Table of Contents

Index to Financial Statements

As Filed with the Securities and Exchange Commission on October 6, 2016

Registration No. 333-208584

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 8

to

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Azure Power Global Limited

(Exact name of Registrant as specified in its Constitution)

| Mauritius | 4931 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Inderpreet Singh Wadhwa

Chief Executive Officer

8 Local Shopping Complex

Pushp Vihar, Madangir, New Delhi 110062, India

Telephone: (91-11) 49409800

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue, 13th Floor, New York, NY 10011

Telephone: (212) 894-8940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Thomas J. Ivey, Esq. Andrea Nicolas, Esq. Rajeev Duggal, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 525 University Avenue #1400 Palo Alto, CA 94301 |

Kirk A. Davenport II, Esq. Wesley C. Holmes, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum offering price(1)(2) |

Amount of registration fee(3) | ||

| Equity shares, par value US$0.000625 per equity share |

US$ 90,170,465 | US$ 10,450.70 | ||

|

| ||||

|

| ||||

| (1) | Includes (a) all equity shares that may be purchased by the underwriters pursuant to an over-allotment option, and (b) all equity shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this Registration Statement and the date the equity shares are first bona fide offered to the public. The equity shares are not being registered for the purpose of sales outside the United States. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| (3) | The Registrant previously paid $18,161 of the total registration fee in connection with the prior filings of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated October 6, 2016

PROSPECTUS

3,409,091 Equity Shares

Azure Power Global Limited

This is the initial public offering of the equity shares of Azure Power Global Limited. We are offering 2,454,546 equity shares and the selling shareholders identified in this prospectus are offering 954,545 equity shares. We will not receive any of the proceeds from the sale of the shares by the selling shareholders. No public market currently exists for our equity shares.

We have applied to list our equity shares on the New York Stock Exchange under the symbol “AZRE.”

We anticipate that the initial public offering price will be between US$21.00 and US$23.00 per equity share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our equity shares involves risks. See “Risk Factors” beginning on page 20 of this prospectus.

| Per Share | Total | |||||||

| Price to the public |

US$ | US$ | ||||||

| Underwriting discounts and commissions(1) |

US$ | US$ | ||||||

| Proceeds to us (before expenses) |

US$ | US$ | ||||||

| Proceeds to the selling shareholders (before expenses) |

US$ | US$ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 175 of this prospectus for additional information regarding total underwriter compensation. |

CDPQ Infrastructures Asia Pte Ltd., or CDPQ, a wholly owned subsidiary of Caisse de dépôt et placement du Québec, has entered into a share purchase agreement pursuant to which it has agreed to purchase $75 million of newly issued equity shares from us at a price per share equal to the lesser of $22.00 per equity share and the initial public offering price to the public in a separate private placement transaction. The underwriters will serve as placement agents for such concurrent private placement and receive a placement agent fee equal to 7% of the total purchase price of the private placement equity shares. The private placement is expected to close immediately after this offering. The issuance and sale of equity shares to CDPQ are being made in reliance on an exemption from registration contained in Regulation S under the Securities Act.

We have granted the underwriters the option to purchase 511,364 additional equity shares on the same terms and conditions set forth above if the underwriters sell more than 3,409,091 equity shares in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the equity shares on or about , 2016.

| Barclays | Credit Suisse |

| Roth Capital Partners |

Prospectus dated , 2016

Table of Contents

Index to Financial Statements

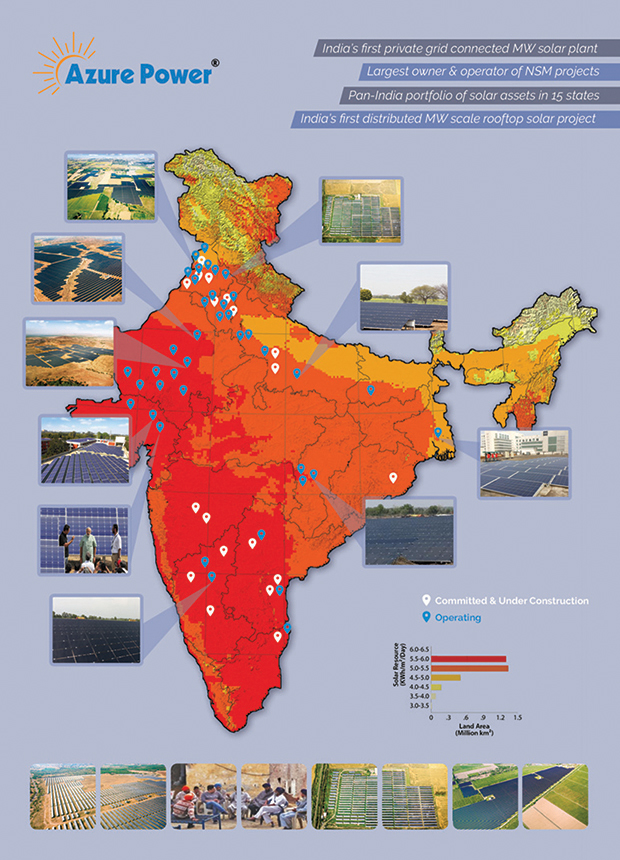

Azure Power® India’s first private grid connected MW solar plant Largest owner & operator of NSM projects Pan-India portfolio of solar assets in 15 states India’s first distributed MW scale rooftop solar project Commited & Under Construction Operating Solar Resource (KWh/m2/Day) 3.0-3.5 3.5-4.0 4.0-4.5 4.5-5.0 5.0-5.5 5.5-6.0 6.0-6.5 0 .3 .6 .9 1.2 1.5 Land Area Million km2

Table of Contents

Index to Financial Statements

|

Azure Power®POWERING UTILITIES Developed India’s first

utility scale solar project in 2009 23 operational utility scale projects

Integrated project development, EPC, financing, O&M services POWERING COMMERCIAL

First distributed solar rooftop operational in India 500+ rooftops covered across the country Solar tariffs in most states are already at grid parity COMMUNITY ENGAGEMENT We hire from local communities Lease land that has few alternative uses

Provide a stream of discretionary cash flow without displacing alternative businesses 100 MW, LARGEST OPERATING PROJECT UNDER NATIONAL SOLAR MISSION

1.46 MW,

LARGEST SCALE DISTRIBUTED USE OF SOLAR POWER FOR LEADING GLOBAL COMPANIES

Table of Contents

Index to Financial Statements

| Page | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 20 | ||||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 60 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

65 | |||

| 100 | ||||

| 110 | ||||

| 135 | ||||

| 147 | ||||

| 150 | ||||

| 153 | ||||

| 165 | ||||

| 167 | ||||

| 173 | ||||

| 175 | ||||

| 183 | ||||

| 184 | ||||

| 184 | ||||

| 184 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. We and the selling shareholders have not, and the underwriters have not, authorized any person to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the equity shares or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus applicable to that jurisdiction.

Table of Contents

Index to Financial Statements

STATISTICAL AND OTHER INDUSTRY AND MARKET DATA

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

We have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product names and website names. Other trademarks and trade names appearing in this prospectus are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this prospectus are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks and trade names.

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Except where the context requires otherwise and for purposes of this prospectus only:

| • | “Azure Power Global,” “we,” “us,” the “Company” or “our” refer to Azure Power Global Limited, together with its subsidiaries (including Azure Power India Private Limited, or AZI, its predecessor and current subsidiary). |

| • | “Our holding company” refers to Azure Power Global Limited on a standalone basis. |

| • | “GAAP” refers to the Generally Accepted Accounting Principles in the United States. |

| • | “US$” or “U.S. dollars” refers to the legal currency of the United States. |

| • | “Rs.,” “rupees” or “Indian rupees” refers to the legal currency of India. |

In this prospectus, references to “U.S.” or the “United States” are to the United States of America, its territories and its possessions. References to “India” are to the Republic of India, and references to “Mauritius” are to the Republic of Mauritius.

Unless otherwise indicated, the consolidated financial statements and related notes included in this prospectus have been presented in Indian rupees and prepared in accordance with GAAP. References to a particular “fiscal” year are to our fiscal year ended March 31 of that year, which is typical in our industry and in the jurisdictions in which we operate. Our fiscal quarters end on June 30, September 30, December 31 and March 31. References generally to a fiscal year refer to the Indian fiscal year ended March 31 of the respective period.

This prospectus contains translations of certain Indian rupee amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, the translation of Indian rupees into U.S. dollars has been made at Rs. 67.51 to US$1.00, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2016, which is the date of our last reported financial statements. We make no representation that the Indian rupee or U.S. dollar amounts referred to in this prospectus could have been converted into U.S. dollars or Indian rupees, as the case may be, at any particular rate or at all.

As used in this prospectus, all references to watts (e.g., megawatts, gigawatts, kilowatt hour, terawatt hour, MW, GW, kWh, etc.) refer to measurements of power generated.

The information in this prospectus gives effect to a 16-for-1 stock split of our equity shares that was effective on October 6, 2016.

ii

Table of Contents

Index to Financial Statements

This summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and consolidated financial statements and the related notes thereto included elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our equity shares. You should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before making an investment decision.

Overview

Our mission is to be the lowest-cost power producer in the world. We sell solar power in India on long-term fixed price contracts to our customers, at prices which in many cases are at or below prevailing alternatives for these customers. We are also developing micro-grid applications for the highly fragmented and underserved electricity market in India. Since inception, we have achieved an 83% reduction in total solar project cost, which includes a significant decrease in balance of systems costs due in part to our value engineering, design and procurement efforts.

We developed India’s first utility scale solar project in 2009. As of July 31, 2016, we operated 24 utility scale projects and several commercial rooftop projects with a combined rated capacity of 357MW which represents a compound annual growth rate, or CAGR, of 114% from July 2012. As of such date we were also constructing 12 projects with a combined rated capacity of 390MW and had an additional 258MW committed, bringing our total portfolio capacity to 1,005MW. Megawatts committed represents the aggregate megawatt rated capacity of solar power plants pursuant to customer power purchase agreements, or PPAs, signed or allotted or where we have been declared as one of the winning bidders, but not yet commissioned and operational as of the reporting date. We are targeting having 520MW operating by December 31, 2016. Our longer term goal is to achieve 5GW committed or operating by December 31, 2020. Our ability to achieve these goals will depend on, among other things, our ability to acquire the required land for the new capacity (on lease or direct purchase), raising adequate project financing and working capital, the growth of the Indian power market in line with current government targets, our ability to maintain our market share of India’s installed capacity as competition increases, the need to further strengthen our operations team to execute the increased capacity, and the need to further strengthen our systems and processes to manage the ensuing growth opportunities, as well as the other risks and challenges discussed under the caption “Risk Factors.”

Utility scale solar projects are typically awarded through government auctions. We believe we have secured more megawatts of capacity in these auctions in the last seven years than any other company in India. We believe the strong demand for our solar power is a result of the following:

| • | Low levelized cost of energy. Our in-house engineering, procurement and construction, or EPC, expertise, purely solar focus, advanced in-house operations and maintenance, or O&M, capability and efficient financial strategy allow us to offer low-cost solar power solutions. |

| • | Strong value proposition for our customers. We manage the entire development and operation process, providing customers with long term fixed price PPAs in addition to high levels of availability and service. This helps us win repeat business. |

| • | Our integrated profile supports growth. Our integrated profile affords us greater control over project development, construction and operation, which provides us with greater insight and certainty on our construction costs and timeline. |

| • | Strong community partnerships. Our ability to build long term community relationships allows us to improve our time of completion, further reducing project development risk. |

1

Table of Contents

Index to Financial Statements

| • | We take a leading role in policy initiatives. We provided input to the government to help it design an auction process supporting multiple winners at differentiated price points and implementing a transparent bidding process open to all participants. For example, we suggested that the government include compulsorily convertible debentures in the calculation of a bidder’s net worth for the purposes of tender qualification, which was ultimately adopted by the government. |

We generate revenue from a mix of leading government utilities and commercial entities. Because we have our own EPC and O&M capabilities, we retain the profit margins associated with those services that other project developers may need to pay to third-party providers.

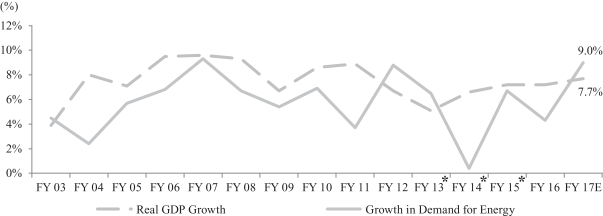

Market Opportunity

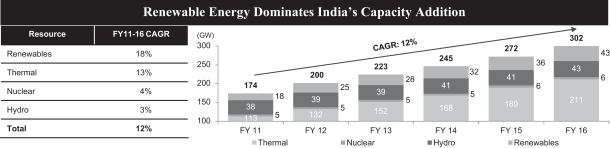

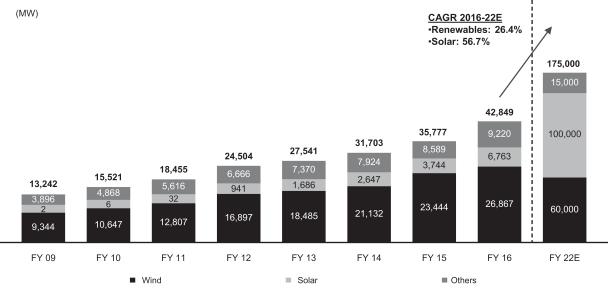

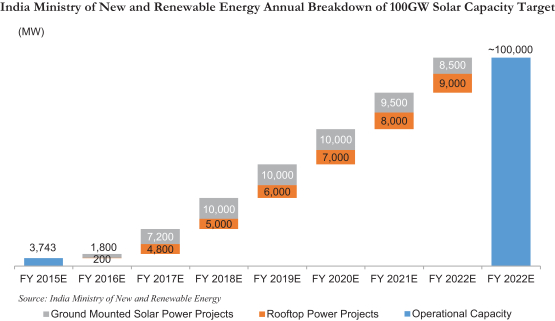

India’s economic growth is intrinsically linked to the increasing consumption of energy and natural resources. Energy demand has outpaced capacity additions in recent years, which has resulted in persistent peak power deficits in the country. Solar is an attractive option to help address this energy gap driven by regional fundamentals and regulatory support by the Indian government. The Indian government increased its 2022 target for solar capacity from 20GW to 100GW.

The following trends have made solar a large, rapidly growing market opportunity:

| • | Peak power deficits and rising power prices. India continues to be plagued by a persistent demand/supply mismatch with a five-year average energy deficit of approximately 5% through March 2016 according to the Ministry of Power, which has resulted in upward pressure in power prices. |

| • | Strong regulatory support. In order to reduce dependence on energy imports and curtail the current trade deficit and the resulting impact on the rupee, the Indian government has taken a number of steps to incentivize the use of renewable sources of energy. These include establishing state-level renewable power purchase obligations and providing capital subsidies (known as viability gap funding) to solar project developers to make solar tariffs competitive in the country. To provide further impetus to solar growth, the Indian government launched the Jawaharlal Nehru National Solar Mission, or the NSM, in 2010. |

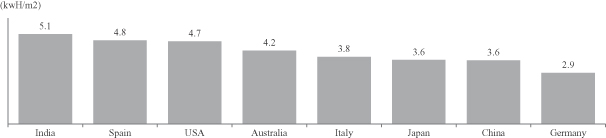

| • | Solar positioned to win among alternatives. India ranks among the highest irradiation-receiving countries in the world with more than 300 days of sunshine per year in much of the country. Solar power generation is viable across most of India, unlike wind and hydro resources which are concentrated in specific regions. In addition, as solar plants can be built near the point of consumption, power produced generally does not incur expensive transmission charges or require infrastructure or transmission investments. Further, unlike nuclear and hydropower, solar power has fewer legal liabilities and environmental constraints. |

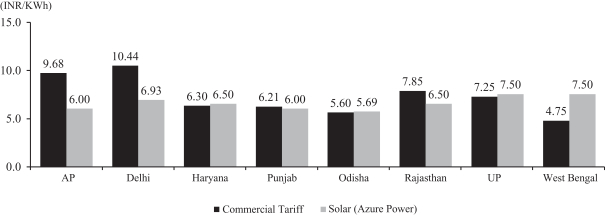

| • | Solar approaching parity. State utilities have seen power costs rise as domestic coal shortages have caused thermal generators to increasingly rely on more expensive imported fuels. An analysis of current tariffs in India indicates that solar power is now competitive with wind, new thermal capacity fueled by imported coal and grid power tariffs for commercial users. Further, diesel power, the most common replacement power source for commercial and off-grid users in the country, is far more expensive than solar power. Additionally, solar panel prices are expected to fall further, which in turn is expected to drive further reductions in solar tariffs. |

| • | Transparent solar auction process. Indian solar auctions are conducted in a transparent manner that ensures bids meet minimum technical and financial criteria. Bidders must meet requirements on project development and execution history in India or the regional market, including bidder experience in the development of similar utility scale power projects. Auctions are not winner-take-all; instead, they are constructed to ensure multiple high-quality developers are allotted portions of the total capacity block. |

2

Table of Contents

Index to Financial Statements

These factors have increased the solar installation to approximately 6.8GW as of March 31, 2016, of which 5.5GW is operating under various state policies and the NSM. Approximately 7.8GW of tenders have been announced under various state policies. In addition, auctions allocating 4.3GW of projects are expected to be announced or completed under the NSM by the end of fiscal year 2017.

Our Approach

We sell energy to government utilities and independent industrial and commercial customers at predictable fixed prices. Since our energy generation does not rely on fossil fuels, our electricity prices are insulated from the volatility of commodity pricing. We also guarantee the electricity production of our solar power plants to our customers.

The typical project plan timeline for our projects is approximately one year. The major stages of project sourcing, development and operation are bidding, land acquisition, financing, material delivery and installation, and monitoring and maintenance. Once a bid is won, a letter of intent is issued and all of our departments initiate their activities. After that, the PPA is signed, which reflects the commercial operation date before which a plant should be commissioned. Generally once the letter of intent is received, we obtain the relevant land permits depending on whether the land is government-owned or private. We generally finance our projects with 75:25 debt-to-equity ratio. Once land is obtained, our EPC team works very closely to construct and deliver the plant in the most efficient manner. Once commissioned, our O&M team monitors performance of all the projects near real time.

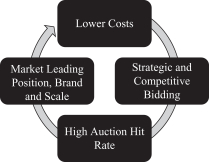

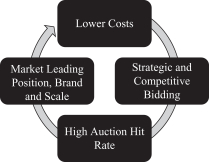

We utilize our integrated project development, EPC, financing and O&M services without involving multiple third-party services. This approach has allowed us to generate efficiencies of scale that further drive down system costs. A low cost structure allows us to bid for auctions strategically, which supports our high auction win rate and helps preserve our market leading position, which further reduces costs.

As the first developer and operator of utility scale solar assets in India, we believe that we are a well-established brand that has grown alongside the burgeoning Indian solar market since 2009. We have proven to be a reliable developer that successfully and expediently executes on our development pipeline and wins repeat business. Our reputation and track record give us an advantage in the auction evaluation process, improving our win rate. As a result, we believe we have become one of the largest purely solar operators in the space, which affords us greater negotiating power with original equipment manufacturers and project finance lenders. This in turn improves our cost and capital structure, which benefits our bid win rate.

We lower the levelized cost of energy through our three-pronged approach as follows:

| • | Value engineering. Our in-house EPC allows us to enhance our system design expertise with each successive project, be flexible with our choice of technology and source from top-tier suppliers that optimizes both the system cost and power yield of the total solar block. |

3

Table of Contents

Index to Financial Statements

| • | Operational performance monitoring. We operate a National Operating Control Center, or NOCC, that allows us to monitor project performance in real-time and allows us to respond rapidly to potential generation anomalies. Feedback from our operating projects also serves to further enhance our project designs, resulting in enhancements for current and new plants. |

| • | Financial strategy. We are able to offset project equity requirements through economic benefits generated by our EPC and O&M businesses. Coupled with our asset financing strategy we are able to optimize the overall cost of capital leading to enhanced economics for our customers and shareholders. |

Our Competitive Strengths

We believe we differentiate ourselves from the competition in a number of key ways.

| • | Market leadership. We have a first mover advantage from the construction of India’s first private utility scale solar photovoltaic power plant in 2009 as well as the implementation of the first megawatt scale rooftop smart city initiative in 2013. Additionally, our strong track record in policy and project development across utility scale, commercial rooftop and micro-grids projects has helped us gain a leading market share in India with an 10.3% share in federal tenders we participated in between March 2014 and July 2016 and a market leading auction win rate of 73% for bids we participated in from 2010 to July 31, 2016. |

| • | Scale and brand-name recognition. We have proven to be a reliable developer with successful and expedient execution of our development pipeline, which has helped us win repeat business. Our reputation and track record provide us an advantage in the auction evaluation process, thereby improving our win rate. As a result, we believe we have become one of the largest solar developers and operators in India. |

| • | In-house EPC and O&M expertise enable cost efficiencies. Our in-house EPC capabilities enhance our ability to be flexible with our choice of technology, which allows us to choose high quality equipment while optimizing the combination of total solar project cost and yield. Our in-house O&M capabilities maximize project yield and performance through proprietary system monitoring and adjustments. We have demonstrated an 83% decrease in total solar project cost since inception in part through continual innovation in our EPC and O&M capabilities. |

| • | Superior technical and execution capabilities. We have developed proprietary systems that significantly reduce the time it takes to design, finance, commission, operate and maintain projects. Our lean and efficient execution expertise facilitates completion of our plants ahead of contracted completion dates, enables us to easily scale our operations without significant increases to headcount, and allows us to construct several projects in parallel without compromising on efficiency. |

| • | Long term, stable cash generation. We typically enter into 25-year, fixed price PPAs with government agencies and independent commercial businesses. As a result of generally reliable solar irradiation in India, our energy production under these PPAs has historically had little volatility, which, coupled with our low operating expenses, makes for predictable cash flows from these agreements. |

| • | Long term community support. We hire from local communities and generally lease land that has few alternative uses, providing local communities with a stream of discretionary cash flow without displacing alternative businesses. As a result we are able to build long term community relationships, which allows us to improve our time of completion, further reducing project development risk. |

| • | Strong management. Our senior leadership team and board of directors include widely recognized experts in solar energy, energy finance and public policy, with track records of building successful businesses. |

4

Table of Contents

Index to Financial Statements

Our Business Strategy

Key elements of our business strategy include the following.

| • | Continue to drive project cost reductions. We will continue to reduce costs by leveraging our in-house EPC and O&M capabilities and by improving our negotiating power with technology providers and project lenders. We expect to further innovate our financing solutions to reduce the cost of energy for our customers and achieve grid parity with local alternatives in the utility market in the next few years. |

| • | Rapidly grow our project portfolio to achieve scale benefits. We intend to rapidly grow our project portfolio, which will enable us to achieve further economies of scale. We plan to significantly expand our presence in commercial and micro-grid applications. In order to continue this growth, we plan to reinvest our operating cash flow into new project development and construction. |

| • | Maintain position as a top Indian solar company. We are the longest tenured solar power producer in India and we believe we have the largest portfolio of operating projects under the NSM and one of the largest portfolios of operating projects in India. We have developed critical operational expertise and regional knowledge that improves project performance and expedites project execution, all of which should help us preserve our market leading position. |

| • | Leverage track record and management relationships to shape policy. We have petitioned governments at the local, state and central levels for substantial changes to solar policy that are essential to the advancement of the solar industry. We plan to leverage our track record, together with our management’s long-running relationships with policy-makers, to influence policy at all governmental levels. |

| • | Expand into new locations. We participate in both national and state level renewable energy auctions. We intend to continue to expand our presence into other states in India and other emerging markets with underserved electricity markets. |

Recent Developments

In September 2016, we entered into a subscription agreement, which was subsequently amended, with an existing investor, IFC GIF Investment Company I, for the sale of 55,535 shares of Series I compulsorily convertible preferred shares for US$25 million. The closing of this transaction is expected to occur before and is not conditioned on our initial public offering.

Series I compulsorily convertible preferred shareholders have a right to convert into equity shares at any point from the date of the issuance at a conversion rate of 1;1, subject to certain anti-dilution protections. Upon the initial public offering, Series I compulsorily convertible preferred shares will convert into such number of equity shares of Azure Power Global Limited prior to the listing of our equity shares to provide the required return.

Risk Factors

Our business and the successful execution of our strategies are subject to certain risks and uncertainties related to our business and our industry, regulation of our business and our corporate structure, doing business in India and ownership of our equity shares, our trading market and this offering. The risks and uncertainties related to our business and our industry include, but are not limited to:

| • | we have never been profitable, and believe we will continue to incur net losses for the foreseeable future; |

| • | the reduction, modification or elimination of central and state government subsidies and economic incentives in India may reduce the economic benefits of our existing solar projects and our opportunities to develop or acquire suitable new solar projects; |

5

Table of Contents

Index to Financial Statements

| • | our long term growth depends in part on the Indian government’s ability to meet its announced targeted capacity; |

| • | our operations are subject to extensive governmental, health and safety and environmental regulations, which require us to obtain and comply with the terms of various approvals, licenses and permits. Any failure to obtain, renew or comply with the terms of such approvals, licenses and permits in a timely manner or at all may have a material adverse effect on our results of operations, cash flows and financial condition; |

| • | our limited operating history, especially with large-scale solar projects, may not serve as an adequate basis to judge our future prospects, results of operations and cash flows; |

| • | our operating results may fluctuate from quarter to quarter, which could make our future performance difficult to predict and could cause our operating results for a particular period to fall below expectations, resulting in a severe decline in the price of our equity shares; |

| • | our substantial indebtedness could adversely affect our business, financial condition, results of operations and cash flows; |

| • | our growth prospects and future profitability depend to a significant extent on global liquidity and the availability of additional funding options with acceptable terms; |

| • | if we fail to comply with financial and other covenants under our loan agreements, our financial condition, results of operations, cash flows and business prospects may be materially and adversely affected; and |

| • | if we fail to maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results and investor confidence in our company and the value of our equity shares may be adversely affected. |

See “Risk Factors” and “Forward-Looking Statements” for a more detailed discussion of these and other risks and uncertainties that we may face.

Concurrent Private Placement

CDPQ Infrastructures Asia Pte Ltd., a wholly owned subsidiary of Caisse de dépôt et placement du Québec has entered into a share purchase agreement pursuant to which it has agreed to purchase $75 million of newly issued equity shares from us at a price per share equal to the lesser of US$22.00 per equity share and the initial public offering price to the public in a separate private placement transaction that is expected to close immediately after this offering. The underwriters will serve as placement agents for such concurrent private placement and receive a placement agent fee equal to 7% of the total purchase price of the private placement equity shares. We refer to the private placement transaction as the “concurrent private placement” and we refer to CDPQ Infrastructures Asia Pte Ltd. as “CDPQ.” Assuming an initial offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, CDPQ will purchase 3,409,091 equity shares from us. The issuance and sale of equity shares to CDPQ are being made in reliance on an exemption from registration contained in Regulation S of the Securities Act. CDPQ has agreed with us not to, directly or indirectly, sell, transfer or dispose of any equity shares acquired in the concurrent private placement for a period of 270 days after the closing of the private placement, subject to certain exceptions. In connection with the private placement, we have agreed to use best efforts to grant CDPQ the right to nominate a person to join our board of directors as a new director after the closing of the private placement, subject to board and shareholder approvals, and the right of first offer to provide equity financing to fund the development or acquisition of new power projects of our subsidiaries, subject to board approval. If the right of first offer is not granted within 30 business days of closing, we will release CDPQ from its lock-up. We have also granted CDPQ certain registration rights in connection with the resale of its equity shares.

6

Table of Contents

Index to Financial Statements

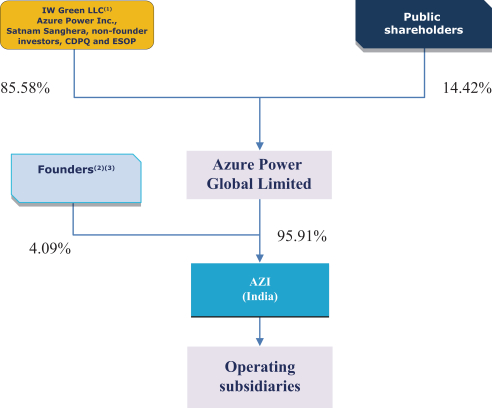

Corporate Structure

Azure Power Global Limited is a company incorporated in Mauritius and is the holding company of AZI. All of our operations at present and following the completion of this offering will be conducted through AZI and its subsidiaries. For details of the current shareholders of Azure Power Global Limited, see “Principal and Selling Shareholders.”

On July 25, 2015, Azure Power Global Limited purchased from the non-founder investors in AZI (i.e., International Finance Corporation, Helion Venture Partners II, LLC, Helion Venture Partners India II, LLC, FC VI India Venture (Mauritius) Ltd., DEG—Deutsche Investitions—und Entwicklungsgesellschaft mbH and Société de Promotion et de Participation Pour la Coopération Économique) the equity shares and convertible securities held by them in AZI and issued an equivalent number of equity shares and convertible securities of Azure Power Global Limited to such non-founder investors on equivalent terms. Prior to the consummation of this offering and the listing of the equity shares pursuant to the offering, the convertible securities of Azure Power Global Limited issued to the non-founder investors will be converted into equity shares of Azure Power Global Limited in an amount that depends, among other factors, on the initial public offering price in the offering. Assuming an initial public offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, a total of 16,019,163 equity shares of Azure Power Global Limited will be issued to the non-founder investors upon the conversion of such convertible securities and there will be a total of 23,640,879 equity shares of Azure Power Global Limited issued and outstanding as of the consummation of this offering and the concurrent private placement. A US$1.00 decrease in the assumed initial public offering price of US$22.00 would increase the total number of equity shares to be issued to the non-founder investors by 360,901 shares and would increase the total number of equity shares of Azure Power Global Limited issued and outstanding as of the confirmation of the offering by 315,446 shares. A US$1.00 increase in the assumed initial public offering price of US$22.00 would decrease the total number of equity shares to be issued to the non-founder investors by 389,783 shares and would decrease the total number of equity shares of Azure Power Global Limited issued and outstanding as of the confirmation of the offering by 348,281 shares. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure” for a more detailed discussion. Because the number of equity shares issued to the non-founder investors will be determined by reference to the initial public offering price in this offering, a change in the assumed initial public offering price would have a corresponding impact on the number of outstanding equity shares presented in this prospectus. The number of equity shares being offered hereby to the public will remain fixed, so long as there is no deal size related changes. However, the total number of equity shares outstanding after the offering and the relative percentage ownership of the investors in this offering and our existing stockholders will depend on the public offering price per equity share and the applicable exchange rate on the date of conversion.

Assuming an initial public offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, IW Green LLC (in which Mr. Inderpreet S. Wadhwa is the sole member), Azure Power Inc. and Mr. Satnam Sanghera, collectively referred to as the APGL Founders, CDPQ and the non-founder investors will own 85.58% of the equity shares in Azure Power Global Limited and 14.42% will be owned by the public investors. The percentage of Azure Power Global Limited that is owned by such shareholders will vary if the initial public offering price changes. For example, a US$1.00 decrease in the assumed initial public offering price would increase the aggregate percentage of Azure Power Global Limited that is owned by the APGL Founders, CDPQ and the non-founder investors to 85.77% and would decrease the percentage of Azure Power Global Limited that is owned by the public investors to 14.23%, while a US$1.00 increase in the assumed initial public offering price would decrease the aggregate percentage of Azure Power Global Limited that is owned by the APGL Founders, CDPQ and the non-founder investors to 85.36% and would increase the percentage of Azure Power Global Limited that is owned by the public investors to 14.64%.

7

Table of Contents

Index to Financial Statements

Azure Power Global Limited intends to utilize substantially all of the net proceeds of this offering and the concurrent private placement (other than approximately US$1.3 million to be retained by Azure Power Global Limited to fund its future operating expenses, including rent, professional fees and other corporate overhead expenses) to purchase 0.76 million equity shares to be issued by AZI at a price of US$148.13 per equity share, assuming that the initial public offering is priced at US$22.00 per equity share of Azure Power Global Limited, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus. Following the completion of this offering and the purchase of additional equity shares of AZI by Azure Power Global Limited, Azure Power Global Limited will own 95.91% of the equity shares of AZI. The percentage ownership of Azure Power Global Limited will vary if the offering size or the initial public offering price changes. For example, a US$1.00 decrease in the assumed equity share price would decrease Azure Power Global Limited’s ownership of AZI by 0.07%. Alternatively, a decrease of US$10 million in the net offering proceeds would decrease Azure Power Global Limited’s ownership of AZI by 0.10%. The remaining 4.09% of the equity shares of AZI will be held by Mr. Inderpreet S. Wadhwa and Mr. Harkanwal S. Wadhwa, collectively referred to as the AZI Founders. Furthermore, the amount for which the AZI Founders sell their shares in AZI (including any sale to Azure Power Global Limited) above the face value of such shares is to be distributed among the founders and non-founders pro rata based on their as converted shareholding in Azure Power Global Limited. Azure Power Global Limited has an option to purchase such equity shares from the AZI Founders. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure” for a more detailed discussion of the option and the lock-in agreement. For details of the intended use of proceeds by AZI upon investment by Azure Power Global Limited into AZI, see “Use of Proceeds.”

The AZI employee stock option plan has been terminated and all options granted pursuant to such plan have been cancelled. Employees who were granted options under the AZI employee stock option plan have been granted options to purchase equity shares of Azure Power Global Limited pursuant to the 2015 Employee Stock Option Plan. Immediately upon the completion of this offering, the 2015 Employee Stock Option Plan will be terminated and replaced by the 2016 Equity Incentive Plan. Options issued pursuant to the 2015 Employee Stock Option Plan will be cancelled and replaced with options to be issued pursuant to the 2016 Equity Incentive Plan. Upon the closing of the offering, there will be 525,280 equity shares issuable upon exercise of outstanding stock options at a weighted average exercise price of Rs. 488 (US$7.23) per share under our employee stock option plan. The number of equity shares outstanding discussed above excludes the 525,280 equity shares issuable upon exercise of outstanding stock options under our 2015 Employer Stock Option Plan.

8

Table of Contents

Index to Financial Statements

The diagram below illustrates our corporate structure upon the completion of this offering and the concurrent private placement assuming an offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, and subsequent subscription of shares of AZI from the proceeds of this offering as described above.

| (1) | The sole member of IW Green LLC is Mr. Inderpreet S. Wadhwa. |

| (2) | Refers to Mr. Inderpreet S. Wadhwa and Mr. Harkanwal Singh Wadhwa. |

| (3) | Azure Power Global Limited has an option to purchase the equity shares from the Founders. See “Management Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure.” |

Corporate Information

We are a public company limited by shares incorporated in Mauritius on January 30, 2015. Our registered office is located at c/o AAA Global Services Ltd., 1st Floor, The Exchange 18 Cybercity, Ebene, Mauritius. Our principal executive offices are located at 8 Local Shopping Complex, Pushp Vihar, Madangir, New Delhi 110062, India, and our telephone number at this location is (91-11) 49409800. Our principal website address is www.azurepower.com. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, 13th Floor, New York, NY 10011.

Dividends

As we are a holding company, we will have to rely on dividends paid to us by our subsidiaries (in particular, our subsidiary in India, AZI) for our cash requirements, including funds to pay dividends and other cash

9

Table of Contents

Index to Financial Statements

distributions to our shareholders, service any debt we may incur and pay our operating expenses. As of the date of this prospectus, AZI has not paid any cash dividends on its equity shares and does not intend to pay dividends to its equity shareholders, including Azure Power Global Limited, in the foreseeable future. See “Dividends and Dividend Policy” for more information.

Enforcement of Civil Liabilities

There is uncertainty as to whether the courts in Mauritius would enforce judgments obtained in the United States against us or our directors or executive officers, as well as the experts named herein, based on the civil liability provisions of the securities laws of the United States or allow actions in Mauritius against us or our directors or executive officers based only upon the securities laws of the United States. Further, foreign judgments may not be given effect by a Mauritius court where it would be contrary to any principle affecting public policy in Mauritius or to the extent that they constitute the payment of an amount which is in the nature of a penalty and not in the nature of liquidated damages.

In addition to and irrespective of jurisdictional issues, neither Mauritian nor Indian courts will enforce a provision of the U.S. federal securities laws that is either penal in nature or contrary to public policy. Specified remedies available under the laws of U.S. jurisdictions, including specified remedies under U.S. federal securities laws, would not be available under Mauritian or Indian law or enforceable in a Mauritian or Indian court, if they are considered to be contrary to Mauritian or Indian public policy. An award of punitive damages under a United States court judgment based upon United States federal securities laws is likely to be construed by Mauritian and Indian courts to be penal in nature and therefore unenforceable in both Mauritius and India. Further, no claim may be brought in Mauritius or India against us or our directors and officers, as well as the experts named herein, in the first instance for a violation of U.S. federal securities laws because these laws have no extraterritorial application under Mauritian or Indian law and do not have force of law in Mauritius or India.

Implications of Being an Emerging Growth Company

As a company with less than US$1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company need not comply with any new or revised financial accounting standard until such date that a non-reporting company is required to comply with such new or revised accounting standard. We have in this prospectus utilized, and we plan in future filings with the Securities and Exchange Commission, or the SEC, to continue to utilize, the modified disclosure requirements available to emerging growth companies. Furthermore, we are not required to present selected financial information or any management’s discussion herein for any period prior to the earliest audited period presented in connection with this prospectus.

We will remain an emerging growth company until the earliest of (a) the last day of our fiscal year during which we have total annual gross revenues of at least US$1.0 billion; (b) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (c) the date on which we have, during the previous 3-year period, issued more than US$1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. If we choose to take advantage of any of these reduced reporting burdens, the information that we provide shareholders may be different than you might get from other public companies.

10

Table of Contents

Index to Financial Statements

Even if we no longer qualify as an emerging growth company, as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as a company that files as a domestic issuer whose securities are registered under the Exchange Act, nor are we generally required to comply with the SEC’s Regulation FD, which restricts the selective disclosure of material non-public information. We intend to take advantage of these exemptions as a foreign private issuer.

11

Table of Contents

Index to Financial Statements

| Equity shares offered by us |

2,454,546 equity shares (2,965,910 equity shares if the underwriters exercise in full their option to purchase additional equity shares). |

| Equity shares offered by the selling shareholders |

954,545 equity shares (actual number of equity shares is subject to change based on pricing information and exchange rate). |

| Option to purchase additional equity shares |

We have granted the underwriters an option, which is exercisable within 30 days from the date of this prospectus, to purchase up to 511,364 additional equity shares from us at the public offering price less the underwriting discount. |

| Concurrent private placement |

CDPQ has agreed to purchase $75 million of newly issued equity shares from us at a price per share equal to the lesser of US$22.00 per equity share and the initial public offering price to the public in a separate private placement transaction that is expected to close immediately after this offering. Assuming an initial offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, CDPQ will purchase 3,409,091 equity shares from us. The issuance and sale of equity shares to CDPQ are being made in reliance on an exemption from registration contained in Regulation S under the Securities Act. CDPQ has agreed with us not to, directly or indirectly, sell, transfer or dispose of any equity shares acquired in the concurrent private placement for a period of 270 days after the date of this prospectus, subject to certain exceptions. In connection with the concurrent private placement, we have agreed to use best efforts to grant CDPQ the right to nominate a person to join our board of directors as a new director and the board of AZI as a new director after the closing of the private placement, subject to board and shareholder approvals, and the right of first offer to provide equity financing to fund the development or acquisition of new power projects of our subsidiaries, subject to board approval. If the right of first offer is not granted within 30 business days of closing, we will release CDPQ from its lock-up. We have also granted CDPQ certain registration rights in connection with the resale of its equity shares. The underwriters will serve as placement agents for such concurrent private placement and receive a placement agent fee equal to 7% of the total purchase price of the private placement equity shares. |

| Equity shares to be outstanding before this offering and the concurrent private placement |

17,777,243 equity shares. |

| Equity shares to be outstanding immediately after this offering and the concurrent private placement |

23,640,879 equity shares (24,152,243 equity shares if the underwriters exercise in full their option to purchase additional equity shares). |

12

Table of Contents

Index to Financial Statements

| Use of Proceeds |

We anticipate that we will receive net proceeds from this offering and the concurrent private placement of approximately US$114.0 million, or approximately US$124.5 million if the underwriters exercise their option to purchase additional equity shares in full. These estimates are based upon an assumed initial public offering price of US$22.00 per equity share, the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts, commissions and estimated aggregate offering expenses payable by us. |

| We intend to use US$112.7 million to fund the purchase by Azure Power Global Limited of equity shares to be issued by AZI, which will occur contemporaneously with the completion of this offering. Net proceeds to be received by AZI as a result of such purchase are intended to be used for our growth capital requirement, new project development and other general corporate purposes. We intend to retain US$1.3 million to fund future operating expenses of Azure Power Global Limited. To the extent the underwriters exercise their option to purchase additional equity shares, the net proceeds from the sale of the additional equity shares will be used to purchase additional equity shares of AZI. See “Use of Proceeds.” |

| We will not receive any of the proceeds from the sale of equity shares by the selling shareholders. |

| Risk Factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the equity shares. |

| Dividend Policy |

We currently intend to retain our earnings, if any, to finance the development and growth of our business and operations as well as expand our business and do not currently anticipate paying dividends on our equity shares in the near future. See “Dividends and Dividend Policy.” |

| Listing |

We have applied to list our equity shares on the New York Stock Exchange. |

| Proposed Trading Symbol |

“AZRE.” |

Certain Assumptions

The number of our equity shares to be outstanding after this offering and the concurrent private placement, the combined voting power that identified shareholders will hold after this offering and the concurrent private placement and the economic interest in our business that identified shareholders will hold after this offering and the concurrent private placement are based on the following assumptions:

| • | Consummation of the sale of 55,535 shares of Series I compulsorily convertible preferred shares for US$25 million, for which the subscription agreement was entered into in September 2016, as described in “Prospectus Summary—Recent Developments.” |

| • | the conversion of compulsorily convertible preferred shares and compulsorily convertible debentures into equity shares, assuming an initial public offering price of US$22.00 per equity share, the midpoint |

13

Table of Contents

Index to Financial Statements

| of the estimated range of the initial public offering price as set forth on the cover page of this prospectus; |

| • | the issuance of 3,409,091 equity shares in the concurrent private placement; and |

| • | our and the selling shareholders’ sale of equity shares in this offering. |

The number of our equity shares to be outstanding after this offering and the concurrent private placement, the combined voting power that identified shareholders will hold after this offering and the concurrent private placement and the economic interest in our business that identified shareholders will hold after this offering and the concurrent private placement excludes the following:

| • | equity shares which may be issued upon the exercise of the underwriters’ option to purchase additional shares of our equity shares; and |

| • | 525,280 equity shares issuable upon exercise of outstanding stock options at a weighted-average exercise price of Rs. 488 (US$7.23) per share under our 2015 Employee Stock Option Plan. |

Except as otherwise indicated, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional equity shares.

14

Table of Contents

Index to Financial Statements

SUMMARY CONSOLIDATED AND PRO FORMA FINANCIAL DATA

Azure Power Global Limited is a company incorporated in Mauritius and is the holding company of AZI. All of its operations are conducted currently through AZI and its subsidiaries. The proceeds of this offering will be used towards a share subscription of AZI by Azure Power Global Limited and will occur contemporaneously with the completion of the offering.

The financial information in this section has been derived from the audited consolidated financial statements as of and for the years ended March 31, 2015 and 2016 included elsewhere in this prospectus.

The unaudited information for the three months ended June 30, 2015 and 2016 was prepared on a basis consistent with that used to prepare our consolidated financial statements and includes all adjustments, consisting of normal and recurring items, that we consider necessary for a fair presentation of our financial condition and results of operations with respect to the relevant periods.

The summary unaudited pro forma balance sheet data as of June 30, 2016 gives effect to the subscription agreement for the sale of Series I compulsorily convertible preferred shares described under “Prospectus Summary—Recent Developments” and the conversion of compulsorily convertible preferred shares and compulsorily convertible debentures into equity shares assuming an initial public offering price of US$22.00 per equity share, the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus. The pro forma as adjusted balance sheet data reflects the abovementioned transactions, the issuance and sale of equity shares in this offering and the concurrent private placement and the use of proceeds therefrom as set forth in “Use of Proceeds,” based on an assumed offering price of US$22.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions, the estimated placement agent fee and estimated offering expenses payable by us.

15

Table of Contents

Index to Financial Statements

The following table should be read together with, and is qualified in its entirety by reference to, the consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus. Among other things, the consolidated financial statements include more detailed information regarding the basis of presentation for the information in the following table. The historical results are not necessarily indicative of the results that may be expected in any future period. The table should also be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Fiscal Year Ended March 31, | Three Months Ended June 30, | |||||||||||||||||||||||

| 2015 | 2016 | 2015 | 2016 | |||||||||||||||||||||

| Rs. | Rs. | US$(1) | Rs. | Rs. | US$(1) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||||||

| Operating revenue: |

||||||||||||||||||||||||

| Sale of power |

1,124,138 | 2,626,148 | 38,900 | 570,194 | 1,021,693 | 15,134 | ||||||||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||||

| Cost of operations (exclusive of depreciation and amortization shown separately below) |

79,816 | 190,648 | 2,824 | 34,703 | 86,515 | 1,282 | ||||||||||||||||||

| General and administrative expenses |

425,952 | 672,841 | 9,967 | 144,958 | 157,085 | 2,327 | ||||||||||||||||||

| Depreciation and amortization |

322,430 | 687,781 | 10,188 | 140,059 | 235,758 | 3,492 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating cost and expenses |

828,198 | 1,551,270 | 22,979 | 319,720 | 479,358 | 7,101 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income |

295,940 | 1,074,878 | 15,921 | 250,474 | 542,335 | 8,033 | ||||||||||||||||||

| Other expense: |

||||||||||||||||||||||||

| Interest expense, net(2) |

831,790 | 2,058,836 | 30,497 | 403,338 | 666,998 | 9,880 | ||||||||||||||||||

| Loss on foreign currency exchange(3) |

299,628 | 343,137 | 5,083 | 107,130 | 140,659 | 2,084 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total other expenses |

1,131,418 | 2,401,973 | 35,580 | 510,468 | 807,657 | 11,964 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss before income taxes |

(835,478 | ) | (1,327,095 | ) | (19,659 | ) | (259,994 | ) | (265,322 | ) | (3,931 | ) | ||||||||||||

| Income tax expense |

(253,112 | ) | (327,745 | ) | (4,855 | ) | 18,412 | 33,648 | 498 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

(1,088,590 | ) | (1,654,840 | ) | (24,514 | ) | (241,582 | ) | (231,674 | ) | (3,433 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to non-controlling interest(4) |

(5,595 | ) | (4,651 | ) | (69 | ) | (1,322 | ) | (5,784 | ) | (86 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to APGL |

(1,082,995 | ) | (1,650,189 | ) | (24,445 | ) | (240,260 | ) | (225,890 | ) | (3,347 | ) | ||||||||||||

| Accretion on Mezzanine CCPS(5) |

(755,207 | ) | (1,347,923 | ) | (19,966 | ) | (259,282 | ) | (122,510 | ) | (1,815 | ) | ||||||||||||

| Accretion to redeemable non-controlling interest(6) |

— | (29,825 | ) | (442 | ) | — | (10,988 | ) | (163 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to APGL equity shareholders |

(1,838,202 | ) | (3,027,937 | ) | (44,853 | ) | (499,542 | ) | (359,388 | ) | (5,325 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to equity shareholders |

||||||||||||||||||||||||

| Basic and diluted(7) |

(1,046 | ) | (1,722 | ) | (26 | ) | (284 | ) | (204 | ) | (3 | ) | ||||||||||||

| Shares used in computing basic and diluted per share amounts |

1,758,080 | 1,758,080 | — | 1,758,080 | 1,758,080 | — | ||||||||||||||||||

| Pro forma basic and diluted loss per share(8) |

— | (67 | ) | (1 | ) | — | (6 | ) | (1 | ) | ||||||||||||||

| Pro forma shares used in computing basic and diluted loss per share(8) |

— | 15,140,287 | — | — | 15,626,847 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Supplemental information (unaudited): |

||||||||||||||||||||||||

| Adjusted EBITDA(9) |

618,370 | 1,762,659 | 26,109 | 390,533 | 778,093 | 11,525 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Azure Power Global Limited’s functional currency is the U.S. dollar and reporting currency is the Indian rupee. Further, AZI’s functional and reporting currency is the Indian rupee. Solely for the convenience of the reader, we have translated the financial information as of and for the fiscal year ended March 31, 2016 and the three months ended June 30, 2016 into U.S. dollars. The rate used for this translation is Rs. 67.51 to |

16

Table of Contents

Index to Financial Statements

| US$1.00, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York as of June 30, 2016, which is the date of our last reported financial statements. |

| (2) | Interest expense, net consists of: |

| Fiscal Year Ended March 31, | Three Months Ended June 30, | |||||||||||||||||||||||

| 2015 | 2016 | 2015 | 2016 | |||||||||||||||||||||

| Rs. | Rs. | US$(a) | Rs. | Rs. | US$(a) | |||||||||||||||||||

| Interest expense: |

||||||||||||||||||||||||

| Compulsorily convertible debentures |

248,831 | 408,172 | 6,046 | 82,277 | 80,712 | 1,196 | ||||||||||||||||||

| Series E compulsorily convertible preferred shares |

96,500 | 263,654 | 3,905 | 27,000 | 55,300 | 819 | ||||||||||||||||||

| Term loans |

598,845 | 1,547,382 | 22,921 | 304,627 | 521,614 | 7,726 | ||||||||||||||||||

| Bank charges and other |

55,454 | 106,568 | 1,579 | 23,296 | 60,872 | 902 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 999,630 | 2,325,776 | 34,451 | 437,200 | 718,498 | 10,643 | |||||||||||||||||||

| Interest income: |

||||||||||||||||||||||||

| Term deposits |

151,860 | 221,532 | 3,281 | 29,430 | 45,767 | 678 | ||||||||||||||||||

| Gain on sale of short term investments |

13,949 | 45,375 | 672 | 4,432 | 5,668 | 84 | ||||||||||||||||||

| Investments held-to-maturity |

— | 33 | 1 | — | 65 | 1 | ||||||||||||||||||

| Interest income from related parties |

2,031 | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Interest expense, net |

831,790 | 2,058,836 | 30,497 | 403,338 | 666,998 | 9,880 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Refer to note (1) above. |

| (3) | Loss on foreign currency exchange consists of: |

| Fiscal Year Ended March 31, | Three Months Ended June 30, | |||||||||||||||||||||||

| 2015 | 2016 | 2015 | 2016 | |||||||||||||||||||||

| Rs. | Rs. | US$(a) | Rs. | Rs. | US$(a) | |||||||||||||||||||

| Unrealized loss on foreign currency loans |

240,656 | 338,297 | 5,011 | 111,796 | 115,009 | 1,704 | ||||||||||||||||||

| Realized loss on foreign currency loans |

(42,280 | ) | (80,542 | ) | (1,193 | ) | (8,423 | ) | (12,713 | ) | (188 | ) | ||||||||||||

| Unrealized loss on derivative instruments |

7,342 | 11,069 | 164 | 2,026 | 5,319 | 79 | ||||||||||||||||||

| Realized loss on derivative instruments |

93,910 | 74,313 | 1,101 | 1,731 | 1,115 | 16 | ||||||||||||||||||

| Other loss on foreign currency exchange |

— | — | — | — | 31,929 | 473 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 299,628 | 343,137 | 5,083 | 107,130 | 140,659 | 2,084 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Refer to note (1) above. |

The unrealized and realized foreign exchange loss represents the foreign currency fluctuations on our non-Indian rupee denominated borrowings.

| (4) | Represents a non-controlling interest of 20% and 48.37% in project subsidiaries and 0.01% of ownership in AZI not held by us or the AZI Founders. |

| (5) | Our Series A, Series B, Series C, Series D, Series F and Series H compulsorily convertible preferred shares, or collectively the Mezzanine CCPS, were accreted to their buyback value through February 26, 2016, so that the carrying amount will equal the mandatory redemption at such date. Subsequently we entered into agreements to extend the buyback date to December 31, 2016 without increasing the buyback value for the Mezzanine CCPS. As the Series A, B, C, D and F compulsorily convertible preferred shares were accreted to their buyback value, no adjustment was considered in their carrying value. For Series H compulsorily convertible preferred shares, redemption value increased by 8% per annum and accretion was undertaken until June 30, 2016. |

| (6) | Represents accretion to the redeemable non-controlling interest in a subsidiary which is accreted to its redemption value. |

17

Table of Contents

Index to Financial Statements

| (7) | Basic and diluted net loss per share attributable to Azure Power Global Limited equity shareholders is computed by dividing the net loss attributable to Azure Power Global Limited equity shareholders by the weighted average number of equity shares outstanding for the year. The potentially dilutive compulsorily convertible preferred shares, compulsorily convertible debentures and share options were excluded from the calculation of dilutive loss per share in those periods where inclusion would be anti-dilutive. |

| (8) | Pro forma net loss per share attributable to Azure Power Global Limited equity shareholders for the fiscal year ended March 31, 2016 and the three months ended June 30, 2016 is calculated as if the compulsorily convertible preferred shares and the compulsorily convertible debentures outstanding as of those respective dates had been converted into equity shares at the beginning of the respective period presented or when compulsorily convertible preferred shares and compulsorily convertible debentures were issued, if later. Compulsorily convertible preferred shares and compulsorily convertible debentures upon the completion of this offering convert into (i) 13,382,207 equity shares as of March 31, 2016 and (ii) 13,868,767 equity shares as of June 30, 2016 based upon the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus. |

| (9) | Adjusted EBITDA is a non-GAAP financial measure. We present Adjusted EBITDA as a supplemental measure of our performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. |

We define Adjusted EBITDA as net loss (income) plus (a) income tax expense, (b) interest expense, net, (c) depreciation and amortization, and (d) loss (income) on foreign currency exchange. We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because:

| • | securities analysts and other interested parties use such calculations as a measure of financial performance and debt service capabilities; and |

| • | it is used by our management for internal reporting and planning purposes, including aspects of our consolidated operating budget and capital expenditures. |

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include:

| • | it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; |

| • | it does not reflect changes in, or cash requirements for, working capital; |

| • | it does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on our outstanding debt; |

| • | it does not reflect payments made or future requirements for income taxes; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA does not reflect cash requirements for such replacements or payments. |

Investors are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis.

18

Table of Contents

Index to Financial Statements

The following table presents a reconciliation of net loss to Adjusted EBITDA:

| Fiscal Year Ended March 31, | Three Months Ended June 30, | |||||||||||||||||||||||

| 2015 | 2016 | 2015 | 2016 | |||||||||||||||||||||

| Rs. | Rs. | US$(a) | Rs. | Rs. | US$(a) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| Net loss |

(1,088,590 | ) | (1,654,840 | ) | (24,514 | ) | (241,582 | ) | (231,674 | ) | (3,433 | ) | ||||||||||||

| Income tax expense |

253,112 | 327,745 | 4,855 | (18,412 | ) | (33,648 | ) | (498 | ) | |||||||||||||||

| Interest expense, net |

831,790 | 2,058,836 | 30,497 | 403,338 | 666,998 | 9,880 | ||||||||||||||||||

| Depreciation and amortization |

322,430 | 687,781 | 10,188 | 140,059 | 235,758 | 3,492 | ||||||||||||||||||

| Loss on foreign currency exchange |

299,628 | 343,137 | 5,083 | 107,130 | 140,659 | 2,084 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

618,370 | 1,762,659 | 26,109 | 390,533 | 778,093 | 11,525 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Refer to note (1) above. |

| As of June 30, | As of June 30, | |||||||||||||||||

| 2016 | 2016 (Pro forma)(5) |

2016

(Pro forma | ||||||||||||||||