Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-211753

The information in this prospectus supplement and the accompanying prospectus is not complete and may be changed. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted

Subject to Completion

Preliminary prospectus supplement dated November 17, 2016

PROSPECTUS SUPPLEMENT

(To prospectus dated August 10, 2016)

Tallgrass Energy GP, LP

8,000,000 Class A Shares

Representing Limited Partner Interests

The selling security holders identified in this prospectus supplement are selling an aggregate of 8,000,000 Class A shares of Tallgrass Energy GP, LP. We will not receive any proceeds from the sale of our Class A shares in this offering.

Our Class A shares trade on the New York Stock Exchange under the symbol “TEGP.” On November 16, 2016, the last sales price of the Class A shares as reported on the New York Stock Exchange was $25.07 per share.

Limited partnerships are inherently different than corporations, and investing in our Class A shares involves risks that are described in the “Risk Factors” section on page S-14 of this prospectus supplement and page 4 of the accompanying base prospectus.

| Per Class A Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount |

$ | $ | ||||||

| Proceeds, before expenses, to selling security holders |

$ | $ | ||||||

The selling security holders have granted the underwriters a 30-day option to purchase up to an additional 1,200,000 Class A shares on the same terms and conditions as set forth above.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Class A shares will be ready for delivery on or about , 2016.

Sole Book-Running Manager

Goldman, Sachs & Co.

The date of this prospectus supplement is , 2016

Table of Contents

Prospectus Supplement

| Information in This Prospectus Supplement and the Accompanying Prospectus |

S-ii | |||

| S-iv | ||||

| S-v | ||||

| S-1 | ||||

| S-11 | ||||

| S-14 | ||||

| S-15 | ||||

| S-16 | ||||

| S-17 | ||||

| S-19 | ||||

| S-21 | ||||

| S-24 | ||||

| S-24 | ||||

| S-24 | ||||

| S-24 |

Prospectus

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 11 | ||||

| 13 | ||||

| Provisions of our Partnership Agreement Relating to Cash Distributions |

24 | |||

| 26 | ||||

| 33 | ||||

| 35 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

S-i

Table of Contents

INFORMATION IN THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of Class A shares. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of Class A shares. Generally, when we refer only to the “prospectus,” we are referring to both this prospectus supplement and the accompanying base prospectus combined. If the information relating to the offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read “Information Incorporated by Reference” on page S-24 of this prospectus supplement.

We have not, and the underwriters and their affiliates and agents have not, authorized any person to provide any information or represent anything about us other than what is contained in this prospectus. None of the information on our website referred to in this prospectus is incorporated by reference herein. We do not, and the underwriters and their affiliates and agents do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in such documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

None of Tallgrass Energy GP, LP, the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in our Class A shares by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in our Class A shares.

Unless the context otherwise requires, references in this prospectus to the following terms have the meanings set forth below:

| • | “our,” “we,” “us” or “TEGP” refers to Tallgrass Energy GP, LP (NYSE: TEGP) in its individual capacity or to Tallgrass Energy GP, LP and its consolidated subsidiaries collectively (including Tallgrass Equity, TEP and their respective subsidiaries), as the context requires; |

| • | “shares” refers to the Class A shares and Class B shares representing limited partner interests in us, and references to our “shareholders” refer to the persons holding such limited partner interests; |

| • | “our general partner” refers to TEGP Management, LLC, the general partner of Tallgrass Energy GP, LP; |

| • | our “partnership agreement” refers to the First Amended and Restated Agreement of Limited Partnership of Tallgrass Energy GP, LP; |

| • | “TEP” refers to Tallgrass Energy Partners, LP (NYSE: TEP) in its individual capacity or to Tallgrass Energy Partners, LP and its subsidiaries collectively, as the context requires; |

| • | “TEP GP” refers to Tallgrass MLP GP, LLC, the general partner of TEP and holder of all of TEP’s incentive distribution rights and general partner interest; |

S-ii

Table of Contents

| • | “Tallgrass Equity” refers to Tallgrass Equity, LLC, which owns a 100% membership interest in TEP GP and 20 million TEP common units representing an approximate 27.41% limited partner interest in TEP as of November 16, 2016; |

| • | “Holdings” refers to Tallgrass Energy Holdings, LLC in its individual capacity or to Tallgrass Energy Holdings, LLC and its subsidiaries and affiliates, other than our general partner, us and our consolidated affiliates, as the context requires. Holdings is the general partner and owner of 50% of the common limited partner interests of Tallgrass Development and the owner of our general partner; |

| • | “Kelso” refers to Kelso & Company in its individual capacity or to Kelso & Company, its affiliated investment funds that directly or indirectly hold interests in Tallgrass Equity, Tallgrass Development, Holdings and other entities under Holdings’ control, as the context requires; |

| • | “EMG” refers to The Energy & Minerals Group in its individual capacity or to The Energy & Minerals Group, its affiliated investment funds that directly or indirectly hold interests in Tallgrass Equity, Tallgrass Development, Holdings and other entities under Holdings’ control, as the context requires; |

| • | “Tallgrass KC” refers to Tallgrass KC, LLC, which is an entity owned by certain members of our and TEP’s management; |

| • | “Tallgrass Development” refers to Tallgrass Development, LP in its individual capacity or to Tallgrass Development, LP and its subsidiaries, collectively, as the context requires; and |

| • | “Exchange Right Holders” refers to certain persons, including Kelso, EMG and Tallgrass KC, that collectively own 100% of the voting power of Holdings, all of our outstanding Class B shares and an equivalent number of units in Tallgrass Equity, or Tallgrass Equity units. The Exchange Right Holders are entitled to exercise the right to exchange such Tallgrass Equity units (together with an equivalent number of Class B shares) for Class A shares at an exchange ratio of one Class A share for each Tallgrass Equity unit exchanged. |

S-iii

Table of Contents

The market and statistical data included in this prospectus supplement regarding the midstream energy services industry, including descriptions of trends in the market and our position and the position of our competitors within the industry, is based on a variety of sources, including independent industry publications, government publications and other published independent sources, information obtained from customers, distributors, suppliers and trade and business organizations, commissioned reports and publicly available information, as well as our good faith estimates, which have been derived from management’s knowledge and experience in the industry in which we operate. Although we have not independently verified the accuracy or completeness of the third-party information included in this prospectus, based on management’s knowledge and experience, we believe that these third-party sources are reliable and that the third-party information included in this prospectus or in our estimates is accurate and complete. While we are not aware of any misstatements regarding the market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Forward-Looking Statements” and “Risk Factors” in this prospectus supplement.

S-iv

Table of Contents

Some of the information included in this prospectus supplement, the accompanying base prospectus, and the documents we incorporate by reference contain forward-looking statements concerning our operations, economic performance and financial condition. Forward-looking statements give our current expectations and contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “could,” “will,” “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this prospectus supplement and the documents we incorporate by reference include our expectations of plans, strategies, objectives, growth and anticipated financial and operational performance, including guidance regarding our and Tallgrass Development’s infrastructure programs, revenue projections, capital expenditures and tax position. Forward-looking statements can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, when considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| • | our ability to pay distributions to our Class A shareholders; |

| • | our expected receipt of, and amounts of, distributions from Tallgrass Equity; |

| • | TEP’s ability to complete and integrate acquisitions from Tallgrass Development or from third parties, including its acquisition of a 25% membership interest in Rockies Express Pipeline LLC that was completed in May 2016, its purchase of an additional 31.3% membership interest in Tallgrass Pony Express Pipeline, LLC that was completed in January 2016, and its acquisition of water business assets in Weld County, Colorado that was completed in December 2015; |

| • | large or multiple customer defaults, including defaults resulting from actual or potential insolvencies; |

| • | changes in general economic conditions; |

| • | competitive conditions in our industry; |

| • | actions taken by third-party operators, processors and transporters; |

| • | the demand for TEP’s services, including crude oil transportation services, natural gas transportation, storage and processing services and water business services; |

| • | our ability to successfully implement our business plan; |

| • | our ability to complete internal growth projects on time and on budget; |

| • | the price and availability of debt and equity financing; |

| • | the level of production of crude oil, natural gas and other hydrocarbons and the resultant market prices of crude oil, natural gas, natural gas liquids and other hydrocarbons; |

| • | the availability and price of natural gas and crude oil, and fuels derived from both, to the consumer compared to the price of alternative and competing fuels; |

| • | competition from the same and alternative energy sources; |

| • | energy efficiency and technology trends; |

S-v

Table of Contents

| • | operating hazards and other risks incidental to transporting crude oil, transporting, storing and processing natural gas, and transporting, gathering and disposing of water produced in connection with hydrocarbon exploration and production activities; |

| • | natural disasters, weather-related delays, casualty losses and other matters beyond our control; |

| • | interest rates; |

| • | labor relations; |

| • | changes in tax status; |

| • | the effects of existing and future laws and governmental regulations; |

| • | the effects of future litigation; and |

| • | certain factors discussed elsewhere in this prospectus. |

Forward-looking statements speak only as of the date on which they are made. While we may update these statements from time to time, we are not required to do so other than pursuant to the securities laws.

Other factors described or incorporated by reference herein, as well as factors that are unknown or unpredictable, could also have a material adverse effect on future results. Please read “Risk Factors” in this prospectus supplement, in the accompanying base prospectus and in the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus for information regarding risks you should consider before making an investment decision. Except as required by applicable securities laws, we do not intend to update these forward-looking statements and information.

S-vi

Table of Contents

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying base prospectus. This summary does not contain all of the information that you should consider before investing in our Class A shares. You should read the entire prospectus supplement, the accompanying base prospectus and the documents incorporated herein by reference and other documents to which we refer for a more complete understanding of this offering. You should read “Risk Factors” beginning on page S-14 of this prospectus supplement and on page 4 of the accompanying base prospectus for more information about important risks that you should consider carefully before buying our Class A shares.

OVERVIEW

TEGP is a limited partnership that has elected to be treated as a corporation for U.S. federal income tax purposes. We were formed as part of a reorganization involving entities that were previously controlled by Tallgrass Equity in order to effect our initial public offering which was completed on May 12, 2015.

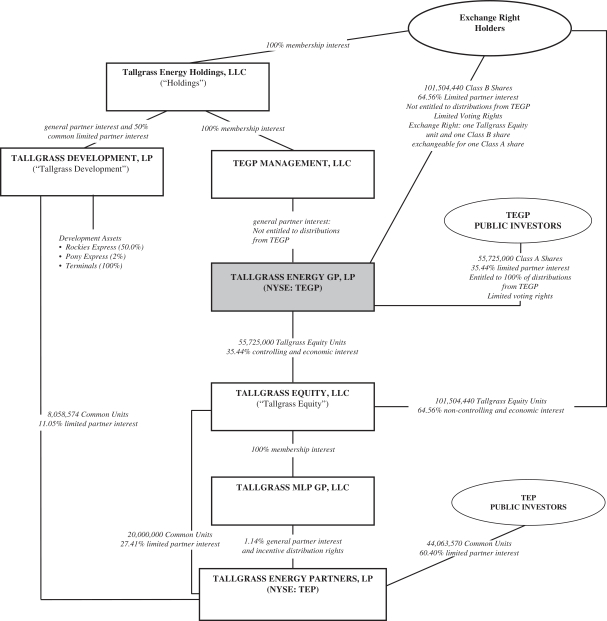

Our sole cash-generating asset is an approximate 30.35% controlling membership interest in Tallgrass Equity. Tallgrass Equity’s sole cash-generating assets consist of the direct and indirect partnership interests in TEP, described below:

| • | 100% of the outstanding membership interests in TEP GP, which owns all of the general partner interest in TEP and all of TEP’s incentive distribution rights. The general partner interest in TEP is represented by 834,391 general partner units, representing an approximate 1.14% general partner interest in TEP at November 16, 2016. |

| • | 20,000,000 TEP common units, representing an approximate 27.41% limited partner interest in TEP at November 16, 2016. |

Based on TEP’s most recent quarterly distribution of $0.795 per TEP common unit for the third quarter of 2016 and the 72,115,405 outstanding TEP common units as of October 31, 2016, aggregate quarterly cash distributions received by Tallgrass Equity were approximately $43.87 million ($26.99 million on incentive distribution rights, $15.9 million on the 20,000,000 TEP common units and $0.98 million on the general partner interest). We and the Exchange Right Holders each received our respective proportionate share of the distributions received with respect to the TEP partnership interests owned by Tallgrass Equity, after Tallgrass Equity deducted certain general, administrative and other similar expenses, our public company expenses and payments of interest on Tallgrass Equity’s outstanding indebtedness. We paid a quarterly cash distribution of $0.2625 per Class A share for the third quarter of 2016, which, based on the 47,725,000 outstanding Class A shares as of October 31, 2016, resulted in an aggregate quarterly cash distribution by us of approximately $12.5 million. This quarterly distribution represents $1.05 per Class A share on an annualized basis, a sequential increase of 7.1% from the second quarter 2016 distribution and an increase of 82.3% from the third quarter 2015 distribution.

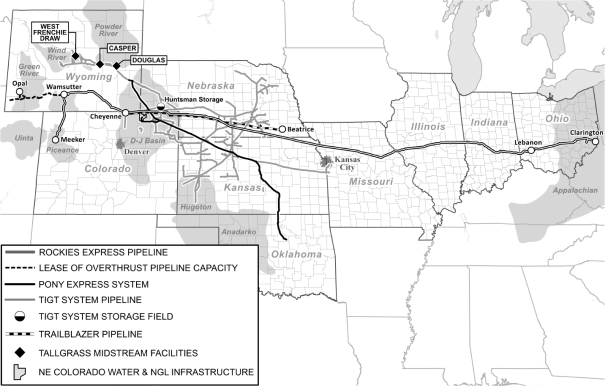

TEP is a publicly traded, growth-oriented limited partnership formed in 2013 to own, operate, acquire and develop midstream energy assets in North America. TEP currently provides crude oil transportation to customers in Wyoming, Colorado, and the surrounding regions through Tallgrass Pony Express Pipeline, LLC (“Pony Express”), which owns a crude oil pipeline commencing in Guernsey, Wyoming and terminating in Cushing, Oklahoma that includes a lateral in Northeast Colorado that commences in Weld County, Colorado, and interconnects with the pipeline just east of Sterling, Colorado (the “Pony Express System”). TEP provides natural gas transportation and storage services for customers in the Rocky Mountain, Midwest and Appalachian regions of the United States through: (1) TEP’s 25% membership interest in Rockies Express Pipeline LLC (“Rockies

S-1

Table of Contents

Express”), a Delaware limited liability company which owns the Rockies Express Pipeline, a FERC-regulated natural gas pipeline system extending from Opal, Wyoming and Meeker, Colorado to Clarington, Ohio (the “Rockies Express Pipeline”), (2) the Tallgrass Interstate Gas Transmission system, a FERC-regulated natural gas transportation and storage system located in Colorado, Kansas, Missouri, Nebraska and Wyoming (the “TIGT System”), and (3) the Trailblazer Pipeline system, a FERC-regulated natural gas pipeline system extending from the Colorado and Wyoming border to Beatrice, Nebraska (the “Trailblazer Pipeline”). TEP also provides services for customers in Wyoming at the Casper and Douglas natural gas processing facilities and the West Frenchie Draw natural gas treating facility (collectively, the “Midstream Facilities”), and natural gas liquids transportation services in Northeast Colorado. TEP performs water business services in Colorado and Texas through BNN Water Solutions, LLC (“Water Solutions”). TEP’s operations are strategically located in and provide services to certain key United States hydrocarbon basins, including the Denver-Julesburg, Powder River, Wind River, Permian and Hugoton-Anadarko Basins and the Niobrara, Mississippi Lime, Eagle Ford, Bakken, Marcellus and Utica shale formations.

TEP intends to continue to leverage its relationship with Tallgrass Development and utilize the significant experience of its management team to execute its growth strategy of acquiring midstream assets from Tallgrass Development and third parties, increasing utilization of its existing assets and expanding its systems through construction of additional assets. TEP’s reportable business segments are:

| • | Crude Oil Transportation & Logistics—the ownership and operation of a FERC-regulated crude oil pipeline system; |

| • | Natural Gas Transportation & Logistics—the ownership and operation of FERC-regulated interstate natural gas pipelines and integrated natural gas storage facilities; and |

| • | Processing & Logistics—the ownership and operation of natural gas processing, treating and fractionation facilities, the provision of water business services primarily to the oil and gas exploration and production industry and the transportation of natural gas liquids. |

S-2

Table of Contents

Tallgrass Energy Partners, LP

TEP’s Assets

TEP’s assets primarily consist of the Pony Express System, the TIGT System, the Trailblazer Pipeline, the Rockies Express Pipeline, the Midstream Facilities, and Water Solutions, each of which is described in more detail below. The following map shows the Pony Express System, the TIGT System, the Trailblazer Pipeline, the Rockies Express Pipeline, the Midstream Facilities, and TEP’s Northeast Colorado and natural gas liquids infrastructure, which includes TEP’s natural gas liquids transportation line and Water Solutions’ freshwater delivery and storage and produced water gathering and disposal systems.

Crude Oil Transportation & Logistics Segment

Pony Express. The Pony Express System is an approximately 764-mile crude oil pipeline commencing in Guernsey, Wyoming, and terminating in Cushing, Oklahoma, with delivery points at the Ponca City Refinery and in Cushing, Oklahoma. It includes a lateral in Northeast Colorado that commences in Weld County, Colorado, and interconnects with the pipeline just east of Sterling, Colorado. TEP believes the Pony Express System is positioned as a low-cost, competitive “base load” alternative with access to the Bakken Shale, DJ Basin and Powder River Basin production. TEP currently owns a 98% membership interest in Pony Express.

S-3

Table of Contents

The table below sets forth certain information regarding TEP’s Crude Oil Transportation & Logistics segment as of December 31, 2015 and for the three months ended December 31, 2015:

| Approximate Design |

Approximate Contractible Capacity Under Contract (2) |

Weighted Average Remaining Firm Contract Life (3) |

Approximate Average Daily Throughput (bbls/d) (4) |

|||||||||

| 320,000 |

100 | % | 4 years | 288,362 | ||||||||

| (1) | Excludes additional capacity related to the Pony Express System’s ability to inject drag reducing agent, which is an additive that increases pipeline flow efficiency. |

| (2) | TEP is required to make no less than ten percent of design capacity available for non-contract, or “walk-up,” shippers. Approximately 100% of the remaining design capacity (or available contractible capacity) is committed under contract. |

| (3) | Based on the average annual reservation capacity for each such contract’s remaining life. |

| (4) | Approximate average daily throughput for the year ended December 31, 2015 was 236,256 bbls/d and is reflective of the volumetric ramp-up during the year due to the construction and expansion efforts of the Pony Express lateral in Northeast Colorado and third-party pipelines with which Pony Express shares joint tariffs. |

Natural Gas Transportation & Logistics Segment

TIGT System. The TIGT System is a FERC-regulated natural gas transportation and storage system with approximately 4,655 miles of varying diameter transportation pipelines serving Wyoming, Colorado, Kansas, Missouri and Nebraska. The TIGT System includes the Huntsman natural gas storage facility located in Cheyenne County, Nebraska. The TIGT System primarily provides transportation and storage services to on-system customers such as local distribution companies and industrial users, including ethanol plants, and irrigation and grain drying operations, which depend on the TIGT System’s interconnections to their facilities to meet their demand for natural gas and a majority of whom pay FERC-approved recourse rates. For the year ended December 31, 2015, approximately 87% of the TIGT System’s transportation revenue was generated from contracts with on-system customers.

Trailblazer Pipeline. The Trailblazer Pipeline is a FERC-regulated natural gas pipeline system with approximately 454 miles of transportation pipelines that begins along the border of Wyoming and Colorado and extends to Beatrice, Nebraska. Substantially all of Trailblazer Pipeline’s currently available design capacity of approximately 902 MMcf/d is subscribed for under firm transportation contracts.

The following tables provide information regarding the TIGT System and the Trailblazer Pipeline as of December 31, 2015 and for the years ended December 31, 2015, 2014 and 2013:

| Approximate Average Daily Throughput (MMcf/d) | ||||||||||||

| Year Ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Transportation |

1,129 | 955 | 991 | |||||||||

| Approximate Number of Miles |

Approximate Capacity |

Total

Firm Contracted Capacity (1) |

Approximate % of Capacity Subscribed under Firm Contracts |

Weighted Average Remaining Firm Contract Life (2) |

||||||||||||||||

| Transportation |

5,109 | 1,982 MMcf/d | 1,428 MMcf/d | 72 | % | 2 years | ||||||||||||||

| Storage |

n/a | 15.974 Bcf | (3) | 11 Bcf | 69 | % | 6 years | |||||||||||||

| (1) | Reflects total capacity reserved under long-term firm fee contracts, including backhaul service, as of December 31, 2015. |

| (2) | Weighted by contracted capacity as of December 31, 2015. |

S-4

Table of Contents

| (3) | The FERC certificated working gas storage capacity. |

Rockies Express Pipeline. TEP owns a 25% membership interest in Rockies Express, a Delaware limited liability company engaged in the ownership and operation of the Rockies Express Pipeline, a FERC-regulated natural gas pipeline system with approximately 1,712 miles of transportation pipelines extending from Opal, Wyoming and Meeker, Colorado to Clarington, Ohio and consisting of three zones:

| • | Zone 1— a 328-mile pipeline from the Meeker Hub in Northwest Colorado, across Southern Wyoming to the Cheyenne Hub in Weld County, Colorado capable of transporting 2.0 Bcf/d of natural gas from west to east; |

| • | Zone 2—a 714-mile pipeline from the Cheyenne Hub to an interconnect in Audrain County, Missouri capable of transporting 1.8 billion cubic feet per day of natural gas from west to east; and |

| • | Zone 3—a 643-mile pipeline from Audrain County, Missouri to Clarington, Ohio, which is bi-directional and capable of transporting 1.8 Bcf/d of natural gas from west to east and 1.8 Bcf/d of natural gas from east to west. |

Rockies Express has long-term agreements to provide west-to-east firm transportation services for approximately 1.6 Bcf/d as of March 31, 2016, with a weighted average remaining contract life on such contracts of approximately 4 years as of December 31, 2015. Rockies Express also has long-term agreements (including binding precedent agreements with respect to the Rockies Express Zone 3 Capacity Enhancement Project) to provide east-to-west firm transportation services in Zone 3 for approximately 2.6 Bcf/d (assuming completion of the Rockies Express Zone 3 Capacity Enhancement Project to add an incremental 0.8 Bcf/d of east to west capacity within Zone 3, currently expected in December of 2016) with a weighted average remaining contract life on such contracts of approximately 17 years as of December 31, 2015. For the year ended December 31, 2015, approximately 98% of Rockies Express’ revenues were generated under firm fee contracts.

In the second quarter of 2016, Rockies Express amended its firm transportation service agreements with Encana Marketing (USA) Inc. (“Encana”), a foundation shipper on the Rockies Express Pipeline, to provide Encana near term rate relief and extend the contract term from 2019 to 2024. This amendment, together with the firm fee contracts for the existing Zone 3 east-to-west capacity and the binding precedent agreements for the Rockies Express Zone 3 Capacity Enhancement Project, are expected to provide Rockies Express revenues beyond 2019 of greater than 75% of Rockies Express’ contracted 2013 west-to-east revenue.

Since 2013, Rockies Express has repaid approximately $450 million of outstanding indebtedness and made approximately $750 million in capital expenditures for internal expansion projects (inclusive of the approximately $285 million expected to be spent from April 1, 2016 through April 2017 on the Rockies Express Zone 3 Capacity Enhancement Project), which has been funded by contributions from its members.

Processing & Logistics Segment

Midstream Facilities. TEP owns and operates natural gas processing plants in Casper and Douglas, Wyoming and a natural gas treating facility at West Frenchie Draw, Wyoming. The Casper and Douglas plants currently have combined processing capacity of approximately 190 MMcf/d. The Casper plant also has a natural gas liquids fractionator with a capacity of approximately 3,500 barrels per day. The natural gas processed and treated at these facilities primarily comes from the Wind River Basin and the Powder River Basin, both in central Wyoming. In the fourth quarter of 2015, TEP completed construction and commenced commercial service on a new natural gas liquids pipeline with an approximate capacity of 19,500 barrels per day that transports natural gas liquids from a processing plant in Northeast Colorado to an interconnect with Overland Pass Pipeline. As of December 31, 2015, approximately 92% of TEP’s reserved processing capacity was subject to firm or volumetric fee contracts, with the majority of fee revenue based on the volumes actually processed. The remaining 8% was subject to commodity sensitive contracts. TEP’s natural gas liquids pipeline in Northeast Colorado is supported by a 10-year lease for 100% of the pipeline capacity, which commenced in the fourth quarter of 2015.

S-5

Table of Contents

The table below sets forth certain information regarding TEP’s Processing & Logistics segment as of December 31, 2015 and for the years ended December 31, 2015, 2014 and 2013:

| Approximate Plant |

Approximate |

Weighted |

Approximate Average Inlet Volumes (MMcf/d) | |||||||||||||||||

| Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

||||||||||||||||||

| 190 |

89 | % | 3 years | 122 | 152 | 133 | ||||||||||||||

| (1) | The West Frenchie Draw natural gas treating facility treats natural gas before it flows into the Casper and Douglas plants and therefore does not result in additional inlet capacity. |

| (2) | Based on the average annual reservation capacity for each such contract’s remaining life. |

Water Solutions. TEP provides water business services through Water Solutions, which owns and operates a freshwater delivery and storage system and a produced water gathering and disposal system in Weld County, Colorado. This system is used to support third party exploration, development, and production of oil and natural gas. Water Solutions also sources treated wastewater from municipalities in Texas and recycles flowback water and other water produced in association with the production of oil and gas in Colorado.

The table below sets forth certain information regarding the Water Solutions assets in TEP’s Processing & Logistics segment as of December 31, 2015 and for the years ended December 31, 2015 and 2014:

| Approximate Capacity Under Contract |

Approximate Current Design Capacity (bbls/d) |

Remaining Contract Life |

Approximate Average Volumes (bbls/d) |

|||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||

| 2015 | 2014 | 2013 | ||||||||||||||||||||||

| Freshwater |

56 | % | 30,863 | (1) | 5 years | 14,579 | 16,433 | — | ||||||||||||||||

| Gathering and Disposal |

80 | % | 35,000 | (2) | 9 years | 7,951 | (2) | — | — | |||||||||||||||

| (1) | Represents the average daily fresh water supply for the BNN Redtail, LLC (“Redtail”) fresh water pipeline acquired in 2014 and the BNN Western, LLC (“Western”) fresh water delivery and storage system in Weld County, Colorado acquired in December 2015. |

| (2) | Represents the daily disposal well injection capacity and the average daily disposal injection volumes, respectively, for Western’s produced water gathering and disposal system in Weld County, Colorado acquired in December 2015. |

TEP’s Strategy

TEP’s principal business objective is to increase its quarterly cash distributions over time while ensuring the ongoing stability of its business. TEP expects to achieve this objective by focusing on the following two core goals:

| • | Investment of Capital in Opportunities Offering Attractive Risk-Adjusted Rates of Return. |

| • | Accretive Acquisitions from Tallgrass Development. Tallgrass Development currently holds the following operating assets, which we refer to as the Development Assets: (i) a 2% membership interest in Pony Express, (ii) a 50% interest in Rockies Express and operation of the Rockies Express Pipeline, and (iii) a 100% interest in Tallgrass Terminals, LLC (“Terminals”). While we expect Tallgrass Development to retain its 2% ownership interest in Pony Express for the foreseeable future, we believe Tallgrass Development will sell its interests in the remaining Development Assets to TEP over time for several reasons, including (a) Tallgrass Development’s obligation under the existing right of first offer in TEP’s favor with respect to its remaining interest in Pony Express and its 50% interest in Rockies Express and the operation of Rockies |

S-6

Table of Contents

| Express Pipeline, which we refer to as the Retained Assets, and (b) Tallgrass Development’s and its affiliates’ substantial aligned economic interests in TEP’s performance and the performance of its general partner. Since TEP’s initial public offering in 2013, TEP has completed four acquisitions from Tallgrass Development with an aggregate purchase price of approximately $2.2 billion. In addition, in 2016, Tallgrass Development assigned to TEP the right to purchase a 25% membership interest in Rockies Express from a unit of Sempra U.S. Gas and Power (“Sempra”), a transaction TEP consummated in May 2016. However, it is uncertain if or when Tallgrass Development will make additional acquisition opportunities available to TEP. |

| • | Organic Development and Increased Utilization. TEP continually evaluates economically attractive, organic expansion opportunities in existing or new areas of operation that will allow it to leverage its market position and other competitive strengths. TEP will continue to target expansion opportunities that are secured by long-term, firm fee contracts. Since 2013, TEP’s management team has completed or is currently overseeing internal expansion projects for TEP and Tallgrass Development totaling over $2 billion of capital expenditures, including approximately (i) $80 million, collectively, on the TIGT System, the Trailblazer Pipeline and the Midstream Facilities, (ii) $1.2 billion on the Pony Express System, (iii) $750 million on the Rockies Express Pipeline and (iv) $70 million at Terminals. TEP’s management team believes that utilizing the existing footprint of both its assets and the Development Assets will continue to provide opportunities for organic growth projects that will generate potentially attractive returns with acceptable levels of business risk. |

| • | Accretive Acquisition from Third-Parties. TEP plans to seek third-party acquisitions of natural gas and crude oil transportation and logistics, natural gas processing, water business services and other energy assets that have characteristics and return opportunities similar to TEP’s current business lines and enable TEP to leverage its existing assets, knowledge and skill sets. |

| • | Financial Stability and Flexibility. |

| • | Stable Operating Cash Flow. TEP will seek to continue to maintain and grow cash flows by increasing utilization of its existing assets in a cost effective manner and by focusing on customer service. TEP’s current contract profile is primarily composed of long-term firm fee contracts. TEP intends to maintain and grow the fee-based component of its contract portfolio through contract renewal negotiations, acquisitions or other growth projects. |

| • | Conservative Capitalization and Financing Policies. TEP intends to continue to target credit metrics consistent with the profile of investment grade midstream energy companies. TEP intends to maintain a conservative and balanced capital structure which, when combined with its stable, fee-based cash flows, will afford it efficient access to the capital markets at a competitive cost of capital. TEP believes this approach will provide it the flexibility to compete for and complete accretive acquisitions and organic growth projects as they become available. |

TEP’s Competitive Strengths

We believe that TEP is well-positioned to successfully execute its strategy because of the following competitive strengths:

| • | Stable Cash Flows Supported by Traditional Midstream Assets. We believe that TEP’s midstream assets, along with its contract profile, give it the ability to maintain stable cash flows and provide operating visibility and flexibility. |

| • | Strategic Infrastructure with Close Proximity to Demand Markets and Supply Sources. We believe TEP’s assets represent an important link to end-user markets in the Midwest and are well positioned to |

S-7

Table of Contents

| provide services to certain key United States hydrocarbon basins, including the Denver-Julesburg, Powder River, Wind River, Permian and Hugoton-Anadarko Basins and the Niobrara, Mississippi Lime, Eagle Ford, Bakken, Marcellus and Utica shale formations. |

| • | Attractive Customer Profile. We believe TEP’s strong customer base, together with its credit approval policies, helps mitigate its potential exposure to defaults by its customers. As of December 31, 2015, greater than 70% of the revenue generated from its top 15 customers (pro forma inclusive of TEP’s 25% membership interest in Rockies Express acquired in May 2016), came from customers rated BB+ or better. |

| • | Relationship with Tallgrass Development. We believe that Tallgrass Development and its affiliates, which directly and indirectly have ownership interests in TEP and its general partner, have substantial aligned economic interests in TEP’s performance and, therefore, are motivated to promote and support the successful execution of TEP’s principal business objectives and to pursue projects that directly or indirectly enhance the value of TEP’s assets. |

| • | Financial Flexibility to Pursue Expansion and Acquisition Opportunities. We believe that TEP’s cash flows and access to debt and equity capital, including through alternative financing arrangements with Tallgrass Development, will provide it financial flexibility to competitively pursue acquisition and expansion opportunities. |

| • | Incentivized Management Team. Members of TEP’s management team are strongly incentivized to grow TEP’s business and cash flows through their direct and indirect ownership interest in Holdings, Tallgrass Equity and TEGP, which are described in more detail under “—Tallgrass Energy Holdings, LLC”. |

TALLGRASS ENERGY HOLDINGS, LLC

Holdings, a privately held limited liability company, is the general partner of Tallgrass Development and owns the general partner of TEGP. As of November 16, 2016, Tallgrass Development owned an approximate 11.05% limited partner interest in TEP and TEGP owned an approximate 30.35% membership interest in (and is the managing member of) Tallgrass Equity, which owned an approximate 27.41% limited partner interest in TEP and, through its ownership of all of the membership interests in TEP’s general partner, TEP’s general partner interest and TEP’s incentive distribution rights. As such, we believe Holdings is motivated to promote and support the successful execution of TEP’s principal business objectives, including the direct or indirect enhancement of the value of TEP’s assets through, for example, the right of first offer with respect to the Retained Assets held by Tallgrass Development, other acquisition opportunities and an executive team with significant industry and management expertise. Although it is uncertain if or when Tallgrass Development will make acquisition opportunities available to TEP, we believe Tallgrass Development will be incentivized to offer TEP the opportunity to acquire the Development Assets and other acquisition opportunities, such as previous offers and sale of the Trailblazer Pipeline, the 98% membership interest in Pony Express and the 25% membership interest in Rockies Express, each of which was immediately accretive to TEP, because of the significant economic interest Tallgrass Development and its affiliates hold in TEP.

PRINCIPAL EXECUTIVE OFFICES AND INTERNET ADDRESS

Our principal executive offices are located at 4200 W. 115th Street, Suite 350, Leawood, Kansas 66211, and our telephone number is (913) 928-6060. Our website is located at www.tallgrassenergy.com. We make available our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (SEC) free of charge through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

S-8

Table of Contents

ORGANIZATIONAL STRUCTURE

Our general partner interest is held by TEGP Management, LLC, whose sole member is Holdings. Holdings is also the general partner of Tallgrass Development. The Exchange Right Holders collectively own 100% of the voting power of Holdings, all of our outstanding Class B shares and an equivalent number of Tallgrass Equity units. The Exchange Right Holders are entitled to exercise the right to exchange their Tallgrass Equity units (together with an equivalent number of Class B shares) for Class A shares at an exchange ratio of one Class A share for each Tallgrass Equity unit exchanged.

While we, like TEP, are structured as a limited partnership, our capital structure and cash distribution policy differ materially from those of TEP. Most notably, (i) we have elected to be treated as a corporation for U.S. federal income tax purposes, (ii) neither our general partner nor the holder of our Class B shares are entitled to receive any distributions from us and (iii) our capital structure does not include incentive distribution rights. Therefore, our distributions are made exclusively to our Class A shares. However, holders of our Class A shares and Class B shares vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or our partnership agreement. The term “shares” used in this prospectus supplement refers to both the Class A shares and Class B shares representing limited partner interests in us.

Our operations are conducted directly and indirectly through, and our operating assets are owned by, our subsidiaries. Our general partner is responsible for conducting our business and managing our operations. However, Holdings effectively controls our business and affairs through the exercise of its rights as the sole member of our general partner, including its right to appoint members to the board of directors of our general partner.

The diagram on the next page depicts our simplified organizational and ownership structure after giving effect to this offering (assuming the underwriters’ option to purchase additional shares is not exercised).

S-9

Table of Contents

S-10

Table of Contents

| Class A shares offered by the selling security holders |

8,000,000 Class A shares, or 9,200,000 Class A shares if the underwriters exercise in full their option to purchase an additional 1,200,000 Class A shares. |

| Option to purchase additional shares |

The selling security holders have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to 1,200,000 additional Class A shares. |

| Class A shares outstanding before this offering |

47,725,000 shares. |

| Class A shares outstanding after this offering |

55,725,000 Class A shares, or 56,925,000 Class A shares if the underwriters exercise in full their option to purchase an additional 1,200,000 Class A shares. |

| Class B shares outstanding after this offering |

101,504,440 Class B shares, or 100,304,440 Class B shares if the underwriters’ option to purchase additional Class A shares is exercised in full. Class B shares vote as a class with Class A shares, but have no right to receive distributions. |

The Class A shares offered hereby will be acquired by the selling security holders immediately prior to the completion of this offering upon exercise by the selling security holders of the Exchange Right for an equivalent number of Class B shares and Tallgrass Equity units. See “Selling Security Holders.”

| Voting power of Class A shares immediately after giving effect to this offering |

35.44%, or 36.21% if the underwriters’ option to purchase additional Class A shares is exercised in full. |

| Voting power of Class B shares immediately after giving effect to this offering |

64.56%, or 63.79% if the underwriters’ option to purchase additional Class A shares is exercised in full. |

| Voting power of TEGP in Tallgrass Equity immediately after giving effect to this offering |

35.44%, or 36.21% if the underwriters’ option to purchase additional Class A shares is exercised in full. |

| When a Tallgrass Equity unit currently held by an Exchange Right Holder is exchanged for a Class A share, TEGP will receive the Tallgrass Equity unit in order to maintain the one-for-one exchange ratio between the Tallgrass Equity units and our Class B shares, on the one hand, and our Class A shares, on the other hand. |

| Use of proceeds |

We will not receive any proceeds from the sale of the Class A shares by the selling security holders in this offering. |

| Please read “Use of Proceeds.” |

S-11

Table of Contents

| Cash distributions |

Our partnership agreement requires that, within 55 days after the end of each quarter, we distribute our available cash to Class A shareholders of record on the applicable record date. We refer to this cash as “available cash,” and it is defined in our partnership agreement. Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions-Our Cash Distribution Policy” in the accompanying base prospectus. |

| Issuance of additional securities |

Our partnership agreement authorizes us to issue an unlimited number of additional Class A shares and other equity securities without the approval of our shareholders. Please read “Description of Our Partnership Agreement—Issuance of Additional Securities” in the accompanying base prospectus. |

| Limited voting rights |

Our general partner manages and operates us. Holders of our Class A shares have only limited voting rights on matters affecting our business. Holders of our Class A shares and Class B shares vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or our partnership agreement. |

| Holders of our Class A shares have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 80% of our outstanding shares, including any shares owned by our general partner, the Exchange Right Holders and their respective affiliates. Following the completion of this offering, the Exchange Right Holders will own an aggregate of approximately 64.56% of our shares, or 63.79% of our shares if the underwriters exercise their option to purchase additional Class A shares in full. Therefore, the Exchange Right Holders have the ability to prevent the involuntary removal of our general partner. Please read “Description of Our Partnership Agreement—Limited Voting Rights” in the accompanying base prospectus. |

| Limited call right |

If at any time our general partner and its affiliates own more than 80% of our outstanding shares, our general partner will have the right, but not the obligation, to purchase all, but not less than all, of the remaining Class A shares at a price not less than the then current market price of the Class A shares as calculated in accordance with our partnership agreement. |

| Exchange Right |

The Exchange Right Holders and any permitted transferees of their Tallgrass Equity units each have the right to exchange all or a portion of their Tallgrass Equity units into Class A shares at an exchange ratio of one Class A share for each Tallgrass Equity unit exchanged, which we refer to as the Exchange Right. The Exchange Right may be exercised only if, simultaneously therewith, an equal number of our Class B shares are transferred by the exercising party to us. Upon such exchange, we will cancel the Class B shares received from the exercising party. |

S-12

Table of Contents

| The above mechanisms are subject to customary conversion rate adjustments for equity splits, equity dividends and reclassifications. |

| If all of the outstanding Tallgrass Equity units held by the Exchange Right Holders were exchanged, along with a corresponding number of Class B shares, for newly-issued Class A shares on a one-for-one basis, the voting power of the Class A shares and Class B shares would be 100% and 0%, respectively. |

| Material U.S. federal income tax consequences |

Although we were formed as a limited partnership, we have elected to be taxed as a corporation for U.S. federal income tax purposes. Under current law, our federal taxable income is subject to a U.S. federal income tax at rates of up to 35% (and a 20% alternative minimum tax on our alternative minimum taxable income in certain cases), and we may be liable for state income taxes at varying rates in states in which TEP operates. Distributions on the Class A shares are treated as distributions on corporate stock for federal income tax purposes. No Schedule K-1s are issued with respect to the Class A shares, but instead a holder of Class A shares receives a Form 1099 from us with respect to distributions received on the Class A shares. Like distributions on corporate stock, our distributions are treated as dividends only to the extent of our current or accumulated earnings and profits (as computed for federal income tax purposes). |

| We anticipate that available deductions will offset our taxable income for, at a minimum, each of the periods ending December 31, 2016, 2017 and 2018, and that during these periods, none of the distributions paid to you should be treated as taxable dividend income under current existing federal tax regulations, but instead will be treated as a return of capital. Distributions not treated as taxable dividends will reduce your tax basis in your Class A shares, or will be taxable as capital gain to the extent they exceed your tax basis in your Class A shares. For additional information, please read “Material U.S. Federal Income Tax Consequences—Consequences to U.S. Holders—Distributions.” |

| In addition, as the Exchange Right Holders exchange their retained interests in Tallgrass Equity and Class B shares in us into our Class A shares in the future, we expect to benefit from additional tax deductions resulting from those exchanges, the amount of which will vary depending on the value of the Class A shares at the time of the exchange. |

| Agreement to be bound by the partnership agreement |

By purchasing a Class A share, you will be deemed to have agreed to be bound by all the terms of our partnership agreement. |

| Listing and trading symbol |

Our Class A shares are listed on the New York Stock Exchange under the symbol “TEGP.” |

S-13

Table of Contents

Our business is subject to uncertainties and risks. Before you invest in our Class A shares, you should carefully consider the risk factors beginning on page 4 of the accompanying base prospectus and those included in our Annual Report on Form 10-K for the year ended December 31, 2015, our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, which are incorporated by reference into this prospectus supplement, together with all of the other information included in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference. If any of the events or circumstances discussed in the foregoing documents or below actually occurs, our business, financial condition, results of operations, liquidity or ability to make distributions could suffer and you could lose all or part of your investment. Please also read “Forward-Looking Statements” in this prospectus supplement and in the accompanying base prospectus.

S-14

Table of Contents

The selling security holders are selling the Class A shares being sold in this offering, including any shares that may be sold in connection with the underwriter’s option to purchase additional shares. See the “Selling Security Holders” section of this prospectus supplement. Accordingly, we will not receive any proceeds from the sale of the Class A shares in this offering.

Tallgrass Equity will pay all expenses in connection with the offering of the Class A shares to be offered by the selling security holders under this prospectus supplement including, without limitation, SEC filing fees and expenses and compliance with state securities laws, except that the selling security holders will pay any underwriting discounts and selling commissions incurred by them in connection with such sales. We will indemnify the selling security holders against liabilities, including liabilities under the Securities Act. We may be indemnified by the selling security holders against liabilities, including liabilities under the Securities Act, which may arise from any written information furnished to us by the selling security holders specifically for use in this prospectus.

S-15

Table of Contents

PRICE RANGE OF CLASS A SHARES AND DISTRIBUTIONS

Our Class A shares trade on the New York Stock Exchange under the symbol “TEGP.” The following table shows the intra-day high and low sales prices per Class A share, as reported by the New York Stock Exchange Composite Transactions Tape, and cash distributions paid per Class A share for the periods indicated.

| Quarter Ended |

High | Low | Distributions per Common Unit |

|||||||||

| December 31, 2016 (1) |

$ | 27.29 | $ | 21.74 | ||||||||

| September 30, 2016 |

$ | 25.99 | $ | 21.88 | $ | 0.2625 | ||||||

| June 30, 2016 |

$ | 26.81 | $ | 16.14 | $ | 0.2450 | ||||||

| March 31, 2016 |

$ | 18.68 | $ | 9.66 | $ | 0.2100 | ||||||

| December 31, 2015 |

$ | 26.10 | $ | 13.30 | $ | 0.1730 | ||||||

| September 30, 2015 |

$ | 32.18 | $ | 17.67 | $ | 0.1440 | ||||||

| June 30, 2015 (2) |

$ | 34.98 | $ | 30.08 | $ | 0.0730 | (3) | |||||

| (1) | The high and low sales prices per Class A share are reported through November 16, 2016. A distribution for the quarter ended December 31, 2016 will not be declared and announced until after the end of the quarter. |

| (2) | The high and low sales prices per Class A share are reported since May 7, 2015, the commencement date of trading. |

| (3) | The distribution represents a prorated amount based upon the number of days between the closing of our initial public offering on May 12, 2015 and the end of the second quarter. |

On November 16, 2016, the last sales price of the Class A shares as reported on the New York Stock Exchange was $25.07 per share. As of November 16, 2016, there was one record holder of our Class A shares.

S-16

Table of Contents

The following table presents information regarding the selling security holders in this offering, the Class A shares that the underwriter has agreed to purchase from the selling security holders and the selling security holders’ Class A shares subject to the underwriter’s option to purchase additional shares. In addition, the nature of any position, office or other material relationship which the selling security holders have had, within the past three years, with us or with any of our predecessors or affiliates, is indicated in a footnote to the table. For information regarding certain material relationships between the selling security holders and us, see, “Certain Relationships and Related Transactions, and Director Independence,” Item 13 of our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 17, 2016. Tallgrass Equity has paid all expenses relating to the registration of the Class A shares by the selling security holders under the Securities Act and will pay any other offering expenses, except that the selling security holders will pay all underwriting discounts and commissions. We will not receive any proceeds from the sale of our Class A shares by the selling security holders.

We prepared the table based on information provided to us by the selling security holders. We have not sought to verify such information.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. As described in “Class A Shares and Class B Shares-Exchange Right” section of the accompanying base prospectus, the holders of Tallgrass Equity units have the right to exchange such Tallgrass Equity units, together with an equal number of Class B shares, for Class A shares on a one-for-one basis.

| Name of Selling |

Class A shares beneficially owned prior to this offering |

Class A shares beneficially owned after this offering |

Additional Class A shares offered if option to purchase additional shares is exercised in full |

Class A shares beneficially owned after this offering if option to purchase additional shares is exercised in full |

||||||||||||||||||||||||||||||||

| Number (1) | % (2) | Combined voting power (3) |

Number of Class A shares offered |

Number | % | Number | % | |||||||||||||||||||||||||||||

| Tallgrass Holdings, LLC(4) |

41,064,165 | 46.2 | % | 26.1 | % | 4,000,000 | 37,064,165 | 39.9 | % | 600,000 | 36,464,165 | 39.0 | % | |||||||||||||||||||||||

| KIA VIII (Rubicon), L.P.(5) |

34,187,117 | 41.7 | % | 21.7 | % | 3,330,117 | 30,857,000 | 35.6 | % | 499,517 | 30,357,482 | 34.8 | % | |||||||||||||||||||||||

| KEP VI AIV (Rubicon), LLC(5) |

5,952,582 | 11.1 | % | 3.8 | % | 579,832 | 5,372,750 | 8.8 | % | 86,975 | 5,285,775 | 8.5 | % | |||||||||||||||||||||||

| Hobbs Ventures, LLC(7) |

472,762 | 1.0 | % | 0.3 | % | 46,051 | 426,711 | 0.8 | % | 6,908 | 419,803 | 0.7 | % | |||||||||||||||||||||||

| Wylie Ventures, LLC(8) |

451,704 | 0.9 | % | 0.3 | % | 44,000 | 407,704 | 0.7 | % | 6,600 | 401,104 | 0.7 | % | |||||||||||||||||||||||

| (1) | Pursuant to Rule 13d-3 under the Exchange Act, a person has beneficial ownership of a security as to which that person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares voting power and/or investment power of such security and as to which that person has the right to acquire beneficial ownership of such security within 60 days. This column represents Class B shares beneficially owned by such persons that can be exchanged for Class A shares on a one-for-one basis pursuant to the Exchange Right. |

| (2) | The percentage of Class A shares shown as being beneficially owned by each person is based on an assumption that each such person exchanged all of such person’s Class B shares for Class A shares pursuant to the Exchange Right and that no other person exercised such other person’s Exchange Right. |

| (3) | Represents the percentage of voting power of the Class A shares and Class B shares held by such person voting together as a single class. |

| (4) | Consists of Class B shares held of record by Tallgrass Holdings, LLC. The manager of Tallgrass Holdings, LLC is EMG Fund II Management, LP. EMG Fund II Management, LP’s general partner is EMG Fund II Management, LLC. John T. Raymond is the sole member of EMG Fund II Management, LLC and as such, has sole voting and dispositive power with respect to the shares held by Tallgrass Holdings, LLC; however he disclaims beneficial ownership of those shares except to the extent of his pecuniary interest therein. John T. Raymond, who serves as the Chief Executive Officer of affiliated investment funds and investment advisers commonly referred to as The Energy & Minerals Group, which includes EMG Fund II Management, LP and EMG Fund II Management, LLC, is one of our directors. Jeffrey A. Ball, who is an employee of The Energy & Minerals Group, is also one of our directors. The address for Tallgrass Holdings, LLC is The Energy & Minerals Group, 811 Main Street, Suite 4200, Houston, TX 77002. |

| (5) | Consists of Class B shares held of record by: (i) KIA VIII (Rubicon), L.P., a Delaware limited partnership, or KIA VIII, and (ii) KEP VI AIV (Rubicon), LLC, a Delaware limited liability company, or KEP VI AIV. KIA VIII and KEP VI AIV, due to their common control, could be deemed to beneficially own each of the other’s shares. Each of KIA VIII and KEP VI AIV disclaim such beneficial ownership. Frank T. Nickell, Thomas R. Wall, IV, George E. Matelich, Michael B. Goldberg, David I. Wahrhaftig, Frank K. Bynum, Jr., Philip E. Berney, Frank J. Loverro, James J. Connors, II, Church M. Moore, Stanley de J. Osborne, Christopher L. Collins, A. Lynn Alexander, Howard A. Matlin, John K. Kim, Henry Mannix, III, Matthew S. Edgerton and Stephen C. Dutton (the “Kelso Individuals”) may be deemed to share beneficial ownership of shares held of record or beneficially owned by KIA VIII and KEP VI AIV, by virtue of their status as managing members of KEP VI AIV and of Kelso GP VIII, LLC, a Delaware limited liability company, the principal business of which is serving as the general partner of KIA VIII |

S-17

Table of Contents

| (Rubicon) GP, L.P., a Delaware limited partnership, the principal business of which is serving as the general partner of KIA VIII. Each of Kelso GP VIII, LLC and KIA VIII (Rubicon) GP, L.P. due to their common control, could be deemed to beneficially own each other’s securities and the shares held of record or beneficially owned by KIA VIII and KEP VI AIV, Kelso GP VIII, LLC disclaims beneficial ownership of all of the securities owned of record, or deemed beneficially owned, by KIA VIII (Rubicon) GP, L.P., KIA VII and KEP VI AIV, except to the extent, if any, of its pecuniary interest therein, and the inclusion of these securities in the table above shall not be deemed an admission of beneficial ownership of all the reported securities for any purpose. KIA VIII (Rubicon) GP, L.P. disclaims beneficial ownership of all of the securities owned of record, or deemed beneficially owned, by Kelso GP VIII, LLC, KIA VIII and KEP VI AIV, except to the extent, if any, of its pecuniary interest therein, and the inclusion of these securities in the table above shall not be deemed an admission of beneficial ownership of all the reported securities for any purpose. The Kelso Individuals may be deemed to share beneficial ownership of securities owned of record or beneficially owned by Kelso GP VIII, LLC, KIA VIII (Rubicon) GP, L.P., KIA VIII and KEP VI AIV, by virtue of their status as managing members of Kelso GP VIII, LLC and KEP VI AIV, but disclaim beneficial ownership of such securities, and the inclusion of these securities in the table above shall not be deemed an admission that any of the Kelso Individuals is the beneficial owner of these securities for any purposes. Frank J. Loverro, who serves as a Managing Director and Co-Chief Executive Officer of Kelso & Company, which manages the investments in KIA VIII, KEP VI AIV, is one of our directors. Stanley de J. Osborne, who serves as a Managing Director of Kelso & Company, is also one of our directors. The business address for these persons is c/o Kelso & Company, 320 Park Avenue, 24th Floor, New York, NY 10022. |

| (6) | Consists of Class B shares held of record by Hobbs Ventures, LLC. Charles Scott Hobbs has sole voting and dispositive power with respect to the shares held by Hobbs Ventures, LLC; however he disclaims beneficial ownership of those shares except to the extent of his pecuniary interest therein. The address for Hobbs Ventures, LLC is 211 W. Del Norte Street, Colorado Springs, CO 80907. |

| (7) | Consists of Class B shares held of record by Wylie Ventures, LLC. Forrest E. Wylie has sole voting and dispositive power with respect to the shares held by Wylie Ventures, LLC; however he disclaims beneficial ownership of those shares except to the extent of his pecuniary interest therein. The address for Wylie Ventures, LLC is 2210 Marguerite Street, Bay City, TX 77414. |

S-18

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

The tax consequences to you of an investment in our Class A shares will depend in part on your own tax circumstances. Although this section updates and adds information related to certain tax considerations, it should be read in conjunction with the risk factors included under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, as updated by our other filings with the SEC incorporated by reference herein, and with “Risk Factors” and “Material U.S. Federal Income Tax Consequences” in the accompanying base prospectus, which provide a discussion of the principal federal income tax considerations associated with the purchase, ownership and disposition of our Class A shares.

The following discussion is limited as described under the caption “Material U.S. Federal Income Tax Consequences” in the accompanying base prospectus. You are urged to consult with, and depend upon, your own tax counsel or advisor about the federal, state, local and foreign tax consequences particular to your circumstances.

TEP Partnership Status

Section 7704 of the Internal Revenue Code of 1986, as amended (the “Code”) provides that publicly traded partnerships will, as a general rule, be taxed as corporations. However, an exception, referred to as the “Qualifying Income Exception,” exists with respect to a publicly traded partnership if 90.0% or more of the publicly traded partnership’s gross income for every taxable year consists of “qualifying income.” Qualifying income includes income and gains derived from the transportation, storage, processing and marketing of crude oil, natural gas and other products thereof. Other types of qualifying income include interest (other than from a financial business), dividends, gains from the sale of real property and gains from the sale or other disposition of capital assets held for the production of income that otherwise constitutes qualifying income. TEP estimates that less than 7% of its current gross income is not qualifying income; however, this estimate could change from time to time. Based upon and subject to this estimate, the factual representations made by TEP and its general partner and a review of the applicable legal authorities, Baker Botts L.L.P. is of the opinion that at least 90.0% of TEP’s current gross income constitutes qualifying income, that TEP will be classified as a partnership for federal income tax purposes, and that each of TEP’s operating subsidiaries, other than Tallgrass Energy Finance Corp. and Tallgrass Colorado Pipeline, Inc., will be disregarded as an entity separate from TEP or will be treated as a partnership for federal income tax purposes.

In rendering its opinion, Baker Botts L.L.P. has relied on factual representations made by TEP and its general partner. The representations made by TEP and its general partner upon which Baker Botts L.L.P. has relied include:

| • | Neither TEP nor any of its operating subsidiaries, other than Tallgrass Energy Finance Corp. and Tallgrass Colorado Pipeline, Inc., is organized as, has elected to be treated as or will elect to be treated as a corporation for U.S. federal income tax purposes; and |

| • | For every taxable year, more than 90.0% of TEP’s gross income has been and will be income of the type that Baker Botts L.L.P. has opined or will opine is “qualifying income” within the meaning of Section 7704(d) of the Code. |

Distributions

Distributions with respect to our Class A shares will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits. Our earnings and profits generally will equal the taxable income allocated to us by TEP, with certain adjustments. These adjustments include recovering depreciation costs more slowly than permitted in computing taxable income and will generally result in our having earnings and profits in excess of our taxable income. To the extent that the amount of a distribution with respect to our Class A shares exceeds our current and accumulated earnings and profits,

S-19

Table of Contents

such distribution will be treated first as a tax-free return of capital to the extent of the U.S. holder’s adjusted tax basis in such Class A shares, which reduces such basis dollar-for-dollar, and thereafter as capital gain. Such gain will be long-term capital gain provided that the U.S. holder has held such Class A shares for more than one year as of the time of the distribution. Subject to the discussion in the accompanying base prospectus under “Material U.S. Federal Income Tax Consequences—3.8% Tax on Unearned Income,” non-corporate holders that receive distributions on our Class A shares that are treated as dividends for U.S. federal income tax purposes generally would be subject to U.S. federal income tax at a maximum tax rate of 20% on such dividends provided certain holding period requirements are met. U.S. corporate holders of our Class A shares that receive a distribution from us treated as a dividend for U.S. federal income tax purposes may be eligible for the corporate dividends-received deduction (subject to certain limitations, including limitations on the aggregate amount of the deduction that may be claimed and limitations based on the holding period of the Class A shares on which the dividends were paid, which holding period may be reduced if the holder engages in risk reduction transactions with respect to its Class A shares).

As a result of the application of the principles of Section 704(c) of the Code to our investment in Tallgrass Equity and the elections made by Tallgrass Equity and TEP under Section 754 of the Code, we are entitled to depreciation and amortization deductions with respect to the assets of TEP computed as if those assets had a tax basis equal to their fair market value at the time of our investment. This will result in depreciation and amortization deductions that we anticipate will offset a substantial portion of our taxable income for, at a minimum, each of the periods ending December 31, 2016, 2017, and 2018. In addition, future exchanges of retained interests in Tallgrass Equity and Class B shares in us for our Class A shares generally will result in additional basis adjustments with respect to our interest in the assets of Tallgrass Equity (and indirectly in TEP). We expect to benefit from additional tax deductions resulting from those adjustments, the amount of which will vary depending on the value of the Class A shares at the time of the exchange.

We anticipate that available deductions will offset our taxable income for, at a minimum, each of the periods ending December 31, 2016, 2017 and 2018, and that during this period none of the distributions paid to you should be treated as taxable dividend income under current existing federal tax regulations, but instead will be treated as a return of capital. This estimate is based on assumptions with respect to TEP’s earnings from its operations, the amount of those earnings allocated to us, our income tax liabilities, the amount of distributions paid to us by TEP, and that there will not be an issuance of significant additional units by TEP without a corresponding increase in the aggregate tax deductions generated by TEP. This estimate is subject to, among other things, numerous business, economic, regulatory, legislative, competitive and political uncertainties beyond our control. Further, this estimate is based on current tax law and tax reporting positions that we and TEP will adopt and with which the Internal Revenue Service could disagree. Accordingly, we cannot assure you that this estimate will prove to be correct. The actual number of years in which distributions paid to you are treated as a return of capital could be more or fewer than estimated, and any differences could be material and could materially affect the value of our Class A shares.

Prospective investors in our Class A shares are encouraged to consult their tax advisors as to the tax consequences of receiving distributions on our Class A shares that do not qualify as dividends for U.S. federal income tax purposes, including, in the case of prospective corporate investors, the inability to claim the corporate dividends received deduction with respect to such distributions.

S-20

Table of Contents

Goldman, Sachs & Co. is acting as sole underwriter for this offering. The company, the selling security holders and the underwriter have entered into an underwriting agreement with respect to the Class A shares being offered. Subject to certain conditions, the underwriter has agreed to purchase 8,000,000 Class A shares.

The underwriter is committed to take and pay for all of the Class A shares being offered, if any are taken, other than the Class A shares covered by the option described below unless and until this option is exercised.

The underwriter has an option to buy up to an additional 1,200,000 Class A shares from the selling security holders. It may exercise that option for 30 days.

The following table shows the per share and total underwriting discounts and commissions to be paid to the underwriter by the selling security holders. Such amounts are shown assuming both no exercise and full exercise of the underwriter’s option to purchase 1,200,000 additional Class A shares.

| Paid by the Selling Security Holders |

||||||||

| No Exercise | Full Exercise | |||||||

| Per Class A share |

$ | $ | ||||||

| Total |

$ | $ | ||||||

Class A shares sold by the underwriter to the public will initially be offered at the initial public offering price set forth on the cover of this prospectus. Any Class A shares sold by the underwriter to securities dealers may be sold at a discount of up to $ per Class A share from the initial public offering price. After the initial offering of the Class A shares, the underwriter may change the offering price and the other selling terms. The offering of the Class A shares by the underwriter is subject to receipt and acceptance and subject to the underwriter’s right to reject any order in whole or in part.

The company and the selling security holders have agreed with the underwriter, subject to certain exceptions, not to dispose of or hedge any of their Class A shares or securities convertible into or exchangeable for Class A shares during the period from the date of this prospectus supplement continuing through the date 120 days after the date of this prospectus supplement, except with the prior written consent of the underwriter. This agreement does not apply to any existing employee benefit plans.