GREEN PLAINS PARTNERS LP

RECAST OF CERTAIN SECTIONS OF THE 2015 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

|

|

|

|

|

Page |

|

|

PART I |

||

|

2 |

||

|

|

|

|

|

Recast Item 1. |

4 |

|

|

|

||

|

PART II |

||

|

|

||

|

Recast Item 6. |

12 |

|

|

|

||

|

Recast Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

15 |

|

|

||

|

PART IV |

||

|

|

||

|

Recast Item 15. |

24 |

|

|

|

||

1

The abbreviations, acronyms and industry terminology used in this report are defined as follows:

Green Plains Partners LP and Subsidiaries:

|

Birmingham |

Birmingham BioEnergy Partners LLC, a subsidiary of BlendStar LLC |

|

BlendStar |

BlendStar LLC and its subsidiaries, the partnership’s predecessor for accounting purposes |

|

Green Plains Capital Company |

Green Plains Capital Company LLC |

|

Green Plains Ethanol Storage |

Green Plains Ethanol Storage LLC |

|

Green Plains Logistics |

Green Plains Logistics LLC |

|

Green Plains Operating Company |

Green Plains Operating Company LLC |

|

Green Plains Partners; the partnership |

Green Plains Partners LP and its subsidiaries |

|

Green Plains Trucking II |

Green Plains Trucking II LLC |

|

MLP predecessor |

BlendStar LLC and its subsidiaries, and the assets, liabilities and results of operations of the ethanol storage and leased railcar assets contributed by Green Plains |

Green Plains Inc. and Subsidiaries:

|

Green Plains; our parent or sponsor |

Green Plains Inc. and its subsidiaries |

|

Green Plains Hereford |

Green Plains Hereford LLC |

|

Green Plains Holdings |

Green Plains Holdings LLC; our general partner |

|

Green Plains Hopewell |

Green Plains Hopewell LLC |

|

Green Plains Obion |

Green Plains Obion LLC |

|

Green Plains Trade |

Green Plains Trade Group LLC |

|

Green Plains Trucking |

Green Plains Trucking LLC |

Accounting Defined Terms:

|

ARO |

Asset retirement obligation |

|

ASC |

Accounting Standards Codification |

|

EBITDA |

Earnings before interest, taxes, depreciation and amortization |

|

Exchange Act |

Securities Exchange Act of 1934, as amended |

|

FASB |

Financial Accounting Standards Board |

|

GAAP |

U.S. Generally Accepted Accounting Principles |

|

IDR |

Incentive distribution right |

|

IPO |

Initial public offering of Green Plains Partners LP |

|

IRA |

Individual retirement account |

|

IRS |

Internal Revenue Service |

|

JOBS Act |

Jumpstart Our Business Startups Act of 2012 |

|

LIBOR |

London Interbank Offered Rate |

|

LTIP |

Green Plains Partners LP 2015 Long-Term Incentive Plan |

|

Nasdaq |

The Nasdaq Global Market |

|

NEO |

Named executive officer |

|

NMTC |

New markets tax credits |

|

PCAOB |

Public Company Accounting Oversight Board |

|

Securities Act |

Securities Act of 1933 |

|

SEC |

Securities and Exchange Commission |

Industry Defined Terms:

|

Bgy |

Billion gallons per year |

|

BNSF |

BNSF Railway Company |

|

CAFE |

Corporate Average Fuel Economy |

|

CARB |

California Air Resources Board |

|

CBOB |

Conventional blendstock for oxygenate blending |

|

Clean Water Act |

Water Pollution Control Act of 1972 |

2

|

CSX |

CSX Transportation, Inc. |

|

DOT |

U.S. Department of Transportation |

|

E15 |

Gasoline blended with up to 15% ethanol by volume |

|

E85 |

Gasoline blended with up to 85% ethanol by volume |

|

EIA |

U.S. Energy Information Administration |

|

EISA |

Energy Independence and Security Act of 2007, as amended |

|

EPA |

U.S. Environmental Protection Agency |

|

FRA |

Federal Railroad Administration |

|

ILUC |

Indirect land usage charge |

|

KCS |

Kansas City Southern Railway Company |

|

LCFS |

Low Carbon Fuel Standard |

|

Mmg |

Million gallons |

|

Mmgy |

Million gallons per year |

|

MTBE |

Methyl tertiary-butyl ether |

|

OSHA |

U.S. Occupational Safety and Health Administration |

|

PHMSA |

Pipeline and Hazardous Materials Safety Administration |

|

RFS II |

Renewable Fuels Standard II |

|

RIN |

Renewable identification number |

|

U.S. |

United States |

|

USDA |

U.S. Department of Agriculture |

3

PART I

References to “we,” “our,” “us” or the “partnership” used in present tense for periods beginning on or after July 1, 2015, refer to Green Plains Partners LP and its subsidiaries. References to the “MLP predecessor” used in a historical context for periods ended on or before June 30, 2015, refer to BlendStar LLC and its subsidiaries, the partnership’s predecessor for accounting purposes, and the assets, liabilities and results of operations of the ethanol storage and leased railcar assets contributed by Green Plains in connection with the IPO on July 1, 2015. References to our “sponsor” in transactions subsequent to the IPO refer to Green Plains.

Formation, Initial Public Offering and Subsequent Drop Down

We are a master limited partnership formed by our parent on March 2, 2015. On July 1, 2015, we completed our IPO of 11,500,000 common units representing limited partner interests. Our common units are traded under the symbol “GPP” on Nasdaq. After completing the IPO, in addition to the interests of BlendStar, we received the assets and liabilities of the ethanol storage and leased railcar assets, previously owned and operated by our parent, in a transfer between entities under common control.

Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets of the Hereford, Texas and Hopewell, Virginia ethanol production facilities from our sponsor in a transfer between entities under common control. The assets were recognized at historical cost and reflected retroactively along with related expenses for periods prior to the effective date of the acquisition, subsequent to the initial dates the assets were acquired by our sponsor, or October 23, 2015, and November 12, 2015, for Hopewell and Hereford, respectively. There were no revenues related to these assets for periods before January 1, 2016, when amendments to our commercial agreements related to the drop down became effective.

Overview

Green Plains Partners is a Delaware limited partnership that provides fee-based fuel storage and transportation services by owning, operating, developing and acquiring ethanol and fuel storage tanks, terminals, transportation assets and other related assets and businesses. We were formed by Green Plains, a vertically integrated ethanol producer, to support its marketing and distribution activities as its primary downstream logistics provider.

We generate a substantial portion of our revenues under fee-based commercial agreements with Green Plains Trade for receiving, storing, transferring and transporting ethanol and other fuels, which are supported by minimum volume or take-or-pay capacity commitments. We do not take ownership or receive any payments based on the value of the ethanol or other fuels we handle. As a result, we do not have any direct exposure to fluctuating commodity prices.

Our parent owns a 62.5% limited partner interest in us, consisting of 4,389,642 common units and 15,889,642 subordinated units, all of our incentive distribution rights and a 2.0% general partner interest. The public owns the remaining 35.5% limited partner interest. The following diagram depicts our simplified organizational structure at December 31, 2015:

4

Our Assets and Operations

Ethanol Storage. Our ethanol storage assets are the principal method of storing the ethanol produced at our parent’s ethanol production plants. Each of our parent’s ethanol production plants are located near major rail lines. Ethanol is distributed from our storage facilities to bulk terminals via truck or railcar.

We own 30 ethanol storage facilities and approximately 47 acres of land. Our storage tanks are located at our parent’s 14 ethanol production plants in Indiana, Iowa, Michigan, Minnesota, Nebraska, Tennessee, Texas and Virginia.

Our ethanol storage tanks have combined storage capacity of approximately 31.8 mmg and aggregate throughput capacity of approximately 1,677 mmgy. For the year ended December 31, 2015, the ethanol storage assets had throughput of approximately 948 mmg, representing 91.1% of our parent’s daily average production capacity. The following table presents additional ethanol production plant details by location:

|

Plant Location |

Initial Operation or Acquisition Date |

Major Rail Line Access |

Plant Production Capacity (mmgy) |

On-Site Ethanol Storage Capacity (thousands of gallons) |

Throughput |

|

Atkinson, Nebraska |

June 2013 |

BNSF |

53 |

2,074 |

45 |

|

Bluffton, Indiana |

Sept. 2008 |

Norfolk Southern |

120 |

3,000 |

116 |

|

Central City, Nebraska |

July 2009 |

Union Pacific |

106 |

2,250 |

101 |

|

Fairmont, Minnesota |

Nov. 2013 |

Union Pacific |

119 |

3,124 |

91 |

|

Hereford, Texas (1) |

Nov. 2015 |

BNSF |

100 |

4,406 |

12 |

|

Hopewell, Virginia (1)(2) |

Oct. 2015 |

Norfolk Southern |

60 |

761 |

- |

|

Lakota, Iowa |

Oct. 2010 |

Union Pacific |

112 |

2,500 |

99 |

|

Obion, Tennessee |

Nov. 2008 |

Canadian National |

120 |

3,000 |

115 |

|

Ord, Nebraska |

July 2009 |

Union Pacific |

55 |

1,550 |

56 |

|

Otter Tail, Minnesota |

Mar. 2011 |

BNSF |

60 |

2,000 |

49 |

|

Riga, Michigan |

Oct. 2010 |

Norfolk Southern |

60 |

1,239 |

50 |

|

Shenandoah, Iowa |

Aug. 2007 |

BNSF |

69 |

1,524 |

69 |

|

Superior, Iowa |

July 2008 |

Union Pacific |

60 |

1,238 |

51 |

|

Wood River, Nebraska |

Nov. 2013 |

Union Pacific |

121 |

3,124 |

94 |

|

Total |

1,215 |

31,790 |

948 |

(1) The ethanol storage and railcar assets at the Hereford and Hopewell plants were acquired on January 1, 2016, from our parent. Throughput for the year ended December 31, 2015, relates only to the period since the assets were acquired by our parent.

(2) The Hopewell plant resumed operations on February 8, 2016.

5

Terminal and Distribution Services. We own and operate eight fuel terminals with access to major rail lines that have combined total storage capacity of approximately 7.4 mmg in Alabama, Louisiana, Mississippi, Kentucky, Tennessee and Oklahoma. We also own approximately five acres of land and lease approximately 19 acres of land where our fuel terminals are located. For the year ended December 31, 2015, the aggregate throughput at these facilities was approximately 321.5 mmg.

Ethanol is transported from our terminals to third-parties for blending with gasoline and transferred to a loading rack for delivery by truck to retail gas stations. Our Birmingham facility is one of 20 facilities in the United States capable of efficiently receiving and offloading ethanol and other fuels from unit trains.

The following table presents additional fuel terminal details by location:

|

Fuel Terminal Facility Location |

Major |

On-Site Storage Capacity |

Throughput Capacity (mmgy) |

|

Birmingham, Alabama - Unit Train Terminal |

BNSF |

6,542 |

300 |

|

Other Fuel Terminal Facilities |

(1) |

880 |

522 |

|

|

7,422 |

822 |

(1) Access to our seven other fuel terminal facilities is available from BNSF, KCS, Canadian National, Union Pacific, Norfolk Southern and CSX.

Transportation and Delivery. Ethanol deliveries to distant markets are shipped using major U.S. rail carriers that can switch cars to other major railroads. Currently, our leased railcar fleet consists of approximately 2,700 railcars with an aggregate capacity of approximately 79.6 mmg. We expect our railcar volumetric capacity will fluctuate over the normal course of business as our existing railcar leases expire and we enter into or acquire new railcar leases. Our volumetric capacity is used to transport product primarily from our fuel terminals or third-party production facilities to international export terminals and refineries located throughout the United States.

We also own and operate a fleet of seven trucks to transport ethanol and other biofuels.

Segments

Our operations consist of one reportable segment with all business activities conducted in the United States.

Our Relationship with Green Plains

Our parent is a vertically integrated producer, marketer and distributor of ethanol and the fourth largest producer in North America. Our parent mitigates commodity price volatility by having operations throughout the ethanol value chain, which differentiates it from other companies focused only on ethanol production.

We benefit significantly from our relationship with our parent. Our assets are the principal method of storing and delivering the ethanol our parent produces for its customers and the commercial agreements with Green Plains Trade account for a substantial portion of our revenues.

Our parent has a majority interest in us through ownership of our general partner, a 62.5% limited partner interest and all of our incentive distribution rights. We believe our parent will continue to support the successful execution of our business strategies given its significant ownership in us and the importance of our assets to Green Plains’ operations.

We entered into several agreements with our parent, which were established in conjunction with the IPO, including: an omnibus agreement; a contribution, conveyance and assumption agreement; an operational services and secondment agreement; and various commercial agreements described below. For additional information related to these agreements, please refer to Note 3 – Initial Public Offering to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

Commercial Agreements with Affiliate

A substantial portion of our revenues and cash flows are derived from our commercial agreements with Green Plains Trade, our primary customer, including a (1) ten-year fee-based storage and throughput agreement, (2) Birmingham terminal services agreement, (3) six-year fee-based rail transportation services agreement and (4) various other transportation and terminal services agreements. For the agreements in their entirety, please refer to the current report on Form 8-K filed with the SEC on July 6, 2015, and the amendments filed with our annual report on Form 10-K, filed with the SEC on February 18,

6

2016, or our 2015 annual report.

Minimum Volume Commitments. Our storage and throughput agreement and certain terminal services agreements with Green Plains Trade are supported by minimum volume commitments. Our rail transportation services agreement is supported by minimum take-or-pay capacity commitments. Green Plains Trade is required to pay us fees for these minimum commitments regardless of the actual throughput or volume, capacity used or amount of product tendered for transport, assuring us that we will receive a certain amount of revenue during the terms of these agreements. The nature of these arrangements will provide stable and predictable cash flows over time.

Storage and Throughput Agreement. Under our storage and throughput agreement, Green Plains Trade is obligated to throughput a minimum of 246.5 mmg of product per calendar quarter at our storage facilities. Green Plains Trade is obligated to pay $0.05 per gallon on all throughput volumes, subject to an inflation escalator based on the producer price index following the last day of the primary term’s fifth year. If Green Plains Trade fails to meet its minimum volume commitment during any quarter, Green Plains Trade will pay us a deficiency payment equal to the deficient volume multiplied by the applicable fee. The deficiency payment may be applied as a credit toward volumes throughput by Green Plains Trade in excess of the minimum volume commitment during the next four quarters, after which time any unused credits will expire. For each of the quarters ended September 30, 2015, and December 31, 2015, Green Plains Trade met its minimum volume commitment, with throughput of 215.6 mmg and 248.8 mmg, respectively. At December 31, 2015, the remaining primary term of our storage and throughput agreement was 9.5 years. The storage and throughput agreement will automatically renew for successive one-year terms unless either party provides written notice of its intent to terminate at least 360 days prior to the end of the remaining primary or renewal term.

The current minimum volume commitment was increased from 212.5 mmg of product per calendar quarter in connection with the acquisition of the Hereford, Texas and Hopewell, Virginia ethanol storage and leased railcar assets, effective January 1, 2016. All other terms and conditions are substantially the same as the initial agreement.

Terminal Services Agreement. Under our terminal services agreement for the Birmingham facility, Green Plains Trade is obligated to pay $0.0355 per gallon on all throughput volumes, subject to a minimum volume commitment of approximately 2.8 mmg per month of ethanol and other fuels, equivalent to 33.2 mmgy, as well as fees for ancillary services. At December 31, 2015, the remaining primary term of the terminal services agreement was approximately two years. The terminal services agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 90 days prior to the end of the remaining primary or renewal term. Other terminal services agreements with Green Plains Trade and third parties also contain minimum volume commitments with various remaining terms.

Rail Transportation Service Agreement. Under our rail transportation services agreement, Green Plains Trade is obligated to transport ethanol and other fuels by rail from identified receipt and delivery points and pay an average monthly fee of approximately $0.0357 per gallon for all railcar volumetric capacity provided. Currently, our minimum railcar volumetric capacity commitment is 79.6 mmg and the weighted average remaining term of all railcar lease agreements is 2.5 years. At December 31, 2015, the remaining primary term of our rail transportation services agreement was 5.5 years. The rail transportation services agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 360 days prior to the end of the remaining primary or renewal term.

We lease our railcars from third parties under lease agreements with various terms. The minimum take-or-pay capacity commitment is reduced by the capacity of the railcars subject to expiration under our lease agreements.

Effective January 1, 2016, as previously amended, the rail transportation services agreement was adjusted pursuant to its terms in connection with the acquisition of the Hereford, Texas and Hopewell, Virginia ethanol storage and leased railcar assets. The minimum railcar volumetric capacity commitment was increased by 6.7 mmg, to its current level.

Green Plains Trade is also obligated to pay a monthly fee of approximately $0.0013 per gallon for logistical operations management and other services based on railcar volumetric capacity obtained by Green Plains Trade from third parties.

Trucking Transportation Agreement. Under our trucking transportation agreement, Green Plains Trade pays us to transport ethanol and other fuels from identified receipt and delivery points by truck. At December 31, 2015, the remaining term of our trucking transportation agreement was six months. The trucking transportation agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 30 days prior to the end of the remaining primary or renewal term. Green Plains Trade is obligated to pay a monthly trucking

7

transportation services fee equal to the aggregate amount of product volume transported in a calendar month multiplied by the applicable rate for each truck lane.

We also entered into an omnibus agreement and an operational services and secondment agreement with our parent. For more information, see Note 3 – Initial Public Offering to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

Competitive Strengths

We believe that the following competitive strengths position us to successfully execute our business strategies:

Stable and Predictable Cash Flows. A substantial portion of our revenues and cash flows are derived from long-term, fee-based commercial agreements with Green Plains Trade, including a storage and throughput agreement, rail transportation services agreement, terminal services agreement and other transportation agreements. Our storage and throughput agreement and certain terminal services agreements are supported by minimum volume commitments, and our rail transportation services agreement is supported by minimum take-or-pay capacity commitments. Green Plains Trade is obligated to pay us fees for these minimum commitments regardless of actual throughput or volume, capacity used or amount of product tendered for transport, assuring us that we will receive a certain amount of revenue during the terms of these agreements.

Advantageous Relationship with Our Parent. Our assets are the principal method of storing and delivering the ethanol our parent produces, and the related agreements with Green Plains Trade include minimum volume or take-or-pay capacity commitments. Furthermore, as general partner and owner of a 62.5% limited partner interest in us and all of our incentive distribution rights, our parent directly benefits from our growth, which provides incentive to pursue projects that directly or indirectly enhance the value of our business and assets. This can be accomplished though organic expansion, accretive acquisitions or the development of downstream distribution services. Under an omnibus agreement, we are granted the right of first offer, for a period of five years, on any ethanol storage asset, fuel terminal facility or transportation asset our parent owns, constructs or acquires and decides to sell.

Quality Assets. Our portfolio of assets have an expected remaining weighted average useful life of over 20 years. Our assets are strategically located in eight states near major rail lines, which minimizes our exposure to weather-related downtime and transportation congestion, while enabling access to markets across the United States. Given the nature of our assets, we expect to incur only modest maintenance-related expenses and capital expenditures in the near future.

Financial Strength and Flexibility. Our borrowing capacity and ability to access debt and equity capital markets provide financial flexibility necessary to achieve our organic and acquisition growth strategies.

Proven Management Team. Each member of our senior management team is an employee of our parent who also devotes time to manage our business affairs. We believe the level of commercial, operational and financial expertise of our senior management team, which averages approximately 25 years of industry experience, will allow us to successfully execute our business strategies.

Business Strategy

We believe ethanol could become an increasingly larger portion of the global fuel supply driven by volatile oil prices, heightened environmental concerns, energy independence and national security concerns. We intend to further develop and strengthen our business by pursuing the following growth strategies:

Generate Stable, Fee-Based Cash Flows. A substantial portion of our revenues and cash flows are derived from our commercial agreements with Green Plains Trade. Under these agreements, we do not have direct exposure to fluctuating commodity prices. We will continue to establish fee-based contracts with our parent and third parties that generate stable and predictable cash flows as we grow.

Grow Organically. We will collaborate with our parent and other potential third-party customers to identify opportunities to construct assets that provide us with stable cash flows through fee-based service agreements. Plant expansion by our parent that increases its production capacity also increases annual throughput at our facilities. Our capital expenditures associated with expansion would be minimal since our ethanol storage facilities have available capacity to accommodate growth.

Acquire Strategic Assets. We intend to pursue strategic acquisitions independently and jointly with our parent to grow

8

our business. The U.S. ethanol production industry is poised for consolidation. Our parent has a proven history of identifying, acquiring and integrating assets that are accretive to its business. Under the omnibus agreement, we have a five-year, right of first offer on any fuel storage, terminal or transportation asset our parent owns, constructs or acquires and decides to sell. In addition, we intend to continually monitor the marketplace to identify and pursue assets that complement or diversify our existing operations, including fuel storage and terminal assets in close proximity to our existing asset base.

Development of Downstream Distribution Services. Our parent will continue to use its logistical capabilities and expertise to further develop downstream ethanol distribution services. We will benefit from our parent’s marketing and distribution strategy due to the strategic locations of our ethanol storage facilities and fuel terminal facilities.

Conduct Safe, Reliable and Efficient Operations. We conduct routine inspections of our assets in accordance with applicable laws and regulations and are committed to maintaining safe, reliable and environmentally compliant operations. We seek to improve our operating performance through preventive maintenance, employee training, and safety and development programs.

Recent Developments

On November 4, 2015, we announced plans to form a joint venture, as a 50% partner, to build an ethanol unit train terminal in Maumelle, Arkansas. The terminal will be capable of unloading 110-car unit trains in less than 24 hours and initially include storage for approximately 4.2 mmg of ethanol. The project is expected to cost approximately $12 million and be completed during the fourth quarter of 2016.

Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets of the Hereford, Texas and Hopewell, Virginia ethanol production facilities from our parent for consideration of $62.3 million. We used our revolving credit facility and cash on hand to fund the purchase. The acquired assets include three ethanol storage tanks that support the plants’ combined production capacity of approximately 160 mmgy and 224 leased railcars with volumetric capacity of approximately 6.7 mmg. We amended the storage and throughput agreement with Green Plains Trade, increasing the minimum volume commitment from 212.5 mmg to 246.5 mmg per calendar quarter. We also adjusted the rail transportation services agreement, increasing the minimum railcar volumetric capacity commitment 6.7 mmg to 79.6 mmg.

Our Competition

Our contractual relationship with Green Plains Trade and the integrated nature of our storage tanks with our parent’s production facilities minimizes potential competition for storage and distribution services provided under our commercial agreements from other third-party operators.

We compete with independent fuel terminal operators and major fuel producers for terminal services based on terminal location, services provided, safety and cost. While there are numerous fuel producers and distributors that own terminal operations similar to ours, they are not typically focused on providing services to third parties. Independent operators are often located near key distribution points with cost advantages and provide more efficient services and distribution capabilities into strategic markets with a variety of transportation options. Companies often rely on independent providers when their own storage facilities cannot handle their volumes or they cannot manage their throughput adequately due to lack of expertise, market congestion, size constraints, optionality or the nature of the materials being stored.

We believe we are well-positioned to compete effectively in a growing market due to our expertise managing third-party terminal services and logistics. We are a low-cost operator, focused on safety and efficiency, capable of managing the needs of multiple constituencies across geographical markets. While the competitiveness of our services can be impacted by competition from new entrants, transportation constraints, industry production levels and related storage needs, we believe there are significant barriers to entry that partially mitigate these risks, including significant capital costs, execution risk, complex permitting requirements, development cycle, financial and working capital constraints, expertise and experience, and ability to effectively capture strategic assets or locations.

Seasonality

Our business is directly affected by the supply and demand for ethanol and other fuels in the markets served by our assets. However, the effects of seasonality on our revenues are substantially mitigated through our fee-based commercial agreements with Green Plains Trade, which include minimum volume or take-or-pay capacity commitments.

9

Major Customer

Revenues from Green Plains Trade, controlled by our parent, totaled approximately $42.5 million, or 83.5%, of our consolidated revenues for 2015. We are highly dependent on Green Plains Trade and expect to derive most of our revenues from them in the foreseeable future. Accordingly, we are indirectly subject to the business risks of Green Plains Trade. For additional information, please read Risk Factors—Risks Related to Our Business. Since a substantial majority of our revenues are, and in the foreseeable future are expected to be, derived from Green Plains Trade, any development that materially and adversely affects Green Plain Trade’s operations, financial condition or market reputation could have a material adverse impact on us.

Regulatory Matters

Government Ethanol Programs and Policies

The domestic ethanol market is impacted by federal mandates under the RFS II, which sets the required volume of renewable fuel to be blended with transportation fuel in the United States. On June 10, 2015, the EPA proposed volume targets for conventional ethanol of 13.25 billion gallons, 13.40 billion gallons and 14.00 billion gallons for 2014, 2015 and 2016, respectively. On November 30, 2015, the EPA announced final volume requirements for conventional ethanol that were higher than the levels proposed in June of 13.61 billion gallons, 14.05 billion gallons and 14.50 billion gallons for 2014, 2015 and 2016, respectively.

In April 2013, the Master Limited Partnership Parity Act was introduced in the U.S. House of Representatives as H.R. 1696 to extend the publicly traded partnership ownership structure to renewable energy projects, including ethanol production. The legislation was proposed to provide a more level financing system and tax burden for renewable energy equal to fossil energy projects. H.R. 1696 did not advance out of committee during the 113th Congress and its co-sponsors have not re-introduced the bill.

Environmental Regulation

Our operations are subject to environmental regulations, including those that govern the handling and release of ethanol, crude oil and other liquid hydrocarbon materials. Compliance with existing and anticipated environmental laws and regulations will increase our overall cost of business, including capital costs to construct, maintain, operate, and upgrade equipment and facilities. However, we do not believe that this will have a material impact on our operations or financial position.

There are also risks of accidental releases into the environment associated with our operations, such as releases of ethanol from our storage facilities. Should an event, such as an accidental release, not be covered by our insurance, we could be subject to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage, and fines or penalties for any related violations of environmental laws or regulations.

Under the omnibus agreement, our parent indemnified us from all known and certain unknown environmental liabilities associated with owning and operating our assets that occurred on or before the closing of the IPO. In turn, we have agreed to indemnify our parent from future environmental liabilities associated with the activities of the partnership.

Construction or maintenance of our terminal and storage facilities may impact wetlands, which are regulated by the EPA and the U.S. Army Corps of Engineers under the Clean Water Act.

Other Regulations

In July 2014, the DOT proposed new regulations to improve the transportation of flammable materials by rail, which it finalized on May 1, 2015. The Enhanced Tank Car Standards and Operational Controls for High-Hazard Flammable Trains calls for an enhanced tank car standard known as the DOT specification 117 and establishes a schedule to retrofit or replace older tank cars that carry crude oil and ethanol. The rule also establishes braking standards intended to reduce the severity of accidents and new operational protocols. Companies that transport hazardous materials must develop more accurate classification protocols. As a result of the final rule, lease costs for railcars may increase over the long term. Additionally, existing railcars could be out of service for a period of time while such upgrades are made, tightening supply in an industry that is highly dependent on railcars to transport product. We intend to retrofit or replace our leased railcars to comply with the new regulations. Retrofitting costs will be reimbursed by Green Plains Trade under our rail transportation services agreement.

10

Employees

We do not have any employees. We are managed and operated by the executive officers of our general partner, who are also officers of our parent, and our general partner’s board of directors. Our general partner and its affiliates have approximately 15 full-time equivalent employees under the direct management and supervision of our general partner for our operations.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available on our website at www.greenplainspartners.com shortly after we file or furnish the information with the SEC. You can also find the charter of our audit committee, as well as our code of ethics in the corporate governance section of our website. The information found on our website is not part of this or any other report we file or furnish with the SEC. For more information on our parent, please visit www.gpreinc.com. Alternatively, investors may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549 or visit the SEC website at www.sec.gov to access our reports and information statements filed with the SEC.

11

Recast Item 6. Selected Financial Data.

The statement of operations data for the years ended December 31, 2015, 2014 and 2013, and the balance sheet data as of December 31, 2015 and 2014, are derived from our audited recast consolidated financial statements and should be read together with the accompanying recast notes included elsewhere in this report.

The balance sheet data as of December 31, 2013, is derived from our audited consolidated financial statements that are not included in this report, which describe a number of matters that materially affect the comparability of the periods presented.

Our results of operations are not comparable to periods prior to our IPO on July 1, 2015, when the storage and transportation agreements between us and Green Plains Trade became effective. The ethanol storage and leased railcar assets contributed by our parent are recognized at historical cost and reflected retroactively in our consolidated financial statements, along with related expenses, such as depreciation, amortization and railcar lease expenses. There were no revenues related to these assets reflected in the consolidated financial statements for periods before July 1, 2015. Periods ended on or before June 30, 2015, include the activities of BlendStar, which provided terminal and trucking services for our parent as well as third parties.

These recast financial statements also reflect the acquisition of the ethanol storage and leased railcar assets of the Hereford, Texas and Hopewell, Virginia ethanol production facilities from our sponsor in a transfer between entities under common control, effective January 1, 2016. The assets were recognized at historical cost and reflected retroactively along with related expenses for periods prior to the effective date of the acquisition, subsequent to the initial dates the assets were acquired by our sponsor, or October 23, 2015, and November 12, 2015, for Hopewell and Hereford, respectively. There were no revenues related to these assets for periods before January 1, 2016, when amendments to our commercial agreements related to the drop down became effective.

The following recast selected financial data should be read together with Recast Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Adjusted EBITDA and Distributable Cash Flow of this report. The financial information below is not necessarily indicative of our expected results for any future period, which could differ materially from historical results due to numerous factors, including those discussed in Item 1A – Risk Factors of our 2015 annual report.

12

|

|

Year Ended December 31, |

||||||||

|

|

2015 |

2014 |

2013 |

||||||

|

Statement of Operations Data: |

|||||||||

|

(in thousands, except per unit information) |

|||||||||

|

Revenues |

$ |

50,937 |

$ |

12,843 |

$ |

11,032 | |||

|

Operations and maintenance |

29,601 | 26,424 | 17,854 | ||||||

|

General and administrative |

3,114 | 1,403 | 1,402 | ||||||

|

Depreciation and amortization |

5,828 | 5,544 | 3,572 | ||||||

|

Operating income (loss) |

12,394 | (20,528) | (11,796) | ||||||

|

Other income (expense) |

(295) | (63) | (719) | ||||||

|

Net income (loss) |

16,108 | (12,833) | (7,810) | ||||||

|

Net loss attributable to MLP predecessor |

(6,628) | (12,833) | (7,810) | ||||||

|

Net loss attributable to sponsor |

(273) |

- |

- |

||||||

|

Net income attributable to the partnership |

23,009 |

- |

- |

||||||

|

|

|||||||||

|

Earnings per limited partner unit (basic and diluted): |

|||||||||

|

Common units |

$ |

0.71 | |||||||

|

Subordinated units |

$ |

0.71 | |||||||

|

|

|||||||||

|

Weighted average limited partner units outstanding (basic and diluted): |

|||||||||

|

Common units |

15,897 | ||||||||

|

Subordinated units |

15,890 | ||||||||

|

|

|||||||||

|

Distribution declared per unit |

$ |

0.8025 | |||||||

|

|

December 31, |

||||||||

|

|

2015 |

2014 |

2013 |

||||||

|

Balance Sheet Data (in thousands): |

|||||||||

|

Cash and cash equivalents |

$ |

16,385 |

$ |

5,705 |

$ |

1,704 | |||

|

Current assets |

33,919 | 12,036 | 7,383 | ||||||

|

Total assets |

95,998 | 79,992 | 73,445 | ||||||

|

Long-term debt |

8,100 | 8,100 | 8,100 | ||||||

|

Total liabilities |

24,188 | 12,685 | 14,194 | ||||||

|

Partners' capital |

71,810 | 67,307 | 59,251 | ||||||

Adjusted EBITDA is defined as earnings before interest expense, income tax expense, depreciation and amortization, plus adjustments for transaction costs related to acquisitions or financing transactions, minimum volume commitment deficiency payments, unit-based compensation expense and net gains or losses on asset sales. Distributable cash flow is defined as adjusted EBITDA less interest paid or payable, cash paid for income taxes and maintenance capital expenditures.

Adjusted EBITDA and distributable cash flow presentations are not made in accordance with GAAP and therefore should not be considered in isolation or as alternatives to net income, operating income or any other measure of financial performance presented in accordance with GAAP to analyze our results. Distributable cash flow computations for periods prior to the partnership’s IPO are not considered meaningful. Refer to Recast Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.

13

The following table presents a reconciliation of net income to adjusted EBITDA for each of the periods presented and a reconciliation of net income to distributable cash flow for the period since the IPO was completed (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post IPO (1) |

|

Year Ended December 31, |

|||||||||

|

|

|

2015 |

|

2015 |

|

2014 |

|

2013 |

|

||||

|

Other Financial Data (in thousands, except per unit data): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

22,736 |

|

$ |

16,108 |

|

$ |

(12,833) |

|

$ |

(7,810) |

|

|

Interest expense |

|

|

327 |

|

|

381 |

|

|

138 |

|

|

768 |

|

|

Income tax benefit |

|

|

(10) |

|

|

(4,009) |

|

|

(7,758) |

|

|

(4,705) |

|

|

Depreciation and amortization |

|

|

3,107 |

|

|

5,828 |

|

|

5,544 |

|

|

3,572 |

|

|

Transaction costs |

|

|

907 |

|

|

907 |

|

|

- |

|

|

- |

|

|

Unit-based compensation expense |

|

|

67 |

|

|

67 |

|

|

- |

|

|

- |

|

|

Adjusted EBITDA |

|

|

27,134 |

|

|

19,282 |

|

$ |

(14,909) |

|

$ |

(8,175) |

|

|

Adjusted EBITDA attributable to the MLP Predecessor |

|

|

- |

|

|

(7,852) |

|

|

|

|

|

|

|

|

Adjusted EBITDA attributable to sponsor |

|

|

(232) |

|

|

(232) |

|

|

|

|

|

|

|

|

Adjusted EBITDA attributable to the partnership |

|

$ |

27,366 |

|

$ |

27,366 |

|

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid or payable |

|

|

327 |

|

|

|

|

|

|

|

|

|

|

|

Maintenance capital expenditures |

|

|

148 |

|

|

|

|

|

|

|

|

|

|

|

Distributable cash flow (2) |

|

$ |

26,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared (3) |

|

$ |

26,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coverage ratio |

|

|

1.03x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents the adjusted EBITDA and DCF computations for the period since the IPO was completed, from July 1, 2015, to December 31, 2015. Amounts have been recast to include the historical results of operations related to the net assets acquired in a transfer between entities under common control; see Note 1 – Basis of Presentation and Description of Business and Note 4 - Acquisition to the consolidated financial statements for further discussion.

(2) DCF computations for periods before our IPO are not considered meaningful.

(3) Includes distributions declared for the quarters ended September 30, 2015, and December 31, 2015.

14

Recast Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

General

The following discussion and analysis includes information management believes is relevant to understand and assess our financial condition and results of operations. This section should be read together with our recast consolidated financial statements and accompanying recast notes contained in this report, as well as risk factors contained in our 2015 annual report.

Information about our business, properties and strategy can be found under Recast Item 1 – Business and a description of our risk factors can be found under Item 1A – Risk Factors in our 2015 annual report.

Overview

We are a master limited partnership formed by our parent to be its principle provider of fuel storage and transportation services. On July 1, 2015, we completed our IPO, and, in addition to the interests of BlendStar, received the assets and liabilities of the ethanol storage and leased railcar assets contributed by our parent in a transfer between entities under common control. We also entered into long-term, fee-based commercial agreements for storage and transportation services with Green Plains Trade, which are supported by minimum volume or take-or-pay capacity commitments.

Industry Factors Affecting our Results of Operations

Ethanol Supply and Demand

The volume of ethanol and other fuels handled at our facilities depends on our parent’s production levels and fuel blending margins, which are impacted by numerous factors that ultimately affect the supply and demand for ethanol and other fuels, including domestic production levels, government policies and mandates, economic incentives, global markets, environmental regulations and the price of feedstock, both domestically and abroad.

Domestic Production. Domestic ethanol production has been steadily increasing to an estimated 14.8 billion gallons in 2015 from 14.3 billion gallons in 2014, according to the EIA. The ethanol production market continues to be fairly fragmented. As of January 23, 2016, there were 216 ethanol plants capable of producing 15.7 bgy according to Ethanol Producer Magazine. The top five producers account for 43% of the domestic production capacity.

Government Policies and Regulations. Federal mandates supporting the use of renewable fuels continue to be a major driver in U.S. demand for ethanol. Ethanol policies are influenced by the desire to reduce fuel emissions and our dependency on foreign oil. In November 2015, the EPA announced final volume requirements for conventional ethanol of 13.61 billion gallons, 14.05 billion gallons and 14.50 billion gallons for 2014, 2015 and 2016, respectively. Significant increases in production capacity beyond the RFS II mandated level could negatively impact the ethanol industry. Reductions to governmental usage mandates could adversely affect the market for ethanol and our results of operations. The results of the 2016 presidential election could impact federal policies regarding renewable fuels. Environmental laws and regulations may impact the cost to produce or transport ethanol, which can indirectly affect supply.

Economic Incentives. Domestic demand has also been influenced by economic incentives for refiners and blenders to use ethanol as an additive to reduce vehicle emissions and increase octane levels based on its relative octane value and the market for RINs, which are used to comply with RFS II. Even though gasoline traded at a discount to ethanol during the year, ethanol continued to be the most economical oxygenate over Gulf Coast alkylate and reformate substitutes, and the most affordable source of octanes over Gulf Coast 93 and toluene substitutes. These incentives may be affected by the price of crude oil, which decreased in price per barrel by approximately 43% from December 31, 2014, to December 31, 2015. Increased consumer acceptance and availability of higher blends such as E15 has also helped to support domestic demand.

Global Markets. Since 2010, the United States has been the world’s largest producer and consumer of ethanol. Approximately 6% of domestic ethanol is marketed worldwide and competes with other sources, primarily Brazil. The United States and Brazil account for more than 80% of all ethanol production worldwide, according to the USDA Foreign Agriculture Service. Annual reported production worldwide has also increased year over year. In 2014, global production was 24.6 billion gallons, according to the U.S. Department of Energy. Increased ethanol production capacity could create excess supply in world markets, resulting in lower ethanol prices throughout the world, including the United States.

A significant change in feedstock prices, transportations rates, foreign exchanges rates and government policies could also alter global supply dynamics in the top producing countries. In the United States, the primary feedstock for ethanol is

15

corn; in Brazil, the primary feedstock for ethanol is sugarcane. In March 2015, the Brazilian government increased their required ethanol blend to 27% from 25% which, along with more competitively priced ethanol produced from corn, significantly reduced U.S. ethanol imports from Brazil.

Our Parent’s Production Levels

Our parent’s operating margins influence its production levels, which in turn affects the volume of ethanol we will store, throughput and transport. Our parent’s operating margins are affected by the supply and demand for ethanol and other fuels, which are impacted by the cost of corn and natural gas, and the market price for ethanol, distillers grains and corn oil.

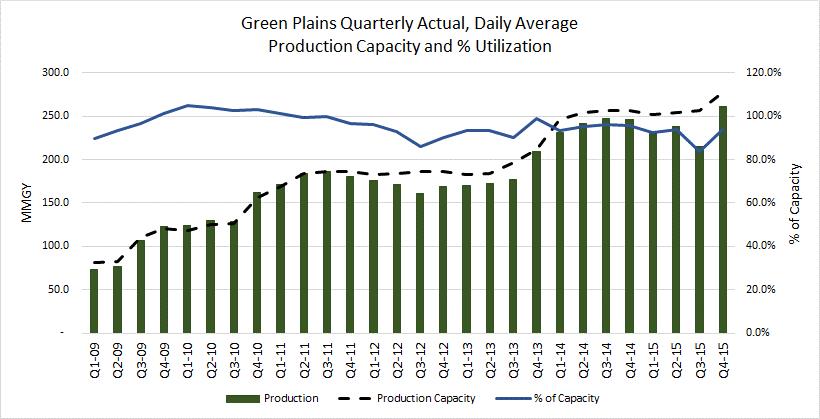

Our parent operated at approximately 91.1% of its average daily production capacity for the year ended December 31, 2015. From January 1, 2009, to December 31, 2015, our parent’s quarterly ethanol production increased 256.4%, from 73.2 mmg to 260.8 mmg, primarily from third-party acquisitions. Over the same time period, our parent’s ethanol production averaged 95.7% of its daily average production capacity and never fell below 83.8%. As part of its Phase I production capacity expansion program, our parent has added 35 mmgy of production capacity as of December 2015 and plans to add up to an additional 50 mmgy over the next twelve months. Our parent will explore other related expansion projects in the future. Our parent’s quarterly actual production, daily average production capacity and utilization are highlighted in the following chart:

Financial Condition and Results of Operations of Our Parent

Our parent guarantees Green Plains Trade’s obligations under our storage and throughput agreement and rail transportation service agreements, which account for a substantial portion of our revenues. Any change in our parent’s business or financial strategy or event that negatively impacts its financial condition, results of operations or cash flows may materially and adversely affect our financial condition, results of operations or cash flows.

Availability of Railcars

The long-term growth of our business depends on the availability of railcars, which we currently lease, to transport ethanol and other fuels on reasonable terms. Railcars may become unavailable due to increased demand, maintenance or other logistical constraints. Future railcar shortages caused by increased demand for railcar transportation or changes in regulatory standards that apply to railcars could negatively impact our business and our ability to grow.

On May 1, 2015, the DOT announced an enhanced tank car standard, known as the DOT specification 117, which establishes a schedule to retrofit or replace older tank cars that carry crude oil and ethanol. The rule may have an adverse effect on our operations as railcar lease costs may increase over the long term and existing railcars may be out of service for

16

an extended period of time while these upgrades are made, tightening supply in an industry that is highly dependent on railcar transportation.

How We Evaluate Our Operations

Our management uses a variety of financial and operating metrics to evaluate our operating results and measure profitability, including: throughput volume and capacity, operations and maintenance expense, adjusted EBITDA and distributable cash flow.

Throughput Volume and Capacity

Our revenues are dependent on the volume of ethanol and other fuels we throughput at our ethanol storage and fuel terminal facilities, and the volumetric capacity that is used to transport ethanol and other fuels by railcars. The volume of ethanol and other fuels we store, throughput or transport, and the railcar volumetric capacity we provide are affected by our parent’s operating margins at its ethanol production plants as well as the overall supply and demand for ethanol and other fuels in markets served directly or indirectly by our assets.

Green Plains Trade is obligated to meet minimum volumes or take-or-pay capacity commitments under our commercial agreements. Our results of operations may be impacted by our parent’s use of our assets in excess of its minimum volume commitments, our ability to capture incremental volumes or capacity from Green Plains Trade or third parties and our ability to retain Green Plains Trade as a customer, enter into contracts with new customers and increase volume commitments.

Operations and Maintenance Expenses

Our management seeks to maximize the profitability of our operations by effectively managing operations and maintenance expenses. Our expenses are relatively stable across a broad range of storage, throughput and transportation volumes and usage, but can fluctuate from period to period depending on maintenance activities. We manage our expenses by scheduling maintenance activities over time to avoid significant variability in our cash flows.

Adjusted EBITDA and Distributable Cash Flow

Adjusted EBITDA is defined as earnings before interest expense, income tax expense, depreciation and amortization, plus adjustments for transaction costs related to acquisitions or financing transactions, minimum volume commitment deficiency payments, unit-based compensation expense and net gains or losses on asset sales.

Distributable cash flow is defined as adjusted EBITDA less interest paid or payable, cash paid for income taxes and maintenance capital expenditures, which are defined under our partnership agreement as cash expenditures (including expenditures for the construction or development of new capital assets or the replacement, improvement or expansion of existing capital assets) made to maintain our operating capacity or operating income.

We believe that the presentation of adjusted EBITDA and distributable cash flow will provide useful information to investors in assessing our financial condition and results of operations. Adjusted EBITDA and distributable cash flow are supplemental financial measures that we use to assess our financial performance; however, these presentations are not made in accordance with GAAP. The GAAP measure most directly comparable to adjusted EBITDA and distributable cash flow is net income. Since adjusted EBITDA and distributable cash flow may be defined differently by other companies in our industry, our definitions of adjusted EBITDA and distributable cash flow may not be comparable to similarly titled measures of other companies, diminishing its utility. Adjusted EBITDA and distributable cash flow should not be considered in isolations or as alternatives to net income, operating income or any other measure of financial performance presented in accordance with GAAP to analyze our results. Refer to Recast Item 6 – Selected Financial Data for reconciliations of net income to adjusted EBITDA and distributable cash flow.

Components of Revenues and Expenses

Revenues. Our revenues consist primarily of volume-based service fees for receiving, storing, transferring and transporting ethanol and other fuels.

For more information about these charges and the services covered by these agreements, please refer to Note 16 – Related Party Transactions to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

17

Operations and Maintenance Expenses. Our operations and maintenance expenses consist primarily of lease expenses related to our transportation assets, labor expenses, outside contractor expenses, insurance premiums, repairs and maintenance expenses and utility costs. These expenses also include fees for certain management, maintenance and operational services to support our facilities allocated by our parent under our operational services and secondment agreement.

General and Administrative Expenses. Our general and administrative expenses consist primarily of employee salaries, incentives and benefits; office expenses; professional fees for accounting, legal, and consulting services; and other costs allocated by our parent. Our general and administrative expenses include direct monthly charges for the management of our assets and certain expenses allocated by our parent under our omnibus agreement for general corporate services, such as treasury, accounting, human resources and legal services. These expenses are charged or allocated to us based on the nature of the expense and our proportionate share of employee time or capital expenditures and operating expenses.

For more information about fees we reimburse our parent for services received, please read Note 16 – Related Party Transactions to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

Other Income (Expense). Other income (expense) includes interest earned, interest expense and other non-operating items.

Results of Operations

Comparability of our Financial Results

For the year ended December 31, 2015, the following discussion reflects the results of the MLP predecessor for the first six months of 2015 and the results of the partnership post-IPO for second half of 2015. The discussion for the year ended December 31, 2015, also includes the results related to assets we acquired from our sponsor since the IPO in a transfer between entities under common control. The years ended December 31, 2014 and 2013, reflect only the results of the MLP predecessor.

Under GAAP, when accounting for transfers of assets between entities under common control, the entity that receives the net assets initially recognizes the assets and liabilities transferred at their carrying amounts at the date of transfer. Prior period financial statements of the transferee are recast for all periods in which the transferred operations were part of the ultimate parent’s consolidated financial statements. On July 1, 2015, in addition to the interests of BlendStar, we received the assets and liabilities of certain ethanol storage and railcar assets contributed by our parent in a transfer between entities under common control. We recognized the assets and liabilities transferred at our parent’s historical cost basis, which are reflected retroactively in the consolidated financial statements presented in this report. Expenses related to these contributed assets, such as depreciation, amortization and railcar lease expenses, are also reflected retroactively in the consolidated financial statements. No revenues related to the operation of the ethanol storage and railcar contributed assets are reflected in the consolidated financial statements for periods before July 1, 2015, the date the related commercial agreements became effective.

Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets of the Hereford, Texas and Hopewell, Virginia ethanol production facilities from our sponsor in a transfer between entities under common control. The assets were recognized at historical cost and reflected retroactively along with related expenses for periods prior to the effective date of the acquisition, subsequent to the initial dates the assets were acquired by our sponsor, or October 23, 2015, and November 12, 2015, for Hopewell and Hereford, respectively. There were no revenues related to these assets for periods before January 1, 2016, when amendments to our commercial agreements related to the drop down became effective.

18

Selected Financial Information and Operating Data

The following table reflects selected financial information (in thousands):

|

|

Year Ended December 31, |

||||||||

|

|

2015 |

2014 |

2013 |

||||||

|

Revenues |

|||||||||

|

Storage and throughput services |

$ |

23,125 |

$ |

- |

$ |

- |

|||

|

Terminal services |

12,006 | 12,129 | 11,032 | ||||||

|

Railcar capacity |

13,818 |

- |

- |

||||||

|

Other |

1,988 | 714 |

- |

||||||

|

Total revenues |

50,937 | 12,843 | 11,032 | ||||||

|

Operating expenses |

|||||||||

|

Operations and maintenance |

29,601 | 26,424 | 17,854 | ||||||

|

General and administrative |

3,114 | 1,403 | 1,402 | ||||||

|

Depreciation |

5,828 | 5,544 | 3,572 | ||||||

|

Total operating expenses |

38,543 | 33,371 | 22,828 | ||||||

|

Operating income (loss) |

$ |

12,394 |

$ |

(20,528) |

$ |

(11,796) | |||

|

|

|||||||||

The following table reflects selected operating data (in mmg, except railcar capacity billed):

|

|

|||||||||

|

|

Year Ended December 31, |

||||||||

|

|

2015 |

2014 |

2013 |

||||||

|

Product volumes |

|||||||||

|

Storage and throughput services (1) |

464.4 |

- |

- |

||||||

|

|

|||||||||

|

Terminal services: |

|||||||||

|

Affiliate |

107.4 | 109.9 | 121.1 | ||||||

|

Non-affiliate |

214.2 | 214.8 | 192.8 | ||||||

|

|

321.6 | 324.7 | 313.9 | ||||||

|

|

|||||||||

|

Railcar capacity billed (daily avg. mmg) (1)(2) |

64.0 |

- |

- |

||||||

|

|

|||||||||

(1) Volumetric data for periods before July 1, 2015, is not considered meaningful, as the related commercial agreements were not in effect prior to that date.

(2) Railcar capacity for 2015 is based on capacity since July 1, 2015, when the commercial agreement became effective.

Year Ended December 31, 2015, Compared with the Year Ended December 31, 2014

Revenues

Revenues generated from our storage and throughput agreement and rail transportation services agreement with Green Plains Trade, executed in connection with our IPO and effective beginning July 1, 2015, were $36.9 million for the year ended December 31, 2015.

Revenues generated by trucking and terminal services increased $1.2 million for the year ended December 31, 2015, compared with the same period for 2014, due to an increase in the number of trucks in service and locations where we do business.

Operations and Maintenance Expenses

Operations and maintenance expenses increased $3.2 million for the year ended December 31, 2015, compared with the same period for 2014, primarily due to increased railcar lease expenses, wages and fuel costs associated with our trucking operations. This was partially offset by a decrease in throughput unloading fees.

19

General and Administrative Expenses

General and administrative expenses increased $1.7 million for the year ended December 31, 2015, compared with the same period for 2014, primarily due to transaction costs related to the formation of the partnership and the acquisition of Hereford, Texas and Hopewell, Virginia storage and transportation assets, additional expenses attributable to being a public company, unit-based compensation and board fees.

Year Ended December 31, 2014, Compared with the Year Ended December 31, 2013

Revenues

Revenues generated by trucking and terminal services increased $1.8 million for the year ended December 31, 2014, compared with the same period in 2013, due to increased non-affiliate throughput revenues across BlendStar terminal facilities of $1.1 million, and the commencement of trucking operations at BlendStar in January 2014, resulting in 2014 revenues of $0.7 million.

Operations and Maintenance Expenses

Operations and maintenance expenses increased $8.6 million for the year ended December 31, 2014, compared with the same period in 2013, primarily due to increased railcar lease expenses.

Depreciation Expense

Depreciation expense increased $2.0 million for the year ended December 31, 2014, compared with the same period for 2013, primarily due to the acquisition of additional storage and leased railcar assets in November 2013.

Liquidity and Capital Resources

Our principal sources of liquidity include cash generated from operating activities and borrowings under our revolving credit facility. Capital expenditures are funded primarily from external sources, using a combination of debt and equity financing.

On July 1, 2015, upon completion of the IPO, we received net proceeds of $157.5 million from the sale of 11,500,000 common units, after deducting underwriting discounts of $10.3 million, structuring fees of $0.9 million and other IPO expenses of approximately $3.8 million. We used the net proceeds to make a cash distribution of $155.3 million to Green Plains, in part, as reimbursement of certain capital expenditures incurred and to pay $0.9 million in origination fees under our new revolving credit facility. We retained the remaining $1.3 million for general partnership purposes.

On December 31, 2015, our cash and cash equivalents were $16.4 million and we had no borrowings against our $100.0 million revolving credit facility. Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets located in Hereford, Texas and Hopewell, Virginia from our parent for consideration of $62.3 million, which we financed by drawing $48.0 million on the revolving credit facility and using cash on hand.

Our ongoing sources of liquidity include cash generated from operations, borrowings under our revolving credit facility and issuances of additional debt and equity securities. We consider opportunities to repay, redeem, repurchase or refinance our debt, depending on market conditions, as part of our normal course of doing business. Our ability to meet our debt service obligations and other capital requirements depends on our future operating performance, which is subject to general economic, financial, business, competitive, legislative, regulatory and other conditions, many of which are beyond our control.

We plan to fund future expansion capital expenditures primarily from external sources, including borrowings under our revolving credit facility and issuances of debt and equity securities, and expect these sources will be adequate for both our short-term and long-term liquidity needs.

Net cash provided by operating activities was $15.7 million in 2015 compared with net cash used by operating activities of $16.3 million in 2014. Cash flows from operating activities were affected primarily by increases in operating profits and decreases in working capital. Net cash used by investing activities was $1.5 million in 2015, primarily due to capital expenditures for expansion projects. Net cash used by financing activities was $3.6 million in 2015, primarily due to IPO-related activity and an equity distribution of $3.3 million from a subsidiary of the MLP predecessor to our parent in February 2015.

20

We incurred capital expenditures of $1.5 million in 2015 for various projects, including $1.2 million related to the purchase of additional trucks and tankers. Capital spending for 2016 is expected to be approximately $6.1 million related to our investment in the Maumelle, Arkansas unit train joint venture, which we expect to finance primarily with our revolving credit facility.

Revolving Credit Facility

On July 1, 2015, Green Plains Operating Company entered into an agreement for a five-year, $100.0 million revolving credit facility with various lenders to fund working capital, acquisitions, distributions, capital expenditures and other general partnership purposes. The revolving credit facility contains customary representations and warranties, affirmative and negative covenants and events of default. The negative covenants restrict our ability to incur additional debt, acquire and sell assets, create liens, invest capital, pay distributions, and materially amend our commercial agreements with Green Plains Trade. The facility can be increased by up to $50.0 million without the consent of the lenders and is available for revolving loans, including sublimits of $15.0 million for swing line loans and $15.0 million for letters of credit. For more information related to our debt, see Note 8 – Debt to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

We had no borrowings outstanding under the revolving credit facility and were in compliance with our debt covenants as of December 31, 2015. Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets located in Hereford, Texas and Hopewell, Virginia from our parent for consideration of $62.3 million, which we financed by drawing $48.0 million on the revolving credit facility and using cash on hand. We expect to maintain compliance with our debt covenants over the next twelve months.

Distributions to Unitholders

The partnership agreement provides for a minimum quarterly distribution of $0.40 per unit, which equates to approximately $13.0 million per quarter, or $51.9 million per year, based on the 2% general partner interest and the number of common and subordinated units currently outstanding. For more information, see Note 11 – Partners’ Capital to the consolidated financial statements included under Recast Item 15 – Exhibits, Financial Statement Schedules.

On October 22, 2015, the board of directors of our general partner declared our first quarterly cash distribution of $0.40 per unit for the third quarter ended September 30, 2015. The distribution was paid on November 13, 2015, to unitholders of record as of November 6, 2015.

On January 21, 2016, the board of directors of our general partner declared a quarterly cash distribution of $0.4025 per unit, or $1.61 per unit on an annualized basis, for the quarter ended December 31, 2015. The distribution is payable on February 12, 2016, to unitholders of record as of February 5, 2016.

Recast Contractual Obligations

Our contractual obligations as of December 31, 2015, were as follows (in thousands):

|

|

|||||||||||||||

|

|

Payments Due By Period |

||||||||||||||

|

Contractual Obligations |

Total |

Less Than |

1-3 Years |

3-5 Years |

More Than |

||||||||||

|

Long-term and short-term debt obligations (1) |

$ |

8,100 |

$ |

- |

$ |

- |

$ |

665 |

$ |

7,435 | |||||

|

Interest and fees on debt obligations (2) |

1,002 | 100 | 200 | 197 | 505 | ||||||||||

|

Operating leases (3) |

64,627 | 22,560 | 26,084 | 15,150 | 833 | ||||||||||

|

Service agreements (4) |

514 | 292 | 222 |

- |

- |

||||||||||

|

Other (5) |

4,030 | 638 | 371 | 1,164 | 1,857 | ||||||||||

|

Total contractual obligations |

$ |

78,273 |

$ |

23,590 |

$ |

26,877 |

$ |

17,176 |

$ |

10,630 | |||||

(1) Includes the current portion of long-term debt and excludes the effect of any debt discounts.

(2) Interest amounts are calculated over the terms of the loans using current interest rates, assuming scheduled principal and interest amounts are paid pursuant to the debt agreements. Includes administrative and/or commitment fees on debt obligations.

(3) Operating lease costs are primarily for property and railcar leases.

(4) Service agreements are related to minimum commitments on unloading contracts.

(5) Includes asset retirement obligations to return property to its original condition at the termination of lease agreements.

21

Effects of Inflation

Inflation in the United States has been relatively low in recent years and we do not expect it to have a material impact on our future results of operations.

Critical Accounting Policies and Estimates

The preparation of our consolidated financial statements requires that we use estimates that affect the reported assets, liabilities, revenues, expenses and related disclosures for contingent assets and liabilities. We base our estimates on experience and assumptions we believe are proper and reasonable. While we regularly evaluate the appropriateness of these estimates, actual results could differ materially from our estimates. The following accounting policies, in particular, may be impacted by judgments, assumptions and estimates used to prepare our consolidated financial statements.

Revenue Recognition

A substantial portion of our revenues and cash flows are derived from commercial agreements with Green Plains Trade. We recognize revenues when evidence of an arrangement exists; there is risk of loss and title transfer to the customer; the price is fixed or determinable; and collectability is reasonably assured. Storage, terminal and transportation services revenues are recognized when services are performed, which occurs when the product is delivered to the customer.