false2023FY0001637207P3Yhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent11111P3Y00016372072023-01-012023-12-3100016372072023-06-30iso4217:USD0001637207us-gaap:CommonClassAMember2024-02-22xbrli:shares0001637207us-gaap:CommonClassBMember2024-02-2200016372072023-12-3100016372072022-12-310001637207us-gaap:CommonClassAMember2023-12-31iso4217:USDxbrli:shares0001637207us-gaap:CommonClassAMember2022-12-310001637207us-gaap:CommonClassBMember2022-12-310001637207us-gaap:CommonClassBMember2023-12-310001637207us-gaap:FranchiseMember2023-01-012023-12-310001637207us-gaap:FranchiseMember2022-01-012022-12-310001637207us-gaap:FranchiseMember2021-01-012021-12-310001637207us-gaap:AdvertisingMember2023-01-012023-12-310001637207us-gaap:AdvertisingMember2022-01-012022-12-310001637207us-gaap:AdvertisingMember2021-01-012021-12-310001637207plnt:CorporateOwnedStoresMember2023-01-012023-12-310001637207plnt:CorporateOwnedStoresMember2022-01-012022-12-310001637207plnt:CorporateOwnedStoresMember2021-01-012021-12-310001637207plnt:EquipmentRevenueMember2023-01-012023-12-310001637207plnt:EquipmentRevenueMember2022-01-012022-12-310001637207plnt:EquipmentRevenueMember2021-01-012021-12-3100016372072022-01-012022-12-3100016372072021-01-012021-12-310001637207us-gaap:CommonClassAMember2023-01-012023-12-310001637207us-gaap:CommonClassAMember2022-01-012022-12-310001637207us-gaap:CommonClassAMember2021-01-012021-12-3100016372072021-12-3100016372072020-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001637207us-gaap:AdditionalPaidInCapitalMember2020-12-310001637207us-gaap:RetainedEarningsMember2020-12-310001637207us-gaap:NoncontrollingInterestMember2020-12-310001637207us-gaap:RetainedEarningsMember2021-01-012021-12-310001637207us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001637207us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001637207us-gaap:AdditionalPaidInCapitalMember2021-12-310001637207us-gaap:RetainedEarningsMember2021-12-310001637207us-gaap:NoncontrollingInterestMember2021-12-310001637207us-gaap:RetainedEarningsMember2022-01-012022-12-310001637207us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001637207us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001637207us-gaap:AdditionalPaidInCapitalMember2022-12-310001637207us-gaap:RetainedEarningsMember2022-12-310001637207us-gaap:NoncontrollingInterestMember2022-12-310001637207us-gaap:RetainedEarningsMember2023-01-012023-12-310001637207us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001637207us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-01-012023-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001637207us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001637207us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001637207us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001637207us-gaap:AdditionalPaidInCapitalMember2023-12-310001637207us-gaap:RetainedEarningsMember2023-12-310001637207us-gaap:NoncontrollingInterestMember2023-12-31plnt:memberplnt:storeplnt:stateplnt:segment0001637207plnt:PlaFitHoldingsLLCMember2015-08-05xbrli:pure0001637207plnt:PlanetIntermediateLLCMemberplnt:PlaFitHoldingsLLCMember2015-08-050001637207plnt:PlanetIntermediateLLCMemberplnt:PlanetFitnessHoldingsLLCMember2015-08-050001637207plnt:PlaFitHoldingsLLCMember2023-12-310001637207us-gaap:FranchisedUnitsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001637207plnt:VendorOneMemberus-gaap:CostOfGoodsProductLineMemberus-gaap:SupplierConcentrationRiskMember2023-01-012023-12-310001637207plnt:VendorOneMemberus-gaap:CostOfGoodsProductLineMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001637207plnt:VendorOneMemberus-gaap:CostOfGoodsProductLineMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001637207us-gaap:CostOfGoodsProductLineMemberplnt:VendorTwoMemberus-gaap:SupplierConcentrationRiskMember2023-01-012023-12-310001637207us-gaap:CostOfGoodsProductLineMemberplnt:VendorTwoMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001637207us-gaap:CostOfGoodsProductLineMemberplnt:VendorTwoMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001637207plnt:VendorOneMemberus-gaap:SupplierConcentrationRiskMemberplnt:AdvertisingServicesMember2023-01-012023-12-310001637207plnt:VendorTwoMemberus-gaap:SupplierConcentrationRiskMemberplnt:AdvertisingServicesMember2023-01-012023-12-310001637207plnt:VendorThreeMemberus-gaap:SupplierConcentrationRiskMemberplnt:AdvertisingServicesMember2023-01-012023-12-310001637207plnt:VendorThreeMemberus-gaap:SupplierConcentrationRiskMemberplnt:AdvertisingServicesMember2021-01-012021-12-310001637207plnt:VendorFourMemberus-gaap:SupplierConcentrationRiskMemberplnt:AdvertisingServicesMember2022-01-012022-12-310001637207plnt:PlacementServicesMember2023-01-012023-12-310001637207plnt:PlacementServicesMember2022-01-012022-12-310001637207plnt:PlacementServicesMember2021-01-012021-12-310001637207srt:MaximumMember2023-01-012023-12-310001637207srt:MinimumMember2023-01-012023-12-310001637207srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001637207srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001637207plnt:InformationTechnologyAndSystemsAssetsMembersrt:MinimumMember2023-12-310001637207plnt:InformationTechnologyAndSystemsAssetsMembersrt:MaximumMember2023-12-310001637207us-gaap:EquipmentMembersrt:MinimumMember2023-12-310001637207us-gaap:EquipmentMembersrt:MaximumMember2023-12-310001637207us-gaap:FurnitureAndFixturesMember2023-12-310001637207us-gaap:VehiclesMember2023-12-310001637207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001637207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001637207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-12-31plnt:agreement0001637207plnt:TRAHoldersMember2023-12-310001637207us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001637207us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001637207us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001637207us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001637207plnt:PfMelvilleLLCMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001637207plnt:MatthewMichaelRealtyLlcMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001637207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001637207us-gaap:EntityOperatedUnitsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001637207us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001637207plnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-100001637207plnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-102022-02-100001637207us-gaap:CommonClassAMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-102022-02-100001637207us-gaap:CommonClassAMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-100001637207plnt:HoldingsUnitsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-102022-02-100001637207us-gaap:CommonClassBMember2022-02-100001637207plnt:SunshineFitnessGrowthHoldingsLLCMemberus-gaap:FranchiseRightsMember2022-02-100001637207plnt:SunshineFitnessGrowthHoldingsLLCMemberus-gaap:FranchiseRightsMember2022-02-102022-02-100001637207us-gaap:CustomerRelationshipsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-100001637207us-gaap:CustomerRelationshipsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-102022-02-100001637207plnt:AreaDevelopmentAgreementsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-100001637207plnt:AreaDevelopmentAgreementsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-02-102022-02-100001637207plnt:SunshineFitnessGrowthHoldingsLLCMember2022-01-012022-12-310001637207plnt:SunshineFitnessGrowthHoldingsLLCMember2021-01-012021-12-310001637207us-gaap:FranchisedUnitsMemberplnt:FloridaAcquisitionMember2023-04-160001637207plnt:FloridaAcquisitionMember2023-04-162023-04-160001637207plnt:FloridaAcquisitionMember2023-04-160001637207plnt:FloridaAcquisitionMemberus-gaap:FranchiseRightsMember2023-04-160001637207plnt:FloridaAcquisitionMemberus-gaap:FranchiseRightsMember2023-04-162023-04-160001637207us-gaap:CustomerRelationshipsMemberplnt:FloridaAcquisitionMember2023-04-160001637207us-gaap:CustomerRelationshipsMemberplnt:FloridaAcquisitionMember2023-04-162023-04-160001637207plnt:SixColoradoStoresMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-08-310001637207plnt:SixColoradoStoresMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-08-312022-08-310001637207us-gaap:LandMember2023-12-310001637207us-gaap:LandMember2022-12-310001637207us-gaap:EquipmentMember2023-12-310001637207us-gaap:EquipmentMember2022-12-310001637207us-gaap:LeaseholdImprovementsMember2023-12-310001637207us-gaap:LeaseholdImprovementsMember2022-12-310001637207us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001637207us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001637207us-gaap:FurnitureAndFixturesMember2022-12-310001637207plnt:InformationTechnologyAndSystemsAssetsMember2023-12-310001637207plnt:InformationTechnologyAndSystemsAssetsMember2022-12-310001637207us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001637207us-gaap:PropertyPlantAndEquipmentOtherTypesMember2022-12-310001637207us-gaap:ConstructionInProgressMember2023-12-310001637207us-gaap:ConstructionInProgressMember2022-12-310001637207srt:MinimumMember2023-12-310001637207srt:MaximumMember2023-12-310001637207us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2023-01-012023-12-310001637207us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-01-012023-12-310001637207us-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:CashAndCashEquivalentsMember2023-01-012023-12-310001637207us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-12-310001637207us-gaap:CommercialPaperMemberplnt:MarketableSecuritiesCurrentMember2023-12-310001637207us-gaap:CommercialPaperMemberplnt:MarketableSecuritiesCurrentMember2023-01-012023-12-310001637207us-gaap:CommercialPaperMemberplnt:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberplnt:MarketableSecuritiesCurrentMember2023-12-310001637207plnt:MarketableSecuritiesCurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207plnt:MarketableSecuritiesCurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-01-012023-12-310001637207plnt:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207us-gaap:FairValueInputsLevel2Memberplnt:MarketableSecuritiesCurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesCurrentMember2023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesCurrentMember2023-01-012023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesCurrentMember2023-12-310001637207plnt:MarketableSecuritiesCurrentMember2023-12-310001637207plnt:MarketableSecuritiesCurrentMember2023-01-012023-12-310001637207plnt:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberplnt:MarketableSecuritiesCurrentMember2023-12-310001637207plnt:MarketableSecuritiesNoncurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207plnt:MarketableSecuritiesNoncurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-01-012023-12-310001637207plnt:MarketableSecuritiesNoncurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207us-gaap:FairValueInputsLevel2Memberplnt:MarketableSecuritiesNoncurrentMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesNoncurrentMember2023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesNoncurrentMember2023-01-012023-12-310001637207us-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesNoncurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberplnt:MarketableSecuritiesNoncurrentMember2023-12-310001637207plnt:MarketableSecuritiesNoncurrentMember2023-12-310001637207plnt:MarketableSecuritiesNoncurrentMember2023-01-012023-12-310001637207plnt:MarketableSecuritiesNoncurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Memberplnt:MarketableSecuritiesNoncurrentMember2023-12-310001637207us-gaap:FairValueInputsLevel1Member2023-12-310001637207us-gaap:FairValueInputsLevel2Member2023-12-310001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2021-04-090001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2021-04-092021-04-090001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2023-01-012023-12-310001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2022-01-012022-12-310001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2022-12-310001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2023-12-310001637207plnt:PlanetFitnessAustraliaHoldingsFormerlyBravoFitHoldingsPtyLtdMember2021-01-012021-12-310001637207plnt:PlanetFitmexLLCMember2023-06-230001637207plnt:PlanetFitmexLLCMember2023-06-232023-06-230001637207plnt:PlanetFitmexLLCMember2023-06-242023-12-310001637207plnt:PlanetFitmexLLCMember2023-10-012023-10-310001637207plnt:PlanetFitmexLLCMember2023-10-310001637207plnt:PlanetFitmexLLCMember2023-12-310001637207plnt:PlanetFitmexLLCMember2023-01-012023-12-310001637207us-gaap:CustomerRelationshipsMember2023-12-310001637207us-gaap:CustomerRelationshipsMember2022-12-310001637207us-gaap:FranchiseRightsMember2023-12-310001637207us-gaap:FranchiseRightsMember2022-12-310001637207us-gaap:TrademarksAndTradeNamesMember2023-12-310001637207us-gaap:TrademarksAndTradeNamesMember2022-12-310001637207plnt:FixedRateSeniorSecuredNotesClassA2IIMemberus-gaap:SeniorNotesMember2023-12-310001637207plnt:FixedRateSeniorSecuredNotesClassA2IIMemberus-gaap:SeniorNotesMember2022-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2Member2023-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2Member2022-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2I2022Member2023-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2I2022Member2022-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2II2022Member2023-12-310001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2II2022Member2022-12-310001637207plnt:FixedRateSeniorSecuredNotesClassA2IMemberus-gaap:SeniorNotesMember2018-08-010001637207plnt:FixedRateSeniorSecuredNotesClassA2IIMemberus-gaap:SeniorNotesMember2018-08-010001637207us-gaap:RevolvingCreditFacilityMemberplnt:VariableFundingNoteFacilityMember2018-08-010001637207us-gaap:SeniorNotesMemberplnt:FixedRateSeniorSecuredNotesClassA2Member2019-12-030001637207us-gaap:SeniorNotesMemberplnt:A3251FixedRateClassA2ISeniorSecuredNotesMember2022-02-100001637207plnt:A4008FixedRateClassA2IISeniorSecuredNotesMemberus-gaap:SeniorNotesMember2022-02-100001637207us-gaap:RevolvingCreditFacilityMemberplnt:A2022VariableFundingNotesMember2022-02-100001637207us-gaap:RevolvingCreditFacilityMemberplnt:A2022VariableFundingNotesMember2022-02-102022-02-100001637207us-gaap:RevolvingCreditFacilityMemberplnt:A2022VariableFundingNotesMember2022-05-092022-05-09plnt:extension00016372072018-08-0100016372072019-12-0300016372072022-02-100001637207plnt:A3251FixedRateClassA2ISeniorSecuredNotesMember2023-01-012023-12-310001637207us-gaap:SecuredDebtMemberplnt:SecuritizedSeniorNotesMember2023-12-3100016372072024-01-012023-12-3100016372072025-01-012023-12-3100016372072026-01-012023-12-3100016372072027-01-012023-12-3100016372072028-01-012023-12-3100016372072029-01-012023-12-310001637207plnt:PrepaidMembershipFeeMember2023-12-310001637207plnt:PrepaidMembershipFeeMember2022-12-310001637207plnt:EnrollmentFeesMember2023-12-310001637207plnt:EnrollmentFeesMember2022-12-310001637207plnt:EquipmentDiscountMember2023-12-310001637207plnt:EquipmentDiscountMember2022-12-310001637207plnt:AnnualMembershipFees1Member2023-12-310001637207plnt:AnnualMembershipFees1Member2022-12-310001637207plnt:AreaDevelopmentAndFranchiseFeesMember2023-12-310001637207plnt:AreaDevelopmentAndFranchiseFeesMember2022-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:FranchiseRevenueMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:FranchiseRevenueMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:FranchiseRevenueMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMemberplnt:FranchiseRevenueMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMemberplnt:FranchiseRevenueMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMemberplnt:FranchiseRevenueMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:EquipmentRevenueMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:EquipmentRevenueMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:EquipmentRevenueMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMemberplnt:EquipmentRevenueMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMemberplnt:EquipmentRevenueMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMemberplnt:EquipmentRevenueMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMemberplnt:EquipmentRevenueMember2023-12-310001637207us-gaap:RelatedPartyMemberplnt:AreaDevelopmentAgreementsMember2023-12-310001637207us-gaap:RelatedPartyMemberplnt:AreaDevelopmentAgreementsMember2022-12-310001637207us-gaap:RelatedPartyMemberplnt:AreaDevelopmentAgreementsMembersrt:ChiefExecutiveOfficerMember2023-12-310001637207us-gaap:RelatedPartyMemberplnt:AreaDevelopmentAgreementsMembersrt:ChiefExecutiveOfficerMember2022-12-310001637207us-gaap:RelatedPartyMemberplnt:TaxBenefitArrangementsMember2023-12-310001637207us-gaap:RelatedPartyMemberplnt:TaxBenefitArrangementsMember2022-12-310001637207us-gaap:RelatedPartyMemberus-gaap:AdministrativeServiceMember2023-10-012023-12-310001637207us-gaap:RelatedPartyMemberus-gaap:AdministrativeServiceMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMemberus-gaap:AdministrativeServiceMember2021-01-012021-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMemberplnt:AmenityTrackingComplianceSoftwareCompanyMember2023-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMember2023-01-012023-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMember2022-01-012022-12-310001637207us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMember2021-01-012021-12-310001637207srt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMemberus-gaap:EntityOperatedUnitsMember2023-12-310001637207srt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMemberus-gaap:EntityOperatedUnitsMember2022-12-310001637207us-gaap:FranchisedUnitsMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMember2023-12-310001637207us-gaap:FranchisedUnitsMembersrt:ChiefExecutiveOfficerMemberplnt:PaymentsForAmenityTrackingComplianceSoftwareMember2022-12-310001637207srt:AffiliatedEntityMemberplnt:CorporateTravelMember2023-01-012023-12-310001637207srt:AffiliatedEntityMemberplnt:CorporateTravelMember2022-01-012022-12-310001637207srt:AffiliatedEntityMemberplnt:CorporateTravelMember2021-01-012021-12-310001637207us-gaap:CommonClassBMember2023-01-012023-12-310001637207plnt:HoldingsUnitsMember2023-01-012023-12-310001637207us-gaap:CommonClassAMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-01-012022-12-310001637207plnt:HoldingsUnitsMemberplnt:SunshineFitnessGrowthHoldingsLLCMember2022-01-012022-12-310001637207plnt:HoldingsUnitsMember2022-01-012022-12-310001637207plnt:HoldingsUnitsMember2021-01-012021-12-310001637207us-gaap:CommonClassBMember2022-01-012022-12-310001637207us-gaap:CommonClassBMember2021-01-012021-12-310001637207plnt:PlaFitHoldingsLLCMember2023-01-012023-12-310001637207plnt:PlaFitHoldingsLLCMember2022-01-012022-12-310001637207plnt:PlaFitHoldingsLLCMember2021-01-012021-12-310001637207us-gaap:CommonClassAMemberus-gaap:InvestorMemberplnt:SecondaryOfferingAndExchangeMember2023-12-310001637207plnt:CommonStockholdersMemberus-gaap:CommonClassAMemberus-gaap:InvestorMemberplnt:SecondaryOfferingAndExchangeMemberplnt:PlaFitHoldingsLLCMember2023-12-310001637207us-gaap:InvestorMemberplnt:SecondaryOfferingAndExchangeMemberplnt:PlaFitHoldingsLLCMember2023-01-012023-12-310001637207plnt:SecondaryOfferingAndExchangeMemberplnt:ContinuingLLCOwnersMember2023-12-310001637207plnt:SecondaryOfferingAndExchangeMemberplnt:ContinuingLLCOwnersMemberplnt:PlaFitHoldingsLLCMember2023-01-012023-12-310001637207plnt:SecondaryOfferingAndExchangeMemberus-gaap:CommonClassBMemberplnt:ContinuingLLCOwnersMember2023-12-310001637207us-gaap:CommonClassBMemberplnt:SecondaryOfferingAndExchangeMemberplnt:ContinuingLLCOwnersMemberplnt:ContinuingLLCOwnersMemberplnt:PlaFitHoldingsLLCMember2023-12-310001637207plnt:A2019AcceleratedShareRepurchaseAgreementMember2019-11-050001637207us-gaap:CommonClassAMemberplnt:A2019AcceleratedShareRepurchaseAgreementMember2022-01-012022-12-310001637207plnt:A2022ShareRepurchaseProgramMember2022-11-040001637207us-gaap:CommonClassAMemberplnt:A2022ShareRepurchaseProgramMember2023-01-012023-12-310001637207plnt:A2022ShareRepurchaseProgramMember2023-12-310001637207us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001637207us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001637207us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001637207us-gaap:PerformanceSharesMember2023-01-012023-12-310001637207us-gaap:PerformanceSharesMember2022-01-012022-12-310001637207us-gaap:PerformanceSharesMember2021-01-012021-12-310001637207us-gaap:EmployeeStockMember2023-01-012023-12-310001637207us-gaap:EmployeeStockMember2022-01-012022-12-310001637207us-gaap:EmployeeStockMember2021-01-012021-12-3100016372072015-08-310001637207us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310001637207srt:MinimumMember2022-01-012022-12-310001637207srt:MaximumMember2022-01-012022-12-310001637207srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001637207srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2022-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2023-12-310001637207srt:MinimumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001637207srt:MaximumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001637207us-gaap:PerformanceSharesMember2022-12-310001637207us-gaap:PerformanceSharesMember2023-12-310001637207us-gaap:EmployeeStockMember2023-12-310001637207us-gaap:CommonClassBMember2023-01-012023-12-310001637207us-gaap:CommonClassBMember2022-01-012022-12-310001637207us-gaap:CommonClassBMember2021-01-012021-12-310001637207us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001637207us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001637207us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001637207us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001637207us-gaap:PerformanceSharesMember2023-01-012023-12-310001637207us-gaap:PerformanceSharesMember2022-01-012022-12-310001637207us-gaap:PerformanceSharesMember2021-01-012021-12-310001637207us-gaap:DomesticCountryMember2023-12-310001637207us-gaap:StateAndLocalJurisdictionMember2023-12-310001637207us-gaap:CommonClassAMemberplnt:ContinuingLLCOwnersMember2023-01-012023-12-310001637207us-gaap:CommonClassAMemberplnt:ContinuingLLCOwnersMember2022-01-012022-12-310001637207plnt:ContinuingLLCOwnersMember2023-01-012023-12-310001637207plnt:ContinuingLLCOwnersMember2022-01-012022-12-310001637207plnt:ContinuingLLCOwnersMember2023-12-310001637207plnt:ContinuingLLCOwnersMember2022-12-310001637207plnt:CivilActionBroughtByFormerEmployeeMemberus-gaap:SettledLitigationMember2022-10-012022-12-310001637207plnt:CivilActionBroughtByFormerEmployeeMemberus-gaap:SettledLitigationMember2022-01-012022-12-310001637207plnt:PlanetFitmexLLCMemberplnt:MexicoAcquisitionMember2022-12-310001637207plnt:PlanetFitmexLLCMemberplnt:MexicoAcquisitionMember2023-01-012023-12-310001637207plnt:PlanetFitmexLLCMemberplnt:MexicoAcquisitionMember2023-10-202023-10-200001637207plnt:PlanetFitmexLLCMemberus-gaap:DiscontinuedOperationsHeldforsaleMemberplnt:MexicoAcquisitionMember2023-10-202023-10-200001637207plnt:PlanetFitmexLLCMemberplnt:MexicoAcquisitionMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-12-282023-12-280001637207plnt:PlanetFitmexLLCMemberplnt:MexicoAcquisitionMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-12-280001637207plnt:AdvertisingPurchaseCommitmentMember2023-12-310001637207plnt:EquipmentPurchaseCommitmentMember2023-12-310001637207country:USplnt:FranchiseSegmentMember2023-01-012023-12-310001637207country:USplnt:FranchiseSegmentMember2022-01-012022-12-310001637207country:USplnt:FranchiseSegmentMember2021-01-012021-12-310001637207us-gaap:NonUsMemberplnt:FranchiseSegmentMember2023-01-012023-12-310001637207us-gaap:NonUsMemberplnt:FranchiseSegmentMember2022-01-012022-12-310001637207us-gaap:NonUsMemberplnt:FranchiseSegmentMember2021-01-012021-12-310001637207plnt:FranchiseSegmentMember2023-01-012023-12-310001637207plnt:FranchiseSegmentMember2022-01-012022-12-310001637207plnt:FranchiseSegmentMember2021-01-012021-12-310001637207country:USplnt:CorporateOwnedStoresSegmentMember2023-01-012023-12-310001637207country:USplnt:CorporateOwnedStoresSegmentMember2022-01-012022-12-310001637207country:USplnt:CorporateOwnedStoresSegmentMember2021-01-012021-12-310001637207us-gaap:NonUsMemberplnt:CorporateOwnedStoresSegmentMember2023-01-012023-12-310001637207us-gaap:NonUsMemberplnt:CorporateOwnedStoresSegmentMember2022-01-012022-12-310001637207us-gaap:NonUsMemberplnt:CorporateOwnedStoresSegmentMember2021-01-012021-12-310001637207plnt:CorporateOwnedStoresSegmentMember2023-01-012023-12-310001637207plnt:CorporateOwnedStoresSegmentMember2022-01-012022-12-310001637207plnt:CorporateOwnedStoresSegmentMember2021-01-012021-12-310001637207plnt:EquipmentSegmentMembercountry:US2023-01-012023-12-310001637207plnt:EquipmentSegmentMembercountry:US2022-01-012022-12-310001637207plnt:EquipmentSegmentMembercountry:US2021-01-012021-12-310001637207us-gaap:NonUsMemberplnt:EquipmentSegmentMember2023-01-012023-12-310001637207us-gaap:NonUsMemberplnt:EquipmentSegmentMember2022-01-012022-12-310001637207us-gaap:NonUsMemberplnt:EquipmentSegmentMember2021-01-012021-12-310001637207plnt:EquipmentSegmentMember2023-01-012023-12-310001637207plnt:EquipmentSegmentMember2022-01-012022-12-310001637207plnt:EquipmentSegmentMember2021-01-012021-12-310001637207plnt:PlacementServicesMemberplnt:FranchiseSegmentMember2023-01-012023-12-310001637207plnt:PlacementServicesMemberplnt:FranchiseSegmentMember2022-01-012022-12-310001637207plnt:PlacementServicesMemberplnt:FranchiseSegmentMember2021-01-012021-12-310001637207us-gaap:OperatingSegmentsMemberplnt:FranchiseSegmentMember2023-01-012023-12-310001637207us-gaap:OperatingSegmentsMemberplnt:FranchiseSegmentMember2022-01-012022-12-310001637207us-gaap:OperatingSegmentsMemberplnt:FranchiseSegmentMember2021-01-012021-12-310001637207us-gaap:OperatingSegmentsMemberplnt:CorporateOwnedStoresSegmentMember2023-01-012023-12-310001637207us-gaap:OperatingSegmentsMemberplnt:CorporateOwnedStoresSegmentMember2022-01-012022-12-310001637207us-gaap:OperatingSegmentsMemberplnt:CorporateOwnedStoresSegmentMember2021-01-012021-12-310001637207plnt:EquipmentSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001637207plnt:EquipmentSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001637207plnt:EquipmentSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001637207us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001637207us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001637207us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001637207us-gaap:OperatingSegmentsMemberplnt:FranchiseSegmentMember2023-12-310001637207us-gaap:OperatingSegmentsMemberplnt:FranchiseSegmentMember2022-12-310001637207us-gaap:OperatingSegmentsMemberplnt:CorporateOwnedStoresSegmentMember2023-12-310001637207us-gaap:OperatingSegmentsMemberplnt:CorporateOwnedStoresSegmentMember2022-12-310001637207plnt:EquipmentSegmentMemberus-gaap:OperatingSegmentsMember2023-12-310001637207plnt:EquipmentSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001637207us-gaap:MaterialReconcilingItemsMember2023-12-310001637207us-gaap:MaterialReconcilingItemsMember2022-12-310001637207us-gaap:NonUsMemberplnt:CorporateOwnedStoresSegmentMember2023-12-310001637207us-gaap:NonUsMemberplnt:CorporateOwnedStoresSegmentMember2022-12-310001637207plnt:FranchiseSegmentMember2023-12-310001637207plnt:FranchiseSegmentMember2022-12-310001637207plnt:CorporateOwnedStoresSegmentMember2023-12-310001637207plnt:CorporateOwnedStoresSegmentMember2022-12-310001637207plnt:EquipmentSegmentMember2023-12-310001637207plnt:EquipmentSegmentMember2022-12-310001637207us-gaap:FranchisedUnitsMember2022-12-310001637207us-gaap:FranchisedUnitsMember2021-12-310001637207us-gaap:FranchisedUnitsMember2020-12-310001637207us-gaap:FranchisedUnitsMember2023-01-012023-12-310001637207us-gaap:FranchisedUnitsMember2022-01-012022-12-310001637207us-gaap:FranchisedUnitsMember2021-01-012021-12-310001637207us-gaap:FranchisedUnitsMember2023-12-310001637207us-gaap:EntityOperatedUnitsMember2022-12-310001637207us-gaap:EntityOperatedUnitsMember2021-12-310001637207us-gaap:EntityOperatedUnitsMember2020-12-310001637207us-gaap:EntityOperatedUnitsMember2023-01-012023-12-310001637207us-gaap:EntityOperatedUnitsMember2022-01-012022-12-310001637207us-gaap:EntityOperatedUnitsMember2021-01-012021-12-310001637207us-gaap:EntityOperatedUnitsMember2023-12-3100016372072023-10-012023-12-310001637207us-gaap:AllowanceForCreditLossMember2022-12-310001637207us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001637207us-gaap:AllowanceForCreditLossMember2023-12-310001637207us-gaap:AllowanceForCreditLossMember2021-12-310001637207us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001637207us-gaap:AllowanceForCreditLossMember2020-12-310001637207us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2022-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2023-01-012023-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2023-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2021-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2022-01-012022-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2020-12-310001637207us-gaap:AllowanceForLossesOnFinanceReceivablesMember2021-01-012021-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001637207us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-37534

PLANET FITNESS, INC.

(Exact name of Registrant as specified in its Charter)

| | | | | |

| Delaware | 38-3942097 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

4 Liberty Lane West, Hampton, NH 03842

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (603) 750-0001

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.0001 Par Value | PLNT | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of the “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Small reporting company | | ☐ |

| | | | | Emerging Growth Company | | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s Class A common stock held by non-affiliates, computed by reference to the last reported sale price of the Class A common stock as reported on the New York Stock Exchange on June 30, 2023 was approximately $5.7 billion.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.0001 per share, and Class B common stock, par value $0.0001 per share, as of February 22, 2024, was 87,023,326 shares and 1,146,094 shares, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the registrant’s 2023 Annual Meeting of Stockholders to be held April 30, 2024, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

Table of Contents

| | | | | | | | |

| | | Page |

| PART I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

Item 9C. | | |

| | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| PART IV | | |

| Item 15. | | |

| Item 16. | | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and our annual report to shareholders contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements reflect, among other things, our current expectations and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, the words “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “goal,” “plan,” “prospect,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “ongoing,” “contemplate,” “future,” “strategy,” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Item 1A. – Risk Factors,” of this report. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information.

PART I

Item 1. Business

Planet Fitness, Inc. is a Delaware corporation formed on March 16, 2015. Planet Fitness, Inc. Class A common stock trades on the New York Stock Exchange under the symbol “PLNT.”

Our Company

Fitness for everyone

We are one of the largest and fastest-growing franchisors and operators of fitness centers in the world by number of members and locations, with a highly recognized national brand. Our mission is to enhance people’s lives by providing a high-quality fitness experience in a welcoming, non-intimidating environment, which we call the Judgement Free Zone. Our bright, clean stores are typically 20,000 square feet, with a large selection of high-quality, purple and yellow Planet Fitness-branded cardio, circuit- and weight-training equipment and friendly staff trainers who offer unlimited free fitness instruction to all our members in small groups through our PE@PF program. We offer this differentiated fitness experience starting at only $10 per month for our standard Classic Card membership. This attractive value proposition is designed to appeal to a broad population, including occasional gym users and people over the age of 14 who do not belong to a gym, particularly those who find the traditional fitness club setting intimidating and expensive. We and our franchisees fiercely protect Planet Fitness’s community atmosphere—a place where you do not need to be fit before joining and where progress toward achieving your fitness goals (big or small) is supported and applauded by our staff and fellow members.

In 2023, we recorded revenues of $1.1 billion and had system-wide sales of $4.5 billion, which we define as monthly dues and annual fees billed by us and our franchisees. We ended the year with approximately 18.7 million members and 2,575 stores in all 50 states, the District of Columbia, Puerto Rico, Canada, Panama, Mexico and Australia. System-wide sales for 2023 include $4.0 billion attributable to franchisee-owned stores, from which we generate royalty revenue, and $475.8 million attributable to our corporate-owned stores. Of our 2,575 stores, 2,319 are franchised and 256 are corporate-owned. Under signed area development agreements (“ADAs”) and franchise agreements as of December 31, 2023, our franchisees have committed to open approximately 1,000 additional stores.

In 2023, our corporate-owned stores had a segment EBITDA margin of 38.2% and had average unit volumes (“AUVs”) of approximately $1.9 million with four-wall EBITDA margins (an assessment of store-level profitability which includes local and national advertising expense) of approximately 42.7%, or approximately 35.4% after applying the current 7% royalty rate. Based on franchisee business reviews and management estimates, we believe that, on average, franchisee stores achieve four-wall EBITDA margins in line with these corporate-owned store four-wall EBITDA margins. For a reconciliation of segment EBITDA margin to four-wall EBITDA margin for corporate-owned stores, see “Management’s Discussion and Analysis of Results of Operations and Financial Condition.”

Our growth is reflected in:

•2,575 stores as of December 31, 2023, compared to 2,001 as of December 31, 2019, reflecting a compound annual growth rate (“CAGR”) of 6.5%;

•18.7 million members as of December 31, 2023, compared to 14.4 million as of December 31, 2019, reflecting a CAGR of 6.8%; and

•53 consecutive quarters of system-wide same store sales growth through the first quarter of 2020, which saw stores temporarily close due to the onset of the COVID-19 pandemic, and ten consecutive quarters of system-wide same store sales growth beginning in the third quarter of 2021 through the fourth quarter of 2023 (which we define as year-over-year growth solely of monthly dues from stores that have been open and for which membership dues have been billed for longer than 12 months).

Planet Fitness – Home of the Judgement Free Zone

We bring fitness to a large, previously underserved segment of the population. Our differentiated member experience is driven by three key elements:

•Welcoming, non-intimidating environment: We believe fitness is essential to both physical and mental health, and every member should feel accepted and respected when they walk into a Planet Fitness regardless of their fitness level. Our stores provide a Judgement Free Zone where members can experience a non-intimidating and supportive environment. Our “come as you are” approach has fostered a strong sense of community among our members, allowing them not only to feel comfortable as they work toward their fitness goals but also to encourage others to do the same. By outfitting our stores with more cardiovascular and light strength equipment, and a limited offering of heavy free

weights, we seek to reinforce our Judgement Free Zone philosophy by discouraging what we call “Lunk” behavior, such as dropping weights and grunting, that can be intimidating to new and occasional gym users.

•Distinct store experience: Because our stores are typically 20,000 square feet and we do not offer non-essential amenities such as group exercise classes, pools, day care centers and juice bars, we have more space for the equipment our members do use. We believe our tailored use of space is, at least in part, why we have not needed to impose time limits on our cardio machines. Part of our unique store experience is the diligence our members and employees have to maintain a clean and sanitized environment. Members’ etiquette typically includes wiping down the equipment before and after use with our sanitization spray, which is FDA-approved to kill COVID-19 and other viruses on surfaces.

•Exceptional value for members: In the U.S., generally starting at only $10 per month, our standard Classic Card membership includes unlimited access to one Planet Fitness location and unlimited free fitness instruction to all members in small groups through our PE@PF program. And, for approximately $24.99 per month, our PF Black Card members have access to all of our stores system-wide and can bring a guest on each visit, which provides an additional opportunity to attract new members. Our PF Black Card members also have access to exclusive areas in our stores that provide amenities such as water massage beds, massage chairs, tanning equipment and more. Through our mobile application and website we also provide members access to PF Perks, which gives all members access to unlock special discounts and offers from popular brands year-round.

Our competitive strengths

We attribute our success to the following strengths:

•Market leader with differentiated member experience, nationally recognized brand and scale advantage. We are one of the largest and fastest-growing franchisors and operators of fitness centers in the world by number of members and locations, with a highly recognized national brand.

•Differentiated member experience. Planet Fitness is the home of the Judgement Free Zone, a place where people of all fitness levels can feel comfortable working out at their own pace, feel supported in their efforts and not feel intimidated by pushy salespeople or other members who may ruin their fitness experience. Our philosophy is simple: Planet Fitness is an environment where members can relax, go at their own pace and be themselves without ever having to worry about being judged. No matter what size the goal, we believe that all of these accomplishments deserve to be celebrated.

•Nationally recognized brand. We have developed a highly relatable and recognizable brand focused on providing our members with a judgement free environment. We do so through fun and memorable marketing campaigns and in-store signage. As a result, we have among the highest aided and unaided brand awareness scores in the U.S. fitness industry, according to our Brand Health research, a third-party consumer study that we have updated tri-annually.

•Scale advantage. Our scale provides several competitive advantages, including enhanced purchasing power and extended warranties with our fitness equipment and other suppliers, and the ability to attract high-quality franchisee partners. In addition, we estimate that our U.S. national advertising fund, funded by franchisees and us, together with our requirement that franchisees spend 7% of their monthly membership dues on local advertising, enabled us and our franchisees to spend over $300 million combined in 2023.

•Exceptional value proposition that appeals to a broad member demographic. Our low monthly membership dues combined with our non-intimidating and welcoming environment, enable us to attract a broad member demographic based on age, household income, gender and ethnicity. Our member base is approximately 50% female and our members come from households of all income levels. Approximately 20% of our stores are located in areas that the US government deems “low income,” providing access to improve health and wellness in underserved communities. Our broad appeal and ability to attract occasional and first-time gym users enable us to continue to target a large segment of the population in a variety of markets and geographies.

•Highly attractive franchise system built for growth. Our easy-to-operate model, strong store-level economics and brand strength have enabled us to attract a team of professional, successful franchisees from a variety of industries. We believe that our strategy to be predominantly franchisee-owned enables us to scale more rapidly than a predominantly company-owned strategy. Our streamlined model features relatively fixed labor costs, minimal inventory, automatic billing and limited cash transactions. The attractiveness of our franchise model is further evidenced by the fact that our franchisees re-invest their capital into the brand, with substantially all of our new stores in 2023 opened by our existing franchisee base. We view our franchisees as strategic partners in expanding the Planet Fitness store base and brand.

•Predictable and recurring revenue streams with high cash flow conversion. While 2020 brought an unprecedented disruption to the general economy, our industry and our business, when operating in a normal business environment, our model provides us with predictable and recurring revenue streams. In 2023, approximately 90% of both our corporate-owned store and franchise revenues consisted of recurring revenue streams, which include royalties, monthly dues and annual fees. Our franchisees are obligated to purchase fitness equipment from us or our required vendor for their new stores and to replace this equipment approximately every five to nine years. As a result, these “equip” and “re-equip” requirements create a predictable and growing revenue stream as our franchisees open new stores under their ADAs.

Our growth strategies

We believe there are significant opportunities to grow our brand awareness, increase our revenues and profitability and deliver shareholder value by executing on the following strategies:

•Continue to grow our store base across a broad range of domestic and international markets. We have meaningfully grown our store count over the last five years, expanding from 2,001 stores as of December 31, 2019 to 2,575 stores as of December 31, 2023. As of December 31, 2023, our franchisees have contractual obligations to open approximately 1,000 additional stores, including more than 500 over the next three years. Because our stores are successful across a wide range of geographies and demographics with varying market characteristics, we believe that our high level of brand awareness and low per capita penetration creates a significant opportunity to open new Planet Fitness stores both in the U.S. and internationally. Based on our internal and third-party analyses, we believe we have the potential to grow our store base to over 5,000 stores in the U.S. alone.

•Drive revenue growth and system-wide same store sales. We have a significant history of positive system-wide same store sales growth and expect to achieve system-wide same store sales growth primarily by:

•Attracting new members to existing Planet Fitness stores. As the population in the markets where we operate continue to focus on health and wellness, we believe we are well-positioned to capture a disproportionate share of these populations given our affordability and appeal to first-time and occasional gym users. Over the years, we have seen our membership penetration rates of each successive generation increase compared to the previous generations. We continue to evolve our offerings and enhance the PE@PF Program, our proprietary small group training program to appeal to our target member base. In addition to our in store experience, we also provide more than 500 workouts to both existing members and prospects via the free Planet Fitness mobile application, featuring differentiated content geared toward engaging with our community outside of our four walls and providing more ways to connect to our target audience – first time and casual gym users.

•Increasing mix of PF Black Card memberships by enhancing value and member experience. We expect to drive sales by attracting new members to join as a PF Black Card member as well as continuing to convert our existing members’ standard Classic Card memberships to our premium PF Black Card membership. We encourage this upgrade by continuing to enhance the value of our PF Black Card benefits through the ability to use any Planet Fitness location, free guest privileges, access premium content on the Planet Fitness mobile app and additional in-store amenities, such as tanning equipment, hydro-massage beds, and affinity partnerships for discounts and promotions. Our PF Black Card members as a percentage of total membership has increased from 61% as of December 31, 2019 to 62% as of December 31, 2023, and our average monthly dues per member have increased from $16.91 to $18.29 over the same period.

•Increase brand investment to drive awareness and growth. We plan to continue to increase our strong brand awareness by leveraging significant marketing expenditures by our franchisees and us, which we believe will result in increased membership in new and existing stores and continue to attract high-quality franchisee partners. As of December 31, 2023, our agency structure consists of one national and two local agencies allowing for integration and coordination of National Advertising Fund (“NAF”) and local advertising spending. Under our current franchise agreement, franchisees are required to contribute 2% annually of their monthly membership dues, and beginning in January 2023 annual dues, to our NAF and Canadian advertising fund. We spent $78.5 million in 2023 to support our national marketing campaigns, our social media platforms and the development of local advertising materials, of which $8.4 million was from our corporate-owned stores and included in store operations expense on our consolidated statements of operations. Under our current franchise agreement, franchisees as well as our corporate-owned stores are also required to spend 7% of their monthly membership dues on local advertising. We expect both our NAF and local advertising spending to grow as our membership grows.

•Continue to expand royalties from increases in average royalty rate and new franchisees. While our current franchise agreement stipulates a monthly royalty rate of 7% of monthly dues and annual membership fees, as of December 31, 2023, only 55% of our stores are paying royalties at the current franchise agreement rate, primarily due to lower rates in historical

agreements. As new franchisees enter our system and, generally, as current franchisees open new stores or renew their existing franchise agreements at the current royalty rate, our average system-wide royalty rate will increase. In 2023, our average royalty rate was 6.5% compared to 6.1% in 2019.

•Grow sales from fitness equipment and related services. Our franchisees are contractually obligated to purchase fitness equipment from us, and in certain international markets, from our required vendors. Due to our scale and negotiating power, we believe we offer competitive pricing for high-quality, purple and yellow Planet Fitness-branded fitness equipment. We expect our equipment sales to grow as our U.S. franchisees open new stores and replace used equipment as required every five to nine years. In addition, we believe that regularly refreshing equipment helps our franchise stores maintain a consistent, high-quality fitness experience and is one of the contributing factors that drives new member growth. In certain international markets, we earn a commission on the sale of equipment by our required vendors to franchisee-owned stores.

Our industry

Due to our unique positioning to a broader demographic, we believe Planet Fitness has an addressable market that is significantly larger than the traditional health club industry, focused on occasional gym users and people over the age of 14 who do not belong to a gym. We compete broadly for consumer discretionary spending related to leisure, sports, entertainment and other non-fitness activities in addition to the traditional health club market. Both our standard Classic Card and PF Black Card memberships are priced significantly below the 2022 industry average of $59 per month, the latest available estimate from our industry’s trade association, the International Health, Racquet & Sportsclub Association’s (“IHRSA”).

Membership

We make it simple for members to join, whether online, through our mobile application or in-store—no pushy sales tactics, no pressure and no complicated rate structures. Our members generally pay the following amounts (or an equivalent amount in the store’s local currency):

•monthly membership dues starting at only $10 for our standard Classic Card membership, or $24.99 for PF Black Card membership;

•current standard annual fees of $49; and

•enrollment fees of $0 to $59.

Belonging to a Planet Fitness store has perks whether members select the standard Classic Card membership or the premium PF Black Card membership. Every member can take advantage of specials and discount offers from third-party retail partners and gets free, unlimited fitness instruction included in their monthly membership fee. Our PF Black Card members also have the right to reciprocal use of all Planet Fitness stores, can bring a friend with them each time they work out, and have access to massage beds and chairs and tanning, among other benefits. PF Black Card benefits extend beyond our store as well, with exclusive specials and enhanced discount offers from select third-party retail partners. While some of our memberships require a cancellation fee, we offer, and require our franchisees to offer, a non-committal membership option.

As of December 31, 2023, we had approximately 18.7 million members. We utilize electronic funds transfer (“EFT”) as our primary method of collecting monthly dues and annual membership fees. Over 86% of membership fee payments to our corporate-owned and franchise stores are collected via Automated Clearing House (“ACH”) direct debit. We believe there are certain advantages to receiving a higher concentration of ACH payments, as compared to credit card payments, including less frequent expiration of billing information and reduced exposure to subjective chargeback or dispute claims and fees.

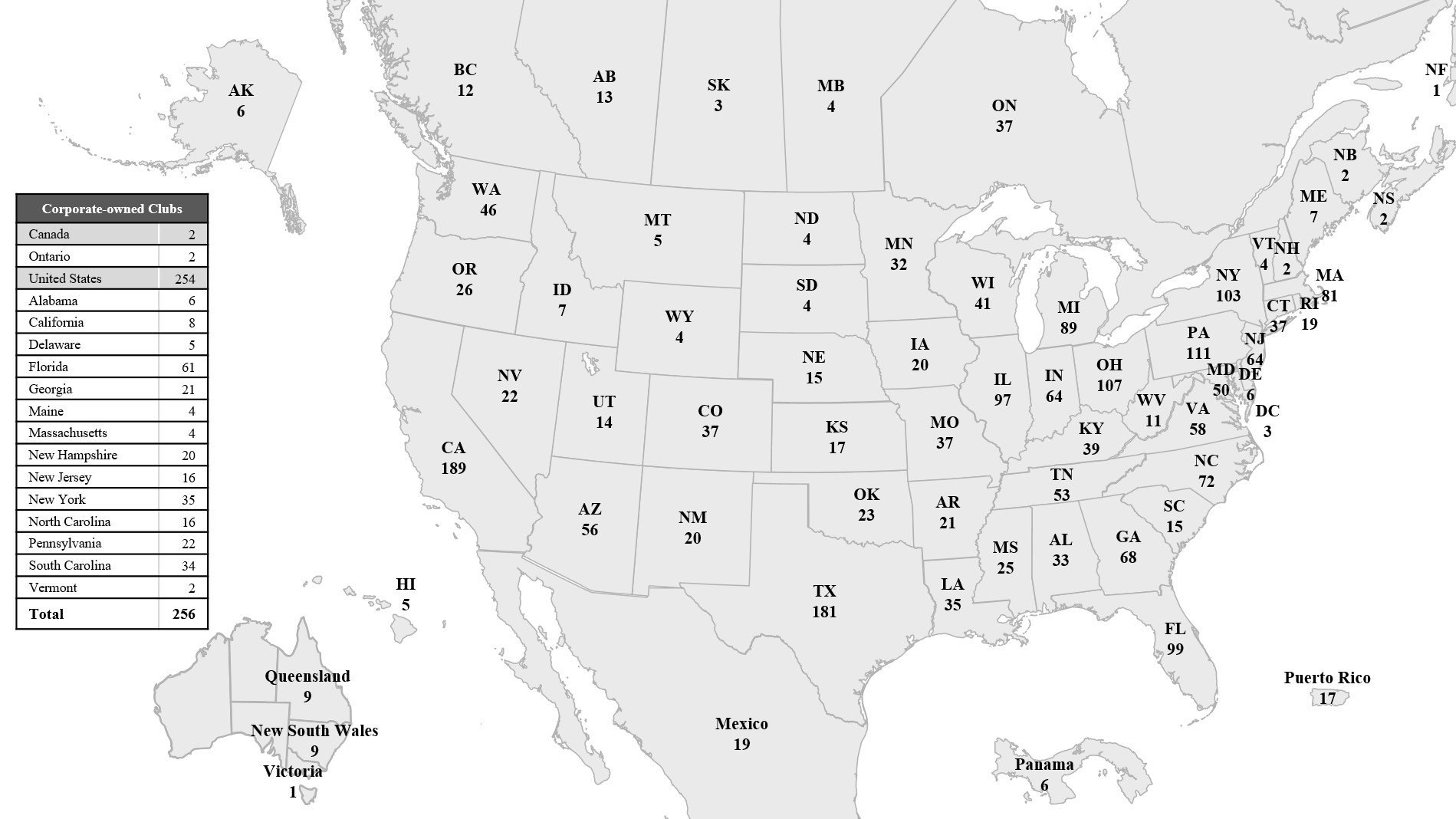

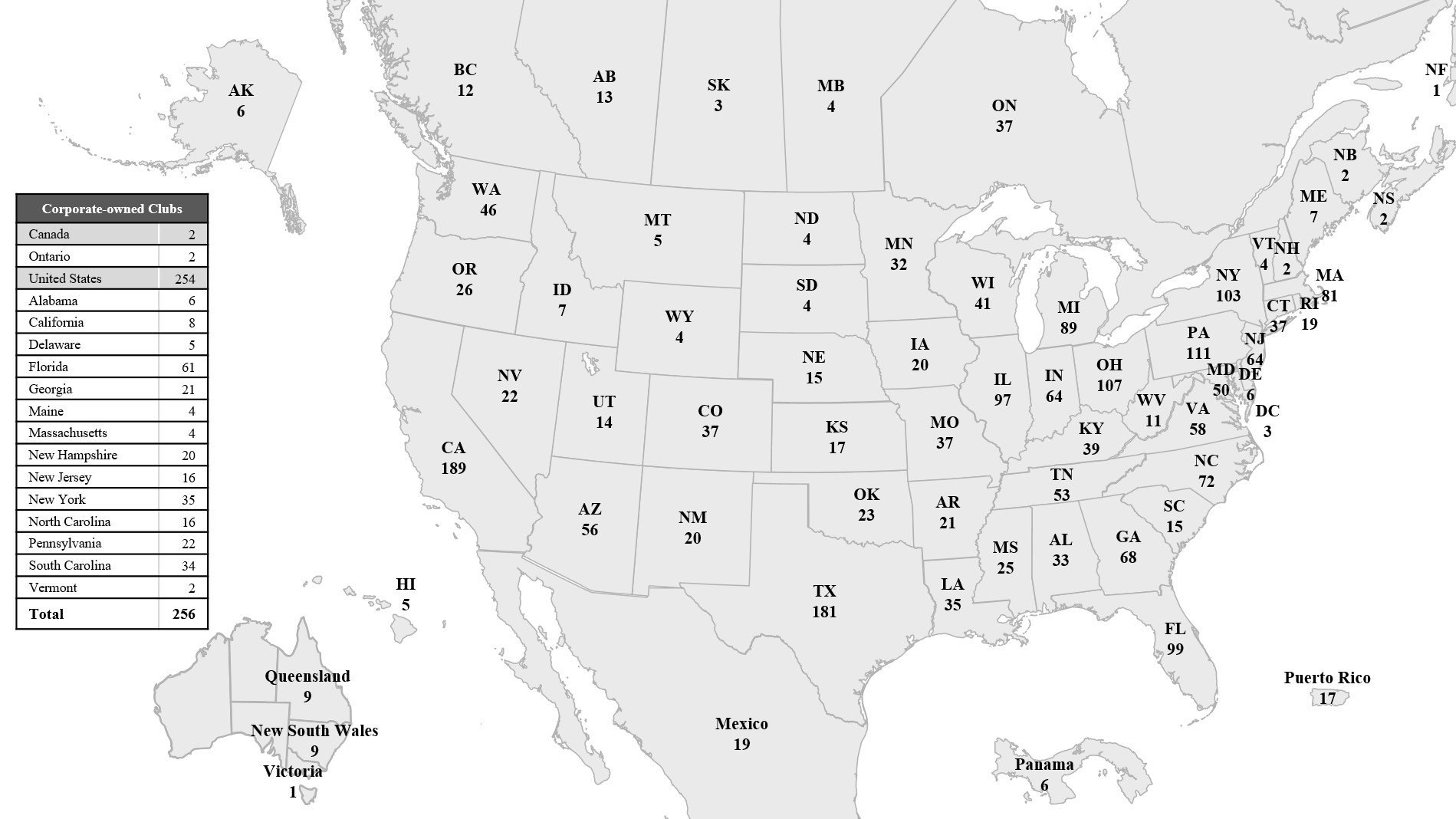

Our stores

We had 2,575 stores system-wide as of December 31, 2023, of which 2,319 were franchised and 256 were corporate-owned, located in all 50 states, the District of Columbia, Puerto Rico, Canada, Panama, Mexico and Australia. The map below shows our franchisee-owned stores by location, and the accompanying table shows our corporate-owned stores by location.

| | |

Franchisee-owned store count by location |

Store model

Our store model is designed to generate attractive four-wall EBITDA margins, strong free cash flow and high returns on invested capital for both our corporate-owned and franchisee-owned stores. Based on franchisee business reviews and management estimates, we believe that, on average, franchisee stores achieve four-wall EBITDA margins in line with these corporate-owned store four-wall EBITDA margins. The stores included in these business reviews represent those stores that voluntarily disclosed such information in response to our request, and we believe this information reflects a representative sample of franchisees based on the franchisee groups and geographic areas represented by these stores.

Fitness equipment

We provide our members with high-quality, Planet Fitness-branded fitness equipment from leading suppliers. In order to maintain a consistent experience across our store base, we stipulate specific pieces and quantities of cardio and strength-training equipment and work with franchisees to review and approve layouts and placement. Due to our scale, we are able to negotiate competitive pricing and secure extended warranties from our suppliers. As a result, we believe we offer equipment at more attractive pricing than franchisees could otherwise secure on their own.

Leases

We lease our corporate headquarters, our corporate-owned store headquarters and all but one of our corporate-owned stores. Our store leases typically have initial terms of 10 years with two five-year renewal options, exercisable at our discretion. Our corporate headquarters serves as our base of operations for substantially all of our executive management and employees who provide our primary corporate support functions.

Franchisees own or directly lease from a third-party each Planet Fitness franchise location. We have not historically owned or entered into leases for Planet Fitness franchisee-owned stores and historically have generally not guaranteed franchisees’ lease agreements, although we have done so in a few certain instances.

Franchising

Franchising strategy

We rely heavily on our franchising strategy to develop new Planet Fitness stores, leveraging the ownership of entrepreneurs with specific local market expertise. As of December 31, 2023, there were 2,319 franchised Planet Fitness stores operated by

103 franchisee groups. The majority of our existing franchise operators are multi-unit operators. As of December 31, 2023, approximately 98% of all franchise stores were owned and operated by a franchisee group that owned at least three stores, and while our largest franchisee owned 194 stores, only 44% of our franchisee groups own ten or more stores. When considering a potential franchisee, we generally evaluate the potential franchisee’s prior experience in franchising or other multi-unit businesses, history in managing profit and loss operations, financial history and available capital and financing.

Area development agreements

An ADA specifies the number of Planet Fitness stores to be developed by the franchisee in a designated geographic area and requires the franchisee to meet certain scheduled deadlines for the development and opening of each Planet Fitness store authorized by the ADA. If the franchisee meets those obligations and otherwise complies with the terms of the ADA, with a few limited exceptions, we agree not to, during the term of the ADA, operate or franchise new Planet Fitness stores in the designated geographic area. The franchisee must sign a separate franchise agreement with us for each Planet Fitness store developed under an ADA and that franchise agreement governs the franchisee’s right to own and operate the Planet Fitness store.

Franchise agreements

For each franchised Planet Fitness store, we enter into a franchise agreement covering standard terms and conditions. Planet Fitness franchisees are not granted an exclusive area or territory under the franchise agreement. The franchise agreement requires that the franchisee operate the Planet Fitness store at a specific location and in compliance with our standard methods of operation, including providing the services, using the vendors and selling the merchandise that we require. The typical franchise agreement has a 10-year term. Additionally, franchisees must purchase equipment from us (or our required vendors in the case of our franchisees located in certain international markets) and generally replace the fitness equipment in their stores and refurbish and remodel their stores periodically. We made the following updates to our typical franchise agreements effective January 1, 2024 for franchisees who selected to be part of our new growth model (the “franchise growth model”) that was announced at the end of 2023:

•franchise agreements have up to a 12-year term with no initial fee instead of a 10-year term and $20,000 initial fee;

•store remodels are required in year 12, in conjunction with a $20,000 fee for the renewal of the franchise agreement, instead of in year 10;

•fitness equipment is required to be replaced every five to nine years instead of every five to seven years, based on store volume;

•join fees are a percentage-based fee for all joins instead of $5 on digital out of club joins.

Site selection and approval

Our stores are generally located in free-standing retail buildings or neighborhood shopping centers, and we consider locations in both high- and low-density markets. We seek out locations with (i) high visibility and accessibility, (ii) favorable traffic counts and patterns, (iii) availability of signage, (iv) ample parking or access to public transportation and (v) our targeted demographics. We use third-party site analytics tools that provide us with extensive demographic data and analysis that we use to review new and existing sites and markets for our corporate-owned stores and franchisee-owned stores. We assess population density and drive time, current tenant mix, layout, potential competition and impact on existing Planet Fitness stores and comparative data based upon existing stores. Our real estate team meets regularly to review sites for future development and follows a detailed review process to ensure each site aligns with our strategic growth objectives and critical success factors.

We help franchisees select sites and develop facilities in these stores that conform to the physical specifications for a Planet Fitness store. Each franchisee is responsible for selecting a site, but must obtain site approval from us.

Design and construction

Once we have approved a franchisee’s site selection, we assist and provide corporate approval in the design and layout of the store and track the franchisee’s progress from lease signing to grand opening. Franchisees are offered the assistance of our franchise support team to track key milestones, coordinate with vendors and make equipment purchases. Planet Fitness brand elements are required to be incorporated into every new store in accordance with our Design Control Documents (“DCD”) and supporting design brand guidelines, and we strive for a consistent appearance across all of our stores, emphasizing clean, attractive facilities, including full-size locker rooms, and modern equipment. Franchisees must abide by our club design standards and requirements related to finishes, fixtures, equipment, and brand design elements, including distinctive touches such as our “Lunk” alarm. We believe these elements are critical to ensure brand consistency and member experience system-wide.

The cost to build a new store includes general contractor costs, the cost of fitness equipment purchased from us as well as costs for non-fitness equipment and leasehold improvements. These amounts can vary significantly depending on a number of factors, including landlord allowances for tenant improvements, store size and construction costs from different geographies.

Franchisee support

We live and breathe the motto One Team, One Planet in our daily interactions with franchisees. We designed our franchise model to be streamlined and easy-to-operate, with efficient staffing and minimal inventory, and is supported by an active, engaged franchise operations system. We provide our franchisees with operational support, marketing materials and training resources.

Training. We continue to update and expand Planet Fitness University, a comprehensive training resource to help franchisees operate successful stores. Courses are delivered online, and content focuses on customer service, operational policies, brand standards, cleanliness, security awareness, crisis management and vendor product information. The core online curriculum is offered in both English and Spanish to support our Spanish-speaking employees. We regularly add and improve the content available on Planet Fitness University as a no-cost service to help enhance training programs for franchisees. Additional training opportunities offered to our franchisees include new owner orientation, operations training and workshops held at Planet Fitness headquarters (when circumstances permit), in stores and through regularly held webinars and seminars.

Operational support and communication. We believe spending quality time with our franchisees in person is an important opportunity to further strengthen our relationships and share best practices. We have dedicated operations and marketing teams providing ongoing support to franchisees. We are hands on—we often attend franchisees’ presales and grand openings, and we host franchisee meetings every other year, known as “PF Huddles.” We also communicate regularly with our franchisee base to keep them informed, and we host a franchise conference every other year that is geared toward franchisees and their operations teams.

We regularly communicate and collaborate with the Independent Franchise Counsel (“IFC”) and its various sub-committees and send a weekly email communication to all franchisees with timely information related to operations, marketing and equipment. Every month, a franchisee newsletter is emailed to franchisees, which generally includes a personal note from our Chief Executive Officer.

Compliance with brand standards—Regional Franchise Operations

Our corporate-owned stores provide incentive compensation for store staff to successfully drive key business metrics in the service, cleanliness, personnel and financial categories, and we encourage our franchisees to follow our lead. We have a dedicated field support team of regional franchise operations managers and directors focused on ensuring that our franchisee-owned stores adhere to brand standards and providing ongoing assistance, training and coaching to all franchisees. We generally perform a site visit and operations review on each franchise store within 30 to 60 days of opening, and each franchisee ownership group is visited at least once per year in multiple locations for a business review with their operations team thereafter.

We also use mystery shoppers to perform anonymous reviews of franchisee-owned stores. We generally select franchisee-owned stores for review randomly but also target underperforming stores and stores that have not performed well on previous visits from their operations team.

Marketing

Marketing strategy

Our marketing strategy is anchored by our key brand differentiators—the Judgement Free Zone, our exceptional value and our high-quality experience. We employ memorable and creative advertising, which not only drives membership sales, but also showcases our brand philosophy, humor and innovation in the industry. We see Planet Fitness as a community gathering place, and the heart of our marketing strategy is to reinforce the “feel good” mental and physical benefits of exercise and create a welcoming in-store environment for our members.

Marketing spending

National advertising. We support our franchisees both at a national and local level. We manage the NAF and Canadian advertising fund for franchisees and corporate-owned stores, with the goals of generating national awareness through advertising and media partnerships, developing and maintaining creative assets to support local sale periods throughout the year, and building and supporting the Planet Fitness community via digital, social media and public relations. Our current U.S. and Canadian franchise agreements require franchisees to contribute approximately 2% annually of their monthly membership dues, and beginning in January 2023 annual dues, to the NAF and Canadian advertising fund, respectively. In 2023, the NAF and Canadian advertising fund spent $78.5 million, of which $8.4 million was from our corporate-owned stores and included in store operations expense on the consolidated statements of operations.

Local marketing. Our current franchise agreement requires franchisees to spend 7% of their monthly dues on local marketing to support branding efforts and promotional sale periods throughout the year. In situations where multiple ownership groups exist in a geographic area, we have the right to require franchisees to form or join regional marketing cooperatives to maximize the impact of their marketing spending. Our corporate-owned stores contribute to, and participate in, regional marketing cooperatives with franchisees where practical. All franchisee-owned stores are supported by our dedicated franchisee marketing team, which provides guidance, tracking, measurement and advice on best practices. Franchisees spend their marketing dollars in a variety of ways to promote business at their stores on a local level. These methods may include direct mail, outdoor (including billboards), television, radio and digital advertisements and local partnerships and sponsorships.

Marketing partnerships

Given our scale and marketing resources through our NAF, we have aligned ourselves with high-profile media partners who have helped to extend the reach of our brand. For the past nine years, we have sponsored “Dick Clark’s New Year’s Rockin’ Eve with Ryan Seacrest,” and have been the sole presenting sponsor of the Times Square New Year’s Eve celebration through the Times Square Alliance, allowing the brand to be featured prominently in TV broadcasts covering Times Square during the celebration. This has allowed us to showcase the Planet Fitness brand and our judgement free philosophy to an estimated over one billion TV viewers across the globe annually at a key time of year when health and wellness is top of mind for consumers.

Judgement Free Generation

The Judgement Free Generation is Planet Fitness’ philanthropic initiative designed to combat the judgement and bullying faced by today’s youth by creating a culture of kindness and encouragement. With our Judgement Free Zone principle as a solid foundation, The Judgement Free Generation aims to empower a generation to grow up contributing to a more judgement free planet— a place where everyone feels accepted and like they belong.

We have partnered with Boys & Girls Clubs of America to make a meaningful impact on the lives of today’s youth. Together with our franchisees, vendors and members, Planet Fitness has donated more than $9.6 million to support anti-bullying, pro-kindness initiatives since 2016.

Competition

In a broad sense, because many of our members are first-time or occasional gym users, we believe we compete with both fitness and non-fitness consumer discretionary spending alternatives for members’ and prospective members’ time and discretionary resources.

To a great extent, we also compete with other industry participants, including:

•other fitness centers;

•recreational facilities established by non-profit organizations such as YMCAs and by businesses for their employees;

•private studios and other boutique fitness offerings;

•racquet, tennis, pickleball and other athletic clubs;

•amenity and condominium/apartment clubs;

•country clubs;

•online personal training and fitness coaching;

•providers of digital fitness content;

•the home-use fitness equipment industry;

•local tanning salons; and

•businesses offering similar services.

The health club industry is highly competitive and fragmented. The number, size and strength of our competitors vary by region. Some of our competitors have an established presence in local markets or name recognition in their respective countries, and some are established in markets in which we have existing stores or intend to locate new stores. This competition is more significant internationally, where we have a limited number of stores and limited brand recognition.