied back strongly as the year progressed. More importantly, however, the strong rebound in credit performance throughout the latter portion of the performance period helped the Fund’s NAV to end the period higher than where it started, and near the original fund offering price.

The overall market continued to see very little default activity outside of the commodity space. However, when including commodities and looking across the entire market, the year-to-date default rate has surpassed 2015’s default volume of $38 billion. Notably, 85% of default activity has come within the energy and metals/mining industries, and has caused Moody’s speculative grade default rate to recently tick up to 4.5%, surpassing its long-term average of 4.2% for the first time since August 2010. For the remainder of 2016, we expect the overall default rate to tick gradually higher to around 5%, led by continuing defaults within the energy space. However, we believe the recent easing of credit market conditions and revival of new issuance will help lead the default rate lower in 2017.

| NUVEEN | 9 |

Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds relative to their comparative benchmarks was the Funds’ use of leverage through the use of bank borrowings. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on NAV and shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance returns during periods when the prices of securities held by a Fund generally are rising. The Funds’ use of leverage had a positive impact on performance in JHY and JHA and a negligible impact on JHD during this reporting period.

As of June 30, 2016, the Funds’ percentages of leverage are shown in the accompanying table.

| JHY | JHD | JHA | ||||||||||

| Effective Leverage* |

25.71 | % | 19.62 | % | 23.94 | % | ||||||

| Regulatory Leverage* |

25.71 | % | 19.62 | % | 23.94 | % | ||||||

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

Bank Borrowings

As noted above, the Funds employ leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table.

| Current Reporting Period | Subsequent to the Close of the Reporting Period |

|||||||||||||||||||||||||||||||

| Fund | January 1, 2016 |

Draws | Paydowns | June 30, 2016 |

Average Balance Outstanding |

Draws | Paydowns | August 25, 2016 |

||||||||||||||||||||||||

| JHY |

$ | 44,000,000 | $ | — | $ | — | $ | 44,000,000 | $ | 44,000,000 | $ | — | $ | — | $ | 44,000,000 | ||||||||||||||||

| JHD |

$ | — | $ | 65,000,000 | $ | — | $ | 65,000,000 | $ | 56,176,471 | * | $ | 25,000,000 | $ | — | $ | 90,000,000 | |||||||||||||||

| JHA |

$ | 25,000,000 | $ | 67,000,000 | $ | — | $ | 92,000,000 | $ | 82,373,626 | $ | — | $ | — | $ | 92,000,000 | ||||||||||||||||

| * | For the period June 14, 2016 (initial draw on borrowings) through June 30, 2016. |

Refer to Notes to Financial Statements, Note 8 – Borrowing Arrangements for further details.

| 10 | NUVEEN |

Information

DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of June 30, 2016. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, the following Funds’ distributions to shareholders were as shown in the accompanying table.

| Per Share Amounts | ||||||||

| Monthly Distributions (Ex-Dividend Date) | JHY | JHA | ||||||

| January 2016 |

$ | 0.0570 | $ | 0.0505 | ||||

| February |

0.0570 | 0.0505 | ||||||

| March |

0.0570 | 0.0505 | ||||||

| April |

0.0570 | 0.0505 | ||||||

| May |

0.0570 | 0.0505 | ||||||

| June 2016 |

0.0570 | 0.0505 | ||||||

| Total Distributions from Net Investment Income |

$ | 0.3420 | $ | 0.3030 | ||||

| Current Distribution Rate* |

6.33 | % | 5.84 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

During July 2016 (subsequent to the close of this reporting period), JHD declared its initial distribution of $0.0505 per share to shareholders, payable in August 2016.

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if a Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of June 30, 2016, all the Funds had positive UNII balances, based upon our best estimate, for tax purposes and positive UNII balances for financial reporting purposes.

All monthly dividends paid by JHY and JHA during the current reporting period, were paid from net investment income. If a portion of the Fund’s monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders would have received a notice to that effect. For financial reporting purposes, the composition and per share amounts of each Fund’s dividends for the reporting period are presented in this report’s Statement of Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

| NUVEEN | 11 |

Share Information (continued)

EQUITY SHELF PROGRAM

Subsequent to the close of this reporting period, JHY filed a registration statement with the Securities and Exchange Commission to issue additional shares through an equity shelf program. Under this program JHY, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above the Fund’s NAV per share.

SHARE REPURCHASES

During August 2015, the Funds’ Board of Trustees authorized JHY to participate in Nuveen’s closed-end fund complex-wide share repurchase program. Under the share repurchase program, the Fund may repurchase up to 10% of its outstanding shares as of the authorization date (approximately 1,240,000 shares) in open-market transactions at the Adviser’s discretion.

As of June 30, 2016, and since the inception of the Fund’s repurchase program, the Fund did not repurchase any of its outstanding shares. As of June 30, 2016, JHD and JHA have not been authorized to participate in the Nuveen’s closed-end fund complex-wide share repurchase program.

During August 2016 (subsequent to the close of this reporting period) the Funds’ Board of Trustees reauthorized JHY and authorized both JHD and JHA to participate in Nuveen’s closed-end fund complex-wide share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares as shown in the accompanying table.

| JHY | JHD | JHA | ||||||||||

| Shares authorized for repurchase |

1,370,000 | 2,705,000 | 2,930,000 | |||||||||

OTHER SHARE INFORMATION

As of June 30, 2016, and during the current reporting period, the Funds’ share prices were trading at premium/(discount) to their share NAVs as shown in the accompanying table.

| JHY | JHD | JHA | ||||||||||

| NAV |

$ | 9.29 | $ | 9.84 | $ | 9.97 | ||||||

| Share price |

$ | 10.81 | $ | 10.33 | $ | 10.37 | ||||||

| Premium/(Discount) to NAV |

16.36 | % | 4.98 | % | 4.01 | % | ||||||

| 6-month average premium/(discount) to NAV |

15.42 | % | 2.80 | %* | 4.14 | % | ||||||

| * | For the period May 10, 2016 (commencement of operations) through June 30, 2016. |

| 12 | NUVEEN |

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen High Income 2020 Target Term Fund (JHY)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at www.nuveen.com/JHY.

Nuveen High Income December 2019 Target Term Fund (JHD)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at www.nuveen.com/JHD.

Nuveen High Income December 2018 Target Term Fund (JHA)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at nuveen.com/JHA.

| NUVEEN | 13 |

JHY

Nuveen High Income 2020 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2016

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

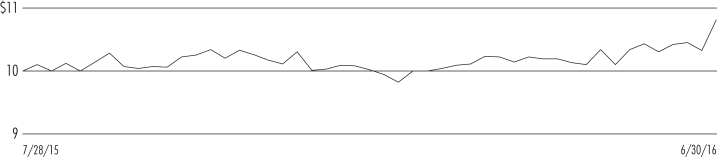

Cumulative Total Returns as of June 30, 2016

| Cumulative | ||||||||

| 6-Month | Since Inception |

|||||||

| JHY at NAV | 10.57% | 1.07% | ||||||

| JHY at Share Price | 12.47% | 15.23% | ||||||

| Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | 8.21% | 1.97% | ||||||

Since inception returns are from 7/28/15. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

| 14 | NUVEEN |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| 1 | Includes 15.4% (as a percentage of net assets) in emerging market countries. |

| NUVEEN | 15 |

JHD

Nuveen High Income December 2019 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2016

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

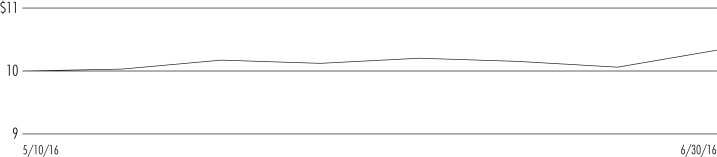

Cumulative Total Returns as of June 30, 2016

| Since Inception |

||||

| JHD at NAV | (0.20)% | |||

| JHD at Share Price | 3.30% | |||

| Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | 2.61% | |||

Since inception returns are from 5/10/16. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

| 16 | NUVEEN |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| 1 | Includes 12.1% (as a percentage of net assets) in emerging market countries. |

| NUVEEN | 17 |

JHA

Nuveen High Income December 2018 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2016

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Cumulative Total Returns as of June 30, 2016

| Cumulative | ||||||||

| 6-Month | Since Inception |

|||||||

| JHA at NAV | 6.79% | 4.30% | ||||||

| JHA at Share Price | 6.09% | 6.94% | ||||||

| Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | 8.21% | 4.22% | ||||||

Since inception returns are from 11/12/15. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

| 18 | NUVEEN |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| NUVEEN | 19 |

Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen Investments on April 22, 2016 for JHY; at this meeting the shareholders were asked to elect Board Members.

| JHY | ||||

| Common Shares |

||||

| Approval of the Board Members was reached as follows: |

||||

| William C. Hunter |

||||

| For |

11,210,805 | |||

| Withhold |

156,979 | |||

| Total |

11,367,784 | |||

| Judith M. Stockdale |

||||

| For |

11,207,891 | |||

| Withhold |

159,893 | |||

| Total |

11,367,784 | |||

| Carole E. Stone |

||||

| For |

11,203,244 | |||

| Withhold |

164,540 | |||

| Total |

11,367,784 | |||

| Margaret L. Wolff |

||||

| For |

11,201,931 | |||

| Withhold |

165,853 | |||

| Total |

11,367,784 | |||

| 20 | NUVEEN |

JHY

| Portfolio of Investments |

June 30, 2016 (Unaudited) |

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| LONG-TERM INVESTMENTS – 131.9% (99.4% of Total Investments) |

| |||||||||||||||||||

| CORPORATE BONDS – 129.1% (97.3% of Total Investments) |

| |||||||||||||||||||

| Aerospace & Defense – 1.9% | ||||||||||||||||||||

| $ | 200 | Bombardier Inc., 144A |

7.500% | 3/15/18 | B | $ | 205,500 | |||||||||||||

| 710 | Bombardier Inc., 144A |

4.750% | 4/15/19 | B | 678,050 | |||||||||||||||

| 1,000 | DigitalGlobe Inc., 144A |

5.250% | 2/01/21 | BB | 930,000 | |||||||||||||||

| 650 | Triumph Group Inc. |

4.875% | 4/01/21 | Ba3 | 611,000 | |||||||||||||||

| 2,560 | Total Aerospace & Defense |

2,424,550 | ||||||||||||||||||

| Airlines – 1.4% | ||||||||||||||||||||

| 1,172 | Air Canada, 144A |

7.750% | 4/15/21 | B+ | 1,215,950 | |||||||||||||||

| 1,140 | VistaJet Malta Finance PLC, 144A |

7.750% | 6/01/20 | B | 515,850 | |||||||||||||||

| 2,312 | Total Airlines |

1,731,800 | ||||||||||||||||||

| Auto Components – 2.4% | ||||||||||||||||||||

| 1,500 | Allied Specialty Vehicle Inc., 144A |

8.500% | 11/01/19 | BB– | 1,518,750 | |||||||||||||||

| 1,500 | American & Axle Manufacturing Inc. |

6.250% | 3/15/21 | BB– | 1,556,250 | |||||||||||||||

| 3,000 | Total Auto Components |

3,075,000 | ||||||||||||||||||

| Banks – 0.6% | ||||||||||||||||||||

| 800 | Popular Inc. |

7.000% | 7/01/19 | BB– | 784,000 | |||||||||||||||

| Building Products – 1.2% | ||||||||||||||||||||

| 1,500 | Taylor Morrison Monarch Communities, 144A |

5.250% | 4/15/21 | BB– | 1,496,250 | |||||||||||||||

| Capital Markets – 0.7% | ||||||||||||||||||||

| 1,000 | KCG Holdings Inc., 144A |

6.875% | 3/15/20 | BB– | 902,500 | |||||||||||||||

| Chemicals – 6.9% | ||||||||||||||||||||

| 1,500 | Eagle Spinco Inc. |

4.625% | 2/15/21 | BB– | 1,535,625 | |||||||||||||||

| 1,000 | Hexion Inc. |

10.000% | 4/15/20 | B3 | 935,000 | |||||||||||||||

| 1,535 | Huntsman International LLC |

4.875% | 11/15/20 | B1 | 1,542,675 | |||||||||||||||

| 920 | Kissner Milling Company Limited, 144A |

7.250% | 6/01/19 | B | 920,000 | |||||||||||||||

| 1,800 | Koppers Inc. |

7.875% | 12/01/19 | Ba3 | 1,836,000 | |||||||||||||||

| 1,000 | Platform Specialty Products Corporation, 144A |

10.375% | 5/01/21 | B+ | 1,007,500 | |||||||||||||||

| 1,300 | Tronox Finance LLC |

6.375% | 8/15/20 | B | 965,250 | |||||||||||||||

| 9,055 | Total Chemicals |

8,742,050 | ||||||||||||||||||

| Commercial Services & Supplies – 3.1% | ||||||||||||||||||||

| 1,500 | APX Group, Inc. |

6.375% | 12/01/19 | B1 | 1,485,000 | |||||||||||||||

| 483 | Casella Waste Systems Inc. |

7.750% | 2/15/19 | B | 492,962 | |||||||||||||||

| 1,430 | GFL Environmental Corporation, 144A |

7.875% | 4/01/20 | B | 1,437,150 | |||||||||||||||

| 500 | GFL Environmental Corporation, 144A |

9.875% | 2/01/21 | B | 532,500 | |||||||||||||||

| 3,913 | Total Commercial Services & Supplies |

3,947,612 | ||||||||||||||||||

| Construction & Engineering – 1.0% | ||||||||||||||||||||

| 1,290 | Michael Baker International LLC / CDL Acquisition Company Inc., 144A |

8.250% | 10/15/18 | B+ | 1,251,300 | |||||||||||||||

| Construction Materials – 1.1% | ||||||||||||||||||||

| 1,320 | Cemex SAB de CV, 144A |

5.875% | 3/25/19 | BB– | 1,359,600 | |||||||||||||||

| Consumer Finance – 4.0% | ||||||||||||||||||||

| 1,000 | Constellis Holdings LLC / Constellis Finance Corporation, 144A |

9.750% | 5/15/20 | B | 954,750 | |||||||||||||||

| 920 | Covenant Surgical Partners Inc., 144A |

8.750% | 8/01/19 | B– | 883,200 | |||||||||||||||

| 1,500 | Navient Corporation |

5.000% | 10/26/20 | BB | 1,406,250 | |||||||||||||||

| NUVEEN | 21 |

| JHY | Nuveen High Income 2020 Target Term Fund | |||

| Portfolio of Investments (continued) | June 30, 2016 (Unaudited) | |||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Consumer Finance (continued) | ||||||||||||||||||||

| $ | 500 | OneMain Financial Holdings, Inc., 144A |

6.750% | 12/15/19 | B | $ | 487,500 | |||||||||||||

| 1,500 | Springleaf Finance Corporation |

5.250% | 12/15/19 | B | 1,396,875 | |||||||||||||||

| 5,420 | Total Consumer Finance |

5,128,575 | ||||||||||||||||||

| Containers & Packaging – 2.9% | ||||||||||||||||||||

| 1,350 | Ardagh Packaging Finance / MP HD USA, 144A |

6.750% | 1/31/21 | B3 | 1,363,500 | |||||||||||||||

| 1,070 | Coveris Holdings SA, 144A |

7.875% | 11/01/19 | B– | 1,039,238 | |||||||||||||||

| 890 | PaperWorks Industries Inc., 144A |

9.500% | 8/15/19 | B– | 818,800 | |||||||||||||||

| 500 | Reynolds Group |

8.250% | 2/15/21 | CCC+ | 523,060 | |||||||||||||||

| 3,810 | Total Containers & Packaging |

3,744,598 | ||||||||||||||||||

| Diversified Consumer Services – 0.2% | ||||||||||||||||||||

| 555 | Gibson Brands Inc., 144A |

8.875% | 8/01/18 | CCC+ | 308,025 | |||||||||||||||

| Diversified Financial Services – 6.4% | ||||||||||||||||||||

| 1,350 | Fly Leasing Limited |

6.750% | 12/15/20 | BB | 1,356,750 | |||||||||||||||

| 500 | Jefferies Finance LLC Corporation, 144A |

7.375% | 4/01/20 | B1 | 453,750 | |||||||||||||||

| 1,000 | Jefferies Finance LLC Corporation, 144A |

7.500% | 4/15/21 | B1 | 897,500 | |||||||||||||||

| 1,500 | Lincoln Finance LTD, 144A |

7.375% | 4/15/21 | BB+ | 1,552,500 | |||||||||||||||

| 1,050 | Nationstar Mortgage LLC Capital Corporation |

7.875% | 10/01/20 | B+ | 984,375 | |||||||||||||||

| 2,000 | NewStar Financial, Inc. |

7.250% | 5/01/20 | BB– | 1,860,000 | |||||||||||||||

| 1,000 | PHH Corporation |

7.375% | 9/01/19 | Ba3 | 987,500 | |||||||||||||||

| 8,400 | Total Diversified Financial Services |

8,092,375 | ||||||||||||||||||

| Diversified Telecommunication Services – 4.7% | ||||||||||||||||||||

| 800 | CenturyLink Inc. |

6.150% | 9/15/19 | BB+ | 851,000 | |||||||||||||||

| 1,330 | CenturyLink Inc. |

5.625% | 4/01/20 | BB+ | 1,376,550 | |||||||||||||||

| 1,000 | Frontier Communications Corporation |

8.500% | 4/15/20 | BB | 1,061,250 | |||||||||||||||

| 1,000 | Frontier Communications Corporation |

8.875% | 9/15/20 | BB | 1,067,500 | |||||||||||||||

| 1,100 | IntelSat Jackson Holdings |

7.250% | 10/15/20 | CCC | 783,750 | |||||||||||||||

| 810 | Windstream Corporation |

7.750% | 10/15/20 | BB– | 793,800 | |||||||||||||||

| 6,040 | Total Diversified Telecommunication Services |

5,933,850 | ||||||||||||||||||

| Electric Utilities – 1.0% | ||||||||||||||||||||

| 1,420 | RJS Power Holdings LLC, 144A |

4.625% | 7/15/19 | B+ | 1,249,600 | |||||||||||||||

| Energy Equipment & Services – 0.7% | ||||||||||||||||||||

| 1,000 | Precision Drilling Corporation |

6.625% | 11/15/20 | BB | 915,000 | |||||||||||||||

| Food & Staples Retailing – 0.9% | ||||||||||||||||||||

| 1,260 | Bi-Lo LLC Finance Corporation, 144A |

9.250% | 2/15/19 | B | 1,096,200 | |||||||||||||||

| Food Products – 2.4% | ||||||||||||||||||||

| 1,500 | JBS Investments GmbH, 144A |

7.750% | 10/28/20 | BB+ | 1,582,500 | |||||||||||||||

| 1,490 | Marfrig Holding Europe BV, 144A |

6.875% | 6/24/19 | B+ | 1,494,470 | |||||||||||||||

| 2,990 | Total Food Products |

3,076,970 | ||||||||||||||||||

| Gas Utilities – 1.3% | ||||||||||||||||||||

| 1,750 | Ferrellgas LP |

6.500% | 5/01/21 | B+ | 1,605,625 | |||||||||||||||

| Health Care Equipment & Supplies – 1.2% | ||||||||||||||||||||

| 1,500 | Tenet Healthcare Corporation |

4.500% | 4/01/21 | BB | 1,507,500 | |||||||||||||||

| Health Care Providers & Services – 4.4% | ||||||||||||||||||||

| 900 | Community Health Systems, Inc. |

8.000% | 11/15/19 | B+ | 878,625 | |||||||||||||||

| 1,400 | Community Health Systems, Inc. |

7.125% | 7/15/20 | B+ | 1,297,926 | |||||||||||||||

| 1,000 | HCA Inc. |

6.500% | 2/15/20 | BBB– | 1,108,750 | |||||||||||||||

| 400 | Iasis Healthcare Capital Corporation |

8.375% | 5/15/19 | CCC+ | 384,250 | |||||||||||||||

| 1,950 | Kindred Healthcare Inc. |

8.000% | 1/15/20 | B– | 1,940,250 | |||||||||||||||

| 5,650 | Total Health Care Providers & Services |

5,609,801 | ||||||||||||||||||

| 22 | NUVEEN |

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Hotels, Restaurants & Leisure – 4.5% | ||||||||||||||||||||

| $ | 750 | Caesars Entertainment Resort Properties LLC |

8.000% | 10/01/20 | B+ | $ | 751,875 | |||||||||||||

| 1,500 | International Game Technology PLC, 144A |

5.625% | 2/15/20 | BB+ | 1,580,625 | |||||||||||||||

| 1,270 | MGM Resorts International Inc. |

6.750% | 10/01/20 | BB | 1,387,475 | |||||||||||||||

| 1,500 | Nathan’s Famous, Inc., 144A |

10.000% | 3/15/20 | B– | 1,601,250 | |||||||||||||||

| 650 | Scientific Games International Inc. |

6.250% | 9/01/20 | B– | 411,125 | |||||||||||||||

| 5,670 | Total Hotels, Restaurants & Leisure |

5,732,350 | ||||||||||||||||||

| Household Durables – 6.3% | ||||||||||||||||||||

| 1,470 | Brookfield Residential Properties Inc., 144A |

6.500% | 12/15/20 | B+ | 1,466,325 | |||||||||||||||

| 1,500 | KB Home |

8.000% | 3/15/20 | B+ | 1,605,000 | |||||||||||||||

| 1,000 | M-I Homes Inc. |

6.750% | 1/15/21 | BB– | 995,000 | |||||||||||||||

| 750 | PulteGroup Inc. |

4.250% | 3/01/21 | BBB– | 773,250 | |||||||||||||||

| 1,500 | Rialto Holdings LLC-Rialto Corporation, 144A |

7.000% | 12/01/18 | B1 | 1,503,750 | |||||||||||||||

| 1,650 | William Lyon Homes Incorporated |

8.500% | 11/15/20 | B– | 1,695,375 | |||||||||||||||

| 7,870 | Total Household Durables |

8,038,700 | ||||||||||||||||||

| Household Products – 0.8% | ||||||||||||||||||||

| 1,000 | HRG Group, Inc. |

7.875% | 7/15/19 | Ba3 | 1,048,750 | |||||||||||||||

| Independent Power & Renewable Electricity Producers – 3.9% | ||||||||||||||||||||

| 1,500 | DPL, Inc. |

6.750% | 10/01/19 | BB | 1,522,500 | |||||||||||||||

| 1,310 | Dynegy Inc. |

6.750% | 11/01/19 | B+ | 1,313,275 | |||||||||||||||

| 1,500 | GenOn Energy Inc. |

9.875% | 10/15/20 | CCC+ | 1,065,000 | |||||||||||||||

| 1,000 | NRG Energy Inc. |

8.250% | 9/01/20 | BB– | 1,030,000 | |||||||||||||||

| 5,310 | Total Independent Power & Renewable Electricity Producers |

4,930,775 | ||||||||||||||||||

| Insurance – 1.0% | ||||||||||||||||||||

| 1,500 | Genworth Financial Inc. |

7.700% | 6/15/20 | Ba3 | 1,335,000 | |||||||||||||||

| Internet & Catalog Retail – 0.8% | ||||||||||||||||||||

| 1,000 | Netflix Incorporated |

5.375% | 2/01/21 | B+ | 1,061,990 | |||||||||||||||

| Internet Software & Services – 1.6% | ||||||||||||||||||||

| 2,001 | Earthlink Inc. |

7.375% | 6/01/20 | Ba3 | 2,081,040 | |||||||||||||||

| Machinery – 3.9% | ||||||||||||||||||||

| 1,450 | BlueLine Rental Finance Corporation, 144A |

7.000% | 2/01/19 | B+ | 1,247,000 | |||||||||||||||

| 1,250 | CNH Industrial Capital LLC |

4.375% | 11/06/20 | Ba1 | 1,262,500 | |||||||||||||||

| 1,200 | CTP Transportation Products LLC-Finance Inc., 144A |

8.250% | 12/15/19 | B | 1,056,000 | |||||||||||||||

| 1,500 | Harsco Corporation |

5.750% | 5/15/18 | Ba1 | 1,413,750 | |||||||||||||||

| 5,400 | Total Machinery |

4,979,250 | ||||||||||||||||||

| Marine – 0.7% | ||||||||||||||||||||

| 936 | Global Ship Lease Inc., 144A |

10.000% | 4/01/19 | B | 835,380 | |||||||||||||||

| Media – 6.7% | ||||||||||||||||||||

| 1,000 | Cablevision Systems Corporation |

7.750% | 4/15/18 | B3 | 1,070,620 | |||||||||||||||

| 1,840 | Cequel Communications Holding I LLC Capital, 144A |

6.375% | 9/15/20 | B– | 1,860,700 | |||||||||||||||

| 1,790 | Clear Channel Worldwide |

7.625% | 3/15/20 | B– | 1,703,185 | |||||||||||||||

| 1,500 | Dish DBS Corporation |

5.125% | 5/01/20 | BB– | 1,530,000 | |||||||||||||||

| 780 | Mediacom Broadband LLC |

5.500% | 4/15/21 | B+ | 795,600 | |||||||||||||||

| 1,500 | WMG Acquisition Group, 144A |

6.000% | 1/15/21 | Ba3 | 1,545,000 | |||||||||||||||

| 8,410 | Total Media |

8,505,105 | ||||||||||||||||||

| Metals & Mining – 8.3% | ||||||||||||||||||||

| 1,250 | Aleris International Inc., 144A |

9.500% | 4/01/21 | B | 1,284,375 | |||||||||||||||

| 1,250 | Allegheny Technologies Inc. |

5.950% | 1/15/21 | B | 1,037,500 | |||||||||||||||

| 1,080 | ArcelorMittal |

6.250% | 8/05/20 | BB+ | 1,134,000 | |||||||||||||||

| 500 | Eldorado Gold Corporation, 144A |

6.125% | 12/15/20 | BB– | 500,000 | |||||||||||||||

| 600 | First Quantum Minerals Limited, 144A |

6.750% | 2/15/20 | B | 501,000 | |||||||||||||||

| NUVEEN | 23 |

| JHY | Nuveen High Income 2020 Target Term Fund | |||

| Portfolio of Investments (continued) | June 30, 2016 (Unaudited) | |||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Metals & Mining (continued) | ||||||||||||||||||||

| $ | 630 | Freeport McMoRan, Inc. |

3.100% | 3/15/20 | BBB– | $ | 595,350 | |||||||||||||

| 500 | Glencore Funding LLC, 144A |

2.500% | 1/15/19 | BBB– | 480,625 | |||||||||||||||

| 1,200 | Gold Fields Orogen Holdings BVI Limited, 144A |

4.875% | 10/07/20 | BB+ | 1,182,000 | |||||||||||||||

| 1,000 | Lundin Mining Corporation, 144A |

7.500% | 11/01/20 | BB– | 1,020,000 | |||||||||||||||

| 1,220 | New Gold Incorporated, 144A |

7.000% | 4/15/20 | B+ | 1,244,400 | |||||||||||||||

| 1,450 | Novellis Inc. |

8.750% | 12/15/20 | B | 1,511,625 | |||||||||||||||

| 10,680 | Total Metals & Mining |

10,490,875 | ||||||||||||||||||

| Multiline Retail – 1.5% | ||||||||||||||||||||

| 2,000 | J.C. Penney Corporation Inc. |

5.650% | 6/01/20 | B+ | 1,880,000 | |||||||||||||||

| Oil, Gas & Consumable Fuels – 14.2% | ||||||||||||||||||||

| 1,250 | Calumet Specialty Products |

6.500% | 4/15/21 | CCC+ | 893,750 | |||||||||||||||

| 750 | Cenovus Energy Inc. |

5.700% | 10/15/19 | BBB | 793,283 | |||||||||||||||

| 1,000 | Crestwood Midstream Partners LP |

6.000% | 12/15/20 | BB– | 945,000 | |||||||||||||||

| 1,450 | Energy Transfer Equity LP |

7.500% | 10/15/20 | BB+ | 1,537,000 | |||||||||||||||

| 1,250 | Genesis Energy LP |

5.750% | 2/15/21 | B+ | 1,181,250 | |||||||||||||||

| 750 | Murphy Oil Corporation |

2.500% | 12/01/17 | BBB– | 747,806 | |||||||||||||||

| 1,650 | NGL Energy Partners LP/Fin Co |

5.125% | 7/15/19 | BB– | 1,501,500 | |||||||||||||||

| 1,000 | Noble Energy Inc. |

5.625% | 5/01/21 | BBB | 1,041,796 | |||||||||||||||

| 1,500 | Northern Tier Energy LLC |

7.125% | 11/15/20 | BB– | 1,526,250 | |||||||||||||||

| 1,000 | Oasis Petroleum Inc. |

7.250% | 2/01/19 | B+ | 957,500 | |||||||||||||||

| 1,480 | Petrobras International Finance Company |

5.375% | 1/27/21 | BB | 1,365,300 | |||||||||||||||

| 1,000 | Southwestern Energy Company |

5.800% | 1/23/20 | BB– | 977,500 | |||||||||||||||

| 1,000 | Sunoco LP / Sunoco Finance Corp., 144A |

5.500% | 8/01/20 | BB | 987,500 | |||||||||||||||

| 1,000 | Sunoco LP / Sunoco Finance Corp., 144A |

6.250% | 4/15/21 | BB | 1,001,870 | |||||||||||||||

| 1,250 | Teekay Corporation, 144A |

8.500% | 1/15/20 | B+ | 1,046,875 | |||||||||||||||

| 825 | WPX Energy Inc. |

7.500% | 8/01/20 | B | 823,449 | |||||||||||||||

| 625 | YPF Sociedad Anonima, 144A |

8.500% | 3/23/21 | B | 670,500 | |||||||||||||||

| 18,780 | Total Oil, Gas & Consumable Fuels |

17,998,129 | ||||||||||||||||||

| Paper & Forest Products – 1.5% | ||||||||||||||||||||

| 1,500 | Mercer International Inc. |

7.000% | 12/01/19 | B+ | 1,515,000 | |||||||||||||||

| 500 | Tembec Industries, Inc., 144A |

9.000% | 12/15/19 | B– | 387,500 | |||||||||||||||

| 2,000 | Total Paper & Forest Products |

1,902,500 | ||||||||||||||||||

| Personal Products – 0.8% | ||||||||||||||||||||

| 1,000 | Albea Beauty Holdings SA, 144A |

8.375% | 11/01/19 | B | 1,050,000 | |||||||||||||||

| Pharmaceuticals – 0.3% | ||||||||||||||||||||

| 500 | VRX Escrow Corp., 144A |

5.375% | 3/15/20 | B– | 427,188 | |||||||||||||||

| Real Estate Investment Trust – 3.7% | ||||||||||||||||||||

| 1,500 | Iron Mountain Inc., 144A |

6.000% | 10/01/20 | BB– | 1,582,500 | |||||||||||||||

| 900 | iStar Inc. |

7.125% | 2/15/18 | B+ | 922,500 | |||||||||||||||

| 1,500 | iStar Inc. |

5.000% | 7/01/19 | B+ | 1,398,750 | |||||||||||||||

| 750 | Vereit Operating Partner |

3.000% | 2/06/19 | BB+ | 750,938 | |||||||||||||||

| 4,650 | Total Real Estate Investment Trust |

4,654,688 | ||||||||||||||||||

| Real Estate Management & Development – 2.0% | ||||||||||||||||||||

| 1,040 | Hunt Companies Inc., 144A |

9.625% | 3/01/21 | N/R | 1,045,200 | |||||||||||||||

| 1,500 | Mattamy Group Corporation, 144A |

6.500% | 11/15/20 | BB | 1,440,000 | |||||||||||||||

| 2,540 | Total Real Estate Management & Development |

2,485,200 | ||||||||||||||||||

| Road & Rail – 1.9% | ||||||||||||||||||||

| 2,000 | Hertz Corporation |

5.875% | 10/15/20 | B | 2,050,000 | |||||||||||||||

| 500 | Jack Cooper Holdings Corporation |

9.250% | 6/01/20 | CCC+ | 320,000 | |||||||||||||||

| 2,500 | Total Road & Rail |

2,370,000 | ||||||||||||||||||

| 24 | NUVEEN |

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Software – 0.4% | ||||||||||||||||||||

| $ | 500 | Infor Us Inc., 144A |

5.750% | 8/15/20 | BB | $ | 524,375 | |||||||||||||

| Specialty Retail – 2.9% | ||||||||||||||||||||

| 1,500 | Best Buy Co., Inc. |

5.500% | 3/15/21 | Baa1 | 1,597,500 | |||||||||||||||

| 1,000 | Guitar Center Inc., 144A |

6.500% | 4/15/19 | B2 | 860,000 | |||||||||||||||

| 1,250 | Toys R Us Property Company II LLC |

8.500% | 12/01/17 | Ba3 | 1,237,500 | |||||||||||||||

| 3,750 | Total Specialty Retail |

3,695,000 | ||||||||||||||||||

| Technology Hardware, Storage & Peripherals – 0.6% | ||||||||||||||||||||

| 800 | NCR Corporation |

4.625% | 2/15/21 | BB | 792,000 | |||||||||||||||

| Thrifts & Mortgage Finance – 1.7% | ||||||||||||||||||||

| 2,130 | Radian Group Inc. |

5.250% | 6/15/20 | BB– | 2,145,972 | |||||||||||||||

| Trading Companies & Distributors – 1.1% | ||||||||||||||||||||

| 1,500 | Avation Capital SA, 144A |

7.500% | 5/27/20 | B+ | 1,425,000 | |||||||||||||||

| Wireless Telecommunication Services – 7.6% | ||||||||||||||||||||

| 1,100 | Digicel Group, Limited, 144A |

8.250% | 9/30/20 | B– | 918,500 | |||||||||||||||

| 1,250 | FairPoint Communications Inc., 144A |

8.750% | 8/15/19 | B | 1,231,250 | |||||||||||||||

| 1,620 | Millicom International Cellular SA, 144A |

4.750% | 5/22/20 | BB+ | 1,628,100 | |||||||||||||||

| 750 | Softbank Corporation, 144A |

4.500% | 4/15/20 | BB+ | 774,375 | |||||||||||||||

| 1,750 | Sprint Communications Inc., 144A |

7.000% | 3/01/20 | BB | 1,832,233 | |||||||||||||||

| 475 | Sprint Communications Inc. |

8.375% | 8/15/17 | B+ | 488,063 | |||||||||||||||

| 1,290 | T-Mobile USA Inc. |

6.250% | 4/01/21 | BB | 1,345,625 | |||||||||||||||

| 1,500 | Wind Acquisition Finance SA, 144A |

4.750% | 7/15/20 | BB | 1,470,000 | |||||||||||||||

| 9,735 | Total Wireless Telecommunication Services |

9,688,146 | ||||||||||||||||||

| $ | 168,707 | Total Corporate Bonds (cost $168,098,121) |

164,060,194 | |||||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| CONVERTIBLE BONDS – 1.5% (1.2% of Total Investments) |

|

|||||||||||||||||||

| Capital Markets – 0.8% | ||||||||||||||||||||

| $ | 1,000 | Prosepect Capital Corporation |

5.750% | 3/15/18 | BBB– | $ | 1,020,000 | |||||||||||||

| Independent Power & Renewable Electricity Producers – 0.7% | ||||||||||||||||||||

| 1,000 | NRG Yield Inc., 144A |

3.250% | 6/01/20 | N/R | 920,000 | |||||||||||||||

| $ | 2,000 | Total Convertible Bonds (cost $1,896,087) |

1,940,000 | |||||||||||||||||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| EMERGING MARKET DEBT AND FOREIGN CORPORATE BONDS – 1.3% (0.9% of Total Investments) |

| |||||||||||||||||||

| Argentina – 1.3% | ||||||||||||||||||||

| $ | 1,500 | Republic of Argentina, 144A |

6.875% | 4/22/21 | B | $ | 1,601,250 | |||||||||||||

| Total Emerging Market Debt and Foreign Corporate Bonds (cost $1,500,000) |

|

1,601,250 | ||||||||||||||||||

| Total Long-Term Investments (cost $171,494,208) |

167,601,444 | |||||||||||||||||||

| NUVEEN | 25 |

| JHY | Nuveen High Income 2020 Target Term Fund | |||

| Portfolio of Investments (continued) | June 30, 2016 (Unaudited) | |||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Value | ||||||||||||||||

| SHORT-TERM INVESTMENTS – 0.8% (0.6% of Total Investments) |

|

|||||||||||||||||||

| REPURCHASE AGREEMENTS – 0.8% (0.6% of Total Investments) | ||||||||||||||||||||

| $ | 1,032 | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/16, repurchase price $1,031,672, collateralized by $955,000 U.S. Treasury Notes, 2.750%, due 11/15/23, value $1,055,275 |

0.030% | 7/01/16 | $ | 1,031,671 | ||||||||||||||

| Total Short-Term Investments (cost $1,031,671) |

1,031,671 | |||||||||||||||||||

| Total Investments (cost $172,525,879) – 132.7% |

168,633,115 | |||||||||||||||||||

| Borrowings – (34.6)% (3), (4) |

(44,000,000 | ) | ||||||||||||||||||

| Other Assets Less Liabilities – 1.9% |

2,481,889 | |||||||||||||||||||

| Net Assets – 100% |

$ | 127,115,004 | ||||||||||||||||||

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets unless otherwise noted. |

| (2) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| (3) | Borrowings as a percentage of Total Investments is 26.1%. |

| (4) | The Fund segregates 100% of its eligible investments (excluding any investments separately pledged as collateral for specific investments in derivatives, when applicable) in the Portfolio of Investments as collateral for Borrowings. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

See accompanying notes to financial statements.

| 26 | NUVEEN |

JHD

| Nuveen High Income December 2019 Target Term Fund | ||

| Portfolio of Investments |

June 30, 2016 (Unaudited) | |

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||||||

| LONG-TERM INVESTMENTS – 122.5% (100.0% of Total Investments) |

| |||||||||||||||||||||||

| CORPORATE BONDS – 119.6% (97.6% of Total Investments) |

| |||||||||||||||||||||||

| Aerospace & Defense – 1.5% | ||||||||||||||||||||||||

| $ | 2,000 | Bombardier Inc., 144A |

7.500% | 3/15/18 | B | $ | 2,055,000 | |||||||||||||||||

| 2,000 | Bombardier Inc., 144A |

4.750% | 4/15/19 | B | 1,910,000 | |||||||||||||||||||

| 4,000 | Total Aerospace & Defense |

3,965,000 | ||||||||||||||||||||||

| Air Freight & Logistics – 1.3% | ||||||||||||||||||||||||

| 3,371 | XPO Logistics, Inc., 144A |

7.875% | 9/01/19 | B2 | 3,438,420 | |||||||||||||||||||

| Airlines – 3.5% | ||||||||||||||||||||||||

| 1,000 | Air Canada 2015-1C Pass Through Trust, 144A |

|

5.000% | 3/15/20 | BB | 962,500 | ||||||||||||||||||

| 1,849 | Air Canada, 144A |

8.750% | 4/01/20 | BB+ | 1,955,318 | |||||||||||||||||||

| 2,500 | American Airlines Group Inc., 144A |

5.500% | 10/01/19 | BB– | 2,475,000 | |||||||||||||||||||

| 2,000 | American Airlines Group Inc., 144A |

4.625% | 3/01/20 | BB– | 1,910,000 | |||||||||||||||||||

| 2,000 | United Continental Holdings Inc. |

6.375% | 6/01/18 | BB– | 2,085,000 | |||||||||||||||||||

| 9,349 | Total Airlines |

9,387,818 | ||||||||||||||||||||||

| Auto Components – 0.9% | ||||||||||||||||||||||||

| 2,250 | Allied Specialty Vehicle Inc., 144A |

8.500% | 11/01/19 | BB– | 2,278,125 | |||||||||||||||||||

| Automobiles – 2.3% | ||||||||||||||||||||||||

| 4,050 | Fiat Chrysler Automobiles NV |

4.500% | 4/15/20 | BB | 4,095,563 | |||||||||||||||||||

| 2,000 | Jaguar Land Rover Automotive PLC, 144A |

|

3.500% | 3/15/20 | BB | 1,975,000 | ||||||||||||||||||

| 6,050 | Total Automobiles |

6,070,563 | ||||||||||||||||||||||

| Banks – 3.2% | ||||||||||||||||||||||||

| 4,500 | CIT Group Inc. |

5.375% | 5/15/20 | BB+ | 4,691,250 | |||||||||||||||||||

| 3,897 | Popular Inc. |

7.000% | 7/01/19 | BB– | 3,819,060 | |||||||||||||||||||

| 8,397 | Total Banks |

8,510,310 | ||||||||||||||||||||||

| Beverages – 0.3% | ||||||||||||||||||||||||

| 700 | Cott Beverages Inc. |

6.750% | 1/01/20 | B– | 729,750 | |||||||||||||||||||

| Capital Markets – 0.5% | ||||||||||||||||||||||||

| 1,500 | KCG Holdings Inc., 144A |

6.875% | 3/15/20 | BB– | 1,353,750 | |||||||||||||||||||

| Chemicals – 2.7% | ||||||||||||||||||||||||

| 1,000 | Hexion Inc. |

6.625% | 4/15/20 | B3 | 836,300 | |||||||||||||||||||

| 500 | Hexion US Finance Corporation |

8.875% | 2/01/18 | CCC | 433,750 | |||||||||||||||||||

| 4,000 | Ineos Group Holdings SA, 144A |

5.875% | 2/15/19 | B– | 3,995,000 | |||||||||||||||||||

| 2,000 | Kissner Milling Company Limited, 144A |

|

7.250% | 6/01/19 | B | 2,000,000 | ||||||||||||||||||

| 7,500 | Total Chemicals |

7,265,050 | ||||||||||||||||||||||

| Commercial Services & Supplies – 7.2% | ||||||||||||||||||||||||

| 2,500 | AerCap Ireland Capital Limited / AerCap Global Aviation Trust |

|

3.750% | 5/15/19 | BBB– | 2,518,750 | ||||||||||||||||||

| 4,995 | APX Group, Inc. |

6.375% | 12/01/19 | B1 | 4,945,050 | |||||||||||||||||||

| 4,500 | GFL Environmental Corporation, 144A |

|

7.875% | 4/01/20 | B | 4,522,500 | ||||||||||||||||||

| 1,500 | International Lease Finance Corporation |

|

6.250% | 5/15/19 | BBB– | 1,616,025 | ||||||||||||||||||

| 3,000 | NES Rental Holdings Inc., 144A |

7.875% | 5/01/18 | B– | 2,850,000 | |||||||||||||||||||

| 2,500 | R.R. Donnelley & Sons Company |

8.250% | 3/15/19 | BB– | 2,693,750 | |||||||||||||||||||

| 18,995 | Total Commercial Services & Supplies |

|

19,146,075 | |||||||||||||||||||||

| Construction & Engineering – 0.9% | ||||||||||||||||||||||||

| 2,500 | Michael Baker International LLC / CDL Acquisition Company Inc., 144A |

|

8.250% | 10/15/18 | B+ | 2,425,000 | ||||||||||||||||||

| NUVEEN | 27 |

| JHD | Nuveen High Income December 2019 Target Term Fund | |||

| Portfolio of Investments (continued) | June 30, 2016 (Unaudited) | |||

| Principal Amount (000) |

Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Construction Materials – 1.4% | ||||||||||||||||||||

| $ | 3,500 | Cemex SAB de CV, 144A |

6.500% | 12/10/19 | BB– | $ | 3,710,000 | |||||||||||||

| Consumer Finance – 2.7% | ||||||||||||||||||||

| 3,000 | Ally Financial Inc. |

4.125% | 3/30/20 | BB+ | 3,007,500 | |||||||||||||||

| 1,500 | Constellis Holdings LLC / Constellis Finance Corporation, 144A |

9.750% | 5/15/20 | B | 1,432,125 | |||||||||||||||

| 2,000 | Springleaf Finance Corporation |

5.250% | 12/15/19 | B | 1,862,500 | |||||||||||||||

| 1,005 | Springleaf Finance Corporation |

6.000% | 6/01/20 | B | 940,931 | |||||||||||||||

| 7,505 | Total Consumer Finance |

7,243,056 | ||||||||||||||||||

| Containers & Packaging – 3.0% | ||||||||||||||||||||

| 3,000 | Ardagh Packaging Finance / MP HD USA, 144A |

6.250% | 1/31/19 | B3 | 3,048,750 | |||||||||||||||

| 2,500 | Coveris Holdings SA, 144A |

7.875% | 11/01/19 | B– | 2,428,125 | |||||||||||||||

| 2,500 | Reynolds Group |

9.875% | 8/15/19 | CCC+ | 2,581,250 | |||||||||||||||

| 8,000 | Total Containers & Packaging |

8,058,125 | ||||||||||||||||||

| Diversified Financial Services – 3.0% | ||||||||||||||||||||

| 1,000 | Jefferies Finance LLC Corporation, 144A |

7.375% | 4/01/20 | B1 | 907,500 | |||||||||||||||

| 2,775 | Nationstar Mortgage LLC Capital Corporation |

9.625% | 5/01/19 | B+ | 2,872,125 | |||||||||||||||

| 2,500 | NewStar Financial, Inc. |

7.250% | 5/01/20 | BB– | 2,325,000 | |||||||||||||||

| 1,000 | Och-Ziff Finance Co LLC, 144A |

4.500% | 11/20/19 | BBB+ | 953,766 | |||||||||||||||

| 1,000 | PHH Corporation |

7.375% | 9/01/19 | Ba3 | 987,500 | |||||||||||||||

| 8,275 | Total Diversified Financial Services |

8,045,891 | ||||||||||||||||||

| Diversified Telecommunication Services – 4.9% | ||||||||||||||||||||

| 4,600 | CenturyLink Inc. |

5.625% | 4/01/20 | BB+ | 4,761,000 | |||||||||||||||

| 3,350 | Frontier Communications Corporation |

8.500% | 4/15/20 | BB | 3,555,188 | |||||||||||||||

| 2,000 | SBA Communications Corporation |

5.625% | 10/01/19 | B | 2,065,000 | |||||||||||||||

| 2,500 | WideOpenWest Finance Capital Corporation |

10.250% | 7/15/19 | CCC+ | 2,587,500 | |||||||||||||||

| 12,450 | Total Diversified Telecommunication Services |

12,968,688 | ||||||||||||||||||

| Electric Utilities – 1.1% | ||||||||||||||||||||

| 3,400 | RJS Power Holdings LLC, 144A |

4.625% | 7/15/19 | B+ | 2,992,000 | |||||||||||||||

| Electronic Equipment, Instruments & Components – 0.9% | ||||||||||||||||||||

| 2,000 | Anixter Inc. |

5.625% | 5/01/19 | BB+ | 2,117,500 | |||||||||||||||

| 375 | Sanmina-SCI Corporation, 144A |

4.375% | 6/01/19 | BB+ | 383,438 | |||||||||||||||

| 2,375 | Total ElectronicEquipment, Instruments & Comp |

2,500,938 | ||||||||||||||||||

| Energy Equipment & Services – 1.1% | ||||||||||||||||||||

| 1,000 | Noble Drilling Corporation |

7.500% | 3/15/19 | BBB | 1,010,000 | |||||||||||||||

| 2,100 | SESI, LLC |

6.375% | 5/01/19 | BB | 2,021,250 | |||||||||||||||

| 3,100 | Total Energy Equipment & Services |

3,031,250 | ||||||||||||||||||

| Food & Staples Retailing – 0.5% | ||||||||||||||||||||

| 1,500 | Bi-Lo LLC Finance Corporation, 144A |

9.250% | 2/15/19 | B | 1,305,000 | |||||||||||||||

| Food Products – 3.3% | ||||||||||||||||||||

| 3,000 | Dole Food Company, 144A |

7.250% | 5/01/19 | B3 | 2,992,500 | |||||||||||||||

| 2,500 | JBS USA LLC, 144A |

8.250% | 2/01/20 | BB+ | 2,587,500 | |||||||||||||||

| 3,300 | Marfrig Holding Europe BV, 144A |

6.875% | 6/24/19 | B+ | 3,309,900 | |||||||||||||||

| 8,800 | Total Food Products |

8,889,900 | ||||||||||||||||||

| Health Care Equipment & Supplies – 2.4% | ||||||||||||||||||||