| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

JAMES L. DOLAN

Executive Chairman

Notice of Annual Meeting and

Proxy Statement

Dear Stockholder:

You are cordially invited to attend our annual meeting of stockholders, which will be conducted via live webcast on Monday, December 11, 2023 at 10:00 a.m. Eastern Time. You can attend the annual meeting via the internet by visiting www.virtualshareholdermeeting.com/MSGS2023. There is no in-person meeting this year for you to attend.

Information on how to vote, attend and ask questions during the annual meeting is described in the enclosed materials. Your vote is important to us.

Sincerely yours,

James L. Dolan

Executive Chairman

October 25, 2023

MADISON SQUARE GARDEN SPORTS CORP., TWO PENNSYLVANIA PLAZA, NEW YORK, NY 10121

PROXY STATEMENT

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of

Madison Square Garden Sports Corp.

The Annual Meeting of Stockholders of Madison Square Garden Sports Corp. will be held on Monday, December 11, 2023, at 10:00 a.m. Eastern Time. You can attend the annual meeting via the internet, vote your shares electronically and submit your questions during the annual meeting, by visiting www.virtualshareholdermeeting.com/MSGS2023 (there is no physical location for the annual meeting). You will need to have your 16-digit control number included on your Notice of Annual Meeting and Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials) to join the annual meeting. We encourage you to allow ample time for online check-in, which will begin at 9:45 a.m. Eastern Time. For further information on how to participate in the meeting please see General Information, “How do I attend, vote and ask questions during the 2023 annual meeting?”

The annual meeting will be held to consider and vote upon the following proposals:

| 1. | Election of directors. |

| 2. | Ratification of the appointment of our independent registered public accounting firm. |

| 3. | An advisory vote on the compensation of the Company’s executive officers. |

| 4. | Conduct such other business as may be properly brought before the meeting. |

Only stockholders of record on October 16, 2023 may vote during the meeting.

Your vote is important to us. Even if you plan on participating in the annual meeting virtually, we recommend that you vote as soon as possible by telephone, by Internet or by signing, dating and returning the proxy card in the postage-paid envelope provided.

| By order of the Board of Directors, |

|

|

| Mark C. Cresitello Senior Vice President, Associate General Counsel & Secretary |

New York, New York

October 25, 2023

MADISON SQUARE GARDEN SPORTS CORP., TWO PENNSYLVANIA PLAZA, NEW YORK, NY 10121

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| Questions and Answers You May Have About Our Annual Meeting and Voting |

6 | |||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| Executive Sessions of Non-Management and Independent Board Members |

13 | |||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 20 | ||||

| 23 | ||||

| Proposal 2 — Ratification of Appointment of Independent Registered Public Accounting Firm |

36 | |||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 45 | ||||

| 48 | ||||

| 57 | ||||

| 58 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 62 | ||||

| 67 | ||||

| 68 | ||||

| 70 |

- i -

| 71 | ||||

| 74 | ||||

| 74 | ||||

| 82 | ||||

| 89 | ||||

| 90 | ||||

| 95 | ||||

| Proposal 3 — Non-Binding Advisory Vote On Named Executive Officer Compensation |

96 | |||

| 97 | ||||

| 98 | ||||

| Relationship Between Us, MSG Entertainment, Sphere Entertainment, and AMC Networks |

98 | |||

| 104 | ||||

| 104 | ||||

| 104 | ||||

| 105 | ||||

| 106 | ||||

| 107 | ||||

| 108 | ||||

| 120 | ||||

| 120 | ||||

| Advance Notice of Proxy Holders and Qualified Representatives |

121 | |||

| 121 | ||||

| A-1 |

- ii -

References to our website in this proxy statement are provided as a convenience and the information contained on, or available through, our website is not part of this or any other document we file with or furnish to the U.S. Securities and Exchange Commission (the “SEC”).

Forward-Looking Statements

This proxy statement may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “anticipates,” “believes,” “estimates,” “may,” “will,” “should,” “could,” “potential,” “continue,” “intends,” “plans,” and similar words and terms used in the discussion of future operating and future financial performance identify forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments or events may differ materially from those in the forward-looking statements as a result of various factors, including financial community perceptions of us and our business, operations, financial condition and the industries in which we operate and the factors described in our filings with the SEC, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. We disclaim any obligation to update any forward-looking statements contained herein, except as may be required by law or applicable regulations.

- iii -

PROXY STATEMENT SUMMARY

This summary highlights selected information in the proxy statement. Please review the entire proxy statement and our Annual Report on

Form 10-K for the fiscal year ended June 30, 2023 before voting.

VOTING ITEMS AND BOARD RECOMMENDATIONS

| Proposals | Board Recommendation | |||

| Proposal 1

|

Election of directors

|

FOR

| ||

| Proposal 2 | Ratification of the appointment of our independent registered public accounting firm

|

FOR | ||

| Proposal 3 | An advisory vote on the compensation of the Company’s executive officers

|

FOR | ||

COMPANY OVERVIEW

Madison Square Garden Sports Corp. (the “Company”) owns and operates a portfolio of assets featuring some of the most recognized teams in all of sports, including the New York Knickerbockers (the “Knicks”) of the National Basketball Association (the “NBA”) and the New York Rangers (the “Rangers”) of the National Hockey League (the “NHL”). Both the Knicks and the Rangers play their home games in Madison Square Garden Arena (“The Garden”),

also known as The World’s Most Famous Arena. The Company’s other professional franchises include two development league teams — the Hartford Wolf Pack of the American Hockey League (the “AHL”) and the Westchester Knicks of the NBA G League (the “NBAGL”). The Company also operates a professional sports team performance center — the Madison Square Garden Training Center in Greenburgh, NY.

1

CORPORATE GOVERNANCE AND BOARD PRACTICES

The Board of Directors of the Company (the “Board”) has adopted Corporate Governance Guidelines (the “Governance Guidelines”) and other practices to promote the functioning of the Board and its committees to serve the best

interests of all our stockholders. The Governance Guidelines and our other governance documents provide a framework for our governance practices, including:

| ✓ | Annual election of directors, with all directors elected to one-year terms

| |

| ✓ | Board composition to include a broad range of skills, experience, industry knowledge, diversity of opinion and contacts relevant to the Company’s business that serves the interests of the holders of both our Class A Common Stock and Class B Common Stock

| |

| ✓ | Board self-assessments conducted at least annually to assess the mix of skills and experience that directors bring to the Board to facilitate an effective oversight function

| |

| ✓ | Robust director nomination criteria to ensure a diversity of viewpoints, background and expertise in the boardroom

| |

| ✓ | Regular executive sessions of independent directors

| |

| ✓ | Independent Board committees, with each of the Audit Committee and the Compensation Committee comprised 100% of independent directors

| |

| ✓ | Restricted stock units subject to holding requirement through end of service on the Board

| |

APPROACH TO FOSTERING DIVERSITY AND INCLUSION

We aim to create an employee experience that fosters the Company’s culture of respect and inclusion. By welcoming the diverse perspectives and experiences of our employees, we all share in the creation of a more vibrant, unified, and engaging place to work.

Together with MSG Entertainment and Sphere Entertainment, we have furthered these objectives under our expanded Talent Management, Diversity and Inclusion (“D&I”) function, including:

Workforce: Embedding Diversity and Inclusion through Talent Actions

| • | Created a common definition of potential and an objective potential assessment to de-bias talent review conversations so employees have an opportunity to learn, grow and thrive. Implemented quarterly performance and career conversations to facilitate regular conversations between managers and employees about goals, career growth and productivity. |

| • | Integrated D&I best practices into our performance management and learning and development strategies with the goal of driving more equitable outcomes. |

| • | Developed an emerging talent list to expand our talent pool to better identify and develop high performing diverse talent for expanded roles and promotion opportunities. |

Workplace: Building an Inclusive and Accessible Community

| • | Continued our efforts with the MSG Diversity & Inclusion Heritage Month enterprise calendar to acknowledge and celebrate culturally relevant days and months of recognition, anchored by our six employee resource groups (“ERGs”): Asian Americans and Pacific Islanders (AAPI), Black, LatinX, PRIDE, Veterans, and Women. Increased combined ERG involvement from 622 members in fiscal year 2022 to 1,120 |

2

| members in fiscal year 2023 (an increase of 80.1%), which includes employees from the Company, MSG Entertainment and Sphere Entertainment. |

| • | Revamped our Conscious Inclusion Awareness Experience, a training program, and created two required educational modules focused on unconscious bias and conscious inclusion within our learning management system. As of June 30, 2023, over 90% of employees across the Company, MSG Entertainment and Sphere Entertainment had completed both required trainings either through the e-modules or through live training sessions. |

| • | Broadened our LGBTQ+ inclusivity strategy, by launching new gender pronoun feature within the employee intranet platform, hosted live allyship and inclusivity trainings, and launched toolkit resources for employees to learn and develop. Together with the PRIDE ERG, marched in the 2022 and 2023 NYC Pride Parades. Hosted a community conversations series focused on “Finding Your Voice as an LGBTQ+ Professional” with a prominent LGBTQ+ elected official and employees of the Company, MSG Entertainment and Sphere Entertainment. |

Community: Bridging the Divide through Expansion to Diverse Stakeholders

| • | Focused on connecting with minority-owned businesses to increase the diversity of our |

| vendors and suppliers by leveraging ERGs and our community, which creates revenue generating opportunities for diverse suppliers to promote their businesses and products. In fiscal year 2023, we and Sphere Entertainment hosted a multi-city holiday market event featuring twenty underrepresented businesses in New York City and Burbank. |

| • | Invested in an external facing supplier diversity portal on our website, which launched in fiscal year 2023. The portal is intended to expand opportunities for the Company, MSG Entertainment and Sphere Entertainment to do business with diverse suppliers, including minority-, women-, LGBTQ+- and veteran-owned businesses. |

| • | Strengthened our commitment to higher education institutions to increase campus recruitment pipelines. In partnership with the Knicks and our social impact team, we hosted the 2nd Annual Historically Black Colleges and Universities (“HBCU”) Night highlighting the important contributions of these institutions and awarded a $60,000 scholarship to a New York City high school student. Additionally, we welcomed two NBA HBCU Fellows in our MSG Sports Business Operations Department covering marketing strategy, ticketing revenue strategy, and basketball operations through the NBA’s HBCU Fellows Program. |

DIRECTOR NOMINEES

The Board has nominated 18 director candidates. Of the 18 nominees, five are Class A nominees and 13 are Class B nominees. Assuming all of the director nominees are elected at the 2023 annual meeting, our Class A director representation will be approximately 28% of the Board, consistent with the 25% minimum required by our Amended and Restated Certificate of Incorporation, as amended (“Certificate of Incorporation”).

All director candidates have been nominated for a one-year term to expire at the 2024 annual meeting of the Company’s stockholders and once their successors have been elected and qualified.

Our Class A nominees are elected by holders of our Class A Common Stock. All Class A nominees are independent and collectively have significant business leadership experience, finance and accounting experience, government

3

service experience, management experience, investment experience, operational and strategic planning experience, and extensive knowledge of the sports and sports media industries.

Our Class B nominees are elected by holders of our Class B Common Stock. Class B nominees collectively have significant industry and business leadership experience, finance and accounting experience, operational and strategic planning experience, and unmatched institutional knowledge of the Company.

Our Board believes that the Company and its stockholders benefit from the combination of Class A and Class B nominees’ diverse perspectives, institutional knowledge, and their collective deep business and investment experience.

Detailed information about each nominee’s background, skills and qualifications can be found under “Proposal 1 — Election of Directors.”

| Class A Director Nominees |

Class B Director Nominees | |||||

| Joseph M. Cohen | James L. Dolan | Quentin F. Dolan | Alan D. Schwartz | |||

| Richard D. Parsons | Charles F. Dolan | Ryan T. Dolan | Brian G. Sweeney | |||

| Nelson Peltz | Charles P. Dolan | Thomas C. Dolan | Vincent Tese | |||

| Ivan Seidenberg | Marianne Dolan Weber | Andrew Lustgarten | ||||

| Anthony J. Vinciquerra | Paul J. Dolan | Stephen C. Mills |

| |||

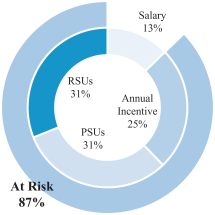

EXECUTIVE COMPENSATION PROGRAM

The Company is a sports business comprised of dynamic and powerful assets and brands. We operate in specialized industries and our named executive officers (“NEOs”) have substantial and meaningful professional experience in these industries. Given the unique nature of our

business, the Company places great importance on its ability to attract, retain, motivate and reward experienced NEOs who can continue to drive our business objectives and achieve strong financial, operational and stock price performance.

| Executive Compensation Principles: | ||

| ✓ | Significant portion of compensation opportunities should be at risk

| |

| ✓ | Long-term performance incentives should generally outweigh short-term performance incentives

| |

| ✓ | Executive officers should be aligned with stockholders through equity compensation

| |

| ✓ | Compensation structure should enable the Company to attract, retain, motivate and reward the best talent in a competitive industry

| |

4

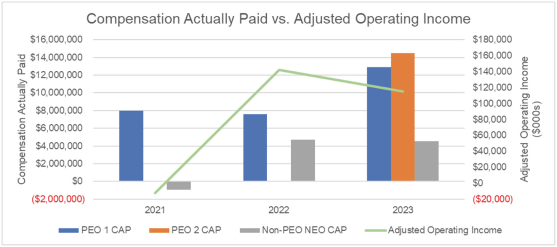

Elements of Compensation & Performance Objectives

The Company compensates its NEOs through base salary, annual incentive awards, long-term incentive awards, perquisites and benefit programs. Our annual and long-term incentive programs provide performance-based incentives for our NEOs tied to key financial and strategic measures that drive long-term stockholder value and reward sustained achievement of the Company’s key financial goals. The Company considers revenues and adjusted operating income (“AOI”) to be the key financial measures of the Company’s operating performance. As such, our Compensation Committee has reflected these

performance measures in our annual incentive awards (in the case of AOI) and long-term incentive performance awards (in the case of AOI and revenues), along with other specific strategic and operating measures. The Company’s long-term incentive program also includes restricted stock units whose value is tied to the performance of the market value of the Company’s Class A Common Stock.

The table below summarizes the elements of our compensation program in effect for fiscal year 2023, and how each element was linked to Company performance. For more information on our executive compensation program and policies, please see “Compensation Discussion & Analysis.”

|

Component

|

Performance Link

|

Description

| ||||||

| Base Salary |

Cash | • Fixed level of compensation determined primarily based on the role, job performance and experience

• Intended to compensate NEOs for day-to-day services performed | ||||||

| Annual Incentive | Cash | Financial (70%)

|

AOI (100%) |

• Performance-based cash incentive opportunity

• Designed to be based on the achievement of pre-determined financial and strategic performance measures approved by the Compensation Committee | ||||

|

Strategic (30%) |

Strategic Objectives | |||||||

| Long-Term Incentive | Performance Stock Units (50%) | Revenues (50%) |

• Financial performance targets are pre-determined by the Compensation Committee and reflect our long-term financial goals

• Cliff-vest after three years to the extent that financial performance targets measured in the last year of the three-year period are achieved | |||||

| AOI (50%) | ||||||||

| Restricted Stock Units (50%) |

Stock Price Performance

|

• Share-based award establishes direct alignment with our stock price performance and stockholder interests • Vest ratably over three years | ||||||

5

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 11, 2023

GENERAL INFORMATION

COMPANY OVERVIEW

Madison Square Garden Sports Corp., incorporated on March 4, 2015, is a Delaware corporation with executive offices at Two Pennsylvania Plaza, New York, NY 10121. In this proxy statement, the words “Company,” “we,” “us,” “our,” “MSG Sports” and “MSGS” refer to Madison Square Garden Sports Corp., a holding

company, and its direct and indirect subsidiaries through which substantially all of our operations are conducted. Our Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “MSGS.” As a result, we are subject to certain of the NYSE corporate governance listing standards.

PROXY STATEMENT MATERIALS

These proxy materials are provided in connection with the solicitation of proxies by our Board for the Annual Meeting of Stockholders, which will be conducted via live webcast at 10:00 a.m. Eastern Time on Monday, December 11, 2023. You can attend the annual meeting via the internet by visiting www.virtualshareholdermeeting.com/MSGS2023.

This proxy statement is first being sent to stockholders on or about October 25, 2023. Unless otherwise indicated, references to “2023,” “fiscal year 2023,” the “2023 fiscal year” and the “year ended June 30, 2023” refer to the Company’s fiscal year ended on June 30, 2023.

QUESTIONS AND ANSWERS YOU MAY HAVE ABOUT OUR ANNUAL MEETING AND VOTING

When and where is the annual meeting being held?

The annual meeting will be held at 10:00 a.m. Eastern Time on Monday, December 11, 2023. Our 2023 annual meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. For more information on how to attend the virtual annual meeting, please see the question titled “How do I attend, vote and ask questions during the 2023 annual meeting?” below.

Who may vote during the annual meeting?

Holders of our Class A common stock, par value $0.01 per share (“Class A Common Stock”), and holders of our Class B common stock, par value $0.01 per share (“Class B Common Stock” and together with Class A Common Stock, collectively, “Company Stock”), as recorded in our stock register at the close of business on

October 16, 2023, may vote during the annual meeting. On October 16, 2023, there were 19,404,363 shares of Class A Common Stock and 4,529,517 shares of Class B Common Stock outstanding. Each share of Class A Common Stock has one vote per share and holders will be voting for the election of five candidates to the Board. Each share of Class B Common Stock has ten votes per share and holders will be voting for the election of thirteen candidates to the Board. As a result of their ownership of all of the shares of Class B Common Stock, members of the Charles F. Dolan family and certain related family entities have the power to elect all of the directors to be elected by the holders of our Class B Common Stock, to approve Proposals 2 (appointment of the Company’s independent registered public accounting firm) and 3 (advisory vote on the compensation of the Company’s executive officers), regardless of how other shares are voted.

6

Why did I receive a Notice of Annual Meeting and Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, the Company has elected to provide access to its proxy materials by Internet. Accordingly, the Company has sent a Notice of Annual Meeting and Internet Availability of Proxy Materials to our stockholders. All stockholders have the ability to access the proxy materials on the website referred to in the Notice of Annual Meeting and Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials by Internet or to request a printed copy may be found in the Notice of Annual Meeting and Internet Availability of Proxy Materials. In addition, our stockholders may request to receive proxy materials in printed form by mail or electronically. If you previously chose to receive proxy materials electronically, you will continue to receive access to these materials via email unless you otherwise elect. The Company encourages our stockholders who have not already done so to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and the environmental impact of the annual meeting.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, EQ Shareowner Services, you are considered a stockholder of record with respect to those shares, and the Notice of Annual Meeting and Internet Availability of Proxy Materials was sent directly to you by the Company. If you request printed copies of the proxy materials by mail, you will also receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other

similar organization, then you are a beneficial owner of shares held in “street name,” and the Notice of Annual Meeting and Internet Availability of Proxy Materials was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to instruct that organization how to vote the shares held in your account. If you requested printed copies of the proxy materials by mail, you will receive a voting instruction form from that organization.

What votes need to be present to hold the annual meeting?

In order to carry on the business of the annual meeting, we need a majority of the votes represented by the outstanding shares eligible to vote on the record date, October 16, 2023, to be present, either by participating in the virtual meeting or by proxy. This is known as a “quorum.” If voting on a particular action is by class, a majority of the votes represented by the outstanding shares of such class constitutes a quorum for such action. Abstentions and broker non-votes (described below) are considered present for purposes of determining a quorum.

How do I vote?

You may vote in advance of the annual meeting by telephone, Internet or mail by following the instructions provided on the Notice of Annual Meeting and Internet Availability of Proxy Materials. If you choose to vote by mail, please sign, date and return the proxy card in the postage-paid envelope provided. You may also vote during the virtual meeting. For more information on how to vote during the meeting, please see the question titled “How do I attend, vote and asking questions during the 2023 annual meeting?” Even if you plan to participate in the virtual annual meeting, the Board strongly recommends that you submit a proxy to vote your shares in advance so that your vote will be counted if you later decide not to participate in the annual meeting.

7

Can my broker vote my shares without instructions from me?

If you are a beneficial owner whose shares are held of record by a brokerage firm, bank, broker-dealer or other similar organization, you must instruct them how to vote your shares. Please use the voting instruction form provided to you by your brokerage firm, bank, broker-dealer or other similar organization to direct them how to vote your shares. If you do not provide voting instructions, your shares will not be voted on the election of directors or any other proposal on which the brokerage firm, bank, broker-dealer or other similar organization does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the brokerage firm, bank, broker-dealer or other similar organization can register your shares as being present at the annual meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under applicable rules.

If you are a beneficial owner whose shares are held of record by a brokerage firm, bank, broker-dealer or other similar organization, your brokerage firm, bank, broker-dealer or other similar organization has discretionary voting authority under applicable rules to vote your shares on the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm (Proposal 2), even if the brokerage firm, bank, broker-dealer or other similar organization does not receive voting instructions from you. However, your brokerage firm, bank, broker-dealer or other similar organization does not have discretionary authority to vote on the election of directors (Proposal 1) and the advisory vote with respect to NEO compensation (Proposal 3) without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

What is the voting requirement to approve each of the proposals?

Election of directors by the holders of our Class A Common Stock requires the affirmative vote of the plurality of votes cast by holders of our Class A Common Stock. Election of directors by the holders of our Class B Common Stock requires the affirmative vote of the plurality of votes cast by holders of our Class B Common Stock. The ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm (Proposal 2) and the advisory vote with respect to NEO compensation (Proposal 3) require the favorable vote of a majority of the votes cast by the holders of our Class A Common Stock and the holders of our Class B Common Stock, voting together as a single class. Abstentions and broker non-votes will not affect the outcome of the proposals because abstentions and broker non-votes are not considered votes cast. As a result of their ownership of all of the shares of our Class B Common Stock, members of the Charles F. Dolan family and certain related family entities have the power to elect all of the directors to be elected by the holders of our Class B Common Stock and to approve the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm (Proposal 2) and the advisory vote with respect to NEO compensation (Proposal 3), regardless of how other shares are voted.

Can I change my vote after I have voted?

Yes. If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the final vote during the annual meeting. You may change your vote prior to the annual meeting by:

| • | re-voting your shares by Internet or by telephone by following the instructions on the Notice of Annual Meeting and Internet Availability of Proxy Materials or proxy card (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted); |

8

| • | signing and returning a valid proxy card or voting instruction form with a later date; |

| • | delivering a written notice of revocation to the Company’s Secretary at Two Pennsylvania Plaza, New York, NY 10121; or |

| • | attending the annual meeting and re-voting your shares electronically during the annual meeting by clicking “Vote Here” on the meeting website (but your participation in the virtual annual meeting will not automatically revoke your proxy unless you validly vote again during the annual meeting). |

If your shares are held of record by a brokerage firm, bank, broker-dealer or other similar organization, you should follow the instructions they provide in order to change your vote.

How will my shares be voted during the annual meeting if I submit a proxy card?

The proxy materials, including the proxy card, are being solicited on behalf of the Board. The Company representatives appointed by the Board (the persons named on the proxy card, or, if applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted as the Board recommends, which is:

| • | FOR the election of each of the Director nominees named in this proxy statement to be elected by holders of the relevant class of Company Stock (Proposal 1); |

| • | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm (Proposal 2); and |

| • | FOR the approval, on an advisory basis, of the compensation of our NEOs (Proposal 3). |

Who participates in and pays for this solicitation?

The Company will bear the expense of preparing, printing and mailing this proxy statement and the

accompanying materials. Solicitation of individual stockholders may be made by mail, personal interviews, telephone, facsimile, electronic delivery or other telecommunications by our executive officers and regular employees who will receive no additional compensation for such activities.

We have retained D.F. King & Co., Inc. to assist with the solicitation of proxies for a fee estimated not to exceed $25,000, plus reimbursement for out-of-pocket expenses. In addition, we will reimburse brokers and other nominees for their expenses in forwarding solicitation material to beneficial owners.

How do I attend, vote and ask questions the 2023 annual meeting?

This year’s annual meeting will be a virtual meeting of stockholders conducted via live webcast. To be admitted to the 2023 annual meeting, you must have been a stockholder of record at the close of business on the record date of October 16, 2023 or be the legal proxy holder or qualified representative of such stockholder. The virtual meeting will afford stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting, which will be posted to our investor relations website, https://investor.msgsports.com, and will be available on www.virtualshareholdermeeting.com/MSGS2023 during the annual meeting.

Attending the Virtual Meeting. To attend the virtual meeting, please visit www.virtualshareholdermeeting.com/MSGS2023. To participate in the annual meeting, you will need the 16-digit control number included on your Notice of Annual Meeting and Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials).

9

Legal Proxy. Stockholders must provide advance written notice to the Company if they intend to have a legal proxy (other than the persons appointed as proxies on the Company’s proxy card) or a qualified representative attend the virtual annual meeting on their behalf. The notice must include the name and address of the legal proxy or qualified representative and must be received by 5:00 p.m. Eastern Time on December 1, 2023. For further details, see “Other Matters — Advance Notice of Proxy Holders and Qualified Representatives.”

For a period of at least 10 days ending on the day before the date of the 2023 annual meeting, a complete list of stockholders entitled to vote during the 2023 annual meeting will be open to the examination of any stockholder during ordinary business hours at our corporate headquarters located at Two Pennsylvania Plaza, New York, NY 10121, or through an alternative method publicly disclosed in advance. If you are interested in viewing the list, please send an email to investor@msgsports.com one business day in advance to schedule your visit.

Voting During the Virtual Meeting. If you have not voted your shares prior to the annual meeting or you wish to change your vote, you will be able to vote or re-vote your shares electronically during the annual meeting by clicking “Vote Here” on the meeting website. Whether or not you plan to attend the meeting, you are encouraged to vote your shares prior to the meeting by one of the methods described in the proxy materials you previously received.

Asking Questions. If you wish to submit a question, you may do so live during the meeting by accessing the meeting at www.virtualshareholdermeeting.com/MSGS2023.

Only questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. If any questions pertinent to meeting matters cannot be answered during the meeting due to time constraints, we will post and answer a representative set of these questions online at

https://investor.msgsports.com. The questions and answers will be available as soon as reasonably practicable after the meeting and will remain available until one week after posting.

Help with Technical Difficulties. If you have any technical difficulties accessing the virtual meeting on the meeting date, please call the phone numbers displayed on the virtual meeting website,www.virtualshareholdermeeting.com/MSGS2023. If there are any technical issues in convening or hosting the meeting, we will promptly post information to our investor relations website, https://investor.msgsports.com, including information on when the meeting will be reconvened.

What is “householding” and how does it affect me?

Stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials may receive only one copy of this Notice of Annual Meeting and Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “2023 Form 10-K”) unless we are notified that one or more of these stockholders wishes to receive individual copies. This “householding” procedure will reduce our printing costs and postage fees as well as the environmental impact of the annual meeting.

Stockholders who participate in householding will continue to receive separate proxy cards.

If you participate in householding and wish to receive a separate copy of this Notice of Annual Meeting and Proxy Statement and any accompanying documents, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact Broadridge Householding Department, by calling their toll-free number, 1-866-540-7095, or by writing to: Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717. You will be removed from the householding program within 30 days of receipt

10

of your instructions, at which time you will then be sent separate copies of the documents.

If you are a beneficial owner, you can request information about householding from your broker, bank or other holder of record.

How can I get electronic access to the proxy materials?

This Notice of Annual Meeting and Proxy Statement, the proxy card and the 2023 Form 10-K are available at www.proxyvote.com.

In accordance with the SEC rules, we are using the Internet as our primary means of furnishing proxy materials to our stockholders. Consequently, most of our stockholders will not receive paper copies of our proxy materials. Instead, we are sending these stockholders a Notice of Annual Meeting and Internet Availability of Proxy Materials with instructions

for accessing the proxy materials, including our proxy statement and the 2023 Form 10-K, and voting by Internet. This makes the proxy distribution process more efficient and less costly and helps conserve natural resources. The Notice of Annual Meeting and Internet Availability of Proxy Materials also provides information on how our stockholders may obtain paper copies of our proxy materials if they so choose. If you previously elected to receive proxy materials electronically, these materials will continue to be sent via email unless you change your election.

If you receive paper copies of our proxy materials and would like to sign up for electronic delivery via email or the Internet, please follow the instructions to vote by Internet at www.proxyvote.com and, when prompted, indicate that you agree to receive or access stockholder communications electronically in future years.

THE DISTRIBUTIONS

The Company was incorporated as MSG Spinco, Inc., an indirect, wholly-owned subsidiary of MSG Networks Inc. (“MSG Networks”). We changed our name to The Madison Square Garden Company on September 30, 2015 (the “MSGS Distribution Date”) in connection with the distribution of all of the Company’s outstanding common stock to the stockholders of MSG Networks (the “MSGS Distribution”). Pursuant to the MSGS Distribution, the Company acquired the entertainment and sports businesses previously owned by MSG Networks through its MSG Entertainment and MSG Sports business segments.

We changed our name to Madison Square Garden Sports Corp. on April 17, 2020 in connection with the distribution of all of the outstanding common stock of MSG Entertainment Spinco, Inc. (which was previously known as Madison Square Garden Entertainment Corp. until the MSGE Distribution (as defined below), is now known as Sphere Entertainment Co., and is referred to herein as

“Sphere Entertainment”) to our stockholders (the “SPHR Distribution”). Pursuant to the SPHR Distribution, Sphere Entertainment acquired the entertainment business previously owned and operated by the Company through its Entertainment segment as well as the sports bookings business which was part of the Sports segment.

On April 20, 2023 (the “MSGE Distribution Date”), Sphere Entertainment distributed approximately 67% of the outstanding common stock of MSGE Spinco, Inc. (now known as Madison Square Garden Entertainment Corp. and referred to herein as “MSG Entertainment”) to its stockholders (the “MSGE Distribution”). Pursuant to the MSGE Distribution, MSG Entertainment acquired the traditional live entertainment business previously owned and operated by Sphere Entertainment through its Entertainment business segment, other than the Sphere business (which was retained by Sphere Entertainment after the MSGE Distribution Date).

11

BOARD AND GOVERNANCE PRACTICES

CORPORATE GOVERNANCE PRACTICES

Our Board has adopted the Governance Guidelines and other practices to promote the functioning of the Board and its committees to serve the best interests of all our stockholders. The Governance Guidelines and our other governance documents provide a framework for our governance practices, including:

| ✓ | Annual election of directors, with all directors elected to one-year terms |

| ✓ | Board composition to include a broad range of skills, experience, industry knowledge, diversity of opinion and contacts relevant to the Company’s business that serves the interests of all stockholders |

| ✓ | Board self-assessments conducted at least annually to assess the mix of skills and experience that directors bring to the Board to facilitate an effective oversight function |

| ✓ | Robust director nomination criteria to ensure a diversity of viewpoints, background and expertise in the boardroom |

| ✓ | Regular executive sessions of independent directors |

| ✓ | Independent Board committees, with each of the Audit Committee and the Compensation Committee comprised 100% of independent directors |

| ✓ | Restricted stock units subject to holding requirement through the end of service on the Board |

Our Governance Guidelines set forth our practices and policies with respect to Board composition and selection, Board meetings, executive sessions of the Board, Board committees, the expectations we have of our directors, selection of the Executive Chairman and Chief Executive Officer, management succession, Board and executive compensation, and Board self-assessment requirements. The full text of our Governance Guidelines may be viewed at our corporate website at www.msgsports.com under Investors — Governance — Corporate Governance — Governance Documents. A copy may be obtained by writing to Madison Square Garden Sports Corp., Two Pennsylvania Plaza, New York, NY 10121; Attention: Corporate Secretary.

STOCKHOLDER ENGAGEMENT

Fostering long-term relationships with our stockholders is a priority for the Company. Engagement helps us gain insight into the issues most important to our stockholders, informing Board discussions and allowing us to consider investors’ views on a range of topics including corporate governance and executive compensation matters.

We regularly engage with stockholders, and during the 2023 fiscal year we engaged with holders of nearly 60% of our Class A Common Stock concerning our Board, governance and executive compensation practices, with the specific goal of seeking stockholder feedback. We greatly value the views of our stockholders, and we look forward to continuing to receive such feedback.

12

BOARD LEADERSHIP STRUCTURE

Our Board has the flexibility to determine whether the roles of chairman and principal executive officer (“PEO”) should be separated or combined. The Board makes this decision based on its evaluation of the circumstances and the Company’s specific needs from time to time. Currently, as Executive Chairman, Mr. James L. Dolan serves as the Company’s chairman and PEO. The Board has determined that combining these roles is the optimal leadership structure for the Company at this time because of Mr. Dolan’s experience with the Company’s business and

industry, as well as his ability to most effectively identify strategic priorities of the Company and ensure execution of the Company’s strategy. The Board may in the future decide to separate the roles of chairman and PEO if it believes that a separation is consistent with the optimal leadership structure for the Company. The Board does not designate a lead independent director and believes it is appropriate not to have one because of the Company’s stockholder voting structure.

BOARD SELF-ASSESSMENT

The Board conducts an annual self-assessment to determine whether the Board and its committees are functioning effectively. Among other things, the Board’s self-assessment seeks input from the directors on whether they have the tools and access necessary to perform their oversight function as well as suggestions for improvement

of the Board’s functioning. In addition, our Audit Committee and Compensation Committee each conducts its own annual self-assessment, which includes an assessment of the adequacy of their performance as compared to their respective charters.

EXECUTIVE SESSIONS OF NON-MANAGEMENT AND INDEPENDENT BOARD MEMBERS

Under our Governance Guidelines, either our directors who are not also executive officers of our Company (the “non-management directors”) or our directors who are independent under the NYSE rules are required to meet regularly in executive sessions with no members of management present. If non-management directors who are not independent participate in

these executive sessions, the independent directors under the NYSE rules are required to meet separately in executive sessions at least once each year. The non-management or independent directors may specify the procedure to designate the director who may preside at any such executive session.

RISK OVERSIGHT

Our Board believes that risk oversight is an important Board responsibility. The Board has delegated risk oversight to the Audit Committee, including oversight of cybersecurity risks. The Audit Committee discusses guidelines and policies governing the process by which the Company’s management assesses and manages the Company’s exposure to risk and discusses the Company’s major financial risk exposures and the steps management has taken to monitor and

control such exposures. The Audit Committee also receives periodic updates from subject matter experts regarding specific risks, such as security of our facilities and cybersecurity. The Compensation Committee considers the Company’s exposure to risk in establishing and implementing our executive compensation program. The Compensation Committee, with the assistance of its independent compensation consultant, reviewed the level of risk incentivized

13

by the Company’s executive compensation program as well as incentive programs below the executive officer level. Based on this assessment and the executive compensation program’s emphasis on long-term performance, its close connection to Company-wide and divisional performance and its equity-based component

designed to align the executive officers’ compensation with the Company’s long-term strategy and growth, the Compensation Committee determined that our executive compensation program does not create incentives for excessive risk-taking that are reasonably likely to have a material adverse effect on the Company.

COMMUNICATING WITH OUR DIRECTORS

Our Board has adopted policies designed to allow our stockholders and other interested parties to communicate with our directors. Any interested party who wishes to communicate with the Board or any director or the non-management directors as a group should send communications in writing to the Chairman of the Audit Committee, Madison Square Garden Sports Corp., Two Pennsylvania Plaza, New York, NY 10121. Any

person, whether or not an employee, who has a concern with respect to our accounting, internal accounting controls, auditing issues or other matters, may, in a confidential or anonymous manner, communicate those concerns to our Audit Committee by contacting the MSG Sports Integrity Hotline, which is operated by a third-party service provider, at 1-844-913-0611 or www.msg.ethicspoint.com.

CODE OF CONDUCT AND ETHICS

Our Board has adopted a Code of Conduct and Ethics for our directors, officers and employees. A portion of this Code of Conduct and Ethics also serves as a code of conduct and ethics for our senior financial officers, including our principal accounting officer and controller. Among other things, our Code of Conduct and Ethics covers conflicts of interest, disclosure responsibilities, legal compliance, reporting and compliance with the Code of Conduct and Ethics, confidentiality, corporate opportunities, fair dealing, protection and proper use of Company assets and equal employment opportunity and harassment. The full

text of the Code of Conduct and Ethics is available on our website at www.msgsports.com under Investors — Governance — Corporate Governance — Governance Documents. In addition, a copy may be obtained by writing to Madison Square Garden Sports Corp., Two Pennsylvania Plaza, New York, NY 10121; Attention: Corporate Secretary. Within the time period required by the SEC, we will post on our website any amendment to the Code of Conduct and Ethics and any waiver applicable to any executive officer, director or senior financial officer.

DIRECTOR INDEPENDENCE

As a “controlled company” we are not subject to the corporate governance rules of the NYSE requiring: (i) a majority of independent directors on our Board, (ii) an independent corporate governance and nominating committee, and (iii) an independent compensation committee. On account of this, and based on our ownership and voting structure, we do not have a majority of independent directors on our Board and we have not created a corporate governance and

nominating committee; however, we maintain an independent compensation committee.

Under the terms of our Certificate of Incorporation, the holders of our Class B Common Stock have the right to elect up to 75% of the members of our Board and there is no requirement that any of those directors be independent or be chosen independently.

14

Despite the fact that our Board does not have a majority of independent directors, we value independent oversight and perspectives in our boardroom. That independent input is fostered by our Certificate of Incorporation, which gives holders of our Class A Common Stock the right to elect at least 25% of our Board, as well as by the presence on our Board of two directors elected by our Class B stockholders who meet the NYSE and SEC standards of independence. Assuming all of the director nominees are elected at the 2023 annual meeting, our Class A director representation will be approximately 28% of the Board, consistent with the 25% minimum required by our Certificate of Incorporation, and independent director representation will be approximately 39%.

Our Board has determined that each of the following non-management directors is “independent” within the meaning of the rules of the NYSE and the SEC: Messrs. Joseph M. Cohen, Richard D. Parsons, Nelson Peltz, Alan D. Schwartz, Ivan Seidenberg, Vincent Tese and Anthony J. Vinciquerra.

In reaching its determination for Messrs. Cohen, Parsons, Peltz, Schwartz, Seidenberg, Tese and Vinciquerra, the Board considered the following:

| • | Mr. Cohen has served as a director of AMC Networks Inc. (“AMC Networks”) (a company that is also controlled by the Dolan Family) since June 2022. He previously served as a director of MSG Networks (a company that is also controlled by the Dolan Family as a subsidiary of Sphere Entertainment) from 2020 to 2021. He previously served in various senior executive roles with Madison Square Garden while the business was part of Cablevision Systems |

| Corporation (“Cablevision”) and was President of MSG Networks from 1977 to 1985. The Board determined that these relationships are not material and that Mr. Cohen is independent within the meaning of the rules of the NYSE and the SEC. |

| • | Mr. Schwartz previously served as a director of MSG Networks from 2010 to 2015. Mr. Schwartz also served as a director of AMC Networks from 2011 to 2016. From time to time, he, or entities for which he serves as an officer or principal, have performed services for AMC Networks. The Board determined that performance of these services, and the receipt of compensation for these services, is not material and that Mr. Schwartz is independent within the meaning of the rules of the NYSE and the SEC. |

| • | Mr. Tese has served as a director of Sphere Entertainment (a company that is also controlled by the Dolan Family) since April 2020 and AMC Networks since 2016. He also previously served as a director of MSG Networks from 2010 to 2015. Mr. Tese’s brother was employed by a subsidiary of the Company until 2020, was employed by a subsidiary of Sphere Entertainment from April 2020 until August 2020, was rehired by Sphere Entertainment in December 2021 and his employment was transferred from Sphere Entertainment to a subsidiary of MSG Entertainment in connection with the MSGE Distribution, in each case, in a non-executive officer position. The Board determined that these relationships are not material and that Mr. Tese is independent within the meaning of the rules of the NYSE and the SEC. |

15

DIRECTOR NOMINATIONS

As permitted under the NYSE rules, we do not have a nominating committee and believe it is appropriate not to have one because of our stockholder voting structure. The Board has nonetheless established a nomination mechanism in our Governance Guidelines for the selection of nominees for election as directors by the holders of our Class A Common Stock (“Class A Directors”) and by the holders of our Class B Common Stock (“Class B Directors”), as follows:

| • | Nominees for election as Class A Directors are recommended to the Board by a majority of the independent Class A Directors then in office. |

| • | Nominees for election as Class B Directors are recommended to our Board by a majority of the Class B Directors then in office. |

Our Certificate of Incorporation provides holders of the Company’s Class B Common Stock the right to elect up to 75% of the members of our Board and holders of our Class A Common Stock the right to elect 25% of the members of our Board.

DIRECTOR SELECTION

Our Board believes that each director nominee should be evaluated based on the skills needed on the Board and his or her individual merits, taking into account, among other matters, the factors set forth in our Governance Guidelines under “Board Composition” and “Selection of Directors.” Those factors include:

| • | The desire to have a Board that encompasses a broad range of skills, expertise, industry knowledge, diversity of viewpoints, opinions, background and experience and contacts relevant to our business; |

| • | Personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | Ability and willingness to commit adequate time to Board and committee matters; and |

| • | The fit of the individual’s skill and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of our Company. |

The Class A Directors evaluate and recommend Class A Director candidates to the Board for nomination as Class A Directors and suggest

individuals for the Board to explore in more depth. The Class A Directors also consider Class A Director nominees recommended by our stockholders. Nominees recommended by our stockholders are given consideration in the same manner as other nominees. Stockholders who wish to nominate directors for election at our 2024 annual meeting may do so by submitting in writing such nominees’ names, in compliance with the procedures and along with other information required by the Company’s Amended By-laws. See “Other Matters — Stockholder Proposals for 2024 Annual Meeting.”

The Class B Directors will consult from time to time with one or more of the holders of our Class B Common Stock to ensure that all Class B Director nominees recommended to the Board are individuals who will make a meaningful contribution as Board members and will be individuals likely to receive the approving vote of the holders of a majority of the outstanding Class B Common Stock. The Class B Directors do not intend to consider unsolicited suggestions of nominees by holders of our Class A Common Stock. We believe that this is appropriate in light of the voting provisions of our Certificate of Incorporation which provide the holders of our Class B Common Stock the exclusive right to elect our Class B Directors.

16

BOARD MEETINGS

The Board met four times during the fiscal year ended June 30, 2023. Each of the directors who was on the Board during the 2023 fiscal year attended at least 75% of the meetings of the Board and the committees of the Board on which he or she served that were held during the time he or she served on the Board.

We encourage our directors to attend annual meetings of our stockholders and believe that attendance at annual meetings is equally as important as attendance at Board and committee meetings. 15 of our 17 then-incumbent directors attended the 2022 annual stockholders’ meeting.

COMMITTEES

Our Board has two standing committees comprised solely of independent directors: the Audit Committee and the Compensation Committee.

Audit Committee

| • | Members: Messrs. Seidenberg (Chair), Tese and Vinciquerra |

| • | Meetings during fiscal year ended June 30, 2023: 4 |

The primary purposes and responsibilities of our Audit Committee are to:

| • | assist the Board in (i) its oversight of the integrity of our financial statements, (ii) its oversight of our compliance with legal and regulatory requirements, (iii) assessing our independent registered public accounting firm’s qualifications and independence, and (iv) assessing the performance of our internal audit function and independent registered public accounting firm. |

| • | appoint, compensate, retain, oversee and terminate the Company’s independent registered public accounting firm and pre-approve, or adopt appropriate procedures to pre-approve, all audit and non-audit services, if any, to be provided by the independent registered public accounting firm; |

| • | review the appointment and replacement of the head of our Internal Audit Department (which is currently provided through services |

| from MSG Entertainment) and to review and coordinate the agenda, scope, priorities, plan and authority of the Internal Audit Department; |

| • | establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by Company employees or any provider of accounting-related services of concerns regarding questionable accounting and auditing matters and review of submissions and treatment of any such complaints; |

| • | review and approve related party transactions that are required to be disclosed under SEC rules or that require such approval under the Company’s Related Party Transaction Approval Policy (if the Audit Committee is then serving as the Independent Committee under such policy); |

| • | conduct and review with the Board an annual self-assessment of the Audit Committee; |

| • | prepare any report of the Audit Committee required by the rules and regulations of the SEC for inclusion in our annual proxy statement; |

| • | review and reassess the Audit Committee charter at least annually; |

| • | report to the Board on a regular basis; and |

| • | oversee corporate risks, including cybersecurity, and provide periodic updates to the Board on such oversight activities. |

17

Our Board has determined that each member of our Audit Committee is “independent” within the meaning of the rules of both the NYSE and the SEC, and that each has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years and is able to read and understand fundamental financial statements, including balance sheets, income statements and cash flow statements. Our Board has also determined that each of Messrs. Seidenberg, Tese and Vinciquerra is an “audit committee financial expert” within the meaning of the rules of the SEC.

Our Board has established a procedure whereby complaints or concerns with respect to accounting, internal controls, auditing and other matters may be submitted to the Audit Committee. This procedure is described under “Board and Governance Practices — Communicating with Our Directors.”

The text of our Audit Committee charter is available on our website at www.msgsports.com under Investors — Governance — Corporate Governance — Governance Documents. A copy may be obtained by writing to Madison Square Garden Sports Corp., Corporate Secretary, Two Pennsylvania Plaza, New York, NY 10121.

Compensation Committee

| • | Members: Messrs. Cohen (Chair), Tese and Vinciquerra |

| • | Meetings during fiscal year ended June 30, 2023: 9 |

The primary purposes and responsibilities of our Compensation Committee are to:

| • | establish our general compensation philosophy and, in consultation with management, oversee the development and implementation of compensation programs; |

| • | review and approve corporate goals and objectives relevant to the compensation of our |

| Chief Executive Officer and our other executive officers who are required to file reports with the SEC under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (together with the Chief Executive Officer, the “Senior Employees”), evaluate the Senior Employees’ performance in light of these goals and objectives and determine and approve their compensation based upon that evaluation; |

| • | approve any new equity compensation plan or material changes to an existing plan; |

| • | oversee the activities of the committee or committees administering our retirement and benefit plans; |

| • | in consultation with management, oversee regulatory compliance with respect to compensation matters, including overseeing the Company’s policies on structuring compensation programs to preserve tax deductibility; |

| • | determine and approve any severance or similar termination payments to be made to Senior Employees (current or former); |

| • | determine the components and amount of Board compensation and review such determinations from time to time in relation to other similarly situated companies; |

| • | prepare any reports of the Compensation Committee to be included in the Company’s annual proxy statement in accordance with the applicable rules and regulations of the SEC; |

| • | conduct and review with the Board an annual self-assessment of the Compensation Committee; and |

| • | report to the Board on a regular basis, but not less than annually. |

18

The Compensation Committee reviews the performance of the Senior Employees, evaluates their performance in light of those goals and objectives and, either as a committee or together with any other independent directors (as directed by the Board), determines and approves the Senior Employees’ compensation level based on this evaluation. In determining the long-term incentive component of our Chief Executive Officer’s compensation, the Compensation Committee considers, among other factors, the Company’s performance and relative stockholder return, the value of similar incentive awards to Chief Executive Officers at comparable companies and the awards given to the Chief Executive Officer in past years.

As discussed above, our Board has determined that each member of our Compensation Committee is “independent” under the rules of the NYSE.

The Compensation Committee may, in its discretion, delegate a portion of its duties and responsibilities to one or more subcommittees of the Compensation Committee. For example, the Compensation Committee may delegate the approval of certain transactions to a subcommittee consisting solely of members of the Compensation Committee who are “non-employee directors” for the purposes of Rule 16b-3 of the Exchange Act. The Compensation Committee has also engaged an independent compensation consultant and independent legal counsel to assist in the performance of its duties and responsibilities. The text of our Compensation Committee charter is available on our website at www.msgsports.com under Investors — Governance — Corporate Governance — Governance Documents. A copy may be obtained by writing to Madison Square Garden Sports Corp., Corporate Secretary, Two Pennsylvania Plaza, New York, NY 10121.

Compensation Committee Interlocks and Insider Participation

Messrs. Cohen, Tese and Vinciquerra currently serve as members of the Compensation

Committee and Mr. Seidenberg served on the Compensation Committee until December 9, 2022. None of them is a current nor a former executive officer or employee of the Company.

Independent Committees

In addition to standing committees, the Company’s Board from time to time appoints or empowers a committee of our Board consisting entirely of independent directors (an “Independent Committee”) to act with respect to specific matters.

The Company has adopted a policy whereby an Independent Committee will review and approve or take such other action as it may deem appropriate with respect to transactions involving the Company and its subsidiaries in which any director, executive officer, greater than 5% stockholder of the Company or any other “related person” (as defined in Item 404 of Regulation S-K adopted by the SEC) has or will have a direct or indirect material interest. This approval requirement covers any transaction that meets the related party disclosure requirements of the SEC as set forth in Item 404, which currently apply to transactions (or any series of similar transactions) in which the amount involved exceeds $120,000.

Our Board has also adopted a special approval policy for transactions with MSG Entertainment, Sphere Entertainment and AMC Networks and their respective subsidiaries whether or not such transactions qualify as “related party” transactions described above. Under this policy, an Independent Committee oversees approval of all transactions and arrangements between the Company and its subsidiaries, on the one hand, and each of MSG Entertainment and its subsidiaries, Sphere Entertainment and its subsidiaries and AMC Networks and its subsidiaries, on the other hand, in which the value or expected value of the transaction or arrangement exceeds $1 million. In addition, an Independent Committee receives a quarterly update from the Company’s internal audit function of all related party transactions, including transactions and arrangements between

19

the Company and its subsidiaries on the one hand, and each of MSG Entertainment and its subsidiaries, Sphere Entertainment and its subsidiaries and AMC Networks and its subsidiaries, on the other hand, regardless of value. To simplify the administration of the approval process under this policy, the Independent Committee may, where appropriate, establish guidelines for certain of these transactions.

For a further discussion of the scope of these policies, see “Related Party Transaction Approval Policy.”

Other Committee Matters

Our Amended By-laws permit the Board to form an Executive Committee of the Board which would have the power to exercise all of the powers and authority of the Board in the management of the business and affairs of the Company, except as limited by the Delaware General Corporation Law. Our Board has not formed an Executive Committee, although it could do so in the future.

Our Amended By-laws also permit the Board to appoint other committees of the Board from time to time which would have such powers and duties as the Board properly determines.

DIRECTOR COMPENSATION

The following table describes the components of our non-employee directors’ compensation

program in effect during the fiscal year ended June 30, 2023:

| Compensation Element(1) |

Compensation(2)(3) | |

| Annual Cash Retainer | $75,000 | |

| Annual Equity Retainer(4) | $160,000 | |

| Annual Audit/Compensation Committee Member Fee | $15,000 | |

| Annual Audit/Compensation Committee Chair Fee | $25,000 |

| (1) | A director who is also a Company employee receives no compensation for serving as a director. |

| (2) | From time to time our Compensation Committee and/or our Board may approve additional or alternate compensation arrangements for directors who serve on other committees of the Board, including Independent Committees. |

| (3) | Non-employee directors have the ability to make a non-revocable annual election to defer all cash compensation (annual cash retainer and, if applicable, committee fees) to be earned in the next calendar year into restricted stock units (the “Deferred Compensation Election”). The Deferred Compensation Election first became available for cash payments to be received in calendar year 2023, with participating directors making their election in 2022. Grants of restricted stock units in lieu of cash compensation are determined by dividing the value of the applicable director’s total annual cash compensation by the 20-trading day average closing market price on the day prior to the grant date (February 15 or the next succeeding business day). Restricted stock units are fully vested on the date of grant but remain subject to a holding requirement until the first business day following 90 days after the director incurs a separation from service (other than in the event of a director’s death, in which case they are settled as soon as practicable), at which time they are settled in stock or, at the Compensation Committee’s election, in cash. Such compensation is made pursuant to the Company’s 2015 Stock Plan for Non-Employee Directors, as amended (the “Director Stock Plan”), which was most recently approved by the Company’s stockholders on December 9, 2016 and is administered by the Compensation Committee. |

| (4) | Each director receives an annual grant of restricted stock units determined by dividing the value of the annual equity retainer by the 20-trading day average closing market price on the day prior to the grant date |

20

| (typically the annual meeting). Restricted stock units are fully vested on the date of grant but remain subject to a holding requirement until the first business day following 90 days after the director incurs a separation from service (other than in the event of a director’s death, in which case they are settled as soon as practicable), at which time they are settled in stock or, at the Compensation Committee’s election, in cash. Such compensation is made pursuant to the Director Stock Plan. |

In order for our directors to develop an intimate familiarity with our teams and the services and support offered to patrons at our events, the Company makes available to each of our non-employee directors without charge up to two tickets per event for up to eight events per calendar year at The Garden, subject to availability. Director attendance at such events is integrally and directly related to the performance of their duties and, as such, we do not deem the receipt of such tickets to be perquisites. These ticket limitations do not apply to special events to which non-employee directors and their guests may have been specifically invited from time to time in their capacity as non-employee directors

of the Company. In addition, non-employee directors are able to purchase tickets to events from the Company, MSG Entertainment and Sphere Entertainment at face value, subject to availability. Tickets provided to non-employee directors are not available for resale.

Director Compensation Table

The table below summarizes the total compensation paid to or earned by each person who served as a non-employee director during the fiscal year ended June 30, 2023. Directors who are current employees of the Company receive no compensation for service as directors and are therefore not identified in the table below.

| Name |

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2)(3) | Total ($) | ||||||||||||

| Joseph M. Cohen |

100,000 | 164,464 | 264,464 | ||||||||||||

| Charles F. Dolan |

75,000 | 164,464 | 239,464 | ||||||||||||

| Charles P. Dolan |

75,000 | 164,464 | 239,464 | ||||||||||||

| Marianne Dolan Weber |

75,000 | 164,464 | 239,464 | ||||||||||||

| Paul J. Dolan |

75,000 | 164,464 | 239,464 | ||||||||||||

| Ryan T. Dolan |

75,000 | 164,464 | 239,464 | ||||||||||||

| Thomas C. Dolan |

75,000 | 164,464 | 239,464 | ||||||||||||

| Andrew Lustgarten(4) |

37,500 | 148,714 | 186,214 | ||||||||||||

| Stephen C. Mills |

75,000 | 164,464 | 239,464 | ||||||||||||

| Richard D. Parsons |

75,000 | 164,464 | 239,464 | ||||||||||||

| Nelson Peltz |

75,000 | 167,155 | 242,155 | ||||||||||||

| Alan D. Schwartz |

75,000 | 204,655 | 279,655 | ||||||||||||

| Ivan Seidenberg |

102,187 | 165,865 | 268,052 | ||||||||||||

| Brian G. Sweeney |

75,000 | 164,464 | 239,464 | ||||||||||||

| Vincent Tese |

109,375 | 164,464 | 273,839 | ||||||||||||

| Anthony J. Vinciquerra |

98,437 | 164,464 | 262,901 | ||||||||||||

| (1) | These amounts represent Board retainer fees earned during the fiscal year ended June 30, 2023, including the value of such amounts that were received by Messrs. Peltz, Schwartz and Seidenberg as restricted stock units pursuant to their Deferred Compensation Election. The amounts reported do not include any reasonable out-of-pocket expenses incurred in attending meetings for which the Company reimburses each non-employee director. |

21

| (2) | This column reflects the grant date fair market value of (i) 1,027 restricted stock units granted in December 2022, to each non-employee director (or in the case of Mr. Lustgarten,749 units to reflect prorated fees for his service on the Board from January 1, 2023 to the 2023 annual meeting), and (ii) with respect to Messrs. Peltz, Schwartz and Seidenberg, this column also reflects the difference between (x) the grant date fair market value of 411, 411 and 548 restricted stock units granted in February 2023 for Board service during calendar year 2023, to Mr. Peltz, Mr. Schwartz and Mr. Seidenberg, respectively, and (y) the retainer fees reported in the Fees Earned or Paid in Cash column for Board service during fiscal year 2023 that were subject to their Deferred Compensation Election. Such grant date fair market values were calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“Topic 718”). The assumptions used by the Company in calculating these amounts are set forth in Note 15 to our financial statements included in our 2023 Form 10-K. The values reflected in this column differ from the $160,000 value set forth in our directors’ compensation program (or any pro rata portion) because the grant date fair value calculated under Topic 718 differs from the 20-trading day average used to determine the number of units granted to directors. |

| (3) | For each non-employee director, the aggregate number of restricted stock units held as of June 30, 2023 is as follows: Charles F. Dolan, 5,128 units; Charles P. Dolan, 5,128 units; Marianne Dolan Weber, 4,499 units; Paul J. Dolan, 2,935 units; Ryan T. Dolan, 2,974 units; Thomas C. Dolan, 5,128 units; Joseph M. Cohen, 2,974 units; Andrew Lustgarten, 749 units; Stephen C. Mills, 2,974 units; Richard D. Parsons, 5,128 units; Nelson Peltz, 5,988 units; Alan D. Schwartz, 5,539 units; Ivan Seidenberg, 4,150 units; Brian G. Sweeney, 5,128 units; Vincent Tese, 5,128 units; and Anthony J. Vinciquerra, 2,974 units. |

| (4) | Effective January 1, 2023, Mr. Andrew Lustgarten ceased to be Chief Executive Officer of the Company and was appointed to serve as a Class B Director by the directors who were elected by the holders of our Class B Common Stock. For a description of the compensation he received as an employee of the Company during fiscal year 2023, see “Executive Compensation Tables.” |

22

PROPOSAL 1 — ELECTION OF DIRECTORS

Our Board has nominated 18 candidates for election to the Board at this year’s annual meeting.

Of the 18 director nominees, five are to be elected by the holders of our Class A Common Stock and 13 are to be elected by the holders of our Class B Common Stock. All 18 nominees have been nominated for a term to expire at the 2024 annual meeting and until their successors have been elected and qualified.

The Company representatives appointed by the Board (the persons named on the proxy card, or, if applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted to elect each of the director nominees below, as applicable, based on whether you are a holder of our Class A Common Stock or Class B

Common Stock. Information on each of our nominees is given below.