Confidentially submitted to the Securities and Exchange

Commission on August 12, 2015. This draft registration statement has not been publicly filed with the Securities and Exchange

Commission and all information herein remains strictly confidential.

As filed with the Securities and Exchange

Commission on _________________, 2015

Registration No. 333-______________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FREECAST, INC.

(Exact name of registrant as specified in its charter)

| Florida |

7990 |

45-2787251 |

(State or other jurisdiction of

incorporation or organization) |

(Primary standard industrial

classification code number) |

(I.R.S. employer

identification number) |

5850 TG Lee Blvd, Suite 310

Orlando, Florida 32822

407 374-1603

(Address, including zip code, and telephone

number,

including area code, of registrant’s principal executive offices)

WHWW, Inc.

390 North Orange Avenue

Suite 1500

Orlando, Florida 32801

407 246-6577

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

Copies to:

| Mitchell

S. Nussbaum |

|

| Giovanni Caruso |

|

| Loeb & Loeb LLP |

|

| 345 Park Avenue |

|

| New York, New York 10154 |

Tel: |

| (212) 407-4000 |

Fax: |

| Fax:

(212) 937-3943 |

|

Approximate date

of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933 check the following box. ¨

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ |

Accelerated filer ¨ |

| |

|

Non-accelerated filer ¨

(Do not check if smaller reporting company) |

Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered | |

Proposed

Maximum

Aggregate

Offering

Price(1)(2) | | |

Amount of

Registration

Fee(3) | |

| Common Stock, $0.0001 par value | |

| | | |

| | |

| Total | |

| | | |

| | |

| (1) | Includes Common Stock that may be issued upon exercise of a 30-day

option granted to the underwriters to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the

proposed maximum aggregate offering price. |

The registrant

hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant

shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such

date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject to Completion,

Preliminary Prospectus

dated August 12, 2015

FREECAST, INC.

______________ shares of common stock

This is our initial public offering of common stock. No public

market currently exists for our common stock. We anticipate the initial public offering price will be between $ and $ per share.

We are selling shares

of common stock.

It is anticipated that our common stock will be listed on the

Nasdaq Capital Market, or Nasdaq, prior to or shortly after the date of this prospectus.

We are an “emerging growth company” as defined

in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced reporting requirements

after this offering. See “Prospectus Summary—Emerging Growth Company Status.”

Investing in our securities involves a high degree of

risk. You should carefully consider the risk factors beginning on page 5 of this prospectus before purchasing shares of our common

stock.

| | |

Price to Public | | |

Underwriting

Discounts and

Commissions | | |

Proceeds to

Us | |

| | |

| | |

| | |

| |

| Per Share | |

$ | | | |

$ | | | |

$ | | |

| | |

| | | |

| | | |

| | |

| Total | |

$ | | | |

$ | | | |

$ | | |

We have granted the underwriters the right to purchase an additional shares

of our common stock to cover over-allotments.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock

to purchasers on , 2015.

Maxim

Group LLC

The date of this prospectus is ,

2015

TABLE OF CONTENTS

SUMMARY

This summary highlights certain information appearing elsewhere

in this prospectus. For a more complete understanding of this offering, you should read the entire prospectus carefully, including

the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this

prospectus before investing in our common stock.

Our Company

FreeCast Inc. (“FreeCast”,

“we”, or “us”) is a content discovery and management company that provides an eMedia guide branded as

“Rabbit TV” to members. We have sold more than 3,000,000 memberships of Rabbit TV and Rabbit TV Plus since our

inception. As of March 31, 2015, we had approximately 751,000 paid members. We generate revenues through membership fees,

advertising, and referral fees. We were founded in 2011 and had revenues of $1.32 million and incurred a net loss of $1.75

million for the fiscal year ended June 30, 2014 and revenues of $954 thousand and a net loss of $1.75 million for the nine

months ended March 31, 2015. Memberships to our eMedia guide are available for purchase in stores (through our agreement with

Telebrands Corp.) and online as Rabbit TV and Rabbit TV Plus.

The basis of our eMedia guide is our proprietary technology

that automatically crawls the internet to locate commercial-quality entertainment content from thousands of sources, including

free, paid, and subscription-based content. Our technology then sorts through and manages the vast majority of the commercial-quality

video, radio and online games on the web, including both live and on-demand video (other than live, local television) from online

free, subscription and Pay-per-view (PPV) services. All of this information is then incorporated into our interactive eMedia guide.

The eMedia guide uses images and related information on customized

guide pages to provide members with an easy way to explore all of the available material from one centralized location. Upon selecting

content to consume, the member is directed to the original source of the content. If content is available for free, the member

is transferred to the website providing the content. If content is available through a subscription service (such as Netflix or

Hulu), we allow the member to log-in to the service through our eMedia guide and the member is then directed to the subscription

service’s website. If the content is PPV, the member is directed to the page requiring payment for the PPV service. We do

not manipulate or distribute the source content, and the provider of the content retains all rights to and management of content.

Our eMedia guide is currently available on computers, smart

phones and tablets, and, by the end of 2015, will be available through a device which will bring our eMedia guide to televisions.

Our strategy is to grow our eMedia guide membership business

domestically and globally. We work constantly to improve the customer experience, with a focus on expanding the content catalogued

by our technology, enhancing our user interface and extending our service to even more Internet-connected devices.

Relationship with Telebrands Corp.

We entered into a distribution agreement with

Telebrands Corp. in October 2012 (the “Distribution Agreement”). The Distribution Agreement grants Telebrands a

license to market, sell and distribute the software and technology relating to our eMedia guide (“Licensed

Software”) and requires Telebrands to use commercially reasonable efforts to market, promote, sell, and distribute

devices providing memberships to the eMedia guide. On June 13, 2014, we entered into an amendment to the Distribution

Agreement (“Amended Distribution Agreement”) with Telebrands. Pursuant to the Amended Distribution Agreement, we

were given the right to market, promote, sell, and distribute the Licensed Software online, except through certain specified

channels. In addition, the Amended Distribution Agreement provides that Telebrands owns the “Rabbit TV” name,

trade names, trademarks, service marks and copyrights. The term of the Distribution Agreement, as amended, ends on December

31, 2017, provided, however, that if more than 10,000,000 memberships are sold by Telebrands on or before December 31, 2017,

then the Distribution Agreement, as amended, shall be extended for an additional five year term. In addition, either party

may terminate the Distribution Agreement in the event that specified conditions are met, including if certain membership

targets are not met, if the other party breaches the Distribution Agreement, or if the other party becomes subject to

bankruptcy laws.

Relationship with Nextelligence, Inc.

On June 30, 2011 we entered into a

Technology License and Development Agreement (as amended, the “Technology Agreement”), with Nextelligence, which is

majority owned and controlled by William A. Mobley, Jr., our founder, Chief Executive Officer and Chairman of the Board of Directors.

The Technology Agreement provides us with an exclusive forty-year license to a web-based toolbar that installs in the end-user’s

browser and any supported email functions and /or chat functions with search and certain other features (“Technology”)

from Nextelligence and for Nextelligence to provide all further development, improvement, modification, maintenance, management

and enhancement services (the “Services”) related to the Technology.

Pursuant to the Technology

Agreement, Nextelligence is entitled to (i) a fix fee of $23,000 per month for the services, and (ii) a technology

license fee of 4% of our gross revenues, as defined in the Technology Agreement.

On January 2, 2015, we entered into

a MCMS Purchase Agreement with Nextelligence (the “MCMS Purchase Agreement”), pursuant to which Nextelligence sold

certain media content management system software to us, in exchange for the extinguishment of the $396,543 debt and a cash payment

of $3,457. Such MCMS Purchase Agreement does not affect or modify the Technology Agreement.

Emerging Growth Company Status

We qualify as an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act. As a result, we are permitted

to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not

emerging growth companies. Accordingly, we have included detailed compensation information for only our three most highly compensated

executive officers and have not included a compensation discussion and analysis (CD&A) of our executive compensation programs

in this prospectus. In addition, for so long as we are an “emerging growth company,” we will not be required to:

| • | engage an auditor to report on our internal controls

over financial reporting pursuant to Section 404(b) of the Sarbanes–Oxley

Act of 2002 (the “Sarbanes–Oxley Act”); |

| • | comply with any requirement that may be adopted by the

Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory

audit firm rotation or a supplement to the auditor’s report providing additional

information about the audit and the financial statements (i.e., an auditor discussion

and analysis); |

| • | submit certain executive compensation matters to shareholder

advisory votes, such as “say-on-pay,” “say-on-frequency,” and

“say-on-golden parachutes;” or |

| • | disclose certain executive compensation related items

such as the correlation between executive compensation and performance and comparison

of the chief executive officer’s compensation to median employee compensation. |

In addition, the JOBS Act provides that an “emerging

growth company” can use the extended transition period for complying with new or revised accounting standards, which we

have elected to take advantage of.

We will remain an “emerging growth company”

until the earliest to occur of:

| • | our reporting $1 billion or more in annual gross revenues; |

| • | our issuance, in a three year period, of more than $1

billion in non-convertible debt; |

| • | the end of the fiscal year in which the market value

of our common stock held by non-affiliates exceeds $700 million on the last business

day of our second fiscal quarter; and |

Our Corporate Information

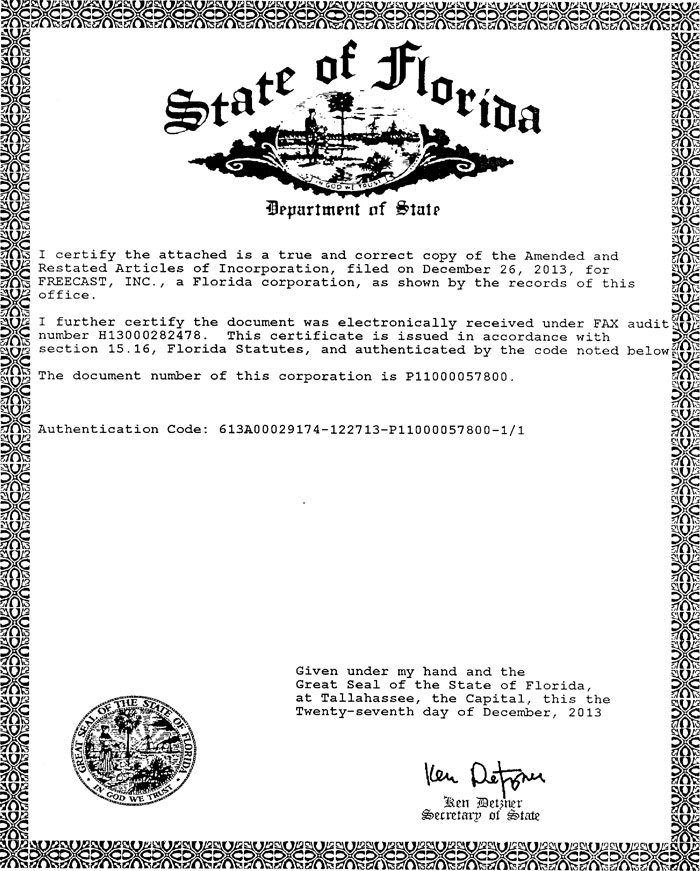

We were incorporated on June 21, 2011

in the State of Florida. Our principal executive offices are located at 5850 TG Lee Blvd, Suite 310, Orlando, Florida 32822. Our

telephone number is 407 374-1603. We maintain a website at www.FreeCast.com. The information contained on our website is not,

and should not be interpreted to be, a part of this prospectus.

THE OFFERING

| Common stock being offered by us |

shares |

| Total common stock offered in this offering |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Over-allotment option |

shares |

| Use of Proceeds |

We intend to use the net proceeds from this offering for working capital and other general

corporate purposes, which may include financing our growth, developing new products, and funding capital expenditures, acquisitions

and investments. |

| Proposed Nasdaq trading symbol |

[____________] |

| Risk Factors |

The securities offered by this prospectus are speculative and involve a high degree of

risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire

investment. See “Risk Factors” beginning on page 5. |

The number of shares of our common stock to be outstanding

after this offering is based on the number of shares outstanding as of February 9, 2015. The number of shares of our common stock

to be outstanding after this offering does not take into account:

| · | 36,199,033

shares of common stock issuable upon the exercise of outstanding warrants as of March

31, 2015 at a weighted average exercise price of $0.25 per share; |

Unless otherwise noted, the information in this prospectus

assumes that the underwriters do not exercise their over-allotment option, and has been adjusted to reflect the filing of our

amended and restated certificate of incorporation and the adoption of our amended and restated by-laws upon the completion of

this offering.

SUMMARY FINANCIAL

AND OTHER DATA

The following table presents our summary

historical financial data for the periods presented and should be read in conjunction with “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and the financial statements and notes thereto included elsewhere

in this prospectus. The statements of operations data for the fiscal years ended June 30, 2013 and 2014 are derived from our audited

financial statements included elsewhere in this prospectus. The statements of operations data for the period ended March 31, 2015

is derived from our unaudited financial statements included elsewhere in this prospectus.

| |

|

Year Ended June 30, |

|

|

Nine Months Ended

March 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

| Statements of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

|

$ |

1,315,480 |

|

|

$ |

183,667 |

|

|

$ |

954,423 |

|

|

$ |

953,070 |

|

| Total Operating Expenses |

|

$ |

2,800,505 |

|

|

$ |

782,067 |

|

|

$ |

2,308,215 |

|

|

$ |

2,061,317 |

|

| Loss From Operations |

|

$ |

(1,727,890 |

) |

|

$ |

(861,562 |

) |

|

$ |

(1,730,191 |

) |

|

$ |

(1,283,430 |

) |

| Total Other Expense |

|

$ |

(17,315 |

) |

|

$ |

(1,089,423 |

) |

|

$ |

(17,817 |

) |

|

$ |

(12,358 |

) |

| Net Loss |

|

$ |

(1,745,205 |

) |

|

$ |

(1,950,985 |

) |

|

$ |

(1,748,008 |

) |

|

$ |

(1,295,788 |

) |

| Net Loss per share, basic and diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.05 |

) |

The pro forma statement of financial condition

data as of March 31, 2015 gives effect to this offering based on an assumed initial public offering price of $ ___ per share,

which is the midpoint of the range listed on the cover page of this prospectus.

| |

|

As

of March 31, 2015 |

|

| |

|

Actual |

|

|

Pro,

Forma, as adjusted |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

| Balance Sheet Data: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

102,651 |

|

|

|

|

|

| Accounts Receivable |

|

|

681,005 |

|

|

|

|

|

| Total Assets |

|

|

910,332 |

|

|

|

|

|

| Total Current Liabilities |

|

|

1,328,924 |

|

|

|

|

|

| Total Liabilities |

|

|

2,584,416 |

|

|

|

|

|

| Total Shareholders’ equity (deficit) |

|

|

(1,674,084 |

) |

|

|

|

|

RISK FACTORS

You should carefully

consider the risks described below and elsewhere in this report, which could materially and adversely affect our business, results

of operations or financial condition. If any of these risks occur, the trading price of our common stock could decline and you

may lose all or part of your investment.

Risks Relating

to Our Business

We may not be able to continue as a going concern without

additional financing. If such financing is not available to us or is not available to us on acceptable terms, we may be forced

to cease operations.

We have a limited

operating history and have incurred recurring losses from operations since inception, accumulating a deficit of $6,263,045 as

of March 31, 2015. For the nine months ended March 31, 2015, we incurred a net loss of 1,748,008 and for the years ended June

30, 2014 and 2013, we incurred net losses of $1,745,205 and $1,950,985, respectively. Our failure to generate sufficient revenues,

reduce spending or raise additional capital could adversely affect our ability to achieve our intended business objectives. These

matters, among others, raise substantial doubt about our ability to continue as a going concern.

Since our inception,

our operations of have been funded primarily through sales of common stock to private investors, debt financing, and exchange

of common stock for services received by us. We cannot be certain that additional funding will be available on acceptable terms,

or at all. To the extent that we raise additional funds by issuing equity securities, our shareholders may experience significant

dilution. Any debt financing, if available, may involve restrictive covenants that impact our ability to conduct business. If

we are not able to raise additional capital when required or on acceptable terms, we may have to (i) significantly delay,

scale back or discontinue the development and/or commercialization of Rabbit TV; (ii) seek collaborators for further development

and commercialization of Rabbit TV; or (iii) relinquish or otherwise dispose of some or all of our rights to technologies

or the products that we would otherwise seek to develop or commercialize.

Products sold through Telebrands Corp. accounted for 45%

or more of our revenues in each of our last two fiscal years, and the deterioration of our relationship with Telebrands would

result in a loss of members and a deterioration of our operating results.

Telebrands Corp. accounted for 54%

and 45% of our revenues in the fiscal years ended June 30, 2014 and 2013. In addition, although we maintain the rights associated

with the technology in our eMedia guide, the Rabbit TV brand (under which our eMedia guide is provided to members) is owned by

Telebrands. Therefore, if our relationship with Telebrands were to deteriorate and we were no longer able to use the Rabbit TV

brand to market our product, we would lose members and our operating results would deteriorate.

Our eMedia guide relies on a technology

that we license from Nextelligence, and any interruption of our rights as a licensee could have a significant adverse impact on

some major aspects of our business, such as product development, customer retention, and sales.

Our eMedia guide has been built on

technology developed by Nextelligence and used by us pursuant to an exclusive forty year license. Nextelligence is principally

owned and controlled by William A. Mobley, Jr., our founder, Chief Executive Officer and Chairman of the Board of Directors. The

Technology Agreement also provides that Nextelligence is obligated to provide all further development, improvement, modification,

maintenance, management and enhancement services related to the technology in exchange for certain payments to Nextelligence by

us. The licensing agreement may be terminated if, among other things, we breach the agreement, if we become insolvent or subject

to the bankruptcy laws, or if there is a change of control (as defined in the agreement). If we were not able to use the technology

for any reason, it could have a significant adverse impact on some major aspects of our business, such as product development,

customer retention, and sales.

If our efforts to attract and retain members are not successful,

our business will be adversely affected.

We have experienced significant

member growth over the past several years. Our service launched in 2012 and we had 583,000 subscribers as of June 30, 2013,

878,000 subscribers as of June 30, 2014, and 751,000 subscribers as of March 31, 2015. Our ability to continue to attract

members will depend in part on our ability to consistently provide our members with a valuable and quality experience for

selecting and viewing TV shows and movies and access to on-line radio stations and games. Furthermore, the relative service

levels, content offerings, pricing and related features of competitors to our service may adversely impact our ability to

attract and retain members. If consumers do not perceive our service offering to be of value, or if we introduce new or

adjust existing services that are not favorably received by them, we may not be able to attract members. In addition, many of

our members are rejoining our service or originate from word-of-mouth advertising from existing members. Our attracting and

retaining members may depend on our ability to:

| · | offer a secure

platform; |

| · | provide tools

and services that meet the evolving needs of consumers; |

| · | provide a wide

range of high-quality product and service offerings; |

| · | enhance the attractiveness

of our platform; |

| · | maintain the

quality of our customer service; and |

| · | continue adapting

to the changing demands of the market. |

If our efforts to satisfy our existing

members are not successful, we may not be able to attract new members, and as a result, our ability to maintain and/or grow our

business will be adversely affected. Members cancel their membership to our service for many reasons, including a perception that

they do not use the service sufficiently, the need to cut household expenses, availability of content is limited, competitive

services provide a better value or experience and customer service issues are not satisfactorily resolved. We must continually

add new members both to replace members who cancel and to grow our business beyond our current member base. If too many of our

members cancel our service, or if we are unable to attract new members in numbers sufficient to grow our business, our operating

results will be adversely affected. If we are unable to successfully compete with current and new competitors in both retaining

our existing members and attracting new members, our business will be adversely affected. Further, if excessive numbers of members

cancel our service, we may be required to incur significantly higher marketing expenditures than we currently anticipate to replace

these members with new members.

If we are not able to continue to innovate or if we fail

to adapt to changes in our industry, our business, financial condition and results of operations would be materially and adversely

affected.

The market for on-line video, radio and

games is characterized by rapidly changing technology, evolving industry standards, new service and product introductions and

changing customer demands. Although we have developed new products and services in order to meet customer demand, new technologies

and evolving business models for delivery of entertainment video continue to develop at a fast pace and we may not be able to

keep up with all of the changes. Consumers are afforded various means for consuming on-line video, radio and games. The various

economic models underlying these differing means of entertainment video delivery include subscription, pay-per-view, ad-supported

and piracy-based models. Several competitors have longer operating histories, larger customer bases, greater brand recognition

and significantly greater financial, marketing and other resources than we do. New entrants may enter the market with unique service

offerings or approaches to distributing on-line video, radio and games and other companies also may enter into business combinations

or alliances that strengthen their competitive positions. The changes and developments taking place in our industry may also require

us to re-evaluate our business model and adopt significant changes to our long-term strategies and business plan. If we are unable

to successfully or profitably compete with current and new competitors, programs and technologies, our business will be adversely

affected, and we may not be able to increase or maintain market share, revenues or profitability.

Changes in consumer viewing habits, including more widespread

usage of demand methods of entertainment video consumption could adversely affect our business.

The manner in which consumers seek entertainment

online is changing rapidly. Digital cable, wireless and Internet content providers are continuing to improve technologies, content

offerings, user interfaces, and business models that allow consumers to access entertainment video-on-demand with interactive

capabilities. The devices through which on-line video, radio and games can be consumed are also changing rapidly. For example,

content from cable service providers may be viewed on laptops and mobile devices and content from Internet content providers may

be viewed on TVs. If competitors providing similar services address the changes in consumer habits in a manner that is better

able to meet content distributor and consumer needs and expectations, our business could be adversely affected.

We may not be able to maintain or grow our revenue or our

business.

We primarily derive our revenue from memberships,

advertising and fees from affiliate programs of content providers, and we have experienced significant growth in our revenue.

We were formed in 2011, had no revenue until 2013 and our revenue grew 616% from fiscal year 2013 to fiscal year 2014. Our revenue

growth may slow or our revenues may decline for many reasons, including decreasing consumer spending, increasing competition,

slowing growth of the consumption of on-line video, radio and games, changes in government policies or general economic conditions.

In addition, our revenue growth rate will likely decline as our revenue grows to higher levels

If we are not able to manage our growth, our business could

be adversely affected.

We are currently engaged in an effort

to grow our service by introducing online access renewal, developing new products, expanding internationally and to residents

of rural areas. As we undertake all these changes, if we are not able to manage the growing complexity of our business, including

improving, refining or revising our systems and operational practices, our business may be adversely affected.

If our efforts to build strong brand identity and improve

member satisfaction and loyalty are not successful, we may not be able to attract or retain members, and our operating results

may be adversely affected.

We must continue to build and maintain

strong brand identity for our products and services, which have expanded over time. We believe that strong brand identity will

be important in attracting members. If our efforts to promote and maintain our existing brands and brands we develop in the future

are not successful, our operating results and our ability to attract members may be adversely affected. From time to time, our

members express dissatisfaction with our service, including, among other things, title availability, processing and service interruptions.

To the extent dissatisfaction with our service is widespread or not adequately addressed, our brand may be adversely impacted

and our ability to attract and retain members may be adversely affected. With respect to our planned international expansion,

we will also need to establish our brand and to the extent we are not successful, our business in new markets would be adversely

impacted.

If we are unable to manage the mix of member acquisition

sources, our member levels and marketing expenses may be adversely affected.

We utilize a broad mix of marketing programs

to promote our service to potential new members. We obtain new members through our online marketing efforts, including paid search

listings, banner ads, text links and permission-based e-mails. In addition, we have engaged in various offline marketing programs,

including TV and radio advertising, direct mail and print campaigns, consumer package and mailing insertions. We maintain an active

public relations program to increase awareness of our service and drive member acquisition. We opportunistically adjust our mix

of marketing programs to acquire new members at a reasonable cost with the intention of achieving overall financial goals. If

we are unable to maintain or replace our sources of members with similarly effective sources, or if the cost of our existing sources

increases, our member levels and marketing expenses may be adversely affected.

If we are unable to continue using our current marketing

channels, our ability to attract new members may be adversely affected.

We may not be able to continue to support

the marketing of our service by current means if such activities are no longer available to us, become cost prohibitive or are

adverse to our business. If companies that currently promote our service decide that we are negatively impacting their business,

that they want to compete more directly with our business or enter a similar business or decide to exclusively support our competitors,

we may no longer be given access to such marketing through them. In addition, if ad rates increase, we may curtail marketing expenses

or otherwise experience an increase in our marketing costs. Laws and regulations impose restrictions on the use of certain channels,

including commercial e-mail and direct mail. We may limit or discontinue use or support of e-mail and other activities if we become

concerned that members or potential members deem such activities intrusive, which could affect our goodwill or brand. If the available

marketing channels are curtailed, our ability to attract new members may be adversely affected.

Although we do not distribute content through our service,

if we are sued for content viewed through our service, our results of operations would be adversely affected.

Although we do not distribute content

through our service, we face potential liability for negligence, copyright, patent or trademark infringement or other claims based

on content linked through our service. We also may face potential liability for content uploaded from our users in connection

with our community-related content or reviews. If we become liable for such activities, then our business may suffer. Litigation

to defend these claims could be costly and the expenses and damages arising from any liability could harm our results of operations.

We cannot assure that we are insured or indemnified to cover claims of these types or liability that may be imposed on us.

We rely upon a number of partners to offer our service.

We currently offer members the ability

to easily navigate available sources of on-line video, radio and games and consume such media through their computers and other

Internet-connected devices. If we are not successful in maintaining existing and creating new relationships, or if we encounter

technological, content licensing or other impediments to our ability to organize content, our ability to grow our business could

be adversely impacted. Furthermore, devices are manufactured and sold by entities other than FreeCast and while these entities

should be responsible for the devices’ performance, the connection between these devices and FreeCast may nonetheless result

in consumer dissatisfaction toward FreeCast and such dissatisfaction could result in claims against us or otherwise adversely

impact our business.

Any significant disruption in our computer systems or those

of third-parties that we utilize in our operations could result in a loss or degradation of service and could adversely impact

our business.

Members and potential members access our

service through our Web site or their TVs, computers, game consoles or mobile devices. Our reputation and ability to attract,

retain and serve our members is dependent upon the reliable performance of our computer systems and those of third-parties that

we utilize in our operations. Interruptions in these systems, or with the Internet in general, including discriminatory network

management practices, could make our service unavailable or degraded. Much of our software is proprietary, and we rely on the

expertise of our engineering and software development teams for the continued performance of our software and computer systems.

Service interruptions, errors in our software or the unavailability of computer systems used in our operations could diminish

the overall attractiveness of our service to existing and potential customers.

Our servers and those of third-parties

we use in our operations are vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could

lead to interruptions and delays in our service and operations as well as loss, misuse or theft of data. Our Web site periodically

experiences directed attacks intended to cause a disruption in service. Any attempts by hackers to disrupt our service or our

internal systems, if successful, could harm our business, be expensive to remedy and damage our reputation. Our insurance does

not cover expenses related to attacks on our Web site or internal systems. Efforts to prevent hackers from entering our computer

systems are expensive to implement and may limit the functionality of our services. Any significant disruption to our service

or internal computer systems could result in a loss of members and adversely affect our business and results of operations.

We utilize our own communications and

computer hardware systems located either in our facilities or in that of a third-party Web hosting provider. In addition, we utilize

third-party Internet-based or “cloud” computing services in connection with our business operations. Problems faced

by our third-party Web hosting or cloud computing providers, including technological or business-related disruptions, could adversely

impact the experience of our members. In addition, fires, floods, earthquakes, power losses, telecommunications failures, break-ins

and similar events could damage these systems and hardware or cause them to fail completely. As we do not maintain entirely redundant

systems, a disrupting event could result in prolonged downtime of our operations and could adversely affect our business.

We rely upon third parties to host certain aspects of our

service and any disruption of or interference with our use of such third party services would impact our operations and our business

would be adversely impacted.

We make use of a number of services provided

by third parties, including distributed computing infrastructure platform for business operations, or what is commonly referred

to as a cloud computing service. We have architected our software and computer systems so as to utilize data processing, storage

capabilities and other services provided by such third parties. Given this, along with the fact that we cannot easily switch our

operations to other providers, any disruption of or interference with our use of current service providers would impact our operations

and our business would be adversely impacted.

We rely heavily on our proprietary technology to locate

and organize on-line video, radio and games and to manage other aspects of our operations, and the failure of this technology

to operate effectively could adversely affect our business.

We continually enhance or modify the technology

used for our operations. We cannot be sure that any enhancements or other modifications we make to our operations will achieve

the intended results or otherwise be of value to our members. Future enhancements and modifications to our technology could consume

considerable resources. If we are unable to maintain and enhance our technology, our ability to retain existing members and to

add new members may be impaired. In addition, if our technology or that of third-parties we utilize in our operations fails or

otherwise operates improperly, our ability to retain existing members and to add new members may be impaired. Also, any harm to

our members’ personal computers or other devices caused by software used in our operations could have an adverse effect

on our business, results of operations and financial condition.

Our business depends on continued and unimpeded access to

the Internet at non-discriminatory prices. Internet access providers and Internet backbone providers may be able to block, limit,

degrade or charge for access to certain of our products and services, which could lead to additional expenses and the loss of

users.

Our products and services depend on the

ability of our customers’ viewers to access the Internet, and certain of our customers’ products require significant

bandwidth to work effectively. Currently, this access is provided by companies that have significant and increasing market power

in the broadband and Internet access marketplace, including incumbent telephone companies, cable companies and mobile communications

companies. Some of these providers have stated that they may take measures that could degrade, disrupt or increase the cost of

user access by restricting or prohibiting the use of their infrastructure to support or facilitate offerings, or by charging increased

fees to provide offerings, while others, including some of the largest providers of broadband Internet access services, have committed

to not engaging in such behavior.

The

ability of the FCC to regulate broadband Internet access services was called into question by an April 2010 ruling of the United

States Court of Appeals for the D.C. Circuit. The FCC then proposed rules regulating broadband Internet access, but on January

14, 2014, the D.C. Circuit Court of Appeals struck down the net neutrality rules adopted by the FCC, determining that the FCC

did not have the authority to issue or enforce net neutrality rules, as it had failed to identify certain service providers as

“common carriers.” On February 26, 2015, the FCC approved a new rule that reclassifies broadband Internet access service

as a telecommunication service and regulates broadband Internet access as a public utility. This new rule is likely to face challenges

in court. In addition, if Congress passes a new law, the FCC’s regulations will be superseded, and it will be the new law

that establishes rules regulating broadband Internet access. AT&T has filed several patent applications for methods to take

advantage of the dissolution of the net neutrality rules, and complaints have begun to mount that certain carriers are slowing

access to various third party on-line and cloud services.

Unless either Congress or the FCC addresses

the scope of its authority it is possible that broadband service providers could impose restrictions on bandwidth and service

delivery that may adversely impact our download speeds or ability to deliver content over those facilities, or impose significant

end user or other fees that could impact the cost of our services to end users, or our delivery costs. As a result of the Court’s

action and the FCC’s inaction, current and future actions by broadband Internet access providers may also result in limitations

on access to our services, a loss of existing users, or increased costs to us, our users or our customers, thereby impairing our

ability to attract new users, or limiting our opportunities and models for revenue and growth.

Changes in how network operators handle and charge for access

to data that travel across their networks could adversely impact our business.

We rely upon the ability of consumers

to access our service through the Internet. To the extent that network operators implement usage based pricing, including meaningful

bandwidth caps, or otherwise try to monetize access to their networks by data providers, we could incur greater operating expenses

and our member acquisition and retention could be negatively impacted.

Most network operators that provide consumers

with access to the Internet also provide these consumers with multichannel video programming. As such, companies like Comcast,

Time Warner Cable and Cablevision have an incentive to use their network infrastructure in a manner adverse to our continued growth

and success. While we believe that consumer demand, regulatory oversight and competition will help check these incentives, to

the extent that network operators are able to provide preferential treatment to their data as opposed to ours, our business could

be negatively impacted.

Privacy concerns could limit our ability to leverage our

member data and our disclosure of or unauthorized access to member data could adversely impact our business and reputation.

In the ordinary course of business and

in particular in connection with merchandising our service to our members, we collect and utilize data supplied by our members.

We currently face certain legal obligations regarding the manner in which we treat such information. Other businesses have been

criticized by privacy groups and governmental bodies for attempts to link personal identities and other information to data collected

on the Internet regarding users’ browsing and other habits. Increased regulation of data utilization practices, including

self-regulation or findings under existing laws, that limit our ability to use collected data, could have an adverse effect on

our business. In addition, if unauthorized access to our member data were to occur or if we were to disclose data about our members

in a manner that was objectionable to them, our business reputation could be adversely affected, and we could face potential legal

claims that could impact our operating results.

Our reputation and relationships with members would be harmed

if our member data, particularly billing data, were to be accessed by unauthorized persons.

We maintain personal data regarding our

members, including names and, in many cases, mailing addresses. With respect to billing data, such as credit card numbers, we

rely on licensed encryption and authentication technology to secure such information. We take measures to protect against unauthorized

intrusion into our members’ data. If, despite these measures, we, or our payment processing services, experience any unauthorized

intrusion into our members’ data, current and potential members may become unwilling to provide the information to us necessary

for them to become members, we could face legal claims, and our business could be adversely affected. Similarly, if a well-publicized

breach of the consumer data security of any other major consumer Web site were to occur, there could be a general public loss

of confidence in the use of the Internet for commerce transactions which could adversely affect our business.

In addition, we do not obtain signatures

from members in connection with the use of credit cards by them. Under current credit card practices, to the extent we do not

obtain cardholders’ signatures, we are liable for fraudulent credit card transactions, even when the associated financial

institution approves payment of the orders. From time to time, fraudulent credit cards are used on our Web site to obtain service.

Typically, these credit cards have not been registered as stolen and are therefore not rejected by our automatic authorization

safeguards. While we do have a number of other safeguards in place, we nonetheless experience some loss from these fraudulent

transactions. We do not currently carry insurance against the risk of fraudulent credit card transactions. A failure to adequately

control fraudulent credit card transactions would harm our business and results of operations.

We may not be able to protect our intellectual property

rights.

We rely on a combination of trademark,

fair trade practice, patent, copyright and trade secret protection laws, as well as confidentiality procedures and contractual

provisions, to protect our intellectual property rights. We also enter into confidentiality agreements with our employees and

any third parties who may access our proprietary information, and we rigorously control access to our proprietary technology and

information.

Intellectual property protection may not

be sufficient and confidentiality agreements may be breached by counterparties, and there may not be adequate remedies available

to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce

our contractual rights. In addition, policing any unauthorized use of our intellectual property is difficult, time-consuming and

costly and the steps we have taken may be inadequate to prevent the misappropriation of our intellectual property. In the event

that we resort to litigation to enforce our intellectual property rights, such litigation could result in substantial costs and

a diversion of our managerial and financial resources. We can provide no assurance that we would prevail in such litigation. In

addition, our trade secrets may be leaked or otherwise become available to, or be independently discovered by, our competitors.

Any failure in protecting or enforcing our intellectual property rights could have a material adverse effect on our business,

financial condition and results of operations.

Intellectual property claims against us could be costly

and result in the loss of significant rights related to, among other things, our Web site, technology, title selection processes

and marketing activities.

Trademark, copyright, patent and other

intellectual property rights are important to us and other companies. Our intellectual property rights extend to our technology,

business processes and the content on our Web site. We use the intellectual property of third-parties in merchandising our products

and marketing our service through contractual and other rights. From time to time, third-parties allege that we have violated

their intellectual property rights. If we are unable to obtain sufficient rights, successfully defend our use, or develop non-infringing

technology or otherwise alter our business practices on a timely basis in response to claims against us for infringement, misappropriation,

misuse or other violation of third-party intellectual property rights, our business and competitive position may be adversely

affected. Many companies are devoting significant resources to developing patents that could potentially affect many aspects of

our business. There are numerous patents that broadly claim means and methods of conducting business on the Internet. We have

not searched patents relative to our technology. Defending ourselves against intellectual property claims, whether they are with

or without merit or are determined in our favor, results in costly litigation and diversion of technical and management personnel.

It also may result in our inability to use our current Web site and technology, or our inability to market our service or merchandise

our products. As a result of a dispute, we may have to develop non-infringing technology, enter into royalty or licensing agreements,

adjust our merchandising or marketing activities or take other actions to resolve the claims. These actions, if required, may

be costly or unavailable on terms acceptable to us.

If we are unable to protect our domain names, our reputation

and brand could be adversely affected.

We currently hold various domain names

relating to our brand, including freecast.com. Failure to protect our domain names could adversely affect our reputation and brand

and make it more difficult for users to find our Web site and our service. The acquisition and maintenance of domain names generally

are regulated by governmental agencies and their designees. The regulation of domain names in the United States may change in

the near future. Governing bodies may establish additional top-level domains, appoint additional domain name registrars or modify

the requirements for holding domain names. As a result, we may be unable to acquire or maintain relevant domain names. Furthermore,

the relationship between regulations governing domain names and laws protecting trademarks and similar proprietary rights is unclear.

We may be unable, without significant cost or at all, to prevent third-parties from acquiring domain names that are similar to,

infringe upon or otherwise decrease the value of our trademarks and other proprietary rights.

We depend on key management as well as experienced and capable

personnel generally, and any failure to attract, motivate and retain our staff could severely hinder our ability to maintain and

grow our business.

We rely on the continued service of our

senior management, including our founder and Chief Executive Officer and Chairman of the Board of Directors William A. Mobley,

Jr., members of our executive team and other key employees and the hiring of new qualified employees. In our industry, there is

substantial and continuous competition for highly skilled business, product development, technical and other personnel. If we

lose the services of any member of management or key personnel, we may not be able to locate suitable or qualified replacements,

and may incur additional expenses to recruit and train new staff, which could severely disrupt our business and growth.

Our brand name and

our business may be harmed by aggressive marketing and communications strategies of our competitors.

Due to competition

in our industry, we have been and may be the target of incomplete, inaccurate and false statements about our company and our services

that could damage our and our management’s reputation and our brand and materially deter consumers from using our service.

Our brand name and our business may be harmed if we are unable to promptly respond to our competitors’ misleading marketing

efforts.

Risks Related

to the Offering

An active trading

market for our common stock may not develop, which may cause our common stock to trade at a discount from the initial offering

price and make it difficult for you to sell the shares you purchase.

Prior to this offering,

there has been no public trading market for our common stock. We cannot predict the extent to which investor interest in our company

will lead to the development or maintenance of an active trading market. The initial public offering price per share of our common

stock has been determined by agreement among us and the underwriters and may not be indicative of the price at which our common

stock will trade in the public trading market after this offering. If an active trading market does not develop, there may be

difficulty selling any shares of our common stock.

The offering price

of our common stock may not be indicative of future market prices of our common stock.

The offering price of the shares of our common stock has been

arbitrarily determined by us and should not be considered an objective indication of our actual value, as it bears no relationship

to our assets, earnings, book value or any other objective financial statement criteria of value.

Our management

will have considerable discretion as to the use of the net proceeds to be received by us from this offering, and such use may

not improve our financial results or increase the trading price of our common stock.

We

have not allocated a significant portion of the net proceeds to be received by us in this offering to any particular purpose,

and our use of such proceeds will be based on our current growth strategies and business conditions. Our management will have

considerable discretion in the application of the net proceeds received by us. You will not have the opportunity, as part of your

investment decision, to assess whether proceeds are being used appropriately. You must rely on the judgment of our management

regarding the application of the net proceeds of this offering. The net proceeds may be used for corporate purposes that do not

improve our efforts to maintain profitability or increase the trading price of our common stock. The net proceeds from this offering,

pending investment in operating assets or businesses, may be placed in investments that do not produce income or that lose value.

After this offering,

William A. Mobley, Jr., our founder, Chief Executive Officer and Chairman of the Board of Directors, individually and through

Nextelligence, Inc., which is majority owned and controlled by him, will own or control in excess of 70.0% of our outstanding

common stock.

After this offering,

William A. Mobley, Jr., our Chief Executive Officer and Chairman of the Board of Directors, individually and through Nextelligence,

Inc., which is majority owned and controlled by him, will own or control in excess of 70.0% of our outstanding common stock. As

a result, Mr. Mobley is able to exercise significant influence over our company, including, but not limited to, any shareholder

approvals for the election of our directors and, indirectly, the selection of our senior management, the amount of dividend payments,

if any, our annual budget, increases or decreases in our share capital, new securities issuance, mergers and acquisitions and

any amendments to our memorandum of association and articles of association. Furthermore, this concentration of ownership may

delay or prevent a change of control or discourage a potential acquirer from making a tender offer or otherwise attempting to

obtain control of us, which could decrease the market price of our shares.

Following this offering, we will

be a “controlled company” as such term is defined in the rules of the Nasdaq Stock Market, and, therefore, you will

not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements

of the Nasdaq Stock Market.

Upon the completion of this offering,

we expect that our Common stock will be listed on the Nasdaq Stock Market. We expect to be a “controlled company”

under the Nasdaq corporate governance standards because more than 50% of the voting power of our common stock following the completion

of this offering will be held by Nextelligence, Inc. A “controlled company” may elect not to comply with certain Nasdaq

corporate governance standards, including the requirements that: (i) we have a majority of our board of directors consists

of “independent directors,” as defined under the Nasdaq rules; (ii) we have a nominating and corporate governance

committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and

responsibilities; and (iii) we have a compensation committee that is composed entirely of independent directors with a written

charter addressing the committee’s purpose and responsibilities. Following this offering, in reliance upon the foregoing

exemptions, a majority of our board of directors will not consist of independent directors, we will not have a nominating and

corporate governance committee, and our compensation committee will not be composed entirely of independent directors, and we

may use any of these exemptions for so long as we are a controlled company. Accordingly, you will not have the same protections

afforded to shareholders of companies that are subject to all of the corporate governance requirements of the Nasdaq Stock Market.

The market price

of our common stock may be volatile, which could cause the value of your investment to decline.

Securities markets

worldwide experience significant price and volume fluctuations. This market volatility, as well as the factors listed below, some

of which are beyond our control, could affect the market price of our common stock:

| · | our

failure to achieve actual operating results that meet or exceed guidance that we may

have provided due to factors beyond our control, such as currency volatility and trading

volumes; |

| · | future

announcements concerning us or our competitors, including the announcement of acquisitions; |

| · | changes

in government regulations or in the status of our regulatory approvals or licensure; |

| · | public

perceptions of risks associated with our services or operations; |

| · | developments

in our industry; and |

| · | general

economic, market and political conditions and other factors that may be unrelated to

our operating performance or the operating performance of our competitors. |

If you purchase

common stock sold in this offering, you will experience immediate and substantial dilution.

Based

upon our unaudited financial statements at and for the six months ended March 31, 2015, if

you purchase common stock sold in this offering, you will experience immediate and substantial dilution of $[__] per share based

on an offering price of $___, because the price that you pay per share will be greater than the net tangible book value per share.

Our existing shareholders will experience an immediate increase in net tangible book value of $[__] per share. In addition, you

may face additional dilution if we issue additional securities in the future to finance our operations.

If securities

or industry analysts do not publish research or reports about our business, if they change their recommendations regarding our

common stock adversely, or if we fail to achieve analysts’ earnings estimates, the market price and trading volume of our

common stock could decline.

The trading market

for our common stock may be influenced by the research and reports that industry or securities analysts publish about us or our

business. If one or more of the analysts who cover us or our industry make unfavorable comments about our market opportunity or

business, the market price of our common stock would likely decline. If one or more of these analysts ceases coverage of us or

fails to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the market price

of our common stock or trading volume to decline. In addition, if we fail to achieve analysts’ earnings estimates, the market

price of our common stock would also likely decline.

If we are unable

to meet the continued listing requirements of the Nasdaq, the Nasdaq will delist our common stock.

Upon

the consummation of this offering, our common stock will be listed on the Nasdaq. In the future, if we are not able to meet the

Nasdaq continued listing standards, we could be subject to suspension and delisting proceedings. A delisting of our common stock

and our inability to list on another national securities exchange could negatively impact us by: (i) reducing the liquidity and

market price of our common stock; (ii) reducing the number of investors willing to hold or acquire our common stock, which could

negatively impact our ability to raise equity financing; (iii) limiting our ability to use a registration statement to offer and

sell freely tradable securities, thereby preventing us from accessing the public capital markets and (iv) impairing our ability

to provide equity incentives to our employees.

Because we do

not intend to pay dividends for the foreseeable future, investors in the offering will benefit from their investment in shares

only if our common stock appreciates in value.

We currently intend

to retain our future earnings, if any, to finance the operation and growth of our business and do not expect to pay any dividends

in the foreseeable future. As a result, the success of an investment in our common stock will depend upon any future appreciation

in its value. Our common stock may not appreciate in value or even maintain the price at which investors in this offering have

purchased their shares.

We cannot predict

our future capital needs. as a result, we may need to raise significant amounts of additional capital. We may be unable to obtain

the necessary capital when we need it, or on acceptable terms, if at all.

Our business depends

on the availability of adequate funding and regulatory capital under applicable regulatory requirements. We currently anticipate

that our available cash resources will be sufficient to meet our presently anticipated working capital and capital expenditure

requirements for at least the next 12 months. We may need to raise additional funds to:

| · | support

more rapid expansion; |

| · | develop

new or enhanced services and products; |

| · | respond

to competitive pressures; |

| · | acquire

complementary businesses, products or technologies; or |

| · | respond

to unanticipated requirements. |

Additional financing may not be available

when needed on terms favorable to us.

For as long as we are an “emerging growth company,”

we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure

about our executive compensation, that apply to other public companies.

We are an “emerging growth company,” as defined

in the Securities Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that

are applicable to other public companies that are not “emerging growth companies,” including, but not limited to,

not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes–Oxley Act,

reduced disclosure obligations regarding executive compensation in our periodic reports and proxy and information statements and

exemptions from the requirements of holding a non-binding advisory vote on executive compensation and of shareholder approval

of any golden parachute payments not previously approved. Because we intend to take advantage of these exemptions, some investors

may find our common stock less attractive, which may result in a less active trading market for our common stock and our stock

price may be more volatile.

In addition, the JOBS Act provides that an “emerging

growth company” can take advantage of the extended transition period for complying with new or revised accounting standards.

We could remain an “emerging growth company”

until June 30, 2021 or, if earlier, (a) the last day of the first fiscal year in which our annual gross revenues exceed $1

billion, (b) if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business

day of the second fiscal quarter of any fiscal year, the last day of such fiscal year, or (c) the date on which we have issued

more than $1 billion in non-convertible debt securities during the preceding three-year period. If we are still a smaller reporting

company (a company with a public float of less than $75 million) after we no longer qualify as an emerging growth company, we

may be able to make use of some of the same exemptions (such as the exemption to the auditor attestation requirements of Section 404(b)

of the Sarbanes–Oxley Act) as were available to us when we qualified as an emerging growth company.

If we fail to maintain an effective system of internal control

over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result stockholders

could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our

common stock.

We are not currently required to comply with Section 404(a)

of the Sarbanes–Oxley Act and are therefore not required to make a formal assessment of the effectiveness of our internal

control over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with the SEC’s

rules implementing Sections 302 and 404 of the Sarbanes–Oxley Act, which will require management to certify financial and

other information in our quarterly and annual reports and provide an annual management report on the effectiveness of controls

over financial reporting. Although we will be required to disclose changes made in our internal controls and procedures on a quarterly

basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to

Section 404 until the year following our first annual report required to be filed with the SEC. However, as an “emerging

growth company,” as defined in the JOBS Act, our independent registered public accounting firm will not be required to formally

attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 until the later of the

year following our first annual report required to be filed with the SEC or the date we are no longer an “emerging growth

company.” At such time, our independent registered public accounting firm may issue a report that is adverse in the event

it is not satisfied with the level at which our controls are documented, designed or operating.

Notwithstanding the fact that we are not yet required to assess

our internal controls over financial reporting, our Chief Executive Officer and Chief Financial Officer have determined that there

may have been, in the past, weaknesses in internal control over financial reporting, relating to our failure to receive documentation

prior to paying certain invoices. As is the case with many companies of our size, (i) we did not have written documentation of

our internal control policies and procedures; (ii) we did not have sufficient segregation of duties within accounting functions;

(iii) we did not have adequate staff and supervision within our accounting function; and (iv) we lacked a sufficient process for

periodic financial reporting, including timely preparation and review of financial reports and statements. Our Chief Executive

Officer and Chief Financial Officer believe that such weaknesses have been substantially remediated through, among other things,

our hiring of a Chief Financial Officer in April 2014.

In addition, to comply with the requirements of being a public

company, we may need to undertake various actions, such as implementing new internal controls and procedures and hiring additional

accounting or internal audit staff. Testing and maintaining internal control can divert our management’s attention from

other matters that are important to the operation of our business. In addition, when evaluating our internal control over financial

reporting, we may identify material weaknesses that we may not be able to remediate in time to meet the applicable deadline imposed

upon us for compliance with the requirements of Section 404. If we identify material weaknesses in our internal control over

financial reporting or are unable to comply with the requirements of Section 404 in a timely manner or assert that our internal

control over financial reporting is effective, or if our independent registered public accounting firm is unable to express an

opinion as to the effectiveness of our internal control over financial reporting, investors may lose confidence in the accuracy

and completeness of our financial reports and the market price of our common stock could be negatively affected, and we could

become subject to investigations by the stock exchange on which our securities are listed, the SEC or other regulatory authorities,

which could require additional financial and management resources.

In the past, we have had weknesses in our internal

control over financial reporting.

Although we are not yet required to assess our internal

controls over financial reporting, our Chief Executive Officer and Chief Financial Officer have determined that there have

been, in the past, weaknesses in our internal control over financial reporting, relating to our failure to receive documentation

prior to paying certain invoices. As is the case with many companies of our size, (i) we did not have written documentation of

our internal control policies and procedures; (ii) we did not have sufficient segregation of duties within accounting functions;

(iii) we did not have adequate staff and supervision within our accounting function; and (iv) we lacked a sufficient process for

periodic financial reporting, including timely preparation and review of financial reports and statements. Our Chief Executive

Officer and Chief Financial Officer believe that such weaknesses have been substantially remediated through, among other things,

our hiring of a Chief Financial Officer in April 2014. Other than the salary and benefits paid to our Chief Financial Officer,

we have not incurred and do not expect to incur material costs in past or ongoing remediation efforts.

Shareholders may

be diluted by the future issuance of additional common stock in connection with our incentive plans, acquisitions or otherwise.

After this offering

we will have approximately ______________ shares of common stock authorized but unissued. Our certificate of incorporation authorizes

us to issue these shares of common stock and options, rights, warrants and appreciation rights relating to common stock for the

consideration and on the terms and conditions established by our board of directors in its sole discretion, whether in connection

with acquisitions, in future common stock offerings or otherwise. We have reserved an aggregate of _________ shares for issuance

under our incentive plan. Any common stock that we issue under any incentive plan would

dilute the percentage ownership held by the investors who purchase common stock in this offering.

Substantial future sales or perceived potential sales of

our common stock in the public market could cause the price of our common stock to decline significantly.

Sales of our common stock or other equity securities in the

public market after this offering, or the perception that these sales could occur, could cause the market price of our common

stock to decline significantly. Upon completion of this offering, we will have _____________ shares of common stock outstanding,

assuming the underwriters do not exercise their option to purchase additional shares, of which _________________ shares of our

common stock, representing ____% of our outstanding common stock immediately after this offering, will not be subject to lock-up

agreements. All shares of common stock sold in this offering will be freely transferable by persons other than our “affiliates”

without restriction or additional registration under the U.S. Securities Act of 1933, as amended, or the Securities Act. The common