Table of Contents

Filed by the Registrant Filed by the Registrant |

Filed by a Party other than the Registrant Filed by a Party other than the Registrant |

Check the appropriate box: |

|

Preliminary Proxy Statement | |||

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

|

Definitive Proxy Statement | ||

|

|

Definitive Additional Materials | ||

|

|

Soliciting Material under §240.14a-12 | ||

Payment of Filing Fee (Check all boxes that apply): | ||

|

|

No fee required. | ||

|

|

Fee paid previously with preliminary materials. | ||

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

Table of Contents

Eden G. Egziabher Founder, Makina Cafe 2024 Notice of Annual Meeting of Stockholders and Proxy Statement 2023 Annual Report Paypal

Table of Contents

Eden G. Egziabher Makina Cafe Long Island City, NY Makina Cafe founder Eden Egziabher was raised amidst a vibrant mix of Ethiopian, Eritrean, and Italian cultures, creating a mosaic of flavors found on her menu. Eden relies on PayPal Zettle to allow New Yorkers to quickly and easily pay for their meals, and she loves the seamless experience of using PayPal to pay her vendors.

Table of Contents

|

Message from Our President and CEO

|

|||||

Dear Stockholders, Colleagues, Customers and Partners:

Over the last two and a half decades, PayPal has been at the forefront of e-commerce innovation. In that time, our belief in the importance of embracing change has allowed us to evolve into who we are today – a global leader in commerce with a two-sided network at scale and steadfast commitment to serving our customers.

When I stepped into the role of PayPal’s President and CEO last September, I knew that to unlock our full potential and drive durable, profitable growth we needed to be more focused and deliberate in every aspect of our business. Since then, I’ve spent time with PayPal’s employees, customers, partners, and stockholders to learn about our greatest strengths, where we need to move faster, what we need to change, and how to instill a culture of innovation that returns PayPal to a position of strength.

I’m pleased with what we’ve been able to accomplish in such a short period of time to reposition PayPal for profitable growth. We’ve put in place a world-class leadership team and organized the business around the customers we serve – consumers, small businesses, and enterprises. We’ve narrowed our focus to the products and services that will have the greatest impact for our customers. And we’ve updated our mission to reflect the evolution of our purpose: revolutionizing commerce globally.

We’re embracing our roots to reshape commerce for the consumers and merchants around the world who rely on PayPal each day – making it faster and simpler for people to connect with each other and make their money go further. Our entire organization is focused on durable growth priorities that will help solve our customers’ most pressing needs and delight them in new ways. We aim to deliver a best-in-class personalized commerce experience, and drive engagement by creating a richer value proposition that makes PayPal the obvious choice for both consumers and businesses.

All the investments and improvements we will make this year are guided by a set of new operating principles that we believe will help us drive value creation over time. The principles we will follow are: start with the customer; focus on profitable growth; drive operating leverage over time; set measurable goals and communicate consistently; and maintain a strong balance sheet.

We’re committed to increasing transparency and accountability, and investing in areas of our business that will drive profitable growth and margin expansion in the years ahead. However, it will take time for these new initiatives and operating model to produce results. 2024 is a transition year focused on execution and moving with velocity to put the organization on a path for long-term success. I know that we’re on the right strategic path that will allow this company to fully embrace the future that awaits us.

I am grateful to our employees who have shown incredible resolve in solving our customers’ greatest challenges and who are working tirelessly to transform PayPal. To our stockholders, customers, and partners, thank you for your continued support and belief in what we can achieve together.

Thank you.

Alex Chriss

President and CEO

April 9, 2024

Table of Contents

|

Message from Our Independent Board Chair

|

|||||

Dear PayPal Stockholders:

2023 was a pivotal year for PayPal as we welcomed Alex Chriss to our Company and to our Board. While steering the successful CEO search and transition, the Board worked closely with management to navigate a complex macroeconomic environment and deliver solid financial and operational results. Looking ahead, we are inspired by the energy and vision that the new leadership team brings to their roles, and we believe PayPal is well-positioned for future profitable growth.

Executive Leadership Transitions

One of the Board’s key priorities in 2023 was to identify a next-generation leader capable of driving growth across the PayPal platform for years to come. After a rigorous search process, we were thrilled to find in Alex a seasoned executive steeped in technology and product leadership experience with an impressive and proven track record of growing businesses.

We are also pleased to have appointed new executives to lead our Finance and People functions, as well as our Global Markets, Small Business & Financial Services and Consumer business units. Their collective expertise, honed through leadership roles at preeminent companies, will be crucial to our path forward. In overseeing these executive transitions, the Board has redoubled our commitment to building relationships with new leaders and ensuring that each of our leaders is cultivating robust talent development processes and succession plans. With this strong leadership team now in place, PayPal is ready to embark on our next chapter of growth and expansion.

Board Composition & Oversight

Collectively, our Board’s balanced and diverse mix of skill sets, experiences and perspectives enables proper oversight of our business as we continue to evolve and grow in a rapidly shifting competitive environment. In particular, the Board’s thoughtful approach to risk oversight supports our enterprise-wide global risk and compliance program to safeguard our customers and our platform, which is of the utmost importance. Our Board is committed to continuous improvement, and the annual Board and committee self-evaluations play a critical role in ensuring the continued effectiveness of our Board and each committee.

Stakeholder Engagement

Robust, ongoing engagement with our stockholders, customers, employees, regulators and other stakeholders is crucial to informing the Board’s decision-making process. Since our 2023 Annual Meeting, we’ve contacted investors representing approximately 50% of our common stock and have engaged with investors holding approximately 19% of our common stock. As part of these efforts, independent directors met with investors representing approximately 12% of our common stock. These discussions covered a variety of subjects, including board composition and oversight, executive compensation and corporate sustainability and impact topics. Stockholders’ feedback provides the Board and management with invaluable perspectives, and we look forward to continuing this important dialogue with our stakeholders.

On behalf of our Board, thank you for your investment in PayPal. I look forward to discussing these developments further with you at the 2024 Annual Meeting on May 22, which will be held via live webcast at www.virtualshareholdermeeting.com/PYPL2024.

Sincerely yours,

John J. Donahoe

Independent Board Chair

April 9, 2024

Table of Contents

Table of Contents

Table of Contents

Forward-Looking Statements

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements that involve expectations, plans or intentions (such as those relating to future business, future results of operations or financial condition, new or planned features or services, acquisitions or divestitures, or management strategies). These forward-looking statements can be identified by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “continue,” “strategy,” “future,” “opportunity,” “plan,” “project,” “forecast” and other similar expressions. These forward-looking statements involve risks and uncertainties that could cause our actual results and financial condition to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others, those discussed in the “Risk Factors,” “Quantitative and Qualitative Disclosures about Market Risk” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We do not intend, and undertake no obligation except as required by law, to update any of our forward-looking statements after the date of this proxy statement to reflect actual results, new information or future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Incorporation by Reference

All website addresses contained in this proxy statement are intended to provide inactive, textual references only. The content on, or accessible through, any website identified in this proxy statement is not a part of, and is not incorporated by reference into, this proxy statement or in any other report or document that we file with the Securities and Exchange Commission.

Table of Contents

Notice of 2024 Annual Meeting

of Stockholders

Wednesday, May 22, 2024

8:00 a.m. Pacific Time

Online at: www.virtualshareholdermeeting.com/PYPL2024

There is no physical location for the 2024 Annual Meeting.

ITEMS OF BUSINESS

| 1. | Election of the 11 director nominees named in this proxy statement. |

| 2. | Advisory vote to approve named executive officer compensation. |

| 3. | Approval of the PayPal Holdings, Inc. 2015 Equity Incentive Award Plan, as Amended and Restated. |

| 4. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditor for 2024. |

| 5. | Consideration of two stockholder proposals, if properly presented at the Annual Meeting. |

| 6. | Such other business as may properly come before the Annual Meeting. |

RECORD DATE

Wednesday, March 27, 2024 (the “Record Date”)

Only stockholders of record at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting.

PARTICIPATION IN VIRTUAL ANNUAL MEETING

We are pleased to invite you to participate in our Annual Meeting, which will be conducted exclusively online at www.virtualshareholdermeeting.com/PYPL2024. See “Important Information About PayPal’s Virtual Annual Meeting” on the following page for additional information.

The Annual Meeting will begin promptly at 8:00 a.m. Pacific Time. The virtual meeting room will open at 7:45 a.m. Pacific Time for registration.

VOTING

Your vote is very important to us. Please act as soon as possible to vote your shares, even if you plan to participate in the Annual Meeting. For specific instructions on how to vote your shares, see “Frequently Asked Questions – Voting Information” beginning on page 116 of this proxy statement.

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF THREE WAYS:

|

INTERNET Visit the website on your proxy card or voting instruction form |

|

BY TELEPHONE Call the telephone number on your proxy card or voting instruction form

|

|

BY MAIL Sign, date and return your proxy card or voting instruction form in the enclosed envelope

| |||||

|

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

| ||||||||||

By Order of the Board of Directors

Brian Y. Yamasaki

Secretary

April 9, 2024

This notice of Annual Meeting and proxy statement and form of proxy are being distributed and made available on or about April 9, 2024.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders To Be Held on May 22, 2024

This proxy statement and PayPal Holdings, Inc.’s 2023 Annual Report are available electronically at

https://investor.pypl.com/financials/annual-reports/default.aspx and (with your 16-digit control number) at www.proxyvote.com.

|

|

1 |

Table of Contents

IMPORTANT INFORMATION ABOUT PAYPAL’S VIRTUAL ANNUAL MEETING

Important Information About PayPal’s

Virtual Annual Meeting

PayPal’s 2024 Annual Meeting will be conducted online only, via live webcast. Stockholders will be able to access the meeting live by visiting www.virtualshareholdermeeting.com/PYPL2024.

We have conducted efficient and effective virtual meetings since PayPal became an independent company in 2015. We intend to continue to ensure that our stockholders are afforded the same rights and opportunities to participate virtually as they would at an in-person meeting. We believe the virtual format makes it easier for stockholders to attend and participate fully and equally in the Annual Meeting because they can join with any Internet-connected device from any location around the world at no cost. Our virtual meeting format encourages participation and communication with our management, helps us engage with all stockholders regardless of size, resources or physical location, saves time and money, reduces our environmental impact and protects the health and safety of attendees.

Participating in the Virtual Annual Meeting

| • | Instructions on how to attend the virtual Annual Meeting are posted at www.virtualshareholdermeeting.com/PYPL2024. |

| • | You may log in to the meeting platform beginning at 7:45 a.m. Pacific Time on May 22, 2024. The meeting will begin promptly at 8:00 a.m. Pacific Time. |

| • | You will need the 16-digit control number provided in your proxy materials to attend the virtual Annual Meeting and listen live at www.virtualshareholdermeeting.com/PYPL2024. |

| • | Stockholders of record and beneficial owners as of the March 27, 2024 Record Date may vote their shares electronically during the virtual Annual Meeting. |

| • | On the date of the Annual Meeting, if you have questions about how to attend and participate or encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 1-844-986-0822 (U.S.) or 1-303-562-9302 (International). |

Additional Information About the Virtual Annual Meeting

| • | Stockholders may submit questions in advance of the meeting at www.proxyvote.com before 8:59 p.m. Pacific Time on May 21, 2024, or during the live meeting at www.virtualshareholdermeeting.com/PYPL2024. |

| • | During the meeting’s question and answer session, members of our executive management team and our Board Chair will answer questions (including those submitted in advance) as time permits. |

| • | Our rules of conduct and procedure for the meeting generally provide that: |

| • | Management will answer stockholder questions after the formal meeting has concluded. |

| • | We limit each stockholder to one question so that we can answer questions from as many stockholders as possible. Questions should be succinct and cover only one topic per question. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized and answered together. In addition, questions may be edited for brevity and grammatical corrections. |

| • | We do not intend to address any questions that are, among other things: irrelevant to the business of the Company or to the business of the Annual Meeting; related to material non-public information of the Company; related to personal matters or grievances; derogatory or otherwise in bad taste; repetitious statements already made by another stockholder; in furtherance of the stockholder’s personal or business interests; or out of order or not otherwise suitable for the conduct of the Annual Meeting, in each case as determined by the Board Chair or Corporate Secretary in their reasonable discretion. |

| • | If there are matters of individual concern to a stockholder and not of general concern to all stockholders, or if we are not able to answer all the questions submitted due to time constraints, stockholders may contact us separately after the meeting through our Investor Relations department by email at investorrelations@paypal.com. |

| • | We will post questions and answers if applicable to the Company’s business on our Investor Relations website as soon as practicable after the Annual Meeting. In addition, a replay of the meeting will be publicly available on our Investor Relations website after the meeting concludes. |

| 2 |

|

Table of Contents

PROXY STATEMENT SUMMARY

Proxy Statement Summary

This summary highlights certain information contained elsewhere in this proxy statement for the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). This summary does not contain all the information that you should consider, and you should read the entire proxy statement carefully before voting.

2024 Annual Meeting Information

|

|

| ||

| TIME AND DATE 8:00 a.m. Pacific Time on May 22, 2024 |

PLACE Online at www.virtualshareholdermeeting.com/PYPL2024. There is no physical location for the Annual Meeting. |

RECORD DATE March 27, 2024 | ||

Proposals to be Voted on and Board Voting Recommendations

| Management Proposals |

Recommendation of the Board | Page | ||||||

| 1 |

Election of the 11 Director Nominees Named in this Proxy Statement |

FOR each of the nominees |

13 | |||||

| 2 |

Advisory Vote to Approve Named Executive Officer Compensation (“say-on-pay” vote) |

FOR | 48 | |||||

| 3 |

Approval of the PayPal Holdings, Inc. 2015 Equity Incentive Award Plan, as Amended and Restated |

FOR | 94 | |||||

| 4 |

Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Auditor for 2024 |

FOR | 107 | |||||

| Stockholder Proposals |

|

|

|

| ||||

| 5 |

Stockholder Proposal – Report on Respecting Workforce Civil Liberties |

AGAINST | 110 | |||||

| 6 |

Stockholder Proposal – Bylaw Amendment: Stockholder Approval of Director Compensation |

AGAINST | 112 | |||||

Our 2023 Key Highlights

Key Executive Leadership Transitions

In February 2023, Dan Schulman announced his intention to retire from the role of President and CEO at year-end. The announcement was a catalyst for our leadership team transformation in 2023 and into 2024. Mr. Schulman’s longstanding leadership at PayPal made a positive and lasting impact, and the Board was committed to identifying a successor with extensive product, technology, and global payments experience who would build on Mr. Schulman’s contributions and be a next-generation leader, capable of driving growth across the PayPal platform for years to come. Largely in connection with the appointment of Mr. Schulman’s successor, we reconstituted our leadership team in late 2023 and early 2024, positioning PayPal for its next phase of growth.

After a rigorous search process, Alex Chriss joined PayPal as President and CEO in September, followed by our new CFO, Jamie Miller, who joined in November. Mr. Chriss joined PayPal from Intuit and has extensive product, technology and global payments experience, which will enable him to drive growth across the PayPal platform for years to come. Ms. Miller was most recently Global CFO of EY and brings a proven track record of driving strong financial results and guiding both public and private companies through dynamic and meaningful transformation.

Additionally, PayPal further strengthened its next-generation leadership team by hiring seasoned leaders across several key roles, including Michelle Gill, who joined to serve as PayPal’s Executive Vice President, General Manager of the newly formed Small Business & Financial Services Group; Diego Scotti, who joined as Executive Vice President, General Manager of our Consumer Group and Global Marketing & Communications; Isabel Cruz, who joined as Executive Vice President, Chief People Officer; and Suzan Kereere, who joined as President, Global Markets. These leadership appointments underscore PayPal’s commitment to building a high-performing organization, with the goal of advancing innovation and solutions to better serve our customers and in turn drive more profitable growth.

|

|

3 |

Table of Contents

PROXY STATEMENT SUMMARY

Our 2023 Key Highlights

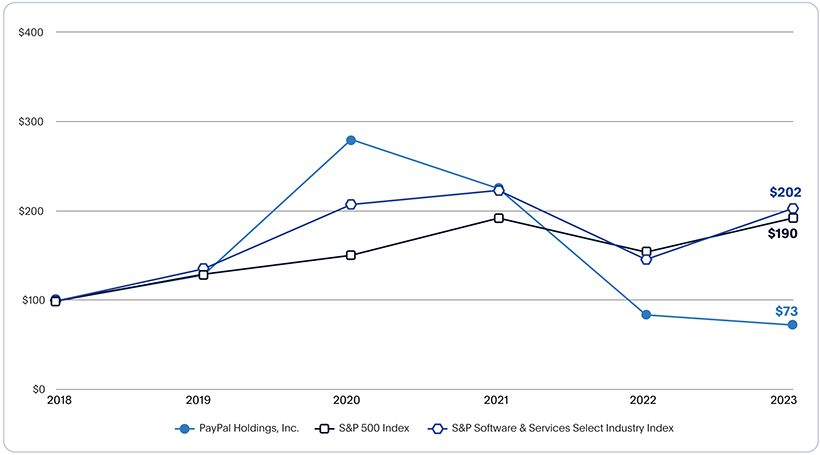

Sound Financial and Operational Performance

In 2023, we delivered solid financial and operating results across our key performance metrics. This was accomplished during a period which saw the successful transition of multiple key leadership roles, accompanied by macroeconomic uncertainty, slowing e-commerce growth and continued geopolitical instability. We ended the year with 426 million active consumer and merchant accounts and $29.8 billion in revenue, an 8% increase compared to 2022. In 2023, we processed 25.0 billion payment transactions and $1.53 trillion in total payment volume across our platform, representing year-over-year increases of 12% and 13%, respectively.

We continued to execute a disciplined capital allocation strategy, returning $5 billion to stockholders through share repurchases in 2023, representing 119% of our free cash flow. In June 2023, we entered into a multi-year agreement with a global investment firm to sell up to €40 billion of our eligible consumer installment receivables portfolio, including a forward-flow arrangement for the sale of future originations, and sold $5.5 billion of loans receivable during the year in connection with this agreement. Additionally, we completed the divestiture of Happy Returns for $466 million in cash proceeds, enabling greater focus on our core business and strategic priorities. Our cost discipline efforts contributed to solid non-GAAP earnings per share and non-GAAP operating margin expansion in 2023.

This progress is a direct result of our sharpened focus, responsible innovation and enhanced cost discipline, which will enable us to execute against our core strategic priorities.

Performance Highlights

The following graphic summarizes key performance highlights for 2023. As described in the Compensation Discussion and Analysis below, in line with our pay-for-performance philosophy, a significant portion of executive compensation is tied to company performance. Notably, the 2023 PayPal Annual Incentive Plan featured both Revenue and Non-GAAP Operating Margin as performance criteria and performance-based restricted stock units granted in 2023 vest in part based on a metric related to Free Cash Flow.

Revenue Non-GAAP Operating Margin1 Free Cash Flow1 Delivering solid revenue growth: Focusing on engaged accounts: Growing payment volume: Efficiency and capital return contributing to earnings growth: +8% 426M $1.53T $5.10 revenue increase from 2022 (spot basis) active accounts (down 2% from 2022) Total Payment Volume (up 13% from 2022) non-GAAP EPS1 growth (up 24% from 2022)

| 1 | Non-GAAP Operating Margin, non-GAAP earnings per diluted share and Free Cash Flow are not financial measures prepared in accordance with generally accepted accounting principles (“GAAP”). For information on how we compute these non-GAAP financial measures and a reconciliation to the most directly comparable financial measures prepared in accordance with GAAP, please refer to “Appendix A: Reconciliation of Non-GAAP Financial Measures” in this proxy statement. |

| 2 | Adjusted free cash flow excludes the net impact of originating European buy now, pay later receivables as held for sale and the subsequent sale of these receivables. |

| 4 |

|

Table of Contents

PROXY STATEMENT SUMMARY

2024 Director Nominees

2024 Director Nominees

The following tables provide summary information about our director nominees. All our 2024 director nominees are independent except Mr. Chriss, our President and CEO. Directors are elected annually by a majority of votes cast. The Board of Directors recommends that you vote “FOR” the election of each of the 11 nominees. See page 13 of this proxy statement for the proposal.

| Directors |

Name | Occupation | Diversity | Age | Director Since |

Independent | Other Public Company Boards |

Committee Memberships | ||||||||||||||

| ARC | COMP | GOV | ||||||||||||||||||||

|

|

Rodney C. Adkins | President,3RAM Group LLC |

D | 65 | 2017 | ● | 3 | ● | ● | |||||||||||||

|

Alex Chriss |

President and CEO, PayPal Holdings, Inc. |

46 | 2023 | - | |||||||||||||||||

|

Jonathan Christodoro | Partner, Patriot Global Management, LP |

47 | 2015 | ● | - | ● | ● | ||||||||||||||

|

John J. Donahoe |

President and CEO, Nike, Inc. |

63 | 2015 |

|

1 | ||||||||||||||||

|

David W. Dorman |

Former Non-Executive Board Chair of CVS Health Corporation |

70 | 2015 | ● | 1 |

|

● | ||||||||||||||

|

Enrique Lores |

President and CEO, HP Inc. |

D | 58 | 2021 | ● | 1 | ● | ||||||||||||||

|

|

Gail J. McGovern | President and CEO, American Red Cross |

W | 72 | 2015 | ● | 1 | ● |

| |||||||||||||

Independent Board Chair

Independent Board Chair

Committee Chair

Committee Chair

ARC = Audit, Risk and Compliance Committee (“ARC Committee”)

COMP = Compensation Committee

GOV = Corporate Governance and Nominating Committee

W = Woman

D = Diverse Ethnicity

|

|

5 |

Table of Contents

PROXY STATEMENT SUMMARY

2024 Director Nominees

| Directors |

Name | Occupation | Diversity | Age | Director Since |

Independent | Other Public Company Boards |

Committee Memberships | ||||||||||||||

| ARC | COMP | GOV | ||||||||||||||||||||

|

Deborah M. Messemer | Former Major Market Managing Partner, KPMG |

W | 66 | 2019 | ● | 2 | ● | ||||||||||||||

|

|

David M. Moffett |

Former CEO, Federal Home Loan Mortgage Corp. |

72 | 2015 | ● | 3 |

|

|||||||||||||||

|

|

Ann M. Sarnoff |

Former Chair and CEO, WarnerMedia Studios & Networks Group |

W | 62 | 2017 | ● | - | ● | ||||||||||||||

|

|

Frank D. Yeary |

Managing Member, Darwin Capital Advisors, LLC |

60 | 2015 | ● | 2 | ● | |||||||||||||||

Independent Board Chair

Independent Board Chair

Committee Chair

Committee Chair

ARC = Audit, Risk and Compliance Committee (“ARC Committee”)

COMP = Compensation Committee

GOV = Corporate Governance and Nominating Committee

W = Woman

D = Diverse Ethnicity

As previously disclosed, Belinda Johnson has informed the Company that she will not stand for re-election as a director at the Annual Meeting. The Board anticipates that it will reduce the size of the Board to 11 directors effective immediately before the Annual Meeting.

In addition, the Company has announced that the Board intends to appoint Carmine Di Sibio as an independent director of the Company effective July 1, 2024. Mr. Di Sibio is currently Global Chair and CEO of EY (“EY”) and has previously announced that he will retire from EY in June 2024. In accordance with EY policy and practice, he is only able to join a public company board upon his retirement. Accordingly, Mr. Di Sibio is not a director nominee in this Proxy Statement. We are providing this disclosure to be transparent with our stockholders and to highlight our continued focus on board refreshment. See “Corporate Governance—New Director to be Appointed After Annual Meeting” for Mr. Di Sibio’s biography and additional information.

The Board and the Corporate Governance and Nominating Committee (the “Governance Committee”) are committed to ensuring that the Board is composed of individuals who have highly relevant skills, professional experience and backgrounds, bring diverse viewpoints and perspectives and effectively represent the long-term interests of stockholders. Below is a snapshot of the diversity, skills and experience of our director nominees. For more information about our Board members, see “Director Experience, Expertise and Attributes” beginning on page 15 of this proxy statement.

| 6 |

|

Table of Contents

PROXY STATEMENT SUMMARY

2024 Director Nominees

Tenure1 Age Gender Ethnic Diversity 6 YRS average tenure of director nominees 62 YRS average age of director nominees 27% of director nominees are women 18% of director nominees are ethnically diverse 1-4 years 5-8 years < 60 years 61-65 years 66+ years Women Men Did Not Disclose Ethnically Diverse White Did Not Disclose

| 1 | PayPal became an independent public company in July 2015. |

Nominee Skills & Experience

| 6 | 9 |

11 | 9 |

11 | 11 | |||||

| Payments / Financial Services / FinTech |

Technology / Innovation | Global Business |

Go to Market | Senior Leadership |

Business Development and Strategy | |||||

|

|

|

|

|

| |||||

| 7 | 3 | 11 | 10 | 11 | 10 | |||||

| Regulatory / Governmental Risk Management and Compliance | Cybersecurity / Information Security Risk Management | Finance / Accounting |

Environmental and Social Risk Management | Human Capital Management |

Other Public Company Board Service | |||||

|

|

|

|

|

| |||||

|

|

7 |

Table of Contents

PROXY STATEMENT SUMMARY

Corporate Governance Highlights

Corporate Governance Highlights

Corporate governance at PayPal is designed to promote the long-term interests of our stockholders, strengthen Board and management accountability, foster responsible decision-making, engender public trust and demonstrate PayPal’s commitment to transparency, accountability, independence and diversity.

| • | 10 of 11 director nominees are independent |

| • | Independent Board Chair with significant responsibilities |

| • | All directors stand for annual election |

| • | Simple majority vote standard for charter/bylaw amendments and mergers/business combinations |

| • | Diverse Board in which 5 of 11 director nominees are women and/or from a diverse ethnic group |

| • | Diverse characteristics considered in assessing Board composition include sexual orientation, ethnicity, nationality and cultural background |

| • | Committed to actively seeking highly qualified women and individuals from underrepresented communities to include in the initial pool from which director nominees are chosen |

| • | Annual performance self-evaluations by the full Board and each committee |

| • | Majority vote standard for uncontested director elections |

| • | Stockholder right to call a special meeting |

| • | Regular review of Board and executive succession planning |

| • | Strong stockholder engagement practices |

| • | Director service limited to no more than four public company boards, including the PayPal Board |

| • | Proxy access for qualifying stockholders |

| • | Robust stock ownership requirements for our executives and directors |

| • | Prohibition on hedging and pledging transactions by executive officers and directors |

| • | Annual Global Impact Report disclosing our performance, progress and strategy on key non-financial risks and opportunities |

To learn more about our corporate governance practices and policies, see page 23 of this proxy statement.

Stockholder Engagement

| Outreach and Engagement |

Contacted holders of 50% of our common stock |

Engaged with holders of 19% of our common stock | ||

| Areas for Stockholder Focus |

Board Composition and Succession Planning

|

Risk Management and Oversight |

Executive Compensation |

Corporate Sustainability and Impact (“CSI”) Matters | ||||

| Highlights of our Practices |

• Governance Committee oversight and regular discussion of director succession and Board refreshment plans

• Five directors added to the Board since 2017

• Board review of executive succession planning at least annually |

• Robust Board oversight of ERCM program

• Committees have clearly defined oversight responsibility of specific risks as outlined in committee charters

• ARC Committee oversees and reviews overall risk management framework and reports to the full Board on risk matters, including cybersecurity and data privacy |

• Compensation Committee evaluates the appropriateness of the Company’s compensation-related performance metrics at least annually, taking into consideration the Company’s overall strategy and stockholder feedback |

• Alignment of CSI disclosures to established frameworks, including IFRS Foundation’s Sustainability Accounting Standards Board (“SASB”) standards and Task Force on Climate- Related Financial Disclosures (“TCFD”) recommendations

• Focus on promoting a culture of community, and ensuring alignment of our global talent and Belonging strategy | ||||

Stockholder conversations following our 2023 Annual Meeting provided significant input to the Compensation Committee’s enhancements made to our executive compensation program as detailed on page 58 of the Compensation Discussion and Analysis (“CD&A”).

| 8 |

|

Table of Contents

PROXY STATEMENT SUMMARY

Executive Compensation Highlights

Executive Compensation Highlights

Our key guiding principle for executive compensation is to closely align the compensation of our executives with the creation of long-term value for our stockholders. We also recognize that the creation of long-term stockholder value begins with attracting exceptionally talented leaders to our Company. 2023 was a transformative year for PayPal as we welcomed several new executives to our leadership team and provided attractive compensation opportunities to induce them to join. We also made several enhancements to our incentive compensation plans to increase focus on profitable growth. Finally, our 2023 incentive programs were designed to strike an appropriate balance between incentivizing top-line growth, profitability, non-financial business initiatives and stockholder value creation over both the short-term and long-term horizons.

To learn more about our executive compensation program, see the CD&A beginning on page 51 of this proxy statement.

Executive Transition-Related Compensation

The Compensation Committee took a thoughtful approach in establishing new hire awards to attract Mr. Chriss and Mses. Miller and Gill to join PayPal and ensure appropriate long-term alignment with stockholders. The offer letters provided to Mr. Chriss and Mses. Miller and Gill included two categories of compensation entitlements: (1) go-forward, ordinary course compensation arrangements and (2) special, non-recurring new hire awards. The non-recurring new hire awards were intended to incentivize Ms. Miller and Ms. Gill to join PayPal’s next-generation leadership team. For Mr. Chriss, the non-recurring new hire awards were also intended to compensate him for a portion of the awards he forfeited in departing from his prior employer to join PayPal. The amounts and types of compensation for each of Mr. Chriss and Mses. Miller and Gill were determined carefully by the Compensation Committee, taking into consideration the NEO’s experience, responsibilities, expertise, compensation at their prior employer, potential contributions to PayPal, the compensation received by the new NEO’s predecessor at PayPal (if applicable), their competitive opportunities, and market compensation for their role with PayPal’s compensation peer group.

The following table summarizes the go-forward compensation arrangements and special, non-recurring new hire awards for Mr. Chriss and Mses. Miller and Gill, which were intended to compensate them for awards they forfeited when joining PayPal or to induce them to accept our offers, as applicable:

|

|

Go-Forward Compensation Arrangements |

|

Special, Non-Recurring New Hire Awards |

|||||||||||||||||||||||||

| NEO |

Annual Base Salary Rate |

Target Annual Incentive Plan Bonus as a Percentage of Annual Base Salary |

Initial RSU Grant |

Initial PBRSU Grant (at target) |

|

Cash Sign- On Bonus |

Make- Whole or Sign-On Incentive RSUs |

|||||||||||||||||||||

| Alex Chriss President & Chief Executive Officer |

$1,250,000 | 200% | $16,750,000 | $ | 17,000,000 |

|

|

|

N/A | $ | 10,000,000 | |||||||||||||||||

| Jamie Miller EVP, Chief Financial Officer |

$ 750,000 | 125% | $ 6,250,000 | $ | 6,250,000 |

|

|

|

$ | 6,000,000 | (1) | $ | 2,000,000 | |||||||||||||||

| Michelle Gill EVP, General Manager – Small Business & |

$ 750,000 | 125% | $ 6,250,000 | $ | 6,250,000 |

|

|

|

$ | 2,000,000 | (1) | $ | 2,000,000 | |||||||||||||||

| 1 | 50% of the Cash Sign-On Bonus was payable in cash within the first two pay periods following the NEO’s start date, with the remaining 50% payable within two pay periods following the 6-month anniversary (each, an “installment”). If the NEO resigns or PayPal terminates the NEO’s employment for cause: (a) on or before the first anniversary of the payment date of the first installment, the NEO must repay 100% of the first installment; (b) after the first anniversary of the payment date of the first installment and on or before the second anniversary of the payment date of the first installment, the NEO must repay the first installment, less 1/24th of the first installment for every full month of the NEO’s active employment with PayPal following the NEO’s start date; and (c) on or before the first anniversary of the payment date of the second installment, the NEO must pay back 100% of the second installment. |

Mr. Chriss and Mses. Miller and Gill will not receive any equity grants during PayPal’s 2024 rewards cycle, apart from their Initial RSU Grants, Initial PBRSU Grants and Sign-On Incentive RSUs.

To find additional details on new hire-related compensation, please see the CD&A section titled “Offer Letter Compensation for New NEOs” on page 53 of this proxy statement.

|

|

9 |

Table of Contents

PROXY STATEMENT SUMMARY

Executive Compensation Highlights

2024 Compensation Program Changes Informed by Investor Feedback

Informed by investor feedback, in January 2024, our Compensation Committee made the following enhancements to our incentive programs to strengthen pay for performance alignment, increase the focus on profitable growth, reduce burn rate (defined as the number of shares subject to equity awards granted during a given year divided by the basic weighted average number of common shares outstanding for that fiscal year) and address historical challenges experienced in connection with setting long-term performance goals.

Enhancements to 2024 PayPal Annual Incentive Plan

| Enhancement |

Rationale | |

| Redesign the plan to fund the bonus pool based on company performance and determine employee payouts based on individual performance |

Company-wide bonus pool and resulting employee bonus starting point to be based on company performance, strengthening pay and performance alignment; individual performance modifier will provide for better upwards or downwards differentiation when specifically warranted | |

| Update metrics to Non-GAAP Operating Income and Transaction Margin Dollars (from Revenue and Non-GAAP Operating Margin) |

Will more closely align performance goals to current Company strategy, including additional focus on driving profitable growth

Additionally, stock-based compensation expense will be included in non-GAAP financial metric reporting, including Non-GAAP Operating Income, beginning in 2024 | |

| Move to 100% cash compensation for short- term incentive program |

Will align actual payout with intended value to be delivered and reduce burn rate | |

Enhancements to 2024-2026 PBRSUS under Long-Term Incentive Program

| Enhancement |

Rationale | |

| Move to relative total shareholder return (rTSR) metric, measured as compared to the S&P 500 (from FX-Neutral Revenue CAGR and Free Cash Flow CAGR), with the target for rTSR vs. the S&P 500 set at the 55th percentile |

More closely aligns PBRSU payouts with long-term shareholder value while effectively motivating leaders to holistically execute during this transitional period while our strategy continues to evolve | |

| Three-year performance period using three discrete measurement periods of 12, 24, and 36 months in calculating payout; no vesting prior to end of the full three-year vesting period. If absolute TSR achievement is negative for the 36-month period, the maximum shares an executive could earn would be capped at 100% of the target number of shares |

Will minimize the potential impact of short-term share price volatility, while maximizing retention value over the entire vesting period; designed to enhance the program’s durability and provide a holistic measure of long-term value creation during PayPal’s strategic pivot | |

2023 Incentive Compensation Plan Outcomes

For 2023, the Compensation Committee approved incentive programs designed to strike an appropriate balance between incentivizing top-line growth, profitability, non-financial business initiatives, and stockholder value creation over both the short-term and long-term horizons.

| 10 |

|

Table of Contents

PROXY STATEMENT SUMMARY

Executive Compensation Highlights

Based on our 2023 results, our incentive plans paid out as follows:

2023 PayPal Annual Incentive Plan (“AIP” or “2023 AIP”)

Under the AIP, 75% of the NEOs’ target incentive was based on company performance. The following table shows the performance goals and actual performance achieved, as determined by the Compensation Committee.

| Company Measure |

Threshold (50% Payout)* |

Target (100% Payout)* |

Maximum (200% Payout)* |

Actual Achieved |

Actual Achieved (Percentage of Target Achieved) | |||||

| Revenue (in $ billions) |

$27.52 | $28.42 | $29.32 | $29.77 | 200% | |||||

| Non-GAAP Operating Margin |

20.40% | 22.40% | 24.40% | 22.43% | 102% | |||||

| Company Performance Score of the AIP | 151% | |||||||||

| * | Linear interpolation applies to revenue and Non-GAAP Operating Margin for results between specific goals. |

The remaining 25% of the NEOs’ target incentive under the AIP was based on individual performance. Payouts under the individual performance component of the AIP were 100% of target for each of our eligible NEOs.

2021-2023 PBRSUs

The following table shows the performance goals and actual performance achieved for the PBRSUs granted in 2021, which vested based on performance during a three-year performance period (the “2021-2023 PBRSUs”).

Measure 0.0% 0.0% Threshold (50% Payout) Target (100% Payout) Actual Achieved (Percentage of Target Achieved) Maximum (200% Payout) Aggregate Percent of Target Achieved 0.0% FX-Neutral Revenue CAGR Free Cash Flow CAGR 15.5% 13.0% 17.5% 15.0% 18.5% 16.0%

Share Authorization Approval

At this year’s Annual Meeting, the Company is asking stockholders to approve the amendment and restatement of the PayPal Holdings, Inc. 2015 Equity Incentive Award Plan (the “Equity Plan”) in order to (i) increase the number of shares authorized for issuance under the Equity Plan by 20 million and (ii) remove the “inverse fungible share ratio” for future awards.

In determining to seek stockholder approval to increase the number of shares reserved for future issuance, the PayPal Compensation Committee and Board of Directors carefully considered a number of important factors, including:

| • | The Equity Plan supports a broad-based program that is critical to our ability to effectively compete for talented employees; |

| • | Equity awards support our pay-for-performance philosophy; |

| • | We have taken a responsible approach to the use of equity, including a number of recent steps that balance stockholder considerations regarding dilution and the vital role of equity in attracting and retaining the talent we need to implement our strategy; |

| • | Our equity request reflects our market for talent; and |

| • | Our strong governance practices protect stockholder interests. |

|

|

11 |

Table of Contents

PROXY STATEMENT SUMMARY

Share Authorization Approval

Equity is a key element of compensation that is critical in the labor markets in which we compete, particularly within our technology function. Accordingly, the Board believes that approval of the equity plan amendment and restatement to authorize additional shares is in the best interests of the Company and its stockholders.

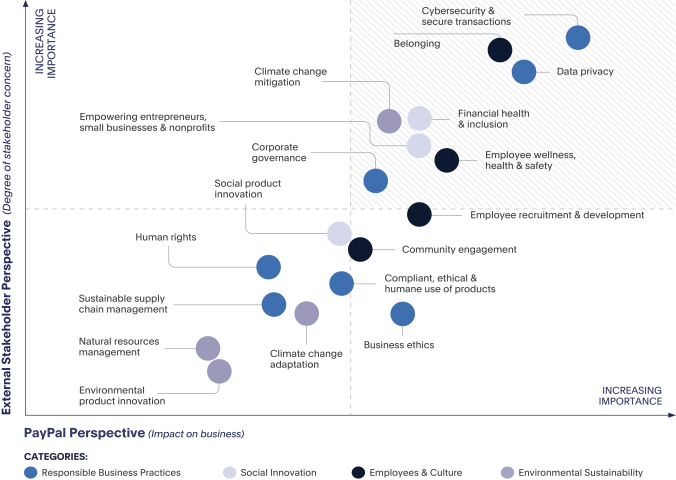

Corporate Sustainability and Impact

Our governance framework is designed to provide sound company oversight, drive Board and management accountability and demonstrate PayPal’s commitment to transparency. We seek to apply the same approach to the oversight, management and implementation of the Company’s corporate sustainability and impact (“CSI”) strategy. Our cross-functional program is managed by executive leaders and implemented through guidance and direction provided by the CSI steering committee. Representatives from the CSI steering committee brief Board committees and executive management on CSI matters periodically and meet with a subcommittee of the Enterprise Risk Management Committee at least annually to review current and emerging CSI-related risk topics.

| Oversight

Our Board of Directors is actively engaged on CSI matters that impact business strategy.

• Governance Committee: Oversight of PayPal’s management of CSI topics, including overall CSI strategy, risks and opportunities, stakeholder engagement and programs and initiatives in social innovation and environmental sustainability

• ARC Committee: Oversight of the Company’s risk framework and enterprise-wide compliance program, including cybersecurity and privacy matters

• Compensation Committee: Oversight of the Company’s strategies and responsibilities related to human capital (global talent) management, including diversity and inclusion, pay equity efforts and corporate culture |

Management

Our executive management directs and manages the execution of our enterprise-wide CSI strategy to help ensure non-financial risks and opportunities are appropriately integrated across the enterprise, including through the Enterprise Risk and Compliance Management Program (ERCM Program)

Implementation

A CSI steering committee and cross-functional working groups with representatives from more than 20 functions are responsible for overall program implementation | |

PayPal recognizes the importance of operating our business in a responsible and sustainable manner. We believe the effective management of key non-financial risks and opportunities plays a role in furthering our strategy and helps to create value for our stockholders, customers, employees and other stakeholders. For more information on our CSI strategy and program, see “Corporate Sustainability and Impact Oversight and Management” beginning on page 40 of this proxy statement, and our most recent Global Impact Report, which is available at https://investor.pypl.com/csi-strategy.

| 12 |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

PROPOSAL 1:

Election of Directors

Based upon a review of their skills, qualifications, expertise and characteristics, the Board has nominated 11 of our current directors for election at the Annual Meeting, to serve until our 2025 Annual Meeting of Stockholders and until their successors are elected and qualified. Each director nominee is independent except Mr. Chriss, our President and CEO. Each of our current directors other than Mr. Chriss has been previously elected by our stockholders. As previously disclosed, Ms. Johnson has informed the Company that she will not stand for re-election as a director at the Annual Meeting. The Board anticipates that it will reduce the size of the Board to 11 directors effective immediately before the Annual Meeting.

We expect that each director nominee will be able to serve if elected. If any director nominee is unable or unwilling to serve at the time of the Annual Meeting, the current Board may identify a substitute nominee to fill the vacancy, reduce the size of the Board or leave a vacancy to fill at a later date.

Directors must be elected by a majority of the votes cast in uncontested elections, which has been our voting standard since we became an independent public company in 2015. This means that the number of votes cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that nominee. (For more information, see “Frequently Asked Questions – Voting Information” on page 116 of this proxy statement.) Each director has submitted an advance, contingent, irrevocable resignation that the Board may accept if stockholders do not re-elect that director. After the certification of any such stockholder vote, the Governance Committee or a committee composed solely of independent directors that does not include the director who was not re-elected will determine whether to accept the director’s resignation. We will publicly disclose any such decision and the rationale behind it.

Director Nominees

The Governance Committee is responsible for recommending to the Board the qualifications for Board membership and for identifying, assessing and recommending qualified director candidates for the Board’s consideration. The Board’s membership qualifications and nomination procedures are set forth in the Governance Guidelines for the Board of Directors (“Governance Guidelines”). Nominees may be suggested by directors, management, stockholders or by a third-party firm.

The Governance Committee and the Board have evaluated each of the director nominees and concluded that it is in the best interests of the Company and its stockholders for each of these individuals to continue to serve as a director. The Board believes that each director nominee has a strong track record of being a responsible steward of stockholders’ interests and brings extraordinarily valuable insight, perspective and expertise to the Board.

To ensure that the Board continues to evolve and be refreshed in a manner that serves the changing business and strategic needs of the Company, the Governance Committee annually reviews with the Board the applicable skills, qualifications, expertise and characteristics of Board nominees in the context of the current Board composition and Company circumstances. The Governance Committee evaluates whether each director demonstrates several key attributes and provides significant and meaningful contributions to the Board. These factors include:

| • | Highly relevant professional experience in payments, financial services, financial technology (“FinTech”), technology, innovation, global business, business development, strategy, legal, regulatory, government, cybersecurity, information security, finance, accounting, consumer, sales, marketing, brand management, talent (human capital) management and/or environmental and social risk management matters; |

| • | Relevant senior leadership/CEO experience; |

| • | Experience and expertise that complement the skill sets of the other director nominees; |

| • | High degree of character and integrity and ability to contribute to strong Board dynamics; |

| • | Highly engaged and able to commit the time and resources needed to provide active oversight of PayPal and its management; |

| • | Sound business judgment; and |

| • | Commitment to enhancing stockholder value. |

In addressing the overall composition of the Board, the Governance Committee considers how each director contributes to the Board’s diversity in terms of gender, sexual orientation, race, ethnicity, nationality, cultural background and age, in addition to the skills, qualifications and expertise that they bring to the Board.

|

|

13 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

Descriptions of Skills and Attributes

We apply the following standards to determine whether a nominee possesses each of the skills and attributes chart below.

| Experience, Expertise and Attributes |

Definition | |

| Payments / Financial Services / FinTech |

Experience developing business strategies that strengthen and enable financial services, including payment services and infrastructure, banking, and technology platforms. | |

| Technology / Innovation |

Possesses knowledge and insights into developing or operating technology businesses, product development and new business models, and anticipating technological trends and driving innovation. | |

| Global Business |

Demonstrated ability to drive growth in markets around the world, including an understanding of diverse competitive and operating environments, economic conditions, regulatory frameworks and cultures. | |

| Go to Market |

Experience in developing strategies to grow sales and market share, executing marketing campaigns, building brand awareness and overall preference among customers, and enhancing the reputation of a business at significant scale. | |

| Senior Leadership |

CEO or other significant senior leadership experience, with a practical understanding of organizations, processes, strategic planning and risk management to assess, develop and implement business strategy, planning, and operations. | |

| Business Development and Strategy |

Experience driving growth through strategic partnerships or business combinations, including assessment of potential partners and targets for strategic and cultural fit, structuring and negotiating agreements, and integrating and streamlining operations. | |

| Regulatory / Governmental Risk Management and Compliance |

Knowledge of and experience with navigating complex legal and regulatory issues, compliance obligations and governmental policies in multiple jurisdictions, including engagement with legislators and regulatory bodies. | |

| Cybersecurity / Information Security Risk Management |

Operational management or oversight of cybersecurity, information security data privacy, or expertise and understanding of how those issues affect business operations, risk management or compliance. | |

| Finance / Accounting |

Oversight or management of the capital structure, financing and investing activities, and financial reporting and internal controls of a sophisticated and complex global business. | |

| Environmental and Social Risk Management |

An understanding of effective management and disclosure of risks and opportunities around environmental sustainability, social aspects of business models and activities, and key governance practices that align with stockholder value creation and stakeholder expectations. | |

| Human Capital Management |

Experience managing or overseeing the business function that attracts, motivates, develops and retains qualified personnel in a competitive talent environment and fostering a corporate culture that encourages and promotes accountability, performance and belonging. | |

| Other Public Company Board Service |

Insight into ensuring strong board and management accountability, protecting stockholder interests, overseeing enterprise risk and adhering to leading governance practices. | |

| 14 |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

Director Experience, Expertise and Attributes

Our Board skills matrix identifies the core skills, expertise and attributes of each director that we consider most relevant in light of our current business strategy and structure. For more information on the qualifications that each director nominee brings to our Board, see the nominee biographies beginning on page 17 of this proxy statement.

| Experience, Expertise and Attributes

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

|

|

Payments / Financial Services / FinTech |

• | • | • | • | • | • | 6 | ||||||||||||||||||

|

|

Technology / Innovation |

• | • | • | • | • | • | • | • | • | 9 | |||||||||||||||

|

|

Global Business |

• | • | • | • | • | • | • | • | • | • | • | 11 | |||||||||||||

|

|

Go to Market |

• | • | • | • | • | • | • | • | • | 9 | |||||||||||||||

|

|

Senior Leadership |

• | • | • | • | • | • | • | • | • | • | • | 11 | |||||||||||||

|

|

Business Development and Strategy |

• | • | • | • | • | • | • | • | • | • | • | 11 | |||||||||||||

|

|

Regulatory / Governmental Risk Management and Compliance |

• | • | • | • | • | • | • | 7 | |||||||||||||||||

|

|

Cybersecurity / Information Security Risk Management |

• | • | • | 3 | |||||||||||||||||||||

|

|

Finance / Accounting |

• | • | • | • | • | • | • | • | • | • | • | 11 | |||||||||||||

|

|

Environmental and Social Risk Management |

• | • | • | • | • | • | • | • | • | • | 10 | ||||||||||||||

|

|

Human Capital Management |

• | • | • | • | • | • | • | • | • | • | • | 11 | |||||||||||||

|

|

Other Public Company Board Service |

• | • | • | • | • | • | • | • | • | • | 10 | ||||||||||||||

Adkins Chriss Christodoro Donahoe Dorman Johnson Lores McGovern Messemer Moffett Sarnoff Yeary Total Directors

|

|

15 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

Focus on Board Refreshment and Diversity

The Governance Committee regularly oversees and plans for director succession and Board refreshment. The Board values succession and refreshment over time as critical components to maintaining an appropriate balance of tenure, diversity, skills and experience needed to promote and support the Company’s long-term strategy. The Board believes that having a mix of experienced directors with a deep understanding of the Company and newer directors who bring fresh perspectives and innovative ideas provides significant benefits to the Company in driving and overseeing its strategy and operations and managing key risks. The Board does not believe in a specific limit for the overall length of time a director may serve. Directors who have served on the Board for an extended period can provide valuable insight into the operations and future of the Company based on their experience with, and understanding of, the Company’s history, policies and objectives.

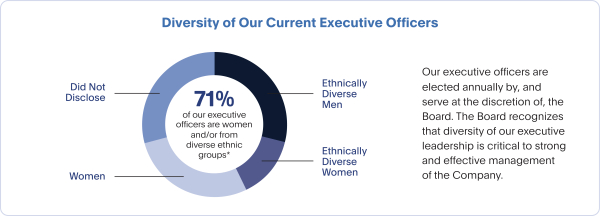

The Governance Committee values diversity as a factor in selecting nominees. When searching for new directors, the Governance Committee actively seeks out highly qualified women and individuals from underrepresented communities to include in the initial pool from which Board nominees are chosen. In keeping with this commitment to diversity and inclusion, our 11 director nominees include three people who identify as women, one person who identifies as African American or Black and one person who identifies as Hispanic or Latinx and White.

Our active Board refreshment process has resulted in a strong mix of diversity and independence, which contributes to effective oversight of management and the Company.

|

Board Diversity Matrix (as of April 9, 2024)

|

| |||||||

| Total Number of Directors |

12 | |||||||

| Part I: Gender Identity |

||||||||

| Female | Male | Did Not Disclose | ||||||

| Directors |

4 | 7 | 1 | |||||

| Part II: Demographic Background |

||||||||

| African American or Black |

- | 1 | - | |||||

| White |

4 | 4 | - | |||||

| Two or More Races or Ethnicities |

- | 1 | - | |||||

| Did Not Disclose Demographic Background |

- | - | 2 | |||||

Stockholder Recommendations and Nominations

Stockholders who would like the Governance Committee to consider their recommendations for director nominees should submit their recommendations in writing by mail to the Governance Committee in care of our Corporate Secretary at PayPal Holdings, Inc., 2211 North First Street, San Jose, California 95131, stating the candidate’s name and qualifications for Board membership. Any such recommendation by a stockholder will receive the same consideration by the Governance Committee as other suggested nominees.

Subject to the nominating stockholder’s compliance with the Company’s certificate of incorporation and bylaws and, if applicable, Exchange Act Rule 14a-19, candidates nominated by a stockholder will be included on a universal proxy card. Such inclusion is not an endorsement of the stockholder nominee.

In addition, our Restated Certificate of Incorporation and Bylaws provide proxy access rights that permit eligible stockholders to nominate candidates for election to the Board in the Company’s proxy statement. These proxy access rights permit a stockholder, or group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years to nominate and include in the Company’s proxy materials director nominees constituting up to 20% of the Board, provided that the stockholder(s) and nominee(s) satisfy the requirements and procedures described in our Restated Certificate of Incorporation and Bylaws.

| 16 |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies

Director Biographies

|

|

||||||||

| RODNEY C. ADKINS President of 3RAM Group LLC

INDEPENDENT |

Board Committees: • ARC • Governance

|

Director since: September 2017 |

Age: 65 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Extensive experience in the technology industry including leadership positions in multiple business units within IBM, including emerging technologies, strategy, global business operations, innovation, product development and brand management |

| • | Significant experience in corporate finance, financial statements and accounting |

| • | In-depth expertise in corporate governance matters as a board member of other public companies |

| • | Expertise in supply chain, procurement and global trade |

Other Public Company Boards:

| • | United Parcel Service, Inc. since 2013 |

| • | W.W. Grainger, Inc. since July 2014 |

| • | Avnet, Inc. (Chair) since 2015 |

Former Public Company Boards within Last Five Years:

| • | PPL Corporation from August 2014 to May 2019 |

Career Highlights:

| • | President of 3RAM Group LLC, a privately held company specializing in capital investments, business consulting services and property management since January 2015 |

| • | Spent over 30 years at International Business Machines Corporation (“IBM”) in various development and management roles, including Senior Vice President of Corporate Strategy from April 2013 to April 2014, Senior Vice President of Systems and Technology Group from October 2009 to April 2013, Senior Vice President of Development & Manufacturing from May 2007 to October 2009 and Vice President of Development of IBM Systems and Technology Group from December 2003 to May 2007 |

|

|

||||||||

| ALEX CHRISS President and Chief Executive Officer of PayPal |

Board Committees: • None |

Director since: September 2023 |

Age: 46 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Extensive product, technology and global payments experience |

| • | Deep expertise in leading high-growth businesses focused on customer-driven innovation |

Other Public Company Boards:

| • | None |

Former Public Company Boards within Last Five Years:

| • | None |

Career Highlights:

| • | President and Chief Executive Officer of PayPal since September 2023 |

| • | Executive Vice President and General Manager, Small Business and Self-Employed, of Intuit Inc. from January 2019 to September 2023 |

| • | Led a global organization responsible for delivering QuickBooks and Mailchimp to millions of customers and for more than half of Intuit’s revenue |

| • | Led Intuit’s successful acquisition of Mailchimp, significantly expanding the capacity of Intuit’s platform and its customer base |

| • | Senior Vice President and Chief Product Officer, Small Business organization of Intuit from January 2017 to December 2018 |

| • | Managed the full suite of QuickBooks products, including payroll and payments platform segments |

| • | Vice President and General Manager, Self-Employed segment of Small Business division of Intuit, Inc. from August 2013 to December 2016 |

| • | Various positions of increasing responsibility at Intuit, Inc. from July 2004 to July 2013 including Business Leader and Director, Intuit Partner Platform |

|

|

17 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies

|

|

||||||||

| JONATHAN CHRISTODORO Partner at Patriot Global Management, LP

INDEPENDENT |

Board Committees: • Compensation • Governance

|

Director since: July 2015 |

Age: 47 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Extensive financial, strategic planning and investment banking experience advising public companies, including at the board level |

| • | Significant experience as both a director and an investor in identifying and evaluating mergers and acquisitions and investment opportunities and portfolio companies across a range of industries, including technology |

Other Public Company Boards:

| • | None |

Former Public Company Boards within Last Five Years:

| • | Frontier Acquisition Corp. from February 2021 to March 2023 |

| • | Pioneer Merger Corp. from November 2020 to January 2023 |

| • | Sandridge Energy, Inc. from June 2018 to May 2021 |

| • | Xerox Corporation from June 2016 to May 2021 |

| • | Herbalife Ltd. from April 2013 to January 2021 |

| • | Lyft, Inc. from May 2015 to March 2019 |

Career Highlights:

| • | Partner at Patriot Global Management, LP, an investment management firm since March 2019 |

| • | Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds from July 2012 to February 2017. |

| • | Served in various investment and research roles from March 2007 to July 2012 |

| • | Began his career as an investment banking analyst at Morgan Stanley, where he focused on merger and acquisition transactions across a variety of industries |

| • | Served in the United States Marine Corps |

|

|

||||||||

| JOHN J. DONAHOE President and Chief Executive Officer of Nike, Inc.

INDEPENDENT BOARD CHAIR

|

Board Committees: • None |

Director since: July 2015 |

Age: 63 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | As eBay Inc. President and CEO, oversaw successful separation of PayPal from eBay Inc. and its establishment as an independent public company |

| • | Expertise in commerce, technology, global strategy, operations and executive leadership |

| • | Extensive track record of creating value, driving innovation and scaling large technology and consumer-facing companies |

Other Public Company Boards:

| • | Nike, Inc. since June 2014 |

Former Public Company Boards within Last Five Years:

| • | ServiceNow, Inc. from April 2017 to June 2020 |

Career Highlights:

| • | President and Chief Executive Officer of Nike, Inc. since January 2020 |

| • | President and Chief Executive Officer of ServiceNow, Inc., a cloud computing company from April 2017 to December 2019 |

| • | President and Chief Executive Officer of eBay Inc. from March 2008 to July 2015, and director of eBay Inc. from January 2008 to July 2015 |

| • | President, eBay Marketplaces from March 2005 to January 2008 |

| • | Worldwide Managing Director of Bain & Company from January 2000 to February 2005 |

| 18 |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies

|

|

||||||||

| DAVID W. DORMAN Former Non-Executive Board Chair of CVS Health Corporation

INDEPENDENT |

Board Committees: • Compensation (Chair) • Governance

|

Director since: June 2015 |

Age: 70 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | In-depth board chair and executive-level experience leading global companies in regulated industries including technology, telecommunications and health care |

| • | Expertise in finance, mergers and acquisitions and investments, strategic planning |

| • | Public company executive compensation, talent management and executive leadership expertise |

Other Public Company Boards:

| • | Dell Technologies, Inc., since September 2016 |

Former Public Company Boards within Last Five Years:

| • | CVS Health Corporation from March 2006 to May 2022 |

Career Highlights:

| • | Founding Partner of Centerview Capital Technology Fund, a private investment firm since July 2013 |

| • | Board Chair of InfoWorks, a portfolio company of Centerview since January 2019 |

| • | Board of Directors of CVS Health Corporation from March 2006 until May 2022 including Non-Executive Board Chair from March 2011 until May 2022 |

| • | Lead Independent Director of the Board of Motorola Solutions, Inc. (formerly Motorola, Inc.), a leading provider of business and communication products and services from May 2011 until May 2015 |

| • | Non-Executive Board Chair of Motorola, Inc. from May 2008 to January 2011 |

| • | Senior Advisor and Managing Director to Warburg Pincus LLC, a global private equity firm from October 2006 to May 2008 |

| • | President and a director of AT&T Corporation from November 2005 to January 2006 |

| • | Board Chair and Chief Executive Officer of AT&T Corporation from November 2002 to November 2005 |

| • | President of AT&T Corporation, from 2000 to 2002, and the Chief Executive Officer of Concert Communications Services, a former global venture created by AT&T Corporation and British Telecommunications plc from 1999 to 2000 |

| • | Served as a Trustee for Georgia Tech Foundation, Inc. |

|

|

||||||||

| ENRIQUE LORES President and CEO, HP Inc.

INDEPENDENT |

Board Committees: • ARC

|

Director since: June 2021 |

Age: 58 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Deep product and operational experience at the highest levels of the information technology industry |

| • | Proven leader in consumer-facing business with extensive international business and leadership experience and global perspective |

Other Public Company Boards:

| • | HP Inc. since November 2019 |

Former Public Company Boards within Last Five Years:

| • | None |

Career Highlights:

| • | President and Chief Executive Officer of HP Inc., an information technology company since November 2019 |

| • | President, Imaging and Printing Solutions, HP Inc. from November 2015 to October 2019 |

| • | Spent over 30 years at The Hewlett-Packard Company in several positions of increasing responsibility ranging from Vice President, Imaging & Printing Group, EMEA to Senior Vice President & General Manager, Business Personal Systems and then Separation Leader from 1989 to 2015 |

|

|

19 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies

|

|

||||||||

| GAIL J. MCGOVERN President and Chief Executive Officer of the American Red Cross

INDEPENDENT

|

Board Committees: • Compensation • Governance (Chair) |

Director since: June 2015 |

Age: 72 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Extensive executive experience in strategic planning across a global organization operating in challenging environments, sales and marketing, customer relations and corporate finance |

| • | Strong expertise in regulatory matters and government relations garnered through leadership positions in regulated industries |

| • | Brings a strong perspective from the academic and nonprofit worlds aligned with PayPal’s mission and vision |

Other Public Company Boards:

| • | DTE Energy Company since June 2003 |

Former Public Company Boards within Last Five Years:

| • | None |

Career Highlights:

| • | President and Chief Executive Officer of the American Red Cross, a humanitarian organization since June 2008 |

| • | Faculty member at the Harvard Business School from 2002 to 2008 |

| • | President of Fidelity Personal Investments from 1998 to 2002 |

| • | Executive Vice President, Consumer Markets Division at AT&T Corporation from 1997 to 1998 |

| • | Serves as a trustee of The Johns Hopkins University School of Medicine |

|

|

||||||||

| DEBORAH M. MESSEMER Former Major Market Managing Partner at KPMG

INDEPENDENT

|

Board Committees: • ARC (Audit Committee Financial Expert)

|

Director since: January 2019 |

Age: 66 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | More than 30 years of experience in finance, strategy, market development, regulation, governance and operations |

| • | Strong leadership and people management experience as the Managing Partner of KPMG’s Bay Area and Northwest region, having led a team of over 3,000 employees |

| • | Extensive expertise in financial reporting, due diligence, mergers and acquisitions and internal controls over financial reporting as Audit Engagement Partner or Senior Relationship Partner for companies in a variety of industries, including financial services and technology |

Other Public Company Boards:

| • | Allogene Therapeutics, Inc. since October 2018 |

| • | TPG, Inc. since January 2022 |

Former Public Company Boards within Last Five Years:

| • | None |

Career Highlights:

| • | Served for over 35 years at KPMG, one of the world’s leading professional services firms, first in the audit practice, then as Audit Engagement Partner or Global Senior Relationship Partner for clients in a variety of industries, including financial services and technology. She was Managing Partner of KPMG’s Bay Area and Northwest region, responsible for leading teams in 10 offices across all functions from 2008 through her retirement in September 2018 |

| • | Served on the Board of Directors of Carbon, Inc., a privately held company |

| 20 |

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Director Biographies

|

|

||||||||

| DAVID M. MOFFETT Former Chief Executive Officer of Federal Home Loan Mortgage Corp.

INDEPENDENT

|

Board Committees: • ARC (Chair) (Audit Committee |

Director since: June 2015 |

Age: 72 | |||||

Experience, Skills and Qualifications Relevant to Nomination Includes:

| • | Strong leadership experience and extensive global financial management and regulatory expertise as a former Chief Executive Officer and Chief Financial Officer of financial services companies |

| • | More than 30 years of strategic finance, mergers and acquisitions, risk management and operational experience in banking and payment processing |

Other Public Company Boards:

| • | Columbia Seligman Premium Technology Growth Fund, Inc. since January 2024 |

| • | Tri-Continental Corp. since January 2024 |

| • | CSX Corporation since May 2015 |

Former Public Company Boards within Last Five Years:

| • | Genworth Financial, Inc. from December 2012 to May 2021 |

Career Highlights:

| • | Lead Independent Director of PayPal from July 2015 to December 2018 |

| • | Chief Executive Officer of Federal Home Loan Mortgage Corp. (“Freddie Mac”) from September 2008 until his retirement in March 2009, and director of Freddie Mac from December 2008 to March 2009 |

| • | Chief Financial Officer of Star Banc Corporation, a bank holding company, starting in 1993. During his tenure, he played an integral role in the acquisition of Firstar Corporation in 1998 and later U.S. Bancorp in 2001. Mr. Moffett remained Chief Financial Officer of U.S. Bancorp until 2007 |