UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

GANNETT CO., INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

The following letter is being provided to shareholders of Gannett Co., Inc.

|

April 17, 2019

Dear Fellow Shareholder,

Your vote is very important. We encourage you to protect the value of your investment in Gannett by voting “FOR ALL” of your board’s eight independent nominees today – online, by telephone or by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided. Please simply discard and do NOT vote using any Blue proxy cards you may receive from MNG. |

|

PROTECT YOUR INVESTMENT!

PLEASE VOTE TODAY ON THE WHITE PROXY CARD!

|

|

Your board of directors and management team are confident that Gannett has significant value creation potential in continuing to execute the company’s digital transformation and USA TODAY NETWORK strategy. We are making meaningful progress as we continue to deliver on our strategic initiatives, and thanks to these efforts, Gannett is well positioned to grow the company and our valuable assets to the benefit of Gannett shareholders and the communities we serve.

MNG Enterprises, Inc. (“MNG”), also known as Digital First Media, a competing news media company majority-owned by the New York based hedge fund Alden Global Capital (“Alden”), is attempting to derail our progress and take control of Gannett. First, it demanded that Gannett sell itself to MNG and – when your board unanimously rejected MNG’s unsolicited proposal, determining that it undervalued Gannett and was not credible – MNG nominated a control slate of candidates, all of whom are closely affiliated with MNG and/or Alden, to stand for election to the Gannett board.

Your vote is very important. Protect the value of your investment by voting today “FOR ALL” of your board’s eight independent nominees – online, by telephone or by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided. Please simply discard and do NOT vote using any Blue proxy cards you may receive from MNG.

Your board comprises actively engaged, independent directors with the right mix of experience and skills to oversee Gannett’s digital transformation and deliver enhanced shareholder value

Your board takes its responsibility to shareholders seriously, and the Nominating and Public Responsibility Committee carefully evaluates and selects our directors based on their collective experience, backgrounds and other attributes, which we believe makes them the best candidates to serve on the Gannett board.

| ||

| All eight of your board’s nominees are highly qualified and independent – and committed to acting in your best interests. They have broad and diverse experience and expertise in areas that are critical to Gannett’s operations and digital transformation, including in finance, business development and strategic planning, mergers and acquisitions, digital media, journalism, marketing and advertising, technology and human resources. | ||

|

Over the last three years, your board and management team have taken decisive actions to build a best-in-class digital marketing solutions organization and local-to-national news network that have driven growth in digital subscribers, audience engagement and advertising and marketing services revenues. While the company’s transformation is ongoing, we have made significant progress as demonstrated by our strong 2018 results:

• Growing digital subscribers by 46%, bringing total paid digital-only subscribers to over 500,000.

• Growing ReachLocal revenues by 15%.

• Growing national digital advertising revenue by 19% and transforming USA TODAY’s advertising revenue to be 75% digital.

We have a clear strategic plan to build on this progress and deliver shareholder value in the near term, with additional upside. Regardless of our confidence in this plan, we have repeatedly stated that we would engage with any party that makes a bona fide, credible proposal that appropriately values the company and is capable of being closed. |

2

|

All of MNG’s nominees are highly conflicted and would reduce the quality of the Gannett board in terms of diversity, skills and experience

In contrast to Gannett’s eight independent nominees, all of MNG’s nominees have irreconcilable conflicts of interest given their close affiliations with MNG and/or Alden – and in some cases their fiduciary duties to MNG and Alden.

ALL OF MNG’S NOMINEES ARE TIED TO HEATH FREEMAN AND ALDEN GLOBAL CAPITAL

| ||

| Many of these affiliations actually go far beyond Alden, MNG and Fred’s, Inc. Mr. Freeman, Mr. Fuchs, Mr. Barton and Ms. Needleman all have other longstanding business and/or personal relationships with each other and/or with Randall Smith, who co-founded Alden with Mr. Freeman and has served as Alden’s chief of investments.

• Mr. Barton’s former privately held company, Freightquote, counted a Smith-related entity as a significant investor, with a $17 million stake (nearly 5% of the company), which was later monetized through transactions involving Smith’s private foundation.

• Mr. Fuchs is president of Rockfleet Broadcasting, Inc., where Mr. Smith or Smith/Alden-affiliated entities have numerous connections. For instance, according to a 2018 lawsuit, as of 2011, Rockfleet had a management agreement with Smith Management LLC (the then-parent company of Alden Global Capital), and as of 2007, Rockfleet Broadcasting II (a Rockfleet entity) was 88% owned by Mr. Smith.1

• Ms. Needleman is a family friend of Mr. Freeman, and they have seemingly known each other for years prior to Ms. Needleman being hand-picked to serve on the Fred’s board, including through business dealings, charitable organizations, a shared alma mater and documented social gatherings. Indeed, Ms. Needleman’s spouse has also represented Alden in real estate dealings, and Ms. Needleman has made a sizeable personal donation to one of their alma mater’s organizations on which Mr. Freeman is chairman of the advisory board. | ||

|

Shareholders should ask: could such nominees objectively evaluate and advise on the actions the board takes on behalf of all Gannett shareholders or would they be beholden to MNG and Alden? Considering the irreconcilable conflicts of interest of MNG’s candidates, Gannett believes electing them to the board would essentially transfer control of the board to MNG and Alden – with no control premium – enabling MNG to advance any agenda it wants at Gannett shareholders’ expense.

|

1 Sola Ltd. et al. v. MNG Enterprises, Inc., Case no. 2018-0134, filed in the Delaware Court of Chancery on March 5, 2018.

3

|

MNG and Alden have a history of value destruction, enriching Alden at other shareholders’ expense

MNG

Recent litigation between MNG and its largest minority shareholder, Solus Alternative Asset Management LP (“Solus”), demonstrates that MNG has siphoned value to Alden, while crippling its newspapers through value-destructive actions. According to the lawsuit, MNG has diverted hundreds of millions of dollars from its newspapers into Alden ventures that have no connection to its media business.2 In its response, MNG admitted to making a number of investments with diverted cash, including investing $248.5 million of workers’ pension funds in funds controlled by Alden and investing $158 million for a 24.8% stake in Fred’s, Alden’s largest single holding.3

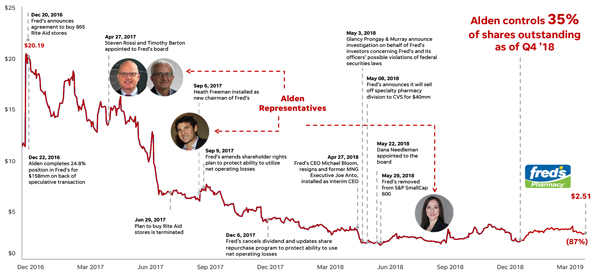

FRED’S, INC.

The Fred’s board has experienced 100% turnover and now consists entirely of Alden-affiliated directors, four of whom MNG is now nominating to serve on your board. At Fred’s, the stock has declined 87% since Alden announced its investment, representing a total of approximately $350 million of shareholder value destruction.4 During this time, Alden replaced Fred’s CEO with an individual from MNG, and nearly all executives who held leadership positions when Alden first invested in Fred’s have since left. With the public equity value drained, it appears that the Alden-controlled Fred’s board is now taking steps to squeeze any remaining value from the assets. An April 11 press release announced that Fred’s will hold liquidation sales and subsequently close 159 stores, or nearly 30% of its footprint, and pursue a process to maximize value – in other words, seek a sale of the company to the highest bidder.

MNG’S NOMINEES – MR. FREEMAN, MR. ROSSI, MR. BARTON AND MS. NEEDLEMAN – HAVE OVERSEEN CONSIDERABLE VALUE DESTRUCTION AT FRED’S

PAYLESS SHOESOURCE

Payless ShoeSource, another of Alden’s portfolio companies, has filed for bankruptcy twice during the past two years. Payless’ turnaround strategy since emerging from its first Chapter 11 bankruptcy in April 2017 has resembled Alden’s strategy at its other investments: with over 600 store closures, the sale of the company’s headquarters, hundreds of layoffs and a lack of investment in its digital presence. Rather than strengthening Payless, these actions led the company down a path that ended in a second bankruptcy and the permanent closure of all U.S. stores.

|

2 Sola Ltd and Ultra Master Ltd v. MNG Enterprises, DE Court of Chancery Case No. 2018-0134-JRS, March 5, 2018.

3 Sola Ltd and Ultra Master Ltd v. MNG Enterprises, DE Court of Chancery Case No. 2018-0134-JRS, March 19, 2018.

4 Based on closing stock prices on March 25, 2019, and December 21, 2016 (the day prior to the filing of Alden’s initial 13D).

4

|

Vote “FOR” an independent board committeed to advancing your interests. Vote “FOR ALL” of Gannett’s independent nominees on the WHITE proxy card today

We believe the choice is clear. A vote “FOR ALL” of Gannett’s nominees on the WHITE proxy card is a vote FOR a board:

Please simply follow the easy instructions on the enclosed WHITE proxy card to submit your proxy by telephone, by Internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided.

We thank you for your continued support.

Sincerely,

J. Jeffry Louis

Chairman of the Gannett board of directors

|

||||||||

|

Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts. The words “believe,” “expect,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek,” “anticipate,” “project” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made and are not guarantees of future performance. Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of our management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Whether or not any such forward-looking statements are in fact achieved will depend on future events, some of which are beyond our control. The matters discussed in these forward-looking statements are subject to a number of risks, trends, uncertainties and other factors that could cause actual results or events to differ materially from those projected, anticipated or implied in the forward-looking statements, including the matters described under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the company’s annual report on Form 10-K for fiscal year 2018 and in the company’s other SEC filings. |

||||||||

| If you have any questions, or need assistance in voting your shares, please call the firm assisting us in the solicitation of proxies:

INNISFREE M&A INCORPORATED

Shareholders call toll-free:

877.456.3507

(from the U.S. and Canada)

|

|

Remember, please simply discard any Blue proxy card you may receive from MNG. Any vote on MNG’s Blue proxy card (even a vote in protest on their nominees) will revoke any earlier proxy card that you have submitted to Gannett. |

||||||

5

|

YOUR VOTE IS VERY IMPORTANT | |||||

|

Your board strongly urges all Gannett shareholders to support our transformative plan to deliver value. Please vote “FOR ALL” of Gannett’s independent director nominees on the WHITE proxy card

A vote for MNG’s nominees is a vote for giving Alden control of Gannett with NO guaranteed premium

|

||||||

Composed of entirely independent directors, who are not beholden to or influenced by ANY outside entity.

Composed of entirely independent directors, who are not beholden to or influenced by ANY outside entity.