|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of Each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

||

|

|

|

|

|

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company

|

Emerging growth company

|

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

14

|

|

|

Item 1B.

|

35 | |

|

Item 2.

|

35 | |

|

Item 3.

|

36 | |

|

Item 4.

|

36 | |

|

PART II

|

||

|

Item 5.

|

37 | |

|

Item 6.

|

40 | |

|

Item 7.

|

40 | |

|

Item 7A.

|

54 | |

|

Item 8.

|

55 | |

|

Item 9.

|

82 |

|

|

Item 9A.

|

82 | |

|

Item 9B.

|

84 |

|

|

Item 9C.

|

84 | |

|

PART III

|

||

|

Item 10.

|

84 | |

|

Item 11.

|

84 | |

|

Item 12.

|

84 | |

|

Item 13.

|

84 | |

|

Item 14.

|

85 | |

|

PART IV

|

||

|

Item 15.

|

85 | |

|

Item 16.

|

89 | |

| • |

our failure to adequately procure and manage our inventory or anticipate consumer demand;

|

| • |

changes in consumer confidence and spending;

|

| • |

risks associated with our status as a “brick and mortar only” retailer;

|

| • |

risks associated with intense competition;

|

| • |

our failure to open new profitable stores, or successfully enter new markets, on a timely basis or at all;

|

| • |

the risks associated with doing business with international manufacturers and suppliers including, but not limited to, potential increases in tariffs on imported goods;

|

| • |

outbreak of viruses or widespread illness, including the continued impact of COVID-19 and continuing or renewed regulatory responses thereto;

|

| • |

our inability to operate our stores due to civil unrest and related protests or disturbances;

|

| • |

our failure to properly hire and to retain key personnel and other qualified personnel;

|

| • |

risks associated with the timely and effective deployment, protection, and defense of computer networks and other electronic systems, including e-mail;

|

| • |

our inability to obtain favorable lease terms for our properties;

|

| • |

the failure to timely acquire, develop, open and operate, or the loss of, disruption or interruption in the operations of, any of our centralized distribution centers;

|

| • |

fluctuations in comparable store sales and results of operations, including on a quarterly basis;

|

| • |

risks associated with our lack of operations in the growing online retail marketplace;

|

| • |

risks associated with litigation, the expense of defense, and potential for adverse outcomes;

|

| • |

our inability to successfully develop or implement our marketing, advertising and promotional efforts;

|

| • |

the seasonal nature of our business;

|

| • |

risks associated with natural disasters, whether or not caused by climate change;

|

| • |

changes in government regulations, procedures and requirements; and

|

| • |

our ability to service indebtedness and to comply with our financial covenants.

|

| Item 1. |

Business.

|

| • |

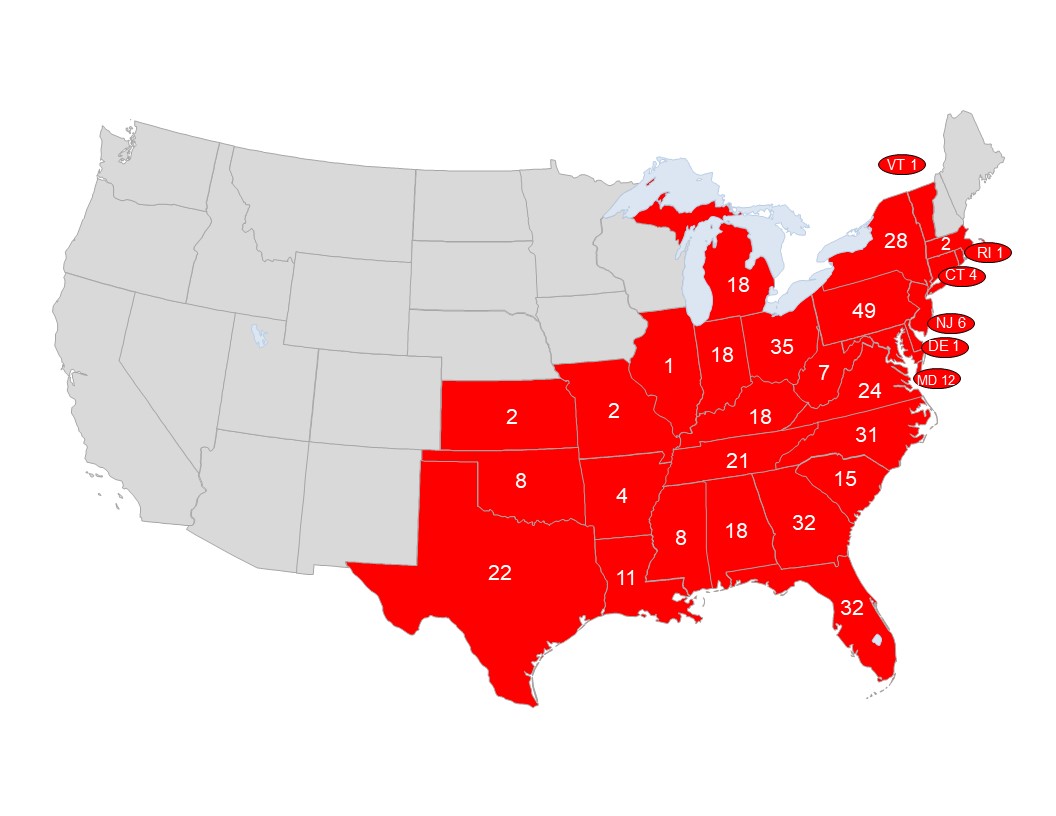

Our store base expanded from 268 stores to 431 stores, a compound annual growth rate, or CAGR, of 12.6% and we entered nine new states;

|

| • |

Comparable store sales grew at an average rate of 1.0% per year;

|

| • |

Net sales increased from $1.077 billion to $1.753 billion, a CAGR of 13.0%; and

|

| • |

Net income increased from $127.6 million to $157.5 million.

|

| • |

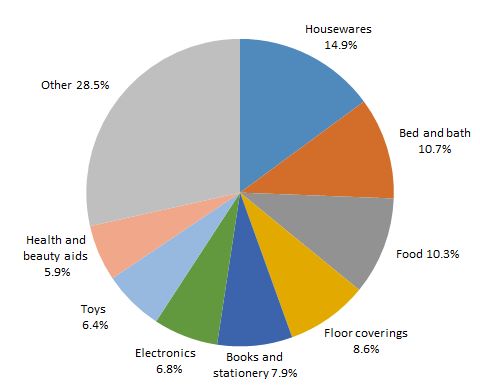

Housewares: cooking

utensils, dishes, appliances, plastic containers, cutlery, storage and garbage bags, detergents and cleaning supplies, cookware and glassware, fans and space heaters, candles, frames and giftware;

|

| • |

Bed and bath: household

goods including bedding, towels, curtains and associated hardware;

|

| • |

Food: packaged food

including coffee, bottled non-carbonated beverages, salty snacks, condiments, sauces, spices, dry pasta, canned goods, cereal and cookies;

|

| • |

Floor coverings: laminate

flooring, commercial and residential carpeting, area rugs and floor mats;

|

| • |

Books and stationery: novels,

children’s, how-to, business, cooking, inspirational and coffee table books, greeting cards and various office supplies and party goods;

|

| • |

Electronics: air

conditioners, home electronics, cellular accessories and as seen on television;

|

| • |

Toys: dolls, action

figures, puzzles, educational toys, board games and other related items;

|

| • |

Health and beauty aids: personal care, hair care, oral care, health and wellness, including PPE related to the COVID-19 pandemic, over-the-counter medicine, first aid, sun care, and

personal grooming; and

|

| • |

Other: hardware, candy,

clothing, sporting goods, pet products, luggage, automotive, seasonal, furniture, summer furniture and lawn & garden.

|

|

2021

|

2020

|

2019

|

||||||||||

|

Stores open at beginning of year

|

388

|

345

|

303

|

|||||||||

|

Stores opened

|

46

|

46

|

42

|

|||||||||

|

Stores closed

|

(3

|

)

|

(4

|

)

|

-

|

|||||||

|

Stores re-opened

|

-

|

1

|

-

|

|||||||||

|

Stores open at end of year

|

431

|

388

|

345

|

|||||||||

| • |

Print and direct mail: During 2021, we

distributed over 677 million highly recognizable flyers. Our flyers are distributed 22 times per year and serve as the foundation of our marketing strategy. They highlight current deals to create shopping urgency and drive traffic and

increase frequency of store visits;

|

| • |

Television and radio: We selectively utilize

creative television and radio advertising campaigns in targeted markets at certain times of the year, particularly during the holiday sales season, to create brand awareness and support new store openings;

|

| • |

Charity and community events: We are dedicated

to maintaining a visible presence in the communities in which our stores are located through the sponsorship of charitable organizations such as Feeding America, Toys for Tots, Children’s Miracle Network, Cal Ripken, Sr. Foundation and

the Kevin Harvick Foundation. We believe supporting these organizations promotes our brand, underscores our values and builds a sense of community; and

|

| • |

Digital marketing and social media: We

maintain an active online presence and promote our brand through our website, our mobile app and social media channels. We also utilize targeted email marketing to highlight our latest brand name offerings and drive traffic to our

stores. In addition, we invest in digital marketing where we target both our current and prospective customers.

|

| • |

implemented procedures for social distancing, cleaning, sanitation, and use of personal protective equipment in our stores, distribution centers, and store support center to adhere to the appropriate CDC

and local guidelines;

|

| • |

supported our team members with COVID-19 paid medical leave and 100% coverage of COVID-19 testing and treatment under our medical plan; and

|

| • |

supported our communities by raising money to provide much needed funding to local food banks through a partnership with Feeding America.

|

| • |

The impact of COVID-19 on our business, operating results, cash flows, year-over-year performance and/or financial condition is significant and uncertain, and the impact could be material and adverse;

|

| • |

Vaccine mandates and other governmental regulations relating to the ongoing COVID-19 pandemic could have a material adverse impact on our business, financial conditions, results of operations, and

prospects;

|

| • |

The impact of COVID-19 and the related testing and vaccination may result in us not being able to accurately forecast health care and other benefit costs, and we are uncertain whether future health care and other benefit costs could

exceed our projections;

|

| • |

We may not be able to execute our opportunistic buying strategy;

|

| • |

Consumer confidence and spending may be reduced in light of factors beyond our control and our financial results may suffer;

|

| • |

Competition may increase in our segment of the retail market, which could put negative pressure on our results of operations and financial condition;

|

| • |

Identification of potential store locations and lease negotiations may not keep pace with our growth strategy;

|

| • |

We are a “brick and mortar only” retailer. Our lack of an online shopping option may mean that we face challenges to grow and retain customers. Our customers, including our loyalty program members, may determine to shop at other

stores or through web-enabled services and therefore not be as likely to shop at our stores;

|

| • |

We may not be able to develop and operate our multiple distribution centers in an efficient or effective manner and that could mean that we do not have sufficient inventory in our store locations. The loss or disruption of one or more

of our distribution centers or disruption of our supply chain or third-party shipping carriers could also make it difficult for us to timely receive or distribute goods to our stores;

|

| • |

External economic pressures over which we have no or limited control, including inflation, occupancy costs, and transportation costs may reduce our profitability;

|

| • |

Inventory management and/or shrinkage or the loss or theft of inventory can result in material negative impacts on our results of operations;

|

| • |

We need to be able to hire and retain the right people to run our stores and our distribution

centers. We also need to hire and retain managerial personnel, a merchant team and executive officers. If we are not effective in these areas, our results may suffer; and

|

| • |

Comparable store sales and results of operations have fluctuated in the past and may do so again in the future.

|

| • |

We are subject to governmental regulations, procedures and requirements that can lead to substantial penalties if we fail to achieve compliance;

|

| • |

We are subject to risks associated with laws and regulations generally applicable to retailers;

|

| • |

From time to time we are involved in legal proceedings from customers, suppliers, employees, governments or competitors; and

|

| • |

From time to time we are involved in legal proceedings from stockholders.

|

| • |

We may fail to maintain the security of information we hold relating to personal information or payment card data of our customers, employees and suppliers;

|

| • |

We may not adequately prepare for or respond to existing and future privacy legislation; and

|

| • |

We may not be able to timely or adequately maintain or upgrade our technology systems needed for operations.

|

| • |

If our estimates or judgments relating to significant accounting policies prove to be incorrect, we could suffer negative financial results; and

|

| • |

Changes to the accounting rules or regulations could have material adverse effects on our results of operations.

|

| • |

There is risk associated with our fluctuating quarterly operating results and we may fall short of prior periods, our projections or the expectations of securities analysts or investors;

|

| • |

We may not declare dividends on our common stock in the foreseeable future; and

|

| • |

There are provisions in our organizational documents that could delay or prevent a change of control.

|

| • |

Our credit facility can limit our ability to find other sources of financing;

|

| • |

There are covenants contained in our credit facility that we must meet in order to be able to use it;

|

| • |

If we are unable to generate sufficient cash flow to meet debt service it could negatively impact our liquidity; and

|

| • |

We cannot guarantee that our share repurchase program will be fully consummated or that it will enhance long-term stockholder value.

|

|

|

• |

energy and gasoline prices;

|

|

|

• |

disposable income of our customers, which may be impacted by unemployment levels, personal debt levels and minimum wages;

|

|

|

• |

discounts, promotions and merchandise offered by our competitors;

|

|

|

• |

negative reports and publicity about the discount retail industry;

|

|

|

• |

outbreak of viruses or widespread illness, including COVID-19, and behavioral changes from a fear of contracting such viruses or illness;

|

|

|

• |

general economic and industry conditions;

|

|

|

• |

food prices;

|

|

|

• |

interest rates and inflation;

|

|

|

• |

the state of the housing market;

|

|

|

• |

customer confidence in future economic conditions;

|

|

|

• |

fluctuations in the financial markets;

|

|

|

• |

tax rates and policies; and

|

|

|

• |

natural disasters, war, terrorism and other hostilities.

|

|

|

• |

entry of new competitors in our markets;

|

|

|

• |

increased operational efficiencies of competitors;

|

|

|

• |

online retail capabilities of our competitors;

|

|

|

• |

competitive pricing strategies, including deep discount pricing by a broad range of retailers during periods of poor customer confidence, low discretionary income or economic uncertainty;

|

|

|

• |

continued and prolonged promotional activity by our competitors;

|

|

|

• |

liquidation sales by our competitors that have filed or may file in the future for bankruptcy;

|

|

|

• |

geographic expansion by competitors into markets in which we currently operate; and

|

|

|

• |

adoption by existing competitors of innovative store formats or retail sales methods, including online.

|

|

|

• |

national and regional economic trends in the United States;

|

|

|

• |

challenges and the impact of COVID-19 and related regulations;

|

|

|

• |

changes in gasoline prices;

|

|

|

• |

changes in our merchandise mix;

|

|

|

• |

the weather;

|

|

|

• |

changes in pricing;

|

|

|

• |

changes in the timing of promotional and advertising efforts; and

|

|

|

• |

holidays or seasonal periods.

|

|

|

• |

requiring that a greater portion of our available cash be applied to pay our rental obligations, thus reducing cash available for other purposes and reducing profitability;

|

|

|

• |

increasing our vulnerability to general adverse economic and industry conditions; and

|

|

|

• |

limiting our flexibility in planning for, or reacting to changes in, our business or in the industry in which we compete.

|

| • |

authorize our Board to issue, without further action by the stockholders, up to 50,000,000 shares of undesignated preferred stock;

|

| • |

subject to certain exceptions, require that any action to be taken by our stockholders be effected at a duly called annual or special meeting and not by written consent;

|

| • |

specify that special meetings of our stockholders can be called only by a majority of our Board or upon the request of the Chairperson of the Board or the Chief Executive Officer;

|

| • |

establish an advance notice procedure for stockholder proposals to be brought before an annual meeting, including proposed nominations of persons for election to our Board;

|

| • |

establish that our Board is divided into three classes until the annual meeting of the stockholders to be held in 2022, with each director serving a one-year term;

|

| • |

prohibit cumulative voting in the election of directors; and

|

| • |

provide that vacancies on our Board may be filled only by a majority of directors then in office, even though less than a quorum.

|

| • |

any derivative action or proceeding brought on behalf of the Company;

|

| • |

any action asserting a claim of breach of a fiduciary duty owed by, or any wrongdoing by, any director, officer or employee of the Company to the Company or the Company’s stockholders;

|

| • |

any action asserting a claim arising pursuant to any provision of the Delaware General Corporate Law, the certification of incorporation (including as it may be amended from time to time), or the fourth amended and restated bylaws;

|

| • |

any action to interpret, apply, enforce or determine the validity of our certificate of incorporation or the fourth amended and restated bylaws; or

|

| • |

any action asserting a claim governed by the internal affairs doctrine.

|

|

|

• |

increase our vulnerability to adverse general economic or industry conditions;

|

|

|

• |

limit our flexibility in planning for, or reacting to, changes in our business or the industries in which we operate;

|

|

|

• |

make us more vulnerable to increases in interest rates, as borrowings under our Credit Facility are at variable rates;

|

|

|

• |

limit our ability to obtain additional financing in the future for working capital or other purposes;

|

|

|

• |

require us to utilize our cash flows from operations to make payments on indebtedness, reducing the availability of our cash flows to fund working capital, capital expenditures, development activity and other general corporate

purposes; and

|

|

|

• |

place us at a competitive disadvantage compared to our competitors that have less indebtedness.

|

|

|

• |

pay dividends on, redeem or repurchase our stock or make other distributions;

|

|

|

• |

incur or guarantee additional indebtedness;

|

|

|

• |

sell stock in our subsidiaries;

|

|

|

• |

create or incur liens;

|

|

|

• |

make acquisitions or investments;

|

|

|

• |

transfer or sell certain assets or merge or consolidate with or into other companies;

|

|

|

• |

make certain payments or prepayments of indebtedness subordinated to our obligations under our Credit Facility; and

|

|

|

• |

enter into certain transactions with our affiliates.

|

| Item 1B. |

Unresolved Staff Comments

|

| Item 2. |

Properties

|

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

2021

|

||||||||

|

High

|

Low

|

|||||||

|

First Quarter

|

$

|

98.58

|

$

|

80.64

|

||||

|

Second Quarter

|

$

|

95.43

|

$

|

75.75

|

||||

|

Third Quarter

|

$

|

94.68

|

$

|

57.86

|

||||

|

Fourth Quarter

|

$

|

75.27

|

$

|

42.40

|

||||

|

2020

|

||||||||

|

High

|

Low

|

|||||||

|

First Quarter

|

$

|

72.77

|

$

|

28.83

|

||||

|

Second Quarter

|

$

|

110.17

|

$

|

64.55

|

||||

|

Third Quarter

|

$

|

112.58

|

$

|

83.08

|

||||

|

Fourth Quarter

|

$

|

123.52

|

$

|

76.74

|

||||

|

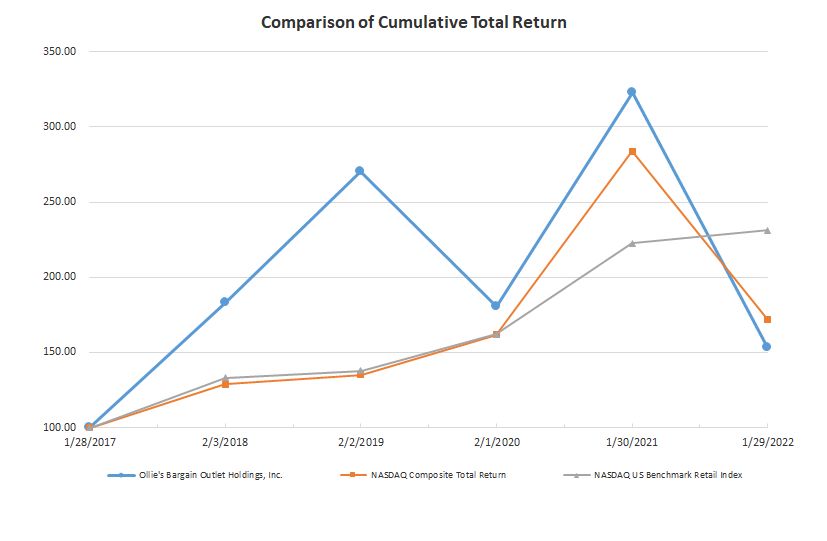

1/28/17

|

2/3/18

|

2/2/19

|

2/1/20

|

1/30/21

|

1/29/22

|

|||||||||||||||||||

|

Ollie’s Bargain Outlet Holdings, Inc.

|

$

|

100.00

|

183.13

|

270.36

|

180.72

|

322.76

|

153.08

|

|||||||||||||||||

|

NASDAQ Composite Total Return Index

|

$

|

100.00

|

128.66

|

135.26

|

161.67

|

283.88

|

171.84

|

|||||||||||||||||

|

NASDAQ US Benchmark Retail Index

|

$

|

100.00

|

133.02

|

137.90

|

162.10

|

222.50

|

231.26

|

|||||||||||||||||

|

Period

|

Total number

of shares

repurchased (1)

|

Average

price paid

per share (2)

|

Total number of

shares purchased

as part of publicly

announced plans or

programs (3)

|

Approximate dollar

value of shares that may

yet be purchased under

the plans or programs (3)

|

||||||||||||

|

October 31, 2021 through November 27, 2021

|

—

|

—

|

—

|

$

|

32,562

|

|||||||||||

|

November 28, 2021 through January 1, 2022

|

—

|

—

|

—

|

$

|

200,032,562

|

|||||||||||

|

January 2, 2022 through January 29, 2022

|

434,474

|

$

|

46.04

|

434,474

|

$

|

180,028,248

|

||||||||||

|

Total

|

434,474

|

434,474

|

||||||||||||||

|

(1)

|

Consists of shares repurchased under the publicly announced share repurchase program.

|

|

(2)

|

Includes commissions for the shares repurchased under the share repurchase program.

|

|

(3)

|

On March 26, 2019, the Board of Directors of the Company authorized the repurchase of up to $100.0 million of shares of the Company’s common stock. This initial tranche expired on March 26, 2021. The

Board authorized the repurchase of another $100.0 million of the Company’s common stock on December 15, 2020 and a $100.0 million increase on March 16, 2021, resulting in $200.0 million approved for share repurchases through January 13,

2023. On November 30, 2021, the Board authorized an additional $200.0 million to repurchase stock pursuant to the Company’s share repurchase program, expiring on December 15, 2023. Shares to be repurchased are subject to the same

considerations regarding timing and amount of repurchases as the initial authorization. As of January 29, 2022, the Company had approximately $180.0 million remaining under its share repurchase program. For further discussion on the share repurchase program, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Liquidity and Capital Resources, Share Repurchase Program.”

|

| Item 6. |

[Reserved]

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

| • |

growing our merchant buying team to increase our access to brand name/closeout merchandise;

|

| • |

adding members to our senior management team;

|

| • |

expanding the capacity of our distribution centers to their current 2.2 million square feet; and

|

| • |

investing in information technology, accounting and warehouse management systems.

|

| • |

growing our store base;

|

| • |

increasing our offerings of great bargains; and

|

| • |

leveraging and expanding Ollie’s Army.

|

| • |

have been remodeled while remaining open;

|

| • |

are closed for five or fewer days in any fiscal month;

|

| • |

are closed temporarily and relocated within their respective trade areas; and

|

| • |

have expanded, but are not significantly different in size, within their current locations.

|

|

2021

|

2020

|

|||||||

|

(dollars in thousands)

|

||||||||

|

Net sales

|

$

|

1,752,995

|

$

|

1,808,821

|

||||

|

Cost of sales

|

1,071,749

|

1,085,455

|

||||||

|

Gross profit

|

681,246

|

723,366

|

||||||

|

Selling, general and administrative expenses

|

447,615

|

418,889

|

||||||

|

Depreciation and amortization expenses

|

19,364

|

16,705

|

||||||

|

Pre-opening expenses

|

9,675

|

10,272

|

||||||

|

Operating income

|

204,592

|

277,500

|

||||||

|

Interest expense (income), net

|

209

|

(278

|

)

|

|||||

|

Income before income taxes

|

204,383

|

277,778

|

||||||

|

Income tax expense

|

46,928

|

35,082

|

||||||

|

Net income

|

$

|

157,455

|

$

|

242,696

|

||||

|

Percentage of net sales(1):

|

||||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

||||

|

Cost of sales

|

61.1

|

60.0

|

||||||

|

Gross profit

|

38.9

|

40.0

|

||||||

|

Selling, general and administrative expenses

|

25.5

|

23.2

|

||||||

|

Depreciation and amortization expenses

|

1.1

|

0.9

|

||||||

|

Pre-opening expenses

|

0.6

|

0.6

|

||||||

|

Operating income

|

11.7

|

15.3

|

||||||

|

Interest expense (income), net

|

0.0

|

(0.0

|

)

|

|||||

|

Income before income taxes

|

11.7

|

15.4

|

||||||

|

Income tax expense

|

2.7

|

1.9

|

||||||

|

Net income

|

9.0

|

%

|

13.4

|

%

|

||||

|

Select operating data:

|

||||||||

|

Number of new stores

|

46

|

46

|

||||||

|

Number of store closings

|

(3

|

)

|

(4

|

)

|

||||

|

Number of stores re-opened

|

-

|

1

|

||||||

|

Number of stores open at end of period

|

431

|

388

|

||||||

|

Average net sales per store (2)

|

$

|

4,254

|

$

|

4,866

|

||||

|

Comparable stores sales change

|

(11.1

|

)%

|

15.6

|

%

|

||||

|

(1)

|

Components may not add to totals due to rounding.

|

|

(2)

|

Average net sales per store represents the weighted average of total net weekly sales divided by the number of stores open at the end of each week for the respective periods presented.

|

|

2021

|

2020

|

|||||||

|

(dollars in thousands)

|

||||||||

|

Net income

|

$

|

157,455

|

$

|

242,696

|

||||

|

Interest expense (income), net

|

209

|

(278

|

)

|

|||||

|

Depreciation and amortization expenses (1)

|

25,114

|

22,746

|

||||||

|

Income tax expense

|

46,928

|

35,082

|

||||||

|

EBITDA

|

229,706

|

300,246

|

||||||

|

Gains from insurance settlements

|

(416

|

)

|

(247

|

)

|

||||

|

Non-cash stock-based compensation expense

|

8,042

|

6,501

|

||||||

|

Adjusted EBITDA

|

$

|

237,332

|

$

|

306,500

|

||||

|

(1)

|

Includes depreciation and amortization relating to our distribution centers, which is included within cost of sales on our consolidated statements of income.

|

|

2021

|

2020

|

|||||||

|

(in thousands)

|

||||||||

|

Net cash provided by operating activities

|

$

|

45,033

|

$

|

361,254

|

||||

|

Net cash used in investing activities

|

(31,830

|

)

|

(30,448

|

)

|

||||

|

Net cash (used in) provided by financing activities

|

(213,352

|

)

|

26,370

|

|||||

|

Net (decrease) increase in cash and cash equivalents

|

$

|

(200,149

|

)

|

$

|

357,176

|

|||

|

Less than 1

year

|

1-3 Years

|

3-5 Years

|

Thereafter

|

Total

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Operating leases (1)

|

$

|

81,360

|

$

|

170,593

|

$

|

111,660

|

$

|

116,040

|

$

|

479,653

|

||||||||||

|

Finance leases

|

607

|

525

|

-

|

-

|

1,132

|

|||||||||||||||

|

Purchase obligations (2)

|

12,300

|

-

|

-

|

-

|

12,300

|

|||||||||||||||

|

Total

|

$

|

94,267

|

$

|

171,118

|

$

|

111,660

|

$

|

116,040

|

$

|

493,085

|

||||||||||

|

(1)

|

Operating lease payments exclude $46.7 million of legally binding minimum lease payments for leases signed, but not yet commenced.

|

|

(2)

|

Purchase obligations represent $12.3 million associated with a construction agreement for the expansion of our York, PA distribution center (entered into on March 7, 2022).

|

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risks

|

| Item 8: |

Financial Statements and Supplementary Data.

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm (

|

56

|

|

Consolidated Financial Statements:

|

|

|

Consolidated Statements of Income for the fiscal years ended January 29, 2022, January 30, 2021

and February 1, 2020

|

58

|

|

Consolidated Balance Sheets as of January 29, 2022 and January 30, 2021

|

59 |

|

Consolidated Statements of Stockholders’ Equity for the fiscal years ended January 29, 2022, January 30, 2021

and February 1, 2020

|

60

|

|

Consolidated Statements of Cash Flows for the fiscal years ended January 29, 2022, January 30, 2021

and February 1, 2020

|

61

|

| 62 | |

|

79

|

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of sales

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

|

|

|

|||||||||

|

Depreciation and amortization expenses

|

|

|

|

|||||||||

|

Pre-opening expenses

|

|

|

|

|||||||||

|

Operating income

|

|

|

|

|||||||||

|

Interest expense (income), net

|

|

(

|

)

|

(

|

)

|

|||||||

|

Income before income taxes

|

|

|

|

|||||||||

|

Income tax expense

|

|

|

|

|||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Earnings per common share:

|

||||||||||||

|

Basic

|

$

|

|

$

|

|

$

|

|

||||||

|

Diluted

|

$

|

|

$

|

|

$

|

|

||||||

|

Weighted average common shares outstanding:

|

||||||||||||

|

Basic

|

|

|

|

|||||||||

|

Diluted

|

|

|

|

|||||||||

|

January 29,

2022

|

January 30,

2021

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Inventories

|

|

|

||||||

|

Accounts receivable

|

|

|

||||||

|

Prepaid expenses and other assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Property and equipment, net

|

|

|

||||||

|

Operating lease right-of-use assets

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Trade name

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Current portion of long-term debt

|

$

|

|

$

|

|

||||

|

Accounts payable

|

|

|

||||||

|

Income taxes payable

|

|

|

||||||

|

Current portion of operating lease liabilities

|

|

|

||||||

|

Accrued expenses and other

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Revolving credit facility

|

|

|

||||||

|

Long-term debt

|

|

|

||||||

|

Deferred income taxes

|

|

|

||||||

|

Long-term operating lease liabilities

|

|

|

||||||

|

Other long-term liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock -

|

|

|

||||||

|

Common stock -

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Treasury - common stock, at cost;

|

(

|

)

|

(

|

)

|

||||

|

Total stockholders’ equity

|

|

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

Common stock

|

Treasury stock

|

Additional

paid-in

|

Retained

|

Total

stockholders’

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

capital

|

earnings

|

equity

|

||||||||||||||||||||||

|

Balance as of February 2, 2019

|

|

$

|

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

$

|

|

||||||||||||||

|

Stock-based compensation expense

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Proceeds from stock options exercised

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Vesting of restricted stock

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Common shares withheld for taxes

|

(

|

)

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||

| Shares repurchased | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Balance as of February 1, 2020

|

|

|

(

|

)

|

(

|

)

|

|

|

|

|||||||||||||||||||

|

Stock-based compensation expense

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Proceeds from stock options exercised

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Vesting of restricted stock

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Common shares withheld for taxes

|

(

|

)

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||

|

Shares repurchased

|

|

|

(

|

)

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Balance as of January 30, 2021

|

|

|

(

|

)

|

(

|

)

|

|

|

|

|||||||||||||||||||

|

Stock-based compensation expense

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Proceeds from stock options exercised

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Vesting of restricted stock

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Common shares withheld for taxes

|

(

|

)

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||

|

Shares repurchased

|

|

|

(

|

)

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||||

|

Net income

|

-

|

|

-

|

|

|

|

|

|||||||||||||||||||||

|

Balance as of January 29, 2022

|

|

$

|

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

$

|

|

||||||||||||||

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization of property and equipment

|

|

|

|

|||||||||

|

Amortization of debt issuance costs

|

|

|

|

|||||||||

|

Gain on sale of assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Deferred income tax provision

|

|

|

|

|||||||||

|

Stock-based compensation expense

|

|

|

|

|||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Inventories

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Accounts receivable

|

(

|

)

|

|

(

|

)

|

|||||||

|

Prepaid expenses and other assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Accounts payable

|

(

|

)

|

|

(

|

)

|

|||||||

|

Income taxes payable

|

(

|

)

|

|

(

|

)

|

|||||||

|

Accrued expenses and other liabilities

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net cash provided by operating activities

|

|

|

|

|||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchases of property and equipment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from sale of property and equipment

|

|

|

|

|||||||||

|

Purchase of intangible asset

|

|

(

|

)

|

|

||||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Repayments on finance leases

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Payment of debt issuance costs

|

|

|

(

|

)

|

||||||||

|

Proceeds from stock option exercises

|

|

|

|

|||||||||

|

Common shares withheld for taxes

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Payment for shares repurchased

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash (used in) provided by financing activities

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net (decrease) increase in cash and cash equivalents

|

(

|

)

|

|

|

||||||||

|

Cash and cash equivalents at the beginning of the year

|

|

|

|

|||||||||

|

Cash and cash equivalents at the end of the year

|

$

|

|

$

|

|

$

|

|

||||||

|

Supplemental disclosure of cash flow information:

|

||||||||||||

|

Cash paid during the year for:

|

||||||||||||

|

Interest

|

$

|

|

$

|

|

$

|

|

||||||

|

Income taxes

|

$

|

|

$

|

|

$

|

|

||||||

|

Non-cash investing activities:

|

||||||||||||

|

Accrued purchases of property and equipment

|

$

|

|

$

|

|

$

|

|

||||||

| (1) |

Organization and Summary of Significant Accounting Policies

|

| (a) |

Description of Business

|

|

|

(b) |

Fiscal Year

|

| (c) |

Principles of Consolidation

|

| (d) |

Use of Estimates

|

| (e) |

Fair Value Disclosures

|

| • |

Level 1 inputs are quoted prices available for identical assets and liabilities in active markets.

|

| • |

Level 2 inputs are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets and liabilities in active markets or

other inputs that are observable or can be corroborated by observable market data.

|

| • |

Level 3 inputs are less observable and reflect the Company’s assumptions.

|

| (f) |

Cash and Cash Equivalents

|

| (g) |

Concentration of Credit Risk

|

| (h) |

Inventories

|

| (i) |

Property and Equipment

|

|

Software

|

|

|

Automobiles

|

|

|

Computer equipment

|

|

|

Furniture, fixtures and equipment

|

|

|

Buildings

|

|

|

Leasehold improvements

|

|

| (j) |

Goodwill/Intangible Assets

|

| (k) |

Impairment of Long-Lived Assets

|

| (l) |

Stock-Based Compensation

|

| (m) |

Cost of Sales

|

| (n) |

Selling, General and Administrative Expenses

|

| (o) |

Advertising Costs

|

| (p) |

Operating Leases

|

| (q) |

Pre-Opening Expenses

|

| (r) |

Debt Issuance Costs

|

| (s) |

Self‑Insurance Liabilities

|

| (t) |

Income Taxes

|

| (u) |

Earnings per Common Share

|

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

|

Weighted average number of common shares outstanding – Basic

|

|

|

|

|||||||||

|

Incremental shares from the assumed exercise of outstanding stock options and vesting of restricted stock units

|

|

|

|

|||||||||

|

Weighted average number of common shares outstanding – Diluted

|

|

|

|

|||||||||

|

Earnings per common share – Basic

|

$

|

|

$

|

|

$

|

|

||||||

|

Earnings per common share – Diluted

|

$

|

|

$

|

|

$

|

|

||||||

| (v) |

Impact of the Novel Coronavirus (“COVID-19”)

|

| (2) |

Net Sales

|

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Beginning balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Revenue deferred

|

|

|

|

|||||||||

|

Revenue recognized

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Ending balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Beginning balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Gift card issuances

|

|

|

|

|||||||||

|

Gift card redemption and breakage

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Ending balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Beginning balance

|

$

|

|

$

|

|

$

|

|

||||||

|

Provisions

|

|

|

|

|||||||||

|

Sales returns

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Ending balance

|

$

|

|

$

|

|

$

|

|

||||||

| (3) |

Property and Equipment

|

|

January 29,

2022

|

January 30,

2021

|

|||||||

|

Land

|

$

|

|

$

|

|

||||

|

Buildings

|

|

|

||||||

|

Furniture, fixtures and equipment

|

|

|

||||||

|

Leasehold improvements

|

|

|

||||||

|

Automobiles

|

|

|

||||||

|

|

|

|||||||

|

Less: Accumulated depreciation and amortization

|

(

|

)

|

(

|

)

|

||||

|

$

|

|

$

|

|

|||||

| (4) |

Commitments and Contingencies

|

|

2022

|

$

|

|

||

|

2023

|

|

|||

|

2024

|

|

|||

|

2025

|

|

|||

|

2026

|

|

|||

|

Thereafter

|

|

|||

|

Total undiscounted lease payments (1)

|

|

|||

|

Less: Imputed interest

|

(

|

)

|

||

|

Total lease obligations

|

|

|||

|

Less: Current obligations under leases

|

(

|

)

|

||

|

Long-term lease obligations

|

$

|

|

| (1) |

|

|

Fiscal Year Ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Cash paid for operating leases

|

$

|

|

$ |

$

|

|

|||||||

|

Operating lease cost

|

|

|

||||||||||

|

Variable lease cost

|

|

|

||||||||||

|

Non-cash right-of-use assets obtained in exchange for lease obligations

|

|

|

||||||||||

|

Weighted-average remaining lease term

|

|

|

||||||||||

|

Weighted-average discount rate

|

|

%

|

|

%

|

|

%

|

||||||

| (5) |

Accrued Expenses

|

|

January 29,

2022

|

January 30,

2021

|

|||||||

|

Compensation and benefits

|

$

|

|

$

|

|

||||

|

Deferred revenue

|

|

|

||||||

|

Insurance

|

|

|

||||||

|

Advertising

|

|

|

||||||

|

Real estate related

|

|

|

||||||

|

Sales and use taxes

|

|

|

||||||

|

Freight

|

|

|

||||||

|

Other

|

|

|

||||||

|

$

|

|

$

|

|

|||||

| (6) |

Debt Obligations and Financing Arrangements

|

| (7) |

Income Taxes

|

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Current:

|

||||||||||||

|

Federal

|

$

|

|

$

|

|

$

|

|

||||||

|

State

|

|

|

|

|||||||||

|

|

|

|

||||||||||

|

Deferred:

|

||||||||||||

|

Federal

|

|

|

|

|||||||||

|

State

|

|

(

|

)

|

|

||||||||

|

|

|

|

||||||||||

|

Income tax expense

|

$

|

|

$

|

|

$

|

|

||||||

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020 |

||||||||||

|

Statutory

federal rate

|

|

%

|

|

%

|

|

%

|

||||||

|

State

taxes, net of federal benefit

|

|

|

|

|||||||||

|

Excess

tax benefits related to stock-based compensation

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Other

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

|

%

|

|

%

|

|

%

|

|||||||

|

January 29,

2022

|

January 30,

2021

|

|||||||

|

Deferred tax assets:

|

||||||||

|

Inventory reserves

|

$

|

|

$

|

|

||||

|

Lease liability

|

|

|

||||||

|

Stock-based compensation

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total deferred tax assets

|

|

|

||||||

|

Deferred tax liabilities:

|

||||||||

|

Tradename

|

(

|

)

|

(

|

)

|

||||

|

Depreciation

|

(

|

)

|

(

|

)

|

||||

|

Operating lease right-of-use assets

|

(

|

)

|

(

|

)

|

||||

|

Total deferred tax liabilities

|

(

|

)

|

(

|

)

|

||||

|

Net deferred tax liabilities

|

$

|

(

|

)

|

$

|

(

|

)

|

||

| (8) |

Equity Incentive Plans

|

|

Number of

options

|

Weighted

average

exercise

price

|

Weighted

average

remaining

contractual

term

(years)

|

Aggregate

intrinsic value

|

|||||||||||||

|

Outstanding at February 2, 2019

|

|

$

|

|

|

|

|||||||||||

|

Granted

|

|

|

||||||||||||||

|

Forfeited

|

(

|

)

|

|

|||||||||||||

|

Exercised

|

(

|

)

|

|

|||||||||||||

|

Outstanding at February 1, 2020

|

|

|

||||||||||||||

|

Granted

|

|

|

||||||||||||||

|

Forfeited

|

(

|

)

|

|

|||||||||||||

|

Exercised

|

(

|

)

|

|

|||||||||||||

|

Outstanding at January 30, 2021

|

|

|

||||||||||||||

|

Granted

|

|

|

||||||||||||||

|

Forfeited

|

(

|

)

|

|

|||||||||||||

|

Exercised

|

(

|

)

|

|

|||||||||||||

|

Outstanding at January 29, 2022

|

|

|

|

$

|

|

|||||||||||

|

Exercisable at January 29, 2022

|

|

|

|

$

|

|

|||||||||||

|

Fiscal Year Ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Risk-free

interest rate

|

|

%

|

|

%

|

|

%

|

||||||

|

Expected

dividend yield

|

|

|

|

|||||||||

|

Expected

life (years)

|

|

|

|

|||||||||

|

Expected

volatility

|

|

%

|

|

%

|

|

%

|

||||||

|

Number

of shares

|

Weighted

average

grant date

fair value

|

|||||||

|

Nonvested balance at February 2, 2019

|

|

$

|

|

|||||

|

Granted

|

|

|

||||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Vested

|

(

|

)

|

|

|||||

|

Nonvested balance at February 1, 2020

|

|

|

||||||

|

Granted

|

|

|

||||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Vested

|

(

|

)

|

|

|||||

|

Nonvested balance at January 30, 2021

|

|

|

||||||

|

Granted

|

|

|

||||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Vested

|

(

|

)

|

|

|||||

|

Nonvested balance at January 29, 2022

|

|

|

||||||

| (9) |

Employee Benefit Plans

|

| (10) |

Common Stock

|

| (11) |

Segment Reporting and Entity-Wide Information

|

|

Fiscal Year Ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Housewares

|

|

%

|

|

%

|

|

%

|

||||||

|

Bed and bath

|

|

|

|

|||||||||

|

Food

|

|

|

|

|||||||||

|

Floor coverings

|

|

|

|

|||||||||

|

Books and stationery

|

|

|

|

|||||||||

|

Electronics

|

|

|

|

|||||||||

|

Toys

|

|

|

|

|||||||||

|

Health and beauty aids

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

|

%

|

|

%

|

|

%

|

|||||||

| (12) |

Quarterly Results of Operations and Seasonality (Unaudited)

|

|

2021

|

2020

|

|||||||||||||||||||||||||||||||

|

Fourth

Quarter

|

Third

Quarter

|

Second

Quarter

|

First

Quarter

|

Fourth

Quarter

|

Third

Quarter

|

Second

Quarter

|

First

Quarter

|

|||||||||||||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||||||

|

Gross profit

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Net income

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Basic earnings per common share

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||||||

|

Diluted earnings per common share

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||||||

|

(13)

|

Transactions with Affiliated and Related Parties

|

| (14) |

Subsequent Event

|

|

January 29,

2022

|

January 30,

2021

|

|||||||

|

Assets

|

||||||||

|

Total current assets

|

$

|

|

$

|

|

||||

|

Long-term assets:

|

||||||||

|

Investment in subsidiaries

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

Liabilities and stockholders’ equity

|

||||||||

|

Total current liabilities

|

$

|

|

$

|

|

||||

|

Total long-term liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Stockholders’ equity:

|

||||||||

|

Common stock

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Treasury stock, at cost

|

(

|

)

|

(

|

)

|

||||

|

Total stockholders’ equity

|

|

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

Fiscal year ended

|

||||||||||||

|

January 29,

2022

|

January 30,

2021

|

February 1,

2020

|

||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of sales

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

|

|

|

|||||||||

|

Depreciation and amortization expenses

|

|

|

|

|||||||||

|

Pre-opening expenses

|

|

|

|

|||||||||

|

Operating income

|

|

|

|

|||||||||

|

Interest expense, net

|

|

|

|

|||||||||

|

Income before income taxes and equity in net income of subsidiaries

|

|

|

|

|||||||||

|

Income tax expense

|

|

|

|

|||||||||

|

Income before equity in net income of subsidiaries

|

|

|

|

|||||||||

|

Net income of subsidiaries

|

|

|

|

|||||||||

|

Net income

|

$

|

|

$

|

|

$

|

|

||||||

| 1. |

Basis of presentation

|

| 2. |

Guarantees and restrictions

|

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

| Item 9A. |

Controls and Procedures

|

|

|

/s/ KPMG LLP

|

|

Philadelphia, Pennsylvania

|

|

|

March 25, 2022

|

|

| Item 9B. |

Other Information

|

| Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

|

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

| Item 11. |

Executive Compensation

|

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence

|

| Item 14. |

Principal Accountant Fees and Services

|

| Item 15. |

Exhibits and Financial Statement Schedules

|

|

Exhibit

no.

|

Description

|

|

3.1†

|

Second Amended and Restated Certificate of Incorporation of Ollie’s Bargain Outlet Holdings, Inc. (incorporated by reference to Exhibit 3.1 to the Current Report filed on Form 8-K by the Company on July 21,

2015 (No. 001-37501)).

|

|

3.2†

|

Second Amended and Restated Bylaws of Ollie’s Bargain Outlet Holdings, Inc. (incorporated by reference to Exhibit 3.2 to the Current Report filed on Form 8-K by the Company on July 21, 2015 (No.

001-37501)).

|

|

3.3†

|

Third Amended and Restated Certificate of Incorporation of Ollie’s Bargain Outlet Holdings, Inc., as effective June 25, 2019 (incorporate by reference to Exhibit 3.1 to the Current Report filed on Form 8-K

by the Company on July 1, 2019 (No. 001-37501)).

|

|

3.4†

|

Fourth Amended and Restated Bylaws of Ollie’s Bargain Outlet Holdings, Inc., as effective June 25, 2019 (incorporated by reference to Exhibit 3.2 to the Current Report filed on Form 8-K by the Company on

July 1, 2019 (No. 001-37501)).

|

|

4.1†

|

Form of Certificate of Common Stock (incorporated by reference to Exhibit 4.1 to Amendment No. 3 to the Form S-1 Registration Statement filed by the Company on July 8, 2015 (No. 333-204942)).

|

|

4.2†

|

Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of 1934 (incorporated by reference to Exhibit 4.2 to the Form 10-K filed by the Company on March

24, 2021 (No. 001-37501)).

|

|

10.1†

|

Amended and Restated Credit Agreement, dated May 22, 2019, among Bargain Parent, Inc., OBO Ventures, Inc. and certain subsidiaries, as borrowers, Manufacturers and Traders Trust Company, as Administrative

Agent, and certain lenders party thereto (incorporated by reference to Exhibit 10.1 to the Current Report filed on Form 8-K by the Company on May 24, 2019 (No. 001-37501)).

|

|

10.2†

|

Amended and Restated Guarantee and Collateral Agreement, dated May 22, 2019, Bargain Parent, Inc., Ollie’s Holdings, Inc., OBO Ventures, Inc. and certain subsidiaries, in favor of Manufacturers and Trading

Trust Company, as Administrative Agent (incorporated by reference to Exhibit 10.2 to the Current Report filed on Form 8-K by the Company on May 24, 2019 (No. 001-37501)).

|

|

10.3†

|

Form of Director and Officer Indemnification Agreement (incorporated by reference to Exhibit 10.9.1 to Amendment No. 3 to the Form S-1 Registration Statement filed by the Company on July 8, 2015 (No.

333-204942)).

|

|

10.4†

|

Form of Sponsor Director Indemnification Agreement (incorporated by reference to Exhibit 10.9.2 to Amendment No. 3 to the Form S-1 Registration Statement filed by the Company on July 8, 2015 (No.

333-204942)).

|

|

10.5†

|

Employment Agreement, dated September 28, 2012, by and between Ollie’s Bargain Outlet, Inc. and John W. Swygert, Jr. (incorporated by reference to Exhibit 10.11 to the Form S-1 Registration Statement filed

by the Company on June 15, 2015 (No. 333-204942)).

|

|

10.6†

|

Employment Agreement, dated May 12, 2014, by and between Ollie’s Bargain Outlet, Inc. and Kevin McLain (incorporated by reference to Exhibit 10.13 to the Form S-1 Registration Statement filed by the Company

on June 15, 2015 (No. 333-204942)).

|

|

Exhibit

no.

|

Description

|

|

10.7†

|

Employment Agreement, dated November 18, 2015, by and between Ollie’s Bargain Outlet, Inc. and Jay Stasz (incorporated by reference to Exhibit 10.1 to the Quarterly Report filed on Form 10-Q by the Company

on December 10, 2015 (No. 001-37501)).

|

|

10.8†

|

Employment Agreement, dated May 3, 2021, by and between Ollie’s Bargain Outlet, Inc. and Eric van der Valk (incorporated by reference to Exhibit 10.1 to the Current Report filed on Form 8-K by the Company

on May 3, 2021 (No. 001-37501)).

|

|

10.9†

|

Employment Agreement, dated October 1, 2021, by and between Ollie’s Bargain Outlet, Inc. and James Comitale (incorporated by reference to Exhibit 10.1 to the Quarterly Report filed on Form 10-Q by the

Company on December 7, 2021 (No. 001-37501)).

|

|

Bargain Holdings Inc. 2012 Equity Incentive Plan (incorporated by reference to Exhibit 10.16 to the Form S-1 Registration Statement filed by the Company on June 15, 2015 (No. 333-204942)).

|

|

|

Form of Stock Option Agreement under Bargain Holdings, Inc. 2012 Equity Incentive Plan (incorporated by reference to Exhibit 10.17 to the Form S-1 Registration Statement filed by the Company on June 15,

2015 (No. 333-204942)).

|

|

|

Form of Stock Option Agreement under 2015 Equity Incentive Plan (incorporated by reference to Exhibit 10.23 to Amendment No. 2 to the Form S-1 Registration Statement filed by the Company on July 6, 2015

(No. 333- 204942)).

|

|

|

Amendment to Employment Agreement, dated July 15, 2015, by and between Ollie’s Bargain Outlet, Inc. and John W. Swygert, Jr (incorporated by reference to Exhibit 10.24 to the Form S-1 Registration Statement

filed by the Company on February 8, 2016 (No. 333-209420)).

|

|

|

Amendment to Employment Agreement, dated July 15, 2015, by and between Ollie’s Bargain Outlet, Inc. and Kevin McLain (incorporated by reference to Exhibit 10.26 to the Form S-1 Registration Statement filed

by the Company on February 8, 2016 (No. 333-209420)).

|

|

|