As filed with the Securities and Exchange Commission on September 16, 2020

Registration No. 333-248495

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| CHINA VTV LIMITED |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 333-203754 |

| 47-3176820 |

| (State or other jurisdiction of incorporation) |

| (Commission File Number) |

| (IRS Employer Identification No.) |

New Times Centre

393 Jaffe Road, Suite 17A

Wan Chai, Hong Kong

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Tijin Song

Chief Executive Officer

New Times Centre

393 Jaffe Road, Suite 17A

Wan Chai, Hong Kong

+85267353339

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jay Kaplowitz, Esq.

Huan Lou, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 37th Floor

New York, New York 10036

Phone: (212) 930-9700

Fax: (212) 930-9725

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered |

| Amount To be Registered |

| Proposed Maximum Aggregate Price Per Share (2) |

|

| Proposed Maximum Aggregate Offering Price (2)(3) |

|

| Amount of Registration Fee(3) |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Shares of Common Stock, par value $0.001 per share (1) |

| 12 ,0 00,000 shares of Common Stock |

| $ | 4.00 |

|

| $ | 48,000,000 |

|

| $ | 6,230.40 |

|

| Total number of securities to be registered |

| 12 ,0 00,000 shares of Common Stock |

| $ | 4.00 |

|

| $ | 48,000,000 |

|

| $ | 6,230.40 |

|

_______________

| (1) | Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this Registration Statement also covers any additional shares of Common Stock which may become issuable to prevent dilution from stock splits, stock dividends and similar events. |

|

|

|

| (2) | Pursuant to Rule 457(c) of the Securities Act of 1933, as amended, estimated on the basis of the proposed maximum aggregate offering price. |

|

|

|

| (3) | The registration fee for securities to be offered by the Registrant is based on an estimate of the proposed maximum aggregate offering price of the securities and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). The registration fee has been paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| 1 |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED September 16 , 2020 |

Up to 12 ,0 00,000 Shares of Common Stock

We are an online media company focusing on providing a web-based platform for all types of contents, such as news, TV shows and entertainment programs. Pursuant to this prospectus, we are offering up to twelve million (12 ,0 00,000) shares of our common stock (the “Common Stock”), par value $0.001 per share. We are offering whole shares and do not offer fractional shares in this offering.

This is a “best efforts” public offering of shares of the Common Stock, par value $0.001 per share, conducted by the Company without any investment bank, although we reserve the right to engage a broker-dealer. We may engage a placement agent for this offering in the future. We are selling a maximum of 12 , 0 0 0,000 shares of the Common Stock for aggregate gross proceeds of $48,000,000 before deducting offering expenses , including placement agent fees, if any . There is no minimum offering amount required as a condition to closing this offering and as a result, the actual public offering amount, any p lacement agent fees, and proceeds to the Company are not presently determinable and may be substantially less than the total maximum offering amount. This offering will terminate 180 days from the date of this prospectus , unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date. In either event, the offering may be closed without further notice to you. Any and all funds for securities purchased in the offering will be transmitted directly to us for our immediate use .

This is a self-underwritten offering. This prospectus is part of a registration statement that permits our officers and directors to sell the shares directly the public with no commission or other remuneration payable to them for any shares that are sold by them. Our officers and directors will sell the shares and intend to offer them to friends, family members, and business acquaintances. In offering the securities on our behalf, our directors and officers will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. Our officers, directors, control persons and affiliates may purchase shares and warrants in this offering.

We may also engage registered broker-dealers to offer and sell the shares of our Common Stock (each a “Placement Agent” and collectively, the “Placement Agents”). We may pay any such registered persons who make such sales a commission of up to a certain percentage of the aggregate purchase price of the shares sold by such Placement Agent in this offering and issue to the Placement Agent a warrant to purchase such number of shares of our common stock in an amount not to exceed certain percentage of the number of shares of C ommon S tock sold by such Placement Agent in this offering , subject to the compliance with the maximum allowable fees under applicable, rules and regulations including the rules of the Financial Industry Regulatory Authority (“FINRA”) and the foreign equivalent agencies where the Placement Agent is regulated . However, we have not entered into any underwriting or agent agreement, arrangement or understanding for the sale of the securities being offered pursuant to this prospectus. This offering is intended to be made solely by the delivery of this prospectus and the accompanying subscription agreements to prospective investors. Any Placement Agent engaged by us for this offering would only be compensated based on the aggregate purchase price of the shares of Common Stock sold by such Placement Agent in this offering.

Our Common Stock is quoted on the OTC Markets under the symbol “CVTV.” On August 26, 2020, the last reported sale price per share of our Common Stock was $2.65. The recent market price of our Common Stock set forth herein will not be used to determine the offering price of our Common Stock. There is no active public market for the Common Stock and the prices quoted on the OTC Markets may not be indicative of the market price of our Common Stock. The offering price of the Common Stock will be arbitrarily determined and will not necessarily bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. The offering price is determined through negotiations with the Company and investors. The investors and the Company have set $4.00 per share for the offering price, which will be finalized prior to closing of the offering. There is no minimum offering amount and we will close the subscription for our shares of Common Stock on a rolling basis. In the near future, we may apply to list our common stock on a national stock exchange; however, there is no assurance that in the event we do apply to list our common stock, our application will be approved.

The offering will terminate at the earlier of (i) the date at which $48,000,000 of our Common Stock has been sold; (ii) the date on which this offering is terminated by the Company in its sole discretion; or (iii) one hundred and eighty (180) days from the effectiveness of this Registration Statement. Until the offering terminates, the proceeds of the offering will be held in the Company’s offering deposit account (“Offering Deposit Account”) maintained solely for the purposes of this offering at a U.S. branch of East West Bank.

| 2 |

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Our common stock is presently quoted on the OTC Markets Pink platform under the symbol “CVTV,” and has had limited trading to date.

Our business and an investment in our securities involve a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We estimate the total expenses of this offering will be approximately $136,000. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount and net proceeds to us, if any, in this offering are presently not determinable and may be substantially less than the maximum offering amount set forth in this prospectus.

The date of this prospectus is ______, 2020

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

| 3 |

|

|

| Page |

| |

|

|

|

|

| |

|

|

| 5 |

| |

|

|

| 11 |

| |

|

|

| 15 |

| |

| Cautionary Note Regarding Forward-Looking Statements and Industry Data |

|

| 29 |

|

|

|

| 29 |

| |

|

|

| 30 |

| |

|

|

| 31 |

| |

|

|

| 30 |

| |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| 33 |

|

|

|

| 46 |

| |

|

|

| 60 |

| |

|

|

| 65 |

| |

|

|

| 68 |

| |

| Security Ownership of Certain Beneficial Owners and Management |

|

| 72 |

|

|

|

| 74 |

| |

|

|

| 75 |

| |

|

|

| 76 |

| |

|

|

| 78 |

| |

|

|

| 78 |

| |

|

|

| 78 |

| |

|

|

| 78 |

| |

|

|

| F-1 |

| |

| 4 |

| Table of Contents |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in this prospectus mean China VTV Limited on a consolidated basis with its wholly-owned subsidiaries.

Company Overview

We are an internet-based online entertainment media company with focuses on audience interaction, entertainment and promotion of young artists (actors, singers and entertainers). The Company is primarily engaged in broadcasting news, videos, television shows, tourists’ programs and other entertainment programs through its application (or “App”) over the internet. Our broadcasting programs can be played via smart TVs, our application or App on both IOS and Android mobile phones or tablets, computers, and satellite TVs. The Company also produces certain original news programs, travel programs, and other entertainment shows, and adapts original literature into internet TV shows, internet movies and video games.

The Company has developed a blockchain-operated cloud-based platform (the “APP Platform”) that distributes streaming media as a standalone product directly to viewers over the Internet, bypassing telecommunications, multichannel television, and broadcast television platforms that traditionally act as a controller or distributor of such content. The Company has built the technology to distribute media programs on smart TVs, computers, Android smart phones via its App (collectively, the “End Devices”) and through multiple social media channels, such as Weibo, Facebook and YouTube.

The Company has an audience of approximately three million and eight hundred thousand (3,800,000) viewers that either follow its social media channels or watch its media programs on End Devices. The Company is at the stage of expanding its viewer base and intends to generate revenue and profits from subscription fees, advertisements and online video games. The Company has started generating revenue; however, there can be no assurance that the Company will grow its revenue or reach profitability as expected or at all.

| 5 |

| Table of Contents |

On February 24, 2020, the Company completed the acquisition of Butterfly Effect Culture Media (Beijing) Co., Ltd., a corporation formed under the laws of China (“Butterfly Effect”), contemplated under the Acquisition Agreement dated December 18, 2019, as amended, pursuant to which the Company effectively controls Butterfly Effect via a series of variable interest entity agreements. Butterfly Effect is a literature and media company that devoted to literary adaptation to another medium, such as television shows, movies, audible books or video games. Butterfly Effect’s business chain starts from composing books or scripts, licensing copyrights, producing moving pictures or video games to eventually distributing the moving pictures, audio products and video games on the internet. With the addition of Butterfly Effect, we expanded our internet media platform business into the content production business and hope that our blockchain cloud-based APP Platform and the content production business may benefit from each other, although there is no assurance of any of such benefits or advantages.

Through mergers and acquisitions, we have become an internet-based online entertainment media company with focuses on audience interaction, entertainment and business opportunities. The Company’s goal is to build fantasy for young entertainment people and create entertainment value for audience. As of the date of this prospectus, the Company primarily distributes news, produces moving pictures and video games, and involves in copyrights commerce. The Company’s executive offices are located at New Times Centre, 393 Jaffe Road, Suite 17A, Wan Chai, Hong Kong and its telephone number at such address is +85267353339.

Recent Developments

Butterfly Effect Acquisition

On December 18, 2019, the Company, VTV Global Culture Media (Beijing) Co., Ltd., a Chinese wholly foreign owned entity and a wholly-owned subsidiary of the Company (“WFOE”), Butterfly Effect, and each and all of Butterfly Effect’s shareholders (each, a “Butterfly Effect Shareholder”, and collectively, “Butterfly Effect Shareholders”) entered into a business acquisition agreement (the “Butterfly Effect Acquisition Agreement”), pursuant to which the Company, through its WFOE, acquired Butterfly Effect through a series of management agreements (the “Butterfly Effect VIE Agreements”) to effectively control and own Butterfly Effect (the “Butterfly Effect Acquisition”).

On February 24, 2020 (the “Butterfly Effect Acquisition Closing Date”), the Company and Butterfly Effect completed the transactions contemplated under the Acquisition Agreement, as amended (the “Closing”), pursuant to which the Company effectively controls Butterfly Effect via the VIE Agreements, which were executed by the WFOE, Butterfly Effect and each Butterfly Effect Shareholder. In accordance with the terms of the Acquisition Agreement, the Company issued a total of 24,000,000 restricted shares (the “Stock Consideration”) of its common stock, par value $0.001 per share, to the Butterfly Effect Shareholders at the stipulated price of $4.00 per share and 1,680,000 restricted shares of common stock to the broker of this Acquisition for introduction and facilitating the completion of the Acquisition.

Shortly after the execution of this Butterfly Effect Acquisition Agreement, the Company, Butterfly Effect and each Butterfly Effect Shareholder entered into two amendments to the Acquisition Agreement, Amendment No. 1 and Amendment No. 2 to reflect updated understandings. In accordance with the Butterfly Effect Acquisition Agreement as amended, in consideration for the effective control over Butterfly Effect and in addition to the Stock Consideration, the Company agreed to pay a total of RMB 288,000,000 (the “Cash Consideration”) (equivalent to $ 42 , 020 ,4 8 5 U.S. dollars at the closing exchange rate published by Bloomberg L . P . on September 8, 2020) to the Butterfly Effect Shareholders pro rata over a period of time ending on December 31, 2021 pursuant to a schedule as set forth in Amendment No. 1.

| 6 |

| Table of Contents |

In addition, the Butterfly Effect Acquisition Agreement and its amendments provide that in the event that Butterfly Effect fails to meet the net profit milestones as set forth in the Butterfly Effect Acquisition Agreement, each Butterfly Effect Shareholder shall return the Common Stock or equivalent amount of cash (the “Claw-back”) according to the following formula:

Shares of Common Stock to be Returned by Each Butterfly Effect Shareholder

=3.8* (the Accumulated Net Income Milestone – Actual Accumulated Net Income for the First, Second and Third Fiscal Years)*Target Shareholder Equity Percentage ÷ the Closing per Share price at One Day Prior to the Return Date

However, subject to the Claw-back provision described above, the Butterfly Effect Acquisition Agreement prescribes that if the Company does not make payments of at least half of the Cash Consideration to the Butterfly Effect Shareholders within one (1) year commencing on the first trading day (excluding the first trading day) of the Common Stock on a national stock exchange, i) the Butterfly Effect shall have the right to appoint the majority of the Company’s Board and manage and operate the Company and its subsidiaries and ii) each of the Butterfly Effect Shareholders shall have the right to receive the number of shares of the Common Stock equal to the result of (the total amount of Cash Consideration – the sum of cash received by the Butterfly Effect Shareholders)/ $2.00 per share* Butterfly Effect Shareholder Equity Percentage.

A copy of the Butterfly Effect Acquisition Agreement was filed as Exhibit 10.1 to a current report on Form 8-K on December 23, 2019. The audited financial statements of Butterfly Effect for the years ended December 31, 2019 and 2018 were filed as an exhibit to a current report on Form 8-K/A on July 29, 2020 and are included in this prospectus as Exhibit 99.1.

Strategic Development with CybEye and Chief Technology Officer

On September 30, 2019, the Company entered into a strategic development agreement (the “Strategic Development Agreement”) with CybEye Image, Inc. (“CybEye”), pursuant to which CybEye is developing and providing technical support and maintenance to the Company’s online streaming media platform (“APP Platform”) and incorporating the blockchain technologies to the Company’s APP Platform to enhance security. The Strategic Development Agreement shall continue in full force and effect until September 29, 2022. During the term of the Strategic Development Agreement, CybEye will develop the APP Platform only for the Company, and will not engage in providing any services to other media companies. Subject to the terms and conditions of the Strategic Development Agreement, the Company shall issue to CybEye two million and five hundred thousand (2,500,000) shares of its unissued and registered common stock at one time and forty thousand (40,000) shares its unissued and registered common stock per month during the term of the Strategic Development Agreement upon the effectiveness of a registration statement to register those shares. Pursuant to the terms of the Strategic Development Agreement, upon listing of the Company’s common stock on a national stock exchange market, the Company shall make a cash payment of $150,000 to CybEye instead of the stock payment at the end of each whole month for CybEye’s services pursuant to this Agreement. Further pursuant to an amendment dated July 23, 2020 to the Strategic Development Agreement, in the event that the Company issues and sells its common stock in a public offering facilitated by a broker-dealer or investment bank at a price less than $4.00 per share (the “Better Price”) within the following twelve (12) months from September 30, 2019, the Company agreed to grant CybEye options to purchase a number of shares of the Company’s common stock which is calculated by multiplying the difference of $4.00 and the Better Price by 2,500,000, then dividing the product by the Better Price, at an exercise price equaling to the Better Price.

In connection with the Strategic Development Agreement, on September 30, 2019, the Company and CybEye entered into a non-exclusive licensing agreement (the “Licensing Agreement”), which was amended on December 13, 2019. Pursuant to the Licensing Agreement, as amended, the Company and its affiliates were granted a fully-paid non-exclusive right and license for a term of twenty (20) years to use and develop any intellectual property and proprietary information, including, without limitation, any patents and trademarks as set forth in Schedule A thereto, which CybEye owns, to carry out the purposes and goals of the Strategic Development Agreement.

In addition, on September 30, 2019, the Company and Mr. Bing Liu (the “Executive”) entered into an executive employment agreement (the “Executive Employment Agreement”), in accordance with which, subject to the approval of the board of directors of the Company (the “Board”), the Executive serves as the Chief Technology Officer (“CTO”) of the Company for a term of three (3) years.

Copies of the Strategic Development Agreement, Licensing Agreement, and Executive Employment Agreement were filed in a current report on Form 8-K on October 3, 2019 and the amendment to the Licensing Agreement was filed in a current report on Form 8-K on December 17, 2019. As of the date of this prospectus, our blockchain-operated App is available for downloading for both iPhone and Android mobile phone users. At the time of this prospectus, we continue our efforts to recruit more mobile phone users to use our App to watch our online media programs.

| 7 |

| Table of Contents |

Xin Mei Culture Distribution Co., Ltd.

The Company engaged Xin Mei Culture Distribution Co., Ltd. (“Xin Mei Technology”) to develop the cloud technology and internet services which are integral to the establishment and maintenance of the first generation of the media platform, the “OTT Platform”. On December 22, 2016, China VTV (HK) and Xin Mei Technology entered into the OTT development and maintenance agreement (the “OTT Development Agreement”) pursuant to which Xin Mei Technology provided the information technology to build and update a customized OTT Platform for China VTV(HK), through which China VTV (HK) may distribute its programs and shows to the audiences’ End Devices. The term of the OTT Development Agreement was five years. The total consideration of the OTT Development Agreement was an aggregate of thirty million (RMB 30,000,000) Chinese dollars (equivalent to $4,474,673 U.S. dollars), which was payable over the five-year period in the combination of cash and the Company’s stock. Later the Company and Xin Mei Technology mutually agreed to terminate the OTT Development Agreement due to changes to the Company’s business needs for new technologies. On December 31, 2018, the Company and Xin Mei Technology entered into a termination agreement, pursuant to which Xin Mei ceased its maintenance services to the Company’s OTT Platform on December 31, 2018 and also waived the Company’s obligation to pay the balance of service fee balance of RMB 16,000,000 in cash or the Company’s common stock. Currently, we are operating through our second generation media distribution platform, APP Platform, which incorporates the blockchain and cloud technologies.

Business Strategy

The Company’s business is based on the blockchain cloud-based APP Platform and internet and develops through various popular social media accounts or channels to distribute both live programs and recorded video programs to certain Chinese-speaking communities outside mainland China. The Company intends to produce customized live programs and commercials for enterprises, non-profit and non-government organizations and municipalities and distribute such contents through its media channels. In addition, the Company plans to develop more members and solicit subscription fees from new members and produce advertisement revenues in the near future.

As of the date of this prospectus, the Company has attracted approximately three million and eight hundred thousand (3,800,000) viewers or subscribers to its programs, most of whom reside in Malaysia, Singapore, Hong Kong, Taiwan, Indonesia, the United States, and Australia. The Company aims to expand its viewer base to other countries, with a focus on Asia, Europe and North America.

Through strategic mergers and acquisitions, the Company is expanding into related business. The Management and Board of Directors of the Company is integrating Butterfly Effect to realize certain synergies that can be brought by the Butterfly Effect Acquisition. For example, Butterfly Effect may in the future distribute its TV shows, movies and video games on the APP Platform to reach audience outside mainland China. Also Butterfly Effect can produce live broadcasting programs designed by the Company. We believe that the addition of Butterfly Effect may boost our influence in the internet media industry.

In the next few years, the Company will emphasize on certain ways to enhance its entertainment value and audience interaction of the APP Platform, such as new programs and applications. The Company plans to expand its footprints in the following areas:

|

| 1. | Constructing and/or purchasing LED outdoor screens in the next two years of up to 500 square meters (approximately 5,382 square feet) for advertisement purposes in major cities, such as Hong Kong, Kula Lumpur, and Taipei. |

|

|

|

|

|

| 2. | Creating various live internet programs, such as online live “Le Xue Internet Anchorwoman”, which the Company believes will reflect the youth’s new life styles and new knowledge and technologies. |

|

|

|

|

|

| 3. | Focusing on introducing new video games to the APP Platform to increase the entertainment value of our platform. |

|

|

|

|

|

| 4. | Improving the artificial intelligence and blockchain technologies in our APP Platform to enhance our viewers’ privacy and online live broadcasting stability. |

|

|

|

|

|

| 5. | Entering into the U.S. movie industry by first establishing a Los Angeles based subsidiary in the movie entertainment business. |

| 8 |

| Table of Contents |

Corporate History and Information

The Company was incorporated in the State of Nevada, originally under the name T-Bamm, on February 19, 2015. The Company was organized to sell Bamboo T-Shirts over the internet. On February 9, 2018, the Company changed its name from T-Bamm to “China VTV Limited” and switched its business from the clothing retail store business to the internet media, moving picture entertainment, internet advertisement and outdoor advertisement.

On March 15, 2019, the Company and Mr. Guoping Chen, the then-Principal Executive Officer and President of the Company, entered into a share exchange agreement (the “Share Exchange Agreement”) with China VTV Ltd. (“China VTV (HK)”), a Hong Kong company, and all of its shareholders ( “China VTV (HK) Shareholders”), pursuant to which the Company acquired all of the issued and outstanding shares of common stock of China VTV (HK) from the China VTV (HK) Shareholders by issuing an aggregate of 110,550,000 restricted shares of common stock of the Company (the “Stock Exchange”) to China VTV (HK) Shareholders pro rata upon closing of the Stock Exchange. Upon closing of the Stock Exchange, China VTV (HK) became a wholly-owned subsidiary of the Company and China VTV (HK) Shareholders now collectively own approximately 51.29% of the then issued and outstanding shares of the Company’s common stock on a fully diluted basis.

On May 6, 2019, pursuant to the Share Exchange Agreement, China VTV (HK) became a wholly-owned subsidiary of the Company, the acquisition was treated as a reverse acquisition, and China VTV (HK)’s business became the Company’s business. At the time of the Reverse Merger, the Company was not engaged in any active business.

China VTV (HK) was incorporated on January 9, 2015 under the laws of the Special Administrative Region of Hong Kong. The authorized capital stock of China VTV (HK) is 1,000,000 shares, all of which were issued and outstanding prior to the closing of the Share Exchange. China VTV (HK) did not update its shareholder registration when the investors or new shareholders invested in it. The Share Exchange Agreement was signed and agreed by all of the shareholders or beneficial owners of China VTV (HK).

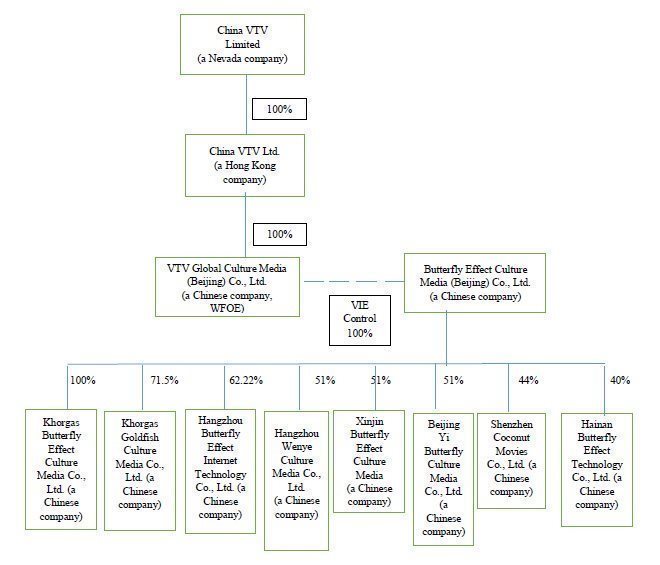

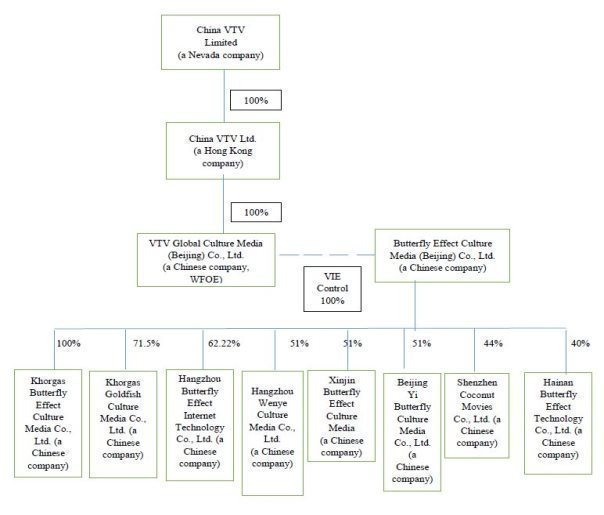

On December 18, 2019, the Company, the WFOE, Butterfly Effect, and each Butterfly Effect Shareholder entered into the Butterfly Effect Acquisition Agreement, pursuant to which the Company, through its WFOE, acquired Butterfly Effect through the Butterfly Effect VIE Agreements to effectively control and own Butterfly Effect. On February 24, 2020, the Company and Butterfly Effect completed the transactions contemplated under the Acquisition Agreement, as amended, and as a result the Company added a new line of business of literary adaptation. Butterfly Effect was incorporated on February 23, 2016 under the laws of the PRC. Butterfly Effect has one wholly owned subsidiary registered in Khorgas, Xinjiang, China and five majority owned Chinese subsidiaries and has minority ownership interest in two Chinese subsidiaries.

The diagram below illustrates our corporate structure following the Stock Exchange and Butterfly Effect Acquisition.

The Company’s consolidated financial statements for the year ended February 29, 2020 do not include the financial information of the following four non-wholly-owned subsidiaries: Hangzhou Wenye Culture Media Co., Ltd., Xinjin Butterfly Effect Culture Media Co, Ltd., Beijing Yi Butterfly Culture Media Co., Ltd., and Shenzhen Coconut Movies Co., Ltd.

A number of shareholders of China VTV (HK) formed China VTV Corp., Ltd. under the laws of PRC to operate in mainland China, which has ceased its operations in April 2017. The Company does not believe there is any potential for a conflict of interest with the company in mainland China because it has ceased all operations.

| 9 |

| Table of Contents |

THE OFFERING

| Common stock offered by us |

| Up to 12 ,0 00,000 shares of Common Stock |

|

|

|

|

| Maximum Offering Amount |

| $48,000,000. There is no minimum offering amount required as a condition to closing this offering and as a result the actual amount raised in this offering may be significantly less than the Maximum Offering Amount. |

|

|

|

|

| Shares of Common Stock outstanding prior to this offering |

| 286,280,000 |

|

|

|

|

| Stock to be outstanding after this offering |

| Up to 298,280,000 shares |

|

|

|

|

| Assumed offering price per Share |

| $4.00 |

|

|

|

|

| Gross Proceeds |

| $48,000,000 at maximum, before deducting any applicable fees, commissions, and expenses |

|

|

|

|

| Term of this offering |

| The Common Stock is being offered by the Company for a period of up to one hundred and eighty (180) days commencing on the date of the effectiveness of this registration statement. The offering will terminate at the earlier of (i) the date at which $48,000,000 of our shares have been sold; (ii) the date on which this offering is terminated by the Company in its sole discretion; or (iii) one hundred and eighty (180) days from the effectiveness of this Registration Statement. |

|

|

|

|

| Minimum Investment Amount |

|

Each investor in this offering needs to purchase at least 125 shares or $500 of the Common Stock |

|

|

|

|

| Subscription Procedures |

| Investors interested in subscribing for the shares of Common Stock in this offering must complete and deliver to the Company a completed subscription agreement to the address provided in the subscription agreement. Upon receipt of the completed subscription agreement, the Company will inform the investor that it has accepted the subscription and promptly send notification of this acceptance if the Company decides to accept the subscription . Then the investor should deliver the purchase price for the number of shares being purchased by wire transfer in immediately available funds using the wire transfer instructions provided in the subscription agreement. Promptly following the receipt of purchase proceeds from the investor, the Company will notify its transfer agent to either deliver the subscribed shares of Common Stock in a book entry form or in the investor’s brokerage account as requested by the investor . All funds for subscriptions in the offering will be transmitted to the Company’s bank account for immediate use by the Company. As a result , upon execution of the subscription agreement by the subscriber and acceptance by the Company , such subscription is irrevocable. The Company shall not offer and sell fractional shares in this Offering. |

|

|

|

|

|

|

| There is no minimum offering amount required as a condition to closing this offering and as a result the actual amount raised in this offering may be significantly less than the Maximum Offering Amount. |

|

|

|

|

| Use of proceeds |

| See “Use of Proceeds” on page 29 of this prospectus. |

|

|

|

|

| Risk factors |

| See “Risk Factors” beginning on page 15 of this prospectus and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

|

|

|

|

| OTC Pink trading symbol |

| CVTV |

| 10 |

| Table of Contents |

SELECTED CONSOLIDATED FINANCIAL INFORMATION

| Summary of Consolidated Balance Sheets Data For the Years Ended February 29, 2020 and February 28, 2019 |

|

|

| February 29, |

|

| February 28, |

| ||

|

|

| 2020 |

|

| 2019 |

| ||

| Assets |

| |||||||

| Current Assets |

|

|

|

|

|

| ||

| Cash |

| $ | 51,551 |

|

| $ | 17,548 |

|

| Accounts receivable |

|

| 79,020 |

|

|

| - |

|

| Advances to suppliers |

|

| 8,648,546 |

|

|

| - |

|

| Copyrights and development costs, net |

|

| 10,919,779 |

|

|

| - |

|

| Other receivables and current assets |

|

| 3,400,963 |

|

|

| - |

|

| Total current assets |

|

| 23,099,859 |

|

|

| 17,548 |

|

| Investment in equity investees, net |

|

| 3,275,929 |

|

|

| - |

|

| Contingent receivable |

|

| 608,914 |

|

|

| - |

|

| Capital assets, net |

|

| 693,192 |

|

|

| - |

|

| Intangible assets, net |

|

| 1,530,000 |

|

|

| - |

|

| Goodwill |

|

| 21,552,596 |

|

|

| - |

|

| Right-of-use assets, net |

|

| 78,638 |

|

|

| - |

|

| Total Assets |

| $ | 50,839,128 |

|

| $ | 17,548 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Deficit | ||||||||

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 601,671 |

|

| $ | - |

|

| Wages payable |

|

| 304,509 |

|

|

| 23,163 |

|

| Short-term debt |

|

| 2,218,050 |

|

|

| - |

|

| Interest payable |

|

| 106,268 |

|

|

| - |

|

| Due to related parties |

|

| 3,819,200 |

|

|

| 592,739 |

|

| Deferred revenue |

|

| 2,547,180 |

|

|

| - |

|

| Acquisition liabilities |

|

| 36,931,000 |

|

|

| - |

|

| Taxes payable |

|

| 222,766 |

|

|

| - |

|

| Lease liabilities |

|

| 84,663 |

|

|

| - |

|

| Other payables |

|

| 4,331,023 |

|

|

| - |

|

| Total current liabilities |

|

| 51,166,330 |

|

|

| 615,902 |

|

| Total liabilities |

|

| 51,166,330 |

|

|

| 615,902 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Deficit |

|

|

|

|

|

|

|

|

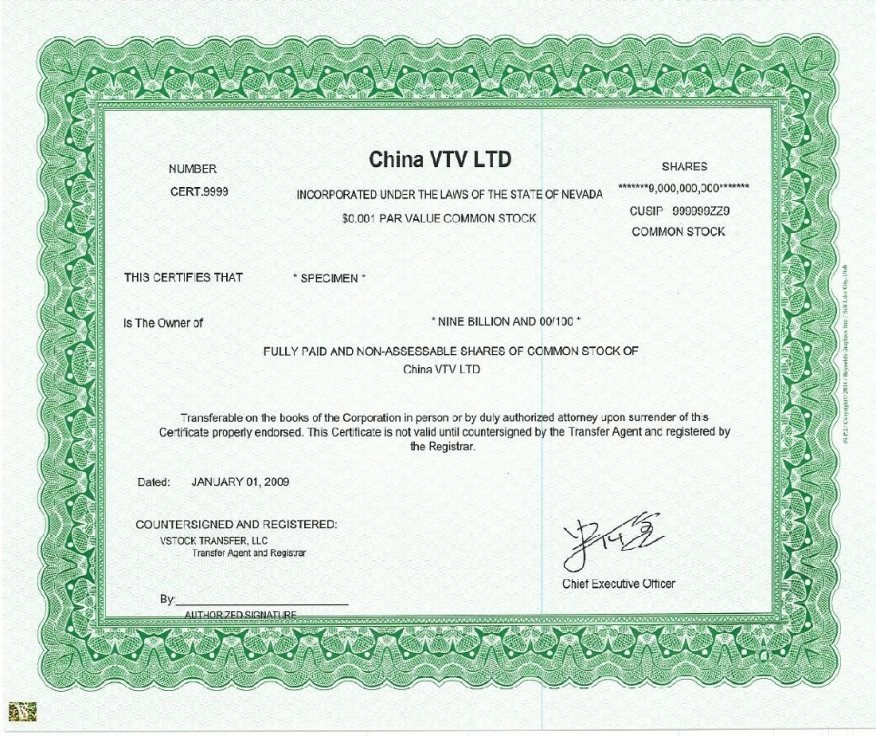

| Common stock, par value $0.001, 600,000,000 shares authorized, 284,280,000 and 105,000,000 shares issued and outstanding as of February 29, 2020 and February 28, 2019, respectively |

|

| 284,280 |

|

|

| 105,000 |

|

| Additional paid-in capital |

|

| 3,681,379 |

|

|

| 1,634,576 |

|

| Subscription receivables and shares issuable, net |

|

| (446,025 | ) |

|

| - |

|

| Accumulated deficit |

|

| (3,844,738 | ) |

|

| (2,337,167 | ) |

| Accumulated other comprehensive loss |

|

| (2,098 | ) |

|

| (763 | ) |

| Total stockholders’ deficit attributable to the Company |

|

| (327,202 | ) |

|

| (598,354 | ) |

| Total stockholders’ deficit |

|

| (327,202 | ) |

|

| (598,354 | ) |

| Total Liabilities and Stockholders’ Deficit |

| $ | 50,839,128 |

|

| $ | 17,548 |

|

| 11 |

| Table of Contents |

| Summary of Consolidated Statements of Operations and Comprehensive Loss Data For the Years Ended February 29, 2020 and February 28, 2019 |

|

|

| For The Years Ended |

| |||||

|

|

| February 29, 2020 |

|

| February 28, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Net revenue |

| $ | 3,834 |

|

| $ | - |

|

| Cost of revenue |

|

| 1,278 |

|

|

| - |

|

| Gross profit |

|

| 2,556 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing expenses |

|

| 6,390 |

|

|

| - |

|

| Research and development expenses |

|

| 231,791 |

|

|

| 861,581 |

|

| General and administrative expenses |

|

| 1,271,630 |

|

|

| 13,426 |

|

| Loss from operations |

|

| (1,507,255 | ) |

|

| (875,007 | ) |

| Interest expense |

|

| 316 |

|

|

| - |

|

| Loss before income tax |

|

| (1,507,571 | ) |

|

| (875,007 | ) |

| Provision for income tax |

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

| $ | (1,507,571 | ) |

| $ | (875,007 | ) |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

| Foreign currency translation loss |

|

| (1,335 | ) |

|

| (763 | ) |

| Comprehensive loss |

|

| (1,508,906 | ) |

|

| (875,770 | ) |

| 12 |

| Table of Contents |

Summary of Consolidated Balance Sheets Data For the Three Months Ended May 31, 2020

|

|

| May 31, |

|

| February29, |

| ||

|

|

| 2020 |

|

| 2020 |

| ||

|

|

| Unaudited |

|

| Audited |

| ||

| Assets |

|

|

|

|

|

| ||

| Current Assets |

|

|

|

|

|

| ||

| Cash |

| $ | 91,177 |

|

| $ | 51,551 |

|

| Accounts receivable |

|

| 652,283 |

|

|

| 79,020 |

|

| Advances to suppliers |

|

| 5,066,081 |

|

|

| 8,648,546 |

|

| Inventories |

|

| 7,422,951 |

|

|

| 4,310,519 |

|

| Copyrights, net |

|

| 8,295,865 |

|

|

| 6,609,260 |

|

| Other receivables and current assets |

|

| 3,580,081 |

|

|

| 3,400,963 |

|

| Total current assets |

|

| 25,108,438 |

|

|

| 23,099,859 |

|

| Investment in equity investees, net |

|

| 3,255,252 |

|

|

| 3,275,929 |

|

| Contingent receivable |

|

| 608,914 |

|

|

| 608,914 |

|

| Capital assets, net |

|

| 678,489 |

|

|

| 693,192 |

|

| Intangible assets, net |

|

| 1,417,548 |

|

|

| 1,530,000 |

|

| Goodwill |

|

| 21,552,596 |

|

|

| 21,552,596 |

|

| Right-of-use assets, net |

|

| 63,180 |

|

|

| 78,638 |

|

| Total Assets |

| $ | 52,684,417 |

|

| $ | 50,839,128 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 611,677 |

|

| $ | 601,671 |

|

| Wages payable |

|

| 361,385 |

|

|

| 304,509 |

|

| Short-term debt |

|

| 2,201,140 |

|

|

| 2,218,050 |

|

| Interest payable |

|

| 120,603 |

|

|

| 106,268 |

|

| Due to related parties |

|

| 2,470,867 |

|

|

| 3,819,200 |

|

| Deferred revenue |

|

| 4,346,200 |

|

|

| 2,547,180 |

|

| Acquisition liabilities |

|

| 36,931,000 |

|

|

| 36,931,000 |

|

| Taxes payable |

|

| 1,459,420 |

|

|

| 222,766 |

|

| Lease liabilities |

|

| 69,320 |

|

|

| 84,663 |

|

| Other payables |

|

| 545,347 |

|

|

| 4,331,023 |

|

| Total current liabilities |

|

| 49,116,959 |

|

|

| 51,166,330 |

|

| Total liabilities |

|

| 49,116,959 |

|

|

| 51,166,330 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

| Common stock, par value $0.001, 600,000,000 shares authorized, 284,280,000 and 284,280,000 shares issued and outstanding as of May 31, 2020 and February 29, 2020, respectively |

|

| 284,280 |

|

|

| 284,280 |

|

| Additional paid-in capital |

|

| 6,896,216 |

|

|

| 3,681,379 |

|

| Subscription receivables and shares issuable, net |

|

| (311,345 | ) |

|

| (446,025 | ) |

| Accumulated deficit |

|

| (2,924,933 | ) |

|

| (3,844,738 | ) |

| Accumulated other comprehensive loss |

|

| (236,173 | ) |

|

| (2,098 | ) |

| Total stockholders’ equity (deficit) attributable to the Company |

|

| 3,708,045 |

|

|

| (327,202 | ) |

| Noncontrolling interests |

|

| (140,587 | ) |

|

| - |

|

| Total shareholders’ equity (deficit) |

|

| 3,567,458 |

|

|

| (327,202 | ) |

| Total Liabilities and Stockholders’ Equity |

| $ | 52,684,417 |

|

| $ | 50,839,128 |

|

| 13 |

| Table of Contents |

Summary of Consolidated Statements of Operations and Comprehensive Loss Data

For the Three Months ended May 31, 2020 and 2019

(UNAUDITED)

|

|

| For The Three Months Ended |

| |||||

|

|

| May 31, 2020 |

|

| May 31, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Net revenue |

| $ | 3,721,618 |

|

| $ | - |

|

| Cost of revenue |

|

| 1,581,567 |

|

|

| - |

|

| Gross profit |

|

| 2,140,051 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| General and administrative expenses |

|

| 1,326,517 |

|

|

| 103,039 |

|

| Income (Loss) from operations |

|

| 813,534 |

|

|

| (103,039 | ) |

| Interest expense |

|

| (15,542 | ) |

|

| - |

|

| Investment impairment |

|

| (19,200 | ) |

|

| - |

|

| Other income |

|

| 426 |

|

|

| - |

|

| Income (Loss) |

|

| 779,218 |

|

|

| (103,039 | ) |

| Provision for income tax |

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

| $ | 779,218 |

|

| $ | (103,039 | ) |

| Net income (loss) attributable to noncontrolling interests |

|

| (140,587 | ) |

|

| - |

|

| Net income (loss) attributable to the Company |

|

| 919,805 |

|

|

| (103,039 | ) |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

| Foreign currency translation loss |

|

| (234,075 | ) |

|

| (227 | ) |

| Comprehensive income (loss) |

|

| 685,730 |

|

|

| (103,266 | ) |

| 14 |

| Table of Contents |

An investment in the Company’s common stock involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this prospectus before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to Our Business and Our Industry

We are subject to the risks associated with operating in an evolving market.

As a company operating in the rapidly evolving online and digital communications market, we face numerous risks and uncertainties. Some of these risks relate to our ability to:

| · | continue to attract users to watch our programs and use our website and mobile applications as the primary means of obtaining news information; |

| · | continue to attract a larger audience to our matrices of Chinese-language content and services by expanding the type and technical sophistication of the content and services we offer; |

| · | develop a sufficiently large customer base for our advertising and marketing services; |

| · | generate revenues derived from our APP subscription fees, campaign and public relation planning, advertising and marketing businesses; |

| · | attract and retain qualified personnel; and |

| · | effectively control our increased costs and expenses as we expand our businesses. |

We will rely on IP TV subscriptions as a significant portion of our revenues, but the online TV business is highly competitive and we may not generate any revenues from the subscription or the revenues as expected.

As we promote our IP TV subscription programs, we expect substantial income from the IP TV subscription fees. However, there are numerous internet TV program providers that have launched their respective IP TV subscription programs, such as Insight IPTV, Roku, Netflix, and Direct TV. In addition, there are a few IP TV companies that provide channels from mainland China, Taiwan and Hong Kong, such as Kylin TV. Although we provide programs primarily in the language of Chinese and the popular IP TV providers in the United States supply TV programs and TV channels in English, we may not be able to distinguish ourselves from the existing IP TV providers regardless of the language of the programs and therefore to generate the revenues from subscription fees as expected or at all.

We will rely on advertising as a significant portion of our revenues, but the online advertising industry is subject to many uncertainties, which may prevent us from generating revenues from advertisement.

The online advertising industry is rapidly evolving in Hong Kong, Taiwan, Singapore, and other Asian countries outside mainland China. Many of our current and potential advertisers have limited experience with the internet as an advertising and marketing medium, have not traditionally devoted a significant portion of their advertising and marketing expenditures or other available funds to web-based advertising and marketing, and may not find the internet to be effective for promoting their products and services relative to traditional print and broadcast media. We may not be successful in attracting new advertisers, convincing our current and potential advertisers to increase their budgets for online advertising and marketing or securing a significant share of those budgets. If the internet does not become more widely accepted as a medium for advertising and marketing, our ability to generate revenues from online advertisement could be negatively affected. Our ability to generate significant advertising and marketing revenues will depend on a number of factors, many of which are beyond our control, including but not limited to:

| 15 |

| Table of Contents |

| · | the development and retention of a large base of users possessing demographic characteristics attractive to advertisers; |

| · | the maintenance and enhancement of our awareness as a media company; |

| · | increased competition and potential downward pressure on online advertising and marketing prices and limitations on web page space; |

| · | changes in government policy that curtail or restrict our online advertising and marketing services or content offerings or increase our costs associated with policy compliance; |

| · | the acceptance of online advertising and marketing as an effective way for advertisers to market their businesses and products; |

| · | advertisers’ preferences for new online advertising and marketing formats, products or business models offered by other competitors and our ability to provide similar or competing new formats, products and solutions; |

| · | the development of independent and reliable means of verifying levels of online advertising and traffic; and |

| · | the effectiveness of our advertising delivery, tracking and reporting systems. |

Our business is highly sensitive to the strength of our brands in the marketplace, and we may not be able to maintain current or attract new users, customers and strategic partners if we do not continue to increase the awareness of our brand name as a media company in the marketplace.

Our operational and financial performance is highly dependent on our strong brands in the marketplace. Such dependency will increase further as the number of internet and mobile users as well as the number of market entrants grows. In order to retain existing and attract new viewers, advertisers and strategic partners, we may need to substantially increase our expenditures to create and maintain brand awareness and brand loyalty. However, we cannot guarantee that the increase of our brand visibility will result in increase in revenues and profits. Our financial performance may not improve even though our programs are well received and recognition of our brand names increases.

Increases in competition and market prices for professionally produced content may have an adverse impact on our financial condition and results of operations.

Competition for quality online advertising content is intense in Hong Kong and PRC. Our competitors include well-capitalized companies, both private and newly listed companies, many of whom operate on a net-loss basis, as well as well-established companies with greater user traffic than ours. If we are unable to secure a large portfolio of professionally produced quality content due to the prohibitively high costs, or if we are unable to manage our content acquisition costs effectively and generate sufficient revenues to outpace the increase in content spending, our website traffic, financial condition and results of operations may be adversely affected.

The expansion of advertisement blocking measures may negatively impact the intended advertising revenues.

The development of software and mobile applications that block advertisements before they appear on a user’s screen may hinder the growth of online and digital advertising. Since advertising revenues may be based on user views, the expansion of advertisement-blocking software and mobile applications may cast shadow over our planned advertising business. As a result, such advertisements will not be tracked as a delivered advertisement. In addition, advertisers may choose not to advertise on our websites or applications because of the expansion of advertisement-blocking measures. In addition, increasing numbers of browsers include technical barriers designed to prevent consumer tracking such as trailing browsing history, which may also adversely impact the growth of online and digital advertising.

We may face regulatory challenges with respect to establishing outdoor LED screens in the future.

As part of our business strategy, we plan to use part of the offering proceeds to c onstruct and/or purchase LED outdoor screens or scalable LED billboards in the next two years of up to 500 square meters (approximately 5,382 square feet) for advertisement purposes in certain major cities, such as Hong Kong, Kula Lumpur, and Taipei. Currently we do not have any permit to establish the intended LED screens in any of the targeted cities and we expect to spend substantial time and efforts regarding the outdoor LED screens in those foreign cities. We cannot assure you that we will obtain any relevant permits to construct or purchase any desirable LED screens or do so with reasonable costs.

| 16 |

| Table of Contents |

If we fail to establish and maintain relationships with content or infrastructure providers, we may not be able to attract and retain users.

In addition to reliance upon our reporters, editors and staff, we rely on numerous third parties to provide high-quality news, video, audio and text content to make our websites and mobile applications more attractive to users and advertisers. Our arrangements with content providers are usually short-term and our content providers may increase the fees they charge us for their content. This trend would increase our costs and operating expenses and could adversely affect our ability to obtain content at an economically acceptable cost. Except for the exclusive content, some of the third party content provided to our websites is also available from other sources or may be provided to other internet companies. If other internet companies present the same or similar content in a superior manner, it would adversely affect our user traffic. On February 24, 2020, we acquired Butterfly Effect and as a result expanded into the content production business. However, we cannot provide any assurance that our new subsidiaries and affiliates will supply sufficient internet contents, such as TV shows and movies which cater to Chinese speakers living outside mainland China.

Our business also depends significantly on relationships with infrastructure providers. We have the Strategic Development Agreement with CybEye to continue further improving the efficiency of the APP Platform with the blockchain technologies. If our relationship with CybEye deteriorates or some of our competitors establishes the same or more advanced platform than what we have, our business operations and financial results may be adversely affected. We may not be able to maintain the relationships with third party vendors or replace them on commercially attractive terms.

We may fail to retain existing users or add new users, or our users may decrease their level of engagement with us.

The size of our user base and the level of our user engagement are critical to our success. Growing our user base and increasing the overall level of user engagement on our live streaming platform are critical to our business. If our user growth rate slows down, our success will become increasingly dependent on our ability to retain existing users and enhance user engagement on our platform. For instance, if our CVTV mobile application or the APP Platform does not provide our users with the entertainment they seek, we may not be able to retain or attract users or increase the frequency or depth of their engagement. A number of online entertainment and communication products that achieved early popularity have since seen the size of their user base or level of user engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our user base or user engagement level in the future. A number of factors could negatively affect user retention, growth and engagement, including if:

|

| · | we are unable to attract new users to our APP Platform or retain existing ones; |

|

|

|

|

|

| · | we fail to introduce new and improved services, or services we introduced are not favorably received by users; |

|

|

|

|

|

| · | we are unable to combat inappropriate or abusive use of our platform, which may lead to negative public perception of us and our brands; |

|

|

|

|

|

| · | information technology issues or other technical problems prevent us from delivering our services in a rapid and reliable manner or otherwise adversely affect the user experience; |

|

|

|

|

|

| · | we suffer from negative publicity, fail to maintain our brands or if our reputation is damaged; |

|

|

|

|

|

| · | we fail to address user concerns related to privacy and communication, safety, security or other factors; and |

|

|

|

|

|

| · | there are adverse changes in our services that are mandated by, or that we elect to make to address, legislation, regulations or government policies. |

| 17 |

| Table of Contents |

If we are unable to grow our user base or enhance user engagement, our platform and mobile applications will become less attractive to our users, which would have a material and adverse impact on our business and operating results.

Changes in technology may render our current technologies obsolete or require us to obtain licenses for introducing new services or make substantial capital investments, financing for which may not be available to us on favorable commercial terms or at all.

The Hong Kong telecommunications industry has been characterized by rapid increases in the diversity and sophistication of the technologies and services offered. As a result, we expect that we will need to constantly upgrade our information technologies and services in order to respond to the competitive industry conditions and customer requirements. Developments of new technologies have rendered some less advanced technologies unpopular or obsolete. If we fail to develop, or obtain timely access to, new technologies, infrastructure and equipment, or if we fail to obtain the necessary licenses to provide our content using these new technologies, we may lose our customers and market share.

In addition, the cost of implementing new technologies, upgrading our networks or expanding capacity could be significant. In particular, we have made and will continue to make substantial capital expenditures in the near future in order to effectively respond to technological changes, such as the continued expansion of our servers. To the extent these expenditures exceed our cash resources, we will be required to seek additional debt or equity financing. Our ability to obtain additional financing on favorable commercial terms will depend on a number of factors. These factors include our financial condition, results of operations, cash flows and the prevailing market conditions in the domestic and international telecommunications industry, the cost of financing and conditions in the financial markets, and the issuance of relevant government and other regulatory approvals. Any inability to obtain funding for our capital expenditures on commercially acceptable terms could jeopardize our expansion plans and materially and adversely affect our business prospects and future results of operations.

If new technologies adopted by us do not perform as expected, or if we are unable to effectively integrate new technologies in a commercially viable manner, our revenue growth and profitability may decline.

We are constantly evaluating new growth opportunities in the internet media industry. Some of these opportunities involve new digital platform technologies for which there are no proven markets, and may not develop as expected. These new technologies may not perform as expected or generate an acceptable rate of return. In addition, we may not be able to successfully develop new technologies to effectively and economically deliver our advertising or marketing services, or be able to compete successfully in the delivery of our news content based on or through new technologies. Furthermore, the success of our mobile applications is substantially dependent on the mobile applications developed by third-party developers. These applications may not be sufficiently developed to support our content and/or advertising and marketing services. If we are unable to deliver commercially viable services or applications based on the new technologies that we adopt, our financial condition and results of operations may be materially and adversely affected.

| 18 |

| Table of Contents |

Our growth may cause significant pressures upon our operational, administrative and financial resources.

Our operational, administrative and financial resources may be inadequate to sustain the growth we want to achieve. As the demands of our users and the needs of our customers change, the number of our users and volume of online advertising increase, requirements for maintaining sufficient servers to provide high-definition online video and mobile activities increase, we will need to increase our investment in our network infrastructure, facilities, personnel and other areas of operations. If we are unable to manage our growth and expansion effectively, the quality of our advertising and marketing services could deteriorate and our business may suffer. Our future success will depend on, among other things, our ability to:

| · | adapt our services and maintain and improve the quality of our services; |

| · | protect our website from hackers and unauthorized access; |

| · | continue training, motivating and retaining our existing employees and attract and integrate new employees; and |

| · | develop and improve our operational, financial, accounting and other internal systems and controls. |

Due to the rapidly evolving market of our industry, we cannot predict whether we will meet internal or external expectations of future performance.

The internet industry is rapidly evolving, and new products, new business models, and new players emerge from time to time in a lot of Asian countries and regions where our primary market is located. In addition, regulatory changes can have an unexpected and disruptive impacts on our business.

We believe our future success depends on our ability to significantly grow our revenues from the planned business models. However, market data on our business, especially on new products, business models and sales channels, are often limited, unreliable or nonexistent. Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in a fast changing market where there are abundant private and public capital to support competing new product developments, new business models and new companies. These risks include our ability to:

| · | offer new and innovative mobile applications; |

| · | attract and retain viewers, subscribers and advertisers; |

| · | react quickly and effectively to regulatory changes; |

| · | respond effectively to competitive pressures and address the effects of strategic relationships or corporate combinations among our competitors; |

| · | attract customers to our advertising and marketing services; |

| · | maintain our current, and develop new, strategic relationships; |

| · | increase awareness of our brand and continue to build viewer loyalty; |

| · | attract and retain qualified managerial and other talented employees; |

| · | upgrade our technology to support increased traffic and expanded services; |

| · | expand the content and services on our network, produce and secure premium content and increase network bandwidth in a cost-effective manner; and |

| · | develop a sufficiently large customer and user base and monetization models for our advertising and marketing services to recover its development costs, network expenditures and marketing expenses and eventually achieve profitability. |

| 19 |

| Table of Contents |

We may not be able to adequately protect our intellectual properties, and we may be subject to intellectual property infringement claims or other allegations by third parties for services we provide or for information or content displayed on, retrieved from or linked to our websites, or distributed to our users, which may materially and adversely affect our business, financial condition and prospects.

We rely on a combination of copyright and trademark laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our intellectual properties. Monitoring unauthorized use of our products is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our intellectual properties, particularly in countries where the laws may not protect our proprietary rights as fully as in the United States. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

Companies in the internet, technology, and media industries are frequently involved in litigation based on allegations of infringement of intellectual property rights, unfair competition, invasion of privacy, defamation and other violations of other parties’ rights. The validity, enforceability and scope of protection of intellectual property rights in internet-related industries are uncertain and still evolving.

For example, we had a trademark dispute with one of the Company’s former partners, China VTV Taiwan Co., Ltd. (“China VTV Taiwan”). On December 7, 2018, the Company filed an opposition to China VTV Taiwan’s mark registration in front of Taiwan Intellectual Property Office with respect to the mark that the Company has used since February 2015 in a number of Asian countries and regions. On November 12, 2019, the Taiwan Intellectual Property Office denied China VTV Taiwan’s mark registration application and China VTV Taiwan appealed such decision to the Ministry of Economic Affairs of Taiwan. On April 14, 2020, the Ministry of Economic Affairs of Taiwan affirmed the decision of the Taiwan Intellectual Property Office that it agreed with the Company on denying China VTV Taiwan’s mark registration in Taiwan. On July 7, 2020, the Company’s wholly owned subsidiary in Hong Kong received the affirmation from the Taiwan Intellectual Property Office to register the Company’s mark and the accompanying text in Taiwan.

Pursuing or defending intellectual property litigation can be costly and impose a significant burden on management and employees, and there can be no assurances that favorable final outcomes will be obtained in all cases. Any resulting liability or expenses, or changes required to our websites to reduce the risk of future liability, may have a material adverse effect on our business, financial condition and prospects.

Privacy concerns may prevent us from selling demographically targeted advertising in the future and make us less attractive to advertisers.

We collect personal data from our user base in order to better understand our users and their needs and to help our advertisers target specific demographic groups. If privacy concerns or regulatory restrictions prevent us from selling demographically targeted advertising, we may become less attractive to advertisers. For example, as part of our future advertisement delivery system, we may integrate user information such as advertisement response rate, name, address, age or email address, with third-party databases to generate comprehensive demographic profiles for individual users.

We do not have any business liability or disruption insurance coverage for our operations, and nor do we have any director and officer liability insurance. Any business disruption, litigation or natural disaster may cause us to incur substantial costs and divert our resources.

| 20 |

| Table of Contents |

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Hong Kong dollars HKD and Chinese dollars RMB into foreign currencies and, if HKD or RMB were to decline in value, reducing our revenues and profits in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in Hong Kong use the Hong Kong Dollar (“HKD”) and operations in mainland China use RMB as the functional currencies. The majority of our expenses incurred are in HKD and RMB and some expenses are incurred in USD. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the HKD depends to a large extent on Hong Kong government policies, relations with PRC, domestic and international economic and political developments as well as supply and demand in the local market.

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our directors, executive officers, senior management and other key employees, many of whom are difficult to replace. The loss of the services of any of our executive officers or other key employees could potentially harm our business operations. Competition for qualified talents in Hong Kong is intense. Our future success is dependent on our ability to attract a significant number of qualified employees and retain existing key employees. If we are unable to do so, our business and growth may be materially and adversely affected. Our need to significantly increase the number of our qualified employees and retain key employees may cause us to materially increase compensation-related costs, including stock-based compensation.

You may have difficulty enforcing judgment against us or our directors and officers.