Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

GREEN PLAINS PARTNERS LP

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

On September 16, 2023, Green Plains Inc., an Iowa corporation (“GPRE”), GPLP Holdings Inc., a Delaware corporation and a wholly owned subsidiary of GPRE (“Holdings”), GPLP Merger Sub LLC, a Delaware limited liability company and a wholly owned subsidiary of Holdings (“Merger Sub”), Green Plains Partners LP, a Delaware limited partnership (“GPP”), and Green Plains Holdings LLC, a Delaware limited liability company and the general partner of GPP (the “General Partner”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Merger Sub will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE (the “Merger”).

Under the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each outstanding common unit representing a limited partner interest in GPP (each, a “GPP Common Unit”) other than GPP Common Units owned by GPRE, the General Partner and their respective affiliates (each, a “GPP Public Common Unit” and the holders of such units, the “GPP Unaffiliated Unitholders”) will be converted into the right to receive, subject to adjustment as described in the Merger Agreement, (i) 0.405 shares of common stock, par value $0.001 per share, of GPRE (the “GPRE Common Stock” and the shares of GPRE Common Stock to be issued in the Merger, the “Stock Consideration”) and (ii) an amount of cash equal to the sum of (a) $2.00 plus (b) the product of (x) $0.455 divided by 90, multiplied by (y) the number of days from, but excluding, the last day of the calendar quarter with respect to which the General Partner has declared a quarterly cash distribution to the holders of GPP Common Units of no less than $0.455 per GPP Common Unit with a record date prior to the date of the closing of the Merger (the “Closing Date”), to, but excluding, the Closing Date, computed on the basis of a 360-day year comprised of twelve 30-day months and the actual number of days for any period less than a calendar month, and rounded to the nearest whole cent, without interest (the “Cash Consideration” and, together with the Stock Consideration, the “Merger Consideration”). In addition, at the Effective Time, each of the outstanding awards relating to a GPP Common Unit issued under a Partnership Long-Term Incentive Plan (as defined in the Merger Agreement) will become fully vested and will be automatically canceled and converted into the right to receive, with respect to each GPP Common Unit subject thereto, the Merger Consideration (plus any accrued but unpaid amounts in relation to distribution equivalent rights). Except for the incentive distribution rights representing limited partner interests in GPP, which will be automatically canceled immediately prior to the Effective Time for no consideration in accordance with the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of July 1, 2015 (as amended, the “Partnership Agreement”), the limited partner interests in GPP owned by GPRE, the General Partner and their respective affiliates prior to the Effective Time will remain outstanding as limited partner interests in the surviving entity. The economic general partner interest in GPP will remain outstanding as a general partner interest in the surviving entity immediately following the Effective Time, and the General Partner will continue as the sole general partner of the surviving entity. No fractional shares of GPRE Common Stock will be issued in the Merger; instead, all fractional shares of GPRE Common Stock to which a GPP Unaffiliated Unitholder otherwise would have been entitled will be aggregated and the resulting fraction will be rounded up to the nearest whole share of GPRE Common Stock.

On September 15, 2023, the board of directors of GPRE (the “GPRE Board”), by unanimous vote, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger and the issuance of GPRE Common Stock as part of the Merger Consideration (the “GPRE Stock Issuance”), are in the best interests of GPRE and its shareholders and (ii) approved and authorized the execution and delivery of the Merger Agreement and that certain Support Agreement, dated as of September 16, 2023, by and among GPP, GPRE and certain holders of GPP Common Units (such holders and GPRE, collectively, the “Support Parties”) (the “Support Agreement” and, together with the Merger Agreement, the “Transaction Documents”) and the consummation of the transactions contemplated thereby, including the Merger and the GPRE Stock Issuance, on the terms and subject to the conditions set forth in the Transaction Documents.

On September 16, 2023, the conflicts committee (the “Conflicts Committee”) of the board of directors of the General Partner (the “GP Board”), by unanimous vote, in good faith, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the GPP Unaffiliated Unitholders, (ii) approved the Transaction Documents and the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents (the foregoing constituting “Special Approval” as defined in the Partnership Agreement) and (iii) recommended to the GP Board the approval by the GP Board of the Transaction Documents and the execution, delivery and performance of the Transaction Documents and the transactions contemplated thereby, including the Merger.

Table of Contents

On September 16, 2023, following receipt of the recommendation of the Conflicts Committee, the GP Board (acting, in part, based upon the recommendation of the Conflicts Committee), by unanimous vote, in good faith, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the GPP Unaffiliated Unitholders, (ii) approved the Transaction Documents and the transactions contemplated thereby, including the Merger, (iii) authorized the execution and delivery of the Transaction Documents and the consummation of the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents and (iv) directed that the Merger Agreement and the Merger be submitted to a vote of the limited partners of GPP (the “GPP Limited Partners”) for approval pursuant to Section 14.3 of the Partnership Agreement and authorized the GPP Limited Partners to act by written consent pursuant to Section 13.11 of the Partnership Agreement.

Pursuant to the Partnership Agreement, the approval of the Merger Agreement and the Merger by GPP requires the affirmative vote or written consent of the holders of a majority of the outstanding GPP Common Units (the “Required Limited Partner Written Consent”). Under the Support Agreement, each Support Party has irrevocably and unconditionally agreed to deliver a written consent, covering all of the GPP Common Units beneficially owned by such Support Party, approving the Merger Agreement and the transactions contemplated thereby, including the Merger, and any other matters necessary for the consummation of the transactions contemplated by the Merger Agreement (the “Written Consent”), as promptly as practicable after the effectiveness of the registration statement of which the accompanying consent solicitation statement/prospectus forms a part. As of September 16, 2023, the Support Parties collectively beneficially owned 11,661,429 GPP Common Units, representing approximately 50.1% of the outstanding GPP Common Units. Accordingly, the delivery of the Written Consent will be sufficient to approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on behalf of the GPP Limited Partners.

The GP Board has set November 30, 2023 as the record date (the “GPP Record Date”) for determining the GPP Limited Partners entitled to execute and deliver written consents with respect to the Merger. If you were a record holder of outstanding GPP Common Units as of the close of business on the GPP Record Date, you may complete, date and sign the enclosed written consent and promptly return it to GPP. See “Written Consents of GPP Limited Partners.”

The accompanying consent solicitation statement/prospectus provides you with detailed information about the proposed Merger and related matters. GPRE and GPP both encourage you to read the entire document carefully. In particular, see “Risk Factors” beginning on page 67 for a discussion of risks related to the Merger, the tax consequences of the Merger and ownership of the GPRE Common Stock received in the Merger, an investment in GPRE Common Stock and GPRE’s business following the consummation of the Merger.

GPRE Common Stock is listed on the Nasdaq under the symbol “GPRE,” and GPP Common Units are listed on the Nasdaq under the symbol “GPP.”

| Sincerely, | ||

| /s/ Todd A. Becker Todd A. Becker President and Chief Executive Officer of Green Plains Inc. |

/s/ Michelle Mapes Michelle Mapes Chief Legal & Administration Officer, Corporate Secretary of Green Plains Partners LP | |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE MERGER OR DETERMINED THAT THE ACCOMPANYING CONSENT SOLICITATION STATEMENT/PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The accompanying consent solicitation statement/prospectus is dated December 4, 2023 and is first being mailed to GPP Limited Partners on or about December 6, 2023.

Table of Contents

1811 Aksarben Drive

Omaha, Nebraska 68106

NOTICE OF SOLICITATION OF WRITTEN CONSENT

To the limited partners of Green Plains Partners LP:

On September 16, 2023, Green Plains Inc., an Iowa corporation (“GPRE”), GPLP Holdings Inc., a Delaware corporation and a wholly owned subsidiary of GPRE (“Holdings”), GPLP Merger Sub LLC, a Delaware limited liability company and a wholly owned subsidiary of Holdings (“Merger Sub”), Green Plains Partners LP, a Delaware limited partnership (“GPP”), and Green Plains Holdings LLC, a Delaware limited liability company and the general partner of GPP (the “General Partner”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Merger Sub will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE (the “Merger”).

The conflicts committee (the “Conflicts Committee”) of the board of directors of the General Partner (the “GP Board”), by unanimous vote, in good faith, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the holders of common units representing limited partner interests in GPP (such units, “GPP Common Units”) other than GPRE, the General Partner and their respective affiliates including officers and directors of such entities and their affiliates (such holders, the “GPP Unaffiliated Unitholders”), (ii) approved the Merger Agreement and that certain Support Agreement, dated as of September 16, 2023, by and among GPP, GPRE, and certain holders of GPP Common Units (such holders and GPRE, collectively, the “Support Parties”) (the “Support Agreement” and, together with the Merger Agreement, the “Transaction Documents”), and the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents (the foregoing constituting “Special Approval” as defined in the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of July 1, 2015) and (iii) recommended to the GP Board the approval by the GP Board of the Transaction Documents and the execution, delivery and performance of the Transaction Documents and the transactions contemplated thereby, including the Merger.

The GP Board, following receipt of the recommendation of the Conflicts Committee (acting, in part, based upon the recommendation of the Conflicts Committee) has unanimously (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the GPP Unaffiliated Unitholders, (ii) approved the Transaction Documents and the transactions contemplated thereby, including the Merger, (iii) authorized the execution and delivery of the Transaction Documents and the consummation of the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents and (iv) directed that the Merger Agreement and the Merger be submitted to a vote of the limited partners of GPP (the “GPP Limited Partners”) for approval pursuant to Section 14.3 of the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of July 1, 2015 (as amended, the “Partnership Agreement”) and authorized the GPP Limited Partners to act by written consent pursuant to Section 13.11 of the Partnership Agreement.

Pursuant to the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of July 1, 2015, as amended by the First Amendment to the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of May 7, 2019, the approval of the Merger Agreement and the Merger by GPP also requires the affirmative vote or written consent of the holders of a majority of the outstanding GPP Common Units. The accompanying consent solicitation statement/prospectus is being delivered to you on behalf of the GP Board to request that the limited partners of GPP (the “GPP Limited Partners”) approve the Merger Agreement and the transactions contemplated thereby, including the Merger, by executing and returning the written consent furnished with the accompanying consent solicitation statement/prospectus.

Table of Contents

In connection with GPP’s entry into the Merger Agreement, GPP, GPRE and certain holders of GPP Common Units have entered into the Support Agreement, pursuant to which each Support Party has irrevocably and unconditionally agreed to deliver a written consent, covering all of the GPP Common Units beneficially owned by such Support Party, approving the Merger Agreement and the transactions contemplated thereby, including the Merger, and any other matters necessary for the consummation of the transactions contemplated by the Merger Agreement (the “Written Consent”), as promptly as practicable after the effectiveness of the registration statement of which the accompanying consent solicitation statement/prospectus forms a part. As of September 16, 2023, the Support Parties collectively beneficially owned 11,661,429 GPP Common Units, representing approximately 50.1% of the outstanding GPP Common Units. Accordingly, the delivery of the Written Consent will be sufficient to approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on behalf of the GPP Limited Partners.

The accompanying consent solicitation statement/prospectus describes the Merger Agreement, the Support Agreement, the Merger, and the actions to be taken in connection with the Merger, as well as provides additional information about the parties involved. Please give this information your careful attention. Copies of the Merger Agreement and the Support Agreement are attached as Annex A and Annex B, respectively, to the accompanying consent solicitation statement/prospectus.

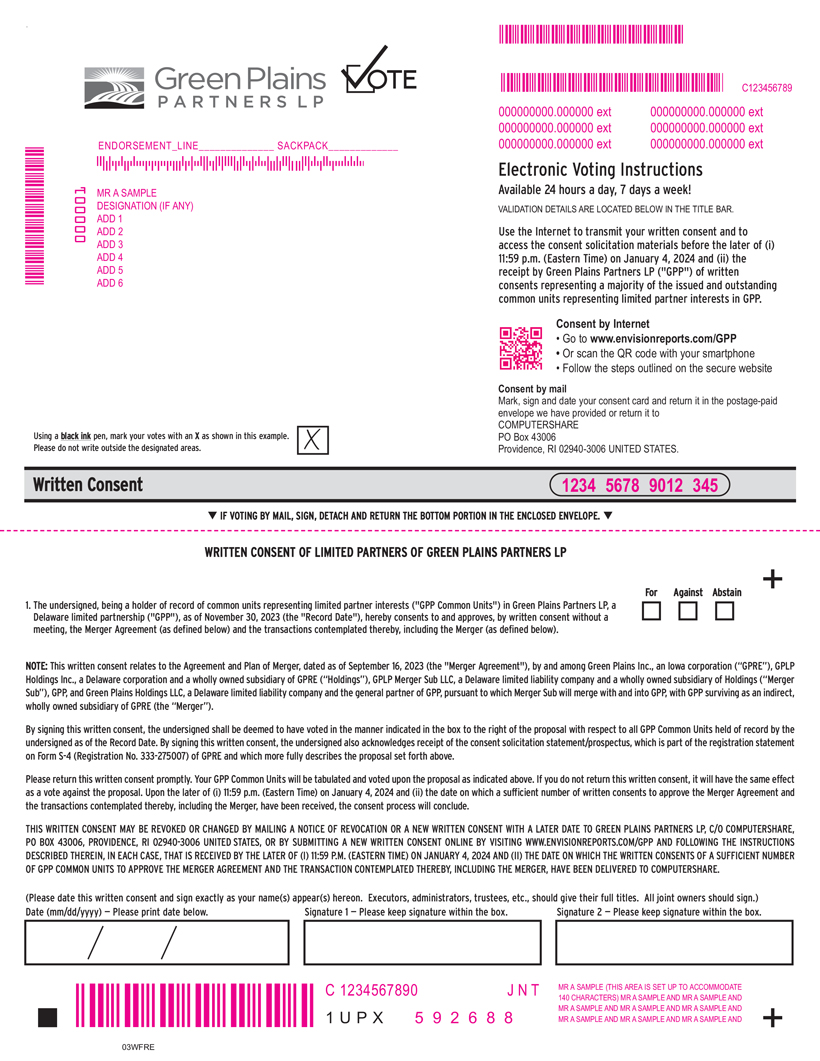

The GP Board has set November 30, 2023 as the record date (the “GPP Record Date”) for determining the GPP Limited Partners entitled to execute and deliver written consents with respect to the Merger. If you were a record holder of outstanding GPP Common Units as of the close of business on the GPP Record Date, please complete, date and sign the written consent furnished with the accompanying consent solicitation statement/prospectus and return it promptly to GPP by one of the means described under “Written Consents of GPP Limited Partners” in the accompanying consent solicitation statement/prospectus.

By order of the Board of Directors of Green Plains Holdings LLC

Sincerely,

/s/ Michelle Mapes

Michelle Mapes

Chief Legal & Administration Officer, Corporate Secretary of

Green Plains Holdings LLC

Table of Contents

IMPORTANT NOTE ABOUT THIS CONSENT SOLICITATION STATEMENT/PROSPECTUS

This consent solicitation statement/prospectus, which forms part of a registration statement on Form S-4 filed with the Securities and Exchange Commission (the “SEC”) by GPRE, constitutes a prospectus of GPRE under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of GPRE Common Stock to be issued in connection with the Merger Agreement. This document also constitutes a consent solicitation statement of GPP under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This consent solicitation statement/prospectus does not constitute an offer to exchange or sell, or a solicitation of offers to exchange or purchase or the solicitation of a proxy in any jurisdiction in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

As permitted under the rules and regulations of the SEC, this consent solicitation statement/prospectus incorporates by reference important business and financial information about GPRE and GPP and their respective subsidiaries from documents filed with the SEC that have not been included in or delivered with this consent solicitation statement/prospectus. This information is available without charge at the SEC’s website at www.sec.gov. You may also obtain certain of these documents at GPRE’s website, www.gpreinc.com, and GPP’s website, www.greenplainspartners.com. Information contained on the websites of GPRE and GPP does not constitute part of this consent solicitation statement/prospectus. See “Where You Can Find More Information.”

You may also request copies of publicly filed documents from GPRE and GPP without charge by requesting them in writing or by telephone at the following address and telephone number:

Green Plains Inc.

Green Plains Holdings LLC

1811 Aksarben Drive

Omaha, Nebraska 68106

Telephone: (402) 884-8700

If you request any such documents, GPRE or GPP will mail them to you by first class mail, or another equally prompt means, after receipt of your request. To obtain timely delivery of these documents prior to the conclusion of the GPP written consent process, you must request the information no later than December 27, 2023.

Please note that copies of the documents provided to you will not include exhibits, unless the exhibits are specifically incorporated by reference into the documents or this consent solicitation statement/prospectus.

The sections entitled “Summary Term Sheet” and “Questions and Answers” below highlight selected information from this consent solicitation statement/prospectus, but they do not include all of the information that may be important to you. To better understand the Merger Agreement and the Merger, and for a more complete description of legal terms thereof, you should carefully read this entire consent solicitation statement/prospectus, including the section entitled “Risk Factors” and the Merger Agreement, a copy of which is attached as Annex A hereto, as well as the documents that are incorporated by reference into this consent solicitation statement/prospectus. See “Where You Can Find More Information.”

You should rely only on the information contained in, or incorporated by reference into, this consent solicitation statement/prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this consent solicitation statement/prospectus. You should not assume that the information contained in or incorporated by reference into, this consent solicitation statement/prospectus is accurate as of any date other than, in the case of this consent solicitation statement/prospectus, the date on the front cover of consent solicitation statement/prospectus and, in the case of information incorporated by reference, the respective dates of such referenced documents. Neither the mailing of this consent solicitation statement/prospectus to the limited partners of GPP nor the issuance by GPRE of shares of its common stock, par value $0.001 per share, as part of the consideration in connection with the Merger will create any implication to the contrary.

i

Table of Contents

GLOSSARY

As used in this consent solicitation statement/prospectus, unless otherwise noted or the context otherwise requires, references to:

“Base Merger Consideration” are to (i) 0.405 shares of GPRE Common Stock and (ii) $2.00 in cash per GPP Common Unit;

“Cash Consideration” are to an amount in cash equal to the sum of (i) $2.00 plus (ii) the product of (a) $0.455 divided by 90, multiplied by (b) the number of days from, but excluding, the last day of the calendar quarter with respect to which the General Partner has declared a quarterly cash distribution to the holders of GPP Common Units of no less than $0.455 per GPP Common Unit with a record date prior to the Closing Date, to, but excluding, the Closing Date, computed on the basis of a 360-day year comprised of twelve 30-day months and the actual number of days for any period less than a calendar month, and rounded to the nearest whole cent;

“Closing” are to the closing of the Merger;

“Closing Date” are to the date on which the Closing actually occurs;

“Conflicts Committee” are to the conflicts committee of the GP Board;

“Code” are to the Internal Revenue Code of 1986, as amended;

“DGCL” are to the Delaware General Corporation Law;

“DOJ” are to the U.S. Department of Justice;

“DRULPA” are to the Delaware Revised Uniform Limited Partner Act, as amended;

“Effective Time” are to the time at which the certificate of merger is filed with the Secretary of the State of Delaware or at such later date or time as may be agreed by GPP and GPRE in writing and specified in the certificate of merger;

“Evercore” are to Evercore Group L.L.C.;

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“Exchange Ratio” are to 0.405 shares of GPRE Common Stock per GPP Common Unit;

“FTC” are to the U.S. Federal Trade Commission;

“General Partner” are to Green Plains Holdings LLC, a Delaware limited liability company and the general partner of GPP;

“General Partner Interest” are to the 2.0% economic general partner interest in GPP held by the General Partner;

“GP Board” are to the board of directors of the General Partner;

“GPP” are to Green Plains Partners LP, a Delaware limited partnership;

“GPP Common Units” are to common units representing limited partner interests in GPP;

ii

Table of Contents

“GPP Limited Partners” are to the limited partners of GPP;

“GPP Public Common Unit” are to each GPP Common Unit that is issued and outstanding as of immediately prior to the Effective Time, other than any GPP Common Units owned by GPRE, the General Partner and their respective affiliates;

“GPP Record Date” are to November 30, 2023;

“GPP Unaffiliated Unitholders” are to holders of GPP Common Units other than GPRE, the General Partner and their respective affiliates;

“GPP Unitholders” are to holders of GPP Common Units;

“GPRE” are to Green Plains Inc., an Iowa corporation;

“GPRE Board” are to the board of directors of GPRE;

“GPRE Bylaws” are to the Fifth Amended and Restated Bylaws of GPRE, dated November 14, 2022;

“GPRE Common Stock” are to the common stock, par value $0.001 per share, of GPRE;

“GPRE Charter” are to the Second Amended and Restated Articles of Incorporation of GPRE, as amended;

“GPRE Organizational Documents” are to the GPRE Charter and the GPRE Bylaws, collectively;

“GPRE Parties” are to GPRE, Holdings and Merger Sub;

“GPRE Shareholders” are to holders of GPRE Common Stock;

“GPRE Stock Issuance” are to the issuance of shares of GPRE Common Stock as part of the Merger Consideration;

“Holdings” are to GPLP Holdings Inc., a Delaware corporation and a wholly owned subsidiary of GPRE;

“HSR Act” are to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended;

“IBCA” are to the Iowa Business Corporation Act, as amended;

“Incentive Distribution Rights” are to incentive distribution rights in GPP;

“Merger” are to the merger of Merger Sub with and into GPP, with GPP surviving such merger;

“Merger Agreement” are to that certain Agreement and Plan of Merger, dated as of September 16, 2023, by and among GPRE, Holdings, Merger Sub, GPP and the General Partner, as the same may be amended or supplemented from time to time;

“Merger Consideration” are to (i) 0.405 shares of GPRE Common Stock and (ii) the Cash Consideration per GPP Common Unit;

“Merger Sub” are to GPLP Merger Sub LLC, a Delaware limited liability company and a wholly owned subsidiary of Holdings;

iii

Table of Contents

“Nasdaq” are to The Nasdaq Stock Market LLC;

“Partnership Agreement” are to the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of July 1, 2015, as amended by the First Amendment to the First Amended and Restated Agreement of Limited Partnership of GPP, dated as of May 7, 2019;

“Partnership LTIP Awards” are to any awards issued under the Partnership LTIP Plan;

“Partnership Long-Term Incentive Plans” are to the Green Plains Partners LP 2015 Long-Term Incentive Plan, including any amendment and/or amendment and restatement thereof, and any other plans or arrangements of GPP or the General Partner providing for the grant of awards of GPP Common Units or cash settled awards valued, in whole or in part, by reference to GPP Common Units, or otherwise relating thereto;

“Schedule 13E-3” are to the Rule 13e-3 transaction statement on Schedule 13E-3 to be filed with the SEC by GPRE in connection with the Merger, as amended from time to time;

“SEC” are to the U.S. Securities and Exchange Commission;

“Securities Act” are to the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder;

“Stock Consideration” are to the right of GPP Unaffiliated Unitholders to receive 0.405 shares of GPRE Common Stock per GPP Common Unit;

“Support Agreement” are to that certain Support Agreement, dated as of September 16, 2023, by and among GPP, GPRE and the Support Parties;

“Support Parties” are to GPRE, Jerry L. Peters, Jerry L. Peters and Kari A. Peters Joint Trust Agreement, dated October 21, 2020, Michelle S. Mapes, Todd A. Becker and G. Patrich Simpkins Jr.;

“Transaction Documents” are to the Merger Agreement and the Support Agreement, collectively; and

“Written Consent” are to the written consent approving the Merger Agreement and the transactions contemplated thereby, including the Merger, that that the Support Parties have agreed to deliver as promptly as practicable after the registration statement of which this consent solicitation statement/prospectus forms a part is declared effective.

iv

Table of Contents

| 1 | ||||

| 9 | ||||

| 57 | ||||

| 60 | ||||

| SELECTED UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION |

61 | |||

| 62 | ||||

| COMPARATIVE MARKET PRICES AND CASH DIVIDEND/DISTRIBUTION INFORMATION |

65 | |||

| 67 | ||||

| 73 | ||||

| 75 | ||||

| 77 | ||||

| 78 | ||||

| 92 | ||||

| COMPARISON OF RIGHTS OF GPRE SHAREHOLDERS AND GPP UNITHOLDERS |

93 | |||

| 109 | ||||

| 113 | ||||

| 117 | ||||

| 123 | ||||

| 124 | ||||

| 125 | ||||

| 128 | ||||

| 128 | ||||

| 129 | ||||

| F-1 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 |

v

Table of Contents

This summary highlights information contained elsewhere in this consent solicitation statement/prospectus and may not contain all of the information that is important to you. We urge you to carefully read the remainder of the consent solicitation statement/prospectus, including the attached annexes, and the other documents to which we have referred you for a more complete understanding of the transactions discussed herein. See “Where You Can Find More Information.”

Information about the Companies

Green Plains Inc.

GPRE is a leading biorefining company focused on the development and utilization of fermentation, agricultural and biological technologies in the processing of annually renewable crops into sustainable value-added ingredients. This includes the production of cleaner low carbon biofuels, renewable feedstocks for advanced biofuels and high purity alcohols for use in cleaners and disinfectants. GPRE is an innovative producer of Ultra-High Protein and novel ingredients for animal and aquaculture diets to help satisfy a growing global appetite for sustainable protein.

GPRE Common Stock is listed on Nasdaq under the symbol “GPRE.”

Additional information about GPRE is included in the section entitled “Information about the Companies” and documents incorporated by reference into this consent solicitation statement/prospectus. See “Where You Can Find More Information.”

GPRE’s principal executive offices are located at 1811 Aksarben Drive, Omaha, Nebraska 68106, and its telephone number is (402) 884-8700.

Green Plains Partners LP and Green Plains Holdings LLC

GPP is a fee-based Delaware limited partnership formed by GPRE to provide fuel storage and transportation services by owning, operating, developing and acquiring ethanol and fuel storage terminals, transportation assets and other related assets and businesses.

The GPP Common Units are listed on Nasdaq under the symbol “GPP.”

Additional information about GPP is included in “Information about the Companies” and the documents incorporated by reference into this consent solicitation statement/prospectus. See “Where You Can Find More Information.”

The General Partner is the general partner of GPP. Its board of directors and executive officers manage GPP. The General Partner is wholly owned by GPRE.

GPP’s and the General Partner’s principal executive offices are located at 1811 Aksarben Drive, Omaha, Nebraska 68106, and its telephone number is (402) 884-8700.

GPLP Holdings Inc.

Holdings is a Delaware corporation and a wholly owned subsidiary of GPRE. Holdings was formed on September 15, 2023 solely for the purpose of effecting the Merger. Holdings has not conducted any activities to date except for activities incidental to its formation and activities undertaken in connection with the Merger.

1

Table of Contents

Holdings’ principal executive offices are located at 1811 Aksarben Drive, Omaha, Nebraska 68106, and its telephone number is (402) 884-8700.

GPLP Merger Sub LLC

Merger Sub is a Delaware limited liability company and a wholly owned subsidiary of Holdings. Merger Sub was formed on September 15, 2023 solely for the purpose of effecting the Merger. In the Merger, Merger Sub will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE. Merger Sub has not conducted any activities to date except for activities incidental to its formation and activities undertaken in connection with the Merger.

Merger Sub’s principal executive offices are located at 1811 Aksarben Drive, Omaha, Nebraska 68106, and its telephone number is (402) 884-8700.

For additional information, see “Information about the Companies.”

The Merger

Pursuant to and in accordance with the terms and conditions of the Merger Agreement, at the Effective Time, Merger Sub, an indirect wholly owned subsidiary of GPRE, will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE. Following the Effective Time, the GPP Common Units will cease to be publicly traded, will be delisted from Nasdaq and will be deregistered under the Exchange Act.

Merger Consideration

Under the terms of the Merger Agreement, at the Effective Time, each outstanding GPP Public Common Unit will be converted into the right to receive, subject to adjustment as described in the Merger Agreement, (i) 0.405 shares of GPRE Common Stock and (ii) an amount of cash equal to the sum of (a) $2.00 plus (b) the product of (x) $0.455 divided by 90, multiplied by (y) the number of days from, but excluding, the last day of the calendar quarter with respect to which the General Partner has declared a quarterly cash distribution to the holders of GPP Common Units of no less than $0.455 per GPP Common Unit with a record date prior to the Closing Date, to, but excluding, the Closing Date, computed on the basis of a 360-day year comprised of twelve 30-day months and the actual number of days for any period less than a calendar month, and rounded to the nearest whole cent, without interest. In addition, at the Effective Time, each of the outstanding awards relating to a GPP Common Unit issued under a Partnership Long-Term Incentive Plan will become fully vested and will be automatically canceled and converted into the right to receive, with respect to each GPP Common Unit subject thereto, the Merger Consideration (plus any accrued but unpaid amounts in relation to distribution equivalent rights). Except for the Incentive Distribution Rights, which will be automatically canceled immediately prior to the Effective Time for no consideration in accordance with the Partnership Agreement, the limited partner interests in GPP owned by GPRE, the General Partner and their respective affiliates prior to the Effective Time will remain outstanding as limited partner interests in the surviving entity. The economic general partner interest in GPP will remain outstanding as a general partner interest in the surviving entity immediately following the Effective Time, and the General Partner will continue as the sole general partner of the surviving entity. No fractional shares of GPRE Common Stock will be issued in the Merger; instead, all fractional shares of GPRE Common Stock to which a GPP Unaffiliated Unitholder otherwise would have been entitled will be aggregated and the resulting fraction will be rounded up to the nearest whole share of GPRE Common Stock.

2

Table of Contents

Financing of the Merger

The total amount of funds necessary to pay the Cash Consideration portion of the Merger Consideration is anticipated to be approximately $23.3 million based on the $2.00 to be received by GPP Unaffiliated Unitholders for each GPP Public Common Unit owned by them, plus approximately $6.2 million relating to unpaid quarterly cash distributions declared by the General Partner and calculated in accordance with the terms of the Merger Agreement, assuming that the Closing Date is January 15, 2024. GPRE expects to fund the Cash Consideration with cash on hand.

GPP Limited Partner Interests Entitled to Consent and Consent Required

The approval of the Merger Agreement and the Merger requires the affirmative vote or written consent of the holders of a majority of the outstanding GPP Common Units. GPP Limited Partners of record at the close of business on the GPP Record Date are entitled to consent to the Merger Agreement and the Merger.

Pursuant to the terms of the Support Agreement, the Support Parties have irrevocably and unconditionally agreed to deliver the Written Consent as promptly as practicable following the effectiveness of the registration statement of which this consent solicitation statement/prospectus forms a part. As of September 16, 2023, the date of the Merger Agreement, the Support Parties collectively beneficially owned 11,661,429 GPP Common Units, representing approximately 50.1% of the outstanding GPP Common Units. Accordingly, the delivery of the Written Consent will be sufficient to approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on behalf of the GPP Limited Partners.

Purpose and Reasons of the GPRE Parties for the Merger

For a discussion of the purposes and reasons of the GPRE Parties for the Merger, see “Special Factors—Purpose and Reasons of the GPRE Parties for the Merger.”

Approval of the Conflicts Committee and the GP Board and the Reasons for their Approvals

At a meeting of the Conflicts Committee held on September 16, 2023, the Conflicts Committee, by unanimous vote, in good faith (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the GPP Unaffiliated Unitholders, (ii) approved the Transaction Documents and the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents (the foregoing constituting “Special Approval” as defined in the Partnership Agreement) and (iii) recommended to the GP Board the approval by the GP Board of the Transaction Documents and the execution, delivery and performance of the Transaction Documents and the transactions contemplated thereby, including the Merger. For a discussion of the many factors considered by the Conflicts Committee in making its determination and approval, see “Special Factors—Approval of the Conflicts Committee and the GP Board and the Reasons for their Approvals.”

At a meeting of the GP Board held on September 16, 2023, the GP Board (acting, in part, based upon the recommendation of the Conflicts Committee), by unanimous vote, in good faith, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of GPP, including the GPP Unaffiliated Unitholders, (ii) approved the Transaction Documents and the transactions contemplated thereby, including the Merger, (iii) authorized the execution and delivery of the Transaction Documents and the consummation of the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Transaction Documents and (iv) directed that the Merger Agreement and the Merger be submitted to a vote of the GPP Limited Partners for approval pursuant to Section 14.3 of the Partnership Agreement and authorized the GPP Limited Partners to act by written consent pursuant to

3

Table of Contents

Section 13.11 of the Partnership Agreement. For a further discussion of the recommendation of the Conflicts Committee to the GP Board, see “Special Factors—Approval of the Conflicts Committee and the GP Board and the Reasons for their Approvals.”

Financial Advisor Discussion Materials Provided to GPRE

GPRE engaged BofA Securities, Inc. (“BofA Securities”) to act as its financial advisor in connection with evaluating the Merger. As part of that engagement, BofA Securities provided, at GPRE’s request, certain discussion materials to GPRE and the GPRE Board (the “BofA Discussion Materials”).

For a description of the BofA Discussion Materials that GPRE and the GPRE Board received from BofA Securities, see the section entitled “Special Factors—Financial Advisor Discussion Materials Provided to GPRE.” Copies of the BofA Discussion Materials are attached as exhibits to the Schedule 13E-3.

Opinion of Evercore—Financial Advisor to the Conflicts Committee

In connection with the proposed Merger, Evercore delivered a written opinion, dated as of September 16, 2023, to the Conflicts Committee, as to the fairness, from a financial point of view and as of the date of the opinion, of the Merger Consideration to the GPP Unaffiliated Unitholders. The full text of the written opinion of Evercore, dated as of September 16, 2023, which sets forth, among other things, the procedures followed, assumptions made, matters considered and qualifications and limitations on the scope of review undertaken in rendering its opinion, is attached hereto as Annex C to this consent solicitation statement/prospectus. You are urged to read Evercore’s opinion carefully and in its entirety. Evercore’s opinion was addressed to, and provided for the information and benefit of, the Conflicts Committee in connection with its evaluation of the fairness of the Merger Consideration, from a financial point of view, and did not address any other aspects or implications of the Merger. Evercore’s opinion should not be construed as creating any fiduciary duty on Evercore’s part to any party and such opinion was not intended to be, and does not constitute, a recommendation to the Conflicts Committee or to any other persons in respect of the Merger, including as to how any holder of GPP Common Units should act or vote in respect of the Merger. The summary of the Evercore opinion set forth herein is qualified in its entirety by reference to the full text of the opinion included as Annex C to this consent solicitation statement/prospectus.

For a description of the opinion that the Conflicts Committee received from Evercore, see “Special Factors—Opinion of Evercore—Financial Advisor to the Conflicts Committee.”

Interests of Certain Persons in the Merger

In considering the information contained in this consent solicitation statement/prospectus, you should be aware that the directors and executive officers of GPRE, its affiliates and the General Partner may have interests in the Proposed Transaction that may be different from, or in addition to, the interest of GPP Unitholders. For a detailed discussion of the interests that the directors and executive officers of GPRE, its affiliates and the General Partner may have in the Proposed Transaction, see “Special Factors—Interests of Certain Persons in the Merger.”

The Merger Agreement

The terms and conditions of the Merger are contained in the Merger Agreement, a copy of which is attached as Annex A to this consent solicitation statement/prospectus. We encourage you to carefully read the Merger Agreement in its entirety, as it is the principal document that governs the Merger.

4

Table of Contents

Termination of the Merger Agreement

The Merger Agreement may be terminated prior to the closing of the Merger by the mutual written consent of GPRE and GPP duly authorized by the GPRE Board and the Conflicts Committee, respectively (whether before or after the Required Limited Partner Written Consent has been obtained) and by either of GPRE or GPP in certain circumstances.

See “The Merger Agreement—Termination of the Merger Agreement.”

Effect of Termination; Termination Expenses

If the Merger Agreement is validly terminated, then, except for amounts payable by GPRE or GPP under certain circumstances, each of the parties will be relieved of its duties and obligations and such termination will be without liability to any party. However, termination will not relieve any party of any liability for failure to consummate the Merger and other transactions contemplated by the Merger Agreement when required under the agreement or for intentional fraud or any willful breach of any covenant or other agreement contained in the Merger Agreement.

See “The Merger Agreement—Effect of Termination; Termination Expenses.”

The Support Agreement

Simultaneously with the execution of the Merger Agreement, GPP and the Support Parties entered into the Support Agreement. Pursuant to the Support Agreement, among other things, the Support Parties have agreed to deliver a written consent, covering all of the GPP Common Units beneficially owned by such Support Party, approving the Merger Agreement and the transactions contemplated thereby, including the Merger, and any other matters necessary for the consummation of the transactions contemplated by the Merger Agreement.

As of September 16, 2023, the date of the Merger Agreement, the Support Parties collectively beneficially owned 11,661,429 GPP Common Units, representing approximately 50.1% of the outstanding GPP Common Units. Accordingly, the delivery of the Written Consent by the Support Parties will be sufficient to approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on behalf of the GPP Limited Partners.

A copy of the Support Agreement is attached as Annex B to this consent solicitation statement/prospectus. We encourage you to carefully read the Support Agreement in its entirety, as it is the principal document that governs the Written Consent.

No Appraisal Rights

GPP Unaffiliated Unitholders will not have appraisal rights in connection with the Merger under applicable law or contractual appraisal rights under the Partnership Agreement or the Merger Agreement.

Regulatory Matters

In connection with the Merger, GPRE and GPP each intend to make all required filings under the Securities Act and the Exchange Act, as well as any required filings or applications with Nasdaq. GPRE and GPP are unaware of any other requirement for the filing of information with, or the obtaining of the approval of, governmental authorities in any jurisdiction that is required for the consummation of the Merger.

The Merger is not reportable under the HSR Act, and therefore, no filings with respect to the Merger were required with the FTC or the Antitrust Division of the DOJ.

5

Table of Contents

Listing of the GPRE Common Stock to be Issued in the Merger; Delisting and Deregistration of the GPP Common Units

GPRE expects to obtain approval to list the shares of GPRE Common Stock to be issued pursuant to the Merger Agreement on Nasdaq, which approval is a condition to the Closing, subject to official notice of issuance. Upon completion of the Merger, the GPP Common Units will cease to be listed on Nasdaq and will be subsequently deregistered under the Exchange Act.

Post-Closing Status of GPP

After the consummation of the Merger, it is expected that GPP will remain an indirect, wholly owned subsidiary of GPRE.

Accounting Treatment

The Merger will be accounted for in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 810—Overall—Changes in a Parent’s Ownership Interest in a Subsidiary. As GPRE controls GPP through its direct ownership of the General Partner and will continue to control GPP after the Merger, the change in GPRE’s ownership interest in GPP will be accounted for as an equity transaction, and no gain or loss will be recognized in GPRE’s consolidated statements of operations. Also, in accordance with ASC 740—Income Taxes, the income tax effects of the Merger are presented in additional paid-in capital.

Additionally, after the Closing, GPRE will no longer reflect the ownership interest in GPP held by the GPP Unaffiliated Unitholders prior to the Closing as noncontrolling interests on GPRE’s consolidated balance sheet nor will GPRE attribute a portion of GPP’s net income to these former unitholders on its consolidated statements of operations.

Comparison of Rights of GPRE Shareholders and GPP Unitholders

GPRE is an Iowa corporation and GPP is a Delaware limited partnership. Ownership interests in a Delaware limited partnership are fundamentally different from ownership interests in an Iowa corporation. For more information concerning these differences, see “Comparison of Rights of GPRE Shareholders and GPP Unitholders.”

Material U.S. Federal Income Tax Consequences

The receipt of shares of GPRE Common Stock and cash in exchange for GPP Public Common Units pursuant to the Merger Agreement will be a taxable transaction to GPP Unaffiliated Unitholders for U.S. federal income tax purposes.

The U.S. federal income tax consequences of the Merger to a GPP Unaffiliated Unitholder will depend on such unitholder’s own personal tax situation. Accordingly, you are strongly urged to consult your tax advisor for a full understanding of the particular tax consequences of the Merger to you.

See “Material U.S. Federal Income Tax Consequences” for a more complete discussion of U.S. federal income tax consequences of the Merger.

6

Table of Contents

Summary of Risk Factors

You should carefully consider all of the risk factors together with all of the other information included in, or incorporated by reference into, this consent solicitation statement/prospectus before deciding whether to sign and deliver the written consent relating to your GPP Common Units. Some of these risks include, but are not limited to, those described below and in more detail under the heading “Risk Factors.”

| • | Because the Exchange Ratio is fixed and because the market price of GPRE Common Stock will fluctuate prior to the completion of the Merger, GPP Unaffiliated Unitholders cannot be sure of the market value of GPRE Common Stock that they will receive as part of the Merger Consideration relative to the value of the GPP Common Units that they will exchange in connection with the Merger. |

| • | The Merger is subject to conditions, including some conditions that may not be satisfied on a timely basis, if at all. Failure to complete the Merger, or significant delays in completing the Merger, could negatively affect each party’s future business and financial results and the trading prices of shares of GPRE Common Stock and GPP Common Units. |

| • | The date GPP Unaffiliated Unitholders will receive the Merger Consideration depends on the completion date of the Merger, which is uncertain. |

| • | GPRE and GPP may incur substantial transaction related costs in connection with the Merger. If the Merger does not occur, GPRE and GPP will not benefit from these costs. |

| • | If the Merger Agreement is terminated, GPRE or GPP may, under specified circumstances, be responsible for the terminating party’s expenses in an amount up to $5 million. |

| • | GPRE and GPP may in the future be targets of securities class action and derivative lawsuits, which could result in substantial costs and may delay or prevent the completion of the Merger. |

| • | The Partnership Agreement limits the duties of the General Partner to GPP Unitholders and restricts the remedies available to GPP Unitholders for actions taken by the General Partner. |

| • | Certain executive officers and directors of the General Partner and GPRE have interests in the Merger that are different from, or in addition to, the interests they may have as GPP Unitholders or GPRE Shareholders, respectively, which could have influenced their decision to support or approve the Merger. |

| • | The opinion of Evercore speaks only as of the date rendered based on circumstances and conditions existing as of the signing of the Merger Agreement and will not reflect changes in circumstances between the signing of the Merger Agreement and the closing date of the Merger. |

| • | Financial projections of GPRE and/or GPP may not prove to be accurate. |

| • | GPP Unitholders will not be entitled to appraisal rights in connection with the Merger. |

| • | The Merger will be a taxable transaction to GPP Unaffiliated Unitholders and, in such case, the resulting tax liability of a GPP Unaffiliated Unitholder, if any, will depend on the unitholder’s particular situation. The tax liability of a GPP Unaffiliated Unitholder as a result of the Merger could be more than expected and could be more than the cash received pursuant to the Merger. |

| • | The U.S. federal income tax treatment of owning and disposing of shares of GPRE Common Stock received in the Merger will be different from the U.S. federal income tax treatment of owning and disposing of GPP Common Units. |

| • | GPP Unitholders will be entitled to different rights as holders of shares of GPRE Common Stock than those to which they are entitled as holders of GPP Common Units. |

7

Table of Contents

| • | The market value of shares of GPRE Common Stock could decline if large amounts of such stock are sold following the Merger; the market value of shares of GPRE Common Stock could also decline as a result of issuances and sales of shares of GPRE Common Stock other than in connection with the Merger. |

| • | The Merger may not be accretive to certain financial metrics, which may negatively affect the market price of shares of GPRE Common Stock. |

In addition, GPRE and GPP face other business, financial operational and legal risks and uncertainties detailed from time to time in GPRE’s and GPP’s respective SEC filings, including, but not limited to those discussed described in Part I, Item 1A of GPRE’s Annual Report on Form 10-K for the year ended December 31, 2022 and Part II, Item 1A of GPRE’s Quarterly Reports on Form 10-Q for the quarterly periods ended June 30, 2023 and September 30, 2023, and Part I, Item 1A of GPP’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and Part II, Item 1A of GPP’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30, 2023, each of which are filed with the SEC and incorporated by reference herein, and in other documents that are incorporated by reference herein.

Litigation Relating to the Merger

Since the initial public announcement of the Merger by GPRE and GPP on September 18, 2023, to the knowledge of GPRE and GPP as of the date hereof, none of GPRE, GPP, the General Partner, Merger Sub or Holdings has been named as a defendant in any lawsuit relating to the Merger.

8

Table of Contents

This section of the document describes the material aspects of the proposed Merger, but may not contain all of the information that is important to you. The following discussion of the Merger is qualified in its entirety by reference to the Merger Agreement. You are urged to carefully read the Merger Agreement in its entirety, a copy of which is attached as Annex A to this consent solicitation statement/prospectus and incorporated by reference herein.

General

On September 16, 2023, GPRE, Holdings, Merger Sub, GPP and the General Partner entered into the Merger Agreement, pursuant to which Merger Sub will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE.

Under the terms of the Merger Agreement, at the Effective Time, each outstanding GPP Public Common Unit will be converted into the right to receive, subject to adjustment as described in the Merger Agreement, (i) 0.405 shares of GPRE Common Stock and (ii) an amount of cash equal to the sum of (a) $2.00 plus (b) the product of (x) $0.455 divided by 90, multiplied by (y) the number of days from, but excluding, the last day of the calendar quarter with respect to which the General Partner has declared a quarterly cash distribution to the holders of GPP Common Units of no less than $0.455 per GPP Common Unit with a record date prior to the Closing Date, to, but excluding, the Closing Date, computed on the basis of a 360-day year comprised of twelve 30-day months and the actual number of days for any period less than a calendar month, and rounded to the nearest whole cent, without interest. In addition, at the Effective Time, each of the outstanding awards relating to a GPP Common Unit issued under a Partnership Long-Term Incentive Plan will become fully vested and will be automatically canceled and converted into the right to receive, with respect to each GPP Common Unit subject thereto, the Merger Consideration (plus any accrued but unpaid amounts in relation to distribution equivalent rights). Except for the Incentive Distribution Rights, which will be automatically canceled immediately prior to the Effective Time for no consideration in accordance with the Partnership Agreement, the limited partner interests in GPP owned by GPRE, the General Partner and their respective affiliates prior to the Effective Time will remain outstanding as limited partner interests in the surviving entity. The economic general partner interest in GPP will remain outstanding as a general partner interest in the surviving entity immediately following the Effective Time, and the General Partner will continue as the sole general partner of the surviving entity. No fractional shares of GPRE Common Stock will be issued in the Merger; instead, all fractional shares of GPRE Common Stock to which a GPP Unaffiliated Unitholder otherwise would have been entitled will be aggregated and the resulting fraction will be rounded up to the nearest whole share of GPRE Common Stock.

Pursuant to the Partnership Agreement, the approval of the Merger Agreement and the Merger by GPP requires the affirmative vote or written consent of the holders of a majority of the outstanding GPP Common Units. Under the Support Agreement, each Support Party has irrevocably and unconditionally agreed to deliver the Written Consent as promptly as practicable after the effectiveness of the registration statement of which this consent solicitation statement/prospectus forms a part. As of September 16, 2023, the date of the Merger Agreement, the Support Parties collectively beneficially owned 11,661,429 GPP Common Units, representing approximately 50.1% of the outstanding GPP Common Units. Accordingly, the delivery of the Written Consent by the Support Parties will be sufficient to approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on behalf of the GPP Limited Partners.

The proposed Merger is a “going-private” transaction under SEC rules and the Exchange Act. Accordingly, Rule 13e-3 and related rules under the Exchange Act require that the GPRE Parties, GPP and the General Partner make certain disclosures regarding the Merger. This section contains various information that you should read carefully. For example, the “Special Factors” section entitled “Effects of the Merger” explains the material steps for completing the Merger and results of the Merger, including identifying the surviving entity. The section entitled “Background of the Merger” explains, among other things, GPRE’s purposes for the Merger, the

9

Table of Contents

alternative methods of achieving such purposes considered by the GPRE Board and the general negotiation of the Merger Agreement. The sections entitled “Approval of the Conflicts Committee and the GP Board and the Reasons for their Approvals” and “GPRE Parties’ Position as to the Fairness of the Merger,” respectively, explain why the Conflicts Committee and the GP Board, on the one hand, and the GPRE Parties, on the other hand, believe the Merger is in the best interests of the GPP Unaffiliated Unitholders. The section entitled “Opinion of Evercore – Financial Advisor to the Conflicts Committee” summarizes the process and methodologies followed by Evercore in rendering its opinion to the Conflicts Committee. You are encouraged to carefully read this “Special Factors” section and this entire consent solicitation statement/prospectus, along with the documents incorporated herein by reference.

Effects of the Merger

On September 16, 2023, GPRE, Holdings, Merger Sub, GPP and the General Partner entered into the Merger Agreement, pursuant to which Merger Sub will merge with and into GPP, with GPP surviving as an indirect, wholly owned subsidiary of GPRE. As of November 30, 2023, GPRE beneficially owned 11,586,548 GPP Common Units, representing approximately 49.8% of the outstanding GPP Common Units, and all of the Incentive Distribution Rights. GPRE also owns 100% of the membership interests of the General Partner, which owns the existing general partner interest in GPP. GPRE controls GPP through its direct ownership of the General Partner and certain of the executive officers and directors of the General Partner are also executive officers and/or directors of GPRE.

If the Merger is completed, (i) GPP will become an indirect, wholly owned subsidiary of GPRE, (ii) the GPP Unaffiliated Unitholders will no longer have an equity interest in GPP, (iii) the GPP Common Units will no longer be listed on Nasdaq, (iv) GPP will commence the suspension and termination of the registration of the GPP Common Units with the SEC, (v) the interests in GPP owned by GPRE, the General Partner and their respective affiliates prior to the Effective Time will remain outstanding as partnership interests in the surviving entity, and (vi) the economic general partner interest in GPP will remain outstanding as a general partner interest in the surviving entity immediately following the Effective Time, and the General Partner will continue as the sole general partner of the surviving entity. No party will deliver any Merger Consideration in respect of the general partner interest held by the General Partner and there will be no change in the ownership thereof.

GPP’s net book value (calculated as total assets minus total liabilities) as of September 30, 2023 was approximately $(1.1) million, and GPP’s net income attributable to the partners for the fiscal quarter ended September 30, 2023 was approximately $9.4 million. As of September 30, 2023, GPRE owned 11,586,548 GPP Common Units, representing an effective beneficial ownership by GPRE of 48.8 % of GPP’s net book value (approximately $(134.5) million) and a 2% general partner interest (approximately $(10,000)), which results in a total effective beneficial ownership by GPRE attributable of approximately 50.8% of GPP’s net income attributable to the partners for the fiscal quarter ended September 30, 2023 (approximately $4.8 million). If the Merger is consummated, GPRE’s aggregate beneficial interest in GPP’s net book value will increase to 100% and net income will increase to 100%. Accordingly, if the Merger is consummated, GPRE’s aggregate beneficial interest in GPP’s net book value will increase to approximately $(1.1) million, and net income attributable to the partners will increase to approximately $9.4 million (based on GPP’s fiscal quarter September 30, 2023 financial data). GPRE and its affiliates will also be entitled to any future increase in GPP’s value and all income generated by GPP’s operations going forward.

Background of the Merger

The senior management of GPRE and GPP, and the GPRE Board and the GP Board, regularly review operational and strategic opportunities to increase value for GPRE’s and GPP’s respective investors. In connection with these reviews, these management teams and boards of directors have from time to time evaluated potential transactions that would further their respective strategic objectives and create value for the GPRE Shareholders and the GPP Unitholders, as applicable. These alternatives included potential acquisitions or

10

Table of Contents

business combination transactions with third parties, potential acquisitions or business combination transactions involving GPRE and GPP and other potential strategic alternatives.

During the first quarter of 2023, senior management of GPRE continued to evaluate a potential business combination transaction involving GPRE and GPP, and in February 2023, GPRE engaged Latham & Watkins LLP (“Latham”) as its legal counsel and began discussions with BofA Securities, Inc. (“BofA Securities”) as its potential financial advisor in connection with its evaluation of its investment in GPP, including the evaluation of a potential take-private transaction as well as continuing with the status quo. Representatives of GPRE, Latham and BofA Securities met a number of times in February, March and April 2023 to evaluate certain considerations associated with a potential take private transaction, including timing and structuring considerations.

On April 19, 2023, the GPRE Board held a special meeting attended by members of GPRE management. At the meeting, GPRE management discussed with the members of the GPRE Board, among other matters, the current market challenges for MLPs such as GPP and advised that GPRE management was continuing to evaluate a transaction whereby GPRE would acquire all of the GPP Public Common Units (the “Proposed Transaction”) with GPRE’s external advisors. The members of the GPRE Board were also provided with certain materials prepared by BofA Securities summarizing the material terms of selected MLP precedent take-private transactions.

On April 26, 2023, BofA Securities was formally engaged as financial advisor to GPRE.

On April 27, 2023, the GPRE Board held a special meeting attended by members of GPRE management and representatives of Latham and BofA Securities. During the meeting, the GPRE Board discussed the Proposed Transaction and received a presentation from representatives of BofA Securities on the Proposed Transaction, including the timing and process associated with the Proposed Transaction and a discussion of the material terms of selected MLP precedent take-private transactions. Representatives of Latham provided the GPRE Board with a presentation on certain legal considerations with respect to the Proposed Transaction, including a review of the directors’ fiduciary duties in the context of evaluating and negotiating the Proposed Transaction, and further reviewed the SEC filings, timing and other considerations applicable to the Proposed Transaction.

On May 2, 2023, the GPRE Board held a special meeting attended by members of GPRE management and representatives of Latham and BofA Securities in order to discuss the Proposed Transaction. Representatives of Latham discussed the timing and process associated with the Proposed Transaction, and the GPRE Board discussed the potential merits of the Proposed Transaction. During the meeting, the GPRE Board authorized and directed Todd A. Becker, GPRE’s President and Chief Executive Officer, to submit a non-binding offer to the General Partner to acquire all GPP Public Common Units in exchange for newly issued shares of GPRE Common Stock for an exchange ratio equal to the closing price of the GPP Common Units divided by the closing price of the GPRE Common Stock, in each case, as of the close of business on May 3, 2023. The GPRE Board further authorized certain officers of GPRE to engage in negotiations and the exchange of information with the GP Board or the Conflicts Committee and their respective legal and financial advisors with respect to the Proposed Transaction and to make recommendations to the GPRE Board regarding the Proposed Transaction.

On May 3, 2023, GPRE submitted to the GP Board a non-binding proposal to acquire all GPP Public Common Units at a fixed exchange ratio of 0.3913 shares of GPRE Common Stock for each GPP Public Common Unit (the “Initial GPRE Proposal”). GPRE also indicated in the Initial GPRE Proposal that, among other things, GPRE expected that the Proposed Transaction would simplify GPRE’s corporate structure and governance, generate near-term earnings and cash flow accretion, reduce SG&A expense associated with operating GPP as a separate, standalone public company and align strategic interests between GPP Unitholders and GPRE Shareholders by creating a single, unified public company with full ownership and control of GPRE’s total platform, including terminal operations. In addition, the Initial GPRE Proposal discussed the challenged market for MLPs since GPP’s initial public offering, as well as certain expected benefits of the Proposed Transaction to GPP Unitholders, including offering GPP Unitholders the ability to retain an investment in a larger, more diversified company with greater trading liquidity and access to capital and the expected enhanced governance rights associated with participation in a traditional corporate governance structure.

11

Table of Contents

On May 4, 2023, GPRE and GPP issued a joint press release announcing the submission of the Initial GPRE Proposal by GPRE to the GP Board. Also on May 4, 2023, GPRE filed with the SEC an amendment to its GPP Schedule 13D disclosing its submission of the Initial GPRE Proposal to the GP Board and attaching the letter setting forth the Initial GPRE Proposal as an exhibit.

On May 8, 2023, the GP Board determined (i) that each of Clay Killinger and Brett Riley satisfied the independence and other requirements set forth in the GPP Partnership Agreement to serve as a member of the Conflicts Committee and (ii) neither of Messrs. Killinger or Riley had any relationship or ownership interest in the General Partner or its affiliates that would interfere with the exercise of his independent judgment in carrying out the responsibilities of a member of the Conflicts Committee in evaluating the Proposed Transaction. The GP Board delegated to the Conflicts Committee, comprised of Messrs. Killinger and Riley, the authority to evaluate the Proposed Transaction. Later that day, the Conflicts Committee members met to discuss the selection of legal counsel in connection with the Proposed Transaction and next steps of the transaction process. During the meeting, the Conflicts Committee considered materials submitted by, and the expertise, experience and credentials of, three potential legal counsel candidates, and unanimously approved the engagement of Gibson, Dunn & Crutcher LLP (“Gibson Dunn”) as its legal counsel with respect to the Proposed Transaction. Gibson Dunn, the Conflicts Committee and GPP executed an engagement letter on May 10, 2023.

On May 10, 2023, the Conflicts Committee met with representatives of Gibson Dunn to discuss certain issues and considerations in connection with the Conflicts Committee’s review and evaluation of the Proposed Transaction, the transaction process and next steps, including with respect to the selection of a financial advisor to the Conflicts Committee.

On May 11, 2023, the Conflicts Committee met with representatives of Gibson Dunn to discuss the role and duties of the Conflicts Committee, the framework for resolution of conflicts of interest involving GPP, the process and recommendations for resolution of conflicts of interest in connection with the Conflicts Committee’s exploration, consideration, review and evaluation of the Proposed Transaction and related topics, including an overview of take-private transactions. The participants also discussed the transaction process and next steps.

On May 11 and 12, 2023, the Conflicts Committee interviewed representatives of three potential financial advisors to advise the Conflicts Committee in connection with the Proposed Transaction, at which interviews a representative of Gibson Dunn was in attendance.

Later on May 12, 2023, the Conflicts Committee met with representatives of Gibson Dunn. At the meeting, the Conflicts Committee approved the engagement of Evercore Group L.L.C.(“Evercore”) as its financial advisor with respect to the Proposed Transaction because of Evercore’s experience and reputation with public mergers and acquisitions, complex transactions involving publicly traded partnerships and representations of conflicts committees, as well as its familiarity with the industry in which GPP and GPRE operate.

On May 16, 2023, the Conflicts Committee met with representatives of Gibson Dunn and Evercore, at which meeting the Conflicts Committee discussed with its advisors certain issues and considerations in connection with the Conflicts Committee’s exploration, consideration, review and evaluation of the Proposed Transaction. After all representatives of Evercore left the meeting, the Conflicts Committee and representatives of Gibson Dunn discussed compensation of the Conflicts Committee in connection with the Proposed Transaction.

On May 19, 2023, the GP Board adopted resolutions that, among other things, (1) confirmed and ratified in all respects the GP Board’s appointment of the Conflicts Committee members; (2) affirmatively determined, after reasonable inquiry, that (i) each member of the Conflicts Committee satisfied the independence and other requirements set forth in the Partnership Agreement to serve as a member of the Conflicts Committee and (ii) no member of the Conflicts Committee had any relationship or ownership interest in the General Partner or its affiliates that would interfere with the exercise of such member’s independent judgment in carrying out the responsibilities of a member of the Conflicts Committee in evaluating the Proposed Transaction; (3) authorized

12

Table of Contents

and ratified the prior action of the Conflicts Committee to (i) review and evaluate the Proposed Transaction and related agreements for and on behalf of GPP and the GPP Unaffiliated Unitholders; (ii) review, evaluate, solicit, structure, and, if deemed sufficiently favorable to the interests of GPP, negotiate, or delegate the ability to negotiate to any persons, the terms and conditions of the Proposed Transaction for and on behalf of GPP and the GPP Unaffiliated Unitholders; (iii) determine whether the Proposed Transaction is in the best interests of GPP and the GPP Unaffiliated Unitholders; (iv) approve, or determine not to approve, the Proposed Transaction, any such approval of the Proposed Transaction to constitute Special Approval pursuant to Section 7.9(b) of the Partnership Agreement; and (v) recommend to the GP Board that the Proposed Transaction be approved or not approved, any such recommendation to approve the Proposed Transaction to constitute Special Approval pursuant to Section 7.9(b) of the Partnership Agreement, or determine not to make any recommendation regarding the Proposed Transaction to the GP Board. The GP Board also authorized and ratified the retention of legal and financial advisors by the Conflicts Committee in its sole discretion.

On May 22, 2023, the Conflicts Committee met with representatives of Gibson Dunn and Evercore to discuss certain unitholder communications with respect to the Proposed Transaction.

On May 23, 2023, representatives of Evercore had a call with representatives of BofA Securities to discuss the Initial GPRE Proposal. Later that day, representatives of Evercore, on behalf of the Conflicts Committee, sent a due diligence request list to BofA Securities.

On June 5, 2023, GPRE provided the Conflicts Committee and its advisors with access to a virtual data room containing due diligence materials with respect to GPP and GPRE. From June 2023 until the execution of the Merger Agreement in September 2023, the Conflicts Committee, with the assistance of its advisors, reviewed and discussed various financial and legal matters and information relating to GPP, GPRE and the Proposed Transaction.

On June 14, 2023, the Conflicts Committee and representatives of Gibson Dunn and Evercore met with management of GPRE and GPP (“Management”) and representatives of BofA Securities and Latham, during which meeting Management and BofA Securities presented to the Conflicts Committee and its advisors a presentation regarding the Proposed Transaction. During the presentation, representatives of BofA Securities discussed proposed terms of the Proposed Transaction and GPRE’s rationale for the Proposed Transaction, and Management discussed the assets and businesses of GPRE and GPP, as well as the financial forecasts of GPRE and GPP, respectively. For more information on the financial forecasts prepared by Management, see “—Unaudited Projected Financial Information.”

Later on June 14, 2023, representatives of Gibson Dunn sent a supplemental due diligence request list to GPRE.

On June 16, 2023, the Conflicts Committee met with representatives of Gibson Dunn and Evercore to discuss the presentation given by Management and BofA Securities on June 14, 2023. After all representatives of Evercore left the meeting, the Conflicts Committee and Gibson Dunn discussed matters related to the Conflicts Committee’s compensation in connection with the Proposed Transaction.

In response to a request by an institutional investor that was a purported holder of GPP Public Common Units, on June 21, 2023, Mr. Brett Riley, the chairperson of the Conflicts Committee, and representatives of Gibson Dunn and Evercore, received an oral presentation from representatives of the investor regarding such investor’s view with respect to the Proposed Transaction.

On June 26, 2023, representatives of Gibson Dunn sent a further revised supplemental due diligence request list to GPRE.

13

Table of Contents

On June 30, 2023, the Conflicts Committee met with representatives of Gibson Dunn and Evercore, during which meeting Evercore reviewed materials prepared by Evercore with respect to the Proposed Transaction. The Conflicts Committee also discussed matters related to its compensation in connection with the Proposed Transaction.

On July 3, 2023, the Conflicts Committee met with representatives of Gibson Dunn and Evercore, during which meeting representatives of Evercore discussed analysis of potential exchange ratios in the Proposed Transaction prepared by Evercore. The Conflicts Committee also discussed with its advisors a potential counterproposal to be delivered by Evercore to BofA Securities on behalf of the Conflicts Committee.