Bermuda |

2834 |

98-1173944 | ||

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company | ||||

| Emerging growth company | ||||||

| | ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee | ||||

| Common Shares, par value $0.0000000341740141 per share (the “Common Shares”) |

17,407,773 |

$8.73 |

$151,969,858.29 |

$14,087.61 | ||||

| | ||||||||

| | ||||||||

(1) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the registrant is also registering an indeterminate number of additional Common Shares that may become issuable as a result of any stock dividend, stock split, recapitalization or other similar transaction. |

(2) |

Estimated solely for the purpose of calculating the registration fee of the securities being registered hereby in accordance with Rule 457(c) and Rule 457(g) under the Securities Act, based on the average of the high and low prices of the Common Shares on December 15, 2021 as reported on The Nasdaq Global Market, which was $8.73 per share. |

Page |

||||

| ii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| 5 | ||||

| 86 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| 118 | ||||

| 245 | ||||

| 251 | ||||

| 267 | ||||

| 273 | ||||

| 276 | ||||

| 278 | ||||

| 292 | ||||

| 294 | ||||

| 296 | ||||

| 302 | ||||

| 304 | ||||

| 305 | ||||

| 306 | ||||

F-1 |

||||

| • | our limited operating history and risks involved in biopharmaceutical product development; |

| • | the fact that we will likely incur significant operating losses for the foreseeable future; |

| • | the impact of public health outbreaks, epidemics or pandemics (such as the COVID-19 pandemic) on our business (including our clinical trials and pre-clinical studies), operations and financial condition and results; |

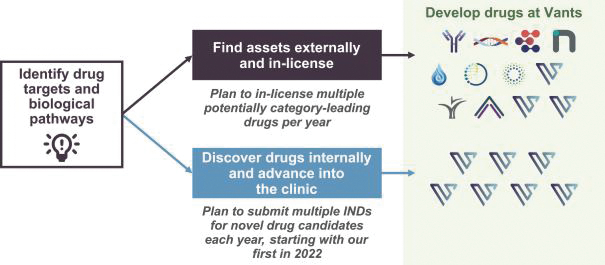

| • | our ability to acquire, in-license or discover new product candidates; |

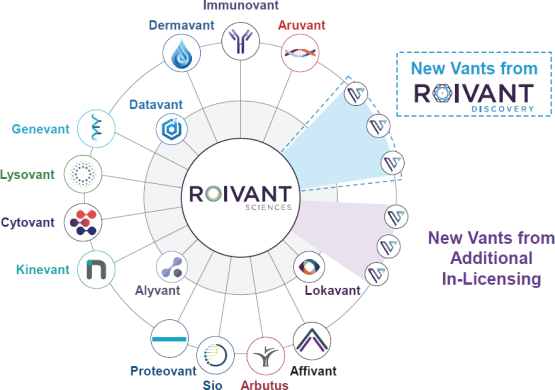

| • | our Vant structure and the potential that we may fail to capitalize on certain development opportunities; |

| • | clinical trials and pre-clinical studies, which are very expensive, time-consuming, difficult to design and implement and involve uncertain outcomes; |

| • | the unproven nature of our approach to the discovery and development of product candidates from our targeted protein degradation platform; |

| • | the novelty, complexity and difficulty of manufacturing certain of our product candidates, including any manufacturing problems that result in delays in development or commercialization of our product candidates; |

| • | difficulties we may face in enrolling and retaining patients in clinical trials and/or clinical development activities; |

| • | the results of our clinical trials not supporting our proposed claims for a product candidate; |

| • | changes in interim, top-line and/or preliminary data from our clinical trials changing as more data becoming available or being delayed due to audit and verification process; |

| • | changes in product manufacturing or formulation that could lead to the incurrence of costs or delays; |

| • | the failure of any third party we contract with to conduct, supervise and monitor our clinical trials to perform in a satisfactory manner or to comply with applicable requirements; |

| • | the fact that obtaining approvals for new drugs is a lengthy, extensive, expensive and unpredictable process that may end with our inability to obtain regulatory approval by the FDA or other regulatory agencies in other jurisdictions; |

| • | the failure of our clinical trials to demonstrate substantial evidence of the safety and efficacy of product candidates, including, but not limited to, scenarios in which our product candidates may cause adverse effects that could delay regulatory approval, discontinue clinical trials, limit the scope of approval or generally result in negative media coverage of us; |

| • | our inability to obtain regulatory approval for a product candidate in certain jurisdictions, even if we are able to obtain approval in certain other jurisdictions; |

| • | our ability to effectively manage growth and to attract and retain key personnel; |

| • | any business, legal, regulatory, political, operational, financial and economic risks associated with conducting business globally; |

| • | our ability to obtain and maintain patent and other intellectual property protection for our technology and product candidates; |

| • | the inadequacy of patent terms and their scope to protect our competitive position; |

| • | the failure to issue (or the threatening of their breadth or strength of protection) or provide meaningful exclusivity for our product candidates or any future product candidate of our patent applications that we hold or have in-licensed; |

| • | the fact that we do not currently and may not in the future own or license any issued composition of matter patents covering certain of our product candidates and our inability to be certain that any of our other issued patents will provide adequate protection for such product candidates; |

| • | the fact that our largest shareholders (and certain members of our management team) own a significant percentage of our stock and will be able to exert significant control over matters subject to shareholder approval; |

| • | the outcome of any legal proceedings that may be instituted against us in connection with the Business Combination and related transactions; |

| • | changes in applicable laws or regulations; |

| • | the possibility that we may be adversely affected by other economic, business and/or competitive factors; and |

| • | other risks and uncertainties, including those described under the heading “Risk Factors.” |

| • | conducted nine international Phase 3 trials, the last eight of which have been successful; |

| • | consummated a $3 billion upfront partnership with Sumitomo Dainippon Pharma (“Sumitomo”); |

| • | developed four drugs that received FDA approval after their transfer to Sumitomo; |

| • | built a pipeline of over 30 drug candidates ranging from early discovery to registration; |

| • | launched Roivant Discovery, our small molecule discovery engine comprising advanced computational physics and machine learning capabilities, integrated with an in-house wet lab facility; and |

| • | created innovative software tools to optimize each stage of the drug discovery, development and commercialization process. |

| • | Our limited operating history and the inherent uncertainties and risks involved in biopharmaceutical product development may make it difficult for us to execute on our business model and for you to assess our future viability. |

| • | We will likely incur significant operating losses for the foreseeable future and may never achieve or maintain profitability. |

| • | The ongoing global pandemic resulting from the outbreak of the novel strain of coronavirus, SARS-CoV-2, COVID-19, could adversely impact our business, including our clinical trials and pre-clinical studies. |

| • | We may not be successful in our efforts to acquire, in-license or discover new product candidates. |

| • | Because we have multiple programs and product candidates in our development pipeline and are pursuing a variety of target indications and treatment approaches, we may expend our limited resources to pursue a particular product candidate and fail to capitalize on development opportunities or product candidates that may be more profitable or for which there is a greater likelihood of success. |

| • | We face risks associated with the Vant structure. |

| • | Clinical trials and pre-clinical studies are very expensive, time-consuming, difficult to design and implement and involve uncertain outcomes. We may encounter substantial delays in clinical trials, or may not be able to conduct or complete clinical trials or pre-clinical studies on the expected timelines, if at all. |

| • | Our approach to the discovery and development of product candidates from our targeted protein degradation platform is unproven, which makes it difficult to predict the time, cost of development and likelihood of successfully developing any product candidates from this platform. |

| • | Certain of our product candidates, including our gene therapy product candidates, are novel, complex and difficult to manufacture. |

| • | Obtaining approval of a new drug is an extensive, lengthy, expensive and inherently uncertain process, and the FDA or another regulator may delay, limit or deny approval. |

| • | Our clinical trials may fail to demonstrate substantial evidence of the safety and efficacy of product candidates that we may identify and pursue for their intended uses, which would prevent, delay or limit the scope of regulatory approval and commercialization. |

| • | Our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval, cause us to suspend or discontinue clinical trials, abandon further development or limit the scope of any approved label or market acceptance. |

| • | We depend on the knowledge and skills of our senior leaders, and may not be able to manage our business effectively if we are unable to attract and retain key personnel. |

| • | Changes in funding for, or disruptions to the operations of, the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal functions on which the operation of our business may rely, which could negatively impact our business. |

| • | We will need to expand our organization and may experience difficulties in managing this growth, which could disrupt operations. |

| • | If we are unable to obtain and maintain patent and other intellectual property protection for our technology and product candidates or if the scope of the intellectual property protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets. |

| • | If the patent applications we hold or have in-licensed with respect to our product candidates fail to issue, if their breadth or strength of protection is threatened, or if they fail to provide meaningful exclusivity for our product candidates or any future product candidate, it could dissuade companies from collaborating with us to develop product candidates, and threaten our ability to commercialize, future drugs. |

| • | Patent terms and their scope may be inadequate to protect our competitive position on current and future product candidates for an adequate amount of time. |

| • | The listing of our securities on Nasdaq did not benefit from the process undertaken in connection with an underwritten initial public offering. |

| • | If our performance does not meet market expectations, the price of our securities may decline. |

| • | We have and will continue to incur increased costs as a result of operating as a public company and our management has and will continue to devote a substantial amount of time to new compliance initiatives. |

| • | Our failure to timely and effectively implement controls and procedures required by Section 404(a) of the Sarbanes-Oxley Act could have a material adverse effect on our business. |

| • | Anti-takeover provisions in our memorandum of association, bye-laws and Bermuda law could delay or prevent a change in control, limit the price investors may be willing to pay in the future for our Common Shares and could entrench management. |

| • | Our largest shareholders and certain members of our management own a significant percentage of our Common Shares and will be able to exert significant control over matters subject to shareholder approval. |

| Issuer |

Roivant Sciences Ltd. |

| Common Shares offered by the Holders |

Up to 17,407,773 Common Shares. |

| Use of Proceeds |

We will not receive any proceeds from any sale of Common Shares by the Holders. See “Use of Proceeds.” |

| Market for Common Shares |

The Common Shares are currently traded on The Nasdaq Global Market under the symbol “ROIV.” |

| Risk Factors |

See “ Risk Factors |

| • | identify new acquisition or in-licensing opportunities; |

| • | successfully identify new product candidates through our computational discovery and targeted protein degradation platforms and advance those product candidates into pre-clinical studies and clinical trials; |

| • | successfully complete ongoing pre-clinical studies and clinical trials and obtain regulatory approvals for our current and future product candidates; |

| • | successfully market our healthcare technology products and services; |

| • | raise additional funds when needed and on terms acceptable to us; |

| • | attract and retain experienced management and advisory teams; |

| • | add operational, financial and management information systems and personnel, including personnel to support clinical, pre-clinical manufacturing and planned future commercialization efforts and operations; |

| • | launch commercial sales of product candidates, whether alone or in collaboration with others, including establishing sales, marketing and distribution systems; |

| • | initiate and continue relationships with third-party suppliers and manufacturers and have commercial quantities of product candidates manufactured at acceptable cost and quality levels and in compliance with the U.S. Food and Drug Administration (the “FDA”) and other regulatory requirements; |

| • | set acceptable prices for product candidates and obtain coverage and adequate reimbursement from third-party payors; |

| • | achieve market acceptance of product candidates in the medical community and with third-party payors and consumers; and |

| • | maintain, expand and protect our intellectual property portfolio. |

| • | delays or difficulties in enrolling patients in our clinical trials, and the consequences of such delays or difficulties, including terminating clinical trials prematurely; |

| • | delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; |

| • | delays or disruptions in non-clinical experiments due to unforeseen circumstances at contract research organizations (“CROs”), and vendors along their supply chain; |

| • | increased rates of patients withdrawing from our clinical trials following enrollment as a result of contracting COVID-19, being forced to quarantine or not accepting home health visits; |

| • | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| • | interruption of key clinical trial activities, such as clinical trial site data monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others or |

| interruption of clinical trial subject visits and study procedures (particularly any procedures that may be deemed non-essential), which may impact the integrity of subject data and clinical study endpoints; |

| • | interruption or delays in the operations of the FDA and comparable non-U.S. regulatory agencies, which may impact review and approval timelines; |

| • | interruption of, or delays in receiving, supplies of our product candidates from our contract manufacturing organizations due to staffing shortages, production slowdowns or stoppages and disruptions in delivery systems; |

| • | limitations on employee resources that would otherwise be focused on the conduct of our clinical trials and pre-clinical studies, including because of sickness of employees or their families, the desire of employees to avoid contact with large groups of people, an increased reliance on working from home or mass transit disruptions; |

| • | other disruptions to our business generally, including from the transition to remote working for the majority of our employees and the implementation of new health and safety requirements for our employees; and |

| • | waiver or suspension of patent or other intellectual property rights. |

| • | increased operating expenses and cash requirements; |

| • | the assumption of indebtedness or contingent liabilities; |

| • | the issuance of our or our subsidiaries’ equity securities which would result in dilution to our shareholders; |

| • | assimilation of operations, intellectual property, products and product candidates of an acquired company, including difficulties associated with integrating new personnel; |

| • | the diversion of our management’s attention from our existing product programs and initiatives in pursuing such an acquisition or strategic partnership; |

| • | retention of key employees, the loss of key personnel and uncertainties in our ability to maintain key business relationships; |

| • | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates, intellectual property, and regulatory approvals; and |

| • | our inability to generate revenue from acquired intellectual property, technology and/or products sufficient to meet our objectives or even to offset the associated transaction and maintenance costs. |

| • | diversion of management time and focus away from operating our business; |

| • | reliance on certain employees of the alliance with Sumitomo who will continue to provide key services for us, including information technology services; |

| • | changes in relationships with strategic partners as a result of product acquisitions or strategic positioning resulting from these transactions; |

| • | risks arising from technological and data platforms shared between us and the alliance with Sumitomo, such as DrugOme ® , including data or other security breaches at Sumitomo or its affiliates that could, in turn, impact us, or disputes over ownership of intellectual property between us and the alliance with Sumitomo, which could impact our access to those platforms; |

| • | non-competition obligations arising from the formation of the alliance with Sumitomo; |

| • | coordination of research and development efforts; and |

| • | litigation or other claims, including claims from terminated employees, customers, former shareholders or other third parties. |

| • | conducting research and development activities in new therapeutic areas or treatment approaches in which we have little to no experience; |

| • | diversion of financial and managerial resources from existing operations; |

| • | actual or potential conflicts among new and existing Vants to the extent they have overlapping or competing areas of focus or pipeline products; |

| • | successfully negotiating a proposed acquisition, in-license or investment in a timely manner and at a price or on terms and conditions favorable to us; |

| • | successfully combining and integrating a potential acquisition into our existing business to fully realize the benefits of such acquisition; |

| • | the impact of regulatory reviews on a proposed acquisition, in-license or investment; and |

| • | the outcome of any legal proceedings that may be instituted with respect to the proposed acquisition, in-license or investment. |

| • | with respect to our biopharmaceutical product candidates: |

| • | the cost and timing of newly launched product candidates or Vants; |

| • | the initiation, timing, progress, costs and results of pre-clinical studies and clinical trials for our product candidates; |

| • | the outcome, timing and cost of meeting regulatory requirements established by the FDA and other comparable non-U.S. regulatory authorities globally; |

| • | the cost of filing, prosecuting, defending and enforcing our patent claims and other intellectual property rights; |

| • | the cost of defending potential intellectual property disputes, including patent infringement actions brought by third parties against us or any of our current or future product candidates; |

| • | the cost and timing of completion of pre-clinical, clinical and commercial manufacturing activities; |

| • | the cost of establishing sales, marketing and distribution capabilities for our product candidates in regions where we choose to commercialize our product candidates on our own; |

| • | the initiation, progress, timing and results of our commercialization of our product candidate, if approved for commercial sale; and |

| • | other costs associated with preparing the commercial launch of our product candidates; |

| • | for our healthcare and drug discovery technologies: |

| • | the costs related to hiring and retaining employees with the expertise necessary to manage these technologies; |

| • | investments in wet labs, computational resources and other facilities; and |

| • | the costs needed to update, maintain and improve these technologies and the infrastructure underlying these technologies, including with respect to data protection and cybersecurity. |

| • | failure to obtain regulatory authorization to commence a trial or reaching consensus with regulatory authorities regarding the design or implementation of our studies; |

| • | other regulatory issues, including the receipt of any inspectional observations on FDA’s Form-483, Warning or Untitled Letters, clinical holds, or complete response letters or similar communications/objections by other regulatory authorities; |

| • | unforeseen safety issues, or subjects experience severe or unexpected adverse events; |

| • | occurrence of serious adverse events in trials of the same class of agents conducted by other sponsors; |

| • | lack of effectiveness during clinical trials; |

| • | resolving any dosing issues, including those raised by the FDA or other regulatory authorities; |

| • | inability to reach agreement on acceptable terms with prospective CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | slower than expected rates of patient recruitment or failure to recruit suitable patients to participate in a trial; |

| • | failure to add a sufficient number of clinical trial sites; |

| • | unanticipated impact from changes in or modifications to protocols or clinical trial design, including those that may be required by the FDA or other regulatory authorities; |

| • | inability or unwillingness of clinical investigators or study participants to follow our clinical and other applicable protocols or applicable regulatory requirements; |

| • | an IRB or EC refusing to approve, suspending, or terminating the trial at an investigational site, precluding enrollment of additional subjects, or withdrawing their approval of the trial; |

| • | premature discontinuation of study participants from clinical trials or missing data; |

| • | failure to manufacture or release sufficient quantities of our product candidate or failure to obtain sufficient quantities of active comparator medications for our clinical trials, if applicable, that in each case meet our quality standards, for use in clinical trials; |

| • | inability to monitor patients adequately during or after treatment; or |

| • | inappropriate unblinding of trial results. |

| • | inability to meet our product specifications and quality requirements consistently; |

| • | delay or inability to procure or expand sufficient manufacturing capacity; |

| • | manufacturing and product quality issues related to scale-up of manufacturing; |

| • | costs and validation of new equipment and facilities required for scale-up; |

| • | failure to comply with applicable laws, regulations and standards, including cGMP and similar standards; |

| • | deficient or improper record-keeping; |

| • | inability to negotiate manufacturing agreements with third parties under commercially reasonable terms; |

| • | termination or nonrenewal of manufacturing agreements with third parties in a manner or at a time that is costly or damaging to us; |

| • | reliance on a limited number of sources, and in some cases, single sources for product components, such that if we are unable to secure a sufficient supply of these product components, we will be unable to manufacture and sell our product candidates in a timely fashion, in sufficient quantities or under acceptable terms; |

| • | lack of qualified backup suppliers for those components that are currently purchased from a sole or single source supplier; |

| • | operations of our third-party manufacturers or suppliers could be disrupted by conditions unrelated to our business or operations, including the bankruptcy of the manufacturer or supplier or other regulatory sanctions related to the manufacturer of another company’s product candidates; |

| • | carrier disruptions or increased costs that are beyond our control; and |

| • | failure to deliver our product candidates under specified storage conditions and in a timely manner. |

| • | we may not be able to demonstrate that a product candidate is safe and effective as a treatment for the targeted indications, and in the case of our product candidates regulated as biological products, that the product candidate is safe, pure, and potent for use in its targeted indication, to the satisfaction of the FDA or other relevant regulatory authorities; |

| • | the FDA or other relevant regulatory authorities may require additional pre-approval studies or clinical trials, which would increase costs and prolong development timelines; |

| • | the results of clinical trials may not meet the level of statistical or clinical significance required by the FDA or other relevant regulatory authorities for marketing approval; |

| • | the FDA or other relevant regulatory authorities may disagree with the number, design, size, conduct or implementation of clinical trials, including the design of proposed pre-clinical and early clinical trials of any future product candidates; |

| • | the CROs that we retain to conduct clinical trials may take actions outside of our control, or otherwise commit errors or breaches of protocols, that adversely impact the clinical trials and ability to obtain marketing approvals; |

| • | the FDA or other relevant regulatory authorities may not find the data from nonclinical, pre-clinical studies or clinical trials sufficient to demonstrate that the clinical and other benefits of a product candidate outweigh its safety risks; |

| • | the FDA or other relevant regulatory authorities may disagree with an interpretation of data or significance of results from nonclinical, pre-clinical studies or clinical trials or may require additional studies; |

| • | the FDA or other relevant regulatory authorities may not accept data generated at clinical trial sites; |

| • | if an NDA, BLA or a similar application is reviewed by an advisory committee, the FDA or other relevant regulatory authority, as the case may be, may have difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of our application or may recommend that the FDA or other relevant regulatory authority, as the case may be, require, as a condition of approval, additional nonclinical, pre-clinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions; |

| • | the FDA or other relevant regulatory authorities may require development of a risk evaluation and mitigation strategy (“REMS”) or its equivalent, as a condition of approval; |

| • | the FDA or other relevant regulatory authorities may require additional post-marketing studies and/or patient registries for product candidates; |

| • | the FDA or other relevant regulatory authorities may find the chemistry, manufacturing and controls data insufficient to support the quality of our product candidate; |

| • | the FDA or other relevant regulatory authorities may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers; or |

| • | the FDA or other relevant regulatory authorities may change their approval policies or adopt new regulations. |

| • | regulatory authorities may withdraw, suspend, vary, or limit their approval of the product or require a REMS (or equivalent outside the United States) to impose restrictions on its distribution or other risk management measures; |

| • | regulatory authorities may require that we recall a product; |

| • | additional restrictions being imposed on the marketing or manufacturing processes of product candidates or any components thereof; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications, require other labeling changes of a product or require field alerts or other communications to physicians, pharmacies or the public; |

| • | we may be required to change the way a product is administered or to conduct additional clinical trials, change the labeling of a product or conduct additional post-marketing studies or surveillance; |

| • | we may be required to repeat pre-clinical studies or clinical trials or terminate programs for a product candidate, even if other studies or trials related to the program are ongoing or have been successfully completed; |

| • | we could be sued and held liable for harm caused to patients; |

| • | we could elect to discontinue the sale of our products; |

| • | our product candidates may become less competitive; and |

| • | our reputation may suffer. |

| • | monitoring and assuring regulatory compliance for clinical trials, manufacturing and testing of good applicable practice (“GxP”) (e.g., GCP, GLP and GMP regulated) products; |

| • | monitoring and providing oversight of all GxP suppliers (e.g., contract development manufacturing organizations and CROs); |

| • | establishing and maintaining an integrated, robust quality management system for clinical, manufacturing, supply chain and distribution operations; and |

| • | cultivating a proactive, preventative quality culture and employee and supplier training to ensure quality. |

| • | restrictions on the manufacture such product candidates; |

| • | restrictions on the labeling or marketing of such product candidates, including a “black box” warning or contraindication on the product label or communications containing warnings or other safety information about the product; |

| • | restrictions on product distribution or use; |

| • | requirements to conduct post-marketing studies or clinical trials, or any regulatory holds on our clinical trials; |

| • | requirement of a REMS (or equivalent outside the United States); |

| • | Warning or Untitled Letters or similar communications from other relevant regulatory authorities; |

| • | withdrawal of the product candidates from the market; |

| • | refusal to approve pending applications or supplements to approved applications that we submit; |

| • | recall of product candidates; |

| • | fines, restitution or disgorgement of profits or revenues; |

| • | suspension, variation or withdrawal of marketing approvals; |

| • | refusal to permit the import or export of our product candidates; |

| • | product seizure; or |

| • | lawsuits, injunctions or the imposition of civil or criminal penalties. |

| • | the efficacy and safety of such product candidates as demonstrated in pivotal clinical trials and published in peer-reviewed journals; |

| • | the potential and perceived advantages compared to alternative treatments, including any similar generic treatments; |

| • | the ability to offer these products for sale at competitive prices; |

| • | the ability to offer appropriate patient financial assistance programs, such as commercial insurance co-pay assistance; |

| • | convenience and ease of dosing and administration compared to alternative treatments; |

| • | the clinical indications for which the product candidate is approved by FDA or comparable non-U.S. regulatory agencies; |

| • | product labeling or product insert requirements of the FDA or other comparable non-U.S. regulatory authorities, including any limitations, contraindications or warnings contained in a product’s approved labeling; |

| • | restrictions on how the product is dispensed or distributed; |

| • | the timing of market introduction of competitive products; |

| • | publicity concerning these products or competing products and treatments; |

| • | the strength of marketing and distribution support; |

| • | favorable third-party coverage and sufficient reimbursement; and |

| • | the prevalence and severity of any side effects or AEs. |

| • | the inability to recruit and retain adequate numbers of effective sales, marketing, reimbursement, customer service, medical affairs, and other support personnel; |

| • | the inability of sales personnel to obtain access to physicians or persuade adequate numbers of physicians to prescribe any future approved products; |

| • | the inability of reimbursement professionals to negotiate arrangements for formulary access, reimbursement, and other acceptance by payors; |

| • | the inability to price products at a sufficient price point to ensure an adequate and attractive level of profitability; |

| • | restricted or closed distribution channels that make it difficult to distribute our products to segments of the patient population; |

| • | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and |

| • | unforeseen costs and expenses associated with creating an independent commercialization organization. |

| • | the federal Anti-Kickback Statute, which is a criminal law that prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, lease, order or recommendation of, any good, facility, item or service, for which payment may be made, in whole or in part, under a federal healthcare program (such as Medicare and Medicaid). The term “remuneration” has been broadly interpreted by the federal government to include anything of value. Although there are a number of statutory exceptions and |

| regulatory safe harbors protecting certain activities from prosecution, the exceptions and safe harbors are drawn narrowly, and arrangements may be subject to scrutiny or penalty if they do not fully satisfy all elements of an available exception or safe harbor. Practices that involve remuneration that may be alleged to be intended to induce prescribing, purchases or recommendations may be subject to scrutiny if they do not qualify for an exception or safe harbor. A person or entity does not need to have actual knowledge of the federal Anti-Kickback Statute or specific intent to violate it to have committed a violation; in addition, the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act. Violations of the federal Anti-Kickback Statute may result in civil monetary penalties up to $100,000 for each violation. Civil penalties for such conduct can further be assessed under the federal False Claims Act. Violations can also result in criminal penalties, including criminal fines and imprisonment of up to 10 years. Similarly, violations can result in exclusion from participation in government healthcare programs, including Medicare and Medicaid; |

| • | the federal false claims laws, including the False Claims Act, which imposes civil penalties, including through civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government, claims for payment that are false or fraudulent; knowingly making, using or causing to be made or used, a false record or statement material to a false or fraudulent claim; or knowingly making or causing to be made, a false statement to avoid, decrease or conceal an obligation to pay money to the federal government. When an entity is determined to have violated the federal civil False Claims Act, the government may impose civil fines and penalties currently ranging from $11,665 to $23,331 for each false claim or statement for penalties assessed after June 19, 2020, with respect to violations occurring after November 2, 2015, plus treble damages, and exclude the entity from participation in Medicare, Medicaid and other federal healthcare programs; |

| • | the federal health care fraud statute (established by Health Insurance Portability and Accountability Act of 1996 (“HIPAA”)), which imposes criminal and civil liability for, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program or making false or fraudulent statements relating to healthcare matters; similar to the federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation; |

| • | the Administrative Simplification provisions of HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act (“HITECH”), and their implementing regulations, which impose obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security, and transmission of individually identifiable health information on health plans, health care clearing houses, and most healthcare providers and their business associates, defined as independent contractors or agents of covered entities that create, receive or obtain protected health information in connection with providing a service for or on behalf of a covered entity; |

| • | various privacy, cybersecurity and data protection laws, rules and regulations at the international, federal, state and local level impose obligations with respect to safeguarding the privacy, security, and cross-border transmission of personal data and health information; |

| • | the federal Civil Monetary Penalties Law, which authorizes the imposition of substantial civil monetary penalties against an entity that engages in activities including, among others (1) knowingly presenting, or causing to be presented, a claim for services not provided as claimed or that is otherwise false or fraudulent in any way; (2) arranging for or contracting with an individual or entity that is excluded from participation in federal health care programs to provide items or services reimbursable by a federal health care program; (3) violations of the federal Anti-Kickback Statute; or (4) failing to report and return a known overpayment; |

| • | the federal Physician Payments Sunshine Act, which requires certain manufacturers of drugs, devices, biologics, and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to the government |

| information related to payments or other “transfers of value” made to physicians, certain other healthcare providers, and teaching hospitals, and requires applicable manufacturers and group purchasing organizations to report annually to the government ownership and investment interests held by the physicians described above and their immediate family members and payments or other “transfers of value” to such physician owners (covered manufacturers are required to submit reports to the government by the 90th day of each calendar year); and |

| • | analogous state and EU and foreign national laws and regulations, such as state anti-kickback and false claims laws, which may apply to our business practices, including but not limited to, research, distribution, sales, and marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third-party payors, including private insurers, or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, and state laws that require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures; and several recently passed state laws that require disclosures related to state agencies and/or commercial purchasers with respect to certain price increases that exceed a certain level as identified in the relevant statutes, some of which contain ambiguous requirements that government officials have not yet clarified; and EU and foreign national laws prohibiting promotion of prescription-only medicinal products to individuals other than healthcare professionals, governing strictly all aspects of interactions with healthcare professionals and healthcare organizations and requiring public disclosure of transfers of value made to a broad range of stakeholders, including healthcare professionals, healthcare organizations, medical students, physicians associations, patient organizations and editors of specialized press. |

| • | the demand for our product candidates, if approved; |

| • | our ability to receive or set a price that we believe is fair for our products; |

| • | our ability to generate revenue and achieve or maintain profitability; |

| • | the amount of taxes that we are required to pay; and |

| • | the availability of capital. |

| • | multiple conflicting and changing laws and regulations such as tax laws, export and import restrictions, employment laws, anti-bribery and anti-corruption laws, regulatory requirements and other governmental approvals, permits and licenses; |

| • | failure by us or our collaborators to obtain appropriate licenses or regulatory approvals for the sale or use of our product candidate, if approved, in various countries; |

| • | difficulties in managing operations in different jurisdictions; |

| • | complexities associated with managing multiple payor-reimbursement regimes or self-pay systems; |

| • | financial risks, such as longer payment cycles, difficulty enforcing contracts and collecting accounts receivable and exposure to currency exchange rate fluctuations; |

| • | varying protection for intellectual property rights; |

| • | natural disasters, political and economic instability, including wars, terrorism and political unrest, outbreak of disease, boycotts, curtailment of trade and other business restrictions; and |

| • | failure to comply with the United States Foreign Corrupt Practices Act (the “FCPA”), including its books and records provisions and its anti-bribery provisions, the United Kingdom Bribery Act 2010 (the “U.K. Bribery Act”), and similar anti-bribery and anti-corruption laws in other jurisdictions, for example by failing to maintain accurate information and control over sales or distributors’ activities. |

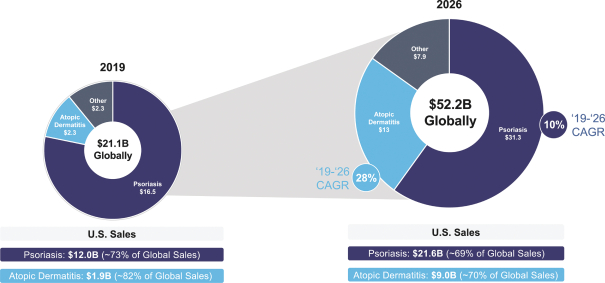

| • | Roflumilast, a PDE4 inhibitor, a potential competitor to tapinarof, in development by Dermavant Sciences (“Dermavant”) for the topical treatment of psoriasis and atopic dermatitis; |

| • | Ruxolitinib, a topical Janus kinase inhibitor, a potential competitor to tapinarof, in development by Dermavant for the topical treatment of atopic dermatitis; |

| • | Teprotumumab, an insulin-like growth factor-1 receptor inhibitor, a potential competitor to batoclimab, in development by Immunovant for the treatment of thyroid eye disease; |

| • | Efgartigimod, an anti-FcRn antibody fragment, and nipocalimab, an anti-FcRn antibody, both potential competitors to batoclimab, in development by Immunovant for the treatment of myasthenia gravis; and |

| • | CTX001, a gene-editing therapy, and LentiGlobin, a gene therapy delivering a modified form of adult hemoglobin, both potential competitors to ARU-1801, in development by Aruvant for the treatment of sickle cell disease. |

| • | impairment of our business reputation and significant negative media attention; |

| • | delay or termination of clinical trials, or withdrawal of participants from our clinical trials; |

| • | significant costs to defend the related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | substantial monetary awards to patients or other claimants; |

| • | inability to commercialize existing product candidates or any future product candidate, if approved; |

| • | product recalls, withdrawals or labeling, marketing or promotional restrictions; |

| • | decreased demand for existing product candidates or any future product candidate, if approved; and |

| • | loss of revenue. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | our financial or other obligations under the license agreement; |

| • | the extent to which our technology and product candidates infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | the sublicensing of patent and other rights; |

| • | our diligence obligations under the license agreements and what activities satisfy those diligence obligations; |

| • | the inventorship or ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our partners; and |

| • | the priority of invention of patented technology. |

| • | others may be able to make formulations or compositions that are the same as or similar to product candidates, but that are not covered by the claims of the patents that we own; |

| • | others may be able to make product candidates that are similar to product candidates that we intend to commercialize that are not covered by the patents that we exclusively licensed and have the right to enforce; |

| • | we, our licensor or any collaborators might not have been the first to make or reduce to practice the inventions covered by the issued patents or pending patent applications that we own or have exclusively licensed; |

| • | we or our licensor or any collaborators might not have been the first to file patent applications covering certain of our inventions; |

| • | others may independently develop similar or alternative technologies or duplicate any of our technologies without infringing our intellectual property rights; |

| • | it is possible that our pending patent applications will not lead to issued patents; |

| • | issued patents that we own or have exclusively licensed may not provide us with any competitive advantages, or may be held invalid or unenforceable as a result of legal challenges; |

| • | our competitors might conduct research and development activities in the United States and other countries that provide a safe harbor from patent infringement claims for certain research and development activities, as well as in countries where we do not have patent rights, and then use the information learned from such activities to develop competitive product candidates for sale in our major commercial markets; and we may not develop additional proprietary technologies that are patentable; |

| • | third parties performing manufacturing or testing for us using our product candidates or technologies could use the intellectual property of others without obtaining a proper license; |

| • | parties may assert an ownership interest in our intellectual property and, if successful, such disputes may preclude us from exercising exclusive rights over that intellectual property; |

| • | we may not develop or in-license additional proprietary technologies that are patentable; |

| • | we may not be able to obtain and maintain necessary licenses on commercially reasonable terms, or at all; |

| • | the patents of others may harm our business; and |

| • | we may choose not to file a patent application in order to maintain certain trade secrets or know-how, and a third party may subsequently file a patent application covering such intellectual property. |

| • | the book-building process undertaken by underwriters that helps to inform efficient price discovery with respect to opening trades of newly listed securities; |

| • | underwriter support to help stabilize, maintain or affect the public price of the new issue immediately after listing; and |

| • | underwriter due diligence review of the offering and potential liability for material misstatements or omissions of fact in a prospectus used in connection with the securities being offered or for statements made by its securities analysts or other personnel. |

| • | actual or anticipated fluctuations in our quarterly and annual financial results or the quarterly and annual financial results of companies perceived to be similar to it; |

| • | changes in the market’s expectations about operating results; |

| • | our operating results failing to meet market expectations in a particular period; |

| • | a Vant’s operating results failing to meet market expectations in a particular period, which could impact the market prices of shares of a public Vant or the valuation of a private Vant, and in turn adversely impact the trading price of our Common Shares; |

| • | the results of clinical trials or pre-clinical studies conducted by us and the Vants; |

| • | changes in financial estimates and recommendations by securities analysts concerning us, the Vants or the biopharmaceutical industry and market in general; |

| • | operating and stock price performance of other companies that investors deem comparable to us; |

| • | changes in laws and regulations affecting our and the Vants’ businesses; |

| • | commencement of, or involvement in, litigation involving MAAC or us; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of debt; |

| • | the volume of our Common Shares available for public sale, which may be limited due to, among other reasons, the extent of redemptions by MAAC stockholders in connection with the consummation of the Business Consummation and the relatively limited free float of our Common Shares, particularly prior to the expiration of the lock-up provisions described elsewhere in this prospectus; |

| • | any significant change in our board of directors or management; |

| • | sales of substantial amounts of our Common Shares directors, executive officers or significant shareholders or the perception that such sales could occur; and |

| • | general economic and political conditions such as recessions, interest rates, fuel prices, international currency fluctuations and acts of war or terrorism. |

| • | a classified board of directors with staggered three-year terms; |

| • | the ability of our board of directors to determine the powers, preferences and rights of preference shares and to cause us to issue the preference shares without shareholder approval; |

| • | the ability of our board of directors to prevent the transfer of capital stock, or the exercise of rights with respect to our capital stock, if the effect of such transfer or exercise of rights would result in a shareholder holding more than 9.9% of the total issued and outstanding shares of our capital stock on a fully diluted basis; and |

| • | requiring advance notice for shareholder proposals and nominations and placing limitations on convening shareholder meetings. |

| • | conducted nine international Phase 3 trials, the last eight of which have been successful; |

| • | consummated a $3 billion upfront partnership with Sumitomo; |

| • | developed four drugs that received FDA approval after their transfer to Sumitomo; |

| • | built a pipeline of over 30 drug candidates ranging from early discovery to registration; |

| • | launched Roivant Discovery, our small molecule discovery engine comprising advanced computational physics and machine learning capabilities, integrated with an in-house wet lab facility; and |

| • | created innovative software tools to optimize each stage of the drug discovery, development and commercialization process. |

| Product Candidate |

Indication |

Vant |

Modality |

Phase | ||||

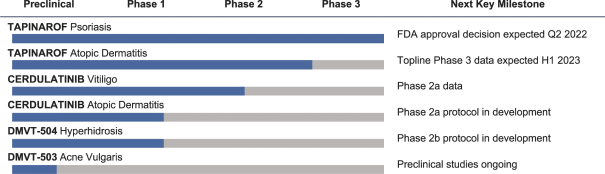

| Tapinarof | Psoriasis | Dermavant | Topical | Registration | ||||

| Tapinarof | Atopic Dermatitis | Dermavant | Topical | Phase 3 | ||||

| Cerdulatinib | Vitiligo | Dermavant | Topical | Phase 2 | ||||

| Batoclimab | Myasthenia Gravis | Immunovant | Biologic | Phase 2 | ||||

| Batoclimab | Warm Autoimmune Hemolytic Anemia | Immunovant | Biologic | Phase 2 | ||||

| Batoclimab | Thyroid Eye Disease | Immunovant | Biologic | Phase 2 | ||||

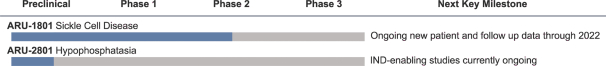

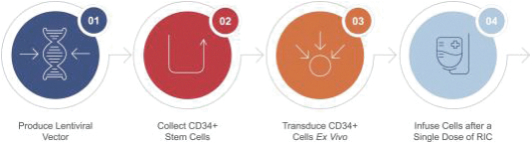

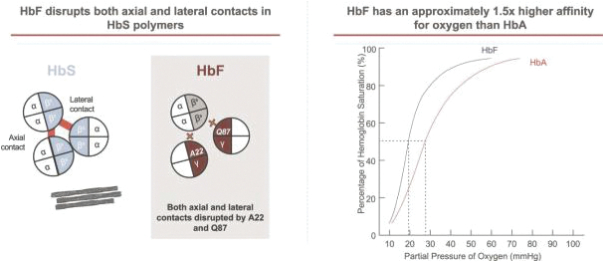

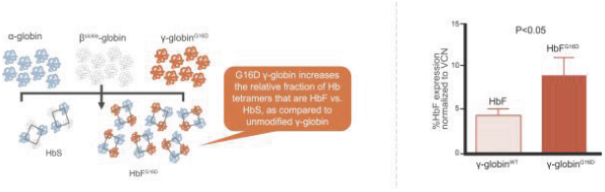

ARU-1801 |

Sickle Cell Disease | Aruvant | Gene Therapy | Phase 2 | ||||

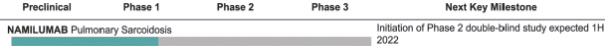

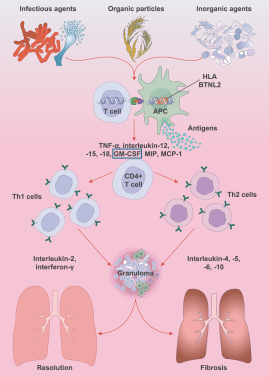

| Namilumab | Sarcoidosis | Kinevant | Biologic | Phase 1 | ||||

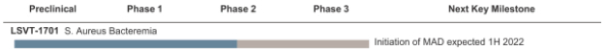

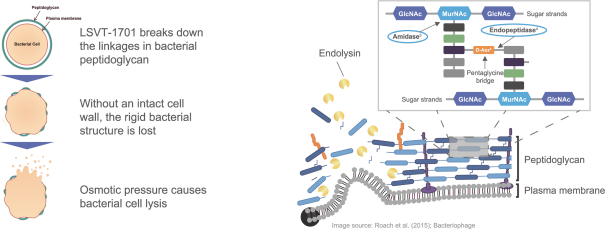

| LSVT-1701 | Staph Aureus Bacteremia | Lysovant | Biologic | Phase 1 | ||||

| Cerdulatinib | Atopic Dermatitis | Dermavant | Topical | Phase 1 | ||||

DMVT-504 |

Hyperhidrosis | Dermavant | Small Molecule | Phase 1 | ||||

DMVT-503 |

Acne | Dermavant | Topical | Preclinical | ||||

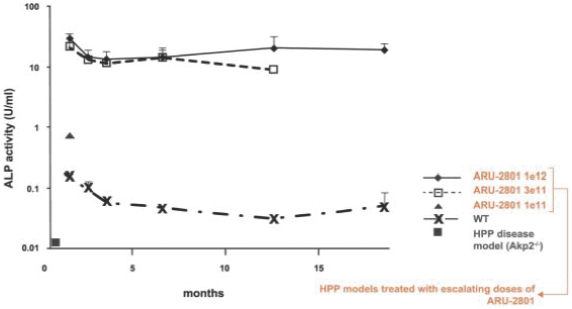

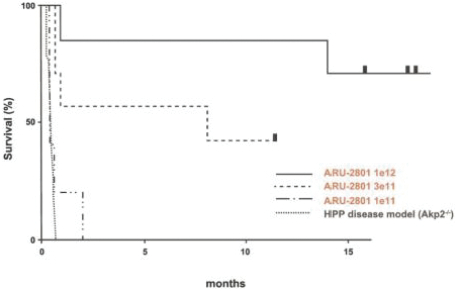

ARU-2801 |

Hypophosphatasia | Aruvant | Gene Therapy | Preclinical | ||||

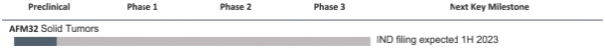

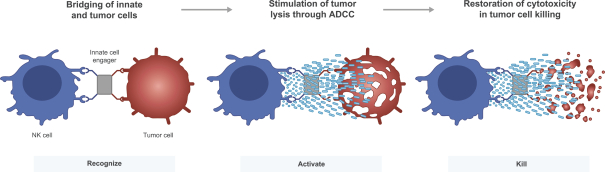

| AFM32 | Solid Tumors | Affivant | Biologic | Preclinical | ||||

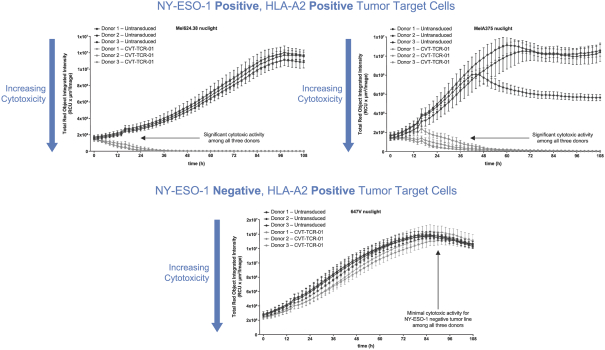

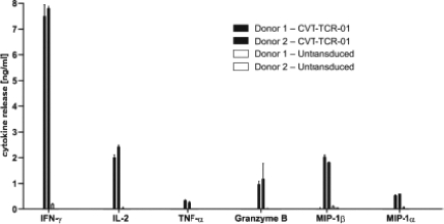

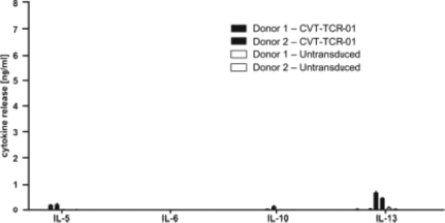

CVT-TCR-01 |

Oncologic Malignancies | Cytovant | Cell Therapy | Preclinical |

| • | A quantum mechanics-based molecular dynamics software platform to predict the interactions, energies and conformational behavior of targets and generate novel drug candidates; |

| • | A supercomputing cluster composed of over 600 graphics processing units; |

| • | A suite of degrader-specific ML tools; |

| • | A wet lab fully equipped for synthetic chemistry, crystallography, biophysics, biochemistry and biology. |

Roivant Ownership | ||||

| Vant |

Basic 1 |

Fully Diluted 2 | ||

| Dermavant |

100% | 85% | ||

| Immunovant |

64% 3 |

59% 3 | ||

| Aruvant |

88% | 79% | ||

| Proteovant |

60% | 60% | ||

| Lysovant |

100% | 99% | ||

| Kinevant |

88% | 88% | ||

| Affivant |

100% | 99% | ||

| Cytovant |

72% | 68% | ||

| Arbutus |

29% 3 |

27% 3 | ||

| Sio Gene Therapies |

25% 3 |

24% 3 | ||

| Genevant |

83% | 67% | ||

| Lokavant |

90% | 84% | ||

| Datavant |

* | * | ||

| Alyvant |

97% | 95% | ||

| * | In June 2021, Datavant entered into a definitive merger agreement to combine with Ciox Health. The transaction closed on July 27, 2021. The implied enterprise value of the combined company at the conversion price cap of the new preferred equity investment made concurrently with the closing of the merger was $7.0 billion. This enterprise value implies an equity value of $6.1 billion (after netting out approximately $900 million of debt and other adjustments). No assurance can be given that the implied enterprise or equity value is an accurate reflection of the value of the combined business at closing or in the future. At closing of the merger and assuming a $7.0 billion enterprise value, Roivant’s ongoing, fully diluted equity ownership in the combined entity was approximately 12% (without giving effect to certain liquidation preferences held by the preferred equity shareholders). |

| 1. | Basic refers to Roivant’s percentage ownership of the issued and outstanding shares of the entity. |

| 2. | Fully diluted refers to Roivant’s percentage ownership of all outstanding equity interests, whether vested or unvested, of the entity. |

| 3. | Denotes entities that are publicly traded. |

| Vant |

Catalyst |

Expected Timing | ||

| Dermavant | Tapinarof NDA filing in psoriasis | Mid-2021 ✓ | ||

| Tapinarof Phase 3 initiation in atopic dermatitis | 2H 2021 ✓ | |||

| FDA approval decision on tapinarof for psoriasis | 2Q 2022 | |||

| Topline data from tapinarof Phase 3 trials in atopic dermatitis | 1H 2023 | |||

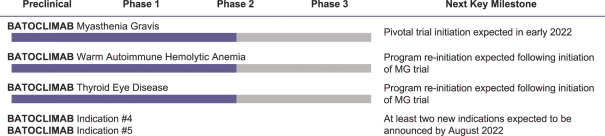

| Immunovant | Initiate pivotal trial in MG | Early 2022 | ||

| Reinitiate program in TED | TBA | |||

| Reinitiate program in WAIHA | TBA | |||

| Announce at least two new indications for batoclimab | 2H 2022 | |||

| Aruvant | First patient dosed with updated ARU-1801 manufacturing process |

2H 2021 ✓ | ||

| Additional clinical data from ARU-1801 Phase 1/2 |

2H 2021 ✓ | |||

ARU-1801 Phase 3 initiation |

1H 2023 | |||

| Kinevant | Namilumab Phase 2 initiation in sarcoidosis | 1H 2022 | ||

| Lysovant | LSVT-1701 MAD initiation | 1H 2022 | ||

| Proteovant | Phase 1 initiation for first degrader candidate | 2022 | ||

| Roivant / Proteovant | Multiple additional degrader candidates entering IND-enabling studies each year |

Starting 2022 | ||

| • | Roivant: |

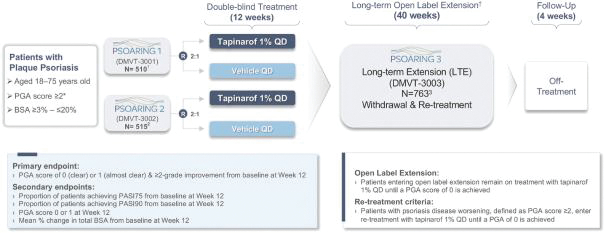

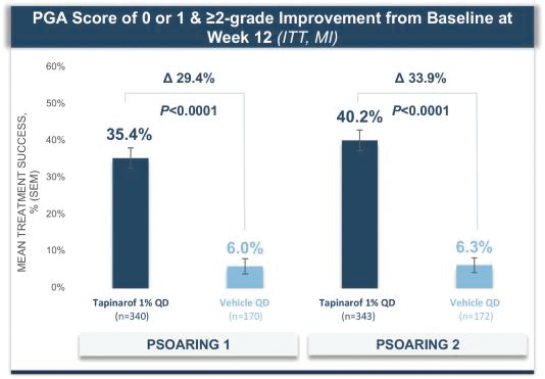

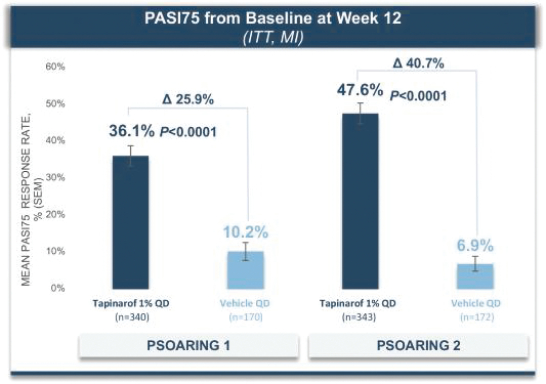

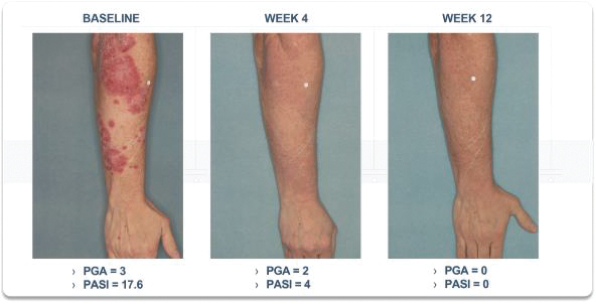

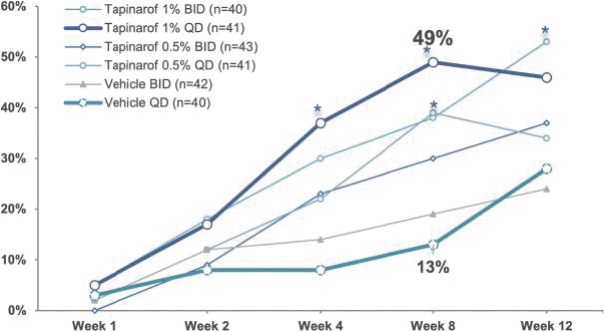

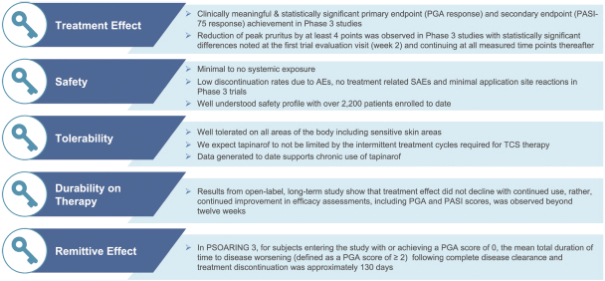

| • | Dermavant: ³ 2 achieving a PGA score of 0 or 1. The study also demonstrated improved and durable results for up to 52 weeks and a median remittive effect off-therapy of approximately four months for patients entering with a PGA score of 0. |

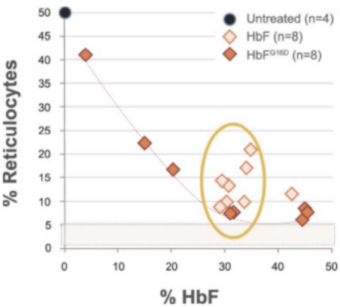

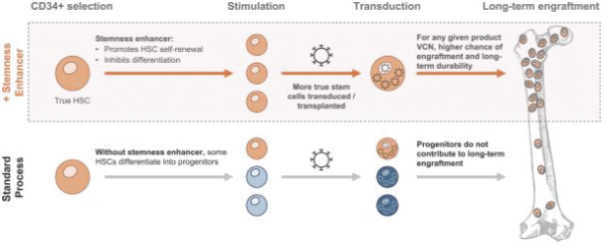

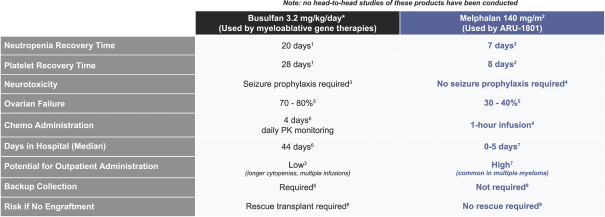

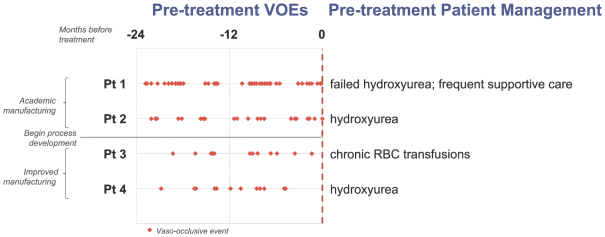

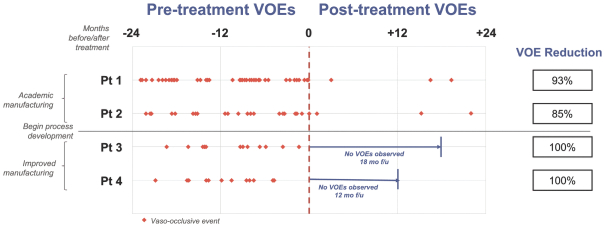

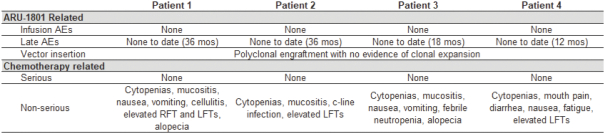

| • | Aruvant: ARU-1801 in sickle cell disease. These patients, the first to be dosed with Aruvant’s updated manufacturing process, have had zero vaso-occlusive events 18 and 12 months after dosing, respectively. Punam Malik, M.D., Director of the Cincinnati Comprehensive Sickle Cell Center and Program Leader of the Hematology and Gene Therapy Program at the Cincinnati Children’s Hospital Medical Center, presented data highlighting the clinically meaningful reduction in vaso-oclusive events of participants in the Phase 1/2 trial and the unique attributes that contribute to the potency of ARU-1801 at the American Society of Hematology (ASH) Annual Meeting on December 13, 2021. |

| • | Sio Gene Therapies: AXO-AAV-GM1 low- and high-dose cohorts. |

| • | Acquisition of Silicon Therapeutics: |

| • | Program-specific costs, including: |

| • | direct third-party costs, which include expenses incurred under agreements with CROs and CMOs, the cost of consultants who assist with the development of our product candidates on a program-specific basis, investigator grants, sponsored research, manufacturing costs in connection with producing materials for use in conducting nonclinical and clinical studies, and any other third-party expenses directly attributable to the development of our product candidates; and |

| • | payments made in connection with asset acquisitions and license agreements upon the achievement of development milestones. |

| • | Consideration for the purchase of in-process research and development (“IPR&D”) through asset acquisitions and license agreements, including: |

| • | cash upfront payments; |

| • | shares and other liability instruments issued; and |

| • | fair value of future contingent consideration payments. |

| • | Unallocated internal costs, including: |

| • | employee-related expenses, such as salaries, share-based compensation, and benefits, for research and development personnel; and |

| • | other expenses, including consulting costs, that are not allocated to a specific program. |

| • | the scope, rate of progress, expense and results of our preclinical development activities, any future clinical trials of our product candidates, and other research and development activities that we may conduct; |

| • | the number and scope of preclinical and clinical programs we decide to pursue; |

| • | the uncertainties in clinical trial design and patient enrollment or drop out or discontinuation rates; |

| • | the number of doses that patients receive; |

| • | the countries in which the trials are conducted; |

| • | our ability to secure and leverage adequate CRO support for the conduct of clinical trials; |

| • | our ability to establish an appropriate safety and efficacy profile for our product candidates; |

| • | the timing, receipt and terms of any approvals from applicable regulatory authorities; |

| • | the potential additional safety monitoring or other studies requested by regulatory agencies; |

| • | the significant and changing government regulation and regulatory guidance; |

| • | our ability to establish clinical and commercial manufacturing capabilities, or make arrangements with third-party manufacturers in order to ensure that we or our third-party manufacturers are able to make product successfully; |

| • | the impact of any business interruptions to our operations due to the COVID-19 pandemic; and |

| • | our ability to maintain a continued acceptable safety profile of our product candidates following approval, if any, of our product candidates. |

Three Months Ended September 30, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Revenue, net |

$ | 13,987 | $ | 1,323 | $ | 12,664 | ||||||

| Operating expenses: |

||||||||||||

| Cost of revenues |

6,381 | 715 | 5,666 | |||||||||

| Research and development |

254,259 | 97,409 | 156,850 | |||||||||

| General and administrative |

437,776 | 59,740 | 378,036 | |||||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

698,416 | 157,864 | 540,552 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(684,429 | ) | (156,541 | ) | (527,888 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Change in fair value of investments |

(32,273 | ) | (84,297 | ) | 52,024 | |||||||

| Gain on sale of investment |

(443,754 | ) | — | (443,754 | ) | |||||||

| Change in fair value of debt and liability instruments |

13,145 | 10,148 | 2,997 | |||||||||

| Gain on consolidation of unconsolidated entity |

— | (28,848 | ) | 28,848 | ||||||||

| Other expense (income), net |

3,692 | (757 | ) | 4,449 | ||||||||

| |

|

|

|

|

|

|||||||

| Loss before income taxes |

(225,239 | ) | (52,787 | ) | (172,452 | ) | ||||||

| Income tax expense |

401 | 711 | (310 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Net loss |

(225,640 | ) | (53,498 | ) | (172,142 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to noncontrolling interests |

(17,159 | ) | (18,100 | ) | 941 | |||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to Roivant Sciences Ltd. |

$ | (208,481 | ) | $ | (35,398 | ) | $ | (173,083 | ) | |||

| |

|

|

|

|

|

|||||||

Six Months Ended September 30, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Revenue, net |

$ | 21,722 | $ | 2,899 | $ | 18,823 | ||||||

| Operating expenses: |

||||||||||||

| Cost of revenues |

7,123 | 895 | 6,228 | |||||||||

| Research and development |

332,885 | 156,143 | 176,742 | |||||||||

| General and administrative |

520,530 | 116,855 | 403,675 | |||||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

860,538 | 273,893 | 586,645 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(838,816 | ) | (270,994 | ) | (567,822 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Change in fair value of investments |

(23,654 | ) | (125,445 | ) | 101,791 | |||||||

| Gain on sale of investment |

(443,754 | ) | — | (443,754 | ) | |||||||

| Change in fair value of debt and liability instruments |

17,730 | 27,273 | (9,543 | ) | ||||||||

| Gain on termination of Sumitomo Options |

(66,472 | ) | — | (66,472 | ) | |||||||

| Gain on deconsolidation of subsidiary and consolidation of unconsolidated entity |

— | (115,364 | ) | 115,364 | ||||||||

| Other expense, net |

3,558 | 2,085 | 1,473 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss before income taxes |

(326,224 | ) | (59,543 | ) | (266,681 | ) | ||||||

| Income tax expense |

494 | 1,932 | (1,438 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Net loss |

(326,718 | ) | (61,475 | ) | (265,243 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to noncontrolling interests |

(36,054 | ) | (22,834 | ) | (13,220 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to Roivant Sciences Ltd. |

$ | (290,664 | ) | $ | (38,641 | ) | $ | (252,023 | ) | |||

| |

|

|

|

|

|

|||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Revenue, net |

$ | 13,987 | $ | 1,323 | $ | 12,664 | $ | 21,722 | $ | 2,899 | $ | 18,823 | ||||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Cost of revenues |

$ | 6,381 | $ | 715 | $ | 5,666 | $ | 7,123 | $ | 895 | $ | 6,228 | ||||||||||||

Three Months Ended September 30, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Program-specific costs: |

||||||||||||

| Tapinarof (Dermavant Sciences Ltd.) |

$ | 67,656 | $ | 8,905 | $ | 58,751 | ||||||

| Batoclimab (Immunovant, Inc.) |

13,479 | 8,465 | 5,014 | |||||||||

| ARU-1801 (Aruvant Sciences Ltd.) |

7,362 | 8,187 | (825 | ) | ||||||||

| Gimsilumab (Kinevant Sciences Ltd.) |

1,384 | 7,178 | (5,794 | ) | ||||||||

| Other program-specific costs |

22,665 | 5,714 | 16,951 | |||||||||

| |

|

|

|

|

|

|||||||

| Total program-specific costs |

112,546 | 38,449 | 74,097 | |||||||||

| |

|

|

|

|

|

|||||||

| Consideration for the purchase of IPR&D through asset acquisitions and license agreements |

82,107 | 45,339 | 36,768 | |||||||||

| Unallocated internal costs: |

||||||||||||

| Share-based compensation |

28,157 | 1,887 | 26,270 | |||||||||

| Personnel-related expenses |

23,760 | 11,386 | 12,374 | |||||||||

| Other expenses |

7,689 | 348 | 7,341 | |||||||||

| |

|

|

|

|

|

|||||||

| Total research and development expenses |

$ | 254,259 | $ | 97,409 | $ | 156,850 | ||||||

| |

|

|

|

|

|

|||||||

Six Months Ended September 30, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Program-specific costs: |

||||||||||||

| Tapinarof (Dermavant Sciences Ltd.) |

$ | 77,413 | $ | 17,319 | $ | 60,094 | ||||||

| Batoclimab (Immunovant, Inc.) |

27,167 | 22,858 | 4,309 | |||||||||

| ARU-1801 (Aruvant Sciences Ltd.) |

9,751 | 11,540 | (1,789 | ) | ||||||||

| Gimsilumab (Kinevant Sciences Ltd.) |

3,453 | 19,503 | (16,050 | ) | ||||||||

| Other program-specific costs |

42,777 | 14,811 | 27,966 | |||||||||

| |

|

|

|

|

|

|||||||

| Total program-specific costs |

160,561 | 86,031 | 74,530 | |||||||||

| |

|

|

|

|

|

|||||||

| Consideration for the purchase of IPR&D through asset acquisitions and license agreements |

82,107 | 45,339 | 36,768 | |||||||||

| Unallocated internal costs |

||||||||||||

| Share-based compensation |

29,772 | 3,006 | 26,766 | |||||||||

| Personnel-related expenses |

45,852 | 20,153 | 25,699 | |||||||||

| Other expenses |

14,593 | 1,614 | 12,979 | |||||||||

| |

|

|

|

|

|

|||||||

| Total research and development expenses |

$ | 332,885 | $ | 156,143 | $ | 176,742 | ||||||

| |

|

|

|

|

|

|||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| General and administrative |

$ | 437,776 | $ | 59,740 | $ | 378,036 | $ | 520,530 | $ | 116,855 | $ | 403,675 | ||||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Change in fair value of investments |

$ | (32,273 | ) | $ | (84,297 | ) | $ | 52,024 | $ | (23,654 | ) | $ | (125,445 | ) | $ | 101,791 | ||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Gain on sale of investment |

$ | (443,754 | ) | $ | — | $ | (443,754 | ) | $ | (443,754 | ) | $ | — | $ | (443,754 | ) | ||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Change in fair value of debt and liability instruments |

$ | 13,145 | $ | 10,148 | $ | 2,997 | $ | 17,730 | $ | 27,273 | $ | (9,543 | ) | |||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Gain on termination of Sumitomo Options |

$ | — | $ | — | $ | — | $ | (66,472 | ) | $ | — | $ | (66,472 | ) | ||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Gain on deconsolidation of subsidiary and consolidation of unconsolidated entity |

$ | — | $ | (28,848 | ) | $ | 28,848 | $ | — | $ | (115,364 | ) | $ | 115,364 | ||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Other expense (income), net |

$ | 3,692 | $ | (757 | ) | $ | 4,449 | $ | 3,558 | $ | 2,085 | $ | 1,473 | |||||||||||

Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||||||||||

2021 |

2020 |

Change |

2021 |

2020 |

Change |

|||||||||||||||||||

(in thousands) |

(in thousands) |

|||||||||||||||||||||||

| Income tax expense |

$ | 401 | $ | 711 | $ | (310 | ) | $ | 494 | $ | 1,932 | $ | (1,438 | ) | ||||||||||

Years Ended March 31, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Revenue, net |

$ | 23,795 | $ | 67,689 | $ | (43,894 | ) | |||||

| Operating expenses: |

||||||||||||

| Cost of revenues |

2,057 | 1,131 | 926 | |||||||||

| Research and development |

832,758 | 263,217 | 569,541 | |||||||||

| General and administrative |

259,878 | 335,766 | (75,888 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Total operating expenses |

1,094,693 | 600,114 | 494,579 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(1,070,898 | ) | (532,425 | ) | (538,473 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Change in fair value of investments |

(95,533 | ) | 136,005 | (231,538 | ) | |||||||

| Change in fair value of debt and liability instruments |

29,845 | (13,722 | ) | 43,567 | ||||||||

| Gain on deconsolidation of subsidiary and consolidation of unconsolidated entity |

(115,364 | ) | (107,344 | ) | (8,020 | ) | ||||||

| Other expense, net |

8,701 | 13,622 | (4,921 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Loss from continuing operations before income taxes |

(898,547 | ) | (560,986 | ) | (337,561 | ) | ||||||

| Income tax expense |

1,686 | 7,124 | (5,438 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Loss from continuing operations, net of tax |

(900,233 | ) | (568,110 | ) | (332,123 | ) | ||||||

| Income from discontinued operations, net of tax |

— | 1,578,426 | (1,578,426 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Net (loss) income |

(900,233 | ) | 1,010,316 | (1,910,549 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Net loss attributable to noncontrolling interests |

(90,999 | ) | (190,193 | ) | 99,194 | |||||||

| |

|

|

|

|

|

|||||||

| Net (loss) income attributable to Roivant Sciences Ltd. |

$ | (809,234 | ) | $ | 1,200,509 | $ | (2,009,743 | ) | ||||

| |

|

|

|

|

|

|||||||

Years Ended March 31, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Revenue, net |

$ | 23,795 | $ | 67,689 | $ | (43,894 | ) | |||||

Years Ended March 31, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Cost of revenues |

$ | 2,057 | $ | 1,131 | $ | 926 | ||||||

Years Ended March 31, |

||||||||||||

2021 |

2020 |

Change |

||||||||||

(in thousands) |

||||||||||||

| Program-specific costs: |

||||||||||||

| IMVT-1401 (Immunovant, Inc.) |

$ | 49,236 | $ | 39,230 | $ | 10,006 | ||||||

| Tapinarof (Dermavant Sciences Ltd.) |

34,002 | 69,394 | (35,392 | ) | ||||||||

| ARU-1801 (Aruvant Sciences Ltd.) |

24,347 | 11,064 | 13,283 | |||||||||

| Gimsilumab (Kinevant Sciences Ltd.) |

21,969 | 7,288 | 14,681 | |||||||||

| RVT-1601 (Respivant Sciences Ltd.) |

6,784 | 16,935 | (10,151 | ) | ||||||||

| AXO-LENTI-PD |

— | 21,219 | (21,219 | ) | ||||||||

| Other program-specific costs |

29,790 | 32,402 | (2,612 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Total program-specific costs |

166,128 | 197,532 | (31,404 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Consideration for the purchase of IPR&D through asset acquisitions and license agreements |

591,916 | 10,250 | 581,666 | |||||||||

| Unallocated internal costs: |

||||||||||||

| Share-based compensation |

22,637 | 7,738 | 14,899 | |||||||||

| Personnel-related expenses |

45,646 | 33,865 | 11,781 | |||||||||

| Other expenses |