Exhibit

Exhibit 99.3

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2019

August 12, 2019

TABLE OF CONTENTS

|

| |

Management’s Discussion and Analysis | |

Caution Regarding Forward-Looking Statements | |

Risk Factors and Uncertainties | |

Non-IFRS Measures, Key Metrics and Other Data | |

Overview and Outlook | |

Consolidated Results of Operations and Cash Flows | |

Segment Results of Operations | |

Liquidity and Capital Resources | |

Reconciliations | |

Summary of Quarterly Results | |

Summary of Significant Accounting Policies | |

Recent Accounting Pronouncements | |

Off Balance Sheet Arrangements | |

Outstanding Share Data | |

Legal Proceedings and Regulatory Actions | |

Disclosure Controls and Procedures and Internal Control over Financial Reporting | |

Further Information | |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (this “MD&A”) provides a review of the results of operations, financial condition and cash

flows for The Stars Group Inc. on a consolidated basis for the three and six months ended June 30, 2019. References to “The Stars Group” or the “Corporation” in this MD&A refer to The Stars Group Inc. and its subsidiaries or any one or more of them, unless the context requires otherwise. This document should be read in conjunction with the information contained in the Corporation’s unaudited interim condensed consolidated financial statements and related notes for the three and six months ended June 30, 2019 (the “Q2 2019 Financial Statements”), the Corporation’s audited consolidated financial statements and related notes for the year ended December 31, 2018 (the “2018 Annual Financial Statements”) and Management’s Discussion and Analysis thereon (the “2018 Annual MD&A”), and the Corporation’s annual information form for the year ended December 31, 2018 (the “2018 Annual Information Form” and together with the 2018 Annual Financial Statements and 2018 Annual MD&A, the “2018 Annual Reports”). These documents and additional information regarding the business of the Corporation are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com, the Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) at www.sec.gov, and the Corporation’s website at www.starsgroup.com.

For reporting purposes, the Corporation prepared the Q2 2019 Financial Statements in U.S. dollars and, unless otherwise indicated, in conformity with International Accounting Standard 34—Interim Financial Reporting of International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The financial information contained in this MD&A was derived from the Q2 2019 Financial Statements. The results of operations for the three and six months ended June 30, 2019 were prepared following the Corporation’s adoption of IFRS 16, Leases (“IFRS 16”) and, consistent with the transition method it chose, comparative information has not been restated. See note 15 of the Q2 2019 Financial Statements. Unless otherwise indicated, all references to “USD” and “$” are to U.S. dollars, “EUR” or “€” are to European Euros, “GBP” or “£” are to British pound sterling, “CDN” or “CDN $” are to Canadian dollars and “AUD” or “AUD $” are to Australian dollars. All percent (%) changes are calculated as the current period amount minus the prior period amount and then divided by the prior period amount and use rounded figures except for gross profit margin, Adjusted EBITDA Margin, QAU, QNY, Net Deposits, Betting Net Win Margin (each as defined below) and per share amounts, which are calculated using unrounded figures. Unless otherwise indicated, all references to a specific “note” refer to the notes to the Q2 2019 Financial Statements.

As at June 30, 2019, the Corporation had three reporting segments, “International”, “United Kingdom” and “Australia”, each with certain major lines of operations, and a “Corporate” cost center, all as further described below. The International segment currently includes the business operations of Stars Interactive Group (i.e., PokerStars, PokerStars Casino, BetStars, Full Tilt and their related brands), the United Kingdom segment currently includes the business operations of Sky Betting & Gaming (i.e., Sky Bet, Sky Vegas, Sky Casino, Sky Bingo, Sky Poker, Oddschecker and their related brands) and the Australia segment currently includes the business operations of BetEasy (each as defined below). See “Segment Results of Operations” below and note 5 of the Q2 2019 Financial Statements for additional information on the Corporation’s reporting segments.

As at June 30, 2019, the Corporation had up to four major lines of operations within each of its reporting segments, as applicable: real-money online poker (“Poker”), real-money online betting (“Betting”), real-money online casino and, where applicable, bingo (collectively, “Gaming”), and other gaming-related revenue, including, without limitation, revenue from social and play-money gaming, live poker events, branded poker rooms, Oddschecker and other nominal sources of revenue, as applicable (collectively, “Other”). As it relates to these lines of operations, online revenue includes revenue generated through the Corporation’s online, mobile and desktop client platforms, as applicable.

For purposes of this MD&A: (i) the term “gaming license” refers collectively to all the different licenses, consents, permits, authorizations, and other regulatory approvals that are necessary to be obtained in order for the recipient to lawfully conduct (or be associated with) gaming in a particular jurisdiction; and (ii) unless the context requires otherwise or otherwise defined (particularly as it relates to the Gaming line of operation as used in this MD&A and the Q2 2019 Financial Statements, which currently only includes real-money online casino and, where applicable, bingo revenue), all references in this MD&A to “gaming” include all online gaming (e.g., poker, casino and bingo) and betting.

Unless otherwise stated, in preparing this MD&A the Corporation has considered information available to it up to August 12, 2019, the date the Corporation’s board of directors (the “Board”) approved this MD&A and the Q2 2019 Financial Statements.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This MD&A, the Q2 2019 Financial Statements and the 2018 Annual Reports contain certain information that may constitute forward-looking information and statements (collectively, “forward-looking statements”) within the meaning of the Private Securities Litigation Reform Act of 1995 and applicable securities laws, including financial and operational expectations and projections, such as certain future operational and growth plans and strategies. These statements, other than statements of historical fact, are based on management’s current expectations and are subject to a number of risks, uncertainties and assumptions, including market and economic conditions, business prospects or opportunities, future plans and strategies, projections, technological developments, anticipated events and trends and regulatory changes that affect the Corporation and its customers, partners, suppliers and industries in which it operates or may operate in the future. Although the Corporation and management believe the expectations reflected in such forward-looking statements are reasonable and are based on reasonable assumptions and estimates as at the date hereof, there can be no assurance that these assumptions or estimates are accurate or that any of these expectations will prove accurate. Forward-looking statements are inherently subject to significant business, regulatory, economic and competitive risks, uncertainties and contingencies that could cause actual events to differ materially from those expressed or implied in such statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “would”, “should”, “believe”, “objective”, “ongoing”, “imply” or the negative of these words or other variations or synonyms of these words or comparable terminology and similar expressions. For example, see “Non-IFRS Measures, Key Metrics and Other Data”, “Overview and Outlook”, “Liquidity and Capital Resources” and “Recent Accounting Pronouncements”.

Specific factors and assumptions include the following: customer and operator preferences and changes in the economy; reputation and brand growth; competition and the competitive environment within addressable markets and industries; macroeconomic conditions and trends in the gaming industry; ability to predict fluctuations in financial results from quarter to quarter; ability to mitigate tax risks and adverse tax consequences, including changes in tax laws or administrative policies relating to tax and the imposition of new or additional taxes, such as value-added (“VAT”), other point of consumption taxes, corporate tax, and gaming duties; the Corporation’s exposure to greater than anticipated tax liability; the Corporation’s substantial indebtedness requires that it use a significant portion of its cash flow to make debt service payments; impact of inability to complete future or announced acquisitions or to integrate businesses successfully, including Sky Betting & Gaming and BetEasy; contractual relationships of The Stars Group with FOX (as defined below) and Sky plc and/or their respective subsidiaries; an ability to realize all or any of the Corporation’s estimated synergies and cost savings in connection with acquisitions, including the Acquisitions (as defined below); bookmaking risks; an ability to realize projected financial increases attributable to acquisitions and the Corporation’s business strategies; ability to mitigate foreign exchange and currency risks; potential changes to the gaming regulatory framework, including without limitation, those that may impact the Corporation’s ability to access and operate in certain jurisdictions, whether directly or through arrangements with locally based operators; the heavily regulated industry in which the Corporation carries on its business; risks associated with interactive entertainment and online and mobile gaming generally; ability to obtain, maintain and comply with all applicable and required licenses, permits and certifications to offer, operate and market its product offerings, including difficulties or delays in the same; significant barriers to entry; current and future laws or regulations and new interpretations of existing laws or regulations, or potential prohibitions, with respect to interactive entertainment or online gaming or activities related to or necessary for the operation and offering of online gaming; legal and regulatory requirements; risks of foreign operations generally; risks associated with advancements in technology, including artificial intelligence; ability to develop and enhance existing product offerings and new commercially viable product offerings; ability of technology infrastructure to meet applicable demand and reliance on online and mobile telecommunications operators; systems, networks, telecommunications or service disruptions or failures or cyber-attacks and failure to protect customer data, including personal and financial information; regulations and laws that may be adopted with respect to the Internet and electronic commerce or that may otherwise impact the Corporation in the jurisdictions where it is currently doing business or intends to do business, particularly those related to online gaming or that could impact the ability to provide online product offerings, including as it relates to payment processing; ability to obtain additional financing or to complete any refinancing on reasonable terms or at all; the Corporation’s secured credit facilities contain covenants and other restrictions that may limit its flexibility in operating its business; ability to recruit and retain management and other qualified personnel, including key technical, sales and marketing personnel; defects in product offerings; losses due to fraudulent activities; management of growth; contract awards; potential financial opportunities in addressable markets and with respect to individual contracts; dependency on customers’ acceptance of its product offerings; consolidation within the gaming industry; litigation costs and outcomes; expansion within existing and into new markets; relationships with vendors and distributors; counterparty risks; failure of systems and controls of the Corporation to restrict access to its products; reliance on scheduling and live broadcasting of major sporting events; and natural events. These factors are not intended to represent a complete list of the factors that could affect the Corporation; however, these factors, as well as those risk factors presented under the heading “Risk Factors and Uncertainties” in the 2018 Annual Information Form, elsewhere in this MD&A and the 2018 Annual Reports and in other filings that The Stars Group has made and may make in the future with applicable securities authorities, should be considered carefully.

The foregoing list of important factors and assumptions may not contain all the material factors and assumptions that are important to shareholders and investors. Shareholders and investors should not place undue reliance on forward-looking statements as the plans, assumptions, intentions or expectations upon which they are based might not occur. The forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement. Unless otherwise indicated by the Corporation, forward-looking statements

in this MD&A describe the Corporation’s expectations as at August 12, 2019, and, accordingly, are subject to change after such date. The Corporation does not undertake to update or revise any forward-looking statements to reflect events and circumstances after the date hereof or to reflect the occurrence of unanticipated events, except in accordance with applicable securities laws.

RISK FACTORS AND UNCERTAINTIES

Certain factors may have a material adverse effect on the Corporation’s business, financial condition and results of operations. Current and prospective investors should carefully consider the risks and uncertainties and other information contained in this MD&A, the Q2 2019 Financial Statements and the 2018 Annual Reports, particularly under the heading “Risk Factors and Uncertainties” in the 2018 Annual Information Form, and in other filings that the Corporation has made and may make in the future with applicable securities authorities, including those available on SEDAR at www.sedar.com, EDGAR at www.sec.gov or The Stars Group’s website at www.starsgroup.com. The risks and uncertainties described herein and therein are not the only ones the Corporation may face. Additional risks and uncertainties that the Corporation is unaware of, or that the Corporation currently believes are not material, may also become important factors that could adversely affect the Corporation’s business. If any of such risks actually occur, the Corporation’s business, financial condition, results of operations, and future prospects could be materially and adversely affected. In that event, the trading price of the common shares of the Corporation (the “Common Shares”) (or the value of any other securities of the Corporation) could decline, and the Corporation’s securityholders could lose part or all of their investment.

NON-IFRS MEASURES, KEY METRICS AND OTHER DATA

This MD&A references non-IFRS financial measures and key metric operational performance measures, including those under the headings “Consolidated Results of Operations and Cash Flows”, “Segment Results of Operations” and “Reconciliations” below. The Corporation believes these measures and metrics will provide investors with useful supplemental information about the financial and operational performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business, identifying and evaluating trends, and making decisions. The Corporation believes that such non-IFRS financial measures provide useful information about its underlying, core operating results and trends, enhance the overall understanding of its past performance and future prospects and allow for greater transparency with respect to metrics and measures used by management in its financial and operational decision-making.

Although management believes these non-IFRS financial measures and key metrics are important in evaluating the Corporation, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. They are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS. These measures may be different from non-IFRS financial measures and key metrics used by other companies and may not be comparable to similar meanings prescribed by other companies, limiting their usefulness for comparison purposes. Moreover, presentation of certain of these measures is provided for period-over-period comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Corporation’s operating results.

Non-IFRS Measures

The Corporation presents the following non-IFRS measures in this MD&A, reconciliations of which to their nearest IFRS measures are provided, as applicable, under “Reconciliations” below:

Adjusted EBITDA

The Corporation defines Adjusted EBITDA as net earnings before financial expenses, income tax expense (recovery), depreciation and amortization, stock-based compensation, restructuring, net earnings (loss) on associate and certain other items as set out in the reconciliation tables under “Reconciliations” below.

The Corporation believes Adjusted EBITDA is a useful performance measure as it provides information regarding the Corporation’s ongoing core operating activities and trends in underlying performance and growth, and is used by management primarily to forecast and budget the allocation of applicable resources, particularly in light of its current strategic initiatives, including its geographic and product expansion strategy.

Adjusted EBITDA Margin

The Corporation defines Adjusted EBITDA Margin as Adjusted EBITDA as a proportion of total revenue.

The Corporation believes Adjusted EBITDA Margin is a useful performance measure as it is representative of the Corporation’s ongoing core business activities and assists management in monitoring the impact of any significant change in revenue generation (e.g., as a result

of geographic or product changes, sporting results or seasonality) or costs (e.g., a change in gaming duty rates or gaming regulatory fees or costs) on the Corporation’s operating performance.

Adjusted Net Earnings

The Corporation defines Adjusted Net Earnings as net earnings before interest accretion, amortization of intangible assets resulting from purchase price allocations following acquisitions, stock-based compensation, restructuring, net earnings (loss) on associate, and certain other items. In addition, as previously disclosed, the Corporation makes adjustments for (i) the re-measurement of contingent consideration, which was previously included in, and adjusted for through, interest accretion, but starting with the Corporation’s interim condensed consolidated financial statements and related notes for the three and nine months ended September 30, 2018 (the “Q3 2018 Financial Statements”), it is a separate line item, (ii) the re-measurement of embedded derivatives and ineffectiveness on cash flow hedges, each of which were new line items in the Q3 2018 Financial Statements, and (iii) certain non-recurring tax adjustments and settlements. Each adjustment to net earnings is then adjusted for the tax impact, where applicable, in the respective jurisdiction to which the adjustment relates. Adjusted Net Earnings and any other non-IFRS measures used by the Corporation that relies on or otherwise incorporates Adjusted Net Earnings that was reported for previous periods have not been restated under the updated definition on the basis that the Corporation believes that the impact of the change to those periods would not be material.

The Corporation believes Adjusted Net Earnings is also a useful performance measure as, similar to Adjusted EBITDA, it provides meaningful information relating to the Corporation’s trends in underlying performance and growth, but it also takes into account the Corporation’s current capital structure, the impact of its geographic diversity on taxes and its historical investments in technology.

Adjusted Diluted Net Earnings per Share

The Corporation defines Adjusted Diluted Net Earnings per Share as Adjusted Net Earnings attributable to the Shareholders of The Stars Group Inc. divided by Diluted Shares. Diluted Shares means the weighted average number of Common Shares on a fully diluted basis, including options, other equity-based awards such as warrants and any convertible preferred shares of the Corporation then outstanding. The effects of anti-dilutive potential Common Shares are ignored in calculating Diluted Shares. Diluted Shares used in the calculation of diluted earnings per share may differ from diluted shares used in the calculation of Adjusted Diluted Net Earnings per Share where the dilutive effects of the potential Common Shares differ. See note 8 in the Q2 2019 Financial Statements. For the three and six months ended June 30, 2019, Diluted Shares used for the calculation of Adjusted Diluted Net Earnings per Share equaled 282,399,213 and 278,181,337, respectively, compared with 215,380,175 and 212,449,078 for the prior year periods, respectively.

The Corporation believes Adjusted Diluted Net Earnings per Share is a useful measure for the same reasons as Adjusted Net Earnings as well as providing a per share measure that factors in the dilutive effect of the Corporation’s outstanding equity and equity-based awards and instruments.

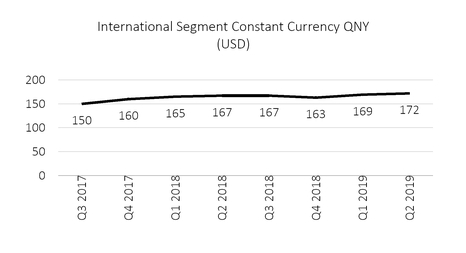

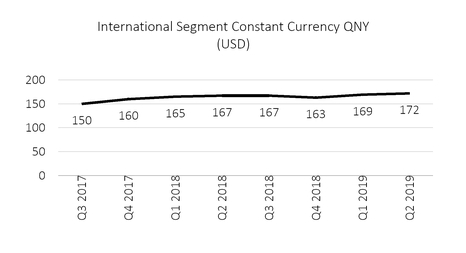

Constant Currency Revenue

The Corporation defines Constant Currency Revenue as IFRS reported revenue for the relevant period calculated using the applicable prior year period’s monthly average exchange rates for its local currencies other than the U.S. dollar. Currently, the Corporation provides Constant Currency Revenue for the International segment and its applicable lines of operations. The Corporation believes providing Constant Currency Revenue for the International segment is useful because it helps show the foreign exchange impact due to currency translation and customer purchasing power, and it facilitates comparison to its historical performance mainly because the U.S. dollar is the primary currency of gameplay on the International segment’s product offerings and the majority of the segment’s customers are from European Union jurisdictions and primarily make deposits in Euros.

The Corporation is also exposed to foreign exchange risk as a result of the Acquisitions, primarily when translating the functional currencies of the United Kingdom segment (i.e., GBP) and Australia segment (i.e., AUD) into U.S. dollars for financial reporting purposes. However, it does not currently provide Constant Currency Revenue for the United Kingdom and Australia segments because the Corporation does not yet have full reported comparative periods for these segments as a result of the respective acquisition dates of Sky Betting & Gaming and BetEasy, and with respect to BetEasy, as of June 30, 2018, the Corporation had not yet completed the previously announced migration of the customers of what was formerly the William Hill Australia business onto the BetEasy platform. The Corporation intends to provide information on the impact of foreign exchange rates for these segments either individually or on a consolidated basis when applicable reported comparative period information is available that the Corporation believes would be reasonably comparable to the current periods as noted above.

Free Cash Flow

The Corporation defines Free Cash Flow as net cash flows from operating activities after adding back customer deposit liability movements and after capital expenditures and debt servicing cash flows (excluding voluntary prepayments).

The Corporation believes that Free Cash Flow is a useful liquidity measure because it believes that removing movements in customer deposit liabilities provides a meaningful understanding of its underlying cash flows as customer deposits are not available funds that the Corporation can use for financial or operational purposes, and removing capital expenditures and debt servicing costs shows cash potentially available for voluntary debt repayments and other financial or operational purposes including to pursue strategic initiatives.

Key Metrics and Other Data

The Corporation currently considers the below noted key metrics in this MD&A for its reporting segments, as applicable. The Corporation does not currently provide consolidated key metrics because management analyzes these metrics primarily on a segment-by-segment basis due to differences in the nature of the applicable segment’s market, customer base and product offerings. Notwithstanding and unless the context otherwise requires, the Corporation believes that readers should consider the applicable metrics together for each segment (but not on a consolidated basis) as customer growth and monetization trends reflected in such metrics are key factors that affect the Corporation’s revenue for the applicable segment.

While management may have provided other non-IFRS financial measures and key metrics in the past, it continues to review and assess the importance, completeness and accuracy of such measures as it relates to its evaluation of the Corporation’s business, performance and trends affecting the same. This includes customer engagement, gameplay, staking or betting levels, depositing activity and various other customer trends, particularly following the introduction of certain customer acquisition initiatives, and the Corporation’s expansion in real-money online casino and sportsbook and the introduction of certain ongoing improvements in the poker ecosystem. As such, management may determine that particular measures that it may have presented in the past are no longer helpful or relevant to understanding the Corporation’s current and future business, performance or trends affecting the same, and as a result it may remove or redefine any such measures, or introduce new or alternative measures. In addition, the Corporation is also continuing to integrate the Acquisitions, as applicable, and once complete, the Corporation may revise or remove currently presented key metrics or report certain additional or other measures in the future. For each applicable period, management intends to provide such metrics and measures that it believes may be the most helpful and relevant to an understanding of the Corporation’s business and performance, including on a consolidated and segmental basis and normalized measures of the same, and trends affecting the foregoing.

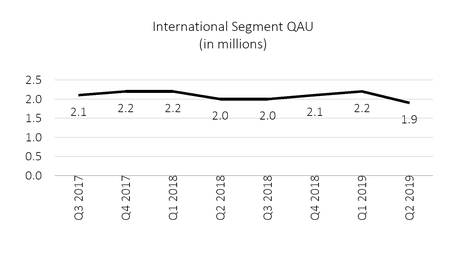

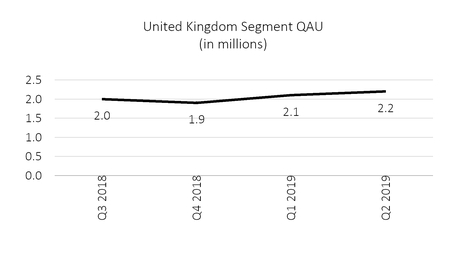

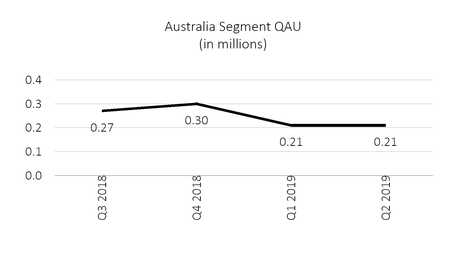

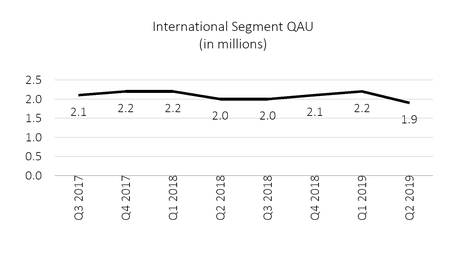

Quarterly Real-Money Active Uniques (QAUs)

The Corporation defines QAUs for the International and Australia reporting segments as active unique customers (online, mobile and desktop client) who (i) made a deposit or transferred funds into their real-money account with the Corporation at any time, and (ii) generated real-money online rake or placed a real-money online bet or wager during the applicable quarterly period. The Corporation defines “active unique customer” as a customer who played or used one of its real-money offerings at least once during the period, and excludes duplicate counting, even if that customer is active across multiple lines of operation (Poker, Gaming and/or Betting, as applicable) within the applicable reporting segment. The definition of QAUs excludes customer activity from certain low-stakes, non-raked real-money poker games, but includes real-money activity by customers using funds (cash and cash equivalents) deposited by the Corporation into such customers’ previously funded accounts as promotions to increase their lifetime value.

The Corporation currently defines QAUs for the United Kingdom reporting segment (which currently includes the SBG (as defined below) business operations only) as active unique customers (online and mobile) who have settled a Stake (as defined below) or made a wager on any betting or gaming product within the applicable quarterly period. The Corporation defines “active unique customer” for the United Kingdom reporting segment as a customer who played at least once on one of its real-money offerings during the period, and excludes duplicate counting, even if that customer is active across more than one line of operation. For the three months ended September 30, 2018, QAUs for the United Kingdom reporting segment also include the applicable pre-acquisition period of July 1, 2018 through July 9, 2018.

QAUs are a measure of the player liquidity on the Corporation’s real-money poker product offerings and level of usage on all its real-money product offerings, collectively. Trends in QAUs affect revenue and financial results by influencing the volume of activity, the Corporation’s product offerings, and its expenses and capital expenditures.

The Corporation has faced and may continue to face challenges in increasing the size of its active customer base within one or more of its reporting segments due to, among other things, competition from alternative products and services for all verticals, as well as regulatory changes, payment processing or other restrictions or macro-economic factors that may impact customer acquisition or the ability of customers to make a deposit or play certain products, high-volume, net-withdrawing customers who detract from the overall poker ecosystem and discourage recreational customers, the use of certain sophisticated technology that may provide an artificial competitive advantage for certain online poker customers over others, and past and potential future weakness in certain global currencies against the U.S. dollar, which decreases the purchasing power of the Corporation’s customer base as the U.S. dollar is the primary currency of gameplay on many of its International segment product offerings. Notwithstanding, the Corporation intends to retain and grow its reporting segments’ customer bases and reactivate dormant users by, as applicable, continuing to improve the poker ecosystem to benefit recreational

players, continuing to introduce new and innovative product offerings, features and enhancements for all verticals, improving the user interfaces, platforms and user experience across its lines of operations, investing in customer relationship management (“CRM”) initiatives, improving the effectiveness of its marketing and promotional efforts, and expanding the availability of its offerings geographically, including through potential acquisitions and strategic transactions, among other things. To the extent the growth of the customer base of a reporting segment of the Corporation continues to decline, that segment’s revenue growth will become increasingly dependent on its ability to increase levels of customer engagement and monetization.

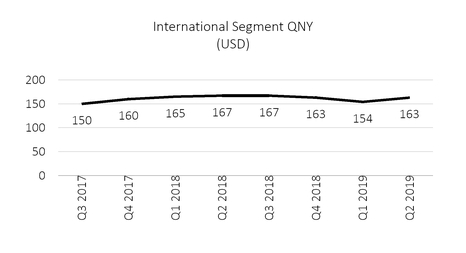

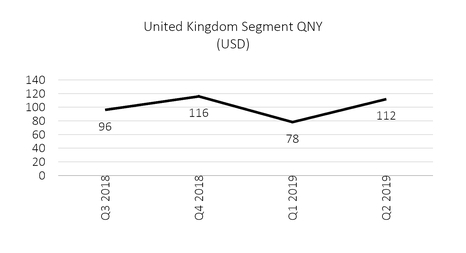

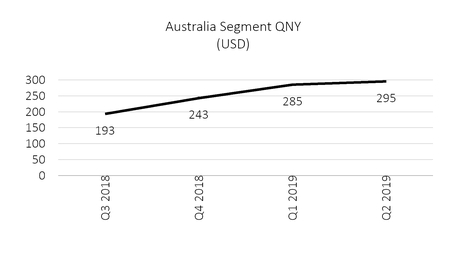

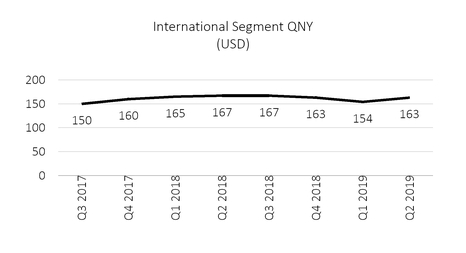

Quarterly Net Yield (QNY)

The Corporation defines QNY as combined revenue for its lines of operation (i.e., Poker, Gaming and/or Betting, as applicable) for each reporting segment, excluding Other revenue, as reported during the applicable quarterly period (or as adjusted to the extent any accounting reallocations are made in later periods) divided by the total QAUs during the same period. For the three months ended September 30, 2018, QNY for the United Kingdom reporting segment also includes the applicable pre-acquisition period of July 1, 2018 through July 9, 2018. The numerator of QNY is a non-IFRS measure.

Trends in QNY are a measure of growth as the Corporation continues to expand its applicable core real-money online product offerings. In addition, the trends in the Corporation’s ability to generate revenue on a per customer basis across its real-money online product offerings are reflected in QNY and are key factors that affect the Corporation’s revenue. The Corporation also provides QNY using Constant Currency Revenue for the International reporting segment.

Many variables can impact a reporting segment’s QNY, including, as applicable, the rake and fees charged in real-money online poker, the applicable margin of online casino games, Stakes and Betting Net Win Margin, the amount of time customers play on its product offerings, offsets to gross revenue for loyalty program rebates, rewards, bonuses, and promotions, VAT and similar taxes in certain jurisdictions, and the amount the applicable reporting segment spends on advertising and other similar expenses. The Corporation currently intends to increase QNY for its reporting segments in future periods by, among other things, and as applicable, (i) continuing to introduce new and innovative product offerings and other initiatives to enhance the customer experience and increase customer engagement, including through CRM initiatives to attract and retain high-value customers, (ii) capitalizing on its existing online poker platforms and offerings, which provides customers with the highest level of player liquidity globally, (iii) cross-selling its online offerings to both existing and new customers, and (iv) continuing to expand and improve its online gaming offerings.

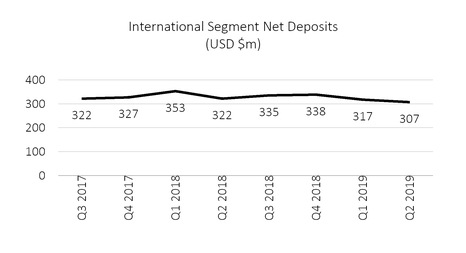

Net Deposits

The Corporation defines Net Deposits for the International segment as the aggregate of gross deposits or transfer of funds made by customers into their real-money online accounts less withdrawals or transfer of funds by such customers from such accounts, in each case during the applicable quarterly period. Gross deposits exclude (i) any deposits, transfers or other payments made by such customers into the Corporation’s play-money and social gaming offerings, and (ii) any real-money funds (cash and cash equivalents) deposited by the Corporation into such customers’ previously funded accounts as promotions to increase their lifetime value.

Net Deposits are representative of the money the Corporation’s customers hold in their accounts to potentially play with, both online and at certain live events. Net Deposits are correlated to the International segment’s reported revenue, as some, all or none of such deposits may eventually be used and become revenue. Trends in Net Deposits are used by management to gauge expected revenue performance across the International segment’s applicable lines of operations and are considered by management when making decisions with respect to applicable product offering changes, including the recent and continuing changes to the Corporation’s online poker ecosystem to benefit and attract high-value, net-depositing customers (primarily recreational players).

Net Deposits are not, and should not be considered, representative of revenue bookings or deferred revenue. Many variables impact the International segment’s Net Deposits, most of which are substantially similar to those noted above impacting the monetization of a product offering as evidenced through QNY. In addition, certain factors have impacted, and may in the future impact, Net Deposits that are not indicative of the performance or underlying health of that segment’s business. For example, as it relates to online poker and following the implementation of certain previously disclosed changes to the poker ecosystem, the movement in customer real-money account balances (i.e., customer deposits) by high-volume, net-withdrawing customers has reduced, and may in the future reduce, Net Deposits as a result of increased withdrawals by such customers, but the Corporation believes that such movements will ultimately create a more attractive environment and experience for recreational players, which in turn may lead to increased Net Deposits. The Corporation believes that the funds in the accounts of the high-volume, net-withdrawing customers are generally not additive to the overall poker ecosystem or to the Corporation’s revenue as such customers generally use only a small portion of them to bet or wager. As the Corporation continues to adjust and improve its product offerings, it expects that such customers may continue to withdraw at greater rates and amounts immediately following such adjustments and improvements, which would impact Net Deposits accordingly.

Stakes and Betting Net Win Margin

The Corporation defines Stakes as betting amounts wagered on the Corporation’s applicable online betting product offerings, and is also an industry term that represents the aggregate amount of funds wagered by customers within the Betting line of operation for the period specified. Betting Net Win Margin is calculated as Betting revenue as a proportion of Stakes. The Corporation uses Stakes and Betting Net Win Margin as measures of the scale of its operations, the engagement of its customers and the performance of its operations across its product offerings and geographic regions. Trends in Stakes are a measure of growth in the Corporation’s Betting line of operations as the Corporation continues to expand its applicable core real-money online betting offerings. Trends in Betting Net Win Margin are primarily a measure of the favorability of the outcomes of sporting and other events and the impact of promotional offerings related to the Corporation’s betting offerings.

Many variables impact a reporting segment’s Stakes, including, as applicable, its QAUs, the seasonality of sporting events throughout the year (such as timing of European football (or soccer) including English Premier League, horse races, rugby seasons, tennis, and others) and major tournaments, such as the FIFA World Cup (“World Cup”) and UEFA European Championships. For example, the World Cup and other major sporting events provide a unique opportunity to drive both customer acquisition and engagement. Furthermore, the amount of external marketing and CRM promotions including free bets and offers and the Corporation’s pricing strategy can lead to positive or negative “recycling of winnings”. Similarly, betting outcomes can also lead to positive or negative “recycling of winnings”. Recycling of winnings refers to customer winnings earned from prior bets that are subsequently used to place additional bets or play other products. The mix of products and markets is also an important driver of total Stakes.

Like Stakes, many variables also impact a reporting segment’s Betting Net Win Margin, including client management and bet limits, sporting results, the mix of Stakes and bet types, and the use of offers, promotions and pricing strategy. For example, the International segment’s Betting Net Win Margin is less exposed to the English Premier League and UK horse racing, and as such, is generally not impacted to the same extent by those particular sporting results as is the United Kingdom segment. Betting Net Win Margin can vary significantly from quarter to quarter depending on the variables noted above; however, over the long term, the Corporation believes these margins tend to become more predictable.

Limitations of Non-IFRS Measures, Key Metrics and Other Data

There are a number of limitations related to the use of such non-IFRS measures as opposed to their nearest IFRS equivalent. Some of these limitations are:

| |

• | these non-IFRS financial measures exclude or are otherwise adjusted for the applicable items listed in the reconciliation tables under “Reconciliations” below and as set forth in the definitions of such measures; and |

| |

• | the income or expenses that the Corporation excludes in its calculation of these non-IFRS financial measures may differ from the income or expenses that its peer companies may exclude from similarly-titled non-IFRS measures that they report. In addition, although certain excluded income or expenses may have been incurred in the past or may be expected to recur in the future, management believes it is appropriate to exclude such income or expenses at this time as it does not consider them as on-going core operating income or expenses of the Corporation. Moreover, certain integration and related costs of the Acquisitions are or will be excluded as being more similar to acquisition-related costs rather than on-going core operating expenses. Management currently believes that, subject to unanticipated events or impacts of anticipated events, over time it should have fewer adjustments or the amounts of such adjustments should decrease, except for acquisition-related, market access or integration costs, which the Corporation may incur in the future based on the Corporation’s strategic initiatives. |

The numbers for the Corporation’s key metrics and related information are calculated using internal company data based on the activity of customer accounts. While these numbers are based on what the Corporation believes to be reasonable judgments and estimates of its customer base for the applicable period of measurement, there are certain challenges and limitations in measuring the usage of its product offerings across its customer base. Such challenges and limitations may also affect the Corporation’s understanding of certain details of its business. In addition, the Corporation’s key metrics and related estimates, including the definitions and calculations of the same, may differ among reporting segments, from estimates published by third parties or from similarly-titled metrics of its competitors due to differences in operations, product offerings, methodology and access to information.

For example, the methodologies used to measure the Corporation’s customer metrics may be susceptible to algorithm, calculation or other technical or human errors, including how certain metrics may be defined (and the assumptions and considerations made and included in, or excluded from, such definitions) and how certain data may be, among other things, integrated, analyzed and reported after the Corporation completes an acquisition or strategic transaction. Moreover, the Corporation’s business intelligence tools may experience glitches or fail on a particular data backup or upload, which could lead to certain customer activity not being properly included in the calculation of a particular key metrics. Another challenge with respect to certain key metrics is that customers could create multiple real-money accounts with the Corporation (in nearly all instances such account creation would violate the Corporation’s applicable terms and

conditions of use), and customers could take advantage of certain customer acquisition incentives to register and interact with the Corporation’s product offerings without actually depositing or transferring funds into their real-money accounts. Furthermore, customers may have more than one account across the Corporation’s brands that currently do not have common or shared account structure, which could lead to such customers being counted more than once for a particular key metric. Although the Corporation typically addresses and corrects any such failures, duplications and inaccuracies relatively quickly, its metrics are still susceptible to the same and its estimations of such metrics may be lower or higher than the actual numbers.

The Corporation regularly reviews its processes for calculating and defining these metrics, and from time to time it may make adjustments to improve their accuracy that may result in the recalculation or replacement of historical metrics or introduction of new metrics. These changes may also include adjustments to underlying data, such as changes to historical figures as a result of accounting adjustments and revisions to definitions in an effort to provide what management believes may be the most helpful and relevant data. These changes may arise as a result of, among other things, the Corporation implementing new technology, software or accounting methods, engaging third-party advisors or consultants, or acquiring or integrating new assets, businesses or business units. The Corporation also continuously seeks to improve its ability to identify irregularities and inaccuracies (and suspend any customer accounts that violate its terms and conditions of use and limit or eliminate promotional incentives that are susceptible to abuse), and its key metrics or estimates of key metrics may change due to improvements or changes in its methodology. Notwithstanding, the Corporation believes that any such irregularities, inaccuracies or adjustments are immaterial unless otherwise stated.

OVERVIEW AND OUTLOOK

Business Overview and Background

The Stars Group is a global leader in the online and mobile gaming and interactive entertainment industries, entertaining millions of customers across its online real- and play-money poker, gaming and betting product offerings, which are delivered through mobile, web and desktop applications. The Stars Group offers these products directly or indirectly under several ultimately owned or licensed gaming and related consumer businesses and brands, including, among others, PokerStars, PokerStars Casino, BetStars, Full Tilt, FOX Bet, BetEasy, Sky Bet, Sky Vegas, Sky Casino, Sky Bingo, Sky Poker, and Oddschecker, as well as live poker tour and events brands, including the PokerStars Players No Limit Hold’em Championship, European Poker Tour, PokerStars Caribbean Adventure, Latin American Poker Tour, Asia Pacific Poker Tour, PokerStars Festival and PokerStars MEGASTACK. The Stars Group is one of the world’s most licensed online gaming operators with its subsidiaries collectively holding licenses or approvals in 21 jurisdictions throughout the world, including in Europe, Australia and the Americas. The Stars Group’s vision is to become the world’s favorite iGaming destination and its mission is to provide its customers with winning moments.

The Stars Group’s primary business and source of revenue is its online gaming and betting businesses. These currently consist of the operations of Stars Interactive Holdings (IOM) Limited and its subsidiaries and affiliates (collectively, “Stars Interactive Group”), which it acquired in August 2014, the operations of Cyan Blue Topco Limited and its subsidiaries and affiliates (collectively, “Sky Betting & Gaming” or “SBG”), which it acquired in July 2018 (the “SBG Acquisition”), and the operations of TSG Australia Pty Ltd and its subsidiaries and affiliates ( collectively, “BetEasy”), which it acquired an 80% equity interest in between February 2018 and April 2018 (BetEasy acquired what was formally the William Hill Australia business in April 2018) (collectively, the “Australian Acquisitions” and together with the SBG Acquisition, the “Acquisitions”). With certain exceptions, The Stars Interactive Group is headquartered in the Isle of Man and Malta and operates globally; SBG is headquartered in and primarily operates in the United Kingdom; and BetEasy is headquartered in and primarily operates in Australia.

For additional information about The Stars Group, including a detailed overview of the business, current strategies and a discussion of the competitive landscape affecting The Stars Group, see the disclosure and discussion elsewhere in this MD&A and the 2018 Annual Information Form. For risks and uncertainties relating to, among other things, The Stars Group, its business, its customers, its regulatory and tax environment and the industries and geographies in which it operates or where its customers are located, see “Risk Factors and Uncertainties” above and in the 2018 Annual Information Form as well as the risks and uncertainties contained elsewhere herein, the Q2 2019 Financial Statements, the 2018 Annual Reports and in other filings that The Stars Group has made and may make in the future with applicable securities authorities. Except as noted herein, for information about The Stars Group’s outlook, see the 2018 Annual Reports, particularly in the 2018 Annual Information Form, including under the headings “Business of the Corporation—Business Strategy of the Corporation” and “—Markets and Customers”.

Recent Corporate and Other Developments

Below is a general summary of certain recent corporate and other developments from the beginning of the second quarter of 2019 through the date hereof. For additional corporate and other developments and highlights, see the Q2 2019 Financial Statements, the 2018 Annual Reports, particularly the 2018 Annual Information Form, and “Further Information” below.

FOX Sports Partnership

On May 8, 2019, the Corporation and FOX Sports (“FOX Sports”), a unit of Fox Corporation (Nasdaq: FOXA, FOX) (“FOX”), announced plans to launch FOX Bet, the first-of-its kind national media and sports wagering partnership in the United States. In addition to a commercial agreement of up to 25 years and associated product launches, FOX also acquired 14,352,331 newly issued Common Shares, representing 4.99% of the Corporation’s then-issued and outstanding Common Shares, at a price of $16.4408 per share, for aggregate proceeds of $236.0 million. The Common Shares issued to FOX are subject to certain transfer restrictions for two years, subject to customary exceptions.

Under the commercial agreement, FOX Sports granted to the Corporation an exclusive license for the use of certain FOX Sports trademarks for a range of immersive games and online sports wagering, and certain exclusive advertising and editorial integration rights on certain FOX Sports broadcast media and digital assets. As part of the transaction, FOX Sports will receive certain brand license, integration and affiliate fees. In addition, during the term of the commercial agreement, the Corporation has agreed to a minimum annual advertising commitment on certain FOX media assets. Prior to the tenth anniversary of the commercial agreement, and subject to certain conditions and applicable gaming regulatory approvals, FOX Sports has the right to acquire up to a 50% equity stake in the Corporation’s U.S. business.

Prepayment of First Lien Term Loans

In May 2019, the Corporation prepaid $250.0 million, including accrued and unpaid interest, of its USD First Lien Term Loan (as defined below), using the proceeds from the issuance of Common Shares to FOX as described above and cash on hand. For additional information, see “Liquidity and Capital Resources” below.

US Market Access Update

On July 9, 2019, the Corporation announced it entered into an agreement with Akwesasne Mohawk Casino Resort (“Mohawk”) that grants the Corporation an option to operate and brand real-money online sports betting, poker and casino in New York on a first skin basis, subject to license availability, state law and regulatory approvals. The agreement also provides that the Corporation will provide support services for the launch and operation of a retail sportsbook at the Akwesasne Mohawk Casino Resort in Northern New York. Under the terms of the agreement, Mohawk will receive a revenue share from the operation of the applicable online offerings by the Corporation and the Corporation will receive a revenue share from the operation of the retail sportsbook from Mohawk.

On July 31, 2019, the Corporation announced it entered into an agreement with Penn National Gaming (Nasdaq: PENN) (“Penn”) that grants it options to operate online betting and gaming offerings in the nine states where Penn currently owns or operates casino properties. As it relates to sports betting, the Corporation’s options currently provide first skin access in Illinois, Indiana, Ohio and Texas, and second skin access in Kansas, New Mexico, Maine, Massachusetts and Michigan. Under the terms of the agreement, Penn received an up-front cash payment of $12.5 million and will receive a revenue share from the operation of the applicable offerings by the Corporation and potential additional cash payments upon and following the Corporation’s exercise of each option.

As of the date hereof, the Corporation now has combined access to up to 20 states under its applicable market access agreements, subject to license availability, state law and regulatory approvals.

Appointment of Independent Director and Senior Management

On August 12, 2019, the Corporation announced the appointment by the Board of John Schappert to serve as a new independent director on the Board and a member of the Board’s Compensation Committee and Technology Committee.

In July 2019, the Corporation also appointed Gino Appiotti as President of the International segment, having previously served as its Managing Director of Poker. Mr. Appiotti has served the Corporation in various senior capacities since 2011 and will report to Mr. Ashkenazi.

Technology Committee of the Board

On August 8, 2019, the Board established a standing Technology Committee of independent directors, which will have certain oversight and monitoring responsibilities with respect to technology-related risks and the overall role of technology in executing the corporation’s business strategy. The Technology Committee is currently comprised of Eugene Roman, John Schappert and Mary Turner, with Mr. Roman serving as the chair.

CONSOLIDATED RESULTS OF OPERATIONS AND CASH FLOWS

Summary consolidated results of the Corporation’s operations, cash flows and certain other items for the three and six months ended June 30, 2019 and 2018, and as at June 30, 2019 and December 31, 2018, as applicable, are set forth below:

|

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

In thousands of U.S. Dollars (except otherwise noted) | | 2019 | | 2018 | | % Change | | 2019 | | 2018 | | % Change |

Revenue | | | | | | | | | | | | |

Poker | | 194,210 |

| | 216,986 |

| | (10.5 | )% | | 411,649 |

| | 462,856 |

| | (11.1 | )% |

Gaming | | 196,891 |

| | 101,941 |

| | 93.1 | % | | 386,102 |

| | 208,651 |

| | 85.0 | % |

Betting | | 227,953 |

| | 80,912 |

| | 181.7 | % | | 383,619 |

| | 108,723 |

| | 252.8 | % |

Other | | 18,564 |

| | 11,673 |

| | 59.0 | % | | 36,632 |

| | 24,173 |

| | 51.5 | % |

Total revenue |

| 637,618 |

|

| 411,512 |

|

| 54.9 | % |

| 1,218,002 |

|

| 804,403 |

|

| 51.4 | % |

| | | | | |

| | | | | | |

Gross profit (excluding depreciation and amortization) |

| 463,708 |

|

| 327,875 |

|

| 41.4 | % |

| 881,456 |

|

| 640,502 |

|

| 37.6 | % |

Gross profit margin (%) | | 72.7 | % | | 79.7 | % | | (8.8 | )% | | 72.4 | % | | 79.6 | % | | (9.0 | )% |

| | | | | |

| | | | | | |

Operating expenses | | | | | |

| | | | | | |

General and administrative | | 276,440 |

| | 262,786 |

| | 5.2 | % | | 535,797 |

| | 404,093 |

| | 32.6 | % |

Sales and marketing | | 79,915 |

| | 54,899 |

| | 45.6 | % | | 164,258 |

| | 104,317 |

| | 57.5 | % |

Research and development | | 13,398 |

| | 9,126 |

| | 46.8 | % | | 25,909 |

| | 17,161 |

| | 51.0 | % |

Operating income |

| 93,955 |

|

| 1,064 |

|

| 8,730.4 | % |

| 155,492 |

|

| 114,931 |

|

| 35.3 | % |

Net financing charges | | 68,245 |

| | 160,360 |

| | (57.4 | )% | | 115,222 |

| | 198,711 |

| | (42.0 | )% |

Net earnings from associates | | — |

| | (1,068 | ) | | 100.0 | % | | — |

| | (1,068 | ) | | 100.0 | % |

Income tax expense (recovery) | | 21,081 |

| | (3,404 | ) | | 719.3 | % | | 7,983 |

| | (2,249 | ) | | 455.0 | % |

Net earnings (loss) |

| 4,629 |

|

| (154,824 | ) |

| 103.0 | % |

| 32,287 |

|

| (80,463 | ) |

| 140.1 | % |

Adjusted Net Earnings ¹ |

| 137,469 |

|

| 131,023 |

|

| 4.9 | % |

| 243,069 |

|

| 269,785 |

|

| (9.9 | )% |

| | | | | |

| | | | | | |

Adjusted EBITDA ¹ |

| 236,734 |

|

| 168,271 |

|

| 40.7 | % |

| 432,089 |

|

| 343,293 |

|

| 25.9 | % |

Adjusted EBITDA Margin ¹ |

| 37.1 | % |

| 40.9 | % |

| (9.3 | )% |

| 35.5 | % |

| 42.7 | % |

| (16.9 | )% |

| | | | | |

| | | | | | |

Earnings (loss) per share | | | | | |

| | | | | | |

Basic ($/Share) | | 0.02 |

| | (1.01 | ) | | 101.7 | % | | 0.12 |

| | (0.52 | ) | | 122.7 | % |

Diluted ($/Share) |

| 0.02 |

|

| (1.01 | ) |

| 101.7 | % |

| 0.12 |

|

| (0.52 | ) |

| 122.6 | % |

Adjusted Diluted Net Earnings per Share ($/Share) ¹ |

| 0.48 |

|

| 0.60 |

|

| (19.4 | )% |

| 0.87 |

|

| 1.27 |

|

| (31.6 | )% |

| | | | | |

| | | | | | |

Net cash inflows from operating activities |

| 173,208 |

|

| 164,011 |

|

| 5.6 | % |

| 283,593 |

|

| 296,080 |

|

| (4.2 | )% |

Net cash outflows from investing activities | | (36,034 | ) | | (230,757 | ) | | 84.4 | % | | (68,790 | ) | | (334,594 | ) | | 79.4 | % |

Net cash (outflows) inflows from financing activities | | (73,553 | ) | | 889,108 |

| | (108.3 | )% | | (275,583 | ) | | 861,289 |

| | (132.0 | )% |

Free Cash Flow ¹ |

| 84,820 |

|

| 84,856 |

|

| — | % |

| 47,307 |

|

| 167,115 |

|

| (71.7 | )% |

|

| | | | | | | | | |

As at | | June 30, 2019 |

|

| December 31, 2018 |

| | % Change |

|

Total assets | | 11,112,280 |

| | 11,265,538 |

| | (1.4 | )% |

Total non-current liabilities | | 5,727,649 |

| | 6,100,164 |

| | (6.1 | )% |

_____________________________

¹ Non-IFRS measure. A reconciliation to its nearest IFRS measure is provided under “Reconciliations” below.

The discussion below sets forth a summary of the results, trends and variances of the Corporation on a consolidated basis. For further discussion and detail of the individual segment results, trends and variances, including details of separate trends in revenue by individual line of operation for each segment, as applicable, and the Corporate cost center, see “Segment Results of Operations” below.

Revenue

Revenue for the three months ended June 30, 2019 increased $226.1 million, or 54.9%, compared to the prior year period. The increase was primarily driven by the SBG Acquisition, which contributed $252.9 million to revenue for the three-month period. With respect to the International and Australia segments, revenue movements in the quarter were primarily as a result of the factors set forth under “Segment Results of Operations—International—Revenue” and “Segment Results of Operations—Australia—Revenue”, respectively.

Revenue for the six months ended June 30, 2019 increased $413.6 million, or 51.4%, compared to the prior year period. The increase was primarily driven by the Acquisitions, which contributed $485.8 million to revenue for the six-month period. With respect to the International segment, revenue decreased in the quarter, primarily as a result of the factors set forth under “Segment Results of Operations—International—Revenue”.

With respect to Canada, the jurisdiction where its registered office is located, and based solely on calculations derived from internal records, the Corporation estimates that revenue derived from customers in Canada, which currently relates only to peer-to-peer Poker, represented less than 2.0% of its total consolidated revenue for each of the three and six months ended June 30, 2019 and less than 4.0% for each of the prior year periods. These estimations are neither itemized nor otherwise separated from the revenue the Corporation reports under IFRS or otherwise, and as such, they cannot be reconciled to a reported IFRS measure.

Foreign Exchange Impact on Revenue

The U.S. dollar was stronger against certain foreign currencies for the three months ended June 30, 2019 compared to the prior year period, which had a negative impact on the International segment’s revenue across all lines of operations. Using Constant Currency Revenue for the International segment in the consolidated results of operations for the three months ended June 30, 2019, revenue would have been $657.2 million, which is $19.6 million higher than actual IFRS revenues, and would have increased by 59.7%, as opposed to 54.9%, compared to the prior year period.

The U.S. dollar was stronger against certain foreign currencies for the six month period ended June 30, 2019 compared to the prior year period, which had a negative impact on the International segment’s revenue across all lines of operations. Using Constant Currency Revenue for the International segment in the consolidated results of operations for the six month period ended June 30, 2019, revenue would have been $1,270.0 million, which is $52.0 million higher than actual IFRS revenues, and would have increased by 57.9%, as opposed to 51.4%, compared to the prior year period.

For a discussion of Constant Currency Revenue for the International segment, see the discussion under “Segment Results of Operations—International—Revenue”.

Gross Profit (Excluding Depreciation and Amortization) and Gross Profit Margin

Gross profit (excluding depreciation and amortization) for the three months ended June 30, 2019 increased $135.8 million, or 41.4%, compared to the prior year period. The increase was primarily driven by the SBG Acquisition, which contributed $177.6 million to gross profit (excluding depreciation and amortization) for the three-month period. This was partially offset by the decrease in revenue and its impact on gross profit within the International segment as well as a reduction in gross profit in the Australian segment year-over-year due to the introduction of point of consumption taxes in the majority of Australian jurisdictions, each as described in “Segmental Results of Operations”. Gross profit margin for the three months ended June 30, 2019 was 72.7%, a decrease of 8.8% compared to the prior year period. The decrease was primarily driven by the change in revenue mix among and across geographies and lines of operations. For example, revenue in locally regulated or taxed geographies, which generally impose higher tax rates, gaming duties, levies and fees, represented approximately 79% of revenue in the three months ended June 30, 2019, compared to approximately 61% of revenue in the prior year period. In addition, Betting and Gaming revenue, which generally have lower gross profit margins than Poker, represented 67% of revenue in the three months ended June 30, 2019, compared to 44% of revenue in the prior year period.

Gross profit (excluding depreciation and amortization) for the six months ended June 30, 2019 increased $241.0 million, or 37.6%, compared to the prior year period. The increase was primarily driven by the Acquisitions, which contributed $320.4 million to gross profit (excluding depreciation and amortization) for the six-month period. This was partially offset by the decrease in revenue and its impact on gross profit within the International segment as described in “Segmental Results of Operations—International”. Gross profit margin for the six months ended June 30, 2019 was 72.4%, a decrease of 9.0% compared to the prior year period primarily driven by the same or substantially similar factors impacting the three month period noted above.

Operating Expenses

General and Administrative

General and administrative expenses for the three months ended June 30, 2019 increased $13.7 million, or 5.2%, compared to the prior year period. The increase was primarily driven by the SBG Acquisition, which added $108.5 million to general and administrative expenses for the three-month period. This was partially offset by a decrease in acquisition-related costs and deal contingent forwards in relation to the Acquisitions of which $95.6 million was incurred in the prior year period within the Corporate cost center.

General and administrative expenses for the six months ended June 30, 2019 increased $131.7 million, or 32.6%, compared to the prior year period. The increase was primarily driven by the Acquisitions, which added $227.4 million to general and administrative expenses for the six-month period. This was partially offset by a decrease in acquisition-related costs and deal contingent forwards in relation to the Acquisitions of which $110.8 million was incurred in the prior year period within the Corporate cost center.

Sales and Marketing

Sales and marketing expenses for the three months ended June 30, 2019 increased $25.0 million, or 45.6%, compared to the prior year period. The increase was primarily driven by the SBG Acquisition, which added $30.7 million to sales and marketing expenses for the quarter. This was partially offset by a reduction in marketing costs in the International segment, in part as a result of additional costs incurred in relation to the World Cup in the prior year period.

Sales and marketing expenses for the six months ended June 30, 2019 increased $59.9 million, or 57.5%, compared to the prior year period. The increase was primarily driven by the Acquisitions, which added $72.9 million to sales and marketing expenses for the quarter. This was partially offset by a reduction in marketing costs in the International segment due to substantially the same factor listed above for the three-month period.

Research and Development

Research and development expenses for the three months ended June 30, 2019 increased $4.3 million, or 46.8%, compared to the prior year period. The increase was primarily driven by the SBG Acquisition, which added $3.5 million to research and development expenses for the three-month period.

Research and development expenses for the six months ended June 30, 2019 increased $8.7 million, or 51.0%, compared to the prior year period. The increase was primarily driven by the Acquisitions, which added $9.0 million to research and development expenses for the six-month period.

Foreign Exchange Impact on Operating Expenses

The Corporation’s expenses are impacted by currency fluctuations. Almost all of its expenses are incurred in either the Euro, British pound sterling, U.S. dollar, Canadian dollar or Australian dollar. There are some natural hedges as a result of customer deposits and revenue made in such currencies; however, the Corporation also enters into certain economic hedges to mitigate the impact of foreign currency fluctuations as it deems necessary. See “Liquidity and Capital Resources—Market Risk—Foreign Currency Exchange Risk” for further information on foreign currency risk.

Net Financing Charges

Net financing charges for the three months ended June 30, 2019 decreased $92.1 million, or 57.4%, compared to the prior year period. The decrease was primarily driven by (i) a $125.0 million loss on the extinguishment of debt recorded in the prior year period following the previously disclosed April 6, 2018 amendment, extension and upsizing of the Corporation’s previous first lien term loans and credit facility, (ii) a $12.2 million gain related to the re-measurement of an embedded derivative recognized in respect of the Senior Notes (as defined below), and (iii) a $7.0 million reduction resulting from the downward re-measurement of the deferred contingent consideration with respect to the acquisition of an additional 18% equity interest in BetEasy during the second quarter of 2018. This was partially offset by increased interest of $41.3 million on the Corporation’s long-term debt primarily related to the First Lien Term Loans (as defined below) and Senior Notes after the effects of hedging activities.

Net financing charges for the six months ended June 30, 2019 decreased $83.5 million, or 42.0%, compared to the prior year period. The decrease was primarily driven by (i) the $125.0 million loss on the extinguishment of debt recorded in the prior year period, (ii) a $34.8 million embedded derivative re-measurement gain, and (iii) a $16.4 million reduction resulting from the downward re-measurement of the deferred contingent consideration as noted above. This was partially offset by increased interest of $82.0 million on the Corporation’s long-term debt primarily related to the First Lien Term Loans and Senior Notes after the effects of hedging activities.

Income Taxes

Income tax expense for the three months ended June 30, 2019 was $21.1 million as compared to an income tax recovery of $3.4 million in the prior year period, which resulted in effective tax rates of 82.0% and 2.2%, respectively. Income taxes for the three months ended June 30, 2019 include an income tax recovery of $10.3 million in relation to the amortization expense of acquired intangible assets from the Acquisitions as compared to $1.4 million for the prior year period.

The income tax expense for the six months ended June 30, 2019 was $8.0 million as compared to an income tax recovery of $2.2 million in the prior year period, which resulted in effective tax rates 19.8% and 2.7%, respectively. The income taxes for the six months ended June 30, 2019 include an income tax recovery of $23.2 million in relation to the amortization expense of acquired intangible assets from the Acquisitions as compared to $1.8 million for the prior year period.

The Corporation’s income taxes for the current period were impacted by the tax recovery on amortization as noted above, the mix of taxable earnings among and across geographies, with an increase in taxable earnings following the Acquisitions in geographies with higher statutory corporate tax rates, and the recognition of deferred tax, as a result of the transfer of customer intangible rights from the Isle of Man to Malta in connection with an internal corporate restructuring, and Australian business continuity tax law change allowing recognition of certain acquired assets. The Corporation expects the mix of taxable earnings to continue to impact income tax expense in future periods as the Corporation’s International segment continues to operate primarily in the Isle of Man and Malta, but its Sky Betting and Gaming and BetEasy businesses operate primarily in the United Kingdom and Australia, respectively, where statutory corporate income tax rates are higher than those in the Isle of Man and Malta.

Net Earnings (Loss)

Net earnings for the three months ended June 30, 2019 was $4.6 million, an increase of 103.0%, compared to net loss of $154.8 million in the prior year period. The increase was primarily driven by (i) the $125.0 million loss on the extinguishment of debt in the prior year period as noted above and (ii) the $95.6 million of acquisition-related costs and deal contingent forwards incurred in connection with the Acquisitions each recorded in the prior year period as noted above. This was partially offset by a $56.3 million increase in the amortization of acquired intangibles from the Acquisitions.

Net earnings for the six months ended June 30, 2019 was $32.3 million, an increase of 140.1%, compared to net loss of $80.5 million in the prior year period. The increase was primarily driven by (i) the $125.0 million loss on the extinguishment of debt in the prior year period as noted above and (ii) the $110.8 million of acquisition-related costs and deal contingent forwards incurred in connection with the Acquisitions each recorded in the prior year period as noted above. This was partially offset by a $114.9 million increase in the amortization of acquired intangibles from the Acquisitions.

Basic and Diluted Net Earnings (Loss) per Share

Basic net earnings per share for the three months ended June 30, 2019 was $0.02, an increase of 101.7%, compared to basic net loss per share of $1.01 for the prior year period, based on weighted average Common Shares outstanding of 281,689,369 and 152,788,098, respectively. Diluted net earnings per share for the three months ended June 30, 2019 was $0.02, an increase of 101.7%, compared to diluted net loss per share of $1.01 for the prior year period, based on weighted average Common Shares outstanding of 282,399,213 and 152,788,098, respectively. The increases were both primarily driven by the increase in net earnings as noted above. This was partially offset by the increases in the weighted average Common Shares outstanding, which were primarily the result of the previously disclosed issuances of Common Shares in connection with the 2018 primary underwritten offering of Common Shares, the Corporation’s mandatory conversion of its preferred shares, the SBG Acquisition, and U.S. market access arrangements during 2018 as well as in connection with the previously announced partnership with FOX Sports. Diluted net loss per share for the prior year period was further negatively impacted as all potentially dilutive securities of the Corporation (i.e., securities exercisable or convertible into Common Shares or equity-based awards that can be settled into Common Shares), were not included in the weighted average Common Share amount above used to calculate diluted earnings (loss) per share because the exercise, conversion or settlement of such securities would be anti-dilutive.

Basic net earnings per share for the six months ended June 30, 2019 was $0.12, an increase of 122.7%, compared to basic net loss per share of $0.52 for the prior year period, based on weighted average Common Shares outstanding of 277,557,011 and 150,523,119, respectively. Diluted net earnings per share for the six months ended June 30, 2019 was $0.12, an increase of 122.6%, compared to diluted net loss per share of $0.52 for the prior year period, based on weighted average Common Shares outstanding of 278,181,337 and 150,523,119, respectively. The increases were primarily driven by the same or substantially similar factors as listed above for the three-month period.

Adjusted EBITDA, Adjusted Net Earnings, and Adjusted Diluted Net Earnings per Share

The primary adjustment from operating income to Adjusted EBITDA for the three and six months ended June 30, 2019 was depreciation and amortization, which increased by $64.5 million and $134.5 million, respectively, compared to the prior year periods, primarily driven by the Acquisitions. In addition to depreciation and amortization, total adjustments and reconciling items collectively decreased by $88.9 million and $86.3 million for the three and six months ended June 30, 2019, respectively, compared to the prior year periods primarily as a result of acquisition-related costs and deal contingent forwards incurred in the prior year period in connection with the Acquisitions as described above. Solely in respect of the six months ended June 30, 2019, this decrease in total adjustments and reconciling items was partially offset by an increase in Other costs (as described in more detail below under the heading “Reconciliations”), which increased $21.8 million largely due to increases in professional fees unrelated to core activities, including the previously announced partnership with FOX Sports and transactions in connection with obtaining potential access to jurisdictions within the United States in which the Corporation currently does not operate, as well as increases to restructuring expenses and certain investigation professional fees.

As it relates to Adjusted Net Earnings and Adjusted Diluted Net Earnings per Share for the three and six months ended June 30, 2019, the primary adjustments from net earnings (loss) and diluted net earnings (loss) per share were (i) the amortization of acquisition intangibles, which increased by $56.3 million and $114.9 million, respectively, compared to the prior year periods, primarily as driven by the Acquisitions, and (ii) gains recorded due to the re-measurement of an embedded derivative recognized in respect of the Senior Notes and of deferred contingent consideration with respect to the acquisition of an additional 18% equity interest in BetEasy during the second quarter of 2018, all as noted above. The prior year periods also included adjustments for (i) a loss on the extinguishment of debt and (ii) acquisition-related costs and deal contingent forwards, each as noted above. Diluted Shares used in the calculation of Adjusted Diluted Net Earnings per Share is consistent with the weighted average Common Shares outstanding used for diluted earnings (loss) per share.

For additional information regarding Adjusted EBITDA, Adjusted Net Earnings and Adjusted Diluted Net Earnings per Share, including applicable definitions and explanations of the relative usefulness of such measures, see “Non-IFRS Measures, Key Metrics and Other Data—Non-IFRS Measures” above. For quantitative reconciliations of such measures to their nearest IFRS measures, see “Reconciliations” below.

Cash Flows by Activity

Cash inflows from Operating Activities

Cash inflows from operating activities for the six months ended June 30, 2019 decreased $12.5 million, or 4.2%, compared to the prior year period. The decrease was primarily driven by (i) $57.4 million of cash outflows in relation to non-cash working capital movements compared to inflows of $18.5 million in the prior year period, and (ii) an increase of $30.7 million in cash income taxes paid by the Corporation as a result of corporate tax payments in the six-month period as well as the settlement of certain tax matters in Australia. This was partially offset by the increase in revenue and gross profit generated from the Corporation’s underlying operations, including the impacts of the Acquisitions, each as noted above.

Cash outflows from Investing Activities