UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________

Commission file number 333-214067

ELECTRAMECCANICA VEHICLES

CORP.

(Exact name of Registrant specified in its

charter)

Not Applicable

(Translation of

Registrant’s name into English)

British Columbia, Canada

(Jurisdiction

of incorporation or organization)

102 East 1st Avenue

Vancouver, British Columbia, Canada, V5T 1A4

(Address of principal executive offices)

Kulwant Sandher; (604) 428-7656;

kulwant@electrameccanica.com

(Name, Telephone, Email and/or

Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class | Name of each exchange on which registered |

| None | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Common Shares Without Par Value

(Title

of Class)

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of business of the period covered by the annual report.

41,783,587 Common Shares Without Par Value

(See item 3.A below)

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Yes [ ] No [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No [X]

Indicate by check mark whether Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non Accelerated Filer [ ] | Emerging Growth Company [X] |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued | Other [ ] |

| by the International Accounting Standards Board [X] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17[ ] Item 18 [ ] If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

Yes [ ] No [X]

- 2 -

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not applicable.

__________

- 3 -

TABLE OF CONTENTS

___________

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains statements that constitute “forward-looking statements”. Any statements that are not statements of historical facts may be deemed to be forward-looking statements. These statements appear in a number of different places in this Annual Report and, in some cases, can be identified by words such as “anticipates”, “estimates”, “projects”, “expects”, “contemplates”, “intends”, “believes”, “plans”, “may”, “will”, or their negatives or other comparable words, although not all forward-looking statements contain these identifying words. Forward-looking statements in this Annual Report may include, but are not limited to, statements and/or information related to: strategy, future operations, the size and value of the order book and the number of orders, the number and timing of building pre-production vehicles, the projection of timing and delivery of SOLOs in the future, projected costs, expected production capacity, expectations regarding demand and acceptance of our products, estimated costs of machinery to equip a new production facility, and trends in the market in which we operate, plans and objectives of management.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions made in light of our experience and our perception of trends, current conditions and expected developments, as well as other factors that we believe to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumption and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company’s ability to build pre-production SOLOs and to begin production deliveries within certain timelines; the Company’s expected production capacity; prices for machinery to equip a new production facility, labor costs and material costs, remaining consistent with the Company’s current expectations; production of SOLOs meeting expectations and being consistent with estimates; equipment operating as anticipated; there being no material variations in the current regulatory environment; and the Company’s ability to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Such risks are discussed in Item 3.D “Risk Factors”. In particular, without limiting the generality of the foregoing disclosure, the statements contained in Item 4.B. – “Business Overview”, Item 5 – “Operating and Financial Review and Prospects” and Item 11 – “Quantitative and Qualitative Disclosures About Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly. Such risks, uncertainties and other factors include but are not limited to:

-

general economic and business conditions, including changes in interest rates;

-

prices of other electric vehicles, costs associated with manufacturing electric vehicles and other economic conditions;

-

natural phenomena;

-

actions by government authorities, including changes in government regulation;

-

uncertainties associated with legal proceedings;

-

changes in the electric vehicle market;

- 2 -

-

future decisions by management in response to changing conditions;

-

the Company’s ability to execute prospective business plans;

-

misjudgments in the course of preparing forward-looking statements;

-

the Company ability to raise sufficient funds to carry out its proposed business plan;

-

consumers’ willingness to adopt three-wheeled single passenger electric vehicles;

-

declines in the range of the Company’s electric vehicles on a single charge over time may negatively influence potential customers’ decisions to purchase such vehicles;

-

developments in alternative technologies or improvements in the internal combustion engine;

-

inability to keep up with advances in electric vehicle technology;

-

inability to design, develop, market and sell new electric vehicles and services that address additional market opportunities;

-

dependency on certain key personnel and any inability to retain and attract qualified personnel;

-

in experience in mass-producing electric vehicles;

-

inability to reduce and adequately control operating costs;

-

failure of the Company’s vehicles to perform as expected;

-

inexperience in servicing electric vehicles;

-

inability to succeed in establishing, maintaining and strengthening the Electrameccanica brand;

-

disruption of supply or shortage of raw materials;

-

the unavailability, reduction or elimination of government and economic incentives;

-

failure to manage future growth effectively; and

-

labor and employment risks.

- 3 -

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. We wish to advise you that these cautionary remarks expressly qualify, in their entirety, all forward-looking statements attributable to our Company or persons acting on our Company’s behalf. The Company does not undertake to update any forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements, except as, and to the extent required by, applicable securities laws. You should carefully review the cautionary statements and risk factors contained in this Annual Report and other documents that the Company may file from time to time with the securities regulators.

- 4 -

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. Selected financial data

The following tables sets forth selected financial information for Electrameccanica Vehicles Corp. (the “Company”) for the fiscal year ended December 31, 2016 and for the period from February 16, 2015 (date of inception) to December 31, 2015 prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The information for the last fiscal year ended December 31, 2016 and for the period from February 16, 2015 to December 31, 2015 have been extracted from the Company’s audited financial statements and related notes included herein and should be read in conjunction with such financial statements appearing in Item 18 – Financial Statements and with the information appearing in Item 5 – Operating and Financial Review and Prospects. The financial statements included in Item 18 in this Annual Report are prepared under IFRS.

The data is expressed in Canadian dollars (“CDN$”), unless otherwise described. We refer readers to “Currency and Exchange Rates” below for a history of exchange rates between the Canadian dollar and the U.S. dollar.

Reported under IFRS

| Statement of Operations | ||

| Year ended Dec. 31, 2015 | Year ended Dec. 31, 2016 | |

| Revenues | - | - |

| Gross Margin | - | - |

| Net Loss | $995,833 | $8,973,347 |

| Basic and Diluted Earnings (Loss) per Share | ($0.22) | ($0.27) |

| Basic and Diluted Earnings Loss per Share after 1 for 5 share split | ($0.04) (1) | N/A |

| Balance Sheet | ||

| December 31, 2015 | December 31, 2016 | |

| Cash | $106,357 | $3,916,283 |

| Current Assets | $197,309 | $4,437,152 |

| Total Assets | $213,118 | $4,787,766 |

| Current Liabilities | $346,416 | $881,176 |

| Total Liabilities | $346,416 | $881,176 |

| Shareholders’ Equity (Deficiency) | ($133,298) | $3,906,590 |

- 5 -

| Notes: | |

| (1) |

After taking into account the 1 for 5 share split effective June 22, 2016. |

Currency and Exchange Rates

Unless otherwise indicated, all references to dollar amounts are to Canadian dollars. The rate of exchange for the U.S. dollar, expressed in Canadian dollars, as of April 25, 2017, was 1.3277, based on the daily noon rate as published by the Bank of Canada. Exchange rates published by the Bank of Canada are available on its website, www.bankofcanada.ca, are nominal quotations – not buying or selling rates – and are intended for statistical or analytical purposes.

The following table sets forth the high and low exchange rates for each month during the previous six months, based on the noon rate as published by the Bank of Canada:

Previous Six Months

| October 2017 |

November 2017 |

December 2017 |

January 2017 |

February 2017 |

March 2017 | |

| High Rate | 1.3403 | 1.3582 | 1.3556 | 1.3438 | 1.3248 | 1.3505 |

| Low Rate | 1.3104 | 1.3337 | 1.3120 | 1.3030 | 1.3004 | 1.3279 |

The following table sets forth:

-

The rates of exchange for the U.S. dollar, expressed in Canadian dollars, in effect at the end of each of the periods indicated;

-

The average of the exchange rates in effect on the last day of each month during such periods; and

-

The high and low exchange rate during such periods, in each case based on the noon rate as published by the Bank of Canada.

Years ending December 31

| 2016 | 2015 | |

| Rate at end of Period | 1.3427 | 1.3840 |

| Average Rate During Period | 1.3248 | 1.2787 |

| High Rate | 1.4589 | 1.3990 |

| Low Rate | 1.2544 | 1.1728 |

B. Capitalization And Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

- 6 -

D. Risk Factors

Our business operations and our securities are subject to a number of substantial risks, including those described below. Any person who is not in a position to lose the entire amount of any investment should not invest in our securities. You should carefully consider the risks described below and the other information in this Annual Report on Form 20F before investing in our common shares. The risks and uncertainties described below are not the only ones we may face. Additional risks and uncertainties that we are unaware of, or that we currently deem to be immaterial, may also become important factors that affect us. If any of these or other risks actually occur, our business, financial condition and operating results, as well as the trading price or value of our securities could be materially and adversely affected.

Risks Relating to our Business and Industry

We have a limited operating history and have not yet generated any revenues.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of your investment. We were formed in February 2015 and we have not yet begun producing or delivering our first vehicle. To date, we have no revenues. We intend in the longer term to derive substantial revenues from the sales of our SOLO vehicle and other intended elective vehicles. The SOLO is in development, and we do not expect to start delivering to customers until the end of the first quarter or early second quarter of 2017. The SOLO vehicle requires significant investment prior to commercial introduction and may never be successfully developed or commercially successful.

It is anticipated that we will experience an increase in losses prior to the launch of the SOLO. For the year ended December 31, 2015, we generated a loss of $995,833. For the fiscal year ended December 31, 2016, we generated a loss of $8,973,347, bringing our accumulated deficit to $9,969,180. We anticipate generating a significant loss for the current fiscal year. The independent auditor’s report on our financial statements includes an explanatory paragraph relating to our ability to continue as a going concern.

We have no revenues, are currently in debt and expect significant increases in costs and expenses to forestall revenues for the foreseeable future. Even if we are able to successfully develop the SOLO, there can be no assurance that we will be commercially successful. If we are to ever achieve profitability we must have a successful commercial introduction and acceptance of the SOLO, which may not occur.

We expect the rate at which we will incur losses to increase significantly in future periods from current levels as we:

-

design, develop and manufacture the SOLO and its components;

-

develop and equip our manufacturing facility;

-

build up inventories of parts and components for the SOLO;

-

open Electrameccanica stores;

-

expand our design, development, maintenance and repair capabilities;

- 7 -

-

develop and increase our sales and marketing activities; and

-

develop and increase our general and administrative functions to support our growing operations.

Because we will incur the costs and expenses from these efforts before we receive any revenues with respect thereto, our losses in future periods will be significantly greater than the losses we would incur if we developed the business more slowly. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in increases in our revenues, which would further increase our losses.

We currently have negative operating cash flows and if we are unable to generate positive operating cash flows in the future our viability as an operating business will be adversely affected.

We have made significant up-front investments in research and development, sales and marketing, and general and administrative expenses in order to rapidly develop and expand our business. We are currently incurring expenditures related to our operations that have generated a negative operating cash flow. Operating cash flow may decline in certain circumstances, many of which are beyond our control. There is no assurance that sufficient revenues will be generated in the near future. Because we continue to incur such significant future expenditures for research and development, sales and marketing, and general and administrative expenses, we may continue to experience negative cash flow until we reach a sufficient level of sales with positive gross margins to cover operating expenses. An inability to generate positive cash flow until we reach a sufficient level of sales with positive gross margins to cover operating expenses or raise additional capital on reasonable terms will adversely affect our viability as an operating business.

In order to carry out our proposed business plan to develop, manufacture, sell and service electric vehicles, we will require a significant amount of capital.

We intend to raise our cash requirements for the next 12 months through the sale of our equity securities in private placements, through shareholder loans or possibly through a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough funds through such capital-raising efforts, we may review other financing possibilities such as bank loans. There is no assurance that any financing will be available to us or if available, on terms that will be acceptable to us. We intend to negotiate with our management and consultants to pay parts of their salaries and fees with stock and stock options in lieu of cash.

Our ability to obtain the necessary financing to carry out our business plan is subject to a number of factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities or substantially change our current corporate structure. There is no guarantee that we will be able to obtain any funding or that we will have sufficient resources to conduct our business as projected, any of which could mean that we will be forced to discontinue our operations.

- 8 -

Terms of subsequent financings may adversely impact your investment.

We may have to engage in common equity, debt, or preferred stock financing in the future. Your rights and the value of your investment in the common stock could be reduced. Interest on debt securities could increase costs and negatively impacts operating results. Preferred stock could be issued in series from time to time with such designation, rights, preferences, and limitations as needed to raise capital. The terms of preferred stock could be more advantageous to those investors than to the holders of common stock. In addition, if we need to raise more equity capital from the sale of common stock, institutional or other investors may negotiate terms at least as, and possibly more, favorable than the terms of your investment. Shares of common stock which we sell could be sold into any market which develops, which could adversely affect the market price.

Our future growth is dependent upon consumers’ willingness to adopt three-wheeled single passenger electric vehicles.

Our growth is highly dependent upon the adoption by consumers of, and we are subject to an elevated risk of any reduced demand for, alternative fuel vehicles in general and electric vehicles in particular. If the market for three-wheeled single passenger electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. Factors that may influence the adoption of alternative fuel vehicles, and specifically electric vehicles, include:

-

perceptions about electric vehicle quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of electric vehicles;

-

perceptions about vehicle safety in general, in particular safety issues that may be attributed to the use of advanced technology, including vehicle electronics and braking systems;

-

the limited range over which electric vehicles may be driven on a single battery charge;

-

the decline of an electric vehicle’s range resulting from deterioration over time in the battery’s ability to hold a charge;

-

concerns about electric grid capacity and reliability, which could derail our efforts to promote electric vehicles as a practical solution to vehicles which require gasoline;

-

the availability of alternative fuel vehicles, including plug-in hybrid electric vehicles;

-

improvements in the fuel economy of the internal combustion engine;

-

the availability of service for electric vehicles;

- 9 -

-

the environmental consciousness of consumers;

-

volatility in the cost of oil and gasoline;

-

government regulations and economic incentives promoting fuel efficiency and alternate forms of energy;

-

access to charging stations, standardization of electric vehicle charging systems and consumers’ perceptions about convenience and cost to charge an electric vehicle;

-

the availability of tax and other governmental incentives to purchase and operate electric vehicles or future regulation requiring increased use of non-polluting vehicles; and

-

perceptions about and the actual cost of alternative fuel.

The influence of any of the factors described above may cause current or potential customers not to purchase our electric vehicles, which would materially adversely affect our business, operating results, financial condition and prospects.

The range of our electric vehicles on a single charge declines over time which may negatively influence potential customers’ decisions whether to purchase our vehicles.

The range of our electric vehicles on a single charge declines principally as a function of usage, time and charging patterns. For example, a customer’s use of their SOLO vehicle as well as the frequency with which they charge the battery of their SOLO vehicle can result in additional deterioration of the battery’s ability to hold a charge. We currently expect that our battery pack will retain approximately 85% of its ability to hold its initial charge after approximately 3,000 charge cycles and 8 years, which will result in a decrease to the vehicle’s initial range. Such battery deterioration and the related decrease in range may negatively influence potential customer decisions whether to purchase our vehicles, which may harm our ability to market and sell our vehicles.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our electric vehicles.

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. For example, fuel which is abundant and relatively inexpensive in North America, such as compressed natural gas, may emerge as consumers’ preferred alternative to petroleum based propulsion. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced electric vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors.

- 10 -

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position. Any failure to keep up with advances in electric vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change we plan to upgrade or adapt our vehicles and introduce new models in order to continue to provide vehicles with the latest technology, in particular battery cell technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our vehicles. For example, we do not manufacture battery cells which makes us dependent upon other suppliers of battery cell technology for our battery packs.

If we are unable to design, develop, market and sell new electric vehicles and services that address additional market opportunities, our business, prospects and operating results will suffer.

We may not be able to successfully develop new electric vehicles and services, address new market segments or develop a significantly broader customer base. To date, we have focused our business on the sale of the SOLO, a three-wheeled single passenger electric vehicle and have targeted mainly urban residents of modest means. We will need to address additional markets and expand our customer demographic in order to further grow our business. Our failure to address additional market opportunities would harm our business, financial condition, operating results and prospects.

Demand in the vehicle industry is highly volatile.

Volatility of demand in the vehicle industry may materially and adversely affect our business prospects, operating results and financial condition. The markets in which we will be competing have been subject to considerable volatility in demand in recent periods. Demand for automobile sales depends to a large extent on general, economic, political and social conditions in a given market and the introduction of new vehicles and technologies. As a new start-up manufacturer, we will have fewer financial resources than more established vehicle manufacturers to withstand changes in the market and disruptions in demand.

We depend on certain key personnel, and our success will depend on our continued ability to retain and attract such qualified personnel.

Our success is dependent on the efforts, abilities and continued service of Jerry Kroll – Chief Executive Officer, Henry Reisner – Chief Operating Officer, Kulwant Sandher – Chief Financial Officer, and Ed Theobald – General Manager. A number of these key employees and consultants have significant experience in the automobile manufacturing industry. A loss of service from any one of these individuals may adversely affect our operations, and we may have difficulty or may not be able to locate and hire a suitable replacement. We have not obtained any “key man” insurance on certain key personnel.

Since we have little experience in mass-producing electric vehicles, any delays or difficulties in transitioning from producing custom vehicles to mass-producing vehicles may have a material adverse effect on our business, prospects and operating results.

Our management team has experience in producing custom designed vehicles and is now switching focus to mass producing electric vehicles in a rapidly evolving and competitive market.

- 11 -

If we are unable to implement our business plans in the timeframes estimated by management and successfully transition into a mass-producing electric vehicle manufacturing business, then our business, prospects, operating results and financial condition will be negatively impacted and our ability to grow our business will be harmed.

We are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on our business and operating results.

We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and legal requirements contained in approvals or that arise under common law. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances, dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odours (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws and/or requirements would have a material adverse effect on our Company and its operating results.

Our vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on our business and operating results.

All vehicles sold must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States vehicles that meet or exceed all federally mandated safety standards are certified under the federal regulations. In this regard, Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials and equipment are among the requirements for achieving federal certification. Failure by us to have the SOLO or any future model electric vehicle satisfy motor vehicle standards would have a material adverse effect on our business and operating results.

If we are unable to reduce and adequately control the costs associated with operating our business, including our costs of manufacturing, sales and materials, our business, financial condition, operating results and prospects will suffer.

If we are unable to reduce and/or maintain a sufficiently low level of costs for designing, manufacturing, marketing, selling and distributing and servicing our electric vehicles relative to their selling prices, our operating results, gross margins, business and prospects could be materially and adversely impacted.

If our vehicles fail to perform as expected, our ability to develop, market and sell our electric vehicles could be harmed.

Our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. For example, our vehicles use a substantial amount of software code to operate. Software products are inherently complex and often contain defects and errors when first introduced. While we have performed extensive internal testing, we currently have a very limited frame of reference by which to evaluate the performance of our SOLO in the hands of our customers and currently have no frame of reference by which to evaluate the performance of our SOLO after several years of customer driving.

- 12 -

We have very limited experience servicing our vehicles. If we are unable to address the service requirements of our future customers our business will be materially and adversely affected.

If we are unable to successfully address the service requirements of our future customers our business and prospects will be materially and adversely affected. In addition, we anticipate the level and quality of the service we will provide our SOLO customers will have a direct impact on the success of our future vehicles. If we are unable to satisfactorily service our SOLO customers, our ability to generate customer loyalty, grow our business and sell additional SOLOs as well as our future intended vehicles could be impaired.

We have very limited experience servicing our vehicles. As of December 31, 2016 we had not sold any SOLOs as we do not plan to begin production of any SOLO vehicles until the end of the first quarter or early second quarter of 2017, and do not have any experience servicing these cars as they do not exist currently. Servicing electric vehicles is different than servicing vehicles with internal combustion engines and requires specialized skills, including high voltage training and servicing techniques.

We may not succeed in establishing, maintaining and strengthening the Electrameccanica brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our business and prospects are heavily dependent on our ability to develop, maintain and strengthen the Electrameccanica brand. Any failure to develop, maintain and strengthen our brand may materially and adversely affect our ability to sell the SOLO and planned electric vehicles. If we are not able to establish, maintain and strengthen our brand, we may lose the opportunity to build a critical mass of customers. Promoting and positioning our brand will likely depend significantly on our ability to provide high quality electric cars and maintenance and repair services, and we have very limited experience in these areas. In addition, we expect that our ability to develop, maintain and strengthen the Electrameccanica brand will also depend heavily on the success of our marketing efforts. To date, we have limited experience with marketing activities as we have relied primarily on the internet, word of mouth and attendance at industry trade shows to promote our brand. To further promote our brand, we may be required to change our marketing practices, which could result in substantially increased advertising expenses, including the need to use traditional media such as television, radio and print. The automobile industry is intensely competitive, and we may not be successful in building, maintaining and strengthening our brand. Many of our current and potential competitors, particularly automobile manufacturers headquartered in Detroit, Japan and the European Union, have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion cells, could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of raw materials. Any such an increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. We use various raw materials in our business including aluminum, steel, carbon fiber, non-ferrous metals such as copper, as well as cobalt. The prices for these raw materials fluctuate depending on market conditions and global demand for these materials and could adversely affect our business and operating results. For instance, we are exposed to multiple risks relating to price fluctuations for lithium-ion cells. These risks include:

- 13 -

-

the inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers of lithium-ion cells required to support the growth of the electric or plug-in hybrid vehicle industry as demand for such cells increases;

-

disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and

-

an increase in the cost of raw materials, such as cobalt, used in lithium-ion cells.

Our business is dependent on the continued supply of battery cells for our vehicles. Any disruption in the supply of battery cells from our supplier could temporarily disrupt the planned production of the SOLO until such time as a different supplier is fully qualified. Moreover, battery cell manufacturers may choose to refuse to supply electric vehicle manufacturers to the extent they determine that the vehicles are not sufficiently safe. Furthermore, current fluctuations or shortages in petroleum and other economic conditions may cause us to experience significant increases in freight charges and raw material costs. Substantial increases in the prices for our raw materials would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased electric vehicle prices. There can be no assurance that we will be able to recoup increasing costs of raw materials by increasing vehicle prices. We have also already announced an estimated price for the base model of our planned SOLO. However, any attempts to increase the announced or expected prices in response to increased raw material costs could be viewed negatively by our potential customers, result in cancellations of SOLO reservations and could materially adversely affect our brand, image, business, prospects and operating results.

The unavailability, reduction or elimination of government and economic incentives could have a material adverse effect on our business, financial condition, operating results and prospects.

Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, the reduced need for such subsidies and incentives due to the perceived success of the electric vehicle, fiscal tightening or other reasons may result in the diminished competitiveness of the alternative fuel vehicle industry generally or our electric vehicles in particular. This could materially and adversely affect the growth of the alternative fuel automobile markets and our business, prospects, financial condition and operating results.

If we fail to manage future growth effectively, we may not be able to market and sell our vehicles successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We plan to expand our operations in the near future in connection with the planned production of the SOLO. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this expansion include:

-

training new personnel;

-

forecasting production and revenue;

-

controlling expenses and investments in anticipation of expanded operations;

- 14 -

-

establishing or expanding design, manufacturing, sales and service facilities;

-

implementing and enhancing administrative infrastructure, systems and processes;

-

addressing new markets; and

-

establishing international operations.

We intend to continue to hire a number of additional personnel, including design and manufacturing personnel and service technicians for our electric vehicles. Competition for individuals with experience designing, manufacturing and servicing electric vehicles is intense, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could seriously harm our business and prospects.

Our business may be adversely affected by union activities.

Although none of our employees are currently represented by a labor union, it is common throughout the automobile industry generally for many employees at automobile companies to belong to a union, which can result in higher employee costs and increased risk of work stoppages. As we expand our business to include full in-house manufacturing of our SOLO vehicle, there can be no assurances that our employees will not join or form a labor union or that we will not be required to become a union signatory. We are also directly or indirectly dependent upon companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition or operating results. If a work stoppage occurs, it could delay the manufacture and sale of our electric vehicles and have a material adverse effect on our business, prospects, operating results or financial condition.

We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We may become subject to product liability claims, which could harm our business, prospects, operating results and financial condition. The automobile industry experiences significant product liability claims and we face inherent risk of exposure to claims in the event our vehicles do not perform as expected or malfunction resulting in personal injury or death. Our risks in this area are particularly pronounced given we have not delivered any SOLO vehicles to date and limited field experience of those vehicles. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product liability claim could generate substantial negative publicity about our vehicles and business and inhibit or prevent commercialization of other future vehicle candidates which would have material adverse effect on our brand, business, prospects and operating results. We plan to maintain product liability insurance for all our vehicles with annual limits of approximately $5 million on a claims made basis, but we cannot assure that our insurance will be sufficient to cover all potential product liability claims. Any lawsuit seeking significant monetary damages either in excess of our coverage, or outside of our coverage, may have a material adverse effect on our reputation, business and financial condition. We may not be able to secure additional product liability insurance coverage on commercially acceptable terms or at reasonable costs when needed, particularly if we do face liability for our products and are forced to make a claim under our policy.

- 15 -

Our patent applications may not result in issued patents, which may have a material adverse effect on our ability to prevent others from interfering with our commercialization of our products.

The status of patents involves complex legal and factual questions and the breadth and effectiveness of patented claims is uncertain. We cannot be certain that we are the first creator of inventions covered by pending patent applications or the first to file patent applications on these inventions, nor can we be certain that our pending patent applications will result in issued patents or that any of our issued patents will afford sufficient protection against someone creating a knockoff of our products, or as a defensive portfolio against a competitor who claims that we are infringing its patents. In addition, patent applications filed in foreign countries are subject to laws, rules and procedures that differ from those of the United States, and thus we cannot be certain that foreign patent applications, if any, will result in issued patents in those foreign jurisdictions or that such patents can be effectively enforced, even if they relate to patents issued in the U.S. In addition, others may obtain patents that we need to take a license to or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and would cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may hold or obtain patents, trademarks or other proprietary rights that would prevent, limit or interfere with our ability to make, use, develop, sell or market our vehicles or components, which could make it more difficult for us to operate our business. From time to time, we may receive communications from holders of patents or trademarks regarding their proprietary rights. Companies holding patents or other intellectual property rights may bring suits alleging infringement of such rights or otherwise assert their rights and urge us to take licenses. In addition, if we are determined to have infringed upon a third party’s intellectual property rights, we may be required to do one or more of the following:

-

cease selling, incorporating certain components into, or using vehicles or offering goods or services that incorporate or use the challenged intellectual property;

-

pay substantial damages;

-

seek a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms or at all;

-

redesign our vehicles or other goods or services; or

-

establish and maintain alternative branding for our products and services.

In the event of a successful claim of infringement against us and our failure or inability to obtain a license to the infringed technology or other intellectual property right, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

- 16 -

You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited because we are incorporated under the laws of the Province of British Columbia, a substantial portion of our assets are in Canada and all of our directors and executive officers reside outside the United States

We are organized under the laws of the Business Corporations Act (British Columbia) and our executive offices are located outside of the United States in Vancouver, British Columbia. All of our directors and officers, as well as our auditor, reside outside the United States. In addition, a substantial portion of their assets and our assets are located outside of the United States. As a result, you may have difficulty serving legal process within the United States upon us or any of these persons. You may also have difficulty enforcing, both in and outside of the United States, judgments you may obtain in U.S. courts against us or these persons in any action, including actions based upon the civil liability provisions of U.S. Federal or state securities laws. Furthermore, there is substantial doubt as to the enforceability in Canada against us or against any of our directors, officers and the expert named in this prospectus who are not residents of the United States, in original actions or in actions for enforcement of judgments of U.S. courts, of liabilities based solely upon the civil liability provisions of the U.S. federal securities laws. In addition, shareholders in British Columbia companies may not have standing to initiate a shareholder derivative action in U.S. federal courts.

As a result, our public shareholders may have more difficulty in protecting their interests through actions against us, our management, our directors or our major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

Risk Related to Our Common Stock

Our executive officers and directors own 74.1% of our common stock.

Our executive officers and directors beneficially own, in the aggregate, 74.1% of our common stock, which includes shares that our executive officers and directors have the right to acquire pursuant to warrants and stock options which have vested and will vest within 60 days of April 25, 2017. As a result, they will be able to exercise a significant level of control over all matters requiring shareholder approval, including the election of directors, amendments to our Articles, and approval of significant corporate transactions. This control could have the effect of delaying or preventing a change of control of the Company or changes in management and will make the approval of certain transactions difficult or impossible without the support of these shareholders.

There currently is no public trading market for our securities and an active market may not develop or, if developed, be sustained. If a public trading market does not develop, you may not be able to sell any of your securities.

There is currently no public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you do wish to resell your shares, you will have to locate a buyer and negotiate your own sale. As a result, you may be unable to sell your shares, or you may be forced to sell them at a loss.

We cannot assure you that there will be a market in the future for our common stock. We intend to apply to have our common stock quoted on the OTCQB operated by the OTC Markets Group Inc. after we receive a trading symbol from the Financial Industry Regulatory Authority (“FINRA”), but if for any reason our common stock is not quoted on the OTCQB or a public trading market does not otherwise develop, purchasers of our securities may have difficulty selling their shares. Even if our common stock is quoted on the OTCQB, the trading of securities on the OTCQB is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price for our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from us or our selling security holders.

- 17 -

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of revenues, we will likely have to issue additional equity securities to obtain working capital we require for the next 12 months. Our efforts to fund our intended business plans will therefore result in dilution to our existing stockholders. In short, our continued need to sell equity will result in reduced percentage ownership interests for all of our investors, which may decrease the market price for our common stock.

Additional issuances of our common stock may result in dilution to our existing common stockholders and issuances of our preferred stock may adversely affect the rights of the holders of our common stock and reduce the value of our common stock.

Our Notice of Articles authorize the issuance of an unlimited number of shares of common stock. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price, if one exists at the time, of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire share of our common stock, your proportionate ownership interest and voting power could be decreased. Further, any such issuances could result in a change of control.

In addition, our Notice of Articles authorize the issuance of an unlimited number of shares of preferred stock. Our Board of Directors has the authority to create one or more series of preferred stock, and without shareholder approval, issue shares of preferred stock with rights superior to the rights of the holders of shares of common stock. As a result, shares of preferred stock could be issued quickly and easily, adversely affecting the rights of holder of shares of common stock and could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult. Although we currently have no plans to create any series of preferred stock and have not present plans to issue any shares of preferred stock, any creation and issuance of preferred stock in the future could adversely affect the rights of the holders of common stock and reduce the value of the common stock.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid any cash or stock dividends and we do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment of any dividends. Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

- 18 -

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by section 15(g) of the Exchange Act, which imposes additional sales practice requirements on broker-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement from you prior to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the value of your investment to decline.

FINRA sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

You may face significant restrictions on the resale of your shares due to state “blue sky” laws. Each state has its own securities laws, often called “blue sky” laws, which: (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration; and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker must also be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by the broker-dealers, if any, who agree to serve as market makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

Resale restrictions for British Columbia residents and other Canadian residents may limit your ability to sell your shares.

If you are a resident of British Columbia, until we have filed a prospectus with the British Columbia Securities Commission, for which a receipt has been issued, and four months and a day have passed from the date you acquired your shares from us, you must rely on an exemption from the prospectus requirements of B.C. securities laws to resell your shares. Since our common stock is not currently quoted on the OTC Bulletin Board, OTC Pink, OTCQB or OTCQX, B.C. residents must comply with the B.C. Securities Commission’s B.C. Instrument 72-502 – Trades In Securities of U.S. Registered Issuers (“BCI 72-502”), which requires, among other conditions, that B.C. residents hold their shares for four months and limit the volume of shares they sell in any 12-month period. These restrictions limit the ability of B.C. residents to resell shares of our common stock in the United States and therefore, may materially affect the market value of your investment.

- 19 -

If our application to have our common stock quoted on the OTCQB is accepted or our common stock is quoted on the OTC Pink, selling securityholders who are residents of all provinces and territories of Canada other than Ontario will instead need to comply with the restrictions and exemptions of Multilateral Instrument 51-105 – Issuers Quoted in the U.S. Over-the-Counter Markets (“MI 51-105”) to resell their shares. This means that such selling securityholders may only sell their shares of our common stock through an investment dealer registered in a jurisdiction of Canada from an account at that dealer in the name of the selling securityholder and the dealer executes the trade through any of the over-the-counter markets in the United States. We believe that MI 51-105 will apply because our executive officers and directors are residents of British Columbia, Canada.

ITEM 4. INFORMATION ON THE COMPANY

Summary

We were incorporated on February 16, 2015 under the laws of British Columbia, Canada, and have a December 31, fiscal year end. We are engaged in the planning, development and manufacturing of single person electric vehicles.

Our principal executive offices are located at 102 East 1st Avenue, Vancouver, British Columbia, Canada, V5T 1A4. Our telephone number is (604) 428-7656. Our website address is www.electrameccanica.com. Information on our website does not constitute part of this Annual Report. Our registered and records office is located at Suite 1500, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, Canada, V6E 4N7.

A. History and development of the Company

Electramecccanica Vehicles Corp. is a development-stage electric vehicle (“EV”) production company incorporated on February 16, 2015 under the laws of British Columbia, Canada. The concept for our Company was developed by Jerry Kroll after years of research and development on advanced EVs.

Upon returning to Vancouver in 2011, Mr. Kroll decided new electric drive systems could revolutionize car assembly and the concept for our Company’s flagship EV called the “SOLO” was born. With the help of long time automotive expert and friend Mr. Reisner, President of Intermeccanica International Inc. (“Intermeccanica”), and Intermeccanica’s vast experience in automotive craftsmanship, our Company’s first prototype was finished in January 2015. To solidify our presence and branding in the EV market, we incorporated in February of 2015 under the name Electrameccanica Vehicles Corp. For the past 10 years, Mr. Kroll has been researching and developing superior technologies for autonomous drive systems and dynamic induction charging. We have plans for ongoing refinements to performance, style, value and efficiency as drive systems, computerization and materials are developed.

- 20 -

In 2015, we entered into an arrangement with Intermeccanica to leverage Intermeccanica’s 50+ years of quality car manufacturing expertise. Pursuant to a Joint Operating Agreement entered into between us, Intermeccanica and Henry Reisner, dated July 15, 2015, and as amended on September 19, 2016, we have an arrangement dealing with leased premises, production assembly and an option to acquire Intermeccanica, as more fully described under the heading “Material Agreements” below, that we believe will further enhance the combination of our proprietary SOLO design with Intermeccanica’s manufacturing expertise. Under the Joint Operating Agreement with Intermeccanica, we have contracted Intermeccanica to assist with the development of the present and future vehicles, and also to provide production and delivery capabilities in conjunction with our own production capabilities. If we decide not to exercise our call option to acquire Intermeccanica, as more fully described below under the heading “Material Agreements,” then under the Joint Operating Agreement Intermeccanica will continue to provide development, production and delivery assistance.

We currently have a modern furnished showroom near the downtown core of Vancouver, where interested consumers may receive more information on the SOLO, review its specs and technical design, and even test-drive one of the existing prototypes.

To date, we have a number of marketing efforts that have succeeded in helping us achieve an order book of approximately $15.6 million, including 600 private pre-sales. Interested consumers are able to place reservations for the SOLO with a $250 refundable deposit. We have 498+ orders to date with a refundable deposit of $250 for 498 SOLOs and a refundable deposit of $1,000 for 11 Super SOLOs; we also have 91+ orders of the Tofino with a refundable deposit of $1,000.

Important Events In the Development of Our Business

Important events in the development of our business are provided under Item 4.B., below, and in other sections of this filing.

Principal Capital Expenditures And Divestitures

Since the date of our inception (February 16, 2015), we have not had any capital divestitures. The only capital expenditures have been for property, plant and equipment, investment and expenditures relating to intellectual property, which occurred in the normal course of our operations. Our total capital expenditures were approximately $357,372 compared with $16,438 for the year ended December 31, 2015. We have financed our capital expenditures primarily by issuing common shares. Further details applicable to our anticipated capital expenditures and funding sources are detailed in Liquidity and Capital Resources in Item 5.B.

Principal Capital Expenditures And Divestitures Currently in Process

As of April 25, 2017 there were no capital expenditures or divestitures in process outside of the normal course of business.

Public Takeover Offers

There have been no public takeover offers by third parties in respect of our shares.

Acquisitions of subsidiaries

We do not have any subsidiaries.

- 21 -

B. Business Overview

General

We are a development-stage EV company focusing on the market demand for Evs that are efficient, cost-effective and environmentally friendly methods for urban residents to commute. We believe that our flagship EV called the SOLO is the answer to such market demand.

We created the SOLO’s first prototype in January of 2015. Since the completion of the prototype, our engineers and designers have devoted efforts to provide the SOLO with an appealing design, and have engaged in proprietary research and development leading to a high performance electric rear drive motor.

The SOLO features a lightweight aerospace composite chassis to allow for a top speed of 130km/h, an attainable cruise speed of 110km/h and is able to go from 0 km/h to 100 km/h in approximately 8 seconds. Our SOLO features a lithium ion battery system that requires only three hours of charging time on a 220-volt charging station or six hours from a 110-volt outlet. The lithium battery system utilizes approximately 8.64 kw/h for up to 160 km in range. We also offer a comprehensive warranty package for two years of unlimited mileage which is included in the price of the SOLO. Standard equipment in the SOLO includes, but is not limited to the following:

-

LCD Digital Instrument Cluster;

-

Power Windows;

-

AM/FM stereo with Bluetooth/ CD/USB;

-

Remote keyless entry system;

-

Rear view backup camera;

-

285 litres of cargo space; and

-

Heater and defogger.

Optional equipment will include air conditioning at an additional cost.

The purchase price for our SOLO is $19,888.

Our production department has completed two pre-production SOLOs as at December 31, 2016, and we intend to produce up to nine further pre-production SOLOs by the end of June 30, 2017. This will allow us to determine if the projected production volume of 10 to 20 SOLOs per month is able to be produced at our existing facilities beginning in January 2017. Producing the preproduction SOLOs allows us to determine and assess the entire production process. Currently, we have increased our production space, organized a production line, ordered components and are in the process of fine tuning the production process through the pre-production SOLOs. We anticipate our production costs to be $15,000 per SOLO, providing a gross margin of 25% based on a sale price of $19,888.

- 22 -

In recognizing the needs of different demographic groups, from the Company’s product plan, we plan to launch additional vehicle models namely, the “Twin,” which features two seats and we believe suitable for urban families, young commuters, empty nesters, and environmentally-conscious consumers. We also plan on launching the Super SOLO, which is a sports car model within our EV product line. The Super SOLO is intended to boast a longer range and a higher top speed, sleek, aerodynamic design and features that will rival existing super sports cars such as the Ferrari 488, Lamborghini Gallardo, etc. For larger compartment needs, we have plans in the future to release the “Cargo,” a larger vehicle than the SOLO that is designed for use as a fleet vehicle with ample storage space which would be best suited for delivery companies such as FedEx, United States Postal Service, and Canada Post. The Cargo is expected to offer the appropriate compartment space for fleet vehicle uses such as delivery, while offering long range capability and cleaner technology.

Refundable deposits have been accepted for the planned Super SOLO and such deposits are able to be returned at any time. Mechanical development on the Super SOLO has begun and progress will determine when this and any other variants can be launched. No set date has been declared at this time. The Super SOLO is intended to be a high performance version of the SOLO.

The Company announced on March 28, 2017, at the Vancouver International Auto Show that it will build the Tofino; an all-electric, two-seater roadster representing an evolution of the Intermeccanica Roadster. The Tofino is equipped with a high-performance, all-electric motor with a top speed of 200 kph (125 mph) and a 0-100 kph (0-60 mph) in less than seven seconds. The chassis and body are made of a lightweight aerospace-grade composite and the car is capable of up to 400 km (250 miles) of range on a full charge. The Company is accepting a refundable of deposit of $1,000 to reserve the Tofino.

Sources and Availability of Raw Materials

We continue to source duplicate suppliers for all of our components, in particular, we are currently sourcing our lithium batteries from Panasonic, Samsung and LT Chem. Lithium is subject to commodity price volatility which is not under our control and could have a significant impact on the price of lithium batteries.

At present, we are subject to the supply of our chassis from one supplier for our production of the SOLO. We have started to source additional suppliers of the chassis to mitigate the risk of being dependent on only one supplier.

Patents and Licenses

We have filed patents on items that our legal counsel deem necessary to protect our products. We do not rely on any licenses from third-party vendors at this time.

Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patent and design applications, trade secrets, including know-how, employee and third party non-disclosure agreements, copyright laws, trademarks and other contractual rights to establish and protect our proprietary rights in our technology. As at April 25, 2017 we had one issued design registration, two allowed design application and six pending patent and design applications with various countries which the Company considers core to its business in a broad range of areas related to the design of the SOLO and its powertrain. We intend to continue to file additional patent applications with respect to our technology. We do not know whether any of our pending patent applications will result in the issuance of patents or whether the examination process will require us to narrow our claims. Even if granted, there can be no assurance that these pending patent applications will provide us with protection.

- 23 -

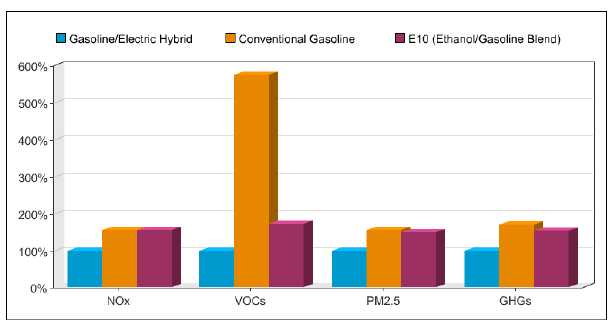

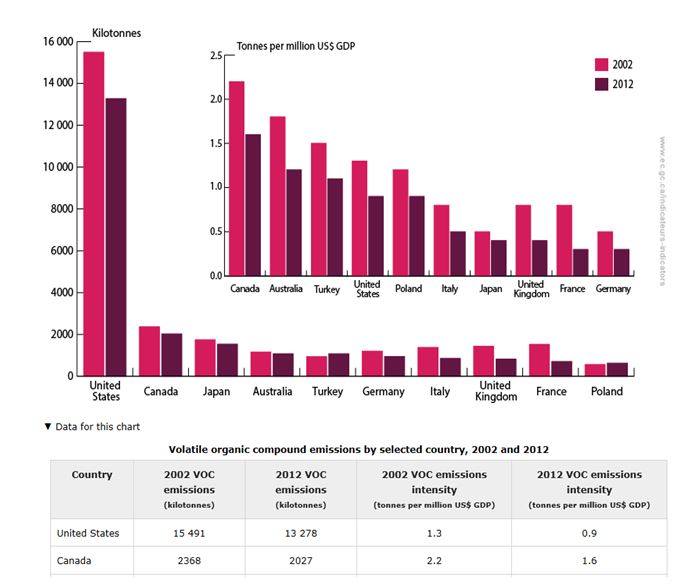

Market Overview

Investment in clean technology has been trending for several years as nations, governments, and society overall become more aware of the damaging effects pollution and greenhouse gas emissions (“GHG”) have on the environment. In an attempt to prevent and/or slow-down these damaging effects and create a more sustainable environment, nations and government agencies have announced their proposals to reduce GHGs, contribute funding into research and development in clean technology, and offer incentives/rebates for clean technology investments by businesses and consumers.

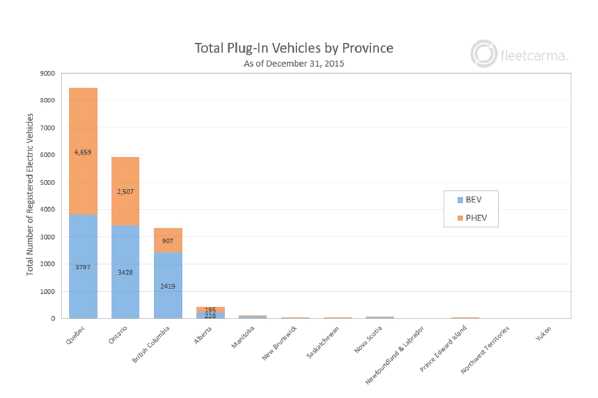

Electric vehicle is a broad term for vehicles that do not solely operate on gas or diesel. Within this alternative vehicle group, there are more categories that further segment into alternative vehicles that embrace different innovative technologies such as: (i) battery electric vehicles (“BEV”); (ii) fuel-cell electric vehicles (“FCV”); or (iii) plug-in hybrid electric vehicles (“PHEV”).

BEVs draw on power from battery management systems to power electric motors instead of from an internal combustion engine, a fuel cell, or a fuel tank. The Nissan Leaf, Tesla Model S, and our SOLO are BEVs.

FCVs typically utilize a hydrogen fuel cell that, along with oxygen from the air, converts chemical energy into electricity which powers the vehicle’s motor. Emissions from a FCV are water and heat, hence making FCVs true zero-emission vehicles.

PHEVs are the hybrid vehicles that have both an electric motor and an internal combustion engine. PHEVs can alternate between using electricity while in its all-electric range or relying on its gas-powered engine. The Chevrolet Volt and the Toyota Prius are examples of PHEVs.

The popularity of EVs have also been met with difficulties in charging convenience. There are far more gas stations available than public EV charging stations: a search on Yellow Pages reveals that there are 439 gas stations alone in the City of Vancouver whereas the entire Province of British Columbia has approximately 500 public EV charging stations. The convenience and availability of public EV charging stations may prove to be an obstacle of mass adoption of Evs.

Consumers may be afraid that their Evs may run out of charge while they are out on the road and this fear is recognized by the public and has been popularized with the term “range anxiety”. Despite this fear, the distance travelled by most urban commuters is a lot lower than the typical range of an EV. Data from Statistics Canada’s National Household Survey in 2011 reported the average Canadian takes 25 minutes to commute to work.

There currently exists different categories of charging stations depending on the voltage they provide. EV owners can often charge at home on a regular 110-volt outlet which may take between 10 hours to 20 hours depending on the model and make of the EV. This type of outlet and charging is termed level 1 charging. Level 2 charging means the voltage at the charging station is typically around 240 volts and this type of outlet is usually available at public charging stations, shopping malls and big box retailer parking lots, and even located in certain residential hi-rises. Charging at a level 2 station typically cuts down the level 1 charge time in half and may require a small fee for the service.

- 24 -

Electric Vehicles/Automotive – Global Market

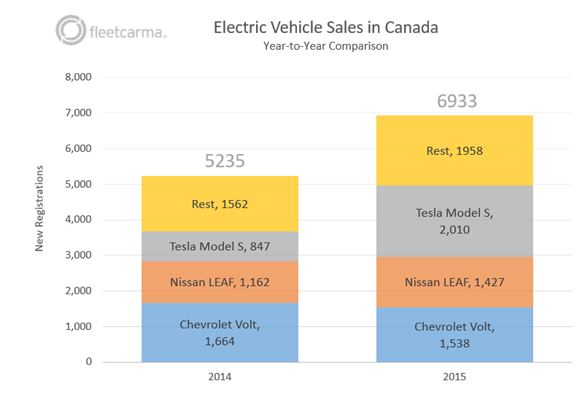

EVs have been around for a number of years, but have only recently gained mass adoption and public interest due to open discussions of GHG emission levels, government and international policies on climate change and pollution, increased literature on Evs, fluctuating fuel costs, and improved battery management systems and EV range. According to Navigant Research, the global light duty EV market is estimated to grow from 2.6 million vehicle sales in 2015 to over 6.0 million vehicle sales in 2024.1

Evs in the global market are gaining adoption by the general public and these efforts have also been aided by traditional automotive manufacturers’ entry into the market. The majority of growth in the EV industry has been led by the following top five EV models: (1) Nissan Leaf; (2) Chevrolet Volt (PHEV); (3) Toyota Prius (PHEV); (4) Tesla Model S; and, (5) Mitsubishi Outlander (PHEV).2 There are few manufacturers that are solely devoted to the manufacturing of Evs, the most well-known and popular one being Tesla Motors.

On a global scale, Evs are gaining popularity, particularly in countries where there is high population density, narrow roads, and limited urban space. According to an April article from Pedestrian Observations3, an online website dedicated to transit-oriented developments, several European countries are formulating programs that ban cars fueled by petrol or diesel. This initiative was introduced by Norway’s Minister for the Environment and co-spokesperson for the Green Party, which expects to implement the ban completely by 2025.4

In France, the Paris region has been calling for a phase-out of the internal combustion engine due to rising levels of particulate pollution from diesel vehicles and the local government is looking into implement more battery charging stations to help commuters refuel along the way.5 The German government is expecting German automakers to spend more money on research and development for improved battery range and charging stations.6