UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended February 3, 2018

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-37501

OLLIE’S BARGAIN OUTLET HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

80-0848819

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

6295 Allentown Boulevard

Suite 1. Harrisburg, Pennsylvania |

17112

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(717) 657-2300

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒

|

Accelerated filer o

|

Non-accelerated filer o

(Do not check if a smaller reporting company) |

Smaller reporting company o

|

Emerging growth company o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $2.2 billion as of July 29, 2017, the last business day of the registrant’s most recently completed second fiscal quarter. For purposes of this calculation only, the registrant has excluded all shares held in the treasury or that may be deemed to be beneficially owned by executive officers and directors of the registrant. By doing so, the registrant does not concede that such persons are affiliates for purposes of the federal securities laws.

The number of issued and outstanding shares of the registrant's common stock, $.001 par value, as of April 2, 2018 was 62,203,435.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for the 2018 Annual Meeting of Stockholders (the “Proxy Statement”), to be filed pursuant to Regulation 14A within 120 days after the end of the 2017 fiscal year, are incorporated by reference into Part III of this Form 10-K.

Cautionary note regarding forward-looking statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1955. Forward-looking statements can be identified by words such as “could,” “may,” “might,” “will,” “likely,” “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “continues,” “projects” and similar references to future periods, prospects, financial performance and industry outlook. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance, such as those contained in “Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this Annual Report on Form 10-K.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions, including recently enacted tax legislation, and the following:

| • | our failure to adequately procure and manage our inventory or anticipate consumer demand; |

| • | changes in consumer confidence and spending; |

| • | risks associated with intense competition; |

| • | our failure to open new profitable stores, or successfully enter new markets, on a timely basis or at all; |

| • | our failure to hire and retain key personnel and other qualified personnel; |

| • | our inability to obtain favorable lease terms for our properties; |

| • | the loss of, or disruption in the operations of, our centralized distribution centers; |

| • | fluctuations in comparable store sales and results of operations, including on a quarterly basis; |

| • | risks associated with our lack of operations in the growing online retail marketplace; |

| • | our inability to successfully implement our marketing, advertising and promotional efforts; |

| • | the seasonal nature of our business; |

| • | risks associated with the timely and effective deployment and protection of computer networks and other electronic systems; |

| • | the risks associated with doing business with international manufacturers; |

| • | changes in government regulations, procedures and requirements; and |

| • | our ability to service our indebtedness and to comply with our financial covenants. |

See “Item 1A, Risk Factors” for a further description of these and other factors. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this Annual Report on Form 10-K. Any forward-looking statement made by us in this annual report speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Ollie’s Bargain Outlet Holdings, Inc. operates on a fiscal year, consisting of the 52- or 53-week period ending on the Saturday nearer January 31 of the following calendar year. References to “2017,” “2016,” and “2015” represent the 2017 fiscal year ended February 3, 2018, the 2016 fiscal year ended January 28, 2017 and the 2015 fiscal year ended January 30, 2016, respectively. 2017 consisted of a 53-week period and each of 2016 and 2015 consisted of a 52-week period. References to “2018” refer to the fiscal year ending February 2, 2019, which consists of a 52-week period.

In this report, the terms “Ollie’s,” the “Company,” “we,” “us” or “our” mean Ollie’s Bargain Outlet Holdings, Inc. and its wholly-owned subsidiaries, unless the context indicates otherwise.

PART I

| Item 1. | Business |

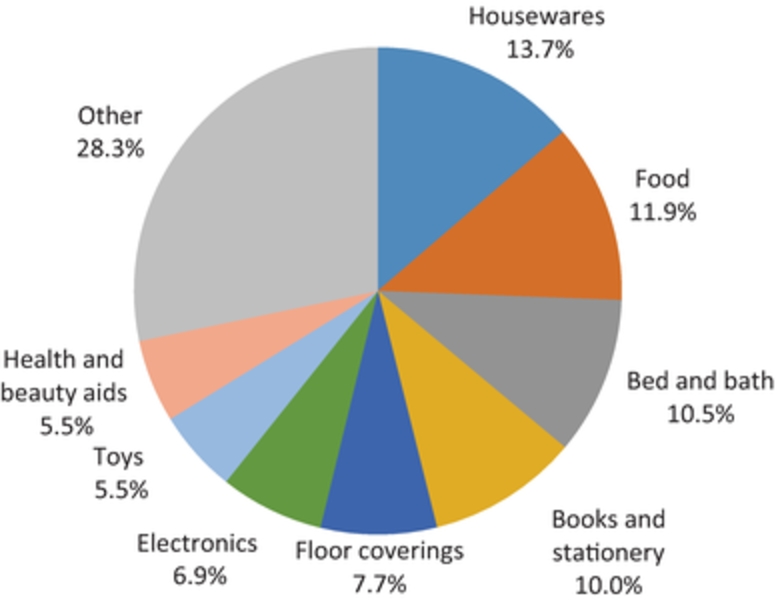

Our company

Ollie’s is a highly differentiated and fast-growing, extreme value retailer of brand name merchandise at drastically reduced prices. Known for our assortment of “Good Stuff Cheap,” we offer customers a broad selection of brand name products, including food, housewares, books and stationery, bed and bath, floor coverings, electronics and toys. Our differentiated go-to market strategy is characterized by a unique, fun and engaging treasure hunt shopping experience, compelling customer value proposition and witty, humorous in-store signage and advertising campaigns. These attributes have driven our rapid growth and strong and consistent store performance.

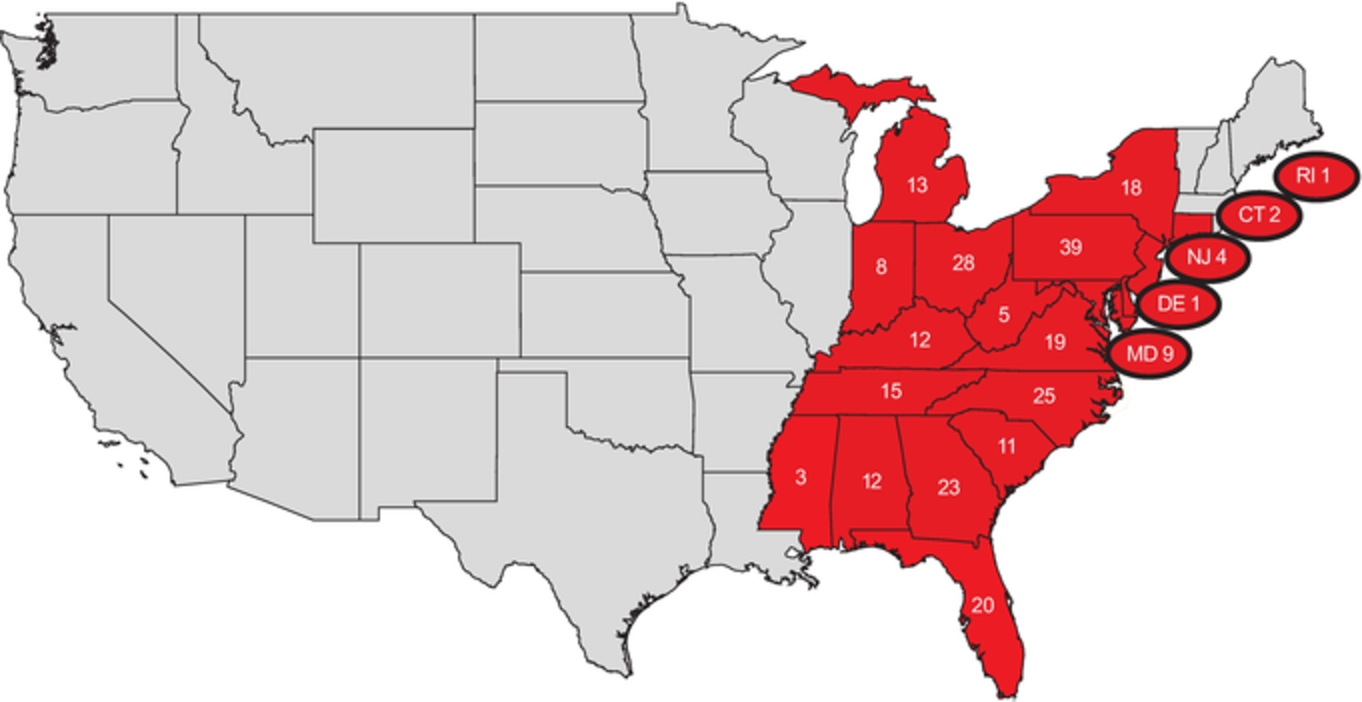

Mark Butler, our Chairman, President and Chief Executive Officer, co-founded Ollie’s in 1982, based on the idea that “everyone in America loves a bargain.” Since opening our first store in Mechanicsburg, PA, we have expanded throughout the Eastern portion of the United States. From the time Mr. Butler assumed his current position as President and Chief Executive Officer in 2003, we have grown from operating 28 stores in three states to 268 stores in 20 states as of February 3, 2018. Our no-frills, “semi-lovely” warehouse style stores average approximately 32,500 square feet and generate consistently strong financial returns across all vintages, geographic regions, population densities, demographic groups, real estate formats and regardless of any co-tenant. Our business model has resulted in positive financial performance during strong and weak economic cycles. We believe there is opportunity for more than 950 Ollie’s locations across the United States based on internal estimates and third party research conducted by Jeff Green Partners, a retail real estate feasibility consultant that provides market analysis and strategic planning and consulting services.

Our constantly changing merchandise assortment is procured by a highly experienced merchant team, who leverage deep, long-standing relationships with hundreds of major manufacturers, wholesalers, distributors, brokers and retailers. These relationships enable our merchant team to find and select only the best buys from a broad range of brand name and closeout product offerings and to pass drastically reduced prices along to our customers. As we grow, we believe our increased scale has provided and will continue to provide us with even greater access to brand name products as many large manufacturers favor large buyers capable of acquiring an entire deal. Our merchant team augments these deals with directly sourced products, including Ollie’s own private label brands and other products exclusive to Ollie’s.

Our business model has produced consistently strong growth and financial performance. From 2013 through 2017 (except as noted):

| • | Our store base expanded from 154 stores to 268 stores, a compound annual growth rate, or CAGR, of 14.8% and we entered six new states; |

| • | Comparable store sales grew at an average rate of 3.7% per year; |

| • | Net sales increased from $540.7 million to $1.077 billion, a CAGR of 18.8%; and |

| • | Net income increased from $19.5 million to $127.6 million. |

1

Our competitive strengths

We believe the following strengths differentiate us from our competitors and serve as the foundation for our current and future growth:

“Good Stuff Cheap”—Ever changing product assortment at drastically reduced prices. Our stores offer something for everyone across a diverse range of merchandise categories at prices up to 70% below department and fancy stores and up to 20-50% below mass market retailers. Our product assortment frequently changes based on the wide variety of deals available from the hundreds of brand name suppliers we have relationships with. We augment these opportunistic deals on brand name merchandise with directly-sourced unbranded products or those under our own private label brands such as Sarasota Breeze, Steelton Tools, American Way and Commonwealth Classics and exclusively licensed recognizable brands and celebrity names such as Magnavox, Marcus Samuelsson Signature Cookware, Josh Capon, Country Living, Popular Mechanics and Wells Lamont. Brand name and closeout merchandise represented approximately 70% and non-closeout goods and private label products collectively represented approximately 30% of our 2017 merchandise purchases. Our treasure hunt shopping environment and slogan “when it’s gone, it’s gone” help to instill a “shop now” sense of urgency that encourages frequent customer visits.

Highly experienced and disciplined merchant team. Our 16-member merchant team maintains strong, long-standing relationships with a diverse group of suppliers, allowing us to procure branded merchandise at compelling values for our customers. This team is led by five senior merchants, including Mark Butler, and has 100 combined years of experience at Ollie’s. We have been doing business with our top 15 suppliers for an average of 13 years, and no supplier accounted for more than 5% of our purchases during 2017. Our well-established relationships with our suppliers, together with our scale, buying power, financial credibility and responsiveness, often makes Ollie’s the first call for available deals. Our direct relationships with our suppliers have increased as we have grown and we continuously strive to broaden our supplier network. These factors provide us with increased access to goods, which enables us to be more selective in our deal-making and, we believe, helps us provide compelling value and assortment of goods to our customers and fuels our continued profitable growth.

Distinctive brand and engaging shopping experience. Our distinctive and often self-deprecating humor and highly recognizable caricatures are used in our stores, flyers, mailers, website and email campaigns. We attempt to make our customers laugh as we poke fun at ourselves and current events. We believe this approach creates a strong connection to our brand and sets us apart from other, more traditional retailers. Our “semi-lovely” stores feature these same brand attributes together with witty signage in a warehouse format that creates a fun, relaxed and engaging shopping environment. We believe that by disarming our customers by getting them to giggle a bit, they are more likely to look at and trust our products for what they are—extremely great bargains. We offer a “30-day no hard time guarantee” as a means to overcome any skepticism associated with our cheap prices and to build trust and loyalty, because if our customers are not happy, we are not happy. We welcome customers to bring back their merchandise within that timeframe for a “no hard time” full refund. We also make it easy for our customers to browse our stores by displaying our products on easily accessible fixtures and by keeping the stores clean and well-lit. We believe our humorous brand image, compelling values and welcoming stores resonate with our customers and define Ollie’s as a unique and comfortable destination shopping location.

Extremely loyal “Ollie’s Army” customer base. Our best customers are members of our Ollie’s Army customer loyalty program, which stands at 8.8 million members as of February 3, 2018. For 2017, approximately 70% of our sales were from Ollie’s Army members, and we grew our base of loyal members by 19.4% during 2017. Ollie’s Army members spend approximately 40% more per shopping trip at Ollie’s than non-members. We identify our target customer as “anyone between the ages of 25-70 with a wallet or a purse” seeking a great bargain.

Strong and consistent store model built for growth. We employ a proven new store model that generates strong cash flow, consistent financial results and attractive returns on investment regardless of the economic environment. Our highly flexible real estate approach has proven successful across all vintages, geographic regions, population densities, demographic groups, real estate formats and regardless of any co-tenant. New stores opened from 2012 to 2016 have generated an average of $4.0 million in net sales in their first 12 months of operations and produced an average payback period of approximately two years. We believe that our consistent store performance, strategically-located distribution centers and disciplined approach to site selection support the portability and predictability of our new unit growth strategy.

2

Highly experienced and passionate founder-led management team. Our leadership team, directed by our co-founder, Chairman, President and Chief Executive Officer, Mark Butler, has guided our organization through its expansion and positioned us for continued growth. Mark Butler has assembled a talented and dedicated team of executives with an average of 25 years of retail experience, including an average of 12 years of experience at Ollie’s. Our senior executives possess extensive experience across a broad range of disciplines, including merchandising, marketing, real estate, finance, store operations, supply chain management and information technology. We believe by encouraging equity ownership and fostering a strong team culture, we have aligned the interests of our executives with those of our stockholders. We believe these factors result in a cohesive team focused on sustainable long-term growth.

Our growth strategy

We plan to continue to drive growth in sales and profitability by executing on the following strategies:

Grow our store base. We believe our compelling value proposition and the success of our stores across a broad range of geographic regions, population densities and demographic groups create a significant opportunity to profitably increase our store count. Our internal estimates and third party research conducted by Jeff Green Partners indicate the potential for more than 950 national locations. Our new store real estate model is flexible and focuses predominately on second generation sites ranging in size from 25,000 to 35,000 square feet. We believe there is an ample supply of suitable low-cost, second generation real estate to allow us to infill within our existing markets as well as to expand into new, contiguous geographies. This approach leverages our distribution infrastructure, field management team, store management, marketing investments and brand awareness. We expect our new store openings to be the primary driver of our continued, consistent growth in sales and profitability.

Increase our offerings of great bargains. We will continue to enhance our supplier relationships and develop additional sources to acquire brand name and closeout products for our customers. Our strong sourcing relationships with leading major manufacturers and our purchasing scale provide us with significant opportunities to expand our ever changing assortment of brand name and closeout merchandise at extreme values. We plan to further invest in our merchandising team in order to expand and enhance our sourcing relationships and product categories, which we expect will drive shopping frequency and increase customer spending.

Leverage and expand Ollie’s Army. We intend to recruit new Ollie’s Army members and increase their frequency of store visits and spending by enhancing our distinctive, fun and recognizable marketing programs, building brand awareness, further rewarding member loyalty and utilizing more sophisticated data driven targeted marketing. We believe these strategies, coupled with a larger store base, will enable us to increase the amount of sales driven by loyal Ollie’s Army customers seeking the next great deal.

Segments

We operate in one reporting segment. See Note 12, “Segment Reporting,” to our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

Our merchandise

Strategy

We offer a highly differentiated, constantly evolving assortment of brand name merchandise across a broad range of categories at drastically reduced prices. Our ever changing assortment of “Good Stuff Cheap” includes brand name and closeout merchandise from leading manufacturers. We augment our brand name merchandise with opportunistic purchases of unbranded goods and our own domestic and direct-import private label brands in underpenetrated categories to further enhance the assortment of products that we offer. Brand name and closeout merchandise represented approximately 70% and non-closeout goods and private label products collectively represented approximately 30% of our 2017 merchandise purchases. We believe our compelling value proposition and the unique nature of our merchandise offerings have fostered our customer appeal across a variety of demographics and socioeconomic profiles.

Our warehouse format stores feature a broad number of categories including food, housewares, books and stationery, bed and bath, floor coverings, electronics and toys as well as other products including hardware, personal health care, candy, clothing, sporting goods, pet and lawn and garden products. We focus on buying cheap to sell cheap and source

3

products as unique buying opportunities present themselves. Our merchandise mix is designed to combine unique and brand name bargains at extremely attractive price points. This approach results in frequently changing product assortments and localized offerings which encourage shopper frequency and a “shop now” sense of urgency as customers hunt to discover the next deal.

The common element of our dynamic merchandise selection is the consistent delivery of great deals to our customers, with products offered at prices up to 70% below department stores and fancy stores and up to 20-50% below mass market retailers. Our product price tags allow customers to compare our competitor’s price against Ollie’s price to further highlight the savings they can realize by shopping at our stores.

Product mix

Examples of our product offerings include:

| • | Housewares: cooking utensils, dishes, appliances, plastic containers, cutlery, storage and garbage bags, detergents and cleaning supplies, cookware and glassware, fans and space heaters, candles, frames and giftware; |

| • | Food: packaged food including coffee, bottled non-carbonated beverages, salty snacks, condiments, sauces, spices, dry pasta, canned goods, cereal and cookies; |

| • | Bed and bath: household goods including bedding, towels, curtains and associated hardware; |

| • | Books and stationery: novels, children’s, how-to, business, cooking, inspirational and coffee table books along with DVDs, greeting cards and various office supplies and party goods; |

| • | Floor coverings: laminate flooring, commercial and residential carpeting, area rugs and floor mats; |

| • | Electronics: air conditioners, home electronics, cellular accessories and as seen on television; |

| • | Toys: dolls, action figures, puzzles, educational toys, board games and other related items; |

| • | Health and beauty aids: personal care, hair care, oral care, health and wellness, over-the-counter medicine, first aid, sun care, and personal grooming; and |

| • | Other: hardware, candy, clothing, sporting goods, pet products, luggage, automotive, seasonal, furniture, summer furniture and lawn & garden. |

The following chart shows the breakdown of our 2017 net sales by merchandise category:

4

Product categories

We maintain consistent average margins across our primary product categories described below.

Brand name and closeout merchandise (approximately 70% of merchandise purchases in 2017)

Our focus is to provide huge savings to our customers primarily through brand name products across a broad range of merchandise. Our experienced merchant team purchases deeply discounted, branded or closeout merchandise primarily from manufacturers, retailers, distributors and brokers. This merchandise includes overstocks, discontinued merchandise, package changes, cancelled orders, excess inventory and buybacks from retailers and major manufacturers.

Non-closeout goods/private label (approximately 30% of merchandise purchases in 2017)

We augment the breadth of our brand name merchandise with non-closeout and private label merchandise. In categories where the consumer is not as brand conscious, such as food, home textiles, and furniture, or when we may not be offering a current brand name merchandise deal, we will buy deeply discounted unbranded merchandise. These extreme value offerings are mixed in the stores with our brand name merchandise. We also have a variety of domestic and direct-import private label merchandise and exclusive products sold under brands such as Sarasota Breeze, Steelton Tools, American Way and Commonwealth Classic. These high quality products are developed in key categories such as housewares, and are designed to create brand-like excitement and complement our brand name merchandise. We also have licenses for private label products that use recognizable celebrity names like Marcus Samuelsson and Josh Capon, or brand names like Country Living, Magnavox, Popular Mechanics and Wells Lamont. We routinely evaluate the quality and condition of these private label goods to ensure that we are delivering our customer a high quality product at a great price.

Merchandise procurement and distribution

Our disciplined buying strategy and strict adherence to purchasing margins support our merchandising strategy of buying cheap to sell cheap.

Merchandising team

Our 16-member merchant team maintains strong, long-standing relationships with a diverse group of suppliers, allowing us to procure branded merchandise at compelling values for our customers. This team is led by five senior merchants, including Mark Butler, and has over 100 combined years of experience at Ollie’s. Our merchants specialize by department in order to build category expertise, in-depth knowledge and sourcing relationships. We believe our buying approach, coupled with long-standing and newly formed relationships, enable us to find the best deals from major manufacturers and pass drastically reduced prices along to our customers. We plan to further invest in and grow our merchandising team in order to expand and enhance our sourcing relationships and product categories, which we expect will drive shopping frequency and increase customer spending.

Merchandise procurement

We believe that our strong sourcing capabilities are the result of our tenured merchant team’s ability to leverage deep, long-standing relationships with hundreds of manufacturers, wholesalers, brokers, retailers and other suppliers. Our merchants maintain direct relationships with brand manufacturers, regularly attend major tradeshows and travel the world to source extreme value offerings across a broad assortment of product categories. We are an ideal partner to major manufacturers because our merchants are experienced and empowered to make quick decisions. Each opportunity is unique and our merchants negotiate directly with the supplier to lock in a particular deal. Our ability to select the most attractive opportunistic purchases from a growing number of available deals enables us to provide a wide assortment of goods to our customers at great bargain prices.

We source from over 1,100 suppliers, and no supplier accounted for more than 5% of our purchases during 2017. Our dedication to building strong relationships with suppliers is evidenced by a 13-year average relationship with our top 15 suppliers. As we continue to grow, we believe our increased scale will provide us with even greater access to brand name products since many major manufacturers seek a single buyer to acquire the entire deal.

Distribution and logistics

We have made significant investments in our distribution network and personnel to support our store growth plan. Currently, we distribute over 90% of our merchandise from our distribution centers in York, PA (603,000 square feet)

5

and Commerce, GA (962,280 square feet). In order to minimize the amount of time our retail stores devote to inventory management, our merchandise is seeded with price tickets and labeled with a bar code for shipping.

Our stores generally receive shipments from our distribution centers two to three times a week, depending on the season and specific store size and sales volume. We utilize independent third party freight carriers and, on average, load and ship between 70 and 80 trucks per day.

We believe our existing distribution capabilities will support our anticipated store growth of between 350 to 400 stores over the next several years.

Our stores

As of February 3, 2018, we operated 268 stores, averaging approximately 32,500 square feet, across 20 contiguous states in the Eastern portion of the United States. Our highly flexible real estate approach has proven successful across all vintages, geographic regions, population densities, demographic groups, real estate formats and regardless of any co-tenant. Our business model has resulted in positive financial performance during strong and weak economic cycles. We have successfully opened stores in six new states since 2013, highlighting the portability of our new store model. The following map shows the number of stores in each of the states in which we operated as of February 3, 2018:

Store design and layout

All of our warehouse format stores incorporate the same philosophy: no-frills, bright, “semi-lovely” stores and a fun, treasure hunt shopping experience. We present our stores as “semi-lovely” to differentiate our stores from other traditional retailers, and to minimize operating and build-out costs. Our stores also welcome our customers with vibrant and colorful caricatures together with witty signage. We attempt to make our customers laugh as we poke fun at ourselves and current events. We believe that by disarming our customers by getting them to giggle a bit, they are able to look at and trust our products for what they are—extremely great bargains.

We believe the store layout and merchandising strategy help to instill a “shop now” sense of urgency and increase frequency of customer visits as customers never know what they might come across in our stores. We make it easy for our customers to browse our stores by displaying our frequently changing assortment of products on rolling tables, pallets and other display fixtures. Our store team leaders are responsible for maintaining our treasure hunt shopping experience, keeping the stores clean and well-lit and ensuring our customers are engaged. We believe our humorous brand image, compelling values and welcoming stores resonate with our customers and define Ollie’s as a unique and comfortable destination shopping location.

6

Expansion opportunities and site selection

We believe we can profitably expand our store count on a national scale to more than 950 locations based on internal estimates and third party research conducted by Jeff Green Partners. Our disciplined real estate strategy focuses on infilling existing geographies as well as expanding into contiguous markets in order to leverage our distribution infrastructure, field management team, store management, marketing investments and brand awareness.

We maintain a pipeline of real estate sites that have been approved by our real estate committee. Our recent store growth is summarized in the following table:

|

|

2017

|

2016

|

2015

|

||||||

|

Stores open at beginning of period

|

|

234

|

|

|

203

|

|

|

176

|

|

|

Stores opened

|

|

34

|

|

|

31

|

|

|

28

|

|

|

Stores closed

|

|

—

|

|

|

—

|

|

|

(1

|

)

|

|

Stores open at end of period

|

|

268

|

|

|

234

|

|

|

203

|

|

We utilize a rigorous site selection and real estate approval process in order to leverage our infrastructure, marketing investments and brand awareness. Members of our real estate team spend considerable time evaluating prospective sites before bringing a new lease proposal to our real estate committee, which is comprised of senior management and executive officers. Our flexible store layout allows us to quickly take over a variety of low-cost, second generation sites, including former big box retail and grocery stores.

We believe there is an ample supply of suitable low-cost, second generation real estate allowing us to infill within our existing markets as well as to expand into new, contiguous geographies. By focusing on key characteristics such as proximity to the nearest Ollie’s store, ability to leverage distribution infrastructure, visibility, traffic counts, population densities of at least 50,000 people within ten miles and low rent per square foot, we have developed a new store real estate model that has consistently delivered attractive returns on invested capital.

Our strong unit growth is supported by our predictable and compelling new store model. We target a store size between 25,000 to 35,000 square feet and an average initial cash investment of approximately $1.0 million, which includes store fixtures and equipment, store-level and distribution center inventory (net of payables) and pre-opening expenses. With our relatively low investment costs and strong new store opening performance, we target new store sales of $3.9 million. New stores opened from 2012 to 2016 have generated an average of $4.0 million in net sales in their first full year of operations and produced an average payback period of approximately two years. We believe that our consistent store performance, corporate infrastructure, including our two distribution centers, and disciplined approach to site selection support the portability and predictability of our new unit growth strategy.

Store-level management and training

Our Senior Vice President of Store Operations oversees all store activities. Our stores are grouped into three regions, divided generally along geographic lines. We employ three regional directors, who have responsibility for the day-to-day operations of the stores in their region. Reporting to the regional directors are 26 district team leaders who each manage a group of stores in their markets. At the store level, the leadership team consists of a store team leader (manager), co-team leader (first level assistant manager) and assistant team leader (second level assistant manager). Supervisors oversee specific areas within each store.

Each store team leader is responsible for the daily operations of the store, including the processing of merchandise to the sales floor and the presentation of goods throughout the store. Store team leaders are trained to maintain a clean and appealing store environment for our customers. Store team leaders and co-team leaders are also responsible for the hiring, training and development of associates. While each store’s sales volume is reviewed to determine the optimal store-level staffing requirements, our typical store employs 16 to 30 associates. Part-time associates generally comprise approximately 60% of the associates in a typical store, with approximately 40% being full-time associates.

We work tirelessly to hire talented people, to improve our ability to assess talent during the interview process and to regularly train those individuals at Ollie’s who are responsible for interviewing candidates. We also devote substantial resources to training our new managers through our Team Leader Training Program. This program operates at 21 designated training stores located across our footprint. It provides an in-depth review of our operations, including merchandising, policies and procedures, asset protection and safety, and human resources. Part-time associates receive structured training as part of their onboarding throughout their first five scheduled shifts.

7

Our Ollie’s Leadership Institute (“OLI”) is a program that is used to equip associates with the ability to advance their career. Each OLI participant receives an individual development plan, designed to prepare him or her for his or her next level position. Our strong growth provides opportunities for advancement and OLI is focused on preparing eligible candidates for these positions. OLI is our preferred source for new supervisors and team leaders as “home grown” talent has proven to be successful. Since the program was implemented in 2009, our internal promotion rate has increased from approximately 18% to approximately 45% in 2017. We believe our training and development programs help create a positive work environment and result in stores that operate at a high level.

Marketing and advertising

Our marketing and advertising campaigns feature colorful caricatures and witty sayings in order to make our customers laugh. We believe that by disarming our customers by getting them to giggle a bit, they are able to look at and trust our products for what they are—extremely great bargains. Our distinctive and often self-deprecating humor and highly recognizable caricatures are used in all of our stores, flyers and advertising campaigns.

We tailor our marketing mix and strategy for each market, deal or promotion. We primarily use the following forms of marketing and advertising:

| • | Print and direct mail: During 2017, we distributed over 500 million highly recognizable flyers. Our flyers are distributed 21 times per year and serve as the foundation of our marketing strategy. They highlight current deals to create shopping urgency and drive traffic and increase frequency of store visits; |

| • | Radio and television: We selectively utilize creative radio and television advertising campaigns in targeted markets at certain times of the year, particularly during the holiday sales season, to create brand awareness and support new store openings; |

| • | Sports marketing, charity and community events: We sponsor professional and amateur athletics including Major League Baseball, NASCAR, National Hockey League, NCAA basketball and football, as well as various local athletic programs. Additionally, we are dedicated to maintaining a visible presence in the communities in which our stores are located through the sponsorship of charitable organizations such as the Children’s Miracle Network, Cal Ripken, Sr. Foundation and the Kevin Harvick Foundation. We believe these sponsorships promote our brand, underscore our values and build a sense of community; and |

| • | Digital marketing and social media: We maintain an active web presence and promote our brand through our website and social media outlets. We also utilize targeted email marketing to highlight our latest brand name offerings and drive traffic to our stores. |

Ollie’s Army

Our customer loyalty program, Ollie’s Army, stands at 8.8 million members as of February 3, 2018, an increase of 19.4% from 2016. In 2017, Ollie’s Army members accounted for approximately 70% of net sales and spent approximately 40% more per shopping trip, on average, than non-members. Consistent with our marketing strategy, we engage new and existing Ollie’s Army members through the use of witty phrases and signage; examples include “Enlist in Ollie’s Army today,” “become one of the few, the cheap, the proud” and “Ollie’s Army Boot Camp…all enlistees will receive 15% off their next purchase.” In addition, for every $250 Ollie’s Army members spend, they receive a coupon for 10% off their next entire purchase. Historically, Ollie’s Army members have demonstrated double-digit redemption rates for promotional activities exclusive to Ollie’s Army members, such as our Valentine’s, Boot Camp and Buzzard 15% off mailers, as well as Ollie’s Army Night, a special annual one-day after-hours sale in December for Ollie’s Army members. We expect to continue leveraging the data gathered from our proprietary database of Ollie’s Army members to better segment and target our marketing initiatives and increase shopping frequency.

Competition

We compete with a diverse group of retailers, including discount, closeout, mass merchant, department, grocery, drug, convenience, hardware, variety, online and other specialty stores.

The principal basis on which we compete against other retailers is by offering an ever changing selection of brand name products at compelling price points in an exciting shopping environment. Accordingly, we compete against a fragmented group of retailers, wholesalers and jobbers to acquire merchandise for sale in our stores.

8

Our established relationships with our suppliers, coupled with our scale, associated buying power, financial credibility and responsiveness, often makes Ollie’s the first call for available deals. Our direct relationships with suppliers have increased as we have grown, and we continuously strive to broaden our supplier network.

Trademarks and other intellectual property

We own multiple state and federally registered trademarks related to our brand, including “Ollie’s,” “Ollie’s Bargain Outlet,” “Good Stuff Cheap,” “Ollie’s Army,” “Real Brands Real Cheap!” and “Real Brands! Real Bargains!” In addition, we maintain a trademark for the image of Ollie, the face of our company. We also own registered trademarks for many of our private labels such as “Sarasota Breeze,” “Steelton Tools,” “American Way” and “Commonwealth Classics,” among others. We are also in the process of prosecuting several other trademarks, both for private label goods and to further identify our services. We enter into trademark license agreements where necessary, which may include our private label offerings, such as the Magnavox products and Marcus Samuelsson Signature Cookware available in our stores. Our trademark registrations have various expiration dates; however, assuming that the trademark registrations are properly renewed, they have a perpetual duration. We also own several domain names, including www.ollies.us, www.olliesbargainoutlet.com, www.olliesarmy.com, www.ollies.cheap, www.sarasotabreeze.com and www.olliesmail.com, and unregistered copyrights in our website content. We attempt to obtain registration of our trademarks as practical and pursue infringement of those marks when appropriate.

Technology

Our management information systems provide a full range of business process assistance and timely information to support our merchandising team and strategy, management of multiple distribution centers, stores and operations, and financial reporting. We believe our current systems provide us with operational efficiencies, scalability, management control and timely reporting that allow us to identify and respond to merchandising and operating trends in our business. We use a combination of internal and external resources to support store point-of-sale, merchandise acquisition and distribution, inventory management, financial reporting, real estate and administrative functions. We continuously assess ways to maximize productivity and efficiency, as well as evaluate opportunities to further enhance our existing systems. Our existing systems are scalable to support future growth.

Government regulation

We are subject to labor and employment laws, including minimum wage requirements, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers and/or govern product standards, the promotion and sale of merchandise and the operation of stores and warehouse facilities. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

We source a portion of our products from outside the United States. The U.S. Foreign Corrupt Practices Act and other similar anti-bribery and anti-kickback laws and regulations generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Our policies and our vendor compliance agreements mandate compliance with applicable law, including these laws and regulations.

Insurance

We maintain third-party insurance for a number of risk management activities, including workers’ compensation, general liability, commercial property, ocean marine, cyber, director and officer and employee benefit related insurance policies. We evaluate our insurance requirements on an ongoing basis to ensure we maintain adequate levels of coverage.

Employees

As of February 3, 2018, we employed more than 6,700 associates, approximately 3,000 of whom were full-time and approximately 3,700 of whom were part-time. Of our total associate base, approximately 140 were based at our store support center in Harrisburg, PA. Our distribution centers employ approximately 500 associates. The remaining were store and field associates. The number of associates in a fiscal year fluctuates depending on the business needs at different times of the year. In 2017, we employed approximately 2,300 additional seasonal associates during our peak holiday sales season. We have a long history of maintaining a culture that embraces our associates. We take pride in providing a great work environment and strong growth opportunities for our associates. None of our associates belong to a union or are party to any collective bargaining or similar agreement.

9

Seasonality

Our business is seasonal in nature and demand is generally the highest in our fourth fiscal quarter due to the holiday sales season. To prepare for the holiday sales season, we must order and keep in stock more merchandise than we carry during other times of the year and generally engage in additional marketing efforts. We expect inventory levels, along with accounts payable and accrued expenses, to reach their highest levels in our third and fourth fiscal quarters in anticipation of increased net sales during the holiday sales season. As a result of this seasonality, and generally because of variation in consumer spending habits, we experience fluctuations in net sales and working capital requirements during the year. Because we offer a broad selection of merchandise at extreme values, we believe we are less impacted than other retailers by economic cycles which correspond with declines in general consumer spending habits and we believe we still benefit from periods of increased consumer spending.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act are available free of charge on our website, www.ollies.us, as soon as reasonably practicable after the electronic filing of such reports with the Securities and Exchange Commission (“SEC”).

| Item 1A. | Risk Factors |

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as other information in this Annual Report on Form 10-K, before deciding whether to invest in the shares of our common stock. The occurrence of any of the events described below could have a material adverse effect on our business, financial condition or results of operations. In the case of such an event, the trading price of our common stock may decline and you may lose all or part of your investment.

Risks Related to our Business and Industry

We may not be able to execute our opportunistic buying, adequately manage our supply of inventory or anticipate customer demand, which could have a material adverse effect on our business, financial condition and results of operations.

Our business is dependent on our ability to strategically source a sufficient volume and variety of brand name merchandise at opportunistic pricing. We do not have significant control over the supply, design, function, cost or availability of many of the products that we offer for sale in our stores. Additionally, because a substantial amount of our store products are sourced by us from suppliers on a closeout basis or with significantly reduced prices for specific reasons, we are not always able to purchase specific merchandise on a recurring basis. We do not have long-term contracts with our suppliers and, therefore, we have no contractual assurances of pricing or access to products and any supplier could discontinue sales to us at any time or offer us less favorable terms on future transactions. We generally make individual purchase decisions for products that become available, and these purchases may be for large quantities that we may not be able to sell on a timely or cost-effective basis. Due to economic uncertainties, some of our suppliers may cease operations or may otherwise become unable to continue supplying discounted or closeout merchandise on terms or in quantities acceptable to us.

We also compete with other retailers, wholesalers and jobbers for discounted or closeout merchandise to sell in our stores. Although we work with a range of suppliers, to the extent that certain of our suppliers are better able to manage their inventory levels and reduce the amount of their excess inventory, the amount of discount or closeout merchandise available to us could also be materially reduced, potentially compromising profit margin goals for procured merchandise.

Shortages or disruptions in the availability of brand name or unbranded products of a quality acceptable to our customers and us could have a material adverse effect on our business, financial condition and results of operations and also may result in customer dissatisfaction. In addition, we may significantly overstock products that prove to be undesirable and be forced to take significant markdowns. We cannot ensure that our merchant team will continue to identify the appropriate customer demand and take advantage of appropriate buying opportunities, which could have a material adverse effect on our business, financial condition and results of operations.

10

Our ability to generate revenues is dependent on consumer confidence and spending, which may be subject to factors beyond our control, including changes in economic and political conditions.

The success of our business depends, to a significant extent, on the level of consumer confidence and spending. A number of factors beyond our control affect the level of customer confidence and spending on merchandise that we offer, including, among other things:

| • | energy and gasoline prices; |

| • | disposable income of our customers; |

| • | discounts, promotions and merchandise offered by our competitors; |

| • | personal debt levels of our customers; |

| • | negative reports and publicity about the discount retail industry; |

| • | unemployment levels; |

| • | minimum wages; |

| • | general economic and industry conditions; |

| • | food prices; |

| • | interest rates; |

| • | the state of the housing market; |

| • | customer confidence in future economic conditions; |

| • | fluctuations in the financial markets; |

| • | tax rates and policies; |

| • | outbreak of viruses or widespread illness; and |

| • | natural disasters, war, terrorism and other hostilities. |

Reduced customer confidence and spending cut backs may result in reduced demand for our merchandise, including discretionary items, and may force us to take inventory markdowns. Reduced demand also may require increased selling and promotional expenses. Adverse economic conditions and any related decrease in customer demand for our merchandise could have a material adverse effect on our business, financial condition and results of operations.

Many of the factors identified above also affect commodity rates, transportation costs, costs of labor, insurance and healthcare, the strength of the U.S. dollar, lease costs, measures that create barriers to or increase the costs associated with international trade, changes in other laws and regulations and other economic factors, all of which may impact our cost of goods sold and our selling, general and administrative expenses, which could have a material adverse effect on our business, financial condition and results of operations.

We face intense competition, which could limit our growth opportunities and adversely impact our financial performance.

We compete with a highly fragmented group of competitors, including discount, closeout, mass merchant, department, grocery, drug, convenience, hardware, variety, online and other specialty stores. We compete with these retailers with respect to price, store location, supply and quality of merchandise, assortment and presentation and customer service. This competitive environment subjects us to the risk of an adverse impact to our financial performance because of the lower prices, and thus the lower margins, that are required to maintain our competitive position. A number of different competitive factors outside of our control could impact our ability to compete effectively, including:

| • | entry of new competitors in our markets; |

| • | increased operational efficiencies of competitors; |

| • | online retail capabilities of our competitors; |

11

| • | competitive pricing strategies, including deep discount pricing by a broad range of retailers during periods of poor customer confidence, low discretionary income or economic uncertainty; |

| • | continued and prolonged promotional activity by our competitors; |

| • | liquidation sales by our competitors that have filed or may file in the future for bankruptcy; |

| • | geographic expansion by competitors into markets in which we currently operate; and |

| • | adoption by existing competitors of innovative store formats or retail sales methods. |

A number of our competitors also have greater financial and operational resources, greater brand recognition, longer operating histories and broader geographic presences than us. We remain vulnerable to the marketing power and high level of customer recognition of these larger competitors and to the risk that these or other competitors could attract our customer base, including, but not limited to the members of Ollie’s Army.

In addition, if any of our competitors were to consolidate their operations, such consolidation may result in competitors with greatly improved financial resources, improved access to merchandise, greater market penetration and other improvements in their competitive positions, as well as result in the provision of a wider variety of products and services at competitive prices by these consolidated companies, which could adversely affect our financial performance.

We cannot guarantee that we will continue to be able to successfully compete against either existing or future competitors. Our inability to respond effectively to competitive pressures, improved performance by our competitors and changes in the retail markets could result in lost market share and have a material adverse effect on our business, financial condition and results of operations.

If we fail to open new profitable stores on a timely basis or successfully enter new markets, our financial performance could be materially adversely affected.

Our primary growth strategy is to open new profitable stores and expand our operations into new geographic regions. We opened 34 and 31 new stores in 2017 and 2016, respectively, as we continue to backfill in existing markets and expand into contiguous geographies. Our ability to timely open new stores depends in part on several factors, including the availability of attractive rents and store locations; the absence of occupancy delays; the ability to negotiate and enter into leases with acceptable terms; our ability to obtain permits and licenses; our ability to hire and train new personnel, especially store managers, in a cost effective manner; our ability to adapt our distribution and other operational and management systems to a changing network of stores; the availability of capital funding for expansion; our ability to respond to demographic shifts in areas where our stores are located and general economic conditions.

We may not anticipate all of the challenges imposed by the expansion of our operations into new geographic markets. Some new stores may be located in areas with different competitive and market conditions, customer tastes and discretionary spending patterns than our existing markets. We may face a higher cost of entry, alternative customer demands, reduced brand recognition and minimal operating experience in these areas. Although we are extremely sensitive to cannibalizing existing stores, opening new stores in our established markets may also result in inadvertent oversaturation, sales volume transfer from existing stores to new stores and reduced comparable store sales, thus adversely affecting our overall financial performance. We may not manage our expansion effectively, and our failure to achieve or properly execute our expansion plans could limit our growth or have a material adverse effect on our business, financial condition and results of operations.

We may not be able to retain the loyalty of our customers, particularly Ollie’s Army members, which could have a material adverse effect on our business, financial condition and results of operations.

We depend on our loyal customer base, particularly members of Ollie’s Army, for our consistent sales and sales growth. Competition for customers has intensified as competitors have moved into, or increased their presence in, our geographic markets and from the use of mobile and web-based technology that facilitates online shopping and real-time product and price comparisons. We expect this competition to continue to increase. Our competitors may be able to offer consumers promotions or loyalty program incentives that could attract Ollie’s Army members or divide their loyalty among several retailers. If we are unable to retain the loyalty of our customers, our net sales could decrease and we may not be able to grow our store base as planned, which could have a material adverse effect on our business, financial condition and results of operations.

12

Our success depends on our executive officers, our merchant team and other key personnel. If we lose key personnel or are unable to hire additional qualified personnel, it could have a material adverse effect on our business, financial condition and results of operations.

Our future success depends to a significant degree on the skills, experience and efforts of our executive officers, our merchant team and other key personnel. The unexpected loss of services of any of our executive officers, particularly Mark Butler, our co-founder, Chairman, President and Chief Executive Officer, or senior members of our merchant team could materially adversely affect our business and operations. Competition for skilled and experienced management in the retail industry is intense, and our future success will also depend on our ability to attract and retain qualified personnel, including our merchant team which is responsible for purchasing and negotiating the terms of our merchandise. Failure to attract and retain new qualified personnel could have a material adverse effect on our business, financial condition and results of operations.

Factors such as inflation, cost increases and energy prices could have a material adverse effect on our business, financial condition and results of operations.

Future increases in costs, such as the cost of merchandise, shipping rates, freight costs and store occupancy costs, may reduce our profitability, given our pricing model. These cost increases may be the result of inflationary pressures which could further reduce our sales or profitability. Increases in other operating costs, including changes in energy prices, wage rates and lease and utility costs, may increase our cost of goods sold or selling, general and administrative expenses. Our low price model and competitive pressures in our industry may have the effect of inhibiting our ability to reflect these increased costs in the prices of our products and, therefore, reduce our profitability and have a material adverse effect on our business, financial condition and results of operations.

If we are not successful in managing our inventory balances, it could have a material adverse effect on our business, financial condition and results of operations.

Our inventory balance represented 70.7% of our total assets exclusive of goodwill, trade name and other intangible assets, net, as of February 3, 2018. Efficient inventory management is a key component of our profitability and ability to generate revenue. To be successful, we must maintain sufficient inventory levels and an appropriate product mix to meet our customers’ demands without allowing those levels to increase to such an extent that the costs to store and hold the goods adversely impact our results of operations. If our buying decisions do not accurately correspond to customer preferences, if we inappropriately price products or if our expectations about customer spending levels are inaccurate, we may have to take unanticipated markdowns to dispose of any excess inventory, which could have a material adverse effect on our business, financial condition and results of operations. We continue to focus on ways to reduce these risks, but we cannot ensure that we will be successful in our inventory management. If we are not successful in managing our inventory balances, it could have a material adverse effect on our business, financial condition and results of operations.

We may not be successful in the implementation of our long-term business strategy, which could materially adversely affect our business, results of operations, cash flows and financial condition.

Our success depends, to a significant degree, on our ability to successfully implement our long-term business strategy. Our ability to successfully implement our business strategy depends on a significant number of factors, including, but not limited to, our ability to:

| • | expand our store base and increase our customers; |

| • | access an adequate supply of quality brand name and closeout merchandise from suppliers at competitive prices; |

| • | achieve profitable sales and to make adjustments as market conditions change; |

| • | foster customer acceptance of our marketing and merchandise strategies; |

| • | respond to competitive pressures in our industry; |

| • | attract and retain store-level and management-level associates; |

| • | properly respond to the dynamics and demands of our market; |

| • | maintain our relationships with our suppliers and customers; |

13

| • | achieve positive cash flow, particularly during our peak inventory build-ups in advance of the holiday sales season; and |

| • | adapt to any revised or new strategic initiatives and organizational structure. |

Any failure to achieve any or all of our business strategies could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to attract, train and retain highly qualified managerial personnel and sales associates in our stores and our distribution centers, our sales, financial performance and business operations may be materially adversely affected.

We focus on providing our customers with a memorable and engaging shopping experience. To grow our operations and meet the needs and expectations of our customers, we must attract, train and retain a large number of highly qualified store management personnel and sales associates, while controlling labor costs. Our ability to control labor costs is subject to numerous external factors, including competition for and availability of qualified personnel in a given market, unemployment levels within those markets, governmental bodies such as the Equal Employment Opportunity Commission and the National Labor Relations Board, prevailing wage rates, minimum wage laws, the impact of legislation governing labor and employee relations or benefits, such as the Affordable Care Act, health insurance costs and our ability to maintain good relations with our associates. We compete with other retail businesses for many of our store management personnel and sales associates in hourly and part-time positions. These positions have had historically high turnover rates, which can lead to increased training and retention costs. We also rely on associates in our distribution centers to ensure the efficient processing and delivery of products from our suppliers to our stores. If we are unable to attract and retain quality sales associates and management personnel, it could have a material adverse effect on our business, financial condition and results of operations.

Our business requires that we lease substantial amounts of space and there can be no assurance that we will be able to continue to lease space on terms as favorable as the leases negotiated in the past.

Other than one store location, which is owned, we lease our store locations, our corporate headquarters and our distribution facilities in York, PA and Commerce, GA. Our stores are leased from third parties, with typical initial lease terms of five to ten years with options to renew for two to four successive five-year periods. We believe that we have been able to negotiate favorable rental rates over the last few years due in large part to the general state of the economy, the increased availability of vacant big box retail sites and our careful identification of favorable lease opportunities. While we will continue to seek out advantageous lease opportunities, there is no guarantee that we will continue to be able to find low-cost second generation sites or obtain favorable lease terms. Many of our lease agreements have defined escalating rent provisions over the initial term and any extensions. Increases in our occupancy costs and difficulty in identifying economically suitable new store locations could have significant negative consequences, which include:

| • | requiring that a greater portion of our available cash be applied to pay our rental obligations, thus reducing cash available for other purposes and reducing profitability; |

| • | increasing our vulnerability to general adverse economic and industry conditions; and |

| • | limiting our flexibility in planning for, or reacting to changes in, our business or in the industry in which we compete. |

We depend on cash flow from operations to pay our lease expenses and to fulfill our other cash needs. If our business does not generate sufficient cash flow from operating activities to fund these expenses and needs and sufficient funds are not otherwise available to us, we may not be able to service our lease expenses, grow our business, respond to competitive challenges or fund our other liquidity and capital needs, which could harm our business. Additional sites that we lease may be subject to long-term non-cancelable leases if we are unable to negotiate our current standard lease terms. If an existing or future store is not profitable, and we decide to close it, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. Moreover, even if a lease has an early cancellation clause, we may not satisfy the contractual requirements for early cancellation under that lease. In addition, if we are not able to enter into new leases or renew existing leases on terms acceptable to us, this could have a material adverse effect on our business, financial condition and results of operations.

14

The loss of, or disruption in the operations of, our centralized distribution centers could materially adversely affect our business and operations.

With few exceptions, inventory is shipped directly from suppliers to our two distribution centers in York, PA, and Commerce, GA, where the inventory is then processed, sorted and shipped to our stores. We depend in large part on the orderly operation of this receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective management of our distribution centers. Increases in transportation costs (including increases in fuel costs), supplier-side delays, reductions in the capacity of carriers, changes in shipping companies, labor strikes or shortages in the transportation industry and unexpected delivery interruptions also have the potential to derail our orderly distribution process. We also may not anticipate changing demands on our distribution system. In addition, events beyond our control, such as disruptions in operations due to fire or other catastrophic events or labor disagreements, may result in delays in the delivery of merchandise to our stores. While we maintain business interruption insurance, in the event our distribution centers are shut down for any reason, such insurance may not be sufficient, and any related insurance proceeds may not be timely paid to us. In addition, our new store locations receiving shipments may be further away from our distribution centers, which may increase transportation costs and may create transportation scheduling strains. Any repeated, intermittent, or long-term disruption in the operations of our distribution centers would hinder our ability to provide merchandise to our stores and could have a material adverse effect on our business, financial condition and results of operations.

Our new store growth is dependent on our ability to successfully expand our distribution network capacity, and failure to achieve or sustain these plans could affect our performance adversely.

We maintain distribution centers in York, PA and Commerce, GA to support our existing stores and our growth objectives. We continuously assess ways to maximize the productivity and efficiency of our existing distribution facilities and evaluate opportunities for additional distribution centers. Should we open additional distribution centers, delays in such openings could adversely affect our future operations by slowing store growth, which could, in turn, reduce sales growth. In addition, any distribution-related construction or expansion projects entail risks which could cause delays and cost overruns, such as shortages of materials, shortages of skilled labor or work stoppages, unforeseen construction, scheduling, engineering, environmental or geological problems, weather interference, fires or other casualty losses and unanticipated cost increases. The completion date and ultimate cost of future projects could differ significantly from initial expectations due to construction-related or other reasons. We cannot guarantee that any project will be completed on time or within established budgets.

We do not compete in the growing online retail marketplace, which could have a material adverse effect on our business, financial condition and results of operations.

Our long-term business strategy does not presently include the development of online retailing capabilities. To the extent that we implement online operations, we would incur substantial expenses related to such activities and be exposed to additional cybersecurity risks. Further, any development of an online retail marketplace is a complex undertaking, and there is no guarantee that any resources we apply to this effort will result in increased revenues or operating performance. However, with the growing acceptance of online shopping and the increased proliferation of mobile devices, competition from other retailers in the online retail marketplace is expected to increase. Certain of our competitors and a number of pure online retailers have established robust online operations. Increased competition from online retailers and our lack of an online retail presence may reduce our customers’ desire to purchase goods from us and could have a material adverse effect on our business, financial condition and results of operations.

Our success depends on our marketing, advertising and promotional efforts. If we are unable to implement them successfully, or if our competitors are more effective than we are, it could have a material adverse effect on our business, financial condition and results of operations.

We use marketing and promotional programs to attract customers to our stores and to encourage purchases by our customers. Although we use various media for our promotional efforts, including regular and Ollie’s Army mailers, email campaigns, radio and television advertisements and sports marketing, we primarily advertise our in-store offerings through printed flyers. In 2017, approximately 70% of our advertising spend was for the printing and distribution of flyers. If the efficacy of printed flyers as an advertising medium declines, or if we fail to successfully develop and implement new marketing, advertising and promotional strategies, such as an effective social media strategy, our competitors may be able to attract the interest of our customers, which could reduce customer traffic in

15

our stores. Changes in the amount and degree of promotional intensity or merchandising strategy by our competitors could cause us to have difficulties in retaining existing customers and attracting new customers. If the efficacy of our marketing or promotional activities declines or if such activities of our competitors are more effective than ours, or if for any other reason we lose the loyalty of our customers, including our Ollie’s Army members, it could have a material adverse effect on our business, financial condition and results of operations.

If we fail to protect our brand names, competitors may adopt trade names that dilute the value of these assets.

We may be unable or unwilling to strictly enforce our trademarks in each jurisdiction in which we do business. Also, we may not always be able to successfully enforce our trademarks against competitors or against challenges by others. Our failure to successfully protect our trademarks could diminish the value and efficacy of our brand recognition and could cause customer confusion, which could have a material adverse effect on our business, financial condition and results of operations.

Fluctuations in comparable store sales and results of operations, including fluctuations on a quarterly basis, could cause our business performance to decline substantially.

Our results of operations have fluctuated in the past, including on a quarterly basis, and can be expected to continue to fluctuate in the future.

Our comparable store sales and results of operations are affected by a variety of factors, including:

| • | national and regional economic trends in the United States; |

| • | changes in gasoline prices; |

| • | changes in our merchandise mix; |

| • | changes in pricing; |

| • | changes in the timing of promotional and advertising efforts; |

| • | holidays or seasonal periods; and |

| • | the weather. |

If our future comparable store sales fail to meet expectations, then our cash flow and profitability could decline substantially, which could have a material adverse effect on our business, financial condition and results of operations.

We rely on manufacturers in foreign countries for merchandise and a significant amount of our domestically-purchased merchandise is manufactured abroad. Our business may be materially adversely affected by risks associated with international trade.

We purchase merchandise directly from suppliers outside of the United States. In 2017, substantially all of our private label inventory purchases were direct imports. Our direct imports represented approximately 16% at cost of our total merchandise purchases in 2017. Additionally, a significant amount of our domestically-purchased merchandise is manufactured abroad. Our ability to identify qualified suppliers and to access products in a timely and efficient manner is a significant challenge, especially with respect to goods sourced outside of North America. Global sourcing and foreign trade involve numerous factors and uncertainties beyond our control, including possible changes to U.S. trade policy, increased shipping costs, increased import duties, more restrictive quotas, loss of most favored nation trading status, currency, work stoppages, transportation delays, port of entry issues, economic uncertainties such as inflation, foreign government regulations, political unrest, natural disasters, war, terrorism, trade restrictions, political instability, the financial stability of vendors, merchandise quality issues, and tariffs. Moreover, negative press or reports about internationally manufactured products may sway public opinion, and thus customer confidence, away from the products sold in our stores. These and other issues affecting our international vendors could have a material adverse effect on our business, financial condition and results of operations.

We are subject to governmental regulations, procedures and requirements. A significant change in, or noncompliance with, these regulations could have a material adverse effect on our business, financial condition and results of operations.