UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from _____ to _____

Commission File Number:

Cable One, Inc.

(Exact name of registrant as specified in its charter)

| | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| (Address of Principal Executive Offices) | (Zip Code) |

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

| Trading Symbol(s) | Name of Each Exchange on Which Registered | |

| |

| | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☑ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2022 was approximately $

There were

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement relating to its 2023 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2022, are incorporated by reference in Part III of this Form 10-K.

| PART I |

||

| Item 1. |

Business |

|

| Item 1A. |

Risk Factors |

|

| Item 1B. |

Unresolved Staff Comments |

|

| Item 2. |

Properties |

|

| Item 3. |

Legal Proceedings |

|

| Item 4. |

Mine Safety Disclosures |

|

| PART II |

||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

| Item 6. |

[Reserved] | |

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

|

| Item 8. |

Financial Statements and Supplementary Data |

|

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| Item 9A. |

Controls and Procedures |

|

| Item 9B. |

Other Information |

|

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 64 |

| PART III |

||

| Item 10. |

Directors, Executive Officers and Corporate Governance |

|

| Item 11. |

Executive Compensation |

|

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

| Item 14. |

Principal Accountant Fees and Services |

|

| PART IV |

||

| Item 15. |

Exhibits and Financial Statement Schedules |

|

| Item 16. |

Form 10-K Summary |

|

| Signatures |

||

| Index to Consolidated Financial Statements |

||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” that involve risks and uncertainties. These statements can be identified by the fact that they do not relate strictly to historical or current facts, but rather are based on current expectations, estimates, assumptions and projections about our industry, business, strategy, acquisitions and strategic investments, dividend policy, financial results and financial condition. Forward-looking statements often include words such as “will,” “should,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words and terms of similar substance in connection with discussions of future operating or financial performance. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. Our actual results may vary materially from those expressed or implied in our forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by us or on our behalf. Important factors that could cause our actual results to differ materially from those in our forward-looking statements include government regulation, economic, strategic, political and social conditions and the following factors:

| ● |

rising levels of competition from historical and new entrants in our markets; |

| ● |

recent and future changes in technology, and our ability to develop, deploy and operate new technologies, service offerings and customer service platforms; |

| ● |

our ability to continue to grow our residential data and business services revenues and customer base; |

| ● |

increases in programming costs and retransmission fees; |

| ● |

our ability to obtain hardware, software and operational support from vendors; |

|

| ● | risks that we may fail to realize the benefits anticipated as a result of our purchase of the remaining interests in Hargray Acquisition Holdings, LLC (“Hargray”) that we did not already own (the “Hargray Acquisition”); |

| ● |

risks relating to existing or future acquisitions and strategic investments by us; |

| ● |

risks that the implementation of our new enterprise resource planning (“ERP”) system disrupts business operations; |

| ● |

the integrity and security of our network and information systems; |

| ● |

the impact of possible security breaches and other disruptions, including cyber-attacks; |

| ● |

our failure to obtain necessary intellectual and proprietary rights to operate our business and the risk of intellectual property claims and litigation against us; |

| ● |

legislative or regulatory efforts to impose network neutrality (“net neutrality”) and other new requirements on our data services; |

| ● |

additional regulation of our video and voice services; |

| ● |

our ability to renew cable system franchises; |

| ● |

increases in pole attachment costs; |

| ● |

changes in local governmental franchising authority and broadcast carriage regulations; |

| ● |

the potential adverse effect of our level of indebtedness on our business, financial condition or results of operations and cash flows; |

| ● |

the restrictions the terms of our indebtedness place on our business and corporate actions; |

| ● |

the possibility that interest rates will continue to rise, causing our obligations to service our variable rate indebtedness to increase significantly; |

| ● | the transition away from the London Interbank Offered Rate ("LIBOR") and the adoption of alternative reference rates; | |

| ● | risks associated with our convertible indebtedness; | |

| ● |

our ability to continue to pay dividends; |

| ● |

provisions in our charter, by-laws and Delaware law that could discourage takeovers and limit the judicial forum for certain disputes; |

| ● |

adverse economic conditions, labor shortages, supply chain disruptions, changes in rates of inflation and the level of move activity in the housing sector; |

|

| ● | pandemics, epidemics or disease outbreaks, such as the COVID-19 pandemic, have, and may continue to, disrupt our business and operations, which could materially affect our business, financial condition, results of operations and cash flows; |

| ● | lower demand for our residential data and business services; | |

| ● |

fluctuations in our stock price; |

| ● |

dilution from equity awards, convertible indebtedness and potential future convertible debt and stock issuances; |

| ● |

damage to our reputation or brand image; |

| ● |

our ability to retain key employees (whom we refer to as associates); |

| ● |

our ability to incur future indebtedness; |

| ● |

provisions in our charter that could limit the liabilities for directors; and |

| ● |

the other risks and uncertainties detailed in the section entitled “Risk Factors” in this Annual Report on Form 10-K and in our subsequent filings with the Securities and Exchange Commission (the "SEC") |

Any forward-looking statements made by us in this document speak only as of the date on which they are made. We are under no obligation, and expressly disclaim any obligation, except as required by law, to update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

PART I

| BUSINESS |

Overview

Cable One, Inc. (“Cable One,” “us,” “our,” “we” or the “Company”) is a leading broadband communications provider committed to connecting customers and communities to what matters most. We strive to deliver an effortless experience by offering solutions that make our customers’ lives easier, and by relating to them personally as our neighbors and local business partners. Powered by our fiber-rich infrastructure, the Cable One family of brands provides residential customers with a wide array of connectivity and entertainment services, including Gigabit speeds, advanced Wi-Fi and video. For businesses ranging from small and mid-market up to enterprise, wholesale and carrier, we offer scalable, cost-effective solutions that enable businesses of all sizes to grow, compete and succeed. We believe the services we provide are critical to the development of new businesses and drive economic growth in the non-metropolitan, secondary and tertiary markets that we serve in 24 Western, Midwestern and Southern states. As of December 31, 2022, approximately 74% of our customers were located in seven states: Arizona, Idaho, Mississippi, Missouri, Oklahoma, South Carolina and Texas. We provided services to more than 1.1 million residential and business customers out of approximately 2.7 million homes passed as of December 31, 2022. Of these customers, approximately 1,060,000 subscribed to data services, 182,000 subscribed to video services and 132,000 subscribed to voice services as of December 31, 2022.

The following map shows the locations of our consolidated markets as of December 31, 2022:

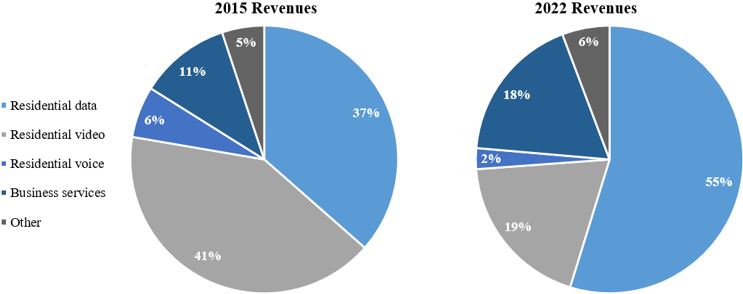

We generate substantially all of our revenues through three primary product lines. Ranked by share of our total revenues during 2022, they are residential data (54.8%), residential video (19.1%) and business services (data, voice and video provided to businesses: 17.9%). The profit margins, growth rates and/or capital intensity of these three primary product lines vary significantly due to competition, product maturity and relative costs.

In 2022, our adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) margins for residential data and business services were approximately five and six times greater, respectively, than for residential video, compared to nine and eleven times greater, respectively, in 2021. The year-over-year change was due primarily to the disaggregation of residential bulk video customers and an additional rate adjustment during 2022, resulting in higher overall residential video margins compared to 2021. We define Adjusted EBITDA margin for a product line as Adjusted EBITDA attributable to that product line divided by revenue attributable to that product line (see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Use of Adjusted EBITDA” for the definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income, which is the most directly comparable measure under generally accepted accounting principles in the United States (“GAAP”)). This margin disparity is largely the result of significant programming costs and retransmission fees incurred to deliver residential video services, which in each of the last three years represented between 64% and 66% of total residential video revenues. Neither of our other primary product lines has direct costs representing as substantial a portion of revenues as programming costs and retransmission fees represent for residential video, and indirect costs are generally allocated on a per primary service unit (“PSU”) basis.

We focus on growing our higher margin businesses, namely residential data and business services, rather than on growing revenues through maximizing customer PSUs. Our strategy acknowledges the industry-wide trends of declining profitability of residential video services and declining revenues from residential voice services. The declining profitability of residential video services is due primarily to increasing programming costs and retransmission fees and competition from other streaming content providers, and the declining revenues from residential voice services are due primarily to the increasing use of wireless voice services instead of residential voice services. Separately, we have also focused on retaining customers who are likely to produce higher relative value over the life of their service relationships with us, are less attracted by discounting, require less support and churn less. This strategy focuses on increasing Adjusted EBITDA, driving higher margins and delivering attractive levels of Adjusted EBITDA less capital expenditures. The following chart shows the relative size of our product lines (as a percentage of total revenue) in 2022 as compared to 2015, the year we became an independent public company following the completion of our spin-off from Graham Holdings Company ("GHC"):

Excluding the effects of recently completed and any potential future acquisitions and divestitures, the trends described above have impacted, and are expected to further impact, our three primary product lines in the following ways:

| ● |

Residential data. We have experienced significant growth in residential data customers and revenues since 2013. We expect growth for this product line to continue over the long-term as we believe upgrades made in our broadband capacity, our ability to offer higher access speeds than many of our competitors, the reliability and flexibility of our data service offerings and our Wi-Fi support service will enable us to continue to grow average monthly revenue per unit ("ARPU") from our existing customers and capture additional market share from both data subscribers who use other providers as well as households in our footprint that do not yet subscribe to data services from any provider. Our broadband plant generally consists of a fiber-to-the-premises or hybrid fiber-coaxial ("HFC") network with ample unused capacity, and we offer our data customers internet products at faster speeds than those available from competitors in most of our markets. During the fourth quarter of 2022, our average residential data customer used 639 Gigabytes of data per month, with nearly 20% of our customers using over 1 Terabyte of data per month. We believe that the capacity and reliability of our networks exceeds that of our competitors in most of our markets and best positions us to meet the continuously increasing consumption demands of customers. We experienced elevated growth rates in residential data customers and revenues during the first two years of the COVID-19 pandemic, but are now seeing a return to more normalized, pre-pandemic growth patterns. |

| ● |

Residential video. Residential video service is an increasingly costly and fragmented business, with programming costs and retransmission fees continuing to escalate in the face of a proliferation of streaming content alternatives. We intend to continue our strategy of focusing on the higher-margin businesses of residential data and business services while de-emphasizing our residential video business. As a result of our video strategy, we expect that residential video customers and revenues will decline further in the future. We now offer Sparklight® TV, an internet protocol-based (“IPTV”) video service that allows customers with our Sparklight TV app to stream our video channels from the cloud. This transition from linear to IPTV video service enables us to reclaim bandwidth, freeing up network capacity to increase data speeds and capacity across our network. |

| ● |

Business services. We have experienced significant growth in business data customers and revenues since 2013. We attribute this growth to our strategic focus on increasing sales to business customers and our efforts to attract enterprise business customers. We expect to experience continued growth in business data customers and revenues over the long-term. Margins for products sold to business customers have remained attractive, which we expect will continue. |

We continue to experience increased competition, particularly from telephone companies; fiber, municipal and cooperative overbuilders; fixed wireless access ("FWA") data providers; over-the-top (“OTT”) video providers; and direct broadcast satellite (“DBS”) television providers. Because of the levels of competition we face, we believe it is important to make investments in our infrastructure. In addition, a key objective of our capital allocation process is to invest in initiatives designed to drive revenue and Adjusted EBITDA expansion. Approximately 65% of our total capital expenditures since 2017 were focused on infrastructure improvements intended to grow these measures. We continue to invest capital to, among other things, increase fiber density and coverage, expand our footprint, increase plant and data capacity, enhance network reliability and improve the customer experience. We offer Gigabit download data service to nearly all of our homes passed and have deployed DOCSIS 3.1, which, together with Sparklight TV, further increases our network capacity and enables future growth in our residential data and business services product lines.

We expect to continue devoting financial resources to infrastructure improvements in existing and newly acquired markets as well as to expand high-speed data service in areas adjacent to our existing network. We believe these investments are necessary to continually meet our customers’ needs and to remain competitive. The capital enhancements associated with recent acquisitions include rebuilding low-capacity markets; reclaiming bandwidth from analog video services; implementing 32-channel bonding; deploying DOCSIS 4.0; consolidating back-office functions such as billing, accounting and service provisioning; migrating products to Cable One's platforms; and expanding our high-capacity fiber network.

Our primary goals are to continue growing residential data and business services revenues, to increase profit margins and to deliver strong Adjusted EBITDA and Adjusted EBITDA less capital expenditures. To achieve these goals, we intend to continue our disciplined cost management approach, remain focused on customers with expected higher relative value and follow through with further planned investments in broadband plant upgrades, including the deployment of DOCSIS 4.0 capabilities and new data service offerings for residential and business customers. We also plan to continue seeking broadband-related acquisition and strategic investment opportunities in rural markets in addition to pursuing organic growth through market expansion projects. Given our strategic focus on our higher margin residential data and business services product lines, we assess our level of capital expenditures relative to Adjusted EBITDA, unlike others in our industry who may compare their capital expenditures to revenues due to their much larger residential video customer bases.

Our business is subject to extensive governmental regulation, which substantially impacts our operational and administrative expenses. In addition, we could be significantly impacted by changes to the existing regulatory framework, whether triggered by legislative, administrative or judicial rulings. Congress and numerous states, including Arizona, Minnesota and Missouri (where we have subscribers), have proposed legislation and/or administrative actions in the past or currently are considering such actions, which could lead to increased regulation of our provision of data services, including proposed rules regarding net neutrality. Several states, including Oregon and Washington (where we also have subscribers), have adopted legislation that requires entities providing broadband internet access service in the state to comply with net neutrality requirements or that prohibits state and local government agencies from contracting with internet service providers that engage in certain network management activities based on paid prioritization, content blocking or other discrimination. We cannot predict whether or when any future changes to the regulatory framework will occur at the federal or state level or whether or to what extent those changes may affect our operations or impose additional costs on our business.

We serve our customers through a plant and network with capacity generally measuring 750 megahertz or higher and have DOCSIS 3.1 capabilities throughout our systems. Our technically advanced fiber-based infrastructure provides for delivery of a full suite of data, video and voice products. Our broadband plant generally consists of a fiber-to-the-premises or HFC network with ample unused capacity, and nearly all of our homes passed have access to Gigabit download speeds, which we believe meaningfully distinguishes our offerings from competitors in most of our markets. As a result of multi-year investments in our plant and network, we increased broadband capacity and reliability, which has enabled and will continue to enable us to offer even higher download speeds to our customers. In addition, we expect to deploy symmetrical Gigabit speeds over our data network in select markets by the end of 2023 and deploy DOCSIS 4.0 beginning in 2024. These upgrades will allow us to further increase plant capacity in support of ongoing increases in consumer demand. We believe these investments will reinforce our competitive strength in this area.

Corporate History

In 1986, The Washington Post Company (the prior name of our former corporate parent, GHC) acquired 53 cable television systems with approximately 350,000 video subscribers in 15 Western, Midwestern and Southern states. We completed over 30 acquisitions and dispositions of cable systems through 2015, both through cash sales and system trades. In the process, we substantially reshaped our original geographic footprint and resized our typical system, including exiting a number of metropolitan markets and acquiring cable systems in non-metropolitan markets that fit our business model. On July 1, 2015, we became an independent company traded under the ticker symbol “CABO” on the New York Stock Exchange after completion of our spin-off from GHC.

In addition to our organic growth, we have also completed a number of acquisitions in recent years. In 2017, we acquired RBI Holding LLC (“NewWave”) for $740.2 million. In 2019, we acquired Delta Communications, L.L.C. (“Clearwave”) for $358.8 million and Fidelity Communications Co. (“Fidelity”) for $531.4 million. In 2020, we acquired Valu-Net LLC (“Valu-Net”) for $38.9 million. In 2020, we contributed the assets of our Anniston, Alabama system (the “Anniston System”) to Hargray in exchange for an approximately 15% equity interest in Hargray and subsequently acquired the remaining approximately 85% equity interest in 2021 for approximately $2.0 billion. We also acquired certain assets and assumed certain liabilities from Cable America Missouri, LLC (“CableAmerica”) for $113.1 million in late 2021.

In 2020, we completed the rebranding of our legacy Cable One consumer-facing business to Sparklight. The Sparklight brand better conveys who we are and what we stand for – a company committed to providing our communities with connectivity that enriches their world. As part of the rebranding, we began streamlining our residential internet service plans and pricing as well as offering faster speeds and unlimited data options on any plan. In addition, we have strengthened and plan to continue to strengthen our commitment to the communities we serve through educational programs, corporate giving and donations of time and resources.

In recent years, we have made investments in several broadband-centric providers serving non-urban markets that follow various strategies similar to our own. Such strategic investments capitalize on opportunities that may not have existed under a full ownership model, allow us to participate more aggressively in the fiber expansion business and may potentially provide future acquisition or investment opportunities, while allowing our management team to focus on our core business and without burdening our cash flow. In 2020, we invested a combined $634.9 million in CTI Towers, Inc. (“CTI”), AMG Technology Investment Group, LLC (“Nextlink”), Wisper ISP, LLC (“Wisper”) and Mega Broadband Investments Holdings LLC (“MBI”) and contributed the assets of the Anniston System to Hargray in exchange for an approximately 15% equity interest. In 2021, we invested a combined $95.8 million in Point Broadband Holdings, LLC (“Point Broadband”), Tristar Acquisition I Corp (“Tristar”) and Nextlink. In 2022, our strategic investment and divestiture activities consisted of the following:

| ● |

On January 1, 2022, we closed a joint venture transaction in which we contributed certain fiber operations (including certain fiber assets of Hargray and a majority of the operations of Clearwave) (the "Clearwave Fiber Contribution") and certain unaffiliated third-party investors contributed cash, to a newly formed entity, Clearwave Fiber LLC ("Clearwave Fiber"). The operations we contributed generated approximately 3% of our consolidated revenues for the three months ended December 31, 2021. Our approximately 58% investment in Clearwave Fiber was valued at $440.0 million as of the closing date. We recognized a non-cash gain of $22.1 million associated with this transaction. Clearwave Fiber is intended to accelerate deployment of fiber internet to residents and businesses in existing markets and near-adjacent areas, as well as to provide connectivity to unserved and underserved areas in such markets via fiber-to-the-premises service. |

| ● |

On March 24, 2022, we invested an additional $5.4 million in Point Broadband and hold a less than 10% ownership interest in Point Broadband. |

| ● |

On April 1, 2022, we contributed our Tallahassee, Florida system to MetroNet Systems, LLC, a fiber internet service provider ("MetroNet"), in exchange for cash consideration of $7.0 million and an equity interest of less than 10% in MetroNet valued at $7.0 million. |

| ● |

On June 1, 2022, we completed a minority equity investment for a less than 10% ownership interest in Visionary Communications, Inc., an internet service provider ("Visionary"), for $7.2 million. |

| ● |

On September 6, 2022, we entered into a subscription agreement with Northwest Fiber Holdco, LLC, a fiber internet service provider ("Ziply"), under which we agreed to invest up to $50.0 million in Ziply for a less than 10% equity interest. We invested $22.2 million in Ziply during November 2022 and expect to invest the remaining $27.8 million during 2023. |

Industry Overview

We are a fully integrated provider of data, video and voice services to residential and business customers across various geographic regions in the United States, with a primary focus on residential data and business services. We provide services that are similar to those provided by cable companies, telephone companies and fiber providers, among others. These providers, each to a varying degree, own and/or lease a network that allows them to deliver their services and distribute their signals to the homes and businesses of subscribers. In addition to building their own network backbone and/or leasing physical access to the network backbone, companies providing video services also purchase licenses to provide their subscribers with access to television channels owned by programmers and broadcasters via distribution over the network backbone. Companies providing video services also typically sell advertising on their video channels.

These providers generate revenue by charging subscription fees to their residential and business customers at rates that vary according to the data, video and/or voice services for which customers subscribe and the type of internet access and equipment furnished to them. These companies generally market and sell their services in bundles or packages in order to maximize the number of PSUs per household, as they believe it is desirable to sell multiple products jointly so that the fixed costs per customer can be spread over multiple PSUs. These providers generally operate in their chosen geographic markets under either non-exclusive franchises or other telecommunications licenses granted by state or local authorities for specified periods of time.

We have a record of consistent, long-term financial and operational success driven by our differentiated operating philosophy and culture. We emphasize focus as opposed to scale, which is a departure from the historical, more conventional strategies employed in our industry, but is well suited to the markets in which we operate and enables us to take advantage of our strengths.

Our Strengths

We leverage a variety of strengths as a service provider, stemming from, among other things, historical and ongoing capital investments in our plant and our focus on serving customers in non-metropolitan markets. These strengths include the following:

Attractive markets and regional diversification. Our customers are located primarily in non-metropolitan, secondary and tertiary markets with favorable competitive dynamics in comparison to major urban centers. In particular:

| ● |

We tend to face less vigorous competition than similar service providers in metropolitan markets at this time. In approximately two-thirds of our footprint, we do not have a wired competitor that offers residential broadband download speeds of 100 Megabits per second ("Mbps") or higher, which is only half the speed of our flagship 200 Mbps residential high-speed data offering. |

| ● |

Advances in technology often come later to our markets — for example, fewer competitors in our markets offer fiber-to-the-premises or "5G" wireless service than in more densely populated markets. |

| ● |

Our subscribers tend to be value-focused, enabling us to save video services costs by not carrying expensive programming options with low subscriber demand. |

| ● |

We are regionally diversified, reducing the impact that an economic downturn in a specific geographic area would have on our overall business. |

Deep customer understanding. We have operated as a non-metropolitan service provider for over 25 years and we are attuned to the unique needs of customers in these areas. In order to understand our customers’ demands and preferences, we routinely conduct customer research through a variety of methods, including customer satisfaction surveys, geo-demographic segmentation studies and other analytics. Together with the direct customer contact we engage in through our virtual call centers and local operating offices, we believe we have gained valuable insight into how to serve customers in non-metropolitan markets, including with respect to providing an optimal mix of data speeds, price points and best-in-class customer service levels. In addition, a significant majority of our associates reside and work in our markets, providing local services through education programs and donations of time and resources that enhance our commitment to the communities we serve.

Superior broadband technology with ample unused capacity. We offer our residential and business data customers internet products at faster speeds than those available from competitors in most of our markets. Our broadband plant generally consists of a fiber-to-the-premises or HFC network with ample unused capacity. During the fourth quarter of 2022, our average residential data customer used 639 Gigabytes of data per month, with nearly 20% of our residential data customers using over 1 Terabyte of data per month. We believe capacity demands such as these cannot be handled by most of the competitors in our markets. In addition, during 2022 our network reliability was 99.5%, significantly exceeding competing service providers who use other technologies and networks.

Our flagship broadband offering for residential customers is a download speed of 200 Mbps, which is at the faster end of the range for similar residential offerings in our markets, although a growing majority of our customers now subscribe to even higher speed offerings. Our fastest broadband offering for our residential customers is currently a download speed of up to 1 Gigabit per second (“Gbps”). We also offer an advanced Wi-Fi solution to residential customers across substantially all of our footprint that provides customers with enhanced Wi-Fi signal strength, which extends and improves the Wi-Fi signal throughout the home. This service is offered free of charge to residential customers who rent one or more modems from us. We are also rolling out a Wi-Fi 6E mesh system offering, the most advanced Wi-Fi system available in the market today. On the business side, we offer our small- and medium-sized business customers up to 5 Gbps symmetrical speeds over fiber in select markets and our enterprise customers 10 Gbps symmetrical speeds over fiber.

Network reliability is critical to our success and is the tenet of our day-to-day operating philosophy. Our investment in and focus on future demand planning has been intended to ensure that network performance is never a barrier to customer satisfaction. Since completing significant, multi-year plant and product enhancements in existing Cable One markets in 2017, we have continued to make ongoing investments in our acquired systems, which has increased our broadband capacity and reliability. We have invested nearly $1.1 billion over the last three years to bring fast, reliable high-speed data service to our markets. We expect to continue to invest in strategic capital projects, including those associated with newly acquired operations and market expansions, because we believe the competitive benefits will be significant, particularly for data services. We also made the following capital investments in 2022:

| ● |

We continued to decrease the average number of data customers per unique service group by aggressively splitting service areas (fiber nodes), which substantially improves data throughput during periods of peak usage, minimizing disruptions in data access speeds to our customers. |

| ● |

We continued to invest in plant upgrade projects, which have enhanced reliability and allowed us to stay ahead of the consumption curve related to broadband capacity and utilization, and plant extension projects, which have expanded the number of serviceable homes and businesses. |

| ● |

We continued to deploy 10 Gbps-capable fiber-to-the-premises technology for both residential and business customers across multiple markets, placing fiber deeper into the network and closer to customers. |

We anticipate that the projects we have invested in over the last several years will facilitate sustained increases in residential data and business services revenues and customer satisfaction.

Low cost structure and competitive pricing. We believe our operating costs, taken as a whole, are as low as or lower than any major service provider. We attribute our low-cost structure to a committed focus on retaining our highest value customers (rather than seeking to obtain as many PSUs as possible) and the lower costs of operating in non-metropolitan markets compared to metropolitan markets. In addition, because we operate our residential and business data services with a competitive plant and cost structure, we are able to offer our customers both attractive pricing and compelling products.

Integration acumen. We believe middle-market acquisition targets continue to provide attractive accretive opportunities. We also continue to learn and adopt best practices and solutions from our acquired operations. Whether it’s our company-wide incentive program we implemented from NewWave, the innovative video chat solution from Fidelity that proved essential to connecting and servicing customers during the pandemic, the adoption of Hargray’s human resources platform or the talented associates who have joined our company across all of our acquisitions, the valuable experience and tangible and intangible gains from these acquisitions has sharpened our expertise in applying our best in class operating model, leading to meaningful synergy realizations and margin expansion beginning shortly after the completion of each acquisition.

Continuous process improvement mindset. From transactional improvements to large scale innovations, continuous process improvement permeates all that we do in order for us to thrive in an increasingly competitive marketplace and remain a cost-efficient operator. For example, we have recently launched our automated field maintenance program and our automated truck roll recommendation engine which provide efficiencies to enable our associates to better serve our customers. The automated field maintenance program monitors our plant and creates work orders prior to a customer experiencing an issue. This further improves the reliability of our service while driving efficient routing for our internal workforce, who are increasingly shifting from reactive to proactive maintenance of our network. Our automated truck roll recommendation engine is a machine learning system that analyzes cable modem signals to determine if a customer’s device is not performing optimally and cannot be fixed via remote troubleshooting. This new process enables our associates and customers to bypass time-consuming steps in the process and move directly to an onsite technician.

Customer satisfaction. We have a customer-focused approach, influencing how we are organized, how we sell our services and how we service our customers. A significant majority of our associates live and work in the communities that we serve and are neighbors to our customers. We believe that our dedication to providing a differentiated customer experience is an important driver of our overall value proposition and creates loyalty, improves customer retention and drives increased demand for our services. We focus on customer satisfaction, with an emphasis on consistently benchmarking our customer satisfaction over time and relative to our competitors based on internally and externally generated customer satisfaction data. We continue to focus on making the lives of our customers easier by providing value-added services, such as expanding customer self-service options through improved residential and business online portals and creating a more personalized experience in updated and refreshed local offices. In addition, we provide 24/7 network monitoring and support to ensure our customers experience the highest quality and most reliable service possible. In 2022, for the second year in a row, we were named to PC Magazine’s list of the ten fastest internet service providers.

Associate satisfaction. Associates are the heart of Cable One. Our operating success is driven by engaged and committed associates. We believe our customers’ satisfaction is tightly linked to our associates’ satisfaction, which has been consistently high throughout the past decade based on routine internal measurements. We currently measure our associate satisfaction annually along with conducting multiple periodic associate surveys. In 2022, for the second year in a row, we were named to Forbes' America's Best Midsize Employers list.

Experienced management team. Our senior management team is comprised of executives who have significant experience in our industry. Our executive officers have an average industry tenure of nearly 24 years and an average tenure at Cable One (or its predecessors) of over 11 years, and we believe this team is deeply knowledgeable about cost and competitive conditions in our markets. They also understand and are deeply committed to our strategy, which we developed, enhanced and updated on a collaborative basis over many years.

Our Strategy

Our purpose is to connect our customers and communities to what matters most by doing right by those we serve, driving progress and lending a hand. We accomplish this through a multi-faceted strategy that builds upon our long track record of focusing on the right markets, the right products and the right customers, as well as controlling our operating and capital costs. More specifically, our strategy includes the following principal components:

Focus on non-metropolitan markets. We believe our decision over two decades ago to concentrate on non-metropolitan markets has served us well, and we intend to continue to focus on offering our products primarily in these markets. The economics of non-metropolitan markets, for which we have optimized our strategy and our operations, are different from operations in major cities and have yielded positive operating results for our business. Because price points for services in non-metropolitan markets are generally lower, and customers in non-metropolitan markets tend to subscribe to fewer PSUs, our average revenue per customer and our PSUs per customer are lower than they might be in metropolitan markets. However, many of our costs are also lower than they would be in metropolitan markets. The dynamics of non-metropolitan markets enable us to operate at attractive margins and earn substantial returns, while remaining consistent with our focus on meeting customer demand for low prices and simultaneously keeping costs down. In addition, we tend to face less vigorous competition than service providers in metropolitan markets.

Prioritize higher growth, higher margin opportunities. We concentrate on the products and customers that maximize Adjusted EBITDA less capital expenditures and provide the best opportunity for profitable growth. We believe residential video and residential voice face inexorable long-term declines. With respect to our video product, programmers and broadcasters are charging higher rates and retransmission fees for content to distributors providing video services (often for content for which viewership is declining), and distributors have had to choose between absorbing those increases to the detriment of their margins or passing on the full cost to customers, which adversely affects customer demand. At the same time, the rapid expansion of OTT offerings has given customers new alternatives to traditional video offerings. In addition, customer demand for wireless voice services has reduced demand for residential voice services for us and others in our industry. As a result, we have reduced our focus on these two products and prioritized higher growth, higher margin opportunities in residential data and business services.

We have declined to cross-subsidize our video business with cash flow from our higher growth, higher margin products, which has resulted in our residential video customers declining at a faster rate than the industry average. Our legacy Cable One residential video PSUs decreased by 34.7% when comparing 2022 versus 2021 and 18.2% when comparing 2021 versus 2020. While this strategy runs contrary to the historical, conventional wisdom in our industry, which put heavy emphasis on video customer counts and maximizing the number of PSUs per customer by bundling and discounting services, we believe it best positions us for long-term success. For us, success in growing and retaining residential data and business customers is far more important than maximizing the number of customers who choose triple-play packages combining data, video and voice services.

Drive growth in residential data and business services. We believe our residential data and business services products provide attractive current and future growth opportunities. Our disciplined prioritization of residential data and business services is generally reflected in all aspects of our business strategy, including pricing, the allocation of sales, marketing and customer service resources, capital spending and supplier negotiations. During 2022, we continued to diversify our revenue streams away from video as residential data and business services represented 72.7% of our total revenues versus 71.3% for 2021 and 68.2% for 2020. We believe we have demonstrated that it is possible to decouple unit growth in our residential data and residential video businesses, which historically were marketed as a package. We focus on selling data-only packages to new customers rather than cross-selling video services to these customers, and a majority of our residential customers are data-only.

Our business services revenues decreased $3.5 million, or 1.1%, in 2022 compared to 2021. Business services revenues included $5.0 million of additional revenues from Hargray and CableAmerica operations in 2022 and included $22.5 million of revenues associated with Clearwave operations that were contributed to Clearwave Fiber in 2021. We expect to generate continued organic growth in business services by leveraging and investing in our existing infrastructure capabilities and footprint to offer higher broadband speeds, more choice and greater value than other providers in our markets and to expand our business services to attract more small, medium-sized and enterprise business customers.

Continue our culture of cost leadership. We believe our total combined operating and capital costs per customer over the past decade have been among the lowest of any service provider with publicly reported numbers and that our operating margins compare very favorably with those of significantly bigger companies in our industry. This is the antithesis of normal economies-of-scale expectations, where higher volumes are expected to create lower costs per customer and increase operating margins. Rather than increasing our size and seeking cost savings through economies-of-scale, we have achieved our lower cost structure over many years by focusing on:

| ● |

serving primarily non-metropolitan, secondary and tertiary markets, which contain different customer dynamics from those in metropolitan markets and would require us to implement additional operational components; |

| ● |

the adoption of new technologies only after they have been tested by other companies, rather than incurring the level of capital expenditures and risk necessary to be an early adopter of most new technologies; |

| ● |

implementing a virtually centralized call center to receive inbound customer service calls and dispatch technicians across all of our markets, while keeping the majority of our call center associates in our non-metropolitan markets; |

| ● |

standardizing our programming offerings across most of our markets, which reduces our customer service costs, in contrast to other service providers that offer different programming packages in different markets; |

| ● |

focusing on retaining and seeking expected higher relative value customers rather than trying to maximize the number of PSUs; |

| ● |

aligning our resources to emphasize increased sales of residential data services and sales to business customers and continuing our disciplined cost management approach, rather than committing resources equally to sales of all of our products; |

| ● |

investing in self-service channels to improve customer satisfaction by allowing us to meet changing customer expectations for around-the-clock service while also avoiding unnecessary wait times; and |

| ● |

implementation of digital transformation initiatives that include automation and customer self-service within our processes, which enables us to better allocate resources to more value-added activities and enables our customers and associates to thrive in an increasingly digital world. |

We believe our strategy has produced positive results for our customers, associates and stockholders and we have begun applying this strategy in our acquired operations. Our strategy has allowed us to continually decrease customer service phone calls and truck rolls. We have been able to achieve these operational efficiencies at the same time as our customer base has grown rapidly, while simultaneously maintaining customer satisfaction scores.

Balanced capital allocation. We are committed to a disciplined approach to evaluating acquisitions, internal and external investments, capital structure optimization and return of capital in order to build long-term stockholder value. We proactively invest in our network, within both existing markets and in near-adjacent areas. We also assess available inorganic opportunities through either full acquisitions of, or strategic investments in, complementary companies as we believe part of our strategy is to be the natural aggregator of rural broadband assets in small cities and large towns. When identifying and assessing acquisition targets, we look for providers with a data-centric product mix, comparable market demographics, geographic alignment, attractive competitive positions, visible growth and margin expansion opportunities, stable financial performance, leading broadband technologies and similar cultures. When evaluating strategic investment opportunities, we look for companies that we would consider acquiring in the future and that have proven operating leaders alongside trusted financial partners. We return capital to shareholders through dividends and opportunistic share repurchases, and may also pay down outstanding debt.

Target higher relative value residential customers. We employ rigorous analytics to gain a deeper understanding of our customers and drive profitable decision making throughout the organization. We use data analytics to help refine our go-to-market strategy and identify customers likely to produce higher relative value over the life of their service relationships with us, rather than seeking to maximize the number of PSUs. Our investments in business intelligence have enabled us to integrate, analyze and visualize increasingly complex data sets, in near real-time, and in a format that drives strategic and operational decisions. As a result, our organization has more rapidly identified, modeled, tested, analyzed and implemented initiatives that align with our strategic focus of attracting and retaining higher relative value customers. Business intelligence also enables us to be more predictive with customer habits and industrywide trends. For example, our decision to focus on data-only customers was guided by such data analytics. We believe that optimizing our relationships with these customers, as video and voice cord-cutting accelerates, is both a necessity and an opportunity for our business.

Our Products

Residential Data Services

Residential data services represented 54.8%, 52.0% and 50.5% of our total revenues for 2022, 2021 and 2020, respectively. We offer simplified data plans with lower pricing and higher speeds across our premium tiers, with download speeds up to 1 Gbps available to nearly all of our residential customers as of December 31, 2022. We also offer our customers the option to purchase an unlimited data plan regardless of speed tier. Further, to meet the increasing bandwidth needs of our customers who use a growing number of devices in the home, we offer most of our customers our advanced Wi-Fi service combining state-of-the-art technology solutions with certified technicians, who locate and configure hardware based on individual customer needs. This service provides customers with enhanced Wi-Fi signal strength, which extends and improves the Wi-Fi signal throughout the home.

Residential Video Services

Residential video services represented 19.1%, 21.2% and 25.1% of our total revenues for 2022, 2021 and 2020, respectively. We offer a broad variety of residential video services, generally ranging from a basic video service to a full digital service with access to hundreds of channels. We now offer Sparklight TV, an IPTV video service that allows customers to stream our video channels from the cloud through a new app on supported devices, such as the Amazon Firestick, Apple TV and Android-based smart televisions, and provides a cloud-based DVR feature that does not require the use of a set-top box.

Business Services

We consider the data, voice and video products we provide to our business customers to be a separate product from our residential versions of these services. Business services represented 17.9%, 19.2% and 17.7% of our total revenues for 2022, 2021 and 2020, respectively. We offer services for businesses ranging in size from small to mid-market, in addition to enterprise, wholesale and carrier customers. We believe we will continue to experience growth in sales to business customers over the long term given the sizeable total addressable market within our footprint and our history of expanding penetration rates.

Our offerings for small businesses are provided over a mixture of our fiber and HFC networks, with all new buildouts being fiber. Our data services offer various options with download speeds ranging from 25 Mbps up to 1 Gbps over HFC, with varying upload speeds, along with managed Wi-Fi. Our small business voice solutions include hosted voice with unified communications as a service from one line to multi-line options, including the availability of popular calling features like simultaneous ring, hunt groups and selective call forwarding. Business video packages range from a basic service tier to a comprehensive selection including variety, news and sports programming in high-definition. Our small- and medium-sized business customers experience up to 5 Gbps symmetrical speeds over fiber in select markets.

We offer delivery of data and voice services using fiber-to-the-premises technology primarily for mid-market customers. This shared fiber architecture provides for symmetrical data speeds ranging from 50 Mbps to 5 Gbps. We expect to expand this technology to additional areas and markets each year for the foreseeable future, especially in our competitive locations.

For enterprise and wholesale customers, we offer dedicated bandwidth and Enterprise Wi-Fi in addition to multiple voice services via fiber optic technology. Our fiber optic-based products include dark fiber in addition to dedicated internet access and E-Line, E-Lan and E-Access Ethernet services. We also offer network-to-network interface connections to other carriers at multiple points of presence across the United States. Our enterprise customers experience symmetrical speeds of up to 10 Gbps over fiber.

Residential Voice Services

Residential voice services represented 2.5%, 3.0% and 3.6% of our total revenues for 2022, 2021 and 2020, respectively. The majority of our residential voice service offerings transmit digital voice signals over our network and are interconnected Voice over Internet Protocol (“VoIP”) services. We also offer traditional telecommunications services through some of our subsidiaries.

Competition

We operate in a highly competitive, subscriber-driven and rapidly changing industry and compete with a growing number of entities that provide a broad range of communications products, services and content to subscribers. Our competitors have historically included, and we expect will continue to include, DBS providers, telephone companies that offer data and video services through digital subscriber line (“DSL”) technology or fiber-to-the-node networks, municipalities and cooperatives with fiber-based networks, regional fiber providers and other service providers that have been granted a franchise to operate in a geographic market in which we are already operating.

We also face increasing competition from wireless telephone companies for our residential voice services, as our customers continue to replace our residential voice services with wireless voice services. New entrants with significant financial resources may compete on a larger scale with our video and data services, and as more wireless voice service providers offer unlimited data options, some customers may choose to forgo our data services altogether. We may also face increasing competition from various providers of wireless internet offerings, including FWA providers that are deploying high-speed “5G” wireless networks where they have higher capacity spectrum and public locations or commercial establishments offering Wi-Fi at no cost. To date we have not faced meaningful FWA-triggered customer losses. If and when FWA meaningfully enters our markets, we believe we will be in a strong long-term competitive position as our wired infrastructure provides for speeds and capacity far in excess of what any FWA competitor can provide given the limitations of the new technology.

In approximately two-thirds of our footprint, we do not have a wired competitor that offers residential broadband download speeds of 100 Mbps or higher, which is only half the speed of our flagship 200 Mbps residential high-speed data offering.

Certain municipalities and cooperatives have also announced plans to construct their own data networks with access speeds that match or exceed ours through the use of fiber-to-the-node or fiber-to-the-premises technology. In some cases, local government entities and municipal utilities may legally compete with us without obtaining a franchise from a state or local governmental franchising authority (“LFA”), reducing their barriers to entry into our markets. The entrance of municipalities as competitors in our markets would add to the competition we face and could lead to some customer attrition.

While not an area of strategic focus for us, our video business also faces substantial and increasing competition from other forms of in-home and mobile entertainment, including, among others, Amazon Prime Video, Apple TV+, Disney+, HBO Max, Hulu, Netflix, Paramount+, Peacock, YouTube TV and an increasing number of new entrants who offer OTT video programming, including many traditional programmers. Because of the significant size and financial resources of many of the companies behind such service offerings, we anticipate that they will continue to invest resources in increasing the availability of video content over the internet, which may result in less demand for the video services we provide. Despite the negative impact this competition has on our video business, these services also generate additional demand for our residential data business due to customers’ continued growing need for data services.

Competition for dedicated fiber-optic services for enterprise business customers is also intense as both local telephone companies and regional overbuilders offer data and voice services over dedicated fiber connections. While certain of these entities are currently more widely known for dedicated fiber services than we are, we maintain a competitive advantage through our local presence and deep customer relationships in the communities we serve.

In addition, in recent years, federal and state governments have offered billions of dollars in subsidies to companies deploying broadband to areas deemed to be “unserved” or “underserved,” using funds from the Federal Communications Commission's (the "FCC") Rural Digital Opportunity Fund ("RDOF") auction in 2020, The American Rescue Plan Act of 2021 (“ARPA”), and The Infrastructure Investment and Jobs Act of 2021 (the “Infrastructure Act”). Although we intend to oppose such subsidies to competitors when directed to areas that we already serve, our challenge efforts may not always be successful and efforts to use governmental funds to subsidize the deployment of broadband in areas that we already serve could result in increased competition.

Human Capital Resources

Associate Metrics

As of December 31, 2022, we had 3,132 full-time and part-time associates, compared to 3,628 full-time and part-time associates at December 31, 2021. The decrease in associates year-over-year was due primarily to the transfer of associates to Clearwave Fiber. None of our associates were represented by a union at December 31, 2022 or 2021. Women represented approximately 33% of our total associate base and 36% of management-level positions at December 31, 2022 compared to 30% of our total associate base and 35% of management-level positions as of December 31, 2021.We were recently named by the Women in Cable Telecommunications Network as one of the 2022 Top Companies for Women to Work based on the results of their most recent pay equity, advancement opportunities and resources workplace diversity survey.

Associate Engagement, Retention and Compensation Programs and Benefits

We believe our associates are our most important resources and are critical to our continued success. We strive to attract, develop, motivate and retain associates with an emphasis on performance and productivity. We seek to maintain alignment, foster accountability and encourage long-term focus throughout all levels of associates at our Company. Our average associate tenure at Cable One (or its predecessors) is nearly 10 years.

Our senior management team is comprised of executives who have significant experience in our industry. They also understand and are deeply committed to our strategy, which we developed, enhanced and updated on a collaborative basis over many years. Our executive officers have an average industry tenureof nearly 24 years and an average tenure at Cable One (or its predecessors) of over 11 years, and we believe this team is deeply knowledgeable about cost and competitive conditions in our markets.

Our total rewards compensation philosophy encompasses pay, health benefits, incentives, wellness and career development options. Our pay-for-performance philosophy permeates our organization. Merit increases are based on individual performance and market conditions, and all associates are eligible for an annual bonus based on objective corporate performance goals shared by everyone in the Company.

We also focus on associate satisfaction. We believe that customer satisfaction is tightly linked to associate satisfaction, which routine internal measurements have shown to be consistently high throughout the past decade. We currently measure our associate satisfaction annually along with conducting multiple periodic associate surveys. Management reviews our associate satisfaction surveys to monitor associate morale and receive feedback on a variety of issues.

Talent Development and Training

We believe in investing in the development and careers of our associates to allow them to reach their potential in a competitive, constantly changing and innovative industry. We engage our associates through internal and external programs to develop specialized knowledge and leadership skills. Associates have access to online development programs for professional skills and certification preparation through our e-learning platform. Specialized technical training for eligible associates helps them grow professionally and enables them to provide differentiated customer experience. Our tuition reimbursement program enables associates to earn certificates in areas such as network programming, data analysis and network administration and security. Others leverage our educational benefits to earn their associates, bachelor’s and master’s degrees.

To prepare associates for current and future leadership roles at our Company, we invest heavily in leadership development programs for everyone from frontline leaders to executive leadership through both in-house and third-party learning courses. Company leaders receive training on leadership expectations, developing associates, building great teams and competing to win to ensure we are consistent in what it means to be a leader at Cable One.

We have a long track record of promoting associates from within, including Julia M. Laulis, our Chair of the Board, President and Chief Executive Officer, who has been with Cable One for more than 20 years and began her career at Cable One as a Director of Marketing.

Health and Safety

Our safety team that is responsible for company-wide safety education and training programs. In an effort to minimize or eliminate hazards, we regularly analyze indicators and areas where risks and injuries can occur. We also have mandatory compliance and safety training for associates, with more than 20,000 instructional hours completed in 2022.

Diversity and Inclusion

We are an equal opportunity employer that strives to provide an inclusive and respectful environment that represents a wide range of backgrounds, cultures and experiences. We are committed to fostering an environment in which all associates and customers are valued. We foster a diverse and inclusive culture by offering competitive compensation, a comprehensive rewards program and opportunities for all of our associates to grow personally and professionally. Our Inclusion and Diversity Advisory Board (the “I&D Advisory Board”) is made up of individuals across the organization from frontline associates to members of management. The I&D Advisory Board was created to further strengthen a culture of respect and inclusion at Cable One. Members of our I&D Advisory Board cultivate resources that are accessible on our intranet, bring in outside speakers and host events to inform, educate and provide all associates with a voice to share their unique experiences, perspectives and viewpoints. In 2022, there were a total of 2,401 participants that joined different sessions provided.

Available Information and Website

Our internet address is www.sparklight.com. We make available free of charge through our investor relations website, ir.cableone.net, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such documents are electronically filed with the SEC. Printed copies of these documents will be furnished without charge (except exhibits) to any stockholder upon written request addressed to our Secretary at 210 E. Earll Drive, Phoenix, Arizona 85012. The SEC maintains a website, www.sec.gov, that contains the reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

The contents of these websites are not incorporated by reference into this Annual Report on Form 10-K and shall not be deemed “filed” under the Exchange Act. Further, our references to website URLs are intended to be inactive textual references only.

Information About Our Executive Officers

The following table presents certain information, as of February 23, 2023, concerning our executive officers.

| Name |

|

Age |

|

Position |

| Julia M. Laulis |

|

60 |

|

Chair of the Board, President and Chief Executive Officer |

| Michael E. Bowker |

|

54 |

|

Chief Operating Officer |

| Todd M. Koetje |

|

46 |

|

Chief Financial Officer |

| Kenneth E. Johnson | 59 | Chief Technology and Digital Officer | ||

| Christopher D. Boone |

40 |

Senior Vice President, Business Services and Emerging Markets |

||

| Megan M. Detz | 46 | Senior Vice President, Human Resources | ||

| Eric M. Lardy |

49 |

Senior Vice President, Operations and Integration |

||

| James A. Obermeyer |

59 |

Senior Vice President, Marketing and Sales |

||

| Peter N. Witty |

55 |

Senior Vice President, General Counsel and Secretary |

Julia M. Laulis

Ms. Laulis has been Chair of the Board since January 2018, Chief Executive Officer and a member of our Board of Directors (the “Board”) since January 2017 and President of Cable One since January 2015.

Ms. Laulis joined Cable One in 1999 as Director of Marketing – Northwest Division. In 2001, she was named Vice President of Operations for the Southwest Division. In 2004, she became responsible for starting Cable One’s Phoenix Customer Care Center. Ms. Laulis was named Chief Operations Officer in 2008, responsible for the Company's three operation divisions and two call centers. In 2012, Ms. Laulis was named Chief Operating Officer, adding sales, marketing and technology to her responsibilities. In January 2015, she was promoted to President and Chief Operating Officer.

Prior to joining Cable One, Ms. Laulis was with Jones Communications in the Washington, D.C. area and Denver, where she served in various marketing management positions. Ms. Laulis began her 39-year career in the cable industry with Hauser Communications.

Ms. Laulis serves on the boards of The AES Corporation, CableLabs and C-SPAN.

Michael E. Bowker

Mr. Bowker has been Chief Operating Officer of Cable One since May 2017.

Mr. Bowker joined Cable One in 1999 as Advertising Regional Sales Manager. Mr. Bowker has been a Vice President of Cable One since 2005. He was named Vice President of Sales in 2012 and was promoted to Senior Vice President, Chief Sales and Marketing Officer in 2014.

Prior to joining Cable One, Mr. Bowker was with AT&T Media Services and TCI Cable, where he served in various sales management positions.

Mr. Bowker serves as Vice Chairman of ACA Connects — America’s Communications Association.

Todd M. Koetje

Mr. Koetje has been Chief Financial Officer of Cable One since July 2022. He previously served as Senior Vice President, Business Development and Finance of Cable One from August 2021 through June 2022.

Prior to joining Cable One, Mr. Koetje served as Managing Director & Group Head of the Technology, Media & Telecommunications Leveraged Finance team at Truist Securities.

Kenneth E. Johnson

Mr. Johnson has been Chief Technology and Digital Officer since January 2023. He previously served as Senior Vice President, Technology Services of Cable One from May 2018 through December 2022.

Mr. Johnson joined Cable One in 2017 as Vice President, Northeast Division following Cable One’s acquisition of NewWave.

Prior to joining Cable One, Mr. Johnson served as Chief Operating Officer and Chief Technology Officer for NewWave. Prior to NewWave, Mr. Johnson was Chief Technology Officer for SureWest Communications and Everest Connections.

Mr. Johnson serves on the board of the Society of Cable Telecommunications Engineers.

Christopher D. Boone

Mr. Boone has been Senior Vice President, Business Services and Emerging Markets of Cable One since January 2021.

Mr. Boone joined Cable One in 2010 as a Business Sales Manager. He was named Vice President of Business Services in 2016.

Prior to joining Cable One, Mr. Boone was with Cox Communications, where he served in various sales management roles.

Megan M. Detz

Ms. Detz has been Senior Vice President, Human Resources of Cable One since May 2021.

Ms. Detz joined Cable One following the Hargray Acquisition.

Prior to joining Cable One, Ms. Detz served as Senior Vice President, Human Resources & Administration at Hargray. Prior to Hargray, Ms. Detz was Chief People Officer at VARIDESK and Senior Vice President, Human Capital at NTT DATA, Inc.

Eric M. Lardy

Mr. Lardy has been Senior Vice President, Operations and Integration of Cable One since June 2020.

Mr. Lardy joined Cable One in 1997 as a manager in one of our systems and has held a variety of positions of increasing responsibility in marketing, operations and system general management. Mr. Lardy was named Vice President, Strategic Planning and Finance in 2014 and was promoted to Senior Vice President in January 2017.

James A. Obermeyer

Mr. Obermeyer has been Senior Vice President, Marketing and Sales of Cable One since February 2020.

Prior to joining Cable One, Mr. Obermeyer served as Vice President of Marketing at Charter Communications. Prior to Charter Communications, he was Managing Director of Brand and Consumer Marketing for NASCAR and Chief Marketing Officer for Supra Telecom.

Mr. Obermeyer serves on the board of the National Cable Television Cooperative.

Peter N. Witty

Mr. Witty has been Senior Vice President, General Counsel and Secretary of Cable One since April 2018.

Prior to joining Cable One, Mr. Witty served as General Counsel and Secretary for Gas Technology Institute (“GTI”), an energy research, development and training organization. Prior to GTI, he spent 10 years with Abbott Laboratories, serving in various positions, including as Senior Counsel and Division Counsel. Mr. Witty previously practiced law as an associate at Latham & Watkins LLP and Ross & Hardies (now McGuireWoods LLP).

Regulation and Legislation

General

Our data, video and voice operations are subject to various requirements imposed by U.S. federal, state and local governmental authorities. The regulation of certain cable rates pursuant to procedures established by Congress has negatively affected our revenues. Certain other legislative, regulatory and judicial matters discussed in this section also have the potential to adversely affect our data, video and voice businesses. The following discussion does not purport to be a complete summary of all the provisions of federal, state and local law that may affect our operations. Proposals for additional or revised regulations and requirements are pending before Congress, state legislatures and federal and state regulatory agencies. We generally cannot predict whether new legislation or regulations, court action or a change in the extent of application or enforcement of current laws and regulations would have an adverse impact on our operations.

Broadband Internet Access Services

Broadband internet access service, which we currently offer in all our systems, is subject to some regulation at the federal level and is not subject to state or local government regulation at this time, except for the state net neutrality laws discussed below.

Regulatory Reclassification and Net Neutrality Regulation. In 2017, the FCC adopted the Restoring Internet Freedom Order (the “Internet Freedom Order”), which reinstated broadband internet access service as an “information service” under Title I of the Communications Act of 1934, as amended (the “Communications Act”). The Internet Freedom Order rescinded the majority of the open internet rules adopted by the FCC in 2015 in the Open Internet Order, with the exception of enhanced disclosure requirements that require broadband internet access service providers to disclose information regarding network management, performance and commercial terms of the service to their customers. In October 2020, the FCC reaffirmed its previous findings about the Internet Freedom Order after certain issues were remanded to it by the U.S. Court of Appeals for the District of Columbia Circuit. In July 2021, President Biden issued an Executive Order on Promoting Competition in the American Economy that encouraged the FCC to consider adopting net neutrality rules similar to those originally adopted in 2015. Numerous parties also have urged the FCC to take action regarding net neutrality. Any such action by the FCC likely would be subject to further judicial review.