Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

| BARNES & NOBLE EDUCATION, INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

2016 Proxy statement

Table of Contents

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

August 17, 2016

Dear Stockholder:

You are cordially invited to attend the 2016 annual meeting of stockholders of Barnes & Noble Education, Inc. (the “Company”). The meeting will be held at 9:00 am, Eastern Time, on September 16, 2016 at the New York Marriott Downtown, 85 West Street, New York, NY 10006 (the “Annual Meeting”).

Information about the meeting and the various matters on which the stockholders will act is included in the Notice of Annual Meeting of Stockholders and the Proxy Statement which follow. Also included are a proxy card and postage-paid return envelope. Proxy cards are being solicited on behalf of the Board of Directors of the Company.

You are urged to read the Proxy Statement carefully and, whether or not you plan to attend the Annual Meeting, to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the enclosed proxy card in the postage-paid return envelope provided.

The Board of Directors unanimously recommends that you vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, (iii) FOR the approval, on an advisory basis, of a vote on compensation of the Company’s named executive officers every year, (iv) FOR the approval of amending the Company’s Equity Incentive Plan, and (v) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 29, 2017.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on September 16, 2016: The Proxy Statement and the Company’s 2016 Annual Report to Stockholders are available online at http://investor.bned.com.

Your vote is extremely important no matter how many shares you own. If you have any questions or require any assistance with voting your shares, please contact Barnes & Noble Education, Inc.’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll-free: (888) 750-5834

Banks and Brokers may call collect: (212) 750-5833

| Sincerely, |

|

| MICHAEL P. HUSEBY Executive Chairman of the Board of Directors |

Table of Contents

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 16, 2016

The Annual Meeting of Stockholders of Barnes & Noble Education, Inc. (the “Company”) will be held at 9:00 am, Eastern Time, on September 16, 2016 at the New York Marriott Downtown, 85 West Street, New York, NY 10006 for the following purposes:

| 1. | To elect two directors to serve until the 2019 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To vote on an advisory (non-binding) vote on executive compensation; |

| 3. | To vote on an advisory (non-binding) role on the frequency of holding an advisory (non-binding) vote on executive compensation; |

| 4. | To vote on an amendment to the Company’s Equity Incentive Plan to increase the number of shares of common stock authorized to be issued under the plan by four million and to approve the material terms of the performance goals under the plan for purposes of Section 162(m) of the Internal Revenue Code; |

| 5. | To ratify the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 29, 2017; and |

| 6. | To transact such other business as may be properly brought before the meeting and any adjournment or postponement thereof. |

Only holders of record of common stock of the Company as of the close of business on August 2, 2016 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

The Board of Directors unanimously recommends that you vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, (iii) FOR the approval, on an advisory basis, of a vote on compensation of the Company’s named executive officers every year, (iv) FOR the approval of the amendment to the Company’s Equity Incentive Plan, and (v) FOR the ratification of the appointment of Ernst & Young LLP as independent registered public accountants for the Company’s fiscal year ending April 29, 2017.

| Sincerely, |

|

| SUZANNE E. ANDREWS Vice President, General Counsel and Corporate Secretary Basking Ridge, New Jersey August 17, 2016 |

The Board of Directors urges you to read the Proxy Statement carefully and, whether or not you plan to attend the Annual Meeting, to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the enclosed proxy card in the postage-paid return envelope provided.

Table of Contents

Table of Contents

BARNES & NOBLE EDUCATION, INC.

120 Mountain View Blvd.

Basking Ridge, New Jersey 07920

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 16, 2016

This Proxy Statement and enclosed proxy card are being furnished commencing on or about August 17, 2016 in connection with the solicitation by the Board of Directors (the “Board”) of Barnes & Noble Education, Inc., a Delaware corporation (the “Company”), of proxies for use at its annual meeting of stockholders to be held on September 16, 2016 and any adjournment or postponement thereof (the “Meeting”) for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

The Board of Directors unanimously recommends that you vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, (iii) FOR the approval, on an advisory basis, of a vote on compensation of the Company’s named executive officers every year, (iv) FOR the approval of amending the Company’s Equity Incentive Plan, and (v) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 29, 2017.

Stockholders Entitled to Vote

Only holders of record of the Company’s common stock, par value $0.01 per share (“Common Stock”), as of the close of business on August 2, 2016 are entitled to notice of and to vote at the Meeting. As of the record date, 46,090,093 shares of Common Stock were outstanding. Each share of Common Stock entitles the record holder thereof to one vote on each matter brought before the Meeting.

How to Vote

Your vote is very important to the Board no matter how many shares of our Common Stock you own. Whether or not you plan to attend the Meeting, we urge you to vote your shares today.

If You Are a Registered Holder of Common Stock

If you are a registered holder of Common Stock (including unvested restricted stock), you may vote your shares either by voting by proxy in advance of the Meeting or by voting in person at the Meeting. By submitting a proxy, you are legally authorizing another person to vote your shares on your behalf. We urge you to use the enclosed proxy card to vote (i) FOR the election of each of the Board of Directors’ nominees, (ii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement, (iii) FOR the approval, on an advisory basis, of a vote on compensation of the Company’s named executive officers every year, (iv) FOR the approval of amending the Company’s Equity Incentive Plan, and (v) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants for the Company’s fiscal year ending April 29, 2017. If you submit your executed proxy card your shares will be voted in accordance with your instructions; however, if you do not indicate how your shares are to be voted, then your shares will be voted in accordance with the Board’s recommendations set forth in this Proxy Statement. In addition, if any other matters are brought before the Meeting (other than the proposals contained in this Proxy Statement), then the individuals listed on the proxy card will have the authority to vote your shares on those other matters in accordance with their discretion and judgment.

Whether or not you plan to attend the Meeting, we urge you to promptly submit a proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the enclosed proxy card in the postage-paid return envelope provided. If you later decide to attend the Meeting and vote in person, that vote will automatically revoke any previously submitted proxy.

1

Table of Contents

If You Hold Your Shares in “Street Name”

If you hold your shares in “street name”, i.e., through a bank, broker or other holder of record (a “custodian”), your custodian is required to vote your shares on your behalf in accordance with your instructions. If you do not give instructions to your custodian, your custodian will not be permitted to vote your shares with respect to “non-discretionary” items, which includes all matters on the agenda other than the ratification of the appointment of the independent registered public accountants. Accordingly, we urge you to promptly give instructions to your custodian to vote FOR all items on the agenda by using the voting instruction card provided to you by your custodian. Please note that if you intend to vote your street name shares in person at the Meeting, you must provide a “legal proxy” from your custodian at the Meeting.

Questions on How to Vote

If you have any questions or require any assistance with voting your shares, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th

Floor New York, NY 10022

Stockholders may call toll-free: (888) 750-5834.

Banks and Brokers may call collect: (212) 750-5833

Quorum and Votes Required

Quorum

The presence in person or by proxy at the Meeting of the holders of shares of Common Stock of the Company having a majority of the voting power of the Common Stock entitled to vote at the Annual Meeting will constitute a quorum.

Votes Required

The two nominees for director receiving the highest vote totals will be elected as directors of the Company.

Approval of the proposal regarding approval, on an advisory basis, of the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the votes cast on the proposal.

Approval of the proposal regarding approval, on an advisory basis, of the frequency of future advisory votes on executive compensation of the Company’s named executive officers requires the affirmative vote of a plurality of the votes cast on the proposal. Stockholders can vote for a frequency of future advisory votes on compensation of named executive officers every year, every 2 years, every 3 years or to abstain.

Because the votes on compensation of named executive officers and the frequency of future votes on executive compensation are advisory, they will not be binding upon the Board.

Approval of the amendment to the Company’s Equity Incentive Plan to increase the number of shares available for issuance under the plan and to approve the material terms of performance goals for purposes of Section 162(m) of the Internal Revenue Code (“Section 162(m)”) requires the affirmative votes of the majority of shares present in person or represented by proxy and entitled to vote on the matter.

Approval of the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants requires the affirmative vote of a majority of the votes cast on the proposal.

Withheld Votes, Abstentions and Broker Non-Votes

With respect to the proposal to elect directors, withheld votes and any “broker non-votes” are not counted in determining the outcome of the election. A “broker non-vote” occurs when a custodian does not vote on a particular proposal because it has not received voting instructions from the applicable beneficial owner and does not have discretionary voting power on the matter in question.

2

Table of Contents

With respect to the proposal regarding approval, on an advisory basis, of compensation of the Company’s named executive officers, abstentions and any “broker non-votes” will not be included in the votes cast and, as such, will have no effect on the outcome of this proposal.

With respect to the proposal regarding approval, on an advisory basis, of the frequency of future advisory votes on executive compensation of the Company’s named executive officers, abstentions and any “broker non-votes” will not be included in the vote cast and, as such, will have no effect on the outcome of this proposal.

With respect to the proposal regarding an amendment to the Company’s Equity Incentive Plan, abstentions are treated as shares present and entitled to vote on the matter and, therefore, will have the same effect as a vote “Against” the proposal. “Broker non-votes” are not considered entitled to vote on these proposals and will have no effect on the outcome of the votes.

With respect to the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants, abstentions will not be included in the votes cast and, as such, will have no effect on the outcome of this proposal.

Withheld votes, abstentions and any “broker non-votes” will be included in determining whether a quorum is present.

Attendance at the Annual Meeting

Attendance at the Meeting or any adjournment or postponement thereof will be limited to stockholders of record of the Company as of the close of business on the record date and guests of the Company. If you are a stockholder of record, your name will be verified against the list of stockholders of record prior to your admittance to the Meeting or any adjournment or postponement thereof. Please be prepared to present photo identification for admission. If you hold your shares in street name, you will need to provide proof of beneficial ownership, such as a brokerage account statement, a copy of a voting instruction form provided by your custodian with respect to the Meeting, or other similar evidence of ownership, as well as photo identification, in order to be admitted to the Meeting. Please note that if you hold your shares in street name and intend to vote in person at the Meeting, you must also provide a “legal proxy” obtained from your custodian.

How to Revoke Your Proxy

Your proxy is revocable. The procedure you must follow to revoke your proxy depends on how you hold your shares.

If you are a registered holder of Common Stock, you may revoke a previously submitted proxy by submitting another valid proxy (whether by telephone, the Internet or mail) or by providing a signed letter of revocation to the Corporate Secretary of the Company before the closing of the polls at the Meeting. Only the latest-dated validly executed proxy will count. You also may revoke any previously submitted proxy and vote your shares in person at the Meeting; however, simply attending the Meeting without taking one of the above actions will not revoke your proxy.

If you hold shares in street name, in general, you may revoke a previously submitted voting instruction by submitting to your custodian another valid voting instruction (whether by telephone, the Internet or mail) or a signed letter of revocation. Please contact your custodian for detailed instructions on how to revoke your voting instruction and the applicable deadlines.

ELECTION OF DIRECTORS-PROPOSAL 1

Introduction

The Board currently consists of seven directors. The directors are divided into three classes, currently consisting of two Class I members whose terms expire upon the election and qualification of their successors at the Meeting, three Class II directors whose terms expire at the 2017 annual meeting of stockholders and two Class III directors whose terms expire at the 2018 annual meeting of stockholders. The Board unanimously recommends using the enclosed proxy card to vote FOR each of the Board’s two nominees for director.

3

Table of Contents

Information Concerning the Directors and the Board’s Nominees

Background information with respect to the Board and the Board’s nominees for election as directors appears below. See “Security Ownership of Certain Beneficial Owners and Management” for information regarding such persons’ holdings of equity securities of the Company.

| Name |

Age | Director Since |

Position | |||

| Nominees for Election at the Meeting | ||||||

| Michael P. Huseby | 61 | 2015 | Executive Chairman | |||

| David A. Wilson* | 75 | 2015 | Director | |||

| Other Directors | ||||||

| Daniel A. DeMatteo* | 68 | 2015 | Director | |||

| David G. Golden* | 58 | 2015 | Director | |||

| Max J. Roberts | 64 | 2015 | Chief Executive Officer | |||

| John R. Ryan* | 71 | 2015 | Director | |||

| Jerry Sue Thornton* | 69 | 2015 | Director | |||

| * | Independent for purposes of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”) corporate governance listing standards. |

At the Meeting, two directors will be elected. Michael P. Huseby and David A. Wilson are the Board’s nominees for election as directors at the Meeting, each to hold office for a term of three years until the annual meeting of stockholders to be held in 2019 and until his successor is elected and qualified. Each of the nominees has consented to be named in this Proxy Statement and to serve on the Board, if elected. However, if any nominee is unable to serve or for good cause will not serve, proxies may be voted for a substitute designated by the Board.

Mr. Golden, Mr. Roberts and Dr. Thornton serve as Class II directors, whose terms expire at the 2017 annual meeting of stockholders. Mr. DeMatteo and Vice Admiral Ryan serve as Class III directors, whose terms expire at the 2018 annual meeting of stockholders. Directors for each class will be elected at the annual meeting of the stockholders held in the year in which the term for that class expires and thereafter will serve for a term of three years.

Nominees for Election as Director

The following individuals are nominees for director at the Meeting. The Board unanimously recommends a vote FOR each of the below nominees for director using the enclosed proxy card.

Michael P. Huseby was a member of the board of directors of Barnes & Noble, Inc. (“Barnes & Noble”) from January 2014 and served as the Chief Executive Officer of Barnes & Noble until the complete legal and structural separation of the Company from Barnes & Noble on August 2, 2015 (the “Spin-Off”). He was elected to the Board of the Company and was appointed Executive Chairman effective August 2, 2015. Previously, Mr. Huseby was appointed Chief Executive Officer of NOOK Media LLC and President of Barnes & Noble in July 2013, and Chief Financial Officer of Barnes & Noble in March 2012. From 2004 to 2011, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Cablevision Systems Corporation, a leading telecommunications and media company, which was acquired by the Altice Group in June 2016. He served on the Cablevision Systems Corporation board of directors in 2000 and 2001. Prior to joining Cablevision, Mr. Huseby served as Executive Vice President and Chief Financial Officer of Charter Communications, Inc., a large cable operator in the United States. Mr. Huseby served on the board of directors of Charter Communications from May 2013 through May 2016. From 1999 to 2002, Mr. Huseby served as Executive Vice President, Finance and Administration, of AT&T Broadband, a provider of cable television services. In addition, Mr. Huseby spent over 20 years at Arthur Andersen, LLP and Andersen Worldwide, S.C., where he held the position of Global Equity Partner. Mr. Huseby serves on the board of directors of CommerceHub, Inc., a cloud-based e-commerce fulfillment and marketing software platform company listed on Nasdaq and is chair of its audit committee and a member of its compensation committee.

Qualifications, Experience, Attributes and Skills. Mr. Huseby has more than 20 years of financial and executive experience, having served as a senior executive at Barnes & Noble, Cablevision Systems Corporation and AT&T Broadband.

4

Table of Contents

Mr. Huseby’s experience also includes his service as a director and audit committee member of Charter Communications and as a member of Cablevision Systems Corporation’s Board of Directors. This experience allows Mr. Huseby to bring to the Board substantial knowledge and a wide range and depth of insights in telecommunications, technology, retail, financial and business matters.

David A. Wilson was elected to the Board in July 2015. Dr. Wilson served as a director of Barnes & Noble from October 2010 until the Spin-Off. From 1995 to December 2013, Dr. Wilson served as President and Chief Executive Officer of the Graduate Management Admission Council, a not-for-profit education association dedicated to creating access to graduate management and professional education that provides the Graduate Management Admission Test (GMAT). From 2009 to 2010, Dr. Wilson was a director of Terra Industries Inc., a producer and marketer of nitrogen products, where he was a member of the audit committee. From 2002 to 2007, Dr. Wilson was a director of Laureate Education, Inc. (formerly Sylvan Learning Systems, Inc.), an operator of an international network of licensed campus-based and online universities and higher education institutions, where he was chairman of the audit committee beginning in 2003. From 1978 to 1994, Dr. Wilson was employed by Ernst & Young LLP (and its predecessor, Arthur Young & Company), serving as an Audit Principal through 1981, as an Audit Partner from 1981 to 1983 and thereafter in various capacities including Managing Partner, National Director of Professional Development, Chairman of Ernst & Young’s International Professional Development Committee and as a director of the Ernst & Young Foundation. From 1968 to 1978, Dr. Wilson served as a faculty member at Queen’s University (1968-1970), the University of Illinois at Urbana-Champaign (1970-1972), the University of Texas (1972-1978), where he was awarded tenure, and Harvard Business School (1976-1977). Dr. Wilson is also on the board of directors of CoreSite Realty Corporation, a publicly traded real estate investment trust, and serves as lead director, chair of the audit committee, and a member of the compensation committee. In November 2015, he was elected as Trustee of Johnson & Wales University, a not for profit institution, and serves as chair of its audit committee and as a member of its finance and budget committee.

Qualifications, Experience, Attributes and Skills. Dr. Wilson has a total of more than 30 years of executive and board-level experience, including serving on the boards of Terra Industries Inc. and Laureate Education, Inc. while those companies were involved in strategic transactions, as well as serving as President and Chief Executive Officer of the Graduate Management Admission Council. Dr. Wilson also has more than 16 years of financial and accounting expertise, including as an Audit Partner at Ernst & Young LLP (and its predecessor, Arthur Young & Company). This experience allows Dr. Wilson to bring to the Board substantial financial and accounting knowledge and valuable insights.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED ABOVE USING THE ENCLOSED PROXY CARD.

Other Directors

Daniel A. DeMatteo was elected as a director in August 2015. Mr. DeMatteo has served as Gamestop, Inc.’s Director and Executive Chairman since June 2010, and previously held other roles with Gamestop, including Chief Executive Officer from August 2008 to June 2010, Vice Chairman and Chief Operating Officer from March 2005 to August 2008, and President and Chief Operating Officer of Gamestop or its predecessor companies since November 1996. Mr. DeMatteo has served as an executive officer in the video game industry since 1988.

Qualifications, Experience, Attributes and Skills. Mr. DeMatteo brings to the Board over 25 years of experience as an executive officer, including 19 years of experience growing Gamestop and its predecessor companies into the world’s largest multichannel video game retailer. As one of the founders of Gamestop, Mr. DeMatteo has demonstrated a record of leadership, innovation and achievement. With his experience in the roles of Executive Chairman, Vice Chairman, Chief Executive Officer, President and Chief Operating Officer, Mr. DeMatteo provides the Board a unique and valuable perspective on corporate operations, strategy and business, including his perspective on the formula for success that has brought Gamestop to its current industry-leading position. The Board also benefits from Mr. DeMatteo’s entrepreneurial spirit and his extensive network of contacts and relationships within the retail industry.

5

Table of Contents

David G. Golden was elected as a director in August 2015. Mr. Golden served as a director of Barnes & Noble from October 2010 until the Spin-Off. Mr. Golden has been a Managing Partner at Revolution Ventures, an early-stage venture affiliate of Revolution LLC, since January 2013. From March 2006 until December 2011, Mr. Golden was a Partner, Executive Vice President and Strategic Advisor at Revolution LLC, a private investment company. Mr. Golden also served as Executive Chairman of Code Advisors LLC, a private merchant bank focused on the intersections of technology and media from its founding in 2010 through 2012. Previously, Mr. Golden served in various senior positions over an 18-year period at JPMorgan Chase & Co. (“JPMorgan”), a financial services firm, and a predecessor company, Hambrecht & Quist Inc. (“Hambrecht & Quist”). Prior to that, Mr. Golden worked as a corporate attorney at Davis Polk & Wardwell LLP. Mr. Golden is a member of the boards of Blackbaud, Inc. and Everyday Health Inc., where he currently serves on their respective audit committees. Mr. Golden also is a member of the advisory boards of Granite Ventures LLC, a technology venture capital firm, and Partners for Growth LLC, a venture lending firm, and is a board member of several private companies. He is a graduate of Harvard College and Harvard Law School, where he was an editor of The Harvard Law Review.

Qualifications, Experience, Attributes and Skills. Mr. Golden has over 20 years of technology and finance experience as an investment banker specializing in the technology sector at JPMorgan, Hambrecht & Quist, and more recently as a managing partner and executive of Revolution Ventures and Executive Chairman of Code Advisors LLC. Mr. Golden’s technology experience also includes his service as a director and Advisory Board member of several technology companies including Blackbaud, Inc., a global provider of software services specifically designed for nonprofit organizations. Mr. Golden’s finance experience at Hambrecht & Quist and JPMorgan included significant work with mergers, capital markets and principal investing, and he has participated as lead merger advisor, equity underwriter or investor on over 150 transactions. Given this experience, Mr. Golden brings to the Board substantial knowledge of the technology sector and meaningful insight into the financial, strategic and capital-related issues technology companies face.

Max J. Roberts serves as our Chief Executive Officer and was elected to the Board in August 2015. Mr. Roberts joined Barnes & Noble College in 1996 as President and became its Chief Executive Officer in August of 2013. Prior to joining Barnes & Noble, Mr. Roberts held senior executive positions at Petrie Retail and R.H. Macy & Company, Inc. Mr. Roberts started his professional career at the global public accounting firm of Touche Ross & Company (currently Deloitte). Mr. Roberts is a Certified Public Accountant and graduated cum laude with a degree in Accounting from Oklahoma Christian University.

Qualifications, Experience, Attributes and Skills. Mr. Roberts has served as either the President or CEO of Barnes & Noble College for 20 years. In this capacity, Mr. Roberts has executive oversight for all strategies and operations of the Company, as well as responsibility for financial results. In addition, having served in senior management positions at R.H. Macy & Company, Inc. and Petrie Retail for over 15 years, Mr. Roberts brings extensive experience in technology, consumer marketing, senior financial management and strategic initiatives. These combined experiences allow Mr. Roberts to bring to the Board substantial knowledge and a wide range and depth of insights in education, technology, retail, financial and business matters.

John R. Ryan was elected to the Board in July 2015. Vice Admiral Ryan served as director of Barnes & Noble from July 2014 until the Spin-Off. Vice Admiral Ryan joined the Center for Creative Leadership’s Board of Governors in 2002 and has served as its President and Chief Executive Officer since 2007. From 2005 to 2007, he served as Chancellor of the State University of New York. Previously, Vice Admiral Ryan served as President of the State University of New York Maritime College from 2002 to 2005, Interim President of the State University of New York at Albany from 2004 to 2005 and Superintendent of the United States Naval Academy, Annapolis, Maryland from 1998 to 2002. Vice Admiral Ryan served in the United States Navy from 1967 to his retirement in 2002, including as Commander of the Fleet Air Mediterranean from 1995 to 1998, Commander of the Patrol Wings for the United States Pacific Fleet from 1993 to 1995 and Director of Logistics for the US Command from 1991 to 1993. Vice Admiral Ryan is also the lead director of CIT Group, Inc. and was a director of Cablevision Systems Corporation from 2002 until it was acquired by the Altice Group in June 2016.

Qualifications, Experience, Attributes and Skills. Vice Admiral Ryan has a total of more than 35 years in military service, more than 10 years as a leader at major universities, and over a decade of executive and board-level experience, including his service as lead director of CIT Group. Vice Admiral Ryan has substantial experience serving on public company boards undergoing strategic transactions, such as separations, including serving as a director of Cablevision during its 2010 spinoff of Madison Square Garden, L.P., its 2011 spinoff of AMC Networks, Inc., and its 2013 sales of Clearview Cinemas and Optimum West to Bow Tie Cinemas and Charter Communications, respectively. This experience allows Vice Admiral Ryan to bring to the Board leadership and expertise in managing large complex organizations, and in particular the environment in which the Company operates.

6

Table of Contents

Jerry Sue Thornton was elected as a director in August 2015. Dr. Thornton currently serves as Chief Executive Officer of Dream Catcher Educational Consulting, a consulting firm that provides coaching and professional development for newly selected college and university presidents. She previously served as President of Cuyahoga Community College from 1992 to 2013 (for which she is now President Emeritus). Prior to serving in that role, she was President of Lakewood College in Minnesota from 1985 to 1991. She also serves as a director of FirstEnergy Corp., Applied Industrial Technologies, Inc. and Republic Powdered Metals, Inc. (RPM, Inc.), and as a director of American Greetings Corporation from 2000 to 2013 until it became a private corporation.

Qualifications, Experience, Attributes and Skills. Dr. Thornton has extensive executive leadership and management experience in higher education as well as public corporate board experience. She served on boards such as National City Corporation (banking) and American Family Insurance as well as other public companies where she served on numerous key board committees. She is a recognized leader in the Northeast Ohio community and the State of Ohio. She has over 40 years of higher education work experience with 32 years in leadership positions. Dr. Thornton brings to the Board broad leadership and business skills, together with her extensive board service for public companies and community organizations.

Meetings and Committees of the Board

The Board met eight (8) times during the Company’s fiscal year 2016, which ended April 30, 2016 (“Fiscal 2016”). All directors attended at least 75% of all meetings of the Board and committees of which he or she was a member.

Based on information supplied to it by the directors and the director nominees, the Board has affirmatively determined that each of Daniel A. DeMatteo, Jerry Sue Thornton, David G. Golden, John R. Ryan and David A. Wilson is “independent” under the listing standards of the NYSE, and has made such determinations based on the fact that none of such persons have had, or currently have, any relationship with the Company or its affiliates or any executive officer of the Company or his or her affiliates, that would currently impair their independence, including, without limitation, any such commercial, industrial, banking, consulting, legal, accounting, charitable or familial relationship.

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee.

Audit Committee. The responsibilities of the Audit Committee include, among other duties:

| • | overseeing the quality and integrity of our financial statements, accounting practices and financial information we provide to the SEC or the public; |

| • | reviewing our annual and interim financial statements, the report of our independent registered public accounting firm on our annual financial statements, Management’s Report on Internal Control over Financial Reporting and the disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | selecting and appointing an independent registered public accounting firm; |

| • | pre-approving all services to be provided to us by our independent registered public accounting firm; |

| • | reviewing with our independent registered public accounting firm and our management the accounting firm’s significant findings and recommendations upon the completion of the annual financial audit and quarterly reviews; |

| • | reviewing and evaluating the qualification, performance, fees and independence of our registered public accounting firm; |

| • | meeting with our independent registered public accounting firm and our management regarding our internal controls, critical accounting policies and practices, and other matters; |

| • | discussing with our independent registered public accounting firm and our management earnings releases prior to their issuance; |

| • | overseeing our internal audit function; |

7

Table of Contents

| • | reviewing and approving related party transactions (see “Certain Relationships and Related Transactions” below); and |

| • | overseeing our compliance program, response to regulatory actions involving financial, accounting and internal control matters, internal controls and risk management policies. |

The Board has adopted a written charter setting out the functions of the Audit Committee, a copy of which is available on the Company’s website at www.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Audit Committee currently are Dr. David A. Wilson (Chair), Daniel A. DeMatteo and David G. Golden. In addition to meeting the independence standards of the NYSE, each member of the Audit Committee is financially literate and meets the independence standards established by the SEC. The Board has also determined that Dr. Wilson, Mr. DeMatteo and Mr. Golden each has the requisite attributes of an “audit committee financial expert” as defined by regulations promulgated by the SEC and that such attributes were acquired through relevant education and/or experience. The Audit Committee met nine (9) times during Fiscal 2016.

Compensation Committee. The responsibilities of the Compensation Committee include, among other duties:

| • | setting and reviewing our general policy regarding executive compensation; |

| • | determining the compensation of our Chief Executive Officer and other executive officers; |

| • | approving employment agreements for our Chief Executive Officer and other executive officers; |

| • | reviewing the benefits provided to our Chief Executive Officer and other executive officers; |

| • | overseeing our overall compensation structure, practices and benefit plans; |

| • | administering our executive bonus and equity-based incentive plans; and |

| • | assessing the independence of compensation consultants, legal counsel and other advisors to the Compensation Committee and hiring, approving the fees and overseeing the work of, and terminating the services of such advisors. |

The Board has adopted a written charter setting out the functions of the Compensation Committee, a copy of which is available on the Company’s website at www.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Compensation Committee currently are David G. Golden (Chair), Daniel A. DeMatteo, Vice Admiral John R. Ryan and Dr. Jerry Sue Thornton. All members of the Compensation Committee meet the independence standards of the NYSE. The members of the Compensation Committee are “non-employee directors” (within the meaning of Rule 16b-3 under the Securities Exchange Act) and “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code (the “Code”)).

The Compensation Committee met six (6) times during Fiscal 2016. The Compensation Committee has engaged Mercer, an independent consulting firm, to provide information, analyses and advice regarding executive compensation and other matters. For further discussion of the nature and scope of the independent compensation consultant’s assignment, see the “Compensation Discussion and Analysis-Roles of the Compensation Committee, Management and our Compensation Consultant in Determining the Compensation of our Named Executive Officers-Role of Compensation Consultant” section of this Proxy Statement.

Corporate Governance and Nominating Committee. The responsibilities of the Corporate Governance and Nominating Committee include, among other duties:

| • | overseeing our corporate governance practices; |

| • | reviewing and recommending to our Board amendments to our committee charters and other corporate governance guidelines; |

| • | reviewing and making recommendations to our Board regarding the structure of our various Board committees; |

| • | identifying, reviewing and recommending to our Board individuals for election to the Board; |

8

Table of Contents

| • | adopting and reviewing policies regarding the consideration of Board candidates proposed by stockholders and other criteria for Board membership; and |

| • | overseeing our Board’s annual self-evaluation. |

The Board has adopted a written charter setting out the functions of the Corporate Governance and Nominating Committee, a copy of which is available on the Company’s website at www.bned.com and is available in print to any stockholder who requests it in writing directed to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

The members of the Corporate Governance and Nominating Committee currently are Vice Admiral John R. Ryan (Chair), Dr. Jerry Sue Thornton and Dr. David A. Wilson.

The Corporate Governance and Nominating Committee consists entirely of independent directors, each of whom meet the independence requirements set forth in the listing standards of the NYSE and our Corporate Governance and Nominating Committee Charter. The Corporate Governance and Nominating Committee met four (4) times during Fiscal 2016.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has ever been an employee of the Company, and none of them had a relationship requiring disclosure in this Proxy Statement under Item 404 of SEC Regulation S-K. None of the Company’s executive officers serves or in Fiscal 2016 served, as a member of the Board or Compensation Committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board or the Company’s Compensation Committee.

Director Qualifications and Nominations

Minimum Qualifications

The Company does not set specific criteria for directors except to the extent required to meet applicable legal, regulatory and stock exchange requirements, including, but not limited to, the independence requirements of the NYSE and the SEC, as applicable. Nominees for director will be selected on the basis of outstanding achievement in their personal careers; board experience; wisdom; integrity; ability to make independent, analytical inquiries; understanding of the business environment; and willingness to devote adequate time to Board duties. While the selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, the Corporate Governance and Nominating Committee believes that each director should have a basic understanding of (a) the principal operational and financial objectives and plans and strategies of the Company, (b) the results of operations and financial condition of the Company and of any significant subsidiaries or businesses, and (c) the relative standing of the Company and its businesses in relation to its competitors.

The Company does not have a specific policy regarding the diversity of the Board. Instead, the Corporate Governance and Nominating Committee considers the Board’s overall composition when considering director candidates, including whether the Board has an appropriate combination of professional experience, skills, knowledge and variety of viewpoints and backgrounds in light of the Company’s current and expected future needs. In addition, the Corporate Governance and Nominating Committee also believes that it is desirable for new candidates to contribute to a variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experiences.

Nominating Process

Although the process for identifying and evaluating candidates to fill vacancies and/or expand the Board will inevitably require a practical approach in light of the particular circumstances at such time, the Board has adopted the following process to guide the Corporate Governance and Nominating Committee in this respect. The Corporate Governance and Nominating Committee is willing to consider candidates submitted by a variety of sources (including incumbent directors, stockholders (as described below), Company management and independent third-party search firms) when reviewing candidates to fill vacancies and/or expand the Board. If a vacancy arises or the Board decides to expand its membership, the Corporate Governance and Nominating Committee may ask each director to submit a list of potential candidates for consideration. The Corporate Governance and Nominating Committee then evaluates each potential candidate’s educational background, employment history, outside commitments and other relevant factors to determine whether he or she is potentially qualified to serve on the Board. At that time, the Corporate Governance and Nominating Committee also will consider potential nominees submitted by stockholders, if any, in accordance with the procedures described below, or by the Company’s management and, if the Corporate Governance and Nominating Committee deems it necessary, retain an independent third-party search firm to provide potential candidates. The Corporate Governance and Nominating Committee seeks to identify and recruit the best available candidates, and it intends to evaluate qualified stockholder nominees on the same basis as those submitted by Board members, Company management, independent third-party search firms or other sources.

9

Table of Contents

After completing this process, the Corporate Governance and Nominating Committee will determine whether one or more candidates are sufficiently qualified to warrant further investigation. If the process yields one or more desirable candidate(s), the Corporate Governance and Nominating Committee will rank them by order of preference, depending on their respective qualifications and the Company’s needs. The Corporate Governance and Nominating Committee Chair will then contact the preferred candidate(s) to evaluate their potential interest and to set up interviews with the full Corporate Governance and Nominating Committee. All such interviews include only the candidate and one or more Corporate Governance and Nominating Committee members. Based upon interview results and appropriate background checks, the Corporate Governance and Nominating Committee then decides whether it will recommend the candidate’s nomination to the full Board.

When nominating a sitting director for re-election, the Corporate Governance and Nominating Committee will consider the director’s performance on the Board and its committees and the director’s qualifications in respect of the criteria referred to above.

Consideration of Stockholder-Nominated Directors

In accordance with its charter, the Corporate Governance and Nominating Committee will consider candidates for election to the Board at a stockholder meeting if submitted by a stockholder in a timely manner. Any stockholder wishing to submit a candidate for consideration for election at a stockholder meeting should send the following information to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

| • | Stockholder’s name, number of shares owned, length of period held, and proof of ownership; |

| • | Name, age and address of candidate; |

| • | A detailed resume describing, among other things, the candidate’s educational background, occupation, employment history for at least the previous five years, and material outside commitments (e.g., memberships on other boards and committees, charitable foundations, etc.); |

| • | A supporting statement which describes the candidate’s reasons for seeking election to the Board; |

| • | A description of any arrangements or understandings between the candidate and the Company and/or the stockholder; and |

| • | A signed statement from the candidate, confirming his/her willingness to serve on the Board. |

In accordance with the charter of the Corporate Governance and Nominating Committee, in order for the Corporate Governance and Nominating Committee to consider a candidate submitted by a stockholder for election at a stockholder meeting, the Company must receive the foregoing information not less than 90 days, nor more than 120 days, prior to such meeting. The Company’s Corporate Secretary will promptly forward such materials to the Corporate Governance and Nominating Committee. The Company’s Corporate Secretary also will maintain copies of such materials for future reference by the Corporate Governance and Nominating Committee when filling Board positions.

Additionally, the Corporate Governance and Nominating Committee will consider stockholder nominated candidates if a vacancy arises or if the Board decides to expand its membership, and at such other times as the Corporate Governance and Nominating Committee deems necessary or appropriate. In any such event, any stockholder wishing to submit a candidate for consideration should send the above-listed information to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

10

Table of Contents

Certain Board Policies and Practices

Corporate Governance Guidelines and Code of Business Conduct and Ethics

The Board has adopted Corporate Governance Guidelines applicable to the members of the Board. The Board has also adopted a Code of Business Conduct and Ethics applicable to the Company’s employees, directors, agents and representatives, including consultants. The Corporate Governance Guidelines and the Code of Business Conduct and Ethics are available on the Company’s website at www.bned.com. Copies of the Corporate Governance Guidelines and the Code of Business Conduct and Ethics are available in print to any stockholder who requests them in writing to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920.

Board Leadership Structure; Lead Independent Director

The Chairman of the Board or the Executive Chairman is selected by the members of the Board, and may or may not be an officer of the Company. Currently, Mr. Huseby, an officer of the Company, serves as the Executive Chairman. The positions of the Executive Chairman and Chief Executive Officer (“CEO”) are separate and the CEO reports directly to the Executive Chairman, while Mr. Huseby reports directly to the Board. The Board has determined that the current structure is appropriate at this time in that it enables Mr. Roberts to focus on his role as CEO of the Company while enabling Mr. Huseby to continue to provide leadership on policy at the Board level. Although the roles of CEO and Executive Chairman are currently separated, the Board has not adopted a formal policy requiring such separation. The Board believes that the right Board leadership structure should, among other things, be determined by the needs and circumstances of the Company and the then current membership of the Board, and that the Board should remain adaptable to shaping the leadership structure as those needs and circumstances change.

In addition, in accordance with the Corporate Governance Guidelines, non-management directors meet in executive sessions at every Board meeting. Independent directors also meet at least once a year in an executive session of only independent directors. Currently, all of the non-management directors are independent directors. Vice Admiral John R. Ryan is currently the Lead Independent Director. The Lead Independent Director, among other things, (a) acts as a liaison between the independent directors and the Company’s management, (b) presides at the executive sessions of non-management and independent directors, and has the authority to call additional executive sessions as appropriate, (c) chairs Board meetings in the Executive Chairman’s absence, (d) coordinates with the Executive Chairman on agendas and schedules for Board meetings, and information sent to the Board, reviewing and approving these as appropriate, and (e) is available for consultation and communication with major stockholders as appropriate.

Risk Oversight

The Board’s primary function is one of oversight. In connection with its oversight function, the Board oversees the Company’s policies and procedures for managing risk. The Board administers its risk oversight function primarily through its Committees. Board Committees have assumed oversight of various risks that have been identified through the Company’s enterprise risk assessment. The Audit Committee reviews the Company’s risk assessment and risk management policies and the Audit Committee reports to the Board on the Company’s enterprise risk assessment.

Communications Between Stockholders and the Board

Stockholders and other interested persons seeking to communicate with the Board should submit any communications in writing to the Company’s Corporate Secretary, Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920. Any such communication must state the number of shares beneficially owned by the stockholder making the communication. The Company’s Corporate Secretary will forward such communication to the full Board or to any individual director or directors (including the non-management directors as a group) to whom the communication is directed.

Attendance at Annual Meetings

All Board members are expected to attend in person the Company’s annual meetings of stockholders and be available to address questions or concerns raised by stockholders.

11

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of shares of Common Stock, as of July 18, 2016, unless otherwise indicated, by each person known by the Company to own beneficially more than five percent of the Company’s outstanding Common Stock, by each director, by each executive officer named in the Summary Compensation Table and by all directors and executive officers of the Company as a group. Except as otherwise noted, to the Company’s knowledge, each person named in the table has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by him, her or it.

| Name of Beneficial Owner |

Shares Beneficially Owned (1) |

Percent of Class (1) |

||||||

| Five Percent Stockholders |

||||||||

| Abrams Capital Management, L.P.(2) |

8,771,492 | 19.01 | % | |||||

| Leonard Riggio(3) |

7,616,947 | 16.51 | % | |||||

| Dimensional Fund Advisors LP(4) |

3,628,863 | 7.87 | % | |||||

| BlackRock, Inc.(5) |

3,346,351 | 7.25 | % | |||||

| Daniel Tisch(6) |

3,161,212 | 6.85 | % | |||||

| The Vanguard Group, Inc.(7) |

2,592,353 | 5.62 | % | |||||

| Directors and Named Executive Officers(8) |

||||||||

| Daniel A. DeMatteo(9) |

9,216 | * | ||||||

| David G. Golden(9) |

36,053 | * | ||||||

| John R. Ryan(9) |

12,625 | * | ||||||

| Jerry Sue Thornton(9) |

9,216 | * | ||||||

| David A. Wilson(9) |

36,053 | * | ||||||

| Max J. Roberts(10) |

274,028 | * | ||||||

| Michael P. Huseby(10)(11) |

245,077 | * | ||||||

| Barry Brover(10) |

63,776 | * | ||||||

| Patrick Maloney(10) |

116,969 | * | ||||||

| Kanuj Malhotra(10) |

53,415 | * | ||||||

| All directors and executive officers as a group (19 persons)(12) |

1,092,595 | 2.37 | % | |||||

| * | Less than 1%. |

| (1) | Pursuant to SEC rules, shares of our Common Stock that an individual or group has a right to acquire within 60 days after July 18, 2016 pursuant to the vesting of restricted stock units are deemed to be beneficially owned by that individual or group and outstanding for the purpose of computing the percentage ownership of that individual or group, but are not deemed to be outstanding for computing the percentage ownership of any other person or group shown in the table. Footnotes (10) and (12) sets forth the number of restricted stock units that are included as beneficially owned. |

| (2) | 7,066,720 of the shares reported are held for the account of Abrams Capital Partners II, L.P., Abrams Capital, LLC may be deemed to beneficially own 8,300,904 of the shares reported, and David C. Abrams, Abrams Capital Management, L.P. and Abrams Capital LLC may be deemed to beneficially own all of such shares. The address of such persons is listed as 222 Berkeley Street, 21st Floor, Boston, Massachusetts 02116. |

| (3) | Mr. Riggio’s holdings are comprised of (a) 3,599,718 shares held by Mr. Riggio, (b) 1,464,134 shares owned by LRBKS Holdings, Inc. (a Delaware corporation beneficially owned by Mr. Riggio and his wife), (c) 2,102,812 shares owned by The Riggio Foundation, a charitable trust established by Mr. Riggio, with himself and his wife as trustees, and (d) 450,283 shares held in a rabbi trust established by Barnes & Noble, Inc. for the benefit of Mr. Riggio pursuant to a deferred compensation arrangement. Mr. Riggio has no voting or dispositive control over the shares in the rabbi trust. The address of Mr. Riggio is in the care of Barnes & Noble, Inc., 122 Fifth Avenue, New York, New York 10011. |

| (4) | The address of such persons is listed as Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

12

Table of Contents

| (5) | BlackRock, Inc. has the sole power to vote 3,266,265 shares and sole power to direct the disposition of 3,346,351 shares. The address of such persons is listed as 55 East 52nd Street, New York, New York 10001. |

| (6) | The address of such persons is listed as 460 Park Avenue, New York, New York 10022. |

| (7) | The Vanguard Group has sole power to vote 43,302 shares, sole power to direct the disposition of 2,549,936 shares and shared power to direct the disposition of 42,417 shares. The address of such persons is listed as 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (8) | The address of all of the officers and directors listed above are in the care of Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey, 07920. |

| (9) | Of these shares, 9,216 are shares of restricted stock. |

| (10) | Includes for each officer the following restricted stock units that will vest on or before September 16, 2016, but do not currently have voting rights: Mr. Roberts-46,082; Mr. Huseby-38,402; Mr. Brover-9,696; Mr. Maloney-19,636 and Mr. Malhotra-6,400. Includes for each officer the following performance shares that have current voting rights, but are subject to forfeiture if certain performance goals are not attained: Mr. Roberts-106,355; Mr. Huseby-59,085; Mr. Brover-19,695; Mr. Maloney-60,425 and Mr. Malhotra-16,740. Does not include restricted stock units scheduled to vest after September 16, 2016. |

| (11) | Pursuant to a marital settlement agreement, Mr. Huseby has agreed to transfer to his former spouse 49,738 shares of Common Stock and 7,526 shares of Common Stock to be issued upon the vesting of restricted stock units. As of the record date, Mr. Huseby retained the power to vote such Common Stock pending transfer. |

| (12) | For directors and officers as a group, includes an aggregate of 46,080 shares of restricted stock held by directors; 176,159 restricted stock units that will vest on or before September 16, 2016 held by officers and 392,291 performance shares held by officers. |

13

Table of Contents

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis summarizes the material elements of our compensation programs for our named executive officers (“NEOs”). For Fiscal 2016, our NEOs were:

| Executive |

Position | |

| Max J. Roberts | Chief Executive Officer | |

| Michael P. Huseby | Executive Chairman | |

| Barry Brover | Chief Financial Officer | |

| Kanuj Malhotra | Chief Strategy & Development Officer; Chief Operating Officer, Digital Education | |

| Patrick Maloney | Executive Vice President and Chief Operating Officer; President, Barnes & Noble College |

Executive Summary

Our executive compensation programs are designed to align with our business strategy; attract, retain, and engage the talent we need to compete in our industry, and align management with stockholders’ interests. Fiscal 2016 executive compensation largely reflected practices that were in effect when we spun off from Barnes & Noble, Inc., our former parent company (“Barnes & Noble”). We completed the legal and structural separation from Barnes & Noble on August 2, 2015 (the “Spin-Off”). In our first year as a standalone public company, our Compensation Committee has worked to adopt best practice governance policies and align pay with performance. We expect our policies and practices will continue to evolve in support of our ongoing business strategy and as we mature as a standalone public company.

Compensation and Governance Highlights

| What we do |

What we don’t do | |||||||||

|

|

Tie a majority of executive pay to performance-based and equity incentives |

|

Pay current dividends or dividend equivalents on unearned restricted stock units | |||||||

|

|

Align annual incentive payouts to clearly stated target performance levels |

|

Permit option repricing without stockholder approval | |||||||

|

|

Vest equity awards over time to promote retention and require a one-year minimum vesting period for equity awards |

|

Provide significant perquisites | |||||||

|

|

Pay severance or accelerate equity only upon termination of employment following a change in control (double trigger) |

|

Pay tax gross ups to executives | |||||||

|

|

Plan to conduct annual say-on-pay votes, as set forth in Proposal 3 of this Proxy Statement |

|

Provide supplemental executive retirement benefits | |||||||

|

|

Require one additional year of time-based vesting for performance shares following the achievement of performance measures |

|

Permit hedging or pledging by executive officers or directors | |||||||

|

|

Subject long-term incentives to a clawback policy | |||||||||

Pay and Performance Alignment in Fiscal 2016

Annual incentives for Fiscal 2016 were awarded based on Company EBITDA (as defined within) performance relative to a pre-defined target level. As described below in more detail, our Fiscal 2016 Company EBITDA performance was 102% of target, which yielded a payout factor of 100% of the target award allocated to the Company goal. In determining individual NEO awards, the Compensation Committee also considered individual performance.

14

Table of Contents

Fiscal 2016 equity grants were delivered in restricted stock units to immediately align executives with stockholders’ interests, and to minimize dilution to stockholders.

Plans for Enhanced Pay-for-Performance Alignment in Fiscal 2017

The Compensation Committee has made the following changes effective for Fiscal 2017:

| • | Adopted an executive compensation peer group that more appropriately reflects Barnes & Noble Education’s competitive market for talent; |

| • | Awarded performance shares in June 2016 that will vest based on company performance during Fiscal 2017—Fiscal 2018 with one additional year of time-based vesting; |

| • | Modified annual incentive pay and performance relationship to provide more rigorous performance objectives and corresponding payout opportunities; and |

| • | Adopted stock ownership guidelines for non-employee directors and plans to adopt guidelines for executives pending stockholder approval of Proposal 4 to amend the Equity Incentive Plan to increase the number of shares available for issuance and approval of performance goals for purposes of Section 162(m). |

Background

In August 2015, we completed the legal separation from Barnes & Noble, at which time we began to operate as an independent publicly-traded company. Prior to the Spin-Off, we operated as Barnes & Noble College, a business segment of Barnes & Noble, and our executive officers participated in the Barnes & Noble’s compensation programs. Prior to the Spin-Off, Mr. Huseby served as the Chief Executive Officer of Barnes & Noble until he was appointed as our Executive Chairman as of August 2, 2015. Prior to the Spin-Off, Messrs. Roberts, Brover and Maloney served as officers of Barnes & Noble College. Mr. Malhotra was previously an employee of Barnes & Noble and was appointed as an executive officer of the Company in connection with the Spin-Off.

The compensation committee of the board of directors of Barnes & Noble determined the compensation of our NEOs, until the completion of the Spin-Off, including the setting of salaries and annual incentive compensation for Fiscal 2016. Our Compensation Committee has made all compensation decisions post-Spin-Off.

The philosophy, objectives and structure of our compensation program is similar to that of Barnes & Noble; however, our Compensation Committee has made modifications to the program and policies and anticipates that the program and policies will continue to evolve.

Compensation Philosophy and Objectives

We are engaged in a very competitive industry, and our success depends upon our ability to attract, motivate and retain qualified executives. Accordingly, the Compensation Committee aims to create total compensation packages that are competitive with programs offered by other companies against whom we compete for talent. At the same time, our Compensation Committee believes that a significant portion of the compensation paid to our executive officers should be tied to our performance, execution of our strategic plan and the value we create for stockholders.

The Compensation Committee’s objectives are to:

| • | attract, retain, and motivate talented executives responsible for the success of our organization; |

| • | provide compensation to executives that is externally competitive, internally equitable, performance-based, and aligned with stockholder interests; and |

| • | ensure that total compensation levels are reflective of company and individual performance and provide executives with the opportunity to receive above-market total compensation for exceptional business performance. |

We structure compensation to be tied to performance. Annual incentive compensation for our executive officers is based on the Company’s financial results, as measured principally by Company EBITDA (earnings before interest, taxes, depreciation and amortization), as adjusted as described within, as well as each individual executive’s contribution to those results.

15

Table of Contents

We use equity incentive awards as a retention incentive and to align the interests of executives with our stockholders’ interests. Beginning with awards made in June 2016, a portion of our equity incentive awards are in the form of performance shares that vest only upon the achievement of pre-established company performance goals.

Compensation Market References

In establishing compensation for Fiscal 2016, the Barnes & Noble compensation committee utilized the peer group for Barnes & Noble. Following the Spin-Off, our Compensation Committee worked with Mercer, its compensation consultant, to develop a peer group for the Company and will review the peer group on an annual basis. In support of its compensation philosophy, the Compensation Committee reviews the following: a) base salary; b) target short-term incentive; c) target total cash compensation; d) actual total cash compensation; e) long-term incentive; and f) target total direct compensation. Executives are matched to market positions based on titles, responsibilities and contributions to the Company. The Compensation Committee reviewed the market at the 25th, 50th and 75th compensation percentile levels of the peer group to determine an appropriate total value and mix of pay for executives.

Although no other public companies are directly comparable to the Company and its business, the Compensation Committee believes the Company competes with companies engaged in retail, education services, and outsourcing and consulting services for executive talent. The post Spin-Off peer group includes companies that are similar in size to the Company based on revenues and market capitalization and also companies with overlapping business model characteristics (e.g., education / technology focus, combination of products and services, strong relationships with business partners, go-to-market strategy, and geographic footprint) as follows:

| Apollo Education Group Inc. | Houghton Mifflin Harcourt Co. | |

| Barnes & Noble, Inc. | K12 Inc. | |

| Broadridge Financial Solutions | Land’s End Inc. | |

| Cabela’s Inc. | McGraw-Hill Education | |

| Chegg Inc. | SP Plus Corp. | |

| Convergys Corp. | Sykes Enterprises Inc. | |

| Finish Line Inc. | Vitamin Shoppe Inc. | |

| GNC Holdings Inc. | Wiley (John) & Sons |

The Company’s revenue approximates the median of the peer group as shown below ($000):

|

|

Peer Group Median | Barnes & Noble Education | ||

|

Revenue - trailing 12 months as of 4/30/2016 |

$1,791 | $1,808 |

However, peer group compensation is just one factor that is considered in determining compensation levels for our executive officers. We also consider: (a) the Company’s business performance; (b) each executive officer’s job responsibilities, experience, prior performance and anticipated future performance; (c) relative compensation among our executive officers; (d) industry-wide business conditions; and (e) the recommendations of our Executive Chairman and Chief Executive Officer (in the case of Messrs. Brover, Maloney and Malhotra).

16

Table of Contents

Roles of the Compensation Committee, Management, and our Compensation Consultant in Determining the Compensation of our Named Executive Officers

Roles of the Compensation Committee and Management

The Compensation Committee is responsible for establishing, implementing and overseeing our compensation program, and reviews and approves our compensation philosophy and objectives. The Compensation Committee also annually reviews and approves annual base salary levels, annual incentive opportunity levels, long-term incentive opportunity levels, employment and severance agreements and any special or supplemental benefits for each of the NEOs and any other executives of the Company earning a base salary of $400,000 or more.

The compensation of our Executive Chairman and Chief Executive Officer is determined by the Compensation Committee in executive session. With respect to compensation for the Chief Executive Officer, the Executive Chairman reviews the Chief Executive Officer’s performance and provides input to the Compensation Committee. The Chief Executive Officer reviews the performance of each of our other executive officers and makes compensation recommendations to the Compensation Committee. The Compensation Committee considers all key elements of compensation separately and also reviews the full compensation package afforded by the Company to executive officers.

Role of the Compensation Consultant

The Compensation Committee has retained Mercer, a wholly-owned subsidiary of Marsh & McLennan Companies, Inc., to assist it with its responsibilities related to the Company’s executive compensation programs and the director compensation program. Mercer’s engagement by the Compensation Committee includes reviewing and recommending the structure of our compensation program and advising on all significant aspects of executive compensation, including base salaries, annual incentives and long-term equity incentives for executives. At the request of the Compensation Committee, Mercer collects relevant market data to allow the Compensation Committee to compare components of our compensation program to those of our peers, provides information on executive compensation trends and implications for us and makes other recommendations to the Compensation Committee regarding certain aspects of our executive compensation program. Our management, our Chief Executive Officer and our Chief Human Resources Officer, and the chair of the Compensation Committee, meet with representatives of Mercer before meetings of the Compensation Committee. In making its final decision regarding the form and amount of compensation to be paid to executives, the Compensation Committee considers the information gathered by and recommendations of Mercer. Mercer has also advised the Compensation Committee on our compensation program for non-employee directors. Mercer’s fees for executive and director compensation consulting to the Compensation Committee in Fiscal 2016 were approximately $165,000. In Fiscal 2016, Mercer was also engaged by the Company to provide consulting services related to employee benefits and to assist the Company in structuring its Human Resources function as a stand-alone company for which it received fees of $155,000. The Company paid $287,000 to Marsh & McLennan Companies, Inc. the parent company of Mercer, for broker services. The Compensation Committee has assessed the independence of Mercer taking into account the following factors identified by the SEC and NYSE as bearing upon independence: (i) Mercer’s provision of other services to the Company; (ii) the fees Mercer received for such services as a percentage of the revenues of Marsh & McLennan, Mercer’s parent; (iii) the policies and procedures of Mercer that are designed to prevent conflicts of interest; (iv) any business or personal relationship of the Mercer consultants with a member of the Compensation Committee; (v) any of our stock owned by the Mercer consultants; and (vi) any business or personal relationship of the Mercer consultants or Mercer with any of our executive officers, and concluded that no conflict of interest exists with respect to the Compensation Committee’s engagement of Mercer.

17

Table of Contents

Overview of Compensation Program Design

Elements of Pay

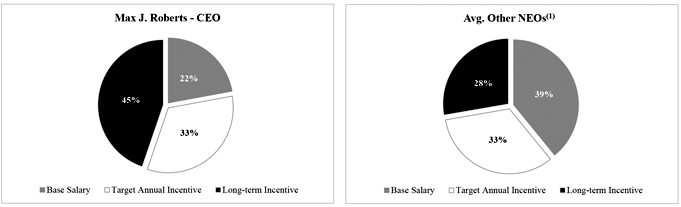

Our compensation structure is primarily composed of base salary, performance-based annual incentive compensation and long-term equity incentives. The mix of Fiscal 2016 target total direct compensation was as follows:

| (1) | Reflects the average pay mix of the NEOs excluding the Chief Executive Officer and the Executive Chairman. The Executive Chairman is excluded because for Fiscal 2016 his compensation structure did not include participation in the annual incentive plan. |

Note that Annual Incentive reflects Fiscal 2016 target opportunity and Long-term Incentive reflects Fiscal 2016 target value on grant date. The total direct compensation mix does not include discretionary bonuses or retention payments.

Base Salary

We pay our NEOs a base salary to provide them with a guaranteed minimum compensation level for their services. An NEO’s base salary is determined by evaluating the external competitive marketplace, internal equity and individual contributions. In Fiscal 2016 prior to the Spin-Off, Barnes & Noble established the base salaries for all of the NEOs.

| Executive Name |

Base Salary in Fiscal 2016 |

|||

| Max J. Roberts |

$ | 900,000 | ||

| Michael P. Huseby |

$ | 500,000 | ||

| Barry Brover |

$ | 505,000 | ||

| Kanuj Malhotra |

$ | 523,400 | (1) | |

| Patrick Maloney |

$ | 767,000 | ||

| (1) | This amount reflects an increase during Fiscal 2016 to Mr. Malhotra’s salary of $515,000 to offset the elimination of a monthly car allowance. |

18

Table of Contents

Performance-Based Annual Incentive Compensation