UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the quarterly period ended

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| Beijing, People’s Republic of | ||

| (Address of principal executive offices) | (Zip Code) |

| (Registrant’s telephone number, including area code) |

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ | Large accelerated filer | ☐ | Accelerated filer |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of May 13, 2024,

DATASEA INC.

TABLE OF CONTENTS

| Page No. | ||

| Part I - Financial Information | ||

| Item 1 | Financial Statements | 1 |

| Item 2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 31 |

| Item 3 | Quantitative and Qualitative Disclosures about Market Risk | 58 |

| Item 4 | Controls and Procedures | 58 |

| Part II - Other Information | ||

| Item 1 | Legal Proceedings | 60 |

| Item 1A | Risk Factors | 60 |

| Item 2 | Unregistered Sales of Equity Securities and Use of Proceeds | 60 |

| Item 3 | Defaults Upon Senior Securities | 60 |

| Item 4 | Mine Safety Disclosures | 60 |

| Item 5 | Other Information | 60 |

| Item 6 | Exhibits | 60 |

i

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

DATASEA INC.

CONSOLIDATED BALANCE SHEETS

| MARCH 31, 2024 (UNAUDITED) | JUNE 30, 2023 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | $ | ||||||

| Accounts receivable | ||||||||

| Inventory, net | ||||||||

| Value-added tax prepayment | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| NONCURRENT ASSETS | ||||||||

| Long-term investment | ||||||||

| Property and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Right-of-use assets, net | ||||||||

| Total noncurrent assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | $ | ||||||

| Unearned revenue | ||||||||

| Accrued expenses and other payables | ||||||||

| Due to related parties | ||||||||

| Operating lease liabilities | ||||||||

| Bank loan payable | ||||||||

| Total current liabilities | ||||||||

| NONCURRENT LIABILITIES | ||||||||

| Operating lease liabilities | ||||||||

| Bank loan payable- non-current | - | |||||||

| Loan payable- non-current | - | |||||||

| Total noncurrent liabilities | - | |||||||

| TOTAL LIABILITIES | ||||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Common stock, $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated comprehensive income | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| TOTAL COMPANY STOCKHOLDERS’ EQUITY (DEFICIT) | ( | ) | ||||||

| Noncontrolling interest | ( | ) | ( | ) | ||||

| TOTAL EQUITY (DEFICIT) | ( | ) | ||||||

| TOTAL LIABILITIES AND EQUITY (DEFICIT) | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

1

DATASEA INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| THREE MONTHS ENDED MARCH 31, | NINE MONTHS ENDED MARCH 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Cost of goods sold | ||||||||||||||||

| Gross profit | ||||||||||||||||

| Operating expenses | ||||||||||||||||

| Selling | ||||||||||||||||

| General and administrative | ||||||||||||||||

| Research and development | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Loss from operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Other income (expenses) | ( | ) | ( | ) | ( | ) | ||||||||||

| Interest income | ||||||||||||||||

| Total non-operating income (expenses), net | ( | ) | ( | ) | ( | ) | ||||||||||

| Loss before income tax | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income tax | ||||||||||||||||

| Loss before noncontrolling interest from continuing operation | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income (loss) before noncontrolling interest from discontinued operation | ( | ) | ( | ) | ||||||||||||

| Less: loss attributable to noncontrolling interest from continuing operation | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Less: loss attributable to noncontrolling interest from discontinued operation | ( | ) | ( | ) | ||||||||||||

| Net loss attribute to noncontrolling interest | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net loss to the Company from continuing operation | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net income (loss) to the Company from discontinued operation | ( | ) | ( | ) | ||||||||||||

| Net loss to the Company | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other comprehensive item | ||||||||||||||||

| Foreign currency translation loss attributable to the Company | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Foreign currency translation gain attributable to noncontrolling interest | ( | ) | ||||||||||||||

| Comprehensive loss attributable to the Company | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Comprehensive income (loss) attributable to noncontrolling interest | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||

| * |

The accompanying notes are an integral part of these consolidated financial statements.

2

DATASEA INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

NINE AND THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(UNAUDITED)

| Common Stock | Additional paid-in | Accumulated | Accumulated other comprehensive | Noncontrolling | ||||||||||||||||||||||||

| Shares | Amount | capital | deficit | income | Total | interest | ||||||||||||||||||||||

| Balance at July 1, 2023 | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Issuance of common stock for equity financing | ||||||||||||||||||||||||||||

| Shares issued for stock compensation expense | - | |||||||||||||||||||||||||||

| Foreign currency translation loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Balance at September 30, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Shares issued for stock compensation expense | - | |||||||||||||||||||||||||||

| Foreign currency translation gain | - | |||||||||||||||||||||||||||

| Balance at December 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Shares issued for stock compensation expense | ||||||||||||||||||||||||||||

| Shares issued for paying officers’ accrued salary and bonus | ||||||||||||||||||||||||||||

| Foreign currency translation loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||||||||||||

| Balance at July 1, 2022 | $ | $ | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Shares issued for stock compensation expense | - | |||||||||||||||||||||||||||

| Foreign currency translation gain (loss) | - | ( | ) | |||||||||||||||||||||||||

| Balance at September 30, 2022 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Shares issued for stock compensation expense | - | |||||||||||||||||||||||||||

| Purchase of minority interest ownership | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Foreign currency translation gain (loss) | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance at December 31, 2022 | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||

| Shares issued for stock compensation expense | - | |||||||||||||||||||||||||||

| Foreign currency translation gain (loss) | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

DATASEA INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| NINE MONTHS ENDED MARCH 31 | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Loss including noncontrolling interest | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile loss including noncontrolling interest to net cash used in operating activities: | ||||||||

| Gain on disposal of subsidiary | ( | ) | ( | ) | ||||

| Bad debt reversal | ( | ) | ||||||

| Depreciation and amortization | ||||||||

| Loss on disposal of fixed assets | ||||||||

| Operating lease expense | ||||||||

| Stock compensation expense | ||||||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ( | ) | ||||

| Inventory | ( | ) | ||||||

| Value-added tax prepayment | ( | ) | ( | ) | ||||

| Prepaid expenses and other current assets | ( | ) | ||||||

| Accounts payable | ( | ) | ||||||

| Unearned revenue | ( | ) | ( | ) | ||||

| Accrued expenses and other payables | ( | ) | ||||||

| Payment on operating lease liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities: | ||||||||

| Acquisition of property and equipment | ( | ) | ( | ) | ||||

| Acquisition of intangible assets | ( | ) | ( | ) | ||||

| Cash received from disposal of fixed assets | ||||||||

| Cash disposed due to disposal of subsidiary | ( | ) | ||||||

| Long-term investment | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Due to related parties | ||||||||

| Proceeds from loan payables | ||||||||

| Repayment of loan payables | ( | ) | ||||||

| Net proceeds from issuance of common stock | ||||||||

| Net cash provided by financing activities | ||||||||

| Effect of exchange rate changes on cash | ( | ) | ( | ) | ||||

| Net increase (decrease) in cash | ( | ) | ||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for income tax | $ | $ | ||||||

| Supplemental disclosures of non-cash financing activities: | ||||||||

| Right-of-use assets obtained in exchange for operating lease liabilities | $ | $ | ||||||

| Transfer of debt owing to the Company’s’ CEO to Mr. Wanli Kuai | $ | $ | ||||||

| Shares issued for paying officers' accrued salary and bonus | $ | $ | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

DATASEA INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024 (UNAUDITED) AND JUNE 30, 2023

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Datasea Inc. (the “Company,”

“Datasea,” or “we,” “us,” “our”) was incorporated in the State of Nevada on September

26, 2014 under the name Rose Rock Inc. and changed its name to Datasea Inc. on May 27, 2015. On May 26, 2015, the Company’s founder,

Xingzhong Sun, sold

On October 29, 2015, the

Company entered into a share exchange agreement (the “Exchange Agreement”) with the shareholders (the “Shareholders”)

of Shuhai Information Skill (HK) Limited (“Shuhai Skill (HK)”), a limited liability company (“LLC”) incorporated

on May 15, 2015 under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China (the “PRC”).

Pursuant to the terms of the Exchange Agreement, the Shareholders, who own

Following the Share Exchange,

the Shareholders, Zhixin Liu and her father, Fu Liu, owned approximately

After the Share Exchange, the Company, through its consolidated subsidiaries and VIE provide smart security solutions primarily to schools, tourist or scenic attractions and public communities in China.

On October 16, 2019, Shuhai Beijing incorporated a wholly owned subsidiary, Heilongjiang Xunrui Technology Co. Ltd. (“Xunrui”), which develops and markets the Company’s smart security system products.

On December 3, 2019, Shuhai Beijing

formed Nanjing Shuhai Equity Investment Fund Management Co. Ltd. (“Shuhai Nanjing”), a joint venture in PRC, in which Shuhai

Beijing holds a

In January 2020, the Company acquired ownership in three entities for no consideration from the Company’s management, which set up such entities on the Company’s behalf (described below).

On January 3, 2020, Shuhai Beijing

entered into two equity transfer agreements (the “Transfer Agreements”) with the President, and a Director of the Company. Pursuant

to the Transfer Agreements, the Director and the President, each agreed, for no consideration, to (i) transfer his

5

On January 7, 2020, Shuhai Beijing

entered into another equity transfer agreement with the President, the Director described above and an unrelated individual. Pursuant

to this equity transfer agreement, the Director, the President and the unrelated individual each agreed to transfer his

On August 17, 2020, Beijing Shuhai formed a new wholly-owned subsidiary Shuhai Jingwei (Shenzhen) Information Technology Co., Ltd (“Jingwei”), to expand the security oriented systems developing, consulting and marketing business overseas.

On November 16, 2020, Guohao

Century formed Hangzhou Zhangqi Business Management Limited Partnership (“Zhangqi”) with ownership of

On November 19, 2020, Guohao

Century formed a

On February 16, 2022, Shuhai

Jingwei formed Shenzhen Acoustic Effect Management Limited Partnership (“Shenzhen Acoustic MP”) with

On February 16, 2022, Shuhai

Jingwei formed Shuhai (Shenzhen) Acoustic Effect Technology Co., Ltd (“Shuhai Shenzhen Acoustic Effect”), a PRC Company, in

which Shuhai Jingwei holds

On March 4, 2022, Shuhai Beijing

formed Beijing Yirui Business Management Development Center (“Yirui”) with

On March 4, 2022, Shuhai Beijing

formed Beijing Yiying Business Management Development Center (“Yiying”) with

On July 31, 2023, Datasea established a wholly owned subsidiary Datasea Acoustic, LLC (“Datasea Acoustic”) in the state of Delaware for expanding the products to the market in North America.

On October 24, 2023, Guozhong

Times formed Shuhai Yiyun (Shenzhen) digital technology Co, Ltd (“Yiyun”) with

6

On January

10, 2024, the Company’s Board of Directors approved a reverse stock split of its authorized and issued and outstanding shares of

common stock, par value $

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

GOING CONCERN

The accompanying consolidated

financial statements (“CFS”) were prepared assuming the Company will continue as a going concern, which contemplates

continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. For the three months

ended March 31, 2024 and 2023, the Company had a net loss of approximately $

During

the nine months ended March 31, 2024, the Company made total prepayments of $

If deemed necessary, management could seek to raise additional funds by way of admitting strategic investors, or private or public offerings, or by seeking to obtain loans from banks or others, to support the Company’s research and development (“R&D”), procurement, marketing and daily operation. While management of the Company believes in the viability of its strategy to generate sufficient revenues and its ability to raise additional funds on reasonable terms and conditions, there can be no assurances to that effect. The ability of the Company to continue as a going concern depends upon the Company’s ability to further implement its business plan and generate sufficient revenue and its ability to raise additional funds by way of a public or private offering. There is no assurance that the Company will be able to obtain funds on commercially acceptable terms, if at all. There is also no assurance that the amount of funds the Company might raise will enable the Company to complete its initiatives or attain profitable operations. If the Company is unable to raise additional funding to meet its working capital needs in the future, it may be forced to delay, reduce or cease its operations.

7

BASIS OF PRESENTATION AND CONSOLIDATION

The CFS were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the SEC regarding CFS. In the opinion of management, such financial information includes all adjustments (consisting only of normal recurring adjustments, unless otherwise indicated) considered necessary for a fair presentation of our financial position at such date and the operating results and cash flows for such periods. Operating results for the three and nine months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the entire year or for any other subsequent interim period. The interim consolidated financial information should be read in conjunction with the Financial Statements and the notes thereto, included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, previously filed with the Securities Exchange Commission (“SEC”) on September 27, 2023.

The accompanying CFS include

the financial statements of the Company and its

VARIABLE INTEREST ENTITY

Pursuant to the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Section 810, “Consolidation” (“ASC 810”), the Company is required to include in its CFS, the financial statements of Shuhai Beijing, its VIE. ASC 810 requires a VIE to be consolidated if the Company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. A VIE is an entity in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards of such entity, and therefore the Company is the primary beneficiary of such entity.

8

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The reporting entity’s determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de - facto agents, have the unilateral ability to exercise those rights. Shuhai Beijing’s actual stockholders do not hold any kick-out rights that affect the consolidation determination.

Through the VIE agreements, Tianjin Information, an indirect subsidiary of Datasea is deemed the primary beneficiary of Shuhai Beijing and its subsidiaries. Accordingly, the results of Shuhai Beijing and its subsidiaries were included in the accompanying CFS. Shuhai Beijing has no assets that are collateral for or restricted solely to settle their obligations. The creditors of Shuhai Beijing do not have recourse to the Company’s general credit.

VIE Agreements

Operation and Intellectual Property Service Agreement – The Operation and Intellectual Property Service Agreement allows Tianjin Information Sea Information Technology Co., Ltd (“WFOE”) to manage and operate Shuhai Beijing and collect an operating fee equal to Shuhai Beijing’s pre-tax income, per month. If Shuhai Beijing suffers a loss and as a result does not have pre-tax income, such loss shall be carried forward to the following month to offset the operating fee to be paid to WFOE if there is pre-tax income of Shuhai Beijing the following month. Furthermore, if Shuhai Beijing cannot pay off its debts, WFOE shall pay off the debt on Shuhai Beijing’s behalf. If Shuhai Beijing’s net assets fall lower than its registered capital balance, WFOE shall provide capital for Shuhai Beijing to make up for the deficit.

Under the terms of the Operation and Intellectual Property Service Agreement, Shuhai Beijing entrusts Tianjin Information to manage its operations, manage and control its assets and financial matters, and provide intellectual property services, purchasing management services, marketing management services and inventory management services to Shuhai Beijing. Shuhai Beijing and its stockholders shall not make any decisions nor direct the activities of Shuhai Beijing without Tianjin Information’s consent.

Stockholders’ Voting Rights Entrustment Agreement – Tianjin Information has entered into a stockholders’ voting rights entrustment agreement (the “Entrustment Agreement”) under which Zhixin Liu and Fu Liu (collectively the “Shuhai Beijing Stockholders”) have vested their voting power in Shuhai Beijing to Tianjin Information or its designee(s). The Entrustment Agreement does not have an expiration date, but the parties can agree in writing to terminate the Entrustment Agreement. Zhixin Liu, is the Chairman of the Board, President, CEO of DataSea and Corporate Secretary, and Fu Liu, a Director of the DataSea (Fu Liu is the father of Zhixin Liu).

Equity Option Agreement –

the Shuhai Beijing Stockholders and Tianjin Information entered into an equity option agreement (the “Option Agreement”),

pursuant to which the Shuhai Beijing Stockholders have granted Tianjin Information or its designee(s) the irrevocable right and option

to acquire all or a portion of Shuhai Beijing Stockholders’ equity interests in Shuhai Beijing for an option price of RMB

Equity Pledge Agreement – Tianjin Information and the Shuhai Beijing Stockholders entered into an equity pledge agreement on October 27, 2015 (the “Equity Pledge Agreement”). The Equity Pledge Agreement serves to guarantee the performance by Shuhai Beijing of its obligations under the Operation and Intellectual Property Service Agreement and the Option Agreement. Pursuant to the Equity Pledge Agreement, Shuhai Beijing Stockholders have agreed to pledge all of their equity interests in Shuhai Beijing to Tianjin Information. Tianjin Information has the right to collect any and all dividends, bonuses and other forms of investment returns paid on the pledged equity interests during the pledge period. Pursuant to the terms of the Equity Pledge Agreement, the Shuhai Beijing Stockholders have agreed to certain restrictive covenants to safeguard the rights of Tianjin Information. Upon an event of default or certain other agreed events under the Operation and Intellectual Property Service Agreement, the Option Agreement and the Equity Pledge Agreement, Tianjin Information may exercise the right to enforce the pledge.

9

As of this report date, there

were no dividends paid from the VIE to the U.S. parent company or the shareholders of the Company. There has been no change in facts and

circumstances to consolidate the VIE.

| March 31, 2024 | June

30, 2023 | |||||||

| Cash | $ | $ | ||||||

| Accounts receivable | ||||||||

| Inventory | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Intangible asset, net | ||||||||

| Right-of-use asset, net | ||||||||

| Other non-current assets | ||||||||

| Total non-current assets | ||||||||

| Total assets | $ | $ | ||||||

| Accounts payable | $ | $ | ||||||

| Accrued liabilities and other payables | ||||||||

| Lease liability | ||||||||

| Loans payable | ||||||||

| Due to related party | ||||||||

| Other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Lease liability - noncurrent | ||||||||

| Long term long payable | ||||||||

| Total non-current liabilities | ||||||||

| Total liabilities | $ | $ | ||||||

| For the Three Months Ended March 31, 2024 | For the Three Months Ended March 31, 2023 | |||||||

| Revenues | $ | $ | ||||||

| Gross profit | $ | $ | ||||||

| Net loss | $ | ( | ) | $ | ( | )* | ||

| For the Nine Months Ended March 31, 2024 | For the Nine Months Ended March 31, 2023 | |||||||

| Revenues | $ | $ | ||||||

| Gross profit | $ | $ | ||||||

| Net income (loss) | $ | ( | ) | $ | ( | )* | ||

| * |

10

USE OF ESTIMATES

The preparation of CFS in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The significant areas requiring the use of management estimates include, but are not limited to, the estimated useful life and residual value of property, plant and equipment, provision for staff benefits, recognition and measurement of deferred income taxes and the valuation allowance for deferred tax assets. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately differ from those estimates and such differences may be material to the CFS.

CONTINGENCIES

Certain conditions may exist as of the date the CFS are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s CFS.

If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed. As of March 31, 2024 and June 30, 2023, the Company has no such contingencies.

CASH

Cash includes cash on hand and demand deposits that are highly liquid in nature and have original maturities when purchased of three months or less.

ACCOUNTS RECEIVABLE

The Company’s policy is to maintain an allowance for potential credit losses on accounts receivable. The Company adopted Accounting Standards Update (“ASU”) 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit losses on financial instruments later codified as Accounting Standard codification (“ASC”) 326 (“ASC 326”), on July 1, 2023. The guidance introduces a revised approach to the recognition and measurement of credit losses, emphasizing an updated model based on expected losses rather than incurred losses. There was no significant impact on the date of adoption of ASC 326.

Under ASC 326, Accounts receivable are recorded at the invoiced amount, net of allowance for expected credit losses. The Company’s primary allowance for credit losses is the allowance for doubtful accounts. The allowance for doubtful accounts reduces the Accounts receivable balance to the estimated net realizable value. The Company regularly reviews the adequacy of the allowance for credit losses based on a combination of factors. In establishing any required allowance, management considers historical losses adjusted for current market conditions, the Company’s customers’ financial condition, the amount of any receivables in dispute, the current receivables aging, current payment terms and expectations of forward-looking loss estimates.

11

All provisions for the allowance

for doubtful accounts are included as a component of general and administrative expenses on the accompanying consolidated statements of

operations and comprehensive loss. Accounts receivable deemed uncollectible are charged against the allowance for credit losses when identified.

Subsequent recoveries of amounts previously written off are credited to earnings in the period recovered. As of March 31, 2024 and June

30, 2023, the Company had a $

INVENTORY

Inventory is comprised principally

of intelligent temperature measurement face recognition terminal and identity information recognition products, and is valued at the lower

of cost or net realizable value. The value of inventory is determined using the first-in, first-out method. The Company periodically estimates

an inventory allowance for estimated unmarketable inventories when necessary. Inventory amounts are reported net of such allowances. There

were $

PROPERTY AND EQUIPMENT

Property and equipment are stated

at cost, less accumulated depreciation. Major repairs and improvements that significantly extend original useful lives or improve productivity

are capitalized and depreciated over the period benefited. Maintenance and repairs are expensed as incurred. When property and equipment

are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any

gain or loss is included in operations.

| Furniture and fixtures | ||||

| Office equipment | ||||

| Vehicles | ||||

| Leasehold improvement |

Leasehold improvements are depreciated utilizing the straight-line method over the shorter of their estimated useful lives or remaining lease term.

INTANGIBLE ASSETS

Intangible assets with finite lives are amortized using the straight-line method over their estimated period of benefit. Evaluation of the recoverability of intangible assets is made to take into account events or circumstances that warrant revised estimates of useful lives or that indicate that impairment exists. All of the Company’s intangible assets are subject to amortization. No impairment of intangible assets has been identified as of the balance sheet date.

Intangible assets include licenses,

certificates, patents and other technology and are amortized over their useful life of

FAIR VALUE (“FV”) OF FINANCIAL INSTRUMENTS

The carrying value of the Company’s short-term financial instruments, such as cash, accounts receivable, prepaid expenses, accounts payable, unearned revenue, accrued expenses and other payables approximates their FV due to their short maturities. FASB ASC Topic 825, “Financial Instruments,” requires disclosure of the FV of financial instruments held by the Company. The carrying amounts reported in the balance sheets for current liabilities qualify as financial instruments and are a reasonable estimate of their FV because of the short period of time between the origination of such instruments and their expected realization and the current market rate of interest.

12

FAIR VALUE MEASUREMENTS AND DISCLOSURES

FASB ASC Topic 820, “Fair Value Measurements,” defines FV, and establishes a three-level valuation hierarchy for disclosures that enhances disclosure requirements for FV measures. The three levels are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 inputs to the valuation methodology include other than those in level 1 quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the FV measurement. |

As of March 31, 2024 and June 30, 2023, the Company did not identify any assets or liabilities required to be presented on the balance sheet at FV on a recurring basis.

IMPAIRMENT OF LONG-LIVED ASSETS

In accordance with FASB ASC 360-10, “Accounting for the Impairment or Disposal of Long-Lived Assets”, long-lived assets such as property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable, or it is reasonably possible that these assets could become impaired as a result of technological or other changes. The determination of recoverability of assets to be held and used is made by comparing the carrying amount of an asset to future undiscounted cash flows expected to be generated by the asset.

If such assets are considered impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the asset exceeds its FV. FV generally is determined using the asset’s expected future undiscounted cash flows or market value, if readily determinable. Assets to be disposed of are reported at the lower of the carrying amount or FV less cost to sell. For the three and nine months ended March 31, 2024 and 2023, there was no impairment loss recognized on long-lived assets.

UNEARNED REVENUE

The Company records payments received in advance from its customers or sales agents for the Company’s products as unearned revenue, mainly consisting of deposits or prepayment for 5G products from the Company’s sales agencies. These orders normally are delivered based upon contract terms and customer demand, and the Company will recognize it as revenue when the products are delivered to the end customers.

LEASES

The Company determines if an arrangement is a lease at inception under FASB ASC Topic 842. Right of Use Assets (“ROU”) and lease liabilities are recognized at commencement date based on the present value of remaining lease payments over the lease term. For this purpose, the Company considers only payments that are fixed and determinable at the time of commencement. As most of its leases do not provide an implicit rate, it uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Company’s incremental borrowing rate is a hypothetical rate based on its understanding of what its credit rating would be. The ROU assets include adjustments for prepayments and accrued lease payments. The ROU asset also includes any lease payments made prior to commencement and is recorded net of any lease incentives received. The Company’s lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise such options.

ROU assets are reviewed for impairment when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC 360, Property, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Company recognized no impairment of ROU assets as of March 31, 2024 and June 30, 2023.

13

REVENUE RECOGNITION

The Company follows Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (ASC 606).

The core principle underlying FASB ASC 606 is that the Company will recognize revenue to represent the transfer of goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange. This will require the Company to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams are identified when possession of goods and services is transferred to a customer.

FASB ASC Topic 606 requires the use of a five-step model to recognize revenue from customer contracts. The five-step model requires the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies each performance obligation.

The Company derives its revenues from product sales and 5G messaging service contracts with its customers, with revenues recognized upon delivery of services and products. Persuasive evidence of an arrangement is demonstrated via product sale contracts and professional service contracts, with performance obligations identified. The transaction price, such as product selling price, and the service price to the customer with corresponding performance obligations are fixed upon acceptance of the agreement. The Company recognizes revenue when it satisfies each performance obligation, the customer receives the products and passes the inspection and when professional service is rendered to the customer, collectability of payment is probable. These revenues are recognized at a point in time after each performance obligations is satisfied. Revenue is recognized net of returns and value-added tax charged to customers.

| For the Three Months Ended March 31, 2024 | For the Three Months Ended March 31, 2023 | |||||||

| 5G AI Multimodal communication | $ | $ | ||||||

| 5G AI Multimodal communication | ||||||||

| Cloud platform construction cooperation project | ||||||||

| Acoustic Intelligence Business | ||||||||

| Ultrasonic Sound Air Disinfection Equipment | ||||||||

| Other | ||||||||

| Smart City business | ||||||||

| Smart community broadcasting system | ||||||||

| Other | ||||||||

| Total revenue | $ | $ | * | |||||

| For the Nine Months Ended March 31, 2024 | For the Nine Months Ended March 31, 2023 | |||||||

| 5G AI Multimodal communication | $ | $ | ||||||

| 5G AI Multimodal communication | ||||||||

| Aggregate messaging platform | ||||||||

| Cloud platform construction cooperation project | ||||||||

| Acoustic Intelligence Business | ||||||||

| Ultrasonic Sound Air Disinfection Equipment | ||||||||

| Other | ||||||||

| Smart City business | ||||||||

| Smart community | ||||||||

| Smart community broadcasting system | ||||||||

| Smart agriculture | ||||||||

| Other | ||||||||

| Total revenue | $ | $ | * | |||||

| * |

14

SEGMENT INFORMATION

FASB ASC Topic 280, “Segment Reporting,” requires use of the “management approach” model for segment reporting. The management approach model is based on the method a company’s management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company. Management determined the Company’s current operations constitutes a single reportable segment in accordance with ASC 280. The Company’s only business and industry segment is high technology and advanced information systems (“TAIS”). TAIS includes smart city solutions that meet the security needs of residential communities, schools and commercial enterprises, and 5G messaging services including 5G SMS, 5G MMCP and 5G multi-media video messaging.

All of the Company’s customers are in the PRC and all revenues for the three and nine months ended March 31, 2024 and 2023 were generated from the PRC. All identifiable assets of the Company are located in the PRC. Accordingly, no geographical segments are presented.

INCOME TAXES

The Company uses the asset and liability method of accounting for income taxes in accordance with FASB ASC Topic 740, “Income Taxes.” Under this method, income tax expense is recognized for the amount of: (i) taxes payable or refundable for the current period and (ii) deferred tax consequences of temporary differences resulting from matters that have been recognized in an entity’s financial statements or tax returns. Deferred tax assets also include the prior years’ net operating losses carried forward. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that includes the enactment date. A valuation allowance is provided to reduce the deferred tax assets reported if based on the weight of the available positive and negative evidence, it is more likely than not some portion or all of the deferred tax assets will not be realized.

The Company follows FASB ASC Topic 740, which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FASB ASC Topic 740 also provides guidance on recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods, and income tax disclosures.

Under the provisions of FASB

ASC Topic 740, when tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities,

while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately

sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available

evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution

of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that

meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than

15

RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses are expensed in the period when incurred. These costs primarily consist of cost of materials used, salaries paid for the Company’s development department, and fees paid to third parties.

NONCONTROLLING INTERESTS

The Company follows FASB ASC Topic 810, “Consolidation,” governing the accounting for and reporting of noncontrolling interests (“NCIs”) in partially owned consolidated subsidiaries and the loss of control of subsidiaries. Certain provisions of this standard indicate, among other things, that NCI (previously referred to as minority interests) be treated as a separate component of equity, not as a liability, that increases and decreases in the parent’s ownership interest that leave control intact be treated as equity transactions rather than as step acquisitions or dilution gains or losses, and that losses of a partially-owned consolidated subsidiary be allocated to non-controlling interests even when such allocation might result in a deficit balance.

The net Income (loss) attributed

to NCI was separately designated in the accompanying statements of operations and comprehensive income (loss). Losses attributable to

NCI in a subsidiary may exceed a non-controlling interest’s interests in the subsidiary’s equity. The excess attributable

to NCIs is attributed to those interests. NCIs shall continue to be attributed their share of losses even if that attribution results

in a deficit NCI balance. On December 20, 2022, Guohao Century acquired a

Zhangqi was

CONCENTRATION OF CREDIT RISK

The Company maintains cash in

accounts with state-owned banks within the PRC. Cash in state-owned banks less than RMB

16

Cash held in accounts at U.S.

financial institutions is insured by the Federal Deposit Insurance Corporation or other programs subject to certain limitations up to

$

FOREIGN CURRENCY TRANSLATION AND COMPREHENSIVE INCOME (LOSS)

The accounts of the Company’s Chinese entities are maintained in RMB and the accounts of the U.S. parent company are maintained in United States dollar (“USD”). The financial statements of the Chinese entities were translated into USD in accordance with FASB ASC Topic 830 “Foreign Currency Matters.” All assets and liabilities were translated at the exchange rate on the balance sheet date; stockholders’ equity is translated at historical rates and the statements of operations and cash flows are translated at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income (loss) in accordance with FASB ASC Topic 220, “Comprehensive Income.” Gains and losses resulting from foreign currency transactions are reflected in the statements of operations.

The Company follows FASB ASC Topic”220-10, “Comprehensive Income (loss).” Comprehensive income (loss) comprises net income (loss) and all changes to the statements of changes in stockholders’ equity, except those due to investments by stockholders, changes in additional paid-in capital and distributions to stockholders.

| March 31, | March 31, | June 30, | ||||||||||

| 2024 | 2023 | 2023 | ||||||||||

| Period-end date USD: RMB exchange rate | ||||||||||||

| Average USD for the reporting period: RMB exchange rate | ||||||||||||

BASIC AND DILUTED EARNINGS (LOSS) PER SHARE (EPS)

Basic EPS is computed by dividing

income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed

similarly, except that the denominator is increased to include the number of additional common shares that would have been outstanding

if the potential common shares had been issued and if the additional common shares were dilutive. Diluted EPS is based on the assumption

that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock

method. Under this method, options and warrants are assumed to have been exercised at the beginning of the period (or at the time of issuance,

if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. For the

three and nine months ended March 31, 2024 and 2023, the Company’s basic and diluted loss per share are the same as a result of

the Company’s net loss.

17

STATEMENT OF CASH FLOWS

In accordance with FASB ASC Topic 230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon the local currencies. As a result, amounts shown on the statement of cash flows may not necessarily agree with changes in the corresponding asset and liability on the balance sheet.

RECLASSIFICATION

Certain prior period accounts have been reclassified to be in conformity with current period presentation, including reclassification of non-current loan payable to non-current bank loan payable.

RECENT ACCOUNTING PRONOUNCEMENTS

In March 2023, the FASB issued ASU 2023-01, Lease (Topic 842): Common Control Arrangements, which clarifies the accounting for leasehold improvements associated with leases between entities under common control (hereinafter referred to as common control lease). ASU 2023-01 requires entities to amortize leasehold improvements associated with common control lease over the useful life to the common control group (regardless of the lease term) as long as the lessee controls the use of the underlying asset through a lease, and to account for any remaining leasehold improvements as a transfer between entities under common control through an adjustment to equity when the lessee no longer controls the underlying asset. This ASU will be effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted for both interim and annual financial statements that have not yet been made available for issuance. An entity may apply ASU 2023-01 either prospectively or retrospectively. The Company’s management does not believe the adoption of ASU 2023-09 will have a material impact on its financial statements and disclosures.

In November 2023, the FASB issued ASU 2023-07, the amendments in the ASU are intended to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss. In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, provide new segment disclosure requirements for entities with a single reportable segment, and contain other disclosure requirements. The purpose of the amendments is to enable “investors to better understand an entity’s overall performance” and assess “potential future cash flows.” The amendments in ASU 2023-07 are effective for all public entities for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company’s management does not believe the adoption of ASU 2023-09 will have a material impact on its financial statements and disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which requires disclosure of incremental income tax information within the rate reconciliation and expanded disclosures of income taxes paid, among other disclosure requirements. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company’s management does not believe the adoption of ASU 2023-09 will have a material impact on its financial statements and disclosures.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the Company’s consolidated financial position, statements of comprehensive income and cash flows.

18

NOTE 3 – PROPERTY AND EQUIPMENT

| March 31, 2024 | June 30, 2023 | |||||||

| Furniture and fixtures | $ | $ | ||||||

| Vehicle | ||||||||

| Leasehold improvement | ||||||||

| Office equipment | ||||||||

| Subtotal | ||||||||

| Less: accumulated depreciation | ||||||||

| Total | $ | $ | ||||||

Depreciation for the three months

ended March 31, 2024 and 2023 was $

The Company disposed $

NOTE 4 – INTANGIBLE ASSETS

| March 31, 2024 | June 30, 2023 | |||||||

| Software registration or using right | $ | $ | ||||||

| Patent | ||||||||

| Software and technology development costs | ||||||||

| Value-added telecommunications business license | ||||||||

| Subtotal | ||||||||

| Less: Accumulated amortization | ||||||||

| Total | $ | $ | ||||||

Software registration or using right represented the purchase cost of customized software with its source code from third party software developer.

Software and technology development cost represented development costs incurred internally after the technological feasibility was established and a working model was produced and was recorded as intangible asset.

Amortization

for the three months ended March 31, 2024 and 2023 was $

The Company disposed $

19

NOTE 5 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

| March 31, 2024 | June 30, 2023 | |||||||

| Security deposit | $ | $ | ||||||

| Prepaid expenses | ||||||||

| Other receivables – Heqin | ||||||||

| Advance to third party individuals, no interest, payable upon demand | ||||||||

| Others | ||||||||

| Total | ||||||||

| Less: allowance for other receivables – Heqin | ||||||||

| Total | $ | $ | ||||||

As of March 31, 2024, prepaid

expenses mainly consisted of prepaid marketing expense of $

Prepaid marketing expense

On September 14, 2023, Tianjin

Information entered into a service agreement with Beijing Guorui Innovation Enterprise Management Consulting Co., Ltd (“Guorui Innovation”)

for a duration of three years from September 15, 2023 to September 14, 2026. Under this agreement, Guorui Innovation is responsible for

generating annual revenue of at least RMB

On September 16, 2023, Tianjin

Information entered an Operation Cooperation Agreement with an unrelated company, Beijing Jincheng Haoda Construction Engineering Co.,

Ltd (“Jincheng Haoda”), for marketing and promoting the sale of acoustic intelligence series products in oversea market. The

cooperation term is from September 16, 2023 through September 15, 2026. Jincheng Haoda is committed to complete RMB

On September 18, 2023, Tianjin

Information entered an Operation Cooperation Agreement with an unrelated company, Beijing Jiajia Shengshi Trading Co., Ltd (‘Jiajia

Shengshi”), for marketing and promoting the sale of acoustic intelligence series products in domestic market. The cooperation term

is from September 18, 2023 through September 17, 2026. Jiajia Shengshi is committed to complete RMB

20

Other receivables – Heqin

On February 20, 2020, Guozhong Times entered an Operation Cooperation Agreement with an unrelated company, Heqin (Beijing) Technology Co, Ltd. (“Heqin”), for marketing and promoting the sale of Face Recognition Payment Processing equipment and related technical support, and other products of the Company including Epidemic Prevention and Control Systems. Heqin has a sales team which used to work with Fortune 500 companies and specializes in business marketing and sales channel establishment and expansion, especially in education industry and public area.

The cooperation term is from

February 20, 2020 through March 1, 2023; however, Heqin is the exclusive distributor of the Company’s face Recognition Payment Processing

products for the period to July 30, 2020. During March and April 2020, Guozhong Times provided operating funds to Heqin, together with

a credit line provided by Guozhong Times to Heqin from May 2020 through August 2020, for a total borrowing of RMB

No profits will be allocated

and distributed before full repayment of the borrowing. After Heqin pays in full the borrowing, Guozhong Times and Heqin will distribute

profits of sale of Face Recognition Payment Processing equipment and related technical support at

In November 2022, Hangzhou Yuetianyun

Data Technology Company Ltd (“Yuetianyun”) agreed and acknowledged a Debt Transfer Agreement, wherein Heqin transferred its

debt from Yuetianyun to Guozhong Times in the amount of RMB

NOTE 6 – LONG TERM INVESTMENT

In November 2021, Shuhai Nanjing

invested RMB

In August 2022, Shuhai Nanjing

invested RMB

The Company accounts for investments

with less than

21

NOTE 7 – ACCRUED EXPENSES AND OTHER PAYABLES

| March 31, 2024 | June 30, 2023 | |||||||

| Other payables | $ | $ | ||||||

| Due to third parties | ||||||||

| Social security payable | ||||||||

| Salary payable– employees | ||||||||

| Total | $ | $ | ||||||

Due to third parties were the short-term advance from third party individual or companies, bear no interest and payable upon demand.

NOTE 8 – LOANS PAYABLE

Loan from banks

On December 12, 2022, Beijing

Shuhai entered a loan agreement with Shenzhen Qianhai WeBank Co., Ltd for the amount of RMB

On January 13, 2023, Shenzhen

Jingwei entered a loan agreement with Shenzhen Qianhai WeBank Co., Ltd for the amount of RMB

On April

25, 2023, Shuhai Beijing entered a loan agreement with China Bank Co., Ltd for the amount of RMB

| Loan | Borrowing | Loan term | Interest | Balance due | ||||||||||||||||||

| Lender | amount | date | in month | rate | Current | Non-current | ||||||||||||||||

| Shenzhen Qianhai WeBank Co., Ltd | % | |||||||||||||||||||||

| Shenzhen Qianhai WeBank Co., Ltd | % | |||||||||||||||||||||

| China Bank Co., Ltd | % | |||||||||||||||||||||

| Total | ||||||||||||||||||||||

Loan from the unrelated parties

On April 24, 2022, the Company

entered a loan agreement with an unrelated party Mr. Wanli Kuai for $

22

NOTE 9 – RELATED PARTY TRANSACTIONS

On

October 1, 2020, the Company’s CEO (also the president) entered into an office rental agreement with Xunrui. Pursuant to the

agreement, the Company rents an office in Harbin city with a total payment of RMB

On July 1, 2021, the Company’s

CEO entered into a car rental agreement with the Company for one year. Pursuant to the agreement, the Company rents a car from the Company’s

CEO for a monthly rent of RMB

On September 1, 2022, the Company

entered a six-month lease for senior officers’ dormitory in Beijing for a total rent of RMB

Due to related parties

As of March

31, 2024 and June 30, 2023, the Company had due to related parties of $

23

NOTE 10 – COMMON STOCK AND WARRANTS

Registered Direct Offering and Concurrent Private Placement in July 2021

On July

20, 2021, the Company entered into a securities purchase agreement with certain institutional investors, pursuant to which the Company

agreed to sell to such investors an aggregate of

Concurrently

with the sale of the shares of the common stock, the Company also sold warrants to purchase

The closing of the sales of these

securities under the securities purchase agreement took place on July 22, 2021. The net proceeds from the transactions were approximately

$

Registered Direct Offering in August and September 2023

On August

1, 2023, the Company entered into two separate subscription agreements with a certain non-U.S. investor, pursuant to which the Company

sold aggregate of

On August

15, 2023, the Company entered into a subscription agreement with another non-U.S. investor, pursuant to which the Company agreed to sell

and the investor agreed to purchase an aggregate of

On September

13, 2023, the Company closed an underwritten public offering of

24

| Number of Warrants * | Average Exercise Price * | Weighted Average Remaining Contractual Term in Years | ||||||||||

| Outstanding as of June 30, 2023 | $ | |||||||||||

| Exercisable as of June 30, 2023 | $ | |||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited | ||||||||||||

| Expired | ||||||||||||

| Outstanding as of September 30, 2023 | ||||||||||||

| Exercisable as of September 30, 2023 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited | ||||||||||||

| Expired | ||||||||||||

| Outstanding as of December 31, 2023 | ||||||||||||

| Exercisable as of December 31, 2023 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ||||||||||||

| Forfeited | ||||||||||||

| Expired | ||||||||||||

| Outstanding as of March 31, 2024 | $ | |||||||||||

| Exercisable as of March 31, 2024 | $ | |||||||||||

| * |

Shares to Independent Directors as Compensation

During the

three months ended March 31, 2024 and 2023, the Company recorded $

Shares to Officers as Compensation

Shares to Officers in Lieu of Salary Payable

On December

31, 2023, the Board of Directors approved to issue

25

Shares to Employee and consultants under the 2018 Equity Incentive Plan

During the three and nine months

ended March 31, 2024, the Company issued

During the

year ended June 30, 2023, the Company issued

NOTE 11 – INCOME TAXES

The Company is subject to income taxes by entity on income arising in or derived from the tax jurisdiction in which each entity is domiciled. The Company’s PRC subsidiaries file their income tax returns online with PRC tax authorities. The Company conducts all of its businesses through its subsidiaries and affiliated entities, principally in the PRC.

The Company’s U.S. parent

company is subject to U.S. income tax rate of

The Company’s offshore

subsidiary, Shuhai Skill (HK), a HK holding company is subject to

As of March 31, 2024 and June

30, 2023, the Company has approximately $

26

| 2024 | 2023 | |||||||

| US federal statutory rates | ( | )% | ( | )% | ||||

| Tax rate difference – current provision | ( | )% | ( | )% | ||||

| Permanent difference | % | % | ||||||

| Effect of PRC tax holiday | % | % | ||||||

| Valuation allowance | % | % | ||||||

| Effective tax rate | % | % | ||||||

| 2024 | 2023 | |||||||

| US federal statutory rates | ( | )% | ( | )% | ||||

| Tax rate difference – current provision | ( | )% | ( | )% | ||||

| Permanent difference | % | % | ||||||

| Effect of PRC tax holiday | % | % | ||||||

| Valuation allowance | % | % | ||||||

| Effective tax rate | % | % | ||||||

| March 31, 2024 | June 30, 2023 | |||||||

| Deferred tax asset | ||||||||

| Net operating loss | $ | $ | ||||||

| R&D expense | ||||||||

| Depreciation and amortization | ||||||||

| Bad debt expense | ||||||||

| Social security and insurance accrual | ||||||||

| Inventory impairment | ||||||||

| ROU, net of lease liabilities | ( | ) | ||||||

| Total | ||||||||

| Less: valuation allowance | ( | ) | ( | ) | ||||

| Net deferred tax asset | $ | $ | ||||||

NOTE 12 – COMMITMENTS

Leases

On July 30, 2019, the Company

entered into an operating lease for its office in Beijing. Pursuant to the lease, the delivery date of the property was August 8,

2019 but the lease term started on October 8, 2019 and expires on

On November 8, 2023, Shuhai Beijing

entered into a new lease agreement for its office in Beijing. Pursuant to the agreement, the agreement commenced on November 8, 2023 and

will expire on December 7, 2024, and has a monthly rent of RMB

On November 8, 2023, Tianjin

information entered into a lease agreement for its office in Beijing. Pursuant to the agreement, the agreement commenced on November 8,

2023 and will expire on December 7, 2024, and has a monthly rent of RMB

In August 2020, the Company

entered into a lease for an office in Shenzhen City, China for three years from August 8, 2020 through August 7, 2023, with a monthly

rent of RMB

27

On August 26, 2020, Tianjin Information

entered into a lease for the office in Hangzhou City, China from September 11, 2020 to October 5, 2022. The first year rent is RMB

On May 10, 2023, Guo Hao Century

entered into a lease for the office in Hangzhou City, China from May 10, 2023 to May 9, 2025. The security deposit is RMB

| Start Date | End Date | Rent expense | ||||||||

| RMB | USD | |||||||||

| $ | ||||||||||

| $ | ||||||||||

On September 30, 2023, the lease was early terminated due to the management’s decision of transferring operations in Hangzhou to Beijing headquarter office for maximizing the efficiency and cost saving.

The Company adopted FASB ASC

Topic 842 on July 1, 2019.

| Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | |||||||

| Operating lease expense | $ | $ | ||||||

| Nine Months Ended March 31, 2024 | Nine Months Ended March 31, 2023 | |||||||

| Operating lease expense | $ | $ | ||||||

| March 31, 2024 | June 30, 2023 | |||||||

| Right-of-use assets | $ | $ | ||||||

| Lease liabilities - current | ||||||||

| Lease liabilities - noncurrent | ||||||||

| Weighted average remaining lease term | ||||||||

| Weighted average discount rate | % | % | ||||||

| 12 Months Ending March 31, | Minimum Lease Payment | |||

| 2025 | $ | |||

| Total undiscounted cash flows | ||||

| Less: imputed interest | ||||

| Present value of lease liabilities | $ | |||

28

NOTE 13 – DISPOSAL OF SUBSIDIARY

On July 20, 2023, the Company’s

shareholders decided to sell Zhangxun to a third party at a price of RMB

| Cash | $ | |||

| Accounts receivable | ||||

| Other current assets | ||||

| Fixed assets, net | ||||

| Intangible assets, net | ||||

| Total assets | ||||

| Accounts payable | $ | |||

| Advance from customers | ||||

| Accrued liability and other payables | ||||

| Loan payables | ||||

| Intercompany payables to existing entities | ||||

| Total liabilities | ||||

| Non-controlling interest | $ | ( | ) |

| THREE MONTHS ENDED MARCH 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | $ | ||||||

| Cost of goods sold | ||||||||

| Gross profit | ||||||||

| Operating expenses | ||||||||

| Selling | ||||||||

| General and administrative | ||||||||

| Research and development | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ||||||

| Gain on disposal | ||||||||

| Other expense, net | ) | |||||||

| Gain (loss) before income tax | ( | ) | ||||||

| Income tax | ||||||||

| Gain (loss) before noncontrolling interest | ( | ) | ||||||

| Less: loss attributable to noncontrolling interest | ( | ) | ||||||

| Net gain (loss) to the Company | $ | $ | ( | ) | ||||

29

| NINE MONTHS ENDED MARCH 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | $ | ||||||

| Cost of goods sold | ||||||||

| Gross profit | ||||||||

| Operating expenses | ||||||||

| Selling | ||||||||

| General and administrative | ||||||||

| Research and development | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ||||||

| Gain on disposal | ||||||||

| Other income, net | ||||||||

| Gain (loss) before income tax | ( | ) | ||||||

| Income tax | ||||||||

| Gain (loss) before noncontrolling interest | ( | ) | ||||||

| Less: loss attributable to noncontrolling interest | ( | ) | ||||||

| Net gain (loss) to the Company | $ | $ | ( | ) | ||||

NOTE 14 – SUBSEQUENT EVENTS

The Company follows the guidance in FASB ASC 855-10 for the disclosure of subsequent events. The Company evaluated subsequent events through the date the financial statements were issued and determined the Company had following subsequent events need to be disclosed.

On April 5, 2024, the board of directors of Datasea

Inc. approved a plan by Ms. Zhixin Liu, the Company’s Chief Executive Officer and Chairman of the Board, to purchase, with her

personal funds, from time to time over the next 12 months, on the open market or otherwise, up to $

30

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue, or other financial items; any statements of the plans, strategies, and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions of performance; and statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations, which it believes are reasonable. However, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to several factors, including:

| ● | uncertainties relating to our ability to establish and operate our business and generate revenue; |

| ● | uncertainties relating to general economic, political, and business conditions in China; |

| ● | industry trends and changes in demand for our products and services; |

| ● | uncertainties relating to customer plans and commitments and the timing of orders received from customers; |

| ● | announcements or changes in our advertising model and related pricing policies or that of our competitors; |

| ● | unanticipated delays in the development, market acceptance, or installation of our products and services; |

| ● | changes in Chinese government regulations; and |

| ● | availability, terms and deployment of capital, relationships with third-party equipment suppliers. |

Overview

Company Structure

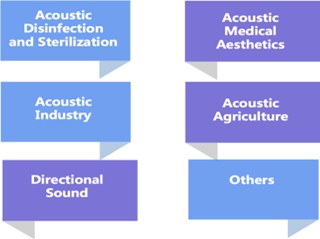

Datasea Inc. (“Datasea,” the VIE, as defined below, and our subsidiaries, collectively, the “Company” or “we” or “us” or “our”) is a global technology company incorporated in Nevada USA on September 26, 2014, with subsidiaries and operating entities located in Delaware and China, that provides acoustics high tech (including ultrasound, infrasound, directional sound, and Schumann resonance), 5G AI multimodal communication and other products and services to various corporate and individual customers. The acoustic business offers a wide range of cutting-edge precision manufacturing products including high-quality sound air disinfection solutions, sound sleep-aid devices, as well as skin repair and beauty solutions. Our products find extensive applications across various industries and sectors, including acoustic industrial, acoustic agriculture, acoustic medical aesthetics, acoustic medical health, acoustic Internet of Things. Datasea serves enterprises and individual users in China with digital and intelligent services utilizing its AI, machine learning and data analytic capabilities that result in an array of 5G application products and solutions. Our common stocks currently listed on the Nasdaq Capital Market are shares of our Nevada holding company that maintains service agreements with the associated operating companies which instead enable us to consolidate the financial results of the VIE and its subsidiaries with Datasea’s corporate group under U.S. GAAP, making Datasea the primary beneficiary of the VIE for accounting purposes.

31

Datasea is not a Chinese operating company, but a Nevada-based holding company. Its subsidiary, Datasea Acoustics LLC, located in Delaware, serves as the global hub for our acoustic business operations, catering to the U.S. and international markets by providing acoustic technologies and application products, and there is no sales outside of PRC yet as of the report date. Additionally, the Company conducts business activities in China through its subsidiary, Tianjin Information Sea Information Technology Co., Ltd. (“Shuhai Tianjin”), and its VIE entity, Shuhai Information Technology Co., Ltd. (“Shuhai Beijing”), along with their subsidiary entities. Shuhai Beijing offers cutting-edge products and solutions in acoustics high tech and 5G Multimodal Communication applications, catering to a wide spectrum of commercial enterprises, households, and individuals in China.

The revenue for the nine months ended March 31, 2024 was $19,612,213. This would represent an increase of $19,396,199 and growth of approximately 8,879.14% as compared to $216,014 revenue that the Company recorded for the nine months ended March 31, 2023. This is also approximately 178% higher than the approximately $7.0 million in revenue recorded for the full fiscal year ended June 30, 2023.

The Company is one of the pioneers in introducing the global concept of “acoustic effects.” And our acoustics high tech products business represents where we want to go as a company. Our acoustic effects are derived by reverse engineering sound characteristics and developing processing mechanisms from the perspective of how sound impacts on people and objects. This has led us to develop acoustic products that address real-world problems across a range of industries, including acoustic industrial, acoustic agriculture, acoustic medical aesthetics, acoustic medical health. During the reporting period, the company continued to upgrade its existing series of soundwave disinfection products, including the HAILIJIA soundwave smart Cloakroom (physical/electronic) dehumidification and disinfection, bathroom model deodorization and disinfection products; as well as the STAR DREAM Sleep Aid (non-contact sleep assistance for sleep) - a refreshing product developed for long-distance buses, long-distance trucks, and workplace individuals; and non-contact soundwave beauty products developed for household use. Currently, the HAILIJIA series comprises over nine flagship products, which are being promoted and sold in the Chinese market through various channels such as direct sales, agents, e-commerce and live streaming.