Table of Contents

As filed with the Securities and Exchange Commission on November 6, 2015

Registration No. 333-205727

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Iberdrola USA, Inc.

(Exact name of registrant as specified in its charter)

| New York | 4911 | 14-1798693 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Durham Hall, 52 Farm View Drive, New Gloucester, Maine 04260

(207) 688-6363

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

R. Scott Mahoney, Esq.

General Counsel

Durham Hall, 52 Farm View Drive, New Gloucester, Maine 04260

(207) 688-6363

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Juan Manuel de Remedios, Esq. John Vetterli, Esq. White & Case LLP 1155 Avenue of the Americas New York, New York 10036 (212) 819-8200 |

Linda L. Randell, Esq. Senior Vice President and General Counsel UIL Holdings Corporation 157 Church Street New Haven, Connecticut 06510 (203) 499-2000 |

Joseph B. Frumkin, Esq. Sullivan & Cromwell LLP 125 Broad Street New York, New York 10004 (212) 558-4000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effectiveness of this registration statement and upon completion of the merger described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

Table of Contents

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered(1) |

Amount to be registered(2) |

Proposed maximum per share |

Proposed maximum aggregate |

Amount of registration fee(4) | ||||

| Common stock, $0.01 par value per share |

57,925,146 | N/A | $2,130,997,288 | $247,393(5) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Relates to securities of the registrant issuable in connection with the proposed merger, or the merger, of UIL Holdings Corporation, a Connecticut corporation, with and into Green Merger Sub, Inc., a Connecticut corporation and a direct wholly-owned subsidiary of the registrant. Pursuant to Rule 416 under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, or the Securities Act, this registration statement also covers an indeterminate number of additional shares of the registrant’s common stock as may be issuable as a result of reclassification, recapitalization, stock split or combination, exchange or readjustment of shares, stock dividends or similar transactions or events. |

| (2) | Represents the maximum number of shares of the registrant’s common stock to be issued in connection with the merger. |

| (3) | Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act and calculated in accordance with Rule 457(f)(1)-(2) and Rule 457(c) of the Securities Act, based on the sum of (i) the product of (A) $47.21, the average of the high and low prices per share of UIL Holdings Corporation common stock as reported on the New York Stock Exchange on July 10, 2015 and (B) 57,628,297, the maximum number of shares of UIL Holdings Corporation outstanding common stock that may be exchanged for the merger consideration, computed as of July 10, 2015, and (ii) the product of (A) $49.83, the average of the high and low prices per share of UIL Holdings Corporation common stock as reported on the New York Stock Exchange on October 15, 2015 and (B) 296,849, the additional number of shares that are being registered in connection with this amendment to the registration statement in respect of shares of UIL Holdings Corporation outstanding common stock that may be exchanged for the merger consideration, computed as of October 15, 2015. As required by Rule 457(f)(3) under the Securities Act, the estimated aggregate amount of cash to be paid by the registrant in the merger, or approximately $604,426,599, has been deducted from the proposed maximum aggregate offering price. |

| (4) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to (i) $116.20 per $1,000,000 of the proposed maximum aggregate offering price calculated as described in note 3 above in connection with the initial filing of this registration statement on July 17, 2015 and (ii) $100.70 per $1,000,000 of the proposed change in maximum aggregate offering price calculated as described in note 3 above in connection with this amendment to the registration statement. |

| (5) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this proxy statement/prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which or to any person to whom it is lawful to make any such offer or solicitation in such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION—DATED NOVEMBER 6, 2015

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

, 2015

Dear Shareowners:

The Board of Directors of UIL Holdings Corporation cordially invites you to attend a special meeting of shareowners of UIL Holdings Corporation, a Connecticut corporation, or UIL, to be held on , 2015, at Eastern time, at Quinnipiac University, Center for Medicine, Nursing and Health Sciences, 370 Bassett Road, North Haven, Connecticut 06473, or the special meeting. As previously announced, on February 25, 2015, UIL entered into a merger agreement providing for the combination of UIL and Iberdrola USA, Inc., a New York corporation, or Iberdrola USA. At the special meeting, you will be asked to consider and vote upon a proposal to approve the merger agreement.

If the merger contemplated by the merger agreement is completed, you will be entitled to receive the merger consideration for each share of UIL common stock you own. The merger consideration consists of cash in the amount of $10.50 plus one share of common stock of the combined company. At the completion of the merger, Iberdrola USA, which is currently wholly-owned by Iberdrola, S.A., a Spanish corporation, will become a publicly-traded company listed on the New York Stock Exchange, or the NYSE, under the trading symbol “AGR”. Iberdrola, S.A. will own 81.5% of the newly listed company at closing, and former UIL shareowners will own the remaining 18.5% of the outstanding shares.

Your vote is very important, regardless of the number of shares you own. The merger cannot be completed unless the owners of at least a majority of the shares of UIL common stock outstanding as of the close of business on October 2, 2015, the record date for the special meeting, vote to approve the merger agreement. A failure to vote or an abstention will have the same effect as a vote “AGAINST” the proposal to approve the merger agreement.

Whether or not you plan to attend the special meeting, I urge you to vote your shares before the meeting over the Internet or via the toll-free telephone number, as described in the accompanying materials. You may also vote by mail by completing, signing and dating the enclosed proxy card and returning it in the pre-addressed, postage-prepaid envelope accompanying the proxy card. YOUR PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS OF UIL. AFTER CAREFUL CONSIDERATION, UIL’S BOARD OF DIRECTORS HAS UNANIMOUSLY ADOPTED THE MERGER AGREEMENT, APPROVED AND DETERMINED THAT IT IS IN THE BEST INTERESTS OF UIL FOR UIL TO CONSUMMATE THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT AND TO EXECUTE AND DELIVER THE MERGER AGREEMENT AND PERFORM UIL’S OBLIGATIONS THEREUNDER, AND RESOLVED TO RECOMMEND THAT UIL SHAREOWNERS APPROVE THE MERGER AGREEMENT AND RELATED TRANSACTIONS. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL TO APPROVE THE MERGER AGREEMENT AND “FOR” THE OTHER MATTERS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. THE BOARD OF DIRECTORS MADE ITS DETERMINATION AFTER CONSULTATION WITH ITS LEGAL AND FINANCIAL ADVISORS AND AFTER CONSIDERING A NUMBER OF FACTORS. In considering the recommendation of the board of directors of UIL, you should be aware that certain directors and executive officers of UIL may have interests in the merger that are different from, or in addition to, the interests of UIL shareowners generally. See the section entitled “Interests of UIL’s Directors and Executive Officers in the Merger” beginning on page 111 of the accompanying proxy statement/prospectus.

In particular, I urge you to read carefully the section entitled “Risk Factors ” beginning on page 37 of the accompanying proxy statement/prospectus. If you have any questions regarding the accompanying proxy statement/prospectus, you may call Okapi Partners of New York, or Okapi, UIL’s proxy solicitor, by calling toll-free at (855) 208-8902.

I urge you to read carefully and in its entirety the accompanying proxy statement/prospectus, including the annexes and the documents incorporated by reference.

James P. Torgerson

President and Chief Executive Officer

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE MERGER OR OTHER TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS OR THE SECURITIES TO BE ISSUED PURSUANT TO THE MERGER UNDER THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS NOR HAVE THEY DETERMINED IF THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS IS ACCURATE OR ADEQUATE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated , 2015 and is first being mailed or otherwise delivered to UIL shareowners on or about , 2015.

Table of Contents

ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information about UIL from other documents that UIL has filed with the U.S. Securities and Exchange Commission, or the SEC, and that are contained in or incorporated by reference into this proxy statement/prospectus. For a listing of documents incorporated by reference into this proxy statement/prospectus, please see the section entitled “Where You Can Find Additional Information” beginning on page 290 of this proxy statement/prospectus. This information is available for you to review at the SEC’s public reference room located at 100 F Street, N.E., Room 1580, Washington, DC 20549, and through the SEC’s website at www.sec.gov.

You may request copies of this proxy statement/prospectus and any of the documents incorporated by reference into this proxy statement/prospectus, without charge, by written request directed to UIL Holdings Corporation, Attention: Sigrid E. Kun, Vice President, Corporate Secretary and Assistant General Counsel, 157 Church Street, P.O. Box 1564, New Haven, Connecticut 06506, Telephone (203) 499-2000; or Okapi Partners of New York, UIL’s proxy solicitor, by calling toll-free at (855) 208-8902.

In order for you to receive timely delivery of the documents in advance of the special meeting of UIL shareowners to be held on , 2015, you must request the information no later than five business days prior to the date of the special meeting, by , 2015.

ABOUT THE PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form S-4 filed with the SEC by Iberdrola USA (File No. 333-205727), constitutes a prospectus of Iberdrola USA under Section 5 of the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, or the Securities Act, with respect to post-merger Iberdrola USA, or the combined company, common stock to be issued to UIL shareowners pursuant to the merger agreement. The term “combined company” as used in this proxy statement/prospectus refers to Iberdrola USA following the completion of the merger. This document also constitutes a proxy statement of UIL under Section 14(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Additionally, this document constitutes a notice of meeting with respect to the special meeting, at which UIL shareowners will be asked to consider and vote upon a proposal to approve the merger agreement and related matters.

UIL has supplied all information contained in or incorporated by reference into this proxy statement/prospectus relating to UIL, and Iberdrola USA has supplied all information contained in this proxy statement/prospectus relating to Iberdrola USA.

You should rely only on the information contained in or incorporated by reference into this proxy statement/prospectus. Iberdrola USA and UIL have not authorized anyone to provide you with information that is different from that contained in or incorporated by reference into this proxy statement/prospectus. This proxy statement/prospectus is dated , 2015, and you should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than such date. Further, you should not assume that the information incorporated by reference into this proxy statement/prospectus is accurate as of any date other than the date of the incorporated document. Neither the mailing of this proxy statement/prospectus to UIL shareowners nor the issuance by the combined company of shares of common stock of the combined company pursuant to the merger agreement will create any implication to the contrary.

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which or to any person to whom it is lawful to make any such offer or solicitation in such jurisdiction.

Table of Contents

UIL Holdings Corporation

157 Church Street, P.O. Box 1564

New Haven, Connecticut 06506

NOTICE OF SPECIAL MEETING OF SHAREOWNERS TO BE HELD ON , 2015

Dear Shareowner,

You are cordially invited to attend a special meeting of shareowners of UIL Holdings Corporation, a Connecticut corporation, or UIL. The special meeting will be held on , 2015, at Eastern time, at Quinnipiac University, Center for Medicine, Nursing and Health Sciences, 370 Bassett Road, North Haven, Connecticut 06473, to consider and vote upon the following matters:

| 1. | a proposal to approve the Agreement and Plan of Merger, dated as of February 25, 2015, as it may be amended from time to time, or the merger agreement, by and among UIL, Iberdrola USA and Green Merger Sub, Inc., a Connecticut corporation and a wholly-owned subsidiary of Iberdrola USA, or merger sub. A copy of the merger agreement is attached as Annex A to the accompanying proxy statement/prospectus; |

| 2. | a proposal to approve, by non-binding, advisory vote, certain existing compensation arrangements for UIL’s named executive officers in connection with the merger contemplated by the merger agreement; and |

| 3. | granting authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement. |

The record date for the special meeting is October 2, 2015. Only shareowners of record as of the close of business on October 2, 2015 are entitled to notice of, and to vote at, the special meeting. All shareowners of record as of that date and time are cordially invited to attend the special meeting in person.

Your vote is very important, regardless of the number of shares of UIL common stock that you own. The merger cannot be completed unless the merger agreement is approved by the affirmative vote of the owners of at least a majority of the shares of UIL common stock outstanding as of the close of business on the record date. Whether or not you plan to attend the special meeting, UIL urges you to vote your shares before the meeting over the Internet or via the toll-free telephone number, as described in the accompanying materials. You may also vote by mail by completing, signing and dating the enclosed proxy card and returning it in the pre-addressed, postage-prepaid envelope accompanying the proxy card. No postage is necessary if mailed in the United States. Voting over the Internet, via the toll-free telephone number or by mailing a proxy card will not limit your right to vote in person or to attend the special meeting. If you hold your shares in “street name” through a bank, brokerage firm or other nominee, you should follow the procedures provided by your bank, brokerage firm or other nominee to vote your shares. If you fail to submit a proxy or to attend the special meeting in person or do not provide your bank, brokerage firm or other nominee with instructions as to how to vote your shares, as applicable, your shares of UIL common stock will not be counted for purposes of determining whether a quorum is present at the special meeting and will have the same effect as a vote “AGAINST” the proposal to approve the merger agreement.

Your proxy is being solicited by the board of directors of UIL. After careful consideration, UIL’s board of directors has unanimously (i) adopted the merger agreement, (ii) approved and determined that it is in the best interests of UIL for UIL to consummate the merger and the other transactions contemplated by the merger agreement and to execute and deliver the merger agreement and perform UIL’s obligations thereunder and (iii) resolved to recommend the approval of the merger agreement by UIL shareowners. UIL’s board of directors unanimously recommends that you vote “FOR” the proposal to approve the merger agreement and “FOR” the other matters described in the accompanying proxy statement/prospectus. The board of directors made its determination after consultation with its legal and financial advisors and after considering a number of factors. In considering the recommendation of the board of directors of UIL, you should be aware that certain directors and executive officers of UIL may have interests in the merger that are different from or in addition to the interests of UIL shareowners generally. See the section entitled “Interests of UIL’s Directors and Executive Officers in the Merger” beginning on page 113 of the accompanying proxy statement/prospectus.

If you personally attend the special meeting, you will be asked to verify that you are a shareowner by presenting an attendance ticket (attached to your proxy card), together with a proper form of identification. Cameras, recording devices and other electronic devices including telephones or other devices with photographic capability may not be used during the meeting and are subject to confiscation. For the safety of attendees, all bags, packages and briefcases are subject to inspection. Your compliance is appreciated.

IT IS IMPORTANT THAT YOU VOTE YOUR SHARES OF UIL COMMON STOCK PROMPTLY. WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE VOTE YOUR SHARES BEFORE THE MEETING OVER THE INTERNET OR VIA THE TOLL-FREE TELEPHONE NUMBER OR BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE PRE-ADDRESSED, POSTAGE-PREPAID ENVELOPE ACCOMPANYING THE PROXY CARD. IF YOU ATTEND THE SPECIAL MEETING AND VOTE IN PERSON, YOUR VOTE BY BALLOT WILL REVOKE ANY PROXY PREVIOUSLY SUBMITTED.

By Order of the Board of Directors,

Sigrid E. Kun

Vice President, Corporate Secretary and

Assistant General Counsel

New Haven, Connecticut

Dated: , 2015

Table of Contents

| Page | ||||||

| 1 | ||||||

| 12 | ||||||

| 12 | ||||||

| 13 | ||||||

| 21 | ||||||

| 22 | ||||||

| 24 | ||||||

| Interests of UIL’s Directors and Executive Officers in the Merger |

24 | |||||

| 25 | ||||||

| 25 | ||||||

| 25 | ||||||

| 26 | ||||||

| Comparison of Shareholder Rights Before and After the Merger |

26 | |||||

| 27 | ||||||

| SUMMARY HISTORICAL COMBINED AND CONSOLIDATED FINANCIAL DATA OF IBERDROLA USA |

28 | |||||

| 30 | ||||||

| 32 | ||||||

| COMPARATIVE HISTORICAL AND UNAUDITED PRO FORMA PER SHARE DATA |

34 | |||||

| 35 | ||||||

| 37 | ||||||

| 37 | ||||||

| 43 | ||||||

| 51 | ||||||

| Risks Relating to Investing in and Ownership of Common Stock of the Combined Company |

63 | |||||

| 67 | ||||||

| 68 | ||||||

| 69 | ||||||

| 71 | ||||||

| 71 | ||||||

| 71 | ||||||

| 71 | ||||||

| 72 | ||||||

| 73 | ||||||

| 74 | ||||||

| 74 | ||||||

| 75 | ||||||

| 75 | ||||||

| ADVISORY VOTE ON MERGER-RELATED COMPENSATION FOR UIL’S NAMED EXECUTIVE OFFICERS |

76 | |||||

| ADJOURNMENT OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES |

79 | |||||

| 80 | ||||||

| 80 | ||||||

| 88 | ||||||

| 89 | ||||||

| 90 | ||||||

| 94 | ||||||

| Certain Unaudited Financial Forecasts Prepared by the Management of UIL |

94 | |||||

| 97 | ||||||

i

Table of Contents

| Page | ||||||

| 106 | ||||||

| 110 | ||||||

| 110 | ||||||

| 110 | ||||||

| 111 | ||||||

| Restrictions on Sales of Shares of the Combined Company Common Stock Received in the Merger |

111 | |||||

| INTERESTS OF UIL’S DIRECTORS AND EXECUTIVE OFFICERS IN THE MERGER |

113 | |||||

| 113 | ||||||

| 114 | ||||||

| 115 | ||||||

| 116 | ||||||

| 116 | ||||||

| 116 | ||||||

| 117 | ||||||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE TRANSACTION |

118 | |||||

| 123 | ||||||

| 123 | ||||||

| 123 | ||||||

| 124 | ||||||

| Post-Merger Governing Documents and Additional Matters Concerning Merger Sub |

124 | |||||

| 125 | ||||||

| 125 | ||||||

| 126 | ||||||

| 126 | ||||||

| 127 | ||||||

| 127 | ||||||

| 131 | ||||||

| 135 | ||||||

| 136 | ||||||

| 137 | ||||||

| 139 | ||||||

| 139 | ||||||

| Reasonable Best Efforts to Obtain Required Approvals; Regulatory Matters |

139 | |||||

| 141 | ||||||

| 142 | ||||||

| 142 | ||||||

| 142 | ||||||

| 144 | ||||||

| 145 | ||||||

| 147 | ||||||

| 147 | ||||||

| 148 | ||||||

| SELECTED HISTORICAL COMBINED AND CONSOLIDATED FINANCIAL DATA OF IBERDROLA USA |

150 | |||||

| 152 | ||||||

| 152 | ||||||

| Factors Affecting Financial Condition and Results of Operations |

154 | |||||

| 159 | ||||||

ii

Table of Contents

| Page | ||||||

| 161 | ||||||

| 163 | ||||||

| 170 | ||||||

| 173 | ||||||

| 177 | ||||||

| 177 | ||||||

| 182 | ||||||

| 186 | ||||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operation of UIL |

187 | |||||

| 188 | ||||||

| 198 | ||||||

| 201 | ||||||

| 231 | ||||||

| 237 | ||||||

| 238 | ||||||

| 239 | ||||||

| 248 | ||||||

| 260 | ||||||

| 260 | ||||||

| 260 | ||||||

| 260 | ||||||

| 260 | ||||||

| 260 | ||||||

| 260 | ||||||

| Advance Notice Requirements for Shareholder Proposals and Director Nominations |

261 | |||||

| 261 | ||||||

| 261 | ||||||

| 262 | ||||||

| Security Ownership of Certain Beneficial Owners and Management of Iberdrola USA |

262 | |||||

| Security Ownership of Certain Beneficial Owners and Management of UIL |

262 | |||||

| 265 | ||||||

| 265 | ||||||

| 266 | ||||||

| 268 | ||||||

| 270 | ||||||

| 271 | ||||||

| COMPARISON OF SHAREHOLDER RIGHTS BEFORE AND AFTER THE MERGER |

272 | |||||

| 272 | ||||||

| Certain Differences between the Rights of UIL Shareowners and the Combined Company Shareholders |

272 | |||||

| 287 | ||||||

| 288 | ||||||

| 289 | ||||||

| 290 | ||||||

| 292 | ||||||

| F-1 | ||||||

| ANNEX A |

Merger Agreement | A-1 | ||||

| ANNEX B |

Form of Shareholder Agreement | B-1 | ||||

| ANNEX C |

Opinion of Morgan Stanley & Co. LLC | C-1 | ||||

| ANNEX D |

Organizational Documents of Green Merger Sub, Inc. | D-1 | ||||

iii

Table of Contents

The following questions and answers are intended to briefly address some commonly asked questions regarding the merger, the merger agreement and the special meeting. These questions and answers may not address all questions that may be important to you as a holder of UIL common stock. Please see the section entitled “Summary” beginning on page 12 of this proxy statement/prospectus and the more detailed information contained elsewhere in this proxy statement/prospectus, the annexes to this proxy statement/prospectus and the documents referred to or incorporated by reference into this proxy statement/prospectus, which you should read carefully and in their entirety.

You may obtain the information incorporated by reference into this proxy statement/prospectus without charge by following the instructions under the section entitled “Where You Can Find Additional Information” beginning on page 290 of this proxy statement/prospectus.

Q: Why am I receiving this proxy statement/prospectus and proxy card?

A: UIL has agreed to combine with Iberdrola USA under the terms of the merger agreement, as further described in this proxy statement/prospectus. If the merger agreement is approved by UIL shareowners and the other conditions to closing under the merger agreement are satisfied or waived, UIL will merge with and into merger sub. Merger sub will be renamed UIL Holdings Corporation and continue as a wholly-owned subsidiary of the combined company upon completion of the merger.

UIL is holding the special meeting to ask its shareowners to consider and vote upon a proposal to approve the merger agreement. UIL shareowners are also being asked to (i) consider and vote upon a proposal to approve, by non-binding, advisory vote, certain existing compensation arrangements for UIL’s named executive officers in connection with the merger and (ii) grant authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement.

This proxy statement/prospectus contains important information about the merger, the merger agreement, a copy of which is attached as Annex A to this proxy statement/prospectus, the special meeting and the proposals to be voted on at the special meeting.

UIL shareowners should read this information carefully and in its entirety. The enclosed voting materials allow shareowners to vote their shares without attending the special meeting in person.

Q: What am I being asked to vote on at the special meeting?

A: You are being asked to (i) consider and vote upon a proposal to approve the merger agreement, (ii) consider and vote upon a proposal to approve, by non-binding, advisory vote, certain existing compensation arrangements for UIL’s named executive officers in connection with the merger and (iii) grant authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement.

Q: Does my vote matter?

A: Yes. Your vote is important. You are encouraged to submit your proxy as promptly as possible. The merger cannot be completed unless the merger agreement is approved by the UIL shareowners. If you fail to submit a proxy or vote in person at the special meeting, or vote to abstain, or you do not provide your bank, brokerage firm or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the proposal to approve the merger agreement. The board of directors of UIL, or the UIL board, unanimously recommends that shareowners vote “FOR” the proposal to approve the merger agreement and the related matters.

1

Table of Contents

Q: What is the proposed merger and what effect will it have on UIL?

A: The proposed merger is the merger of UIL with and into merger sub, a direct, wholly-owned subsidiary of Iberdrola USA, with merger sub continuing as the surviving corporation. As a result of the merger, UIL will no longer be a publicly held company and will cease its separate corporate existence. Following the merger, UIL common stock will be delisted from the NYSE and deregistered under the Exchange Act, and UIL will no longer be required under Sections 13 or 14 of the Exchange Act to file periodic reports and proxy and information statements with the SEC in respect of UIL common stock. Following the merger, the combined company will become a publicly traded company with its common stock listed on the NYSE and registered under the Exchange Act. The combined company will be subject to the reporting requirements of Sections 13 and 14 of the Exchange Act to file periodic reports and proxy and information statements with the SEC in respect of the common stock of the combined company.

Q: What is the vote required to approve each proposal at the special meeting?

A: The approval of the merger agreement requires the affirmative vote of the owners of a majority of the shares of UIL common stock outstanding as of the close of business on October 2, 2015, the record date for the special meeting. Because the affirmative vote required to approve the merger agreement is based upon the total number of outstanding shares of UIL common stock, if you fail to submit a proxy or vote in person at the special meeting, or vote to abstain, or if your shares of UIL common stock are held through a bank, brokerage firm or other nominee and you do not provide your bank, brokerage firm or other nominee with instructions, as applicable, this will have the same effect as a vote “AGAINST” the proposal to approve the merger agreement.

The approval of the merger-related executive compensation requires that the votes favoring the action cast by the owners of the shares entitled to vote thereon exceed the votes opposing the action cast by such shareowners; however, such vote is non-binding and advisory only. If you vote to abstain or if you fail to submit a proxy or to vote in person at the special meeting or if your shares of UIL common stock are held through a bank, brokerage firm or other nominee and you do not instruct your bank, brokerage firm or other nominee to vote your shares of UIL common stock, as applicable, your shares of UIL common stock will not be voted, but this will not have an effect on the approval, by non-binding, advisory vote, of the merger-related executive compensation.

If no quorum is present, authorization for proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement requires the affirmative vote of the owners of a majority of shares of UIL common stock present in person or represented by proxy and entitled to vote thereon. If a quorum is present, authorization for proxy holders to vote in favor of one or more adjournments of the special meeting would require that the votes favoring the action cast by the owners of the shares entitled to vote thereon exceed the votes opposing the action cast by such shareowners. If no quorum is present and your shares of UIL common stock are present at the special meeting but are not voted on the proposal, or if you vote to abstain on the proposal, each will have the effect of a vote “AGAINST” granting authority to proxy holders to vote in favor of one or more adjournments of the special meeting. If a quorum is present and your shares of UIL common stock are not voted on granting authority to proxy holders to vote in favor of one or more adjournments of the special meeting, or if you have given a proxy and abstained on the adjournments of the special meeting, your shares will not be counted in respect of, and will not have an effect on, the vote to grant authority to proxy holders to vote in favor of one or more adjournments of the special meeting. Whether or not a quorum is present, if you fail to submit a proxy and to attend the special meeting or if your shares of UIL common stock are held through a bank, brokerage firm or other nominee and you do not instruct your bank, brokerage firm or other nominee to vote your shares of UIL common stock, as applicable, your shares of UIL common stock will not be voted, but this will not have an effect on the vote to grant authority to proxy holders to vote in favor of one or more adjournments of the special meeting.

See the section entitled, “The UIL Special Meeting—Record Date and Quorum” beginning on page 71 of this proxy statement/prospectus.

2

Table of Contents

Q: Did the UIL board adopt the merger agreement?

A: Yes. At a meeting on February 25, 2015, the UIL board unanimously adopted the merger agreement and approved and determined that it is in the best interests of UIL for UIL to consummate the merger and the other transactions contemplated by the merger agreement and to execute and deliver the merger agreement and perform its obligations thereunder.

Q: How does the UIL board recommend that I vote at the special meeting?

A: The UIL board unanimously recommends that UIL shareowners vote “FOR” the proposal to approve the merger agreement, “FOR” the proposal to approve, by non-binding, advisory vote, certain existing compensation arrangements for UIL’s named executive officers in connection with the merger, and “FOR” granting authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement. See the section entitled “The Merger—UIL’s Reasons for the Merger” beginning on page 90 of this proxy statement/prospectus.

Q: What will I receive if the merger is completed?

A: If the merger is completed, each share of UIL common stock issued and outstanding immediately prior to the completion of the merger will be converted into the right to receive one validly issued share of common stock of the combined company, credited as fully paid, and $10.50 in cash, without interest and less any applicable withholding taxes, or the per share merger consideration.

Q: What is the value of the per share merger consideration?

A: The exact value of the per share merger consideration that UIL shareowners receive will depend on the price per share of the common stock of the combined company at the time of the completion of the merger. This price will not be known at the time of the special meeting and may be less than the current price of UIL common stock or the price per share of UIL common stock at the time of the special meeting. Based on the closing stock price per share of UIL common stock on the NYSE on February 25, 2015, the last trading day before public announcement of the merger, of $42.33, and estimating the value of the stock consideration (as defined below) received based on the mid-point of the combined company’s estimated 2016 and 2017 earnings per share valued at peer price-to-earnings multiples of 17.5x and 16.5x, respectively, the estimated value of the per share merger consideration would be $52.75 for each share of UIL common stock (which includes the $10.50 per share cash consideration). You are encouraged to obtain current market quotations of UIL common stock. See the section entitled “Where You Can Find Additional Information” beginning at page 290 of this proxy statement/prospectus.

Q: How does the per share merger consideration compare to the market price per share of UIL common stock prior to the announcement of the merger?

A: Based on the estimated value of the per share merger consideration of $52.75 for each share of UIL common stock (estimated as discussed above), the per share merger consideration would represent a premium of approximately 24.6% to the closing price per share of UIL common stock on February 25, 2015, the last trading day prior to the public announcement of the proposed merger. The per share merger consideration would represent a premium of approximately 19.3% to the average closing price per share of UIL common stock over the 30-day period ending on February 25, 2015.

Q: What will holders under UIL stock-based plans receive in the merger?

A: Upon completion of the merger, each award of restricted UIL common stock granted under the UIL 2008 Stock and Incentive Compensation Plan and the UIL Deferred Compensation Plan that is outstanding and

3

Table of Contents

unvested or otherwise subject to forfeiture or other restrictions as of immediately prior to the completion of the merger will be converted into the right to receive the number of validly-issued restricted shares of common stock of the combined company equal to the product (rounded up to the nearest whole number) of the number of restricted shares of UIL common stock multiplied by an exchange factor. The exchange factor is the sum of one plus a fraction, (i) the numerator of which is $10.50 and (ii) the denominator of which is the average of the volume weighted averages of the trading prices per share of UIL common stock on the NYSE (as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source mutually selected by the parties to the merger agreement) on each of the ten consecutive trading days ending on (and including) the trading day that immediately precedes the closing date of the merger minus $10.50. Any restricted shares of common stock of the combined company received in exchange for restricted shares of UIL common stock will be subject to the same terms and conditions (including vesting and forfeiture restrictions) that were applicable to the corresponding restricted shares of UIL common stock immediately prior to the completion of the merger.

Each award of restricted UIL common stock that vests by its terms upon the completion of the merger will be converted into the right to receive the per share merger consideration upon completion of the merger.

Upon completion of the merger, each award of restricted stock units, performance shares, stock units, phantom stock units or other similar rights or awards granted or deferred under the UIL 2008 Stock and Incentive Compensation Plan or the UIL Deferred Compensation Plan and relating to shares of UIL common stock that is outstanding immediately prior to the completion of the merger will be converted into an award of restricted stock units, performance shares, stock units, phantom stock units or other similar rights or awards, as applicable, relating to shares of common stock of the combined company of the same type and on the same terms and conditions, with the number of such shares being equal to the product (rounded up to the nearest whole number) of the number of shares of UIL common stock subject to the equity award granted by UIL multiplied by the exchange factor.

If any UIL restricted stock awards or other equity awards are subject to any performance-based vesting or other performance conditions immediately prior to the completion of the merger, the performance determination will be made pursuant to the terms of such restricted stock awards or other equity awards.

Upon completion of the merger, no participant in the UIL 2012 Non-Qualified Employee Stock Purchase Plan will have any right under such plan to purchase or acquire any shares of UIL common stock and no further payroll deductions will be made under such plan and the UIL 2012 Non-Qualified Employee Stock Purchase Plan will terminate upon completion of the merger.

Q: Why am I being asked to consider and vote on the proposal to approve, by non-binding, advisory vote, certain existing compensation arrangements for named executive officers of UIL in connection with the merger?

A: Under SEC rules, UIL is required to seek a non-binding, advisory vote with respect to the compensation that may be paid or become payable to its named executive officers that is based on, or otherwise relates to, the merger.

Q: What will happen if UIL shareowners do not approve this merger-related executive compensation?

A: UIL shareowner approval of the compensation that may be paid or become payable to UIL’s named executive officers that is based on, or otherwise relates to, the merger is not a condition to completion of the merger. The vote is an advisory vote and will not be binding on UIL or the surviving corporation in the merger. If the merger is completed, the merger-related compensation may be paid to UIL’s named executive officers to the extent payable in accordance with the terms of their compensation agreements and arrangements even if UIL shareowners do not approve, by non-binding, advisory vote, the merger-related executive compensation.

4

Table of Contents

Q: Do any of UIL’s directors or executive officers have interests in the merger that differ from or are in addition to my interests as a shareowner of UIL common stock?

A: In considering the recommendation of the UIL board with respect to the proposal to approve the merger agreement and the other matters described in this proxy statement/prospectus, you should be aware that certain directors and executive officers of UIL may have interests in the merger that are different from, or in addition to, the interests of UIL shareowners generally. The UIL board was aware of and has considered these interests, among other matters, in evaluating and negotiating the merger agreement and approving the merger, and in recommending that the merger agreement be approved by UIL shareowners. See the sections entitled “Interests of UIL’s Directors and Executive Officers in the Merger” beginning on page 113 of this proxy statement/prospectus and “Advisory Vote on Merger-Related Compensation for UIL’s Named Executive Officers” beginning on page 76 of this proxy statement/prospectus.

Q: What equity stake will UIL shareowners hold in the combined company immediately following the merger?

A: The merger agreement provides that holders of shares of UIL common stock as of immediately prior to the completion of the merger will hold, in the aggregate, 18.5% of the issued and outstanding shares of common stock of the combined company immediately following the completion of the merger. The combined company will be a “controlled company” within the meaning of the rules of the NYSE and intends to rely on exemptions from certain corporate governance requirements. As a result of their reduced ownership percentages, former UIL shareowners will have less voting power in the combined company than they now have with respect to UIL and will not have the ability to control the outcomes of matters voted upon by all of the shareholders of the combined company.

Q: Where will the shares of common stock of the combined company that I receive in the merger be publicly traded?

A: Iberdrola USA has applied to the NYSE to list its shares, which will become shares of the combined company common stock, under the trading symbol “AGR.” The listing of the combined company common stock on the NYSE is one of the closing conditions under the merger agreement. See the section entitled, “The Merger Agreement—Conditions to Completing the Merger” beginning on page 144 of this proxy statement/prospectus.

Q: When do you expect the merger to be completed?

A: Subject to the satisfaction or waiver of the closing conditions described under the section entitled “The Merger Agreement—Conditions to Completing the Merger” beginning on page 144 of this proxy statement/prospectus, including the approval of the merger agreement by UIL shareowners at the special meeting, the merger will close as soon as reasonably practicable; UIL and Iberdrola USA expect that the merger will close on or before December 31, 2015. However, it is possible that factors outside the control of both companies could result in the merger being completed at a different time or not at all.

Q: What are the material United States federal income tax consequences of the merger to UIL shareowners?

A: It is a condition to the completion of the merger that Iberdrola USA and UIL receive written opinions from their respective counsel to the effect that the merger will qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, or the Code. Assuming the merger qualifies as a reorganization, a U.S. holder exchanging its shares of UIL common stock for a combination of common stock of the combined company and cash pursuant to the merger agreement will generally recognize gain (but not loss) in an amount equal to the lesser of (i) the amount of cash received in exchange for shares of UIL common stock

5

Table of Contents

in the merger and (ii) the excess of the “amount realized” in the transaction (i.e., the fair market value of the shares of common stock of the combined company at the effective time of the merger plus the amount of cash received in exchange for shares of UIL common stock in the merger) over its tax basis in its surrendered shares of UIL common stock.

Any gain recognized upon the exchange will generally be capital gain, and will be long-term capital gain if, as of the effective date of the merger, the U.S. holder’s holding period with respect to its surrendered shares of UIL common stock exceeds one year. Depending on certain facts specific to each U.S. holder, any gain recognized could be taxable as a dividend rather than capital gain.

For a definition of “U.S. holder” and a more detailed discussion of the material United States federal income tax consequences of the merger, see the section entitled “Material United States Federal Income Tax Consequences of the Transaction.”

Each holder is encouraged to consult its tax advisors as to the tax consequences of the merger in the holder’s particular circumstances, including the applicability and effect of the alternative minimum tax and any state, local or foreign and other tax laws and of changes in those laws.

Q: Who can vote at the special meeting?

A: All holders of record of shares of UIL common stock as of the close of business on October 2, 2015, the record date, are entitled to receive notice of, and to vote at, the special meeting. Each holder of shares of UIL common stock is entitled to cast one vote on each matter properly brought before the special meeting for each share of UIL common stock that such holder owned of record as of the close of business on the record date.

Q: When and where is the special meeting?

A: The special meeting will be held on , 2015, at Eastern time, at Quinnipiac University, Center for Medicine, Nursing and Health Sciences, 370 Bassett Road, North Haven, Connecticut 06473. If you personally attend the special meeting, you will be asked to verify that you are a shareowner by presenting an attendance ticket (attached to your proxy card), together with a proper form of identification. If your shares of UIL common stock are held through a bank, brokerage firm or other nominee, please bring proof of your beneficial ownership of such shares to the special meeting. Acceptable proof could include an account statement showing that you owned shares of UIL common stock on the record date.

For additional information about the special meeting, see the section entitled “The UIL Special Meeting” beginning on page 71 of this proxy statement/prospectus.

Q: How will I receive the merger consideration to which I am entitled?

A: After receiving the proper documentation from you, following the completion of the merger, the exchange agent will forward to you the shares of common stock of the combined company and cash to which you are entitled. If you own UIL common stock in book-entry form or through a broker, bank or other holder of record, you will not need to obtain share certificates to submit for exchange to the exchange agent, nor will you receive certificated shares of Iberdrola USA common stock. However, you or your broker, bank or other nominee will need to follow the instructions provided by the exchange agent in order to properly surrender your UIL common stock. More information on the documentation you are required to deliver to the exchange agent may be found in the section entitled “The Merger Agreement—Exchange of Shares” beginning on page 126 of this proxy statement/prospectus.

6

Table of Contents

Q: Will my shares of common stock of the combined company acquired in the merger receive a dividend?

A: After the completion of the merger, as a holder of shares of common stock of the combined company you will receive the same dividends on shares of common stock of the combined company that all other holders of shares of common stock of the combined company will receive for any dividend record date that occurs after the merger is completed.

Former UIL shareowners who held UIL book-entry shares immediately prior to the completion of the merger will be automatically entitled to be paid dividends otherwise payable on the shares of common stock of the combined company. Former UIL shareowners who held UIL share certificates immediately prior to the completion of the merger will not be entitled to be paid dividends otherwise payable on the shares of common stock of the combined company into which their shares of UIL common stock are exchangeable until they surrender their UIL share certificates according to the instructions provided to them. Dividends will be accrued for these shareowners and they will receive the accrued dividends when they surrender their UIL share certificates, subject to abandoned property laws. These shareowners will also receive all dividends with a record date prior to the completion of the merger that have been declared by UIL with respect to the shares of UIL common stock but that have not been paid on those shares of UIL common stock that they hold.

The combined company will initially set its dividend at UIL’s current quarterly dividend of $0.432 per share and expects to target a dividend based on a 65% to 75% payout ratio long-term, subject to consideration and approval by the combined company board of directors, or the combined company board. All future dividends of the combined company will remain subject to consideration and approval by the Iberdrola USA board of directors.

Q: What is the difference between holding shares as a shareowner of record and as a beneficial owner?

A: If your shares of UIL common stock are registered directly in your name with the transfer agent of UIL, Broadridge Corporate Issuer Solutions, Inc., or Broadridge, you are considered the shareowner of record with respect to those shares. As the shareowner of record, you have the right to vote, to grant a proxy for your vote directly to UIL or to a third party to vote at the special meeting.

If your shares are held by a bank, brokerage firm or other nominee, you are considered the beneficial owner of shares held in “street name,” and your bank, brokerage firm or other nominee is considered the shareowner of record with respect to those shares. Your bank, brokerage firm or other nominee will send you, as the beneficial owner, a package describing the procedure for voting your shares. You should follow the instructions provided by them to vote your shares. You are invited to attend the special meeting; however, you may not vote these shares in person at the special meeting unless you obtain a “legal proxy” from your bank, brokerage firm or other nominee that holds your shares, giving you the right to vote the shares at the special meeting.

Q: If my shares of UIL common stock are held in “street name” by my bank, brokerage firm or other nominee, will my bank, brokerage firm or other nominee automatically vote those shares for me?

A: Your bank, brokerage firm or other nominee will only be permitted to vote your shares of UIL common stock if you instruct your bank, brokerage firm or other nominee how to vote. You should follow the procedures provided by your bank, brokerage firm or other nominee regarding the voting of your shares of UIL common stock. In accordance with the rules of the NYSE, banks, brokerage firms and other nominees who hold shares of UIL common stock in “street name” for their customers have authority to vote on “routine” proposals when they have not received instructions from beneficial owners. However, banks, brokerage firms and other nominees are precluded from exercising their voting discretion with respect to non-routine matters, such as the proposal to approve the merger agreement, the proposal to approve, by non-binding, advisory vote, of the merger-related executive compensation and the granting of authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement. As a result, absent specific

7

Table of Contents

instructions from you, banks, brokerage firms or other nominees are not empowered to vote your shares of UIL common stock at the special meeting. The effect of not instructing your broker how you wish your shares to be voted will be the same as a vote “AGAINST” the proposal to approve the merger agreement, and will not have an effect on the proposal to approve, by non-binding, advisory vote, of the merger-related executive compensation or on the granting of authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement.

Q: How many votes do I have?

A: Each UIL shareowner is entitled to one vote for each share of UIL common stock held of record as of the close of business on the record date. As of the close of business on the record date, there were 56,629,377 outstanding shares of UIL common stock.

Q: What constitutes a quorum for the special meeting?

A: The presence at the special meeting, in person or represented by proxy, of owners of a majority of the shares of UIL common stock outstanding as of the close of business on the record date constitutes a quorum for the purposes of the special meeting. Abstentions are considered for purposes of establishing a quorum. A quorum is necessary to transact business at the special meeting. Once a share of UIL common stock is represented at the special meeting, it will be counted for the purpose of determining a quorum at the special meeting and any adjournment of the special meeting. However, if a new record date is set for the adjourned special meeting, then a new quorum will be determined.

Q: How do I vote?

A: You can vote your shares of UIL common in the following ways, depending on whether you are a shareowner of record or a beneficial owner:

Shareowner of Record. If you are a shareowner of record, you may vote your shares of UIL common stock on matters presented at the special meeting in any of the following ways:

| • | by telephone or over the Internet, by accessing the telephone number or Internet website specified on the enclosed proxy card. Proxies delivered over the internet or by telephone must be submitted by 11:59 p.m. Eastern time on , 2015. Please be aware that if you vote by telephone or over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible; |

| • | by completing, signing, dating and returning the enclosed proxy card in the pre-addressed, postage-prepaid envelope accompanying the proxy card; or |

| • | in person—you may attend the special meeting and cast your vote there. |

Beneficial Owner. If you are a beneficial owner, please refer to the instructions provided by your bank, brokerage firm or other nominee to see which of the above choices are available to you. Please note that if you are a beneficial owner and wish to vote in person at the special meeting, you must obtain a legal proxy from your bank, brokerage firm or other nominee.

Q: How do I vote my shares held in my 401K plan account?

A: If you are a participant in UIL’s 401K Plan, you can vote your UIL common stock held in your plan account by completing, signing and dating your voting instruction form and returning it in the enclosed postage-paid envelope, through the Internet or by telephone as instructed on your voting instruction form. The plan trustee will vote the shares held in your plan account in accordance with your instructions. Shares of UIL common stock held

8

Table of Contents

in UIL’s 401K plan for which no instructions from participants are received will be voted by the plan trustee in the same proportion as shares of UIL common stock for which voting instructions are received from participants.

Q: How can I change or revoke my vote?

A: You have the right to revoke a proxy, whether delivered over the Internet, by telephone or by mail, at any time before it is exercised, by voting again at a later date through any of the methods available to you, by attending the special meeting and voting in person, or by giving written notice of revocation to UIL prior to the time the special meeting begins. Written notice of revocation should be mailed to: UIL Holdings Corporation, Attention: Sigrid E. Kun, Vice President, Corporate Secretary and Assistant General Counsel, 157 Church Street, P.O. Box 1564, New Haven, Connecticut 06506. For a full description of proxy submittals and revocations, see the section entitled “The UIL Special Meeting—Proxies and Revocations” beginning on page 73 of this proxy statement/prospectus.

Q: If a shareowner gives a proxy, how are the shares of UIL common stock voted?

A: Regardless of the method you choose to vote, the individuals named on the enclosed proxy card will vote your shares of UIL common stock in the way that you indicate. When completing the Internet or telephone processes or the proxy card, you may specify whether your shares of UIL common stock should be voted “FOR” or “AGAINST” or to “ABSTAIN” from voting on all, some or none of the specific items of business to come before the special meeting.

If you properly sign your proxy card but do not mark the boxes showing how your shares should be voted on a matter, the shares represented by your properly signed proxy will be voted “FOR” the proposal to approve the merger agreement, “FOR” the proposal to approve, by non-binding, advisory vote, of the merger-related executive compensation and “FOR” granting authority to proxy holders to vote in favor of one or more adjournments of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the merger agreement.

Q: What should I do if I receive more than one set of voting materials?

A: If you hold shares of UIL common stock in “street name” and also directly as a record holder or otherwise or if you hold shares of UIL common stock in more than one brokerage account, you may receive more than one set of voting materials relating to the special meeting. Please complete, sign, date and return each proxy card (or cast your vote by telephone or Internet as provided on your proxy card) or otherwise follow the voting instructions provided in this proxy statement/prospectus in order to ensure that all of your shares of UIL common stock are voted. If you hold your shares in “street name” through a bank, brokerage firm or other nominee, you should follow the procedures provided by your bank, brokerage firm or other nominee to vote your shares. If you hold your shares in “street name” through more than one bank, brokerage firm or other nominee, you should follow the procedures provided by each of your banks, brokerage firms or other nominees in respect of each set of voting materials to vote the portion of your shares held through such bank, brokerage firm or other nominee.

Q: What happens if I sell my shares of UIL common stock before the special meeting?

A: The record date is earlier than both the date of the special meeting and the completion of the merger. If you transfer your shares of UIL common stock after the record date but before the special meeting, you will, unless the transferee requests a proxy from you, retain your right to vote at the special meeting but will transfer the right to receive the per share merger consideration to the person to whom you transfer your shares. In order to receive the per share merger consideration, you must hold your shares at the time of the completion of the merger.

9

Table of Contents

Q: What happens if I sell or otherwise transfer my shares of UIL common stock after the special meeting but before the completion of the merger?

A: If the merger agreement is approved by UIL shareowners at the special meeting and you sell or otherwise transfer your shares after the special meeting but before the completion of the merger, you will have transferred the right to receive the per share merger consideration to the person to whom you transfer your shares. In order to receive the per share merger consideration upon completion of the merger, you must hold your shares of UIL common stock at the time of the completion of the merger.

Q: Who will solicit and pay the cost of soliciting proxies?

A: UIL is making this solicitation and will bear the expense of printing and mailing proxy materials to its shareowners. UIL will ask banks, brokers and other custodians, nominees and fiduciaries to send proxy materials to beneficial owners of shares and to secure their voting instructions, if necessary, and UIL will reimburse them for their reasonable expenses in so doing. UIL’s directors, officers and employees may also solicit proxies personally or by telephone, but they will not be specifically compensated for soliciting proxies. UIL has retained Okapi, for a fee of up to $20,000 plus expenses, to aid in the solicitation of proxies by similar methods.

Q: What do I need to do now?

A: Even if you plan to attend the special meeting in person, after carefully reading and considering the information contained in this proxy statement/prospectus, please vote promptly to ensure that your shares are represented at the special meeting. If you hold your shares of UIL common stock in your own name as the shareowner of record, you may submit a proxy to have your shares of UIL common stock voted at the special meeting in one of three ways:

| • | by telephone or over the Internet, by accessing the telephone number or Internet website specified on the enclosed proxy card. Proxies delivered over the internet or by telephone must be submitted by 11:59 p.m. Eastern time on , 2015. Please be aware that if you vote by telephone or over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible; |

| • | by completing, signing, dating and returning the enclosed proxy card in the pre-addressed, postage-prepaid envelope accompanying the proxy card; or |

| • | in person—you may attend the special meeting and cast your vote there. |

If you decide to attend the special meeting and vote in person, your vote by ballot will revoke any proxy previously submitted. If you are a beneficial owner, please refer to the instructions provided by your bank, brokerage firm or other nominee to see which of the above choices are available to you. Please note that if you are a beneficial owner and wish to vote in person at the special meeting, you must obtain a legal proxy from your bank, brokerage firm or other nominee.

Q: Should I send in my share certificates now?

A: No, please do NOT return your share certificate(s) with your proxy. If the merger agreement is approved by UIL shareowners and the merger is completed, and you hold physical share certificates, you will be sent a letter of transmittal as promptly as reasonably practicable after the completion of the merger describing how you may exchange your shares of UIL common stock for the per share merger consideration. If your shares of UIL common stock are held in “street name” through a bank, brokerage firm or other nominee, you will receive instructions from your bank, brokerage firm or other nominee as to how to effect the surrender of your “street name” shares of UIL common stock in exchange for the per share merger consideration.

10

Table of Contents

Q: Where can I find the voting results of the special meeting?

A: The preliminary voting results will be announced at the special meeting. In addition, within four business days following certification of the final voting results, UIL intends to file the final voting results with the SEC on a Current Report on Form 8-K.

Q: Am I entitled to exercise appraisal rights instead of receiving the per share merger consideration for my shares of UIL common stock?

A: UIL shareowners of record do not have appraisal rights under the Connecticut Business Corporation Act, or CBCA, in connection with the merger.

Q: Are there any risks that I should consider in deciding whether to vote for the proposal to approve the merger agreement?

A: Yes. You should read and carefully consider the risk factors set forth in the section entitled “Risk Factors” beginning on page 37 of this proxy statement/prospectus. You also should read and carefully consider the risk factors contained in the documents that are incorporated by reference into this proxy statement/prospectus.

Q: What are the conditions to completion of the merger?

A: In addition to the approval of the merger agreement by UIL shareowners as described above, completion of the merger is subject to the satisfaction of a number of other conditions, including the receipt of required regulatory approvals, the accuracy of UIL’s and Iberdrola USA’s respective representations and warranties under the merger agreement (subject to certain materiality exceptions), Iberdrola USA’s and UIL’s performance of their respective obligations under the merger agreement, the absence of a material adverse effect on Iberdrola USA or UIL (as described in the merger agreement), authorization for the listing of Iberdrola USA common stock on the NYSE and receipt of specified tax opinions. For a more complete summary of the conditions that must be satisfied or waived prior to completion of the merger, see the section entitled “The Merger Agreement—Conditions to Completing the Merger” beginning on page 144 of this proxy statement/prospectus.

Q: What happens if the merger is not completed?

A: If the merger agreement is not approved by UIL shareowners or if the merger is not completed for any other reason, UIL shareowners will not receive any consideration for their shares of UIL common stock. Instead, UIL will remain an independent public company, UIL common stock will continue to be listed and traded on the NYSE and registered under the Exchange Act and UIL will continue to file periodic reports with the SEC. Under certain circumstances, UIL may be required to pay Iberdrola USA a termination fee of $75,000,000 and/or reimburse its expenses in connection with the merger up to $15,000,000, with any reimbursement of expenses being credited toward, and offset against, the payment of the termination fee. See the section entitled “The Merger Agreement—Termination,” “The Merger Agreement—Effect of Termination” and “The Merger Agreement—Fees and Expenses” beginning on pages 145, 147 and 147, respectively, of this proxy statement/prospectus.

Q: Who can help answer any other questions I have?

A: If you have additional questions about the merger, need assistance in submitting your proxy or voting your shares of UIL common stock, or need additional copies of this proxy statement/prospectus or the enclosed proxy card, please contact Okapi, UIL’s proxy solicitor, by calling toll-free at (855) 208-8902.

11

Table of Contents

This summary highlights information contained elsewhere in this proxy statement/prospectus. Iberdrola USA and UIL urge you to read carefully the remainder of this proxy statement/prospectus, including the attached annexes, the documents incorporated by reference into this proxy statement/prospectus and the other documents to which Iberdrola USA and UIL have referred you because this section does not provide all the information that might be important to you with respect to the merger and the related matters being considered at the UIL special meeting. See also the section entitled “Where You Can Find Additional Information” on page 290. Iberdrola USA and UIL have included page references to direct you to a more complete description of the topics presented in this summary.

Information About The Companies (Page 69)

Iberdrola USA

Durham Hall, 52 Farm View Drive

New Gloucester, Maine 04260

(207) 688-6300

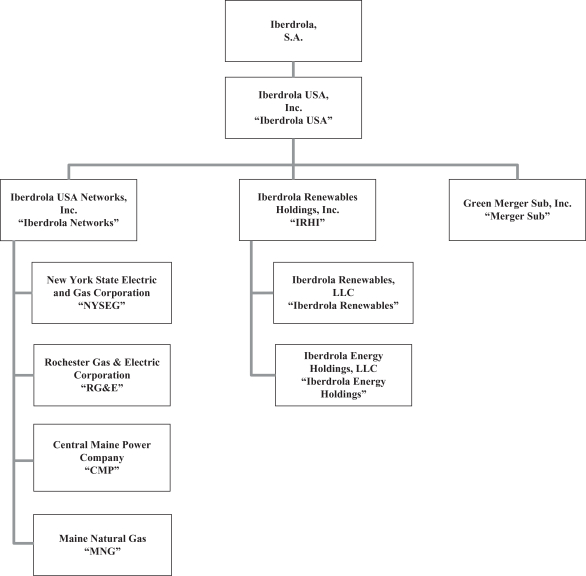

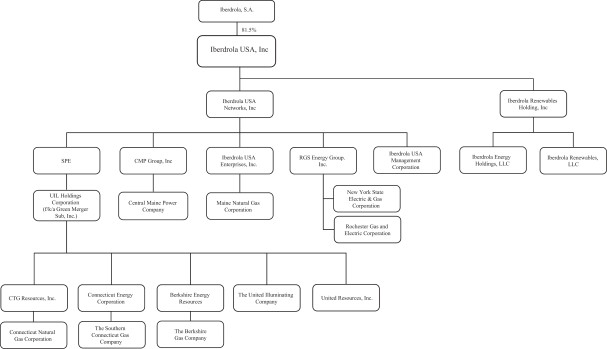

Iberdrola USA is a direct, wholly-owned subsidiary of Iberdrola, S.A., a corporation (sociedad anónima) organized under the laws of Spain, one of the world’s leading energy companies. Iberdrola USA holds the U.S. operations of Iberdrola, S.A. through its direct, wholly-owned subsidiaries, including Iberdrola USA Networks, Inc., or Iberdrola Networks, and Iberdrola Renewables Holdings, Inc., or IRHI. IRHI in turn holds subsidiaries including Iberdrola Renewables LLC, or Iberdrola Renewables and Iberdrola Energy Holdings, LLC, or Iberdrola Energy Holdings. Iberdrola Networks owns and operates the regulated utility businesses of Iberdrola USA through its subsidiaries, including electric transmission and distribution and natural gas distribution, while Iberdrola Renewables operates a portfolio of renewable energy generation facilities primarily using onshore wind power, and also solar, biomass and thermal power. Iberdrola Energy Holdings operates the natural gas storage facilities and gas trading businesses of Iberdrola USA through Iberdrola Energy Services LLC (gas trading) and Enstor Inc. (gas storage). Additionally, Iberdrola USA holds merger sub, a direct and wholly-owned subsidiary newly formed in Connecticut for the sole purpose of completing the merger. See “—Merger Sub.”

There is currently no public trading market for Iberdrola USA common stock. Iberdrola USA has applied to list its common stock on the NYSE under the symbol “AGR” in connection with the merger. Iberdrola USA is headquartered in New Gloucester, Maine, where its senior management maintains offices and is responsible for overall executive, financial and planning functions. For additional information about Iberdrola USA, see the section entitled “Additional Information About Iberdrola USA” beginning on page 201 of this proxy statement/prospectus.

Merger Sub

Durham Hall, 52 Farm View Drive

New Gloucester, Maine 04260

(207) 688-6327

Green Merger Sub, Inc., or merger sub, is a Connecticut corporation and a direct wholly-owned subsidiary of Iberdrola USA that was formed solely in contemplation of the merger, has not commenced any operations, has only nominal assets and has no liabilities or contingent liabilities, except as described in this proxy statement/prospectus, nor any outstanding commitments other than as set forth in the merger agreement. Merger sub has not incurred any obligations, engaged in any business activities or entered into any agreements or arrangements with any third parties other than the merger agreement.

12

Table of Contents

UIL

157 Church Street

New Haven, Connecticut 06510

(203) 499-2000

The primary business of UIL is ownership of its operating regulated utility businesses. The utility businesses consist of the electric distribution and transmission operations of The United Illuminating Company, or UI, and the natural gas transportation, distribution and sales operations of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation, and The Berkshire Gas Company. UI is also a party to a joint venture with certain affiliates of NRG Energy, Inc. pursuant to which UI holds 50% of the membership interests in GCE Holding LLC, whose wholly-owned subsidiary, GenConn Energy LLC, operates peaking generation plants in Devon, Connecticut and Middletown, Connecticut. UIL is headquartered in New Haven, Connecticut, where its senior management maintains offices and is responsible for overall executive, financial and planning functions.

UIL common stock is listed on the NYSE under the symbol “UIL.”

The Merger and the Merger Agreement (Page 123)

The terms and conditions of the merger are contained in the merger agreement, a copy of which is attached as Annex A to this proxy statement/prospectus. You are encouraged to read the merger agreement carefully and in its entirety, as it is the legal document that governs the merger.

Pursuant to the merger agreement, UIL will merge with and into merger sub. Upon completion of the merger, merger sub will continue as the surviving corporation and a wholly-owned subsidiary of the combined company. Following the merger, the combined company will be a publicly traded company with its common stock listed on the NYSE and registered under the Exchange Act. Following the merger, UIL common stock will be delisted from the NYSE, deregistered under the Exchange Act and cease to be publicly traded. The UIL board recommends that you vote “FOR” the proposal to approve the merger agreement and “FOR” the other matters described in this proxy statement/prospectus.

Effects of the Merger; Merger Consideration (Page 125)

As of the effective time, each issued share of UIL common stock that is owned by UIL (other than any shares owned on behalf of third parties) immediately prior to the effective time will automatically be cancelled and cease to exist, and no consideration will be delivered or deliverable in connection with such cancellation. Upon the terms and subject to the conditions set forth in the merger agreement, each issued and outstanding share of UIL common stock (other than any shares owned directly or indirectly by UIL, but including any shares owned by UIL on behalf of third parties) will be converted into the right to receive (i) one validly issued share of common stock of the combined company, credited as fully paid, which, when issued, ranks equally in all respects with all of the shares of common stock of the combined company then in issue and (ii) $10.50 in cash, without interest and less any applicable withholding taxes, referred to as the merger consideration. The shares of common stock of the combined company issued in the merger to UIL shareowners will represent 18.5% of the total number of shares of common stock of the combined company outstanding as of that time.

For a full description of the merger consideration, see the section entitled “The Merger Agreement—Effects of the Merger; Merger Consideration” beginning on page 125 of this proxy statement/prospectus.

13

Table of Contents

Treatment of UIL Stock Plans and UIL Equity-Based Awards (Page 125)

Each award of restricted UIL common stock granted under the UIL stock plans that is outstanding and unvested or otherwise subject to forfeiture or other restrictions as of immediately prior to the effective time of the merger, or the UIL restricted shares, other than those UIL restricted shares that vest by their terms upon the completion of the merger, will be converted into the right to receive the number of validly-issued restricted shares of common stock of the combined company calculated pursuant to an exchange ratio.