Preliminary Offering Circular

August 12, 2016

Subject to Completion

An offering statement pursuant to Regulation A relating to these securities has been filed with the United States Securities and Exchange Commission (the “SEC”). Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the SEC is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

HOMEUNION HOLDINGS, INC.

________ Shares of Common Stock

This is our initial public offering. No public market currently exists for our shares. We are selling shares of our common stock. We expect that the initial public offering price will be between $ and $ per share. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “HMU.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and, as such, may elect to comply with certain reduced reporting requirements for this Offering Circular and future filings after this offering.

| PER SHARE | TOTAL OFFERING | |||||||||

| Public Offering Price | $ | $ | ||||||||

| Underwriting Discounts and Commissions (1) | $ | $ | ||||||||

| Proceeds, before expenses, to HomeUnion(2) | $ | $ | ||||||||

(1) We have agreed to reimburse certain expenses of our underwriter. Please refer to the section entitled “UNDERWRITING AND PLAN OF DISTRIBUTION” beginning on page 29 of this Offering Circular for additional information regarding total underwriter compensation.

(2) We estimate that our total offering expenses, including underwriting discount and commissions, will be approximately $ ..

See “Risk Factors” on page 12 to read about factors you should consider before buying shares of our common stock.

The underwriter has agreed to use its best efforts to procure potential purchasers for the shares of common stock offered pursuant to this Offering Circular.

The shares are being offered on an all or none basis. The offering will commence on the date of this Offering Circular. All investor funds received from the date of this Offering Circular to the closing date of this offering, which shall take place on , 2016, will be deposited into an escrow account until closing. The closing date is also the termination date of this offering. If, on the closing date, investor funds are not received for the full amount of shares to be sold in this offering, the offering will terminate and any funds received will be returned promptly, without interest.

The date of this Offering Circular is , 2016

This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR APPLICABLE STATE SECURITIES LAWS, AND THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION. HOWEVER, THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| · | we have a limited operating history; |

| · | difficulties and challenges in scaling our business model significantly; |

| · | the general economic condition in the real estate rental market; |

| · | our ability to attract and maintain qualified customers to use our services; |

| · | the success of our marketing strategies; |

| i |

| · | the availability and supply of residential rental properties; |

| · | our ability to provide timely and profitable asset management services to our customers; |

| · | our dependence on third-party contractors to perform asset management services; |

| · | compliance with multi-state regulations and laws governing real estate transactions; |

| · | failure to maintain requisite brokerage license in states where we operate; |

| · | loss of services by third parties who provide data and analytics for our customers; |

| · | we have incurred significant losses and may not be profitable; |

| · | our inability to attract and maintain qualified employees; |

| · | our ability to respond to technological challenges; |

| · | security breaches of our online platform; and |

| · | additional costs incurred to operate as a public company. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

| ii |

This summary highlights information contained elsewhere in this Offering Circular and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire Offering Circular, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this Offering Circular. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company”, “HomeUnion” and similar designations refer to HomeUnion Holdings, Inc. and its subsidiaries.

Mission

Our mission is to democratize residential real estate investment by enabling individual investors to remotely invest in this asset class in a trusted and hands free manner.

Overview

We are the leading online investment management platform dedicated to the residential real estate market, enabling investors to invest outside their local geography. We do this by providing individual investors with a comprehensive, end-to-end solution for the selection, acquisition, management and sale of residential real estate properties. Our proprietary platform combines the power of technology and the experience of local real estate experts to make investment in residential real estate seamless and transparent. We are the first company in our industry to offer individual investors a comprehensive suite of services to remotely invest in residential properties throughout the U.S. with a simplified online process, focusing primarily on single-family rental (SFR) assets. Our platform enables investors to maximize returns, protects assets and provides advice on how to achieve specific investment and fixed income goals. We currently operate in 18 markets in 10 states in the U.S. and continue to expand our geographical reach.

Historically, individual investors have faced significant challenges when investing in real estate. There has been no reliable and comprehensive national level data on available investment properties; no easy and cost-effective way to acquire properties remotely; no straightforward and inexpensive mechanism to analyze, monitor and track investment returns; no easy and inexpensive process for remote management of properties; and no efficient method to sell the properties when necessary. As a result, individual investors who did not have special access or substantial resources were limited to purchasing properties in local geographies, which was often constrained by limited supply and resulted in suboptimal investment performance and missed opportunities.

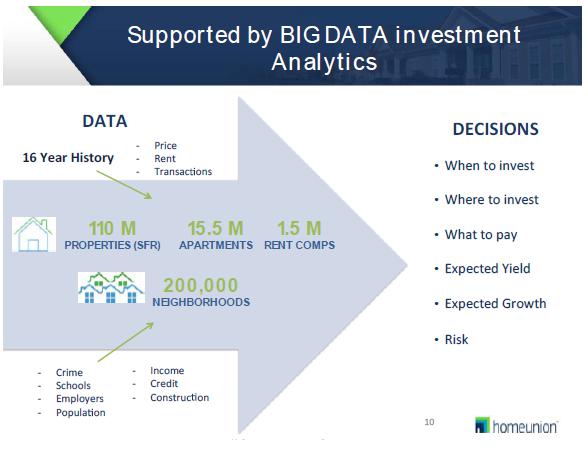

We founded HomeUnion to create a seamless process for individual investors to invest in residential real estate regardless of location. We accomplish this through our online platform that provides transaction automation for the selection and acquisition of a selective pool of properties tailored to the investment goals of each investor. We support the selection process with a combination of big data-based analytics and local, in-person research which together provide risk analysis, detailed expected returns, and the optimal bid ranges for every investment property on our portal. Our selection process and pre-acquisition due diligence create more predictability in returns and also more accurately matches properties with investors’ financial goals such as budget, risk and yield. Once a property is selected by our customer, we manage the entire process of acquisition, including negotiation, appraisal, documentation, and closing. Our mortgage brokers assist customers in obtaining and securing loans to purchase the property. Once the property is acquired, our asset management team provides ongoing support and assistance, including the placement of qualified tenants, collection of rents, monitoring property upkeep and providing repair and maintenance services through third party contractors. In the event the customer decides to sell the property, we can maintain the asset management revenue by marketing the rented property to other investors on our extensive online network. Alternatively, our local market agents can market the property to a prospective homeowner in that market, if the property owner so chooses.

We have a local presence in 18 markets and hold real estate licenses in 10 states, where we source and manage properties. This provides us with a local market infrastructure for vetting, acquiring and managing the properties. It also serves as a critical feedback loop to continuously improve our investment decision support analytics. By using a combination of proprietary asset management systems and central and local market infrastructure, we serve as a single source of management for all investment properties.

1

Our revenue was $0.3 million and $1.2 million for the fiscal years ended December 31, 2014, and 2015, respectively. Our gross transaction volume, which represents the total price of properties purchased by our customers, was $6.2 million and $17.8 million for the fiscal years ended December 31, 2014 and 2015, respectively, and $16.9 million for the six months ended June 30, 2016.

Market Opportunity

Real estate investment has long been recognized as an effective way to create wealth and serve as a portfolio diversification strategy. Within the real estate umbrella, Single Family Rentals (SFRs) are recognized as the most stable yield vehicle across economic cycles over an extended period of time. Making SFRs more than a local (within 50 miles from where one lives) investment vehicle has been a challenge due to lack of information, complex processes, and difficulty in remotely managing rentals and repairs remotely. HomeUnion solves these problems by applying substantial analytics, process automation and machine learning, coupled with experienced local teams of real estate professionals.

Additionally, the appreciation of property values and rents since 2011, and a low interest rate environment over the past seven years, have made the fundamentals for investing in real estate quite strong.

The total addressable market is $52.5 billion for SFR and apartment transactions, asset management and mortgage brokerage fees. One million SFR transactions occur each year, resulting in $9.6 billion in potential brokerage fees. Apartment brokerage fees are estimated at $2.1 billion annually. The total potential asset management fee market is $38.9 billion for SFRs and apartments. Mortgage broker fees are potentially $1.9 billion annually.

Residential real estate investment has grown to be a multi-billion dollar market as it represents an important asset class for many investors due to the following characteristics:

| · | Attractive Returns. Based on our own analysis and research of available data, single-family real estate returns have averaged 7.8 percent over the last 25 years. |

| · | Diversification from the Market. Residential real estate prices are generally uncorrelated to the stock market; therefore it presents an opportunity for portfolio diversification. |

| · | Availability and Cost of Financing. The interest rate environment is attractive and government agencies, financial institutions and private lenders are providing loans to investors to acquire investment real estate. |

| · | Tax Benefits. There are several tax benefits including deduction of mortgage interest, depreciation and other costs from gross rental income thereby reducing the tax burden and also helping investors defer capital gains tax via 1031 exchanges. |

| · | Improving Property Fundamentals. According to Zillow, single-family home rents climbed 8.9 percent between the end of 2010 and year-end 2015. According to the National Association of Realtors, single-family home prices have climbed 20 percent from the trough in the first quarter of 2010 through the end of 2015. |

We believe our market opportunity is bolstered by the recent trend towards a larger number of new households opting to rent rather than buy. According to the Urban Institute, 28 percent of new households rented in the 1990s compared to 62 percent in the current decade. There is also expected to be over 13 million new renter households between 2010 and 2030 with homeownership declining from 65.1 percent to 61.3 percent. Across nearly every age cohort, the homeownership rate is expected to decrease by 2030. The homeownership rate for those aged 45 to 54 is anticipated to be 64.9 percent in 2030, down from 71.5 percent for the same cohort in 2010. Similarly, those aged 55 to 64 are expected to have a homeownership rate of 69.6 percent in 2030, compared to 77.3 percent in 2010.

2

Challenges of Real Estate Investment

An individual investor faces multiple challenges when pursuing real estate investment of residential rental properties, particularly properties located outside of the investor’s immediate geographical area. Some of the challenges we seek to address include:

| · | Lack of Comprehensive Data on Remote Properties. Investors do not have access to reliable, up-to-date and comprehensive data on the best available SFRs throughout the U.S. |

| · | Lack of Decision Support Analytics. Most of the raw data that is available is targeted to prospective homeowners and not investors. |

| · | No Easy Way to Acquire Remote Properties. Even if an investor is able to identify a property in a location that is outside their geographic area, there are a number of hurdles in acquiring the property. |

| · | Managing Remote Properties is Difficult. Investors have to rely on a local property manager for locating a qualified tenant with appropriate financial credentials. |

| · | Lack of Market Data to Make Purchase and Sales Decisions. Investors do not have easy access to up-to-date and comprehensive local market data to determine if they should sell their property or take advantage of buying opportunities. |

| · | No Easy Way to Sell Remote Properties. The investor has to vet and select a remote realtor and rely on his or her abilities to sell the property in a timely fashion and at the right price. |

Our Solution

HomeUnion has built an end-to-end online investment management solution that provides investors with a seamless and trusted method to remotely invest in residential real estate properties throughout the U.S. that meet their investment goals. We accomplish this through a combination of transaction automation, big data-based decision support analytics, local infrastructure and a fully integrated acquisition, financing and asset management mechanism. Our solution provides customers with an efficient and user-friendly online experience through each critical decision point in the real estate investment cycle, which can be divided into four phases:

| · | Selection of Investment Property; |

| · | Acquisition of Property; |

| · | Asset Management; and |

| · | Sale and Disposition of Property. |

Selection of Investment Property

We have developed a sophisticated predictive algorithm for potential investment opportunities by evaluating over 110 million homes and 200,000 neighborhoods, or approximately 95 percent of the single-family homes in the U.S. We select neighborhoods and properties based on data science and feedback from local licensed real estate professionals who are typically our employees. By subscribing to our services, our customers gain access to a wealth of information from a single source with respect to a large pool of potential SFR investments in multiple states in the U.S. The entire property selection process is conducted through our proprietary online platform, thereby eliminating our customers’ need to travel to the property site before making the final decision to purchase.

Acquisition of Property

Once the customer has selected one or more properties for purchase through our platform, we provide a fully managed service to complete the acquisition process. We arrive at an optimal bid price; negotiate and communicate with sellers; conduct inspections and procure insurance. Our fully managed acquisition process includes a technology platform that offers a streamlined process to prepare, complete, finalize and execute all documents and contracts required to consummate the acquisition.

3

Through our subsidiary HomeUnion Lending, Inc., we provide licensed mortgage brokerage services that enable our customers to quickly secure financing for the acquisition. Our mortgage operation is fully integrated with our online technology platform and supported by experienced loan officers who guide our customers through the entire home financing process. As a full service mortgage brokerage, we provide different options of financing to our customers, including agency conforming loans, jumbo loans, IRA account and asset-based loans.

In addition, we bring every investment property that we renovate up to a quality standard that we call the HomeUnion Home. This helps with renter satisfaction and builds a long-term brand for our company as a desired renter destination.

Asset Management

We use a proprietary workflow based management system called Embrace in conjunction with a streamlined and effective property management system for the renting, maintenance and management of investment properties. In addition we provide comprehensive consolidated performance reporting on all investment properties held by an investor. Our property management services include:

| · | Advertising of rental property; |

| · | Screening of tenants based on ability to pay, past history and a background check; |

| · | Analysis of optimal rental payments for each property using our proprietary rent valuation models; |

| · | Preparation and negotiation of lease agreement; |

| · | On-going repair, maintenance and upgrades of properties; |

| · | Coordination and communication with tenants; |

| · | Collection of rental payments; and |

| · | Lease renewals and rent escalations per market conditions. |

We have vendor management systems that monitor and track the performance of the vendors we have agreements with in order to ensure that all repair and maintenance work are performed within quality, cost and time parameters.

Sale and Disposition of Properties. When investors are ready to sell their assets they are able to list the property on our portal for sale to another investor on HomeUnion. This allows investors to sell properties without having to remove the tenant if they choose to do so. We believe this facilitates an unprecedented transparent exchange between the buyer and seller given HomeUnion’s performance history on the property.

Revenue Model

Our revenue is comprised of two primary components, transaction revenue which is generated upon the purchase of a property and recurring asset management revenue which is generated on a monthly basis and tied to the rental proceeds and other fees for the properties we manage.

Transaction Revenues

Transaction revenues are made up of asset selection and acquisition fees which we charge our customers for the use of our platform and services, real estate brokerage commissions which we earn by representing the buyer in the real estate transaction and mortgage brokerage and referral revenue which we generate from our lending partners.

Recurring Asset Management Revenues

We charge our customers a fee for managing their assets, which include placement of qualified tenants, collection of rents, monitoring property upkeep and providing repair and maintenance services.

For more information, please see the “Management’s Discussion and Analysis” section of the Offering Circular.

4

Key Operating Metrics

We measure our business using operating metrics. We use these metrics to analyze our business performance, determine financial forecasts, and help develop long-term strategic plans. We review the following key business metrics:

| Six months ended June 30, 2016 | Year ended December 31, 2015 | Year ended December 31, 2014 | ||||||||||

| Cumulative net subscribers at end of period | 70,510 | 50,235 | 6,154 | |||||||||

| Transaction volume closed per period ($ M) | $ | 16.87 | $ | 17.76 | $ | 6.21 | ||||||

| Average investment amount per investor | $ | 249,269 | $ | 322,426 | $ | 187,894 | ||||||

| Assets Under Management – AUM – at end of period ($ M) | $ | 37.72 | $ | 19.63 | $ | 2.80 | ||||||

Cumulative Net Subscribers

A subscriber is someone who has opted to receive information from our Company via emails. A subscriber can unsubscribe at any time. The number of net subscribers is the number of subscribers who are receiving emails after removing the ones who have unsubscribed. The number of net subscribers indicates the awareness of the HomeUnion brand and is a leading indicator of future business volume.

Transaction Volume Closed per Period

The transaction volume is the value of the real estate, as determined by the purchase price, purchased in a given period. Transaction associated revenues are recognized on completion or closing of a transaction. Our transaction revenues are derived as a percentage of the real estate transacted on our platform.

Average Investment Amount per Investor

Our investors typically buy multiple properties from us over time. As a measure of our success in generating additional revenue from our existing customers, we track the total investment made by investors who have bought their first investment home from us at least 6 months prior to the reporting date. The average investment includes the total purchase price of all the homes which will include investors’ down payment and loan, if any. This figure is as of the end of the period reported. A higher average investment amount per investor leads to a higher revenue per investor. There was one high net worth investor who bought several properties in the last quarter of 2015, which had increased the average investment amount per investor at the end of 2015.

Assets Under Management (AUM)

Assets Under Management is the aggregate value of real estate assets being managed by HomeUnion. Included in the AUM is the total acquisition cost which is the purchase price of the property as well as the closing costs and fees and capital improvement costs. Asset management fees are charged as a percentage of the rent, which is dependent on the AUM, along with other fees. Asset management revenue is an annuity revenue and continues until either the property is sold by the investor or the asset management agreement is terminated for any reason.

For more information related to our financials including key operating metrics, please see the “Management’s Discussion and Analysis” section of the Offering Circular.

Our Competitive Strengths

Our proprietary online platform and decision support analytics provides individual investors with the ability to remotely invest in SFRs and other residential properties. We believe we are the first company in our industry to combine technological capability and local infrastructure to allow potential customers to invest in a large pool of residential rental properties in multiple states in the U.S. Our differentiating factors include:

5

| · | Big Data Driven Analytics. We believe that we have industry leading analytics that calibrates risk, calculates expected returns, generates optimal bid ranges and provides rich neighborhood information to assist customers with their decision making process. |

| · | Automated Asset Selection and Acquisition Technology. We have developed a unique asset selection technology that builds personalized real estate portfolios for investors based upon their financial goals. |

| · | Workflow Driven Asset Management and Reporting Technology. We have created a proprietary workflow management system that tracks the investment process from end-to-end while working with best-in-class customer relationship and property management software. |

| · | Ongoing Revenue Generation from Asset Management. Our asset management group supports a continuous relationship with our customers, and a consistent revenue stream outside of the transaction market. |

| · | Local Infrastructure in Local Markets. Real estate is extremely local and we have a team of licensed real estate employees in the locations that we serve. |

| · | Market Research Services. We provide comprehensive research in all our markets around local economies and trends that affect investment properties such as employment, transaction activity or population growth. |

| · | Lending Brokerage Operations. We have established HomeUnion Lending, Inc. as a mortgage broker to help investors secure financing for their properties. |

| · | Large Subscribed User Base. We currently have over 70,000 subscribed users who receive offers and information from us on a regular basis. We believe this will be an attractive target as we continue to develop our business model to allow all investor types to invest in fractional/crowd funding investment opportunities that we may offer in the future. |

| · | Highly Experienced Management Team and Advisors. We have a seasoned management team with extensive experiences in real estate management and investment operations. We are also guided by a board of advisors consisting of industry leaders and experts who assist us in the areas of technology and investment management. |

Our Growth Strategies

We plan to use a number of different initiatives to continue to scale our business model and expand our operations to additional markets.

| · | Nurture Existing Clients. Many of our clients buy multiple properties and we believe they will continue to invest over time as their current assets perform. Our current clients also serve as a source of referrals for new clients and this will reach an inflection point as the customer base continues to grow. |

| · | Expand Omni Channel Marketing. We combine online and offline channels to generate prospective investor leads. In addition, we generate significant organic content around real estate investing. This content drives traffic to our website as well as our coverage in the press. |

| · | Expand Locations for Sourcing Properties. We believe that there are many more locations in the U.S. where viable investment properties can be sourced much like the current locations in which we operate. This will allow us to offer a greater number and variety of investment properties on our portal. |

6

| · | Offer More Multi-family Investments. We believe that we can continue to expand the multi-family residential (MFR) offerings, as we expect significant demand from high-net-worth investors. In general, MFRs do not trade efficiently and there is less availability of government agency financing. |

| · | Crowd Funding of Real Estate Funds. The Company plans to create multiple small real estate funds tailored with different objectives and distribute them to retail investors. This will allow investors to participate with a much smaller investment, between $2,500 and $5,000, and own a fractional piece of a diversified pool. |

| · | Outreach to International Investors. U.S. real estate has long been a safe haven for international investors and this is even more so under the current global geopolitical and economic scenario. We have begun outreach to investors in India and the Asia Pacific region. |

Our Risks

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section immediately following this Offering Circular Summary. These risks include, but are not limited to, the following:

| · | We have a limited track record in executing our business model, making it difficult to evaluate our financial performance and future prospects; |

| · | The success of our business is significantly related to general economic conditions and the real estate industry, particularly the residential rental markets. |

| · | We may not be able to attract and maintain qualified customers to use our services, and our marketing strategies may not produce the desirable result. |

| · | Our success depends substantially on our ability to scale our operations significantly, and we may not be able to do so in a timely manner or at all. |

| · | We may not be able to sustain a sufficient curated set of rental properties and/or expand our operation to include additional property categories. |

| · | We outsource a portion of our asset management services to third party contractors and we may not have full control over the quality of their services. |

| · | We may not be able to maintain local real estate brokerage licenses to operate our business in states or to obtain new brokerage licenses to operate in additional states. |

| · | We depend on third parties to provide critical information and analytics regarding real estate investment and the loss of such relationship may negatively affect our business. |

| · | We have incurred significant losses since inception and we anticipate that we will continue to incur losses for the foreseeable future. |

| · | If we are unable to attract and retain qualified and experienced employees, including solutions managers, loan officers and other real estate professionals, our growth may be limited and our business and operating results could suffer. |

| · | There has been no public market for our common stock prior to this offering, and investors may not be able to resell shares at or above the public offering price. |

7

| · | The market price for our common stock may be volatile, which could contribute to the loss of some or all of your investment. |

Company and Other Information

We were initially formed as a limited liability company under the laws of the State of Delaware in 2009 as “innovativeREsolutions LLC,” and we changed our name to “HomeUnion Services LLC” in March 2010. In 2013, we converted HomeUnion Services LLC to a Delaware corporation and changed the name to “HomeUnion Holdings, Inc.”, which is holding company that holds several direct and indirect operating subsidiaries, including HomeUnion Inc., which is our main operating company. We also formed an indirect subsidiary, typically a limited liability company, in each state where we have active operations in order to facilitate the real estate transactions and compliance with local regulations in such state. The following chart sets forth our current corporate organizational structure, including our subsidiaries that have active operations in selected states:

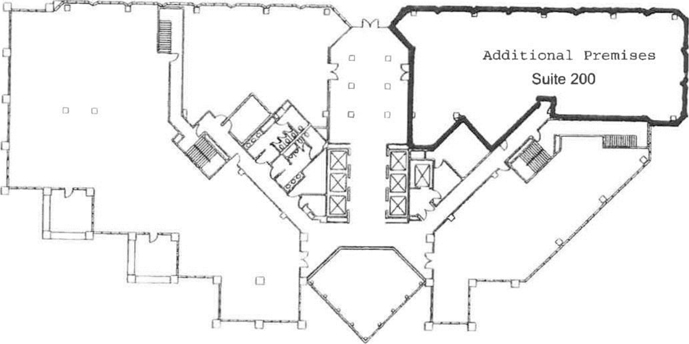

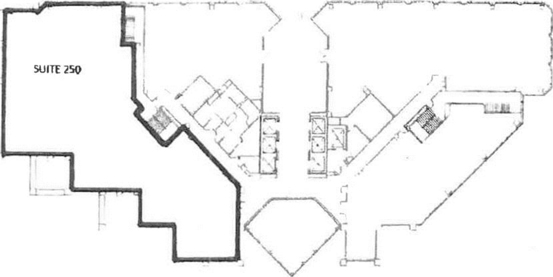

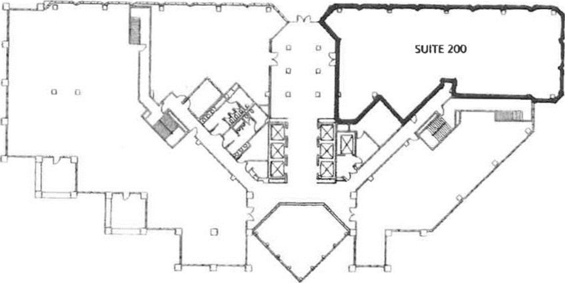

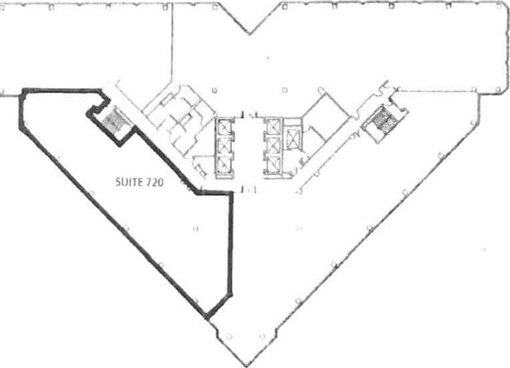

Our principal executive office is located at 2010 Main Street #250, Irvine, CA 92614, and our telephone number is 888-507-1650. Our website address is www.homeunion.com. We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

We own various U.S. federal copyright, trademark registrations and applications, and unregistered trademarks, including the following marks referred to in this Offering Circular: “HomeUnion”. All other copyrights, trademarks or trade names referred to in this Offering Circular are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Offering Circular are referred to without the symbols ® and ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

This Offering Circular summary highlights information contained elsewhere and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire Offering Circular, including our financial statements and the related notes included elsewhere in this Offering Circular. You should also consider, among other things, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case appearing elsewhere in this Offering Circular.

8

|

Common stock offered by us |

Shares | |

| Common stock to be outstanding immediately after this offering | Shares | |

| Use of proceeds | We intend to use the net proceeds from this offering to scale our business model and expand our operation, including increasing and enhancing our technological infrastructure and capabilities, including improving and increasing data collection and analysis; broadening our sales and marketing channels to additional media outlets; increasing the scale and scope of internal operations to accommodate additional customers and transactions; and direct investment in selected real estate rental properties. In addition, in the event that the gross proceeds from this offering is equal to or exceeds $12,000,000, our major stockholder, Artiman Ventures (“Artiman”), will have the option to require us to use up to 30% of the gross proceeds of the offering to repay certain 2016 convertible promissory notes held by Artiman. We will use any remaining proceeds for working capital or other general corporate purposes. See “Use of Proceeds” on page 32 in the Offering Circular for more detail. | |

| Risk factors | You should carefully read “Risk Factors” on page 12 in this Offering Circular for a discussion of factors that you should consider before deciding to invest in our common stock. | |

| Offering Process and Escrow Arrangement | The shares are being offered on an all or none basis. The offering will not be completed unless we sell the number of shares specified on the cover page of this Offering Circular. We will establish an escrow account at SunTrust Bank for the benefit of investors to receive the funds for the purchases of the shares. SunTrust Bank will serve as the escrow agent. The escrow account will be opened on the date of this Offering Circular and will remain open until the closing date. All funds received into the escrow account after the pricing of the offering will be held in a non-interest bearing account in accordance with Rule 15c2-4 under the Securities Exchange Act of 1934, as amended. On the closing date, upon confirmation by the underwriter that investors will fund their investments through their brokerage accounts, the underwriter’s clearing agent will transfer an amount equal to the gross proceeds of the offering to the escrow account for the benefit of the investors. In addition, on the closing date, the escrow agent will notify the underwriter whether the full amount necessary to purchase the shares to be sold in this offering has been received. If, on the closing date, funds are not received in respect of the full amount of shares to be sold in this offering, then all funds that were deposited into the escrow account will be returned promptly to investors, and the offering will terminate. |

9

| Proposed NASDAQ Capital Market Listing | We have applied to list our common stock on the NASDAQ Capital Market under the symbol “HMU.” |

The number of shares of our common stock to be outstanding after this offering is based on 12,269,674 shares of our common stock outstanding as of December 31, 2015 and excludes:

| · | 6,115,614 shares of common stock issuable upon the exercise of stock options outstanding as of December 31, 2015 at a weighted average exercise price of $0.22 per share; |

| · | 6,433,126 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan which shares will be rolled over to the 2016 Equity Incentive Plan (the “2016 Plan”); |

| · | additional shares of common stock reserved for future issuance under our 2016 Plan, which will become effective immediately prior to the completion of this offering; |

| · | shares of common stock issuable upon the conversion of an aggregate of $10,700,433 in outstanding principal and accrued interest on our convertible promissory notes held by Artiman (the “Artiman Notes”) as of July 31, 2016, upon the completion of this offering, at a conversion price equal to 80% of the initial public offering price set forth on the cover page of this Offering Circular, assuming that Artiman does not require us to use any net proceeds of this offering to prepay any Artiman Notes and elects to convert all of the outstanding Artiman Notes upon completion of this offering, and assuming the offering is completed on September 30, 2016; and |

| · | shares of common stock issuable upon conversion of $1,750,000 in principal amount of Artiman Notes issued after July 31, 2016 upon completion of this offering, assuming that the offering is completed on September 30, 2016. |

Unless otherwise indicated, all information in this Offering Circular reflects or assumes the following:

| · | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the completion of this offering; |

| · | the conversion of all of our outstanding shares of convertible preferred stock into an aggregate of 30,528,485 shares of common stock upon the completion of this offering assuming that the offering is completed on September 30, 2016; and |

| · | a one-for- reverse split of our common stock, which became effective on . |

The precise number of shares of our common stock to be issued upon the conversion of the Artiman Notes upon the completion of this offering will vary depending on the actions to be taken by Artiman pursuant to the terms of such notes. Under the Artiman Notes, immediately following the completion of the offering, Artiman has the right to convert some or all of the Artiman Notes at a conversion price equal to 80% of the initial public offering price of this offering. Furthermore, if the gross proceeds from this offering is equal to or exceeds $12,000,000, Artiman has the option to require us to use up to 30% of the gross proceeds to repay the outstanding principal amount and unpaid accrued interest under the Artiman Notes.

In the event that the gross proceeds of this offering is equal to or exceeds $12,000,000, and assuming that Artiman requires us to use up to 30% of the gross proceeds of this offering to repay the Artiman Notes and elects to convert all of the remaining Artiman Notes, and assuming that we sold all of the shares set forth on the cover page of this Offering Circular at an assumed public offering price of $ per share, the midpoint of the price range set forth on the cover page of this Offering Circular, the total number of outstanding shares after the completion of this offering will be shares.

11

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below along with all of the other information contained in this Offering Circular, including our financial statements and the related notes, before deciding whether to purchase our common stock. If any of the adverse events described in the following risk factors, as well as other factors which are beyond our control, actually occurs, our business, results of operations and financial condition may suffer significantly. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Related to Our Business Operation and Industry

We have a limited track record in executing our business model, which makes it difficult to evaluate our financial performance and future prospects.

We have been operating our current business since 2013 and have a limited track record in executing our business model. Our future success depends on our ability to attract new customers and clients, scale up our online real estate management platform, expand our operations to additional geographical areas, and increase our supply of qualified rental properties, including multi-family rental properties. In addition, a full service online real estate investment platform is a relatively new industry that may require many years to develop and mature. Due to the emerging and evolving nature of our business and technologies, the factors influencing our financial performance may be different from those typically affecting our competitors. As a result, it may be difficult to evaluate our financial performance and future prospects and to compare our business and performance with our competitors and peer companies. If we are not successful in executing our current business plan, our business, financial condition, results of operations and prospects could be adversely affected.

The success of our business is significantly related to general economic conditions and the real estate industry, particularly the residential rental markets and, accordingly, our business could be harmed by an economic slowdown and downturn in real estate asset values, rental activities and property sales.

Our business is closely tied to general economic conditions in the real estate industry and the residential rental market. As a result, our economic performance, and our ability to attract new customers to purchase rental properties and implement our business strategies may be significantly and adversely affected by changes in national and local economic conditions. The condition of the real estate markets in which we operate is cyclical and depends on the condition of the economy in the United States, and on the perceptions of investors of the overall economic outlook. Rising interest rates, declining employment levels, declining demand for real estate, declining real estate values or periods of general economic slowdown or recession or the perception that any of these events may occur have negatively impacted the real estate market in the past and may in the future negatively impact our operating performance. In addition, the economic condition of each local market where we operate may depend on one or more key industries within that market, which, in turn, makes our business sensitive to the performance of those industries.

We have experienced in past years, and expect in the future to be negatively impacted by, periods of economic slowdown or recession, and corresponding declines in the demand for real estate and related services, within the markets in which we operate. The previous recession and the downturn in the real estate market have resulted in and may result in:

| · | a general decline in rents due to defaulting tenants or less favorable terms for renewed or new leases; |

| · | a decline in actual and projected sale prices of our properties, resulting in lower returns on the properties in which we have invested; |

| · | higher interest rates, higher loan costs, less desirable loan terms and a reduction in the availability of mortgage loans, all of which could increase costs and limit our ability to acquire additional real estate assets; |

12

| · | fewer purchases and sales of properties by clients, resulting in a decrease in acquisition transaction fees, property management fees, brokerage commissions and other fees; and |

| · | lack of buyers who meet our qualifications to purchase rental properties through our online platform. |

We have only a limited ability to change our operations promptly in response to these negative factors, which can have an adverse effect on our ability to grow and expand our business operations.

We may not be able to attract and maintain qualified customers to use our services, and our marketing strategies may not produce the desirable result, which will adversely affect our ability to develop and grow our business operations.

The success and profitability of our business depend substantially on our ability to attract new and qualified customers who use our services, because our revenue model is based on the number of transactions completed by qualified customers who pay various fees to us for such transactions. Our business model involves a high degree of operational intensity and costs, thus it is critical that we increase our customer base significantly from our existing level to offset such costs. We intend to expand and enhance our marketing strategies to attract more customers via online and offline channels. However, there is no guarantee that these strategies will be successful. Furthermore, the cost of implementing these marketing strategies may not produce sufficient number of customer conversions to achieve a positive return.

Our ability to convert potential customers to purchase our services depends on numerous factors that are not completely within our control, including:

| · | rate of return in residential real estate investment as compared to other investment assets, including stocks, bonds and other securities; |

| · | the availability of other real estate investments, including REITs and commercial real estate properties, that are not currently offered by us; |

| · | the potential customer’s familiarity and comfort with online real estate investment versus the traditional “brick and mortar” real estate investment services; |

| · | the financial qualification and credit history of potential customers; |

| · | the interest rate environment for mortgage loans; |

| · | sufficiency of supply of real estate properties that meet the investment objectives of potential customers; and |

| · | the general economic and real estate market conditions. |

In addition, we are highly dependent on long-term customer relationships to generate revenues based on our end-to-end real estate investment services. If we are unable to maintain our existing client relationships and expand our existing client base, our revenue source may decline. Our customers may terminate our services if the rate of return of their rental property declines, and such decline can occur due to a many reasons, such as inability to secure qualified tenants; longer period of vacancy; higher costs of repair and maintenance; and disputes with tenants. Other factors may also cause our existing customers to terminate our relationships, including:

| · | loss of or delay or default by tenants on rental payments; |

| · | changes in the customer’s investment objectives and portfolios; |

13

| · | financial conditions of the customers; and |

| · | improved rate of return from other investment options. |

Our success depends substantially on our ability to scale our operations significantly, and we may not be able to do so in a timely manner, or at all.

Currently we generate a limited amount of revenues with a relatively small number of transactions. In order for us to expand and grow, we are required to scale our business model and expand our services significantly to accommodate additional customers and transactions. We intend to expend significant financial and human resources to scale up our business, including implementing of aggressive marketing efforts; recruiting, training and hiring additional employees and real estate professionals qualified to perform our services; expanding our technology infrastructure to accommodate new transactions; increasing supplies of real estate properties that meet our investment criteria, including expansion into multi-family rental units; and expanding our operations overseas to acquire more international customers. Our planned expansion involves complex coordination of various elements of our business operation and requires significant resources, and there can be no assurance we can successfully scale our business to achieve the anticipated financial performance. We may incur significant expenses for these plans without corresponding returns, which would harm our business, financial condition and results of operations.

We may not be able to sustain a sufficient curated set of rental properties or expand our operation to include additional property categories.

Currently our operation focuses primarily on providing end-to-end services for the investment of single family rental (“SFR”) properties throughout the U.S. In order to ensure a favorable return on investment, it is important to identify those SFR properties with the desirable characteristics to produce sufficient income and appreciation to offset the costs of acquisition. We have developed a sophisticated analytics to assist our customers to select the appropriate SFR properties for his or her individual circumstances. However, we may not be able to identify a sufficient number of SFR properties with the optimal characteristics for our customers due to number of factors, including the limited geographical areas in which we currently serve, the competition from other buyers for the property; the turn-over rates of SFR properties; and the general SFR rental market. If we cannot identify or secure a sufficient number of viable SFR properties, we may not be able to continue or expand our customer base and generate additional revenues.

We also plan to increase our offerings of other property categories on our platform, particular multi-family rental properties and apartment buildings which currently consist only a small percentage of our available properties. We have limited experience in the acquisition, management and sales of multi-family rental properties, and we will be required to incur additional costs to accommodate new property categories, including updating and enhancing our information analytics, recruiting and training new solutions manager and other real estate professionals, and establishing new relationships with banks, contractors and other vendors. There is no guarantee that we will be able to achieve growth and profitability in the multi-family rental market or any other property categories that we intend to pursue in the future.

The success of our asset management business depends on various factors, including our ability to secure qualified tenants for rental properties, tenant occupancy and rental rates, which, if adversely affected, could cause our operating results to suffer.

A significant portion of our property management business involves facilitating the leasing and rental of single family and multi-family rental properties. In certain areas of operation, there may be inadequate supply of residential property to meet demand, and there is a potential for a decline in the number of overall lease and brokerage transactions. In areas where the supply of residential rental properties exceeds demand, we may not be able to renew leases or obtain new tenants for our owned and managed rental properties as leases expire. Moreover, the terms of new leases and renewals (including renovation costs or costs of concessions to tenants) may be less favorable than current leases. Our revenues may be adversely affected if we fail to promptly find tenants for substantial amounts of vacant space, if rental rates on new or renewal leases are significantly lower than expected. We may be unable to continue to lease properties for our clients in a profitable manner.

14

Our ability to lease properties also depends on:

| · | the attractiveness of the properties to potential tenants; |

| · | competition from other available properties that are not listed on our platform; |

| · | our ability to provide adequate maintenance and obtain insurance and to pay increased operating expenses, which may not be passed through to tenants; |

| · | the availability of capital to periodically renovate, repair and maintain the properties, as well as for other operating expenses; and |

| · | the existence of potential tenants desiring to lease the properties. |

We outsource a portion of our asset management services to third party contractors and we may not have full control over the quality of their services.

We have entered into agreements with local licensed contractors and vendors to provide certain home maintenance services for tenants in our customers’ properties, including services relating to structural repairs, plumbing, electrical upgrades and other maintenance work. We have established procedures to ensure that these third party contractors are appropriately screened and meet our stringent standard of quality. Despite these procedures, we do not have complete control over the services provided by third-party contractors who are not our employees. If they fail to perform their services timely, or if they are unable to provide the quality of work expected by our customers, our brand and reputation will suffer and we may lose our customers, which will have an adverse effect on our financial condition and results of operations.

Decreases in the performance of the properties we manage are likely to result in a decline in the amount of asset management fees we collect.

Our asset management fees are generally structured as a percentage of the rental fees generated by the properties that we manage, and in some cases structured as a percentage of the property value regardless of the rental fees. As a result, our revenues are adversely affected by decreases in the performance of the properties we manage and declines in rental value. Property performance will depend upon, among other things, our ability to control operating expenses (some of which are beyond our control) and financial conditions generally and in the specific areas where properties are located and the condition of the real estate market in general. If the performance or rental values of the properties we manage decline, the asset management fees we derive from such properties could be materially adversely affected.

If we fail to comply with laws and regulations applicable to us in our role as a real estate broker, property/asset manager or mortgage broker, we may incur significant financial penalties.

We are subject to numerous federal, state, local and foreign laws and regulations specific to the services we perform in our business, as well as laws of broader applicability, such as tax, securities and employment laws. Brokerage of real estate sales, leasing, mortgage and loan transactions and the provision of property management and valuation services require us to maintain applicable licenses in each U.S. state and certain foreign jurisdictions in which we perform these services. If we fail to maintain our licenses or conduct these activities without a license, or violate any of the regulations covering our licenses, we may be required to pay fines (including treble damages in certain states), return commissions received or have our licenses suspended or revoked.

As a licensed real estate broker, we and our licensed employees are subject to certain statutory due diligence, disclosure and standard-of-care obligations. Failure to fulfill these obligations could subject us or our employees to litigation from parties who purchased, sold or leased properties that we brokered or managed. In addition, we may become subject to claims by participants in real estate sales claiming that we did not fulfill our statutory obligations as a broker.

15

We may not be able to maintain local real estate brokerage licenses to operate our business in states or to obtain new brokerage licenses to operate in additional states.

We are required to maintain a valid real estate brokerage license to operate our asset management services in each state where our customers purchased properties, including identification of tenants and collection of rents, and currently we have operations in 10 states in the U.S. In order to obtain and maintain these licenses, we enter into a broker agreement with a third party broker in each state who possesses the necessary state licenses to perform the required management services. However, some of these third-party brokers are independent contractors and not our employees, and they may terminate our agreements at any time without cause by providing us with one month advance notice. If any broker terminates the agreement with and otherwise decides to leave or lose its brokerage license, we will not be able to maintain a valid brokerage license in such state to continue our operations, which will result in a significant disruption to our business operations. Furthermore, while we may be able to identify a replacement broker with the appropriate license to work with us, we may not be able to do so quickly because it may be difficult and time consuming to negotiate these broker agreements, and any delay in engaging a replacement broker which would cause significant interruption to our operations and adversely affect our results of operations. Furthermore, we intend to expand our operations into additional states based on the attractiveness of real estate investment in such states as determined by our analytics. If so, we are required to enter into additional broker agreements to obtain the necessary real estate licenses for these additional states. There is no guarantee that we will be able to do so in a timely manner, or at all, and failure to do so would have an adverse effect on our business operations.

We depend on third parties to provide critical information and analytics regarding real estate investment and the loss of such relationships or services may negatively affect our business

In order to attract and maintain customers, we must assist them with making informed decisions and building an individualized portfolio by providing continuous, up-to-date and expert in-depth analysis of the rental market and expected income and cash flow stream. While we produce some of this data internally, a significant portion of the data is purchased from third-party providers for which there is no certainty of uninterrupted availability. We have entered into a Master Services Agreement with CoreLogic Solutions, LLC (“CoreLogic”), pursuant to which CoreLogic provides us various real estate related analytics data. Pursuant to the Master Services Agreement, CoreLogic is required to provide such services under individual Statement of Work negotiated from time to time, and the Statement of Work typically expires 36 months from the date of the Statement of Work unless it is renewed and extended by written agreement between the parties. Our current primary Statement of Work will expire on November 2017. Any disruption of our ability to provide data to our employees and/or customers could damage our reputation, and our operating results could be adversely affected. Furthermore, there is no guarantee that the analytics and data provided to us by CoreLogic are always complete and accurate, and any incomplete and inaccurate information may reduce the quality and accuracy of our analysis of the customer’s projected investment returns. If our customers cannot achieve the expected return due to incomplete or faulty information regarding the properties, we may lose such customers, which will have an adverse effect on our financial conditions and results of operations.

Our planned international operation may be subject to additional risks

As part of our strategy to scale our business and achieve rapid growth, we intend to expand our online services to customers located outside of the U.S., including India, China, Europe and other parts of the world. We have limited experiences in conducting international real estate transactions and our efforts may not be successful due to a number of additional risk factors, including:

| · | the burden of complying with multiple and potentially conflicting regulations and laws, including laws governing real estate transactions; |

| · | laws restricting foreign companies from conducting business; |

| · | unexpected changes in regulatory requirements; |

| · | the impact of different business cycles and economic instability; |

16

| · | political instability and civil unrest; |

| · | potentially adverse tax consequences; |

| · | tariff regimes of the countries in which we do business; and |

| · | geographic, time zone, language and cultural differences between personnel in different areas of the world. |

| · | Increased costs |

Failure by our customers to make timely mortgage payments may adversely affect our results of operations.

Our services are available to all types of customers, including individuals, retail and high net-worth investors and IRA investors. We have not established a comprehensive screening procedure to assess customer suitability, except for the basic credit check to ensure that potential customers are qualified for a housing loan or mortgage to purchase the rental property. If our customers are not able to make mortgage payments or otherwise default on their loans, we may not be able to continue to collect asset management fees or fees relating to the sale of the property, which may adversely affect our financial conditions and results of operations.

Risks Relating to Our Financial Condition

We have incurred significant losses since inception and we anticipate that we will continue to incur losses for the foreseeable future.

We are in the early stage of our development and have incurred operating losses since we began operations, and our net losses were $14.0 million and $5.0 million and for the fiscal years ended December 31, 2015 and 2014, respectively. As of December 31, 2015, we had an accumulated deficit of $21.6 million. We do not know whether or when we will generate sufficient revenue to become profitable.

We have devoted most of our financial resources to marketing our services to scale up our technology and operations to meet additional demand of customers, and to grow our platform to include additional supplies of properties. We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future as we continue to expand our business operations.

Our independent registered public accounting firm has expressed substantial doubt as to our ability to continue as a going concern.

In its audit report for the fiscal years ended 2015 and 2014, the opinion of our independent registered public accounting firm, included an emphasis paragraph as to the uncertainty of our ability to continue as a going concern. Most notably, significant recurring net losses and negative cash flows from operations from inception through 2015 raise substantial doubt about the Company’s ability to continue as a going concern. If we are unable to obtain bank financing, raise capital or generate enough cash from operations to sustain our business, then we may have to liquidate assets or curtail our operations.

We need to raise a significant amount of capital to expand and grow our business and we may not be able to raise such capital on terms favorable to us, or at all.

We expect capital outlays and operating expenditures to increase over the next several years as we expand our marketing infrastructure and increase the scale of our operation to meet accelerating customer demand. Following the completion of this offering, we believe our financial resources will be adequate to sustain our current operations until the breakeven point. However, we may need to raise additional capital to sustain our growth. We cannot be certain that we will be able to obtain financing on terms acceptable to us, or at all. Our failure to obtain adequate and timely funding will materially adversely affect our business and our ability to develop our products and would have a material adverse effect on the value of your investment.

17

Risks Related to Our Internal Organization and Corporate Structure

If we are unable to attract and retain qualified and experienced employees, including solutions managers, loan officers and other real estate professionals, our growth may be limited and our business and operating results could suffer.

Our success is highly dependent upon the efforts of our employees, including solutions managers, loan officers and other real estate professionals, and we have dedicated significant resources and time to recruit and train these employees. If these employees and personnel depart, we will lose the substantial time and resources we have invested in training and developing those individuals and our business, financial condition and results of operations may suffer. Additionally, such events may have a disproportionate adverse effect on our operations if the most experienced managers or professionals do not remain with us or if these events occur in geographic areas where substantial amounts of our brokerage revenues are generated. In addition, our competitors may attempt to recruit our managers and professionals, and if we are not able to provide attractive compensation and benefits to our employees, we may face attrition.

An increasing component of our growth has also occurred through the recruiting, training and retention of key experienced managers and financing professionals. Any future growth through attracting these types of employees will be partially dependent upon the continued availability of qualified candidates fitting the culture of our firm at reasonable terms and conditions. However, individuals whom we would like to recruit or retain may not agree to terms and conditions acceptable to us.

If we fail to attract and keep senior management and key employees, we may be unable to successfully develop our business and expand our operations.

Our future growth and success depend on our ability to recruit, retain, manage and motivate our employees. We are highly dependent on our senior management team, including our Chief Executive Officer, as well as the other principal members of our management teams. Although we have offer letters with our senior management members, these agreements do not prevent them from terminating their employment with us at any time. The loss of the services of any member of our senior management or scientific team or the inability to hire or retain experienced management personnel could adversely affect our ability to execute our business plan and harm our operating results. Replacing key personnel may be difficult and may take an extended period of time because of the limited number of individuals in our industry with the breadth of skills and experience required to operate our business.

We will need to significantly increase the size of our organization, and we may experience difficulties in managing growth.

We are currently a small company with 100 full-time employees as of June 30, 2016. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate additional employees. In addition, to meet our obligations as a public company, we will need to increase our general and administrative capabilities. Our management, personnel and systems currently in place may not be adequate to support this future growth. Our future financial performance and our ability to scale up our business operations and to compete effectively will depend, in part, on our ability to manage any future growth effectively. Our staff, financial resources, systems, procedures or controls may be inadequate to support our operations and our management may be unable to manage successfully future market opportunities or our relationships with customers and other third parties.

If we do not respond to technological changes or upgrade our technology systems, our growth prospects and results of operations could be adversely affected.

To remain competitive, we must continue to enhance and improve the functionality, features and security of our technology infrastructure. Infrastructure upgrades may require significant capital investment outside of the normal course of business. In the future, we will likely need to improve and upgrade our technology, database systems and network infrastructure in order to allow our business to grow in both size and scope. Without such improvements, our operations might suffer from unanticipated system disruptions, slow performance or unreliable service levels, any of which could negatively affect our ability to provide rapid customer service. We may face significant delays in introducing new services, sales professional tools and enhancements. In addition, the expansion and improvement of our systems and infrastructure may require us to commit substantial financial, operational and technical resources, with no assurance that our business will improve.

18

Interruption, unauthorized breaches, or failure of our information technology, communications systems or data services could hurt our ability to effectively provide our services

Our business requires the continued operation of information technology and communication systems and network infrastructure. Our ability to conduct our multi-state business may be adversely impacted by disruptions or breaches to these systems or infrastructure. Our information technology and communications systems are vulnerable to damage or disruption from fire, power loss, telecommunications failure, system malfunctions, computer viruses, third-party misconduct or penetration and criminal acts, natural disasters such as hurricanes, earthquakes and floods, acts of war or terrorism, or other events which are beyond our control. In addition, the operation and maintenance of these systems and networks is, in some cases, dependent on third-party technologies, systems and service providers for which there is no certainty of uninterrupted availability. Any of these events could cause system interruption, delays, and loss of critical data or intellectual property (such as our analytics, property lists and other proprietary research) and may also disrupt our ability to provide services to or interact with our clients, and we may not be able to successfully implement contingency plans that depend on communication or travel. We have disaster recovery plans and backup systems to reduce the potentially adverse effect of such events, but our disaster recovery planning may not be sufficient and cannot account for all eventualities. A catastrophic event that results in the destruction or disruption of any of our data centers or our critical business or information technology systems could severely affect our ability to conduct normal business operations and, as a result, our future operating results could be adversely affected. Our business relies significantly on the use of residential real estate data. Failure to maintain the security of our information and technology networks, including personally identifiable and client information could adversely affect us.

Security breaches and other disruptions could compromise our information and expose us to liability, which could cause our business and reputation to suffer. In the ordinary course of our business, we collect and store sensitive data, including our proprietary business information and intellectual property, and that of our clients and personally identifiable information of our employees and contractors, in our data centers and on our networks. The secure processing, maintenance and transmission of this information is critical to our operations. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. A significant actual or potential theft, loss, fraudulent use or misuse of client, employee or other personally identifiable data, whether by third parties or as a result of employee malfeasance or otherwise, non-compliance with our contractual or other legal obligations regarding such data or a violation of our privacy and security policies with respect to such data could result in significant costs, fines, litigation or regulatory actions against us. Such an event could additionally disrupt our operations and the services we provide to clients, damage our reputation, and cause a loss of confidence in our services, which could adversely affect our business, revenues and competitive position. Additionally, we increasingly rely on third-party data storage providers, including cloud storage solution providers, resulting in less direct control over our data. Such third parties may also be vulnerable to security breaches and compromised security systems, which could adversely affect our reputation.

Upon the completion of this offering, we will be an emerging growth company and subject to less rigorous public reporting requirements

Upon the completion of this offering, we expect to become a public reporting company under the Exchange Act, and thereafter publicly report on an ongoing basis as an “emerging growth company” under the reporting rules set forth under the Exchange Act. If we elect not to do so, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. In either case, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

19

Upon the completion of this offering, we expect to elect to become a public reporting company under the Exchange Act. If we elect to do so, we will be required to publicly report on an ongoing basis as an “emerging growth company” (as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act) under the reporting rules set forth under the Exchange Act. For so long as we remain an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other Exchange Act reporting companies that are not “emerging growth companies”, including but not limited to:

| · | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| · | taking advantage of extensions of time to comply with certain new or revised financial accounting standards; |

| · | being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

| · | being exempt from the requirement to hold a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We expect to take advantage of these reporting exemptions until we are no longer an emerging growth company. We would remain an “emerging growth company” for up to five years, although if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an “emerging growth company” as of the following December 31.