UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission File Number 001-37469

Green Plains PARTNERS LP

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware |

47-3822258 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

450 Regency Parkway, Suite 400, Omaha, NE 68114 |

(402) 884-8700 |

|

(Address of principal executive offices, including zip code) |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: Common Units Representing Limited Partnership Interest

Name of exchanges on which registered: Nasdaq Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non‑accelerated filer ☒ Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

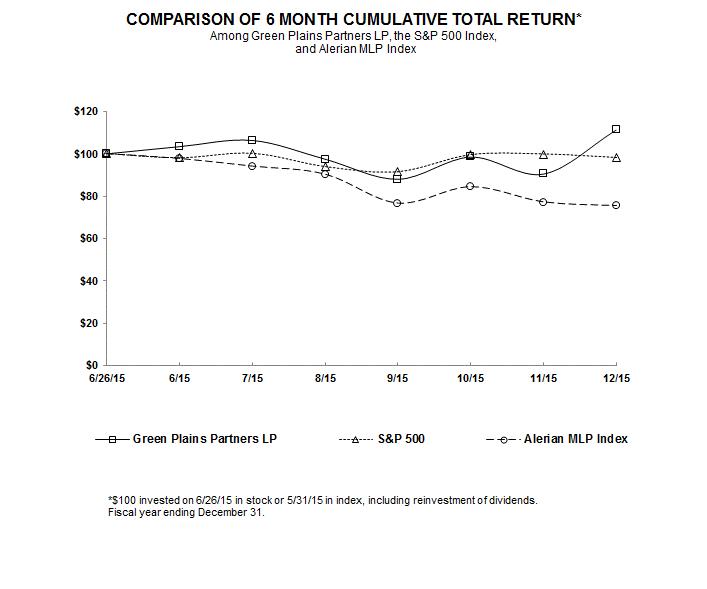

The aggregate market value of the registrant’s common units held by non-affiliates of the registrant as of June 30, 2015, based upon the last sale price of the common units on such date, was approximately $245.1 million. For purposes of this calculation, executive officers and directors and holders of 10% of more of the registrant’s common units are deemed to be affiliates of the registrant. Common units began trading on June 26, 2015; however, our initial public offering closed on July 1, 2015.

As of February 12, 2016, the registrant had 15,899,731 common units and 15,889,642 subordinated units outstanding.

|

|

|

|

|

|

Page |

|

|

PART I |

||

|

2 |

||

|

|

|

|

|

Item 1. |

5 |

|

|

Item 1A. |

11 |

|

|

Item 1B. |

37 |

|

|

Item 2. |

37 |

|

|

Item 3. |

37 |

|

|

Item 4. |

37 |

|

|

PART II |

||

|

Item 5. |

38 |

|

|

Item 6. |

40 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

42 |

|

Item 7A. |

51 |

|

|

Item 8. |

51 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

51 |

|

Item 9A. |

51 |

|

|

Item 9B. |

52 |

|

|

PART III |

||

|

Item 10. |

53 |

|

|

Item 11. |

57 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

61 |

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence. |

63 |

|

Item 14. |

67 |

|

|

PART IV |

||

|

Item 15. |

68 |

|

|

70 |

||

1

The abbreviations, acronyms and industry terminology used in this annual report are defined as follows:

Green Plains Partners LP and Subsidiaries:

|

Birmingham |

Birmingham BioEnergy Partners LLC, a subsidiary of BlendStar LLC |

|

BlendStar |

BlendStar LLC and its subsidiaries, the partnership’s predecessor for accounting purposes |

|

Green Plains Capital Company |

Green Plains Capital Company LLC |

|

Green Plains Ethanol Storage |

Green Plains Ethanol Storage LLC |

|

Green Plains Logistics |

Green Plains Logistics LLC |

|

Green Plains Operating Company |

Green Plains Operating Company LLC |

|

Green Plains Partners; the partnership |

Green Plains Partners LP and its subsidiaries |

|

Green Plains Trucking II |

Green Plains Trucking II LLC |

|

MLP predecessor |

BlendStar LLC and its subsidiaries, and the assets, liabilities and results of operations of the ethanol storage and leased railcar assets contributed by Green Plains |

Green Plains Inc. and Subsidiaries:

|

Green Plains; our parent |

Green Plains Inc. and its subsidiaries |

|

Green Plains Hereford |

Green Plains Hereford LLC |

|

Green Plains Holdings |

Green Plains Holdings LLC; our general partner |

|

Green Plains Hopewell |

Green Plains Hopewell LLC |

|

Green Plains Obion |

Green Plains Obion LLC |

|

Green Plains Trade |

Green Plains Trade Group LLC |

|

Green Plains Trucking |

Green Plains Trucking LLC |

Accounting Defined Terms:

|

ARO |

Asset retirement obligation |

|

ASC |

Accounting Standards Codification |

|

EBITDA |

Earnings before interest, taxes, depreciation and amortization |

|

Exchange Act |

Securities Exchange Act of 1934, as amended |

|

FASB |

Financial Accounting Standards Board |

|

GAAP |

U.S. Generally Accepted Accounting Principles |

|

IDR |

Incentive distribution right |

|

IPO |

Initial public offering of Green Plains Partners LP |

|

IRA |

Individual retirement account |

|

IRS |

Internal Revenue Service |

|

JOBS Act |

Jumpstart Our Business Startups Act of 2012 |

|

LIBOR |

London Interbank Offered Rate |

|

LTIP |

Green Plains Partners LP 2015 Long-Term Incentive Plan |

|

Nasdaq |

The Nasdaq Global Market |

|

NEO |

Named executive officer |

|

NMTC |

New markets tax credits |

|

PCAOB |

Public Company Accounting Oversight Board |

|

Securities Act |

Securities Act of 1933 |

|

SEC |

Securities and Exchange Commission |

Industry Defined Terms:

|

Bgy |

Billion gallons per year |

|

BNSF |

BNSF Railway Company |

|

CAFE |

Corporate Average Fuel Economy |

|

CARB |

California Air Resources Board |

|

CBOB |

Conventional blendstock for oxygenate blending |

2

|

Clean Water Act |

Water Pollution Control Act of 1972 |

|

CSX |

CSX Transportation, Inc. |

|

DOT |

U.S. Department of Transportation |

|

E15 |

Gasoline blended with up to 15% ethanol by volume |

|

E85 |

Gasoline blended with up to 85% ethanol by volume |

|

EIA |

U.S. Energy Information Administration |

|

EISA |

Energy Independence and Security Act of 2007, as amended |

|

EPA |

U.S. Environmental Protection Agency |

|

FRA |

Federal Railroad Administration |

|

ILUC |

Indirect land usage charge |

|

KCS |

Kansas City Southern Railway Company |

|

LCFS |

Low Carbon Fuel Standard |

|

Mmg |

Million gallons |

|

Mmgy |

Million gallons per year |

|

MTBE |

Methyl tertiary-butyl ether |

|

OSHA |

U.S. Occupational Safety and Health Administration |

|

PHMSA |

Pipeline and Hazardous Materials Safety Administration |

|

RFS II |

Renewable Fuels Standard II |

|

RIN |

Renewable identification number |

|

U.S. |

United States |

|

USDA |

U.S. Department of Agriculture |

3

Cautionary Statement Regarding Forward-Looking Statements

The SEC encourages companies to disclose forward-looking information so investors can better understand future prospects and make informed investment decisions. As such, we have included forward-looking statements in this report or by reference to other documents filed with the SEC.

Forward-looking statements are made in accordance with safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on current expectations which involve a number of risks and uncertainties and do not relate strictly to historical or current facts, but rather to plans and objectives for future operations. These statements include words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “outlook,” “plan,” “predict,” “may,” “could,” “should,” “will” and similar words and phrases as well as statements regarding future operating or financial performance or guidance, business strategy, environment, key trends and benefits of actual or planned acquisitions.

Factors that could cause actual results to differ from those expressed or implied are discussed in this report under Item 1A – Risk Factors or incorporated by reference. Specifically, we may experience fluctuations in future operating results due to changes in general economic, market or business conditions; foreign imports of ethanol; fluctuations in demand for ethanol and other fuels; risks of accidents or other unscheduled shutdowns affecting our assets, including mechanical breakdown of equipment or infrastructure; risks associated with changes to federal policy or regulation; ability to comply with changing government usage mandates and regulations affecting the ethanol industry; price, availability and acceptance of alternative fuels and alternative fuel vehicles, and laws mandating such fuels or vehicles; changes in operational costs at our facilities and for our railcars; failure to realize the benefits projected for capital projects; competition; inability to successfully implement growth strategies; the supply of corn and other feedstocks; unusual or severe weather conditions and natural disasters; ability and willingness of parties with whom we have material relationships, including Green Plains Trade, to fulfill their obligations; labor and material shortages; changes in the availability of unsecured credit and changes affecting the credit markets in general; and other risk factors detailed in our reports filed with the SEC.

We believe our expectations regarding future events are based on reasonable assumptions; however, these assumptions may not be accurate or account for all risks and uncertainties. Consequently, forward-looking statements are not guaranteed. Actual results may vary materially from those expressed or implied in our forward-looking statements. In addition, we are not obligated and do not intend to update our forward-looking statements as a result of new information unless it is required by applicable securities laws. We caution investors not to place undue reliance on forward-looking statements, which represent management’s views as of the date of this report or documents incorporated by reference.

4

PART I

References to “we,” “our,” “us” or the “partnership” used in present tense for periods beginning on or after July 1, 2015, refer to Green Plains Partners LP and its subsidiaries. References to the “MLP predecessor” used in a historical context for periods ended on or before June 30, 2015, refer to BlendStar LLC and its subsidiaries, the partnership’s predecessor for accounting purposes, and the assets, liabilities and results of operations of the ethanol storage and leased railcar assets contributed by Green Plains.

Formation and Initial Public Offering

We are a master limited partnership formed by our parent on March 2, 2015. On July 1, 2015, we completed our IPO of 11,500,000 common units representing limited partner interests. Our common units are traded under the symbol “GPP” on Nasdaq. After completing the IPO, in addition to the interests of BlendStar, we received the assets and liabilities of the ethanol storage and leased railcar assets, previously owned and operated by our parent, in a transfer between entities under common control.

Overview

Green Plains Partners is a Delaware limited partnership that provides fee-based fuel storage and transportation services by owning, operating, developing and acquiring ethanol and fuel storage tanks, terminals, transportation assets and other related assets and businesses. We were formed by Green Plains, a vertically integrated ethanol producer, to support its marketing and distribution activities as its primary downstream logistics provider.

We generate a substantial portion of our revenues under fee-based commercial agreements with Green Plains Trade for receiving, storing, transferring and transporting ethanol and other fuels, which are supported by minimum volume or take-or-pay capacity commitments. We do not take ownership or receive any payments based on the value of the ethanol or other fuels we handle. As a result, we do not have any direct exposure to fluctuating commodity prices.

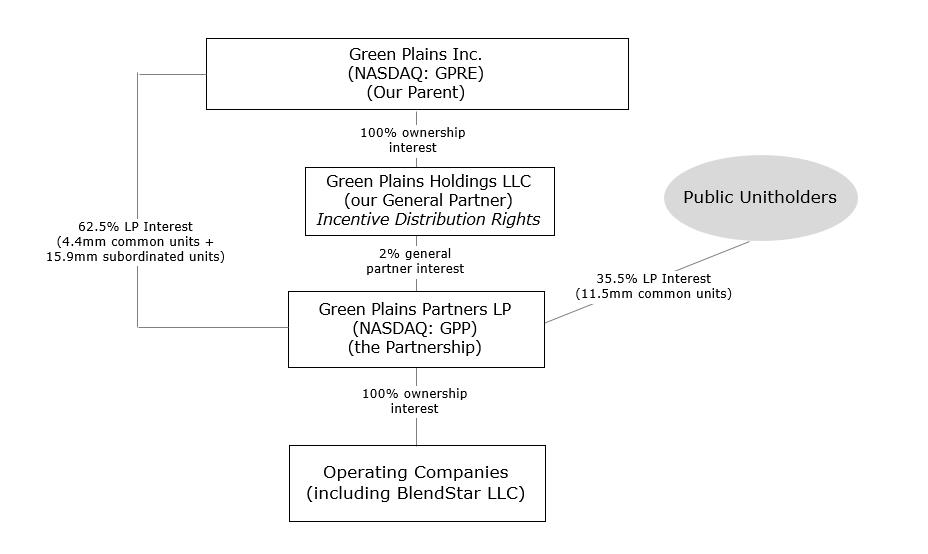

Our parent owns a 62.5% limited partner interest in us, consisting of 4,389,642 common units and 15,889,642 subordinated units, all of our incentive distribution rights and a 2.0% general partner interest. The public owns the remaining 35.5% limited partner interest. The following diagram depicts our simplified organizational structure at December 31, 2015:

Our Assets and Operations

Ethanol Storage. Our ethanol storage assets are the principal method of storing the ethanol produced at our parent’s ethanol production plants. Each of our parent’s ethanol production plants are located near major rail lines. Ethanol is

5

distributed from our storage facilities to bulk terminals via truck or railcar.

We own 30 ethanol storage facilities and approximately 47 acres of land. Our storage tanks are located at our parent’s 14 ethanol production plants in Indiana, Iowa, Michigan, Minnesota, Nebraska, Tennessee, Texas and Virginia.

Our ethanol storage tanks have combined storage capacity of approximately 31.8 mmg and aggregate throughput capacity of approximately 1,677 mmgy. For the year ended December 31, 2015, the ethanol storage assets had throughput of approximately 948 mmg, representing 91.1% of our parent’s daily average production capacity. The following table presents additional ethanol production plant details by location:

|

Plant Location |

Initial Operation or Acquisition Date |

Major Rail Line Access |

Plant Production Capacity (mmgy) |

On-Site Ethanol Storage Capacity (thousands of gallons) |

Throughput |

|

Atkinson, Nebraska |

June 2013 |

BNSF |

53 |

2,074 |

45 |

|

Bluffton, Indiana |

Sept. 2008 |

Norfolk Southern |

120 |

3,000 |

116 |

|

Central City, Nebraska |

July 2009 |

Union Pacific |

106 |

2,250 |

101 |

|

Fairmont, Minnesota |

Nov. 2013 |

Union Pacific |

119 |

3,124 |

91 |

|

Hereford, Texas (1) |

Nov. 2015 |

BNSF |

100 |

4,406 |

12 |

|

Hopewell, Virginia (1)(2) |

Oct. 2015 |

Norfolk Southern |

60 |

761 |

- |

|

Lakota, Iowa |

Oct. 2010 |

Union Pacific |

112 |

2,500 |

99 |

|

Obion, Tennessee |

Nov. 2008 |

Canadian National |

120 |

3,000 |

115 |

|

Ord, Nebraska |

July 2009 |

Union Pacific |

55 |

1,550 |

56 |

|

Otter Tail, Minnesota |

Mar. 2011 |

BNSF |

60 |

2,000 |

49 |

|

Riga, Michigan |

Oct. 2010 |

Norfolk Southern |

60 |

1,239 |

50 |

|

Shenandoah, Iowa |

Aug. 2007 |

BNSF |

69 |

1,524 |

69 |

|

Superior, Iowa |

July 2008 |

Union Pacific |

60 |

1,238 |

51 |

|

Wood River, Nebraska |

Nov. 2013 |

Union Pacific |

121 |

3,124 |

94 |

|

Total |

1,215 |

31,790 |

948 |

(1) The ethanol storage and railcar assets at the Hereford and Hopewell plants were acquired on January 1, 2016, from our parent. Throughput for the year ended December 31, 2015, relates only to the period since the assets were acquired by our parent.

(2) The Hopewell plant resumed operations on February 8, 2016.

Terminal and Distribution Services. We own and operate eight fuel terminals with access to major rail lines that have combined total storage capacity of approximately 7.4 mmg in Alabama, Louisiana, Mississippi, Kentucky, Tennessee and Oklahoma. We also own approximately five acres of land and lease approximately 19 acres of land where our fuel terminals are located. For the year ended December 31, 2015, the aggregate throughput at these facilities was approximately 321.5 mmg.

Ethanol is transported from our terminals to third-parties for blending with gasoline and transferred to a loading rack for delivery by truck to retail gas stations. Our Birmingham facility is one of 20 facilities in the United States capable of efficiently receiving and offloading ethanol and other fuels from unit trains.

The following table presents additional fuel terminal details by location:

|

Fuel Terminal Facility Location |

Major |

On-Site Storage Capacity |

Throughput Capacity (mmgy) |

|

Birmingham, Alabama - Unit Train Terminal |

BNSF |

6,542 |

300 |

|

Other Fuel Terminal Facilities |

(1) |

880 |

522 |

|

7,422 |

822 |

(1) Access to our seven other fuel terminal facilities is available from BNSF, KCS, Canadian National, Union Pacific, Norfolk Southern and CSX.

Transportation and Delivery. Ethanol deliveries to distant markets are shipped using major U.S. rail carriers that can switch cars to other major railroads. Our leased railcar fleet consists of approximately 2,500 railcars with an aggregate capacity of approximately 76.3 mmg. We expect our railcar volumetric capacity will fluctuate over the normal course of business as our existing railcar leases expire and we enter into or acquire new railcar leases. Our volumetric capacity is used to transport product primarily from our fuel terminals or third-party production facilities to international export terminals and

6

refineries located throughout the United States.

We also own and operate a fleet of seven trucks to transport ethanol and other biofuels.

Segments

Our operations consist of one reportable segment with all business activities conducted in the United States.

Our Relationship with Green Plains

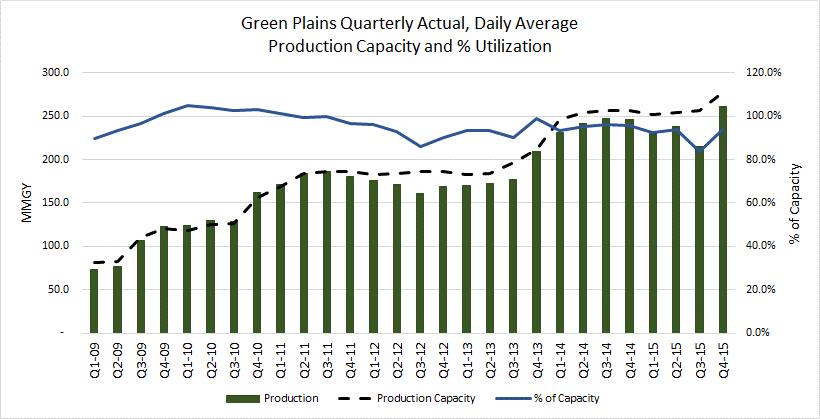

Our parent is a vertically integrated producer, marketer and distributor of ethanol and the fourth largest producer in North America. Our parent mitigates commodity price volatility by having operations throughout the ethanol value chain, which differentiates it from other companies focused only on ethanol production.

We benefit significantly from our relationship with our parent. Our assets are the principal method of storing and delivering the ethanol our parent produces for its customers and the commercial agreements with Green Plains Trade account for a substantial portion of our revenues.

Our parent has a majority interest in us through ownership of our general partner, a 62.5% limited partner interest and all of our incentive distribution rights. We believe our parent will continue to support the successful execution of our business strategies given its significant ownership in us and the importance of our assets to Green Plains’ operations.

We entered into several agreements with our parent, which were established in conjunction with the IPO, including: an omnibus agreement; a contribution, conveyance and assumption agreement; an operational services and secondment agreement; and various commercial agreements described below. For additional information related to these agreements, please refer to Note 3 – Initial Public Offering to the consolidated financial statements in this report.

Commercial Agreements with Affiliate

A substantial portion of our revenues and cash flows are derived from our commercial agreements with Green Plains Trade, our primary customer, including a (1) ten-year fee-based storage and throughput agreement, (2) Birmingham terminal services agreement, (3) six-year fee-based rail transportation services agreement and (4) various other transportation and terminal services agreements. For the agreements in their entirety, please refer to the current report on Form 8-K filed with the SEC on July 6, 2015, and the amendments filed with this report.

Minimum Volume Commitments. Our storage and throughput agreement and certain terminal services agreements with Green Plains Trade are supported by minimum volume commitments. Our rail transportation services agreement is supported by minimum take-or-pay capacity commitments. Green Plains Trade is required to pay us fees for these minimum commitments regardless of the actual throughput or volume, capacity used or amount of product tendered for transport, assuring us that we will receive a certain amount of revenue during the terms of these agreements. The nature of these arrangements will provide stable and predictable cash flows over time.

Storage and Throughput Agreement. Under our storage and throughput agreement, Green Plains Trade is obligated to throughput a minimum of 246.5 mmg of product per calendar quarter at our storage facilities. Green Plains Trade is obligated to pay $0.05 per gallon on all throughput volumes, subject to an inflation escalator based on the producer price index following the last day of the primary term’s fifth year. If Green Plains Trade fails to meet its minimum volume commitment during any quarter, Green Plains Trade will pay us a deficiency payment equal to the deficient volume multiplied by the applicable fee. The deficiency payment may be applied as a credit toward volumes throughput by Green Plains Trade in excess of the minimum volume commitment during the next four quarters, after which time any unused credits will expire. For each of the quarters ended September 30, 2015, and December 31, 2015, Green Plains Trade met its minimum volume commitment, with throughput of 215.6 mmg and 248.8 mmg, respectively. At December 31, 2015, the remaining primary term of our storage and throughput agreement was 9.5 years. The storage and throughput agreement will automatically renew for successive one-year terms unless either party provides written notice of its intent to terminate at least 360 days prior to the end of the remaining primary or renewal term.

The current minimum volume commitment was increased from 212.5 mmg of product per calendar quarter in connection with the acquisition of the Hereford, Texas and Hopewell, Virginia ethanol storage and leased railcar assets, effective January 1, 2016. All other terms and conditions are substantially the same as the initial agreement.

7

Terminal Services Agreement. Under our terminal services agreement for the Birmingham facility, Green Plains Trade is obligated to pay $0.0355 per gallon on all throughput volumes, subject to a minimum volume commitment of approximately 2.8 mmg per month of ethanol and other fuels, equivalent to 33.2 mmgy, as well as fees for ancillary services. At December 31, 2015, the remaining primary term of the terminal services agreement was approximately two years. The terminal services agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 90 days prior to the end of the remaining primary or renewal term. Other terminal services agreements with Green Plains Trade and third parties also contain minimum volume commitments with various remaining terms.

Rail Transportation Service Agreement. Under our rail transportation services agreement, Green Plains Trade is obligated to transport ethanol and other fuels by rail from identified receipt and delivery points and pay an average monthly fee of approximately $0.0358 per gallon for all railcar volumetric capacity provided. Currently, our minimum railcar volumetric capacity commitment is 76.3 mmg and the weighted average remaining term of all railcar lease agreements is 2.9 years. At December 31, 2015, the remaining primary term of our rail transportation services agreement was 5.5 years. The rail transportation services agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 360 days prior to the end of the remaining primary or renewal term.

We lease our railcars from third parties under lease agreements with various terms. The minimum take-or-pay capacity commitment is reduced by the capacity of the railcars subject to expiration under our lease agreements.

Effective January 1, 2016, the rail transportation services agreement was amended in connection with the acquisition of the Hereford, Texas and Hopewell, Virginia ethanol storage and leased railcar assets. The amended agreement increased the minimum railcar volumetric capacity commitment by 6.7 mmg, to its current level. All other terms and conditions are substantially the same as the initial agreement.

Green Plains Trade is also obligated to pay a monthly fee of approximately $0.0013 per gallon for logistical operations management and other services based on railcar volumetric capacity obtained by Green Plains Trade from third parties.

Trucking Transportation Agreement. Under our trucking transportation agreement, Green Plains Trade pays us to transport ethanol and other fuels from identified receipt and delivery points by truck. At December 31, 2015, the remaining term of our trucking transportation agreement was six months. The trucking transportation agreement will automatically renew for successive one-year renewal terms unless either party provides written notice of its intent to terminate at least 30 days prior to the end of the remaining primary or renewal term. Green Plains Trade is obligated to pay a monthly trucking transportation services fee equal to the aggregate amount of product volume transported in a calendar month multiplied by the applicable rate for each truck lane.

We also entered into an omnibus agreement and an operational services and secondment agreement with our parent. For more information, see Note 3 – Initial Public Offering to the consolidated financial statements in this report.

Competitive Strengths

We believe that the following competitive strengths position us to successfully execute our business strategies:

Stable and Predictable Cash Flows. A substantial portion of our revenues and cash flows are derived from long-term, fee-based commercial agreements with Green Plains Trade, including a storage and throughput agreement, rail transportation services agreement, terminal services agreement and other transportation agreements. Our storage and throughput agreement and certain terminal services agreements are supported by minimum volume commitments, and our rail transportation services agreement is supported by minimum take-or-pay capacity commitments. Green Plains Trade is obligated to pay us fees for these minimum commitments regardless of actual throughput or volume, capacity used or amount of product tendered for transport, assuring us that we will receive a certain amount of revenue during the terms of these agreements.

Advantageous Relationship with Our Parent. Our assets are the principal method of storing and delivering the ethanol our parent produces, and the related agreements with Green Plains Trade include minimum volume or take-or-pay capacity commitments. Furthermore, as general partner and owner of a 62.5% limited partner interest in us and all of our incentive distribution rights, our parent directly benefits from our growth, which provides incentive to pursue projects that directly or indirectly enhance the value of our business and assets. This can be accomplished though organic expansion, accretive acquisitions or the development of downstream distribution services. Under an omnibus agreement, we are granted the right of first offer, for a period of five years, on any ethanol storage asset, fuel terminal facility or transportation asset our parent owns, constructs or acquires and decides to sell.

8

Quality Assets. Our portfolio of assets have an expected remaining weighted average useful life of over 20 years. Our assets are strategically located in eight states near major rail lines, which minimizes our exposure to weather-related downtime and transportation congestion, while enabling access to markets across the United States. Given the nature of our assets, we expect to incur only modest maintenance-related expenses and capital expenditures in the near future.

Financial Strength and Flexibility. Our borrowing capacity and ability to access debt and equity capital markets provide financial flexibility necessary to achieve our organic and acquisition growth strategies.

Proven Management Team. Each member of our senior management team is an employee of our parent who also devotes time to manage our business affairs. We believe the level of commercial, operational and financial expertise of our senior management team, which averages approximately 25 years of industry experience, will allow us to successfully execute our business strategies.

Business Strategy

We believe ethanol could become an increasingly larger portion of the global fuel supply driven by volatile oil prices, heightened environmental concerns, energy independence and national security concerns. We intend to further develop and strengthen our business by pursuing the following growth strategies:

Generate Stable, Fee-Based Cash Flows. A substantial portion of our revenues and cash flows are derived from our commercial agreements with Green Plains Trade. Under these agreements, we do not have direct exposure to fluctuating commodity prices. We will continue to establish fee-based contracts with our parent and third parties that generate stable and predictable cash flows as we grow.

Grow Organically. We will collaborate with our parent and other potential third-party customers to identify opportunities to construct assets that provide us with stable cash flows through fee-based service agreements. Plant expansion by our parent that increases its production capacity also increases annual throughput at our facilities. Our capital expenditures associated with expansion would be minimal since our ethanol storage facilities have available capacity to accommodate growth.

Acquire Strategic Assets. We intend to pursue strategic acquisitions independently and jointly with our parent to grow our business. The U.S. ethanol production industry is poised for consolidation. Our parent has a proven history of identifying, acquiring and integrating assets that are accretive to its business. Under the omnibus agreement, we have a five-year, right of first offer on any fuel storage, terminal or transportation asset our parent owns, constructs or acquires and decides to sell. In addition, we intend to continually monitor the marketplace to identify and pursue assets that complement or diversify our existing operations, including fuel storage and terminal assets in close proximity to our existing asset base.

Development of Downstream Distribution Services. Our parent will continue to use its logistical capabilities and expertise to further develop downstream ethanol distribution services. We will benefit from our parent’s marketing and distribution strategy due to the strategic locations of our ethanol storage facilities and fuel terminal facilities.

Conduct Safe, Reliable and Efficient Operations. We conduct routine inspections of our assets in accordance with applicable laws and regulations and are committed to maintaining safe, reliable and environmentally compliant operations. We seek to improve our operating performance through preventive maintenance, employee training, and safety and development programs.

Recent Developments

On November 4, 2015, we announced plans to form a joint venture, as a 50% partner, to build an ethanol unit train terminal in Maumelle, Arkansas. The terminal will be capable of unloading 110-car unit trains in less than 24 hours and initially include storage for approximately 4.2 mmg of ethanol. The project is expected to cost approximately $12 million and be completed during the fourth quarter of 2016.

Effective January 1, 2016, we acquired the ethanol storage and leased railcar assets of the Hereford, Texas and Hopewell, Virginia ethanol production facilities from our parent for initial consideration of $62.5 million. We used our revolving credit facility and cash on hand to fund the purchase. The acquired assets include three ethanol storage tanks that support the plants’ combined production capacity of approximately 160 mmgy and 224 leased railcars with volumetric capacity of approximately 6.7 mmg. We amended the storage and throughput agreement with Green Plains Trade, increasing

9

the minimum volume commitment from 212.5 mmg to 246.5 mmg per calendar quarter. We also amended the rail transportation services agreement, increasing the minimum railcar volumetric capacity commitment 6.7 mmg to 76.3 mmg.

Our Competition

Our contractual relationship with Green Plains Trade and the integrated nature of our storage tanks with our parent’s production facilities minimizes potential competition for storage and distribution services provided under our commercial agreements from other third-party operators.

We compete with independent fuel terminal operators and major fuel producers for terminal services based on terminal location, services provided, safety and cost. While there are numerous fuel producers and distributors that own terminal operations similar to ours, they are not typically focused on providing services to third parties. Independent operators are often located near key distribution points with cost advantages and provide more efficient services and distribution capabilities into strategic markets with a variety of transportation options. Companies often rely on independent providers when their own storage facilities cannot handle their volumes or they cannot manage their throughput adequately due to lack of expertise, market congestion, size constraints, optionality or the nature of the materials being stored.

We believe we are well-positioned to compete effectively in a growing market due to our expertise managing third-party terminal services and logistics. We are a low-cost operator, focused on safety and efficiency, capable of managing the needs of multiple constituencies across geographical markets. While the competitiveness of our services can be impacted by competition from new entrants, transportation constraints, industry production levels and related storage needs, we believe there are significant barriers to entry that partially mitigate these risks, including significant capital costs, execution risk, complex permitting requirements, development cycle, financial and working capital constraints, expertise and experience, and ability to effectively capture strategic assets or locations.

Seasonality

Our business is directly affected by the supply and demand for ethanol and other fuels in the markets served by our assets. However, the effects of seasonality on our revenues are substantially mitigated through our fee-based commercial agreements with Green Plains Trade, which include minimum volume or take-or-pay capacity commitments.

Major Customer

Revenues from Green Plains Trade, controlled by our parent, totaled approximately $42.5 million, or 83.5%, of our consolidated revenues for 2015. We are highly dependent on Green Plains Trade and expect to derive most of our revenues from them in the foreseeable future. Accordingly, we are indirectly subject to the business risks of Green Plains Trade. For additional information, please read Risk Factors—Risks Related to Our Business. Since a substantial majority of our revenues are, and in the foreseeable future are expected to be, derived from Green Plains Trade, any development that materially and adversely affects Green Plain Trade’s operations, financial condition or market reputation could have a material adverse impact on us.

Regulatory Matters

Government Ethanol Programs and Policies

The domestic ethanol market is impacted by federal mandates under the RFS II, which sets the required volume of renewable fuel to be blended with transportation fuel in the United States. On June 10, 2015, the EPA proposed volume targets for conventional ethanol of 13.25 billion gallons, 13.40 billion gallons and 14.00 billion gallons for 2014, 2015 and 2016, respectively. On November 30, 2015, the EPA announced final volume requirements for conventional ethanol that were higher than the levels proposed in June of 13.61 billion gallons, 14.05 billion gallons and 14.50 billion gallons for 2014, 2015 and 2016, respectively.

In April 2013, the Master Limited Partnership Parity Act was introduced in the U.S. House of Representatives as H.R. 1696 to extend the publicly traded partnership ownership structure to renewable energy projects, including ethanol production. The legislation was proposed to provide a more level financing system and tax burden for renewable energy equal to fossil energy projects. H.R. 1696 did not advance out of committee during the 113th Congress and its co-sponsors have not re-introduced the bill.

10

Environmental Regulation

Our operations are subject to environmental regulations, including those that govern the handling and release of ethanol, crude oil and other liquid hydrocarbon materials. Compliance with existing and anticipated environmental laws and regulations will increase our overall cost of business, including capital costs to construct, maintain, operate, and upgrade equipment and facilities. However, we do not believe that this will have a material impact on our operations or financial position.

There are also risks of accidental releases into the environment associated with our operations, such as releases of ethanol from our storage facilities. Should an event, such as an accidental release, not be covered by our insurance, we could be subject to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage, and fines or penalties for any related violations of environmental laws or regulations.

Under the omnibus agreement, our parent indemnified us from all known and certain unknown environmental liabilities associated with owning and operating our assets that occurred on or before the closing of the IPO. In turn, we have agreed to indemnify our parent from future environmental liabilities associated with the activities of the partnership.

Construction or maintenance of our terminal and storage facilities may impact wetlands, which are regulated by the EPA and the U.S. Army Corps of Engineers under the Clean Water Act.

Other Regulations

In July 2014, the DOT proposed new regulations to improve the transportation of flammable materials by rail, which it finalized on May 1, 2015. The Enhanced Tank Car Standards and Operational Controls for High-Hazard Flammable Trains calls for an enhanced tank car standard known as the DOT specification 117 and establishes a schedule to retrofit or replace older tank cars that carry crude oil and ethanol. The rule also establishes braking standards intended to reduce the severity of accidents and new operational protocols. Companies that transport hazardous materials must develop more accurate classification protocols. As a result of the final rule, lease costs for railcars may increase over the long term. Additionally, existing railcars could be out of service for a period of time while such upgrades are made, tightening supply in an industry that is highly dependent on railcars to transport product. We intend to retrofit or replace our leased railcars to comply with the new regulations. Retrofitting costs will be reimbursed by Green Plains Trade under our rail transportation services agreement.

Employees

We do not have any employees. We are managed and operated by the executive officers of our general partner, who are also officers of our parent, and our general partner’s board of directors. Our general partner and its affiliates have approximately 15 full-time equivalent employees under the direct management and supervision of our general partner for our operations.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available on our website at www.greenplainspartners.com shortly after we file or furnish the information with the SEC. You can also find the charter of our audit committee, as well as our code of ethics in the corporate governance section of our website. The information found on our website is not part of this or any other report we file or furnish with the SEC. For more information on our parent, please visit www.gpreinc.com. Alternatively, investors may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549 or visit the SEC website at www.sec.gov to access our reports and information statements filed with the SEC.

Investing in our common units involves a high degree of risk. You should carefully consider the risks described below together with the other information set forth in this report before making an investment decision. Any of the following risks and uncertainties could have a material adverse effect on our financial condition, results of operations, cash flows and ability to make distributions to our unitholders. If that occurs, we may not be able to pay distributions on our common units, the trading price of our common units could decline materially, and you could lose all or part of your investment. Although many of our business risks are comparable to those faced by a corporation engaged in a similar business, limited partner interests are inherently different from the capital stock of a corporation and involve additional risks described below. The risks

11

discussed below are not the only risks we face. We may experience additional risks and uncertainties not currently known to us or as a result of developments occurring in the future. Conditions that we currently deem to be immaterial may also materially and adversely affect our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

Risks Related to Our Business and Industry

We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders.

In order to pay the minimum quarterly distribution of $0.40 per unit per quarter, or $1.60 per unit on an annualized basis, we will require available cash of approximately $13.0 million per quarter, or approximately $51.9 million per year, based on the 2% general partner interest and the number of common units and subordinated units outstanding. We may not have sufficient available cash each quarter to enable us to pay the minimum quarterly distribution. The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

|

· |

the volume of ethanol and other fuels that we handle; |

|

· |

the fees with respect to the volumes and capacity that we handle; |

|

· |

our entitlement to payments associated with the minimum commitments under our commercial agreements with Green Plains Trade; |

|

· |

timely payments under the commercial agreements by Green Plains Trade and other third parties; and |

|

· |

prevailing economic conditions. |

In addition, the actual amount of cash we have available for distribution will also depend on other factors, some of which are beyond our control, including:

|

· |

the amount of our operating expenses and general and administrative expenses, including reimbursements to our general partner in respect of those expenses; |

|

· |

the level of capital expenditures we make; |

|

· |

the cost of acquisitions and organic growth projects, if any; |

|

· |

our debt service requirements and other liabilities; |

|

· |

fluctuations in our working capital needs; |

|

· |

our ability to borrow funds and access capital markets; |

|

· |

restrictions that are contained in our revolving credit facility and other debt service requirements; |

|

· |

the amount of cash reserves established by our general partner; and |

|

· |

other business risks affecting our cash levels. |

The services we provide under commercial agreements with Green Plains Trade account for a substantial portion of our revenues. Therefore, we are subject to the business risks of Green Plains Trade and, as a result of its direct ownership by our parent, to the business risks of our parent. If Green Plains Trade is unable to satisfy its obligations under the commercial agreements with us for any reason, our revenues would decline and our financial condition, results of operations, cash flows and ability to make distributions to our unitholders would be adversely affected.

We entered into a storage and throughput agreement and two transportation services agreements with Green Plains Trade in connection with the IPO. Green Plains Trade’s obligations under such commercial agreements are guaranteed by our parent. Additionally, we have assumed all of BlendStar’s terminal services agreements with Green Plains Trade. The services we provide under commercial agreements with Green Plains Trade account for a substantial portion of our revenues for the foreseeable future; therefore we are subject to the risk of nonpayment or nonperformance by Green Plains Trade and our parent under the commercial agreements. Any event, whether related to our operations or otherwise, that materially and adversely affects Green Plains Trade’s or our parent’s financial condition, results of operations or cash flows may adversely affect our ability to sustain or increase cash distributions to our unitholders. Accordingly, we are indirectly subject to the following operational and business risks of our parent and its subsidiaries (including Green Plains Trade), among others:

12

|

· |

the price volatility of corn, natural gas, ethanol, distillers grains, corn oil and crude oil and our parent’s ability to manage the spread among the prices for such commodities; |

|

· |

our parent’s risk management strategies, including hedging transactions that may limit its gain and expose it to other risks; |

|

· |

Green Plains Trade’s liquidity could be materially and adversely affected if third parties are unable to make payments for their sales; |

|

· |

the ethanol industry’s dependency on government usage mandates for blending ethanol with gasoline which influences ethanol production and ethanol prices; |

|

· |

our parent’s indebtedness may limit its ability to obtain additional financing, and our parent may also face difficulties complying with the terms of its debt agreements; |

|

· |

covenants and events of default in our parent’s debt agreements could limit its ability to undertake certain types of transactions and adversely affect its liquidity; |

|

· |

our parent has capital needs and planned and unplanned maintenance expenses for which its internally generated cash flows and other sources of liquidity may not be adequate; |

|

· |

the dangers inherent in our parent’s operations could cause disruptions and could expose our parent to potentially significant losses, costs or liabilities; |

|

· |

environmental risks, incidents and violations that could give rise to material remediation costs, fines and other liabilities; |

|

· |

our parent may incur significant costs to comply with state and federal environmental, economic, health and safety, energy and other laws, policies and regulations and any changes in those laws, policies and regulations; |

|

· |

a material decrease in the supply of corn available to our parent’s ethanol production plants could significantly reduce its production levels; |

|

· |

demand for ethanol is uncertain and may be affected by changes to federal mandates, public perception, consumer acceptance and overall consumer demand for transportation fuel which would affect our parent’s results of operations; |

|

· |

increased federal support of cellulosic ethanol may result in reduced competitiveness of our parent’s corn-derived ethanol production; |

|

· |

replacement technologies under development may result in the obsolescence of corn-derived ethanol or our parent’s process systems which would materially impact our parent’s operations, cash flow and financial position; |

|

· |

severe weather, including earthquakes, floods, fire and other natural disasters, could cause damage to our parent’s ethanol production plants, disrupt our parent’s operations or interrupt the supply of our parent’s corn supply for its ethanol production plants and our parent’s ability to distribute ethanol; |

|

· |

our parent could incur substantial costs or disruptions in its business if it cannot obtain or maintain necessary permits and authorizations on favorable terms; |

|

· |

Green Plains Trade could incur substantial penalties if it inadvertently traded or trades ethanol with invalid RINs; |

|

· |

our parent could incur substantial costs in order to generate or obtain the necessary number of RINs credits in connection with mandates to blend renewable fuels into the petroleum fuels produced and sold in the United States; |

|

· |

our parent may be required to provide remedies for the delivery of off-specification ethanol, distillers grains or corn oil; |

|

· |

competition in the ethanol industry is intense, and an increase in competition in the areas in which our parent’s ethanol is sold, or an increase in foreign ethanol production, could adversely affect our parent’s sales and profitability; |

|

· |

general economic conditions; |

|

· |

our parent’s insurance policies do not cover all losses, costs or liabilities that our parent may experience; |

|

· |

our parent could be subject to damages based on claims brought by its customers or lose customers as a result of a failure of its products to meet certain quality specifications; |

|

· |

the loss by our parent of any of its key personnel; and |

13

|

· |

terrorist attacks, cyber-attacks, threats of war or actual war. |

Ethanol production and marketing is a highly competitive business subject to changing market demands and regulatory environments. Any change in our parent’s business or financial strategy to meet such demands or requirements may negatively impact our parent’s financial condition, results of operations or cash flows and, in turn, may adversely affect our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

Ethanol production, storage and transportation, and marketing is highly competitive. In the United States, our parent’s operations compete with other corn processors and refiners. Some of our parent’s competitors are larger than our parent, and there are also many smaller competitors. Farm cooperatives comprised of groups of individual farmers have been able to compete successfully in the ethanol production industry. As of December 31, 2015, the top ten domestic producers accounted for approximately 55% of all production, with production capacities ranging from approximately 300 mmgy to 1,800 mmgy. If our parent’s competitors consolidate or otherwise grow or our parent is unable to similarly increase its size and scope, our parent’s business and prospects may be significantly and adversely affected. Additionally, there is a risk of foreign competition in the ethanol industry. Foreign producers, including those in Brazil, the second largest ethanol producer in the world, may be able to produce ethanol at lower input costs, including costs of feedstock, facilities and personnel, than our parent.

Additionally, our parent may consider opportunities presented by third parties with respect to its assets covering the ethanol value chain, including its ethanol production plants. These opportunities may include offers to purchase assets and joint venture propositions. Our parent may also change the focus of its operations by developing new facilities, suspending or reducing certain operations, modifying or closing facilities or terminating operations. Changes may be considered to meet market demands, to satisfy regulatory requirements or environmental and safety objectives, to improve operational efficiency or for other reasons. Our parent actively manages its assets and operations, and, therefore, changes of some nature, possibly material to its business relationship with us, are likely to occur at some point in the future. No such changes will be subject to our consent.

A change in our parent’s business or financial strategy, contractual obligations or risk profile may negatively impact its financial condition, results of operations, cash flows or creditworthiness. In turn, our cash flows from our commercial agreements with Green Plains Trade and, therefore, our ability to sustain or increase cash distributions to our unitholders may be materially and adversely affected. Moreover, our creditworthiness may be adversely affected by a decline in our parent’s creditworthiness, increasing our borrowing costs or hindering our ability to access the capital markets. Please also refer to the following risk factor in this report: “Our parent’s existing debt arrangements requiring it to abide by certain restrictive loan covenants may adversely affect our ability to grow our business, our ability to pay cash distributions to our unitholders and our credit profile. Our ability to obtain credit in the future may also be affected by our parent’s credit ratings, our own credit profile and the environment for access to capital for master limited partnerships.” A third-party purchaser may identify alternative service providers and opt for minimum volume commitments or minimum take-or-pay capacity commitments or decide to allow the commercial agreements to expire at the end of the original term. Such third party may also operate the ethanol production plants in a suboptimal manner, increasing the frequency of turnarounds and reducing capacity utilization.

Furthermore, conflicts of interest may arise between our general partner and its affiliates, including our parent and Green Plains Trade, on the one hand, and us and our unitholders, on the other hand. Green Plains Trade may suspend, reduce or terminate its obligations under the commercial agreements with us in certain circumstances, which could have a material adverse effect on our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

We have no control over our parent or Green Plains Trade, which are currently our primary source of revenue and primary customers, and our parent and Green Plains Trade may elect to pursue a business strategy that does not favor us and our business.

Our substantial dependence on our parent’s ethanol production plants could adversely affect our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

We believe that a substantial portion of our revenues for the foreseeable future will be derived from operations supporting our parent’s ethanol production plants. Any event that renders these ethanol production plants temporarily or permanently unavailable or that temporarily or permanently reduces production rates at any of these ethanol production plants could adversely affect our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

14

Green Plains Trade may suspend, reduce or terminate its obligations under the commercial agreements with us in certain circumstances, which could have a material adverse effect on our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

All of our commercial agreements with Green Plains Trade include provisions that permit Green Plains Trade to suspend, reduce or terminate its obligations under the agreements if certain events occur. Under all of our commercial agreements, these events include a material breach of such agreements by us, the occurrence of certain force majeure events that would prevent Green Plains Trade or us from performing our respective obligations under the applicable commercial agreement and the minimum commitment, if any, not being available to Green Plains Trade for any reason not resulting from or relating to an action or inaction by Green Plains Trade.

As defined in each of our commercial agreements, force majeure events include any acts or occurrences that prevent services from being performed under the applicable commercial agreement, such as:

|

· |

federal, state, county, or municipal orders, rules, legislation, or regulations; |

|

· |

acts of God, including fires, floods, storms, earthquakes or other severe weather events; |

|

· |

compliance with orders of courts or any governmental authorities; |

|

· |

explosions, wars, terrorist acts or riots; |

|

· |

strikes, lockouts or other industrial disturbances; and |

|

· |

events or circumstances similar to those above (including disruption of service provided by third parties) that prevent a party’s ability to perform its obligations under the agreement, to the extent that such events or circumstances are beyond the party’s reasonable control. |

Accordingly, under the commercial agreements, there will be a broad range of events that could result in our no longer being required to store, throughput or transport Green Plains Trade’s minimum commitments and Green Plains Trade no longer being required to pay the full amount of fees that would have been associated with its minimum commitments. Additionally, we have no control over the business decisions of our parent or Green Plains Trade, and conflicts of interest may arise between our general partner and its affiliates, including our parent and Green Plains Trade, on the one hand, and us and our unitholders, on the other hand. Neither our parent nor Green Plains Trade is required to pursue a business strategy that favors us or utilizes our assets; however, they could elect to decrease ethanol production or shutdown or reconfigure an ethanol production plant. Furthermore, a single event or business decision relating to one of our parent’s ethanol production plants could have an impact on the commercial agreements with us. These actions, as well the other activities described above, could result in a reduction or suspension of Green Plains Trade’s obligations under the commercial agreements. Any such reduction or suspension would have a material adverse effect on our financial condition, results of operations, cash flows, and ability to make distributions to our unitholders.

If Green Plains Trade satisfies only its minimum commitments under the commercial agreements between Green Plains Trade and us that provide for minimum commitments, or if we are unable to renew or extend any commercial agreements with Green Plains Trade, our ability to make distributions to our unitholders will be reduced.

Neither our parent nor Green Plains Trade is obligated to use our services with respect to volumes or volumetric capacity of ethanol or other fuels in excess of the applicable minimum commitment under the respective commercial agreements. Our ability to distribute the minimum quarterly distribution to our unitholders will be adversely affected if we do not receive, store, transfer, transport or deliver additional volumes or use volumetric capacity for Green Plains Trade or other third parties at our ethanol storage facilities, at our fuel terminal facilities or on our railcars.

In addition, at December 31, 2015, the remaining primary term of Green Plains Trade’s obligations under each agreement extends for 9.5 years in the case of the storage and throughput agreement, up to approximately 2.0 years in the case of the terminal services agreements that provide for minimum commitments, 5.5 years in the case of the rail transportation services agreement and six months in the case of the trucking transportation agreement. If, at the end of the remaining primary term, our parent and Green Plains Trade elect not to extend these agreements and, as a result, fail to use our assets and we are unable to generate additional revenues from third parties, our ability to pay cash distributions to our unitholders will be reduced. Furthermore, any renewal of the commercial agreements with Green Plains Trade may not be on favorable commercial terms. For example, depending on prevailing market conditions at the time of contract renewal, Green Plains Trade may desire to enter into contracts under different fee arrangements. To the extent we are unable to renew the commercial agreements with Green Plains Trade on terms that are favorable to us, our revenue and cash flows could decline and our ability to pay cash distributions to our unitholders could be materially and adversely affected.

15

We do not own our railcar fleet and our railcar assets are subject to lease agreements with several lessors. As our railcar leases expire, Green Plains Trade’s minimum take-or-pay capacity commitment will be reduced proportionately. If we do not enter into new commercial arrangements with respect to rail transportation services, our ability to make distributions to our unitholders may be reduced.

Our fleet of railcars is leased by us from several lessors pursuant to lease agreements with remaining terms ranging from less than one year to approximately six years with a weighted average remaining term of 2.9 years. As our railcar lease agreements expire, the respective volumetric capacity of those expired leases will no longer be subject to the rail transportation services agreement, and Green Plains Trade’s minimum take-or-pay capacity commitment will be reduced proportionately. Of our current leased railcar fleet, 43.0%, 4.4%, 14.0% and 12.6% of the railcar volumetric capacity have terms that expire in the years ended December 31, 2016, 2017, 2018 and 2019, respectively, or approximately 74.0% of our total current railcar volumetric capacity during that time frame. If at the end of the terms under the lease agreements we do not enter into new commercial arrangements with respect to rail transportation services, our revenues and cash flows could decline and our ability to pay cash distributions to our unitholders could be materially and adversely affected.

Railcars used to transport ethanol and other fuels may need to be retrofitted or replaced to meet new rail safety standards.

The U.S. ethanol industry has long relied on railroads to deliver its product to market. We currently lease approximately 2,500 railcars. On May 1, 2015, the DOT, through PHMSA and FRA, and in coordination with Transport Canada, announced the final rule, “Enhanced Tank Car Standards and Operational Controls for High-Hazard Flammable Trains”. The rule calls for an enhanced tank car standard known as the DOT specification 117, or DOT-117 tank car, and establishes a schedule for retrofitting or replacing older tank cars carrying crude oil and ethanol. The rule also establishes new braking standards that are intended to reduce the severity of accidents and the so-called “pile-up effect”. Under prescribed circumstances, new operational protocols apply including reduced speed, routing requirements and local government notifications. In addition, persons that offer hazardous material for transportation must develop more accurate classification protocols. These regulations will result in upgrades or replacements of our railcars, and may have an adverse effect on our operations as lease costs for railcars may increase over the long term. Additionally, existing railcars could be out of service for a period of time while such upgrades are made, tightening supply in an industry that is highly dependent on such railcars to transport its product.

Rail logistical problems may cause delays in the transportation of our products which could negatively impact our financial performance.

There has been an overall decrease in rail traffic throughout the United States, primarily due to the decrease in the price of crude oil, resulting in reduced rail transport of crude oil from shale producing areas. Lower demand and a mild winter resulted in fewer rail delays and logistical problems during the year ended December 31, 2015. However, rail delays have caused some ethanol plants to slow or suspend production in the past. Due to the location of our parent’s ethanol production plants, we have not historically been materially affected by these logistical problems. If inadequate rail logistics arise, we may face delays in returning railcars to our parent’s ethanol production plants, which may affect our ability to transport product, which in turn could have a negative effect on our financial performance.

The ethanol industry is dependent on government usage mandates affecting ethanol production and any changes to such regulation could adversely affect the market for ethanol and our results of operations.

The domestic market for ethanol is impacted by federal mandates for blending ethanol with gasoline. The RFS II statutory mandate level for conventional biofuels for 2016 is 14.5 bgy. Future demand will be largely dependent upon the economic incentives to blend based upon the relative value of gasoline versus ethanol, taking into consideration the relative octane value of ethanol, environmental requirements and the RFS II mandate. Any significant increase in production capacity beyond the RFS II mandated level may have an adverse impact on ethanol prices.

Due primarily to drought conditions in 2012 and claims that the blending of ethanol into the motor fuel supply would be constrained by the market’s unwillingness to accept greater than ten percent ethanol blends, legislation aimed at reducing or eliminating the renewable fuel use required by RFS II was introduced in Congress. On April 10, 2013 the Renewable Fuel Standard Elimination Act was introduced as H.R. 1461. The bill was intended to repeal RFS II. Also introduced on April 10, 2013 was the RFS Reform Bill, H.R. 1462, which would have prohibited more than ten percent ethanol in gasoline and reduced the RFS II mandated volume of renewable fuel. On May 14, 2013, the Domestic Alternatives Fuels Act of 2013 was introduced in the U.S. House of Representatives as H.R. 1959 to allow ethanol produced from natural gas to be used to meet the RFS II mandate. These bills failed to make it out of congressional committee and were not enacted into law. We believe RFS II is a significant component of national energy policy that reduces dependence on foreign oil by the United States. Our

16

parent’s operations could be adversely impacted if legislation reducing the RFS II mandate is enacted, which could in turn adversely impact our business.

Additionally, under the provisions of the EISA, the EPA has the authority to waive the mandated RFS II requirements in whole or in part. To grant the waiver, the EPA administrator must determine, in consultation with the Secretaries of Agriculture and Energy, that one of two conditions has been met: (1) there is inadequate domestic renewable fuel supply or (2) implementation of the requirement would severely harm the economy or environment of a state, region or the United States.

On November 21, 2014, the EPA announced it would not finalize 2014 renewable fuel volumetric obligations under the RFS II before the end of 2014. In light of this delay in issuing the 2014 RFS II standards, the compliance demonstration deadline for the 2013 and 2014 RFS II standards was deferred to 2015. The EPA made modifications to ensure that RINs generated in 2012 were valid for demonstrating compliance with the 2013 applicable standards. The EPA reached a settlement in connection with a lawsuit filed against the agency in March 2015 by the American Petroleum Institute and the American Fuel and Petrochemical Manufacturers alleging that the EPA failed to meet congressionally mandated RFS II deadlines. On November 30, 2015, the EPA announced final volume requirements for conventional ethanol, which were higher than levels previously proposed of 13.61 billion gallons, 14.05 billion gallons and 14.50 billion gallons for 2014, 2015 and 2016, respectively.

To measure compliance with RFS II, RINs are generated and are attached to renewable fuels, such as the ethanol our parent produces and that we store, and detached when the renewable fuel is blended into the transportation fuel supply. Detached RINs may be retired by obligated parties to demonstrate compliance with RFS II or may be separately traded in the market. The market price of detached RINs may affect the price of ethanol in certain U.S. markets as obligated parties may factor these costs into their purchasing decisions. Moreover, at certain price levels for various types of RINs, it becomes more economical to import foreign sugar cane ethanol. If changes to RFS II result in significant changes in the price of various types of RINs, it could negatively affect the price of ethanol, which could adversely affect our parent’s operations, which could in turn adversely impact our business.

Federal law mandates the use of oxygenated gasoline in the winter in areas that do not meet Clean Air Act standards for carbon monoxide. If these mandates are repealed, the market for domestic ethanol could be diminished. Additionally, flexible-fuel vehicles receive preferential treatment in meeting CAFE standards. However, high blend ethanol fuels such as E85 result in lower fuel efficiencies. Absent the CAFE preferences, it may be unlikely that auto manufacturers would build flexible-fuel vehicles. Any change in these CAFE preferences could reduce the growth of E85 markets and result in lower ethanol prices, which could adversely impact our parent’s, and consequently our, operating results.

To the extent that such federal or state laws or regulations are modified, the demand for ethanol may be reduced, which could negatively and materially affect our ability to operate profitably.

We may not be able to increase our third-party revenues significantly or at all due to competition and other factors, which could limit our ability to grow and extend our dependence on our parent.

Part of our growth strategy includes diversifying our customer base by acquiring or developing new assets independently from our parent. Our ability to increase our third-party revenue is subject to numerous factors beyond our control, including competition from third parties and the extent to which we lack available capacity when third parties require it.

We can provide no assurance that we will be able to attract any material third-party service opportunities. Our efforts to attract new unaffiliated customers may be adversely affected by (1) our relationship with our parent, (2) our desire to provide services pursuant to fee-based contracts, (3) our parent’s operational requirements at its ethanol production plants and (4) our expectation that our parent will continue to utilize substantially all of the available capacity of our assets. Our potential customers may prefer to obtain services under other forms of contractual arrangements under which we would be required to assume direct commodity exposure. In addition, we will need to establish a reputation among our potential customer base for providing high-quality service in order to successfully attract unaffiliated third parties.

If we are unable to make acquisitions on economically acceptable terms from third parties, our future growth would be limited, and any acquisitions we may make may reduce, rather than increase, our cash flows and ability to make distributions to our unitholders.

A portion of our strategy to grow our business and increase distributions to our unitholders is dependent on our ability to acquire businesses or assets that increase our cash flows. The acquisition component of our growth strategy is based, in large

17

part, on our expectation of ongoing divestitures of complementary assets by industry participants, including in conjunction with acquisitions by our parent. A material decrease in such divestitures would limit our opportunities for future acquisitions and could adversely affect our ability to grow our operations and increase cash distributions to our unitholders. If we are unable to make acquisitions from third parties because we are unable to identify attractive acquisition candidates, negotiate acceptable purchase contracts, obtain financing for these acquisitions on economically acceptable terms or we are outbid by competitors, our future growth and ability to increase distributions will be limited. Furthermore, even if we do consummate acquisitions that we believe will be accretive, they may in fact result in a decrease in cash flows. Any acquisition involves potential risks, including, among other things:

|

· |

mistaken assumptions about revenues and costs, including synergies; |

|

· |

an inability to integrate successfully the businesses or assets we acquire; |

|

· |

the assumption of unknown liabilities; |

|

· |

limitations on rights to indemnity from the seller; |

|

· |

mistaken assumptions about the overall costs of equity or debt financing; |

|

· |

the diversion of management’s attention from other business concerns; |

|

· |

unforeseen difficulties operating in new product areas or new geographic areas; and |

|

· |

customer or key employee losses at the acquired businesses. |

If we consummate any future acquisitions, our capitalization and results of operations may change significantly, and our unitholders will not have the opportunity to evaluate the economic, financial and other relevant information that we will consider in determining the application of these funds and other resources.

Our right of first offer to acquire any of our parent’s new ethanol storage assets, fuel terminal facilities or ethanol or transportation fuel assets is subject to risks and uncertainty, and ultimately we may not acquire any of those assets.